1. Introduction

The emissions trading scheme (ETS) is the world’s leading emissions reduction policy [

1,

2], including the E.U. ETS, Korean ETS, Australian ETS, and Chinese ETS, to name a few. ETSs are an important institutional innovation that use market mechanisms to control and reduce greenhouse gas emissions and promote the green and low-carbon transformation of economic development methods. Generally speaking, regulators set and allocate emission allowances to participants under a system of aggregate control and allowance trading. They combine environmental performance and flexibility through market-based trading instruments to make it possible for participants to achieve emission reduction goals at the least cost. Extensive research has confirmed the significant impact of ETSs on carbon emissions and energy consumption, such as the findings of Bel and Joseph [

3], Lise et al. [

4], and Schäfer [

5]. At the same time, the economic impact of ETSs has also received considerable attention from the scientific community, including authors such as Choi et al. [

6], Koch and Themann [

7], and Nong et al. [

8].

The dual role in economic growth and emissions reduction organically links ETSs to green total factor productivity (GTFP) [

9]. Subject to limited resources and increasingly serious environmental pollution, resources and environment are no longer only endogenous variables to promote but are also constraints to limit economic development, so the concept of green development is proposed. Therefore, GTFP, which takes pollutant emissions into account in the output indicator system, is more acceptable than total factor productivity, which only considers economic output. Moreover, ETSs mainly cover industrial enterprises [

10,

11], which are the primary sources of carbon emissions [

12]. In this sense, the ETS has the most direct impact on industrial enterprises, thus leading to a new important question that is different from regional GTFP: whether an ETS has influenced the industrial green total factor productivity (IGTFP). In this context, Chen and Hibiki [

10] explored the effect of ETSs on IGTFP and IGTFP’s calculated indicators. However, the underlying remains unknown. Moreover, in the heterogeneity analysis of the effect of ETSs on IGTFP, it is important to figure out which factors are driving such a heterogeneous effect, but this has also been neglected in existing studies. Given this background, this paper investigates the effects of ETSs on IGTFP and the underlying mechanisms. In other words, this study answers two fundamental theoretical questions: one is the effects of an ETS on IGTFP, and the other is the association mechanism between an ETS and IGTFP.

