1. Introduction

Green innovation represents the future of China’s economy. Combining the principles of greenness and innovation, it is committed to maximizing the comprehensive benefits of technology, resources, economy, and environment, serving as a core driving force and a realistic requirement for regional high-quality development [

1,

2]. Heavy-polluting enterprises are central to green innovation, as their ability to achieve energy saving, emission reduction, and green development determines the success of sustainable development strategy in China. China’s existing environmental policies mostly adhere to Porter’s hypothesis. It argues that well-designed environmental regulations can furnish enterprises with information and incentives for technological innovation and lead to an “innovation compensation effect” and “first-mover advantage” for enterprises in the long run [

3]. However, the effect of environmental policies that have been in place for many years has not been satisfactory [

4], with ineffective law enforcement by local governments and even collusion between the government and enterprises. These challenges have resulted in a “softening” of environmental regulation. Consequently, China’s ecological and environmental situation is still serious [

5]. The relationship between coercive policies and green innovation strategies demonstrates an inverted U-shape, where moderate coercive policies can effectively promote the implementation of green innovation strategies by enterprises. However, excessively high or low coercive policies may dissuade enterprises from adopting green innovation strategies [

6].

As a result, aiming at decreasing resource depletion and environmental pollution, China has introduced the environmental, social, and governance (ESG) rating system as a market mechanism, which is not legally enforceable, to incentivize relevant enterprises to engage in green innovation activities and enhance their sustainable development capabilities. ESG ratings, serving as a comprehensive assessment methodology that considers environmental, social, and governance factors, have attracted widespread attention from investors to evaluate the sustainable performance of companies from a more holistic perspective [

7]. Compared with the mandatory pressure of environmental regulations, ESG ratings, as a third-party regulatory tool, exert normative pressure from the external market in a “bottom-up” fashion, compelling companies to proactively initiate changes and actively engage in green innovation activities [

8]. Under the leadership of the “dual carbon” goal, China’s ESG development has accelerated. According to the China Association of Listed Companies, the number of ESG-related reports issued by A-share listed companies increased from 371 in 2009 to 1738 by the end of June 2023, with the disclosure rate of 34%. Notably, the ESG disclosure rate of Sino-Securities 300 exceeds 90%. ESG, as an important value driver for sustainable development, is increasingly acknowledged by both real enterprises and investment institutions.

With the promotion of ESG, the positive impact of ESG ratings on corporate investment efficiency, financial performance, corporate value, and stock market performance has been demonstrated in research [

9,

10,

11,

12,

13]. However, some scholars have raised concerns about potential “greenwashing” behavior resulting from ESG ratings. They argue that conducting environmental testing and establishing an ESG system may require substantial capital investment and not yield short-term benefits. Therefore, companies have an incentive to divert public opinion through “greenwashing” behavior to mislead the public and seize undue advantages [

14,

15,

16]. Lax regulatory penalties have also been the main reason for the prevalence of “greenwashing” in recent years. China has not clarified the penalties for “greenwashing” in the ESG field, resulting in a very low cost of non-compliance and further exacerbating the “greenwashing” behavior among domestic companies [

17]. Considering the possible “greenwashing” behavior of heavy polluters, it remains to be explored whether the ESG ratings really promote the green activities among them and effectively enhance their green innovation capabilities.

In this research, the ESG rating is regarded as an exogenous market shock event. Meanwhile, we adopt a multi-time-point difference in difference (DID) approach to explore the impact of ESG ratings on the green innovation of listed heavily polluting enterprises in China. The results reveal the following:

