1. Introduction

Human civilization is undergoing a transformative shift from the Information Technology era to the Data Age, which is marked by exponential data growth and digital interconnectivity [

1]. Across sectors, from domestic firms to multinational enterprises, the volume, velocity, and variety of data being produced have reached unprecedented levels. This surge underscores the strategic value of data-driven technologies in identifying innovative market opportunities, optimizing decision-making, and fostering competitive advantages in a rapidly evolving digital economy [

2,

3,

4,

5,

6].

Within this landscape, Big Data Analytics Capabilities (BDACs) have emerged as critical enablers of business agility and long-term sustainability [

7]. A BDAC empowers organizations to sense market shifts, respond to external uncertainties, reallocate resources, and make evidence-based strategic decisions [

8,

9]. The effective use of BDACs fosters strategic flexibility, enabling firms to pursue innovation-driven strategies and secure a sustainable competitive edge [

10,

11]. However, despite its growing adoption, the impact of BDACs on firm performance has shown inconsistencies, especially in resource-constrained environments. These inconsistencies are often linked to a lack of strategic alignment, fragmented processes, inadequate digital infrastructure, and an overreliance on technological tools without contextual grounding [

12,

13,

14].

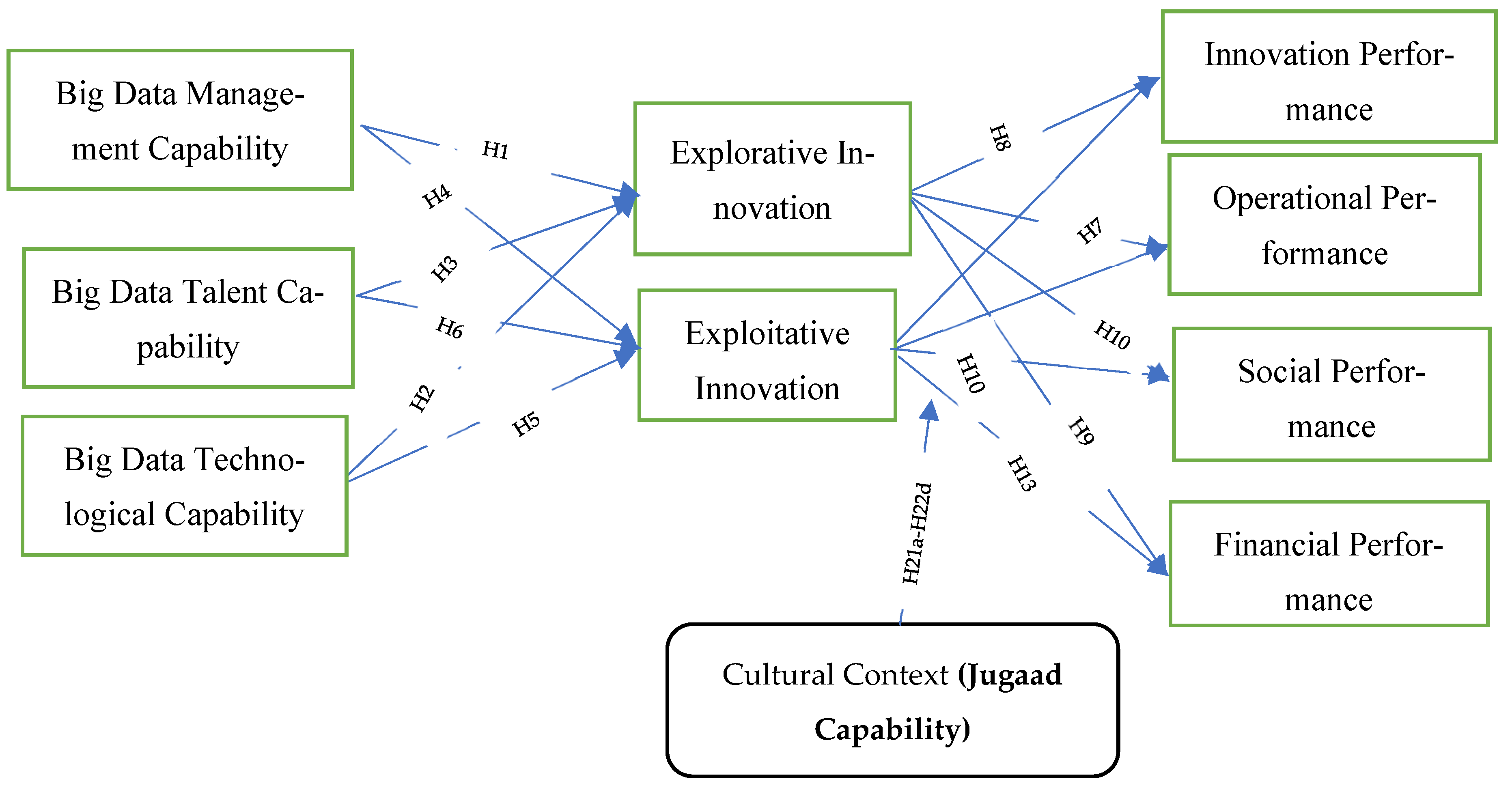

From a sustainability perspective, innovation is essential to addressing environmental challenges, social development, and economic resilience, particularly in developing economies. Drawing on the Resource-Based View (RBV) and Dynamic Capabilities (DCs) theory, this study positions BDAC as a strategic organizational resource that supports two distinct yet complementary forms of innovation: explorative innovation (EXPLRI), which involves radical changes and the pursuit of new knowledge, and exploitative innovation (EXPLI), which enhances existing processes, optimizes operations, and delivers incremental value [

15,

16,

17]. These innovation pathways contribute directly to SDG 9 (Industry, Innovation, and Infrastructure), SDG 8 (Decent Work and Economic Growth), and SDG 12 (Responsible Consumption and Production), by promoting sustainable industrial development, technological upgrading, and efficiency.

However, achieving a balance between exploration and exploitation is particularly challenging in developing economies like Pakistan, where firms often grapple with severe resource limitations, rigid institutional frameworks, and socio-economic volatility. In such settings, Jugaad, a culturally rooted form of frugal and improvisational innovation, emerges as a vital enabler of organizational resilience and sustainability. Jugaad facilitates low-cost, flexible, and adaptive solutions to complex problems using limited resources [

18,

19], thereby contributing to environmental sustainability, (SDG 13—Climate Action and SDG 12—Responsible Consumption) by minimizing waste and maximizing resource efficiency, and to social sustainability (SDG 10—Reduced Inequalities), by enabling inclusive participation and community-based innovation in underserved regions.

Despite the mounting global attention on data analytics and innovation strategies, the existing literature remains largely positioned on Western business frameworks [

20], offering inadequate insights into how local cultural practices shape innovation and sustainability within Asian economies [

21,

22]. Research regarding culture-based innovation continues to develop in Asia, yet the combination of cultural elements with data analysis methods in developing economies remains scant. Particularly, how the integration of BDACs, dual innovation, and frugal innovation culture (Jugaad) could influence sustainable firm performances across environmental, social, and economic dimensions—and contribute to the United Nations’ 2030 Agenda for Sustainable Development—remains underexplored.

Although very little of the current literature on innovation and data analytics is based on developing economies, frameworks such as the European Innovation Scoreboard and the U.S. National Innovation System are mostly applicable to advanced economies with robust infrastructure, extensive R&D spending, and developed policy environments. Consequently, they can hardly be applied in resource-constrained environments such as Pakistan. That is one reason this current study has contextualized a model that considered a native practice of innovation like Jugaad to capture the realities of new markets.

