1. Introduction

Environmental issues have received substantial attention in corporate green operations [

1,

2]. To achieve green operations, an increasing number of companies are focusing on

green innovation [

3], which is referred to as innovation to address environmental issues and achieve sustainable development. Green innovation includes green product design and process innovation to enable energy savings, pollution prevention, and waste recycling [

4]. Green innovation helps enterprises mitigate environmental risks [

5], promote resource efficiency [

6], reduce pollution rates [

7,

8], improve environmental performance [

9], and improve ecological reputation [

10]. Therefore, enterprises can benefit from green innovation by addressing global environmental issues to promote corporate development [

11].

Beyond corporate behavior impact on green innovation [

12,

13], scholars have also studied the influence of external institutions on corporate green innovation, environmental regulation [

14,

15], government subsidies [

16], and financial institutions [

17,

18]. Information exchange and coordination with external institutions are favorable for green innovation, allowing individual enterprises to engage in complex technological innovation with fewer capacity concerns and reduce technological and market uncertainties in green innovation activities [

19,

20]. Extant research focuses on the impact of internal organizational capabilities on green innovation or the impact of interactions between enterprises and external institutions on green innovation [

21]. A single institution cannot perform all tasks of a green innovation ecosystem and requires multiple actors to collaborate for innovation [

22]. Green innovation ecosystems are viable ways to collaborate to nurture a heterogeneous green value proposition for participants [

23]. Previous studies on green innovation ecosystems include the game between enterprises and upstream and downstream enterprises [

24,

25], the government-university-industry cooperative alliance [

23], and the interaction mechanism between external environmental regulation and corporate internal green innovation processes [

26]. Despite the existence of studies on green innovation systems, little is known about the government’s influence on participation in green innovation.

