1. Introduction

Since the reform and opening-up policy in China, there has been a remarkable surge in economic development and energy consumption. In 2009, China became the world’s leading energy consumer. As of 2021, China’s primary energy consumption reached 158.53 EJ, representing approximately 26.6% of global consumption [

1,

2]. Presently, over 40% of China’s territory is occupied by resource-dependent cities, many of which have entered mature or declining periods [

3]. Continually exploiting natural resources has even led some cities to the brink of resource depletion and urban decay [

4]. The economic growth of China has been significantly reliant on an extensive development model in the past decades [

5]. Compared to developed countries, the secondary sector has played a more substantial role than the tertiary sector in economic development [

6]. Notably, the manufacturing industry holds a significant share in the industrial structure, characterized by high energy consumption and low efficiency. This poses challenges to achieving sustainable economic development and imposes substantial constraints on existing growth patterns [

7], underscoring the urgent need to address the issue of an unbalanced industrial structure.

On the other hand, there is a growing concern about the ecological imbalances and public health hazards stemming from environmental pollution. Research indicates that emissions such as sulfur dioxide, particulate matter, and industrial wastewater have a notable adverse impact on public and infant health [

8]. Moreover, air pollution negatively affects the well-being of residents [

9] and may even trigger psychological health issues like anxiety and depression [

10]. The subsequent decline in subjective well-being further exacerbates the overall health of residents, creating a detrimental cycle [

11].

Given the dual challenges of an unbalanced industrial structure and environmental pollution, green transformation has emerged as a crucial path for achieving sustainable development and modernizing the Chinese economy. Green transformation entails a shift from an extensive development model centered around natural resources (characterized by high input, consumption, and pollution) to a technology-centric intensive development model (characterized by low input and consumption and zero pollution) [

12]. Traditional economic growth models, such as the Solow and endogenous growth models, assume technological progress as the decisive factor for sustainable economic development. However, these models often overlook energy constraints and environmental performance, resulting in an inadequate and incomplete assessment of economic development quality [

13]. In 1992, the Asian Productivity Organization (APO) introduced the concept of green total factor productivity (GTFP), providing a metric that balances economic development and environmental protection.

Existing research indicates that enhancing green total factor productivity and driving urban green transformation involves crucial pathways such as green technological innovation [

14], digital economic development [

15], and the development of green finance [

16]. Some scholars have also demonstrated the positive impact of foreign direct investment (FDI) on a clean production, improving the green total factor productivity [

17]. However, the existing literature primarily focuses on the effects of environmental regulations, sustainable development, and green credit policies on urban green transformation, with limited attention paid to innovation and entrepreneurship support policies. This paper aims to fill this gap by focusing on the impact of innovation and entrepreneurship support policies on urban green transformation.

As a vital component of environmental governance, the government’s fiscal expenditures typically range from 20% to 45% of the gross domestic product [

18]. Both fiscal expenditures [

19] and education expenditures [

20] are crucial in influencing urban green transformation. The composition of fiscal expenditures significantly affects both the economy and environmental pollution [

18]. Increased funding for research and innovation (i.e., fiscal technology expenditures) can promote the dissemination of clean technologies, enhance resource efficiency, reduce pollution output, and facilitate urban green transformation [

21]. This paper introduces fiscal technology expenditures as a variable and examines its potential mediating role.

The potential contributions of this paper include (1) confirming the promoting effect of innovation and entrepreneurship support policies on urban green transformation; (2) in terms of mechanisms, revealing the partial mediating role of fiscal technology expenditures; (3) examining the “spillover effects” of innovation and entrepreneurship support policies in the field of environmental protection, exploring synergistic solutions that consider both economic development and environmental governance; and (4) practically providing a reference for fiscal decision making and policy optimization, helping fiscal authorities invest in urban green development.

The remainder of this paper proceeds as follows.

Section 2 provides the policy background, surveys the existing literature, and presents the study’s hypotheses.

Section 3 explains the research design, covering the data sources and processing, the variable definition, the descriptive statistics, and the model establishment.

Section 4 presents and interprets the empirical results and the robustness checks.

Section 5 investigates the heterogeneity effects.

Section 6 summarizes the paper’s key findings, including conclusions, a comparative analysis with similar studies, and policy implications.

Section 7 discusses the limitations of this study and future research directions.

