Evaluation of Fiscal and Non-Fiscal Policies for Electric Vehicles—A Multi-Criterion Sorting Approach

Abstract

1. Introduction

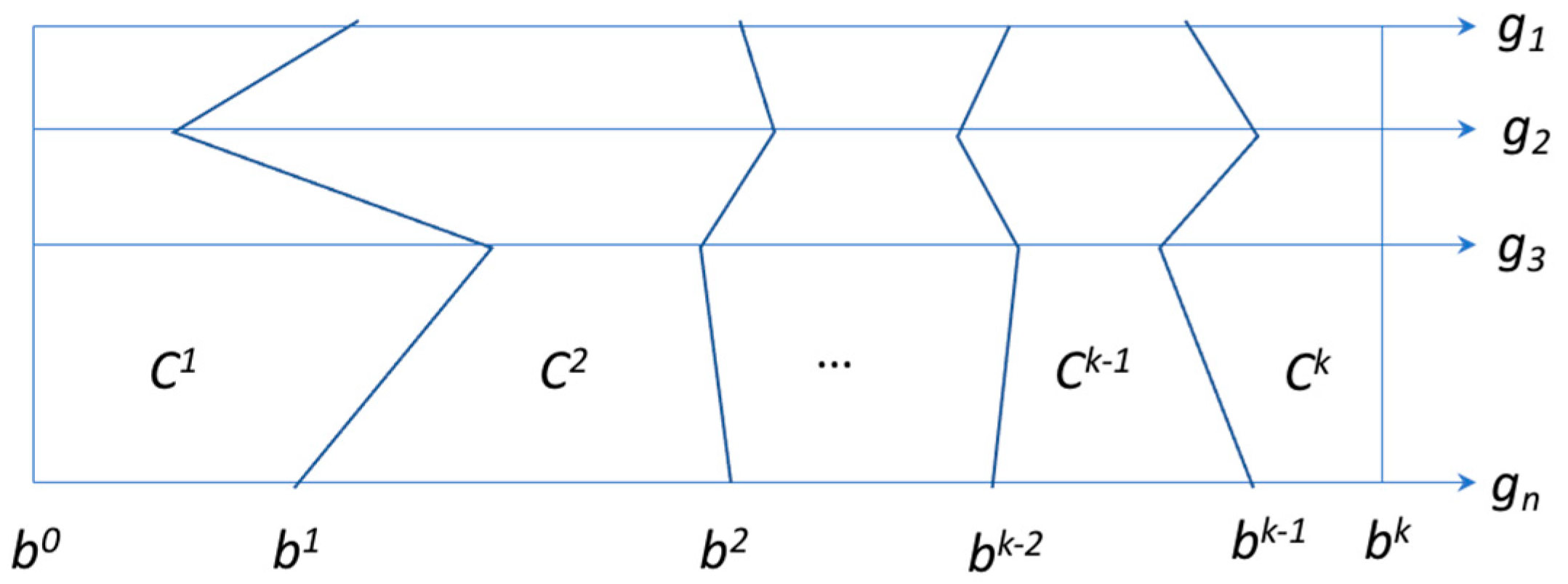

2. The ELECTRE TRI Method

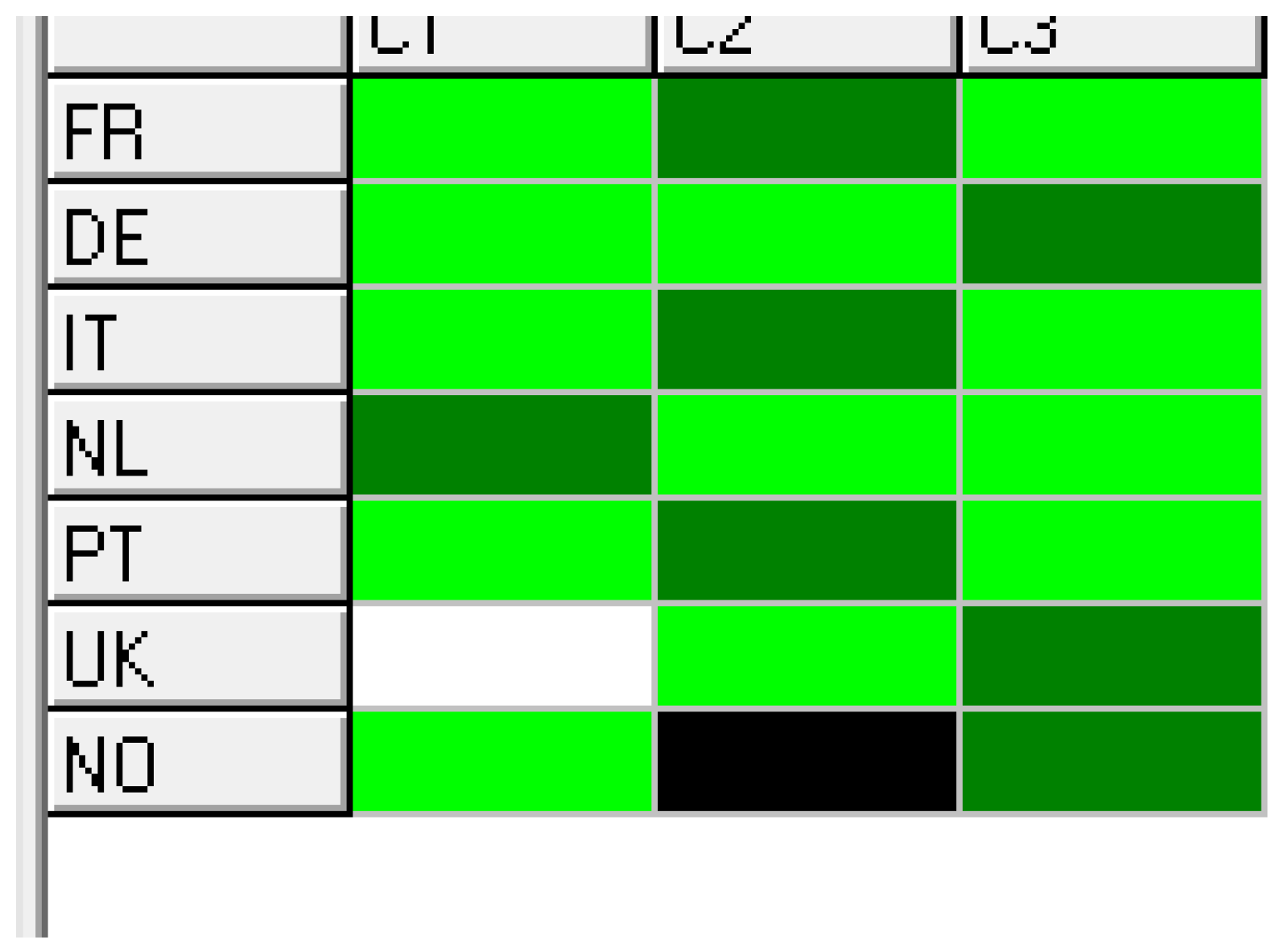

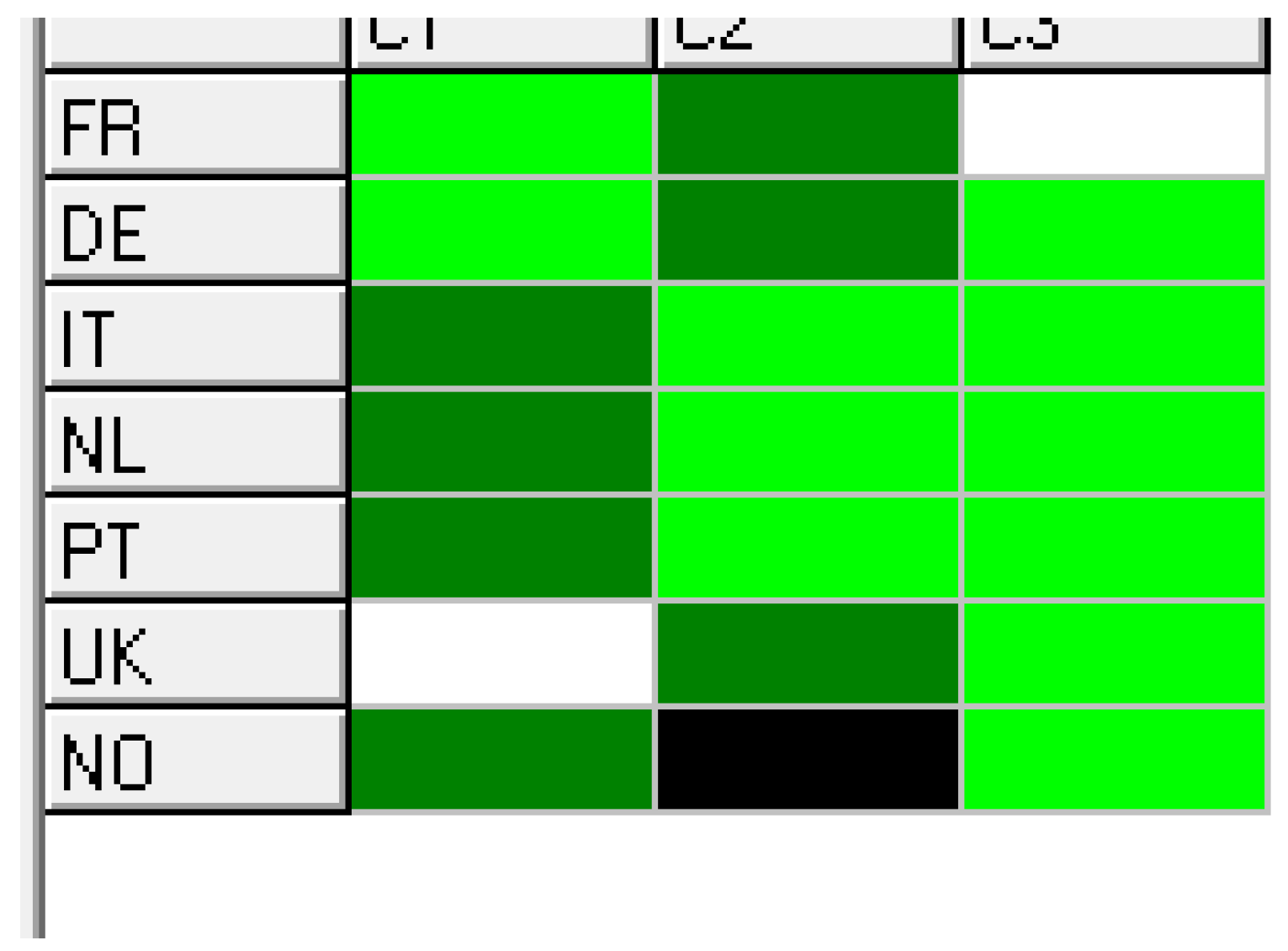

