Abstract

This study, situated in the context of China’s transportation and logistics industry, explores the impact of digital transformation on corporate environmental, social, and governance (ESG) performance, as well as the role played by green innovation. Analyzing data from 95 A-share listed transportation companies from 2011 to 2021, this paper examines the relationship between digital transformation and corporate ESG performance, drawing on information asymmetry and agency theories. The research finds that digital transformation significantly elevates corporate ESG levels, with more pronounced effects in state-owned and large enterprises. The degree of financing constraints modulates this relationship, indicating a stronger enhancement of ESG performance by digital transformation under lower financing constraints. Moreover, green innovation serves as a mediator between digital transformation and corporate ESG performance, revealing that digital transformation boosts ESG outcomes through fostering green innovation. The contribution of this study lies in providing new insights into the relationship between digital transformation and corporate ESG performance in a specific industry context, expanding the field through a lens of mechanisms and conditions, and underscoring the central mediating influence of green innovation.

1. Introduction

With the increasing severity of global climate change and resource constraints, the environmental, social, and governance (ESG) performance of corporations is garnering heightened attention [1]. The ESG concept, which emphasizes sustainable corporate development, was first introduced in 1992 by the United Nations Environment Programme Finance Initiative (UNEP FI). It encourages businesses to incorporate environmental, social, and governance considerations into their decision-making processes. ESG principles prioritize the pursuit of social value and sustainable corporate growth over purely economic gains, emphasizing the importance of quality and efficiency in business development [1].

These principles align well with China’s current goals of achieving high-quality economic and sustainable development [2]. In recent years, the Chinese government has been introducing new policies to promote the implementation of ESG practices among businesses, supporting China’s dual carbon goals (peak carbon and carbon neutrality) and the high-quality development of its economy and society. For instance, in May 2022, China’s State-owned Assets Supervision and Administration Commission (SASAC) released the “Plan to Improve the Quality of State-Owned Enterprises’ Listed Companies”, aiming to achieve full coverage of ESG reporting by central enterprises by 2023 and to promote the establishment of an ESG rating system among these enterprises. These developments underscore the growing importance of ESG performance in corporate management and development.

In China, the transportation and logistics industry holds a strategic position in both economic development and people’s lives, forming a crucial part of the national economy. With the progression of the era, the current Chinese transportation and logistics industry exhibits several distinctive features. First, it involves substantial asset investment. The transportation and logistics sector, being a foundational and service-oriented industry directly related to public welfare, grows rapidly in tandem with the national economy [3]. The continuous development of the Chinese economy and the increasing activities in global trade have driven the expansion and rapid growth of this sector [4]. Second, it is undergoing a transformational phase. To enhance operational efficiency and reduce industry bottlenecks, the sector is integrating advanced digital technologies such as GPS tracking, the Internet of Things (IoT), and AI-driven logistics management systems. Third, the industry is characterized by high energy consumption and significant environmental impact. It is the third-largest source of emissions in China [5], accounting for 12% of the country’s total carbon emissions [6], and the energy consumption and carbon emissions of the transportation sector are expected to continue rising rapidly with the high-speed development of the economy. Fourth, the industry faces stringent regulation and intense competition. The regulatory environment in China is evolving, increasingly emphasizing environmental standards and sustainable practices. The coexistence of state-owned, private, and foreign enterprises also contributes to heightened competition within this diverse sector.

Additionally, the COVID-19 pandemic has had significant negative impacts and brought about considerable volatility to the global transportation systems and ports [7]. Xu et al. (2022) [8], utilizing the GARCH-MIDAS model, analyzed the volatility of the Baltic Dry Index (BDI) during the pandemic. Their analysis highlights the vulnerability of the global transportation network in the face of such crises, underscoring the need for transportation companies to strengthen their resilience against risks. Hence, achieving sustainable development in this industry is crucial not only for its own progress but also for the comprehensive, superior development of the national economy. In response, China’s transportation and logistics industry is focusing on ESG practices to facilitate a low-carbon transformation and address issues related to high emissions, pollution, and challenges in social and environmental governance that hinder high-quality development. ESG practices in this industry are proving effective. According to the latest statistics from the “China Listed Companies ESG Action Report (2022–2023)”, nearly 40% of the 121 A-share listed companies in the Chinese transportation and logistics sector have an ESG rating of A or higher. However, over 30% of these companies have an ESG rating of C or lower, indicating significant potential and prospects for further development of ESG practices in the transportation and logistics industry.

Meanwhile, digital transformation has become a key development trend across various industries. Digital technologies have spurred the growth of a vibrant digital economy. The prevailing view is that digital transformation is one of the essential pathways for contemporary enterprises to foster innovation [9,10], enhance corporate value [11], and achieve sustainable and high-quality development [12]. Additionally, new digital technologies such as big data analytics can be applied in internal data management, tracking, and sharing, enhancing operational efficiency [13] and rational decision-making capabilities of corporate leaders.

Consequently, this study aims to explore the impact of digital transformation on ESG performance within China’s transportation industry and to unravel the underlying mechanisms of this influence. The pertinent literature is categorized into three distinct sections for a comprehensive analysis: the first section examines the effects of corporate ESG; the second section delves into factors influencing corporate ESG practices; and the third section assesses the outcomes of digital transformation.

Current research on corporate ESG is often carried out from the perspective of internal governance, and the research related to the impact effects or economic consequences of corporate ESG is one of the important topics [14]. On the one hand, the measurement and rating of corporate ESG has its limitations, and there is no unified measurement standard and scale for ESG research worldwide [14], and there is no consistent view of the data sources of ESG. The mainstream choices are the KLD database [15,16] and the Thomson Reuters ASSET4 database [17], while other databases that are more in line with the institutional context and characteristics of the country are also used in some emerging countries. Existing research organizations have developed their own ESG evaluation systems, with different databases and measurement frameworks referenced, while the institutional data used in each study differ, which could result in skewed outcomes across different research. On the other hand, there is no uniform view in the academic community about the economic effects of corporate ESG. Some scholars believe that ESG performance does not have a positive impact on companies, and even has a negative impact. Firstly, from the neoclassical economic theory, for enterprises, environmental and social responsibility have strong externalities, and spending on these two aspects will not bring monetary benefits but rather increase additional costs, waste enterprise resources, and weaken enterprise competitiveness [18,19] and enterprise value [20,21]. In addition, stakeholders may perceive firms as over-investing in ESG performance, which may have a “crowding out” effect on the firm’s primary business, leading to balance sheet deterioration due to inefficient firm investment [22]. In addition, So Ra Park (2022) [23] and Liu (2023) [24] argue that focusing on ESG performance can create a “greenwashing” effect, whereby firms may seek higher ESG ratings by overstating their investments in environmental protection and green carbon reduction, which can distort disclosure information. Other studies, however, suggest that corporate ESG performance can have positive economic consequences. Fundamentally, ESG performance can enhance stakeholders’ trust and satisfy external requirements for firms in terms of environmental and social benefits [25]; superior ESG performance can also enhance firms’ financial performance, promote operational efficiency, alleviate firms’ financing constraints [26,27,28], and increase firms’ value [29,30,31]. For stakeholders and enterprises, ESG performance can effectively alleviate the principal–agent conflict between internal and external shareholders, increase the degree of corporate information disclosure, reduce the difficulty of information access for stakeholders, and allow enterprises to obtain broader and deeper capital support [32] and higher return on investment [33].

