1. Introduction

The industrial structure and competitive environment are changing rapidly because of the development of digital technology. Moreover, the era of digital transformation (DT), in which the transformation of the industrial ecosystem itself is triggered, has arrived [

1]. DT greatly interests scholars, executives, and policymakers as digital technologies continue to be integrated into products, services, and processes [

2]. Overall, DT has caused destructive innovation that countries and major companies should respond to [

3].

As a major part of the fourth industrial revolution, DT has become a core keyword that comprehensively encompasses all industries worldwide since the World Economic Forum in 2016 [

4]. In addition, this has been set as one of the business goals of most companies and has become one of the main activities requiring significant investment in time, human resources, and capital [

5]. Fundamentally, from a corporate management perspective, DT derives from internal operational improvements, such as productivity improvement, work efficiency, and operational optimization, using digital technology in data-driven new businesses and strategies that renew customer experience explained as an activity of management innovation of various companies [

6]. With the advent of the digital economy and the profound adjustment of technology and market environments, an increasing number of Chinese enterprises are turning to digital technology, encouraging organizational optimization and accelerating the pace of product and service innovation, providing a new impetus for China’s economic development [

7]. The same is true of Korea.

Academic interest in environmental, social, and corporate governance (ESG) issues is increasing as companies introduce ESG as a management strategy that meets the needs of the new era. ESG consists of detailed elements of the environment, society, and corporate governance. In addition, it comprises financial factors, such as operating profit sales, and non-financial factors, such as environmental protection, social problem solving, and improvement of corporate governance, and includes core values that can enhance corporate sustainability [

8]. In the case of Korea, from 2025, ESG disclosure will be mandatory for stock market-listed companies with total assets of KRW 2 trillion or more, and from 2030, ESG disclosure will be expanded to all KOSPI-listed companies, accelerating ESG management [

9]. In September 2020, China’s ‘carbon neutrality’ policy proposal became a major driving force in promoting ESG development. Moreover, the ESG concept is internally consistent with the upgrading of China’s economy from a macro perspective.

The increasing global awareness of climate and environmental issues has accelerated discussions on ESG management. At the same time, DT is already making significant contributions to reducing pollutant emissions and protecting the environment, enabling people to solve a range of traditional problems in a digital way [

10]. ESG management and DT are now inevitable trends for companies. Hence, an empirical and theoretical framework that comprehensively considers them is needed. Based on the resource-based view theory, this study reveals the internal impact mechanism of DT and ESG management on firm performance.

According to the RBV, the competitive advantage of an enterprise lies in how it acquires valuable and scarce resources and capabilities. Nasiri et al. [

11] argued that the DT of the supply chain of an enterprise can help it achieve a more stable and robust supply chain network, which in turn improves the ability to share information, collaborate, and integrate among supply chain members, and helps to achieve a sustainable competitive advantage. At different stages of DT, enterprises have different requirements for internal organizational structure, digital development strategy, and other related resources or capabilities [

12], and they drive the DT of the enterprise through coordination between them. The resource-based theory holds that ESG management can exploit and utilize the internal resources of the enterprise, and the ability to use these resources is the basis for enhancing the enterprise value [

13].

