Analysis of EU’s Coupled Carbon and Electricity Market Development Based on Generative Pre-Trained Transformer Large Model and Implications in China

Abstract

1. Introduction

2. An Overview of Electricity and Carbon Markets in the European Union

2.1. Electricity Market in European Union

2.2. Carbon Market in European Union

3. Coupling Analysis of Carbon and Electricity Markets

3.1. Coupling Coordination Model

3.2. Coupling Analysis Algorithm Based on the GPT Large Model

3.2.1. Policy Classification

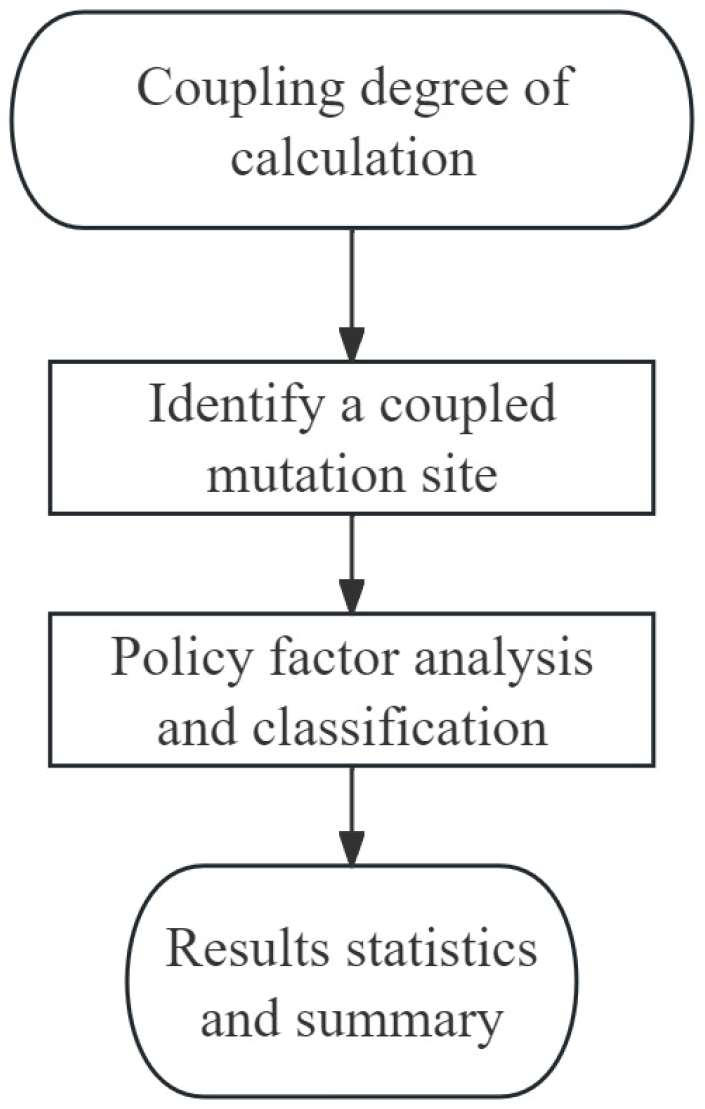

3.2.2. Coupling Analysis Algorithm Process

3.3. Data Preprocessing

3.3.1. Electricity Market Data

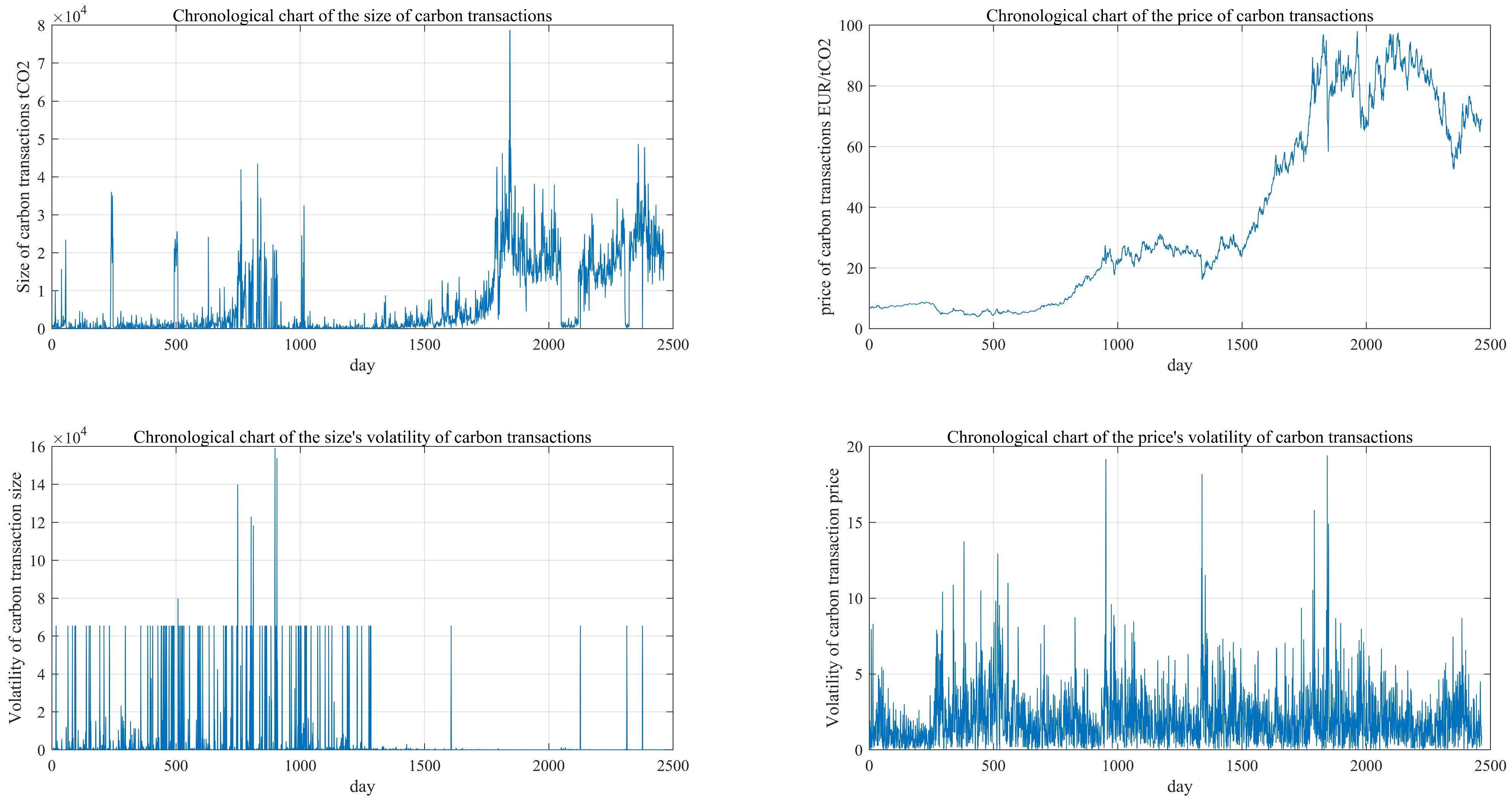

3.3.2. Carbon Market Data

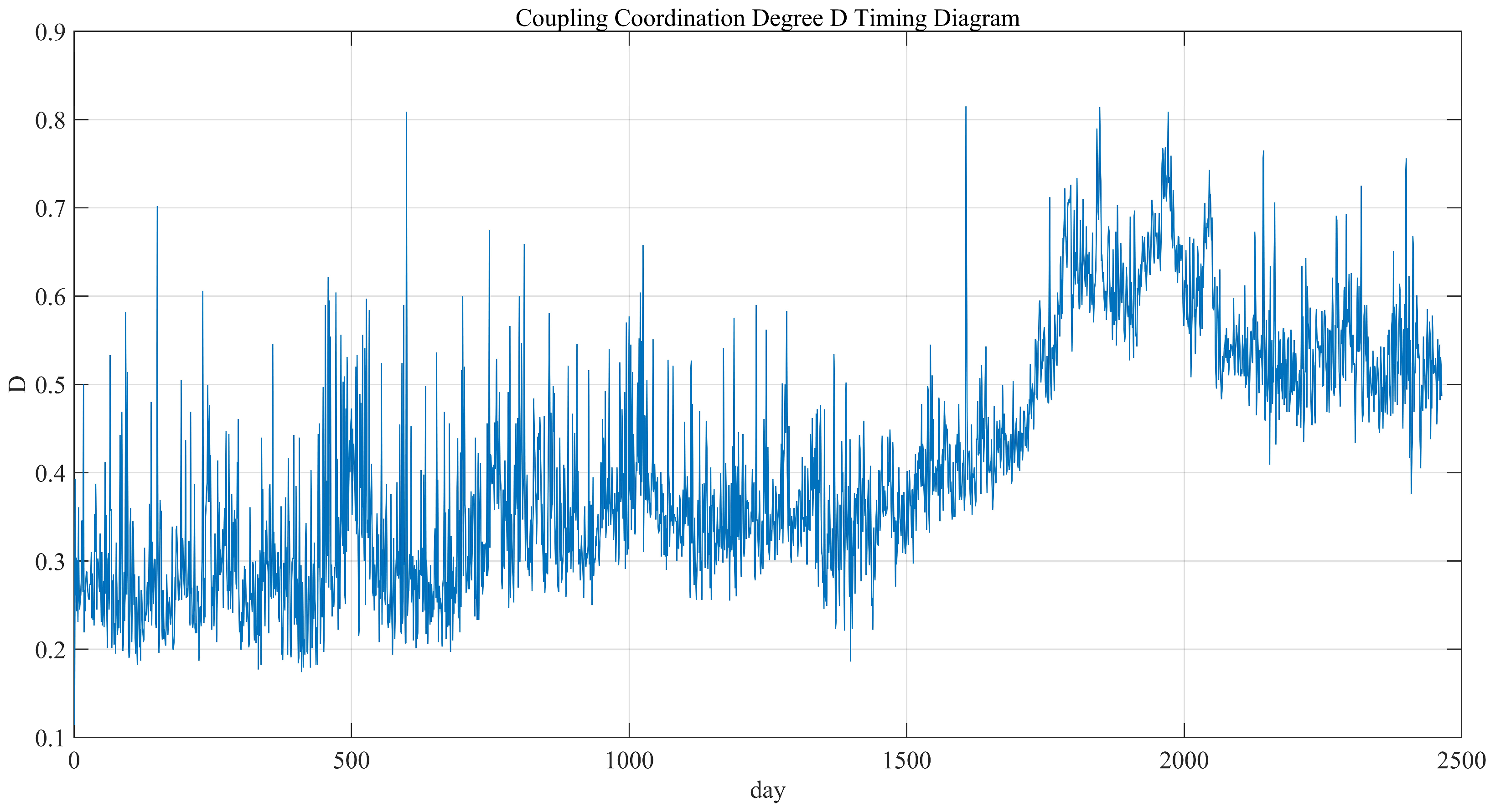

3.4. Results

4. Analogical Analysis of the Chinese Market

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Cui, J.; Song, F.; Jiang, Z. Efficiency vs. equity as China’s national carbon market meets provincial electricity markets. China Econ. Rev. 2023, 78, 101915. [Google Scholar] [CrossRef]

- Liu, X.; Jin, Z. An analysis of the interactions between electricity, fossil fuel, and carbon market prices in Guangdong, China. Energy Sustain. Dev. 2020, 55, 82–94. [Google Scholar] [CrossRef]

- Cheng, Y.; Chung, M.; Tsang, K. Electricity Market Reforms for Energy Transition: Lessons from China. Energies 2023, 16, 905. [Google Scholar] [CrossRef]

