1. Introduction

Integrated energy systems (IESs), which couple multiple energy sources, have become critical in promoting clean energy consumption, decarbonization, and emission reduction. These systems exemplify the shift from centralized to distributed energy systems, integrating various energy participants, adopting intermittent renewable energy sources, and dynamically balancing energy supply and demand.

IESs typically exhibit high complexity in the system structure, dynamic characteristics, operation modes, and diversity in equipment categories and disciplines. Therefore, integrated energy management systems (IEMSs) play a critical role in IESs, because IESs integrate various energy system components through information sharing and coordinated operation enabled by IEMSs [

1].

However, the more ‘integrated’ an IES is, the more integration an IEMS must demonstrate. Standalone monitoring systems are often provided in combination with the physical energy equipment by each individual energy equipment manufacturer. In IEMSs, difficulties arise in data exchange and the integration of these heterogeneous monitoring subsystems and smart subsystems that are developed by other vendors to fulfill the analysis, forecast, coordination, and decision-making functions [

2,

3].

From the data science perspective, the difficulty in data exchange results from heterogeneous data models across different systems. Previous studies have tried to standardize data models involved in IEMSs to solve the challenges in data exchange within IEMSs. Nevertheless, due to the broad domain coverage of IEMSs and the incumbency of existing data models, a widely accepted IEMS data model standard in academia or industry is absent. In 2023, the authors of [

4] proposed a community-driven trinity method consisting of a data model framework, a connector platform, and operation strategy to connect data islands in IEMSs, pivoting away from trying to create data model standards. The proposed method offers a promising direction for reaching consensus on data models and data exchange between vendors and subsystems by collaborative and software-aided means. Nevertheless, the method targets the exchange of time series data within IEMSs.

As more and more IESs are involved in increasingly diverse power trading activities, the data and algorithms in IEMSs are beginning to serve the decision making of power trading. During the process of data exchange among multiple subsystems in IEMSs, different subsystem developers have different understandings of the power trading rules, including power products, entities, and price forms that the IES is subject to, leading to inconsistency in the operation as well as semantics and context of the exchanged data. Previous research on power trading data models has focused on applications in the data management of systems of the market operators and between systems of different market operators. Few studies have been conducted on data models related to power trading rules from the perspective of power trading decision making and optimized operation processes within the IEMS of a market participant. Meanwhile, it is analyzed in this paper that the exchange of power trading rule data directly via the existing community-driven data exchange method for time series data has drawbacks, such as losing rule structures, frequent requests on infrequently updated data, and lack of global consistency.

This study aims to develop a data modeling and synchronization method to facilitate the synchronization of power trading rules across the heterogeneous subsystems of IEMSs, with the background that unified data model standards in the field are still absent. The method is designed by analyzing the features of synchronization of power trading rule data, figuring out the drawbacks using general data exchange methods for IEMSs, and draws on methods in other areas to solve the drawbacks. The method is validated by realizing the software platform and applying the method including the software in a case study. The proposed method consists of two parts: a framework of power trading rules from the perspective of market participants and a software platform called the power trading rule synchronizer. The proposed method minimizes the applicable rules’ semantic ambiguity, and automatically translates human semantics to machine-readable rule files. Since subsystems can load all power trading rules directly from the machine-readable rule files, the subsystems themselves can then be kept agnostic to the change of power trading rules, hitherto fostering efficient synchronization and the execution of the same set of power trading rules across multiple subsystems within an IEMS.

The main contributions of this study include:

- (1)

Proposing a framework for modeling power trading rules that allows the unambiguous description of rules applicable to the IEMS, so that the different vendors of the subsystems of IEMSs can avoid misalignment resulting from each reading through and sorting out the initially freely written and lengthy rules.

- (2)

Designing and setting up a power trading rule synchronizer based on the framework, which translates the human-aligned power trading rules to machine-readable configuration files to allow subsystems to be adaptive and synchronized to the changing rules. The synchronizer was realized, and a case study demonstrated the application of the framework and the synchronizer, wherein an IES engaged in three to five power trading products successfully synchronized and updated the applicable rules across subsystems.

Based on these contributions, other researchers can further extend the proposed method to other rule-related data exchanges in IEMSs in fields such as carbon trading and gas trading.

The rest of the paper is organized as follows:

Section 2 reviews previous research on data models related to power trading rules and discusses the features of power trading rules that differentiate the synchronization of power trading rules from time series data exchange within the IEMS.

Section 3 introduces the data modeling and synchronization method for power trading rules.

Section 4 presents a case study verifying the effectiveness of the proposed method.

Section 5 discusses the quantitative benefits of using the proposed method. Finally,

Section 6 concludes the paper.

2. Literature Review

Data from different sources can exhibit four types of heterogeneity: structural, syntax, implementation, and semantic heterogeneity [

5]. Only when these heterogeneities are resolved can data integration and exchange between subsystems be carried out smoothly. A data model defines the structure, syntax, semantics, and even implementation of the data and is the cornerstone of data integration and exchange [

6]. Since power trading rules are also a kind of data, the synchronization and aligned understanding of power trading rules among different subsystems can be reached if data models about power trading rules are standardized. However, searching in literature with the keywords ‘power market model’ or ‘power trading model’ leads to many mechanism or algorithm models of the power market rather than data models of power trading rules. For example, [

7] reviews power market models and trends and divides power market models into three categories: optimization, balance, and simulation. In comparison, data asset management is still in the early stages in the field of the power market, as Luo et al. mentioned in 2023 [

8].

The search across three platforms—ScienceDirect, MDPI, and IEEE—with keyword combinations of ‘data model’ or ‘metadata’ with ‘power trading’ or ‘power market’ led to only a limited number of papers on power trading data models. Based on the data operators, these papers can be categorized into three groups, as shown in

Figure 1: those for market operators’ systems, generation groups or utilities’ systems, and consumers’ or prosumers’ systems.

2.1. For Market Operators’ Systems

Research efforts on power trading data models started by serving the internal systems of power trading centers to enable the management of large amounts of data.

In 2011, Liu et al. [

9] designed a market data model for the bidding and clearing of power transactions in trading center platforms in China. In 2013, Long et al. [

10] designed a few standardized libraries, including a parameter library and rule library, for the trading center platforms to flexibly cater to the diversity, complexity, and volatility of long-term settlements executed in China. In 2014, Guo et al. [

11] proposed data models of power trading contracts to develop a power contract management system for the market operator in China. Meanwhile, the international IEC has been continuously developing the standard framework for energy market communications called IEC 62325, which facilitates data integration between market operators and between market operators and traders. Although inherited from the IEC 62325, existing data models of market entities were found unable to meet the emerging needs of a single social entity to register as multiple types of market entity in China [

12].To solve the problem, Dong et al. [

12] designed unified data models in 2020 to describe market participants in trading center platforms.

