Conceptual Models of Franchisee Behaviors in the Dietary Supplements and Cosmetics to Imply the Business Investments

Abstract

1. Introduction

2. Literature Review

2.1. Franchise Business and Theories

2.1.1. Franchise Business

2.1.2. Rational Choice Theory

2.2. Factors Influencing the Decision Making

2.3. Decision-Making Process

3. Proposed Model and Hypothesis Development

3.1. Formulate Model

3.2. Hypothesis Development

3.2.1. Pre-Purchase Decision Making

Franchise Fee

Franchise Benefits

Investment Risk

Franchise Product

Franchise Reputation

Franchise Experience

Franchise Support

3.2.2. Decision-Making Process (DMP)

3.2.3. Post-Purchase Factors

Continuous Investment (CI)

Word of Mouth (WM)

Franchise Loyalty (FL)

4. Research Methodology

4.1. Questionnaires and Data Collection

4.2. The Scope of Survey

4.3. Questionnaire Design

4.4. Statistical Data Analysis

5. Results

5.1. Measurement Model

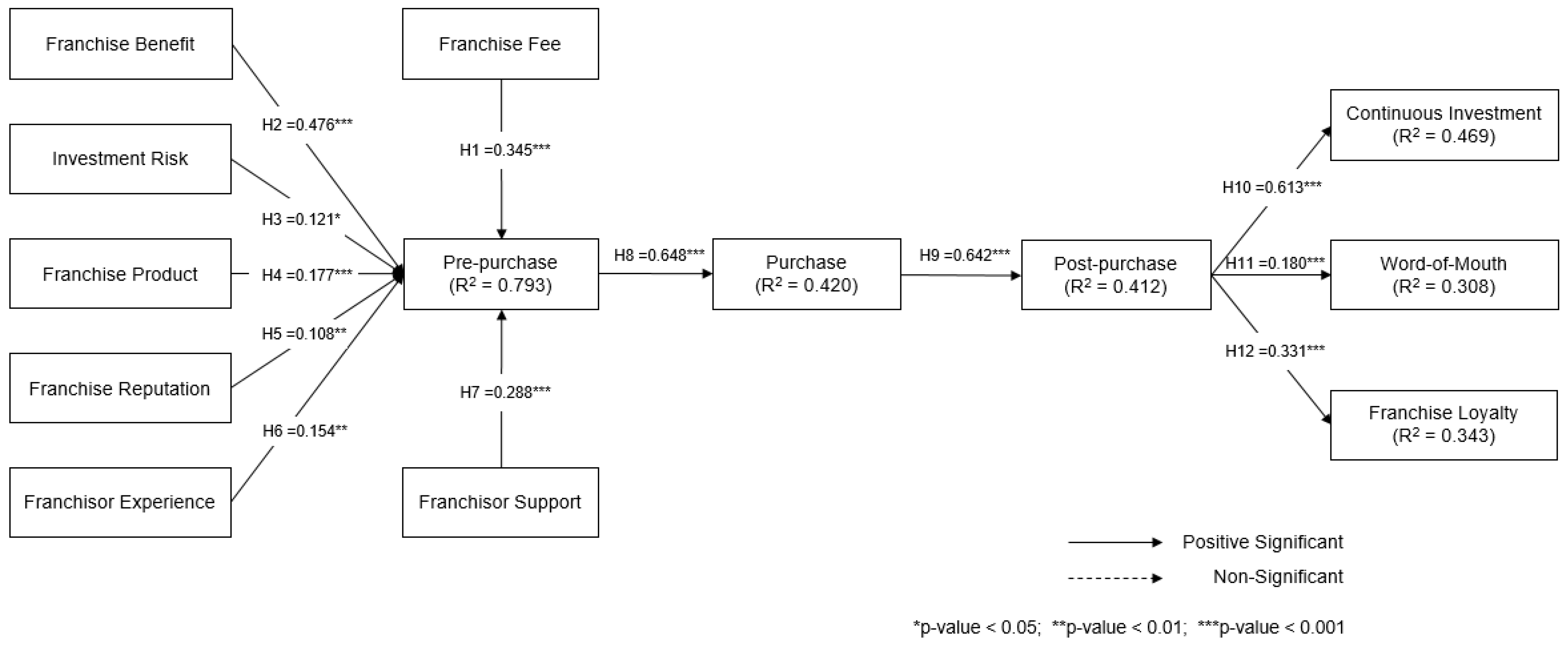

5.2. Structural Model

5.3. Model Fit

6. Discussion of Findings and Interpretation

6.1. Comparisons between a Proposed Research Model and Previous Works

6.2. Implications

7. Conclusions, Limitations, and Future Research

7.1. Conclusions

7.2. Limitations and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Gorovaia, N.; Pajić, M.; Windsperger, J. Performance of knowledge transfer mechanisms: The case of franchising networks. Ind. Mark. Manag. 2023, 115, 539–549. [Google Scholar] [CrossRef]

- Adie, B.A. Franchising our heritage: The UNESCO World Heritage brand. Tour. Manag. Perspect. 2017, 24, 48–53. [Google Scholar] [CrossRef]

- Lee, J.-H.; Choi, H.-M. Sustainable restaurant franchising: Franchisor social support for franchisee resilience and intention to retain business during the COVID-19 pandemic. J. Hosp. Tour. Manag. 2023, 54, 415–425. [Google Scholar] [CrossRef]

- Dubey, V.K.; Matthes, J.M.; Saini, A. Impact of socioeconomic values collaboration on performance in franchising. J. Bus. Res. 2023, 162, 113877. [Google Scholar] [CrossRef]

- Jell-Ojobor, M.; Hajdini, I.; Windsperger, J. Governance of international franchise networks: Combining value creation and value appropriation perspectives. J. Bus. Res. 2022, 139, 267–279. [Google Scholar] [CrossRef]

- Semrau, T.; Biemann, T. When sergeants can outrank generals: Person-organization fit and the performance of franchisees as agents of their franchisor. J. Bus. Ventur. 2022, 37, 106177. [Google Scholar] [CrossRef]

- Perdreau, F.; Le Nadant, A.-L.; Khelil, N. Franchise capabilities and system performance: A configurational perspective. Ind. Mark. Manag. 2023, 113, 326–340. [Google Scholar] [CrossRef]

- Shiwen, L.; Ahn, J. Role of employee personality traits in job performance in the restaurant food franchise context. Int. J. Hosp. Manag. 2023, 113, 103512. [Google Scholar] [CrossRef]

- Lee, Y.-K.; Kim, S.-H.; Seo, M.-K.; Hight, S.K. Market orientation and business performance: Evidence from franchising industry. Int. J. Hosp. Manag. 2015, 44, 28–37. [Google Scholar] [CrossRef]

- Rosado-Serrano, A.; Navarro-García, A. Alternative modes of entry in franchising. J. Bus. Res. 2023, 157, 113599. [Google Scholar] [CrossRef]

- Rosado-Serrano, A.; Paul, J.; Dikova, D. International franchising: A literature review and research agenda. J. Bus. Res. 2018, 85, 238–257. [Google Scholar] [CrossRef]

- Gorovaia, N.; Windsperger, J. The choice of contract duration in franchising networks: A transaction cost and resource-based view. Ind. Mark. Manag. 2018, 75, 125–133. [Google Scholar] [CrossRef]

- Perrigot, R.; López-Fernández, B.; Basset, G. Conflict management capabilities in franchising. J. Retail. Consum. Serv. 2021, 63, 102694. [Google Scholar] [CrossRef]