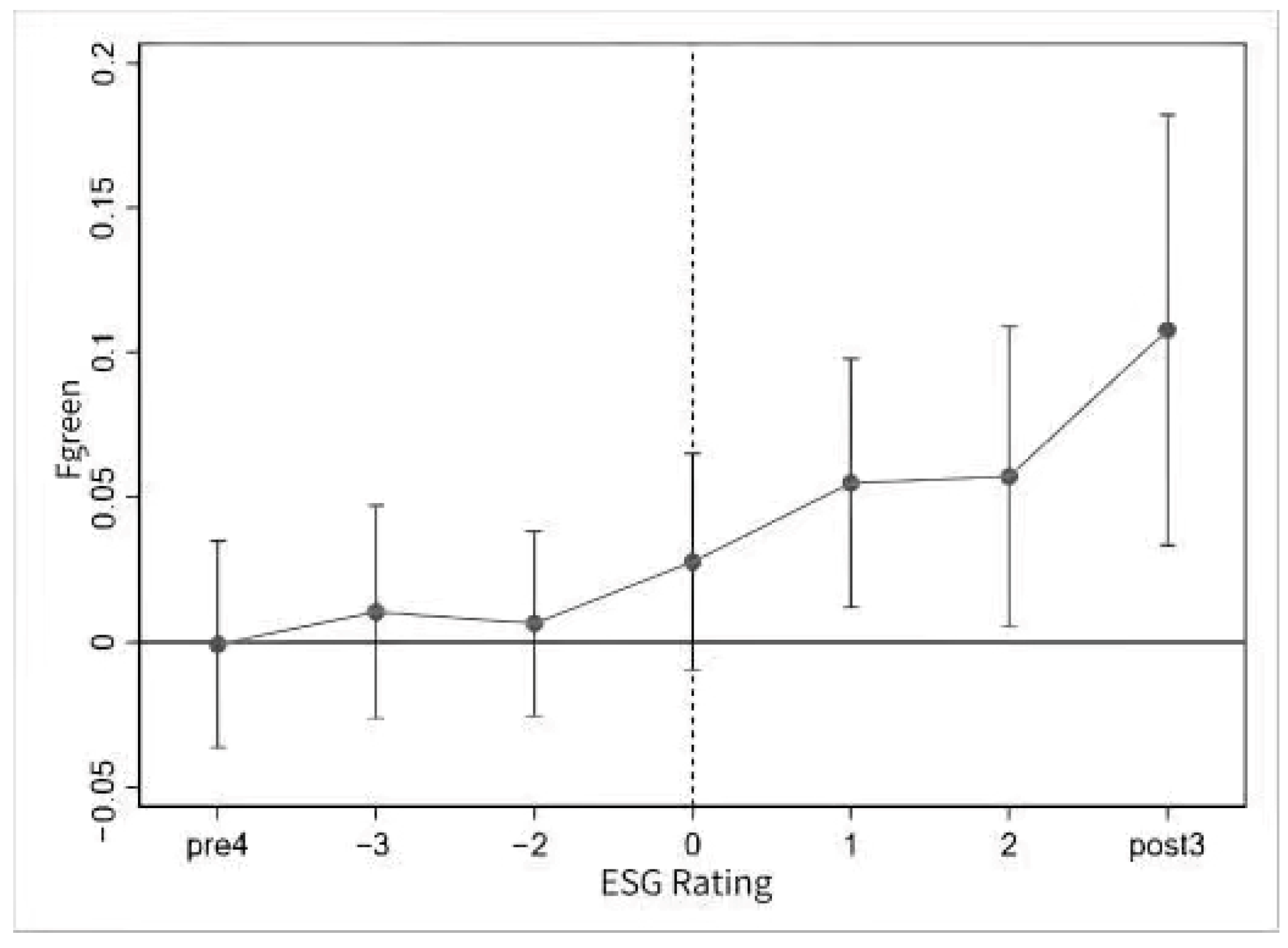

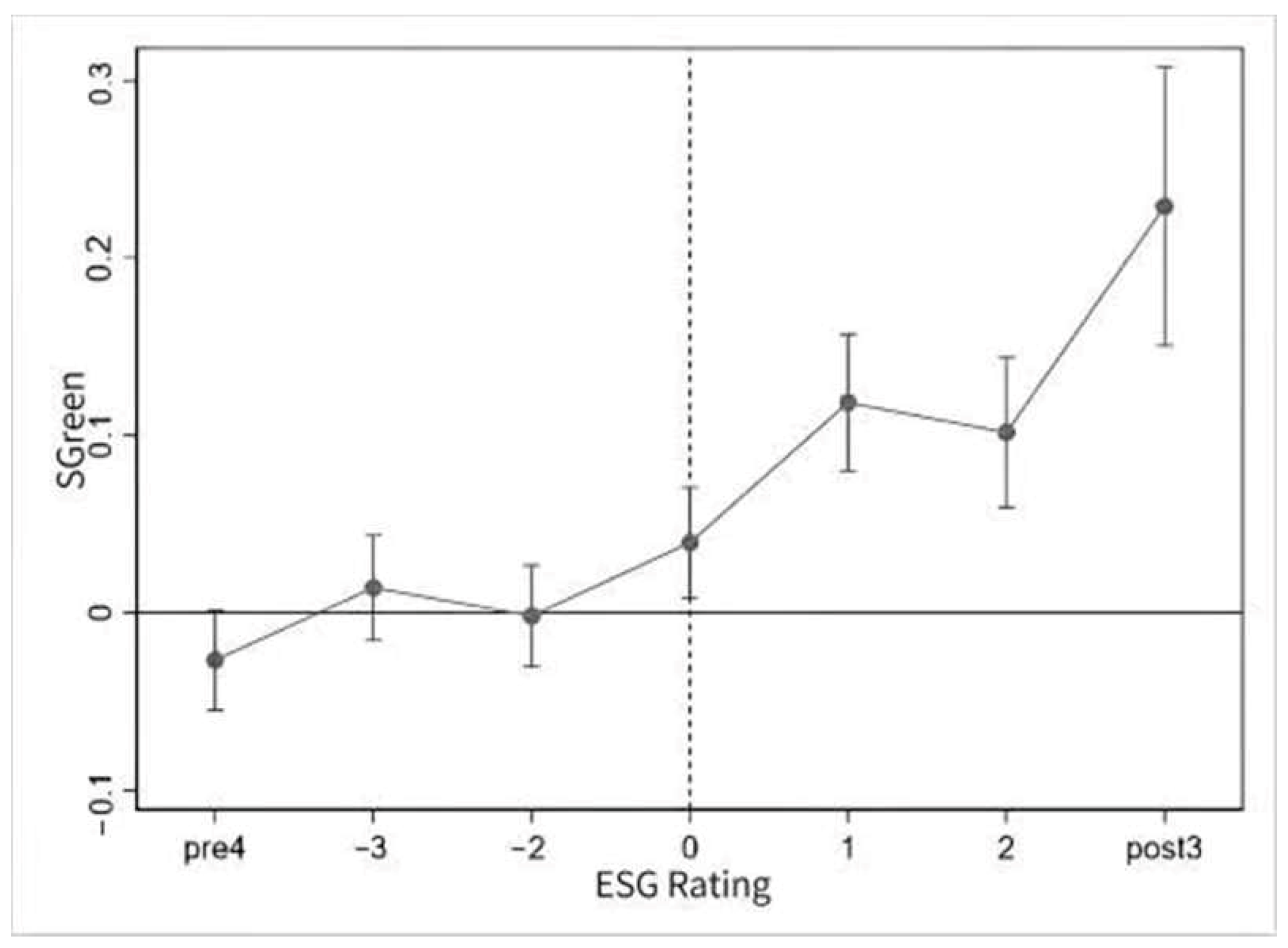

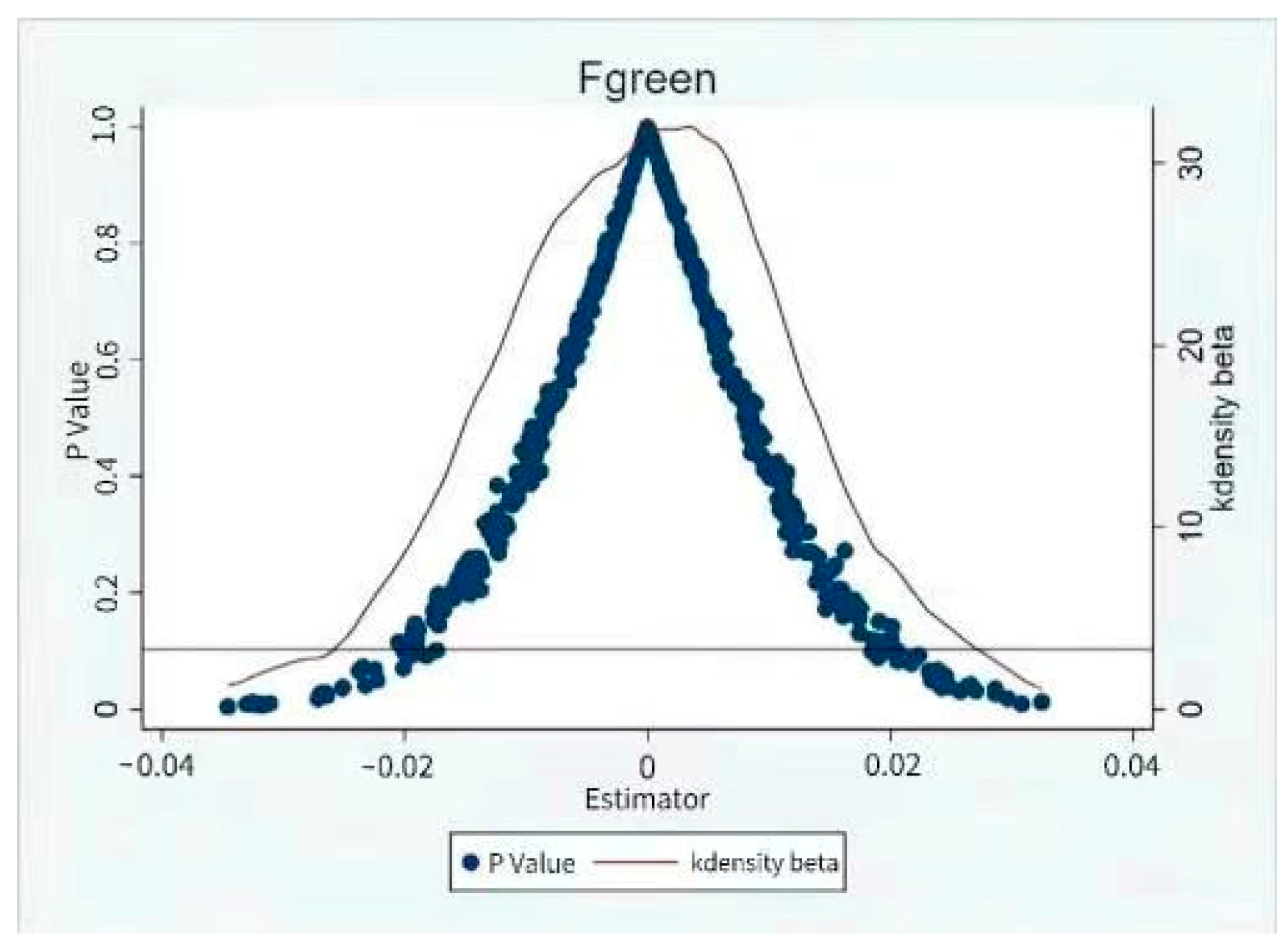

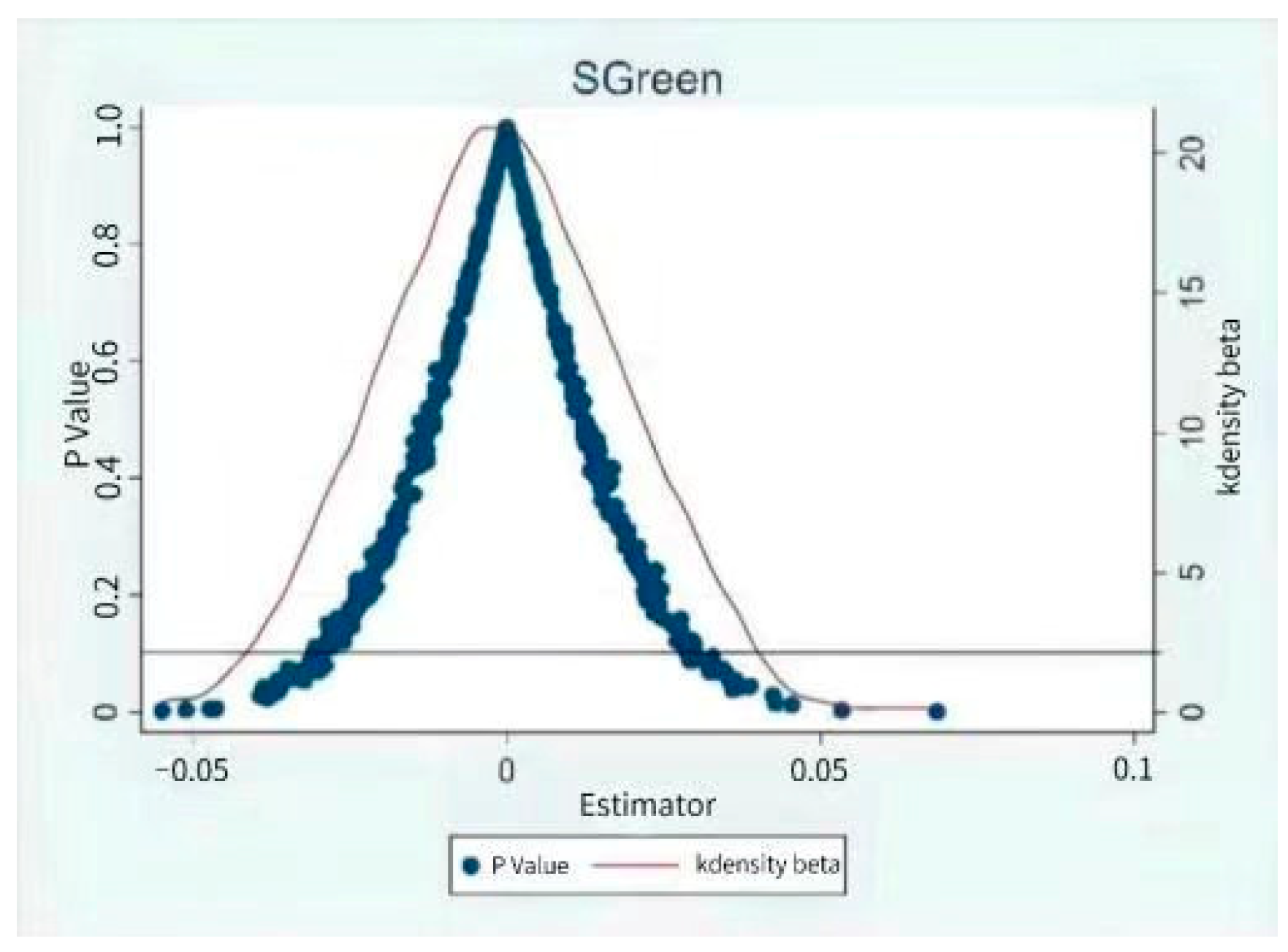

- (1)

The implementation of ESG ratings exerts a significant positive impact on listed companies in heavily polluting industries, reflected in the increased number and citation frequency of green patent applications. This quantitatively and qualitatively confirms that the ESG ratings can effectively enhance the green innovation capabilities of high-polluting enterprises. Moreover, this conclusion is further verified and consolidated through a series of robustness tests, including parallel trend tests, placebo experiments, variable substitution, and adjustments during the regression.

- (2)

ESG ratings play a key role in reducing financing constraints and increasing risk-taking, thereby promoting green innovation in high-polluting enterprises. Due to the inherent uncertainty of innovation activities, enterprises should pay attention to stable and continuous financial support. In addition, the acceptance of risk by management and external stakeholders also determines the enterprise’s ability to engage in green innovation activities. Therefore, ESG ratings, by alleviating financing constraints and enhancing the risk-bearing capacity of internal and external stakeholders, facilitate the progress of enterprises in green innovation.

