Investigating the Interconnection between Environmental, Social, and Governance (ESG), and Corporate Social Responsibility (CSR) Strategies: An Examination of the Influence on Consumer Behavior

Abstract

1. Introduction

2. Literature Review

2.1. Environmental, Social, and Governance (ESG)

2.1.1. Environmental

2.1.2. Social

2.1.3. Governance

2.2. Corporate Social Responsibility (CSR)

- Corporate cause promotions: supporting and raising awareness for social causes;

- Corporate social marketing: implementing marketing campaigns to drive behaviour change in society;

- Cause-related marketing: making contributions based on product sales;

- Corporate philanthropy: making contributions to benefit the community;

- Community service: engaging employees in volunteer activities;

- Socially responsible business practices: integrating increased social responsibility into day-to-day business operations.

2.3. ESG vs. CSR

2.4. Consumer Behaviour (CB)

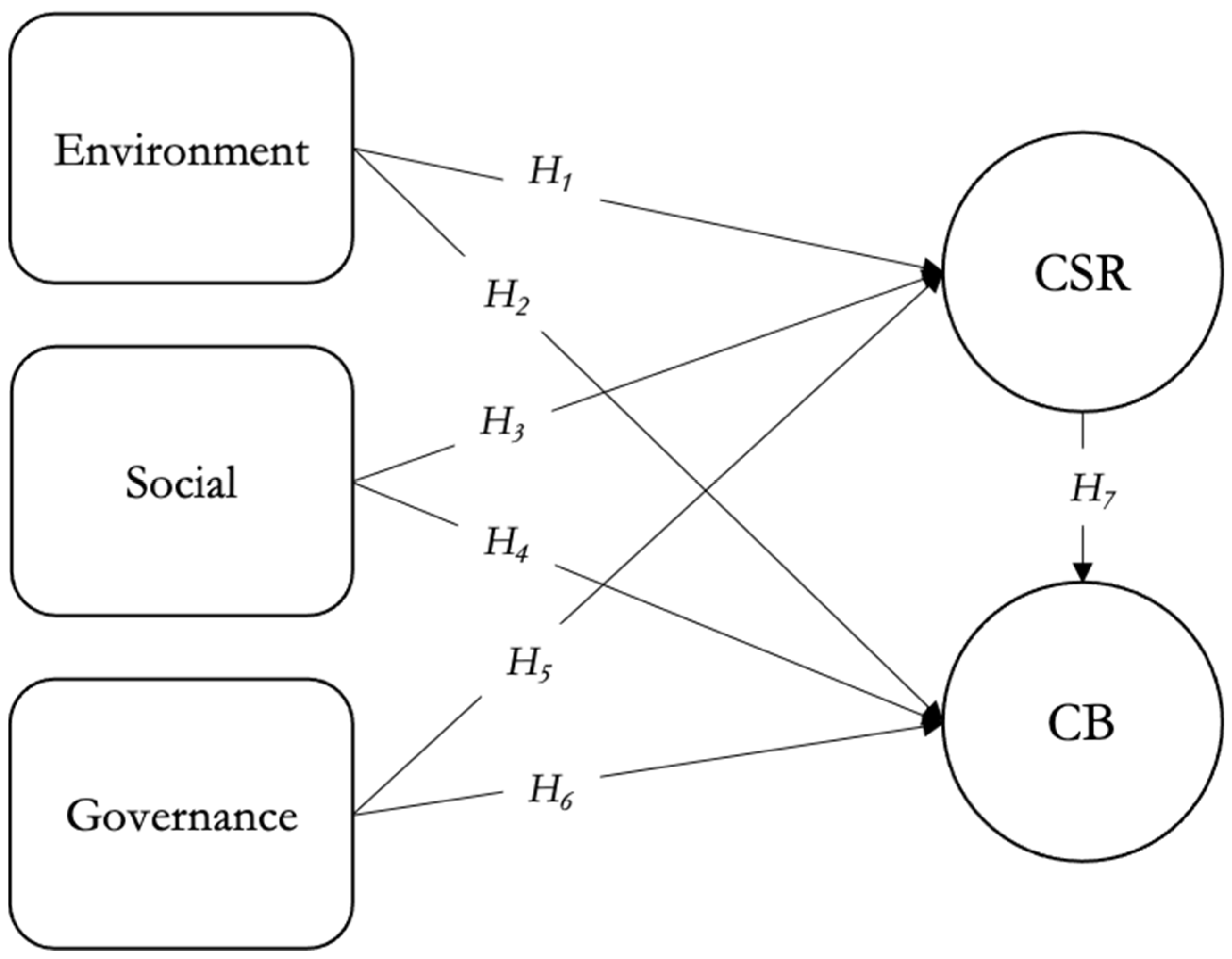

3. Research Methodology

3.1. Variable Operatinalisation and Distribution

3.2. Data Collection and Questionnaire

3.3. Data Analysis

3.3.1. Descriptive Statistics

3.3.2. Linear Structural Relational Model (LISREL)

4. Results