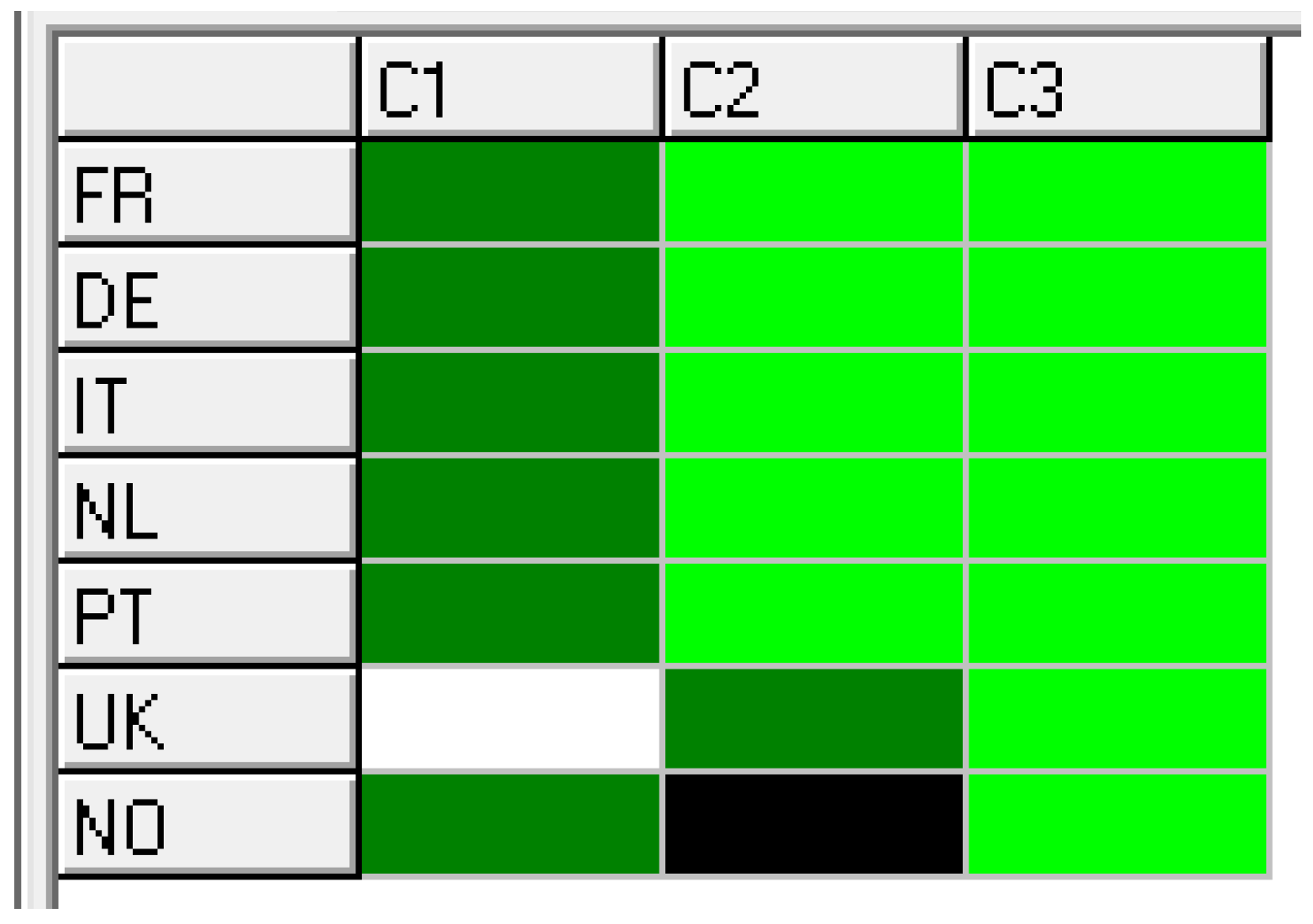

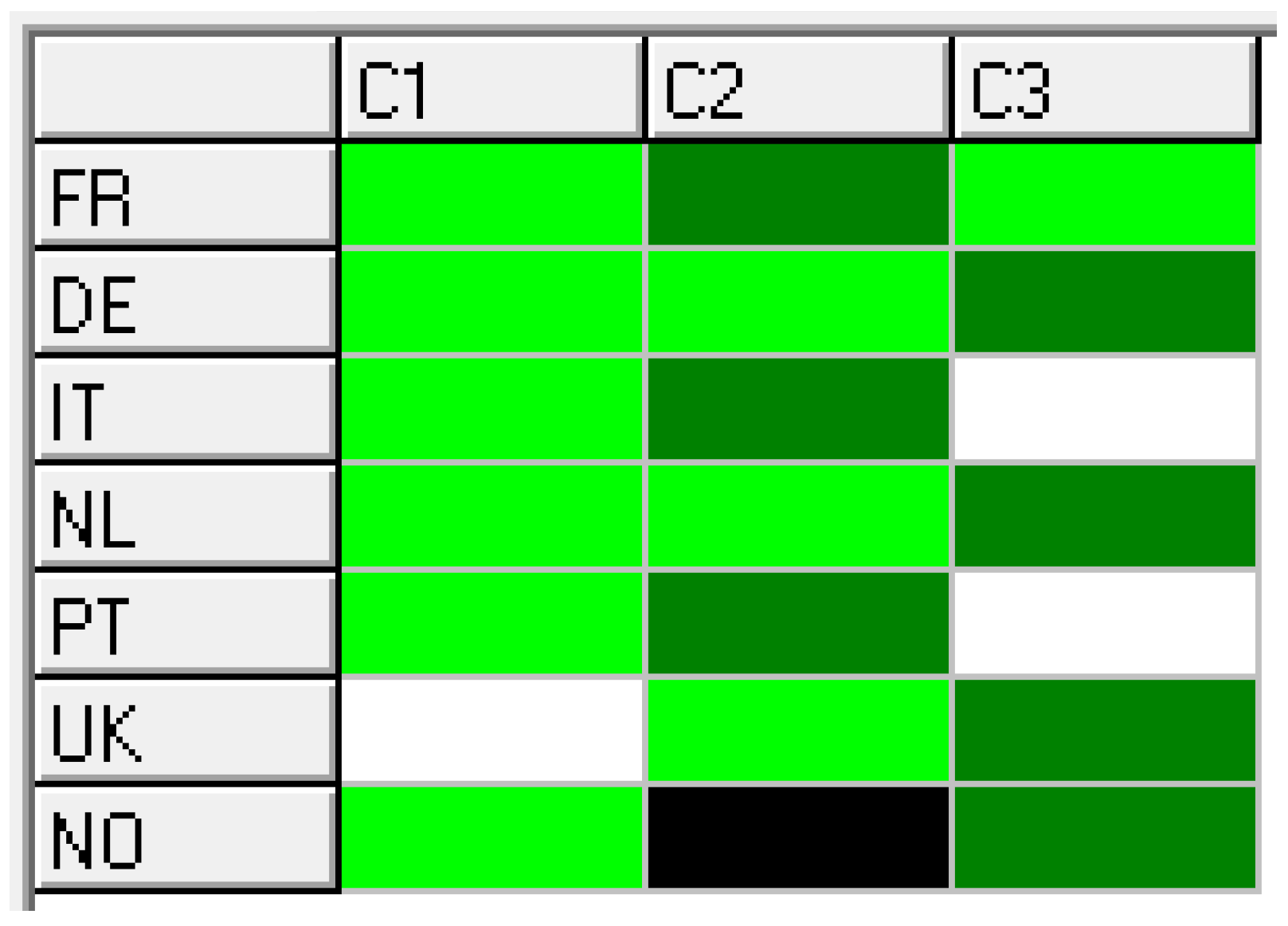

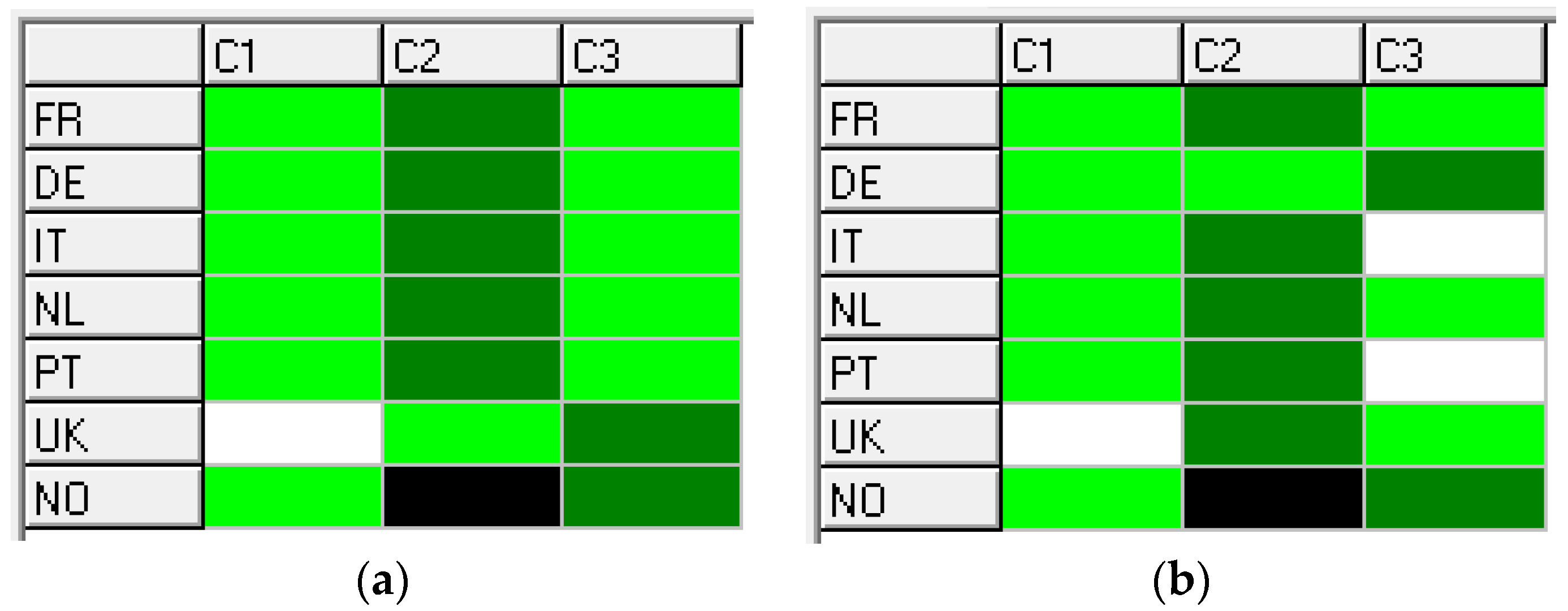

3. The MCDA Model

3.1. Context for the MCDA Model

3.2. Definition of the Criteria and Input Data

- Traffic regulation incentives (g1) [–]—Relates to the free use of bus/fast/high occupancy vehicle lanes, parking spots, toll bridges, ferries; higher score for countries with more permissions in a scale of 4 levels [0, 1, 2, 3].

