Abstract

Digital transformation is increasingly recognized as a key driver of sustainable development, enabling suppliers to improve efficiency, reduce resource consumption, and adapt to changing market demands. However, it remains a challenging process for suppliers, often hindered by resource and capacity constraints. This study investigates how government subsidies can facilitate supplier digital transformation, considering supply chain diffusion and local government competition dynamics. Using data from A-share listed companies in China between 2010 and 2021, our analysis reveals that government subsidies significantly promote supplier digital transformation by encouraging a more diversified downstream customer base. Moreover, customer digital transformation can facilitate supplier digital transformation, but spillover effects are higher within the same jurisdiction than across different jurisdictions. This study further identifies that the impact of government subsidies is more pronounced under higher opportunistic risk but is constrained by systemic risk. Additionally, suppliers with higher human capital and a smaller digital divide with customers exhibit greater effectiveness in adopting innovation diffusion. These findings provide valuable insights into optimizing local government subsidies policies to enhance supplier digital transformation and contribute to the broader goal of sustainable development.

1. Introduction

As key market participants, enterprises play a crucial role in advancing sustainable development strategies while fostering economic growth. However, traditional production and operational models often lead to resource wastage and environmental pollution, posing significant challenges to sustainable development. The integration of digital technology offers enterprises a transformative opportunity to overcome these bottlenecks, facilitating a shift from extensive growth to a green, efficient, and sustainable development model. Firstly, digital technology enables enterprises to optimize production processes, enhance resource utilization efficiency, and streamline internal management, thereby achieving green management throughout the entire life cycle [1]. Secondly, digital technology facilitates interaction between enterprises and stakeholders, which helps to enhance brand image and demonstrate social responsibility, thus creating new opportunities for sustainable growth [2]. Moreover, by promoting data sharing and collaboration within the supply chain, enterprises can collaborate with upstream and downstream partners to develop greener, low-carbon supply chain strategies [3]. Despite these potential benefits, data indicates that a mere 25% of enterprises in China have embarked on digital transformation, while over 55% have yet to complete basic equipment digitalization upgrades. Existing studies generally believe that under fiscal and political incentives, local governments are motivated to provide subsidies to alleviate the resource and capacity constraints faced by enterprises in digital transformation [4], but the focus of the analysis is limited to the impact of government subsidies on the internal digital transformation of enterprises, ignoring the linkage between the upstream and downstream of the supply chains.

Early research underscores the interconnections between suppliers and customers regarding information, knowledge, and social resources, highlighting their mutual reinforcement in fostering corporate innovation [5,6,7]. Theoretically, customer digital transformation, as a comprehensive innovation practice, serves as a crucial source for the diffusion of innovation experience and knowledge along the supply chain. This creates significant external resources for upstream suppliers, facilitating their learning and adoption processes, which in turn drives their own digital transformation. Focusing on the spillover effect is crucial for several reasons. First, it elucidates the propagation path of digital transformation within the supply chain. This not only improves the overall operational efficiency of the supply chain, promotes collaborative innovation, and enhances the resilience of the supply chain, but also provides a basis for policy formulation. Second, understanding this effect can clarify the behavioral logic of local governments. To limit the spillover effects from local customers to other jurisdictions, local governments often intervene to restrict the access of suppliers from outside jurisdiction to the local market. This regulatory approach aims to preserve the local economic benefits and maintain control over the market dynamics within their territories. Thus, the role of government subsidies is not limited to specific firms but can also facilitate or hinder collaborative transformation of upstream and downstream firms within the supply chain by influencing supply chain configuration.

In practice, government subsidies are often used as a tool for competition between local governments. Early studies have generally verified the role of government subsidies in attracting foreign investment and highly skilled talents [8,9,10]. In recent years, the role of government subsidies in helping local enterprises expand their markets has been valued. Taking the financial subsidies for the promotion and application of new energy vehicles as an example, local governments implement subsidies according to a certain proportion of the national subsidy standard. This approach is intended to stimulate market demand, but it has also triggered a “subsidy war”. Among the 88 demonstration cities in China, the total promotion amount of the bottom 40 cities is lower than 80% of the top 5 cities, indicating a highly imbalanced development status of the new energy vehicle market. Against the backdrop of the “official promotion tournament” [11,12], the market competition between local enterprises and the official competition among local officials are more closely tied together: the promotion prospects of local officials largely depend on the competitive performance of enterprises within their jurisdiction in the national market. The expansion into cross-regional markets can be construed as a form of protective strategy, safeguarding the political and economic interests of both officials and enterprises from potential erosion.

To this end, this paper investigates how government subsidies influence the collaborative transformation of upstream and downstream firms within the supply chain from the supply chain perspective and the local government competition perspective, utilizing data from listed firms spanning 2010 to 2021. This analysis is of substantial practical significance.

Discussions on digital transformation often center on the technologies themselves, neglecting the broader social, economic, and institutional contexts in which firms operate. This paper breaks away from the single “technology-driven” perspective, making several significant contributions:

- (1)

- Understanding Firm Behavior in Supply Chains: This study emphasizes the significance of supply chain relationships in comprehending how firms undergo digital transformation. It demonstrates that customer digital transformation facilitates supplier digital transformation, with the intensity of spillover effects varying based on whether the supplier and customer are situated within the same jurisdiction. This finding enriches the literature on the factors influencing supplier digital transformation.

- (2)

- Geographical Context of Government Subsidies: This study examines the geographical configuration of supply chains, illustrating that government subsidies can both encourage suppliers to diversify their downstream customer base and restrict the flow of local customer purchases to non-local suppliers. This dual role enriches the understanding of efficiency losses in resource allocation resulting from market segmentation.

- (3)

- Improved Identification of Subsidies: Considering the heterogeneity in the effects of different government subsidies, this study introduces a novel approach to identifying government subsidies related to digital transformation by constructing a corpus based on patent data, thereby excluding the effects of other subsidy policies. This not only represents a valuable addition to the existing literature but also aids in clarifying the economic effects of specific government subsidies.

2. Theoretical Analysis and Research Hypotheses

2.1. Impact of Government Subsidies on Supplier Digital Transformation

Synthesizing the findings of the survey and research, it was identified that suppliers face several main barriers to digital transformation. The main obstacles faced by suppliers in digital transformation include insufficient financial support, increased information security risks, shortage of digitally skilled employees, insufficient supply of information technology experts, strong internal resistance to change, lack of practical experience among management, and uncertainty about industry digital standards [13,14]. All discovered obstacles are related to resources and can be divided into tangible resources and intangible resources. The former includes financial resources, human resources, and material resources, while the latter includes the reputation, culture, knowledge, experience, and relationships with stakeholders of the enterprise.

Considering the current research findings, the Resource-Based Theory (RBT) can provide theoretical support for this study of “how government subsidies can alleviate the resource constraints of suppliers” in the context of digital transformation. Resource-based theory posits that suppliers can maintain and enhance their competitive advantages through effective resource management [15]. This theory has further developed into strategic factor market theory focusing on the resource acquisition process, enterprise theory emphasizing the knowledge-based view, and dynamic capability theory highlighting the ability to adapt to the environment.

On the one hand, government subsidies significantly improve suppliers’ access to crucial resources. Financial support reduces the economic pressure on supplier companies to acquire key technologies and highly skilled personnel [16,17], which not only improves the technical level of supplier companies but also enhances their competitiveness in the strategic factor market to support their digital transformation. On the other hand, government subsidies promote the diffusion of knowledge and skills [18,19]. The government supports suppliers’ cooperation with higher education institutions or research centers by funding R&D activities, collaborative projects, and training programs, thereby accelerating technology transfer and knowledge application. This cross-border cooperation greatly enhances employees’ digital skills and overall knowledge base; at the same time, government subsidies enhance suppliers’ environmental adaptability and risk response capabilities [20,21]. By leveraging government subsidies, suppliers gain the flexibility and resilience needed to adapt to market fluctuations and technological advancements, maintaining a continuous and robust trajectory towards digital transformation.

In summary, government subsidies not only assist suppliers in addressing their immediate resource and skill needs but also enhance their adaptability and overall competitiveness through long-term restructuring and capacity enhancement. This multifaceted support accelerates the pace of supplier digital transformation. Consequently, this paper proposes Hypothesis 1.

Hypothesis 1.