As power becomes tradable across different trading centers, data models on power trading to enable data exchange between the systems of different trading centers were also studied. In 2019, Shao et al. [

13] proposed a unified model for China’s two-tier power market to manage the market data of 27 provinces in China. In 2023, Xu et al. [

14] proposed a data model for multiple trading centers to exchange data to complete cross-provincial and cross-regional transaction settlements. In 2020, Santos et al. [

15] proposed an approach for developing software tools to solve auction-based local electricity market transactions. Although the proposed method focuses on the market operator side rather than the internal data exchange on the market participant side, it tackled the challenge of constant updates to the data models and business rules by designing a structure of the engine and loading configuration files. The configurations contain human and machine-readable data models.

The purpose of these data models is to facilitate data exchange and management within a market operator’s system or between systems of different market operators rather than from the perspective of power trading decision-making process within a market participant. In fact, the data models employed by market operation systems are seldom visible to market participants.

2.2. For Generation Companies and Utilities’ Systems

Immensely little research focuses on the power trading data models designed for utilities. This phenomenon might be because utilities operate large energy generators traditionally and typically employ customized and proprietary energy data management systems (EDMSs) to manage data exchange processes according to market rules. Once the market rules change, utilities just have vendors to tailor the EDMSs [

16,

17]. Ulbricht et al. [

16] mentioned that trends such as renewable energy forecasting, mobile consumption, and smart grids have led to technical challenges in data integration and analytics. However, little research was found in the literature on designing the data exchange methods for utility systems.

2.3. For Consumers and Prosumers’ Systems, Including IEMSs

With the development of distributed energy and electrification, the energy supply, storage, and consumption equipment used close to consumers have become increasingly diverse. Different equipment manufacturers often offer standard systems for monitoring and control with each energy equipment, such as photovoltaic panels and electric charging pillars. The customized integration of the subsystems and incorporation of algorithms into a holistic IEMS can be costly from the consumers’ perspective. Thus, the difficulties in data exchange and lack of data model standards in the realm of IEMSs come to light.

The data models involved in IEMSs can primarily come from two domains: power and energy system simulation and intelligent system operation. Both domains have existing attempts at data model standards, some of which involve electricity trading rules to varying degrees. In the power and energy system simulation domain, electricity market ontology (EMO) [

18] was developed in 2016 to provide MASCEM semantic interoperability with external agent-based systems and has been extended to more power markets. The Open Energy Ontology (OEO) [

19] was proposed in 2021 to try to unify the ontologies of multiple domains for the purpose of energy system analysis. In the intelligent system operation domain, Šterk et al. [

20] produced a data model report for the European project eBadge in 2014. New data models covering the process of distributed energy resources at home to participate in power balancing were proposed after the evaluation of the suitability of standards, such as IEC standards and openADR [

21]. In 2019, Schott et al. [

22] proposed a common data model for user-side power flexibility developed in collaboration with several German companies. The European Telecommunications Standards Institute (ETSI) released the Smart Appliances REFerence (SAREF) [

23] ontology in 2020 that covers the energy domain while aligning with the oneM2M standard [

24]. However, these standards focus on a specific application scenario or a high-level abstraction of a subdomain. Moreover, as Santos et al. summarized in 2023 [

25], there is considerable heterogeneity among the data model standards in the power and energy domain, hardening their integration and adoption.

To sum up, previous research in the field mainly focused on defining data models for some trading products and processes for trading systems of the market operator. The purpose of these data models was to facilitate the exchange and integration of data between multiple submodules operated by the power trading centers rather than from the perspective of making power trading decisions of a market participant. Data model standards proposed for energy system simulation or smart system operation can be options for the systems on the market participant’s side. Nevertheless, the heterogeneity and limitation of existing data model standards hinder their integration and adoption. Figuring out a standard, neutral method to facilitate different subsystems of an IEMS to align on the power trading rule data rather than reinventing or extending another wheel may well be a practical direction to solve the rule data interoperability problem in IEMSs. It is also inspired by the literature [

4] that when data models and business rules constantly change, fixed predefined data models are not optimal to support data exchanges. The separation of data models into configuration files of system engines is promising to allow software systems to be adaptive to the changing data model and business rules.

3. Data Modeling and Synchronization Method of Power Trading Rules in IEMSs

3.1. Features of Synchronization of Power Trading Rule Data

3.1.1. General Data Exchange Methods for IEMSs

As the operation support of IESs, IEMSs typically need to integrate data collection subsystems of different energy equipment and various forecasting and optimization scheduling algorithm models for the entire or part of IESs by enabling the data exchange between the different subsystems. However, the subsystems of IEMSs are often developed by different vendors, which inevitably results in heterogeneity in the data models of the subsystems of IEMSs.

Previous studies have tried to standardize data models involved in IEMSs through CIM or ontology to cope with the challenges in data exchange within IEMSs [

26]. Nevertheless, due to the broad domain coverage of IEMSs, low concentration of application suppliers, and the incumbency of domains, it is mentioned in both academia and industry that a widely accepted IEMS data model standard is absent [

16]. Inspired by methods to solve similar problems in areas such as biology and microscopic, Zhou et al. [

4] switched from attempting to create data model standards but proposed a collaborative and software-aided approach to solve the dilemma. The approach consisted of a data model framework, an IEMS data connector platform, and an operation strategy. The approach could foster the alignment in data models and execution of data exchange needs between humans and subsystems in an IEMS project.

3.1.2. Difference in Synchronization of Power Trading Rule Data from General Data Exchange

In principle, power trading rules are also a kind of data that are needed and processed in various subsystems of IEMSs, so that the IEMS can support the power trading business. In this sense, the exchange of data related to power trading rules between the subsystems of IEMSs can theoretically also be realized using the same methods, just as other data, including measurement and monitoring data, do. However, in practical application, power trading rule data have the following features that necessitate a dedicated design.

- (1)

Objective but interpretation-deviated: Power trading rules exist objectively but are written in the free-text format in documents. In turning free-text data into the fixed processing logic of software, different people’s interpretations of applicable and often complex power trading rules will lead to deviations in software processing logic. IEMSs may involve multiple subsystems developed by various vendors. Consistencies in the interpretation and implementation of power trading rules across all involved subsystems of IEMSs are desirable. In comparison, the exchange of time series data in IEMSs, such as the real-time power of a wind turbine, serves the purpose of bilateral data exchange between data production and consumption subsystems.