- Boley, B.B.; Russell, Z.A.; Woosnam, K.M. Functional and Self-Congruity’s influence on lodging choice: A comparison of franchise and independent accommodations. J. Hosp. Tour. Manag. 2022, 50, 318–326. [Google Scholar] [CrossRef]

- Bondesson, N. An exploratory investigation of the elements of B2B brand image and its relationship to price premium. Ind. Mark. Manag. 2010, 39, 1269–1277. [Google Scholar]

- González-Márquez, R.; Rosa-Díaz, I.M.; Caro-González, F.J.; Galán-González, J.L. Where to internationalise and why: Country selection by restaurant franchises. J. Retail. Consum. Serv. 2023, 72, 103287. [Google Scholar] [CrossRef]

- Proctor, D.; Dunne, G.; Flanagan, S. Towards a model of sports franchise leverage for destination marketing. J. Destin. Mark. Manag. 2023, 30, 100829. [Google Scholar] [CrossRef]

- Boulay, J.; Caemmerer, B.; Evanschitzky, H.; Duniach, K. Multi-unit franchising from franchisor and franchisee perspectives: Antecedents, performance outcomes, and the optimal mini-chain size. J. Bus. Res. 2020, 113, 49–58. [Google Scholar] [CrossRef]

- Hadjielias, E.; Dada, O.; Eliades, K. Entrepreneurial process in international multiunit franchise outlets: A social capital perspective. J. Bus. Res. 2021, 134, 13–28. [Google Scholar] [CrossRef]

- Schweiger, B.; Albers, S.; Vanderstraeten, J.; Gibb, J. A capabilities perspective on membership management in franchise networks. Ind. Mark. Manag. 2020, 90, 60–78. [Google Scholar] [CrossRef]

- Kacker, M.; Perrigot, R. Retailer use of a professional social media network: Insights from franchising. J. Retail. Consum. Serv. 2016, 30, 222–233. [Google Scholar] [CrossRef]

- Rosado-Serrano, A.; Paul, J. A new conceptual model for international franchising. Int. J. Hosp. Manag. 2018, 75, 179–188. [Google Scholar] [CrossRef]

- Perdreau, F.; Fréchet, M. Learning, contractual capabilities, and contract duration changes in franchise networks. J. Retail. Consum. Serv. 2022, 64, 102777. [Google Scholar] [CrossRef]

- Sié, L.; Pett, T.; Hipkin, I. Exploring franchise system development in France. J. Bus. Ventur. Insights 2015, 4, 14–19. [Google Scholar] [CrossRef]

- Brookes, M.; Altinay, L. Knowledge transfer and isomorphism in franchise networks. Int. J. Hosp. Manag. 2017, 62, 33–42. [Google Scholar] [CrossRef]

- Maciejewski, B.; Jaana, M.; Keely, E.; Crowe, L.; Liddy, C. Social franchising: Scale and spread of innovation in Canada. Health Policy Technol. 2018, 7, 217–223. [Google Scholar] [CrossRef]

- Abdul Ghani, M.F.; Hizam-Hanafiah, M.; Mat Isa, R.; Abd Hamid, H. A Preliminary Study: Exploring Franchising Growth Factors of Franchisor and Franchisee. J. Open Innov. Technol. Mark. Complex. 2022, 8, 138. [Google Scholar] [CrossRef]

- Shaikh, A. Conceptualizing fairness in franchisor–franchisee relationship: Dimensions, definitions and preliminary construction of scale. J. Retail. Consum. Serv. 2016, 28, 28–35. [Google Scholar] [CrossRef]

- Crosno, J.L.; Tong, P.Y. Just going through the motions? An empirical investigation of control, compliance, and performance in franchisor-franchisee relationships. J. Bus. Res. 2018, 92, 360–373. [Google Scholar] [CrossRef]

- Jindal, R.P.; Sivadas, E.; Kang, B. Dissolution of franchise relationships: Intention, behavior, and the role of uncertainty. Ind. Mark. Manag. 2021, 92, 140–153. [Google Scholar] [CrossRef]

- Griessmair, M.; Hussain, D.; Windsperger, J. Trust and the tendency towards multi-unit franchising: A relational governance view. J. Bus. Res. 2014, 67, 2337–2345. [Google Scholar] [CrossRef]

- Guo, S.-L. When less may be more: A dyadic view of franchise contracts. Long Range Plan. 2023, 56, 102343. [Google Scholar] [CrossRef]

- Yakimova, R.; Owens, M.; Sydow, J. Formal control influence on franchisee trust and brand-supportive behavior within franchise networks. Ind. Mark. Manag. 2019, 76, 123–135. [Google Scholar] [CrossRef]

- Wu, C.-W. Antecedents of franchise strategy and performance. J. Bus. Res. 2015, 68, 1581–1588. [Google Scholar] [CrossRef]

- Hoffman, R.C.; Munemo, J.; Watson, S. International Franchise Expansion: The Role of Institutions and Transaction Costs. J. Int. Manag. 2016, 22, 101–114. [Google Scholar] [CrossRef]

- Pénard, T.; Perrigot, R. Online search—Online purchase in franchising: An empirical analysis of franchisor website functionality. J. Retail. Consum. Serv. 2017, 39, 164–172. [Google Scholar] [CrossRef]

- Nyadzayo, M.W.; Matanda, M.J.; Rajaguru, R. The determinants of franchise brand loyalty in B2B markets: An emerging market perspective. J. Bus. Res. 2018, 86, 435–445. [Google Scholar] [CrossRef]

- Pandey, S.K.; Mookerjee, A. Assessing the role of emotions in B2B decision making: An exploratory study. J. Indian Bus. Res. 2018, 10, 170–192. [Google Scholar] [CrossRef]

- Jell-Ojobor, M.; Windsperger, J. The Choice of Governance Modes of International Franchise Firms—Development of an Integrative Model. J. Int. Manag. 2014, 20, 153–187. [Google Scholar] [CrossRef]

- Choudhary, P.K.; Routray, S.; Upadhyay, P.; Pani, A.K. Adoption of enterprise mobile systems—An alternative theoretical perspective. Int. J. Inf. Manag. 2022, 67, 102539. [Google Scholar] [CrossRef]

- Li, H.; Luo, X.; Zhang, J.; Sarathy, R. Self-control, organizational context, and rational choice in Internet abuses at work. Inf. Manag. 2018, 55, 358–367. [Google Scholar] [CrossRef]

- Sashi, C.M.; Brynildsen, G. Franchise network relationships and word of mouth communication in social media networks. Ind. Mark. Manag. 2022, 102, 153–163. [Google Scholar] [CrossRef]

- Ghantous, N.; Christodoulides, G. Franchising brand benefits: An integrative perspective. Ind. Mark. Manag. 2020, 91, 442–454. [Google Scholar] [CrossRef]

- Gillis, W.E.; Combs, J.G.; Yin, X. Franchise management capabilities and franchisor performance under alternative franchise ownership strategies. J. Bus. Ventur. 2020, 35, 105899. [Google Scholar] [CrossRef]

- Panda, S.; Paswan, A.K.; Mishra, S.P. Impact of positioning strategies on franchise fee structure. Ind. Mark. Manag. 2019, 81, 30–39. [Google Scholar] [CrossRef]

- Badrinarayanan, V.; Suh, T.; Kim, K.-M. Brand resonance in franchising relationships: A franchisee-based perspective. J. Bus. Res. 2016, 69, 3943–3950. [Google Scholar] [CrossRef]