As a key strategic partner in the China–Pakistan Economic Corridor (CPEC), Pakistan stands at a critical juncture in its journey toward sustainability-oriented, innovation-led growth. This pioneering study, one of the first in the country, explores how firms innovate under resource constraints, offering fresh insights into the dynamics of business resilience in emerging markets. By leveraging BDACs, Pakistani firms can overcome structural limitations and unlock new opportunities for strategic decision-making and innovation that are both economically viable and socially responsible—supporting global efforts toward inclusive, equitable, and sustainable development as outlined in the SDGs.

To address this gap, the present study proposes a holistic framework that links BDAC to sustainable firm performance through the mediating mechanisms of explorative and exploitative innovation and the moderating role of Jugaad. By conceptualizing BDAC as a strategic resource composed of BDMGMT (management), BDTECH (technology), and BDTAL (talent), and by integrating Jugaad as an indigenous innovation enhancer, this study offers a novel lens on adaptive innovation in resource-limited contexts. It contributes to theory by extending RBV and DC frameworks into culturally nuanced settings and offers practical insights for decision-makers seeking to balance formal digital capabilities with informal, frugal innovation strategies for long-term sustainability in line with the SDGs.

Accordingly, this study seeks to answer the following research questions:

What impact do BDAC components (BDMGMT, BDTAL, and BDTECH) have on explorative and exploitative innovations in resource-constrained environments?

How do these innovations affect firm performance metrics (innovation, market, social, and financial)?

Do EXPLRI and EXPLI dynamically interact to mediate BDAC’s impact on firm performance?

Can a Jugaad capability moderate the relationship between explorative and exploitative innovations performance outcomes?

This paper begins with a literature review and theoretical framework to contextualize the BDAC and its relation to innovation. The Methodology section details the study design, data collection, and analysis approach. Findings are presented next, followed by a discussion of theoretical and managerial implications. This paper concludes by outlining key contributions, limitations, and avenues for future research.

2. Theoretical Background

This study adopts a theoretical framework combining the Resource-Based View (RBV) and Dynamic Capabilities Theory (DCT) to explore how Big Data Analytics (BDA) capabilities, management (BDMGMT), talent (BDTAL), and technology (BDTECH) influence sustainable performance through EXPLRI and EXPLI. According to [

23], the RBV suggests that firms gain competitive advantage by leveraging unique resources. Similarly, Ref. [

24] underscores that organizations must continuously enhance their capabilities to maintain competitiveness, where BDA capabilities act as strategic tools for innovation.

As EXPLRI makes existing processes more efficient, the EXPLI executes risky disruptive methods to create novel innovations. It is pertinent to mention here that these BDA capabilities further help in transforming organizational resources into innovative products and services, thus improving market performance, together with better financial outcomes [

25] and superior social responsibility [

26,

27]. Successful organizations always pay balanced attention to exploratory and exploitative innovations as per the theory of ambidexterity [

28]. EXPLI works to optimize current practices, while EXPLRI pushes organizational boundaries by pursuing new opportunities. Companies need to adopt both approaches as fundamental strategies when working in changing market conditions.

The combination of exploratory as well as exploitive innovations provides an improved performance [

29], as both individually support organizational growth and productivity [

30]. The study by [

31,

32,

33] highlights the fundamental importance of BDA capabilities in business success. According to them the BDTAL capability develops innovation competencies, and BDTECH delivers AI-powered exploration, while BDMGT maintains data governance systems for sustained improvement.

Hence, innovations serve as connectors between BDA capabilities and their positive impact on sustainable performance. Evidence regarding the BDA–firm performance relationship exists [

33,

34], but the intermediary effect of innovations lacks a sufficient research investigation. The research initiates an investigation linking BDA capabilities to simultaneous exploratory and exploitative innovation as a driver for sustainable performance.

It is also pertinent to mention here that in order to enrich the theoretical contribution, this study contemplates the interaction between formalized innovation through BDACs and informal, improvisational innovation via Jugaad. As the BDAC embodies innovation processes that are well structured, highly data-driven, and rooted in formal governance [

35], Jugaad operates on frugality, flexibility, and adaptability [

36] under constraints.

These two logics may clash in rigid organizational settings, especially where top-down analytics-based controls restrict experimentation or grassroots creativity [

37,

38]. However, harmonization is possible under enabling leadership and adaptive cultures [

39]. For example, a flexible organizational structure and decentralized decision-making allows Jugaad to complement BDACs by generating context-sensitive insights that enrich exploratory innovation [

40]. In such cases, the BDAC provides predictive analytics and a scaling capacity, while Jugaad ensures localized agility, creating a hybrid innovation system that balances structure with spontaneity. Thus, the meeting of BDACs and Jugaad can result in either conflict or synergy depending on internal organizational factors, such as governance models, the leadership orientation, and an openness to bottom-up innovation.

BDACs, including BD management, talent, and technology, are typically structured, formalized, and resource-intensive processes that enable firms to collect, process, and act on large-scale data for a strategic advantage [

41]. These capabilities are central to fostering both exploratory and exploitative innovation, as they enable insight-driven experimentation and the optimization of existing operations [

42].

However, in emerging market contexts, cultural and contextual moderators, such as the Jugaad capability, introduce a layer of informal, improvisational logic into how innovation is enacted. Jugaad, characterized by frugality, flexibility, and creative problem-solving under constraints, often stands in contrast to the systematic nature of BDACs [

43]. While BDAC follows formalized routines and protocols, Jugaad embodies flexible improvisation, reflecting a bottom-up innovation logic that is deeply embedded in cultural practices.

In this study, Jugaad is conceptualized as a cultural moderator that shapes the relationship between BDACs and innovation ambidexterity. Rather than mediating the effect of the BDAC, Jugaad influences the strength and direction of this relationship, depending on contextual conditions. For example, in environments with high resource constraints or institutional voids [

20], firms with strong BDACs may find their impact on innovation outcomes enhanced when the Jugaad capability is high, enabling local improvisation, rapid iteration, and cost-effective scaling. Conversely, in environments with low contextual frugality or high formalization, the rigid nature of BDACs may overpower or marginalize informal approaches like Jugaad.

This dynamic reflects non-linear and feedback-based interactions between formal capabilities (BDACs) and informal innovation logic (Jugaad). Rather than assuming a linear input–output relationship between analytics and innovation, this study acknowledges that the BDAC can both influence and be reshaped by local, adaptive cultural capacities over time [

44]. Thus, the innovation process is not unidirectional but evolves through ongoing adaptation, improvisation, and the recombination of formal and informal practices—a process akin to bricolage [

45,

46], reverse innovation [

47], and Gandhian innovation, which also emphasize innovation under resource constraints.

By integrating these frugal innovation perspectives, this study offers a more pluralistic and context-sensitive view of how the BDAC operates in diverse environments. It addresses the tension between structured and unstructured innovation pathways, while also positioning Jugaad as a strategic cultural moderator that enhances or limits the outcomes of formal innovation capabilities depending on institutional and market contexts.

The positioning of Jugaad is especially salient in emerging markets due to its alignment with institutional voids theory [

38]. Institutional voids refer to the absence or inefficiency of formal market institutions—such as regulatory systems, financial intermediaries, or innovation ecosystems—which are typically present in developed economies. In such contexts, Jugaad emerges as a contextually embedded innovation logic that compensates for structural gaps [

48].