- (2)

Variables in time, location, and power products: Power trading rules can differ in provinces, markets, power products, and participants. Power trading rules can also change from time to time. Once there is a change in the power products that the IEMS is trading, or in the participant roles that the IEMS is playing, or once the rules are updated, the related processing logic of all the subsystems that provide the data to support the decision making of power trading will have to be uniformly changed. Such a change can bring considerable costs if the power trading rules are hard-coded in all the subsystems.

Moreover, the use case of exchanging power trading rules in IEMSs is also different from that of exchanging time series data. Time series data are exchanged between each pair of data production and consumption subsystems of IEMSs. For example, the real-time power of a wind turbine in SCADA is exchanged to power the product forecast subsystem. In comparison, the exchange of power trading rule data is essentially a kind of data synchronization across multiple subsystems rather than simply a bilateral exchange. The difference between data exchange between the subsystems of IEMSs and the synchronization of power trading rule data among the subsystems of IEMSs is illustrated in

Figure 2.

Taking the data feature of the power trading rules and the use case into consideration, the direct application of data exchange methods for the time series data of IEMSs to power trading rule data has the following drawbacks:

- (1)

Losing structure: the structure of power trade rule data, such as the interlink between power products, market participant roles, and price formats, cannot be fully reflected using the time series data format.

- (2)

Frequent requests on infrequently updated data: it can be costly and wasteful for subsystems to query power trade rule data frequently, but the data remain infrequently updated, such as once a year.

- (3)

Lack of global consistency: The bilateral exchange of applicable power trading rule data may lead to conflicts within an IEMS. Instead, the power trading rules in which an IEMS is involved should be unique across all related subsystems in an IEMS.

Therefore, new methods are to be designed according to the features and use case of the power trading rule data to tackle these drawbacks to ensure consistencies in the applicable power trading rules across all involved subsystems of IEMSs. Considering that data model standards on power trading rules have not been unified and widely accepted from the perspective of market participants according to the literature review in

Section 2, as well as the complexity of power trading rules themselves, this study draws on Zhou et al.’s [

4] ideas to enable consistent rule data synchronization in an IEMS in a collaborative and software-aided way through a combination of data modeling frameworks and a software platform.

3.2. Data Model Framework for Power Trading Rules

The data model standards of the power trading centers cannot be fully used and directly applied as standards for IEMS subsystems that serve internal trading decisions. As summarized in the literature review in

Section 2, there has been research on the data models of the power trading rules from the perspective of the market operators, which focused on the internal logic of the market operation systems, such as the participant registration process [

12], contract structure [

11], clearing process, and settlement process. The data models of the market operation systems do not care about the internal structure of the IES. In contrast, for IESs as a market participant, the subsystems of the IEMSs should coordinate to support the trading decision-making process, which does not care about the registration, contract, clearing, and settlement process but should instead focus on the data about ‘which part of the IES acts as which role and bids which quotation for which products’. Based on extensive industrial field research and the analysis of the features and use case of the power trading rule data in

Section 3.1, a data model framework to describe power trading rules on the market participants’ side is proposed. As shown in

Figure 3, the framework comprises three hierarchical parts: power trading product, market participant, and price format.

An IEMS often engages in trading multiple power products with different rules simultaneously, such as power spot products and demand response. In the framework, each power product can be associated with various market participants, while each market participant can be associated with multiple price formats. Moreover, each power product or price format is linked to a data model so that the attributes of the power product or price format can be defined. These data models can vary in IEMSs and time, but the subsystems of the same IEMS can see the same details of the data models.

The market participant part identifies with which type of participant the IEMS is trading the products. An IEMS may participate in trading different trading products in the role of different participants. For example, in an industry park, factories can participate in medium-term and long-term power products and ancillary service, while staff dormitories as residential users cannot. Energy storage devices can participate in demand response either independently or as an integrated part of the factory. The market participant can be associated with a unique topological node in the IES, such as an entity in the data twin of the IEMS data connector or a metering point in an Internet-of-Things (IoT) platform to ensure for all subsystem vendors the clear and consistent identification of the object scope to participate.

The price format part specifies the quotation requirements for a given market participant in each trading product. Different products may require different price formats, influencing the optimal generation operation and consumption mode. For example, power generation participants need to declare startup costs, minimum stable output, operating costs, and multisegment quotation curves in spot market products. In contrast, users and electricity resellers must declare unit electricity prices for various demand intervals when trading power spot products.

The proposed framework can help users align unambiguously on the targeted power trading rules. For instance, the often-heard term ‘trading once every 15 min’ can be interpreted in the following four totally different versions:

- (1)

The minimum product time resolution is 15 min.

- (2)

The minimum quotation time resolution is 15 min.

- (3)

Transactions can be executed up to 15 min before delivery.

- (4)

Transactions occur every 15 min.

These four interpretations can be delineated clearly with the proposed framework:

- (1)

A power product is defined with a data model whose attribute name ‘product time resolution_min’ has a value of 15.

- (2)

A price format is defined with a data model whose attribute name ‘time resolution_min’ has a value of 15.

- (3)

A price format is defined with a data model whose attribute name ‘gate closure_min’ has a value of 15.

- (4)

A power product is defined with a data model whose attribute name ‘transaction cycle_min’ has a value of 15.

The proposed framework enables, at the human-to-human level, an unambiguous definition of the power trading rules that an IEMS is subject to, helping IEMS application vendors understand the system’s trading requirements. The framework can work independently or cope with other data frameworks in use, such as those in the IEMS data connector. However, it will be hard for any framework to be executed if the applicable rules defined according to the framework are aligned only between humans, but the subsystems are unaffected. In fact, the definitions according to the framework and the values of the data models in the framework, must be saved and synchronized at the machine-to-machine level, ensuring automated and coordinated application of the rules across subsystems in IEMSs.

3.3. Power Trading Rule Synchronizer

The power trading rule synchronizer is constructed to synchronize the power trading rule data among various subsystems in IEMSs, considering the data’s structure, low update frequency, and global consistency features. The rule synchronizer consists of two parts, as shown in

Figure 4: the power trading rule configuration interface and the power trading rule converter. The rule synchronizer can work alone or cope with other IoT software or data exchange platforms, such as the IEMS data connector, if any, in the IEMS, to better manage the data models or define the object scope. The rule synchronizer was implemented in Golang.

The power trading rule configuration interface offers an intuitive graphical interface. It allows business specialists of IES owners and subsystem vendors, even without any programming background, to create, read, update, and delete (CRUD) the applicable power trading rules intuitively. The configuration interface follows the data model framework for power trading rules in

Section 3.2. Users can intuitively configure the power trading products, the associated market participant roles, and the price format.

