A Study on the Impact of Income Gap on Consumer Demand: An Empirical Test Based on the Spatial Panel Durbin Model

Abstract

1. Introduction

2. Literature Review

2.1. Microscopic Perspective

2.2. Macro Perspective

3. Data Sources, Variable Selection, and Empirical Model

3.1. Data Source and Processing

3.2. Variable Declaration

3.2.1. Explained Variable

3.2.2. Core Explanatory Variable

3.2.3. Control Variables

3.3. Model Setting

3.3.1. Setting of Baseline Regression Model

3.3.2. Spatial Durbin Model

4. An Empirical Analysis of the Impact of the Income Gap on Consumer Demand

4.1. Baseline Regression Result

4.2. Spatial Spillover Effect Analysis

4.2.1. Analysis of Overall Empirical Results of Spatial Spillover Effect

4.2.2. Empirical Analysis of Spatial Effects of Heterogeneity

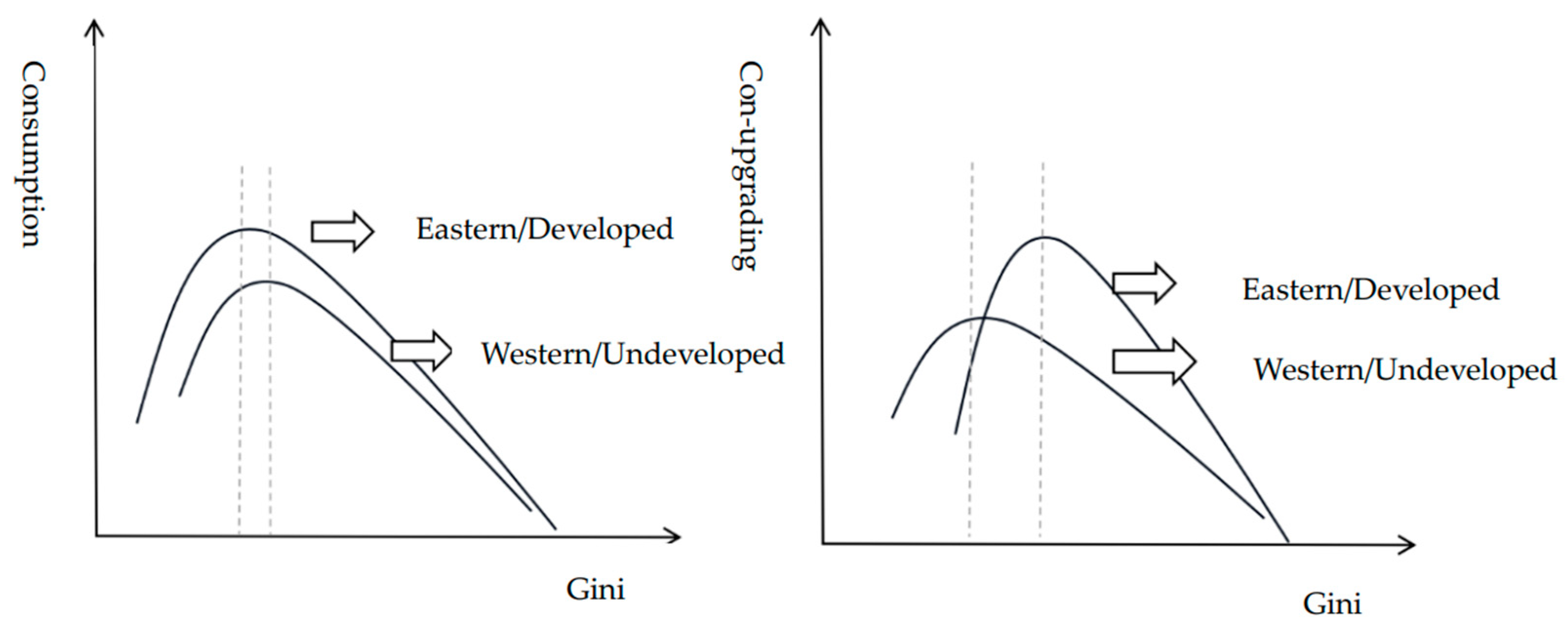

- Analysis of the empirical results of each region divided by geographical location

- 2.

