From Carbon to Capability: How Corporate Green and Low-Carbon Transitions Foster New Quality Productive Forces in China

Abstract

1. Introduction

2. Literature Review and Hypothesis Development

2.1. Literature Review

2.1.1. Green and Low-Carbon Transition

2.1.2. New Quality Productive Forces

2.1.3. Review

2.2. Hypothesis Developme

3. Research Design

3.1. Variable Construction

3.1.1. Dependent Variable

3.1.2. Independent Variable

3.1.3. Control Variables

3.2. Empirical Strategy

3.2.1. Baseline Model and Endogeneity Mitigation

3.2.2. Causal Inference via Difference-in-Differences (DID)

3.3. Data and Sample Construction

4. Empirical Results

4.1. Baseline Regression Results

4.2. Robustness Checks

4.2.1. Alternative Measure of the Explanatory Variable (GLCT)

4.2.2. Alternative Measure of the Dependent Variable (NQPF)

4.2.3. Data Trimming Procedure

4.2.4. Adjustments to Clustering Methodology

4.2.5. Propensity Score and Entropy-Balancing Methods

4.2.6. Alternative Identification Strategy

4.2.7. Instrumental Variable Estimation

4.3. Mechanism Analysis

4.3.1. Financing-Optimization Effect

4.3.2. The Moderating Role of Collaborative Innovation

4.3.3. The Optimization Effect of Resource Allocation

4.4. Heterogeneity Analysis

4.4.1. Ownership-Based Heterogeneity

4.4.2. Heterogeneity in Firm-Level Carbon Emission Intensity

4.4.3. Sectoral Heterogeneity

4.4.4. Regional Heterogeneity

5. Discussion

5.1. Summary of Key Findings

5.2. Theoretical and Practical Implications

5.3. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix A.1. Construction of the Intelligent Transformation Index (Table A1 and Table A2)

| First-Level Indicator | Second-Level Indicator | Measurement Method |

|---|---|---|

| Intelligent Investment | Software Investment | Ratio of intelligence-related intangible assets to total assets. |

| Hardware Investment | Ratio of intelligence-related fixed assets to total assets. | |

| Intelligent Technology Application | Intelligent Technology Level | Frequency of keywords related to core AI technologies in corporate annual reports. (See Table A2 for keywords) |

| Intelligent Technology Application Depth | Frequency of keywords related to intelligent business applications in corporate annual reports. (See Table A2 for keywords) |

| Category | Keywords (Examples) |

|---|---|

| Intelligent Technology Level Keywords | Artificial Intelligence, Machine Learning, Deep Learning, Computer Vision, Natural Language Processing, Intelligent Robotics, Biometrics, Voice Recognition |

| Intelligent Technology Application Keywords | Smart Finance, Intelligent Logistics, Smart Healthcare, Smart City, Smart Grid, Intelligent Manufacturing, Smart Customer Service, Intelligent Security |

Appendix A.2. Construction of the Digitization Index (Table A3)

| Dimension | Keywords (Examples) |

|---|---|

| Artificial Intelligence | Machine Learning, Deep Learning, Image Recognition, Natural Language Processing, Intelligent Decision Support, Automated Driving |

| Big Data Technology | Big Data, Data Mining, Text Mining, Data Visualization, Augmented Reality (AR), Virtual Reality (VR), Hybrid Reality |

| Cloud Technology | Cloud Computing, SaaS, PaaS, IaaS, Multi-Party Secure Computation, Green Computing, IoT, Information Physical Systems |

| Blockchain Technology | Blockchain, Digital Currency, Distributed Ledger, Differential Privacy, Smart Contract, DeFi (Decentralized Finance) |

| Digital Technology Application | Mobile Internet, Industrial Internet, E-commerce, Mobile Payment, NFC Payment, Smart Energy, Smart Transportation, Fintech, Open Banking |

Appendix A.3. Representative Examples from the GLCT Keyword Lexicon (Table A4)

| Domain | Original Keywords (Chinese) | English Translation |

|---|---|---|

| Advocacy and Commitments | 绿色, 低碳, 环保, 可持续, 生态文明, … | Green, Low-Carbon, Environmental Protection, Sustainable, Ecological Civilization, … |

| Strategic Orientation | 节能, 循环, 新能源, 协调发展, 能源转型, … | Energy Saving, Circular/Recycling, New Energy, Coordinated Development, Energy Transition, … |

| Technological Innovation | 清洁能源, 碳捕集, 能源效率, 污水处理, 高耗能设备替代, … | Clean Energy, Carbon Capture, Energy Efficiency, Wastewater Treatment, High-consumption Equipment Replacement, … |

| Emissions Abatement | 减排, 排污, 回收, 零排放, 温室气体, … | Emission Reduction, Discharge, Recovery, Zero-Emission, Greenhouse Gas, … |

| Monitoring and Compliance | 碳足迹, 碳核查, ISO14001 [82], 环境绩效, 碳排放交易, … | Carbon Footprint, Carbon Verification, ISO14001 [82], Environmental Performance, Carbon Emission Trading, … |