Government subsidies have a positive facilitating effect on the supplier’s digital transformation.

2.2. Mechanisms of Government Subsidies Influencing Supplier Digital Transformation

Government subsidies can enhance the diversity of local suppliers’ downstream customers through several ways. Firstly, government subsidies can help suppliers reduce the cost of entering new markets [22,23]. Secondly, government subsidies can be allocated to hire market access consultants who provide suppliers with professional advice on the laws and regulations, market demand, and competitive landscape of target markets. These consultancy services help suppliers gain a precise understanding of new market requirements, formulate effective market entry strategies, and reduce the challenges and uncertainties associated with entering new markets [24,25]. Thirdly, government subsidies support suppliers in conducting targeted R&D to develop products or services tailored to the needs of local markets [26,27]. This targeted R&D enables suppliers to offer more competitive and relevant products in diverse markets. Fourthly, government subsidies enable suppliers to participate in international exhibitions, business seminars, and industry exchange activities. These platforms help suppliers establish connections with potential customers and partners, increase corporate exposure, enhance market recognition, and open up new sales channels [28,29,30]. Through these measures, suppliers can significantly expand their market coverage and diversify their customer base.

A stable and concentrated customer base can facilitate suppliers to consolidate resources and share information along the supply chain, thus improving inventory management and operational efficiency [31,32]. However, interdependence among supply chain participants is not always beneficial but may instead lead to severe squeezes. Such squeezes are manifested not only in opportunistic behaviors on both sides of the transaction [33], but also in customers’ use of their dominant position to impose unfair pricing on suppliers, which in turn reduces suppliers’ profitability [34]. Furthermore, when supply chain collaboration breaks down, suppliers face losses not only from reduced profits but also from downtime, increased costs associated with finding new partners and switching costs for establishing new relationships. Consequently, customer concentration increases the various risks faced by suppliers and forces suppliers to hedge these risks by holding more cash reserves for precautionary motives, which in turn leads to a ‘crowding out’ of innovative resources [35]. While extensive literature examines the economic consequences of customer concentration, its impact on the digital transformation of firms remains largely unaddressed.

Digital transformation is a comprehensive initiative that encompasses production processes, operational frameworks, management approaches, and information architectures. It requires substantial capital and resources due to significant investment risks, high technical barriers, and extended payback periods, all of which contribute to elevated transformation costs and inherent uncertainties [36]. According to the stakeholder theory [37], customers, as key stakeholders of suppliers, have needs and expectations that significantly influence suppliers’ business decisions. Thus, the interests and constraints of customers are critical considerations for suppliers during digital transformation. When customer concentration is excessively high, customers’ bargaining power significantly increases, leading to compressed profit margins that further deter suppliers’ investments in digital transformation, creating a substantial obstacle to transformation.

Additionally, high customer concentration amplifies the commercial, operational, and financial risks faced by suppliers, making it difficult for them to bear the additional risks of digital transformation. Specifically, large customers can exert downward pressure on product prices or extend payment terms, thereby heightening suppliers’ commercial risks. If the customer changes suppliers or extends the industrial chain for independent research and development, the supplier will lose important sales channels, which will further increase the supplier’s business risk. Moreover, when a large customer faces a financial crisis, suppliers may struggle to recover anticipated sales revenue, which will adversely affect the funds required for the supplier’s normal operation and thus increase the supplier’s financial risk [38]. Suppliers may also be compelled to invest heavily in relationship-specific assets to retain these customers [39]; however, as these investments become more specialized, the uncertainty surrounding their liquidation value rises, thereby diminishing the supplier’s resilience to financial challenges.

In summary, high customer concentration reduces suppliers’ capacity to manage the risks associated with digital transformation, leading them to cut back on their transformation investments. Simultaneously, increased risk compels suppliers to maintain larger cash reserves as a safeguard against customer-related uncertainties, thereby restricting the capital and resources necessary for digital transformation. Customer diversity and customer concentration are two opposing concepts, and the negative effects of customer concentration also confirm the positive effects of customer diversity on supplier digital transformation. Based on these considerations, this paper proposes Hypothesis 2.

Hypothesis 2.

Government subsidies promote the diversification of supplier downstream customer bases, which subsequently accelerates the supplier digital transformation.

2.3. Competition among Local Governments Prevents Spillover Effects from Crossing Administrative Boundaries

Drawing on the theory of diffusion of innovation [40], the practical experiences and knowledge generated by customers during digital transformation will spread along the supply chain, providing upstream suppliers with learning and adoption resources. Existing research on supply chain relationships predominantly addresses the flow of production factors and the diffusion of knowledge between upstream and downstream enterprises [41]. It also explicates the phenomenon of inter-firm knowledge spillover through the demand feedback mechanism of customers and the external competitive pressure mechanism exerted on suppliers [6,42]. Considering that the spillover effects of customers’ digital transformation are primarily achieved through technology sharing, standardization requirements, and collaborative projects, suppliers can expedite their own digitalization processes by closely collaborating with customers. This partnership allows suppliers to access and implement these innovations promptly and effectively.

From the product dimension, customer demands are increasingly inclined towards high customization and digital enhancement, compelling suppliers to continually adopt new design and manufacturing technologies to improve their products’ market adaptability. Innovations such as 3D printing and smart manufacturing systems are driving a paradigm shift from traditional mass production methods to more flexible manufacturing approaches. From the process dimension, the integration of digital technologies has refined and enhanced the operational processes of customers. To maintain collaborative efficiency within the supply chain, suppliers must optimize their production, design, and R&D methodologies in alignment with modularization, versioning, and openness requirements. From an organizational perspective, as customers strive to implement networked and flat organizational structures, suppliers must adapt and optimize their management models. This transition from traditional industrial management to digital management necessitates investments in enterprise resource planning, manufacturing execution systems/distributed control systems, product lifecycle management, and other integrative systems. These systems facilitate internal resource integration, dismantle information silos, and externally support the precise alignment of information, capital, and technology among supply chain participants, thereby enhancing overall supply chain efficiency. From the business model dimension, the cross-border expansion of horizontal businesses and the integration of vertical businesses require suppliers to evolve from traditional single product or service providers to comprehensive digital solutions platforms. This evolution encompasses the development of customized online support services and data-driven maintenance services, as well as a shift from one-time transactions to ongoing subscription-based revenue models. Such models enhance customer retention and market competitiveness. Based on these considerations, this paper proposes Hypothesis 3.

Hypothesis 3.

The digital transformation of customers serves as a catalyst for supplier digital transformation.

The advent of new digital technologies compresses time and spatial distances, while digital platforms expand consumer markets and deepen economic linkages between regions. This evolution further exacerbates the imbalance in the distribution of value-added tax (VAT) across regions. For local governments, the local market is no longer the primary “home base” for maximizing fiscal revenues, nor is it the “reserve” for maintaining local fiscal expenditures. Consequently, local governments must reassess their roles and strategies to adapt to a more dynamic and interconnected economic landscape. Local government subsidy strategies play a dual role in this transformation, promoting the diversification of suppliers’ downstream customers and enhancing the internal linkages and self-sufficiency of the local economy. In practice, due to the relatively limited scope of jurisdiction, local governments typically allocate financial resources exclusively within their jurisdictions, making it challenging to mobilize resources from other parts of the country. As a result, they often strive to match the needs of local customers with those of local suppliers. To achieve this objective, local governments distort upstream factor prices by subsidizing suppliers, thereby stimulating local consumption and reducing dependence on foreign products. Specifically, to prevent local customers from sourcing outside their jurisdictions, local governments engage in competitive subsidy practices. These subsidies are used as tools to influence the degree of cross-regional cooperation between customer firms and suppliers by adjusting the intensity of subsidies policies. This approach not only restricts the free flow of capital and technology but also discourages knowledge spillovers from local customers to suppliers outside the jurisdiction. Based on these considerations, this paper proposes Hypothesis 4.

Hypothesis 4.

Taking into account the competitive dynamics between local governments, spillovers from customers to suppliers within the same jurisdiction are higher than those from customers to suppliers across different jurisdictions.