4.1. Demographic Statistics

4.2. LISREL Testing

4.2.1. Covariance Matrix

4.2.2. Goodness-of-Fit Testing

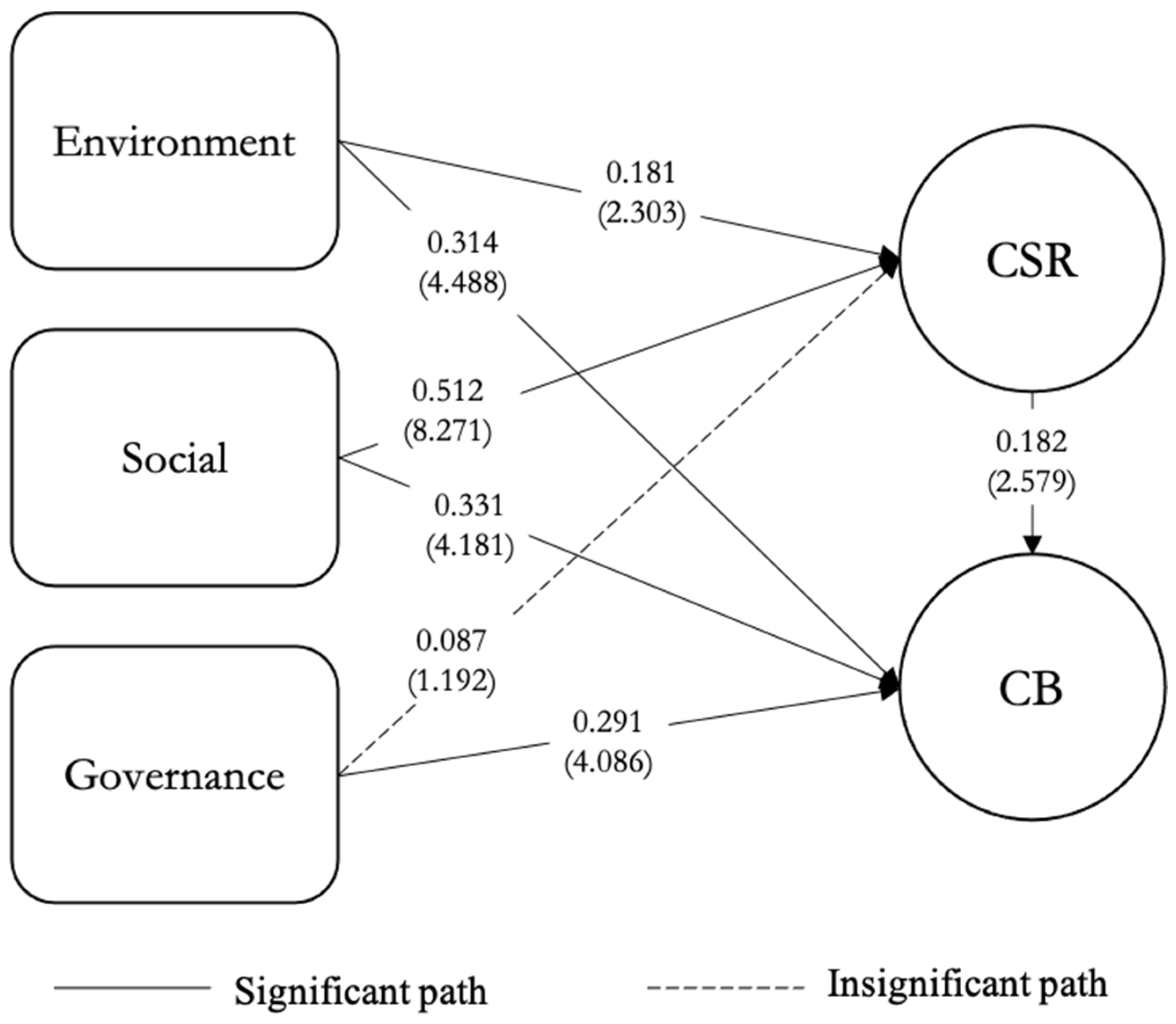

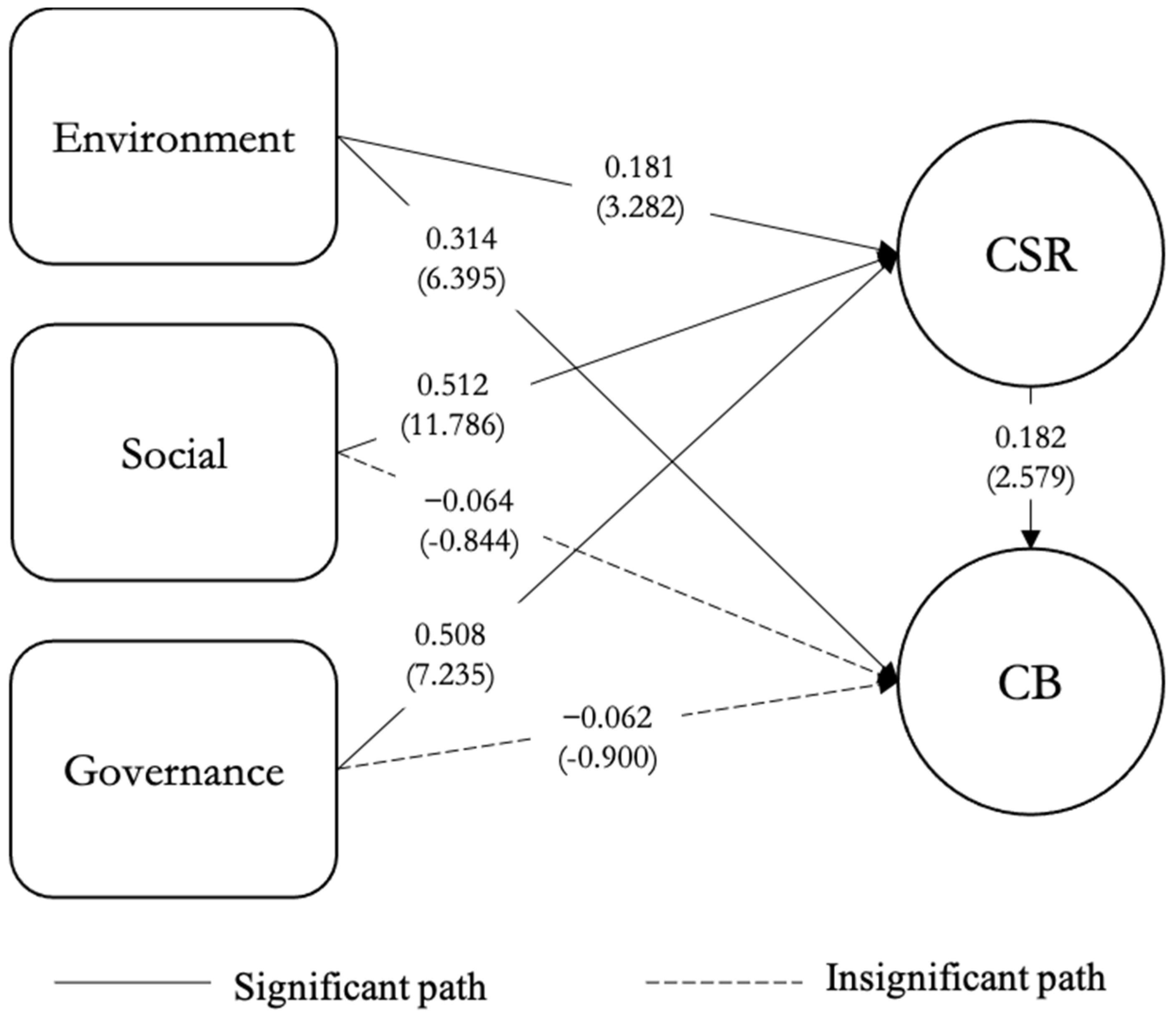

4.2.3. Hypotheses Testing

5. Discussion and Conclusions

5.1. Summary of the Research Result

5.2. Theoretical Impliction

5.3. Managerial Implication

5.4. Limitations and Future Research Suggestion

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Emmert, A. The Rise of the Eco-Friendly Consumer. Available online: https://www.strategy-business.com/article/The-rise-of-the-eco-friendly-consumer (accessed on 13 February 2023).

