1. Introduction

The effects of technological innovation on economic growth have long been debated in the economics literature. At the beginning of the 20th century, Kondratiev argued that technological breakthroughs are the cause of long-run economic cycles [

1], and Solow [

2] proved that technological progress is responsible for output growth that cannot be explained by capital and labor productivity. In contrast, Lucas [

3] and Romer [

4] argued that technology promotes long-run growth through the diffusion of knowledge (spillover effects), which is not only an economic phenomenon but also improves social welfare, ranging from education to health, infrastructure to income distribution. However, it is also emphasized that technological progress does not reduce income inequality. Some studies argue that technology worsens income inequality (IEQ) by widening the gap between skilled and unskilled labor in terms of its effects on labor productivity and wage structure [

5,

6,

7,

8]. This has led to a debate in the economic literature on the Kuznets Curve and whether economic growth leads to income inequality.

Kuznets [

9] argued that higher income levels and economic growth will lead to higher inequality in the early stages of industrialization and economic growth, while a long-run inverse U-shaped relationship in IEQ follows as a country develops and approaches a steady state of growth. The Kuznets Curve (KC), which is widely accepted in the literature, has shaped the development literature for many years and encouraged other studies. However, it is insufficient to explain the new income distribution dynamics created by technological change. Therefore, the Technological Kuznets Curve (TKC) hypothesis was developed to understand the time-varying effects of technological developments on IEQ [

10].

TKC refers to an approach that highlights that the effects of technological advancement on IEQ are not static but dynamic over time [

11]. Technological innovations in this framework can thus temporarily exacerbate income inequalities because they confer a competitive edge on high-skilled labor and capital-intensive industries. But over time, this asymmetry tended to diminish as technology became more widely distributed throughout the economy, workers learned new skills, and public policies intervened [

12]. As the widespread effects of technology modify not just growth but income distribution too, the TKC approach stresses the need to address technological transformation processes from a social justice perspective [

13]. Here, it is argued that the two sides of the TKC (technology and knowledge) interact, in the sense that the increase in technological innovation increases productivity and incomes; however, when the initialization terms have an exclusive nature, without access mechanisms, inequality is left behind [

14]. Accordingly, based on the literature on knowledge spillovers and skill-biased technological change (SBTC), it is argued that while technological innovations support productivity and income growth, these gains can be unequally distributed. While inequality can increase without inclusive mechanisms for access to technology, technology can be a powerful tool for reducing inequality when supported by public policies such as skills development, social support, and digital inclusion [

8]. So, it is argued that developed countries and developing countries have to think of innovative areas, and social and economic components of policy in order to reduce inequality alongside innovative components. In this framework, the TKC approach brings to the agenda not only the economic impacts of technological development, but also the social inclusiveness of technological transformation, in line with Sustainable Development Goals (SDGs), one of the global goals for reducing inequalities.

The SDGs are a set of global goals created by the United Nations. They aim to make development more inclusive and fair. The programme has 17 targets to achieve by 2030. One of these targets is SDG-10, entitled “Reducing Inequalities”, which includes targets to reduce inequalities in income, opportunity, and access between and within nations. The subcomponents of this goal include SDG-10.1, which states that the income growth rate of the bottom 40 percent of society should be higher than the average income growth rate and SDG-10.2, which aims at promoting equal opportunities for all individuals to participate in social life, increasing their economic, social and political inclusion. In line with the TKC hypothesis, the extent to which the opportunities created by technological innovations can be utilized (inclusiveness and efficiency) is directly related to the targets of SDG-10. In this context, it is crucial that public policies are shaped in line with SDG-10 targets so that technology can be a tool that balances inequality rather than deepens it. At this point, the TKC hypothesis, which argues that the impact of technological development on inequality can change over time and can be reversed when guided by appropriate policies, provides a powerful theoretical framework to explain this process.

