Heterogeneous Effects of China’s Carbon Market on Carbon Emissions—Evidence from a Regression Control Method

Abstract

:1. Introduction

2. Literature Review and Research Hypothesis

2.1. Research Progress on the Effects of CTP Policy

2.2. CTP’s Carbon Emission Reduction Effects and Hypothesis Development

3. Empirical Research Design

3.1. Model Specification

3.2. Variables

3.2.1. Dependent Variables

3.2.2. Independent Variables

3.2.3. Mechanism and Environmental Variables

3.3. Sample Selection and Data Collection

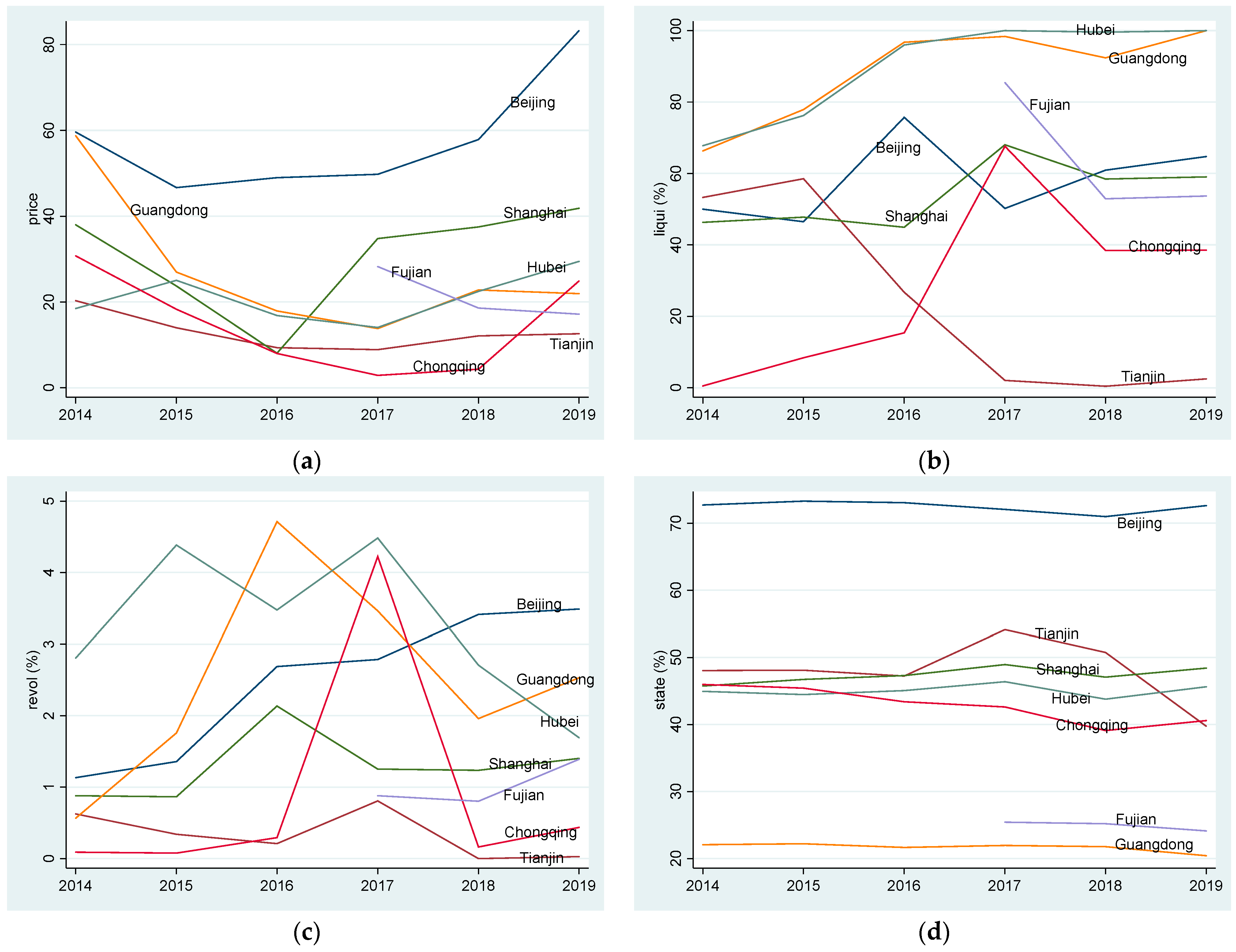

3.4. Characteristic Facts

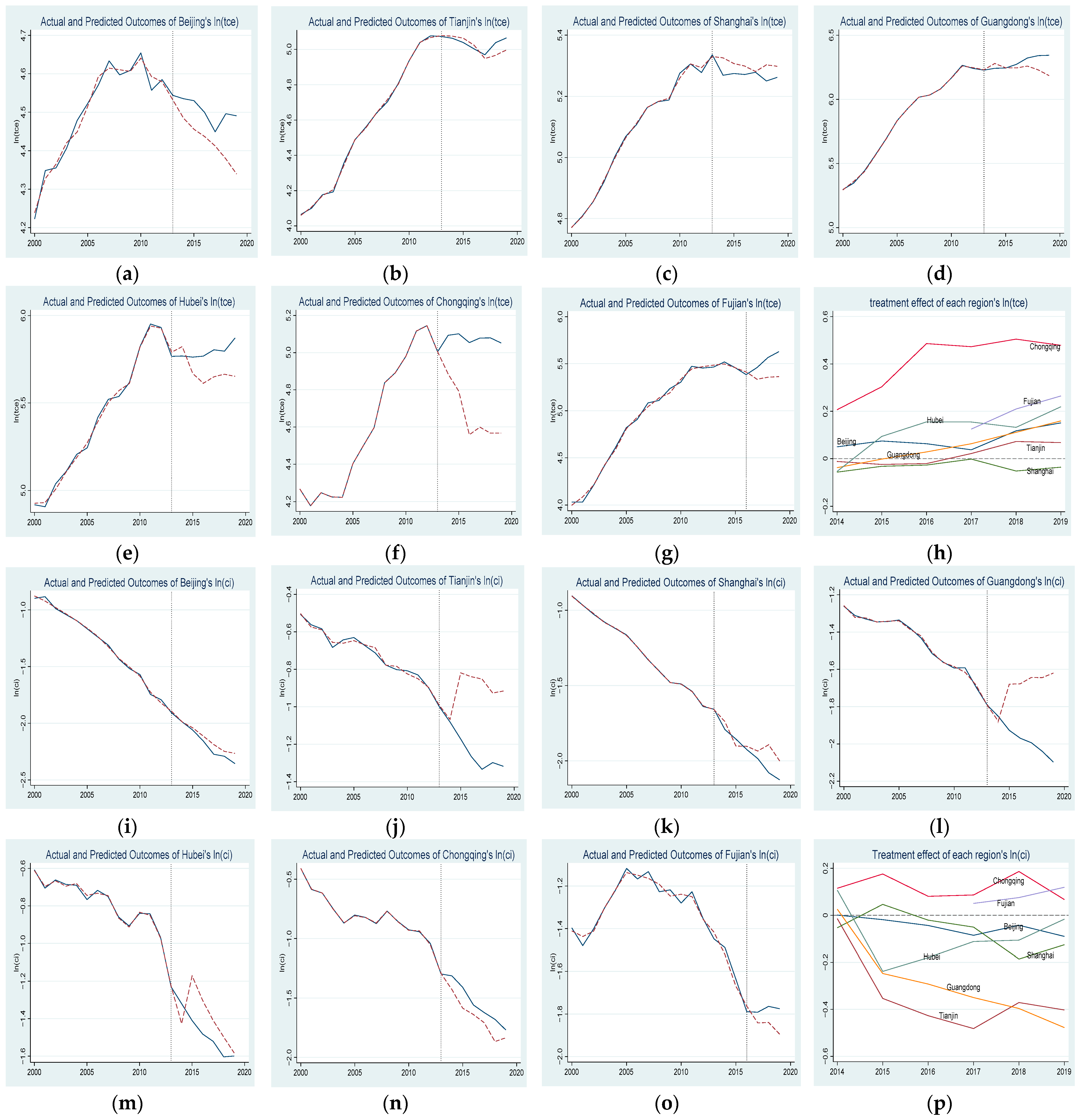

4. Estimation of Treatment Effects

4.1. Baseline Model Estimation Results

4.2. Results of Average Treatment Effect

4.3. Robust Analysis

- (1)

- Changing model parameters

- (2)

- Analysis of the impacts of spillover effects

4.4. Factors Affecting the Disparity of CTP Policy Impacts

5. Discussion

6. Conclusions and Policy Recommendations

6.1. Conclusions

6.2. Policy Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ahmad, M.; Zhao, Z.-Y.; Li, H. Revealing stylized empirical interactions among construction sector, urbanization, energy consumption, economic growth and CO2 emissions in China. Sci. Total. Environ. 2018, 657, 1085–1098. [Google Scholar] [CrossRef] [PubMed]

