Optimization Decision Study of Business Smart Building Clusters Considering Shared Energy Storage

Abstract

1. Introduction

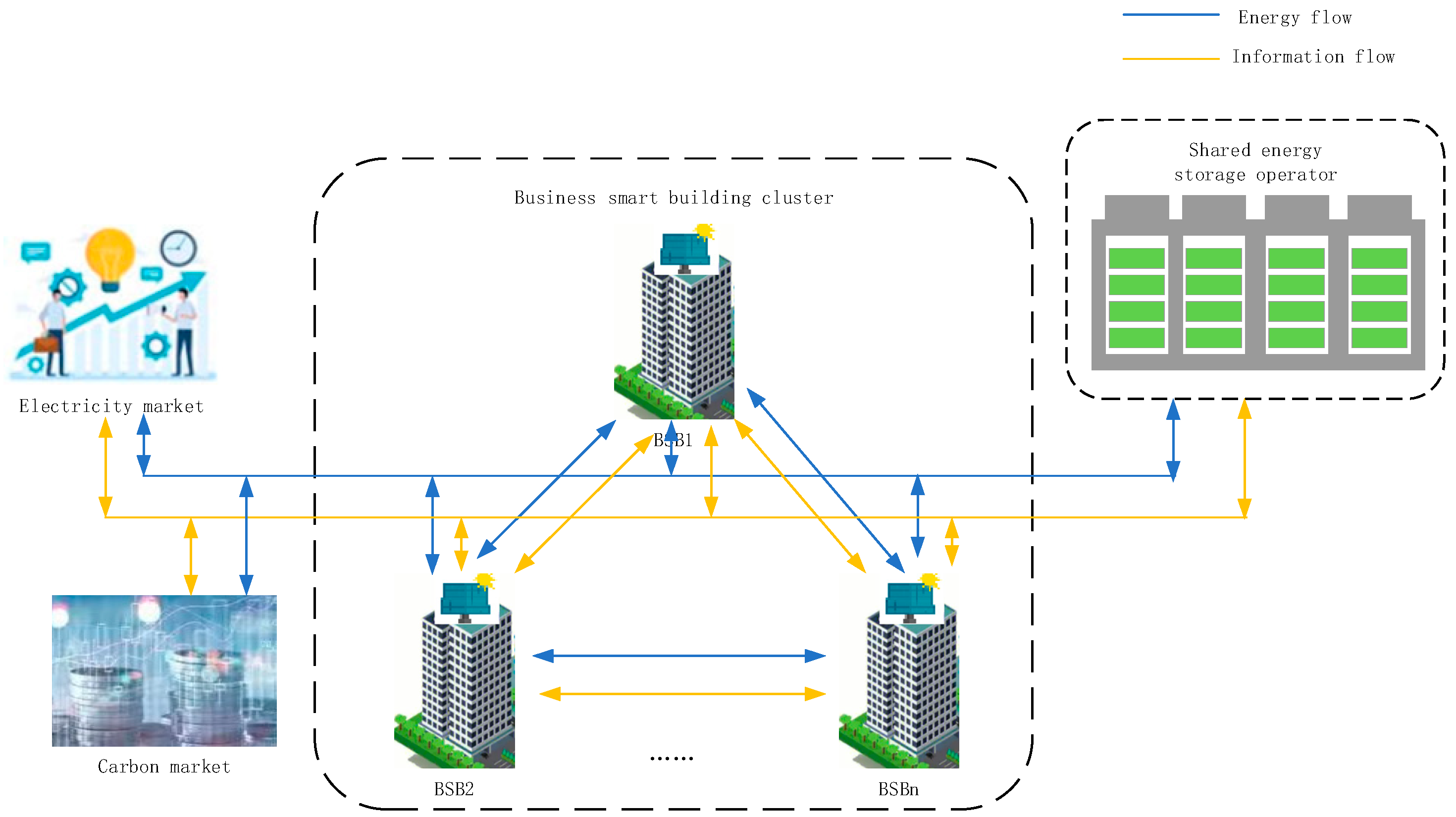

2. Energy Trading Framework for BSB Clusters

3. Energy Trading Model for BSB

3.1. Objective Function

- (1)