- Chi, Y.; Guan, Z.; Zhao, Y. The impact of allocation methods on carbon emission trading under electricity marketization reform in China: A system dynamics analysis. Energy 2022, 259, 125034. [Google Scholar] [CrossRef]

- Guo, H.; Cheng, A.; Zhang, X. Power market reform in China: Motivations, progress, and recommendations. Energy Policy 2020, 145, 111717. [Google Scholar] [CrossRef]

- Cao, J.; Zhang, L.; Xu, Y. When carbon emission trading meets a regulated industry: Evidence from the electricity sector of China. J. Public Econ. 2021, 200, 104470. [Google Scholar] [CrossRef]

- Li, J.; Wang, Y.; Xu, S. China’s flexibility challenge in achieving carbon neutrality by 2060. Renew. Sustain. Energy Rev. 2022, 158, 112112. [Google Scholar] [CrossRef]

- Lyu, J.; Sun, Y.; Liu, Y. Price volatility in the carbon market in China. J. Clean. Prod. 2020, 255, 120171. [Google Scholar] [CrossRef]

- Zachmann, G.; Grubb, M.; Newbery, D. Unity in Power, Power in Unity: Why the EU Needs More Integrated Electricity Markets; Bruegel Policy Brief No. 03/2024; Bruegel: Brussels, Belgium, 2024. [Google Scholar]

- Fleschutz, M.; Fröhlingsdorf, A.; Mattig, B. The effect of price-based demand response on carbon emissions in European electricity markets: The importance of adequate carbon prices. Appl. Energy 2021, 295, 117040. [Google Scholar] [CrossRef]

- Wang, Y.; Chen, M.; Wang, L. Carbon-oriented operational planning in coupled electricity and emission trading markets. IEEE Trans. Power Syst. 2020, 35, 3145–3157. [Google Scholar] [CrossRef]

- Lu, Y.; Liu, W.; Chai, L. Coupling mechanism and synergic development of carbon market and electricity market in the region of Beijing–Tianjin–Hebei. Energies 2023, 16, 1726. [Google Scholar] [CrossRef]

- Yuan, J.; Zhang, H.; Li, R. The impact of electricity-carbon market coupling on system marginal clearing price and power supply cost. Environ. Sci. Pollut. Res. 2023, 30, 84725–84741. [Google Scholar] [CrossRef] [PubMed]

- Potrč, S.; Savić, M.; Mihajlović, B. Sustainable renewable energy supply networks optimization: The gradual transition to a renewable energy system within the European Union by 2050. Renew. Sustain. Energy Rev. 2021, 146, 111186. [Google Scholar] [CrossRef]

- Jamasb, T.; Pollitt, M. Electricity market reform in the European Union: Review of progress toward liberalization and integration. Energy J. 2005, 26, 11–41. [Google Scholar] [CrossRef]

- Ciferri, D.; D’Errico, M.C.; Polinori, P. Integration and convergence in European electricity markets. Econ. Politica 2020, 37, 463–492. [Google Scholar] [CrossRef]

- Newbery, D.; Griffin, J.; Keats, P. Market design for a high-renewables European electricity system. Renew. Sustain. Energy Rev. 2018, 91, 695–707. [Google Scholar] [CrossRef]

- Li, Y.; Liu, X.; Zhang, B. How do the electricity market and carbon market interact and achieve integrated development? A bibliometric-based review. Energy 2023, 265, 126308. [Google Scholar]

- Boutabba, M.A.; Lardic, S. EU emissions trading scheme, competitiveness, and carbon leakage: New evidence from cement and steel industries. Ann. Oper. Res. 2017, 255, 47–61. [Google Scholar] [CrossRef]

- Richstein, J.C.; Chappin, É.J.L.; de Vries, L.J. The market (in-) stability reserve for EU carbon emission trading: Why it might fail and how to improve it. Util. Policy 2015, 35, 1–18. [Google Scholar] [CrossRef]

- Gong, X.; Wang, Y.; Zhang, T. Analyzing spillover effects between carbon and fossil energy markets from a time-varying perspective. Appl. Energy 2021, 285, 116384. [Google Scholar] [CrossRef]