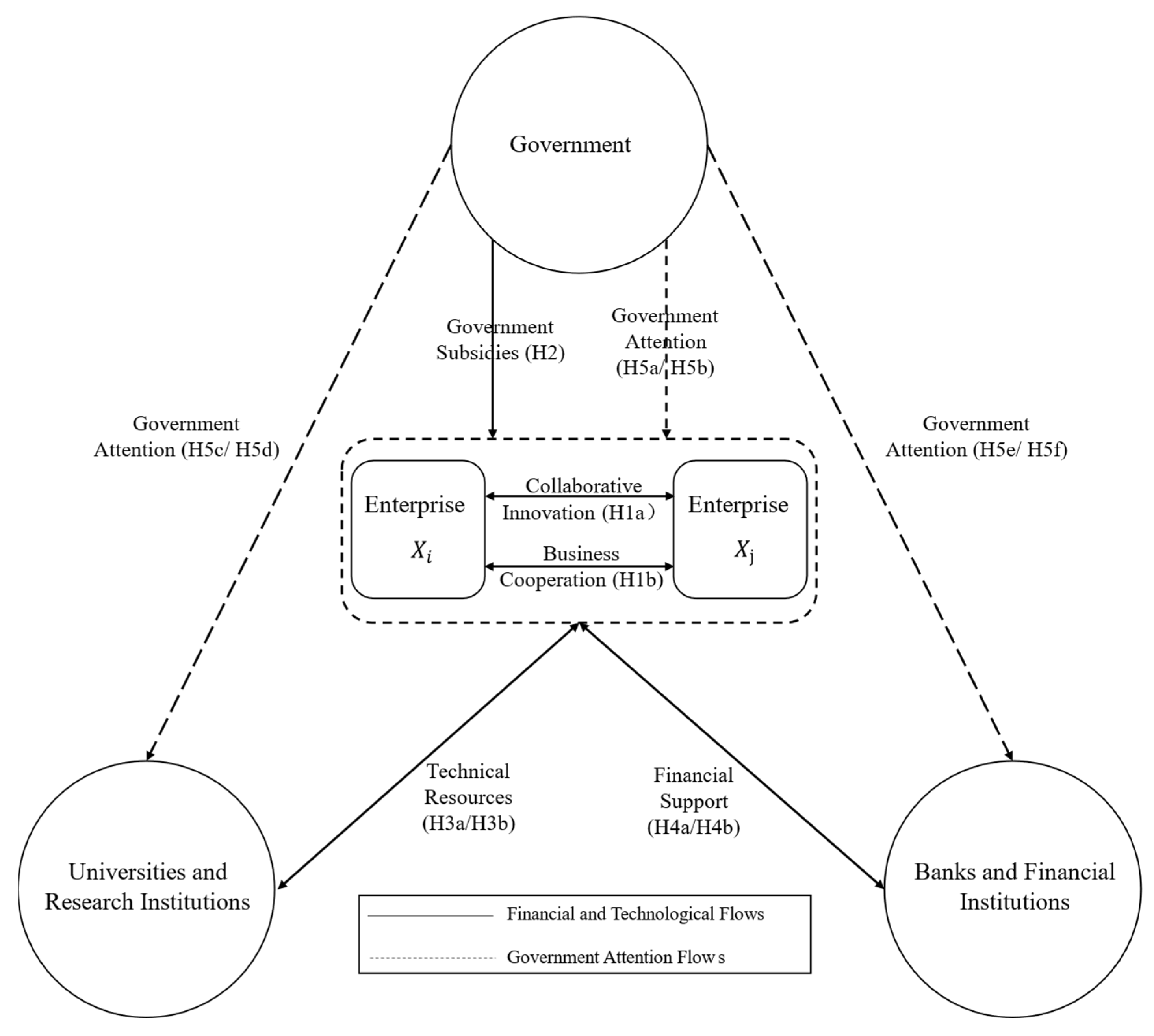

This study addresses this research gap by constructing a green innovation ecosystem based on resource dependence theory (RDT) to examine the roles of government, the contribution of participants, and the influence of government in the innovation ecosystem. RDT emphasizes that enterprises obtain resources for sustainable development through interdependence and interaction with their surroundings [

27]. Innovation in collaboration with other enterprises or institutions to form an innovation ecosystem is essential for resource access. A national innovation system (NIS) is an innovation network formed by the collaborative innovation of various sectors and institutions within a country [

28]. Extant research mainly considers NIS as an innovation system that includes government, academia, and enterprises [

29] and lacks attention to the complementarity between NIS and financial institutions [

30]. Considering the large upfront investment in green innovation [

31], high output uncertainty [

32], and double externality [

33], financial support from an external party is crucial for firms to engage in green innovation. Therefore, this study introduces financial institutions to research the national green innovation systems. Specifically, the innovation ecosystem is viewed as an entity comprising the government, research institutions (universities), enterprises, and financial institutions to increase corporate green innovation for national ecological development.

In this innovation ecosystem, the government provides subsidies for enterprises’ green innovation, banks provide financial support for green innovation, and enterprises cooperate with research institutions in industry-academia-research to provide technical support and resource allocation for green innovation. Furthermore, the government provides guidance to enterprises, research institutions, and financial institutions through resource allocation [

34] and signaling effects [

35]. Considering that government policy takes a long time to draft, develop, and implement, as well as the regional differences for enforcement, the role of government is hardly recognized in a timely and adequate manner in the national green innovation system [

36]. There is a concern regarding the process by which managers selectively focus on certain information while ignoring other parts [

37]. Attention is an important part of governmental decision-making, arguing that government resource allocation and priorities change as the attention of policymakers shifts [

38]. The annual work report of the local government summarizes the government’s work in the past year and discloses its priorities in the coming years. Therefore, government attention measured by government work reports is more flexible than government policies, which can also reflect regional differences [

39]. The frequency of words related to ecological development, green innovation, and innovative talent in government work reports reflects the extent to which the government pays attention to green innovation.

