Abstract

In the context of global competition, enterprises are increasingly adopting technology mergers and acquisitions (M&As) as a strategic approach to enhance their sustainable competitiveness. This study investigates the impact of technology M&As on the sustainable competitiveness of enterprises, focusing on Chinese A-share listed companies from 2007 to 2021. Employing a staggered difference-in-difference (DID) model for empirical analysis, the findings reveal that technology M&As significantly boost the sustainable competitiveness of enterprises by 6.2% compared to non-technology M&A firms. Moreover, the study employs a mediation effect model to demonstrate that technology M&As contribute to improved enterprise productivity levels and market power. Heterogeneity analysis further indicates that the positive effects are more pronounced in firms with a strong ESG performance and those with lower levels of digital development. The study offers valuable insights for corporate strategic planning and policy-making, emphasizing the role of technology M&As in fostering enterprise sustainability and competitiveness.

1. Introduction

In an era of accelerated global economic integration, the landscape of corporate competition has intensified, necessitating that enterprises innovate technologically and continuously expand their markets to maintain competitiveness. Technology M&As have emerged as a strategic lever for companies to bolster their market stance. Despite the increasing prevalence of technology M&A activities among Chinese enterprises, there exists a notable gap in the research regarding their impact on sustainable competitive advantage. This gap underscores the need for a comprehensive exploration into how technology M&As contribute to sustainable competition among enterprises, guiding Chinese enterprises towards informed M&A decisions.

In recent years, there has been widespread scholarly attention on research related to technology M&As. The existing research has predominantly focused on the immediate financial outcomes of M&As, with less attention given to the long-term strategic benefits, such as sustainable competitive advantages [1,2]. In the research concerning the impact of technology M&A on the long-term strategic interests of enterprises, scholars are progressively exploring the relationship between technology M&As and sustainable competitive advantages from various perspectives. On the one hand, the technology M&A is viewed as an effective way for enterprises to expand markets and increase their market share. Through technology M&As, enterprises can quickly acquire advanced technologies, core talents, and abundant market resources, thus enhancing their competitiveness [3]. Successful technology M&As can enhance a company’s innovation capabilities, improve the quality of its products and services, and strengthen the long-term sustainable competitiveness [4]. In the context of China, some researchers found that Chinese enterprises can effectively acquire key technologies and market resources through technology M&As, which is of significant importance for enhancing their sustainable competitive advantage [5]. On the other hand, technology M&As involve certain risks, such as cultural differences, technological integration difficulties, and management conflicts, which may lead to poor integration after M&As, and even weaken the enterprise’s sustainable competitiveness [6]. Furthermore, the impact of technology M&As on sustainable competitive advantage depends on various factors, such as transaction heterogeneity and the nature of property rights of enterprises [7]. In the process of sustainable development, ESG and digital development inevitably have a significant impact on enterprises’ sustainable competitive advantage. The importance of Environmental, Social, and Governance (ESG) standards lies in their ability to help enterprises identify and manage the risks and opportunities that may affect their long-term value creation. There is a study showing that companies with high ESG scores tend to achieve higher market values and a better financial performance [8]. Furthermore, a company’s commitment to environmental and social responsibilities can enhance its brand image, promote loyalty among consumers and investors, and thus improve its competitive advantage [9]. The impact of digital development on competitive advantages is also significant. The application of digital technologies can not only improve the operational efficiency of companies but can also create new business models and revenue streams. The research indicates that digitally mature companies perform better in the market than those with lower levels of digitalization, exhibiting stronger innovation capabilities and higher levels of customer satisfaction [10]. In China, with the rapid development of the digital economy, digital transformation has become key for enterprises to gain a sustainable competitive advantage [11].

However, despite these studies offering valuable insights, systematic research on how technology M&As impact the sustainable competitive advantage of Chinese enterprises remains relatively limited. Especially when taking into consideration China’s unique market environment and policy background, in-depth research on the impacts of technology M&As is particularly important [12]. No consensus has been reached on the effects of technology M&As on sustainable competitive advantage, whether positive or negative. The impact of the mechanism of ESG performance after technology M&A, the degree of the digital transformation of enterprises, and the level of digital development in the region in which enterprises are located on the enterprise sustainable competitiveness remains unclear. How to fully leverage the positive effects of technology M&As and avoid potential risks remains a critical research question. Therefore, this study aims to fill this gap in the literature by exploring the impact and mechanisms of technology M&As on the sustainable competitive advantage of Chinese A-share listed companies, providing empirical evidence to guide enterprises and policy-makers. This study seeks to determine whether Chinese A-share listed enterprises can enhance their sustainable competitive advantage through technology M&As and what the underlying mechanisms of this are, and how the acquiring company’s ESG performance and digitalization level affect the sustainable competitive advantage in the context of technology M&As. The conclusions of these research questions provide empirical evidence for enhancing sustainable competitiveness through technology M&As.

This research holds both theoretical and practical significance. Theoretically, it delves into the relationship and mechanisms between technology M&As and sustainable competitive advantage, constructing a new theoretical framework based on the resource-based theory, dynamic capabilities theory, market power theory, and production efficiency theory, showing the key factors of technology M&A’s impact on sustainable competitive advantage, and expanding the literature on technology M&As and the high-quality development of enterprises [13,14]. Practically, this study offers valuable references for enterprises implementing technology M&A processes, aiding in improving M&A success rates, encouraging active participation in technology M&As, enhancing sustainable competitiveness, and contributing to China’s high-quality economic development. Moreover, the findings provide empirical evidence for government departments to formulate related policies, facilitating the perfection of China’s corporate M&A policy system, promoting technological progress, and optimizing the industrial structure.

Relative to the existing research, this study’s main contributions are as follows: 1. Few scholars have explored the relationship and mechanisms between technology M&As and sustainable competitive advantage. This article offers new insights into technology M&A decision-making; 2. Staggered difference-in-differences (DID) refers to scenarios where the timing of policy implementation varies between individuals, and individual status regarding policy intervention is prone to frequent changes. The use of a staggered DID model assesses the sustainable competitiveness effects of technology M&As, effectively eliminating biases due to individual differences and unrelated time trends, facilitating the acquisition of the “net effect” of technology M&As, and further overcoming endogeneity; 3. This study innovatively examines the heterogeneous impacts of technology M&As on sustainable competitive advantage from the perspectives of ESG performance and digital development, offering references for government policy assessments of technology M&A qualifications.

The structure of this paper is as follows: Section 2 reviews the literature and proposes the research hypotheses on the impact of technology M&As on sustainable competitive advantage. Section 3 describes the empirical data and research methods used. Section 4 presents and discusses the main results of the econometric models. Finally, Section 5 summarizes the empirical research findings, providing targeted policy recommendations and practical insights for enterprises implementing technology M&As for future sustainable development.

2. Literature Review and Research Hypotheses

2.1. Literature Review

In the field of enterprise sustainable competitiveness, researchers have explored the impact of corporate culture, technological innovation, and M&As from various perspectives. The relationship between technology M&As and sustainable competitive advantage has garnered widespread attention among scholars [6,15]. However, a consensus on the research findings has yet to be achieved. On the one hand, some researchers argue that, through technology M&As, acquiring enterprises can obtain the target company’s technological assets, knowledge, patent rights, and human resources. This acquisition enhances the enterprise’s technology and innovation capabilities, accelerates the pace of product development and market introduction, and increases production efficiency. Moreover, technology M&As can assist companies in entering new market sectors, achieving diversification and global expansion, enhancing market power, and strengthening their sustainable competitive capability [16,17]. On the other hand, findings from some studies indicate that technology M&As may increase financial risk, reduce management efficiency, complicate technology integration, lead to resource wastage, and lead to challenges such as legal and regulatory issues, corporate culture clashes, and loss of talent [18,19], undermining the enterprise sustainable competitiveness.