- Bayer, P.; Aklin, M. The European Union emissions trading system reduced CO2 emissions despite low prices. Proc. Natl. Acad. Sci. USA 2020, 117, 8804–8812. [Google Scholar] [CrossRef] [PubMed]

- Braungardt, S.; Bei der Wieden, M.; Kranzl, L. EU emissions trading in the buildings sector: An ex-ante assessment. Clim. Policy 2024, 1–15. [Google Scholar] [CrossRef]

- Li, Z.P.; Liu, J.; Zhang, L. Scenario simulation of the EU carbon price and its enlightenment to China. Sci. Total Environ. 2020, 723, 137982. [Google Scholar] [CrossRef] [PubMed]

- Cong, X. Expression and Mathematical Property of Coupling Model, and Its Misuse in Geographical Science. Econ. Geogr. 2019, 39, 18–25. [Google Scholar]

- Moslehi, S.; Reddy, T.A. Sustainable development and engineering practices: Bridging the gap between strategic goals and local implementation. Sustain. Cities Soc. 2016, 26, 227–239. [Google Scholar]

- Wang, M.; Zhang, Q.; Wang, X. Impact of market regulation on economic and environmental performance: A game model of endogenous green technological innovation. J. Clean. Prod. 2020, 277, 123969. [Google Scholar] [CrossRef]

- Hartley, K.; van Santen, R.; Kirchherr, J. Policies for transitioning towards a circular economy: Expectations from the European Union (EU). Resour. Conserv. Recycl. 2020, 155, 104634. [Google Scholar] [CrossRef]

- Wigger, A. The new EU industrial policy: Authoritarian neoliberal structural adjustment and the case for alternatives. In Authoritarian Neoliberalism; Routledge: London, UK, 2020; pp. 121–137. [Google Scholar]

- Gao, X.; Zhang, W. The Role of Innovation Incentive Policies on the Innovation Performance of Knowledge Workers in SOEs. Sustainability 2023, 15, 2424. [Google Scholar] [CrossRef]

- Milner, H.V. Interests, Institutions, and Information: Domestic Politics and International Relations; Princeton University Press: Princeton, NJ, USA, 2020. [Google Scholar]

- Tang, H.; Zhang, J. An agile and lightweight social computing approach to emergency management. IEEE Trans. Syst. Man Cybern. Syst. 2016, 46, 1075–1087. [Google Scholar] [CrossRef]

| Coupling Coordination Degree D Value Range | Coordination Level | Degree of Coupling and Coordination |

|---|---|---|

| 1 | extreme imbalance | |

| 2 | severe imbalance | |

| 3 | moderate disorder | |

| 4 | mild disorder | |

| 5 | on the verge of collapse | |

| 6 | barely dysfunctional | |

| 7 | primary coordination | |

| 8 | intermediate coordination | |

| 9 | well coordinated | |

| 10 | high-quality coordination |

| Policy Factor | First-Level Classification | Second-Level Classification | Definition |

| strategic policy | market-regulating policy | Intervening directly in the market’s supply–demand relationship and price signals, adjusting the market’s operating mechanism, and ensuring the market’s stability and effectiveness. | |

| expectation management policy | Formulating long-term strategies and goals, clarifying policy directions, influencing market players’ expectations and investment decisions, and guiding the market towards transformation. | ||

| structural adjustment policy | Deep-level reform of market structures and mechanisms to promote the transformation and upgrading of the energy and economic structures and achieve profound changes in the market and industry. | ||

| innovation incentive policy | Policy incentives and financial support promote the development of clean technologies and the use of renewable energy, stimulate technological innovation and industrial upgrading, and promote a green transformation of the economy. | ||

| operational policy | international cooperation policy | Addressing the global challenge of climate change and promoting international action to reduce carbon emissions through international agreements and transnational cooperation. | |

| emergency adjustment policy | In case of emergency, temporary and targeted short-term measures should be taken to deal with sudden problems and ensure market stability and energy supply. |