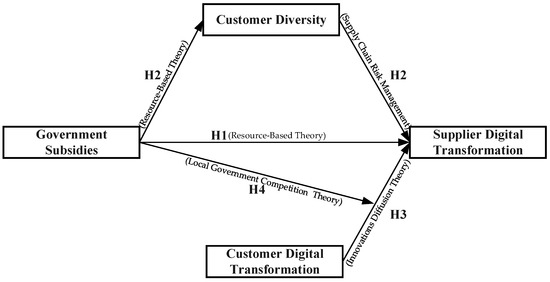

Combining the above, research model constructed in this paper is shown in Figure 1.

Figure 1.

Research Model of Government Subsidies Facilitates Supplier Digital Transformation.

3. Research Design

3.1. Model Construction and Variable Setting

To test the impact of government subsidies on supplier digital transformation, this study constructs the following benchmark model:

In this model, the dependent variable is the digital transformation level of supplier i in year t (). The independent variables include the government subsidies related to digital transformation received by this supplier and the combined digital transformation level of downstream customers (). The term denotes control variables, , and denote year, regional, and industry fixed effects, respectively, and is a randomized disturbance term. Additionally, robust standard errors clustered at the city level are used to control for within-group autocorrelation problems. Model (1) focuses on the coefficients , . If is significantly positive, then it indicates that government subsidies can facilitate supplier digital transformation, thereby validating Hypothesis 1. If is significantly positive, then it indicates that customer digital transformation can facilitate supplier digital transformation, thereby validating Hypothesis 3.

To validate the mechanism of government subsidies on supplier digital transformation, referring to Baron and Kenny [43], this paper constructs the following model:

The mechanisms () of interest in this paper include the degree of customer concentration () and the degree of customer localization (). If and are both significantly positive, then it indicates that government subsidies accelerate supplier digital transformation by promoting the diversification of supplier downstream customer bases, thereby validating Hypothesis 2. In addition, the level of digital transformation is calculated separately for customers located in the same city as the supplier () and for customers located in a different city from the supplier (). If is greater than , then it indicates that spillovers from customers to suppliers within the same jurisdiction are higher than those from customers to suppliers across different jurisdictions, thereby validating Hypothesis 4.

3.2. Variable Selection and Description

3.2.1. Dependent Variable

Supplier Digital Transformation (). Recognizing that digital transformation involves the deep integration of various aspects of supplier production and operations with digital technology, this paper employs text analysis to identify this process, drawing on the studies of Verhoef et al. [44] and Zhai et al. [45]. By calculating the frequency of keywords indicative of “digital transformation” in annual reports, we construct a detailed depiction of the suppliers’ level of digital transformation. Given the right-skewed distribution of keyword frequencies, we use the natural logarithm of the sum of keyword frequencies after adding 1 to measure the level of digital transformation. This approach, while leveraging the advantage of internal information through active supplier disclosure, is susceptible to the influences of capital market dynamics and industrial policies, potentially leading to discrepancies between reported and actual digital transformation levels. To complement this, we also refer to Geng et al. [46] and examine digital intangible assets disclosed in financial statements. We measure the level of digital transformation by the ratio of digital intangible assets to the total intangible assets of the supplier. This method is grounded in accounting and financial reporting standards, making it less prone to manipulation and providing a more accurate reflection of the enterprise’s comprehensive benefits. Consequently, this dual approach mitigates the overestimation risk inherent in text analysis, offering a balanced and realistic assessment of the digital transformation levels within enterprises.

3.2.2. Independent Variable

Government Subsidies: Annual reports disclose the specific amount of each subsidy program received by the supplier. Established research typically measures government subsidy intensity by aggregating all subsidies, which may include those unrelated to digital transformation. However, different types of subsidies yield inconsistent effects. Therefore, this study screens for digital transformation subsidies by identifying specific keywords in the project names or breakdowns of government grants in the notes to the firm’s financial statements. Given the significant variation in how listed enterprises standardize the disclosure of subsidy information, some enterprises may name the subsidy project based on digital technology or its practical application, while others may use the policy objectives of the project. To address this, two types of keywords are used for identification.

The first category of keywords is related to subsidy functions, including “Service industry transformation”, “Strategic emerging industries”, “Modern information service”, “Enterprise informatization”, “Industry transformation”, “Industrial economic upgrading”, “New industrialization”, “Industrial upgrading”, “Industrial transformation” and so on. The second category of keywords pertains to digital technology and its practical applications. The “PatSnap” patent database (https://www.zhihuiya.com accessed on 1 July 2022) categorizes each patent by its technical subject and application field (For example, the technical subjects of artificial intelligence include “Convolutional neural network”, “Computer vision”, “Pattern perception”, “Reinforcement learning”, “Knowledge mapping”, “Natural language processing” and so on; The applications of artificial intelligence include “Medical automation diagnosis”, “Location-based services”, “Selective content distribution”, “Natural language translation” and so on). Here, the technical subject illustrates the core content of the underlying technology, while the application field delineates the specific scenarios where this technology is applied. Using keywords such as “Big Data”, “Artificial Intelligence”, “Cloud Computing”, “Blockchain”, “Internet of Things”, “Virtual Reality”, and “Quantum Communication” in patent titles or abstracts to search for relevant patents, and using Python to write a web crawler program to obtain specific information of each patent so as to construct a “Digital Technology and Practical Applications” dictionary.

Customer Digital Transformation (). Given that each supplier corresponds to multiple customers annually, the dataset is constructed in the format of “Supplier-Year-Customer-Proportion of the supplier’s sales to the customer relative to the total sales of the year—Whether supplier and customer are in the same city—Customer Digitization Transformation Level”. Subsequently, using “Supplier-Year” as the grouping variable, the digitization levels of customers are weighted and summed according to the proportion of sales to each customer within the group. This calculation results in a combined value representing the digitization level of downstream customers. Further, by using “Supplier-Year-Whether supplier and customer are in the same city” as the grouping variable and applying the same weighted summation method, the digital transformation level of customers located in the same city as the supplier () and those located in different cities from the supplier () can be calculated.

3.2.3. Mechanism Variables

Degree of Customer Concentration: A high degree of customer concentration is indicated when a supplier’s main sales revenue is derived from a small number of customers, reflecting a high dependence on these few customers. Conversely, a supplier that sells products or provides services to a larger number of customers on average demonstrates a diversified customer structure, corresponding to a low degree of customer concentration. Therefore, the degree of customer concentration can be measured using the proportion of the supplier’s sales to the top five customers for the year as a percentage of total annual sales.

Degree of Customer Localization: A high degree of customer localization is indicated when a supplier’s main sales revenue comes from local customers, reflecting a high dependence on the local market. Conversely, a supplier that sells its products or provides services to a broader range of markets outside its jurisdiction demonstrates geographical diversification of customers, corresponding to a low degree of customer localization. The degree of customer localization is measured using the proportion of the supplier’s sales to local firms among the top five customers as a percentage of total annual sales.

3.2.4. Control Variables

To eliminate the influence of confounding factors, referring to the existing literature [46,47,48,49], a series of control variables were added, including supplier age, supplier size, supplier ownership, Tobin’s Q, net profit margin of total assets, growth rate of total assets, financing constraints, proportion of independent directors, degree of checks and balances on equity, etc. Year, region and industry fixed effects are also introduced to exclude the effects of unobservable factors at all levels. Table 1 lists the definitions of the main variables.

Table 1.

Definition of variables.

3.3. Data Sources and Descriptive Statistics

This study selects China’s A-share listed companies from 2010 to 2021 as a research sample. Financial indicators, upstream and downstream purchasing and sales data are obtained from the CSMAR database, and the text of “Management’s Discussion and Analysis”, which measures the digitization level of enterprises, is obtained from the China Research Data Service Platform (CNRDS). In the event of missing textual information, it will be supplemented by visiting the websites of Shanghai and Shenzhen Stock Exchanges and reviewing the relevant annual reports. In instances of missing textual information, supplementation is achieved through the examination of the Shanghai and Shenzhen Stock Exchange websites, along with the relevant annual reports. Following the acquisition of raw data, the subsequent steps were undertaken for processing. Considering the special characteristics of the financial industry, samples whose suppliers or customers belong to the industry are excluded. To minimize data bias resulting from the absence of information in the annual reports of non-listed enterprises, only samples where both suppliers and customers are listed enterprises were retained. Samples with missing or abnormal key variables were excluded, as well as those with a listing status of ST and *ST in the current year. As a consequence of these procedures, 2197 observations were obtained. The descriptive statistical results of the main variables are presented in Table 2.