The impact of technology M&As on corporate sustainable competitiveness is contingent upon various factors. Previous studies primarily discussed this impact from the perspectives of transaction heterogeneity between the acquirer and the acquiree, and the nature of corporate property rights. Scholars categorize M&As into domestic and cross-border, finding that the success of cross-border M&As hinges on the acquiring enterprise’s ability to navigate cultural and governance differences [20]. In the high-tech industry, overseas M&As positively correlate with corporate productivity, especially among leading companies. Conversely, in low-tech sectors, domestic M&As show a positive correlation with productivity, particularly in lagging companies. Moreover, the research categorizing technology M&As into horizontal, vertical, and hybrid M&As has revealed that horizontal M&As diminish enterprises’ innovation performance, vertical M&As do not significantly affect innovation performance [21], and hybrid M&As impact both vertical and horizontal competition [22]. Furthermore, studies have shown that sufficient knowledge absorption and integration capabilities can yield successful innovation outcomes post-acquisition, with a more substantial impact on novelty than quantity, highlighting a threshold effect [23,24]. State-owned enterprises, compared to their non-state counterparts, possess certain advantages in absorbing technological innovations [25]. Despite the increasing intensity of market competition and the frequency of technology M&As, few scholars have delved into the mechanisms through which technology M&As influence corporate sustainable competitiveness. The clarity on this mechanism is lacking, necessitating further research.

In summary, existing studies have explored the relationship between technology M&As and corporate sustainable competitiveness, providing a solid foundation for this research. However, the current body of research has several shortcomings. Firstly, there is no consensus on the impact that technology M&As have on corporate sustainable competitiveness [26]. Secondly, in the existing mechanisms focusing on how technology M&As affect sustainable competitiveness, factors such as enterprise ESG performance and digitalization level have not been thoroughly investigated. Companies pay a high level of attention to the disclosure of environmental information [27], and there is observed heterogeneity in the impact of ESG reports on the market performance of listed companies [28]. Additionally, investments in digitalization and the digitalization applications made by enterprises significantly affect their competitiveness [29]. Consequently, environmental social responsibility and the level of digital development are critical to the sustainable development of modern enterprises. To understand these mechanisms in more depth, a more comprehensive theoretical framework should be developed, incorporating a multidimensional analysis of the factors influencing technology M&As regarding corporate sustainable competitiveness [5,30]. Therefore, there is an urgent need to delve deeper into the effects and mechanisms of technology M&As regarding corporate sustainable competitiveness and to provide further empirical evidence for the relationship between them and related fields of study.

2.2. Research Hypotheses

According to the Resource-Based View (RBV) [31], an enterprise’s core competitiveness is determined by its possession of unique, inimitable, and irreplaceable resources and capabilities. In the context of technology M&As, the proprietary technology, R&D teams, and intellectual property of the acquired companies often exhibit these characteristics. Technology M&As, as a means to acquire and integrate external technological resources, profoundly influence the allocation of corporate resources and the formation of core capabilities [32]. By acquiring companies with advanced technology and R&D capabilities, enterprises directly gain and integrate these resources, effectively enhancing their technological level and innovation capacity [33]. Integrating these resources into technological innovation and knowledge accumulation enables enterprises to better adapt to rapidly changing market environments. Technology M&As help enterprises maintain agility in fast-changing markets, quickly adapting to new technologies and market demands [34]. By integrating external technology, enterprises can better respond to market competition, increase the differentiation of products and services, and enhance their sustainable competitiveness. Furthermore, the Resource-Based View also emphasizes the portability and substitutability of resources. In technology M&As, by merging and integrating technological resources, enterprises can create unique combinations that are more difficult to substitute, thus consolidating their competitive position. This synergistic effect aids in creating a sustainable competitive advantage [35]. Due to the heterogeneity and difficulty in the imitation of resources, due to the complexity and tacitness of the knowledge, traditional methods such as contracts, purchases, and strategic alliances struggle to facilitate knowledge transfer [36]. However, technology M&As, by transferring control, can effectively overcome these challenges.

From the perspective of dynamic capabilities theory, technology M&As represent a prudent strategy for firms to reconfigure resources and bolster their innovation capabilities in response to changes in the internal and external environment [37]. Through technology M&As, acquiring enterprises can offset declines in their own innovation capability by gaining the technological resources of the target enterprises [38]. Successful high-tech M&As generate technologies with significant innovative potential [15], enhancing the enterprise’s independent innovation. Due to the lengthy investment cycle in R&D, businesses may struggle to adapt to rapidly changing market environments. Therefore, companies often resort to acquiring external innovative technologies as a strategy to swiftly expand into new business areas, significantly reducing the technology development time [39]. Such M&As facilitate rapid technological upgrades and cross-industry integration. Post-acquisition, through the absorption and transformation of knowledge, companies enhance their resource base and technological capabilities, achieving leapfrogging progress [40]. This strategy enables enterprises to gain an enterprise foothold in competitive markets and sustain their competitive advantage. For companies that are less technologically developed, have weak R&D capabilities, or lack sufficient investment in R&D, the acquisition of technologically advanced companies can rapidly enhance their innovation capacity to withstand fierce competition [41].

Consequently, enterprises engaging in technology M&As can complement their knowledge, achieve technological upgrades and cross-industry leaps, and thus secure a competitive edge in the market, enhancing and sustaining corporate competitiveness [42]. Based on the above analysis, the following hypothesis is proposed:

Hypothesis 1.

Technology M&As enhance enterprise sustainable competitiveness.

According to Porter [43], enterprises gain a competitive advantage in the market by continuously improving their production efficiency, reducing costs, and enhancing product quality and service levels. Technological innovation plays a crucial role in improving corporate productivity. Technology M&As introduce advanced production technologies and management experiences to enterprises. The introduction and integration of new technologies can lead to optimized production processes and efficiency enhancements, thus boosting productivity and reducing the cost per unit of production. Enterprises are better positioned to meet market demands, improve the quality of products or services, reduce production costs, and ultimately enhance their market competitiveness. Additionally, digital technologies also play a significant role in improving production efficiency [44,45]. Technology M&As often involve the integration of digital aspects, enabling enterprises to better utilize data analytics, automation, and smart manufacturing technologies. This assists in meeting the production demands of the digital era, enhancing overall production efficiency, and strengthening sustainable competitiveness. Through digital M&As, enterprises can quickly and directly access digital assets. These assets include not only tangible digital devices and machinery that significantly improve production efficiency and product quality but also intangible digital technologies, user bases, and talent, facilitating the establishment of platform-based business models, enhancing operational efficiency, and expanding service-oriented business related to products. The M&As can increase a company’s bargaining power in the short term and operational efficiency in the long term. This dual advantage, by optimizing economies of scale and improving negotiations with suppliers and customers, supports the sustainable competitive advantage [46]. Moreover, the strategic alignment of technology M&As in a competitive cooperative environment enhances the efficiency of technological progress [47]. The strategic compatibility between the parties involved in the acquisition can lead to better performance outcomes and productivity improvements. Therefore, technology M&As can promote innovation, improve strategic alignment, affect competitive dynamics, and support the strategic and efficient integration of technological resources, enhancing the productivity and sustainable competitiveness of enterprises.

Market Power Theory emphasizes the impact of an enterprise’s position in the market on its sustainable competitiveness. This theory suggests that technology M&As, by expanding an enterprise’s size, enhancing its market share, broadening its product or service lines, and boosting its brand influence, help to elevate an enterprise’s status within the industrial chain and the market [48,49]. According to Porter [50], an enterprise’s competitive position in the market has a profound impact on its profitability and sustainable competitiveness. The market power enhancement effect of technology M&As may stem from the scale effects that occur after M&As, the expanded market share, and the stronger supply chain integration [51]. Moreover, Market Power Theory also highlights enterprises’ pricing power and market share control. Technology M&As enable enterprises to better master their market pricing rights, formulate flexible pricing strategies, and increase their market share, thus dominating the market. Rational pricing for market dominance, in turn, improves profit levels. Furthermore, technology M&As accelerate the digital transformation of enterprise production and business models, enhancing their market power. For manufacturing, the transfer and application of knowledge and technology can improve product quality and reduce marginal costs [52]. The renowned Schumpeter Hypothesis posits that market power is necessary to safeguard technological innovation outcomes [53]. The more monopolistic the market structure, the higher the concentration, and the more conducive it is to technological innovation. However, the Neoclassical school later questioned this idea, arguing that a perfectly competitive market structure is the most efficient, and under certain conditions, a competitive market structure is more conducive to innovation, promoting R&D activities more effectively than a complete monopoly [54]. Technological innovation is a critical factor affecting sustainable competitiveness. Thus, technology M&As help enterprises establish a stronger position in the market, strategize globally, expand their market share, and enhance their global market power. Such market power endows enterprises with greater risk resistance, increasing their sustainable competitiveness. Based on the above analysis, the following hypothesis is proposed:

Hypothesis 2.