- Analysis of empirical results of each region according to the degree of economic development

4.3. Robustness Test

5. Conclusions and Suggestions

- (1)

- The income gap significantly influences consumer demand. Therefore, managing the income gap among people has become a crucial strategy to boost consumer demand amidst changing income levels. Managing the income gap among inhabitants involves boosting the income of low-income groups through various means throughout fluctuations in income levels, rather than just taking from the wealthy to give to the poor. Efforts should focus on prioritizing employment, increasing employment opportunities, raising the income of the middle- and low-income groups, and subsequently boosting overall societal demand by expanding the middle-income segment. This will help stimulate a positive consumption cycle.

- (2)

- Enhancing residents’ income levels will boost consumer demand by diversifying income sources through initiatives like labor mobility, employment training, financial transfers to low- and middle-income groups, increased government transfer payments to low-income groups, and targeted subsidies for social fairness. We aim to increase consumer spending.

- (3)

- To increase the amount of consumption among its citizens, the state ought to give priority to assisting the western region and places that are less developed. Creating platforms for the exchange of technology and knowledge to facilitate the movement of factors between regions, promoting the free flow of production factors across regions, and addressing obstacles to residents’ consumption by leveraging spatial relationships between regions are all ways in which this can be accomplished in order to boost the demand from customers in the region and the communities that are adjacent to it.

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Pradhan, P.; Costa, L.; Rybski, D.; Lucht, W.; Kropp, J.P. A systematic study of Sustainable Development Goal (SDG) interactions. Earth’s Future 2017, 5, 169–179. [Google Scholar] [CrossRef]

- Mathez-Stiefelefel, S.L.; Zimmermann, A.B.; von Dach, S.W.; Molden, D.; Breu, T. Focus issue: Food security and sustainable development in mountains. Mt. Res. Dev. 2018, 38, 277. [Google Scholar] [CrossRef]

- Niu, W. Three Basic Elements of Sustainable Development. Bull. Chin. Acad. Sci. 2014, 29, 410–415. [Google Scholar]

- Wang, D.; Qiao, Z. The Influence of Capital Deepening on Regional Economic Development Gap: The Intermediary Effect of the Labor Income Share. Sustainability 2022, 14, 16853. [Google Scholar] [CrossRef]

- Liu, P.; Qian, T.; Huang, X.; Dong, X. The connotation, realization path, and measurement method of common prosperity. Manag. World 2021, 37, 117–129. [Google Scholar]

- Piketty, T.; Yang, L.; Zucman, G. Capital Accumulation, Private Property, and Rising Inequality in China, 1978–2015. Am. Econ. Rev. 2019, 109, 2469–2496. [Google Scholar] [CrossRef]

- Chen, B. Income Distribution and Household Consumption in China: Theory and Empirical Research based on China. Nankai Econ. Res. 2012, 1, 33–49. [Google Scholar]

- Gan, L.; Zhao, N.; Sun, Y. Income inequality, liquidity constraint, and household saving rate in China. Econ. Res. J. 2018, 53, 34–50. [Google Scholar]

- Modigliani, F.; Brumberg, R. Utility Analysis and the Consumption Function: An Interpretation of Cross-Section Data. In Post Keynesian Economics; Allen and Unwin: London, UK, 1955. [Google Scholar]

- Friedman, M. A Theory of the Consumption Function; National Bureau of Economic Research: Princeton, NJ, USA, 1957. [Google Scholar]

- Hall, R.E. Stochastic Implications of the Life Cycle-Permanent Income Hypothesis: Theory and Evidence. J. Political Econ. 1978, 86, 971–987. [Google Scholar] [CrossRef]

- Qi, H.; Zhang, J. The spatial spillover effect of consumption growth in the earlier affluent regions in the process of common prosperity. J. Xi’an Jiaotong Univ. (Soc. Sci. Ed.) 2022, 42, 10–22. [Google Scholar]

- Chamon, M.; Prasad, E. Why Are the Saving Rates of Urban Households in China Rising? Am. Econ. J. Macroecon. 2010, 2, 93–130. [Google Scholar] [CrossRef]

- Kraay, A. Household Savings in China. World Bank Econ. Rev. 2000, 14, 545–570. [Google Scholar] [CrossRef]

- Wan, G.; Zhang, Y.; Niu, J. Liquidity constraints, uncertainty, and Chinese household consumption. Econ. Res. 2001, 11, 35–44+94. [Google Scholar]