Table 2.

Descriptive statistics for variables.

4. Analysis of Empirical Results

4.1. Benchmark Regression Analysis

Table 3 reports the results of the baseline regression. The regression results are consistent between the two methods, controlling for region, year, and industry. The results of Method 1 are illustrated below. The regression coefficient of government subsidies in column (1) is 0.012 and significant at the 1% level, implying that government subsidies increase the level of suppliers’ digital transformation. Column (2) further controls for the digital transformation level of downstream customers, with a regression coefficient of 0.412, also significant at the 1% level, implying that downstream customers’ digital transformation can promote suppliers’ digital transformation. These results support the validity of Hypotheses 1 and 3.

Table 3.

Impact of Government Subsidies on Supplier Digital Transformation.

4.2. Endogeneity Test

4.2.1. Replacement of Dependent Variable

① Construct a dictionary from the four dimensions of “modern information systems”, “digital technology application”, “intelligent manufacturing”, and “Internet business models”. The logarithm of the sum of keyword frequencies is taken to obtain the indicators under the new dictionary measure. ② Standardize the number of digital transformation keywords calculated in Method 1 by dividing by the total vocabulary of the annual reports. ③ Match the main classification numbers of listed companies’ patents with the “Statistical Classification of the Digital Economy and its Core Industries (2021)”, screen out patent activities related to the digital economy, and take the logarithm of the sum of digital patents to measure the enthusiasm of enterprises in promoting the digitalization process.

The regression results are shown in Appendix A. The regression coefficients for government subsidies and customer digital transformation levels remain positive and significant at least at the 5% level, consistent with the benchmark regression results.

4.2.2. Controlling for Reverse Causation

① This study re-estimates the regression using the one-period lagged government subsidy as the independent variable. ② The average value of government subsidies within the same city and industry is selected as the instrumental variable for government subsidies in a two-stage least squares (2SLS) regression. Firstly, local governments proactively implement subsidy measures to align with central industrial policies, thus selecting and supporting suppliers in different industries based on central policy directions. Secondly, local government subsidies typically originate from their fiscal revenues, which vary according to the economic development level of different regions. Therefore, using the average government subsidy within the same city and industry as an instrumental variable effectively reflects the level of policy support for a specific industry in a specific region. This instrumental variable theoretically has no direct connection to the supplier’s level of digital transformation but is closely related to the potential government subsidies the supplier may receive, thereby meeting the basic requirements of an instrumental variable. ③ Firstly, a probability model is established to predict the likelihood of suppliers receiving government subsidies. Then, the inverse Mills ratio for the suppliers is calculated. Finally, this ratio is incorporated into the baseline regression model for re-estimation of the coefficients.

The regression results are shown in Appendix B. After including the one-period lagged government subsidy in the model, the coefficient for this variable remains significantly positive. The validity test statistics for the instrumental variable indicate that there are no issues with weak instruments or under-identification, and its regression coefficient also remains significantly positive. Additionally, after controlling for the inverse Mills ratio, the regression coefficient for government subsidies remains significantly positive.

4.2.3. Omitted Variable Issue

① If suppliers have already obtained critical knowledge and resources on effectively implementing digital transformation through their social networks, this may prompt them to adopt digital transformation measures earlier. When such suppliers receive government subsidies because they appear more “well-prepared”, it may misleadingly suggest that their digital transformation success is primarily due to government subsidies. Considering the influence of supplier social networks, relevant characteristic variables are added, including independent director network centrality, institutional investor shareholding ratio, whether the supplier holds bank shares, and whether the actual controller of the enterprise controls multiple companies. ② Although year, region, and industry fixed effects have been controlled, specific events occurring in certain regions or industries in particular years may still not be fully captured. Therefore, this study adds interaction fixed effects between industry and year, as well as region and year.

The regression results are shown in Appendix C. After adding the characteristic variables reflecting supplier social networks, the regression coefficients for government subsidies and customer digital transformation levels remain significantly positive. Further controlling for the interaction fixed effects, the magnitude and significance of the core explanatory variables’ coefficients did not change substantially.

4.3. Robustness Test

4.3.1. Excluding the Influence of Central Policies

In 2018, the Ministry of Commerce, along with eight other departments, jointly initiated the “Supply Chain Innovation and Application Pilot” program to promote the development of industrial supply chain systems. Consequently, supplier digital transformation may be influenced by central policies. To accurately assess the true effect of local government subsidies, this study excludes enterprises (When either the supplier or the customer is included in the pilot list, this record is eliminated from the sample) and cities (When either the supplier or the customer is located in a pilot city, this record is eliminated from the sample) included in the pilot list from the sample starting from the pilot year and onwards, then re-examines the data. The regression results, shown in Appendix D, indicate that the regression coefficients for government subsidies and customer digital transformation levels remain significantly positive, supporting the fundamental conclusions of this paper.

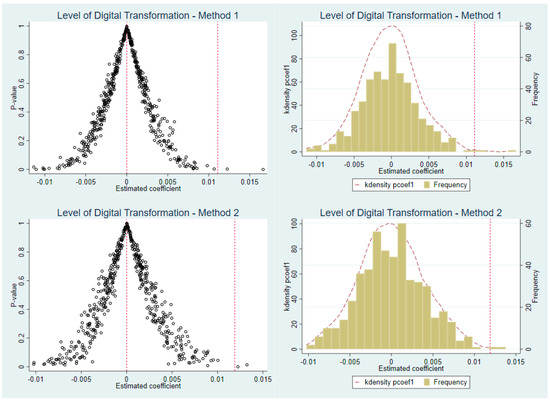

4.3.2. Propensity Score Matching and Placebo Tests

① The sample is divided into a treatment group and a control group based on whether the supplier receives government subsidies. The control variables mentioned earlier are selected as matching covariates, and 1:5 nearest neighbor matching within a 0.05 caliper is employed. The matched treatment and control groups satisfy the common support assumption, and the mean values of covariates in both groups show no significant differences, meeting the balance requirement. ② If it is other unobserved confounding factors that increase the level of supplier digital transformation, then randomly matching government subsidies with suppliers and re-testing, the increase in government subsidies still promotes the digital transformation of firms. Conversely, if there is no such effect, the role of other potential confounding factors can be ruled out.

The results are shown in Appendix E. Re-testing the relationships between variables based on the matched sample, the regression coefficients for government subsidies and customer digital transformation levels remain significantly positive. Additionally, this study conducts 500 placebo tests, and the estimated coefficients for government subsidies measured by both methods in the baseline regression are located to the left of the 5th percentile of the placebo test coefficient distribution. This indicates that it is almost impossible to obtain the baseline regression results through random matching. The sample obtained through random matching does not reflect the impact of government subsidies on supplier digital transformation. Therefore, the hypothesis that other potential unobserved factors improve the level of supplier digital transformation is not supported.

4.3.3. Annual Report Information Disclosure Issues

The level of digital transformation measured by Method 1 is based on the number of keywords extracted from annual report text, which may be influenced by annual report information disclosure issues. Therefore, this study employs the following three methods for verification. ① Exclude national and provincial high-tech suppliers from the sample. The business activities of high-tech suppliers are highly related to digital transformation keywords, potentially leading to an overestimation of their level of digital transformation. ② Exclude suppliers penalized by the China Securities Regulatory Commission (CSRC) or stock exchanges to reduce analysis bias caused by potential misconduct, such as exaggerating or manipulating data in annual report disclosures. ③ Exclude suppliers deemed unqualified in information disclosure evaluations by the Shenzhen Stock Exchange, as these suppliers are more likely to manipulate annual report text information.

The results, shown in Appendix F, indicate that under different sample screening schemes, the regression coefficients for government subsidies and customer digital transformation levels remain significantly positive, supporting the basic conclusions of this study.

4.4. Influence Mechanism Test

Table 4 shows the results of the mechanism test (The complete regression results are shown in Appendix G). Columns (1) to (3) report the mechanism test results of how government subsidies accelerate supplier digital transformation by promoting the diversification of their downstream customer structure. Under both measurement methods, the regression coefficients of customer concentration on the level of supplier digital transformation are significantly negative at the 5% level, and the regression coefficient of government subsidies on customer concentration is significantly negative at the 10% level. This indicates that increased customer concentration negatively impacts supplier digital transformation, but government subsidies can reduce supplier customer concentration.