- Nyadzayo, M.W.; Matanda, M.J.; Ewing, M.T. Franchisee-based brand equity: The role of brand relationship quality and brand citizenship behavior. Ind. Mark. Manag. 2016, 52, 163–174. [Google Scholar] [CrossRef]

- Keränen, J.; Jalkala, A. Three strategies for customer value assessment in business markets. Manag. Decis. 2014, 52, 79–100. [Google Scholar] [CrossRef]

- Leek, S.; Christodoulides, G. A framework of brand value in B2B markets: The contributing role of functional and emotional components. Ind. Mark. Manag. 2012, 41, 106–114. [Google Scholar] [CrossRef]

- Nyadzayo, M.W.; Matanda, M.J.; Ewing, M.T. Brand relationships and brand equity in franchising. Ind. Mark. Manag. 2011, 40, 1103–1115. [Google Scholar] [CrossRef]

- Zachary, M.A.; McKenny, A.F.; Short, J.C.; Davis, K.M.; Wu, D. Franchise branding: An organizational identity perspective. J. Acad. Mark. Sci. 2011, 39, 629–645. [Google Scholar] [CrossRef]

- Petcharat, T.; Leelasantitham, A. A retentive consumer behavior assessment model of the online purchase decision-making process. Heliyon 2021, 7, e08169. [Google Scholar] [CrossRef] [PubMed]

- Puengwattanapong, P.; Leelasantitham, A. A Holistic Perspective Model of Plenary Online Consumer Behaviors for Sustainable Guidelines of the Electronic Business Platforms. Sustainability 2022, 14, 6131. [Google Scholar] [CrossRef]

- Liang, H.; Lee, K.-J.; Huang, J.-T.; Lei, H.-W. The optimal decisions in franchising under profit uncertainty. Econ. Model. 2013, 31, 128–137. [Google Scholar] [CrossRef]

- Meiseberg, B.; Perrigot, R. Pricing-based practices, conflicts and performance in franchising. Eur. Manag. J. 2020, 38, 939–955. [Google Scholar] [CrossRef]

- Perrigot, R.; Basset, G. Resale pricing in franchised stores: A franchisor perspective. J. Retail. Consum. Serv. 2018, 43, 209–217. [Google Scholar] [CrossRef]

- Altinay, L.; Brookes, M.; Madanoglu, M.; Aktas, G. Franchisees’ trust in and satisfaction with franchise partnerships. J. Bus. Res. 2014, 67, 722–728. [Google Scholar] [CrossRef]

- Oh, D.; Yoo, M.; Lee, Y. A holistic view of the service experience at coffee franchises: A cross-cultural study. Int. J. Hosp. Manag. 2019, 82, 68–81. [Google Scholar] [CrossRef]

- Nyadzayo, M.W.; Matanda, M.J.; Ewing, M.T. The impact of franchisor support, brand commitment, brand citizenship behavior, and franchisee experience on franchisee-perceived brand image. J. Bus. Res. 2015, 68, 1886–1894. [Google Scholar] [CrossRef]

- Watson, A.; Dada, O.; Grünhagen, M.; Wollan, M.L. When do franchisors select entrepreneurial franchisees? An organizational identity perspective. J. Bus. Res. 2016, 69, 5934–5945. [Google Scholar] [CrossRef]

- Davies, M.A.P.; Lassar, W.; Manolis, C.; Prince, M.; Winsor, R.D. A model of trust and compliance in franchise relationships. J. Bus. Ventur. 2011, 26, 321–340. [Google Scholar] [CrossRef]

- Ruz-Mendoza, M.Á.; Trifu, A.; Cambra-Fierro, J.; Melero-Polo, I. Standardized vs. customized firm-initiated interactions: Their effect on customer gratitude and performance in a B2B context. J. Bus. Res. 2021, 133, 341–353. [Google Scholar] [CrossRef]

- Tóth, Z.; Mrad, M.; Itani, O.S.; Luo, J.; Liu, M.J. B2B eWOM on Alibaba: Signaling through online reviews in platform-based social exchange. Ind. Mark. Manag. 2022, 104, 226–240. [Google Scholar] [CrossRef]

- Bang, D.; Choi, K.; Jang, S. Are franchise royalty fees related to franchisors’ support of franchisees? Evidence from the restaurant industry. Int. J. Hosp. Manag. 2023, 114, 103555. [Google Scholar] [CrossRef]

- Maruyama, M.; Yamashita, Y. Revenue versus incentive: Theory and empirical analysis of franchise royalties. J. Jpn. Int. Econ. 2014, 34, 154–161. [Google Scholar] [CrossRef]

- Jang, S.; Park, K. A sustainable franchisor-franchisee relationship model: Toward the franchise win-win theory. Int. J. Hosp. Manag. 2019, 76, 13–24. [Google Scholar] [CrossRef]

- Altinay, L. Selecting partners in an International Franchise Organisation. Int. J. Hosp. Manag. 2006, 25, 108–128. [Google Scholar] [CrossRef]

- Yeung, R.M.W.; Brookes, M.; Altinay, L. The hospitality franchise purchase decision making process. Int. J. Contemp. Hosp. Manag. 2016, 28, 1009–1025. [Google Scholar] [CrossRef]

- Calderon-Monge, E.; Pastor-Sanz, I.; Sendra-García, J. How to select franchisees: A model proposal. J. Bus. Res. 2021, 135, 676–684. [Google Scholar] [CrossRef]

- Petcharat, T.; Jattamart, A.; Leelasantitham, A. A conceptual model to imply a negative innovation assessment framework on consumer behaviors through the electronic business platforms. J. Retail. Consum. Serv. 2023, 74, 103450. [Google Scholar] [CrossRef]

- Sun, K.-A.; Lee, S. Competitive advantages of franchising firms and the moderating role of organizational characteristics: Evidence from the restaurant industry. Int. J. Hosp. Manag. 2019, 77, 281–289. [Google Scholar] [CrossRef]

- Altinay, L.; Brookes, M.; Aktas, G. Selecting franchise partners: Tourism franchisee approaches, processes and criteria. Tour. Manag. 2013, 37, 176–185. [Google Scholar] [CrossRef]

- Lee, Y.-K.; Nor, Y.; Choi, J.; Kim, S.; Han, S.; Lee, J.-H. Why does franchisor social responsibility really matter? Int. J. Hosp. Manag. 2016, 53, 49–58. [Google Scholar] [CrossRef]

- Brookes, M.; Altinay, L.; Aktas, G. Opportunistic behaviour in hospitality franchise agreements. Int. J. Hosp. Manag. 2015, 46, 120–129. [Google Scholar] [CrossRef]

- Doherty, A.M. Market and partner selection processes in international retail franchising. J. Bus. Res. 2009, 62, 528–534. [Google Scholar] [CrossRef]

- Wang, Y.-C.; Ryan, B.; Yang, C.-E. Employee brand love and love behaviors: Perspectives of social exchange and rational choice. Int. J. Hosp. Manag. 2019, 77, 458–467. [Google Scholar] [CrossRef]

- Hair, J.F., Jr.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM), 2nd ed.; Sage Publications: Thousand Oaks, CA, USA, 2017. [Google Scholar]

- Cochran, W.G.; Carroll, S.P. A sampling investigation of the efficiency of weighting inversely as the estimated variance. Biometrics 1953, 9, 447–459. [Google Scholar] [CrossRef]

- Hair, J.; Anderson, R.; Tatham, R.L.; Black, W.C. Multivariate Data Analysis, 5th ed.; Prentice-Hall: Upper Saddle River, NJ, USA, 1998. [Google Scholar]