Where the BDAC requires stable infrastructures and data systems, Jugaad substitutes missing institutional functions through informal networks, frugal engineering, and community-level problem-solving. It enables innovation by providing alternative institutional scaffolding, such as a reliance on kinship ties, informal credit, or street-level knowledge systems. Therefore, Jugaad is not merely a stopgap; it is a systemic response to institutional shortcomings and plays a pivotal role in sustaining innovation in underdeveloped environments [

49].

This study theorizes Jugaad as an institutional workaround that reshapes the innovation pathway [

48] under resource and infrastructure constraints, thereby enhancing both exploratory and exploitative outcomes in data-scarce or institutionally weak environments.

Furthermore, a Jugaad culture influences the connection between exploratory and exploitative innovations and organizational output. Theoretically the link is not well established in past research. Jugaad stands as a South Asian phenomenon which describes entrepreneurial methods of overcoming resource limitations to generate practical solutions [

19]. The capability enables organizations to create purposeful solutions from limited resources because it constitutes frugal innovation [

50], which proves beneficial particularly in the growing Asian markets like Pakistan. Organizations can use the Jugaad strategic capability to handle contrasting tensions that exist between explorative and exploitative innovation. Jugaad serves organizations by guiding them through the movement between uncertain explorations of new markets and the development phase that optimizes existing business procedures.

Businesses adopting Jugaad exploit their resource boundaries to develop exploratory and exploitative innovative approaches that lead to performance improvements. Organizations use the Dynamic Capabilities Theory (DCT) to achieve success, as it demonstrates how they can successfully mobilize market shift resources [

24]. The Jugaad approach lets companies direct their innovation strategies toward useful resource use and new discovery areas to enhance their market position.

Therefore, the moderating mechanism of Jugaad allows emerging market firms to handle the conflicting requirements between exploratory and exploitative innovations through an adaptive operational capacity that redirects organizational resources for short-term requirements while pursuing long-term objectives. Jugaad functions as a controlling mechanism which helps organizations maintain an equilibrium between exploratory innovations’ risks and exploitative innovations’ efficiency gains, thus improving their business performance in dynamic and resource-scarce spaces. Jugaad serves as a crucial factor that helps organizations adopt exploratory and exploitative innovations while simultaneously enhancing their operational performance in resource-constrained emerging markets.

4. Methodology

4.1. Sampling

The data was gathered from manufacturing firms functional in the major province of Pakistan Punjab, considered as the hub of industry. According to (IQAir, 2020) [

162], these cities are also listed among the world’s most polluted cities due to industrial pollution. Secondly, the authors also deemed it essential to list down the industries (manufacturing and service) that are involved in some kind of innovation and also have sustainability at the core of their business. For this purpose, special help was given from the Chamber of Commerce and Industry associated with these cities. Permission was also obtained in advance from the participants to fill in the survey for this research, with the help of the Chambers. All the participants in this study were randomly selected. It has been generally seen that women’s participation in surveys is quite low. Therefore, we encouraged the top management to provide equal chances to women participant if her name is chosen in the random selection.

The periodic questionnaires were distributed physically as well as through the electronic medium among the respondents wherever they felt comfortable. The data collection took place in two phases with an interval of five weeks to control for common method bias. The study has received consent for data collection from the participating individuals and organizations. In addition, the research team paid a visit to companies at separate times (morning, evening, etc.) to control the problems of the common method bias and social desirability. The research team were available during the data collection (online and on call) for the selected organizations. The participants’ names, addresses, and answers were kept confidential. It is also pertinent to mention here that all the items were not only carefully adopted but experts from academia and industry also validated them in terms of content, ease of reading, understanding the concept, etc., so that confusion at the respondent end could be minimized.

The data for the survey was collected by the manufacturing firms as unit of analysis. Employees of the firm at senior positions, such general managers, plant managers, research and development heads, etc., were asked to respond to the survey. This study is correctional in nature. Using the formula of [

18], the sample size was calculated as 373, as the population for the study comprised more than ten thousand manufacturing units located in the largest province of Pakistan Punjab. The sample size also went under attrition process and was increased to 40% as suggested by [

163]. All other 522 survey questionnaires were randomly distributed physically as well as online in two phases, keeping in view the convenience of the respondents. A total of 221 and 197 questionnaires were returned back in first and second phase, respectively. Only 13 questioners were dropped from the analysis as they were either empty or not filled properly. Hence, further analysis was conducted with 418 responses. For current research, a simple random sampling was adopted to ensure the true representation of the data chosen. Demographic details are provided in

Table 1.

Table 1 provides a detailed demographic breakdown of employees across various industries, segmented by age, gender, and job level. In terms of gender distribution, the Leather and Apparel industries have the highest number of employees across multiple age groups, particularly in the 36–40 and above 40 categories for both men and women. The Plastic industry also shows a significant workforce presence, especially in the 36–40 age group for men (14 employees) and the same age group for women (10 employees). The Pharmaceutical and Renewable Energy industries have relatively fewer employees across all age groups, indicating a more limited workforce. When examining job levels, the Leather and Plastic industries dominate at the Senior level, with 20 and 18 employees, respectively, while the Consumer Electronics and Apparel industries have the highest representation at the Executive level, suggesting a leadership presence in these sectors. The Renewable Energy industry, in contrast, has the lowest employee distribution across all job levels, reflecting a potential gap in workforce size or industry growth. Overall, the data highlights industry-specific employment patterns, where traditional manufacturing sectors like Leather, Apparel, and Plastic maintain a substantial workforce across different levels, while emerging sectors such as Renewable Energy and Machinery and Equipment have comparatively lower workforce representation.

4.2. Measures

The authors adopted existing instruments for measuring the variables in order to avoid reliability and validity issues. For instance, the items for BDMGMT Capability were adapted from [

164] and BDTECH Capability was adapted from [

165], while BDTAL Capability was adapted from [

19]. Explorative and exploitative innovation was adapted from [

166]. Firm financial performance was measured using scale adopted from [

167], innovation performance from [

168], and financial performance adapted from [

169]. While social performance was adapted from [

170]. Jugaad capability (cultural context) was measured with a six-item scale, which was adopted from the past studies [

47,

52,

116,

171,

172,

173,

174,

175]. All the items were measured on a 5-point Likert scale. Both SPSS (

https://www.ibm.com/products/spss) and Smart Pls version 4.1.1.4 were used to run the measurement and structural model.

4.3. Data Analysis and Results

This study conducted the PLS-SEM technique presented using the Smart PLS 4.0 to access the measurement and structural model, which uses a variance-based approach [

176]. Secondly, it manages formative constructions, higher order constructs, mediations, and moderation (interaction effect), etc., in a more effective way [

177]. The data analysis was conducted using Partial Least Squares Structural Equation Modeling (PLS-SEM), which was realized through SmartPLS 4. The choice of PLS-SEM instead of covariance-based SEM (CB-SEM) was made with the help of a variety of methodological and theoretical considerations. The research model proposes a number of latent constructs (BDAC, EXPLRI, EXPLOI, sustainable performance) and hypothesized structural relationships, including direct, mediated, and moderated effects (i.e., moderating effect of Jugaad capability). PLS-SEM can easily deal with more complicated forms of hierarchical and interaction models and can do so even in cases where the model complexity is great compared to the sample size.

Since the main aim of the present study is to produce more of a prediction type and to contribute to the RBV–DC theoretical framework by way of inclusion of a culturally situated capability (Jugaad), PLS-SEM is well suited to theory development and prediction, rather than confirmatory modeling, because its focus is on maximizing explained variance (R2 values) in endogenous constructs.