Table 4.

Mechanism test.

Columns 4 to 6 report the mechanism test results of how government subsidies accelerate supplier digital transformation by promoting the geographical diversification of their downstream customers. Under both measurement methods, the regression coefficients of customer localization on the level of supplier digital transformation are significantly negative at the 10% level, and the regression coefficient of government subsidies on customer localization is also significantly negative at the 10% level. This indicates that increased customer localization negatively impacts supplier digital transformation, but government subsidies can reduce the degree of customer localization. These results support the validity of Hypotheses 2.

Furthermore, by comparing the regression coefficients of the digital transformation level of local customers () with that of non-local customers (), it is found that, under different mechanisms and measurement methods, the regression coefficients of are consistently higher than those of . This indicates that the spillover effects within the same region are higher than those across regions, thus validating Hypothesis 4.

4.5. Heterogeneity Analysis

The effects of government subsidies and customer spillover may vary due to differences in the internal and external environments of suppliers, and exploring these variations has significant practical implications. On one hand, mechanism analysis indicates that government subsidies accelerate supplier digital transformation by promoting the diversification of downstream customers. However, external risk shocks can also impact supply chain configurations [51]. External risks include opportunistic risks and systemic risks; the former is related to the supplier’s market position and industry competition intensity, while the latter is related to the duration and scope of major unexpected events. Generally, the higher the opportunistic risk, the more pronounced the effect of government subsidies, whereas the higher the systemic risk, the more limited the effect of government subsidies. On the other hand, combining the innovation diffusion theory, scholars have found that the effectiveness of innovation diffusion reception is mainly influenced by factors such as enterprise human capital and technological proximity [6,52]. Specifically, the higher the supplier’s human capital and the smaller the “digital divide” between suppliers and customers, the better the supplier’s reception of innovation diffusion. To test these hypotheses, the sample is grouped according to relevant characteristic variables, and the differences in regression coefficients between groups are compared. The complete regression results are shown in Appendix H.

4.5.1. Opportunistic Risk

Market-dominant suppliers are those that hold a leading position in the market, possessing high bargaining power within the supply chain. This allows them to ensure stable product sales, thereby reducing the likelihood of opportunistic behavior. However, when competition within the supplier’s industry intensifies, downstream customers have more alternative trading partners, weakening the supplier’s control over its customers. This also makes downstream customers more prone to engaging in opportunistic behavior. This study uses market share (Supplier market share is equal to the ratio of that supplier’s sales revenue to the total sales revenue of all suppliers in the same industry) to measure a supplier’s market dominance and divides the sample into high market dominance and low market dominance groups based on the median market share for each year. The Herfindahl-Hirschman Index (HHI) (The ratio of each supplier’s sales revenue in the industry to the industry’s total sales revenue is first calculated and then squared and totaled) is utilized to measure industry competition intensity, and the sample is divided into low competition intensity and high competition intensity groups based on the median HHI for each year. The grouped regression results are shown in Table 5. Compared to suppliers with high market dominance, government subsidies more significantly promote digital transformation in suppliers with low market dominance. Similarly, compared to industries with low competition intensity, government subsidies more significantly promote digital transformation in suppliers within highly competitive industries. Therefore, for suppliers facing higher opportunistic risk, the effect of government subsidies is more pronounced.

Table 5.

Heterogeneity analysis of opportunistic risk.

4.5.2. Systemic Risk

The sudden outbreak of the U.S.-China trade war provides an opportunity to study the heterogeneity of the impact of government subsidies on supplier digital transformation under different levels of systemic risk. In March 2018, the United States announced the first list of tariffs on Chinese imports, marking the beginning of the U.S.-China trade war. Due to its long duration and wide scope, this event increased the uncertainty of the business environment faced by enterprises and destabilized commercial relationships within the supply chain. Therefore, the period before 2018 is classified as the low systemic risk sample, while the period from 2018 onwards is classified as the high systemic risk sample. The grouped regression results are shown in Table 6. When suppliers face lower systemic risk, government subsidies significantly promote their digital transformation. However, when suppliers face higher systemic risk, the effect of government subsidies is not as pronounced. In a high systemic risk environment, suppliers not only deal with their own operational pressures but also face multiple challenges such as supply chain disruptions, raw material shortages, and shrinking market demand. Government subsidies alone are insufficient to fully offset these impacts.

Table 6.

Heterogeneity analysis of systemic risk.

4.5.3. Human Capital

This study measures the level of human capital in suppliers by the proportion of employees with a bachelor’s degree or higher to the total number of employees. Based on the median human capital level for each year, the sample is divided into low human capital and high human capital groups. The grouped regression results are shown in columns 1 to 4 of Table 7. When the level of human capital in suppliers is high, customer digital transformation significantly promotes supplier digital transformation. Conversely, when the level of human capital in suppliers is low, customer digital transformation does not significantly promote supplier digital transformation. These results collectively indicate that customer digital transformation generates more significant spillover effects for suppliers with higher human capital.

Table 7.

Heterogeneity analysis of human capital and digital divide.

4.5.4. Digital Divide

The OECD defines the digital divide as the significant gap in access to information and communication technologies and the use of the internet among individuals, businesses, and geographic regions across different socio-economic levels. Based on this concept, the digital divide in this study specifically refers to the gap in digital transformation levels between upstream and downstream enterprises in the supply chain. This study measures the size of the digital divide by the absolute difference in digital transformation levels between suppliers and customers. Based on the median digital divide for each year, the sample is divided into low digital divide and high digital divide groups. The grouped regression results are shown in columns 5 to 8 of Table 7. When the digital divide is large, customer digital transformation does not significantly promote supplier digital transformation. Conversely, when the digital divide is small, customer digital transformation significantly promotes supplier digital transformation. These results collectively indicate that customer digital transformation generates more significant spillover effects for suppliers with a smaller digital divide.

4.6. Further Analysis: Externalities of Government Subsidies

Each customer corresponds to multiple suppliers, and each local government, in order to compete for the customer and make the customer purchase from its own jurisdiction, would indirectly influence the downstream customer’s business decision-making behavior through subsidies to local suppliers, so this study mainly focuses on the degree of supplier concentration and the degree of supplier localization (The supplier concentration of customer is measured by the proportion of purchases from the customer’s top 5 suppliers for the year to the total annual purchases, and the supplier localization of customer is measured by the proportion of purchases from local listed companies among the customer’s top 5 suppliers for the year to the total annual purchases). The dataset is constructed in the format: “Customer-Year-Supplier-Whether Customer and Supplier Are in the Same City- Proportion of customer’s purchases from the supplier to its total annual purchases-Government Subsidies Received by the Supplier”. Using “Customer-Year-Whether Customer and Supplier Are in the Same City” as the grouping variable, government subsidies received by suppliers are weighted by the percentage of purchases within each group and then divided by the sum of the percentage of purchases to obtain the subsidy intensity per unit of purchase. This standardized indicator allows for cross-regional comparisons. Following these steps, a final sample of 1355 observations was obtained. The subsidy intensity received by upstream suppliers located in the same city as the customer is denoted as , and the subsidy intensity received by upstream suppliers located in different cities from the customer is denoted as . Regression equations for and with and are established respectively, with relevant control variables included, as shown below. The complete regression results can be found in Appendix I.

Columns (1) and (2) of Table 8 report the effect of the intensity of government subsidies received by upstream suppliers on the degree of supplier localization of customers. The regression coefficients for are significantly positive at the 1% level, while the regression coefficients for are significantly negative at least at the 5% level. This indicates that increasing the subsidy intensity for upstream suppliers located in the same city as the customer can enhance the degree of supplier localization of customers. Conversely, increasing the subsidy intensity for upstream suppliers located in different cities from the customer can reduce the degree of supplier localization of customers. This implies that local governments within and outside the jurisdiction engage in subsidy competition around customers. By adjusting the intensity of subsidy policies, local governments influence the cross-regional cooperation between customers and suppliers.

Table 8.

Impact of government subsidies received by suppliers on customer behavior.