- Idowu, S.O. Introduction. In Current Global Practices of Corporate Social Responsibility in the Era of Sustainable Development Goals; Idowu, S.O., Ed.; Springer: London, UK, 2021; pp. xiii–xiv. ISBN 978-3-030-68386-3. [Google Scholar]

- Sarpong, S. Why Have We Forgotten “Government Social Responsibility”? Charting the Course for Sustainability in Governance. In Current Global Practices of Corporate Social Responsibility in the Era of Sustainable Development Goals; Idowu, S.O., Ed.; Springer: London, UK, 2021; pp. 803–805. [Google Scholar]

- Döttling, R.; Kim, S. ESG Investments and Investors’ Preferences. CESifo Forum 2021, 22, 12–16. [Google Scholar]

- PwC. Consumers’ Behaviours, Technological Preferences and Expectations Continue to Evolve. How Can Companies Meet Them Where They Want to Be? Available online: https://www.pwc.com/consumerinsights (accessed on 13 February 2023).

- Dathe, T.; Helmold, M.; Dathe, R.; Dathe, I. Corporate Social Responsibility (CSR) versus Environmental Social Governance (ESG). In Corporate Social Responsibility (CSR), Sustainability and Environmental Social Governance (ESG) Approaches to Ethical Management; Springer: Berlin, Germany, 2022; pp. 135–136. [Google Scholar]

- Carl, M. Indonesia. Available online: https://insights.slaughterandmay.com/apac-esg-indonesia/index.html (accessed on 14 February 2023).

- Coomans, B.; Rianda, B. Sustainability Reporting in Indonesia. Available online: https://www.moores-rowland.com/articles/SustainabilityReportinginIndonesia (accessed on 14 February 2023).

- Anggraeni and Partners. Regulations of ESG Investing and Its Implementation in Indonesia 2023. Available online: https://www.lexology.com/library/detail.aspx?g=b2c4682c-393d-48c8-b20c-a955c17e8eac (accessed on 14 February 2023).

- Tseng, K.-Y.; Huang, H.-N.; Chang, A.; Wei, T. Environmental, Social & Governance Law Taiwan 2023. Available online: https://iclg.com/practice-areas/environmental-social-and-governance-law/taiwan (accessed on 14 February 2023).

- Qiu, J. Taiwan Stock Exchange Mandates ESG Disclosure. Available online: https://www.glasslewis.com/taiwan-stock-exchange-mandates-esg-disclosure/ (accessed on 14 February 2023).

- Gupta, P. Understanding and Adopting ESG—An Overview. Available online: https://www.rhtlawasia.com/wp-content/uploads/2021/11/ESG-Part-I-The-Evolution-of-ESG-from-CSR.pdf (accessed on 23 March 2023).

- Hummels, H.; Bauer, R.; Martens, J. Going Mainstream: The Future of ESG Investing; Newsweek and Think Big Partners WLL©: New York, NY, USA, 2018. [Google Scholar]

- Park, E.; Kim, K. What Drives “Customer Loyalty”? The Role of Corporate Social Responsibility. Sustain. Dev. 2018, 27, 304–311. [Google Scholar] [CrossRef]

- Mersham, G. What Is ESG and How Does It Differ from CSR 2022. Available online: https://www.researchgate.net/publication/362407722_What_is_ESG_and_how_does_it_differ_from_CSR?channel=doi&linkId=62e877537782323cf193ab0f&showFulltext=true (accessed on 23 March 2023).

- Billio, M.; Costola, M.; Hristova, I.; Latino, C.; Pelizzon, L. Inside the ESG Ratings: (Dis)Agreement and Performance. Corp. Soc. Responsib. Environ. Soc. Gov. 2021, 28, 1423–1548. [Google Scholar] [CrossRef]

- ASDUN. ESG: [Environmental, Social, Governance] Framework of the Association for Supporting the SDGs for the UN. Available online: http://asdun.org/?page_id=2528&lang=en#:~:text=ESG%20%3A%20%5BEnvironmental%2C%20Social%2C%20Governance%5D%20Framework%20of%20the,and%20shareholders%20around%20the%20world (accessed on 14 December 2023).

- EBA. EBA Report on Management and Supervision of ESG Risks for Credit Institutions and Investment Firms; European Banking Authority: La Défense, France, 2021; pp. 22–47.