The final sample comprises 418 valid responses, and PLS-SEM is statistically more powerful and robust, especially when the data distribution is non-normal and the model is complex and includes a large number of indicators. By comparison, CB-SEM would need a larger sample and would require multivariate normality, which is frequently not satisfied in data in the context of developing economies. The conceptual model incorporates reflective indicator constructs (e.g., dimensions of sustainable performance and the components of BDAC). PLS-SEM is more flexible in modeling such constructs; PLS-SEM does not impose the restrictive identification conditions that cannot be avoided in CB-SEM.

There are interaction effects (Jugaad capability moderates) in the model, which PLS-SEM efficiently processes via product indicator or two-stage processes, and thus robust estimation is possible without fear of multicollinearity that usually affects interaction terms in regression-based techniques.

In this study Harman’s single-factor test was conducted to observe the common method bias (CMB). As the first component accounted for only 32.01% of the total variance (which is far below the threshold value of 50%), Ref. [

120] implies that CMB is not present in the study. The VIF (Variance Inflation Factor) ranged between 2.23 and 3.21, which is below the threshold of 5.0 [

146], implying the absence of multicollinearity.

4.4. Model Analysis

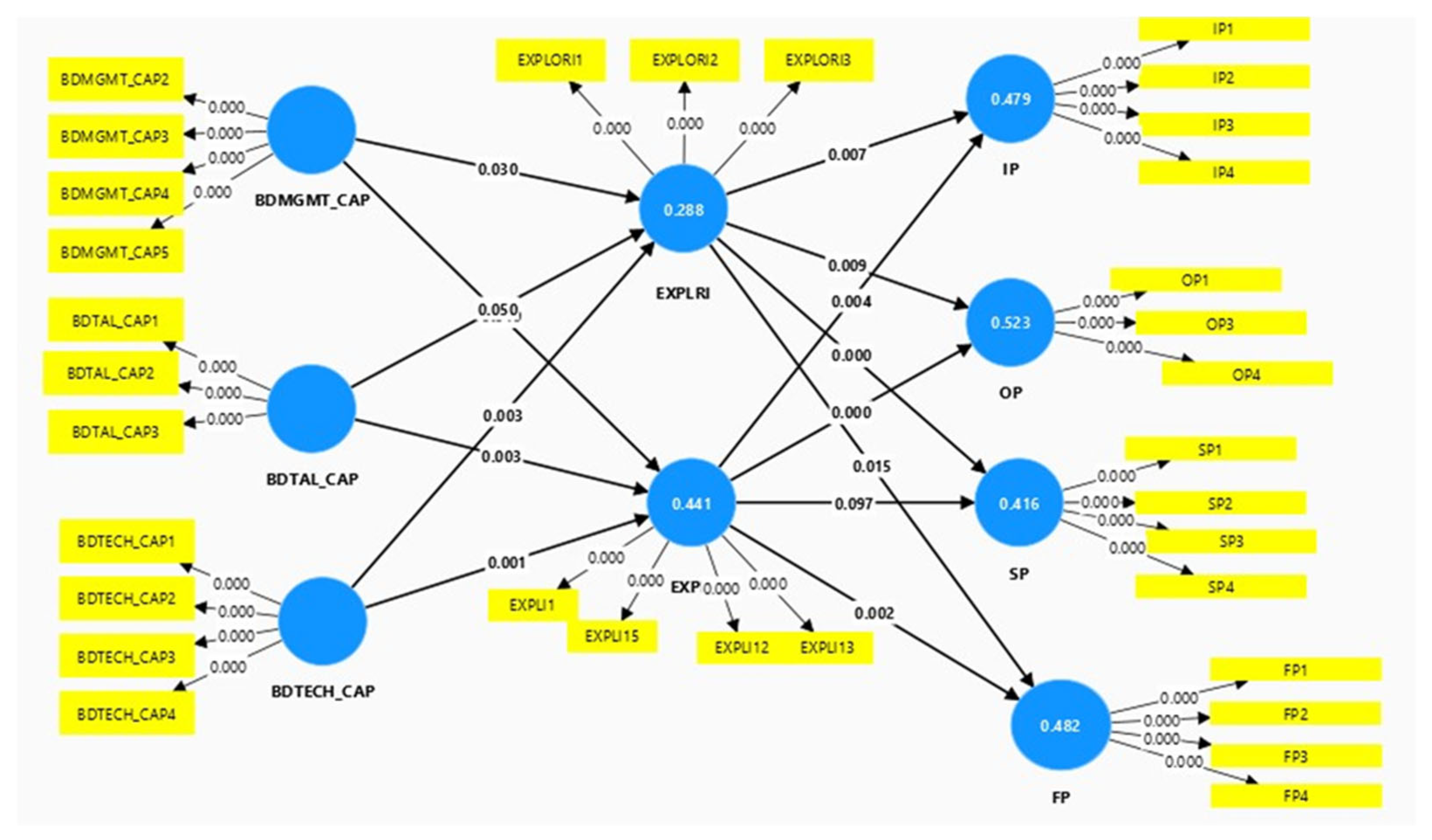

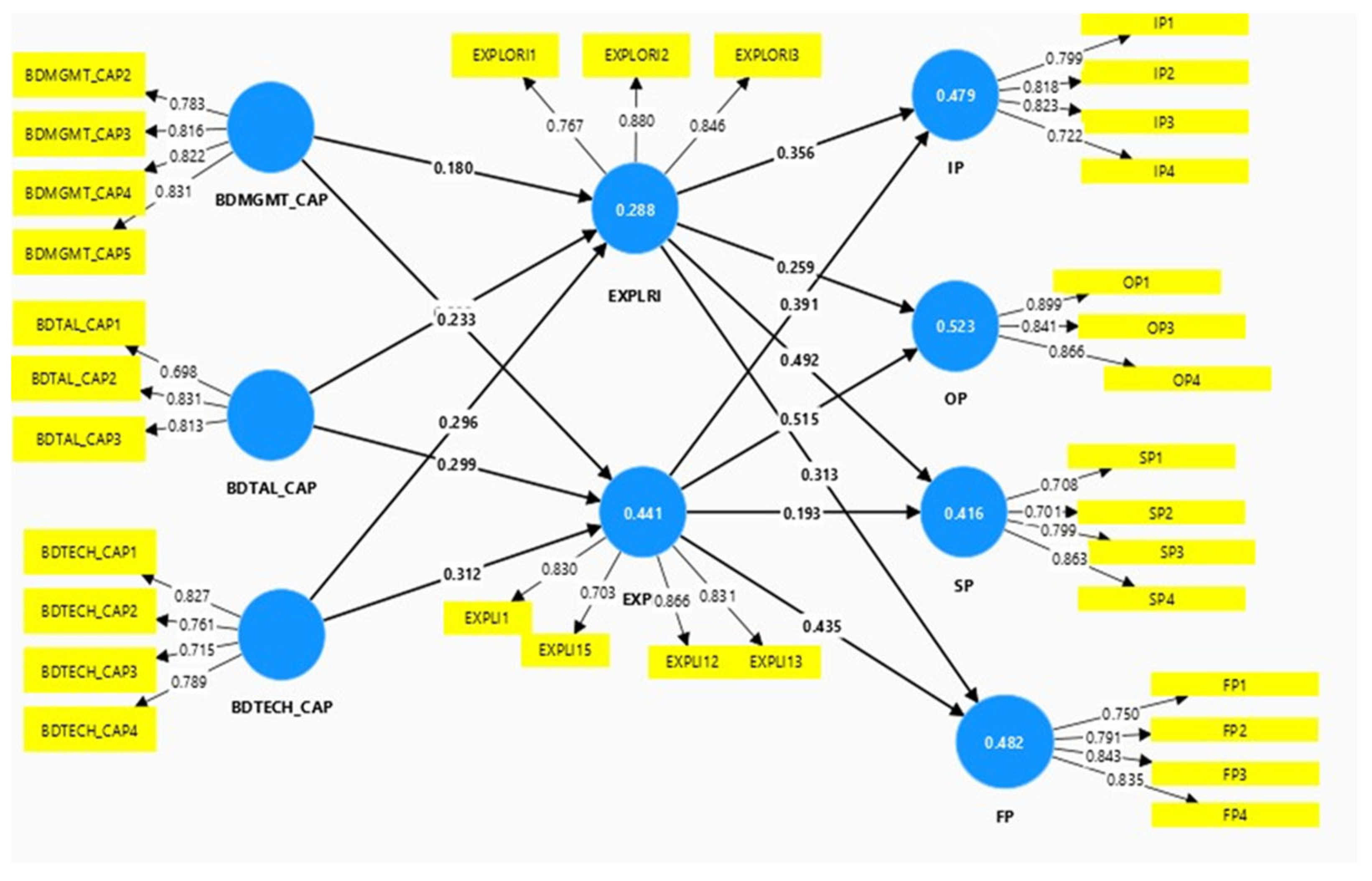

The results of the measurement model analysis are shown in

Table 2. It is evident that the loadings of all the items are above the minimum value of 0.708, as suggested by [

178]. The AVE values were analyzed for convergent validity, as all the values were above 0.50 threshold set by [

179]. Both CR and Cronbach alps values were within the prescribed limits of 0.70 and above, which ensured satisfactory construct validity. Heterotrait–Monotrait ratio of correlations (HTMT) criteria of [

180] was used, and all the values were found to be below 0.90, signifying that all the constructs demonstrate discriminant behavior, as shown in

Table 3.

Table 4 also reconfirms the discriminant validity through Fornell and Larker criterion.