- Ye, H. On the Relationship between Liquidity Constraints, Short-sighted Behavior, and Weak Consumer Demand in China. Econ. Res. 2000, 11, 39–44. [Google Scholar]

- Tian, Q.; Ma, J.; Gao, T. Analysis of Regional Differences in Factors Influencing Consumption of Urban Residents in China. Manag. World 2008, 7, 27–33. [Google Scholar]

- Hang, B. The buffering and reserve behavior of farmers under the formation of habits. Econ. Res. 2009, 44, 96–105. [Google Scholar]

- Fang, F. A Study on the Reasons for Insufficient Consumer Demand among Chinese Residents: Based on Data from Urban and Rural Provinces in China. Chin. Soc. Sci. 2009, 2, 68–82+205–206. [Google Scholar]

- Frank, R.H.; Levine, A.S. Expenditure Cascades. Cornell Univ. Mimeogr. 2010, 9, 45–61. [Google Scholar]

- Drechsel-Grau, M.; Schmid, K.D. Consumption-savings Decisions Under Upward-looking Comparisons. J. Econ. Behav. Organ. 2014, 106, 254–268. [Google Scholar] [CrossRef]

- Bertrand, M.; Morse, A. Trickle-down Consumption. Rev. Econ. Stat. 2016, 98, 863–879. [Google Scholar] [CrossRef]

- Doorn, J.V. Aggregate consumption and the distribution of incomes. Eur. Econ. Rev. 1975, 6, 67–80. [Google Scholar] [CrossRef]

- Santaeulalia-Llopis, R.; Zheng, Y. The Price of Growth: Consumption Insurance in China 1989–2009. Am. Econ. J. Macroecon. 2018, 10, 1–35. [Google Scholar] [CrossRef]

- Kirshner, J. Keynes, Capital Mobility and the Crisis of Embedded Liberalism. Rev. Int. Political Econ. 1999, 6, 20–28. [Google Scholar] [CrossRef]

- Yang, T. Income Distribution and Effective Demand; Economic Science Press: Beijing, China, 2001. [Google Scholar]

- Zhou, L.; Chen, Y. Digital inclusive finance and urban-rural income gap: Theoretical mechanism, empirical evidence, and policy choices. World Econ. Res. 2022, 5, 117–134+137. [Google Scholar]

- Xu, Y.; Zhang, Y. The impact of urban-rural income gap on rural consumption: “restraining effect” or “demonstration effect”. Rural. Econ. 2021, 8, 18–28. [Google Scholar]

- Chen, B.; Wu, J.; Wang, W. The impact of new-type urbanization and urban-rural income gap on residents’ consumption and regional differences. Bus. Econ. Res. 2021, 18, 42–45. [Google Scholar]

- Wu, X.M.; Wu, D. An empirical study on the relationship between average consumption propensity and income distribution of urban residents in China. J. Quant. Tech. Econ. 2007, 5, 22–32. [Google Scholar]

- Wang, W.; Guo, X. Income inequality and high savings rate in China: Theoretical and empirical research from the perspective of targeted consumption. Manag. World 2011, 9, 21–29. [Google Scholar]

- Zhu, G.; Fan, J.; Yan, Y. China’s sluggish consumption and income distribution: Theory and data. Econ. Res. 2002, 5, 72–80+95. [Google Scholar]

- Yang, T.; Liu, X. A Study on the Optimal Income Gap of Residents to Maximize Consumption. Economist 2008, 1, 77–85. [Google Scholar]

- Huang, C.; Zhang, X. Innovation-driven, spatial spillover, and residents’ consumption demand. Inq. Into Econ. Issues 2020, 2, 11–20. [Google Scholar]

- Haithcoat, T.L.; Avery, E.E.; Bowers, K.A.; Hammer, R.D.; Shyu, C.R. Income Inequality and Health: Expanding Our Understanding of State-Level Effects by Using a Geospatial Big Data Approach. Soc. Sci. Comput. Rev. 2021, 39, 543–561. [Google Scholar] [CrossRef]

- Barrett, G.F.; Crossley, T.F.; Worswick, C. Consumption and Income Inequality in Australia. Econ. Rec. 2000, 76, 116–138. [Google Scholar] [CrossRef]

- Liu, M. A Study on the Spatial Effect of Consumption among Chinese Residents: A Test Based on Consumption Theory. Explor. Econ. Issues 2015, 10, 27–32. [Google Scholar]