Technology M&As promote an increase in enterprise productivity levels and market power, thereby enhancing enterprise sustainable competitiveness.

Enterprise ESG performance is closely linked to their sustainable development and competitiveness. Technology M&As, by introducing advanced environmental technologies, social responsibility practices, and effective corporate governance mechanisms, can enhance an enterprise’s ESG performance [55]. Such improvements in ESG performance help to boost the company’s image among investors and consumers, consequently increasing their market value.

By integrating more environmentally friendly technologies and management practices through technology M&As, companies can reduce potential legal and environmental risks and enhance their reputation in ESG domains. This makes them more attractive to investors, facilitating easier access to long-term funding and reducing financing constraints [56]. Companies with a strong ESG performance send positive signals to the market. Institutional investors generally favor companies with higher ESG ratings [57]. To attract investors and institutions, companies are more proactive in fulfilling their environmental and social responsibilities and strengthening corporate governance. Such strategic decisions focus on long-term sustainable development rather than short-term gains. For example, companies may invest a portion of their profits into R&D with long-term benefits, promoting technological innovation and enhancing sustainable competitiveness. Based on this analysis, the following hypothesis is proposed:

Hypothesis 3.

Technology M&As have a more pronounced effect on enhancing the sustainable competitiveness of companies with a strong ESG performance.

Investments and applications in digitalization significantly impact an enterprise’s competitiveness. Technology M&As provide an opportunity for regions and companies with low levels of digitalization to introduce advanced technologies, digital management systems, and innovative business models, helping to address their digital transformation shortcomings and enhancing their competitiveness in the digital age. Firstly, regions and companies with low levels of digitalization face challenges such as outdated technology and limited market development [58]. Technology M&As offer a pathway to quickly access advanced technologies, knowledge, and experiences, compensating for the digital lag [59]. By integrating advanced technologies, companies can gain a first-mover advantage in markets with low digitalization, enhancing the competitiveness of their products and services.

Secondly, technology M&As can also bring updates to organizational culture and management experiences. In regions and companies with low levels of digitalization, traditional management models and cultures may hinder digital transformation. The introduction of new management ideas and cultures through technology M&As can stimulate innovation and promote the successful implementation of digital strategies. For companies with low digital transformation levels, technology M&As can accelerate the implementation of their digital strategies. The acquired companies often possess specialized knowledge and experience in the digital domain. By integrating these resources, companies can more rapidly and effectively cross boundaries, accessing the resources and technologies required for digitalization and significantly improving their level of digitalization [60]. This helps to enhance operational efficiency and reduce costs.

Overall, as an essential stage in the high-quality development of the digital economy in the new era, corporate digital transformation essentially represents a comprehensive integration of all aspects of a business with digital technology. This innovation-driven transformation can help companies seize the initiative in market competition, gaining an advantage and enhancing sustainable competitiveness in the digital age [61]. Based on this analysis, the following hypothesis is proposed:

Hypothesis 4.

Technology M&A has a more obvious effect on the sustainable competitiveness of enterprises in regions with a low level of digitalization and enterprises with a low degree of digital transformation.

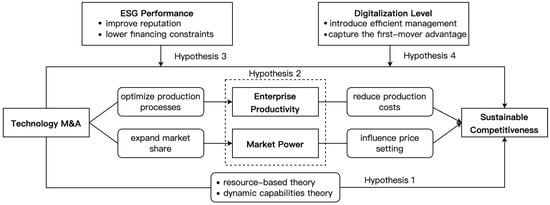

The framework in this research is shown in Figure 1.

Figure 1.

Conceptual framework.

3. Research Design

3.1. Sample Selection and Data Sources

This study gathered M&A data of A-share listed companies from 2007 to 2021, sourced from the CSMAR database, which served as the initial sample. The year 2007 marks the first year of the implementation of the new accounting standards by Chinese enterprises. The quality of financial reporting of Chinese listed companies has been significantly improved, with enhanced reliability and more consistency in the data. Based on data availability and completeness, the sample period was selected to include up to the year 2021. The M&A samples were filtered to exclude incomplete transactions, retain buyer transactions, and remove cases involving debt restructuring, tender offers, related transactions, court auctions, asset liquidations, and anywhere the M&A transaction amount was missing or less than 10,000. This process yielded 5578 M&A events. Following the criteria established in previous studies [62,63,64], 740 technology M&A events were identified, involving 449 companies. These companies formed the experimental group, while non-tech M&A companies listed on A-shares during the same period served as the control group, excluding ST and financial companies, and those with significant anomalies (e.g., debt to assets ratio over 1), resulting in 3697 non-tech M&A companies. Financial data were sourced from the CSMAR database, and patent information was sourced from the CNRDS database. To minimize outlier impacts, continuous samples were trimmed at the 1% and 99% levels for analysis. Table 1 details the industry distribution of the technology M&A experimental group, primarily in computer, communications and other electronic equipment manufacturing, electrical machinery and equipment manufacturing, chemical raw materials and chemical products manufacturing, pharmaceutical manufacturing, and special equipment manufacturing.

Table 1.

Industry distribution of technology M&A companies.

3.2. Model Construction

As technology M&As occur at different times between companies, the technology M&A behavior of companies can be regarded as a quasi-natural experiment. This article draws on the practices of scholars [65] to use a staggered DID to examine the impact of technology M&As on corporate market power. The specific model settings are as follows:

Among them, is the sustainable competitiveness of enterprises. TMAit is a dummy variable for whether the enterprise conducts technology M&As. If enterprise i has a technology M&A in period t, then the enterprise’s TMA value will be 1 in every year after period t. If the enterprise has no technology M&As during the entire sample period, the value will be 0. The coefficient of reflects the treatment effect of technology M&As on the sustainable competitiveness of enterprises. If the coefficient of this variable is significantly positive, it means that technology M&As promote improvements in the sustainable competitiveness of enterprises. is a control variable. The article includes company characteristics (enterprise age, solvency, enterprise value, cash flow, etc.) and corporate governance (ownership structure, audit quality, executive and board structure) to alleviate the impact of the omitted variables on the research. μi is an individual fixed effect, which is used to control the unobservable individual heterogeneity that does not change over time. λt is a time fixed effect, which is used to control the influence of factors that do not vary with individuals but change with time (such as emergencies in a specific year). εit is a random disturbance term.

3.3. Variable Description

3.3.1. Explained Variable

The explained variable in this article is enterprise sustainable competitiveness. It should be noted that it is difficult to explain the enterprise sustainable competitiveness with a single variable. This is a comprehensive indicator composed of multidimensional capabilities [66]. The existing literature is usually constructed using an indicator system method to measure the enterprise sustainable competitiveness. One researcher explores several key factors affecting the sustainable growth of enterprises, summarizing finance, market, management, technology, information, talent, corporate culture, and their external environment as the main driving forces for the sustainable development of enterprises [67]. Chinese researchers also categorize the sustainable competitiveness of enterprises into seven dimensions: strategic resources, learning capability, innovation, management systems, strategic management skills, corporate values, and dynamic organizational adjustment [68].