- Ringle, C.M.; Wende, S.; Becker, J.-M. SmartPLS 3; SmartPLS GmbH: Boenningstedt, Germany, 2015. [Google Scholar]

- Anderson, J.C.; Gerbing, D.W. Structural equation modeling in practice: A review and recommended two-step approach. Psychol. Bull. 1988, 103, 411–423. [Google Scholar] [CrossRef]

- Roldán, J.L.; Sánchez-Franco, M.J. Variance-Based Structural Equation Modeling: Guidelines for Using Partial Least Squares in Information Systems Research. In Research Methodologies, Innovations and Philosophies in Software Systems Engineering and Information Systems; IGI Global: Hershey, PA, USA, 2012. [Google Scholar]

- Henseler, J.; Hubona, G.; Ray, P.A. Using PLS path modeling in new technology research: Updated guidelines. Ind. Manag. Data Syst. 2016, 116, 2–20. [Google Scholar] [CrossRef]

- Phaosathianphan, N.; Leelasantitham, A. A plenary free individual traveler life cycle for assessment of adoption intelligent travel assistant. Heliyon 2020, 6, e04428. [Google Scholar] [CrossRef]

- Wetzels, M.; Odekerken-Schroder, G.; van Oppen, C. Using PLS path modeling for assessing hierarchical construct models: Guidelines and empirical illustration. MIS Q. 2009, 33, 177–195. [Google Scholar] [CrossRef]

- Barthélemy, J. Agency and institutional influences on franchising decisions. J. Bus. Ventur. 2011, 26, 93–103. [Google Scholar] [CrossRef]

- Ramírez-García, C.; Ramón-Jerónimo, M.Á.; García-Álvarez de Perea, J.; Vélez-Elorza, M.L. Risk sources and the effectiveness of the control system in the franchisor’s risk perception management. Ind. Mark. Manag. 2024, 117, 202–219. [Google Scholar] [CrossRef]

| Title | Authors (Year) | Objective | Method | Finding |

|---|---|---|---|---|

| Sustainable restaurant franchising: Franchisor social support for franchisee resilience and intention to retain business during the COVID-19 pandemic. | [3] | Explore the franchisor social support required for franchisees to overcome the undesirable COVID-19 pandemic and examine the influences of franchisor social support. | Employed a PLS-SEM to estimate the model, using 168 valid responses from restaurant franchisees in South Korea who survived the COVID-19 pandemic. | Franchisees’ resilience plays a role as a full mediator in the association between franchisor’s affective support and franchisees’ intention to retain business. |

| A Preliminary Study: Exploring Franchising Growth Factors of Franchisor and Franchisee. | [27] | Identify the growth factors of franchising, from both the franchisors’ and franchisees’ viewpoints. | Adopted semi-structured interviews with five service firms from two different brands, including franchisors and franchisees. | Three growth factors emerged from this study: product and service innovation, franchisor–franchisee tolerance, and government support. |

| Franchise network relationships and word of mouth communication in social media networks. | [42] | Examines how the size of a franchise network impacts WOM communication in social media networks. | SEM are estimated for franchise networks in the top 200 U.S. restaurants with data from Twitter. | Loyalty and liking mediate the relationship between franchise network size and WOM in social media networks. |

| Governance of international franchise networks: Combining value creation and value appropriation perspectives. | [39] | Develops a new perspective on the franchisor’s choice of international governance modes as a value creation and value appropriation mechanism. | Primary data from 162 international franchise systems headquartered in eight countries. | Intangible knowledge-based resources and transaction cost factors for the franchisor’s choice between equity modes. |

| Franchising brand benefits: An integrative perspective. | [43] | An integrative view of franchise branding by examining brand benefits from three theoretical perspectives and data from two stakeholders. | Quantitative analysis of 37 interviews with franchisees (n = 22) and franchisors (n = 15) revealing diverse brand benefits. | Significant perceptual gaps, with franchisors having a much narrower view of brand benefits than franchisees, which could potentially be detrimental for this subtype of B2B brands. |

| Franchise management capabilities and franchisor performance under alternative franchise ownership strategies. | [44] | Empirically exploit the theoretical distinction between plural form and turnkey franchise ownership strategies. | Quantitative analysis of sample of 229 franchisors. | Franchise management capabilities relate positively to franchisor performance among plural form franchisors. |

| Impact of positioning strategies on franchise fee structure. | [45] | Identifies the positioning strategies employed by franchisors and investigates their relationship with the franchise fee structure. | Quantitative analysis of 1234 US franchisors. | Both upfront fee and loyalty rate are positively associated with network size and classroom and on-the-job training, and negatively with franchising experience and support services. |

| Brand resonance in franchising relationships: A franchisee-based perspective. | [46] | Investigates the antecedents of brand resonance in the franchising context. | Quantitative analysis of 209 South Korean franchisees through SEM. | Franchisor’s knowledge specificity, franchisor’s trade equity, and franchisee’s trust in franchisors are instrumental in the formation of brand resonance. |

| Franchisee-based brand equity: The role of brand relationship quality and brand citizenship behavior. | [47] | Investigates the role of brand relationship quality and brand citizenship behavior in franchising. | Quantitative analysis of 363 Australian franchisees through SEM. | Brand relationship quality promotes brand citizenship behavior, thereby enhancing franchise-based brand equity. |

| Three strategies for customer value assessment in business markets. | [48] | Examines brand positioning strategies for industrial firms providing customer solutions. | Multiple case studies, involving four industrial firms providing customer solutions. | Identifies four possible brand position strategies for industrial firms providing customer solutions. |

| A framework of brand value in B2B markets: The contributing role of functional and motional components. | [49] | Creates a framework of brand value in B2B markets. | Literature review and 10 exploratory interviews with B2B supplier managers. | Both functional (e.g., technology, quality, etc.) and emotional (e.g., risk reduction, trust, etc.) contribute to the development of industrial brand equity. |

| Brand relationships and brand equity in franchising. | [50] | Investigates how brand relationships can be leveraged to enhance brand citizenship behavior and brand equity in franchise channels. | Semi-structured interviews with 14 franchisees. | Franchisors play an important role in promoting brand citizenship behavior of franchisees, which in turn enhances brand equity. |

| Franchise branding: An organizational identity perspective. | [51] | Franchise branding from an organizational identity perspective. | Content analysis of corporate websites. | Franchise 500 use language associated with market orientation, entrepreneurial orientation, and charismatic rhetoric when compared to lower-performing franchises. |

| An exploratory investigation of the elements of B2B brand image and its relationship to price premium. | [15] | To explore the elements of B2B brand image and its relationship to price premium. | Qualitative study through interviews of buyers of corrugated packaging | Brand image elements such as product solution, service, distribution, relationship, and company association positively influence price premium. |

| Title | Journal | Year | Author(s) | Input Factors before Decision-Making Process | Output Factors after Decision-Making Process | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Franchise Fee | Franchise Benefit | Investment Risk | Franchise Product | Franchise Reputation | Franchise Experience | Franchise Support | Continuous Investment | Word of Mouth | Franchise Loyalty | ||||

| Impact of positioning strategies on franchise fee structure. | Industrial Marketing Management | 2019 | [45] | ✓ | ✓ | ✓ | ✓ | ||||||

| Resale pricing in franchised stores: A franchisor perspective. | Journal of Retailing and Consumer Services | 2018 | [56] | ✓ | ✓ | ||||||||