The TKC hypothesis suggests that the impact of technological progress on IEQ may change over time, and that this relationship may follow an inverted U-shaped course, initially increasing inequality, but after a certain threshold, it may produce decreasing effects. This dynamic structure emphasizes that the impact of economic growth on inequality is not static, and that the direction of this process largely depends on the quality of public policies. In this respect, SDG-10 (Reducing Inequalities) has a strong parallelism with the TKC hypothesis. In fact, growth itself is not the only way to reduce inequality; redistributing growth across all segments of society is also key to reducing inequality. While technological advances may initially increase inequalities by favoring those who can offer highly skilled labor and have wealth in the form of capital, such effects can be avoided in the long run through targeted policy action. In realizing this balance, directing public spending towards education, skills development, and social protection in line with SDG-10, which aims to reduce income inequality, plays a critical role [

15]. Furthermore, expanding financial access, making digital transformation policies inclusive, and integrating low-income groups into innovation processes will ensure that technology creates opportunities for the whole of society, not just for capital owners and the highly skilled [

16]. Thus, the increase in welfare generated by technological progress can become a stabilizing factor rather than deepening income inequality. In this context, growth policies need to be shaped by technological transformation processes that prioritize not only economic development but also social justice. The success of this transformation depends on the orientation of inclusive public spending. Therefore, technological progress needs to be considered not only in the context of growth but also in the context of SDG-10 by emphasizing the stabilizing role of public spending. In line with this perspective, this study is primarily related to SDG-10, namely “Reducing Inequalities” and aims to empirically examine whether technological innovations in Türkiye follow a course in line with the TKC hypothesis, as well as to assess the stabilizing role of public expenditures.

The approach to the relationship between growth and inequality developed by Kuznets in 1955 has been updated several times in the intervening years, adapted to different dimensions, and reinterpreted in the light of various social, economic, and technological transformations. In particular, in the 2020s, when digitalization, automation, and the transition to a knowledge-based economy are accelerating, the TKC hypothesis, developed to explain the impact of this transformation on income distribution, offers a dynamic and policy-interactive framework that goes beyond the classical model. In this context, testing the validity of the TKC hypothesis for Türkiye, which is a G20 country and continues its full membership negotiations with the European Union, is extremely important not only at the theoretical level but also in terms of guiding development policies. Although the Turkish economy has periodically regained growth momentum, this has largely been due to cyclical fluctuations, and it still lags behind advanced economies in the widespread and equitable use of technology at the societal level. Depending on the sophistication of technology and the extent to which it is used in society, this can exacerbate income inequality. Analyzing the effectiveness of public spending in this context, while testing the TKC hypothesis in the case of Türkiye, contributes to the development of a policy perspective that is directly in line with SDG-10. Therefore, the priority of this study is to carry forward the inequality debates established in 1955 to the 2020s through the TKC hypothesis, to reveal the impact of technological transformation on income distribution in Türkiye, to analyze the stabilizing role of public expenditure in this process, and to relate the findings obtained to SDG-10 and its subcomponents. Thus, the aim is to provide policymakers with an analysis of the impact of technological transformation on IEQ and the determinant role of public expenditure in a developing economy in a current and local context.

This study aims to examine whether the TKC hypothesis is valid in Türkiye. In this respect, it can be argued that the study can make several important contributions. The first one is that the study provides a contribution to the literature on the TKC approach, and the second one is to fill the gap in the absence of a study in this context for the Turkish economy. Secondly, investigating the impact of public expenditures in Türkiye in line with the goal of reducing IEQ, which is one of the SDGs, is also among the findings that can be obtained. For this purpose, in line with the related literature, the Gini coefficient is chosen as an indicator of IEQ and the number of patents as an indicator of technological innovation in Türkiye for the period 1990–2021. Third, in order to take into account the neglected structural breaks and to obtain stronger empirical results, the methodological framework based on Fourier approximations is adopted in the empirical analysis of the study. Lastly, the Fourier DOLS and Fourier CCR methods are used to test the robustness of the long-term coefficient estimates. These estimators, in addition to taking structural breaks into account by using Fourier functions, provide robust and consistent estimates in terms of avoiding autocorrelation and endogeneity problems.