The factors influencing the fulfillment of corporate environmental, social, and governance (ESG) responsibilities are diverse and have been subject to various interpretations. For instance, Haozhe Han (2022) suggests that domestic and foreign institutional investors’ investments and holdings can drive improvements in corporate ESG performance [34]. Research by Chebbi et al. (2022) and Eliwa et al. (2023), using Saudi Arabian listed companies as samples, indicates that the size and independence of the board of directors can enhance corporate ESG disclosures, with board composition also impacting ESG performance [35,36]. From an external perspective, studies have found that the advancement of green finance systems reform can significantly improve corporate ESG investment performance [37]. Additionally, intensifying environmental regulation and enforcement can enhance corporate ESG performance [38]. Despite these findings, substantial gaps and unexplored areas still exist regarding the internal and external drivers of corporate ESG performance.

There is a growing body of research on digital transformation, exploring its impacts from multiple dimensions, yet without a unified consensus. Some studies suggest that digital transformation might have adverse effects on companies. For example, digital transformation can lead to the broader disclosure of negative information about a company, potentially diminishing external confidence, weakening financial resilience, reducing investment inflows, and lowering capital diversity [39]. Furthermore, the establishment of digital platforms could potentially disrupt the functioning of traditional markets [40]. Conversely, other scholars have identified numerous positive effects of digital transformation. It represents a comprehensive and collaborative shift, integrating new digital tools with traditional business management models [41,42] and combining information and communication technologies to enhance a company’s ability to access internal and external information [11]. The impact of digital transformation on businesses can be broadly categorized into two aspects: (1) Economic Performance: digital transformation can enhance a company’s economic performance and promote value growth [43,44]. (2) Non-Economic Performance: digital transformation also promotes non-economic performance, such as enhancing corporate social responsibility and improving reputation [45]. Moreover, public opinion shaped by digital platforms and network technologies can also influence corporate behavior and strategy [46].

However, research specifically focusing on the impact of digital transformation on businesses in certain industries remains limited. Further deepening and broadening the study of digital transformation in businesses is necessary. Several research studies have been initiated regarding the interplay between digital shift and corporate ESG outcomes. For instance, Wu and Li (2023) found that the greater the external environmental unpredictability, the more diminished the beneficial effect of digital transition on corporate ESG performance [47]. Lu et al. (2022) focused on information disclosure and discovered that the inclusivity of digital finance in digital transformation can enhance corporate ESG disclosure [48].

In summary, from both theoretical and empirical perspectives, numerous scholars have examined the macro and micro impacts of corporate digital transformation and ESG performance. However, there is a notable gap in the literature regarding the influence of digital transformation on corporate ESG performance, especially a lack of empirical evidence from key industries like transportation and logistics.

Against this backdrop, this study seeks to explicitly investigate the following research question: how does digital transformation impact the ESG performance of transportation and logistics companies in China, and what roles do green innovation and financing constraints play in this context?

Accordingly, this study selects a sample of 95 A-share listed companies in China’s transportation industry from 2011 to 2021. It employs a two-way fixed effects model, moderation effect testing model, and mediation effect testing procedure to investigate the impact of digitalization on corporate ESG outcomes. Moreover, it delves into the “hidden mechanisms” of how digital transformation influences corporate ESG achievements, offering a deeper exploration of this relationship. Based on information asymmetry theory and agency theory, digital transformation and financing constraints have interactive effects, such as digital transformation can reduce information asymmetry to alleviate financing constraints [47]. Also, some studies suggest that digital transformation can significantly promote enterprises’ green innovation capability [48]. This article, based on agency theory, selects financing constraints as a moderating variable. It also primarily examines the mediating effect of green innovation from the perspectives of resource-based theory, legitimacy theory, and stakeholder theory.

The novel contributions and incremental advancements of this research are manifested in the subsequent aspects: (1) There is a lack of discussion in the context of specific industries in the current existing studies, and this study selects such an important and distinctive industry as the transport industry, which provides new evidence in the field and offers policy implications for related practices. (2) This research centers on the association between digitalization and companies’ ESG metrics, not only verifying its impact but also expanding it from the perspectives of mechanisms and conditions. The moderating effect of financing constraints is examined, the complexity of the interaction between the three is discussed, and the differential impact of the nature of business operations and firm size is explored. (3) The intermediary function of green practice in the impact of the digital shift on the ESG efforts of transportation industry companies is explored, and the inner mechanism of the effect is revealed, trying to open the hidden “black box”, which is a useful addition the development of related theories.

The structure of the remaining sections of this study is outlined as follows: Section 2 delineates the research hypotheses of this paper; Section 3 details the research methodology, encompassing the selection of samples, data sources, variable definition, and measurement, and model setup; Section 4 reports the empirical results and discussion; Section 5 describes the conclusions of the study, policy recommendations, limitations, and future research directions.

2. Theoretical Analysis and Hypothesis Development

2.1. Digitalization and ESG Outcomes of Enterprises

Digital transformation has become an important trend in the development of today’s industries. The application of artificial intelligence, big data, blockchain, and other cutting-edge technologies can significantly improve the operational efficiency, management level, and competitiveness of enterprises, which holds considerable importance for the enduring advancement of businesses [41,43]. Especially for traditional industries such as the transport industry, digital transformation can effectively achieve digital empowerment and promote sustainable and high-quality development of enterprises. Moreover, digital platforms and information-sharing platforms effectively link the information barriers between stakeholders and enterprises and solve the problem of low information exchange efficiency in transport enterprises [11]. At the same time, the integration of digital technology and enterprise production, operation, and management promotes enterprise innovation [10], which is conducive to the long-term development of traditional enterprises and better performance of social benefits [43,49]. All of the above provide conditions and guarantees for the improvement of the ESG performance of enterprises in the transport industry.

First, digital transformation can promote the green development of enterprises. On the one hand, digital transformation can significantly promote the development of green technology innovation [48]. The development of green technology can improve the environmental performance of enterprises, help enterprises treat the symptoms, and reduce the cost of pollution control. For example, the use of IoT and sensor technologies can detect the energy use and pollutant emissions of enterprises in real time [50]. Conversely, digital techniques amplify the extent of corporate environmental information disclosure. by building information sharing and management systems [25] so that stakeholders’ requirements for corporate environmental performance can be efficiently and quickly transmitted to the enterprise, thus enhancing the degree of corporate environmental protection.

Second, digital transformation provides technical support for the fulfillment of corporate social responsibility. Firstly, drawing from information asymmetry theory and stakeholder theory, digital technologies are instrumental in reducing information asymmetry and transaction costs. This leads to increased transparency and enhanced disclosure of corporate information [51], thereby facilitating more effective oversight and constraint of enterprises by stakeholders and the external environment. As a result, this fosters a greater assumption of social responsibilities by corporate management. Secondly, digital transformation is conducive to strengthening the collaboration of various departments within the enterprise, improving the efficiency of resource allocation, and enabling the management to obtain comprehensive information more efficiently to make correct decisions. Consequently, the use of digital technology will swiftly enhance the competitive edge of businesses, and enterprises will have more focus on the practice and implementation of social responsibility. Finally, while information barriers are broken down by digital transformation, the ability of external information mastery of enterprises is also enhanced, which improves the stability of financial resources and the availability of capital [42,52], and thus enterprises will have more capital to obtain better social responsibility performance.

Thirdly, digital transformation contributes to the enhancement of enterprise governance. Based on the principal–agent framework, enterprise digital transformation builds an internal information management system and information platform, accelerates the flow of information within the enterprise, makes the executive decision-making information transparent, and reduces the problem of information asymmetry, thus effectively mitigating the problem of conflict of interest between the principal and agent, and finally improves the governance efficiency of the enterprise [53]. In addition, the new generation of digital technology has solved many of the difficulties of traditional enterprises when it comes to internal governance. For example, blockchain technology can be used to ensure that information is transparent and difficult to tamper with, greatly enhancing the standardization and transparency of corporate governance.