Figure 2 and

Figure 3 show the measurement model and structural model output of smart PLS 4.

4.5. Structural Model Analysis

Structural model was run using 5000 bootstraps to examine the significance of the hypothesized relationships, as shown in

Figure 2.

Table 5 shows the direct and indirect effects. BDAMGT, BDATAL, and BDATECH capacities have a direct effect on EXPLI, with β = 0.598 and

p < 0.05; β = 0.598 and

p < 0.05; and β = 0.598 and

p < 0.05, respectively. Furthermore, BDA management capability, BDA talent capability, and BDA technological capability have a direct effect on EXPI, with β = 0.598 and

p < 0.05; β = 0.598 and

p < 0.05; and β = 0.598 and

p < 0.05, respectively.

Similarly, the direct effect of exploitative innovation on financial performance, Inn performance, OP, and SP was found to be significant, with β = 0.598 and p < 0.05; β = 0.598 and p < 0.05; and β = 0.598 and p < 0.05, respectively. It was also found that the direct effect of explorative innovation on FP, IP, OP, and SP was found to be significant, with β = 0.598 and p < 0.05; β = 0598 and p < 0.05; and β = 0.598 and p < 0.05, respectively.

Lastly it was found that exploitative innovation mediated the relationship between BDA management capability and sustainable advantage (FP, IP, OP, and SP), with β = 0.598 and p < 0.05.

Also, exploitative innovation mediated the relationship between BDA talent capability and sustainable advantage (FP, IP, MP, and SP), with β = 0.598 and p < 0.05.

Exploitative innovation mediated the relationship between BDA technological capability and sustainable advantage (FP, IP, OP, and SP), with β = 0.598 and p < 0.05.

Furthermore, it was found that explorative innovation mediated the relationship between BDA management capability and sustainable advantage (FP, IP, OP, and SP), with β = 0.598 and p < 0.05.

It is also found that explorative innovation mediated the relationship between BDA talent capability and sustainable advantage (FP, IP, OP, and SP), with β = 0.598 and p < 0.05.

Lastly, explorative innovation mediated the relationship between BDA technological capability and sustainable advantage (FP, IP, OP, and SP), with β = 0.598 and p < 0.05.