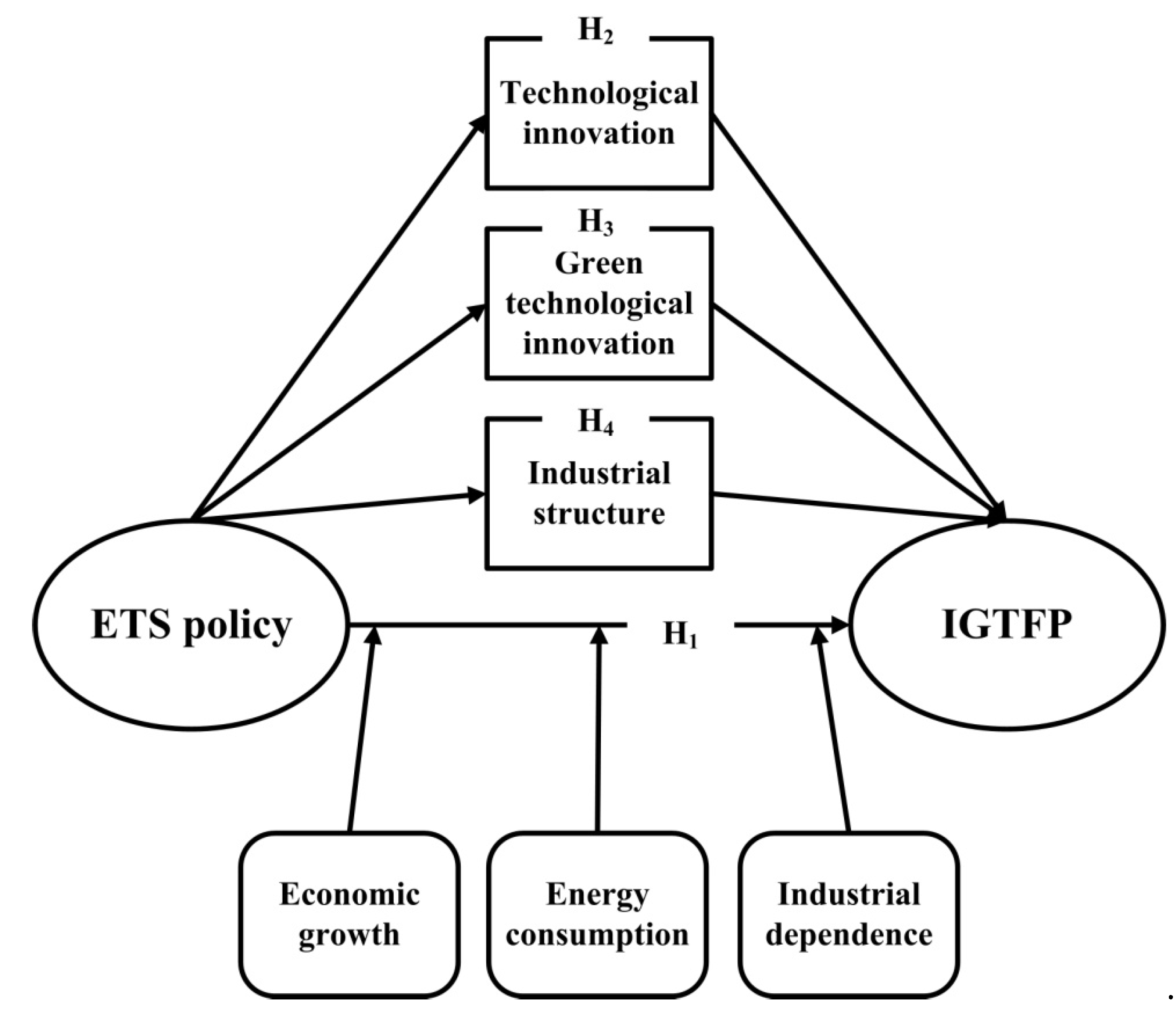

Unlike the existing studies, this study has the following significant theoretical and practical contributions. Firstly, it investigates the impact of an ETS on IGTFP, which enriches the research spectrum of ETS impact. Secondly, and more importantly, the paper discusses the possible mediating mechanisms and regional heterogeneity of the ETS’s effects on IGTFP, thus enriching and deepening the theoretical understanding of the link between the ETS and IGTFP. Specifically, we reveal how the ETS enhances IGTFP through changes in technological innovation, green technology innovation, and industrial structure. We also explore the effects of economic development, energy consumption, and industrial dependence on the nexus of the ETS on IGTFP. Finally, this study provides key policy recommendations for enhancing the positive impact of ETSs on IGTFP, which provides a solid reference for the broader diffusion of ETSs and the green transition of the industrial sectors.

2. Literature Review and Theoretical Hypotheses

The E.U. ETS was implemented earlier and has more influence among the global ETS systems. De Perthuis and Trotignon [

13], Flachsland et al. [

14], and Verde et al. [

15] discussed the working mechanisms of the E.U. ETS in terms of subsidy allocation, international convergence, environmental policy convergence, and price floors. In addition, Brohé and Burniaux [

16], Borghesi et al. [

17], Koch and Themann [

7], and Stuhlmacher et al. [

18] estimated the impact of the E.U. ETS on carbon emissions, low-carbon investment and innovation, and firm productivity. Apart from the E.U. ETS, Chevallier [

19], Choi et al. [

6], Nong et al. [

8], and Wakabayashi and Kimura [

20] confirmed the economic and carbon emission impacts of ETSs (including related information) in Australia, Korea, Vietnam, and metropolitan Tokyo (Japan), respectively. With the promotion of the ETS in China, research on ETSs in China has continued to grow in recent years. These studies have also shown that the ETS reduces China’s carbon emissions and energy consumption [

21]. In addition, the research also refers to the effects on corporate profitability [

22], low-carbon investment [

23], income inequality [

24], and haze pollution concentration [

25].

Unlike total factor productivity, GTFP indicates the harmonious development of regional resources, the environment, and the economy and guides economic development to incorporate the reasonable consumption of energy and resources and the reduction in environmental pollution [

26,

27]. Since the core concept of low-carbon transition is to reduce energy consumption and carbon emissions, green total factor productivity becomes increasingly important in the ETS context. Therefore, the accounting of GTFP and factors influencing it have also received considerable scholars’ attention. For example, Lin and Chen [

26], Lee and Lee [

27], Song et al. [

28], Cao et al. [

29], Xie et al. [

30], and Jin et al. [

31], respectively, evidenced the effects of factor market distortion, green finance, fiscal decentralization, e-commerce development, energy consumption transition, and political competition on GTFP. Furthermore, given the significant economic and environmental impacts of the ETS on the pilot regions, Zhang et al. [

32] confirmed that the DEA efficiency of the carbon trading market in the ETS pilot regions increases significantly. Li et al. [

9] recently showed that the ETS significantly increases GTFP in the pilot regions.

