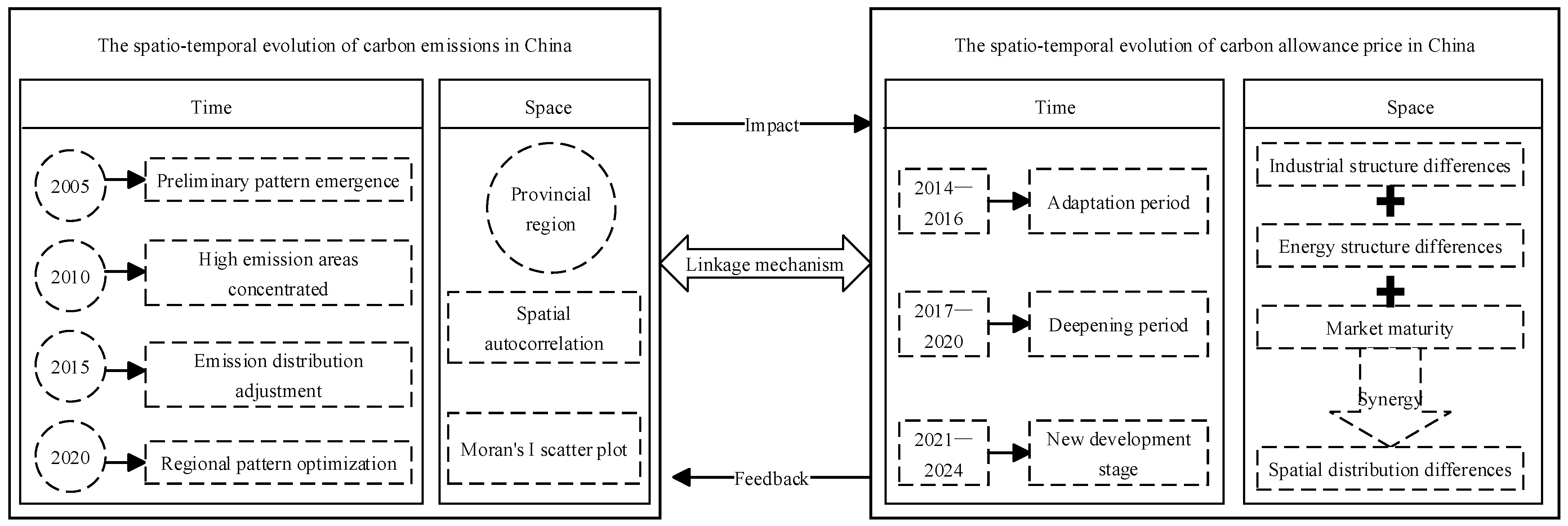

4.3.1. Analysis of the Spatio-Temporal Evolution of Carbon Emissions in China

- (1)

Temporal evolution characteristics of carbon emissions

This study employed ArcGIS 10.7 software to identify observation points for the years 2005, 2010, 2015, and 2020, categorizing the 30 provinces into five carbon emission zones: Lowest Carbon Emission Zone, Lower Carbon Emission Zone, Medium Carbon Emission Zone, Higher Carbon Emission Zone, and Highest Carbon Emission Zone. The results of the analysis are illustrated in

Figure 2.

Around 2005, the initial patterns of carbon emissions emerged, with regional disparities gradually widening. In 2005, the spatial distribution of carbon emissions in China displayed significant coastal aggregation characteristics. As illustrated in

Figure 2, emissions were predominantly concentrated in economically developed regions such as Beijing–Tianjin–Hebei, the Yangtze River Delta, and the Pearl River Delta. During this period, the national economy was in the mid-stages of industrialization, with energy-intensive industries heavily concentrated in coastal provinces. High-carbon sectors, including steel, cement, and chemicals, became the primary contributors to carbon emissions, resulting in significantly elevated emission levels in these regions compared to the central and western regions. The comparatively lower emission levels in the central and western regions were primarily attributed to their industrial structures, which remained predominantly agrarian, preventing large-scale energy consumption. Due to China’s heavy reliance on coal for energy supply, carbon emission intensity increased in northern areas rich in coal resources, such as Shanxi and Inner Mongolia, although these regions had not yet become the core areas of national carbon emissions.

Around 2010, high carbon emission areas became increasingly concentrated, and spatial agglomeration effects intensified. The spatial pattern and aggregation effects of carbon emissions in China experienced significant changes during this period. As shown in

Figure 2, the center of carbon emissions expanded from the eastern coastal regions to North China, Northeast China, and parts of the central and western regions. Resource endowments played a pivotal role in this transformation, as industries such as coal, steel, and electricity experienced agglomeration effects driven by energy supply and policy support. The implementation of the Western Development Strategy has expedited the industrialization process in provinces such as Sichuan and Guizhou, resulting in heightened energy consumption and a subsequent increase in carbon emissions. North China and Northeast China evolved into new high-carbon emission zones due to their abundant coal resources and enhanced energy supply guarantees. In provinces like Shanxi and Inner Mongolia, increased energy development based on the coal industry significantly raised carbon emissions, creating new high-emission areas. The Beijing–Tianjin–Hebei region, characterized by a robust industrial base and high energy consumption demand, exacerbated its carbon emissions, thus transforming the northern region into a high-density emission area.