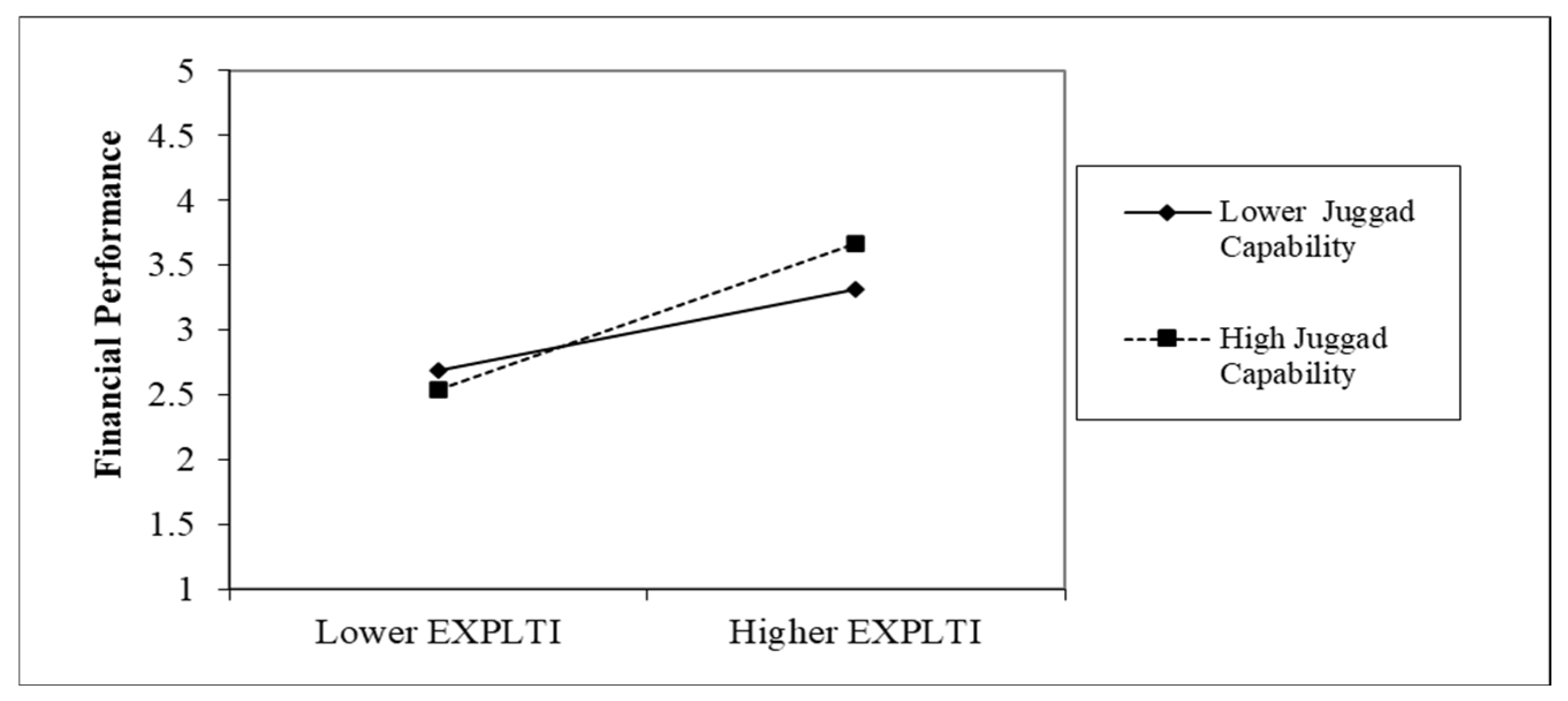

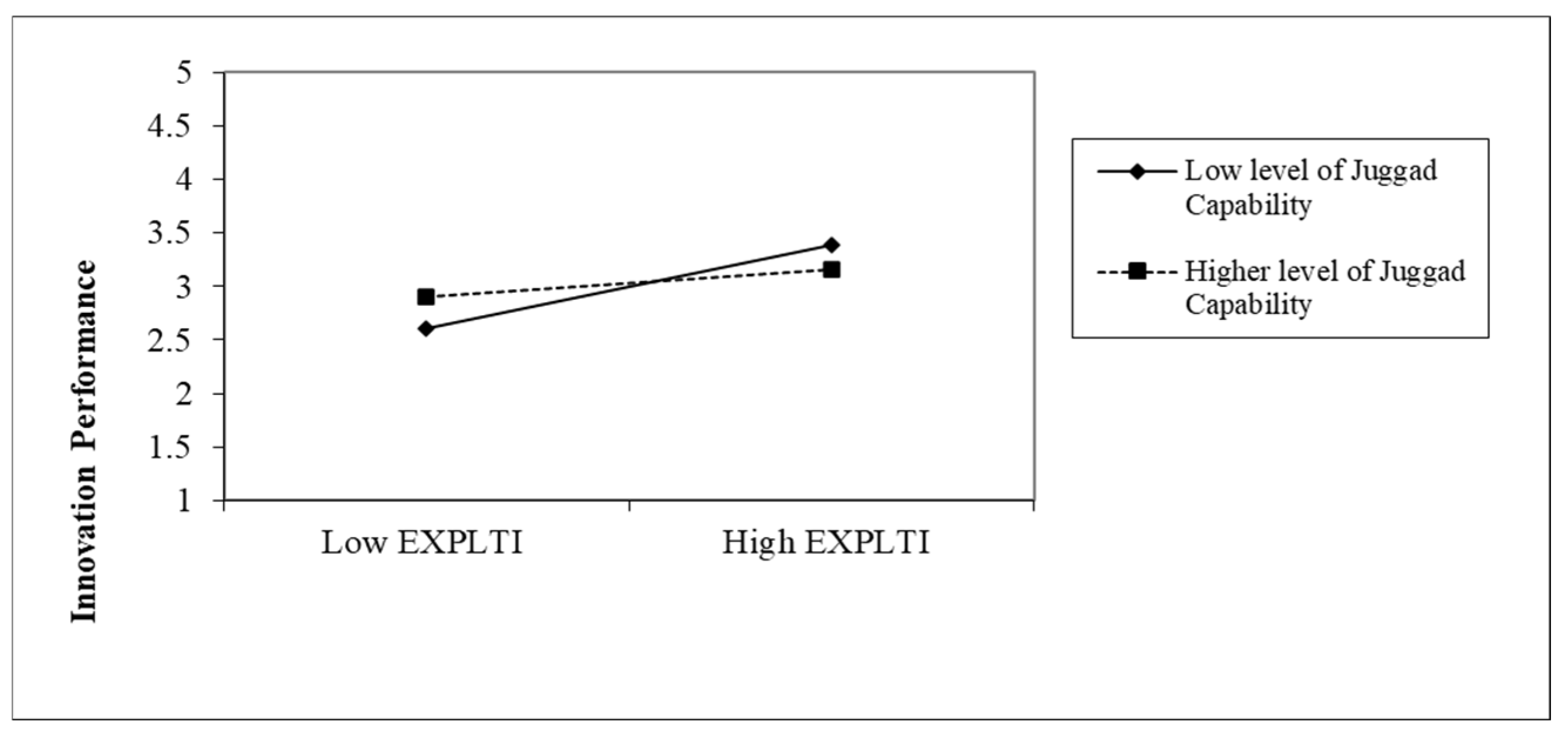

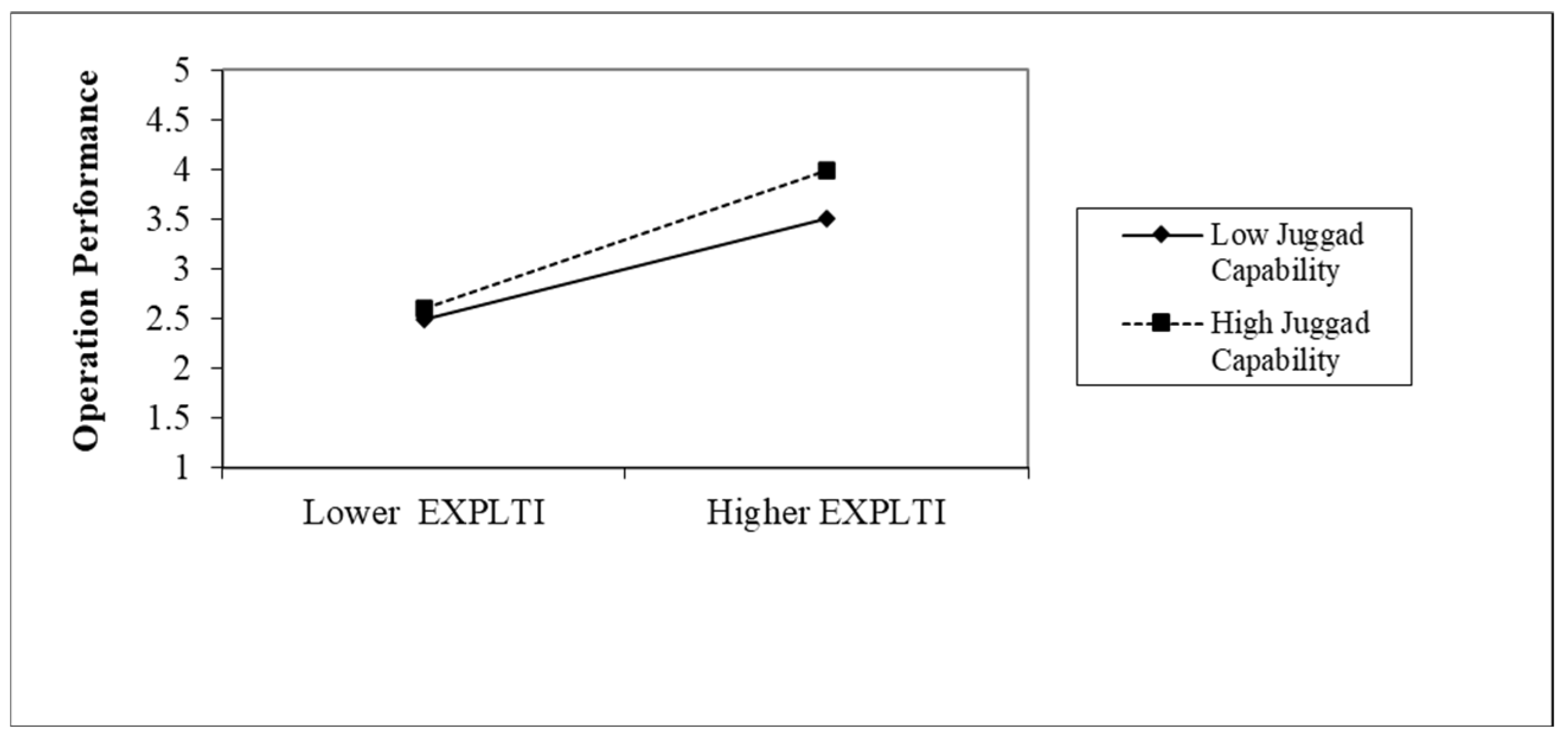

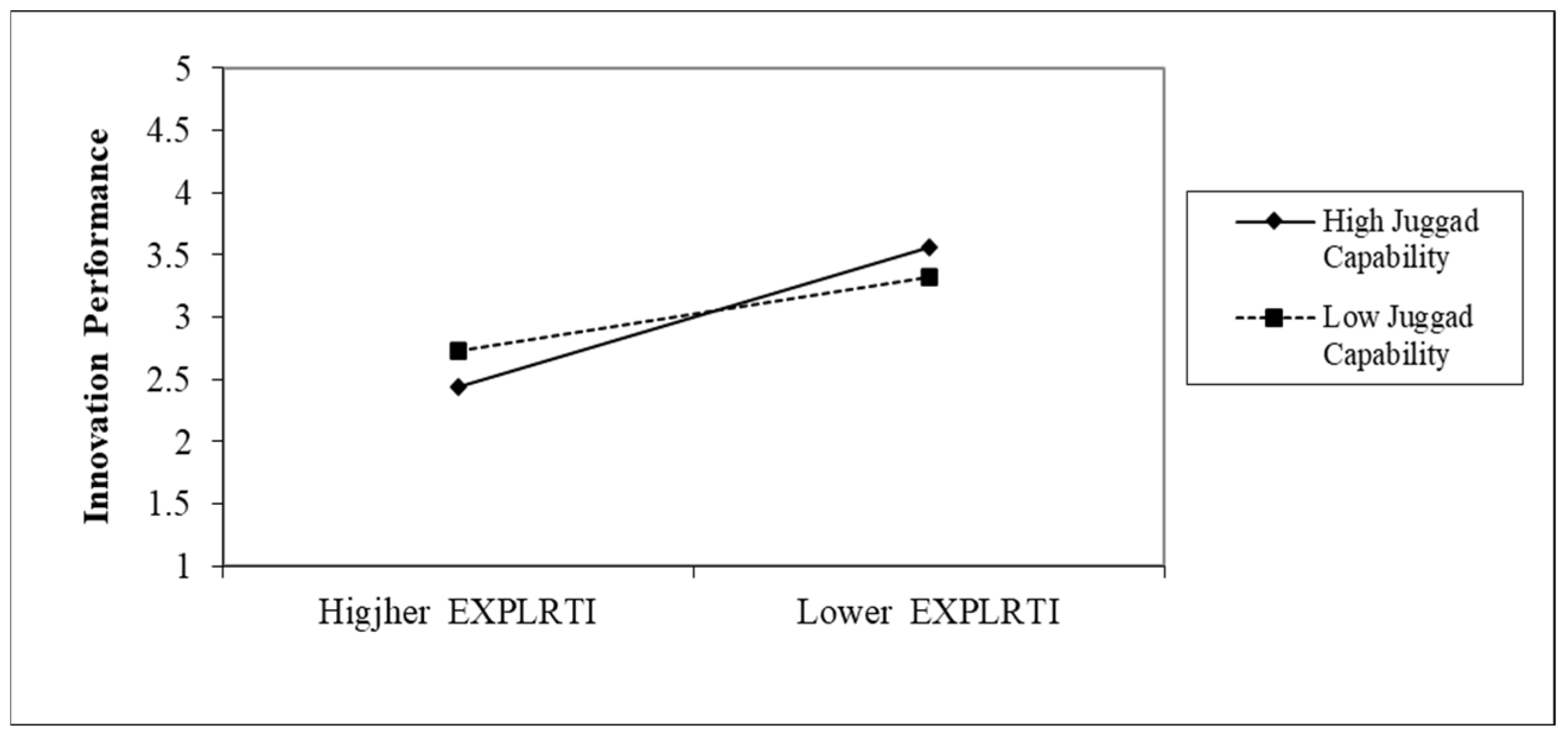

4.6. Moderation Analysis Results

Table 6 shows that Jugaad capability moderates the relationship between exploitative innovation and FP, IP, and OP (with (β = 0.248,

p < 0.01), (β = 0.206,

p < 0.01), (β = 0.178,

p < 0.01), respectively). While the moderating role of Jugaad capability on social performance was found to be non-significant.

The moderating effect of Jugaad capability between explorative innovation and innovation performance was found to be negatively significant, with (β = −0.259,

p < 0.01). Whereas no other moderating effect of Jugaad capability between explorative innovation and other performance outcomes was found to be significant.

Figure 4,

Figure 5,

Figure 6 and

Figure 7 show all moderation graphs for all the significant relationships.

4.7. Muti-Group Analysis (Firm Size)

The multi-group analysis

Table 7, confirmed that the influence of managerial big data capability on exploitative innovation is significantly stronger in large firms compared to medium-sized firms (β = 0.382 vs. 0.059,

p = 0.050). This finding underscores the superior ability of large organizations to leverage managerial data resources in the driving process of optimization and incremental innovation. From a Resource-Based View (Barney, 1991) [

23], this suggests that larger firms have more established data infrastructures and formalized managerial routines, enabling the more effective exploitation of existing capabilities. The result is also consistent with Dynamic Capabilities Theory (Teece, 2007) [

24], which emphasizes the importance of integrating and reconfiguring firm resources to respond to operational needs and sustain performance in complex environments.

The permutation-based MGA for specific indirect effects revealed two statistically significant differences between large- and medium-sized firms. First, the indirect effect of BDMGMT_CAP on financial performance via exploitative innovation was significantly stronger in large firms (β = 0.259) compared to medium-sized firms (β = 0.012), with a permutation