In addition, in China, the transport industry is gradually introducing relevant new energy sources and technologies, and in the future, the transport and energy networks will be more synergistic and linked, and systematic and sustainable reduction in greenhouse gas emissions and green development will surely serve as an important direction. As a result, society is paying more attention to the social benefits and governance level of these enterprises, and ESG performance is regarded as an important indicator. Digitalization and intelligence provide more convenient access and technological support for these needs in the transport industry. In summary, this paper proposes the following hypotheses:

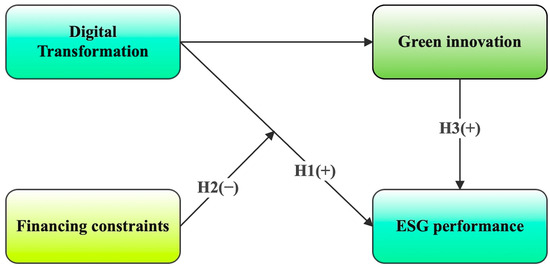

Hypothesis 1 (H1).

Digital transformation positively promotes the ESG performance of enterprises in the transport industry.

2.2. Mechanisms of Corporate Digital Transformation on Corporate ESG Performance

2.2.1. Corporate Digital Transformation, Financing Constraints, and Corporate ESG Performance

Corporate financing constraints refer to the limitations and difficulties faced by enterprises in financing, mainly stemming from the information asymmetry between enterprises and external financiers. Specifically, external investors do not have full access to private information such as operating conditions and profitability within the enterprise, resulting in the enterprise’s financing costs becoming more expensive and a difficult financing environment. In contrast, firms with lower information symmetry can often obtain lower-cost financing support, and severe financing constraints can constrain firms’ investment and development [54].

Existing literature suggests that firms’ financing constraints can negatively affect their ESG performance [55]. When a firm’s access to external financing is constrained, the funds available for its ESG practices are also reduced, making it difficult to improve ESG performance. In contrast, when firms have access to finance, the funds available to them for investment increase, which can increase the likelihood that they will make strategic investments. Specifically, for ESG practices, some scholars have pointed out that reduced financing constraints can prompt firms to invest more in ESG aspects such as environmental governance and employee welfare [56]. Reduced financing constraints mean that firms have more abundant funds to spend on important ESG initiatives. For example, firms can invest more resources in green technology research and development and green production, which contributes to sustainable development. In addition, declining financing constraints increase the likelihood that companies will make charitable donations and employee training, which promotes greater corporate social responsibility. Adequate financing can also be allocated toward improving internal controls and governance within a company, such as the appointment of independent directors. This is beneficial in reducing the agency costs associated with the enterprise. In summary, reduced financing constraints create positive incentives for corporate ESG practices, giving them more abundant sources of funding to improve their performance in environmental protection, social responsibility, and corporate governance. Specifically for the transport sector, the industry is highly capital-intensive, and infrastructure development requires substantial financial support. As a result, financing constraints can more significantly constrain companies’ ESG inputs and initiatives.

Meanwhile, digital transformation, as an important means to enhance corporate performance and sustainable development, has received widespread attention for its contribution to ESG performance. However, digital transformation also requires a certain amount of financial support, and financing constraints may constrain firms from undertaking digital transformation. In contrast, firms with fewer financing constraints have more adequate funds to implement digitalization.

Therefore, this study infers that in capital-intensive industries such as transport, firms with smaller financing constraints are in a better position to carry out digital transformation and derive positive effects from it in terms of enhancing ESG performance. In contrast, firms with greater financing constraints have insufficient funds for digital transformation, which may reduce the ESG-enhancing effect of digitization. Based on the above theoretical analyses, this study proposes the following hypotheses.

Hypothesis 2 (H2).

In the transport industry, financing limitations exert a dampening moderating influence on the correlation between digital transition and companies’ ESG outcomes.

2.2.2. Enterprise Digital Transformation, Green Innovation, and Corporate ESG Performance

First, enterprise digital transformation can promote enterprise green innovation progress. Digital transformation improves the capital availability of enterprises by breaking down information barriers and reducing information asymmetry [42,51]. At the same time, information dissemination and digital management frameworks significantly bolster intra-enterprise collaborative capabilities and enhance the efficiency of resource distribution within the organization. This, in turn, offers financial stability for businesses to augment investment in green technique development, thereby fostering the advancement of green technologies more effectively. Additionally, as per the theory of principal–agent relationships, digital transformation alleviates the conflict between stakeholders and enterprises and allows corporate executives to be supervised by external and stakeholder supervision to better fulfill the requirements of stakeholders on the environmental performance of the enterprise and the development of green innovation technology [48].

Secondly, the rapid development of the transport industry has put pressure on the environment and society, and it is imperative to achieve green and sustainable development in this industry. Meanwhile, digital transformation has become an important means to support the transformation and upgrading of traditional industries. By building intelligent IoT systems and applying big data analysis, digitalization can help transport enterprises achieve more accurate and optimized operations, reduce resource consumption and emissions, and promote green development [57]. In addition, the innovative application of digital technology can also inspire businesses to undertake research and development in green technology and develop more environmentally friendly transport tools or systems. By applying technologies such as digital twins and predictive analyses, enterprises can better design green products. Some scholars have pointed out that digital transformation significantly promotes green innovation investment and the performance of transport enterprises [58]. Therefore, digital transformation is also a very important way and means to develop green innovation technology in the transport industry.

Finally, green innovation can promote corporate ESG performance. Firstly, the continuous enhancement of a company’s green innovation capabilities implies an improvement in its green production capacity. According to the Resource-Based View, this leads to competitive differentiation for the company, thereby achieving cost reduction and efficiency improvement in its green operations, as well as an enhancement in financial performance [59]. This is conducive to the company’s better fulfillment of its environmental responsibilities. Second, an enterprise’s outstanding green innovation capability can serve as the enterprise’s “green business card”, which can gain more stakeholder trust, improve the enterprise’s reputation [60], and thus obtain more investment to achieve better enterprise ESG performance. In conclusion, this study infers that digital transformation can promote green innovation practices in transport companies and enhance corporate ESG performance on this basis. Hence, this research puts forward the subsequent hypotheses.

Hypothesis 3 (H3).

In the transport industry, corporate digital transformation can contribute to corporate ESG practice by driving business eco-innovation.

We constructed hypotheses as a theoretical framework model, as shown in Figure 1.

Figure 1.

Theoretical framework model.

3. Methodology

3.1. Sample and Data

This paper selects companies in the transport industry listed on China’s A-share market from 2011 to 2021 as the research object. The industry classification standard is the Guidelines for Industry Classification of Listed Companies, and the transport industry includes railway transport, road transport, water transport, air transport, loading and unloading and transport agencies, warehousing, and postal industries. The sample selected for this study encompasses all the aforementioned sub-sectors, ensuring a comprehensive and diverse representation that facilitates a holistic view of the ESG levels and digital transformation impacts in the entire transportation industry. The rationale for choosing this specific sample and timeframe is threefold. Firstly, this period marks a rapid phase of digital transformation and ESG development in China’s transportation and logistics industry, representing a critical juncture. Additionally, considering data availability, this decade offers an abundance of relevant data for research, providing direct and scientific evidence for the study. Secondly, the target industry of this paper, namely, the transportation sector, as a crucial driver of China’s economy, faces unique challenges and opportunities in digital transformation and ESG integration and is also at the forefront of adopting technological and regulatory changes. Furthermore, focusing on A-share listed companies ensures that the sample comprises firms subject to rigorous reporting standards and investor scrutiny, thereby providing reliable and detailed data for analysis.