- Electricity transaction cost

- (2)

- Carbon trading costs

- (3)

- SES charge/discharge costs

- (4)

- PV operating costs

- (5)

- HVAC and flexible load conditioning costs

3.2. Constraints

- (1)

- Electrical power balance constraints

- (2)

- Carbon emission constraints

- (3)

- Charge and discharge power and capacity constraints for SES

- (4)

- Constraints on HVAC

- (5)

- Constraints on flexible loads

4. BSB Cluster Energy Trading Model with P2P Transactions

4.1. Objective Function

4.2. Constraints

5. CVaR-Based Energy Trading Model for a Cluster of Business Smart Buildings

5.1. Risk Assessment Model for CVaR

5.2. Energy Trading Strategies for a Cluster of BSB Considering CVaR

6. Example Analysis

6.1. Parameter Setting and Scene Description

- (1)

- Parameter setting

- (2)

- Scene description

6.2. Analysis of Simulation Results

6.2.1. Total Cost Analysis of BSBs in Different Cases

6.2.2. Analysis of the Results of P2P Energy Trading between BSBs

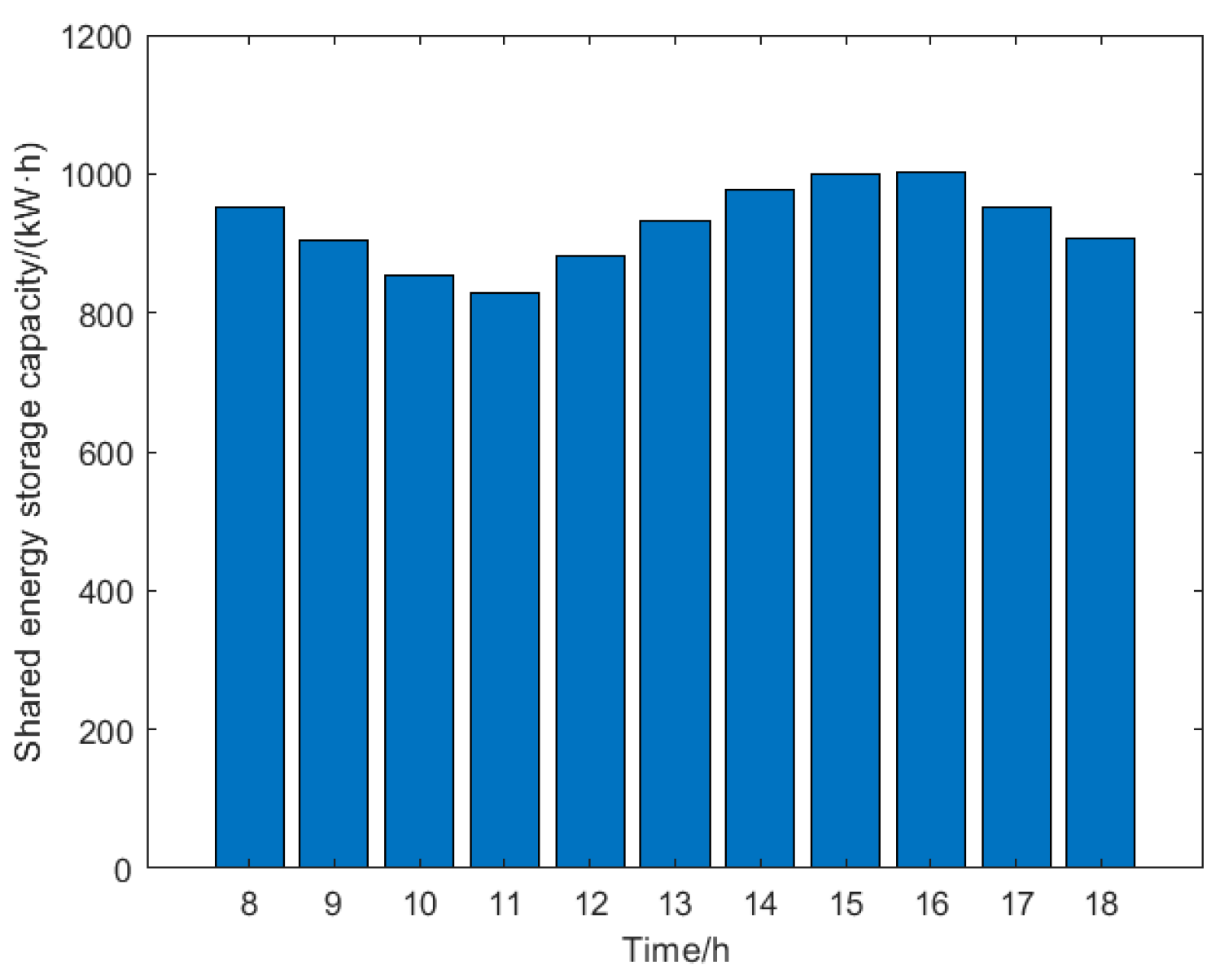

6.2.3. Capacity Changes in SES

6.2.4. Analysis of Transaction Results Considering CVaR Values

7. Conclusions

- (1)

- The shared energy storage system can store power during the lower hours of the building load and release power during the peak hours of electricity consumption, which can effectively level out the deviation of PV output and realize the cost of purchasing power for the building clusters.

- (2)

- The P2P energy sharing transaction reduces the dependence on external energy sources, reduces the operating costs of the BS building cluster as well as each building while meeting the building loads, and improves the flexibility of the building cluster operation as well as the level of in-building PV consumption.

- (3)

- P2P energy sharing itself has the advantage of carbon reduction, and the text couples carbon trading into P2P energy trading, which can further explore the potential of BSBs to reduce emissions and lower the operating costs of BSBs.