- Wu, Y.; Pan, H. A Study on the Spatial Spillover Effect of Total Factor Productivity on Resident Consumption. Financ. Theory Pract. 2020, 41, 126–131. [Google Scholar]

- Yang, X.; Hao, Y.; Yu, D.S. The impact of income disparity on total consumption: A numerical simulation study. J. Quant. Tech. Econ. 2014, 31, 20–37. [Google Scholar]

- Ji, Y.; Ning, L. A study on the impact of income gap on consumption under the Relative income hypothesis. Res. Quant. Tech. Econ. 2018, 35, 97–114. [Google Scholar]

- Li, J.; Li, H. Urban-rural income gap and residents’ consumption structure: From the perspective of relative income theory. J. Quant. Tech. Econ. 2016, 33, 97–112. [Google Scholar]

- Qiao, Z.; Xu, H.X. Resident income growth, distribution structure, and consumption upgrading: An analysis based on China’s experience. Soc. Sci. Front. 2023, 1, 62–72. [Google Scholar]

- Ma, H.; Xi, H. Income gap, Social security, and improving residents’ happiness and sense of gain. Soc. Secur. Res. 2020, 1, 86–98. [Google Scholar]

- Yi, X.; Li, J.; Wan, G.; Yang, B. The Inhibitive Effect of Household Consumption on Wealth Gap: Mechanism Exploration and Empirical Evidence. J. Quant. Tech. Econ. 2023, 40, 27–47. [Google Scholar] [CrossRef]

- Loayza, N.; Schmidt-Hebbel, K.; Servén, L. What Drives Saving across the World. Rev. Econ. Stat. 2000, 82, 70–79. [Google Scholar] [CrossRef]

- Yi, X.; Yang, B. Empirical test of Determinants of household consumption rate in countries (regions) around the world. World Econ. 2015, 38, 3–24. [Google Scholar]

- Zhao, X. Basic and Useful Econometrics; Peking University Press: Beijing, China, 2017; pp. 40–52. [Google Scholar]

- Angrist, J.D.; Pischke, J.S. Mostly Harmless Econometrics: An Empiricistís Companion; Princeton University Press: Princeton, NJ, USA, 2009; pp. 47–50. [Google Scholar]

- Tian, W.; Jia, J.; Bo, N.; Yin, L. The spatial effect of inter-provincial income gap in China: An empirical study based on SDM model. East China Econ. Manag. 2018, 8, 65–71. [Google Scholar]

- Wu, S.; Xu, Z. How digital economy drives high-quality consumption: Theory and experience. J. Shanxi Univ. Financ. Econ. 2023, 45, 1–15. [Google Scholar]

- Chen, Q. Advanced Econometrics and Stata Application, 2nd ed.; Higher Education Press: Beijing, China, 2014; p. 586. [Google Scholar]

- Li, S.; Zhao, X. The impact of income gap on the upgrading of urban household consumption structure. Res. World 2019, 11, 41–47. [Google Scholar]

- Xiao, W.; Zhou, R. Research on the linkage mechanism of supply-side reform and innovation-driven strategy: Based on the perspective of China’s economic growth impetus transformation. Value Eng. 2017, 36, 35–39. [Google Scholar]

- Sun, J.; Liang, D. Income gap, market size, and the escape from the dilemma of industrial upgrading in China. Hubei Soc. Sci. 2009, 7, 91–94. [Google Scholar]

- Corneo, G.; Jeanne, O. Conspicuous Consumption, Snobbism and Conformism. J. Public Econ. 1997, 66, 55–71. [Google Scholar] [CrossRef]

- Liu, Y.; Li, C.; Cheng, L. The Impact of Income Gap on the Technological Innovation Capability of China’s High tech Industries: An Empirical Test Based on the Spatial Panel Durbin Model. Contemp. Econ. Res. 2022, 2, 119–128. [Google Scholar]

| Variable Name | Consumption | Con-Upgrading | ||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Gini | 1.057 *** | 0.945 *** | 1.289 *** | 1.147 *** |