The data in this paper come from the WIND database CSMAR database, in which the ESG performance data of enterprises come from the Huazheng ESG rating system, and the digital transformation data of enterprises are obtained through text analysis and word frequency statistics of listed companies’ annual reports, which come from the official websites of the Shenzhen Stock Exchange (SZSE) and the Shanghai Stock Exchange (SSE).

To ensure the accuracy of the research results, the sample data were processed as follows: (1) The sample enterprises of ST and *ST categories in the current year were excluded. This is because these enterprises have certain financial problems or other abnormalities in the current year, which may lead to inaccurate research conclusions. (2) Sample enterprises with serious missing relevant data were excluded. (3) Finally, this study contains 726 sample observations of transport enterprises, totaling 95 listed enterprises in the transport industry. The data processing software used was Stata16.0.

3.2. Variable Definition

3.2.1. Explained Variables

The explanatory variable of this paper is corporate ESG performance. Referring to Shan Wu et al. (2023) [47], Deli Wang et al. (2022) [61], and Hu Jie et al. (2023) [62], the Huazheng ESG rating data are used as a proxy variable for corporate ESG performance. Among them, the Huazheng ESG ratings are divided into 9 levels (from low to high as C, CC, CCC, B, BB, BBB, A, AA, and AAA), and the ratings are conducted four times a year. Thus, their rating results have certain scientific validity and effectiveness. Further, this paper assigns a score of 1–9 to the ratings from low to high, with higher values indicating higher ESG performance, and uses the average of the ratings for each year as the ESG performance of the enterprise for that year. In addition, this paper further selects the ESG performance score data provided by Bloomberg Consulting as the alternative explanatory variables to ensure the robustness of this paper’s conclusions.

3.2.2. Core Explanatory Variables

The core explanatory variable of this paper is enterprise digital transformation. The method of measuring enterprise digital transformation is difficult in current research; this paper mainly refers to the method of Wu Fei et al. (2021) [42], which adopts the method of text analysis and word frequency statistics to construct enterprise digital transformation indicators and quantifies digitalization level through the frequency of digital-related terms present in the annual reports of businesses.

3.2.3. Moderating Variables

Financing constraints are the moderating variables in this paper. There are many indexes to measure financing constraints, among which the SA index reduces the interference of the endogeneity problem to some extent and considers the financial characteristics of enterprises. Therefore, this paper selects the SA index as the proxy variable for financing constraints. The formula for measuring the SA index is as follows:

In Equation (1), Size is the natural logarithm of the total assets of the enterprise in millions, and Age indicates the age of the enterprise. The SA index calculated according to the formula is negative, and its absolute value is used in the paper as a measure of financing constraints, with larger absolute values indicating greater financing constraints.

3.2.4. Mediating Variable

The mediating variable in this paper is green innovation. It is measured in this paper as the total count of green invention patents applied for and awarded to firms.

3.2.5. Control Variables

We referenced Hu Jie et al. (2023) [62] and Shan Wu et al. (2023) [47] to select relevant control variables as follows: company scale (size), duration of company establishment (age), rate of revenue increase (growth), debt-to-equity ratio (lev), ratio of non-executive directors (indep), two positions in one (dual), shareholding concentration (top1), board size (board), year (Year) and individual (Firm) fixed effects.

Control variables are intended to account for other factors that might influence a company’s ESG performance, thereby enabling a more accurate estimation of the relationship between digital transformation and ESG outcomes. Specifically, this paper selects variables related to corporate characteristics for control. Their impact on a company’s ESG level may be attributed to the following reasons: 1. Size: larger companies may have more resources to achieve ESG objectives. 2. Age: older companies might possess more mature management systems, which could affect their ESG performance. 3. Growth: rapidly growing companies are likely to face greater environmental and social responsibility pressures. 4. Lev: higher levels of debt may limit a company’s ability to invest in the ESG arena. 5. Indep: independent directors might be more capable of objectively assessing a company’s ESG performance. 6. Dual: this governance structure could influence the company’s decision-making process and ESG strategies. 7. Top1L: high concentration of ownership might reduce attention to ESG issues. 8. Board: larger boards could provide a diversity of perspectives but may also lower decision-making efficiency.

The above-mentioned main variables are defined in Table 1.

Table 1.

Definition and measurement of variables.

3.2.6. Descriptive Statistics

Table 2 reports the results of the descriptive statistics of the variables. The minimum value of the explanatory variable corporate ESG performance is 3, the maximum value is 8, and the mean value is 6.850, suggesting that the majority of companies in the sample exhibit medium to high ESG practice levels, but there are still some differences between firms within the transport industry. The core explanatory variable, Digital Transformation (Digital), ranges from a minimum of 0 to a maximum of 5.638, with an average of 2.552 and a standard deviation of 1.131. This range suggests that, while some enterprises in the sample exhibit low digital development, there is significant variation in digital maturity levels across companies, with certain businesses maintaining minimal digitalization or not having embarked on digital transformation at all. The minimum value of financing constraints is 2.902, the maximum value is 4.617, the mean is 3.785, and the standard deviation is 0.302, indicating that most of the enterprises face the existence of financing constraints because the differences in the degree of fluctuation are not large. The minimum value of green innovation is 0, the maximum value is 2.639, and the mean value is 0.126, which shows that the overall level of green innovation of enterprises in the transport industry is still low.

Table 2.

Descriptive statistics of variables.

3.3. Model Setting

The primary methodology employed in this article is the two-way fixed effects model, providing a stable framework for analyzing the dynamics of digital transformation in the transportation industry and its impact on corporate ESG practices. This approach is advantageous for several reasons. First, it is well-suited for handling panel data, which comprises the sample data used in this study. The model facilitates the analysis of both cross-sectional and time series variations. Second, the model effectively controls for unobserved heterogeneity, which may be constant over time but vary across different entities. It accounts for the time-invariant characteristics of individual entities as well as overall trends over time, thus isolating the specific impacts of digital transformation on ESG performance. Third, the model helps mitigate endogeneity issues, such as omitted variable bias, which is crucial for accurately estimating the effects of digital transformation. Additionally, the moderation effect model and mediation effect testing procedure are utilized to explore the roles of financing constraints and green innovation capability in the relationship between digital development and corporate ESG outcomes.

Specifically, Model (2) validates the effect of digitalization on enterprise ESG outcomes. Model (3) incorporates the interaction variable between digital transition and financing limitations, along with the financing constraints themselves, and the coefficients of the interaction term can be used to analyze the moderating effect of financing constraints. Models (4) and (5) use the “two-step method” to examine the intermediary function of environmental innovation.

where i denotes the firm, t denotes the year, the explanatory variable is the firm’s ESG performance (ESG), the core explanatory variable is the firm’s digital transformation (Digital), Controls is the aforementioned control variable, the mediating variable is green innovation (Green), the moderating variable is the financing constraints (FC), and the moderating effect is tested using the interaction term . are the individual fixed effect and the time fixed effect, respectively, and is the random error term.