Around 2015, industrial transfer and policy-driven adjustments resulted in changes to carbon emission distribution. During this period, China’s carbon emission patterns further evolved, as illustrated in

Figure 2, displaying characteristics of intensified polarization and regional differentiation. On the one hand, northern regions, notably Beijing–Tianjin–Hebei, Shandong, Shanxi, and Henan, continue to witness an increase in carbon emissions, establishing themselves as the most carbon-intensive areas in the country. Despite the national implementation of energy structural adjustments and energy-saving emission reduction policies, industries such as coal, steel, and electricity in these regions remain in a phase of peak development, hindering effective reductions in carbon emissions. On the other hand, coastal regions, including the Yangtze River Delta and the Pearl River Delta, are accelerating industrial upgrades and promoting the development of high-end manufacturing and services, resulting in a slowdown in the growth of carbon emissions. In the southwest, emissions continued to rise due to the influence of energy development and infrastructure construction. The spatial patterns of carbon emissions began to reflect regional differentiation, with emissions in the eastern coastal and some central provinces stabilizing or declining, while significant pressures persisted in northern heavy industrial bases and resource-dependent provinces.

Around 2020, the low-carbon transition accelerated, and regional carbon emission patterns were optimized. During this period, new changes emerged in the spatial distribution of carbon emissions in China, as illustrated in

Figure 2, indicating an overall trend of convergence. This improvement can be attributed to the promotion of low-carbon technologies, adjustments to the energy structure, and the establishment of a carbon trading market. In regions represented by Shanghai, Jiangsu, and Guangdong, the industrial structure increasingly shifted toward a green economy and intelligent manufacturing, resulting in a decrease in carbon emissions. In addition, the green financial reform and innovation pilot projects carried out in Zhejiang, Jiangxi, and Guangdong since 2017 have also had a positive effect on promoting carbon emission reduction in some areas by guiding the flow of financial resources to green industries, further promoting the optimization of regional structures. Concurrently, influenced by national policies aimed at achieving carbon peak and carbon neutrality, traditional high-emission areas such as Beijing–Tianjin–Hebei and Shandong accelerated energy-saving renovations and eliminated outdated production capacity, leading to an initial turning point in emissions. However, resource-oriented regions such as Shanxi, Inner Mongolia, and Shaanxi, where coal industries still predominate, did not exhibit significant short-term declines in carbon emissions. Throughout this period, the carbon emissions pattern in China exhibited a more optimized trend, particularly with notable progress in low-carbon transitions in developed coastal regions, although resource-dependent areas continued to face substantial emissions pressure.

In conclusion, the evolution of carbon emissions in China over time is characterized by distinct phases and region-specific differences. From 2005 to 2020, the distribution of carbon emissions in China experienced a northward shift, a diffusion into central and western regions, and a coexistence of convergence and differentiation. This change was influenced by adjustments in industrial structures, shifts in energy consumption patterns, and the comprehensive impact of regional economic development, policy regulation, and technological advancements.

- (2)