3. Research Design

3.1. Sample Selection, Data Preprocessing, and Data Sources

In 2016, the State Council of China established the first batch of 28 mass entrepreneurship and innovation demonstration bases. Subsequently, in 2017 and 2020, two additional batches comprising a total of 184 such bases were announced. The pilot bases include regional demonstration bases, university and research institute demonstration bases, and enterprise demonstration bases. The third batch of pilot cities, introduced in 2020, faced a brief implementation period, compounded by the lingering effects of the COVID-19 pandemic after 2020. Throughout the pandemic, numerous cities experienced prolonged lockdowns, causing disruptions to the vibrancy of urban innovation and entrepreneurship, financial expenditures on technology, and overall macroeconomic development to varying extents. These circumstances created challenges for accurately assessing the effects of policies. Adding to this challenge, the National Bureau of Statistics of China (NBS) has not yet disclosed data for 2022 and 2023, posing difficulties for relevant analyses. Consequently, this study opted for the experimental group to be composed of cities where the first and second batches of announced bases are located. Since the locations of universities, research institutes, and enterprise demonstration bases coincide with those of regional demonstration bases, after screening and deduplication, a total of 51 cities were compiled as the experimental group. The remaining 233 cities served as the control group.

A panel dataset spanning from 2010 to 2021 was compiled, comprising data from 284 cities. Samples with substantial missing values were excluded, and linear interpolation was applied to address minor missing values. A 1% winsorization was performed to trim the extreme values. To mitigate potential heteroscedasticity issues, a logarithmic transformation was applied to all variables in the regression.

The data utilized were sourced from the “China Statistical Yearbook”, “China Urban Statistical Yearbook”, “China Energy Statistical Yearbook”, and “China Environmental Statistical Yearbook”.

3.2. Variable Structure

3.2.1. Dependent Variable: Green Total Factor Productivity (GTFP)

Data envelopment analysis (DEA) is a linear programming method that evaluates the performance of decision-making units (DMUs) by integrating multiple inputs and outputs [

62]. DEA is more objective than the stochastic frontier analysis (SFA) model, which requires pre-specifying the production function and the inefficiency term [

63]. Traditionally, DEA models do not consider environmental factors when measuring total factor productivity (TFP). Scholars have recently improved this method by incorporating undesirable outputs and calculated indicators such as green efficiency and GTFP, which examine economic efficiency more comprehensively from the perspective of sustainable development [

64].

The GML index is the Malmquist index calculated through the global DEA model considering undesirable outputs. The global DEA model is based on the production frontier composed of all the cities’ data in all the years; that is, all the data have only one frontier. The Malmquist index is a productivity index constructed by measuring the changes in efficiency, and it measures the changes in efficiency as ratios.

DEA models usually include the CCR (Charnes–Cooper–Rhodes model) and BBC (Banker–Charnes–Cooper model) with radial measures [

65], and the SBM (slacks-based measure) model with non-radial measures [

66,

67]. However, radial measures are more accurate only when all the inputs or outputs behave similarly. When there is excess input or insufficient output, that is, there is non-zero slack in the input or output, radial DEA will overestimate the efficiency value of the DMUs. At the same time, oriented DEA must ignore the changes in input or output, and the results calculated do not conform to the objective reality (Wang Bing, 2010). In the presence of slack, radial measures tend to overestimate efficiency [

68]. Tone (2001) constructed a new DEA model, namely the SBM model, a non-radial and non-oriented DEA model [

69]. “Radial” requires that the inputs or outputs change proportionally when evaluating efficiency, while “oriented” requires that the model selection be based on inputs (assuming outputs are constant) or outputs (assuming inputs are constant) when evaluating efficiency. Compared with the CCR and BBC, the slacks-based measure (SBM) has a larger input (output) vector ratio, is more accurate, and considers slack. However, the SBM model proposed by Tone (2001) has a drawback: the efficiency value calculated can be kept only in the interval (0, 1], and an efficient DMU takes the value of 1, while regions less than one are regarded as invalid states. Therefore, we cannot compare the efficient DMUs based on this. To address this limitation, Tone (2002) furtherly constructed a super-efficiency SBM model, which allows efficiency values greater than one and provides a condition for efficient DMU comparisons [

70].

The SBM-GML model uses the SBM model to calculate the global Malmquist–Luenberger productivity index (GML), solves the slack variable problem, and overcomes the linear programming measurement time–distance function problem. Following the method of He et al. [

71], this study used the super SBM model to estimate the efficiency of DMUs with undesirable outputs and the GML index to measure the changes in the GTFP of each city over time. In referring to [

66,

72,

73], the input indicators of labor and energy factors include the number of employees in the urban area and the city-level energy consumption. In contrast, the input indicators of capital factors include the city’s capital stock and the building area in the urban area. GDP was used as the expected output variable, and industrial sulfur dioxide, industrial wastewater, and industrial dust emissions were used as undesirable output variables. The details are shown in

Table 1.

Using each prefecture-level city as a decision-making unit, the super SBM model consists of

n DMUs with

α input indicators,

β1 expected outputs, and

β2 unexpected outputs. Therefore, the SBM is formulated as follows:

subject to

where

,

, and

are the input, expected output, and unexpected output, respectively; λ is the weight of the indicators;

ρ is the GTFP value of the DMUs; and when 0 ≤

ρ < 1, the DMU is considered inefficient, while

ρ ≥ 1 indicates efficiency.