The structure of this paper is outlined as follows. The next section will focus on a review of the relevant theoretical and empirical literature, the contribution of the study to the literature, and the development of hypotheses. The methodology is described in

Section 3. Empirical findings are displayed in

Section 4. In

Section 5, the results are discussed, and the paper is concluded by providing some conclusions and policy recommendations in

Section 6.

4. Empirical Findings

At the initial stage of the empirical analysis, the unit root tests of the variables were performed with ADF and FADF tests and are offered in

Table 2. Accordingly, only for the lnTECH series, the Fourier terms are significant according to the F test. Therefore, FADF results for the lnTECH series and ADF results for other series are interpreted. These results show that all series become are I(1). From this point of view, the FADL approach can be used for cointegration.

The second stage of the empirical analysis focuses on the examination of the cointegration relationship among the variables, employing the FADL approach as outlined in

Table 3. The data shown in

Table 3 demonstrate that the absolute value of the test statistic for the ADL (2,1,1,1,2) model surpasses the critical value at the 5% significance level. It is concluded that a cointegration relationship exists between the variables in this context. Accordingly, Hypothesis 3 cannot be rejected. There is a long-run interaction between quantitative developments in patent applications, changes in public expenditures, and IEQ in Türkiye.

Following the identification of the cointegration relationship, the long-run coefficients of this cointegration relationship are tested with the Fourier FMOLS estimator and reported in

Table 4. Accordingly, the effects of all independent variables on the dependent variable lnGINI in the long run are statistically significant. A 1% increase in lnTECH increases lnGINI by 0.036%, while a 1% increase in lnTECH2 decreases lnGINI by 0.002%. This result confirms that the TKC hypothesis is valid for Türkiye in the long run. In addition, a 1% increase in lnGOV decreases lnGINI by 0.013% in the long run. Following the identification of the cointegration relationship, the long-run coefficients of this cointegration relationship are tested with the Fourier FMOLS estimator and reported in

Table 4. Accordingly, the effects of all independent variables on the dependent variable lnGINI in the long run are statistically significant. An increase of 1% in lnTECH results in a 0.036% increase in lnGINI, whereas a 1% increase in lnTECH2 leads to a 0.002% decrease in lnGINI. This finding supports the validity of the TKC hypothesis for Türkiye over the long term. A 1% increase in lnGOV results in a 0.013% decrease in lnGINI in the long run. Therefore, Hypothesis 1 and Hypothesis 2 cannot be rejected. In Türkiye, while technological innovation represented by patent applications initially has a negative impact on income distribution measured by the GINI coefficient, inequalities in income distribution decrease after a certain break in line with the improvements in patent applications. In other words, the increase in public expenditures in Türkiye contributes to the reduction in income inequalities in the long run by weakening the initial negative effect between technological innovation and IEQ.

The robustness check of the findings obtained from the Fourier FMOLS estimator is performed with the Fourier DOLS and Fourier CCR estimators and presented in

Table 5 and

Table 6, respectively. According to the Fourier DOLS results in

Table 5, the effect of all independent variables on the dependent variable lnGINI is statistically significant at the respective significance levels. In the long term, lnTECH has a positive effect on lnGINI that is equal to about 0.116%. lnTECH2 has a negative effect on lnGINI, which is about 0.007%. Based on this result, the TKC theory seems to be true in Türkiye. Finally, it has been observed that lnGOV has a negative long-term effect on lnGINI, equal to about 0.0244%.

The findings of the Fourier CCR estimator in

Table 6 show that the effects of all independent variables on the dependent variable lnGINI in the long run are statistically significant. The long-run findings show that lnTECH and lnTECH2 have positive (0.018%) and negative (0.001%) effects on lnGINI, respectively. This result proves the existence of the TKC hypothesis in Türkiye in the long run. Moreover, in the long run, a 1% increase in lnGOV decreases lnGINI by 0.007%.

