1. Introduction

The increase in greenhouse gas emissions, particularly carbon dioxide (CO

2), resulting from economic growth poses significant risks and challenges to human society, economies, and ecosystems, thereby threatening sustainable development [

1]. The average global warming caused by human activities reportedly reached 1.14 °C between 2013 and 2022 and 1.26 °C in 2022 [

2]. Climate change endangers global biodiversity and the well-being of future generations, requiring collaborative efforts from countries. Green innovation is crucial for addressing global climate change because it can reduce greenhouse gas emissions, promote sustainable development, create economic growth and employment opportunities, and improve the quality of social life. Consequently, green innovation has become a widely discussed topic.

Rhodes and Wield [

3] introduced the term “green innovation” to refer to the development of environmentally friendly products and technologies from the research stage to the market. The Porter hypothesis indicates that appropriate environmental regulations promote green innovation [

4]. However, no consensus has been achieved in the literature regarding the relationship between environmental regulations and green innovation. The first category of research found that environmental regulations lead to increased pollution control costs for enterprises, which displaces investment in research and development (R&D) and decreases their level of green innovation [

5,

6,

7]. The second category revealed that environmental regulations stimulate an “innovation compensation” effect, which offsets the cost of environmental pollution control and enhances the level of green innovation [

8,

9,

10]. The third category found a nonlinear effect of environmental regulations on the level of green innovation [

11,

12,

13]. This lack of consensus may stem from variations in the environmental regulations studied and the research samples and methods employed. Therefore, a specific and thorough analysis is necessary to provide additional empirical evidence on the relationship between environmental regulations and green innovation, and to propose replicable policy recommendations in order to mitigate climate change-induced challenges and promote global sustainable development.

After more than 40 years of rapid growth following the reform and opening-up of the Chinese economy, the country has shifted from high-speed to high-quality growth, striving to achieve harmonious coexistence between humans and nature. China has actively implemented a low-carbon city pilot policy (LCCPP) to facilitate low-carbon transformation to achieve sustainable development. The first batch of low-carbon city pilots was launched in 2010, followed by the second and third batches in 2012 and 2017, respectively, covering 81 cities across eastern, central, and western China [

14]. The goals, tasks, focal points, and implementation paths of the pilot cities vary considering that regions across China have achieved diverse levels of development and resource endowment [

15]. Positive interactions and developments among regions have been promoted by expanding the scope of the pilot program and leveraging the comparative advantages of different regions. In addition, LCCPP has explored effective pathways for greenhouse gas emissions control and green low-carbon development in different types of regions, thus driving China’s low-carbon transformation [

16]. Therefore, LCCPP has distinct characteristics for adapting to local conditions [

17]. Consequently, studying the relationship between environmental regulations and green innovation from the LCCPP perspective offers two significant advantages. First, it enables the examination of the characteristics of low-carbon transformation in regions with different geographies, natural endowments, and levels of economic development, thereby providing replicable experiences and policy recommendations for other developing countries to achieve low-carbon transformation [

18]. Second, the selection of pilot cities covering various regions in China eliminates sample selection bias, thus allowing for a good quasi-natural experiment to accurately identify the causal effects of environmental regulations on green innovation [

19].

In addition, China is witnessing a boom in its digital economy while promoting low-carbon transformation. According to the “China Digital Economy Development White Paper (2021)” released by the China Academy of Information and Communications Technology, the penetration rates of the digital economy in the service, industrial, and agricultural sectors are 40.7%, 21.10% and 8.9%, respectively. The digital economy contributes to energy conservation, emission reduction, efficient resource utilization, and environmental risk management; it also promotes green and sustainable development, including low-carbon lifestyles, and a green economy [

20]. The two factors of low-carbon transformation and enterprise digital transformation are important manifestations of China’s transition from high-speed to high-quality growth [

21]. The integrated development of these factors has optimized the economic structure and promoted industrial structure transformation and upgrading, thus facilitating the application and popularization of digital technologies in the green sector and the realization of a development model that is intelligent, sustainable, innovative, and efficient with a low-carbon focus. Therefore, the impact of LCCPP on enterprises’ green innovation should be explored within the context of the digital economy, and corresponding policy recommendations must be proposed to enrich the existing literature.