- Michieka, N.M.; Fletcher, J.; Burnett, W. An empirical analysis of the role of China’s exports on CO2 emissions. Appl. Energy 2013, 104, 258–267. [Google Scholar] [CrossRef]

- Chevallier, J.; Nguyen, D.K.; Reboredo, J.C. A conditional dependence approach to CO2-energy price relationships. Energy Econ. 2019, 81, 812–821. [Google Scholar] [CrossRef]

- Li, W.; Lu, C. The research on setting a unified interval of carbon price benchmark in the national carbon trading market of China. Appl. Energy 2015, 155, 728–739. [Google Scholar] [CrossRef]

- Chen, X.; Lin, B. Towards carbon neutrality by implementing carbon emissions trading scheme: Policy evaluation in China. Energy Policy 2021, 157, 112510. [Google Scholar] [CrossRef]

- Zhou, C.; Qi, S. Has the pilot carbon trading policy improved China’s green total factor energy efficiency? Energy Econ. 2022, 114, 106268. [Google Scholar] [CrossRef]

- Hong, Q.; Cui, L.; Hong, P. The impact of carbon emissions trading on energy efficiency: Evidence from quasi-experiment in China’s carbon emissions trading pilot. Energy Econ. 2022, 110, 106025. [Google Scholar] [CrossRef]

- Yu, H.; Jiang, Y.; Zhang, Z.; Shang, W.-L.; Han, C.; Zhao, Y. The impact of carbon emission trading policy on firms’ green innovation in China. Financial Innov. 2022, 8, 55. [Google Scholar] [CrossRef]

- Xiao, Y.; Huang, H.; Qian, X.-M.; Chen, L. Can carbon emission trading pilot facilitate green development performance? Evidence from a quasi-natural experiment in China. J. Clean. Prod. 2023, 400, 136755. [Google Scholar] [CrossRef]

- Chen, Z.; Zhang, X.; Chen, F. Do carbon emission trading schemes stimulate green innovation in enterprises? Evidence from China. Technol. Forecast. Soc. Chang. 2021, 168, 120744. [Google Scholar] [CrossRef]

- Huang, D.; Chen, G. Can the Carbon Emissions Trading System Improve the Green Total Factor Productivity of the Pilot Cities?—A Spatial Difference-in-Differences Econometric Analysis in China. Int. J. Environ. Res. Public Health 2022, 19, 1209. [Google Scholar] [CrossRef] [PubMed]

- Chen, Z.; Song, P.; Wang, B. Carbon emissions trading scheme, energy efficiency and rebound effect–Evidence from China’s provincial data. Energy Policy 2021, 157, 112507. [Google Scholar] [CrossRef]

- Liu, B.; Ding, C.J.; Hu, J.; Su, Y.; Qin, C. Carbon trading and regional carbon productivity. J. Clean. Prod. 2023, 420, 138395. [Google Scholar] [CrossRef]

- Xie, Y.; Guo, Y.; Zhao, X. The impact of carbon emission trading policy on energy efficiency—Evidence from China. Environ. Sci. Pollut. Res. 2023, 30, 105986–105998. [Google Scholar] [CrossRef] [PubMed]

- Tao, M.; Goh, L.T. Effects of Carbon Trading Pilot on Carbon Emission Reduction: Evidence from China’s 283 Prefecture-Level Cities. Chin. Econ. 2022, 56, 1–24. [Google Scholar] [CrossRef]

- Pan, X.; Pu, C.; Yuan, S.; Xu, H. Effect of Chinese pilots carbon emission trading scheme on enterprises’ total factor productivity: The moderating role of government participation and carbon trading market efficiency. J. Environ. Manag. 2022, 316, 115228. [Google Scholar] [CrossRef]

- Yang, X.; Zhang, J.; Bi, L.; Jiang, Y. Does China’s Carbon Trading Pilot Policy Reduce Carbon Emissions? Empirical Analysis from 285 Cities. Int. J. Environ. Res. Public Health 2023, 20, 4421. [Google Scholar] [CrossRef]

- Xia, Q.; Li, L.; Dong, J.; Zhang, B. Reduction Effect and Mechanism Analysis of Carbon Trading Policy on Carbon Emissions from Land Use. Sustainability 2021, 13, 9558. [Google Scholar] [CrossRef]