| Franchise network relationships and word of mouth communication in social media networks. | Industrial Marketing Management | 2022 | [42] | ✓ | |||||||||

| A sustainable franchisor-franchisee relationship model: Toward the franchise win-win theory. | International Journal of Hospitality Management | 2019 | [66] | ✓ | ✓ | ||||||||

| The impact of franchisor support, brand commitment, brand citizenship behavior, and franchisee experience on franchisee-perceived brand image. | Journal of Business Research | 2015 | [59] | ✓ | ✓ | ✓ | ✓ | ||||||

| Selecting partners in an International Franchise Organization. | International Journal of Hospitality Management | 2006 | [57] | ✓ | ✓ | ✓ | ✓ | ||||||

| Selecting franchise partners: Tourism franchisee approaches, process, and criteria. | Tourism Management | 2013 | [67] | ✓ | ✓ | ✓ | |||||||

| The hospitality franchise purchase decision making process. | International Journal of Hospitality Management | 2016 | [68] | ✓ | ✓ | ✓ | |||||||

| How to select franchisees: A model proposal. | Journal of Business Research | 2021 | [69] | ✓ | ✓ | ✓ | ✓ | ||||||

| Title | Journal | Year | Author(s) | Decision-Making Process (DMP) | |||||

|---|---|---|---|---|---|---|---|---|---|

| Need Recognition | Information Search | Alter. Evaluation | Intention Recognition | Purchase | Post-Purchase | ||||

| The hospitality franchise purchase decision making process | International Journal of Hospitality Management | 2016 | [68] | ✓ | ✓ | ✓ | - | ✓ | ✓ |

| A retentive consumer behavior assessment model of the online purchase decision-making process | Heliyon | 2021 | [52] | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| A Holistic Perspective Model of Plenary Online Consumer Behaviors for Sustainable Guidelines of the Electronic Business Platforms | MDPI: Sustainability | 2022 | [53] | ✓ (Pre-purchase) | - | ✓ | ✓ | ||

| A conceptual model to imply a negative innovation assessment framework on consumer behaviors through the electronic business platforms | Journal of Retailing and Consumer Services | 2023 | [70] | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ |

| Title | Year | Business Type | Input | Process | Output | ||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Franchisor Support | Franchisee Experience | Risk | Benefit | Product Quality | History and Growth of Franchise | Franchise Fee (Cost) | Usefulness and Ease of Use | Quality and Trust | Trust | Satisfaction | Brand Commitment | Brand Citizenship Behavior | Need Recognition | Information Search | Alter Evaluation | Intention Recognition | Purchase | Post-Purchase | Intention to Continue | Brand Image/Reputation | Recommend | Re-Purchase | Profitability | Honesty and Trustworthiness | |||

| T1 * | 2019 | B-B | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||

| T2 * | 2015 | B-B | ✓ | ✓ | ✓ | ✓ | ✓ | ||||||||||||||||||||

| T3 * | 2006 | B-B | ✓ | ✓ 1 | ✓ | ✓ | |||||||||||||||||||||

| T4 * | 2013 | B-B | ✓ 2 | ✓ | ✓ | ✓ 3 | ✓ | ||||||||||||||||||||

| T5 * | 2015 | B-B | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||

| T6 * | 2021 | B-B | ✓ | ✓ | ✓ | ✓ | |||||||||||||||||||||

| T7 * | 2018 | - | ✓ | ✓ | ✓ | ||||||||||||||||||||||

| T8 * | 2021 | B-C | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||||||||

| T9 * | 2022 | B-C | ✓ 4 | ✓ 4 | ✓ 4 | ✓ 4 | ✓ 4 | ||||||||||||||||||||

| Proposed Research Model | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ 4 | ✓ 4 | ✓ 4 | ✓ 4 | ✓ 4 | ✓ | ✓ | ✓ | ✓ | ✓ | |||||||||

| Variables | Level | Respondents (N = 490) | ||

|---|---|---|---|---|

| Frequency | Percentage | Cumulative | ||

| Gender | Male | 157 | 32.04 | 32.04 |

| Female | 298 | 60.82 | 92.86 | |

| LGBTQ+ | 35 | 7.14 | 100.00 | |

| Age | 18–24 | 50 | 10.02 | 10.02 |

| 25–34 | 175 | 35.07 | 45.09 | |

| 35–44 | 145 | 29.06 | 74.15 | |

| 45–54 | 72 | 14.43 | 88.58 | |

| 55–64 | 45 | 9.02 | 97.60 | |

| >64 | 12 | 2.40 | 100.00 | |

| Education | Lower than a bachelor’s degree | 177 | 35.47 | 35.47 |

| Bachelor’s degree or equivalent | 245 | 49.10 | 84.57 | |

| Master’s degree | 72 | 14.43 | 99.00 | |

| Doctorate degree or higher | 5 | 1.00 | 100.00 | |

| Length of franchise business experience | <1 year | 112 | 22.44 | 22.44 |

| 1–3 years | 234 | 46.89 | 69.34 | |

| 4–6 year | 86 | 17.23 | 86.57 | |

| 7–9 years | 41 | 8.22 | 94.79 | |

| >10 years | 26 | 5.21 | 100.00 | |

| Franchise member package (loyalty fees) | Silver | 216 | 43.29 | 43.29 |

| Gold | 198 | 39.68 | 82.97 | |

| Platinum | 85 | 17.03 | 100.00 | |

| Monthly income per month (Baht) | <100,000 | 232 | 46.49 | 46.49 |

| 100,001–500,000 | 218 | 43.69 | 90.18 | |

| 500,001–1,000,000 | 19 | 3.81 | 93.99 | |

| 1,000,001–3,000,000 | 16 | 3.21 | 97.19 | |

| 3,000,001–5,000,000 | 7 | 1.40 | 98.60 | |

| 5,000,001–10,000,000 | 4 | 0.80 | 99.40 | |

| >10,000,000 | 3 | 0.60 | 100.00 | |

| Abbr. | Measurement Items | Mean | S.D. | Loading (>0.70) | Outer VIF (<5.00) | Source |

|---|---|---|---|---|---|---|

| Franchise Fee (FF) | ||||||

| FF1 | I believe the initial royalty and annual concession fee to buy a franchise affect the decision to buy a franchise. | 4.370 | 0.725 | 0.794 | 1.211 | Adapted from [9,29,55] |

| FF2 | I believe investment grade formats such as Platinum, Gold, Silver packages, etc., impact purchasing a franchise. | 4.513 | 0.681 | 0.834 | 1.175 | |

| FF3 | I believe that business startup fees and service fees in investing in franchises affect the decision to invest in a franchise. | 4.230 | 0.864 | 0.762 | 1.214 | |

| Franchise Benefit (FB) | ||||||

| FB1 | I believe that saving marketing costs or investing in other operations affects the decision to invest in a franchise. | 4.529 | 0.654 | 0.744 | 1.438 | Adapted from [20,43] |

| FB2 | I believe that management with a clear system of regulations makes it easier to administer. It affects the decision to invest in a franchise. | 4.558 | 0.617 | 0.748 | 1.672 | |

| FB3 | I believe there are benefits to be gained from investing in a particular franchise. It affects the decision to invest in a franchise. | 4.459 | 0.700 | 0.753 | 1.800 | |

| Investment Risk (IR) | ||||||

| IR1 | I believe investing in businesses is less risky. It affects the decision to invest in a franchise. | 4.319 | 0.725 | 0.758 | 1.491 | Adapted from [1,18,44] |

| IR2 | I believe having the franchisor’s support makes it less risky. It affects the decision to invest in a franchise. | 4.267 | 0.864 | 0.789 | 1.397 | |