p-value of 0.001. This indicates that managerial big data capabilities are more effectively translated into financial gains in larger firms through refined and incremental innovation processes, consistent with the logic of strategic resource leverage (Barney, 1991) [

23] and data-driven operational efficiencies (Wamba et al., 2020) [

22].

Second, the indirect effect of BDMGMT_CAP on social performance via exploitative innovation also showed a significant difference (

p = 0.006), again favoring larger firms. This suggests that managerial data capabilities not only optimize financial outcomes but also support sustainability and social responsibility agendas more effectively in complex organizational structures (Teece, 2007 [

24]; George et al., 2014 [

54]). Medium-sized firms, in contrast, may lack the systemic integration and process maturity to realize such socially oriented returns from their Big Data Management strategies.

5. Discussion

This study examines BDMGMT, BDTAL, and BDTECH capabilities to determine their impact on explorative and exploitative innovations, which enhance sustainable performance in innovation, operation, social, and financial dimensions. Big data capabilities produce substantial benefits for explorative and exploitative innovation that pave the way for data-driven organizational success.

The research findings demonstrate how the BDMGMT capability boosts explorative and exploitative innovation, making it crucial for accomplishing innovation ambidexterity. The research by [

165,

181,

182] along with the present study show that the BDMGMT capability boosts explorative innovation through new insights discovery, adaptability enhancements, and the sustainable innovation pursuit. Strategic data integration through the BDMGMT capability creates opportunities for both experimental creativity and active product development [

41,

77,

183].

The BDMGMT capability has substantial effects on exploitative innovation because it optimizes processes and improves cost performance along with productivity [

29,

184]. Organizations understand the BDMGMT capability as a fundamental organizational resource based on the RBV perspective [

20,

91]. The performance of BDMGMT promotes continuous operational enhancement alongside innovation sustainability, which enables firms to keep their competitive position in dynamic markets [

98,

142].