- Xuan, D.; Ma, X.; Shang, Y. Can China’s policy of carbon emission trading promote carbon emission reduction? J. Clean. Prod. 2020, 270, 122383. [Google Scholar] [CrossRef]

- Tian, G.; Yu, S.; Wu, Z.; Xia, Q. Study on the Emission Reduction Effect and Spatial Difference of Carbon Emission Trading Policy in China. Energies 2022, 15, 1921. [Google Scholar] [CrossRef]

- Zhang, Y.; Li, S.; Luo, T.; Gao, J. The effect of emission trading policy on carbon emission reduction: Evidence from an inte-grated study of pilot regions in China. J. Clean. Prod. 2020, 265, 121843. [Google Scholar] [CrossRef]

- Lan, J.; Li, W.; Zhu, X. The road to green development: How can carbon emission trading pilot policy contribute to carbon peak attainment and neutrality? Evidence from China. Front. Psychol. 2020, 13, 962084. [Google Scholar] [CrossRef] [PubMed]

- Yi, L.; Bai, N.; Yang, L.; Li, Z.; Wang, F. Evaluation on the effectiveness of China’s pilot carbon market policy. J. Clean. Prod. 2020, 246, 119039. [Google Scholar] [CrossRef]

- Shen, J.; Tang, P.; Zeng, H. Does China’s carbon emission trading reduce carbon emissions? Evidence from listed firms. Energy Sustain. Dev. 2020, 59, 120–129. [Google Scholar] [CrossRef]

- Li, Z.; Wang, J. Spatial spillover effect of carbon emission trading on carbon emission reduction: Empirical data from pilot regions in China. Energy 2022, 251, 123906. [Google Scholar] [CrossRef]

- Liu, Y.; Liu, S.; Shao, X.; He, Y. Policy spillover effect and action mechanism for environmental rights trading on green in-novation: Evidence from China’s carbon emissions trading policy. Renew. Sust. Energ. Rev. 2022, 153, 111779. [Google Scholar] [CrossRef]

- Yu, W.; Luo, J. Impact on Carbon Intensity of Carbon Emission Trading—Evidence from a Pilot Program in 281 Cities in China. Int. J. Environ. Res. Public Health 2022, 19, 12483. [Google Scholar] [CrossRef]

- Li, Z.; Wang, J. Spatial emission reduction effects of China’s carbon emissions trading: Quasi-natural experiments and policy spillovers. Chin. J. Popul. Resour. Environ. 2021, 19, 246–255. [Google Scholar] [CrossRef]

- Wang, X.Q.; Su, C.W.; Lobonţ, O.R.; Li, H.; Nicoleta-Claudia, M. Is China’s carbon trading market efficient? Evidence from emissions trading scheme pilots. Energy 2022, 245, 123240. [Google Scholar] [CrossRef]

- Lin, B.; Huang, C. Analysis of emission reduction effects of carbon trading: Market mechanism or government intervention? Sustain. Prod. Consum. 2022, 33, 28–37. [Google Scholar] [CrossRef]

- Hsiao, C.; Ching, H.S.; Wan, S.K. A Panel Data Approach for Program Evaluation: Measuring the Benefits of Political and Economic Integration of Hong Kong with Mainland China. J. Appl. Econ. 2012, 27, 705–740. [Google Scholar] [CrossRef]

- Hsiao, C.; Zhou, Q.K. Panel Parametric, Semiparametric, and Nonparametric Construction of Counterfactuals. J. Appl. Economet. 2019, 34, 463–481. [Google Scholar] [CrossRef]

| Treated Unit | Neighboring or Paired Assisted Units |

|---|---|

| Beijing | Hainan, Hubei, Inner Mongolia, Tianjin, Xinjiang, Yunnan |

| Tianjin | Beijing, Gansu, Guangxi, Hubei, Xinjiang |

| Shanghai | Jiangsu, Ningxia, Shanxi, Shaanxi, Xinjiang, Yunnan, Zhejiang |

| Guangdong | Fujian, Guangxi, Guizhou, Hainan, Hunan, Inner Mongolia, Jiangxi, Xinjiang |

| Hubei | Anhui, Chongqing, Henan, Hunan, Jiangxi, Shaanxi, Xinjiang, Zhejiang |

| Chongqing | Guizhou, Hubei, Hunan, Shaanxi, Shandong, Sichuan, Xinjiang, Zhejiang |