| IR3 | I believe the franchise business model is less risky. It affects the decision to invest in a franchise. | 4.453 | 0.722 | 0.825 | 1.309 | |

| Franchise Product (FP) | ||||||

| FP1 | I believe that the products of well-known franchises are well-known in the market. It affects the decision to invest in a franchise. | 4.531 | 0.619 | 0.732 | 1.436 | Adapted from [9,59] |

| FP2 | I believe the franchise’s products are of good quality. It affects the decision to invest in a franchise. | 4.495 | 0.710 | 0.743 | 1.507 | |

| FP3 | I believe the franchise’s products are popular with consumers. It affects the decision to invest in a franchise. | 4.354 | 0.762 | 0.721 | 1.294 | |

| Franchise Reputation (FR) | ||||||

| FR1 | I believe that established and experienced franchisees affect the decision to invest in a franchise. | 4.418 | 0.787 | 0.896 | 2.309 | [46,55,73] |

| FR2 | I believe that the franchise’s reputation and recognition in the market affect the decision to invest in a franchise. | 4.321 | 0.823 | 0.874 | 2.090 | |

| FR3 | I believe that the image of the franchise business affects the decision to invest in a franchise. | 4.380 | 0.756 | 0.882 | 2.169 | |

| Franchisor Experience (FE) | ||||||

| FE1 | I believe that working with a franchise brand has a straightforward process. It affects the decision to invest in a franchise. | 4.459 | 0.700 | 0.747 | 1.415 | [6,59] |

| FE2 | I believe the franchise’s branding expertise affects the decision to invest in a franchise. | 4.230 | 0.803 | 0.739 | 1.600 | |

| FE3 | I believe having a franchise brand experience affects the decision to invest in a franchise. | 4.558 | 0.601 | 0.787 | 1.547 | |

| Franchisor Support (FS) | ||||||

| FS1 | I believe that marketing and promotional support from the franchise owner affects investment decisions. | 4.507 | 0.660 | 0.750 | 1.352 | [1,55,59,60] |

| FS2 | I believe that support in educating franchise investors affects the decision to invest in a franchise. | 4.453 | 0.722 | 0.828 | 1.160 | |

| FS3 | I believe that the after-sales support of the franchise business affects the decision to invest in a franchise. | 3.646 | 0.948 | 0.719 | 1.493 | |

| Continuous Investment (CI) | ||||||

| CI1 | I believe that achieving the target returns in franchising has an impact on the continuous operation of the franchise business. | 4.024 | 0.835 | 0.832 | 1.634 | [9,37,59] |

| CI2 | I believe in receiving continuous support from good franchise owners. It has an impact on the continued operation of the franchise business. | 4.286 | 0.909 | 0.867 | 1.759 | |

| CI3 | I believe that if I have good success with the franchise brand, it will impact the franchise business’s continuous operation. | 4.206 | 0.794 | 0.741 | 1.320 | |

| Word of Mouth (WM) | ||||||

| WM1 | I believe that if I have good support from the franchise owner, I will refer others interested in investing in a franchise. | 3.552 | 1.046 | 0.902 | 2.635 | Adapted from [42] |

| WM2 | I believe that if I am satisfied with the franchise business, I will refer others who are interested in investing in a franchise. | 3.400 | 1.107 | 0.909 | 2.755 | |

| WM3 | I believe that if I succeed with my franchise business, I will refer others interested in investing in a franchise. | 3.578 | 1.010 | 0.914 | 2.664 | |

| Franchise Loyalty (FL) | ||||||

| FL1 | I believe if I succeed, I will have confidence and trust in the franchise brand I invest in. | 3.693 | 1.111 | 0.758 | 1.668 | [37,43,46,59,72] |

| FL2 | If I were proud of my franchise business, I would be successful with investing in a franchise business. | 3.907 | 0.982 | 0.902 | 2.181 | |

| FL3 | I believe I will be loyal to the brand if I am successful with investing in a franchise business. | 4.230 | 0.864 | 0.811 | 1.502 | |

| Pre-purchase (PP) | ||||||

| PP1 | If I am interested in franchising, how can I perform an assessment to invest in a franchise business? | 4.513 | 0.681 | 0.852 | 1.768 | [53,70] |

| PP2 | I believe that the influential factors before investing in a franchise (examined inquired above) affect investment in the franchise business. | 4.459 | 0.700 | 0.828 | 1.677 | |

| PP3 | I believe that if I have sufficient information to make an informed decision from the franchisor, I will be able to evaluate it to invest in the business. | 4.453 | 0.722 | 0.858 | 1.728 | |

| Purchase (PU) | ||||||

| PU1 | I believe franchising is a good business worth investing in. I will invest in that franchise business. | 4.507 | 0.660 | 0.847 | 1.745 | [53,70] |

| PU2 | I believe that if there was an easy process for investing in a franchise business, I would invest in that franchise business. | 4.354 | 0.762 | 0.803 | 1.509 | |

| PU3 | I believe that if I decide to invest in a franchise business, I will not hesitate to invest in a franchise business. | 4.451 | 0.719 | 0.864 | 1.814 | |

| Post-purchase (PO) | ||||||

| PO1 | I believe that maintaining a good quality product or merchandise promotes a longer post-investment period. | 4.265 | 0.814 | 0.701 | 1.310 | [53,70] |

| PO2 | I believe that having good support from the franchisor after investment is important in a franchise business. | 4.230 | 0.803 | 0.728 | 1.442 | |

| PO3 | I believe it is important to maintain a good reputation and brand image throughout the post-investment period. | 4.202 | 0.773 | 0.744 | 1.353 | |

| Constructs | Item Code | Cronbach’s Alpha (>0.70) | Composite Reliability (CR) (>0.70) | Average Variance Extracted (AVE) (>0.50) |

|---|---|---|---|---|

| Franchise Fee | FF | 0.772 | 0.846 | 0.593 |

| Franchise Benefit | FB | 0.785 | 0.851 | 0.518 |

| Investment Risk | IR | 0.700 | 0.843 | 0.552 |

| Franchise Product | FP | 0.793 | 0.706 | 0.553 |

| Franchise Reputation | FR | 0.860 | 0.861 | 0.782 |

| Franchise Experience | FE | 0.707 | 0.805 | 0.563 |

| Franchisor Support | FS | 0.767 | 0.865 | 0.552 |

| Pre-purchase | PP | 0.802 | 0.806 | 0.716 |

| Purchase | PU | 0.789 | 0.791 | 0.703 |

| Post-purchase | PO | 0.743 | 0.745 | 0.594 |

| Continuous Investment | CI | 0.745 | 0.756 | 0.664 |

| Word of Mouth | WM | 0.894 | 0.897 | 0.825 |

| Franchise Loyalty | FL | 0.767 | 0.790 | 0.682 |

| CN * | PP | FR | FB | FF | FE | FP | IR | FS | FL | CI | PO | PU | WM |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| PP | 0.846 | ||||||||||||