- (3)

More obviously, ESG ratings significantly enhance the green innovation capabilities of private and large enterprises. This difference may stem from the government credit endorsements and broader financing channels of state-owned enterprises (SOEs) as well as the direct participation of party organizations in major decisions. This, in turn, limits the impact of ESG ratings on easing financing constraints and enhancing risk-taking capabilities. In contrast, the ESG ratings demonstrate a limited effect on small and medium-sized enterprises because they often face resource scarcity and tend to pursue certain development and survival rather than investing in risky innovation projects that may yield returns. Furthermore, our research reveals that ESG ratings not only promote the end-of-pipe governance in heavily polluting enterprises but also strengthen source governance, thereby advancing environmental protection and sustainable development practices throughout the governance chain.

The marginal contributions of this research are primarily reflected in the following aspects:

Firstly, previous research has focused more on the role of government regulation and support as well as the impact of intrinsic corporate characteristics, with relatively less discussion on market factors [

18,

19,

20,

21,

22]. This research reveals, from the perspective of market incentives, how ESG ratings function as effective market information transmission mechanisms and significantly promote green innovation in listed companies in the heavily polluting industries of China. For this purpose, a theoretical analysis framework is constructed, and strong empirical evidence is provided, offering new insights and references for academics and policymakers.

Secondly, we expanded the scope of traditional credit market research by shifting the focus from the information asymmetry among financing entities to the influence of market incentive mechanisms [

23,

24]. With special attention to the market ESG rating, this research analyzes how it acts as an information intermediary in the credit market to transmit signals and mitigate information asymmetry. Furthermore, based on the role of market incentive mechanisms, it alleviates corporate financing constraints, increases stakeholders’ risk-bearing willingness, and stimulates corporate investment and outcomes in green innovation, thus promoting sustainable development.

Lastly, our research is subjected to the following relevance and significance for stakeholders. For government departments, “voluntary regulation” in the Chinese market, such as ESG ratings, can provide effective, flexible, and dynamic incentives. This conclusion yields theoretical and empirical support for the government to exert its role in market coordination, facilitating the formulation of more precise and matching policies to market development, thus promoting the long-term interests of enterprises. Moreover, our research reveals the signaling effect of ESG ratings for enterprises. Specifically, the ESG ratings help enterprises to convey their commitment to environmental and social responsibilities. Furthermore, they provide investors and regulatory agencies with new means to assess corporate value and risk, aiding them in making wiser investment and regulatory decisions. Overall, this research highlights the importance of market incentive mechanisms in promoting the green development of enterprises and enhancing the overall welfare of society, thereby providing new insights and strategies for sustainable corporate development.