The GML index is the rate of change in GTFP from periods t to t + 1 and requires further processing. Following the approach of Lyu et al. [

15], we set the GTFP of each city in 2010 to 1 and subsequently multiplied the GML of each year to obtain the GTFP for all cities from 2010 to 2021.

3.2.2. Core Explanatory Variable: DID

The core explanatory variable in this study is the interaction term DID:

where treated is a dummy variable representing the implementation of the national mass entrepreneurship and innovation demonstration base policy. If a city implemented the base pilot in 2016 or 2017, treated is set to 1; otherwise, it is set to 0. post is a dummy variable representing pre- and post-policy implementation, with 0 indicating pre-implementation and 1 indicating post-implementation.

3.2.3. Mediating Variable: Fiscal Technology Expenditure

This study selected fiscal technology expenditure as a mediating variable to further explore its role in the impact of entrepreneurship and innovation support policies on urban green transformation.

3.2.4. Control Variables

Drawing on the work of Chai et al. and Xie et al. [

74,

75], we selected GDP per capita, average wages of employed staff, public budget expenditure, degree of marketization, and population density as control variables. The degree of marketization, following the practices of Fan Gang and others [

76,

77,

78], evaluates the relative degree of the marketization of each prefecture-level city from five aspects: government-market relationship, development of non-state-owned economy, development of product market, development of factor market, and development of market intermediary organizations and legal system environment. Each aspect comprises 19 indicators or sub-indicators, which are synthesized into five “aspect indices” for marketization progress. These five aspect indices are then combined into a relative index of marketization progress.

3.3. Descriptive Statistics

Table 2 reports the sample’s descriptive statistics results, indicating reasonable variable metrics with no extreme outliers.

3.4. Model Establishment

To explore the impact of implementing innovation and entrepreneurship support policies on urban green transformation, this study, referencing Tian et al. [

79], employed a comprehensive model for investigation. The specific steps are outlined as follows.