The main contributions of this study are threefold: First, it analyzes the roles of enterprises, governments, research institutions, and financial institutions in the national green innovation system, which provides a reference for countries keen on ecological problems and green development. Second, this study examines collaborative innovation among governments, financial institutions, research institutions, and enterprises, and how to increase corporate green innovation from an innovation system perspective. The government’s role in developing a green innovation system to influence other participants in green systems is also highlighted. This study offers theoretical insights into the adoption of governmental actions to realize the collaborative innovation of multiple participants in green innovation ecosystems. Finally, this study develops a series of game models to analyze the national green innovation system. The game models examine the effects of financial markets, corporate collaboration innovation, industry-academia-research cooperation, government subsidies, and government environmental regulation on corporate green innovation. This study substantiates the role of national green innovation systems in promoting green innovation through analysis using game models and empirical methods.

3. Data and Research Methodology

3.1. A Market Equilibrium Model of National Green Innovation System Based on Nash-Cournot Equilibrium Theory

Game theory is viewed as a mathematical model of strategic interactions between independent agents that provides decision makers with prescriptions and recommendations to help develop and implement effective strategies [

105]. Therefore, this study constructs a Nash-Cournot game model that involves enterprises, governments, financial institutions, and research institutions.

Consider an industry with

N firms facing an inverse demand function

The cost function of the firm is

c is the fixed cost per unit.

The profit function for firms 1 and 2 for Period 1 is

According to the Nash-Cournot equilibrium

.

In Period 2, firm

begins to engage in green innovation, and the effective R&D investment of firm

consists of the firm’s R&D investment and R&D spillover from other firms [

106].

is the effective R&D investment for firm ; is the individual R&D investment for firm ; is an R&D spillover parameter. .

The green innovation output function is positively correlated with R&D input, but considers the marginal decreasing effect of R&D output. The green innovation output function is monotonically increasing and concave [

16]; thus, the innovation output function is:

The cost of company

at this point is:

According to the Nash-Cournot equilibrium

.

At this point, the price of the product in equilibrium is greater than the price in period 1 and the firm’s output is less than the price in period 1. Since it is difficult for consumers to accept the price increase, the firm will still sell at the period 1 price. The firm’s profit in period 2 is

Considering the R&D spillover after a firm’s green innovation, the firm’s output and profits will be significantly lower in period 2.

Under the national green innovation system, enterprises are encouraged to conduct green cooperative R&D when their effective R&D investment is.

Consider the equilibrium conditions for firm

under a national green innovation system.

is the environmental tax charge, and

is negatively related to R&D investment;

is the external input to corporate green innovation for firm

, including direct government subsidies

, green credit from financial institutions

. Considering that green credits are generally policy-oriented and have low interest rates, they are neglected.

is the increment of industry-research cooperation on green enterprise innovation,

.

At this point, the equilibrium price under the national green innovation system is

While government regulations increase firm costs in a national green innovation system, government subsidies, green credit, and internal collaboration reduce firm costs. When the external inputs of firm are higher than the internal inputs of firm, that is, is greater than (), the equilibrium market price is lower. The higher the enhancement brought about by industry-research cooperation for corporate green innovation, the lower the equilibrium market price. Therefore, the market will be put into production at a new equilibrium price and consumers will buy products with lower inputs. Both consumers and manufacturers benefit from a national green innovation system.

3.2. Sample Selection and Data Sources

China is a major energy-consuming country; however, in recent years, it has committed to ecological development. Although the concept of ecological civilization construction was first proposed at the 17th Congress of the Communist Party of China (CPC) in 2007, the positioning of the circular economy was further enhanced at the 18th CPC Congress in 2012. The report of the 19th Party Congress further calls for the establishment of a sound economic system of green, low-carbon, and circular development to promote the overall green transformation of China’s economy and society. China has elevated its ecological initiatives to the level of a national strategy, and green innovation is no longer just a corporate-level issue. Simultaneously, China has made great strides in talent development, scientific research, and socio-economic development. Therefore, it is informative to take China as an example to establish a national green innovation system.