- Benefits in the taxation of ICEV company cars (g2) [EUR]—lower benefits stimulate the adoption of EV.

- Consumer purchase incentives and uptake of EV (g3) [EUR]—Electric vehicle purchase incentives

- Tax benefits (g4) [–]—Register tax and VAT benefits given to BEVs; higher score for countries with more tax benefits in a scale of 4 levels [0, 1, 2, 3].

- Public fast charging points per 100 km of highway (g5) [#]—A proxy for how pervasive the charging networks is in each country.

- Ratio of tax shares in consumer prices of gasoline vs. electricity (g6) [EUR]—A proxy for capturing if higher ratios are likely to influence more the consumers’ option for buying an EV.

4. Results and Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- IEA. World Energy Outlook. 2022. Available online: https://www.iea.org/reports/world-energy-outlook-2022 (accessed on 10 January 2023).

- Distribution of Carbon Dioxide Emissions in the European Union in 2020. Available online: https://www.statista.com/statistics/999398/carbon-dioxide-emissions-sources-european-union-eu/ (accessed on 1 March 2023).

- Carbon Dioxide Emissions from Road Transportation in the European Union (EU-27) from 1990 to 2020. Available online: https://www.statista.com/statistics/1236763/road-transportation-greenhouse-gas-emissions-eu-by-mode/ (accessed on 1 March 2023).

- Davis, S.J.; Liu, Z.; Deng, Z.; Zhu, B.; Ke, P.; Sun, T.; Guo, R.; Hong, C.; Zheng, B.; Wang, Y.; et al. Emissions rebound from the COVID-19 pandemic. Nat. Clim. Chang. 2022, 12, 412–414. [Google Scholar] [CrossRef]

- European Environmental Agency. CO2 Performance of New Passenger Cars in Europe. Available online: https://www.eea.europa.eu/ims/co2-performance-of-new-passenger (accessed on 10 January 2023).

- Ayodele, B.V.; Mustapa, S.I. Life Cycle Cost Assessment of Electric Vehicles: A Review and Bibliometric Analysis. Sustainability 2020, 12, 2387. [Google Scholar] [CrossRef]

- Available online: http://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32019R0631 (accessed on 10 January 2023).

- Available online: https://www.consilium.europa.eu/en/press/press-releases/2022/06/02/fit-for-55-package-council-adopts-its-position-on-three-texts-relating-to-the-transport-sector/ (accessed on 10 January 2023).

- IEA. Global EV Outlook 2022. Available online: https://www.iea.org/reports/global-ev-outlook-2022 (accessed on 10 January 2023).

- Available online: https://www.eea.europa.eu/ims/new-registrations-of-electric-vehicles (accessed on 10 January 2023).

- Available online: https://www.statista.com/statistics/642799/eu-total-sales-electric-vehicles/ (accessed on 10 January 2023).

- Sierzchula, W.; Bakker, S.; Maat, K.; van Wee, B. The influence of financial incentives and other socio-economic factors on electric vehicle adoption. Energy Policy 2014, 68, 183–194. [Google Scholar] [CrossRef]

- Hardman, S.; Chandan, A.; Tal, G.; Turrentine, T. The effectiveness of financial purchase incentives for battery electric vehicles—A review of the evidence. Renew. Sustain. Energy Rev. 2017, 80, 1100–1111. [Google Scholar] [CrossRef]

- Rietmann, N.; Lieven, T. How policy measures succeeded to promote electric mobility—Worldwide review and outlook. J. Clean. Prod. 2019, 206, 66–75. [Google Scholar] [CrossRef]

- Lutsey, N. Transition to a Global Zero-emission Vehicle Fleet: A Collaborative Agenda for Governments. The International Council on Clean Transportation (ICCT). 2015. Available online: https://theicct.org/publications/transition-global-zero-emission-vehicle-fleet-collaborative-agenda-governments (accessed on 10 January 2023).