The power trading rule converter automatically translates the user configuration in the configuration interface to rule configuration files in three formats: XML, JSON, and YAML. These formats are human- and machine-friendly, open, widely used, and independent of any programming language. The human readability of the rule files allows users to read through the applicable rules offline. The machine readability ensures that the rule configuration files can be parsed directly by subsystems using various programming languages and technology stacks, isolating the rules from the code. The subsystems can automatically or semiautomatically update internal power trading related logic by reading the fields, attributes, and values in the rule configuration file. This approach is similar to the one offered by Google Cloud, in which JSON and YAML configuration files are used to automatically deploy and update the internal logic of multiple apps [

27]. The power trading rule converter serves as a source server after converting the user configuration to the rule configuration files. It provides one-way synchronization to subsystems through FTP, SFTP protocols, or the rsync command. Each subsystem has the flexibility to choose either way, by their own synchronization implementation components, to obtain file updates according to each vendor’s preference and technology stack: passively wait for the power trading rule converter to synchronize updates to the subsystem by the PORT mode of FTP; actively request files periodically from the power trading rule converter by the PASV mode of FTP; enhance security by SFTP; leverage rsync with the inotify function to monitor and actively synchronize any changes from the power trading rule converter. Since each IEMS has only one rule configuration file in each format, and every version change in the configuration interface will be automatically updated in configuration files in real time, the power trading rule converter always provides the latest single source of truth about applicable power trading rules to the subsystems. The subsystems can then be programmed to load the attributes and values automatically from the configuration file. If the values of the attributes in the rule configuration files are updated, the subsystems can automatically load the new values in their internal processing logic after obtaining and parsing the latest rule configuration files. If the attributes are not findable or redundant with those already in one subsystem, the developer of the subsystem can simply map the attribute names in the rule configuration files with existing fields in the internal processing logic, if needed, with the aid of the visualized collaborative configuration on the power trading rule configuration interface to align the context of the attributes.

Figure 5 illustrates the steps of synchronizing the power trading rules to the subsystems by the traditional manual method and the proposed method. Traditionally, applying the power trading rules in the subsystems involves the business specialist of each subsystem vendor understanding the rules in the free-text format, writing specifications to software developers, and code developers modifying the subsystem codes. Each step can suffer from comprehending deviation from the previous step and between different vendors. In contrast, the power trading rule configuration interface provides an intuitive graphical user interface to foster the alignment of the applicable power trading rules according to the data model framework for power trading rules at the human-to-human level. The power trading rule converter realizes that applicable power trading rules are synchronized and implemented among different subsystems at the machine-to-machine level. Any updates on the applicable power trading rules can be configured by users through the power trading rule configuration interface, translated into new rule configuration files, made available to subsystems by the power trading rule converter, and then loaded by subsystems. The configuration files are both human- and machine-readable. Subsystems can then be programmed to be agnostic to power trading rules, loading any power trading rule-related values from the rule configuration files. Combining the power trading rule configuration interface and the power trading rule converter, the power trading rule synchronizer fosters the alignment of the applicable power trading. It allows flexible changes to be synchronized among subsystems without altering the underlying codes.

4. Case Study

4.1. Project Introduction

This paper leverages a case study of the IES of an industrial park located in Jiangsu Province, China.

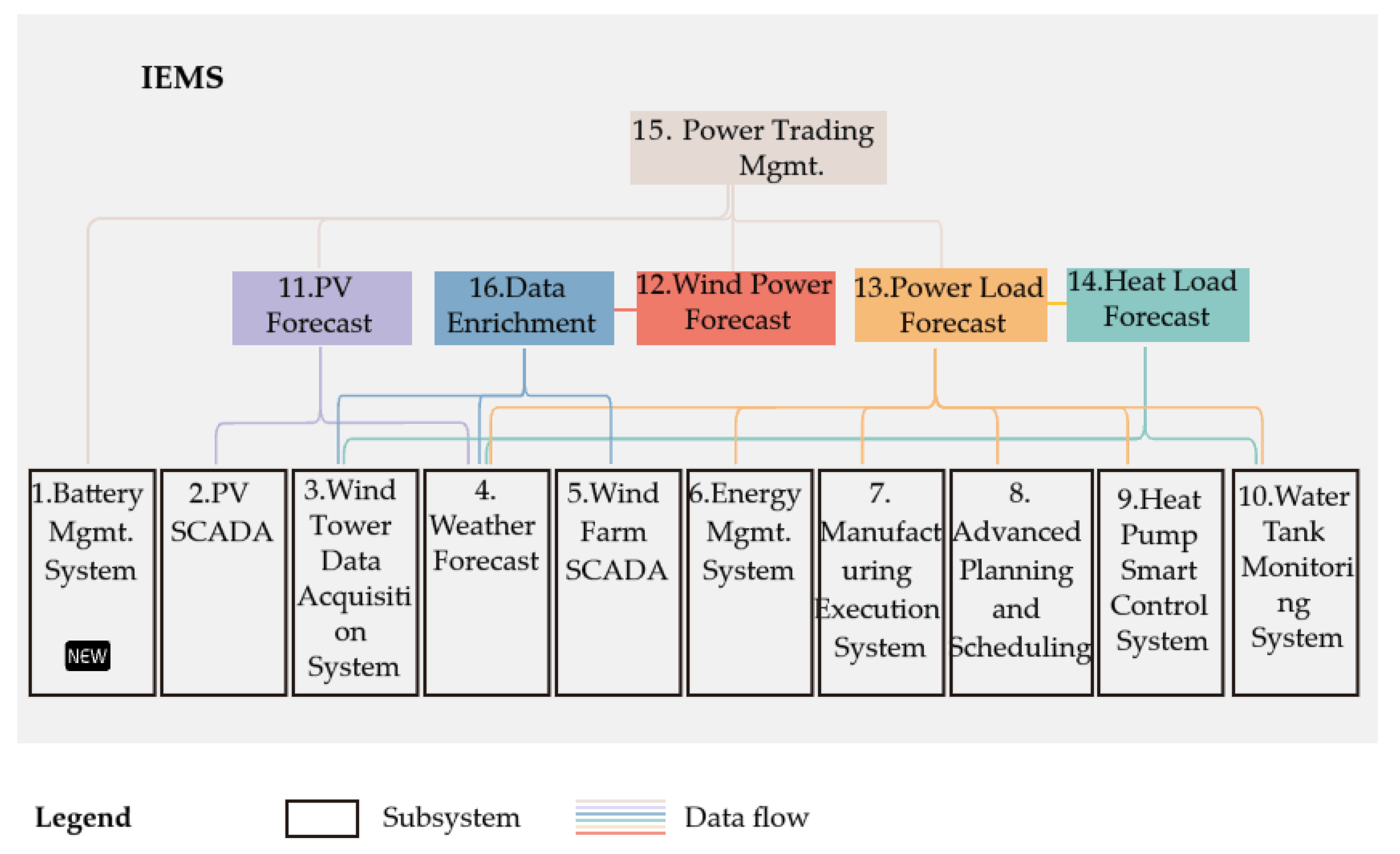

Figure 6 shows the subsystems of the IEMS of the industrial park, as well as the data flow between the subsystems. The ‘power trading management’ subsystem manages trading decisions, contract management, billing, and settlements for various power trading products. The trading decision-making function of the subsystem relies on forecast data from four subsystems: wind power generation forecast, photovoltaic power generation forecast, power load forecast, and battery management system. The three forecast subsystems depend further on data from nine other subsystems. Therefore, consistent power trading rules among all 16 subsystems are essential to coordinate the whole data exchange and processing chain.