Using China as a research sample can provide lessons for other countries pursuing ecological governance. After excluding special treatment companies that have financial abnormalities with the risk of delisting, companies listed later than 2011, companies in the financial sector, and 2136 Chinese A-share listed companies in the Shanghai and Shenzhen exchanges from 2011 to 2020 were selected for this study.

All enterprise-level data sources used in this study are obtained from the WIND data terminal. WIND is a comprehensive database focusing on Chinese finance and economics. Enterprise Green Patent Data were obtained from the WinGo platform. WinGo Green Patent Database provides listed enterprises with green patent information, mainly the number of green patent applications and grants according to the World Intellectual Property Organization (WIPO) patent classification and Organization for Economic Cooperation and Development (OECD) patent classification. Government attention data was obtained from government work reports and the National Bureau of Statistics. WinGo platform was used for text analysis. We analyze the text data processing in three steps: (1) Download the government work report and government statistical yearbook from the government website. (2) Use WinGo text data platform to conduct text analysis of the government work report and calculate the frequency of words related to government environmental protection, green innovation, and talent concern. (3) Use Stata to process the data and perform empirical regression analysis. R&D data from regional universities and institutions was obtained from the China Science and Technology Statistical Yearbook.

3.3. Variables

3.3.1. Measure of Government Attention

Text analysis is a popular method for measuring government attention and has been widely used in many areas of social science research as a combination of qualitative and quantitative research methods [

107]. This study analyzes the text of the work reports of 329 Chinese prefectural governments from 2011 to 2020 and identifies ecological environment attention, green development attention, basic research, and scientific and technological talent attention. Government attention was measured by the number of words and sentences related to ecological development, green innovation, and innovation talent concerns in prefecture-level government annual work reports. The specific process of text analysis inputs the initial word set, analyzes similar words, expands the word set, and obtains the word frequency.

3.3.2. Measure of Regional Universities and Research Institution R&D Capacity

This study selected the number of research institutions in a province, researchers, internal R&D expenditures, R&D projects, and research output, such as papers and patents, to construct the regional research intensity index of the research institution. This study selected the number of universities in the province, university R&D personnel, internal R&D expenditure, R&D projects, and research output to construct regional university research intensity.

3.3.3. Measure of Green Innovation

Patents are a typical proxy for innovation output, and many scholars use the number of patents granted as a direct indicator of a firm’s innovation output [

13,

108]. In addition, some scholars have used the Herfindahl-Hirschman Patent index (HHI) to measure the concentration of a firm’s innovation activities and argue that firms need to enhance their core competencies and focus on a specific technology area to deepen their technological activities and improve their specialization [

109,

110]. However, for green innovation, a wide range of innovations involving multiple fields can achieve the strategic goal of corporate green development. Therefore, this study considers that patent dispersion can better reflect the quality of corporate green innovation.

This study examines green innovation from two perspectives: green patent granted data, including the number of green patents granted and the number of green invention patents granted, and enterprise green patent diversity data. In this study, the Herfindahl-Hirschman index (HHI) method at the group level was adopted to calculate green patent diversity.

The World Intellectual Property Organization (WIPO) launched a tool designed to facilitate the retrieval of patent information related to environmentally friendly technologies, dividing green patents into seven subcategories: alternative energy production, transportation, energy conservation, waste management, agriculture and forestry, administrative regulation and design, and nuclear energy. is the percentage of green patents for each company category.

3.3.4. Control Variables

To improve the accuracy of our results, we must minimize the internal and external changes that might impact company performance. We controlled for corporate management data, R&D investment, and profitability in the analyses. Board diversity is a key governance mechanism to improve corporate green performance. Following Jiang and Yuan [

111], we include a series of corporate management data that impacts a firm’s green innovation. Corporate management data include corporate equity concentration (percentage of shares held by the top ten shareholders), percentage of institutional ownership, management salaries, agency costs, and board size. Additionally, corporate R&D investment and profitability can affect corporate green innovation [

112]. Corporate profitability includes the ratio of corporate EBIT to total assets, return on assets, and operating margins. The variables used in the study are shown in

Table 1.