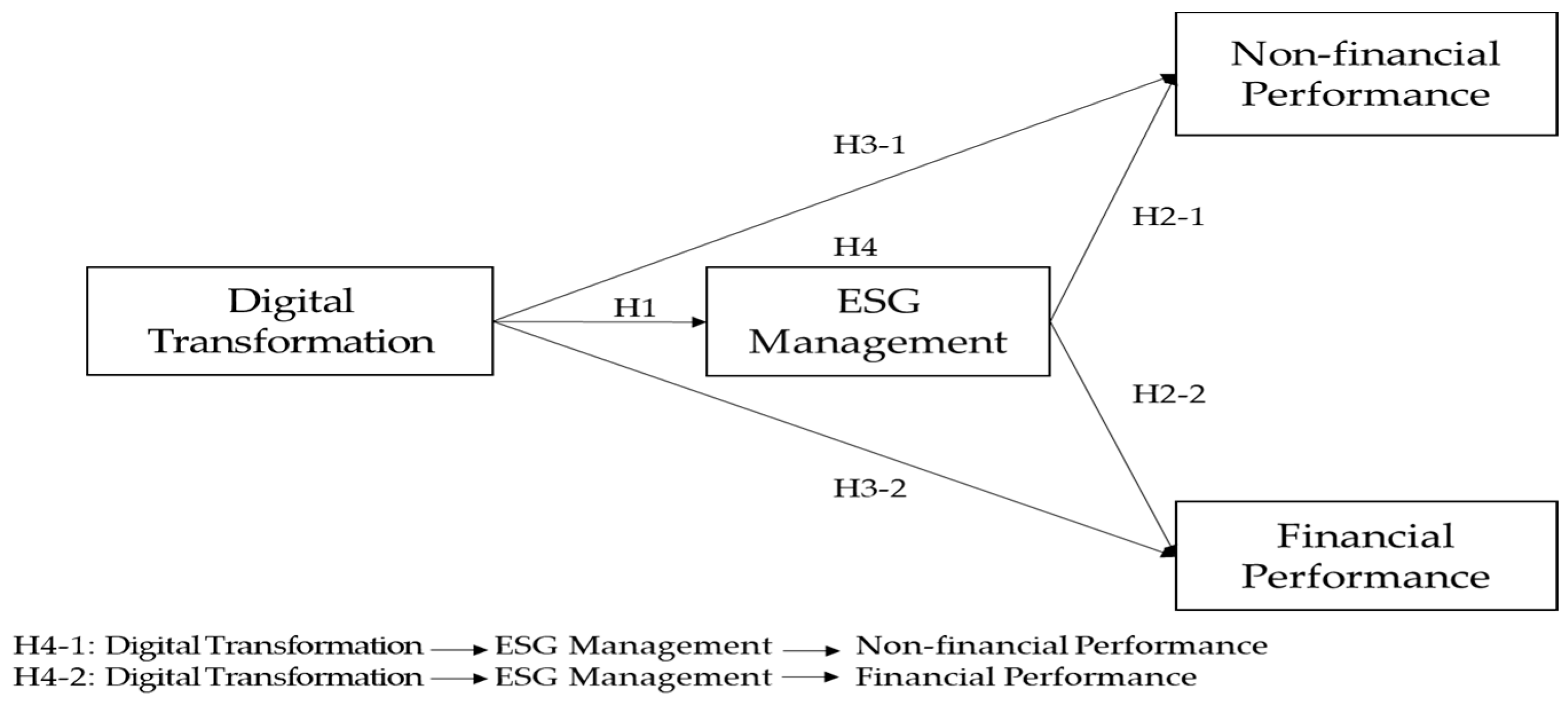

Therefore, from the perspective of resource-based theory, combined with previous studies, theoretical analysis, and empirical research, this study conducted exploratory research to verify the causal relationship between DT, ESG management, and enterprise performance. It provides a new theoretical perspective for studying the impact of DT and ESG management on enterprise performance. This paper reports the differences between Korea and China in DT, ESG management, and corporate performance and provides implications for the sustainable development of Korean and Chinese enterprises.

The remainder of this paper is organized as follows.

Section 2 outlines the theoretical background that establishes theoretical systematicity through prior research and a theory review, focusing on the concepts of related major variables (e.g., DT, ESG management, and corporate performance).

Section 3 summarizes the hypotheses and research model of the study and the analysis method.

Section 4 reports the empirical analyses conducted based on the hypotheses. Finally,

Section 5 summarizes the research results and strategic implications.

4. Empirical Analysis

This study developed research hypotheses and constructed theoretical models by searching, summarizing, and analyzing the existing literature on DT, ESG management, corporate performance, and other variables. The questionnaire was designed based on the research hypotheses and theoretical models. This study adopted the mature scale verified by the existing research in the questionnaire design process to ensure a scientific and rigorous questionnaire design. At the same time, the number of overall items in the questionnaire was controlled within a reasonable range. The quality of the questionnaire was tested using a pre-survey. The final valid questionnaire did not contain the data obtained from the pre-survey.