Spatial distribution characteristics of carbon emissions

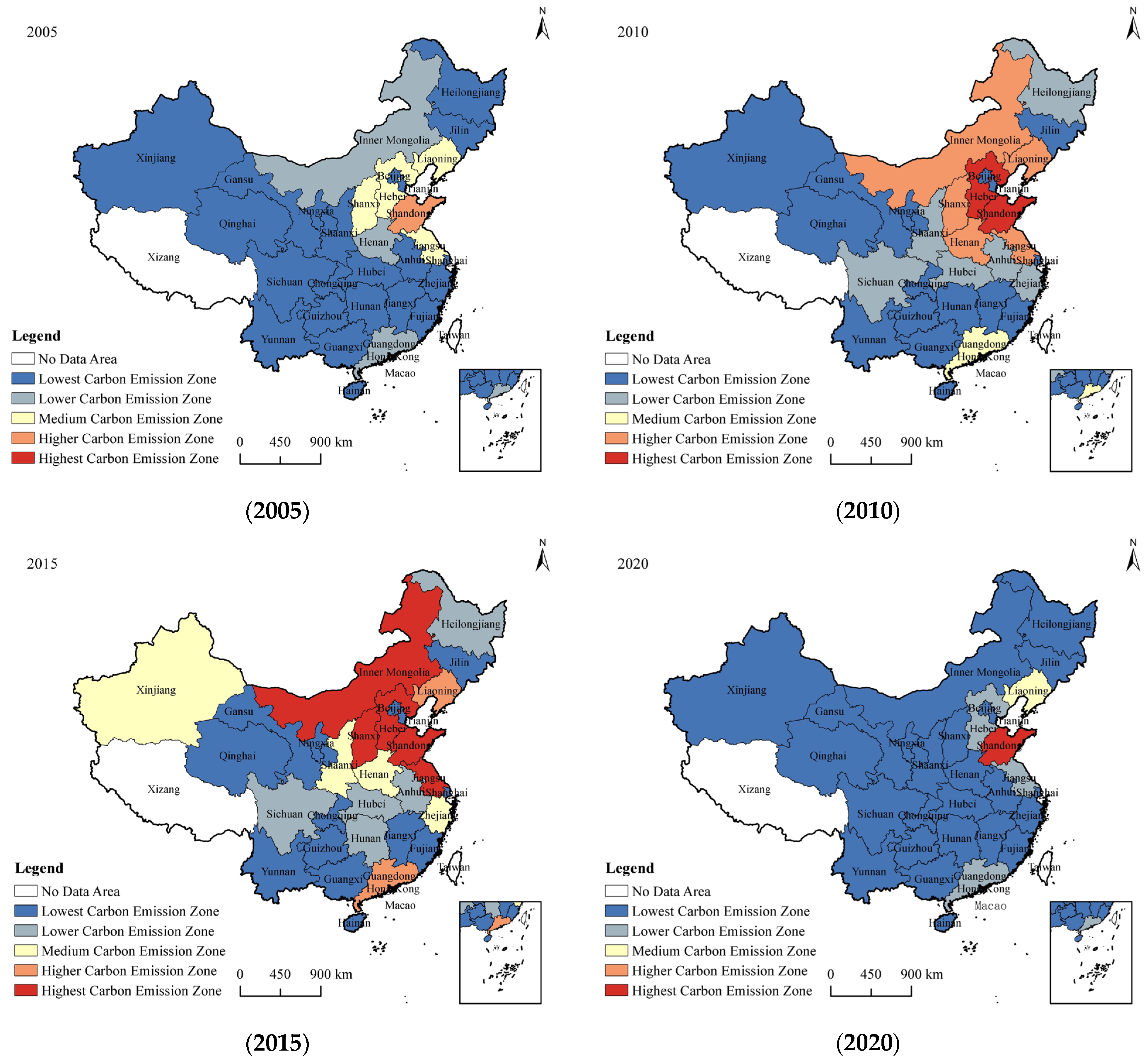

The values of Moran’s I and P presented in

Figure 3 indicate that the spatial correlation of carbon emissions gradually diminishes over time, highlighting the growing regional disparities and imbalances in carbon emissions across various regions. From 2005 to 2020, the spatial distribution of carbon emissions demonstrates distinct aggregation effects, with spatial auto-correlation and regional differences exhibiting continuous variability from year to year.

The horizontal coordinate (z) represents the standardized value of a variable within a specific region, indicating its deviation relative to all regions.

The vertical coordinate (Wz) indicates the spatial lag value for that region, defined as the weighted average of the variable among its neighboring regions.

Around 2005, the spatial aggregation effect of carbon emissions began to emerge. As illustrated in

Figure 3, Moran’s I index stands at 0.2633, with a

p-value of 0.0121, indicating a significant positive spatial correlation in carbon emissions across China in 2005. There exists a degree of clustering between geographic areas of high and low carbon emissions. Coastal provinces such as Shandong, Jiangsu, and Liaoning are situated in high–high clustering areas, characterized by relatively high self-observed values and adjacency to high-value regions, where neighboring areas also exhibit elevated carbon emission volumes. This pattern reflects characteristics of industrial concentration and energy-intensive consumption. In contrast, western and certain central regions, including Xinjiang, Guizhou, and Gansu, reside in low–low clustering areas, exhibiting low self-observed values alongside neighboring areas. These regions primarily focus on agriculture and primary industries, resulting in lower carbon emission levels. The spatial heterogeneity of carbon emissions during this period is pronounced, with coastal provinces in the east exhibiting a tendency towards high energy consumption industries, while western provinces generally show lower emissions. The clustering effect of carbon emissions is primarily influenced by energy consumption, industrial structure, and regional economic development, which establishes a foundation for subsequent spatial expansion and regional differentiation.

Around 2010, spatial expansion and clustering effects strengthened. The spatial distribution of carbon emissions demonstrated significant expansion, with Moran’s I index at 0.2437 and a

p-value of 0.0247, indicating that the spatial aggregation effect of carbon emissions nationwide remains significant, with increasingly pronounced clustering effects. As highlighted in

Figure 3, regions with high carbon emissions are no longer confined to eastern and coastal areas; regions such as North China and Northeast China have also experienced a substantial increase in carbon emissions, particularly in Shanxi and Inner Mongolia, where high-carbon-emission industries, such as coal and steel, dominate. This trend has resulted in notable growth in carbon emissions. Furthermore, the promotion of the Western Development policy has led to rising carbon emissions in areas like Sichuan and Guizhou, indicating a notable trend of spatial expansion. Although carbon emissions in coastal eastern regions remain elevated, noticeable increases in emissions have also begun to emerge in northern and central-western areas. The spatial aggregation effect of carbon emissions in China has been further enhanced, revealing significant regional disparities and imbalances, particularly with rising emissions in central–western regions, pointing to a spatial expansion trend in carbon emissions.

Around 2015, regional disparities intensified, accompanied by a slight decrease in spatial auto-correlation. The spatial distribution characteristics of carbon emissions underwent further change, with a Moran’s I index of 0.2237 and a p-value of 0.0286, indicating a decrease in auto-correlation compared to the prior two years. Provinces exhibiting high carbon emissions are predominantly concentrated in economically developed regions such as Beijing–Tianjin–Hebei, the Yangtze River Delta, and the Pearl River Delta. Notably, carbon emissions in Shandong, Shanxi, and Henan continue to rise, establishing these areas as major sources of carbon emissions. Traditional energy and high-energy-consuming industries remain highly concentrated in these regions, sustaining a pronounced spatial aggregation effect for carbon emissions. In contrast, the growth rate of carbon emissions in some coastal areas, such as Jiangsu, Zhejiang, and Guangdong, has decelerated, largely due to industrial structural adjustments and the promotion of green, low-carbon technologies. During this period, regional disparities have intensified, with carbon emissions in eastern coastal and certain central regions stabilizing or declining, while carbon emissions pressures in northern and resource-based areas remain high, highlighting evident spatial differentiation.