- Li, T.-T.; Wang, K.; Sueyoshi, T.; Wang, D.D. ESG: Research Progress and Future Prospects. Sustainability 2021, 13, 11663. [Google Scholar] [CrossRef]

- Dedunu, H.H.; Sedara, D. Chapter 8 Impact of Environmental, Social, and Governance Practices on the Consumer Buying Decision. In Intellectual Capital as a Precursor to Sustainable Corporate Social Responsibility; Marco-Lajara, B., Zaragoza-Sáez, P., Martínez-Falcó, J., Eds.; IGI Global’s InfoSci: Hershey, PN, USA, 2023; pp. 129–147. [Google Scholar]

- Hunjet, A.; Jurinić, V.; Vuković, D. Environmental Impact of Corporate Social Responsibility. EDP Sci. 2021, 92, 1–11. [Google Scholar] [CrossRef]

- Koh, H.-K.; Burnasheva, R.; Suh, Y.G. Perceived ESG (Environmental, Social, Governance) and Consumers’ Responses: The Mediating Role of Brand Credibility. Sustainability 2022, 14, 4515. [Google Scholar] [CrossRef]

- Liu, M.T.; Liu, Y.; Mo, Z.; Zhao, Z.; Zhu, Z. How CSR Influences Customer Behavioural Loyalty in the Chinese Hotel Industry. Asia Pac. J. Mark. Logist. 2020, 32, 1–22. [Google Scholar] [CrossRef]

- Oh, J. 3 Paradigm Shifts in Corporate Sustainability Marks New Era of ESG. Available online: https://www.weforum.org/agenda/2021/09/3-paradigm-shifts-in-corporate-sustainability-to-esg/ (accessed on 2 April 2021).

- Pompella, M.; Costantino, L. ESG Disclosure and Sustainability Transition: A New Metric and Emerging Trends in Responsible Investments. TalTech J. Eur. Stud. 2023, 13, 8–39. [Google Scholar] [CrossRef]

- Caroll, A.B. A Three-Dimensional Conceptual Model of Corporate Performance. Acad. Manag. Rev. 1979, 4, 497–505. [Google Scholar] [CrossRef]

- Carroll, A.B. The Pyramid of Corporate Social Responsibility: Toward the Moral Management of Organizational Stakeholders; Business Horizons: Bloomington, IN, USA, 1991. [Google Scholar]

- Michelon, G.; Boesso, G.; Kumar, K. Examining the Link between Strategic Corporate Social Responsibility and Company Performance: An Analysis of the Best Corporate Citizens. Corp. Soc. Responsib. Environ. Soc. Gov. 2012, 20, 81–94. [Google Scholar] [CrossRef]

- Moratis, L. Out of the Ordinary? Appraising ISO 26000′s CSR Definition. Int. J. Law Manag. 2016, 58, 26–47. [Google Scholar] [CrossRef]

- Hallgren, R. CSR, ESG & SDGS: What Do They Mean? What’s the Difference? BoardClic: Stockholm, Sweden, 2021. [Google Scholar]

- Wirba, A.V. Corporate Social Responsibility (CSR): The Role of Government in Promoting CSR. J. Knowl. Econ. 2023, 1–27. [Google Scholar] [CrossRef]

- Ryan, M.J.; Bonfield, E. The Fishbein Extended Model and Consumer Behavior. J. Consum. Res. 1975, 2, 118–136. [Google Scholar] [CrossRef]

- Nayeem, T.; Murshed, F.; Dwivedi, A. Brand experience and brand attitude: Examining a credibility-based mechanism. Mark. Intell. Plan. 2019, 821–833. [Google Scholar] [CrossRef]

- Burton, S.; Lichtenstein, D.R.; Netemeyer, R.G.; Garretson, J.A. A Scale for Measuring Attitude Toward Private Label Products and an Examination of Its Psychological and Behavioral Correlates. J. Acad. Mark. Sci. 1998, 26, 294–304. [Google Scholar] [CrossRef]

- Collins-Dodd, C.; Lindley, T. Store Brands and Retail Differentiation: The Influence of Store Image and Store Brand Attitude on Store Own Brand Perceptions. J. Retail. Consum. Serv. 2003, 10, 345–352. [Google Scholar] [CrossRef]

- Wu, P.C.; Yeh, G.Y.-Y.; Hsiao, C.-R. The Effect of Store Image and Service Quality on Brand Image and Purchase Intention for Private Label Brands. Australas. Mark. J. 2011, 19, 30–39. [Google Scholar] [CrossRef]

- Nunnally, J.C.; Bernstein, I.H. The Theory of Measurement Error. In Psychometric Theory; Nunnally, J.C., Bernstein, I.H., Eds.; McGraw-Hill: New York, NY, USA, 1994; pp. 211–246. [Google Scholar]