Appendix A.4. Timeline and Coverage of Low-Carbon Pilot Cities (Table A5)

| Batch | Date of Implementation | List of Pilot Cities/Regions |

|---|---|---|

| Batch 1 | 19 July 2010 | Hubei, Yunnan, Guangdong, Shaanxi, Liaoning, Chongqing, |

| Xiamen, Nanchang, Baoding, Tianjin, Shenzhen, Hangzhou, Guiyang | ||

| Batch 2 | 26 November 2012 | Beijing, Shanghai, Hainan, Qinhuangdao, Hulunbuir, |

| Daxing’anling Prefecture, Huai’an, Ningbo, Nanping, Ganzhou, | ||

| Jiyuan, Guangzhou, Zunyi, Kunming, Yan’an, Shijiazhuang, | ||

| Jincheng, Jilin, Suzhou, Zhenjiang, Wenzhou, Chizhou, | ||

| Jingdezhen, Qingdao, Wuhan, Guilin, Guangyuan, Jinchang, Urumqi | ||

| Batch 3 | 7 January 2017 | Wuhai, Dalian, Karamay, Changzhou, Jinhua, Hefei, Huangshan, |

| Xuancheng, Liu’an, Gongqingcheng, Fuzhou, Jinan, Yantai, | ||

| Changsha, Chenzhou, Zhongshan, Liuzhou, Chengdu, Yuxi, | ||

| Ankang, Dunhuang, Yinchuan, Wuzhong, Yining, Hotan, | ||

| 1st Division Alar, Shenyang, Chaoyang, Nanjing, Jiaxing, | ||

| Quzhou, Huaibei, Sanming, Ji’an, Weifang, Changyang Tujia | ||

| Autonomous County, Zhuzhou, Xiangtan, Sanya, Qiongzhong | ||

| Li and Miao Autonomous County, Pu’er City Simao District, | ||

| Lhasa, Lanzhou, Xining, Changji |

Appendix A.5. Regional Classification of Chinese Provinces

References

- Rockström, J.; Steffen, W.; Noone, K.; Persson, Å.; Chapin, F.S.; Lambin, E.F.; Lenton, T.M.; Scheffer, M.; Folke, C.; Schellnhuber, H.J.; et al. A safe operating space for humanity. Nature 2009, 461, 472–475. [Google Scholar] [CrossRef]

- Tu, Z.; Liu, B.; Jin, D.; Wei, W.; Kong, J. The effect of carbon emission taxes on environmental and economic systems. Int. J. Environ. Res. Public Health 2022, 19, 3706. [Google Scholar] [CrossRef]

- Falkner, R. The Paris Agreement and the new logic of international climate politics. Int. Aff. 2016, 92, 1107–1125. [Google Scholar] [CrossRef]

- Green, F.; Stern, N. China’s changing economy: Implications for its carbon dioxide emissions. Clim. Policy 2017, 17, 423–442. [Google Scholar] [CrossRef]

- Xi, J. Full Text: Statement by Xi Jinping at General Debate of 75th UNGA. China Daily, 2020. Available online: https://www.chinadaily.com.cn/a/202009/23/WS5f6a640ba31024ad0ba7b1e7.html (accessed on 13 April 2025).