Around 2020, the optimization of carbon emission patterns occurred alongside a weakening of spatial correlation. The carbon emission pattern in China has been further optimized, with Moran’s I value decreasing to 0.1185 and a p-value of 0.2486, indicating a significant reduction in spatial auto-correlation, along with increasingly evident regional disparities. Since 2017, China has launched pilot green financial reform and innovation programs in Zhejiang, Jiangxi, and Guangdong, guiding the flow of resource allocation to green and low-carbon industries through green credit, green bonds, and other financial instruments. This mechanism has significantly facilitated the low-carbon transformation of some developed coastal regions, promoting the accelerated upgrading of their industrial structure to smart manufacturing and green services. Because of this, the growth rate of carbon emissions in places such as Shanghai, Jiangsu, and Guangdong has slowed down significantly or even shown a downward trend. Traditional high-carbon emission areas such as Beijing–Tianjin–Hebei and Shandong face considerable pressure for emissions reduction. Influenced by national carbon peaking and carbon neutrality policies, carbon emissions in these regions have slowed. Resource-based regions such as Shanxi, Inner Mongolia, and Shaanxi are still at a high carbon emission level due to the fact that coal and other high-carbon industries are still dominant, and the penetration of green financial mechanisms is limited. Overall, the spatial distribution of carbon emissions in 2020 exhibits a clear trend towards optimization, with further reductions in emissions in developed eastern areas, while certain resource-based regions in the central–west still experience substantial carbon emission pressures.

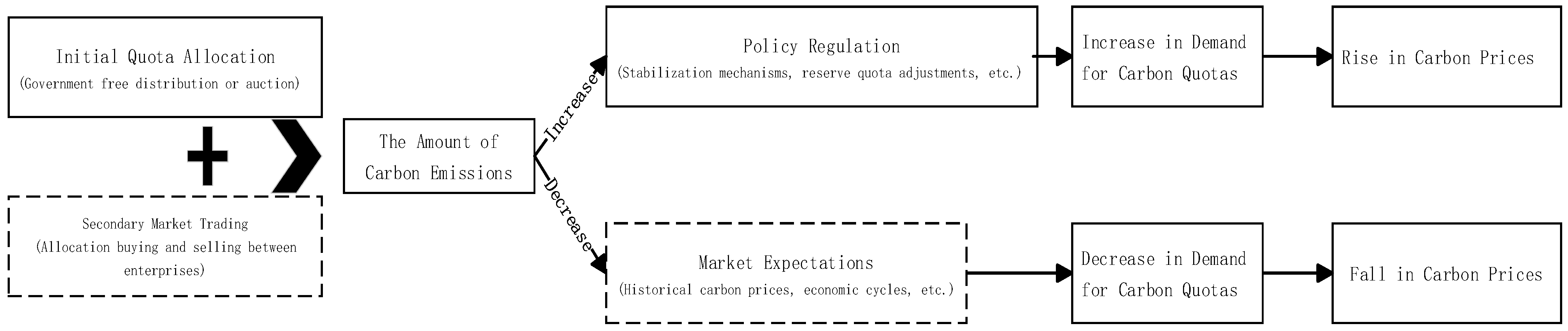

4.3.2. Analysis of the Spatio-Temporal Evolution of Carbon Allowance Price in China

- (1)

Temporal evolution characteristics of carbon allowance prices

Since the implementation of the pilot program, China’s carbon emissions trading market has transitioned from initial exploration to gradual deepening, ultimately leading to the establishment of a unified national market. The temporal evolution of carbon allowance prices is influenced by various factors, including policy direction, market supply and demand, and macroeconomic cycles. The expansion of the scope of market participants at different stages and the trend towards the financialization of carbon allowances would also have an impact on the price formation mechanism and volatility characteristics. As illustrated in

Figure 4, the carbon trading market remained immature during its early stages, exhibiting significant price fluctuations and distinct experimental characteristics across regional markets. With continuous improvements in the carbon market, the trading mechanism has been progressively optimized, resulting in a discernible upward trend in overall carbon prices.

In 2014–2016: The carbon market was in its infancy, characterized by low prices and minimal fluctuations. As shown in

Figure 4, the carbon allowance prices in various pilot cities remained relatively low, reflecting the market’s early stage of development. The trading mechanisms across different regional carbon markets were still being explored, resulting in low market activity and price levels that were quite similar across areas. During this period, significant regional price disparities emerged; Beijing and Shenzhen exhibited relatively higher prices, indicating more mature market mechanisms, whereas prices in Hubei and Guangdong were lower, suggesting that these markets were still undergoing supply–demand adjustments. The market’s immaturity resulted in pronounced price volatility; for instance, the carbon price in Beijing reached 54.95 CNY/ton in 2014 but dropped to 47.56 CNY/ton in 2015, with significant declines also observed in Guangdong. During this phase, market mechanisms had not yet been fully established, the scope of market participants was narrower, the trading volume was smaller, and the carbon price was mainly affected by the quota allocation and the willingness of enterprises to participate.