Due to the different positions and rhythms of various economic sectors in green development, some scholars have calculated the GTFP of different sectors separately, such as extractive industries [

33], agriculture [

34], and the metal industry [

35]. In addition, Zhong et al. [

36] calculated the GTFP of the overall industrial sector in the Chinese Yangtze River economic belt. Although its coverage is expanding, the Chinese pilot ETS covers mainly the industrial sector [

37,

38,

39,

40,

41], which accounts for the biggest part of China’s carbon emissions. The national ETS launched in 2021 also focuses only on the crucial industrial sector: the power sector. Moreover, the future expansion of the national ETS will also be focused on the industrial sector [

42,

43]. Therefore, the economic and environmental impacts of China’s ETS are actually more concentrated in the industrial sector [

44,

45,

46]. Thus, the change in the industrial sector is significant when looking at the impact of the ETS. Thus, combining the above significant effects of the ETS, the ETS coverage of the industrial sector, and the definition of GTFP, the nexus of IGTFP and the ETS constitutes a fundamental theoretical and practical question in the context of green development. Considering the existing discoveries and the practice of ETSs in China, we attempt to explain the theoretical relationship between ETSs and IGTFP and thus derive the basic hypothesis of this article:

Hypothesis 1 (H1). The ETS significantly affects IGTFP.

Technological innovation is an essential mechanism in the process of ETSs. Theoretically, an ETS stimulates the development of new technologies in manufacturing engineering, energy efficiency, and carbon sequestration to reduce carbon emissions. New technological advances likewise increase productivity and reduce environmental pollution, thus helping to improve IGTFP. Technological innovation is also a means to enhance resource allocation and production efficiency and thus effectively increases the level of green total factor productivity [

47,

48]. However, Bel and Joseph [

49] asserted that a large surplus of quota allocation would lead to a very limited or even negative impact on technological innovation. In particular, the advancement of green and low-carbon technologies is one of the more desired outputs of ETSs, as opposed to general technological innovation. Technological innovation, which refers to the innovation of production technologies, includes new technologies development, or the application of existing technologies to innovation. The purpose of green technology innovation is to preserve the environment, also known as ecotechnology innovation. Thus, the impact of ETSs on green technological innovation has been widely confirmed by existing studies.

For instance, Rogge and Hoffmann [

50] found that the E.U. ETS influences the speed and direction of technological innovation in power generation technologies. Teixidó et al. [

51] identified a greater increase in innovation and adoption of low-carbon technologies due to the reform of the E.U. ETS. Similarly, Gao and Wang [

52] argued that appropriate ETS design can effectively encourage firms to invest in low-carbon technologies, and Liu and Sun [

53] concluded that China’s pilot ETS could significantly contribute to low-carbon technology innovation. However, some studies deviate from these above findings. For example, in some resource-based industrial businesses, Zhao et al. [

54] discovered significant green innovation improvements rather than any evidence that the pilot ETS had an effect on the industry or all manufacturing industries. Chen et al. [

55] even pointed out that the Chinese ETS inhibits the development of green innovation. Their argument was that businesses primarily choose to reduce output under the ETS framework rather than promote green technology innovation. Therefore, we further hypothesize:

Hypothesis 2 (H2). Technological innovation mediates the effects of ETSs on IGTFP significantly.

Hypothesis 3 (H3). Green technological innovation mediates the effects of ETSs on IGTFP significantly.

Obviously, ETSs bring additional operating costs to industrial enterprises, which will cause a certain shift of resources and investments away from industrial enterprises to other industries, mainly to the tertiary sector, i.e., changing the industrial structure. This change will lead to a decrease in industrial value added and industrial inputs such as human, capital, and energy, which are the main input–output indicators of IGTFP; therefore, a change in industrial structure may lead to the IGTFP change. On the other hand, ETSs may also lead to the industrial upgrading of industrial firms due to technological, managerial, and product improvements. Several studies have confirmed the above-mentioned impact of ETSs on industrial structure. For example, as a result of the implementation of the E.U. ETS, Zang et al. [

56] discovered that the industrial structure is being upgraded and that its impact is increasing.

Additionally, Hu et al. [

44] and Liu et al. [

57] discovered that ETSs reduce emissions by restructuring industries; Tan et al. [

58] figured out that ETSs improve energy use efficiency by changing industrial structures as well. As an important stimulus for economic growth, industrial restructuring determines the direction of economic development and the quality of environmental protection, which in turn becomes a meaningful way to enhance green total factor productivity [

59]. Meanwhile, upgrading and adjusting industrial structures will promote the continuous optimization of resource allocation and improvement of production efficiency, effectively supporting the increase in GTFP [

60]. Therefore, we also hypothesize:

Hypothesis 4 (H4). Industrial structures significantly mediate the effects of ETSs on industrial green total factor productivity.