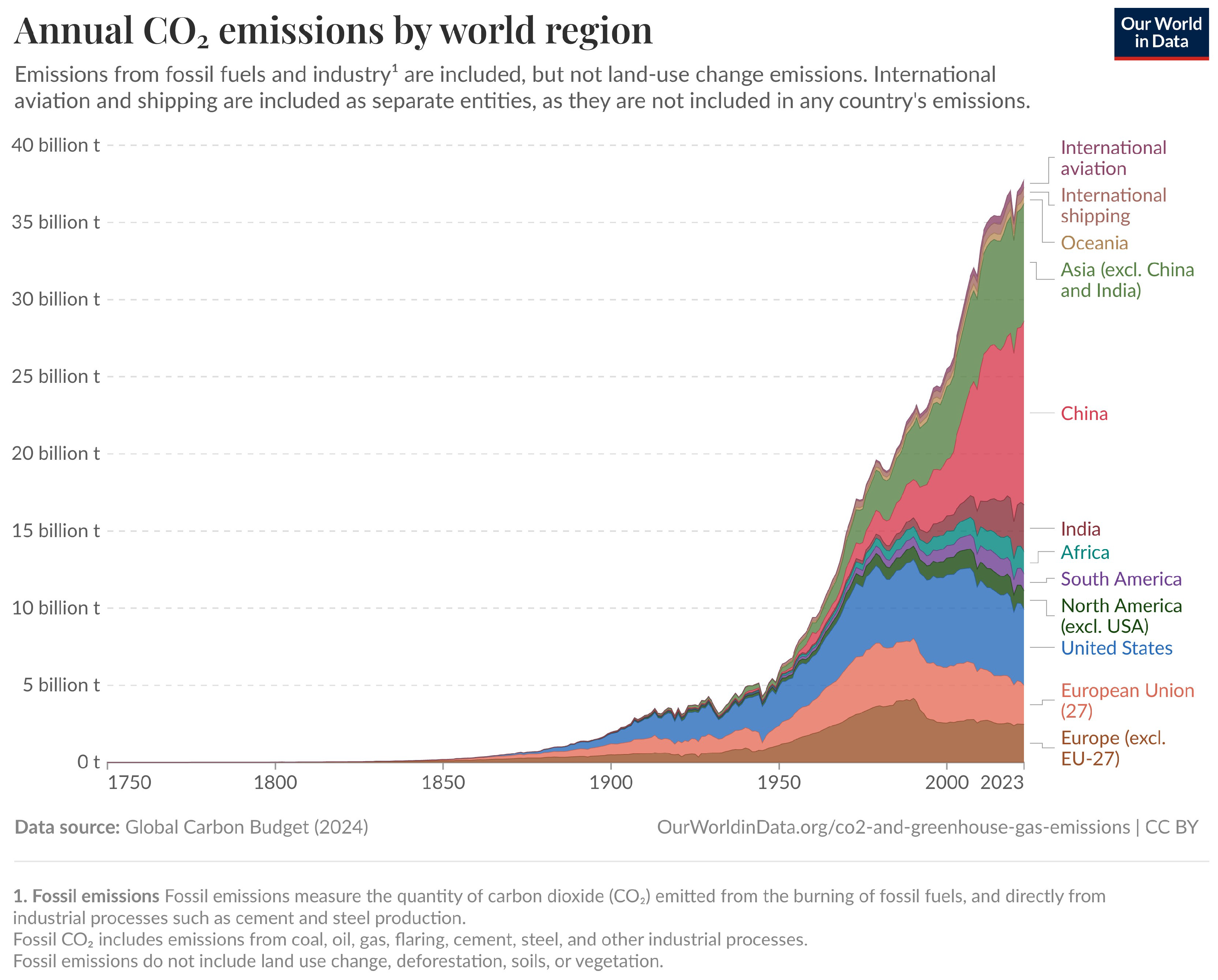

- Ritchie, H.; Roser, M. CO2 emissions. Our World in Data. 2020. Available online: https://ourworldindata.org/co2-emissions (accessed on 13 April 2025).

- Zhang, X.; Wang, W.; Yu, Y. Research on the influence of digital intelligence transformation on the new quality productivity of enterprises. Stud. Sci. Sci. 2024, 43, 943–954. [Google Scholar] [CrossRef]

- Zhang, X.; Ma, Y. Generative artificial intelligence technology empowers the emergence of new quality productive forces: Value implication, operation mechanism and practice path. e-Gov 2024, 4, 17–25. [Google Scholar] [CrossRef]

- Wang, K.; Lin, C. Can Low-Carbon Transition Impact the High-Quality Development of the Manufacturing Industry?—Experience Evidence from a Low-Carbon Pilot Policy. Sustainability 2024, 16, 10739. [Google Scholar] [CrossRef]

- Fankhauser, S.; Jotzo, F. Economic growth and development with low-carbon energy. WIREs Clim. Change 2018, 9, e495. [Google Scholar] [CrossRef]

- Jin, H.; Wang, Q.; Wu, L. Sustainable city development from the perspective of corporate green innovation and governance. Sustain. Cities Soc. 2024, 102, 105216. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Peterson, S.R.; Portney, P.R.; Stavins, R.N. Environmental Regulation and the Competitiveness of U.S. Manufacturing: What Does the Evidence Tell Us? J. Econ. Lit. 1995, 33, 132–163. [Google Scholar]

- Osório, A. Not everything is green in the green transition: Theoretical considerations on market structure, prices and competition. J. Clean. Prod. 2023, 427, 139300. [Google Scholar] [CrossRef]

- Wang, B.; Khan, I.; Ge, C.; Naz, H. Digital transformation of enterprises promotes green technology innovation—The regulated mediation model. Technol. Forecast. Soc. Change 2024, 209, 123812. [Google Scholar] [CrossRef]

- Brazzola, N.; Moretti, C.; Sievert, K.; Patt, A.; Lilliestam, J. Utilizing CO2 as a strategy to scale up direct air capture may face fewer short-term barriers than directly storing CO2. Environ. Res. Lett. 2024, 19, 054037. [Google Scholar] [CrossRef]

- Pan, J. The Development Paradigm of Ecological Civilization. In China’s Environmental Governing and Ecological Civilization; Springer: Berlin/Heidelberg, Germany, 2016; pp. 29–49. [Google Scholar] [CrossRef]

- Nie, D.; Li, H.; Qu, T.; Liu, Y.; Li, C. Optimizing supply chain configuration with low carbon emission. J. Clean. Prod. 2020, 271, 122539. [Google Scholar] [CrossRef]

- Xu, J.; Cui, J. Low-carbon cities and firms’ green innovation. Chin. Ind. Econ. 2020, 12, 178–196. (In Chinese) [Google Scholar] [CrossRef]

- Xiong, G.; Shi, D.; Li, M. The effect of low-carbon pilot cities on the green technology innovation of enterprises. Sci. Res. Manag. 2020, 41, 93–102. (In Chinese) [Google Scholar] [CrossRef]

- Zheng, Y.; Zhang, J.; Wang, M.; Liu, P.; Shu, T. Low-Carbon Manufacturing or Not? Equilibrium Decisions for Capital-Constrained News Vendors with Subsidy and Carbon Tax. Sustainability 2023, 15, 11779. [Google Scholar] [CrossRef]

- Latour, B. Telling Friends from Foes in the Time of the Anthropocene. In The Anthropocene and the Global Environmental Crisis: Rethinking Modernity in a New Epoch; Hamilton, C., Bonneuil, C., Gemenne, F., Eds.; Routledge: Oxfordshire, UK, 2015; pp. 145–155. [Google Scholar]

- Foroudastan, S.; Poe, L.; Dees, O. International Environmental Regulation for Industry. In Proceedings of the Annual Conference & Exposition, Chicago, IL, USA, 18–21 June 2006. [Google Scholar] [CrossRef]

- Lin, Z.; Lin, H.; Deng, X. Corporate Income Tax Reform and Technological Innovation of Chinese Firms. Chin. Ind. Econ. 2013, 3, 111–123. (In Chinese) [Google Scholar] [CrossRef]