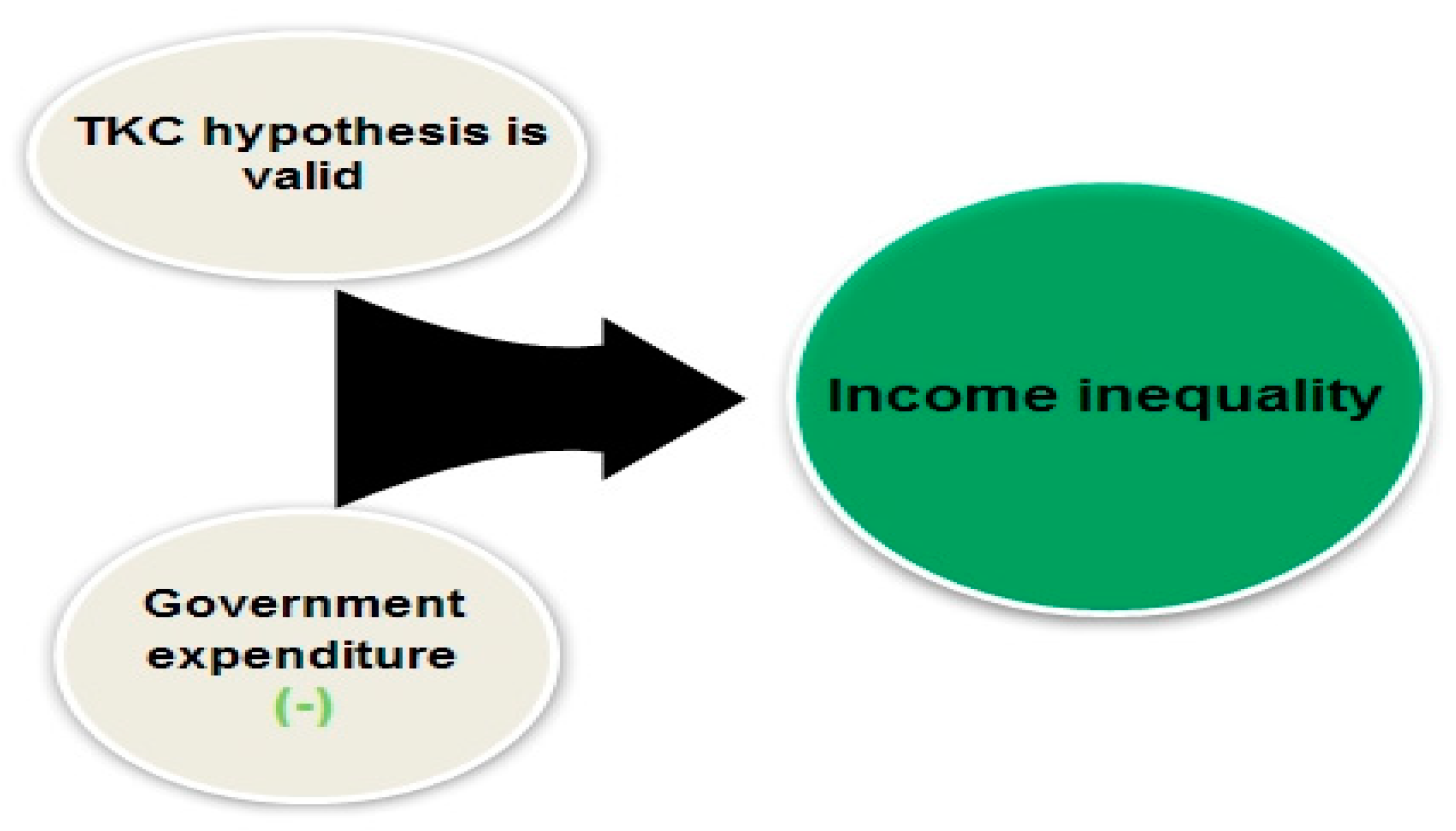

The results of the Fourier FMOLS estimator complement those of the Fourier DOLS and Fourier CCR estimators. This suggests consistency of the estimations. The overall findings of the research are given in

Figure 2 below.