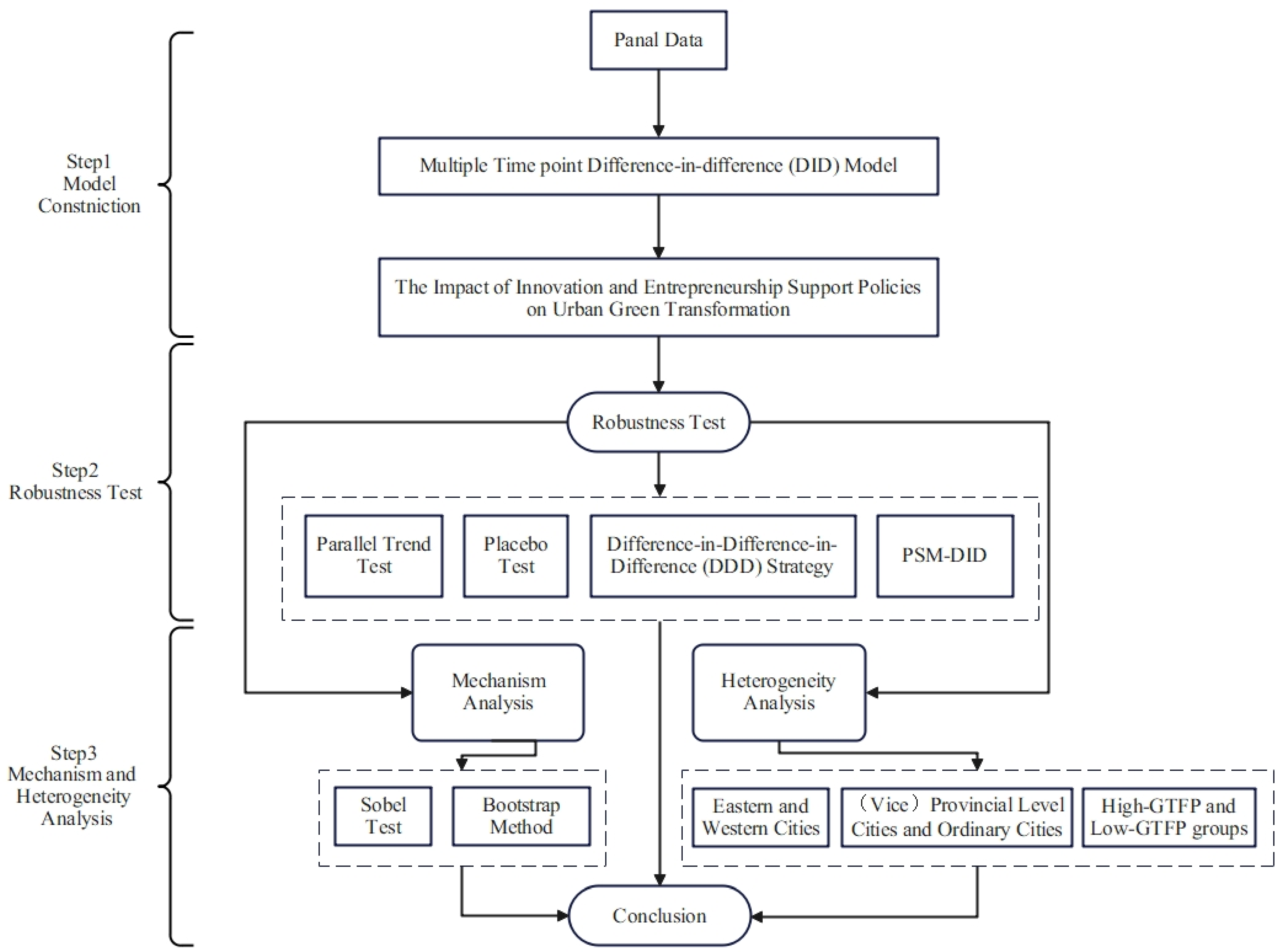

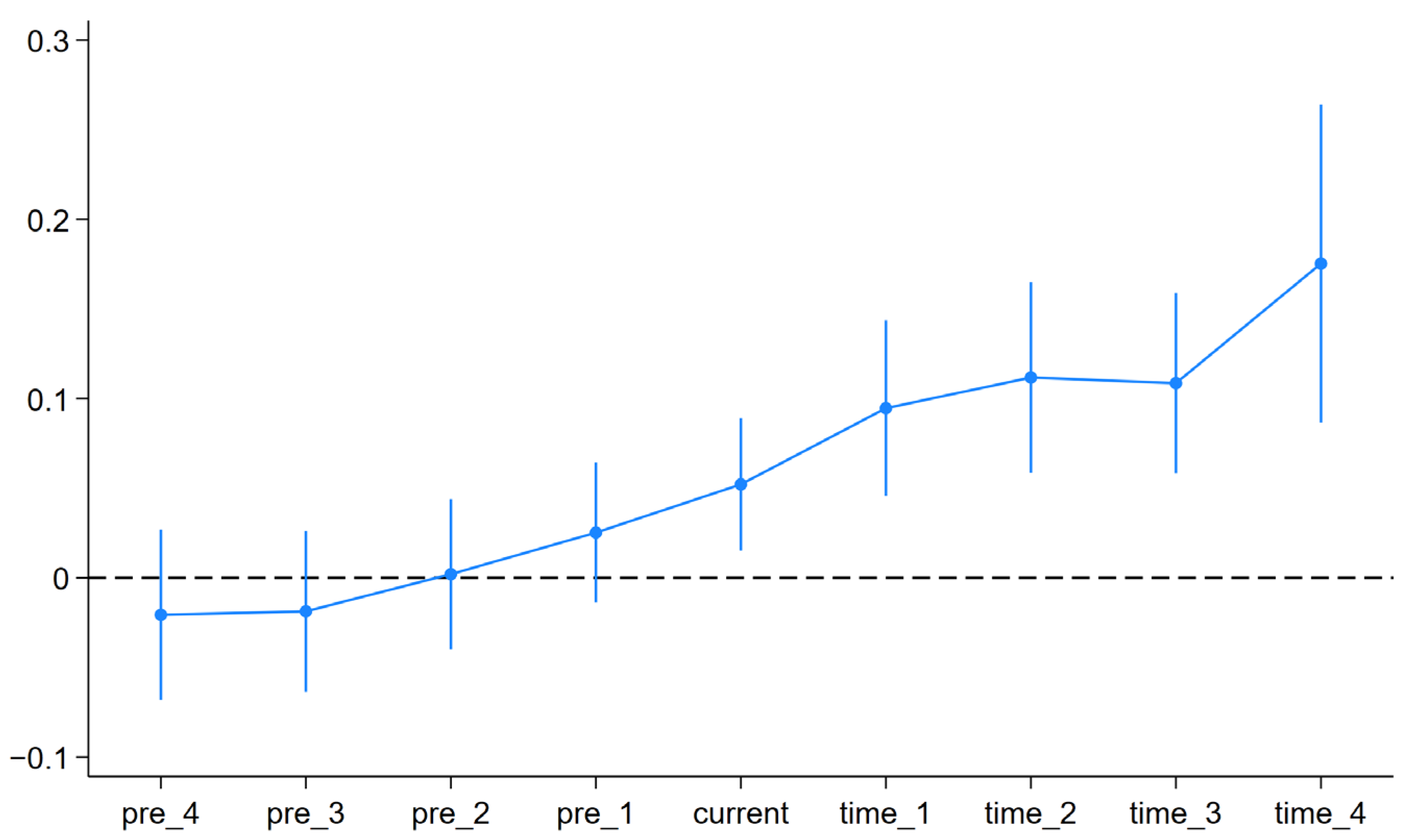

This research regards the establishment of mass entrepreneurship and innovation demonstration bases as a quasi-natural experiment. The pilot cities receive various policy preferences. Therefore, the establishment of mass entrepreneurship and innovation demonstration bases may impact urban green transformation, while non-pilot cities are unaffected. Since the demonstration bases were established in several phases, this study adopted a multi-time point difference-in-difference (DID) approach to examine the policy effects. Finally, to mitigate the influence of inherent differences between cities on the results, a combination of propensity score matching and the difference-in-difference strategy (PSM-DID) was employed for further verification.