The current study demonstrates that BDTECH as a prediction tool delivers data-driven innovation through a predictive analysis. Ref. [

102] demonstrated that data-trained leadership advances exploitative innovation effectively, but this finding contradicts [

185] in manufacturing supply chain studies. Investigations show that BDTECH establishes a beneficial relationship with exploratory innovation, since a rapid data evaluation aids in changing and uncertain situations [

33]. The incorporation of core technologies in BDTECH systems provides businesses with improved market reaction capabilities and operational effectiveness, as documented by [

186]. The integration of AI and machine learning with BDTECH systems facilitates real-time analytics, enhancing data-driven decision-making and operational agility [

187]. Furthermore, the incorporation of business design thinking principles strengthens concept testing and automated workflows, contributing to more efficient and innovative processes [

110]. These findings underscore the synergistic potential of advanced analytics and strategic design methodologies in optimizing organizational performance. The collected research strengthens the strategic position of BDTECH, which enables organizations to develop exploratory and exploitative innovation strategies. Therefore, we argue that our findings are quite in line with the past studies as discussed above.

The current study also empirically proves that the BDTAL capability positively affects innovation through its dual association with operational and conceptual advancements. The results of our study are in line with [

14,

188,

189,

190,

191], who demonstrated, in their respective studies, that talent management delivers strategic insights from big data, which aid the creation of new products and process innovations. Our results are also in line with the work of [

29,

165,

192], which shows that BDTAL facilitates exploitative innovation through its ability to direct targeted improvements. The results demonstrate that big data talent development needs to be viewed both as a strategic resource and technical asset to enable firms to extract value for innovative exploration along with operational enhancement [

193].

Furthermore, this research confirms the separate yet simultaneous impact that explorative and exploitative innovation has on organization performance across operational, innovation, social, and financial dimensions. Each separate hypothesis test demonstrates that types of innovation support performance in unique and compatible ways to demonstrate how ambidextrous strategies produce maximum value.

Research data demonstrate that explorative and exploitative innovation generates positive effects on operational performance, as we initially suggested. The emphasis of exploitative innovation on process optimization and efficiency enhancement drives significant improvements in resource utilization and productivity [

145]. The ability of explorative innovation to improve adaptability and agility lets companies respond effectively to external environment changes by implementing new process solutions [

109]. Organizations gain operational excellence and complexity management capabilities through these innovation types working together.

The analysis of the innovation performance hypothesis also produced meaningful results. Explorative innovation drives firms to develop disruptive products as well as establish entry points for new markets, according to the findings of [

194], thus demonstrating its primary function in proactive innovation development. The innovation approach of exploitative innovation brings small changes to existing products, which ensure market leadership through production optimization. Various studies confirm that innovation ambidexterity leads to better innovation outcomes and performance results [

195,

196].

Social performance receives dual contributions from the innovation types we examined, according to our findings. Explanatory innovation helps social progress by creating innovative solutions for difficult societal issues [

197], and exploitative innovation improves corporate responsibility by maintaining sustainable practice development [

41,

198]. This study confirms that innovative approaches serve as a tool to unite business targets with social and environmental priorities.

This research verified that financial performance receives a direct influence from both explorative and exploitative innovation. The implementation of explorative innovation drives the market expansion, along with new product development, thus leading to revenue increases, but utilizing exploitative innovation enables profitability gains through cost reductions and operational excellence improvements [

199,

200]. The results address [

201]’s warning about the dangers of focusing excessively on exploitation, which results in hampered long-term growth. The current research indicates that organizations should adopt an integrated approach, which optimizes both their revenue generation and financial profitability metrics and is quite in line with the work of [

142,

202,

203]. The research indicates that firms can boost their total performance through the strategic management of innovation types as separate but matched elements.

The results of the moderation analysis provide valuable insights into how the Jugaad capability interacts with exploitative and explorative innovation to influence various dimensions of firm performance. Specifically, the findings show that the Jugaad capability strengthens the relationship between exploitative innovation and FP, IP, and OP, while it has a limited impact on SP.

On the other hand, the interaction between the Jugaad capability and explorative innovation shows mixed results, with significant negative effects on innovation performance but no significant effect on other performance indicators, including financial, operational, and social performance. This discussion elaborates on these findings in light of the existing literature and theoretical frameworks.

The interaction between the Jugaad capability and exploitative innovation significantly enhances the financial performance, innovation performance, and operational performance. These results align with past studies highlighting the positive relationship between exploitative innovations (i.e., refining and extending existing technologies and processes) and organizational performance [

23]. Jugaad, as a form of resourceful problem-solving in resource-constrained environments, may amplify the effectiveness of exploitative innovations by enabling firms to maximize the value derived from existing technologies and processes. This can lead to an improved financial performance (through cost reduction and resource optimization), an enhanced innovation performance (by improving incremental innovations), and a better operational performance (by streamlining processes and increasing efficiency).

Previous research, such as that by [

204], supports the idea that exploitation (i.e., refining existing capabilities) leads to short-term performance improvements. This study further validates that the Jugaad capability, which involves adaptive, improvisational, and low-cost solutions, can significantly support firms in leveraging existing resources to create immediate value. The findings also resonate with [

205], who found that firms with high capabilities in exploiting their existing knowledge base are more likely to achieve superior performance outcomes, particularly in mature industries.

In contrast, the Jugaad capability appears to have a less favorable relationship with explorative innovation, particularly in terms of IP. The negative impact indicates that the Jugaad capability fails to effectively foster risk–reward innovative strategies needed for explorative concepts. The implementation of explorative innovation demands an extensive investment combined with specialized knowledge to search for new solutions in unfamiliar domains and experiment with new technologies. The Jugaad capability creates limitations in managing exploratory initiatives because of its natural dependence on adaptive resource management and limited resources. Explorative innovation traditionally leads to positive outcomes [

23] for driving long-term growth and extreme performance advancements, yet these findings differ from the current research results.

Many studies point out that Jugaad as a form of frugal innovation struggles to align with exploratory initiatives, which need significant investments and failure acceptance [

135]. The fast-and-cheap characteristics of Jugaad tend to produce inadequate exploratory innovation results in settings where experimentation risks are high. The uncertainty levels present in explorative activities create difficulties for frugal innovation, as reported by [

206], which explains the negative interaction effect on innovation performance.

Interestingly, the moderation effects of the Jugaad capability on social performance are generally non-significant, both in relation to exploitative innovation and explorative innovation. This suggests that Jugaad does not directly influence the social outcomes of innovation, such as employee well-being, community engagement, or corporate social responsibility. One possible explanation for this is that the Jugaad capability, which typically focuses on solving practical, resource-based challenges, may not necessarily prioritize social objectives or broader societal impacts. According to [

54], frugal innovations, while efficient, tend to be more operationally oriented and may not fully address the social and ethical dimensions of innovation. Moreover, Jugaad, in its emphasis on speed and cost-effectiveness, may overlook the social or environmental consequences of its solutions, making it less effective in promoting social performance.

In addition to the main and interaction effects, the comparative analysis of the different firm categories also produces more insight on the effect of the organizational scale on the utility of big data capabilities. The findings show that bigger companies are capable of a more competent use of managerial data skills regarding structured innovation situations. In particular, the managerial capability and process-driven innovation efforts were found to be more closely linked in such firms and were of increasing significance to the creation of value, both to the economy and society. Further, the indirect roles of performance elevations due to the innovation channel effects turned out to be largely significant in large firms. These trends imply that the level and effectiveness of data-enabled innovation practices also depend decisively on the maturity of the organization and the structure of available resources. In the context of a medium-size enterprise, the findings indicate that the comparative analysis of capabilities and structural nimbleness may be needed to use a big data investment to the full extent, particularly in the contexts that focus on polishing and taking advantage of what is already there.