Korea and China have similar histories and cultures, but there are some differences in the political systems and economic levels. Therefore, comparing two important Asian countries with similar and different perspectives would be academically and practically meaningful. In particular, it is worth exploring whether there is a difference between them in terms of the impact of DT on corporate performance. Thus, an empirical analysis was conducted on companies interested in DT and ESG management in Korea and China. The questionnaire was distributed using a simple random sampling technique in Shandong Province, China, and Chung Cheongbuk-do, Korea. In China, the questionnaire was collected through the ‘Wenjuanxing’ online platform; 175 questionnaires were collected, and 151 questionnaires were used for the final statistical analysis after excluding inadequate responses. The South Korean questionnaire was collected through on-site visits and online surveys; 152 questionnaires were collected, and 146 samples were used for the final analysis after improperly written questionnaires were excluded. The survey period was from 5 March 2022 to 5 July 2022.

Table 1 lists the characteristics of the sample.

4.1. Measures

All research variables (e.g., DT, ESG management, non-financial performance, financial performance) in this study were measured on a five-point Likert scale ranging from 1, ‘strongly disagree’, to 5, ‘strongly agree’. The specific measurement items are as follows (

Table 2).

4.2. Validity and Reliability Analysis

According to a previous study [

3], the PLS-SEM method estimates the path coefficient by minimizing the prediction error between latent variables and the measurement errors of the variables measured in the study. Therefore, the predictive power can be maximized by minimizing errors among variables. Hence, there is a high likelihood that the practical application of the PLS-SEM technique will improve the validity and reliability of the research analysis results. The evaluation stage of PLS-SEM consists mainly of two stages. The first stage evaluates the measurement model, and the second evaluates the structural model [

76]. Measurement models should be evaluated for reliability and validity to ensure that all structures are adequately measured through indicators. The internal consistency was analyzed using Cronbach’s α, CR (composite reliability), and AVE (average variance extracted). Cronbach’s α ranged from 0.81 to 0.93 (reference value 0.7 or more), and the composite reliability ranged from 0.84 to 0.92 (reference value 0.7 or more), all exceeding the reference value, confirming that internal consistency reliability had been secured. The AVE value ranged from 0.63 to 0.84 (a reference value of 0.5 or more), which was evaluated as having convergent validity [

6].

Table 3 and

Table 4 list the specific results. In particular, all the variables used in this research model exceeded the reference value, indicating that internal consistency is met.

This study attempted to solve the ‘common method bias (CMB)’ by investigating the VIF values simultaneously, which was also described in the relevant part [

77,

78]. The VIF values were between 1.57 and 3.4 without exceeding the maximum value of 5. In the method, no risk of CMV (common method variance) was detected. The multicollinearity between the endogenous latent variables and latent variables is determined using the internal model VIF values [

79]. No multicollinearity was observed between independent variables because the evaluation result showed that the VIF value was less than the threshold of 5.

The discriminant validity of the measurement variables used in this study was verified. The discriminant validity indicates the degree to which a potential variable differs from other latent variables. The evaluation method judges that the discriminant validity can be seen if the average variance extracted value of each of the two latent variables is greater than the square of the correlation coefficient between the two latent variables [

50].

As shown in

Table 5, the correlation coefficient between the latent variables was less than the square root (diagonal) of the AVE value. According to Wijaya et al. [

80] and considering the Fornell–Larcker test, Hair et al. [

81] also proposed observing the HTMT to analyze discriminant validity. In this approach, the discriminant validity was considered reasonable when the HTMT value did not exceed the threshold of 0.90 [

82]. As determined using Smart-PLS (

Table 6), all HTMT values were lower than 0.800, confirming that the latent variables have convergent and discriminant validity [

83,

84].

4.3. Testing the Hypotheses

The structural models were assessed before performing the hypothesis tests. The PLS-SEM can evaluate the structural model with the determination coefficient (R

2) and predictive relevance (Q

2). According to Falk and Miller, R

2 > 10% means that the interpretability of the model is acceptable, i.e., one potential variable is the factor that causes a change in another variable [

85]. If the Q

2 value is greater than 0, the exogenous latent variable has overall predictive suitability for the endogenous latent variable [

86]. Thus, a model has predictive relevance when Q

2 ≥ 0, where a larger Q

2 indicates stronger predictive relevance [

87]. The Q

2 of ESG management was 0.185 with a value of 0 or higher (See

Table 7). Therefore, the Q

2 of the structural model for endogenous potential variables exists [

88]. The SRMR value ranges from 0 to 1; values < 1.00 indicate a model with a good fit [

89]. SRMR < 0.08 indicates a good fit between the model and the data, and SRMR < 0.05 indicates an excellent fit [

90]. The observed SRMR value of 0.071 in Korea and China indicated a good fit for the model.