In 2017–2020: Market mechanisms improved, accompanied by rising prices and significant regional differentiation. The gradual enhancement of market mechanisms led to a general increase in price levels and noticeable price differentiation across regions. As illustrated in

Figure 4, the carbon allowance prices in Beijing, Shanghai, and Guangdong displayed increased volatility, with market transactions becoming more active. The average and median prices in some regions rose, indicating a growing market demand. However, prices in Fujian and Chongqing remained low, reflecting disparities in the development of carbon markets across various regions. During this period, some areas began to introduce paid quota trading, which increased trading volumes and progressively moved carbon allowance prices toward supply–demand equilibrium. Some pilot regions had begun to explore the use of carbon quotas as financial assets for financing collateral or derivative product design, and the financial attributes of carbon quotas had been gradually enhanced, increasing the market’s sensitivity to price and volatility. The acceleration of global climate governance and domestic energy restructuring bolstered expectations regarding carbon emission costs, further driving up carbon prices. This upward trend indicates that these regions established relatively stable quota allocation mechanisms and market operation rules during the pilot phase, with market demand gradually expanding due to policy encouragement.

From 2021 to Present: The national carbon market was initiated, experiencing rising prices and increased volatility. As shown in

Figure 4, market prices in Beijing, Shanghai, and other regions have significantly increased, with further expansion in price volatility; notably, the gap between the highest and lowest prices in Beijing has widened, reflecting a more mature market mechanism and increased trading activity. The mechanism for forming national carbon prices is gradually being unified, and the trading rules across regional carbon markets are becoming more consistent, enhancing market liquidity and broadening participation, which collectively contributes to an overall increase in carbon prices. Following the national targets for carbon peaking and carbon neutrality, the trading mechanisms in pilot markets continue to improve, leading to significant increases in companies’ demand for carbon quotas. After 2022, prices rebounded again, particularly in Beijing, Guangdong, and Shanghai, all of which reached new highs, demonstrating that the functioning of the national carbon market has revealed its incentive effects on local markets. Differences in the allocation of allowances, the pace of sectoral inclusion, and the use of financial instruments in different regions continue to influence carbon price movements during this period. The establishment of a unified national carbon market will have profound long-term impacts on market trends, although further convergence of prices across regions may still require time.

- (2)

Spatial distribution characteristics of carbon allowance prices

Significant differences exist in the spatial distribution of carbon allowance prices across various regions in China, as illustrated in

Figure 5. This regional characteristic is influenced not only by market supply and demand dynamics but is also closely related to industrial structure, energy structure, and market maturity. Variations in industrial structure determine the intensity of demand within the carbon market, while energy structure affects the supply levels. Additionally, market maturity influences trading activity and price stability in the carbon market.

Differences in industrial structure directly affect carbon prices. In regions such as Beijing, Shanghai, and Guangdong, robust economic development and the concentration of energy-intensive industries lead to strong demand in the carbon market. As shown in

Figure 5, carbon prices have consistently remained high. In 2023, the carbon price in Beijing reached 101.14 CNY/ton, while prices in Shanghai, Guangdong, and other regions ranged from 60 to 75 CNY/ton. In contrast, regions like Hubei and Chongqing primarily consist of traditional manufacturing and energy industries, resulting in higher carbon emissions and a relatively low number of market participants, which contributes to lower carbon prices. In 2023, the carbon prices in Hubei and Chongqing were 45.79 CNY/ton and 35.10 CNY/ton, respectively.

Differences in energy structure also influence the spatial distribution of carbon prices. Coastal regions have a relatively optimized energy structure, with a higher proportion of non-fossil energy. This situation results in higher carbon emission costs and increased pressure on companies to reduce emissions, leading to robust demand in the carbon market and sustained high carbon prices. Conversely, the central and western regions primarily depend on coal as their major energy source. Although these regions exhibit high carbon emissions, the slow pace of industrial upgrading and lower participation in carbon trading lead to reduced market activity and lower carbon prices. With the advancement of the national carbon market, carbon prices in the central and western regions are gradually increasing, and a trend toward market integration is beginning to emerge.

Market maturity is another critical factor influencing regional differences in carbon prices. The carbon markets in the eastern coastal regions were established earlier, boasting more refined trading rules and numerous market participants, which contribute to lower price volatility. In contrast, the carbon markets in the central and western regions remain in the development stage, characterized by fewer market participants and insufficient liquidity, resulting in greater price volatility. Furthermore, regulatory oversight and policy enforcement by local governments significantly impact carbon prices. In cities like Beijing and Shanghai, government regulation of the carbon market is relatively stringent, allowing carbon prices to remain elevated over time. Conversely, in regions where policy enforcement is weaker, maintaining high carbon prices presents more challenges.

As the national carbon market continues to deepen, regional disparities in carbon prices may gradually diminish. However, due to substantial differences in industrial foundations and energy structures across regions, the differentiation in carbon prices is likely to persist for an extended period. In the future, as carbon market mechanisms improve, carbon prices in the central and western regions are expected to gradually converge with those in the eastern regions, resulting in a more balanced development of the carbon market.