4. Results and Discussion

4.1. Statistical Modeling

Table 3 presents the findings. The initial column reveals a significant and positive correlation between digital shift and firms’ ESG outcomes at the 5% significance level, indicated by a coefficient of 0.072. This suggests that an increase in the degree of digital transformation of firms in the transport industry has a facilitating effect on firms’ ESG performance, validating research hypothesis H1. Column (2) of Table 3 examines the moderating effect of financing constraints. At the 10% significance level, the interplay between financing constraints and digitalization demonstrates a notably negative effect (with an absolute coefficient value of 0.138), validating that financing constraints negatively moderate the positive link between digital transition and ESG level. Specifically, as transport enterprises face increased constraints, the beneficial impact of their digital transformation on ESG performance diminishes, thereby corroborating the validity of hypothesis H2. The final pair of columns in Table 3 examine the intermediary function of eco-innovation. Column (3) indicates a significant and positive correlation between firms’ digital transition and green technique progress at a 1% significance level (with a coefficient of 0.052), whereas column (4) reveals that when considering both digitalization and environmental technologies, they each positively influence firms’ ESG practice level at the 5% and 10% significance levels, respectively (with coefficients of 0.066 and 0.112). To summarize, within the transport sector, digitalization development fosters the advancement of corporate green techniques, which consequently bolster the corporate ESG level. This suggests that green technology progress acts as an intermediary between digital shift and ESG outcomes. Consequently, research hypothesis H3 is likewise confirmed.

Table 3.

Regression analysis.

4.2. Robustness Test

4.2.1. Replacement of Explanatory Variables

The robustness test was conducted using benchmark regression. In the baseline regression, this study utilizes the Huazheng ESG rating’s segmentation scale, ranging from 1 to 9, as a proxy measure for corporate ESG performance. In order to verify the robustness of the core findings, this study substitutes the Huazheng corporate ESG performance data (ESG) used in the baseline model with the evaluation scores of corporate ESG performance data (PESG) provided by Bloomberg Consulting. Bloomberg’s corporate ESG data are scored on a 0–100 scale and brought into the model for regression analysis after logarithmic processing. Table 4, column (1), displays the outcome that digital shifts within transport companies continue to make a significant contribution to corporate ESG performance at a 5% significance level, with a coefficient of 1.079. This proves that the conclusion of research hypothesis H1 remains robust and credible.

Table 4.

Substitution of explanatory variables and endogeneity tests.

4.2.2. Endogeneity Test

The empirical testing process of this paper may be endogenous due to mutual causation, i.e., the digital transformation of enterprises in the transport industry affects the ESG performance of enterprises, and at the same time, enterprises with better ESG performance will be more inclined to carry out digital transformation.

In addition, because there is a certain time lag in the promotion effect of digital transformation on firms’ ESG performance, this paper introduces the lagged-one period (L.Digital) of the core explanatory variable of firms’ digital transformation (Digital) into the model for the regression to complete the endogeneity test. Column (2) of Table 4 demonstrates the regression results; the variable of the lagged one period of firms’ digital transformation is positive (coefficient of 0.044) at the 10% significance level, which verifies that the paper’s core findings are documented to be credible.

4.2.3. Winsorize

Although this paper is only conducted within the transport industry and the sample data size is not large, the findings may still be affected by outliers. Therefore, in this paper, the explanatory variables (Digital), the explained variables (ESG), and all the control variables are Winsorized at 1% and 99% of the quartiles, and then the treated variables are replaced with the original variables for the benchmark regression analysis. The regression results are shown in column (1) of Table 5. After the Winsorize process, the digital transformation of enterprises still has a significant positive contribution to the ESG of enterprises at the 5% level, the coefficient of 0.071 is very similar to the coefficient of 0.072 in the original model, and the significance levels and coefficients of the rest of the control variables are also very similar to those in the original model, which proves the conclusion to be robust and reliable.

Table 5.

Robustness tests.

4.3. Heterogeneity Test

Different-sized transportation enterprises exhibit variability in how digital transition enhances their corporate ESG outcomes. Firstly, large companies have abundant financial strength and are better equipped to bear the high input costs required for digital transformation. If companies do not have sufficient reserve resources, they cannot fully release digital dividends and thus obtain the positive effect of enhancing ESG performance. Secondly, the decision-making and operation chains of large transport companies are more complex, and digital transformation can open up information barriers and help coordinate various departments to improve ESG levels. On the contrary, SMEs’ digital transformation often faces difficulties such as insufficient management teams, which limits the role of digitalization in promoting ESG. Based on the theory of economies of scale, this study argues that large transport companies are able to take advantage of the synergies of digitization, have the competitive advantage of economies of scale, and obtain greater ESG enhancement. Therefore, this paper argues that in the transport industry, the positive effect of digitalization on firms’ ESG practice is more pronounced for larger transportation enterprises. To examine this hypothesis, the samples were categorized based on the median size of the enterprises, followed by separate regression analyses for each group.

Columns (1) and (2) of Table 6 report the regression results. Column (1) demonstrates that in large transport firms, the association between companies’ digitalization level and their ESG achievements stands at 0.111, which is a significant positive correlation at the 1% significance level, whereas Column (2) shows that there is no significant correlation between firms’ digital transformation and firms’ ESG performance when firms’ size is small. Therefore, digital transformation has a better contribution to corporate ESG performance in large transport companies.

Table 6.

Heterogeneity test.

Additionally, past research indicates that the nature of a company’s ownership can impact its digital transformation process. Wu et al. (2021) [42] suggest that state-owned enterprises (SOEs), facing less competitive pressure in the market and lacking innovation incentives, tend to have weaker engagement with digital technologies, which hinders their digital transformation. However, some scholars argue that the effect of digital transformation on enhancing the ESG performance of SOEs is more pronounced. On the one hand, SOEs, with ample resources, are well-positioned to develop digital technologies and have stronger capabilities in implementing ESG practices [62]. On the other hand, SOEs often take on more social responsibilities and are more inclined to endorse and implement digital policies [55]. In summary, the nature of property rights is a significant yet unsettled factor in determining impact. Studying its influence in the transportation industry can help in tailoring appropriate policies to achieve desired objectives.

To examine if ownership type in transport sector firms influences the impact of the digital shift on their ESG ratings, this study performs sub-sample regressions for both state-owned and non-state-owned enterprises, and the results of the regression are shown in Table 6, Column (3) and Column (4). Column (3) demonstrates that at the 1% level, in state-owned enterprises, corporate digital transformation has a significant contribution to corporate ESG. Column (4) reveals that within non-state-owned companies, the link between corporate digitalization and ESG practice is not statistically significant. A plausible explanation for this is that SOEs, owing to their inherent ties with the government, are more apt to receive governmental financial backing. They encounter comparatively milder external financing restrictions and experience reduced financing expenses than non-SOEs. Moreover, in China, SOEs need to take on more social responsibility, and transport companies need to carry out low-carbon reforms to protect the environment and achieve sustainable development in accordance with the national call. In addition, SOEs receive more technical support and assistance from the government for digital transformation than non-SOEs. Therefore, in the transport industry, the digital transformation of enterprises shows a better contribution to the ESG performance of SOEs.

4.4. Discussion

Currently, the transportation and logistics sector is experiencing a rapid evolution toward digitalization, greening, and decarbonization. However, there is a notable gap in the literature regarding the relationship between ESG achievements and the level of digitalization in the transportation industry. Our study provides empirical evidence addressing this gap, indicating that the digital transformation of enterprises positively contributes to the enhancement of ESG practices in the transportation sector. This paper utilizes a two-way fixed effects model to analyze panel data from 95 transportation companies listed on China’s A-share market. Additionally, we endeavor to reveal the mediating role of green technology innovation in this relationship and examine how different levels of financing constraints might influence these outcomes. Our primary findings and discussions are as follows.