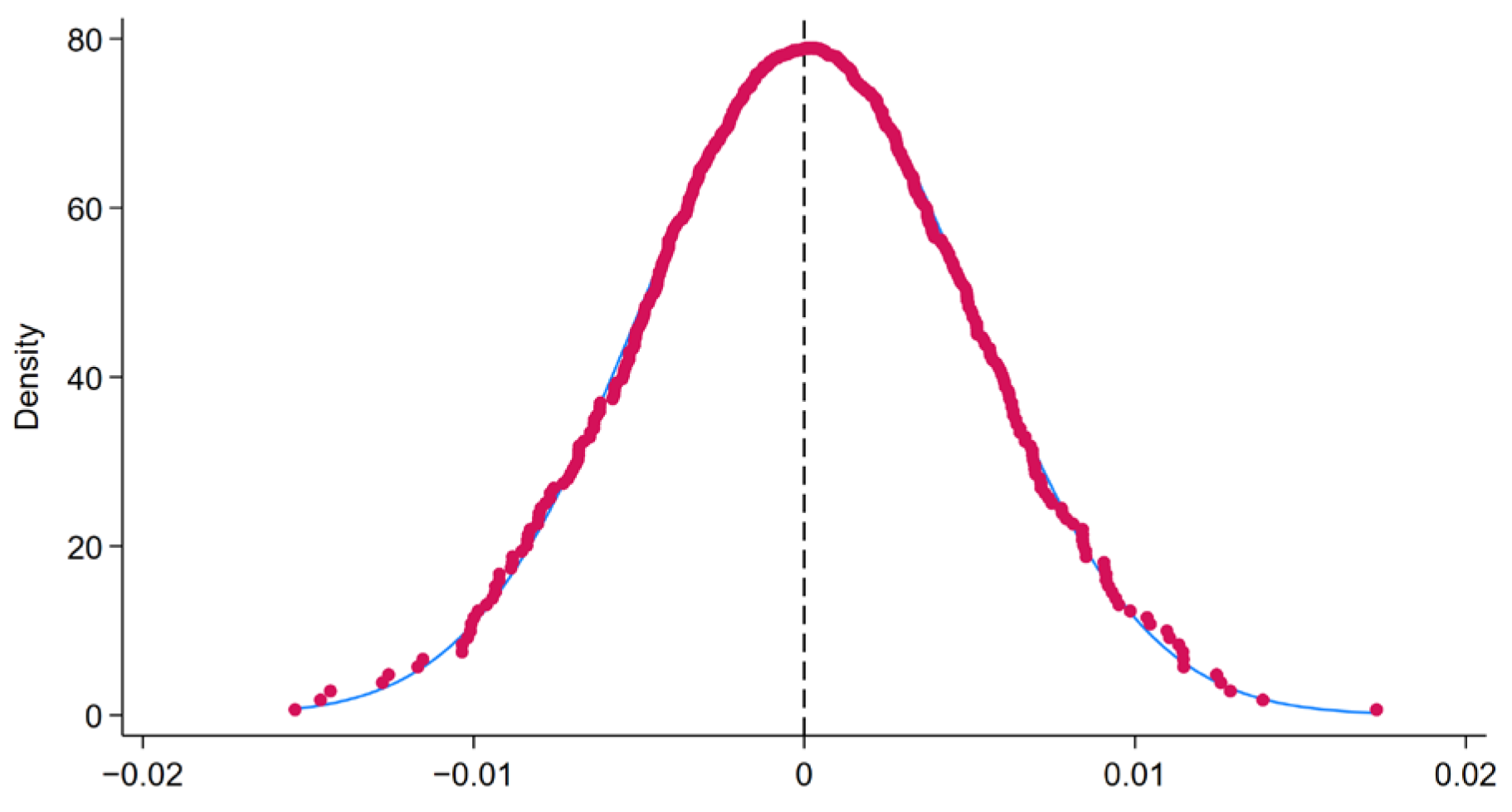

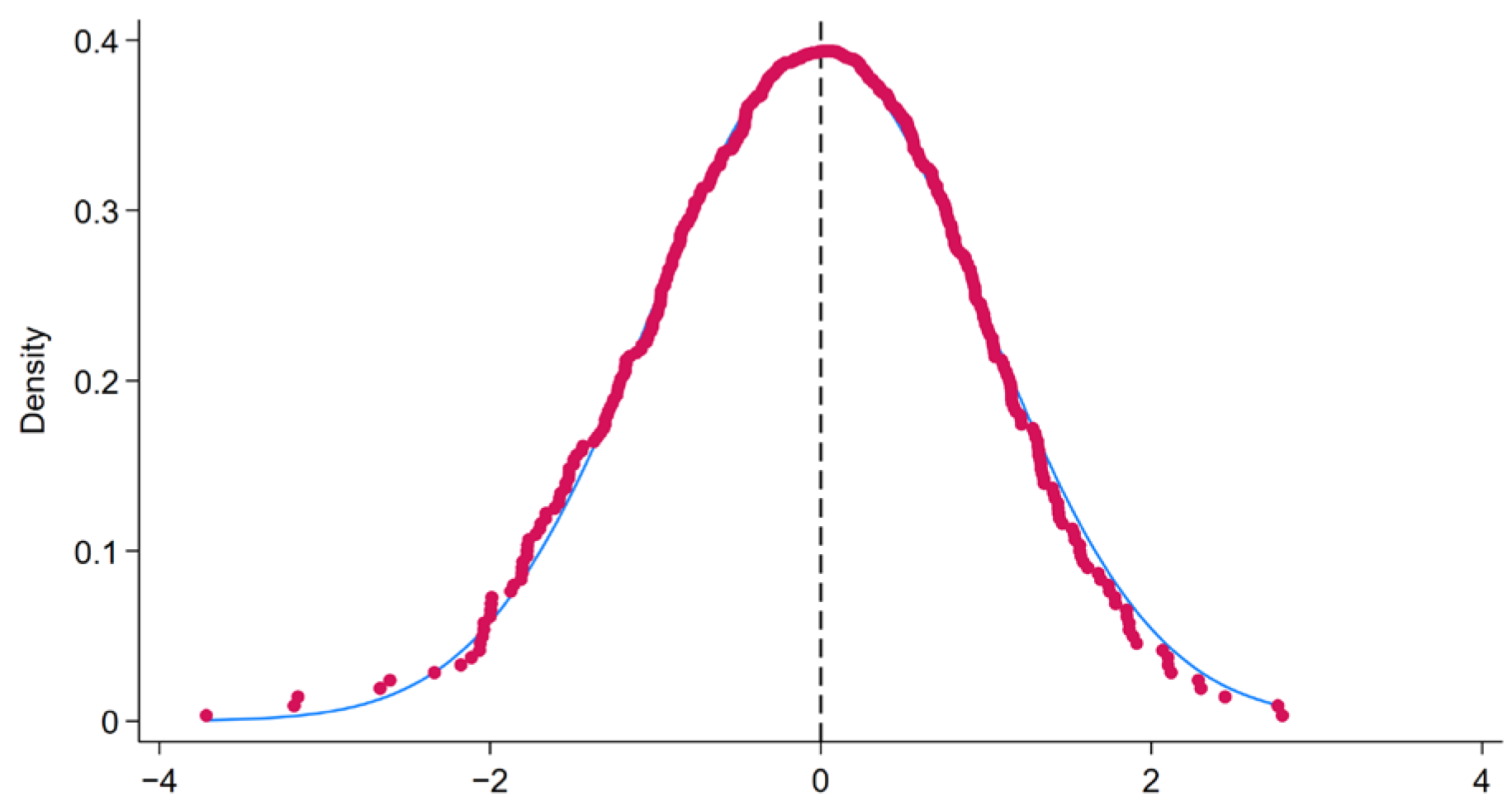

Initially, the effectiveness of the multi-time point DID was examined through parallel trend testing. Subsequently, robustness tests were conducted using placebo tests, the difference-in-difference-in-difference strategy (DDD), and the PSM-DID, among other methods. Additional robustness tests, including lagged regressions, winsorization, and replacing dependent variables, were performed to examine the regression results’ robustness further.

- 3.

Mechanism and Heterogeneity Analyses

As the “Implementation Opinions” call for policies to be implemented through fiscal expenditure on science and technology, this study investigated the mediating role of fiscal technology expenditure to explore further the mechanism by which the establishment of innovation and entrepreneurship support policies affects urban green transformation. Additionally, to analyze the differences in policy implementation effects, three groups were established based on geographical location (eastern and western cities), administrative level ((vice) provincial-level and ordinary cities), and GTFP levels (high and low). This aimed to analyze the variations in green transformation under the policy across different regions, administrative levels, and GTFP groups.

The specific steps are illustrated in

Figure 1.