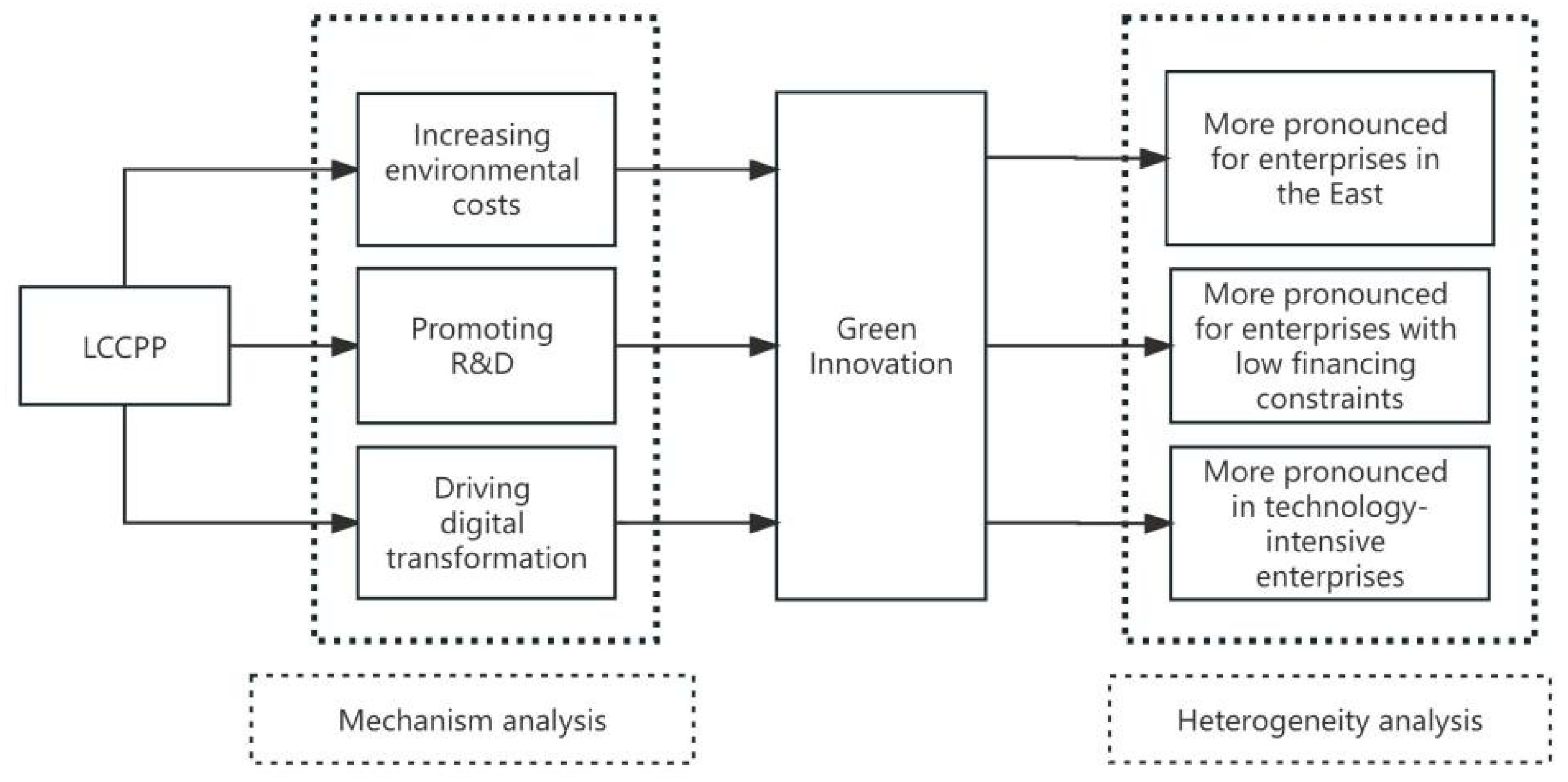

Based on the 2003–2021 data of Chinese A-share listed enterprises, this study uses LCCPP as a quasi-natural experiment and employs a difference-in-differences (DID) approach to examine the impact of LCCPP on enterprises’ green innovation in a digital economy. The findings of this research are as follows: (1) LCCPP effectively improves enterprises’ green innovation levels. (2) The mechanisms of this improvement include increasing environmental costs, increasing investment in R&D, and promoting enterprises’ digital transformation. (3) The promotion effect of LCCPP on enterprises’ green innovation is highly pronounced in eastern regions, regions with low financing constraints, and technology-intensive enterprises. (4) This promotion effect is positively correlated with the digital economy level in the region in which the enterprise is located.

This study’s marginal contributions are mainly reflected in the following three aspects. First, this study verifies the influence of LCCPP on enterprises’ green innovation at the micro-level and provides new evidence for exploring the relationship between environmental regulations and enterprises’ green innovation. Second, from the perspective of environmental costs, R&D investment, and enterprises’ digital transformation, this study analyzes the transmission path of LCCPP on enterprises’ green innovation in the context of digital economy development. Third, this study examines the heterogeneity of the impact, including factors such as the region in which the enterprise is located, financing constraints, and production factor endowments, to deepen the understanding of the effects of LCCPP in the context of a digital economy. This study also provides policy support to improve policy design and enhance enterprises’ green innovation levels and sustainable development.