5. Discussion

The long-run results of this study’s estimated Fourier ADL model indicate that lnTECH and lnTECH2 are significant and positively and negatively affect lnGINI, respectively, in Türkiye. The results indicate that the TKC hypothesis might hold for Türkiye, and the effects of technological innovation on IEQ tend to vary with time. Unlike the results shown in Biyase et al. [

27], Shukla [

35], Wang et al. [

14], this finding aligns with results from Elfaki and Ahmed [

15], Gravina and Lanzafame [

13], Kim [

12], and Tang et al. [

11].

The properness of the TKC hypothesis is crucial for Türkiye, one of the world’s top 20 economies, and negotiating EU membership. Because technological innovation can be an important argument that can be used to reduce the GINI. At this point, determining the turning point of the TKC will be important in helping to develop interpretations and policies to reduce the GINI of technological innovation and, in this context, to combat IEQ. In the findings of the study for the case of Türkiye, the turning point in the number of patent applications in 2008 indicates that while technological innovation initially increases IEQ, this effect may reverse when the number of patent applications approaches 2015. The fact that 2008 coincided with the global financial crisis reveals how technological innovation in Türkiye is shaped by economic fluctuations and the vulnerabilities of the financial system. Moreover, the 2015 (units) critical threshold value determined in the number of patent applications indicates that technological progress has started to become more inclusive and reduce IEQ.

The result that technological innovation, as measured by patent applications, initially leads to an increase in IEQ is consistent with the SBTC explanation. This is because, in the early phases of technological innovation, high-skilled laborers and capital proprietors gain, but low-skilled workers fail to readjust to such evolution and hence fall behind. But as soon as the estimated threshold value of criticality is exceeded, the diffusion of technology, the acceleration of skills acquisition processes, and of public spending, etc., all come into play and have a leveling effect on inequality. This result is aligned with the TKC hypothesis on which the study is theoretically grounded, indicating that technological innovation can be more balanced beyond a threshold. Policymakers may derive this very threshold to handle technological transformation processes in a way to form a more equitable income distribution in society.

The common finding of Fourier FMOLS, DOLS, and CCR is that in the long run, public expenditures have a reducing effect on IEQ in the study. These outcomes are consistent with the results of Kim [

12], Sánchez and Pérez-Corral [

16], and Tang et al. [

11]. As it accumulates, the TKC hypothesis posits that technological progress enables a skill-biased transformation, benefits high-skilled labor, but this inequality erodes over time as expansion of access to technology occurs, leading to public policies such as education, infrastructure, and social protection. Consequently, the findings of the study are very much in line with the notion that public spending acts as a stabilizing force during technological innovation and can reduce IEQ in the long run within this framework. For policymakers, these findings imply that simply relying on technological innovation will not reduce inequality, as its potentiality, the process can and should be governed, and the benefits made more stable through the wise use of public expenditures. Public investments in education, infrastructure, and social support mechanisms, in particular, could help equalize out the imbalances created by technological progress and make income distribution more equitable in the long run. Hence, this finding might suggest that the TKC hypothesis should be supported by public expenditures, and that the technological progress based on market-free dynamics could deepen inequalities.

Another implication of the empirical findings in the light of public expenditures is that economic decision-makers can transform the impact of technological innovation on IEQ over time through public policies such as education reforms, R&D support, and digital transformation strategies. Thus, it is understood that the public sector can eliminate technology-induced inequalities. In the interaction between technological innovation and the GINI coefficient, the 2015 critical threshold value calculated for the number of patent applications in 2008 supports this empirically. In conclusion, the empirical findings showing that the TKC hypothesis may be valid in Türkiye strongly suggest that technological progress needs to be evaluated in terms of social justice. In this context, the findings of this study suggest that Türkiye’s technology-oriented growth policies can be considered as a critical tool not only in promoting economic growth but also in combating IEQ.