- Xie, X.; Wang, R.; Hu, J. Green Process Innovation and Corporate Performance in the Context of Government’s Financial Incentive: An Empirical Study Based on Content Analysis. Manag. Rev. 2020, 32, 109–124. [Google Scholar] [CrossRef]

- Yang, L.; Song, S.; Liu, C. Green signals: The impact of environmental protection support policies on firms’ green innovation. Bus. Strategy Environ. 2024, 33, 3258–3278. [Google Scholar] [CrossRef]

- Wang, R.; Liu, L. The Impact Mechanism of Executive Incentive on Corporate Environmental Performance. In Proceedings of the 2021 2nd International Conference on Modern Education Management, Innovation and Entrepreneurship and Social Science (MEMIESS 2021), Xi’an, China, 2–4 July 2021; Atlantis Press: Dordrecht, The Netherlands, 2021; pp. 7–11. [Google Scholar] [CrossRef]

- Zhang, K.; Wan, S.; Zhou, Y. Executive Compensation, Internal Governance and ESG Performance. Finance Res. Lett. 2024, 66, 105614. [Google Scholar] [CrossRef]

- Zhu, C.; Liu, X.; Chen, D.; Yue, Y. Executive Compensation and Corporate Sustainability: Evidence from ESG Ratings. Heliyon 2024, 10, e32943. [Google Scholar] [CrossRef]

- Liu, S.X. Correct Understanding of New Quality Productive Forces under the Background of the Digital Economy. New Financ. 2024, 10, 10–12. Available online: https://kns.cnki.net/kcms2/article/abstract?v=OsVNzKNazbR4P63VzzUnpUtJfs7HSCWIXAL-D4xiyhN62e6KXK7AT9rxRPMZLNTlcKm5o7x4T5fEe1TMq5CJ_0IP_1XRSI1WFlMqwzg2D_aKGLDj40r79ZWNym4Dr887HSNC1XSLn-CZRttkyECTjsHMVnwm-FimYPhggLKNTf9lJpUN0ZXxYQxY9vin2n_o4vblLuhg068=&uniplatform=NZKPT&language=CHS (accessed on 3 July 2025). (In Chinese).

- Xie, D.; Rong, Y. Theoretical Origins, Historical Evolution, and Practical Pathways of Developing New Quality Productive Forces. Shandong Soc. Sci. 2024, 6, 5–15. (In Chinese) [Google Scholar] [CrossRef]

- Qu, S. Accelerating the Development of New Quality Productive Forces: Historical Context, Core Features, Supporting Platforms, and Pathways to Realization. Contemp. World Social. 2024, 2, 39–46. (In Chinese) [Google Scholar] [CrossRef]

- Xie, D.; Zhong, L. The Empowerment Logic of China’s New Quality Productivity. Ind. Technol. Econ. 2024, 43, 3–13+161. (In Chinese) [Google Scholar]

- Yan, Z. New Quality Productivity Forces: Emergence Context, Theoretical Connotation, and Development Path. Hunan Soc. Sci. 2024, 83–90. Available online: https://link.cnki.net/urlid/43.1161.C.20240911.1130.024 (accessed on 3 July 2025). (In Chinese).

- Guo, X.; Tang, Y. Innovative Paths for Improving the Modern Cultural Industry System Driven by New Quality Productivity Forces. Jiangsu Soc. Sci. 2024, 5, 77–86+242. (In Chinese) [Google Scholar] [CrossRef]

- Pu, Q.; Xiang, W. New Quality Productivity and Its Utilizations – New Driving Force for Chinese Modernization. J. Xinjiang Norm. Univ. (Philos. Soc. Sci.) 2024, 45, 77–85. (In Chinese) [Google Scholar] [CrossRef]

- Xiao, F.; He, J. New Quality Productivity: A New Direction of Productivity Development in the Intelligent Era. J. Nanchang Univ. (Humanit. Soc. Sci.) 2023, 54, 37–44. (In Chinese) [Google Scholar] [CrossRef]

- Gray, W.B.; Shadbegian, R.J. Plant vintage, technology, and environmental regulation. J. Environ. Econ. Manag. 2003, 46, 384–402. [Google Scholar] [CrossRef]

- Walker, W.R. The transitional costs of sectoral reallocation: Evidence from the clean air act and the workforce. Q. J. Econ. 2013, 128, 1787–1835. [Google Scholar] [CrossRef]

- Kneller, R.; Manderson, E. Environmental regulations and innovation activity in UK manufacturing industries. Res. Energy Econ. 2012, 34, 211–235. [Google Scholar] [CrossRef]

- Lanoie, P.; Patry, M.; Lajeunesse, R. Environmental regulation and productivity: Testing the porter hypothesis. J. Prod. Anal. 2008, 30, 121–128. [Google Scholar] [CrossRef]

- Porter, M.E.; Linde, C.v.d. Toward a New Conception of the Environment-competitiveness Relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Palmer, K. Environmental regulation and innovation: A panel data study. Rev. Econ. Stat. 1997, 79, 610–619. [Google Scholar] [CrossRef]

- Ramanathan, R.; He, Q.; Black, A.; Ghobadian, A.; Gallear, D. Environmental regulations, innovation and firm performance: A revisit of the Porter hypothesis. J. Clean. Prod. 2017, 155, 79–92. [Google Scholar] [CrossRef]

- Hamamoto, M. Environmental Regulation and the Productivity of Japanese Manufacturing Industries. Res. Energy Econ. 2006, 28, 299–312. [Google Scholar] [CrossRef]