The rest of this paper is organized as follows:

Section 2 elaborates on the theoretical basis of the impact of LCCPP on green innovation and describes the research hypotheses.

Section 3 introduces the model setting and data processing.

Section 4 presents the baseline regression, robustness tests, and mechanism analysis.

Section 5 discusses the heterogeneity analysis. Finally,

Section 6 concludes the study and outlines policy implications.

2. Theoretical Foundation and Hypotheses

LCCPP is implemented in the form of environmental regulations, which include establishing emission standards, restricting high-pollution enterprises, and strengthening environmental supervision. These measures encourage enterprises to adopt additional environmentally friendly and low-carbon production methods, achieving a win–win situation for economic growth and environmental protection [

22]. This notion is consistent with Porter’s hypothesis, which suggests that governments can drive enterprises toward environmental protection and sustainable development through regulations and incentives [

4]. Based on Porter’s hypothesis and considering the background of China’s digital economy development, LCCPP can influence enterprises’ green innovations through several pathways.

First, LCCPP may promote enterprises’ green innovations by increasing environmental costs. As a government regulatory policy, the LCCPP will increase the environmental costs of enterprises. The increase in environmental costs may stimulate the demand for green innovation and improve the environmental performance of enterprises. On the one hand, the increase in environmental costs will make enterprises pay more attention to their environmental impacts and also make them realize the importance of environmental management [

23]. This realization will prompt enterprises to generate more demand for green innovation, through green innovation in production, management, and technology, to reduce energy consumption, reduce pollutant emissions, and improve the efficiency of resource utilization, to achieve green development and reduce environmental costs. On the other hand, the increase in environmental protection costs of enterprises will make them pay more attention to the improvement of environmental performance [

24]. By carrying out green innovation, enterprises can introduce more environmentally friendly technologies and processes, reduce the use of energy and raw materials, and minimize the generation and emission of waste, thus improving their environmental performance. In this way, enterprises can not only comply with relevant environmental laws and regulations, but also meet the market demand for green products and gain social and market recognition.

Second, LCCPP may promote green innovation by stimulating increased R&D investment. The government can provide financial, tax, or other incentive measures to encourage enterprises to increase R&D investment, particularly in the low-carbon and environmental sectors, thus fostering technological innovation [

25]. Such measures can motivate enterprises to develop and apply further environmentally friendly and low-carbon production technologies and processes toward green development. Increased R&D investment will allow enterprises to enhance their technological capabilities and core competitiveness [

26]. With the promotion of LCCPP, enterprises actively engage in green innovation, providing further environmentally friendly and energy-efficient products and services to meet market demands for green consumption, thereby strengthening their market competitiveness. The encouragement of increased R&D investment through LCCPP helps promote industrial structure upgrading and transformation [

27]. Through technological innovation, enterprises can reduce resource consumption, decrease emissions, enhance resource utilization efficiency, and drive economic development in a low-carbon, green, and sustainable direction.

Finally, LCCPP may promote enterprises’ green innovations by facilitating digital transformation. Government regulatory policies can drive the digital transformation of enterprises [

28]. LCCPP as an environmental regulatory policy may positively contribute to the digital transformation of enterprises. Digital transformation is the sociotechnical process of utilizing digitized techniques to expand organizational contexts in terms of business models, business processes, commercial offerings, etc. [

29,

30]. Digital transformation brings more opportunities and tools for green innovation. Through data-driven decision-making, intelligent technologies, innovation synergy, and the application of emerging technologies, companies can achieve greater breakthroughs and results in the field of green innovation and realize the goal of sustainable development. First is data-driven decision-making. Digital transformation provides companies with more data collection and analysis capabilities, enabling them to better understand their resource use, environmental impacts, and opportunities for green innovation [

31]. Through in-depth analyses of large amounts of data, companies can more accurately assess environmental risks, find improvements in energy and resource efficiency, and develop more targeted green innovation strategies. Next are smart and automated technologies. Digital transformation is driving the application of smart and automated technologies that can help companies achieve the more efficient use of resources and reduce waste [

32]. For example, IoT technology can monitor energy consumption and emissions in real-time, providing fine-grained management and control to reduce environmental loads. At the same time, automation technology can reduce errors and waste in human operations and improve the efficiency and sustainability of production processes. The third is innovation synergy and open innovation [

33]. Digital transformation brings more opportunities for cooperation and collaboration in enterprise innovation. Through digital platforms and cloud computing technologies, enterprises can more easily collaborate with suppliers, partners, academia, and social organizations to jointly promote the development of green innovation. This open innovation model helps bring together the wisdom and resources of all parties to promote the rapid iteration and application of green technologies and solutions. Finally, there is the application of emerging technologies. Digital transformation has led to the development and application of many emerging technologies, such as artificial intelligence, blockchain, and big data analytics [

34]. These technologies have the potential for green innovation, for example, through artificial intelligence and big data analytics, the management and scheduling of energy systems can be optimized to improve the efficiency of energy use, and blockchain technology can achieve decentralization and traceability of energy transactions and promote the application and development of renewable energy [

35]. Based on these points, the following two hypotheses are proposed:

Hypothesis 1: LCCPP can promote enterprises’ green innovation.