Combining previous research and the characteristics of listed companies, this paper constructs an indicator system for enterprise sustainable competitiveness, focusing on three aspects: resources, technology, and market. The rationale for this is as follows: resources are the foundation for the existence and development of an enterprise; technology is the primary force driving the enterprise sustainable competitiveness; and the market ensures there is solid support for enterprise sustainable competitiveness [69]. In terms of resources, the paper draws on the approach of a Chinese scholar [70] and selects the scale of enterprise employees, the ratio of working capital, and the scale of fixed assets to reflect the human resources, financial resources, and material resources of an enterprise, respectively. Technologically, the capability is primarily reflected in the enterprise’s technology conversion rate, which the paper depicts through labor productivity and gross profit margin. In the market aspect, the paper selects sub-indicators from expansion capability, growth capability, operational capability, and profitability, with specific indicator details provided in Table 2.

Table 2.

Sustainable competitiveness indicator system.

After obtaining the enterprise’s sustainable competitiveness index system, this paper uses the factor analysis method to conduct a comprehensive index evaluation. Regarding the motivation for factor analysis, the methods for evaluating composite indicators are typically divided into subjective and objective types. In the realm of objective evaluation, methods such as correlation coefficients, factor analysis, and principal component analysis are utilized within statistics; conversely, subjective evaluation encompasses techniques like fuzzy evaluation, expert weighting, and analytic hierarchy process. Each evaluation method has its advantages and limitations: objective evaluation methods can provide more precise outcomes, but the difficulties in their implementation and their required workload are substantial; in contrast, subjective evaluation methods are more flexible and practical, yet their accuracy may be lower due to the involvement of subjective judgment. Considering that sustainable competitiveness is a multidimensional composite indicator, this paper adopts the commonly used objective evaluation method of factor analysis to conduct a quantitative analysis of sustainable competitiveness. This paper first uses KMO and Bartlett’s sphericity test to test the suitability of factor analysis. The results show that the test p value is 0.000, indicating a strong correlation between variables and that the test is suitable for factor analysis. Secondly, the principal component analysis method was used to extract four common factors based on the principle that the maximum eigenvalue is greater than 1. The four common factors reflect most of the information of the original variables. Finally, according to the proportion of the common factor variance contribution rate to the cumulative variance contribution rate, which serves as the weight, the comprehensive score of the enterprise’s sustainable competitiveness can be obtained by linearly weighting the four common factors.

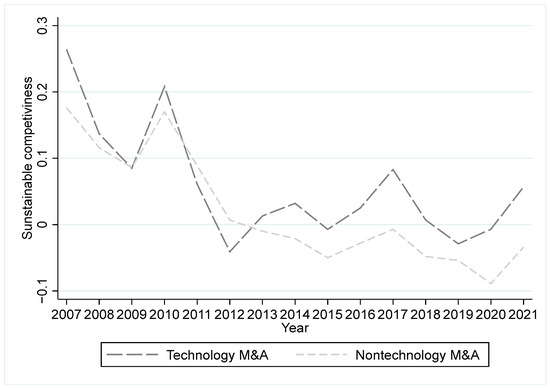

In order to more intuitively analyze the dynamic evolution of the sustainable competitiveness of the listed companies, Figure 2 is presented. It is noted that throughout the sample period, from the perspective of technology M&A, the sustainable competitiveness of technology M&A companies and non-technology M&A companies showed the same changing trend before 2012, and there was little difference in the sustainable competitiveness of the two types of companies. However, after 2012, the sustainable competitiveness of technology M&A companies showed an obvious upward trend that is faster than that of non-technology M&A companies and higher than that of non-technology M&A companies. According to the distribution of technology M&A companies, technology M&A became popular in China in 2011, and more and more companies have joined the ranks of technology M&A. This shows, to a certain extent, that the difference in the sustainable competitiveness of enterprises is caused by technology M&As. Initially, the common trend assumption was verified.

Figure 2.

Dynamic evolution trend of enterprise sustainable competitiveness.

3.3.2. Explanatory Variables

The core explanatory variable is the technology M&A dummy variable (TMA), which is obtained by multiplying the technology M&A experimental group dummy variable (Treat) and the M&A period dummy variable (Post). If the company has a technology M&A, Treat takes a value of 1; otherwise, it takes a value of 0. It should be noted that the judgment of an enterprise’s technology M&As in this article is based on the practices of scholars [63,64]. If one of the following conditions is met, it is a technology M&A: the purpose of the main merging company in merging is clearly to acquire technologies or a certain patent in the announcement; the target company has obtained patents within the past three years. It should be noted that the existing research usually relies on the target company having obtained patents within the last five years, while the requirements of this article are more stringent and are identified based on whether patents have been obtained within the past three years. Post takes a value of 1 in the year of corporate M&As and in subsequent years; otherwise, it takes a value of 0. Considering that enterprises may have made multiple technology M&As during the sample period, this article sets the treatment year based on the time of the first M&A.

3.3.3. Control Variables

In order to control the influence of other factors on the study and alleviate the problem of omitted variables as much as possible, this article draws on the practices of scholars [71,72], and selects nine control variables from the company’s characteristics and corporate governance levels, including enterprise age, liquidity ratio, capital density, enterprise value, cash liquidity level, ownership concentration, audit quality, executive structure, and the proportion of independent directors. Table 3 reports the measurement of the main variables.

Table 3.

Variable definition.

3.3.4. Basic Feature Analysis

- Descriptive Statistics

Before conducting empirical testing, this article first conducted a statistics analysis of the basic characteristics of the main variables. The mean value of SubC is 0.002, the minimum value is −1.935, and the maximum value is 4.965, which means that there is a large gap in the sustainable competitiveness of the sample companies. The mean value of TMA is 0.067, which means that only 6.7% of the sample has technology M&As. In the same way, the descriptive statistics results of the control variables can be analyzed accordingly, and it can be seen that the sample companies’ solvency, potential growth opportunities, and cash flow levels all show large differences. The sample companies are mainly composed of male executives, with female executives accounting for only 16%. Only 5.5% of the sample companies hired the Big Four international accounting enterprises for auditing, and the gap in audit quality is obvious. In order to avoid the impact of multicollinearity, Table 4 also reports the multicollinearity diagnosis results. It is noted that the VIF values of each variable are less than 10, which means that there is no serious multicollinearity in the variables in this article, which means that the selection of control variables in this article has a certain rationality.

Table 4.

Descriptive statistics.

In order to further compare the differences in the sustainable competitiveness and influencing factors of enterprises in the experimental group and the control group, this article presents the independent sample t test results in Table 5. It is noted that the mean value of SubC in the control group is −0.005, which is significantly lower than the mean value of SubC in the experimental group (0.042) at the 1% significance level, indicating that the sustainable competitiveness of technology M&A companies is higher than that of non-technology M&A companies. From the perspective of company characteristic variables, the capital intensity of technology M&A companies is higher than that of non-tech M&A companies, but the age of establishment, asset–liability ratio, and cash flow level are generally lower than those of non-tech M&A companies. The t-test results of corporate governance variables show that the corporate governance level of companies with non-technology M&As is generally higher than that of companies with technology M&As.

Table 5.

Independent sample t test.

- 2.

- Correlation Analysis

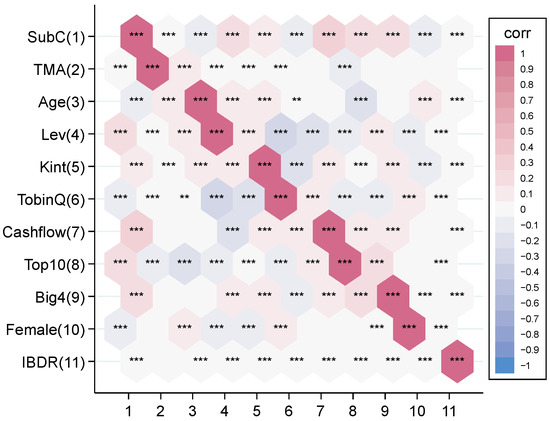

In order to avoid the “pseudo” regression phenomenon, this article also tested the correlation of the variables in the article; the correlation coefficient heat map is presented in Figure 3 based on the correlation coefficient. The depth of the color represents the strength of the correlation. The darker the color, the stronger the correlation. *, **, and *** indicate significant correlation at the 10%, 5%, and 1% significance levels. Blank spaces indicate that the correlation is not significant. It can be seen that, at the 1% significance level, although the correlation coefficient between TMA and SubC is not large, it shows a significant positive correlation, which means that technology M&As have a strong positive correlation with the sustainable competitiveness of enterprises. At the same time, it can also be seen that most of the control variables have a significant correlation with the company’s sustainable competitiveness, indicating that the selection of control variables in this article has a certain rationality. At the same time, the correlation coefficient heat map shows that there is also a certain correlation between the control variables, but the color is relatively light, which once again shows that the variables in the article do not show serious multicollinearity.