- Daddi, T.; Testa, F.; Iraldo, F. A Cluster-based Approach as an Effective Way to Implement the Environmental Compliance Assistance Programme: Evidence from Some Good Practices. Local Environ. 2010, 15, 73–82. [Google Scholar] [CrossRef]

- Yu, C.H.; Wu, X.; Zhang, D.; Chen, S.; Zhao, J. Demand for green finance: Resolving financing constraints on green innovation in China. Energy Policy 2021, 153, 112255. [Google Scholar] [CrossRef]

- Liu, P.J.; Song, C.; Xin, J. Does green governance affect financing constraints? Evidence from China’s heavily polluting enterprises. China J. Account. Res. 2022, 15, 100267. [Google Scholar] [CrossRef]

- Chen, H.; Wu, H.; Zhang, L.; Tang, Y.; Lu, S. Does green financial policy promote the transformation of resource-exhausted cities? - Evidence from the micro level. Resour. Policy 2024, 88, 104500. [Google Scholar] [CrossRef]

- Macaire, C.; Naef, A. Impact of Green Central Bank Collateral Policy: Evidence from the People’s Bank of China. arXiv 2021. [Google Scholar] [CrossRef]

- Hu, Z.; Zhang, J.; Chang, C.P. AI and green credit: A new catalyst for green innovation in Chinese enterprises. Oeconomia Copernic. 2024. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, F.; Yoshino, N. Sustainable Solutions for Green Financing and Investment in Renewable Energy Projects. Energies 2020, 13, 788. [Google Scholar] [CrossRef]

- Cao, E.; Yu, M. The bright side of carbon emission permits on supply chain financing and performance. Omega 2019, 88, 24–39. [Google Scholar] [CrossRef]

- Guo, Y.; Yu, M.; Xu, M.; Tang, Y.; Huang, J.; Liu, J.; Hao, Y. Productivity gains from green finance: A holistic and regional examination from China. Energy Econ. 2023, 127, 107105. [Google Scholar] [CrossRef]

- Aghion, P.; Dewatripont, M.; Stein, J.C. Academic Freedom, Private-sector Focus, and the Process of Innovation. RAND J. Econ. 2008, 39, 617–635. [Google Scholar] [CrossRef]

- Filippelli, S.; Troise, C.; Bigliardi, B.; Corvello, V. Examining the influence of entrepreneurial ecosystem pressure on the economic, social, and environmental orientation of startups. Technol. Forecast. Soc. Change 2025, 210, 123900. [Google Scholar] [CrossRef]

- Luthra, S.; Sharma, M.; Kumar, A.; Joshi, S.; Collins, E.; Mangla, S. Overcoming barriers to cross-sector collaboration in circular supply chain management: A multi-method approach. Transp. Res. Part E Logist. Transp. Rev. 2022, 157, 102582. [Google Scholar] [CrossRef]

- Trischler, J.; Johnson, M.; Kristensson, P. A service ecosystem perspective on the diffusion of sustainability-oriented user innovations. J. Bus. Res. 2020, 116, 552–560. [Google Scholar] [CrossRef]

- Roper, S.; Vahter, P.; Love, J.H. Externalities of openness in innovation. Res. Policy 2013, 42, 1544–1554. [Google Scholar] [CrossRef]

- Wei, S.; Zhang, Z.; Ke, G.Y.; Chen, X. The more cooperation, the better? Optimizing enterprise cooperative strategy in collaborative innovation networks. Physica A 2019, 534, 120810. [Google Scholar] [CrossRef]

- Santis, R.D.; Esposito, P.; Lasinio, C.J. Environmental regulation and productivity growth: Main policy challenges. Int. Econ. 2021, 165, 264–277. [Google Scholar] [CrossRef]

- Conway, E.; Paterson, F.; Baranova, P. The Transition to a Low-Carbon Economy: A Call for Collaborative Action Towards the ‘New Normal’; Palgrave Macmillan: Cham, Switzerland, 2017; pp. 199–210. [Google Scholar] [CrossRef]

- Wang, T.; Tang, J.; Wang, X.; He, Q. Assessing capital allocation efficiency under environmental regulation. Financ. Res. Lett. 2024, 62, 105104. [Google Scholar] [CrossRef]

- Kluczek, A.; Olszewski, P. Energy audits in industrial processes. J. Clean. Prod. 2017, 142, 3437–3453. [Google Scholar] [CrossRef]

- Han, W.; Zhang, R.; Zhao, F. The measurement of new quality productivity and new driving force of the chinese economy. J. Quant. Technol. Econ. 2024, 41, 5–25. (In Chinese) [Google Scholar] [CrossRef]

- Ren, Y. Research on the green total factor productivity and its influencing factors based on system GMM model. J. Ambient Intell. Human Comput. 2020, 11, 3497–3508. [Google Scholar] [CrossRef]

- Song, J.; Zhang, J.; Pan, Y. Research on the impact of ESG development on new quality productive forces of enterprises-empirical evidence from Chinese A-share listed companies. Contemp. Econ. Manag. 2024, 46, 1–11. [Google Scholar] [CrossRef]

- State Council of the People’s Republic of China. Report on the Work of the Government, 2025. Delivered by Premier Li Qiang at the Third Session of the 14th National People’s Congress. Available online: https://www.gov.cn/yaowen/liebiao/202503/content_7013163.htm (accessed on 14 April 2025). (In Chinese)