| (2.660) | (2.604) | (6.95) | (6.233) | |

| Gini2 | −2.017 *** | −1.328 *** | −1.366 *** | −1.267 *** |

| (−4.020) | (−2.852) | (−5.87) | (−5.543) | |

| Income | 0.200 *** | 0.029 *** | ||

| (36.239) | (9.868) | |||

| Assets | 0.038 *** | 0.003 | ||

| (8.915) | (1.403) | |||

| Age | −0.009 *** | −0.001 *** | ||

| (−14.648) | (−3.350) | |||

| Health | −0.033 *** | −0.040 *** | ||

| (−6.281) | (−14.101) | |||

| Education | 0.025 *** | 0.005 *** | ||

| (16.280) | (5.941) | |||

| Old ratio | −0.067 *** | −0.025 * | ||

| (−2.857) | (−1.912) | |||

| Child ratio | 0.019 | −0.116 *** | ||

| (0.495) | (−5.830) | |||

| Matrimony | 0.161 *** | 0.030 *** | ||

| (7.954) | (2.786) | |||

| Family size | 0.069 *** | 0.029 *** | ||

| (16.484) | (14.071) | |||

| Number of properties | 0.080 *** | 0.024 *** | ||

| (7.524) | (4.746) | |||

| Constant term | 10.294 *** | 7.775 *** | 1.372 | 1.670 *** |

| (132.690) | (86.343) | (37.69) | (34.212) | |

| Year | Yes | Yes | Yes | Yes |

| County | Yes | Yes | Yes | Yes |

| N | 15,162 | 15,162 | 15,162 | 15,162 |

| R-squared | 0.247 | 0.448 | 0.060 | 0.095 |

| Year | Gini Moran’s I | Consumption Moran’s I | Con-Upgrading Moran’s I |

|---|---|---|---|

| 2010 | 0.195 ** (1.962) | 0.179 ** (2.056) | 0.254 *** (2.490) |

| 2012 | 0.195 ** (1.965) | 0.182 ** (2.100) | 0.216 * (2.171) |

| 2014 | 0.188 * (1.899) | 0.183 ** (2.092) | 0.222 ** (2.217) |

| 2016 | 0.203 ** (2.029) | 0.183 ** (2.086) | 0.207 ** (2.086) |

| 2018 | 0.186 * (1.880) | 0.190 ** (2.153) | 0.184 * (1.894) |

| 2020 | 0.210 ** (2.087) | 0.180 ** (2.054) | 0.273 *** (2.669) |

| Model | LM | LR | WALD |

|---|---|---|---|

| Spatial lag | 26.337 *** | 352.64 *** | 434.14 *** |

| Spatial error | 38.060 *** | 329.99 | 419.77 *** |

| Variable Name | Consumption | Con- Upgrading | Variable Name | Consumption | Con- Upgrading |

|---|---|---|---|---|---|

| Gini | 0.217 *** | 7.148 *** | W Gini | 0.802 *** | 3.519 *** |

| (0.066) | (0.250) | (0.136) | (0.801) | ||

| Gini2 | −0.215 *** | −7.581 *** | W Gini2 | −0.468 *** | −3.683 *** |

| (0.071) | (0.274) | (0.150) | (0.859) | ||

| Income | 0.008 ** | 0.012 *** | W Income | 0.035 *** | 0.086 *** |

| (0.004) | (0.004) | (0.002) | (0.009) | ||

| Assets | 0.005 *** | 0.008 *** | W Assets | 0.005 *** | 0.027 *** |

| (0.000) | (0.002) | (0.001) | (0.004) | ||

| Age | −0.002 *** | 0.002 *** | W Age | −0.001 ** | 0.004 *** |

| (0.000) | (0.000) | (0.000) | (0.001) | ||

| Health | 0.020 *** | 0.017 *** | W Health | −0.015 *** | −0.032 *** |

| (0.001) | (0.003) | (0.002) | (0.006) | ||

| Education | 0.002 *** | 0.002 * | W Education | 0.006 *** | −0.013 *** |

| (0.000) | (0.001) | (0.001) | (0.002) | ||

| Old ratio | 0.062 *** | 0.242 *** | W Old ratio | 0.256 *** | 0.225 *** |

| (0.006) | (0.021) | (0.015) | (0.061) | ||

| Child ratio | −0.037 *** | 0.100 *** | W Child ratio | 0.031 *** | 0.058 ** |

| (0.004) | (0.015) | (0.008) | (0.029) | ||

| Matrimony | −0.004 | −0.091 *** | W Matrimony | 0.159 *** | −0.429 *** |

| (0.004) | (0.016) | (0.009) | (0.038) | ||

| Family size | 0.007 *** | 0.008 *** | W Family size | 0.005 *** | 0.036 *** |

| (0.001) | (0.003) | (0.002) | (0.006) | ||

| Number of properties | 0.001 | −0.001 | W Number of properties | −0.006 | 0.036 * |