Figure 3.

Correlation coefficient heat map. ** and *** significantly at the 5% and 1% levels, respectively.

4. Analysis of Empirical Results

4.1. Analysis of Benchmark Regression Results

Considering that the correlation cannot describe the causal relationship between variables, a regression analysis is also needed. Table 6 reports the DID estimation results under two-way fixed-effects regression and clusters the enterprise level. Column (1) does not consider the influence of control variables, and the coefficient of the TMA is 0.057 (p < 0.01), which means that, compared with companies without technology M&As, companies with technology M&As have higher sustainable competitiveness, indicating that technology M&As promote enterprise sustainable competitiveness. Column (2) controls the influence of company characteristics, and the coefficient of TMA is still positive at the 0.01 significance level. Column (3) further controls the impact of corporate governance, and the coefficient of TMA is 0.062 (p < 0.05), indicating that the positive impact of technology M&As on the sustainable competitiveness of enterprises still holds after considering the impact of control variables. Enterprises that have not engaged in technology M&As can increase by an average of 6.2% in sustainable competitiveness, thereby confirming Hypothesis 1, which may be attributed to the fact that enterprises engaging in technology M&As can achieve knowledge complementarity, accomplish technological upgrades and cross-industry leaps, and ensure they have a market competitive advantage, enhancing their corporate competitiveness.

Table 6.

Baseline regression results.

4.2. Robustness Test

4.2.1. Parallel Trend Test

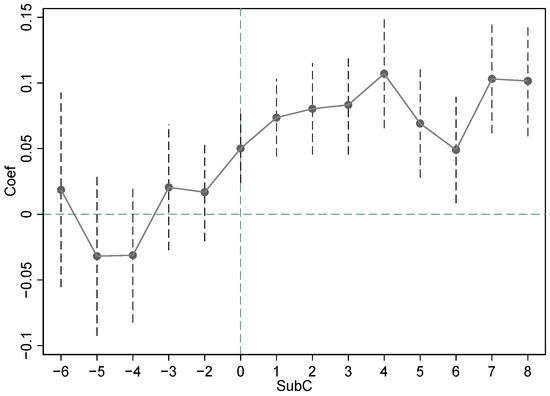

The use of a DID model needs to satisfy the parallel trend assumption; that is, before a company undergoes technology M&As, the samples of the experimental group and the control group should be comparable. There are two ways to test parallel trends in the existing literature: one is to directly compare the time trends of the means of the dependent variables of different groups; the other is the event study method, that is, introducing the interaction term between dummy variables and policy variables at each time point into the regression. If the coefficient of the interaction term is not significant before the policy occurs, this means that the parallel trend test is satisfied. In order to avoid the subjectivity brought by method 1, this article uses the event study method to conduct a parallel trend test to set the model, as follows:

Among them, j represents the year in which the technology M&A of the relative enterprise was completed; that is, j−1 represents the year before the technology M&A was completed. indicates that the relative value of the jth year when enterprise i completes technology M&As in year t is 1; otherwise, it is 0. This article draws on the practice of existing scholars and uses the year before the completion of technology M&As as the base period. It conducts a two-way fixed effects model again to obtain the average treatment effect over the years and draws the coefficient diagram and confidence interval of the interaction term between the time dummy variable and the experimental group dummy variable. The abscissa “0” reflects the year of the policy, with the left side being before the policy and the right side being after the policy was implemented. The dotted line is the 95% confidence interval. If the confidence interval does not include 0, this indicates the significance of the coefficient. From the parallel trend test in Figure 4, it can be seen that, before the completion of technology M&As, the coefficients of the experimental group and the control group are not significant, which means that the samples of the experimental group and the control group fit the common trend and are comparable. It is not difficult to see that the policy effect of technology M&As gradually increases and reaches its maximum in the fourth period, indicating that the promotional effect of technology M&As on the sustainable competitiveness of enterprises has a certain degree of sustainability and becomes more and more obvious as technology M&As advance.

Figure 4.

Parallel trend test. The dotted line is the 95% confidence interval.

4.2.2. Placebo Test

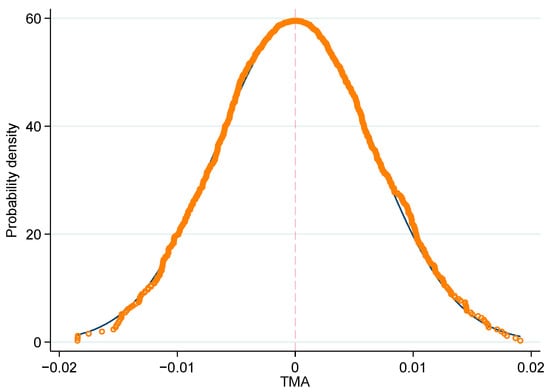

Although a two-way fixed effects model was used in the previous DID analysis, there may still be other, unobservable forms of interference. Therefore, this article constructs an intermittent placebo test to test whether the DID method identification is affected by the interference of unobserved disturbance factors which change over time. If the real policy effect is significantly different from the placebo policy effect, this means that the improvement of the enterprise’s sustainable competitiveness is caused by technology M&As, rather than other unobservable system factors. The specific method is as follows: first, group the data according to enterprises, then randomly select a year from the annual variables in each group as the policy time and obtain the hypothetical DID coefficient estimator, then use the Bootstrap method to perform 1000 repeated samplings to obtain 1000 placebo treatment effect coefficients. In this way, the kernel density plot shown in Figure 5 was plotted. The solid line in the figure is the TMA coefficient kernel density curve, and the dotted line is the TMA coefficient estimator. It is easy to see that the TMA coefficient kernel density curve of the placebo test is symmetrically distributed on both sides of x = 0, showing an approximately normal distribution, and the DID coefficient of the benchmark model treatment group is significantly different from that of the randomly selected treatment group, indicating that the improvement in the company’s sustainable competitiveness is due to technology M&As, rather than other, unobservable factors.

Figure 5.

Placebo test. The orange hollow circles represent the coefficients for placebo regression. The blue line is the kernel density curve of the placebo regression coefficient.

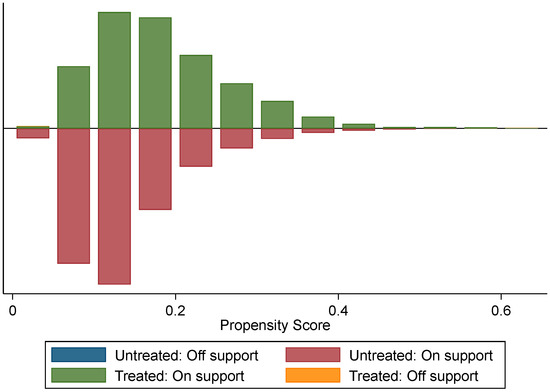

4.2.3. PSM-DID

According to the previous independent sample t test, it can be seen that the experimental group and the control group contain obvious systematic differences. In order to alleviate the endogeneity problem caused by sample selection bias, this article further uses propensity score matching to find a suitable control group for the experimental group. Considering that enterprise technology M&A will be affected by the company’s characteristics, corporate governance, and the company’s own technical level, this article selected enterprise age (Age), asset–liability ratio (Lev), total asset turnover rate (ATO), equity concentration (Top10), the proportion of independent directors (IBDR), the proportion of female executives (Female) and the number of corporate invention patents (PAT) as covariates, and these matched using the nearest neighbor 1:1 method with a caliper radius of 0.01. Finally, the sample after PSM was used for DID estimates. In order to verify the PSM effect, a balance test is also needed. The balance test results in Table 7 show that before PSM, the mean values of the covariates in the experimental group and the control group showed significant differences at the 1% significance level. After PSM, the p values of the t test for the mean values of the covariates were greater than 0.05, and the absolute values of the standard deviation percentage of each variable were less than 10%, which means that the systematic differences between the experimental group and the control group were eliminated, indicating that the PSM effect is better. At the same time, it can be seen from the common support test in Figure 6 that as long as a small number of processing variables are not in the common support range, PSM only loses a small number of samples, and PSM has a better effect.