The IES participated in multiple power trading products, with the applicable rules changing along with the changes in the tariff structure, the composition of the energy system, and the market rules. From the year 2020 to 2023, the industrial park was engaged in three different power trading products, which are long-term power trading and two kinds of demand response products. Since 2023, the applicable power trading rules were changed in three ways: The power spot market was opened, and a new trading product called ‘power spot’ was added to the list of IES trading products. The staff dormitory, as part of the IES, was switched to the household power tariff, thus being excluded from participation in power markets. A battery power storage was newly installed in the IES. It served as part of the IES when the IES was trading in the power spot and long-term markets, and it participated independently in the demand response market for higher prices as an interruptible load.

All the applicable power trading rules were modeled and synchronized among the subsystems of the IEMS with the aid of the proposed method in this paper. The data model framework structured and aligned the interpretation of the applicable trading rules, while the power trading rule synchronizer configured, stored, updated, and synchronized the rules across the subsystems.

4.2. Initial Synchronization of Power Trading Rules

The IES started participating in power trading in the year 2020, when it traded two types of electricity products: long-term electricity trading and demand response. The demand response was further divided into two subcategories based on the notification time.

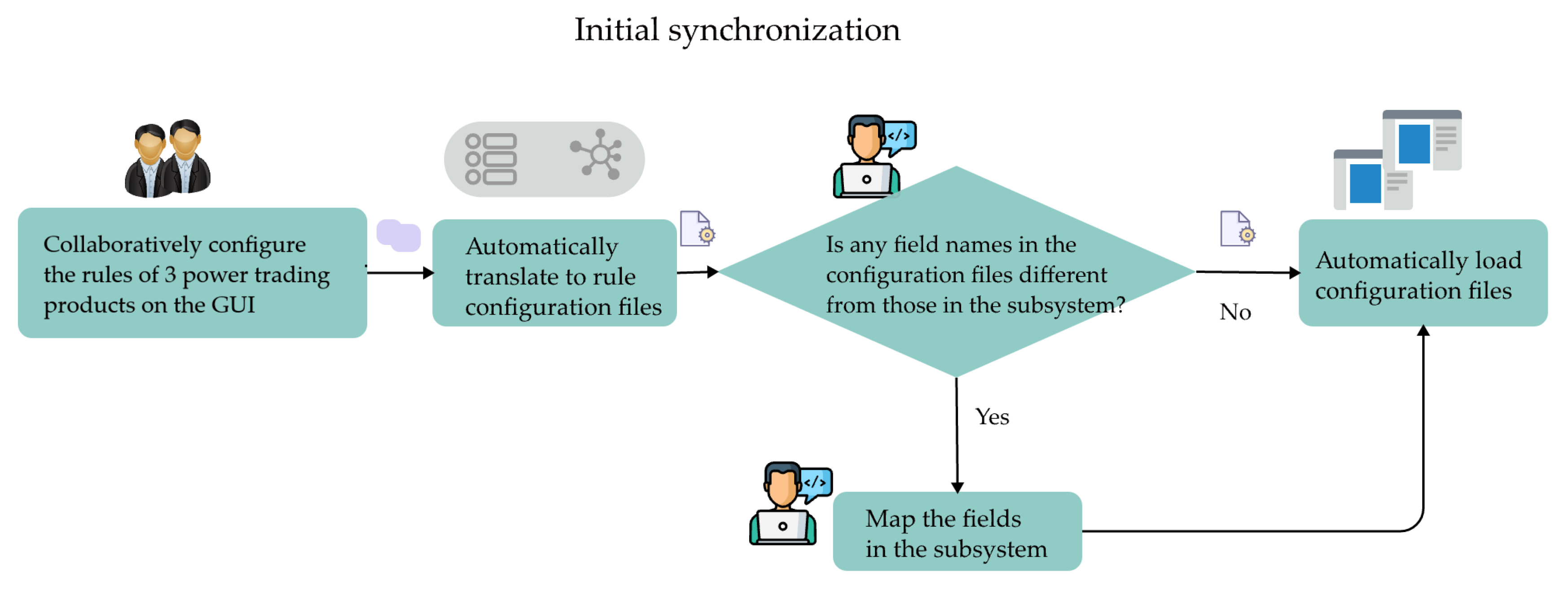

Figure 7 is a flow chart about the process of the rules synchronized to and implemented in subsystems using the proposed method.

Therefore, the IEMS operator created three power trading products linked to two data models: power energy product and demand response, as shown in

Figure 8.

From 2020 to 2023, the IES participated in all three power trading products as a large consumer. Thus, the three products were linked to the same ‘market participant’ as ‘large consumer’. The role was linked to a node called ‘industrial park’, which represented the whole industrial park according to the conventions of the daily operator of IEMSs. Since the long-term power product and the demand response product have different price formats, two price formats were also created on the configuration interface of the power trading rule synchronizer. Altogether, the applicable power trading rules were configured in the rule synchronizer, as shown in

Figure 9. Through the power trading rule configuration converter, these configurations were converted into rule configuration files in JSON, XML, and YAML formats. All the subsystems of IEMSs then loaded the same configuration in any of the rule configuration formats via the file transfer protocol (FTP). Some of the attribute names in the configuration file were identical to those in the subsystems, so that the rules in the configuration files were directly and automatically implemented in the subsystems. The other attribute names in the configuration files were different from those in the subsystems. The software developers looked up the descriptions of the attributes in the configuration interface when they were unsure about the meaning of the attributes and then simply mapped the attribute names in the configuration files with those applied in the subsystems, after which the rules could also be automatically implemented in the subsystems. Without the proposed method, the three sets of power trading rules would have to be manually conveyed verbally or in free-text form from the IEMS owner to 15 subsystem vendors and then further to the software product and development teams, which would be error-prone.