The hypotheses testing and verification were conducted using Smart PLS. Based on Chin [

91] and Hair et al. [

79], bootstrapping was rotated 5000 times to verify. When verifying a research hypothesis, the critical ratio (C.R.) value, which represents the statistical significance level of the path coefficient, is considered first. If the C.R. value is outside the standard range (−1.96 to +1.96), the null hypothesis is rejected at the 95% confidence level (if not, the research hypothesis is accepted). Therefore, it is judged to be statistically significant.

The results for Korea showed that the DT had a positive effect on ESG management (t = 11.706,

p = 0.000), as listed in

Table 8. Hence, ESG management positively affects the non-financial performance (t = 4.712,

p = 0.000) and financial performance (t = 2.215,

p = 0.027) of a company. In addition, the DT positively affected the non-financial performance (t = 3.879,

p = 0.000) and financial performance (t = 6.321,

p = 0.000) of the company. Therefore, Hypotheses 1, 2-1, 2-2, 3-1, and 3-2 were accepted.

In the case of China, the DT positively affected ESG management (t = 7.264, p = 0.000). ESG management affected the non-financial performance of the company (t = 5.589, p = 0.000) but did not affect the financial performance (t = 1.160, p = 0.246). In addition, the DT positively affected the non-financial performance (t = 4.406, p = 0.000) and financial performance (t = 5.108, p = 0.000) of companies. That is, Hypotheses 1, 2-2, 3-1, and 3-2 were accepted, but Hypothesis 2-2 was rejected.

4.4. Mediating Effect Verification

This study analyzed the mediating effects using a non-parametric bootstrapping approach to test the importance of the indirect effects proposed by Preacher et al. [

92] and Zhao et al. [

93]. The percentile bootstraps and bias correction bootstraps were calculated with 5000 resampling to test for specific indirect effects. As a result, the mediating effect was significant (

p < 0.05).

Bootstrapping was performed to test the mediating effect hypothesis (

Table 9). In the case of Korea, the mediating effect of ESG management in the relationship between DT and non-financial performance was proven (t = 4.182,

p = 0.000). The mediating effect of ESG management on the relationship between DT and financial performance was statistically significant (t = 2.081,

p = 0.038).

In the case of China, the mediating effect of ESG management in the relationship between DT and non-financial performance was statistically significant (t = 3.912, p = 0.000). In the relationship between DT and financial performance, however, the mediating effect of ESG management was not statistically significant (t = 1.101, p = 0.271).

5. Conclusions

5.1. Discussion

This study examined the effects of DT on corporate performance, the mediating role of ESG management, and the differences between Korea and China.

First, DT positively affects ESG management. DT and ESG management in the Korean and Chinese cases produced the same research results. This is consistent with Peng et al. [

94], who reported that ‘DT has an impact on ESG by improving resource utilization, optimizing enterprise management processes, and improving internal governance’. In conclusion, DT can initiate competitive advantages for companies, improve risk-taking, and promote enterprises to pay attention to ESG [

95]. Thus, business managers should combine DT and ESG management to take full advantage of the positive effects of DT.

Second, Korea and China have different analysis results on the relationship between ESG management and corporate performance. From the perspective of the relationship between ESG management and non-financial performance, Korea and China had a positive influence. The corporate value can be improved by acquiring a good image from investors and consumers as a company that helps solve social and environmental problems, and trust can be gained by minimizing management risks.

In Korea, ESG management has a positive impact on corporate financial performance. In China, however, ESG management did not match the financial performance of the company. Because ESG management levels in Korea and China are different, they have shown different results. In addition, ESG management does not produce short-term profits but affects the financial and non-financial performance of companies in the mid-to-long term. In the case of China, most companies are still in the early stages of ESG management, so it is difficult to assess its effects on financial performance. Many difficulties will be encountered when attempting to improve the ESG of Chinese enterprises. The cost of ESG practice is too high, the investment of capital and human resources is too high, and ESG impacts corporate performance [

96]. Nevertheless, companies with good ESG performance may have a negative impact on short-term profits due to increased R&D investment. In the long term, however, such companies have high growth potential, and their financial performance will improve significantly [

97].