Table 7.

Balance test.

Figure 6.

Common support range.

After the above tests, the samples after PSM are further used for DID estimation. Considering that propensity score matching has a certain sensitivity to the matching method, as a robustness check, Table 8 also reports the DID estimation results of nearest neighbor 1:1 without replacement and kernel matching. Judging from the regression results, no matter which matching method is used, the coefficient of TMA is significantly positive, indicating that the model is still robust after considering the sample selection problem.

Table 8.

PSM-DID estimation results.

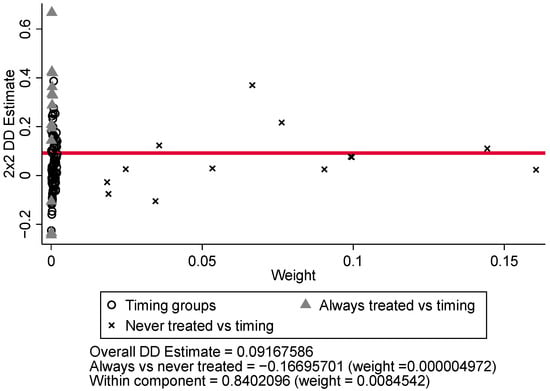

4.2.4. Period Heterogeneity Treatment Effects

Since the sample companies had technology M&As in different years, the time at which the treatment groups became pilot subjects is staggered. At this time, the average treatment effect obtained by multi-time-point DID regression will change with the group and time, resulting in biased or unstable average processing effects being obtained from the two-way fixed effects. Specifically, three types of reference groups will be generated under the time-varying processing time point: the companies that underwent technology M&As were the treatment group and the companies that subsequently made technology M&As were the control group; the companies that underwent technology M&As were the treatment group and the companies that never had technology M&As were the control group; the companies that made technology M&As later were the treatment group and the companies that made technology M&As early were the control group. Since the treatment effect of companies that conducted technology M&A at the early stage is not constant, but will be affected by time trends and time-varying average treatment effects, using the early treatment group as a control group of companies that conducted technology M&A in the later period will lead to the problem of heterogeneous treatment effects. This leads to estimation bias, especially if the treatment effect depends on the weight and size of the third type of DID term. If this type of weight is larger, it will affect the robustness of the model. In order to verify the robustness of the model, this article uses the method of Goodman–Bacon to perform Bacon decomposition on the staggered DID estimation results. The decomposition results in Table 9 show that the difference caused by different treatment times accounts for 6.58% of the total effect, and the component effect caused by the difference between the always treated group and the untreated group is almost 0. The treatment effect of using the untreated group as the control group accounts for 92.27% of the total, and the difference within the same group accounts for 0.85%. The red horizontal line in Figure 7 is the two-way fixed effect 2×2DD estimator. You can see that the DD estimator of the two-way fixed effect is 0.092, which is the weighted sum of different groups.

Table 9.

Bacon decomposition results.

Figure 7.

Bacon decomposition results. The red line represents overall DD estimate.

From the previous preliminary decomposition, it can be seen that the influence from differences within and between groups is small. In order to calculate the possible time-varying heterogeneous treatment effects and weights, this article further describes the staggered DID in detail. Considering that Bacon’s detailed decomposition is currently not possible, including control variables, this paper only performed a regression of the treatment variables, and reports the detailed Bacon decomposition results in Table 10. According to the previous analysis, the time-varying heterogeneous treatment effect depends on the weight in the case of “the treatment group of companies that completed technology M&A later and the companies that completed technology M&A early as the control group”. The results show that the average treatment effect weight of this type is 3.51%, which is comparatively small, indicating that the time-varying heterogeneous treatment effect has no substantial impact on the results of the baseline model.

Table 10.

Bacon detailed decomposition results.

4.2.5. Tests to Change the Control Group

Considering that the market monopoly power and specific advantages of enterprises with different ownership will cause differences in ownership in the sustainable competitiveness of enterprises, in order to avoid the sample self-selection problems caused by differences in the ownership of enterprises in the control group, this article tested central state-owned enterprises, local state-owned enterprises, and non-state-owned enterprises as control groups. Secondly, since the control group of the benchmark regression includes non-technical M&A companies that underwent M&As, in order to avoid the impact of corporate M&A on the research and as a robustness test, this article excludes such companies. From the regression results in Table 11, we can see that after changing the control group, the coefficients of TMA are all significantly positive, which once again verifies the robustness of the model.

Table 11.

Robustness test results after changing the control group.

4.2.6. Other Methods

In order to further enhance the robustness of the model, this paper also conducted the following tests. First, the industry effect was further fixed on the basis of the company and year fixed effects, taking into account the impact of industry factors on the study. According to the regression results of column (1) in Table 12, after considering the influence of industry factors, the coefficient of TMA is still positive. Secondly, considering that although the individual effects and annual effects are fixed in this article, the model may still be affected by common factors at the provincial level and year; therefore, this article further fixed the provincial time trend based on the baseline regression. From the estimation results of column (2), after controlling for the time trend of provinces, the positive effect of technological progress on market power is still significant. Finally, in order to eliminate the impact of specific emergencies on the research, this article eliminated the data from the financial crisis in 2007 and 2008, and eliminated the year of the “stock market crash” in 2015 to obtain the regression results presented in column (3). After the impact of special events, the model remains robust.

Table 12.

Robustness test results of other methods.

4.3. Mechanism Analysis

The previous benchmark model verified the positive impact of technology M&As on the sustainable competitiveness of enterprises, and verified the robustness of the model in various ways. Next, we will further examine the mechanism of technology M&As on the sustainable competitiveness of enterprises. This article draws on the three-step method to construct the following intermediary effect model and make judgments based on the sequential method.

Med is the mechanism variable, which represents, respectively, enterprise productivity level (TFP) and market power (Markup) in this article. Model (3) is used to test the impact of technology M&As on enterprise productivity and market power, and model (4) is used to test the direct effect of technology M&As on sustainable competitiveness after controlling for the impact of mechanism variables. Other variables are consistent with the baseline model and will not be described again. Model (1) is the total effect of technology M&As on the sustainable competitiveness of enterprises.

The coefficients of and are all significant; when the coefficient of is not significant, Med is a complete mediator; when the coefficient of is significant, but the degree of influence is decreased compared to , this indicates that Med is a partial mediator. If only one of the coefficients of and is significant, a further Sobel test or Bootstrap test is required for judgment.

This article uses the corporate price markup rate as a measure of corporate market power. Market power reflects the pricing or bargaining power of enterprises, but it is not equivalent to market share [73]. This article calculates the company’s price markup by constructing a transcendental logarithmic production function [74]. Compared with the Cobb–Douglas (C-D) production function, the transcendental logarithmic production function can calculate the output elasticity of each enterprise in different periods, and does not need to satisfy the assumption of constant returns to scale in enterprise production.