- Cronbach, L.J. Coefficient Alpha and the Internal Structure of Tests. Psychometrika 1951, 16, 297. [Google Scholar] [CrossRef]

- Casella, G.; Berger, R.L. 4 Multiple Random Variables: 4.5 Covariance and Correlation. In Statistical Inference; Casella, G., Berger, R.L., Eds.; Thomson Learning: Pacific Grove, CA, USA, 2002; pp. 169–170. [Google Scholar]

- Dodge, Y. Goodness of Fit Test. In The Concise Encyclopedia of Statistics; Dodge, Y., Ed.; Springer: Berlin/Heidelberg, Germany, 2008; pp. 233–235. [Google Scholar]

- Price, J. Chi-Square Tests 2000. Available online: http://people.uncw.edu/pricej/teaching/statistics/chisquare.htm#:~:text=A%200%20means%20the%20two,%2D1)(c%2D1) (accessed on 17 November 2023).

- Lin, J. Confirmatory Factor Analysis (CFA) in R with Lavaan; UCLA: Los Angeles, CA, USA, 2021. [Google Scholar]

- First, I.; Khetriwal, D.S. Exploring the Relationship Between Environmental Orientation and Brand Value: Is There Fire or Only Smoke? Bus. Strategy Environ. 2010, 19, 90–103. [Google Scholar] [CrossRef]

- Solomon, J.F.; Lin, S.W.; Norton, S.D.; Solomon, A. Corporate Governance in Taiwan: Empirical Evidence from Taiwanese Company Directors. Corp. Gov. Int. 2003, 11, 235–247. [Google Scholar] [CrossRef]

- Risza, H.; Mayasari, I.; Adi, H.K.; Wiadi, I.; Handini, R.S.; Driarkoro, R.Y.P. The Implementation of the Environmental, Social, and Governance Program to Support the Business Sustainability: A Case Study of Indonesian Companies; Atlantis Press: Dordrecht, The Netherlands, 2023; pp. 343–349. [Google Scholar] [CrossRef]

- Saleem, F.; Gopinath, C. Corporate Social Responsibility and Customer Behavior: A Developing Country Perspective. Lahore J. Bus. 2015, 4, 1–22. [Google Scholar] [CrossRef]

- Mandiri Institute. ESG Report: Industry for Tomorrow: Towards ESG Implementation in Indonesia; Mandiri Institute: Jakarta, Indonesia, 2022. [Google Scholar]

| Factors | Variables | Description | Author |

|---|---|---|---|

| ESG | Environmental | Represents the assessment of a business’ contribution to the environment, with a particular emphasis on critical environmental issues. | Dedunu and Sedara (2023) [20] |

| Social | Encompasses the organisation’s relationship with its stakeholders, including employees, suppliers, customers, and the communities in which it operates. | ||

| Governance | Assesses how a firm is governed and managed, which places particular emphasis on company leadership, leadership incentives, stakeholder rights, tax strategies, board structure, and internal controls that aim to foster transparency and accountability. | ||

| CSR | CSR | The principles, policies, and actions adopted by a firm to address social, economic, and environmental concerns voluntarily, without external mandates or regulations. | Carroll (1991) [27] |

| CB | Brand attitude | Customers’ inclination to respond positively or negatively to a brand, based on their assessment of the product, previous purchases, or self-evaluations. | Burton, Lichtenstein, Netemeyer, Garretson (1998) [34] |

| Purchase intention | An important aspect of consumer behaviour that studies customers’ inclination to continue buying a brand and remain loyal instead of switching to competitors. | Wu, Yeh, and Hsiao (2011) [36] |