3.4. Research Methodology

To test the influence of each participant in the green innovation system (i.e., banks, research institutions, universities, etc.) on corporate green innovation, i.e., Hypotheses 1–4, this study uses a panel data fixed effects model with the introduction of industry- and time-fixed effects [

113].

where

is the explained variable for firm

at time

.

is the explanatory variable for firm

at time

.

is a vector of the firm-level control variables.

To test Hypotheses 5a–5f, this study uses the causal step technique [

114]. The moderation model was tested using a causal step technique analysis as a way to eliminate the interaction between the control variables and the main variables [

115].

where

is the explained variable for firm

at time

.

is the moderating variable for firm

at time

.

is the explanatory variable for firm

at time

.

is the interaction between the explained and moderating variables.

is a vector of the firm-level control variables.

5. Discussion

5.1. Theoretical Contribution

The main theoretical contributions of this study are as follows: First, it proposes a national green innovation system based on RDT and NIS. This study examines an innovation ecosystem comprising the government, research institutions (universities), enterprises, and financial institutions to increase corporate green innovation and promote national ecological development. This study adds to the resource dependence theory in the field of green innovation by focusing on the impact of specific resources of each participant in the green innovation system on corporate green innovation. This study obtained consistent findings with existing studies on factors that increase green innovation such as policy regulation [

15,

121], government subsidies [

89,

118], financing constraints [

18], industry-academia collaboration [

23], and corporate collaboration [

75,

77]. With the introduction of the concept of government attention, this study finds the government is able to effectively link various players in the green innovation system. Government attention is found to be an effective approach to coordinate collaborative innovation among participants in a green innovation system, providing a new line of research for resource dependence theory and green innovation. In addition, this study introduces financial institutions into the green innovation system to fill the gap of neglecting the complementarity between NIS and financial institutions in the study of green innovation system [

30].

Second, to analyze the role of the government in national green innovation systems, this study introduces the concept of attention. The prefecture-level municipal government work report is both a summary of the government’s work in the past year and a disclosure of the government’s priorities in the coming years. Therefore, this study measures government attention based on the number of occurrences of words and phrases related to ecological development, green innovation, and innovation talent concerns in the annual work reports of prefecture-level municipal governments in China through textual analysis of these reports. Through an empirical analysis of the national green innovation system, this study finds that government attention has a moderating role in the effects of enterprise cooperation, industry-academia cooperation, financial institutions, and government subsidies on the output of green innovation and the patent diversity of enterprises.

Third, this study constructs a Nash-Cournot equilibrium under the national green innovation system, incorporating the effects of corporate cooperation, industry-research cooperation, government subsidies, policy regulation, and bank loans. The results show that when external green R&D funds such as loans and subsidies of enterprises are higher than internal green R&D investment, the economic effect of the market equilibrium achieved by corporate green innovation is better than that of the market equilibrium without green innovation. Furthermore, industry-research cooperation is beneficial for enterprise green innovation. This study extends the research on corporate cooperation on corporate innovation [

106], government subsidies, and loan size on green innovation [

16]. A positive effect of the national green innovation system constructed in this study on green enterprise innovation was also found.

5.2. Practice Implication

This study proposes a national green innovation system and finds positive effects of firms’ innovation cooperation experience, good commercial credit, government subsidies, and regional university R&D intensity on firms’ green innovation output and green innovation patent diversity. In a study on the impact of bank loans on corporate green innovation, differences were found between the impact of short-term and long-term loans on corporate green innovation. Short-term loans are unfavorable to corporate green innovation output and green innovation patent diversity; long-term loans are favorable to corporate green innovation output but unfavorable to green innovation patent diversity. Government attention has a direct positive impact on corporate green innovation and strengthens the positive impact of collaborative innovation experience, government subsidies, and long-term loans on corporate green innovation output. This study found that SOEs have significantly higher green patent output, patent diversity, government attention, corporate cooperation, government subsidies, and bank credit than their non-SOE counterparts. However, the effects of corporate collaboration and government subsidies on green innovation are significantly higher in non-SOEs than in SOEs, and the intensity of the moderating role of government attention on the effects of non-SOE collaboration on green innovation is higher in SOEs. The implications of the study’s results are presented below.