- State Council of the People’s Republic of China. Opinions on Further Promoting the Healthy Development of Flexible Employment, 2021. Available online: https://www.gov.cn/zhengce/zhengceku/2021-12/03/content_5655701.htm (accessed on 14 April 2025). (In Chinese)

- State Council of the People’s Republic of China. Notice on Issuing the “2024–2025 Energy Conservation and Carbon Reduction Action Plan”, 2024. Available online: https://www.gov.cn/zhengce/content/202405/content_6954322.htm (accessed on 14 April 2025). (In Chinese)

- Wu, C. Studies on How New Quality Productivity Drives High-Quality Development of Enterprises. Adv. Econ. Manag. Political Sci. 2024, 94, 221–228. [Google Scholar] [CrossRef]

- Ding, Y.; Zhou, X. Research on Predicting Enterprise New Quality Productivity Based on K-Means Clustering and BP Neural Network. Trans. Econ. Bus. Manag. Res. 2024, 11, 343–351. [Google Scholar] [CrossRef]

- Ding, X.; Xu, Z.; Petrovskaya, M.V.; Wu, K.; Ye, L.; Sun, Y.; Makarov, V.M. Exploring the impact mechanism of executives’ environmental attention on corporate green transformation: Evidence from the textual analysis of Chinese companies’ management discussion and analysis. Environ. Sci. Pollut. Res. 2023, 30, 76640–76659. [Google Scholar] [CrossRef] [PubMed]

- Olley, S.; Pakes, A. The Dynamics of Productivity in the Telecommunications Equipment Industry. Econometrica 1996, 64, 1263–1297. [Google Scholar] [CrossRef]

- Yang, S.; Jahanger, A.; Hossain, M.R. How effective has the low-carbon city pilot policy been as an environmental intervention in curbing pollution? Evidence from Chinese industrial enterprises. Energy Econ. 2023, 118, 106523. [Google Scholar] [CrossRef]

- Manso, G. Motivating Innovation. J. Financ. 2011, 66, 1823–1860. [Google Scholar] [CrossRef]

- Whited, T.M.; Wu, G. Financial Constraints Risk. Rev. Financ. Stud. 2006, 19, 531–559. [Google Scholar] [CrossRef]

- Li, H.; Yin, P. Does tax refund policy boost executive compensation? Econ. Anal. Policy 2024, 84, 898–911. [Google Scholar] [CrossRef]

- Yu, Z. Environmental Protection Interview, Government Environmental Protection Subsidies and Enterprise Green Innovation. Foreign Econ. Manag. 2021, 43, 22–37. (In Chinese) [Google Scholar] [CrossRef]

- Chen, R.; Wu, L. Calculation and analysis of the efficiency of resource allocation for technological innovation in China. PLoS ONE 2024, 19, e0308960. [Google Scholar] [CrossRef]

- Richardson, S. Over-investment of Free Cash Flow. Rev. Account. Stud. 2006, 11, 159–189. [Google Scholar] [CrossRef]

- Kang, Y.S.; Kim, B.Y. Ownership structure and firm performance: Evidence from the Chinese corporate reform. China Econ. Rev. 2012, 23, 471–481. [Google Scholar] [CrossRef]

- ISO14001:2005; International Organization for Standardization. Environmental Management Systems—Requirements with Guidance for Use. ISO: Geneva, Switzerland, 2005.

| Dimension | Component | Sub-Indicator | Metric | Sign |

|---|---|---|---|---|

| Tangible Factors | Innovative Labor | Innovative Labor Quantity | R&D Personnel Share | + |

| Innovative Labor Compensation | R&D Payroll Intensity | + | ||

| Educational Attainment | Share of College-Educated Workers | + | ||

| Digital Expertise in Management | Management’s Digital Background Dummy | + | ||

| Advanced Capital | Automation Intensity | Robot Adoption Rate | + | |

| Fixed Asset Intensity | + | |||

| Infrastructure Modernization | High-Speed Rail(HSR) Access Dummy | + | ||

| 5G Infrastructure Dummy | + | |||

| Novel Inputs | Environmental Stewardship | Environmental, Social and Governance(ESG) Environmental Score | + | |

| Innovation Commitment | Direct R&D Expenditure Ratio | + | ||

| Intangible Asset Intensity | + | |||

| Intangible Factors | Technology | R&D Effort | R&D Intensity | + |

| Innovation Yield | Patent Stock (log) | + | ||

| Production System | Smart Manufacturing | Artificial Intelligence(AI) Adoption Index (log) | + | |

| Green Transition | Green Innovation (log) | + | ||

| Industrial Synergy | Information and Communications Technology(ICT)-Industry Integration Dummy | + | ||

| Digital Assets | Digital Transformation | Digitization Index (log) | + |

| Category | Variable | Mean | Median | Std. Dev. | Min | Max | N |

|---|---|---|---|---|---|---|---|

| GLCT Sub-Dimensions | Advocacy & Commitments | 0.45 | 0.46 | 0.19 | 0 | 1 | 33,768 |

| Strategic Orientation | 0.28 | 0.24 | 0.20 | 0 | 1 | 33,768 | |

| Technological Innovation | 0.03 | 0.00 | 0.07 | 0 | 0.91 | 33,768 | |

| Emissions Abatement | 0.21 | 0.19 | 0.14 | 0 | 1 | 33,768 | |

| Monitoring & Compliance | 0.02 | 0.00 | 0.04 | 0 | 1 | 33,768 |

| Category | Variable | Symbol | Mean | Med. | Std. | Min | Max | N |

|---|---|---|---|---|---|---|---|---|

| Dependent Var. | New Quality Productive Forces | 7.31 | 5.49 | 4.52 | 0.04 | 20.28 | 33,768 | |