In addition to the four hypotheses mentioned above, the variability of the operating mechanisms of the ETS in different pilot regions may cause its impact on the IGTFP to be regionally different. For example, in Beijing and Shanghai, the ETS covers enterprises (units) that emit 10,000 tons or more of CO

2 directly or indirectly per year. In Tianjin, enterprises with annual integrated energy use of more than 10,000 tons of standard coal will be included in the ETS. Differently, Shenzhen has fewer high-carbon industries, and the standard setting of ETS-covered industries is mainly focused on the construction industry. In addition, with respect to quota allocation, significant differences still exist between ETS pilot regions, with multiple coexisting allocation methods, including grandfathering, benchmarking, and auctions [

61].

Regional heterogeneity of the impact of the ETS on IGTFP is also theoretically caused by the different socioeconomic characteristics of the pilot regions, such as economic development, industrial characteristics, and energy use. The heterogeneous effect of the ETS has already received extensive attention, such as the research by Li et al. [

9] and Zhang and Zhang [

24]. Li et al. [

9] analyzed the heterogeneous effects of ETSs on regional green total factor productivity in cities with different types of industrial structures, while Zhang and Zhang [

24] examined the heterogeneous effects of ETSs on income inequality based on different spatial clusters. In contrast to existing studies, we examine whether the impact of ETSs on IGTFP varies significantly across different cities with various economic growth, energy use, and industrial dependence, additionally considering that the operational mechanisms of ETSs in different regions are also influenced by regional socioeconomic characteristics [

42]. Conclusively,

Figure 1 shows the theoretical framework of this article.

3. Methodology

Similar to several studies that have looked at the effects of ETSs on IGTFP, we employ a quasinatural, empirical, difference-in-differences (DID) approach. In October 2011, seven provinces and cities launched local pilot projects for carbon emission trading. However, it was not until 2013 that China’s ETS was first officially piloted in Shenzhen, Guangdong Province, and later extended to the above-mentioned provinces and cities and Fujian Province. The regional pilot ETS ran until July 2021, when China’s nationwide ETS for the power sector went live. During the pilot period, China’s ETS had a significant impact on the economic and environmental aspects of the pilot regions. Considering the COVID-19 pandemic, we examine the impact of the ETS on the IGTFP as of 2019. We develop the following time-varying DID model to estimate the ETS’s impact on the IGTFP:

where

y denotes the IGTFP;

i and

t denote the city and time, respectively;

γi and

λt represent the region-fixed effects and time-fixed effects, respectively;

did denotes the policy dummy variable; and

con denotes control variables. The coefficient

θ is the policy effect to be estimated, i.e., the effect of the ETS on the IGTFP. According to the idea of the DID method and the actual implementation of the ETS policy in China, seven provinces were selected as the experimental group, while other regional cities constitute the control group. In addition, since the ETS policy was implemented at different times in different regions, the

did is 1 if the city belongs to the experimental group in the treatment period; otherwise, the

did is 0.

Since the IGTFP is not reported in the existing statistical system, we manually measured the IGTFP for each city. First, similar to Lee and Lee [

27], Li et al. [

9], and Zhong et al. [

36], we identified GDP as the desired output indicator; various pollutant emissions as the undesired output indicator; and labor, capital, and energy as input indicators. Accordingly, the input–output variables involved in the calculation of IGTFP included industrial value added, wastewater emissions, SO

2 emissions, dust emissions, labor inputs, capital inputs, and energy inputs. Industrial-value-added data were obtained from iFinD (

http://www.51ifind.cn/index.php?c=index&a=home accessed on 17 March 2022). Since there is no GDP price index for prefecture-level cities, we used the GDP price index of each province to obtain the real industrial value added, using 2005 as the base period. We used the entropy method to integrate three pollutant emissions as the nondesired output. Industrial labor is the number of persons employed in industrial sectors at year end. We used industrial fixed capital stock to represent capital inputs that are estimated using the following perpetual inventory method:

where

ICAPt is the annual fixed capital stock of each city,

It is the annual new industrial fixed asset investment of each city,

δ is the fixed capital depreciation rate, and

ICAPt−1 is the fixed capital stock of each city in the previous year. Using a 10% division of the city’s 2005 industrial fixed asset investment, each city’s initial industrial capital stock is measured. The annual amount of industrial fixed assets investment in each city is determined by the product of the city’s total social fixed assets investment and the ratio of industrial value added to the GDP in that year. As a rule, the capital natural depreciation rate is 9.6%. The fixed capital stock of each city also depreciated according to the fixed asset investment price index of each province for the base period of 2005. We use industrial electricity consumption to represent industrial energy input.