Firstly, the results of our empirical analysis indicate that enhancing digital transformation capabilities in a transportation company is conducive to improving its ESG performance. This conclusion aligns with mainstream academic perspectives [47,48,49,55,56,62]. This may be attributed to several factors. Initially, digital transformation drives green development through innovative technologies like the IoT and big data, enhancing environmental performance and reducing pollution management costs. Secondly, in line with agency and information asymmetry theories, digitalization supports corporate social responsibility by increasing transparency and reducing information asymmetries, thus facilitating more effective management and stakeholder engagement. Lastly, digitalization enhances corporate governance through the integration of advanced technologies such as blockchain, ensuring information transparency and mitigating internal conflicts of interest. Our empirical findings corroborate that in the transportation industry, the advancement of digital transformation similarly elevates the level of ESG outcomes.

Secondly, our research findings further demonstrate that in transportation companies with lesser financing constraints, the impact of digital transformation on enhancing ESG practices is more pronounced. This observation aligns with the studies of several scholars [55,61] yet contrasts with the perspective of Lu et al. (2022) [48], who argue that digital transformation in companies with greater financing constraints more effectively promotes the fulfillment of ESG responsibilities. This discrepancy might be attributed to the cautious investment decisions in financially constrained companies, where digital transformation optimizes resource allocation and enhances transparency, reducing improper management practices. Consequently, this aids in optimizing the environmental, social responsibility, and governance structure of enterprises, meeting the market and investors’ demands for high ESG standards. However, from the viewpoint of agency theory, our study posits that transportation companies with fewer financing constraints possess more abundant funds to support digital transformation, technological innovation, and infrastructure upgrades, thereby better achieving environmental efficiency and refined operational management. Digital transformation enhances internal control mechanisms through more accurate and transparent data management, optimizing corporate governance structures, and reducing agency costs. This perspective is corroborated by the empirical research conducted in our study. Therefore, we contend that in the context of higher capital accessibility, digital transformation in transportation enterprises robustly drives the improvement in ESG performance.

Thirdly, our study identifies a significant mediating role of green technology innovation in the relationship between digital transformation and ESG levels in transportation companies. This finding is in line with the research of Wu et al. (2023) and Hu et al. (2023) [47,62]. On the one hand, digital transformation dissolves information barriers and mitigates information asymmetry, providing ample funding for companies to engage in green technological innovation. Digital platforms also facilitate closer communication between corporate management and stakeholders, hastening the fulfillment of external demands for greening [48]. On the other hand, ecological technology innovation creates favorable conditions for transportation companies to fulfill their ESG responsibilities. According to resource-based theory, green process innovation grants companies a competitive edge; environmentally friendly transportation services become more popular in the market, enhancing corporate financial performance [59]. Furthermore, from the perspectives of legitimacy theory and stakeholder theory, enhancing green practices helps companies gain public trust, improve relations with stakeholders, and access more external resources [63]. Additionally, scholars examining the ecological footprint in South Asia have empirically validated that technological innovation can promote sustainable development [64]. Therefore, we encourage transportation companies to focus on green product innovation in their digital transformation endeavors, as it can significantly elevate ESG outcomes.

5. Conclusions and Implications

5.1. Research Conclusions

Using a sample of A-share listed companies in the transport industry from 2011 to 2021, this paper empirically examines the impact of digital transformation on corporate ESG performance and the mediating mechanism, as well as the differences in this impact across firms of different sizes and ownership types. The research initially identifies that digitalization development significantly influences corporate ESG practice in the transport sector, and this observation maintains its robustness following various endogeneity treatments and robustness assessments. Secondly, this study observes that financing constraints can influence the positive impact of digital transition on corporate ESG ratings. Specifically, this positive effect is diminished when transport firms face heightened financing constraints. Thirdly, regarding the mechanism of action, the digital transformation of transportation companies aids in elevating their green innovation level, which in turn boosts their ESG performance via the critical pathway of green innovation. This implies that the progress of green techniques acts as an intermediary in the relationship between digitalization development and ESG outcomes within transportation companies. Fourthly, additional analysis reveals that the impact of digital transition on ESG ratings significantly differs among various types of firms. Notably, its contribution to corporate ESG outcomes is more substantial in larger transportation companies and state-owned transport enterprises.

Moreover, compared to non-state-owned enterprises, the facilitating effect of digital transformation is more pronounced in state-owned transportation companies. This study enriches the understanding of the impact relationship between corporate digital transformation and ESG ratings in the transportation sector. It offers exploratory research into the pathways through which digital transformation affects the ESG level, providing empirical insights for the transportation industry to further deepen its digital transformation and implement ESG practices effectively.

5.2. Policy Recommendations

This study highlights the important role of digital transformation in improving environmental, social, and corporate governance (ESG) performance in the transport industry. It highlights the need for government-supportive policies and industry practices that favor this transformation. Drawing from these results, the following recommendations are proposed in this paper.

5.2.1. Policy Recommendations for Governments

First, governments need to facilitate digital transformation. This can include tax incentives, subsidies, or funding for technologies that directly address the unique operational challenges of this sector [47], such as real-time tracking systems, advanced logistics management software, and environmentally friendly transportation technologies. These incentives should aim to foster an ecosystem where transportation enterprises are motivated to adopt digital solutions that enhance efficiency, reduce environmental impact, and improve supply chain management.

Second, the government needs to help enterprises ease financing constraints and promote green innovation. This can involve offering low-interest loans, guarantees, or other financial aid for investments in digital technologies that contribute to eco-friendly transportation solutions, like electric vehicle fleets, energy-efficient logistics operations, and emission-reduction technologies. Additionally, public sector support for research and development should be directed toward innovations that advance sustainable transportation practices [62].

Third, governments should develop differentiated policies. The positive impact of digital transformation can be maximized by developing targeted policies for enterprises of different sizes and natures (SOEs and private enterprises). For SOEs, special funds could be allocated to support digital innovation and R&D projects that enhance public transportation systems, improve freight logistics, and promote sustainable urban mobility solutions. Training in digital technologies should be provided to ensure employees are equipped to implement these initiatives [55]. For private enterprises, especially SMEs, the focus should be on alleviating financing challenges through guarantees or low-interest loans, particularly aimed at digital improvements that increase operational efficiency and reduce the environmental footprint in transportation and logistics services.

5.2.2. Recommendations for Transport Enterprises

First, business managers should increase their investment in digitalization and pay attention to ESG performance. Business managers in the transportation sector should prioritize investments in digital technologies that directly enhance the efficiency of transport and logistics operations. This includes advanced fleet management systems, GPS tracking, and automation technologies that streamline logistics processes [48,61].

Second, managers need to focus on innovation-driven strategies and seize various financing opportunities. It is recommended to work on digitally driven green innovations, such as the adoption of clean energy and energy-efficient technologies. Actively seeking financing opportunities from governments and financial institutions should be geared specifically toward supporting these transportation-focused digital transformation programs, such as subsidies for electric vehicle adoption or grants for developing green logistics infrastructure.

Finally, business managers should consider the size of the enterprise and the nature of ownership. Large transport enterprises and state-owned enterprises should leverage their scale and resources to lead digital transformation. They should focus on large-scale initiatives like modernizing public transportation systems, investing in smart infrastructure, or developing integrated logistics platforms. In addition, small- and medium-sized transport enterprises should seek partnerships and government support to overcome resource constraints. They should focus on niche areas like specialized logistics services or regional transportation solutions. They should also be cautious about investing too much money to avoid major losses caused by blind digitalization investments.