| FR | 0.594 | 0.884 | |||||||||||

| FB | 0.753 | 0.482 | 0.780 | ||||||||||

| FF | 0.777 | 0.542 | 0.621 | 0.784 | |||||||||

| FE | 0.777 | 0.529 | 0.794 | 0.751 | 0.803 | ||||||||

| FP | 0.599 | 0.498 | 0.700 | 0.641 | 0.721 | 0.773 | |||||||

| IR | 0.780 | 0.572 | 0.693 | 0.740 | 0.794 | 0.699 | 0.893 | ||||||

| FS | 0.785 | 0.574 | 0.636 | 0.726 | 0.743 | 0.655 | 0.873 | 0.793 | |||||

| FL | 0.236 | 0.240 | 0.155 | 0.522 | 0.312 | 0.206 | 0.339 | 0.354 | 0.826 | ||||

| CI | 0.382 | 0.357 | 0.404 | 0.638 | 0.551 | 0.503 | 0.634 | 0.591 | 0.401 | 0.815 | |||

| PO | 0.545 | 0.493 | 0.516 | 0.674 | 0.710 | 0.686 | 0.708 | 0.667 | 0.331 | 0.613 | 0.703 | ||

| PU | 0.648 | 0.596 | 0.607 | 0.620 | 0.668 | 0.721 | 0.702 | 0.765 | 0.223 | 0.457 | 0.642 | 0.839 | |

| WM | 0.052 | 0.033 | 0.041 | 0.299 | 0.140 | 0.040 | 0.155 | 0.161 | 0.525 | 0.233 | 0.180 | 0.629 | 0.908 |

| Hypothesis | Path | Path Coefficient (β) (>0.10) | t-Value (>1.96) | p-Value * (<0.05) | Inner VIF (<5.00) | Supported |