The subsequent content of this article is arranged as follows. The second part elaborates on the institutional background of this research, develops theoretical derivations, and proposes research hypotheses. The third part describes the data sources, empirical models, and descriptive statistics adopted. The fourth part presents the main empirical results of ESG ratings and green innovation in heavily polluting enterprises and then analyzes the intrinsic mechanisms. The fifth section explores whether ESG ratings improve both source control and end-of-pipe governance for green innovation and analyzes the heterogeneity in the relationship between ESG ratings and green innovation in heavily polluting enterprises. Subsequently, the sixth part summarizes and discusses the main findings of this research and gives relevant policy recommendations.

2. Institutional Background, Theoretical Analysis, and Research Hypothesis

2.1. Institutional Background

In the historical context of China’s economic development, environmental issues have consistently occupied a pivotal position. During the era of planned economy, industrialization often came at the expense of the environment, leading to resource depletion and environmental pollution, with insufficient awareness regarding environmental protection among enterprises and citizens. Since the inception of the reform and opening-up policy in 1978, marking China’s transition from a planned to a market-oriented economy, environmental policies have undergone a multi-stage evolution. Initially, environmental protection primarily served the planned economy, relying heavily on mandatory regulations. Various government laws and regulations were utilized to restrict market participants, aiming to maintain market order and social stability. However, with the establishment of the socialist market economy system, environmental regulatory policies have shifted from a singular focus on “pollution prevention” to embracing the broader concept of “ecological civilization”. This shift signifies a deeper understanding of environmental issues and a commitment to pursuing sustainable development. In this evolutionary process, the limitations of mandatory regulations gradually became apparent, especially in promoting innovation and adapting to dynamic market conditions. Analyzing the evolution of China’s environmental regulatory policies against the backdrop of market economy development reveals a transition from reliance on mandatory regulation toward market-driven transformation. This highlights the evolving role of the government in environmental protection, gradually shifting from direct intervention to leveraging market mechanisms and social forces. Especially in the process of the dual carbon goals, carbon peaking, and carbon neutrality, the importance of market participation has become increasingly prominent.

Market participants, including enterprises, third-party institutions, and citizens, have been endowed with increased responsibilities and autonomy to innovate and adapt to rapidly evolving market demands. This shift promotes innovation in environmental protection technologies and management approaches, enhances resource utilization efficiency, and promotes the progression of a green economy. Concurrently, the introduction of market mechanisms such as carbon trading and ESG ratings provides the possibility of achieving a win-win outcome for environmental protection and economic development.

Overall, the evolution of China’s environmental initiatives represents a transition from government-led to market-driven transformation, facilitating environmental protection and establishing the groundwork for sustainable economic development. With the proposal and implementation of the dual carbon goals, market participants will exert increasingly pivotal effects, while the government will continue to play its role in policy formulation and regulation to achieve the environmental protection goals.

China’s economic and institutional context provides this research with a unique perspective and advantage. Firstly, with the active involvement and guidance of the government, the Chinese market exhibits distinct characteristics from those of other countries, presenting a rich case study for examining the effectiveness of market tools under diverse institutional frameworks. Secondly, the continuous development and improvement of the Chinese market serve as a testing ground for exploring market incentive mechanisms, helping to reveal the potential effects and trajectories of such mechanisms. These characteristics render this research academically pioneering and forward-looking, while also ensuring the rigor and practical applicability of the research results. Lastly, as the world’s second-largest economy, China boasts a diversified industrial landscape and regional distribution, and the breadth and diversity of company samples provide sufficient credibility and extensibility for the research.

2.2. Theoretical Analysis and Research Hypothesis

2.2.1. ESG Ratings and Corporate Green Innovation

In China, with the increasing emphasis on the concept of green sustainable development, heavy-polluting enterprises characterized by high energy consumption and pollution are facing unprecedented challenges. Meanwhile, they have drawn significant attention from the government and the public in various dimensions, such as environmental protection, social responsibility fulfillment, and governance. The emergence of ESG ratings has rendered the environmental costs of these enterprises more transparent. Faced with external pressure from public opinion and regulation, these enterprises are motivated to seek green innovation to adapt to the constantly evolving external environment and mitigate ESG risks. ESG ratings not only afford enterprises an opportunity to demonstrate their potential for green development but also exert a positive impact on green innovation in terms of resource allocation optimization, governance structure enhancement, and innovation in incentive mechanisms [

25].