3.4.1. Direct Effects of Innovation and Entrepreneurship Support Policies on Urban Green Transformation

This study employed a multi-time point DID model to investigate the impact of the national mass entrepreneurship and innovation demonstration base policy on urban GTFP. The estimated model is as follows:

where

GTFPit represents the green total factor productivity of city

i in year

t. The term

α denotes the intercept, while

DIDit is a dummy variable that signifies whether city i has implemented the mass entrepreneurship and innovation demonstration base pilot in year

t. The row vector

represents the coefficients for control variables, and

is a column vector representing six control variables. The terms

ui and

Yt capture the individual and time effects, respectively, and

represents the random disturbance term. The estimated coefficient

reflects the relative impact of supportive policies for innovation and entrepreneurship on GTFP.

3.4.2. Mediating Effect of Fiscal Technology Expenditure

Building on Equation (7), the following model was established to test the mediating effect of fiscal technology expenditure:

where

tgovit represents fiscal technology expenditure for city

i in year

t; if

β2,

β3, and

β4 are all significantly positive, the partial mediating role of fiscal technology expenditure can be confirmed. Other variables are the same as specified in Equation (7) and are not reiterated here.

5. Heterogeneity Analysis

Heterogeneity in the innovation effect is observed across different regions in the country. In non-resource-based eastern cities characterized by higher economic development, abundant science and technology enterprises, and ample green innovation resources, the promotional impact of green innovation on GTFP is more pronounced [

85]. Given that green innovation is a crucial pathway through which fiscal technology expenditures influence urban green transformation, is there also heterogeneity in the promoting effects of fiscal technology expenditures and innovation and entrepreneurship support policies on urban green transformation?

In following the work of Chai et al. [

29,

86], the sample was divided based on the following criteria: (a) in using the Hu Huanyong Line (also known as the Aihui–Tengchong Line or the Heihe–Tengchong Line, the Hu Huanyong Line is an imaginary line that divides China into two parts with contrasting population densities that stretches from the city of Heihe in the northeast to Tengchong in the south, diagonally across China; the eastern portion, which is further subdivided into north and south halves, is home to 94% of China’s population and covers 43% of its total area, whereas the western portion, which constitutes 57% of China’s territory, is home to only 6% of the country’s population 1; the line was proposed by Chinese population geographer Hu Huanyong in 1935 and called a “geo-demographic demarcation line”) as a basis, the sample was divided into eastern and western cities; (b) based on administrative levels, the sample was divided into (vice) provincial-level cities and ordinary cities; and (c) based on whether the GTFP of the city is greater than the median, the cities were divided into high-GTFP and low-GTFP groups. Subsequently, grouping regression was performed for these three criteria to study the heterogeneous impact of innovation and entrepreneurship support policies on fiscal technology spending and GTFP.

The regression results indicate that regardless of whether the sample belongs to eastern or western cities, (vice) provincial-level cities, or ordinary cities, and whether GTFP is higher than the median, implementing the demonstration base policy significantly increases fiscal technology spending at the prefecture-level city. However, only in eastern cities, (vice) provincial-level cities, and cities with high GTFP do innovation and entrepreneurship support policies significantly impact urban green transformation.

In observing the regression coefficients, it was found that in eastern cities, (vice) provincial-level cities, and cities with high GTFP, the coefficient of the demonstration base policy on fiscal technology spending is higher than in western cities, ordinary cities, and cities with low GTFP. This is consistent with the empirical conclusions of previous scholars [

29,

87]. One possible explanation is that eastern cities, (vice) provincial-level cities, and cities with high GTFP have stronger fiscal capacities to support innovation and entrepreneurship, enabling a better expansion of fiscal technology spending and effectively promoting urban green transformation. This further confirms the mediating role of fiscal technology spending in innovation, entrepreneurship, and urban green transformation. Specific regression results are presented in

Table 11.

6. Research Conclusions, Discussion, and Policy Recommendations

6.1. Conclusions and Discussion

Innovation and entrepreneurship have always been hot topics for local economic development [

88]. As the main body of the market economy, enterprises are the key engines for urban green transformation, which is the only way to achieve high-quality and sustainable development [

89]. Previous studies on urban green sustainable development primarily focused on the effects of environmental policies, while the research on innovation and entrepreneurship support policies have also stayed at the economic level. This paper breaks out of the mindset that environmental and economic development are mutually opposed by innovatively studying the policy spillover effects of innovation and entrepreneurship policies at the environmental level and obtaining rich conclusions.

This study focused on the pilot projects of two batches of innovation and entrepreneurship demonstration bases in 2016 and 2017. In utilizing panel data from 284 prefecture-level cities in China spanning from 2010 to 2020, a multi-time point difference-in-difference (DID) model was employed to investigate the impact of innovation and entrepreneurship policies on urban green transformation. The empirical results indicate the following key findings: (1) generally speaking, supportive policies for innovation and entrepreneurship enhance urban green total factor productivity, suggesting a positive effect on urban green transformation; (2) fiscal and technological expenditures play partial mediating roles in the mechanism, fostering green technological innovation, improving human capital, and enhancing energy structure, thereby driving urban green transformation; and (3) the impact of innovation and entrepreneurship supportive policies on green transformation varies across cities, with a significant positive effect observed in eastern, (vice) provincial-level cities, and cities with high GTFP.