- (4)

- The introduction of the CVaR model allows for the quantification of BSB returns and risks under PV output uncertainty, providing different risk management measures for decision-makers with different risk appetites, thus assisting decision-makers in determining risk appetites that meet their own psychological expectations and corresponding trading decisions.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Huo, T.F.; Du, Q.X.; Xu, L.B.; Shi, Q.W.; Cong, X.B.; Cai, W.G. Timetable and roadmap for achieving carbon peak and carbon neutrality of China’s building sector. Energy 2023, 274, 127330. [Google Scholar] [CrossRef]

- Ang, J.H.; Yusup, Y.; Zaki, S.A.; Salehabadi, A.; Ahmad, M. Comprehensive Energy Consumption of Elevator Systems Based on Hybrid Approach of Measurement and Calculation in Low- and High-Rise Buildings of Tropical Climate towards Energy Efficiency. Sustainability 2022, 14, 4779. [Google Scholar] [CrossRef]

- China Association for Building Energy Efficiency. China Building Energy Consumption and Carbon Emissions Research Report (2023). Architecture 2024, 02, 46–59. [Google Scholar]

- Liang, L.; Fu, C.C.; Gao, Y.X.; Su, T.C.; Wan, F.H.; Xiong, X.; Pan, M.Z.; Guan, W. An optimal siting and economically optimal connectivity strategy for urban green 5G BS based on distributed photovoltaic energy supply. Energy Convers. Manag. 2023, 301, 118043. [Google Scholar] [CrossRef]

- Fontenot, H.; Ayyagari, K.S.; Dong, B.; Gatsis, N.; Taha, A. Buildings-to-distribution-network integration for coordinated voltage regulation and building energy management via distributed resource flexibility. Sustain. Cities Soc. 2021, 69, 102832. [Google Scholar] [CrossRef]

- Haider, H.; Jun, Y.; Rashed, G.I.; Peixiao, F.; Kamel, S.; Li, Y.H. A robust optimization model for microgrid considering hybrid renewable energy sources under uncertainties. Environ. Sci. Pollut. Res. 2023, 30, 82470–82484. [Google Scholar] [CrossRef]