| Description | Total | Taiwan | Indonesia | |||

|---|---|---|---|---|---|---|

| Nationality | 403 | (100%) | 201 | (49.876%) | 202 | (50.124%) |

| Area | 403 | (100%) | 201 | (100%) | 202 | (100%) |

| Countryside | 109 | (27.047%) | 59 | (29.353%) | 50 | (24.752%) |

| City | 294 | (72.953%) | 142 | (70.647%) | 152 | (75.248%) |

| Gender | 403 | (100%) | 201 | (100%) | 202 | (100%) |

| Female | 243 | (60.298%) | 130 | (64.677%) | 113 | (55.941%) |

| Male | 160 | (39.702%) | 71 | (35.323%) | 89 | (44.059%) |

| Education | 403 | (100%) | 201 | (100%) | 202 | (100%) |

| Highschool Grad | 62 | (15.385%) | 16 | (7.970%) | 46 | (22.772%) |

| VoTech Program 1 | 25 | (6.203%) | 2 | (0.995%) | 23 | (11.386%) |

| Bachelor’s Degree | 267 | (66.253%) | 144 | (71.642%) | 123 | (60.891%) |

| Master’s Degree | 47 | (11.663%) | 37 | (18.408%) | 10 | (4.950%) |

| Doctoral Degree | 2 | (0.496%) | 2 | (0.995%) | 0 | (0%) |

| Marital status | 403 | (100%) | 201 | (100%) | 202 | (100%) |

| Single | 315 | (78.168%) | 189 | (94.030%) | 126 | (62.376%) |

| Married | 86 | (21.340%) | 12 | (5.970%) | 74 | (36.634%) |

| Divorced | 0 | (0%) | 0 | (0%) | 0 | (0%) |

| Widow | 2 | (0.496%) | 0 | (0%) | 2 | (0.990%) |

| Age | 403 | (100%) | 201 | (100%) | 202 | (100%) |

| Under 18 | 2 | (0.496%) | 0 | (0%) | 2 | (0.990%) |

| 18–25 | 230 | (57.072%) | 134 | (66.667%) | 96 | (47.525%) |

| 26–35 | 90 | (22.333%) | 50 | (24.876%) | 40 | (19.802%) |

| 36–45 | 24 | (5.955%) | 11 | (5.473%) | 13 | (6.436%) |

| 46–55 | 34 | (8.437%) | 6 | (2.985%) | 28 | (13.861%) |

| Over 55 | 23 | (5.707%) | 0 | (0%) | 23 | (11.386%) |

| Occupation | 403 | (100%) | 201 | (100%) | 202 | (100%) |

| Student | 221 | (54.839%) | 139 | (69.154%) | 82 | (40.594%) |

| Company employee | 99 | (24.566%) | 45 | (22.388%) | 54 | (26.733%) |

| Civil servant | 16 | (3.970%) | 0 | (0%) | 16 | (7.921%) |

| Self-employed | 53 | (13.151%) | 17 | (8.456%) | 36 | (17.822%) |

| Homemaker | 13 | (3.226%) | 0 | (0%) | 13 | (6.436%) |

| Retired | 1 | (0.248%) | 0 | (0%) | 1 | (0.495%) |

| Chairman | 0 | (0%) | 0 | (0%) | 0 | (0%) |

| Monthly income | 403 | (100%) | 201 | (100%) | 202 | (100%) |

| Less than USD 250 | 173 | (42.928%) | 78 | (38.806%) | 95 | (47.030%) |

| USD 251–USD 500 | 109 | (27.047%) | 48 | (23.881%) | 61 | (30.198%) |

| USD 501–USD 1000 | 50 | (12.407%) | 19 | (9.453%) | 31 | (15.347%) |

| USD 1001–USD 2500 | 52 | (12.903%) | 46 | (22.886%) | 6 | (2.970%) |

| USD 2501–USD 5000 | 16 | (3.970%) | 7 | (3.483%) | 9 | (4.455%) |

| More than USD 50,000 | 3 | (0.744%) | 3 | (1.493%) | 0 | (0%) |

| Constructs | Pooled | Taiwan | Indonesia |

|---|---|---|---|

| Environmental | 0.936 | 0.936 | 0.882 |

| Social | 0.888 | 0.888 | 0.906 |

| Governance | 0.988 | 0.980 | 0.998 |

| CSR | 0.905 | 0.905 | 0.977 |

| CB | 0.923 | 0.923 | 0.988 |

| Pooled | CSR | CB | E | S | G |

| CSR | 1.001 | ||||

| CB | 0.714 | 0.870 | |||

| E | 0.704 | 0.634 | 0.826 | ||

| S | 0.674 | 0.586 | 0.660 | 0.781 | |

| G | 0.811 | 0.709 | 0.762 | 0.669 | 0.971 |

| Pooled | CSR | CB | E | S | G |

| CSR | 1.115 | ||||

| CB | 0.829 | 0.941 | |||

| E | 0.832 | 0.770 | 0.914 | ||

| S | 0.735 | 0.638 | 0.686 | 0.765 | |

| G | 0.984 | 0.873 | 0.880 | 0.723 | 1.166 |

| Pooled | CSR | CB | E | S | G |

| CSR | 1.115 | ||||

| CB | 0.587 | 0.797 | |||

| E | 0.832 | 0.480 | 0.914 | ||

| S | 0.735 | 0.516 | 0.686 | 0.765 | |

| G | 0.984 | 0.528 | 0.880 | 0.723 | 1.166 |

| Fit Measures | Pooled | Taiwan | Indonesia |

|---|---|---|---|

| χ2 | 0.00 | 0.00 | 0.00 |

| P | 1.00 | 1.00 | 1.00 |

| RMSEA | 0.00 | 0.00 | 0.00 |

| Independent Variables | Dependent Variables | Hypotheses | Est | t-Value | Supported (Yes/No) |