4.3. Update Synchronization of Power Trading Rules

Since 2023, the industrial park participated in a newly opened market called the power spot market. Concurrently, the dormitory within the park was excluded from the power market participation due to switching to the household power tariff. Battery storage was newly installed and could participate in multiple power products. These changes resulted in multiple changes in the applicable power rules to the IEMS. Without the application of the proposed method, such changes in the power trading rules could have led to manual coordination of changing the codes of all subsystems involved. However, starting in 2020, the subsystems of the IEMS had been agnostic to power trading rules and synchronized the power trading rules from the configuration files’ output by the power trading rule synchronizer.

Figure 10 is a flow chart about the process of the updates synchronized to and implemented in subsystems using the proposed method. The changes in power trading rules in 2023 were easily updated within clicks in the power trading rule configuration interface, as shown in

Figure 11. The power trading rule converter then translated the updates into new rule files. Although the number of power products, the linked nodes, and the participants were updated, no new attributes needed to be created. Each subsystem could then directly load the updates from the configuration files and implement the rules quickly, accurately, and unambiguously without the engagement of software developers. Without the proposed method, such updates would have to be manually conveyed from the IEMS owner to 16 subsystem vendors. Each vendor would have to check manually whether the subsystem needed modifications. If needed, the vendor would have to involve product managers and developers to update the codes accordingly.

5. Discussion on the Quantitative Benefits

The proposed method can directly enhance efficiency and ensure consistency in the synchronization and implementation of complicated power trading rules among the subsystems of an IEMS. Subsequently, the method can also indirectly bring emission reduction benefits to society by empowering IEMSs to participate in multiple types of power trading products, such as power spot, demand response, and ancillary services. However, it is difficult in practice to conduct a comparative experiment on the quantitative direct and indirect benefits with and without the proposed method on two identical IEMSs. This section tries to set up a simplified quantitative model of the direct and indirect effects of the proposed method to shed light on the magnitude of the effects.

5.1. Quantitative Model of the Benefits

The proposed method brings twofold benefits.

First, by avoiding manual coordination, natural language ambiguity, and code modifications during the synchronization and implementation of power trading rules among different subsystems of IEMSs, the proposed method reduces manpower consumption, which leads to direct emission reduction benefits. Assume that:

- (1)

There are N subsystems involved in power trading rule synchronization in an IEMS.

- (2)

There are R groups of power trading rules involved.

- (3)

The average number of annual changed rule attribute values is U%, with U% ∈ [0, 1].

- (4)

The average number of annual new rule attributes is V%, with V% ∈ [0, +∝].

- (5)

The workdays that subsystem developers need to understand the rules in free-text format and convert them into program requirements is .

- (6)

The workdays that business specialists need to understand the rules in free-text format and make subsequent changes in the rule configuration on the graphical power trading rule configuration interface is .

- (7)

The workdays that subsystem developers need to map new attributes in the rule configuration files to existing fields in the processing logic is ,while it does not require any code development from subsystem developers when only the rule attribute values are changed and synchronized to subsystems.

The initial status is that the subsystems of an IEMS have been adapted to the power trading rules based on manual coordination and customized code development and by the power trading rule synchronizer. Once the power trading rules need to be updated, the workload of implementing the updates in the subsystems one by one by traditional manual coordination and code modification can be expressed as Equation (1). In comparison, using the proposed method requires only one business specialist from the vendors or from the IES owner to convert the updates in power trading rules in natural language into the configuration in the power trading rules synchronizer, leaving the subsystems to automatically receive and implement the updates via machine-readable configuration files. The workload of using the proposed method to the power trading rule synchronizer can be expressed as Equation (2).

In practice, the absolute values of

,

, and

depend on the familiarity of each subsystem developer with the power trading rules. However,

is larger than the sum of

and

, since

involves the business specialists and developers of each subsystem to understand natural language rules and update requirements and code modifications that are more complicated than field mapping. For simplification, assume that

= 8

= 4

, the saved workdays using the proposed method compared to the traditional manual method can be expressed as Equation (3). Assume that each human produces

ton CO

2e per workday. The direct emission reduction impact brought by the proposed method can be calculated by Equation (4).

Second, by synchronizing the power trading rules to the subsystems, IEMSs are empowered to participate in power trading in a data-driven and overall optimized manner, thereby indirectly bringing about emission reduction benefits. The emission reduction that an IEMS can achieve by participating in power trading depends on the hardware settings of the IES as well as the operation of the IEMS. Ming Jin et al. [

28] conducted a simulation based on the data of six actual microgrid IESs and found that compared with operation at a fixed electricity price, optimizing the operation by responding to the real-time electricity price of the market can reduce carbon emissions by 3.7% to 4.7% due to a higher penetration of renewable energy and demand response. Assume the participation of the IEMS in power trading brings

of reduced carbon emissions of the IES, the annual average power of the IES is

, the annual average emission factor of the IES is

; thus, the annual emission reduction brought about by the IEMS participating in power trading can be expressed by Equation (5).

5.2. Quantitative Benefits of the Method in the Case Study

Table 1 summarizes the parameter values for estimating the quantitative benefits of the proposed method in the case study mentioned in the

Section 4. The values of

N,

Power,

R,

, and

V% can be directly obtained from IESs, IEMSs, and by counting the power trading rules described in

Section 4.2 and

Section 4.3.

is estimated by considering the annual utilization hours of photovoltaic and wind power generated and the officially announced emission factor of the power grid in Jiangsu Province, China [

29].

is taken as 0.01 tons of CO

2 equivalent per man-day according to the data published by the Nature Conservancy [

30].

is calculated as the average value mentioned in the literature [

28].

By substituting the values in

Table 1 into Equations (3)–(5), applying the proposed method in the IEMS of the case study in

Section 4 brings direct savings on system code development of 672 man-days, reducing 6.72 tons of carbon emission for the updates in the power trading rules in all the 16 subsystems of the IEMS in the year 2023. The method also leads to an indirect emission reduction of 3563.3 tons CO

2e annually by promoting the IEMS to engage in power trading with all the subsystems coordinated by implementing the same power trading rules. It is worth noting that the parameter values vary depending on the actual engineering circumstances, the familiarity and development capability of system vendors, and project coordination. The quantitative model provides a simplified estimation of the complicated engineering process. The calculated quantitative benefits of the method are to show the order of magnitudes of the benefits rather than absolute exact values.