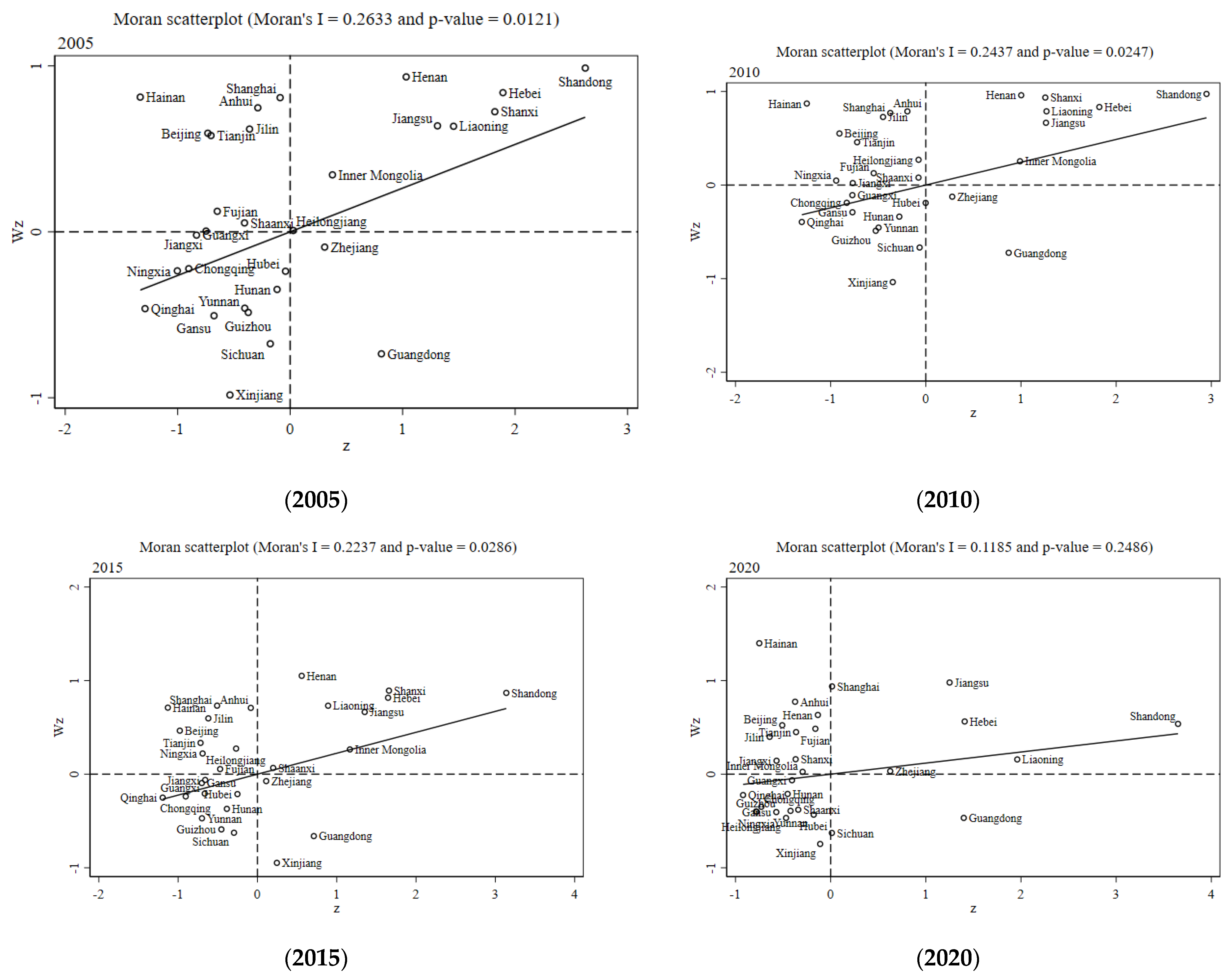

4.3.3. Analysis of the Interaction Mechanism Between Carbon Emissions and Carbon Allowance Prices

- (1)

Analysis of Theoretical mechanisms

The relationship between carbon emission volumes and carbon prices demonstrates complex dynamic characteristics within a market economy. Theoretically, carbon allowances, as tradable assets, have their prices primarily dictated by market supply and demand. Changes in carbon emissions directly impact the supply and demand relationship for carbon allowances, indicating a significant correlation between these two factors. However, the development of the carbon market in China has introduced multiple influencing factors, leading to instability in their interaction.

From a temporal perspective, the correlation between carbon emission volumes and carbon prices during the early stages of China’s carbon market was relatively weak. This weakness was primarily attributed to underdeveloped market mechanisms and delayed supply mechanisms for carbon allowances, which hindered the effective reflection of actual changes in carbon emissions through carbon prices. Following the launch of the pilot market in 2013, carbon allowances were allocated based on historical emission levels, resulting in a surplus and relatively stable fluctuations in carbon prices. Nevertheless, as the carbon market evolved, increases in carbon emissions gradually heightened market demand, leading to greater price volatility, particularly during the preparation phase of the national carbon market in 2017, when significant fluctuations in carbon prices were noted in some pilot regions.

From a spatial perspective, the correlation between carbon emission volumes and carbon prices exhibits significant regional variations. Areas with higher carbon emissions, such as Guangdong and Hubei, tend to have higher carbon allowance prices. Conversely, in regions with lower carbon emissions, like Shenzhen, the prices of carbon allowances display stronger characteristics of market regulation. This disparity is closely associated with regional industrial structures, energy consumption patterns, and the intensity of policy implementation. In Guangdong Province, where manufacturing is concentrated in cities such as Guangzhou and Foshan, carbon emissions are relatively high, resulting in active market transactions and pronounced price fluctuations. In contrast, Shenzhen’s industrial structure is more aligned with low-carbon development, leading to a more stable supply and demand in the carbon market and relatively smaller fluctuations in carbon prices.