| Serial Number | Date | D | Brief Content of the Policy | ||||

|---|---|---|---|---|---|---|---|

| 1 | 31 July 2015 | ↑ | ↓ | ↑ | ↑ | 0.7 | The Market Stabilization Reserve (MSR) was adopted to remove some carbon allowances and regulate the balance between market supply and demand. |

| 2 | 24 November 2015 | ↓ | ↓ | ↑ | ↓ | 0.65 | Prepared for the Paris Agreement, proposed reforms to strengthen the carbon market, and anticipated and managed market changes. |

| 3 | 11 October 2016 | ↓ | ↓ | ↑ | ↑ | 0.64 | The proposed reform of the EU ETS aims to address the problems of market oversupply and low carbon prices. |

| 4 | 1 May 2017 | ↑ | ↑ | ↑ | ↑ | 0.82 | Published the report “Carbon Pricing Status and Trends 2017” to analyze the implementation of carbon pricing mechanisms around the world. |

| 5 | 19 September 2017 | ↑ | ↓ | ↑ | ↓ | 0.67 | Published the 2017 Global Carbon Pricing Overview report, which pointed out newly implemented carbon pricing mechanisms. |

| 6 | 24 November 2017 | ↑ | ↓ | ↑ | ↓ | 0.68 | An agreement was reached on reforming the EU ETS, with important adjustments to the market mechanism. |

| 7 | 13 February 2018 | ↑ | ↑ | ↑ | ↓ | 0.64 | Approved the EU ETS reform plan to enhance market flexibility and adaptability. |

| 8 | 18 December 2018 | ↓ | ↓ | ↓ | ↓ | 0.65 | A long-term strategy for EU climate and energy policy was published, emphasizing the synergies of the carbon market and the need for international cooperation. |

| 9 | 27 December 2018 | ↑ | ↓ | ↑ | ↓ | 0.69 | Released a draft climate law that sets a target of reducing emissions by at least 55% by 2030 and improved the coverage of the emissions trading system. |

| 10 | 14 October 2019 | ↑ | ↑ | ↑ | ↑ | 0.67 | Initial discussions on the European Green Deal to promote the transition to a green economy and climate goals. |

| 11 | 5 April 2021 | ↑ | ↑ | ↑ | ↑ | 0.82 | Proposed follow-up reforms to the EU ETS to expand the scope of emissions trading. |

| 12 | 6 April 2021 | ↑ | ↑ | ↓ | ↓ | 0.76 | The EU Climate Law was approved, establishing a legal framework for achieving climate neutrality by 2050. |

| 13 | 1 November 2021 | ↑ | ↑ | ↑ | ↑ | 0.66 | Signing of the Global Carbon Market Cooperation Statement to discuss the need for carbon market cooperation. |

| 14 | 2 November 2021 | ↑ | ↓ | ↓ | ↑ | 0.73 | Initiated capacity-building projects in the carbon market, provided technical assistance and financial support, and helped developing countries participate in the international carbon market. |

| 15 | 1 April 2022 | ↓ | ↑ | ↓ | ↑ | 0.66 | Proposals for reform of the carbon market were released, emphasizing market stability and transparency. |

| 16 | 1 May 2022 | ↑ | ↑ | ↑ | ↑ | 0.65 | Published annual environmental reports to assess the operation and future prospects of the carbon market. |

| 17 | 5 May 2022 | ↓ | ↓ | ↓ | ↑ | 0.60 | The REPowerEU initiative was launched to reduce dependence on Russian energy and develop renewable energy sources. |

| 18 | 20 September 2022 | ↓ | ↑ | ↑ | ↓ | 0.60 | Proposed urgent energy measures to deal with the energy crisis. |

| 19 | 1 Dember 2022 | ↑ | ↓ | ↓ | ↑ | 0.62 | The latest EU ETS report was released, highlighting future carbon emission targets and their market impact. |