Judging from the mechanism test results presented in Table 13, the coefficient of TMA shown in column (1) is 0.018 (p < 0.01), indicating that technology M&As promote corporate productivity levels, which means that technology M&As can lead to knowledge and technology spillover effects, which is beneficial to improvement in corporate productivity levels. In column (2), the coefficient of TFP is 0.286 (p < 0.01), and the coefficient of TMA drops from 0.062 to 0.057 (p < 0.01), indicating that the improvement in enterprise productivity level promotes the sustainable competitiveness of enterprises. The existing research shows that the reciprocal of total factor productivity reflects the marginal cost of the enterprise, which means that technology M&As reduce the marginal cost of the enterprise by improving the productivity level of the enterprise, thereby improving the sustainable competitiveness of the enterprise. This indicates that the productivity of the enterprise has a partial intermediary effect, and the indirect effect accounts for 8.06% of the total effect, which means that technology M&As can not only directly promote the sustainable competitiveness of enterprises, but can also indirectly improve the sustainable competitiveness of enterprises by promoting their productivity levels. In the same way, the regression results of columns (3) and (4) can be analyzed accordingly; the coefficient of TMA is 0.008 (p < 0.05), which means that technology M&As increase the market power of enterprises; the coefficient of markup in column (4) is 0.701 (p < 0.01); and the coefficient of TMA dropped to 0.056 (p < 0.01), indicating that the market power of enterprises promotes their sustainable competitiveness. Based on the above analysis, it can be seen that technology M&As promote the increase in corporate productivity levels and market power, and help companies to stabilize their market positions, gain a greater market share, improve their corporate bargaining power, and thus enhance the enterprise’s sustainable competitiveness, which validates Hypothesis 2.

Table 13.

Mechanism test results.

4.4. Heterogeneity Analysis

4.4.1. The Impact of Corporate ESG Performance

Considering that corporate ESG performance will affect the smoothness of corporate technology M&As, it will also affect the relationship between technology M&As and the company’s sustainable competitiveness. According to the signaling theory, companies with a strong ESG performance release positive signals to the market. At the same time, companies with a strong ESG performance have higher information transparency, which is conducive to the smooth progression of technology M&As. In addition, as institutional investors generally prefer companies with high ESG ratings, in order to gain the favor of investment institutions, companies will more actively fulfill their environmental protection and social responsibilities and strengthen their corporate governance, and their decision-making behaviors will pay attention to long-term sustainable development. Companies with a strong ESG performance face lower financing constraints, which can provide sufficient financial support for the digestion and absorption of knowledge and technology after technology M&As, which is conducive to further improving the sustainable competitiveness of companies. Therefore, technology M&As have a more obvious impact on the sustainable competitiveness of companies with a strong ESG performance. In order to verify the above conjecture, this article divides the sample companies into high- and low-ESG-performance groups based on the industry median of corporate ESG performance and performs a sub-sample regression.

The data on corporate ESG performance in this article come from the CNRDS database. The CNRDS ESG database combines the actual situation of Chinese companies and selects 58 segmented indicators to measure corporate ESG from six aspects: products, charity, volunteer activities and social controversies, diversity, employee relations, environment, and corporate governance. This article sums up the advantage (concern) performance scores of each subcategory, and uses the advantage score minus the attention score to obtain the net advantage score of each subcategory. Finally, the sum of the net advantage score of the six subcategories is used as a quantification of corporate ESG performance. Judging from the regression results in Table 14, the coefficient of TMA is significantly positive in both sets of regressions, and the p-value of the Bootstrap test is 0.073, indicating that, at the 0.1 significance level, there are differences in ESG performance in the impact of technology M&As on the sustainable competitiveness of enterprises. Companies with a strong ESG performance send positive signals to the market, enhance their reputation, increase market value, gain favor with investors, and reduce financing constraints, and thus technology M&As have a more pronounced impact on the sustainable competitiveness of companies with a strong ESG performance, which validates Hypothesis 3.

Table 14.

Considering the impact of corporate ESG.

4.4.2. The Impact of Digitalization Level

In order to examine the impact of digitalization level on the relationship between technology M&As and the sustainable competitiveness of enterprises, this article conducted an empirical test of the difference in the impact of digital development from the perspective of macro- and micro-enterprises. At the macro-level, based on the 2021 “China Regional Digital Development Index Report”, the article ranks Guangdong, Zhejiang, Beijing, Jiangsu, and Shanghai, Chongqing, Shandong, Tianjin, Fujian, and Sichuan as among the top 10 digitalization levels, representing regions with high digital development levels; other regions are regarded as regions with low digitalization levels. The samples were divided into high-digitalization-level groups and low-digitalization-level groups according to the digitalization level of the region in which the company is located. At the micro-level, this article uses the method of quantifying the degree of the digital transformation of listed companies. Enterprise digital transformation is not simply the digitization of enterprise information data, but the use of cutting-edge digital technology computing and hardware systems to promote the digitization of enterprise production materials and production processes to achieve the important goal of increasing efficiency and improving quality. In order to characterize the intensity of corporate digital transformation, this article used the frequency of corresponding keywords in the annual reports of listed companies as a proxy variable for the degree of corporate digital transformation. At the technical level, we used artificial intelligence technology, big data technology, cloud computing technology, blockchain technology and the application of digital technology as characteristic keywords to build a characteristic lexicon of corporate digital transformation, and used text mining technology to extract text from the annual reports of listed companies. The word frequency was counted to form the final summed word frequency, which is used to describe the degree of digital transformation of the enterprise.

Judging from the regression results in Table 15, the regression coefficient of TMA is significantly positive in columns (1) and (2). Further, through Bootstrap test, the empirical p value is 0.000, which means that technology M&As have a more obvious impact on the sustainable competitiveness of regional enterprises with a low digitalization level. The results of columns (3) and (4) show that technology M&As have a more obvious impact on the sustainable competitiveness of enterprises with low levels of digital transformation. A possible reason for this is that regions with a high level of digitalization have a more complete business environment, lower enterprise transaction costs, and more fair and equitable enterprise competition, while enterprises in regions with a low level of digitalization have higher transaction costs and the competition among enterprises is more intense when there are limited resources. According to the competition escape effect theory, the enterprises in this region will use technology M&As to quickly improve their technological competitiveness. In addition, the companies with a high degree of digital transformation have achieved efficiency and quality improvements in corporate production and operations, and their sustainable competitiveness is higher than that of companies with a low degree of digital transformation. Based on the above analysis, it can be seen that technology M&As have a more obvious impact on the sustainable competitiveness of enterprises with low digitalization levels. Thus, Hypothesis 4 is validated.

Table 15.

Considering the impact of digitalization level.

5. Conclusions and Discussion

5.1. Main Conclusions

Against the background of promoting the sustainable development of enterprises, an increasing number of companies are adopting technology mergers and acquisitions as a strategic means to enhance their sustainable competitiveness. This article took Chinese A-share listed companies from 2007 to 2021 as the research sample, and took acquiring companies that have undergone technology M&As as the experimental group. The staggered DID model was used to examine the impact of technology M&As on the sustained competitiveness of enterprises. The results show that technology M&As significantly promote the sustained competitiveness of enterprises, and compared to non-technology M&As, the sustained competitiveness of technology M&As is 6.2% higher. These conclusions remain robust after considering unobservable systemic factors, endogeneity, heterogeneous treatment effects, and special events through placebo tests, changing control groups, PSM-DID, Bacon decomposition, and varying sample sizes. Moreover, the study employed a mediation effect model to demonstrate that technology M&As contribute to improved enterprise productivity levels and market power, thereby enhancing the sustainable competitiveness of enterprises. Subsequent considerations were given to the heterogeneous effects of corporate ESG performance and digital development on the relationship between technology M&As and the sustained competitiveness of enterprises. It is found that technology M&As have a more pronounced effect on enhancing the sustainable competitiveness of enterprises with a strong ESG performance. For companies in regions with low levels of digital development and companies with low degrees of digital transformation, implementing a strategy of technology M&As has a more noticeable effect on improving sustained competitiveness. Therefore, technology M&As are an important factor in enhancing the sustainable competitiveness of enterprises.

5.2. Theoretical Enlightenment

Companies undertake technology M&As to obtain the technological assets, knowledge, patents, and talent resources of target companies, aiming to enhance their competitiveness and innovation capabilities. The existing research primarily focuses on the impacts of technology M&As on enterprise innovation, performance, and innovative outcomes [15]. However, technology M&A is a complex and important field, with many issues still deserving further exploration. This paper’s investigation into the impact and mechanisms of technology M&As on sustainable competitive advantage serves as a supplement and extension to the existing literature on technology M&As and innovation.