Columns (3) and (4) of Table 8 report the effect of the intensity of government subsidies received by upstream suppliers on the supplier concentration of downstream customers. The regression coefficients for and are all significantly negative at the 1% level. This indicates that increasing the intensity of upstream supplier subsidies reduces the supplier concentration of customers, regardless of whether the suppliers and customers are in the same city. Therefore, government subsidies optimize the customer’s supply chain structure by stimulating competition among upstream suppliers, enabling customers to choose partners from a more diversified group of suppliers. Lower supplier concentration not only improves customers bargaining power in the supply chain but also reduces potential supply risks and enhances their resilience to market volatility.

Combining the results of the above analyses, it can be concluded that local government subsidies to upstream suppliers lead to an increase in supplier localization for local customers while reducing supplier concentration for local customers. This results in supplier diversification within the region, thereby hindering cross-regional spillover effects.

5. Discussion

This study provides important insights into the role of government subsidies. On one hand, government subsidies play a crucial role in accelerating the digital transformation of suppliers by facilitating the diversification of their downstream customer base. Traditional literature, grounded in resource-based theory and signal transmission theory, emphasizes the function of government subsidies in providing financial support to suppliers while reducing information asymmetry between suppliers and investors [53,54,55]. In contrast, this paper investigates the role of government subsidies as a competitive instrument. Beyond attracting foreign investment and skilled personnel [8,9,10], these subsidies also protect local economic interests by incentivizing local suppliers to increase customer diversity. The negative impact of customer concentration on suppliers’ risk-taking, external financing, innovation, and CSR performance has been extensively explored in the literature [38,56,57,58]. Similarly, customer concentration poses operational and financial risks for suppliers, making it challenging for them to assume the additional risks associated with digital transformation, thereby delaying this process. Our empirical findings confirm the facilitating effect of customer diversification on supplier digital transformation. This insight clarifies the mechanisms through which government subsidies operate, thereby enriching the conventional theoretical understanding of government subsidies and underscoring their competitive attributes in dynamic market environments.

On the other hand, while customer digital transformation can significantly promote supplier digital transformation, the spillover effects are markedly stronger within the same region than across different regions. Although the existing literature has increasingly focused on the drivers of enterprise digital transformation—primarily from the perspectives of organizational characteristics, resource investment, and government financial and tax support [4,59,60]—the role of customers within the supply chain has received insufficient attention. The transformative impact of customer digital transformation on production methods and value creation processes disseminates along the supply chain, thereby providing essential external support for the digital transformation of upstream suppliers. Further analysis reveals that local government subsidies directed towards upstream suppliers lead to increased supplier localization for local customers, consequently hindering the cross-regional spillover effects of customer digital transformation. While previous studies have concentrated on local governments protecting firms within their jurisdictions through mechanisms such as taxing foreign firms or imposing administrative barriers [61,62], this paper demonstrates that local governments may employ more subtle strategies, such as adjusting the intensity of upstream subsidies, to influence the degree of cross-regional cooperation between customers and suppliers. As a result, local government competition contributes to reduced levels of digital collaboration in cross-regional supply chains.

Moreover, as the risk of opportunism increases, the positive impact of government subsidies on supplier digital transformation becomes more pronounced. Conversely, when systemic risk escalates, the effectiveness of these subsidies is notably constrained. Previous studies have indicated that excessive reliance on a limited number of major customers can expose suppliers to demand shocks, unfavorable contract modifications, higher switching costs, and diminished bargaining power [34]. In environments characterized by heightened opportunistic risks, suppliers are more likely to utilize government subsidies to diversify their supply chain configurations, thereby facilitating a more substantial digital transformation. However, when systemic risk emerges, it tends to sequentially impact all parties within the supply chain, undermining existing collaborative relationships [63]. Under such circumstances, even with government subsidies, suppliers may adopt a conservative approach to safeguard their current operations. Finally, the effectiveness of innovation diffusion is significantly influenced by the level of suppliers’ human capital and the extent of the digital divide between suppliers and customers. This finding aligns with existing literature, which emphasizes that greater technological similarity among firms within the supply chain promotes more efficient resource sharing and knowledge diffusion [5,52,64].

Expanding further, government subsidies not only facilitate digital transformation but also play a vital role in advancing sustainable development goals. By promoting digital adoption, these subsidies help suppliers optimize resource utilization, reduce waste, and implement more energy-efficient processes, thereby contributing to environmental sustainability. However, due to the influence of local government competition, subsidies can restrict the spillover effects of customer digital transformation across jurisdictions, hindering collaborative transformation within cross-regional supply chains. This may also reduce transparency and collaboration, making it challenging to establish resilient and adaptive networks capable of responding to dynamic market demands. Therefore, this study underscores the dual role of government subsidies as a double-edged sword in promoting sustainable development.

6. Conclusions

To promote sustainable development, policymakers must acknowledge the dual role of government subsidies. While reinforcing the positive impact of government subsidies on the digital transformation of suppliers, it is important to mitigate the negative impact of local government competition. Therefore, policies should aim to establish a balanced subsidy framework that not only fosters innovation and digital adoption but also enhances transparency, collaboration, and knowledge-sharing across regions. Based on this perspective, this study offers the following recommendations to maximize the role of government subsidies in promoting sustainable development.

First, local governments should establish innovation funds to support cooperative R&D and market research activities, which will enhance product development and market comprehension, thereby enabling suppliers to devise effective market entry strategies. Additionally, subsidy policies should account for the synergistic benefits within upstream and downstream supply chains. Implementing a cross-regional data-sharing platform and a coordination committee will facilitate unified subsidy strategies, promote resource sharing, and address issues effectively, ensuring alignment with broader strategic goals. Furthermore, subsidies should be tailored to market dynamics, with targeted financial support and independent third-party oversight being essential for suppliers with low market dominance and high industry competition. Establishing a risk-sharing mechanism and providing specialized subsidies for training initiatives will foster innovation diffusion and help bridge the digital divide. This comprehensive approach will significantly enhance digital transformation across the entire supply chain.

7. Limitations and Future Research

This study has some limitations that deserve future inquiry. First, a significant gap lies in the lack of analysis regarding the differing effects of various digital transformation subsidies, such as those aimed at skills training versus hiring digital experts. Future research should address these distinctions to enhance understanding of how specific subsidy types influence the digital transformation process. Second, the complexity and broad scope of digital transformation result in the absence of a universally accepted measurement index. Although the digital transformation index developed in this study serves as a relatively effective tool for assessing transformation levels and efforts have been made to compile a comprehensive thesaurus, precise measurement of enterprise digital transformation remains an area for further exploration. Third, incomplete disclosure of information by listed companies concerning their customers or suppliers may obscure critical insights. While reviewing annual reports and official websites helps mitigate this bias, comprehensive information on supply chain companies remains limited and requires further improvement.

Author Contributions

Conceptualization, X.H. and X.C.; methodology, X.H.; formal analysis, X.H. and X.C.; investigation, X.H. and X.C.; data curation, X.H.; writing—original draft preparation, X.H. and X.C.; writing—review and editing, X.H., X.C. and F.W.; visualization, X.H. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data are available from authors upon reasonable request.

Acknowledgments

We would like to thank the anonymous reviewers for their careful reading of our manuscript and their many helpful comments and suggestions.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A. Replacement of Dependent Variable

Table A1.

Regression results under different substitution methods.

Table A1.

Regression results under different substitution methods.

| (1) | (2) | (3) | ||||

|---|---|---|---|---|---|---|

| (①) | (②) | (③) | ||||

| (①) | 0.188 *** | (3.88) | ||||

| (②) | 0.033 *** | (3.57) | ||||

| (③) | 0.055 ** | (2.17) | ||||

| Government Subsidies | 0.019 *** | (3.65) | 0.248 *** | (3.33) | 0.007 * | (1.85) |

| Supplier age | −0.015 * | (−1.79) | −0.014 | (−0.07) | −0.018 ** | (−1.98) |

| Supplier size | 0.184 *** | (5.73) | 1.534 ** | (2.41) | 0.172 *** | (7.73) |

| Supplier ownership | 0.291 *** | (3.56) | 4.341 ** | (2.51) | 0.081 | (0.91) |

| Tobin’s Q | −0.013 | (−0.51) | 2.711 * | (1.77) | 0.038 ** | (2.15) |

| Net profit margin of total assets | 1.312 *** | (3.24) | −14.121 | (−0.91) | 0.806 *** | (3.09) |

| Growth rate of total assets | 0.063 ** | (2.46) | 0.644 | (0.96) | 0.019 | (0.51) |

| Financing constraints | 0.008 | (0.16) | 1.131 ** | (1.98) | 0.009 | (0.42) |

| Proportion of independent directors | 1.016 ** | (2.06) | 12.851 * | (1.78) | −0.161 | (−0.59) |

| Degree of checks and balances on equity | 0.117 ** | (2.33) | 2.970 *** | (2.70) | −0.045 | (−0.76) |

| Constant | −0.565 | (−1.18) | −24.766 ** | (−2.20) | −0.572 * | (−1.84) |

| Observations | 2197 | 2197 | 2197 | |||

| City FE | YES | YES | YES | |||

| Year FE | YES | YES | YES | |||

| Industry FE | YES | YES | YES | |||

| Adj. R-squared | 0.375 | 0.221 | 0.289 | |||

Note: ***, **, and * indicate significance at the 1%, 5%, and 10% statistical levels, respectively; values in parentheses are city-level clustering robustness t-statistics.