Based on the above input–output indicators, we refer to Feng et al. [

35] and Zhong et al. [

36] to integrate the metafrontier approach and the Malmquist–Luenberger productivity index to measure the IGTFP of each city. All calculations were conducted in MAXDEA8.0. software.

To avoid as much as possible the endogeneity problem of the ETS due to omitted variables in the model (1), we introduced various factors affecting IGTFP as control variables. First, referring to Song et al. [

28], the control variables contain foreign investment, resident population, and residents’ education. To prevent other possible omitted variables, we further added the economic development, the proportion of value added in the tertiary sector, and the proportion in the secondary sector as control variables. Foreign investment is measured as the ratio of total foreign investment utilized to GDP, population density is measured as the amount of resident population per square kilometer, residents’ education is measured as the ratio of urban education financial expenditure to GDP, and economic development is measured by GDP per capita. GDP per capita is also converted to real values based on 2005 constant prices.

Technological innovation and green technology innovation are indicated by the number of patents granted and green patents granted, respectively. We collected green patents from the patent database of the China National Intellectual Property Administration. The industrial structure is expressed as the ratio of the tertiary sector’s value added to the secondary sector’s value added.

Table 1 summarizes the above key variables, their measurements, and their data sources. We used linear interpolation to estimate the missing data for individual cities with a few particular years.

According to

Table 1, we obtained a total of 4140 observations, including 690 samples in the experimental group and 3450 samples in the control group from 276 cities between 2005 and 2019.

Table 2 reports the descriptive statistics.

5. Conclusions and Policy Implications

The ETS is the leading policy for achieving a low-carbon transition. This paper investigates the effects of the ETS on the IGTFP and its dynamics by using Chinese prefecture-level panel data from 2005 to 2019 before the national ETS run. The results demonstrate that the ETS contributes to the increase in IGTFP in the pilot regions, and the growth becomes progressively significant over time. However, the positive effect does not become significant until 2016. The ETS raises the IGTFP through improving green technological innovation and industrial structure, but the expected mediating mechanism of general innovation is absent. In addition, the ETS contributes more to the IGTFP in cities with higher economic growth and energy use levels. However, the higher proportion of secondary industry in the city means a smaller optimistic effect of the ETS on the IGTFP. A number of significant policy implications are highlighted in the article based on the aforementioned finding.

First, the article provides scientific evidence for the national expansion of the ETS in China beyond the power sector. For China’s low-carbon transition and the absolute strategic foundation of its economy, the industrial sector is essential. The positive impact of the ETS on China’s IGTFP will reinforce China’s confidence that the ETS could be expanded to include more industrial sectors such as mining and manufacturing, in addition to the power sector.

Second, green technological innovation should be significantly improved. Specifically, it is proposed that quotas and subsidies be provided for green technological innovation in the industrial sector within the ETS framework. The use of renewable electricity should be encouraged in industrial enterprises and in the development of carbon sequestration technologies, carbon conversion technologies, and emission reduction technologies in the industrial sector, especially in the power sector. In addition, in order to force industrial enterprises to achieve technological emission reduction, a modest decrease in the overall free quota of the ETS is suggested; on the contrary, the auction mechanism should be strengthened. In addition, the price of carbon should be moderately increased under the market framework to exceed the cost of carbon reduction.

Third, the ETS causes a decrease in the secondary sector (mainly the industrial sector). As the main covered sector of the ETS, industrial sector development requires protection under the ETS framework. In addition to technological innovation, management and product upgrading in the industrial sector are also necessary and urgent. In addition, although ETS policies should be strict and prudent, a national unified carbon market should still maintain regional flexibility with regard to industrial friendliness, especially in industrial-dependent cities.

Fourth, the improvement in regional economic performance contributes to the positive effect of the ETS on the IGTFP. Economically developed regions can provide more flexible policy packages for the ETS implementation due to their solid socioeconomic support. Notably, economic growth remains a priority for regional development while the ETS is being implemented. Therefore, it is recommended that a coordinated growth mechanism be built for the ETS and the IGTFP based on economic development.

Despite the above findings, the paper has some limitations that warrant further exploration in the future. For example, in calculating the IGTFP, we assume that undesired output indicators include three pollutants. Due to the lack of statistical data, we do not consider another important indicator of green development, namely, industrial CO2 emissions. In the future, we can consider more nondesired output indicators to better characterize the IGTFP, provided data are available. In addition, this article only explores the direct effects of the ETS on the IGTFP, without considering possible spatial spillover effects. We can continue to explore whether the ETS also has indirect effects on the IGTFP in neighboring regions in the future.