The research conclusions of this paper also have extensive connections with previous studies from different countries. Firstly, from the perspective of the policy’s main effect, there is prior evidence to imply that innovation and entrepreneurship have potential environmental effects. Our research results are consistent with those of studies such as those by Gu et al., who used a double-threshold regression model to verify that regional innovation can expand the effect of industrial digitalization on the efficiency of urban green development [

90]. Burch et al. pointed out that small- and medium-sized enterprises can flexibly fill the local gaps and have great potential in urban sustainable transformation [

91]. Secondly, from the perspective of the mediation path, in past studies, the sustainable policies implemented by the urban government mainly relied on non-governmental organizations to provide advice and assistance to enterprises [

92], lacking a direct driving force from the government; different from the Western-style small government, this study focused on the Chinese-style big government scenario, and the role of government action in promoting the coordinated development of economy and environment. Thirdly, from the perspective of urban heterogeneity, this paper found that for the western, non-provincial cities and low-GTFP cities in China, the innovation and entrepreneurship policies have no noticeable effect on urban green transformation, because, on the one hand, there is a lot of overlap between the three categories of western, non-provincial cities and low-GTFP cities, and these economically underdeveloped cities have limited government fiscal capacities and low fiscal science and technology expenditures; on the other hand, the gradual decline of urban green innovation efficiency from eastern to western cities pointed out by Wang et al. may be another reason [

93], and a low green innovation efficiency may hinder the transmission of fiscal science and technology expenditure to promote urban green transformation.

6.2. Policy Recommendations

This study provides theoretical support for better government involvement in urban green transformation. Based on the research findings, the following policy recommendations are proposed.

To promote urban green transformation, intensifying the implementation of supportive innovation and entrepreneurship policies is recommended. Specifically, the government may consider establishing dedicated funds to support green technological innovation and sustainable development projects. By providing fiscal support and tax incentives and encouraging and attracting more innovative enterprises to engage in R&D and practices in the green sector, cities can achieve green transformation more rapidly and effectively. Additionally, it is suggested that the government establish a more flexible policy framework to adapt to different cities’ diverse needs and characteristics, ensuring that policies can achieve more significant effects nationwide.

- 2.

Increasing Fiscal Technological Expenditure for Green Innovation.

In pursuing green innovation, the government should consider increasing fiscal technological expenditure. Establishing special funds to support R&D projects of high-tech small and micro enterprises and universities is recommended, ensuring that these projects receive sufficient support in the early stages and providing a solid technological foundation for urban green transformation. Furthermore, it is essential to refine and optimize support policies for demonstration bases further, offering more financial support and tax incentives to innovative enterprises, thus becoming a driving force for urban green transformation.

- 3.

Considering Regional Differences in Policy Formulation.

Given the urban heterogeneity in green transformation resulting from the construction of national innovation and entrepreneurship demonstration bases, the central government, in formulating policies, should comprehensively consider regional disparities. Differentiated policy measures could be adopted for western, non-provincial-level cities and cities with lower GTFP, such as further reducing the tax burden on innovative enterprises and streamlining approval processes to enhance their competitiveness in green transformation.

7. Limitations and Future Research Directions

Although this study considered the impact and mechanism of innovation and entrepreneurship support policies on urban green transformation, some limitations still provide opportunities for further research on relevant topics.

First, the statistical data have timeliness, and the sample data of this paper only go up to 2021. The statistical data of 2022 need to be queried after the publication of the China Statistical Yearbook 2023 in 2024 (not yet publicized), which will have a specific adverse impact on the current academic research and the government’s flexible adjustment of policies to achieve the best results. However, it is regrettable that obtaining relevant data is beyond the scope of this study.

Second, regarding variable selection, this paper considered only fiscal technology expenditure as one mediator. Still, there are many other factors at work, such as the innovation and entrepreneurship policies, that have been verified to promote the technological innovation of small- and medium-sized enterprises [

94], and technological innovation has always been the driving force of green transformation [

12]. These factors are likely to play mediating roles in the process of innovation and entrepreneurship support policies promoting urban green transformation.

Third, this study is based on GTFP and studied the driving factors of urban green transformation from a static perspective. Due to the lack of dynamic evaluation indicators for green transformation in the academic field, we were unable to conduct a quantitative study on urban green transformation from a dynamic perspective.

It is suggested that future researchers use the latest authoritative data to verify this paper’s findings further. They can also develop dynamic evaluation indicators for green transformation and assess relevant factors from a dynamic perspective. Moreover, they can explore other mediating variables that affect urban green transformation under the theme of innovation and entrepreneurship. Depending on the different mediating variables, they can provide more targeted suggestions for the government’s decision making on urban green transformation.