| Core Indep. Var. | Green & Low-Carbon Transit. Index | 0.07 | 0.04 | 0.09 | 0 | 1.20 | 33,768 | |

| Control Vars. | Firm Age | 2.88 | 2.94 | 0.34 | 1.61 | 3.50 | 33,768 | |

| Firm Size (log assets) | 22.17 | 21.98 | 1.32 | 18.71 | 26.07 | 33,768 | ||

| Leverage | 0.42 | 0.40 | 0.21 | 0.06 | 0.94 | 33,768 | ||

| Capital Intensity | 2.57 | 1.94 | 2.24 | 0.40 | 15.09 | 33,768 | ||

| Liquidity Ratio | 0.58 | 0.59 | 0.20 | 0.10 | 0.97 | 33,768 | ||

| ROA | 0.04 | 0.04 | 0.07 | −0.32 | 0.27 | 33,768 | ||

| Price-to-Book | 3.92 | 2.73 | 4.30 | −2.26 | 34.02 | 33,768 | ||

| Tobin’s Q | 2.07 | 1.62 | 1.40 | −2.09 | 9.06 | 33,768 | ||

| Clean Audit Opinion | 0.97 | 1.00 | 0.18 | 0 | 1.00 | 33,768 | ||

| Largest Shareholder (%) | 34.29 | 31.95 | 14.98 | 9.09 | 84.11 | 33,768 | ||

| Control-Cash Divergence | 4.53 | 0.00 | 7.25 | 0 | 29.73 | 33,768 | ||

| Board Independence (%) | 0.38 | 0.36 | 0.05 | 0.22 | 0.57 | 33,768 | ||

| Sales Growth | 0.16 | 0.10 | 0.43 | −0.62 | 2.78 | 33,768 |

| Dependent Variable: New Quality Productive Forces (NQPF) | ||||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Core Explanatory Variable: Contemporary GLCT | Core Explanatory Variable: Lagged GLCT | |||

| GLCT | 3.118 *** | 2.476 *** | 1.447 ** | 1.552 ** |

| (0.598) | (0.597) | (0.600) | (0.634) | |

| L.GLCT | 1.441 *** | 0.703 | ||

| (0.609) | (0.532) | |||

| L2.GLCT | 1.096 * | |||

| (0.640) | ||||

| age | −0.132 | −0.310 | −0.085 | |

| (0.457) | (0.524) | (0.625) | ||

| size | 0.467 *** | 0.438 *** | 0.444 *** | |

| (0.062) | (0.065) | (0.068) | ||

| lev | −0.277 | −0.376 | −0.407 | |

| (0.227) | (0.239) | (0.253) | ||

| capital | −0.018 | −0.026 * | −0.022 | |

| (0.015) | (0.016) | (0.017) | ||

| liquid | −1.039 *** | −0.962 *** | −0.952 *** | |

| (0.211) | (0.224) | (0.241) | ||

| roa | −0.014 | 0.003 | 0.004 | |

| (0.009) | (0.010) | (0.011) | ||

| TobinQ | −1.217 *** | −1.022 *** | −1.025 *** | |

| (0.325) | (0.330) | (0.334) | ||

| PB | 0.070 *** | 0.004 | 0.009 | |

| (0.024) | (0.026) | (0.028) | ||

| AO | 0.151 | 0.123 | 0.086 | |

| (0.115) | (0.115) | (0.114) | ||

| top1 | −0.001 | 0.002 | 0.007 | |

| (0.004) | (0.004) | (0.004) | ||

| Seperation | −0.003 | −0.003 | −0.004 | |

| (0.006) | (0.006) | (0.007) | ||

| BI1 | −0.923 | −0.872 | −0.780 | |

| (0.587) | (0.601) | (0.631) | ||

| SGrow | −0.058 | −0.084 ** | −0.085 ** | |

| (0.038) | (0.039) | (0.040) | ||

| Constant | 7.085 *** | −1.879 | −0.436 | −1.149 |

| (0.043) | (1.821) | (2.022) | (2.315) | |

| Firm Fixed Effects | YES | YES | YES | YES |

| Time Fixed Effects | YES | YES | YES | YES |

| Observations | 33,768 | 33,768 | 29,258 | 24,955 |

| R2 | 0.758 | 0.761 | 0.771 | 0.781 |

| VARIABLES | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| Explanatory Variable | Dependent Variable: New Quality Productive Forces (NQPF) | ||||

| Robustness | Robustness | ||||

| Alt. Explan. Var. | Alt. Measure | PCA | Factor Analysis | TFP | |

| GLCT | 0.220 *** | 1.144 *** | 0.470 * | 0.210 *** | 0.305 *** |

| (0.043) | (0.414) | (0.084) | (0.049) | (0.106) | |

| Controls | YES | YES | YES | YES | YES |

| Firm Fixed Effects | YES | YES | YES | YES | YES |

| Year Fixed Effects | YES | YES | YES | YES | YES |

| Observations | 33,768 | 30,370 | 33,768 | 33,768 | 30,431 |

| R2 | 0.761 | 0.825 | 0.550 | 0.774 | 0.905 |

| VARIABLES | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| Sample | Alt. Class. | PSM | Entropy | DID | |