| Fujian | Guangdong, Henan, Jiangxi, Ningxia, Xinjiang Zhejiang |

| Variable | Unit | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|---|

| tce | Mt | 600 | 251.533 | 192.505 | 0.814 | 937.117 |

| ci | t/K¥ | 600 | 0.542 | 0.385 | 0.023 | 2.599 |

| gdppc | ¥ | 600 | 14,702.980 | 10,331.790 | 1768.000 | 65,126.000 |

| pop | M | 600 | 44.318 | 27.085 | 5.170 | 124.890 |

| indsh | % | 600 | 42.877 | 8.049 | 15.990 | 61.960 |

| sersh | % | 600 | 45.069 | 8.856 | 29.640 | 83.690 |

| ecost | - | 600 | 0.376 | 0.064 | 0.220 | 0.610 |

| fdide | % | 600 | 45.744 | 53.240 | 4.760 | 579.860 |

| trade | % | 600 | 31.210 | 37.133 | 1.280 | 171.130 |

| fisde | % | 600 | 9.771 | 3.357 | 4.790 | 24.520 |

| paq | 600 | 20,592.630 | 45,329.890 | 45.000 | 358,769.000 |

| Treated Unit | Beijing | Tianjin | Shanghai | Guangdong | Hubei | Chongqing | Fujian |

|---|---|---|---|---|---|---|---|

| Outcome Variable: ln(tce) | |||||||

| Number of Predictors | 7 | 9 | 7 | 8 | 5 | 12 | 7 |

| CVMSE | 0.003 | 0.001 | 0.001 | 0.001 | 0.006 | 0.005 | 0.007 |

| R2 | 0.978 | 1.000 | 0.999 | 1.000 | 0.997 | 1.000 | 0.997 |

| Outcome Variable: ln(ci) | |||||||

| Number of Predictors | 5 | 6 | 11 | 9 | 10 | 12 | 8 |

| CVMSE | 0.003 | 0.003 | 0.001 | 0.002 | 0.009 | 0.012 | 0.004 |

| R2 | 0.997 | 0.986 | 1.000 | 0.997 | 0.996 | 0.999 | 0.977 |

| Provincial Region | Whole Evaluation Period | The First Three-Year Period | The Second Three-Year Period | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Actual | Predicted | ATE | Actual | Predicted | ATE | Actual | Predicted | ATE | |

| Panel A: ATE on ln(tce) | |||||||||

| Beijing | 4.500 | 4.418 | 0.082 | 4.522 | 4.459 | 0.062 | 4.479 | 4.377 | 0.102 |

| Tianjin | 5.030 | 5.013 | 0.017 | 5.035 | 5.055 | −0.019 | 5.025 | 4.971 | 0.054 |

| Shanghai | 5.268 | 5.302 | −0.035 | 5.272 | 5.311 | −0.039 | 5.264 | 5.294 | −0.030 |

| Guangdong | 6.295 | 6.241 | 0.054 | 6.253 | 6.257 | −0.004 | 6.336 | 6.225 | 0.111 |

| Hubei | 5.795 | 5.678 | 0.117 | 5.766 | 5.701 | 0.065 | 5.824 | 5.655 | 0.169 |

| Chongqing | 5.076 | 4.662 | 0.415 | 5.083 | 4.745 | 0.337 | 5.070 | 4.578 | 0.492 |

| Fujian | 5.551 | 5.352 | 0.200 | 5.551 | 5.352 | 0.200 | |||

| Panel B: ATE on ln(ci) | |||||||||

| Beijing | −2.187 | −2.141 | −0.047 | −2.068 | −2.047 | −0.021 | −2.306 | −2.234 | −0.073 |

| Tianjin | 1.245 | 0.904 | −0.342 | 1.174 | 0.909 | −0.265 | 1.317 | 0.898 | −0.418 |

| Shanghai | −1.960 | −1.895 | −0.065 | −1.857 | −1.848 | −0.009 | −2.063 | −1.942 | −0.121 |

| Guangdong | −1.980 | −1.691 | −0.289 | −1.916 | −1.745 | −0.171 | −2.044 | −1.636 | −0.408 |

| Hubei | −1.490 | −1.399 | −0.091 | −1.404 | −1.300 | −0.104 | −1.575 | −1.497 | −0.078 |

| Chongqing | −1.558 | −1.677 | 0.119 | −1.426 | −1.550 | 0.124 | −1.690 | −1.803 | 0.113 |

| Fujian | −1.777 | −1.859 | 0.082 | −1.777 | −1.859 | 0.082 | |||

| Panel C: ATE on Economic Growth measured via ln(tce)−ln(ci) | |||||||||

| Beijing | 6.687 | 6.559 | 0.129 | 6.590 | 6.506 | 0.083 | 6.785 | 6.611 | 0.175 |