|---|---|---|---|---|---|

| E | CSR | H1 | 0.111 | 1.732 | No |

| S | CSR | H2 | 0.313 | 5.802 | Yes |

| G | CSR | H3 | 0.532 | 10.136 | Yes |

| E | CB | H4 | 0.181 | 2.671 | Yes |

| S | CB | H5 | 0.122 | 2.135 | Yes |

| G | CB | H6 | 0.258 | 4.298 | Yes |

| CSR | CB | H7 | 0.295 | 5.798 | Yes |

| Independent Variables | Dependent Variables | Hypotheses | Est | t-Value | Supported (Yes/No) |

|---|---|---|---|---|---|

| E | CSR | H1 | 0.181 | 2.303 | Yes |

| S | CSR | H2 | 0.314 | 4.488 | Yes |

| G | CSR | H3 | 0.512 | 8.271 | Yes |

| E | CB | H4 | 0.331 | 4.181 | Yes |

| S | CB | H5 | 0.087 | 1.192 | No |

| G | CB | H6 | 0.291 | 4.086 | Yes |

| CSR | CB | H7 | 0.182 | 2.579 | Yes |

| Independent Variables | Dependent Variables | Hypotheses | Est | t-Value | Supported (Yes/No) |

|---|---|---|---|---|---|

| E | CSR | H1 | 0.181 | 3.282 | Yes |

| S | CSR | H2 | 0.314 | 6.395 | Yes |

| G | CSR | H3 | 0.512 | 11.786 | Yes |

| E | CB | H4 | −0.064 | −0.844 | Yes |

| S | CB | H5 | 0.508 | 7.235 | No |

| G | CB | H6 | −0.062 | −0.900 | No |

| CSR | CB | H7 | 0.294 | 4.318 | Yes |

| Hypotheses | Supported (Est.) | ||

|---|---|---|---|

| Pooled | Taiwan | Indonesia | |

| H1: E → CSR | No 0.111 * | Yes 0.181 | Yes 0.181 |

| H2: S → CSR | Yes 0.313 | Yes 0.314 | Yes 0.314 |

| H3: G → CSR | Yes 0.532 | Yes 0.512 | Yes 0.512 |

| H4: E → CB | Yes 0.181 | Yes 0.331 | No −0.064 * |

| H5: S → CB | Yes 0.122 | No 0.087 * | Yes 0.508 |

| H6: G → CB | Yes 0.258 | Yes 0.291 | No −0.062 * |

| H7: CSR → CB | Yes 0.295 | Yes 0.182 | Yes 0.294 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nugroho, D.P.D.; Hsu, Y.; Hartauer, C.; Hartauer, A. Investigating the Interconnection between Environmental, Social, and Governance (ESG), and Corporate Social Responsibility (CSR) Strategies: An Examination of the Influence on Consumer Behavior. Sustainability 2024, 16, 614. https://doi.org/10.3390/su16020614

Nugroho DPD, Hsu Y, Hartauer C, Hartauer A. Investigating the Interconnection between Environmental, Social, and Governance (ESG), and Corporate Social Responsibility (CSR) Strategies: An Examination of the Influence on Consumer Behavior. Sustainability. 2024; 16(2):614. https://doi.org/10.3390/su16020614

Chicago/Turabian StyleNugroho, Deinera P. D., Yi Hsu, Christian Hartauer, and Andreas Hartauer. 2024. "Investigating the Interconnection between Environmental, Social, and Governance (ESG), and Corporate Social Responsibility (CSR) Strategies: An Examination of the Influence on Consumer Behavior" Sustainability 16, no. 2: 614. https://doi.org/10.3390/su16020614

APA StyleNugroho, D. P. D., Hsu, Y., Hartauer, C., & Hartauer, A. (2024). Investigating the Interconnection between Environmental, Social, and Governance (ESG), and Corporate Social Responsibility (CSR) Strategies: An Examination of the Influence on Consumer Behavior. Sustainability, 16(2), 614. https://doi.org/10.3390/su16020614