| Screening | Method | Balancing | |||

| GLCT | 2.824 *** | 2.340 *** | |||

| (0.698) | (0.588) | ||||

| GLCT_Matched | 0.227 *** | 0.191 *** | |||

| (0.069) | (0.056) | ||||

| DID | 0.367 *** | ||||

| (0.130) | |||||

| Controls | YES | YES | YES | YES | YES |

| Firm Fixed Effects | YES | YES | YES | YES | YES |

| Year Fixed Effects | YES | YES | YES | YES | YES |

| Observations | 33,768 | 33,764 | 23,352 | 33,768 | 33,768 |

| R2 | 0.760 | 0.764 | 0.788 | 0.767 | 0.760 |

| VARIABLES | (1) | (2) |

|---|---|---|

| GLCT | NQPF | |

| GLCT | 0.42 *** | |

| (0.013) | ||

| City_GLCT | 0.88 ** | |

| (0.45) | ||

| Control Variables | YES | YES |

| Firm Fixed Effects | YES | YES |

| Year Fixed Effects | YES | YES |

| Observations | 26,862 | 26,862 |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Dependent Variable: New Quality Productive Forces () | ||||||

| −0.086 *** | ||||||

| (0.027) | ||||||

| 0.219 *** | ||||||

| (0.069) | ||||||

| 5.116 * | ||||||

| (2.783) | ||||||

| 0.210 | ||||||

| (0.259) | ||||||

| 50.09 ** | ||||||

| (21.23) | ||||||

| −4.60 * | ||||||

| (2.41) | ||||||

| 0.970 *** | ||||||

| (0.283) | ||||||

| 0.155 *** | ||||||

| (0.042) | ||||||

| −2.691 *** | ||||||

| (1.209) | ||||||

| −0.090 | ||||||

| (0.088) | ||||||

| −7.499 *** | ||||||

| (3.542) | ||||||

| 0.154 | ||||||

| (0.434) | ||||||

| 1.526 *** | 2.415 *** | 1.96 *** | 1.339 *** | 3.561 *** | 2.881 *** | |

| (0.644) | (0.813) | (0.54) | (0.615) | (0.736) | (0.735) | |

| Control Variables | YES | YES | YES | YES | YES | YES |

| Firm Fixed Effects | YES | YES | YES | YES | YES | YES |

| Year Fixed Effects | YES | YES | YES | YES | YES | YES |

| Observations | 28,186 | 33,566 | 33,566 | 33,238 | 33,352 | 25,605 |

| R2 | 0.774 | 0.479 | 0.750 | 0.763 | 0.763 | 0.768 |

| VARIABLES | Firm Ownership | Carbon Emission Intensity | ||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| SOEs | Non-SOEs | High-Emission | Low-Emission | |

| GLCT | 1.754 ** | 2.382 *** | 4.526 *** | 1.045 |

| (0.841) | (0.832) | (1.095) | (0.675) | |

| Controls | YES | YES | YES | YES |

| Firm FE | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES |

| Observations | 11,378 | 22,333 | 11,542 | 21,769 |

| R2 | 0.790 | 0.755 | 0.797 | 0.747 |

| VARIABLES | Strategic Alignment | Factor Intensity | Regulatory Pressure | ||||

|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

| Clean Industries | Non-Clean Industries | Tech-Intensive | Labor-Intensive | Capital-Intensive | Heavily Polluting | Non-Heavily Polluting | |

| GLCT | 2.388 *** | 2.258 | 2.923 *** | 2.102 * | 2.464 ** | 2.608 ** | 2.631 *** |

| (0.666) | (1.745) | (1.105) | (1.205) | (1.008) | (1.016) | (0.807) | |

| Controls | YES | YES | YES | YES | YES | YES | YES |

| Firm FE | YES | YES | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES | YES | YES |

| Observations | 26,280 | 7469 | 15,732 | 11,548 | 6128 | 9518 | 24,237 |

| R2 | 0.759 | 0.753 | 0.758 | 0.758 | 0.739 | 0.738 | 0.769 |

| VARIABLES | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| Eastern | Central | Western | Northeastern | |

| GLCT | 2.500 ** | 3.088 * | 2.500 ** | 4.223 |

| (1.189) | (1.746) | (1.189) | (3.091) | |

| Controls | YES | YES | YES | YES |

| Firm FE | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES |

| Observations | 4338 | 4627 | 4338 | 1327 |

| R2 | 0.754 | 0.763 | 0.754 | 0.753 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Teng, L.; Luo, Y.; Wei, S. From Carbon to Capability: How Corporate Green and Low-Carbon Transitions Foster New Quality Productive Forces in China. Sustainability 2025, 17, 6657. https://doi.org/10.3390/su17156657

Teng L, Luo Y, Wei S. From Carbon to Capability: How Corporate Green and Low-Carbon Transitions Foster New Quality Productive Forces in China. Sustainability. 2025; 17(15):6657. https://doi.org/10.3390/su17156657

Chicago/Turabian StyleTeng, Lili, Yukun Luo, and Shuwen Wei. 2025. "From Carbon to Capability: How Corporate Green and Low-Carbon Transitions Foster New Quality Productive Forces in China" Sustainability 17, no. 15: 6657. https://doi.org/10.3390/su17156657

APA StyleTeng, L., Luo, Y., & Wei, S. (2025). From Carbon to Capability: How Corporate Green and Low-Carbon Transitions Foster New Quality Productive Forces in China. Sustainability, 17(15), 6657. https://doi.org/10.3390/su17156657