- Morstyn, T.; Collett, K.A.; Vijay, A.; Deakin, M.; Wheeler, S.; Bhagavathy, S.M.; Fele, F.; McCulloch, M.D. OPEN: An open-source platform for developing smart local energy system applications. Appl. Energy 2020, 275, 115397. [Google Scholar] [CrossRef]

- Andreev, M.; Bay, Y.; Malyuta, B. Novel method for setting up the relay protection of power systems containing renewable energy sources and hydrogen energy storage systems. Int. J. Hydrogen Energ. 2023, 48, 29425–29445. [Google Scholar] [CrossRef]

- Li, L.X.; Cao, X.L.; Zhang, S. Shared energy storage system for prosumers in a community: Investment decision, economic operation, and benefits allocation under a cost-effective way. J. Energy Storage 2022, 50, 104710. [Google Scholar] [CrossRef]

- Lu, Q.Y.; Yang, Y.G.; Xie, P.P.; Chen, Y.; Wu, J.K.; Lei, Z. Two-stage optimized operation strategy for wind farm cluster lease-sharing energy storage. Grid Technol. 2024, 48, 1146–1165. [Google Scholar]

- Ma, M.T.; Huang, H.J.; Song, X.L.; Pena-Mora, F.; Zhang, Z.; Chen, J. Optimal sizing and operations of shared energy storage systems in distribution networks: A bi-level programming approach. Appl. Energy 2021, 307, 118170. [Google Scholar] [CrossRef]

- Cao, S.M.; Zhang, H.L.; Cao, K.; Chen, M.; Wu, Y.; Zhou, S.Y. Day-Ahead Economic Optimal Dispatch of Microgrid Cluster Considering Shared Energy Storage System and P2P Transaction. Front. Energy Res. 2021, 9, 645017. [Google Scholar] [CrossRef]

- Duan, P.F.; Zhao, B.X.; Zhang, X.H.; Fen, M.D. A day-ahead optimal operation strategy for integrated energy systems in multi-public buildings based on cooperative game. Energy 2023, 275, 127395. [Google Scholar] [CrossRef]

- Esmat, A.; de Vos, M.; Ghiassi-Farrokhfal, Y.; Palensky, P.; Epema, D. A novel decentralized platform for peer-to-peer energy trading market with blockchain technology. Appl. Energy 2020, 282, 116123. [Google Scholar] [CrossRef]

- Li, B.; Qin, Q.Y.; Qi, B. An overview of the design of blockchain-based distributed energy trading schemes. Grid Technol. 2019, 43, 961–972. [Google Scholar]

- Hahnel, U.J.J.; Herberz, M.; Pena-Bello, A.; Parra, D.; Brosch, T. Becoming prosumer: Revealing trading preferences and decision-making strategies in peer-to-peer energy communities. Energy Policy 2019, 137, 111098. [Google Scholar] [CrossRef]

- Zhou, W.; Xu, C.M.; Yang, D.X.; Peng, F.X.; Guo, X.L.; Wang, S. Study on demand response strategy of electric vehicle fleet considering willingness dynamic adjustment under P2P energy sharing. Chin. J. Electr. Eng. 2023, 43, 8217–8230. [Google Scholar]

- Yan, M.Y.; Shahidehpour, M.; Paaso, A.; Zhang, L.X.; Alabdulwahab, A.; Abusorrah, A. Distribution Network-Constrained Optimization of Peer-to-Peer Transactive Energy Trading Among Multi-Microgrids. IEEE Trans. Smart Grid 2021, 12, 1033–1047. [Google Scholar] [CrossRef]

- Wang, G.; Tan, Z.F.; Tan, Q.K.; Yang, S.B.; Lin, H.Y.; Ji, X.H.; Gejirifu, D.; Song, X.Y. Multi-Objective Robust Scheduling Optimization Model of Wind, Photovoltaic Power, and BESS Based on the Pareto Principle. Sustainability 2023, 11, 305. [Google Scholar] [CrossRef]