Hypothesis 2: Increasing environmental costs, boosting R&D investment, and driving digital transformation are important mechanisms through which LCCPP promotes green innovation in enterprises.

Significant regional disparities exist in economic development and environmental pollution in China. The eastern coastal regions are relatively developed, whereas the central and western regions are relatively underdeveloped, with weak environmental protection awareness and capabilities. Industrialization has led to severe environmental pollution in some cities [

36]. Therefore, the promotion effect of LCCPP on enterprises’ green innovation may vary across regions owing to variations in environmental governance pressure, technological and industrial intensity, policy support, and market demand in the eastern, central, and western regions.

First, compared with the western region, eastern China is technologically and industrially more advanced, providing better conditions for enterprises to engage in green innovation [

37]. Moreover, enterprises in the eastern region are generally more innovative and technologically capable, enabling them to better respond to environmental requirements and develop green technologies and products. Second, when implementing LCCPP in the eastern region, the Chinese government often provides more policy support and incentive measures, such as fiscal subsidies, tax reductions, and research funding support, to encourage green innovation among enterprises [

38]. These policy supports can effectively promote the enthusiasm of enterprises for green innovation. Finally, the eastern region has a larger market scale, and the consumer demand for environmentally friendly products and services is relatively higher here. This demand motivates enterprises in the eastern region to engage in green innovation to meet market demand and gain a competitive advantage [

39].

LCCPP is developed and implemented at the urban level, but ultimately impacts enterprises. Given differences in factors such as financing constraints and types of production elements, enterprises’ responses and adaptability to LCCPP also vary, resulting in heterogeneity [

40].

The promotion effect of LCCPP on enterprises’ green innovation may vary in terms of funding support, investment attraction, policy benefits, and market competitive advantages due to different financing constraints. First, LCCPP usually provides financial subsidies, research funding support, and other means to provide enterprises with the necessary financial support for green innovation. For enterprises with low financing constraints, these support measures can alleviate the economic burden of green innovation and encourage further active innovation [

41]. Second, the implementation of LCCPP often attracts further green investment and social capital attention. For enterprises with low financing constraints, these investments and attention may provide additional financing opportunities and resources, ensuring they gain the necessary support for green innovation. Third, LCCPP often provides policy incentives such as tax reductions and preferential loan interest rates for green innovation projects. For enterprises with low financing constraints, these preferential policies can reduce the financing costs of their green innovation projects and increase their motivation for innovation [

42]. Finally, enterprises can provide additional environmentally friendly and sustainable products and services through green innovation, thereby gaining a competitive advantage in the market. Enterprises with low financing constraints have a greater opportunity to gain a competitive market advantage through green innovation because they can better allocate resources and funds for innovation [

43].

The promotion effect of LCCPP on enterprises’ green innovation may vary in terms of technological advantages, technological driving force, market demand, and policy support considering the different types of production elements. First, technology-intensive enterprises usually possess strong R&D and innovation capabilities, enabling them to respond quickly to the environmental requirements proposed by LCCPP [

44]. These enterprises may be highly capable of developing environmentally friendly technologies and products and adapting to policy requirements. Second, the advanced technologies and specialized knowledge of technology-intensive enterprises regarding green innovation allow them to better apply high-tech and clean production technologies to promote green innovation [

45]. LCCPP implementation provides further development opportunities for these enterprises, and gives them a competitive advantage in the field of green innovation. Third, technology-intensive enterprises are usually highly concerned about market demand and technological trends, allowing them to accurately grasp market opportunities for green products and services. LCCPP promotion may drive more market demand toward green and environmentally friendly products. Moreover, technology-intensive enterprises are likely to meet this market demand because of their technological advantages [

46]. Finally, LCCPP often supports technology-intensive enterprises via research funding, tax reductions, and other preferential policies. These support measures can encourage enterprises to engage actively in green innovation [

47]. Hence, Hypothesis 3 is proposed.

Hypothesis 3: The promoting effect of LCCPP on green innovation is greatly pronounced for enterprises in the eastern region, those with low financing constraints, and technology-intensive enterprises.

Based on the formation mechanism of LCCPP and related research, the role, mechanism and heterogeneity of LCCPP in promoting enterprises’ green innovation levels are determined (

Figure 1).