Appendix B. Controlling for Reverse Causation

Table A2.

Regression results under different endogeneity control methods.

Table A2.

Regression results under different endogeneity control methods.

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

(Method 1) | (Method 2) | (Method 1) | (Method 2) | (Method 1) | (Method 2) | |

| (Method 1) | 0.409 *** | 0.412 *** | 0.413 *** | |||

| (4.58) | (4.56) | (4.60) | ||||

| (Method 2) | 0.505 ** | 0.501 ** | 0.500 ** | |||

| (2.01) | (1.99) | (1.99) | ||||

| One-period lagged government subsidy | 0.010 ** | 0.008 ** | ||||

| (2.50) | (2.60) | |||||

| Instrumental variable | 0.012 *** | 0.013 *** | ||||

| (2.70) | (2.67) | |||||

| Heckman | 0.012 *** | 0.011 *** | ||||

| (3.46) | (3.24) | |||||

| Inverse Mills ratio | −1.280 ** | −0.515 | ||||

| (−2.11) | (−1.03) | |||||

| Supplier age | −0.001 | −0.011 | −0.001 | −0.011 | 0.012 | −0.006 |

| (−0.13) | (−1.29) | (−0.06) | (−1.23) | (1.16) | (−0.55) | |

| Supplier size | 0.110 *** | 0.069 ** | 0.110 *** | 0.067 *** | 0.041 | 0.041 |

| (3.05) | (2.55) | (3.28) | (2.61) | (1.02) | (1.17) | |

| Supplier ownership | 0.192 ** | 0.172 ** | 0.192 ** | 0.170 ** | 0.050 | 0.114 |

| (2.36) | (2.16) | (2.40) | (2.17) | (0.51) | (1.47) | |

| Tobin’s Q | 0.047 * | 0.127 ** | 0.049 ** | 0.129 ** | 0.058 ** | 0.133 ** |

| (1.88) | (2.06) | (1.99) | (2.09) | (2.33) | (2.17) | |

| Net profit margin of total assets | 0.869 ** | −1.126 | 0.864 ** | −1.140 | 0.586 | −1.247 * |

| (2.49) | (−1.60) | (2.46) | (−1.63) | (1.65) | (−1.78) | |

| Growth rate of total assets | −0.000 | −0.021 | −0.009 | −0.028 | 0.019 | −0.017 |

| (−0.01) | (−0.96) | (−0.40) | (−1.30) | (0.77) | (−0.66) | |

| Financing constraints | 0.003 | 0.026 | 0.002 | 0.024 | −0.029 | 0.012 |

| (0.11) | (0.97) | (0.07) | (0.88) | (−0.90) | (0.48) | |

| Proportion of independent directors | 0.748 * | 0.293 | 0.716 * | 0.246 | −0.168 | −0.094 |

| (1.83) | (0.93) | (1.81) | (0.77) | (−0.31) | (−0.19) | |

| Degree of checks and balances on equity | 0.119 ** | 0.048 | 0.121 ** | 0.050 | 0.143 *** | 0.059 |

| (2.45) | (0.99) | (2.50) | (1.05) | (2.68) | (1.24) | |

| Constant | −1.096 ** | −0.592 | 0.681 | 0.113 | ||

| (−2.03) | (−1.23) | (0.76) | (0.14) | |||

| Observations | 2197 | 2197 | 2197 | 2197 | 2195 | 2195 |

| Region FE | YES | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES | YES |

| Industry FE | YES | YES | YES | YES | YES | YES |

| Kleibergen-Paap rk LM statistic | 80.515 *** | 80.245 *** | ||||

| Kleibergen-Paap rk Wald F statistic | 8834.100 | 8615.792 | ||||

| Adj. R-squared | 0.347 | 0.112 | 0.0349 | 0.0066 | 0.350 | 0.114 |

Note: ***, **, and * indicate significance at the 1%, 5%, and 10% statistical levels, respectively; values in parentheses are city-level clustering robustness t-statistics.

Appendix C. Omitted Variable Issue

Table A3.

Regression results after adding control variables.

Table A3.

Regression results after adding control variables.

| (1) | (2) | (3) | (4) | |||||

|---|---|---|---|---|---|---|---|---|

| (Method 1) | (Method 1) | (Method 1) | (Method 2) | |||||

| (Method 1) | 0.412 *** | (4.28) | 0.440 *** | (4.57) | ||||

| (Method 2) | 0.501 ** | (2.04) | 0.499 ** | (2.05) | ||||

| Government Subsidies | 0.011 *** | (3.09) | 0.011 *** | (2.99) | 0.017 *** | (4.10) | 0.016 *** | (2.69) |

| Supplier age | −0.005 | (−0.55) | −0.012 | (−1.38) | −0.002 | (−0.20) | −0.014 | (−1.25) |

| Supplier size | 0.113 *** | (3.05) | 0.067 ** | (2.43) | 0.098 * | (1.89) | 0.088 ** | (2.09) |

| Supplier ownership | 0.188 ** | (2.39) | 0.151 * | (1.86) | 0.189 ** | (2.18) | 0.160 | (1.48) |

| Tobin’s Q | 0.048 * | (1.94) | 0.124 * | (1.92) | 0.034 | (1.07) | 0.148 | (1.60) |

| Net profit margin of total assets | 0.913 *** | (2.69) | −1.079 | (−1.50) | 1.226 *** | (2.66) | −1.153 | (−1.40) |

| Growth rate of total assets | 0.014 | (0.58) | −0.018 | (−0.89) | 0.064 * | (1.79) | 0.019 | (0.53) |

| Financing constraints | 0.004 | (0.13) | 0.023 | (0.91) | 0.613 | (1.13) | 0.884 | (1.51) |

| Proportion of independent directors | 0.623 | (1.54) | 0.178 | (0.58) | 0.528 | (1.18) | −0.042 | (−0.09) |

| Degree of checks and balances on equity | 0.114 ** | (2.52) | 0.047 | (0.95) | 0.136 *** | (2.62) | 0.040 | (0.69) |

| Independent director network centrality | 0.061 | (0.89) | −0.015 | (−0.25) | 0.113 | (1.42) | 0.021 | (0.30) |

| Institutional investor shareholding ratio | −0.001 *** | (−2.88) | −0.001 ** | (−2.58) | −0.001 *** | (−2.69) | −0.001 ** | (−2.09) |

| whether the supplier holds bank shares | −0.008 | (−0.12) | −0.089 | (−1.51) | −0.034 | (−0.44) | −0.123 | (−1.47) |

| whether the actual controller of the enterprise controls multiple companies | −0.006 | (−0.08) | −0.024 | (−0.46) | 0.042 | (0.48) | −0.062 | (−1.00) |

| Constant | −0.960 ** | (−2.08) | −0.336 | (−0.67) | −0.337 | (−0.66) | 0.450 | (0.76) |

| Observations | 2080 | 2080 | 1943 | 1943 | ||||

| Region FE | YES | YES | YES | YES | ||||

| Year FE | YES | YES | YES | YES | ||||

| Industry FE | YES | YES | YES | YES | ||||

| Industry×Year | YES | YES | ||||||

| Region×Year | YES | YES | ||||||

| Adj. R-squared | 0.346 | 0.110 | 0.342 | 0.005 | ||||

Note: ***, **, and * indicate significance at the 1%, 5%, and 10% statistical levels, respectively; values in parentheses are city-level clustering robustness t-statistics.