Firstly, ESG ratings rely on the information disclosed by companies concerning their environmental protection and social responsibilities. They can reflect whether heavily polluting enterprises are actively assuming responsibility and adhering to the principles of sustainable development. Green innovation, as a risky and uncertain activity, needs substantial sustained financial support in its initial stages. ESG ratings, through signaling, guide the influx of investor funds by garnering policy support, such as tax incentives and government grants, to generate a resource effect on green innovation and reduce the financial burden on corporations [

26]. Secondly, ESG ratings improve corporate information transparency and effectively mitigate information asymmetry among corporate stakeholders [

27]. Based on the stakeholder theory, studies have scrutinized the factors driving corporate “greenwashing” behavior and concluded that such behavior is complex and usually involves interactions among multiple stakeholders. The lack of effective supervision of management’s speculative actions, motivated by economic benefits and the avoidance of regulatory penalties, is a primary driver behind the “greenwashing” of enterprises [

28]. Therefore, promoting the effectiveness of supervision can partially inhibit the “greenwashing” behavior of enterprises. As an important external governance mechanism in the capital market, ESG ratings are issued by practitioners with professional knowledge backgrounds, facilitating the identification of “greenwashing” behaviors of corporate managers. The ESG ratings issued by them are closely scrutinized by the public and the media, which reduces the cost of monitoring the management by external investors [

29]. As a result, strengthening external supervision can effectively curb managerial opportunism, promoting management to allocate corporate resources, improve governance practices, actively fulfill social responsibilities, and mitigate the risk of corporate “greenwashing” by addressing agency problems and optimizing internal controls, thus exerting a governance effect on green innovation [

30]. Furthermore, in the context of promoting the development of a green economy, innovation becomes an indispensable means for heavily polluting enterprises to break through the limitations caused by high emissions and high pollution and eliminate backward production capacity. ESG ratings, as a soft market regulatory tool, exert an incentive effect on green innovation, motivating enterprises to proactively enhance their production processes, ramp up research and development efforts in areas such as green technology and green products, elevate the levels of green innovation, improve the resource utilization efficiency, and achieve the long-term sustainable development of enterprises. Finally, while the issue of greenwashing cannot be overlooked in ESG ratings, it is particularly challenging within China’s heavily polluting industrial sectors due to stringent legal and environmental regulations [

31]. Such industries face significant barriers and costs associated with greenwashing, making them susceptible to market backlash, reputational harm, and reduced stakeholder support, ultimately impacting their performance [

32]. Thus, compared to greenwashing, ESG ratings are more likely to truly promote substantial progress in green innovation for these enterprises. Based on the above analysis, this research proposes the following research hypothesis:

Hypothesis 1. ESG ratings promote green innovation of heavily polluting companies.

2.2.2. ESG Ratings, Financing Constraints, and Green Innovation

The high-input and high-risk characteristics of green innovation activities require enterprises to secure financial support from external sources [

33]. With the growing societal awareness of sustainable development and environmental protection, ESG ratings have emerged as a crucial tool for enterprises to gain investors’ trust and financial support in the financing market. Firstly, ESG ratings can improve the management level and transparency of enterprises. Driven by ESG ratings, enterprises are compelled to comprehensively review their environmental, social, and governance performance as well as continuously improve and enhance their management level. Additionally, ESG ratings require companies to disclose relevant information and data to enhance their transparency and credibility. These initiatives bolster the operational efficiency and management level of enterprises, reduce their operational risks, and increase the trust of investors and financial institutions [

34]. Consequently, they expand the financing possibilities for enterprises and increase the availability of funds, thus protecting green innovation activities necessitating large capital investment by enterprises. Secondly, good ESG ratings can help companies reduce financing costs. Companies with good ESG ratings signal long-term value creation and can negotiate more advantageous terms in the financing market, such as lower interest rates and longer repayment terms. This reduces financing costs and releases more funds for corporate green innovation activities. Therefore, this research proposes the following research hypothesis:

Hypothesis 2. ESG ratings facilitate green innovation in heavily polluting companies by alleviating corporate financing constraints.