Third, Korea and China have all achieved positive results in studying the relationship between DT and corporate performance. This result is consistent with the complementary view of RBV that digital technologies need to be integrated with the company strategy to form a strong dynamic capability to realize the value of digital technologies [

5]. DT based on a resource-based view theory is an effective means for enterprises to improve sustainable performance [

13]. Therefore, using DT appropriately can improve the corporate image or customer satisfaction and help increase sales and profits. Usually, companies that accelerate DT and adapt quickly to the digital environment have relatively high performance and market value, while companies that do not will continue to lose their competitive advantage. DT has been associated with using digital technologies to improve industry efficiency and productivity [

98]. Therefore, these results are consistent with previous studies.

Finally, this research examined the positive mediating effects of ESG management between DT and corporate performance. In the case of Korea, ESG management has a mediating effect between DT and corporate performance (non-financial and financial performance). In China, ESG management has a mediating effect between DT and corporate non-financial performance. On the other hand, there was no mediating effect between DT and corporate financial performance. Hence, ESG management activities are ineffective in the short term but effective in the mid-to-long term. Through exchanges with stakeholders, especially consumers, stakeholders can be aware of the ESG management activities of a company. Moreover, when stakeholders understand this, it can be converted into final management performance. Basically, efforts to disclose or evaluate corporate ESG information are not to promote ESG activities but to develop a structure that can form a positive relationship with financial performance.

5.2. Implications

This research has the following academic implications. From the RBV, using digital technology to achieve standardized and efficient communication with customers in DT can consolidate the existing market of enterprises, reduce the information and time costs of enterprises, and improve the performance of enterprises. This paper discussed the mechanism of DT on corporate performance, provided in-depth thinking, and enriched the research results of DT. Nevertheless, there are still some gaps in the research on the mechanism of the influence of DT on corporate performance. This paper compensates for this gap by introducing ESG management as a mediating mechanism, bringing new thinking when analyzing how DT affects the integrated development of the corporate environment, social responsibility, and corporate governance. Moreover, the study enriches the literature on corporate DT [

94].

This study has the following practical implications. Enterprises should grasp the advantages DT brings. According to the empirical research in this paper, DT can help improve the level of attention enterprises pay to ESG management, and enterprises should be fully aware of the social support and economic benefits brought by the investment of DT and ESG management. ESG performance is an important measure of corporate sustainability and is widely recognized as one of the critical factors for long-term success. Enterprises should change their business philosophy and combine ESG management with enterprise resource mobilization to improve the overall operational efficiency of enterprises and achieve high-quality development. Companies should consider their strengths and weaknesses, implement DT and ESG operations in a local context, and combine the two to maximize the spillover effects of DT on enterprise performance. Considering that the government and external stakeholders are increasingly interested in corporate ESG performance, a new idea to explore the impact of corporate ESG management in the context of the digital economy has been presented. Government departments should improve the incentive policies and standard systems for DT and ESG management by enterprises; help enterprises change their governance concepts, methods, and norms; systematically promote institutional innovation; and deepen reform for DT and ESG management.

Moreover, a comparison of Korea and China, which are important and adjacent in Asia, and conducting an empirical analysis indicated differences and related implications between the two countries. South Korea and China pay more attention to DT, but the two countries focus differently on ESG. In recent years, South Korean enterprises have used ESG as a business strategy, while Chinese enterprises focus mainly on ESG disclosure and ESG evaluation. Therefore, the practice of ESG in enterprises of the two countries is different, which leads to differences between Korea and China. This study expands the existing literature on the effects of DT and the driving factors of ESG management and reports ways in which DT affects ESG management, providing an empirical basis for further deepening ESG theory and practice in Korea and China under the digital environment.

5.3. Limitations and Future Research

Although this study contains the above meaningful academic and policy implications, it had the following limitations, which may be important for future research. First, there is a limit to generalizing the results of this study because the results were derived from a cross-sectional study rather than a longitudinal study. A supplementary study through a longitudinal study should be conducted because there may be a time lag when measuring management performance. Second, there are limitations in sample selection. This study researched companies in Chungcheongbuk-do in Korea and Shandong Province in China. In the future, it will be necessary to expand the study to other regions of the two countries or other countries. Third, the investigation did not compare the impact of DT on business performance across different industries or company sizes. This can limit the competence to assess the relative effectiveness of DT in various contexts. Nevertheless, academic, policy, and practical implications through the basic model of this study could be a valuable basis for future research.