5.3. Research Limitations and Future Research

This study also has some limitations. Firstly, the multifaceted factors influencing corporate ESG performance. The fulfillment of ESG responsibilities by companies is affected by various elements, including the behavior of institutional investors, board structure, management shareholding, external regulation, and enforcement. Due to the specific industry focus and data availability in our sample, these variables were not considered in the empirical study, and their complexity could lead to endogeneity issues. Secondly, the multidimensional effects of digital transformation. The academic community has not yet reached a consensus on the impacts of digital transformation. Some studies indicate potential adverse effects, such as the amplification of negative corporate information disclosure, while others find positive impacts. These divergent viewpoints could affect the interpretation of our findings. Lastly, although this research explores the relationship between digital transformation and corporate ESG performance, the investigation into the inherent mechanisms of this relationship is not yet thorough. For instance, while some studies have demonstrated that information transparency and decision-making efficiency are mediating pathways [62], whether these conclusions remain consistent in the transportation industry is still unknown.

Future research should delve into the impact of broader socio-economic factors and internal corporate factors on the ESG level of companies in the transportation industry. A deeper understanding of how these elements interact could offer more nuanced insights into ESG outcomes within the transport sector. Additionally, there exists an opportunity to explore how various facets of digital transformation, including emerging technologies like artificial intelligence and blockchain, uniquely influence ESG practice across different industry contexts. Furthermore, comparative studies across industries could elucidate how specific characteristics of certain sectors, such as transportation, affect the interplay between digital transformation and ESG performance. These avenues of research could provide a more detailed and comprehensive perspective on the complex relationships between digitalization, socio-economic factors, and corporate sustainability practices.

Author Contributions

Writing—original draft preparation, L.Y.; writing—data curation and analysis, J.X.; writing—review and editing, X.Y. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are available from authors upon reasonable request.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Gillan, S.L.; Koch, A.; Starks, L.T. Firms and social responsibility: A review of ESG and CSR research in corporate finance. J. Corp. Financ. 2021, 66, 101889. [Google Scholar] [CrossRef]

- Dong, X.; Sun, Z. Head off a Danger or Overreach Itself: Can ESG Performance Reduce Business Risk? J. Cent. Univ. Financ. Econ. 2023, 7, 57–67. [Google Scholar]

- Li, W. Research on the Relationship between Corporate Social Responsibility and Financial Performance—Based on the Data Analysis of Listed Companies in Transportation Industry. Res. Financ. Econ. Issues 2012, 4, 89–94. [Google Scholar]

- Yang, Y.; Zhao, A. On the Relationship Between the Transportation Industry and Economic Growth. J. Transp. Syst. Eng. Inf. Technol. 2003, 2, 65–71. [Google Scholar]

- Wang, J.; Ma, X. Influencing factors of carbon emissions from transportation in China: Empirical analysis based on two-level econometrics method. Beijing Da Xue Xue Bao 2021, 57, 1133–1142. [Google Scholar]

- Liu, J.; Huang, F.; Chen, B. Research on Influencing Factors and Emission Reduction Strategies of Carbon Emission in Transportation Industry. Highway 2023, 68, 252–259. [Google Scholar]

- Xu, L.; Yang, Z.; Chen, J.; Zou, Z. Spatial-temporal heterogeneity of global ports resilience under Pandemic: A case study of COVID-19. Marit. Policy Manag. 2023. [Google Scholar] [CrossRef]

- Xu, L.; Zou, Z.; Zhou, S. The influence of COVID-19 epidemic on BDI volatility: An evidence from GARCH-MIDAS model. Ocean Coast. Manag. 2022, 229, 106330. [Google Scholar] [CrossRef]

- Guo, X.; Chen, X. The impact of digital transformation on manufacturing-enterprise innovation: Empirical evidence from China. Sustainability 2023, 15, 3124. [Google Scholar] [CrossRef]

- Nambisan, S.; Lyytinen, K.; Majchrzak, A.; Song, M. Digital innovation management. MIS Q. 2017, 41, 223–238. [Google Scholar] [CrossRef]

- Paunov, C.; Rollo, V. Has the internet fostered inclusive innovation in the developing world? World Dev. 2016, 78, 587–609. [Google Scholar] [CrossRef]

- Zhou, H.; Li, X.Y.; Li, X.L. Can the Digital Economy Improve the Level of High-Quality Financial Development? Evidence from China. Sustainability 2023, 15, 7451. [Google Scholar] [CrossRef]

- Karimi, J.; Walter, Z. The role of dynamic capabilities in responding to digital disruption: A factor-based study of the newspaper industry. J. Manag. Inf. Syst. 2015, 32, 39–81. [Google Scholar] [CrossRef]

- Li, T.-T.; Wang, K.; Sueyoshi, T.; Wang, D.D. ESG: Research progress and future prospects. Sustainability 2021, 13, 11663. [Google Scholar] [CrossRef]

- Lee, D. Corporate social responsibility of US-listed firms headquartered in tax havens. Strateg. Manag. J. 2020, 41, 1547–1571. [Google Scholar] [CrossRef]

- Jia, Y.; Gao, X.; Julian, S. Do firms use corporate social responsibility to insure against stock price risk? Evidence from a natural experiment. Strateg. Manag. J. 2020, 41, 290–307. [Google Scholar] [CrossRef]

- Kim, S.; Lee, G.; Kang, H.G. Risk management and corporate social responsibility. Strateg. Manag. J. 2021, 42, 202–230. [Google Scholar] [CrossRef]

- Atan, R.; Alam, M.M.; Said, J.; Zamri, M. The impacts of environmental, social, and governance factors on firm performance: Panel study of Malaysian companies. Manag. Environ. Qual. Int. J. 2018, 29, 182–194. [Google Scholar] [CrossRef]

- Duque-Grisales, E.; Aguilera-Caracuel, J. Environmental, social and governance (ESG) scores and financial performance of multilatinas: Moderating effects of geographic international diversification and financial slack. J. Bus. Ethics 2021, 168, 315–334. [Google Scholar] [CrossRef]

- Friedman, M. The social responsibility of business is to increase its profits. In Corporate Ethics and Corporate Governance; Springer: Berlin/Heidelberg, Germany, 2007; pp. 173–178. [Google Scholar]

- Garcia, A.S.; Orsato, R.J. Testing the institutional difference hypothesis: A study about environmental, social, governance, and financial performance. Bus. Strategy Environ. 2020, 29, 3261–3272. [Google Scholar] [CrossRef]

- Alexander, G.J.; Buchholz, R.A. Corporate social responsibility and stock market performance. Acad. Manag. J. 1978, 21, 479–486. [Google Scholar] [CrossRef]

- Park, S.R.; Oh, K.-S. Integration of ESG information into individual investors’ corporate investment decisions: Utilizing the UTAUT framework. Front. Psychol. 2022, 13, 899480. [Google Scholar] [CrossRef]

- Liu, M.; Luo, X.; Lu, W.-Z. Public perceptions of environmental, social, and governance (ESG) based on social media data: Evidence from China. J. Clean. Prod. 2023, 387, 135840. [Google Scholar] [CrossRef]

- Reber, B.; Gold, A.; Gold, S. ESG disclosure and idiosyncratic risk in initial public offerings. J. Bus. Ethics 2022, 179, 867–886. [Google Scholar] [CrossRef]

- Edmans, A. Does the stock market fully value intangibles? Employee satisfaction and equity prices. J. Financ. Econ. 2011, 101, 621–640. [Google Scholar] [CrossRef]

- Deng, X.; Kang, J.-K.; Low, B.S. Corporate social responsibility and stakeholder value maximization: Evidence from mergers. J. Financ. Econ. 2013, 110, 87–109. [Google Scholar] [CrossRef]

- Flammer, C. Does corporate social responsibility lead to superior financial performance? A regression discontinuity approach. Manag. Sci. 2015, 61, 2549–2568. [Google Scholar] [CrossRef]

- Albuquerque, R.; Koskinen, Y.; Zhang, C. Corporate social responsibility and firm risk: Theory and empirical evidence. Manag. Sci. 2019, 65, 4451–4469. [Google Scholar] [CrossRef]