2.2.3. ESG Ratings, Risk-Taking, and Green Innovation

The development of corporate green innovation activities requires enterprises to have a high risk-taking capability. This is primarily attributed to the fact that green innovation involves high risks and uncertainties that are difficult to assess and requires significant time and human costs while encountering a variety of risks, such as technological difficulties that cannot be broken through and difficulties in obtaining innovation results, or lagging in innovation results [

35]. The principal–agent dilemma in enterprises is also a critical cause for insufficient risk-taking behavior. Owners prefer to achieve the long-term goal of the enterprise through innovation and other activities. In contrast, managers are more inclined to choose conventional projects with stable cash flows and lower risks to safeguard their interests and reputation. External investors typically advocate for reduced risk-taking behavior and invest in lower-risk and more prudent short-term projects for capital safety and a quick return [

36]. Various principal–agent conflicts arising from differing objectives of the parties will further reduce corporate willingness to take risks and engage in high-risk green innovation and other activities. ESG ratings can effectively alleviate information asymmetry and principal–agent conflicts [

37]. Firstly, ESG ratings represent the demand to embed the concept of green development into all decisions of corporate strategic planning. The pressure exerted by ESG ratings can constrain management behaviors and mitigate possible short-sightedness. In addition, ESG ratings convey socially responsible information that reflects the long-term orientation of enterprises toward sustainable development, thus enhancing the willingness of external investors to take risks on green innovation activities and to pay increased attention to corporate long-term development goals [

38]. Based on the above analysis, this research posits the following research hypothesis:

Hypothesis 3. ESG ratings facilitate green innovation in heavily polluting companies by enhancing corporate risk-taking capability.

6. Conclusions and Policy Recommendations

ESG adheres to multiple value orientations, emphasizes the coordinated development of the economy, environment, and society, and promotes enterprises from the single pursuit of maximizing self-interest to maximizing social value. Therefore, it plays a pivotal role for enterprises in achieving sustainable development. Based on the sample data of heavy-polluting enterprises listed on the Shanghai and Shenzhen A-shares from 2010 to 2020, we investigate the impact of ESG rating on the green innovation of these enterprises. The results are summarized as follows: (1) Hypothesis 1 was confirmed: ESG ratings significantly foster green innovation within enterprises in heavily polluting sectors. Subsequent robustness tests reinforced this finding. While there are parallels with prior research [

40,

41], this study uniquely addresses the oversight of heavy-polluting industries, thereby contributing novel insights to the field. (2) Hypotheses 2 and 3 were substantiated, demonstrating that the alleviation of financing constraints and the enhancement of risk-taking capabilities are pivotal mechanisms through which ESG ratings encourage green innovation in enterprises within heavily polluting industries. These conclusions draw primarily upon the concept of information asymmetry and align with the perspectives and analytical framework presented by Wu et al. [

42]. (3) Moreover, our research suggests that ESG ratings do not markedly enhance green innovations in SMEs and SOEs operating within heavily polluting sectors. We propose that this may be due to small and medium-sized enterprises placing a higher emphasis on survival and growth rather than on social and ecological responsibilities. Furthermore, the intricate governance structures and resource allocations of state-owned enterprises may dampen the efficacy of ESG ratings on their green innovation initiatives. This stance is corroborated by a substantial body of literature and numerous studies [

49,

50,

51]. Drawing from the empirical findings, this research delineates the following policy implications.

Firstly, there is a need to strengthen the role of ESG ratings in guiding and incentivizing green innovation. This can be achieved by promoting the integration of ESG concepts into the strategic development plans of enterprises. Through the transmission mechanism of ESG ratings, enterprises can be incentivized to increase their investment in low-carbon technological progress and scientific and technological innovation. Simultaneously, they are encouraged to strengthen the focus of supervision and crackdowns on possible “greenwashing” behaviors at the law and regulation levels, thereby curbing such deceptive behaviors. Consideration should also be given to incorporating ESG principles into the assessment criteria for SOEs. Additionally, the private economy can also leverage ESG to enhance credit enhancement, thereby solving the financing difficulties and high financing costs, ultimately comprehensively promoting the favor of social capital to the green industry.

Secondly, it is imperative to establish a mandatory ESG disclosure system. At present, domestic ESG disclosure largely remains at a stage of encouragement and voluntary participation. Consequently, consideration can be given to expanding the scope of enterprises with mandatory disclosure, such as from large listed companies to SMEs or from key industries (like finance, minerals, and electric power) to other industries. At the specific institutional level, the introduction of a “non-disclosure is interpretation” rule could be instrumental in actively promoting China’s ESG practice gradually toward standardization, systematization, and localization.

Thirdly, it is recommended to actively create a favorable ESG external environment. Government regulators should clear the obstacles to ESG disclosure such as a lack of practical rules, insufficient motivation for disclosure, and difficulties in data integration. Meanwhile, government regulators can give certain incentives to companies participating in ESG. In particular, financial regulators can provide policy incentives to enterprises with higher ESG ratings in IPO, refinancing, bond issuance, etc. Simultaneously, stringent penalties should be imposed on enterprises that fail to disclose or provide false information in accordance with the requirements. In this way, it may create a favorable environment for the development of ESG investment.