Changes in carbon emissions serve as direct drivers of the supply and demand dynamics within the carbon market, playing a crucial role in shaping carbon allowance prices. In a well-functioning market, an increase in carbon emissions signals a rise in market demand for carbon allowances, subsequently driving up carbon prices. Conversely, a decrease in carbon emissions may result in reduced market demand, exerting downward pressure on carbon prices. However, the actual operation of the carbon market in China reveals that this relationship is not linear and is influenced by a multitude of factors, including policy decisions, market expectations, and trading behaviors. The impact mechanism is illustrated in

Figure 6:

Policy regulation plays a significant role in shaping the relationship between variations in carbon emissions and carbon prices. During the early stages of the carbon market’s operation, carbon allowances were primarily distributed at no cost, resulting in relatively low pressure on enterprises to reduce carbon emissions. Even with increases in carbon emissions, this did not necessarily trigger a corresponding rise in carbon prices. As the market mechanism evolved, the government gradually introduced paid allowance trading and enhanced carbon reduction assessments, thereby establishing a more direct relationship between changes in carbon emissions and carbon prices. Following the official launch of the national carbon market in 2021, the power industry was among the first sectors integrated into the market. Due to its substantial carbon emissions, market demand surged, driving carbon prices up from an average of CNY 30 per ton during the pilot phase to nearly CNY 60 per ton.

Market expectations are crucial in this context. Prior to the launch of the national carbon market, concerns over tightening carbon allowances led some enterprises to preemptively purchase large quantities of allowances, thereby increasing both market demand and carbon prices. Furthermore, market expectations can amplify price volatility. When enterprises anticipate a rise in carbon prices, they tend to accumulate allowances, further driving up prices; conversely, if they expect a decline in carbon prices, they may liquidate their holdings, resulting in price fluctuations. Additionally, market expectations influence enterprises’ investment decisions related to emissions reductions. If long-term increases in carbon prices are anticipated, companies may boost their investments in low-carbon technologies to mitigate future compliance costs. Ultimately, market expectations not only affect short-term price volatility but also shape long-term price trends in the carbon market to a considerable extent.

Carbon allowance price serves as a crucial regulatory instrument within the carbon market, influencing not only the trading behavior of enterprises but also generating feedback effects on overall carbon emissions, as illustrated in

Figure 7. An increase in carbon prices may incentivize enterprises to expedite their emissions reduction efforts, whereas fluctuations in carbon prices can induce more cautious decision-making regarding emissions reductions among companies.

As carbon prices continue to rise, the cost of carbon emissions for enterprises increases, directly promoting the adoption of low-carbon technologies and the optimization of industrial structures. In the Guangdong carbon market, high-carbon-emission industries such as steel and electricity have accelerated energy-saving renovations and technological upgrades in response to rising carbon prices. Some enterprises have reduced carbon emission intensity by improving energy utilization efficiency, thereby decreasing the demand for carbon allowances, which results in a suppressive effect of carbon prices on emissions. However, if carbon prices rise too rapidly, enterprises may face excessive short-term emission reduction pressures, negatively impacting their production and operations and potentially triggering market fluctuations. Therefore, reasonable control of carbon price volumes and the assurance of stable carbon market operations are crucial for achieving long-term emission reduction targets.

The impact of carbon price fluctuations on enterprises’ carbon emission decisions is intricate. In situations of significant market volatility, some enterprises may opt to delay carbon reduction investments to mitigate the operational pressures arising from short-term cost increases. During the initial phase of the national carbon market’s launch, some enterprises chose to curtail trading rather than actively pursue emission reduction measures, primarily due to uncertainty regarding carbon price trends. This, to some extent, weakened the regulatory impact of the carbon market. Thus, stabilizing expectations within the carbon market and minimizing the magnitude of carbon price fluctuations is essential for enhancing the market’s regulatory effectiveness.

- (2)

Empirical test results

In order to further verify the linkage mechanism between carbon emissions and carbon allowance price, this study selects the data of carbon emissions and carbon allowance price of Shanghai from 2013 to 2024 and constructs the Vector Autoregressive (VAR) model to carry out empirical research.