- Maier, S.; Street, A.; McKinnon, K. Risk-averse portfolio selection of renewable electricity generator investments in Brazil: An optimised multi-market commercialisation strategy. Energy 2016, 115, 1331–1343. [Google Scholar] [CrossRef]

- Nojavan, S.; Majidi, M.; Zare, K. Risk-based optimal performance of a PV/fuel cell/battery/grid hybrid energy system using information gap decision theory in the presence of demand response program. Int. J. Hydrog. 2017, 42, 11857–11867. [Google Scholar] [CrossRef]

- Fan, W.; Tan, Z.F.; Li, F.Q.; Zhang, A.M.; Ju, L.W.; Wang, Y.W.; De, G.J.R.F. A two-stage optimal scheduling model of integrated energy system based on CVaR theory implementing integrated demand response. Energy 2022, 263, 125783. [Google Scholar] [CrossRef]

- Liu, Z.Q.; Cui, Y.P.; Wang, J.Q.; Yue, C.; Agbodjan, Y.S.; Yang, Y. Multi-objective optimization of multi-energy complementary integrated energy systems considering load prediction and renewable energy production uncertainties. Energy 2022, 254, 124399. [Google Scholar] [CrossRef]

- Fu, Y.; Sun, Q.; Wennersten, R. Effectiveness of the CVaR method in risk management in an integrated energy system. Energy Rep. 2020, 6, 1010–1015. [Google Scholar] [CrossRef]

- Zhang, C.; Liang, H.; Yang, L.F. A distributionally robust approximate framework consider CVaR constraints for energy management of microgrid. Sustain. Energy Grids Netw. 2023, 36, 101172. [Google Scholar] [CrossRef]

- Wang, J.L.; Zhou, Y.D.; Zhang, Y.; Lin, F.; Wang, J.X. Risk-Averse Optimal Combining Forecasts for Renewable Energy Trading under CVaR Assessment of Forecast. Errors. IEEE Trans. Power Syst. 2023, 39, 2296–2309. [Google Scholar] [CrossRef]

- Mediwaththe, C.P.; Shaw, M.; Halgamuge, S.; Smith, D.B.; Scott, P. An incentive-compatible energy trading framework for neighborhood area networks with shared energy storage. IEEE Trans. Sustain. Energy 2019, 11, 467–476. [Google Scholar] [CrossRef]

- Wang, X.Y.; Liu, Z. Development and Practice of Virtual Power Plant Participation in Grid Regulation and Market Operation. Power Syst. Autom. 2022, 46, 158–168. [Google Scholar]

- Lu, Q.; Guo, Q.S.; Zeng, W. Optimization scheduling of an integrated energy service system in community under the carbon trading mechanism: A model with reward-penalty and user satisfaction. J. Clean. Prod. 2021, 323, 129171. [Google Scholar] [CrossRef]

- Li, Z.N.; Su, S.; Jin, X.L.; Xia, M.C.; Chen, Q.F.; Yamashita, K. Stochastic and distributed optimal energy management of active distribution network with integrated office buildings. CSEE J. Power Energy Syst. 2022, 1–12. [Google Scholar]

- Cui, S.C.; Wang, Y.W.; Shi, Y.; Xiao, J.W. An Efficient Peer-to-Peer Energy-Sharing Framework for Numerous Community Prosumers. IEEE Trans. Industr Inform. 2020, 16, 7402–7412. [Google Scholar] [CrossRef]

- Wei, Z.N.; Chen, Y.; Huang, W.J.; Xu, Z.; Sun, G.Q.; Zhou, Y.Z. Optimal allocation model of multiple power supply capacity in virtual power plant considering conditional value-at-risk. Power Syst. Autom. 2018, 42, 39–46. [Google Scholar]