6. Conclusions and Recommendations

As fluctuating renewable energy and distributed energy become increasingly popular in the form of IES, more IESs are participating in power trading as market participants. However, due to the lack of data model standards in power trading rules, the semantic ambiguity of power trading rules in free-text format, and the innate data exchange difficulty across heterogeneous subsystems of IEMSs, the subsystems of an IEMS may work under different power trading rules, resulting in the uncoordinated operation of different parts of the IES. Current data exchange methods in the IEMS for time series data, if applied to the synchronization of power trading rule data, can result in drawbacks, such as losing rule structure, costly requests, and lack of global consistency.

Given the reality in engineering that the subsystems of IEMSs are provided by a wide range of vendors, this paper pivots from proposing a fixed data model standard on power trading rules that awaits brutal forced execution among all vendors. Instead, this paper proposes a collaborative and software-aided approach to foster the alignment of the applicable power trading rules among the subsystem developers in an IEMS at the human-to-human and machine-to-machine levels. The proposed method comprises two parts: the data model framework for power trading rules and the software platform called power trading rule synchronizer. The framework aims to ensure an unambiguous understanding of the applicable power trading rules on a human-to-human level within an IEMS. The proposed framework includes three hierarchical layers: power product, market participant, and price format. The rule synchronizer provides an intuitive interface for IEMS operators and subsystem vendors to configure and read the applicable power trading rules according to the proposed data model framework. Moreover, the rule synchronizer can automatically convert the configured rules into machine-readable configuration files for subsystems to load via the FTP to synchronize the applicable rules.

The proposed method was demonstrated by a case study. In the case study, the IEMS of an industrial park needed to obtain wind power, photovoltaic power, and power load forecasts, as well as energy storage charging and discharging conditions from four subsystems for power trading. The first three subsystems required further data from nine other subsystems. The IES participated in three to five power trading products with different market participant roles and price formats. Through the proposed synchronization method, personnel without programming knowledge configured and updated the applicable trading rules intuitively. After the configuration, the rules were automatically converted into machine-readable formats and synchronized across 16 subsystems. As market conditions and IESs evolved, changes in power trading rules could be configured, converted, and synchronized within the IEMS continuously using the proposed method. An estimated direct saving of 672 man-days could be achieved using the proposed method compared to traditional manual coordination and code modification to update and implement the rules in all 16 subsystems. The case study demonstrated that the proposed method enhanced the operability and convenience of managing accurate, unified, and updated power trading rules across multiple subsystems.

This paper is, however, only a preliminary study that demonstrates the idea of aligning the understanding of different subsystem vendors on rules with data model frameworks, while synchronizing the aligned rules automatically to subsystems in a software-aided way. Future research can explore in three directions: enhancing the comprehensiveness and other structure possibilities of the data model frameworks with more applications in real IEMSs in different regions; designing a more sophisticated rule synchronizer to actively engage in the subsystems rather than just providing rule files and waiting for subsystems to parse; extending the proposed method to other rule-related data in the IEMS, such as carbon trading rules and gas trading rules.

Author Contributions

Conceptualization, Y.Z.; methodology, Y.Z.; software, Y.Z.; validation, Y.Z.; formal analysis, Y.Z.; investigation, Y.Z.; resources, Y.Z.; writing—original draft preparation, Y.Z.; writing—review and editing, L.M.; visualization, Y.Z.; supervision: L.M., W.N., Z.L. and X.Z.; project administration, Y.Z. and C.H.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Major Program of the National Social Science Foundation of China (21&ZD133) and the National Natural Science Foundation of China (W2433112). This research was also supported by the ASEAN Talented Young Scientist Program of Guangxi (ATYSP2023008), the Guangxi Philosophy and Social Science Research Project (23CYJ021 and 22BGL003), the GUAT Special Research Project on the Strategic Development of Distinctive Interdisciplinary Fields (TS2024511 and TS2024311), and the Guilin University of Aerospace Technology (KX202207601).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author due to privacy of the case study project.

Acknowledgments

This work was supported by the National Natural Science Foundation of China [grant no. 71934006], the Major Project of the National Social Science Foundation of China [grant no. 21&ZD133], and the State Key Laboratory of Power Systems in Tsinghua University [project no. SKLD17Z02 and project no. SKLD21M14]. The authors gratefully acknowledge support from BP in the form of the Phase IV Collaboration between Tsinghua and BP and the support from Tsinghua-Rio Tinto Joint Research Centre for Resources, Energy, and Sustainable Development.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Wu, J.; Yan, J.; Jia, H.; Hatziargyriou, N.; Djilali, N.; Sun, H. Integrated Energy Systems. Appl. Energy 2016, 167, 155–157. [Google Scholar] [CrossRef]

- Viesi, D.; Baldessari, G.; Polderman, A.; Sala, S.; Zanetti, A.; Bolognese, M.; Pellegrini, C.; Crema, L. Developing and testing an “Integrated Energy Management System” in a ski resort: The “Living Lab Madonna di Campiglio”. Clean. Energy Syst. 2023, 4, 100050. [Google Scholar] [CrossRef]

- Zhou, K.; Fu, C.; Yang, S. Big data driven smart energy management: From big data to big insights. Renew. Sustain. Energy Rev. 2016, 56, 215–225. [Google Scholar] [CrossRef]

- Zhou, Y.; Ma, L.; Ni, W. A Community-driven Trinity Method of Data Model Framework, Connector Platform, and Operation Strategy to Connect Data Islands in Integrated Energy Systems. In Proceedings of the 15th International Conference on Applied Energy, Doha, Qatar, 3–7 December 2024. [Google Scholar]

- Verstichel, S.; Ongenae, F.; Loeve, L.; Vermeulen, F.; Dings, P.; Dhoedt, B.; Dhaene, T.; Turck, F.D. Efficient data integration in the railway domain through an ontology-based methodology. Transp. Res. Part C Emerg. Technol. 2011, 19, 617–643. [Google Scholar] [CrossRef]

- Taheriyan, M.; Knoblock, C.A.; Szekely, P.; Ambite, J.L. Learning the semantics of structured data sources. J. Web Semant. 2016, 37, 152–169. [Google Scholar] [CrossRef]

- Ventosa, M.; Baíllo, Á.; Ramos, A.; Rivier, M. Electricity market modeling trends. Energy Policy 2005, 7, 897–913. [Google Scholar] [CrossRef]

- Luo, Z.; Liu, Y.; Zhou, Y.; Chen, X.; Su, Y.; Lyu, J. Research on Power Market Data Asset Management Framework. In Proceedings of the 2023 5th International Conference on Electrical Engineering and Control Technologies (CEECT), Chengdu, China, 15–17 December 2023; IEEE: Piscataway, NJ, USA, 2023; pp. 645–649. [Google Scholar]