| (0.002) | (0.008) | (0.005) | (0.019) | ||

| rho | 0.063 * | 0.148 * | |||

| (0.036) | (0.085) | ||||

| Log-L | 847.545 | 605.401 | |||

| Sigma2 | 0.000 *** | 0.000 *** | |||

| (0.000) | (0.000) | ||||

| R-squared | 0.364 | 0.921 | |||

| N | 180 | 180 |

| Variable Name | Eastern | Central | Western | |||

|---|---|---|---|---|---|---|

| Consumption | Con- Upgrading | Consumption | Con- Upgrading | Consumption | Con- Upgrading | |

| Gini | 0.174 * | 7.097 *** | 0.289 * | 8.463 *** | 0.788 *** | 7.925 *** |

| (0.090) | (0.555) | (0.149) | (1.189) | (0.287) | (0.705) | |

| Gini2 | −0.221 * | −7.587 *** | −0.345 * | −8.766 *** | −0.882 *** | −8.709 *** |

| (0.116) | (0.593) | (0.180) | (1.266) | (0.336) | (0.824) | |

| W Gini | 1.663 *** | 2.569 * | 0.435 * | 2.544 * | 0.331 ** | 6.212 *** |

| (0.608) | (1.325) | (0.225) | (1.892) | (0.270) | (1.106) | |

| W Gini2 | −1.757 *** | −2.802 * | −0.335 * | −2.776 * | −0.241 * | −6.953 *** |

| (0.669) | (1.450) | (0.174) | (1.456) | (0.126) | (1.198) | |

| Control | Yes | Yes | Yes | Yes | Yes | Yes |

| rho | 0.286 ** | 0.248 ** | 0.123 * | 0.092 * | 0.323 ** | 0.425 ** |

| (0.125) | (0.124) | (0.07) | (0.052) | (0.148) | (0.166) | |

| Log-L | 266.536 | 202.199 | 214.316 | 165.982 | 336.549 | 248.935 |

| Sigma2 | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| R-squared | 0.210 | 0.619 | 0.001 | 0.006 | 0.258 | 0.963 |

| N | 60 | 60 | 48 | 48 | 72 | 72 |

| Variable Name | Developed | Undeveloped | ||

|---|---|---|---|---|

| Consumption | Con- Upgrading | Consumption | Con- Upgrading | |

| Gini | 0.406 *** | 6.791 *** | 0.139 | 6.644 *** |

| (0.155) | (0.436) | (0.249) | (0.764) | |

| Gini2 | −0.452 *** | −7.171 *** | −0.119 | −7.079 *** |

| (0.165) | (0.466) | (0.301) | (0.929) | |

| W Gini | −0.221 | 3.394 *** | 0.753 *** | 5.008 *** |

| (0.474) | (0.794) | (0.191) | (1.500) | |

| W Gini2 | 0.205 * | −3.571 *** | −0.575 *** | −5.815 *** |

| (0.209) | (0.844) | (0.206) | (1.699) | |

| Control | Yes | Yes | Yes | Yes |

| rho | 0.050 * | 0.048 * | 0.311 *** | 0.195 * |

| (0.028) | (0.026) | (0.118) | (0.113) | |

| Log-L | 416.673 | 313.834 | 359.880 | 267.731 |

| Sigma2 | 0.000 *** | 0.000 *** | 0.000 *** | 0.000 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | |

| R-squared | 0.448 | 0.846 | 0.602 | 0.676 |

| N | 96 | 96 | 84 | 84 |

| Variable Name | Replace Explanatory Variable | Replace Explained Variable | |

|---|---|---|---|

| Consumption | Con- Upgrading | Average Consume Propensity | |

| Top 10% of income | 0.086 *** | 2.774 *** | |

| (0.025) | (0.096) | ||

| Top 10% of income squared | −0.063 *** | −2.223 *** | |

| (0.165) | (0.466) | ||

| W-Top 10% of income | 0.367 *** | 1.373 *** | |

| (0.052) | (0.310) | ||

| Top 10% of income squared | −0.137 *** | −1.080 *** | |

| (0.044) | (0.252) | ||

| Gini | 0.019 *** | ||

| (0.006) | |||

| Gini2 | −0.019 *** | ||

| (0.006) | |||

| W Gini | 0.072 *** | ||

| (0.012) | |||

| W Gini2 | −0.042 *** | ||

| (0.013) | |||

| Control | Yes | Yes | Yes |

| rho | 0.063 * | 0.148 * | 0.066 * |

| (0.033) | (0.085) | (0.035) | |

| Log-L | 847.575 | 605.540 | 1282.048 |

| Sigma2 | 0.000 *** | 0.000 *** | 0.000 *** |

| (0.000) | (0.000) | (0.000) | |

| R-squared | 0.364 | 0.921 | 0.363 |

| N | 180 | 180 | 180 |

| Variable Name | Consumption | Con- Upgrading | Variable Name | Consumption | Con- Upgrading |

|---|---|---|---|---|---|

| L. Cons | −0.004 | ||||

| (0.023) | |||||

| L. Con-up | −0.010 | ||||

| (0.045) | |||||

| Gini | 0.170 ** | 7.270 *** | W Gini | 0.805 *** | 2.979 *** |

| (0.081) | (0.300) | (0.159) | (0.881) | ||

| Gini2 | −0.154 * | −7.697 *** | W Gini2 | −0.460 *** | −3.077 *** |

| (0.089) | (0.328) | (0.176) | (0.944) | ||

| Income | 0.002 * | 0.011 ** | W Income | 0.037 *** | 0.089 *** |

| (0.001) | (0.005) | (0.003) | (0.010) | ||

| Assets | 0.005 *** | 0.008 *** | W Assets | 0.006 *** | 0.023 *** |

| (0.000) | (0.002) | (0.001) | (0.004) | ||

| Age | −0.002 *** | 0.002 *** | W Age | −0.001 *** | 0.005 *** |

| (0.000) | (0.000) | (0.000) | (0.001) | ||

| Health | 0.021 *** | 0.019 *** | W Health | −0.015 *** | −0.027 *** |

| (0.001) | (0.004) | (0.002) | (0.009) | ||

| Education | 0.002 *** | 0.002 * | W Education | 0.006 *** | −0.012 *** |

| (0.000) | (0.001) | (0.001) | (0.002) | ||

| Old ratio | 0.058 *** | 0.262 *** | W Old ratio | 0.251 *** | 0.232 *** |

| (0.006) | (0.022) | (0.017) | (0.066) | ||

| Child ratio | −0.036 *** | 0.092 *** | W Child ratio | 0.037 *** | 0.036 |

| (0.005) | (0.017) | (0.010) | (0.036) | ||

| Matrimony | −0.002 | −0.086 *** | W Matrimony | 0.160 *** | −0.426 *** |

| (0.004) | (0.016) | (0.009) | (0.038) | ||

| Family size | 0.007 *** | 0.011 *** | W Family size | 0.004 ** | 0.034 *** |

| (0.001) | (0.003) | (0.002) | (0.007) | ||

| Number of properties | −0.001 | −0.004 | W Number of properties | −0.006 | 0.031 |

| (0.002) | (0.009) | (0.005) | (0.020) | ||

| rho | 0.031 * | 0.126 * | |||

| (0.018) | (0.072) | ||||

| Log-L | 672.517 | 466.859 | |||

| Sigma2 | 0.000 *** | 0.000 *** | |||

| (0.000) | (0.000) | ||||

| R-squared | 0.382 | 0.928 | |||

| N | 150 | 150 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, D. A Study on the Impact of Income Gap on Consumer Demand: An Empirical Test Based on the Spatial Panel Durbin Model. Sustainability 2024, 16, 4282. https://doi.org/10.3390/su16104282

Wang D. A Study on the Impact of Income Gap on Consumer Demand: An Empirical Test Based on the Spatial Panel Durbin Model. Sustainability. 2024; 16(10):4282. https://doi.org/10.3390/su16104282

Chicago/Turabian StyleWang, Dan. 2024. "A Study on the Impact of Income Gap on Consumer Demand: An Empirical Test Based on the Spatial Panel Durbin Model" Sustainability 16, no. 10: 4282. https://doi.org/10.3390/su16104282

APA StyleWang, D. (2024). A Study on the Impact of Income Gap on Consumer Demand: An Empirical Test Based on the Spatial Panel Durbin Model. Sustainability, 16(10), 4282. https://doi.org/10.3390/su16104282