Theoretically, this study enriches the resource-based view and the dynamic capabilities theory by emphasizing the role of technology M&As in resource acquisitions and capability enhancement. It further clarifies how companies can rapidly acquire unique resources and dynamic capabilities through external pathways, thereby enhancing their core competitiveness. Moreover, by applying the theories of market power and production efficiency, this research broadens the understanding of technology M&A strategic decisions, especially how they enhance competitiveness by affecting a company’s market position and improving productivity.

Finally, the exploration of ESG performance and digital transformation not only responds to current hot topics of corporate social responsibility and the digital era but also offers a new theoretical perspective on the role of technology M&As in modern corporate governance and digital strategy.

5.3. Practical Implications

This paper provides several policy recommendations and practical insights for governments and enterprises.

In the area of technology upgrading and innovation incentives, the government should establish special support programs to encourage enterprises to enhance their technological levels and innovation capabilities through technology M&As, including providing financial and tax incentive policies and financial support, and attracting talent. At the same time, the government should establish an evaluation and monitoring mechanism to ensure that enterprises can effectively enhance their sustainable competitiveness in M&A activities. At the level of M&A policies, the government should introduce M&A guidelines to encourage enterprises to improve their environmental protection, social responsibility, and corporate governance performance.

In the field of technology M&A positioning, enterprises should assess their specific shortcomings in technology innovation and research and development capabilities. This assessment will guide the targeted selection of M&A candidates, ensuring rapid M&As of essential technologies and the capabilities for practical application outputs. Furthermore, enterprises should conduct proactive market and technological trend analyses to inform their M&A decisions and expedite product development and market application. Additionally, to enhance their sustainable market competitiveness, enterprises should develop clear strategies for market expansion and brand enhancement. This ensures effective integration after M&As, expanding enterprises’ market share and elevating their brand influence. Employing professional integration teams and frameworks will facilitate a smooth elevation of market position and effective resource integration during the M&A process. Lastly, in the context of M&As supporting digital transformation, enterprises should choose targets that offer advanced digital technologies and managerial expertise to meet their digital transformation needs. After M&As, the integration of digital technology resources and optimization of management processes should accelerate digital transformation, enhancing operational efficiency and market responsiveness.

5.4. Limitations and Future Research Directions

Firstly, this study explores the impact of technology M&As on sustained corporate competitiveness under the conditions of varying ESG performances and digitalization levels. The ESG performance and digitalization level of enterprises are affected by many factors in the process of technology M&As, and these influencing conditions can be further explored and expanded.

Secondly, the study only focuses on China, revealing that technology M&As positively influence the sustainable competitiveness of enterprises. It also finds that both ESG performance and the degree of digitalization positively moderate the impact that technology M&As have on the enterprise’s sustainable competitiveness. However, considering the unique political institutions and economic development strategies of other countries, it is uncertain whether these findings are applicable to other markets. This area requires further investigation.

Third, this study was limited to analyzing 740 technology M&A events from 2007 to 2021 as its research sample. In the future, as the number of technology M&A events in China increases and the database becomes more comprehensive, there will be an opportunity to expand the sample size. This expansion could enhance the robustness and accuracy of the study’s findings, providing more reliable insights into the effects of technology M&A.

Funding

This research was funded by the National Natural Science Foundation of China, grant number 72072009.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The datasets used and/or analyzed during the current study are available from the author on reasonable request.

Conflicts of Interest

The author declares no conflicts of interest.

References

- Angwin, D. Speed in M&A Integration: The First 100 Days. Eur. Manag. J. 2004, 22, 418–430. [Google Scholar] [CrossRef]

- Desyllas, P.; Hughes, A. Do High Technology Acquirers Become More Innovative? Res. Policy 2010, 39, 1105–1121. [Google Scholar] [CrossRef]

- Hitt, M.A.; Harrison, J.S.; Ireland, R.D. Mergers & Acquisitions: A Guide to Creating Value for Stakeholders; Oxford University Press: Oxford, UK, 2001. [Google Scholar]

- Zollo, M.; Meier, D. What Is M&A Performance? Acad. Manag. Perspect. 2008, 22, 55–77. [Google Scholar] [CrossRef]

- Zhou, X.; Mitkova, L.; Zhang, Y.; Huang, L.; Cunningham, S.; Shang, L.; Yu, H.; Wang, K. Technology-Driven Mergers and Acquisitions of Chinese Acquirers: Development of a Multi-Dimensional Framework for Post-Innovation Performance. Int. J. Technol. Manag. 2018, 78, 280–309. [Google Scholar] [CrossRef]

- Weber, Y. Corporate Cultural Fit and Performance in Mergers and Acquisitions. Hum. Relat. 1996, 49, 1181–1202. [Google Scholar] [CrossRef]

- Alimov, A.; Officer, M.S. Intellectual Property Rights and Cross-Border Mergers and Acquisitions. J. Corp. Financ. 2017, 45, 360–377. [Google Scholar] [CrossRef]

- Friede, G.; Busch, T.; Bassen, A. ESG and Financial Performance: Aggregated Evidence from More than 2000 Empirical Studies. J. Sustain. Financ. Invest. 2015, 5, 210–233. [Google Scholar] [CrossRef]

- Servaes, H.; Tamayo, A. The Impact of Corporate Social Responsibility on Firm Value: The Role of Customer Awareness. Manag. Sci. 2013, 59, 1045–1061. [Google Scholar] [CrossRef]

- Kane, G.C.; Palmer, D.; Phillips, A.N.; Kiron, D.; Buckley, N. Strategy, Not Technology, Drives Digital Transformation. MIT Sloan Manag. Rev. Del. 2015, 57181, 27. [Google Scholar]

- Xue, F.; Zhao, X.; Tan, Y. Digital Transformation of Manufacturing Enterprises: An Empirical Study on the Relationships between Digital Transformation, Boundary Spanning, and Sustainable Competitive Advantage. Discret. Dyn. Nat. Soc. 2022, 2022, 16. [Google Scholar] [CrossRef]

- Zhu, H.; Zhu, Q. Mergers and Acquisitions by Chinese Firms: A Review and Comparison with Other Mergers and Acquisitions Research in the Leading Journals. Asia Pac. J. Manag. 2016, 33, 1107–1149. [Google Scholar] [CrossRef]

- Reddy, K.S. Extant Reviews on Entry-Mode/Internationalization, Mergers & Acquisitions, and Diversification: Understanding Theories and Establishing Interdisciplinary Research. Pac. Sci. Rev. 2014, 16, 250–274. [Google Scholar] [CrossRef]

- Capron, L. The Long-Term Performance of Horizontal Acquisitions. Strateg. Manag. J. 1999, 20, 987–1018. [Google Scholar] [CrossRef]

- Cloodt, M.; Hagedoorn, J.; Van Kranenburg, H. Mergers and Acquisitions: Their Effect on the Innovative Performance of Companies in High-Tech Industries. Res. Policy 2006, 35, 642–654. [Google Scholar] [CrossRef]

- Neamat, S. A Strategy for the Growth and Internationalization of Companies: International Mergers and Acquisitions. J. Appl. Sci. Technol. Trends. 2022, 3, 20–26. [Google Scholar] [CrossRef]

- Ren, L.; Xie, G.; Krabbendam, K. Sustainable Competitive Advantage and Marketing Innovation within Firms: A Pragmatic Approach for Chinese Firms. Manag. Res. Rev. 2010, 33, 79–89. [Google Scholar] [CrossRef]

- Kumar, K.N.; Upadhyay, D.M.; Maheshwari, P.D.D. An Examination of Financial Performance Before and after Mergers: A Case Study of Selected Indian Pharmaceutical Companies. J. Res. Adm. 2023, 5, 4132–4142. [Google Scholar]

- Cheng, C.; Yang, M. Enhancing Performance of Cross-Border Mergers and Acquisitions in Developed Markets: The Role of Business Ties and Technological Innovation Capability. J. Bus. Res. 2017, 81, 107–117. [Google Scholar] [CrossRef]

- Lee, S.-J.; Kim, S.; Kim, J. A Comparative Study of Cross-Border and Domestic Acquisition Performances in the South Korean M&A Market: Testing the Two Competing Theories of Culture. Sustainability 2019, 11, 2307. [Google Scholar] [CrossRef]