- Liu, F.; Yang, L.; Hong, Y. Study on the Design and System Implementation of Multi-adaptive Energy Transaction Model. East China Electr. Power 2011, 39, 27–32. [Google Scholar]

- Long, S.; Zhang, X.; Yang, Z.; Geng, J.; Huang, L. A Component Library Based Flexible Electricity Settlement Method. Autom. Electr. Power Syst. 2013, 37, 89–94. [Google Scholar]

- Guo, Y.; Shao, P.; Huang, C.; Zhang, J. Design of Electricity Market Contract Management System Based on Metadata. In Proceedings of the 2014 2nd International Conference on Software Engineering, Knowledge Engineering and Information Engineering (SEKEIE 2014), Singapore, 5–6 August 2014; pp. 167–171. [Google Scholar]

- Dong, L.; Qian, Z.; Fei, Y.; Lei, L.; Chen, C.; Qiu, S. The Analysis and Design of Unified Data Model for Electricity Market under the Background of Deepening Design. J. Phys. Conf. Ser. 2020, 1642, 12016. [Google Scholar] [CrossRef]

- Shao, P.; Ye, F.; Guo, Y.; Liu, Y.; Zhang, J.; Wang, G. Power Market Unified Model Technology Architecture Based on IEC 62325. In Proceedings of the 2019 IEEE 3rd Information Technology, Networking, Electronic and Automation Control Conference (ITNEC), Chengdu, China, 15–17 March 2019; IEEE: Chengdu, China, 2019; pp. 1474–1477. [Google Scholar]

- Xu, J.; Long, S.; Xie, W.; Wang, Y.; Dong, J.; Zhou, L. Research on Key Data Interaction Models of Trans-regional and Trans-provincial Power Exchange Settlement. In Proceedings of the 2023 13th International Conference on Power and Energy Systems (ICPES), Chengdu, China, 8–10 December 2023; pp. 576–580. [Google Scholar]

- Santos, G.; Faria, P.; Vale, Z.; Pinto, T.; Corchado, J.M. Constrained Generation Bids in Local Electricity Markets: A Semantic Approach. Energies 2020, 13, 3990. [Google Scholar] [CrossRef]

- Ulbricht, R.; Fischer, U.; Lehner, W.; Donker, H. Rethinking Energy Data Management: Trends and Challenges in Today’s Transforming Markets. In Datenbanksysteme für Business, Technologie und Web (BTW); Gesellschaft für Informatik e.V.: Bonn, Germany, 2013; pp. 421–440. [Google Scholar]

- Zhang, Y.; Li, H.; Wang, X. Electricity Market Decision Support System for Power Plants. In Proceedings of the 9th International Conference on Modelling, Identification and Control, Kunming, China, 10–12 July 2017. [Google Scholar]

- Santos, G.; Pinto, T.; Vale, Z.; Praça, I.; Morais, H. Electricity Markets Ontology to support MASCEM’s simulations. In Proceedings of the International Conference on Practical Applications of Agents and Multi-Agent Systems, Sevilla, Spain, 1–3 June 2016; pp. 393–404. [Google Scholar]

- Booshehri, M.; Emele, L.; Flügel, S.; Förster, H.; Frey, J.; Frey, U.; Glauer, M.; Hastings, J.; Hofmann, C.; Hoyer-Klick, C.; et al. Introducing the Open Energy Ontology: Enhancing data interpretation and interfacing in energy systems analysis. Energy AI 2021, 5, 100074. [Google Scholar] [CrossRef]

- Šterk, M.; Sernec, R.; Nemček, P.; Migliavacca, G.; Zani, A.; Kramar, D.; Šavli, A.; Turha, B.; De Castro, D.B.; Sauer, I. The eBADGE Data Model Report—First Version Deliverable Report. 2014. Available online: https://cordis.europa.eu/docs/projects/cnect/0/318050/080/deliverables/001-eBADGED311Finalv221412014.pdf (accessed on 16 October 2024).

- Fernández-Izquierdo, A.; Cimmino, A.; Patsonakis, C.; Tsolakis, A.C.; García-Castro, R.; Ioannidis, D.; Tzovaras, D. OpenADR ontology: Semantic enrichment of demand response strategies in smart grids. In Proceedings of the International Conference on Smart Energy Systems and Technologies (SEST), Istanbul, Turkey, 7–9 September 2020; IEEE: Piscataway, NJ, USA, 2020; pp. 1–6. [Google Scholar]

- Schott, P.; Sedlmeir, J.; Strobel, N.; Weber, T.; Fridgen, G.; Abele, E. A Generic Data Model for Describing Flexibility in Power Markets. Energies 2019, 12, 1893. [Google Scholar] [CrossRef]

- European Telecommunications Standards Institute (ETSI). TS 103 410-1—V1.1.2.—SmartM2M; Extension to SAREF; Part 1: Energy Domain; ETSI: Sophia Antipolis, France, 2020. [Google Scholar]

- oneM2M. Partners oneM2M Technical Specification: TS0012-Base Ontology; oneM2M: Memphis, TN, USA, 2018. [Google Scholar]

- Santos, G.; Morais, H.; Pinto, T.; Corchado, J.M.; Vale, Z. Intelligent energy systems ontology to support markets and power systems co-simulation interoperability. Energy Convers. Manag. 2023, 20, 100495. [Google Scholar] [CrossRef]

- Nepsha, F.S.; Nebera, A.A.; Andrievsky, A.A.; Krasilnikov, M.I. Development of an Ontology for Smart Distributed Energy Systems. IFAC-PapersOnLine 2022, 55, 454–459. [Google Scholar] [CrossRef]

- Google Cloud Creating JSON Configuration Files for Your Deployments. Available online: https://cloud.google.com/appengine/docs/admin-api/creating-config-files (accessed on 17 September 2024).

- Jin, M.; Feng, W.; Marnay, C.; Spanos, C. Lawrence Berkeley National Lab. LBNL, B.C.U.S. Microgrid to enable optimal distributed energy retail and end-user demand response. Appl. Energy 2018, 210, 1321–1335. [Google Scholar] [CrossRef]

- Cai, B.; Zhao, L.; Zhang, Z.; Lu, X.; Jia, M. China Regional Power Grids Carbon Dioxide Emission Factors (in Chinese); Ministry of Ecology and Environment of the People’s Republic of China: Beijing, China, 2023. [Google Scholar]

- The Nature Conservancy What Is a Carbon Footprint? Available online: https://www.nature.org/en-us/get-involved/how-to-help/carbon-footprint-calculator/#:~:text=A%20carbon%20footprint%20is%20the,is%20closer%20to%204%20tons (accessed on 2 September 2024).

| Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).