On the other hand, our research findings are directly related to the core principles of SDG-10. In the short term, technology can increase inequality; for example, due to the digital divide, high-skilled individuals may earn more income, while low-skilled individuals may be left behind. In the longer term, however, a more equitable balance in income distribution can be achieved through widespread technology adoption and the implementation of effective policies. This is in line with the sub-targets of SDG-10. It is directly linked to SDG-10.1 and SDG-10.2. In this context, technological innovation can exacerbate inequality if not driven and supported. But if driven by inclusive public policy, it can become a powerful tool to narrow inequality gaps. This suggests that SDG-10 can be addressed not only through redistribution but also through proactive technological and educational strategies [

15].

6. Conclusions and Policy Recommendations

Overall, this study is to test the effect of lnTECH and lnGOV on lnGINI in the scope of the TKC hypothesis for Türkiye. The empirical model is tested using the ADF unit root, ADL cointegration, and the FMOLS estimator anchored on Fourier functions. To test the robustness of the long-run coefficients estimated with the Fourier FMOLS estimator, the Fourier DOLS and CCR estimators are also employed. The results of the study show that the TKC hypothesis is confirmed in the long term in Türkiye. In addition, the empirical evidence also demonstrates that lnGOV decreases the lnGINI and, as such, decreases IEQ in Türkiye. A set of policy recommendations is made based on the findings from the study.

Policies also need to be designed to mitigate the adverse effects of technological advancements on IEQ and achieve more equitable economic growth in Türkiye. This includes increasing skills training and creating specialized workforce programs for low-skilled laborers. Scholarships and incentives for students studying in STEM (science, technology, engineering, and mathematics) fields should be increased, and continuing education programs should be supported for the existing workforce to adapt to technology. In addition, individuals’ adaptation to technological developments should be facilitated through lifelong learning programs. Promoting research and development (R&D) and innovation plays an important role in reducing inequality. Special support should be provided to increase access to technology for small and medium-sized enterprises (SMEs), and the start-up ecosystem should be strengthened to foster the development of innovative enterprises. There should be mechanisms to incentivize patent applications, and policies should be implemented that ensure the diffusion of technology production in different segments. The process will also be facilitated by the strategic orientation of public expenditures. Investments in education, infrastructure, and social support mechanisms can mitigate the inequalities created by technological progress and create a more equitable distribution of income. However, this increased access will require urgent supportive action from both the state and the public. The digital world gets access to low-income groups through free digital education platforms, access to the internet, and technology hardware. A public–private partnership funding model for digital transformation promotes collaborative industry-academia projects that encourage technology-based solutions.

These policy recommendations provide a comprehensive strategy for reducing inequalities in line with the core principles of SDG-10. Our recommendations are of particular relevance to Goal 10’s subdimensions 10.1 and 10.2. In the context of Target 10.1 (ensuring fairness in income distribution), concrete solutions are proposed, such as developing workforce programs for low-skilled workers and increasing skills training. STEM scholarships and continuing education programs have the potential to accelerate income growth for the bottom 40 percent of society by increasing economic mobility through education. Redirecting public spending towards education, infrastructure, and social support mechanisms can go a long way towards reducing income inequalities by enabling low-income groups to benefit more from economic opportunities. Implementation of these recommendations, which are also critical for Target 10.2 (Strengthening Social, Economic and Political Inclusion), will promote social and economic inclusion. Increasing access to technology for small and medium-sized enterprises (SMEs) and supporting innovative start-ups broadens economic inclusion and strengthens equal opportunities.

This study has some fundamental limitations. First of all, the study was conducted only for Türkiye. In addition, this study offers several opportunities for researchers interested in research on development economics. The TKC, which lies at the main focus of the study, is a relatively new topic. Hence, in future studies, a similar topic can be studied for different countries or country groups on the basis of high-value-added products using different current econometric approaches such as quantile and wavelet.