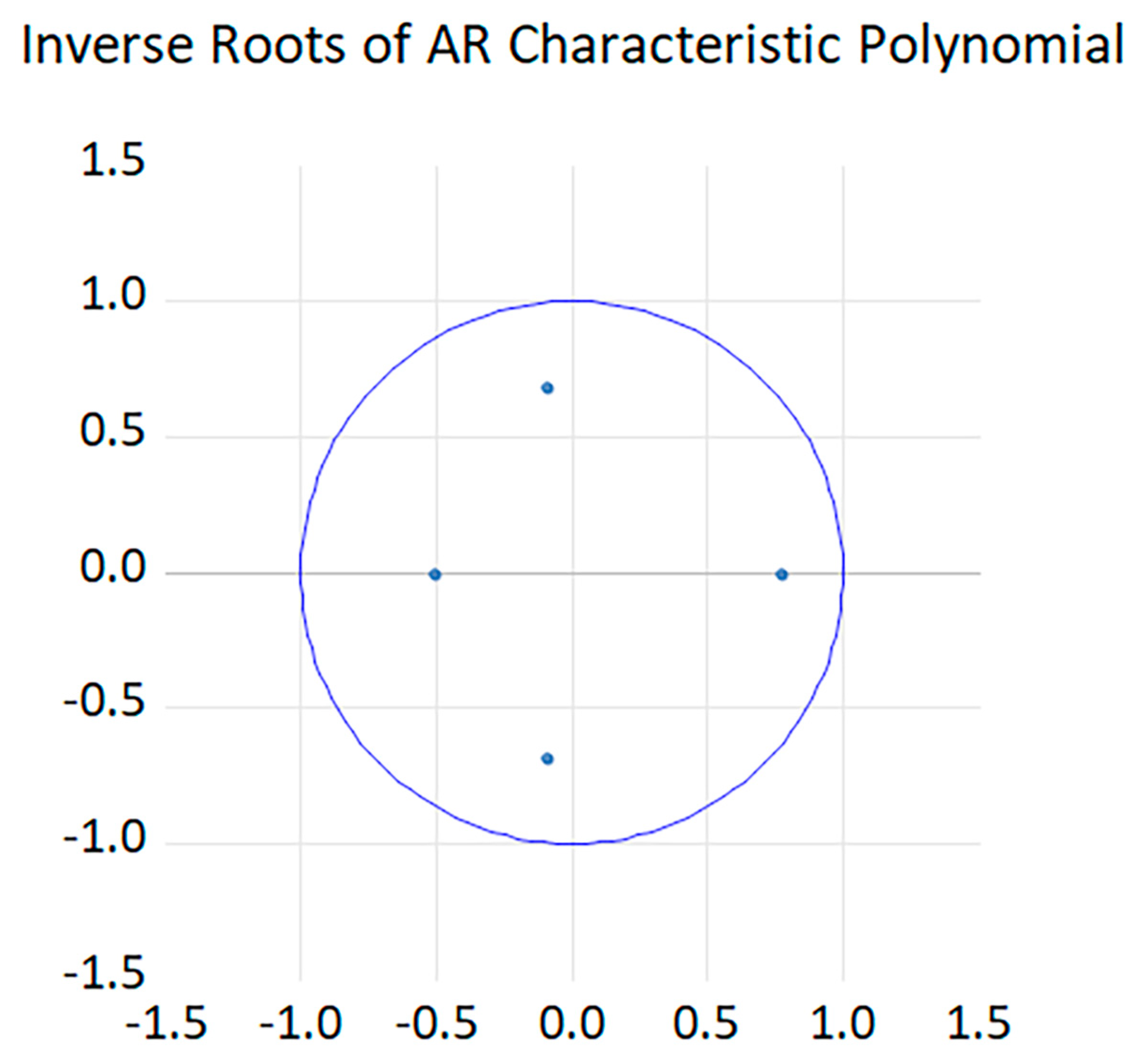

First, the VAR model is constructed after the smoothness test of the variables, and the inverse root plots of the AR characteristic polynomials, as shown in

Figure 8, are used to test the model stability. All characteristic roots are located within the unit circle, indicating that the model is stable and feasible.

Subsequently, a variance decomposition analysis is conducted to explore the explanatory structure between carbon emissions and carbon prices. The results of the decomposition are shown in

Figure 9, which shows that the explanatory ability of carbon allowance price to the fluctuation of carbon emission increases period by period: it is about 30% in the first period and then rises to more than 60% after the fifth period, which indicates that the change in carbon price plays a more and more important role in the fluctuation of carbon emission. Correspondingly, the degree of explanation of carbon emissions on carbon price fluctuations reaches more than 50% in the first period and remains stable in the later period, reflecting the continuous influence of carbon emission levels on price expectations in the carbon market. This result suggests a strong bi-directional explanatory relationship between the two.

To further elucidate the dynamic transmission mechanism, this paper conducts a shock response analysis. As illustrated in

Figure 10, when the carbon price experiences a positive shock, carbon emissions exhibit a negative response in the first period, reach their maximum inhibitory effect in the second to fourth periods, and subsequently level off. This trend indicates that an increase in carbon prices can effectively inhibit carbon emission behavior, demonstrating the efficacy of the carbon market price mechanism in regulating enterprises’ emission reduction activities and validating the carbon price feedback effect mechanism proposed in the theoretical framework. Conversely, when carbon emissions undergo positive shocks, the carbon price begins to rise in the second period and gradually declines in the subsequent periods. This outcome aligns with the mechanism whereby carbon emissions influence the supply and demand for carbon allowances, thereby driving up the carbon price, as outlined in the theoretical section. Furthermore, fluctuations in carbon emissions positively impact carbon prices by shaping market expectations regarding future quota constraints, reflecting the dual mechanism of supply, demand, and expectations within the carbon market.

In summary, there is a significant linkage mechanism between the carbon allowance price and carbon emissions in Shanghai, and the carbon price can not only guide the emission reduction behavior but also be affected by the fluctuation of emission level. As one of the regions with more complete trading mechanisms in the domestic pilot market, Shanghai’s carbon trading mechanism is more mature, and its data quality and market activity are at the forefront of the pilot cities. Its carbon emission behavior is more sensitive to the feedback of carbon price, which can better reflect the operating characteristics of the market mechanism. Therefore, taking Shanghai as an example to carry out impulse response and variance decomposition analysis helps to reveal the linkage mechanism between carbon emissions and carbon allowance price and also provides valuable experience reference for the improvement of the national carbon market.