- European Alternative Fuels Observatory. On the Electrification Path: Europe’s Progress towards Clean Transportation. Available online: https://www.eafo.eu/sites/default/files/2021-03/EAFO%20Europe%20on%20the%20electrification%20path%20March%202021.pdf (accessed on 10 January 2023).

- International Energy Agency. International Energy Agency. Hybrid and Electric Vehicles—The Electric Drive Delivers. April 2015. Available online: https://ieahev.org/wp-content/themes/newTheme/assets/pdfs/2015_annual_report.pdf (accessed on 10 January 2023).

- Witkamp, B.; van Gijlswijk, R.; Bolech, M.; Coosemans, T.; Hooftman, N.S. The Transition to a Zero Emission Vehicles Fleet for Cars in the EU by 2050: Pathways and Impacts: An Evaluation of Forecasts and Backcasting the COP21 Commitments. European Alternative Fuels Observatory. 2017. Available online: https://cris.vub.be/ws/portalfiles/portal/35220288/The_Transition_to_a_ZEV_car_fleet_EU_2050_an_EAFO_study.pdf (accessed on 10 January 2023).

- Bakker, S.; Maat, K.; van Wee, B. Stakeholders interests, expectations, and strategies regarding the development and implementation of electric vehicles: The case of the Netherlands. Transp. Res. Part A Policy Pract. 2014, 66, 52–64. [Google Scholar] [CrossRef]

- Figenbaum, E. Perspectives on Norway’s supercharged electric vehicle policy. Environ. Innov. Soc. Transit. 2017, 25, 14–34. [Google Scholar] [CrossRef]

- Milne, R. Reality of Subsidies Drives Norway’s Electric Car Dream. Financial Times. 2017. Available online: https://www.ft.com/content/84e54440-3bc4-11e7-821a-6027b8a20f23 (accessed on 10 January 2023).

- Fridstrøm, L. The Norwegian Vehicle Electrification Policy and Its Implicit Price of Carbon. Sustainability 2021, 13, 1346. [Google Scholar] [CrossRef]

- Broadbent, G.; Metternicht, G.; Wiedmann, T. Increasing Electric Vehicle Uptake by Updating Public Policies to Shift Attitudes and Perceptions: Case Study of New Zealand. Energies 2021, 14, 2920. [Google Scholar] [CrossRef]

- Xue, C.; Zhou, H.; Wu, Q.; Wu, X.; Xu, X. Impact of Incentive Policies and Other Socio-Economic Factors on Electric Vehicle Market Share: A Panel Data Analysis from the 20 Countries. Sustainability 2021, 13, 2928. [Google Scholar] [CrossRef]

- Ivanova, G.; Moreira, A.C. Antecedents of Electric Vehicle Purchase Intention from the Consumer’s Perspective: A Systematic Literature Review. Sustainability 2023, 15, 2878. [Google Scholar] [CrossRef]

- Pelegov, D.V.; Chanaron, J.-J. Electric Car Market Analysis Using Open Data: Sales, Volatility Assessment, and Forecasting. Sustainability 2023, 15, 399. [Google Scholar] [CrossRef]

- Vrabie, C. Electric Vehicles Optimism versus the Energy Market Reality. Sustainability 2022, 14, 5388. [Google Scholar] [CrossRef]

- Cavallaro, F.; Danielis, R.; Nocera, S.; Rotaris, L. Should BEVs be subsidized or taxed? A European perspective based on the economic value of CO2 emissions. Transp. Res. Part D Transp. Environ. 2018, 64, 70–89. [Google Scholar] [CrossRef]

- Nocera, S.; Basso, M.; Cavallaro, F. Micro and Macro modelling approaches for the evaluation of the carbon impacts of transportation. Transp. Res. Procedia 2017, 24, 146–154. [Google Scholar] [CrossRef]

- Hidrue, M.K.; Parsons, G.R.; Kempton, W.; Gardner, M.P. Willingness to pay for electric vehicles and their attributes. Resour. Energy Econ. 2011, 33, 686–705. [Google Scholar] [CrossRef]

- Roy, B.; Bouyssou, D. Aide Multicritère à la Décision: Méthodes et Cas; Economica: Paris, France, 1993; Available online: https://basepub.dauphine.fr/handle/123456789/4522 (accessed on 10 January 2023).