Appendix D. Excluding the Influence of Central Policies

Table A4.

Regression results after deletion of pilot cities and pilot enterprises.

Table A4.

Regression results after deletion of pilot cities and pilot enterprises.

| (1) | (2) | (3) | (4) | |||||

|---|---|---|---|---|---|---|---|---|

| (Method 1) | (Method 1) | (Method 2) | (Method 2) | |||||

| (Method 1) | 0.441 *** | (4.96) | 0.415 *** | (4.62) | ||||

| (Method 2) | 0.534 ** | (2.05) | 0.660 * | (1.72) | ||||

| Government Subsidies | 0.012 *** | (3.38) | 0.011 *** | (3.20) | 0.012 *** | (3.23) | 0.011 *** | (2.64) |

| Supplier age | −0.002 | (−0.25) | −0.012 | (−1.26) | −0.003 | (−0.39) | −0.015 * | (−1.81) |

| Supplier size | 0.110 *** | (3.24) | 0.071 *** | (2.70) | 0.083 *** | (2.90) | 0.050 ** | (2.44) |

| Supplier ownership | 0.190 ** | (2.36) | 0.178 ** | (2.23) | 0.180 ** | (2.20) | 0.145 ** | (2.28) |

| Tobin’s Q | 0.051 ** | (2.08) | 0.134 ** | (2.17) | 0.045 * | (1.95) | 0.063 *** | (2.79) |

| Net profit margin of total assets | 0.878 ** | (2.54) | −1.089 | (−1.57) | 1.320 *** | (3.31) | −0.288 | (−0.70) |

| Growth rate of total assets | −0.012 | (−0.56) | −0.027 | (−1.29) | −0.018 | (−0.72) | −0.046 ** | (−2.41) |

| Financing constraints | −0.004 | (−0.14) | 0.022 | (0.86) | −0.029 | (−0.94) | −0.011 | (−0.76) |

| Proportion of independent directors | 0.825 ** | (2.07) | 0.285 | (0.89) | 0.556 | (1.22) | −0.074 | (−0.22) |

| Degree of checks and balances on equity | 0.126 *** | (2.66) | 0.049 | (0.96) | 0.102 * | (1.86) | 0.066 | (1.07) |

| Constant | −1.149 ** | (−2.20) | −0.643 | (−1.36) | −0.919 ** | (−2.04) | −0.253 | (−0.82) |

| Observations | 2148 | 2148 | 1838 | 1838 | ||||

| Region FE | YES | YES | YES | YES | ||||

| Year FE | YES | YES | YES | YES | ||||

| Industry FE | YES | YES | YES | YES | ||||

| Adj. R-squared | 0.352 | 0.118 | 0.344 | 0.135 | ||||

Note: Columns (1) and (2) are the results after excluding pilot firms, and columns (3) and (4) are the results after excluding pilot cities; ***, **, and * indicate significance at the 1%, 5%, and 10% statistical levels, respectively; values in parentheses are city-level clustering robustness t-statistics.

Appendix E. Propensity Score Matching and Placebo Tests

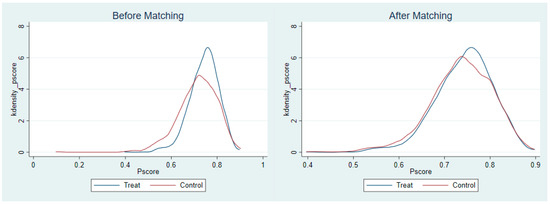

Figure A1.

Kernel density plots before and after propensity score matching.

Table A5.

Balance test for propensity score matching.

Table A5.

Balance test for propensity score matching.

| Mean | %Reduct | t-Test | |||||

|---|---|---|---|---|---|---|---|

| Treated | Control | %Bias | |Bias| | t | p > |t| | ||

| Age | Before Matching | 16.742 | 17.895 | −18.6 | −3.98 | 0 | |

| After Matching | 16.742 | 16.752 | −0.2 | 99.1 | −0.05 | 0.961 | |

| Size | Before Matching | 7.6815 | 7.4127 | 21 | 4.42 | 0 | |

| After Matching | 7.6815 | 7.66 | 1.7 | 92 | 0.5 | 0.615 | |

| Soe | Before Matching | 1.5455 | 1.4983 | 9.4 | 1.95 | 0.051 | |

| After Matching | 1.5455 | 1.5638 | −3.7 | 61.2 | −1.05 | 0.295 | |

| TobinQ | Before Matching | 1.9709 | 2.007 | −2.4 | −0.53 | 0.599 | |

| After Matching | 1.9709 | 1.9392 | 2.1 | 12.2 | 0.64 | 0.52 | |

| Roa | Before Matching | 0.04205 | 0.038 | 4.9 | 1.09 | 0.274 | |

| After Matching | 0.04205 | 0.04196 | 0.1 | 97.7 | 0.03 | 0.972 | |

| Grow | Before Matching | 0.29394 | 0.32122 | −3.8 | −0.81 | 0.416 | |

| After Matching | 0.29394 | 0.27182 | 3.1 | 18.9 | 0.99 | 0.32 | |

| FC | Before Matching | −1.0068 | −1.0255 | 4.7 | 1.28 | 0.202 | |

| After Matching | −1.0068 | −1.0012 | −1.4 | 69.7 | −1.36 | 0.173 | |

| Indrate | Before Matching | 0.37503 | 0.36975 | 7.7 | 1.58 | 0.114 | |

| After Matching | 0.37503 | 0.37222 | 4.1 | 46.9 | 1.14 | 0.253 | |

| Own | Before Matching | 0.69385 | 0.72386 | −4.8 | −1.01 | 0.314 | |

| After Matching | 0.69385 | 0.70368 | −1.6 | 67.3 | −0.45 | 0.654 | |

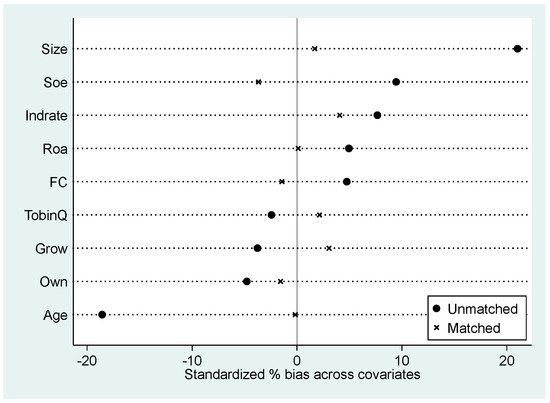

Figure A2.

Comparison of standardized bias before and after matching.

Table A6.

Regression results for matched samples.

Table A6.

Regression results for matched samples.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| (Method 1) | (Method 2) | |||

| (Method 1) | 0.420 *** | (4.60) | ||

| (Method 2) | 0.380 * | (1.79) | ||

| Government Subsidies | 0.013 *** | (3.01) | 0.011 ** | (2.18) |

| Supplier age | −0.001 | (−0.16) | −0.008 | (−0.93) |

| Supplier size | 0.104 *** | (2.85) | 0.081 *** | (2.75) |

| Supplier ownership | 0.152 * | (1.94) | 0.155 ** | (2.01) |

| Tobin’s Q | 0.049 * | (1.67) | 0.144 * | (1.81) |

| Net profit margin of total assets | 0.979 ** | (2.43) | −1.045 | (−1.39) |

| Growth rate of total assets | −0.021 | (−0.61) | −0.006 | (−0.22) |

| Financing constraints | 0.033 | (0.23) | 0.246 | (1.04) |

| Proportion of independent directors | 0.788 ** | (2.13) | 0.020 | (0.09) |

| Degree of checks and balances on equity | 0.128 *** | (2.70) | 0.012 | (0.31) |

| Constant | −1.008 * | (−1.90) | −0.436 | (−0.94) |

| Observations | 1840 | 1840 | ||

| Region FE | YES | YES | ||

| Year FE | YES | YES | ||

| Industry FE | YES | YES | ||

| Adj. R-squared | 0.345 | 0.109 | ||

Note: ***, **, and * indicate significance at the 1%, 5%, and 10% statistical levels, respectively; values in parentheses are city-level clustering robustness t-statistics.

Figure A3.

Placebo tests.

Appendix F. Annual Report Information Disclosure Issues

Table A7.

Regression results after deleting firms with specific characteristics.

Table A7.