| 20 | 3 January 2023 | ↑ | ↓ | ↓ | ↓ | 0.61 | Published a climate policy work plan for 2023 and committed to future emission reduction measures. |

| 21 | 13 March 2023 | ↑ | ↓ | ↓ | ↓ | 0.63 | Discussed the link between green bonds and the carbon market to encourage the development of low-carbon technologies. |

| 22 | 1 May 2023 | ↑ | ↑ | ↑ | ↑ | 0.78 | A report on the future development strategy of the carbon market was released, emphasizing the goal of achieving emission neutrality before 2030. |

| 23 | 18 May 2023 | ↑ | ↓ | ↑ | ↑ | 0.65 | Discussed enhancing the interoperability of cross-border carbon transactions and promoting market integration. |

| 24 | 7 August 2023 | ↑ | ↓ | ↑ | ↑ | 0.62 | Published a carbon market integration report and made recommendations for optimizing the carbon pricing mechanism. |

| 25 | 23 October 2023 | ↓ | ↓ | ↓ | ↑ | 0.63 | Encouraged the development of low-carbon technologies through programs that support renewable energy technologies. |

| 26 | 7 November 2023 | ↑ | ↓ | ↓ | ↓ | 0.62 | A draft policy for the standardization of cross-border carbon trading was launched to promote market integration. |

| 27 | 28 November 2023 | ↑ | ↑ | ↑ | ↓ | 0.61 | Extended emergency energy measures to deal with the impact of the Russia–Ukraine conflict. |

| 28 | 4 Dember 2023 | ↑ | ↑ | ↓ | ↓ | 0.60 | Discussed a carbon-neutral policy framework and increased investment in green infrastructure. |

| 29 | 27 Dember 2023 | ↑ | ↓ | ↓ | ↑ | 0.65 | Published annual environmental and climate change reports, assessing the performance of the carbon market and recommendations for reform. |

| 30 | 2 January 2024 | ↑ | ↓ | ↓ | ↑ | 0.61 | Released the 2024 Climate Policy Framework, which sets out the priorities for carbon market reform. |

| 31 | 28 March 2024 | ↓ | ↓ | ↑ | ↓ | 0.65 | Discussed future emission reduction targets and made recommendations to enhance the integration of international carbon markets. |

| 32 | 1 May 2024 | ↓ | ↑ | ↓ | ↑ | 0.78 | A report on the future development strategy of the carbon market was released, emphasizing the goal of achieving emission neutrality before 2030. |

| 33 | 9 May 2024 | ↑ | ↑ | ↑ | ↓ | 0.62 | Discussed a green bond policy framework to support renewable energy projects. |

| 34 | 29 May 2024 | ↓ | ↑ | ↓ | ↑ | 0.64 | Published annual environmental and climate change reports and assessed the operation of the carbon market and reform proposals. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, Y.; Ni, S.; Tang, X.; Xie, S.; Wang, P. Analysis of EU’s Coupled Carbon and Electricity Market Development Based on Generative Pre-Trained Transformer Large Model and Implications in China. Sustainability 2024, 16, 10747. https://doi.org/10.3390/su162310747

Li Y, Ni S, Tang X, Xie S, Wang P. Analysis of EU’s Coupled Carbon and Electricity Market Development Based on Generative Pre-Trained Transformer Large Model and Implications in China. Sustainability. 2024; 16(23):10747. https://doi.org/10.3390/su162310747

Chicago/Turabian StyleLi, Yao, Siyuan Ni, Xi Tang, Sizhe Xie, and Peng Wang. 2024. "Analysis of EU’s Coupled Carbon and Electricity Market Development Based on Generative Pre-Trained Transformer Large Model and Implications in China" Sustainability 16, no. 23: 10747. https://doi.org/10.3390/su162310747

APA StyleLi, Y., Ni, S., Tang, X., Xie, S., & Wang, P. (2024). Analysis of EU’s Coupled Carbon and Electricity Market Development Based on Generative Pre-Trained Transformer Large Model and Implications in China. Sustainability, 16(23), 10747. https://doi.org/10.3390/su162310747