- Roy, B. The outranking approach and the foundations of electre methods. Theory Decis. 1991, 31, 49–73. [Google Scholar] [CrossRef]

- Mousseau, V.; Slowinski, R.; Zielniewicz, P. A user-oriented implementation of the ELECTRE-TRI method integrating preference elicitation support. Comput. Oper. Res. 2000, 27, 757–777. [Google Scholar] [CrossRef]

- Dias, L.C.; Mousseau, V. IRIS: A DSS for multiple criteria sorting problems. J. Multi-Criteria Decis. Anal. 2003, 12, 285–298. [Google Scholar] [CrossRef]

- FIER Automotive & Mobility; Weken, H.; Bestebreurtje, E.; van der Wilt, S.; Kroon, R. Dutch BEV Policy In an International Perspective. June 2021. Available online: https://www.rvo.nl/sites/default/files/2021/07/Dutch%20BEV%20policy%20in%20an%20international%20perspective%20-%20June%202021.pdf (accessed on 10 January 2023).

- Transport & Environment. Break-up with Combustion Engines—How Going 100% Electric for New Cars & Vans by 2035 is Feasible in all EU Countries. May 2021. Available online: https://ecodes.org/images/que-hacemos/01.Cambio_Climatico/Incidencia_politicas/Movilidad/20210510_Break-up_with_combustion_engines_BriefingBloomergNEF_Study.pdf (accessed on 10 January 2023).

- European Green Deal. Available online: https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal_en (accessed on 10 November 2021).

- Wang, Q.; Li, S.; Pisarenko, Z. Heterogeneous effects of energy efficiency, oil price, environmental pressure, R&D investment, and policy on renewable energy—Evidence from the G20 countries. Energy 2020, 209, 118322. [Google Scholar] [CrossRef]

| Criteria Country | g1 (max) | g2 (min) | g3 (max) | g4 (max) | g5 (max) | g6 (max) |

|---|---|---|---|---|---|---|

| France | 0 | 12% | 6.000 € | 1 | 18 | 1.43 |

| Germany | 2 | 12% | 4.000 € | 0 | 47 | 1.09 |

| Italy | 1 | 30% | 6.000 € | 0 | 13 | 2.86 |

| Netherlands | 1 | 22% | 0 | 2 | 35 | 1.07 |

| Portugal | 0 | 9% | 0 | 2 | 12 | 1.16 |

| UK | 1 | 13% | 5.220 € | 2 | 130 | 1.61 |

| Norway | 3 | 20% | 0 | 3 | 655 | 2.03 |

| Criteria | g1 | g2 | g3 | g4 | g5 | g6 |

|---|---|---|---|---|---|---|

| Parameter | Traffic regulation incentives [-] | Benefits in the taxation of company cars [%] | Consumer purchase incentives [EUR] | Tax benefits [-] | Public fast charging points per 100 km of highway (#) | Ratio tax shares in consumer prices of gasoline vs. electricity [-] |

| g(b1) | 1 | 12 | 1500 | 1 | 8 | 1.2 |

| q1 | 0 | 1 | 200 | 0 | 1 | 0.1 |

| p1 | 1 | 2 | 400 | 1 | 2 | 0.2 |

| g(b2) | 2 | 8 | 4000 | 2 | 20 | 2.0 |

| q2 | 0 | 1 | 400 | 0 | 1 | 0.2 |

| p2 | 1 | 2 | 600 | 1 | 3 | 0.3 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Clímaco, I.; Henggeler Antunes, C. Evaluation of Fiscal and Non-Fiscal Policies for Electric Vehicles—A Multi-Criterion Sorting Approach. Sustainability 2023, 15, 6213. https://doi.org/10.3390/su15076213

Clímaco I, Henggeler Antunes C. Evaluation of Fiscal and Non-Fiscal Policies for Electric Vehicles—A Multi-Criterion Sorting Approach. Sustainability. 2023; 15(7):6213. https://doi.org/10.3390/su15076213

Chicago/Turabian StyleClímaco, Isabel, and Carlos Henggeler Antunes. 2023. "Evaluation of Fiscal and Non-Fiscal Policies for Electric Vehicles—A Multi-Criterion Sorting Approach" Sustainability 15, no. 7: 6213. https://doi.org/10.3390/su15076213

APA StyleClímaco, I., & Henggeler Antunes, C. (2023). Evaluation of Fiscal and Non-Fiscal Policies for Electric Vehicles—A Multi-Criterion Sorting Approach. Sustainability, 15(7), 6213. https://doi.org/10.3390/su15076213