|---|---|---|---|---|---|---|

| H1 | FF–PP | 0.354 | 9.723 | 0.000 | 2.912 | Yes |

| H2 | FB–PP | 0.476 | 9.586 | 0.000 | 2.459 | Yes |

| H3 | IR–PP | 0.121 | 2.241 | 0.025 | 1.535 | Yes |

| H4 | FP–PP | 0.177 | 4.673 | 0.000 | 2.480 | Yes |

| H5 | FR–PP | 0.108 | 2.755 | 0.006 | 1.617 | Yes |

| H6 | FE–PP | 0.154 | 2.735 | 0.006 | 2.231 | Yes |

| H7 | FS–PP | 0.288 | 5.378 | 0.000 | 2.618 | Yes |

| H8 | PP–PU | 0.648 | 16.109 | 0.000 | 1.000 | Yes |

| H9 | PU–PO | 0.642 | 20.000 | 0.000 | 1.000 | Yes |

| H10 | PO–CI | 0.613 | 19.926 | 0.000 | 1.000 | Yes |

| H11 | PO–WM | 0.180 | 4.354 | 0.000 | 1.000 | Yes |

| H12 | PO–FL | 0.331 | 7.978 | 0.000 | 1.000 | Yes |

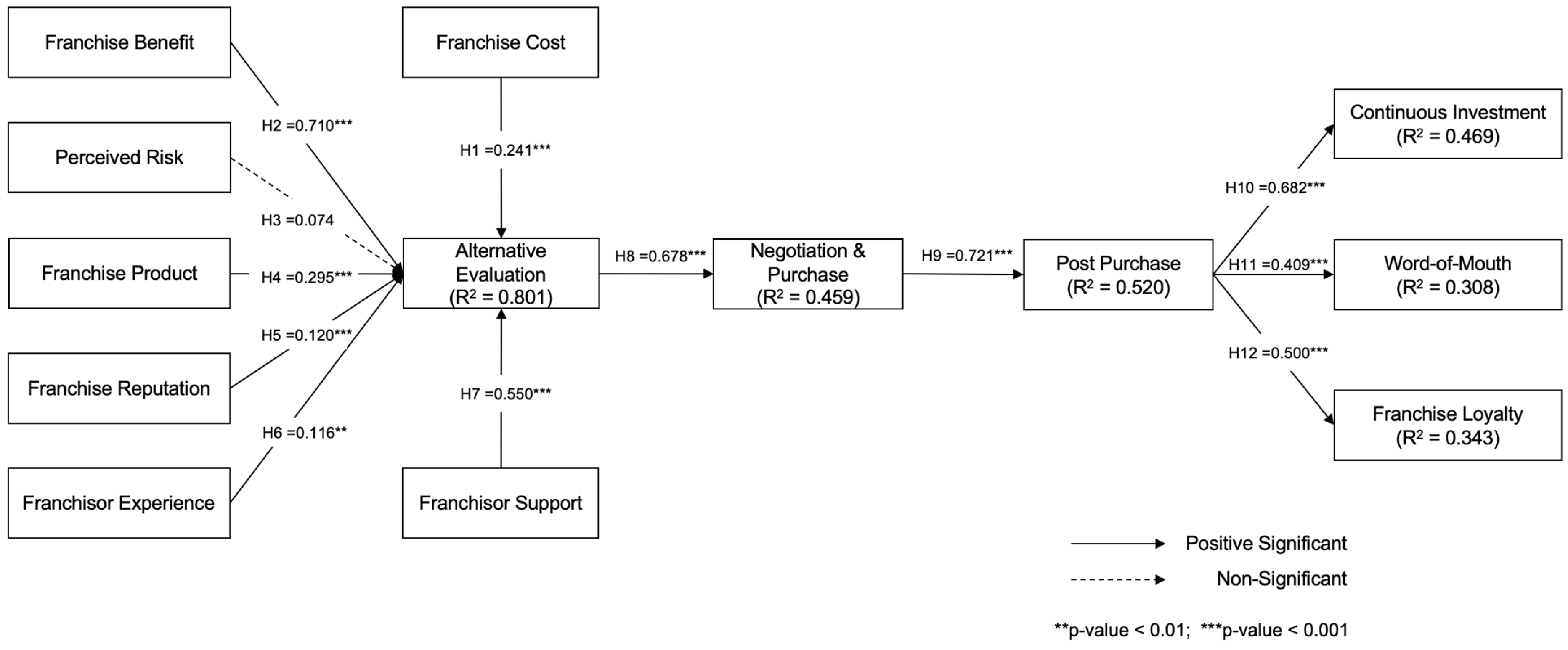

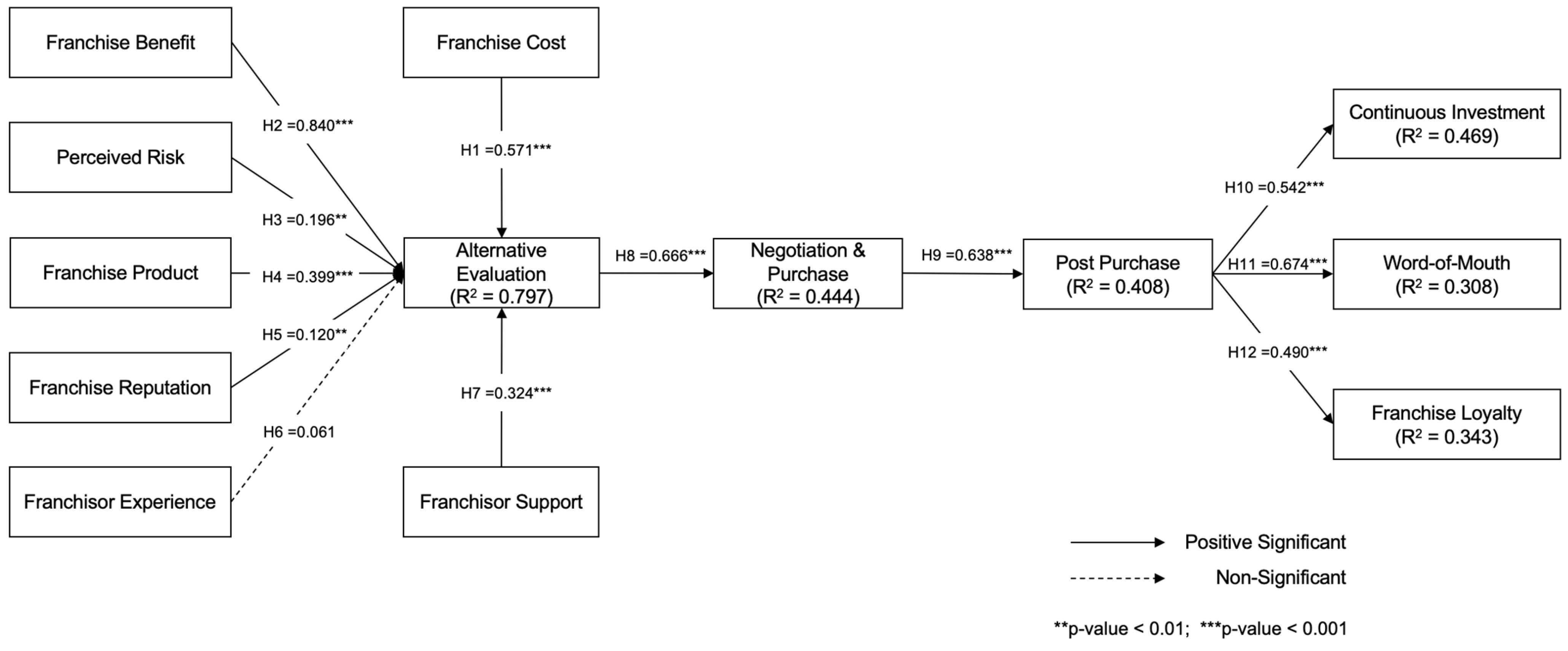

| Hypothesis | Path | Path Coefficient (β) (>0.10) | t-Value (>1.96) | p-Value (<0.05, <0.01) | Inner VIF (<5.00) | Supported | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| H | M | L | H | M | L | H | M | L | H | M | L | H | M | L | ||

| H1 | FF–PP | 0.569 | 0.241 | 0.571 | 8.837 | 5.319 | 13.510 | 0.000 | 0.000 | 0.000 | 1.386 | 2.388 | 1.732 | Yes | Yes | Yes |

| H2 | FB–PP | 0.347 | 0.710 | 0.840 | 8.717 | 13.215 | 15.268 | 0.000 | 0.000 | 0.000 | 2.012 | 1.381 | 2.022 | Yes | Yes | Yes |

| H3 | IR–PP | 0.042 | 0.074 | 0.196 | 0.937 | 1.867 | 2.349 | 0.349 | 0.062 | 0.019 | 4.730 | 3.003 | 1.642 | No | No | Yes |

| H4 | FP–PP | 0.236 | 0.295 | 0.399 | 6.981 | 7.579 | 9.887 | 0.000 | 0.000 | 0.000 | 2.110 | 2.779 | 1.993 | Yes | Yes | Yes |

| H5 | FR–PP | 0.207 | 0.120 | 0.120 | 5.970 | 3.965 | 3.619 | 0.000 | 0.000 | 0.000 | 1.779 | 1.622 | 2.002 | Yes | Yes | Yes |

| H6 | FE–PP | 0.048 | 0.116 | 0.061 | 1.572 | 3.139 | 1.603 | 0.116 | 0.002 | 0.109 | 2.301 | 1.572 | 3.033 | No | Yes | No |

| H7 | FS–PP | 0.266 | 0.550 | 0.324 | 5.678 | 12.692 | 7.287 | 0.000 | 0.000 | 0.000 | 1.733 | 1.903 | 2.210 | Yes | Yes | Yes |

| H8 | PP–PU | 0.740 | 0.678 | 0.666 | 25.842 | 19.950 | 19.417 | 0.000 | 0.000 | 0.000 | 1.000 | 1.000 | 1.000 | Yes | Yes | Yes |

| H9 | PU–PO | 0.746 | 0.721 | 0.638 | 32.911 | 28.423 | 19.773 | 0.000 | 0.000 | 0.000 | 1.000 | 1.000 | 1.000 | Yes | Yes | Yes |

| H10 | PO–CI | 0.685 | 0.682 | 0.542 | 28.812 | 25.900 | 16.813 | 0.000 | 0.000 | 0.000 | 1.000 | 1.000 | 1.000 | Yes | Yes | Yes |

| H11 | PO–WM | 0.555 | 0.409 | 0.674 | 17.717 | 12.688 | 25.251 | 0.000 | 0.000 | 0.000 | 1.000 | 1.000 | 1.000 | Yes | Yes | Yes |

| H12 | PO–FL | 0.586 | 0.500 | 0.490 | 20.179 | 16.280 | 15.615 | 0.000 | 0.000 | 0.000 | 1.000 | 1.000 | 1.000 | Yes | Yes | Yes |

| Package Level | Model Fit Value | |||||||

|---|---|---|---|---|---|---|---|---|

| Determination Coefficient (R2) | Standardized Root Mean-Square Residual (SRMR) | Goodness of Fit (GoF) | ||||||

| Pre-Purchase (PP) | Purchase (PU) | Post-Purchase (PO) | Continuous Investment (CI) | Word of Mouth (WM) | Franchise Loyalty (FL) | |||

| High Investment (Platinum) | 0.841 | 0.547 | 0.556 | 0.469 | 0.308 | 0.343 | 0.043 | 0.532 |

| Medium Investment (Gold) | 0.801 | 0.459 | 0.520 | 0.469 | 0.308 | 0.343 | 0.033 | 0.532 |

| Low Investment (Silver) | 0.797 | 0.444 | 0.408 | 0.469 | 0.308 | 0.343 | 0.056 | 0.507 |

| Capital Market Investor Type | Cosmetics and Dietary Supplement Franchise Business Investors | Independent Investors in the Capital Market | ||

|---|---|---|---|---|

| Investor Level | High-Level Investor | Medium-Level Investor | Low-Level Investor | |

| Investment Consideration Factors for Investors | ||||

| Products | ✓ | ✓ | ✓ | ✓ |

| Brand Reputation | ✓ | ✓ | ✓ | ✓ |

| Brand Experience | × | ✓ | × | ✓ |

| Brand Support | ✓ | ✓ | ✓ | ✓ |

| Franchise Fees | ✓ | ✓ | ✓ | - |

| Received Benefits from Brand | ✓ | ✓ | ✓ | ✓ |

| Investment Risk | × | × | ✓ | ✓ |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Suttidharm, P.; Leelasantitham, A. Conceptual Models of Franchisee Behaviors in the Dietary Supplements and Cosmetics to Imply the Business Investments. Sustainability 2024, 16, 4287. https://doi.org/10.3390/su16104287

Suttidharm P, Leelasantitham A. Conceptual Models of Franchisee Behaviors in the Dietary Supplements and Cosmetics to Imply the Business Investments. Sustainability. 2024; 16(10):4287. https://doi.org/10.3390/su16104287

Chicago/Turabian StyleSuttidharm, Patcharapol, and Adisorn Leelasantitham. 2024. "Conceptual Models of Franchisee Behaviors in the Dietary Supplements and Cosmetics to Imply the Business Investments" Sustainability 16, no. 10: 4287. https://doi.org/10.3390/su16104287

APA StyleSuttidharm, P., & Leelasantitham, A. (2024). Conceptual Models of Franchisee Behaviors in the Dietary Supplements and Cosmetics to Imply the Business Investments. Sustainability, 16(10), 4287. https://doi.org/10.3390/su16104287