| Tianjin | 3.785 | 4.109 | 0.359 | 3.861 | 4.146 | 0.246 | 3.708 | 4.073 | 0.472 |

| Shanghai | 7.228 | 7.197 | 0.030 | 7.129 | 7.159 | −0.030 | 7.327 | 7.236 | 0.091 |

| Guangdong | 8.275 | 7.932 | 0.343 | 8.169 | 8.002 | 0.167 | 8.380 | 7.861 | 0.519 |

| Hubei | 7.285 | 7.077 | 0.208 | 7.170 | 7.001 | 0.169 | 7.399 | 7.152 | 0.247 |

| Chongqing | 6.634 | 6.339 | 0.296 | 6.509 | 6.295 | 0.213 | 6.760 | 6.381 | 0.379 |

| Fujian | 7.328 | 7.211 | 0.118 | 7.328 | 7.211 | 0.118 | |||

| Treated Unit | ln(tce) | ln(ci) |

|---|---|---|

| Beijing | 8 | 9 |

| Tianjin | 7 | 8 |

| Shanghai | 9 | 9 |

| Guangdong | 9 | 7 |

| Hubei | 8 | 7 |

| Chongqing | 8 | 8 |

| Fujian | 9 | 7 |

| Treated Unit | ln(tce) | ln(ci) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| SignN | SignP | SignS | ATES 1 | ∆ATE 2 | SignN | SignP | SignS | ATES 1 | ∆ATE 2 | |

| Beijing | √ 3 | √ | √ | 0.179 | 0.097 | √ | √ | √ | −0.142 | −0.095 |

| Tianjin | √ | √ | × 4 | −0.049 | −0.066 | √ | √ | √ | −0.323 | 0.019 |

| Shanghai | √ | √ | √ | −0.074 | −0.039 | √ | √ | √ | −0.182 | −0.117 |

| Guangdong | √ | √ | √ | 0.082 | 0.029 | √ | √ | √ | −0.232 | 0.058 |

| Hubei | √ | √ | √ | 0.208 | 0.091 | √ | √ | √ | −0.372 | −0.281 |

| Chongqing | √ | √ | √ | 0.481 | 0.066 | √ | √ | √ | 0.058 | −0.061 |

| Fujian | √ | √ | √ | 0.125 | −0.075 | √ | √ | √ | 0.123 | 0.041 |

| Factor | Multi-Level Ordered Logit Model | Multi-Level Ordered Probit Model |

|---|---|---|

| price | −0.099 ** (0.044) | −0.049 ** (0.022) |

| liqui | 0.064 ** (0.031) | 0.032 * (0.017) |

| revol | −0.350 (0.454) | −0.198 (0.264) |

| state | 0.224 * (0.125) | 0.134 * (0.074) |

| lngdppc | −401.906 * (206.693) | −212.445 * (111.974) |

| lngdppc2 | 19.056 ** (9.679) | 10.098 ** (5.252) |

| lnpop | −10.140 ** (4.623) | −5.300 ** (2.370) |

| lnpaq | 10.069 ** (3.954) | 5.521 *** (1.981) |

| indsh | 0.878 *** (0.330) | 0.506 *** (0.179) |

| /cut1 | −1998.992 ** (1073.846) | −1049.319 ** (582.706) |

| /cut2 | −1995.520 ** (1073.649) | −1047.407 ** (582.649) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, F.; Fu, Y.; Wang, W. Heterogeneous Effects of China’s Carbon Market on Carbon Emissions—Evidence from a Regression Control Method. Sustainability 2024, 16, 89. https://doi.org/10.3390/su16010089

Liu F, Fu Y, Wang W. Heterogeneous Effects of China’s Carbon Market on Carbon Emissions—Evidence from a Regression Control Method. Sustainability. 2024; 16(1):89. https://doi.org/10.3390/su16010089

Chicago/Turabian StyleLiu, Feng, Yu Fu, and Weiguo Wang. 2024. "Heterogeneous Effects of China’s Carbon Market on Carbon Emissions—Evidence from a Regression Control Method" Sustainability 16, no. 1: 89. https://doi.org/10.3390/su16010089

APA StyleLiu, F., Fu, Y., & Wang, W. (2024). Heterogeneous Effects of China’s Carbon Market on Carbon Emissions—Evidence from a Regression Control Method. Sustainability, 16(1), 89. https://doi.org/10.3390/su16010089