- Shin, D. Corporate Esg Profiles, Matching, and the Cost of Bank Loans; University of Washington: Washington, DC, USA, 2021. [Google Scholar]

- Grimaldi, F.; Caragnano, A.; Zito, M.; Mariani, M. Sustainability engagement and earnings management: The Italian context. Sustainability 2020, 12, 4881. [Google Scholar] [CrossRef]

- Galbreath, J. ESG in focus: The Australian evidence. J. Bus. Ethics 2013, 118, 529–541. [Google Scholar] [CrossRef]

- Velte, P. Does ESG performance have an impact on financial performance? Evidence from Germany. J. Glob. Responsib. 2017, 8, 169–178. [Google Scholar] [CrossRef]

- Han, H. Does increasing the QFII quota promote Chinese institutional investors to drive ESG? Asia-Pac. J. Account. Econ. 2023, 30, 1627–1643. [Google Scholar] [CrossRef]

- Chebbi, K.; Ammer, M.A. Board composition and ESG disclosure in Saudi Arabia: The moderating role of corporate governance reforms. Sustainability 2022, 14, 12173. [Google Scholar] [CrossRef]

- Eliwa, Y.; Aboud, A.; Saleh, A. Board gender diversity and ESG decoupling: Does religiosity matter? Bus. Strategy Environ. 2023, 32, 4046–4067. [Google Scholar] [CrossRef]

- Zhang, X.; Zhao, X.; Qu, L. Do green policies catalyze green investment? Evidence from ESG investing developments in China. Econ. Lett. 2021, 207, 110028. [Google Scholar] [CrossRef]

- Lu, S.; Cheng, B. Does environmental regulation affect firms’ ESG performance? Evidence from China. Manag. Decis. Econ. 2023, 44, 2004–2009. [Google Scholar] [CrossRef]

- Ghasemaghaei, M.; Calic, G. Assessing the impact of big data on firm innovation performance: Big data is not always better data. J. Bus. Res. 2020, 108, 147–162. [Google Scholar] [CrossRef]

- Xu, L.; Shi, J.; Chen, J. Agency encroachment and information sharing: Cooperation and competition in freight forwarding market. Marit. Policy Manag. 2023, 50, 321–334. [Google Scholar] [CrossRef]

- Vial, G. Understanding digital transformation: A review and a research agenda. Manag. Digit. Transform. 2021, 28, 13–66. [Google Scholar] [CrossRef]

- Wu, F.; Hu, H.; Lin, H.; Ren, X. Enterprise digital transformation and capital market performance: Empirical evidence from stock liquidity. Manag. World 2021, 37, 130–144. [Google Scholar]

- Liu, F. How digital transformation improve manufacturing’s productivity: Based on three influencing mechanisms of digital transformation. Financ. Econ. 2020, 2020, 93–107. [Google Scholar]

- Zhao, C.; Wang, W.; Li, X. How does digital transformation affect the total factor productivity of enterprises. Financ. Trade Econ 2021, 42, 114–129. [Google Scholar]

- Kane, G.C. How Facebook and Twitter are reimagining the future of customer service. MIT Sloan Manag. Rev. 2014, 55, 1–6. [Google Scholar]

- Chen, J.; Li, P.; Wang, X.; Yi, K. Above management: Scale development and empirical testing for public opinion monitoring of marine pollution. Mar. Pollut. Bull. 2023, 192, 114953. [Google Scholar] [CrossRef]

- Wu, S.; Li, Y. A Study on the Impact of Digital Transformation on Corporate ESG Performance: The Mediating Role of Green Innovation. Sustainability 2023, 15, 6568. [Google Scholar] [CrossRef]

- Lu, Y.; Wang, L.; Zhang, Y. Does digital financial inclusion matter for firms’ ESG disclosure? Evidence from China. Front. Environ. Sci. 2022, 10, 1029975. [Google Scholar] [CrossRef]

- Wang, X.; Luan, X.; Zhang, S. Corporate R&D investment, ESG performance and market value—The Moderating effect of enterprise digital level. Stud. Sci. Sci 2023, 41, 896–904. [Google Scholar]

- Wang, S.; Ouyang, L.; Yuan, Y.; Ni, X.; Han, X.; Wang, F.-Y. Blockchain-enabled smart contracts: Architecture, applications, and future trends. IEEE Trans. Syst. Man Cybern. Syst. 2019, 49, 2266–2277. [Google Scholar] [CrossRef]

- Zhang, Q.; Yang, M.; Lv, S. Corporate digital transformation and green innovation: A quasi-natural experiment from integration of informatization and industrialization in China. Int. J. Environ. Res. Public Health 2022, 19, 13606. [Google Scholar] [CrossRef]

- Frynas, J.G.; Mol, M.J.; Mellahi, K. Management innovation made in China: Haier’s Rendanheyi. Calif. Manag. Rev. 2018, 61, 71–93. [Google Scholar] [CrossRef]

- Zhou, Z.; Li, Z. Corporate digital transformation and trade credit financing. J. Bus. Res. 2023, 160, 113793. [Google Scholar] [CrossRef]

- Fazzari, S.; Hubbard, R.G.; Petersen, B.C. Financing Constraints and Corporate Investment; National Bureau of Economic Research: Cambridge, UK, 1987; pp. 8–32. [Google Scholar]

- Hao, Y.; Zhang, Y. Research on the influence of digital transformation on enterprise ESG performance under the “double carbon” goal. Sci.-Technol. Manag. 2022, 24, 80–91. [Google Scholar] [CrossRef]

- Zhai, H.; Liu, Y. Research on the Relationship among Digital Finance Development, Financing Constraint and Enterprise Green Innovation. Sci. Technol. Prog. Policy 2021, 38, 116–124. [Google Scholar]

- Genzorova, T.; Corejova, T.; Stalmasekova, N. How digital transformation can influence business model, Case study for transport industry. Transp. Res. Procedia 2019, 40, 1053–1058. [Google Scholar] [CrossRef]

- Tsakalidis, A.; Gkoumas, K.; Pekár, F. Digital transformation supporting transport decarbonisation: Technological developments in EU-funded research and innovation. Sustainability 2020, 12, 3762. [Google Scholar] [CrossRef]

- Qing, L.; Chun, D.; Dagestani, A.A.; Li, P. Does proactive green technology innovation improve financial performance? Evidence from listed companies with semiconductor concepts stock in China. Sustainability 2022, 14, 4600. [Google Scholar] [CrossRef]

- Peattie, K.; Ratnayaka, M. Responding to the green movement. Ind. Mark. Manag. 1992, 21, 103–110. [Google Scholar] [CrossRef]

- Wang, D.; Peng, K.; Tang, K.; Wu, Y. Does FinTech development enhance corporate ESG performance? Evidence from an emerging market. Sustainability 2022, 14, 16597. [Google Scholar] [CrossRef]

- Hu, J.; Han, Y.; Zhong, Y. How corporate digital transformation affects corporate ESG performance-evidence from Chinese listed companies [J/OL]. Ind. Econ. Rev. 2022, 1, 1–19. [Google Scholar]

- Qing, L.; Alnafrah, I.; Dagestani, A.A. Does green technology innovation benefit corporate financial performance? Investigating the moderating effect of media coverage. Corp. Soc. Responsib. Environ. Manag. 2023. [Google Scholar] [CrossRef]

- Qing, L.; Usman, M.; Radulescu, M.; Haseeb, M. Towards the vision of going green in South Asian region: The role of technological innovations, renewable energy and natural resources in ecological footprint during globalization mode. Resour. Policy 2024, 88, 104506. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).