- Zhang, F.Y. Research on V2G Standby Decision-Making and Consumer Price Subsidy Model Based on CVaR Risk Measurement. Ph.D. Thesis, Chongqing University, Chongqing, China, 2019. [Google Scholar]

- Ren, W.S.; Gao, H.J.; Liu, Y.B.; Liu, J.Y.; Li, C.Y.; Liu, X.L. Intelligent Building Cluster Power Day Optimization and Sharing. Grid Technol. 2019, 43, 2568–2577. [Google Scholar]

- Shen, S.C.; Han, H.T.; Zhou, Y.Z.; Sun, G.Q.; Wei, Z.N.; Hu, G.W. Conditional value-at-risk-based P2P trading model for electricity-carbon-standby in multi-virtual power plants. Power Syst. Autom. 2022, 46, 147–157. [Google Scholar]

- Zhao, H.R.; Wang, X.J.; Li, B.K.; Siqin, Z.Y.; Zhao, M.R.; Wang, Y.W. Distributed Robust Optimal Scheduling of Multi-Community Optical Storage Systems Considering Energy Sharing. Power Syst. Autom. 2022, 46, 21–31. [Google Scholar]

- Shanghai Environmental Energy Exchange. National Carbon Market Monthly Transaction Data. Available online: https://www.cneeex.com/c/2023-06-30/494296.shtml (accessed on 25 August 2023).

| Parameters | Retrieve Value |

|---|---|

| minimum volume/(kW·h) | 300 |

| maximum volume/(kW·h) | 1350 |

| maximum charging and discharging power/kW | 50 |

| charging and discharging efficiency/% | 95 |

| charge/discharge operating cost/(yuan/kW·h) | 0.15 |

| Cases | Electricity Trading Costs/(yuan) | Carbon Trading Costs/(yuan) | Running Costs/(yuan) | Total Costs/(yuan) |

|---|---|---|---|---|

| 1 | 4200.18 | 0 | 766.4 | 4966.58 |

| 2 | 4103.34 | −1479.02 | 758.16 | 3382.48 |

| 3 | 3899.67 | 0 | 756.24 | 4655.91 |

| 4 | 3932.2 | −1452.06 | 739.98 | 3220.12 |

| 5 | 3845.19 | −1401.63 | 996.55 | 3440.11 |

| 6 | 3834.5 | −1450.13 | 715.5 | 3099.87 |

| Categories | Deterministic Model | CvaR Model | ||||

|---|---|---|---|---|---|---|

| Day before Stage/yuan | Intraday Stage/yuan | BSB Costs/yuan | Day before Stage/yuan | Intraday Stage/yuan | BSB Costs/yuan | |

| BSB1 | −1580.5 | 1650.6 | 70.1 | −1376.2 | 931.2 | −445.0 |

| BSB2 | 1745.9 | 381.9 | 2127.8 | 1758.2 | 146.8 | 1905 |

| BSB3 | 1540.5 | 317.0 | 1857.5 | 1689.8 | 191.4 | 1881.2 |

| Total costs | 1705.9 | 2349.5 | 4055.4 | 2071.8 | 1269.4 | 3341.2 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhao, W.; Xu, S.; Guo, P. Optimization Decision Study of Business Smart Building Clusters Considering Shared Energy Storage. Sustainability 2024, 16, 3422. https://doi.org/10.3390/su16083422

Zhao W, Xu S, Guo P. Optimization Decision Study of Business Smart Building Clusters Considering Shared Energy Storage. Sustainability. 2024; 16(8):3422. https://doi.org/10.3390/su16083422

Chicago/Turabian StyleZhao, Wenhui, Shuting Xu, and Peng Guo. 2024. "Optimization Decision Study of Business Smart Building Clusters Considering Shared Energy Storage" Sustainability 16, no. 8: 3422. https://doi.org/10.3390/su16083422

APA StyleZhao, W., Xu, S., & Guo, P. (2024). Optimization Decision Study of Business Smart Building Clusters Considering Shared Energy Storage. Sustainability, 16(8), 3422. https://doi.org/10.3390/su16083422