This study finds the role of government, banks, research institutions (universities), and industry collaboration in enhancing corporate green innovation with Chinese firms as the research sample. This provides practical implications for countries that are committed to increasing corporate green innovation for national ecological development. First, at the government level, it is essential to clarify the government’s leadership position in the national green innovation system and ensure continuous attention to green innovation development. The state should ensure green innovation intellectual property protection, encourage enterprises to cooperate in green innovation, promote industry-academia green innovation, improve enterprise credit processes, and optimize enterprise loan structures. Second, at the bank level, there is a need to accelerate the approval process for enterprises to obtain loans, improve the structure of enterprise loans, and optimize the interest rate of enterprise loans. Long-term corporate loans should be the primary financing method for high-quality enterprises, reducing corporate loan fees and encouraging innovation. Third, at the enterprise level, enterprises should leverage green innovation R&D cooperation, create a suitable operational environment for industry cooperation, and actively cooperate with universities and research institutions for green innovation. Finally, from the perspective of research institutions and universities, the government should encourage intellectual exchange between enterprises and research institutions, broaden the channels for knowledge exchange between industry and academia, and ensure that the outcomes of research institutions and universities on green innovation can be exchanged to benefit enterprises and green development in the country. To increase the development of national green innovation, it is necessary to establish and improve the national green innovation system; recognize the collaboration among the government, enterprises, R&D institutions, and financial institutions to improve the legislative protection of intellectual property rights; encourage green innovation cooperation among enterprises; take advantage of financial institutions’ financing services; and improve the cooperation path between enterprises and universities.

5.3. Limitations and Future Research

Green innovation is an emerging concept in China, and the disclosure system for corporate green innovation is not well developed, despite the country’s commitment to environmental protection. With improvements in legislation related to corporate environmental information, more scholars will focus on corporate green innovation research.

Second, the national green innovation system requires the participation of government, financial institutions, R&D institutions, and enterprises. However, currently, only data from provincial research institutes and universities are available, and such data are not sufficiently accurate. With the disclosure of research data from research institutions and universities at the prefectural level, more scholars will examine direct collaborative innovation between research institutions and firms in detail.

Third, there is little research on government attention, and no widely accepted measure of government attention. In addition to the government work reports issued by the Chinese government, some countries and economies such as the United States, Russia, and the European Union also have the state of the nation addresses [

122,

123], which provide scholars with an adequate research base to study government attention. Therefore, this study suggests future research may further examine the concept of government attention and its related research. In addition, this study emphasizes the important role of government influence on green innovation in firms, but scholars disagree on the role of government on green innovation [

124], so future research can test the influence of government on green innovation in different countries and economies. Finally, this study proposes the concept of green innovation ecosystem and verifies its validity in China, but whether green innovation ecosystem is used in other countries or economies still needs to be tested.

6. Conclusions

Based on NIS and RDT, this study examines the concept of a national green innovation system. To increase green innovation and ecological development, a country should fully develop a synergy of innovation among the government, enterprises, research institutions, and financial institutions. This study provides both theoretical and empirical evidence for the positive impact of national green innovation systems on corporate green innovation. Based on the Nash-Cournot equilibrium theory, this study considers the effects of corporate R&D cooperation, government policies and subsidies, industry-academia cooperation, and bank credit on green innovation. The results show that when external R&D funding, such as loans and subsidies, is greater than internal R&D investment, the profits and equilibrium prices of firms under market equilibrium conditions are better than those without green innovation. In the empirical testing stage, this study finds that (1) good commercial credit and corporate innovation cooperation drive corporate green innovation, (2) government subsidies increase corporate green innovation, (3) regional universities’ R&D intensity increases corporate green innovation, but regional R&D intensity cannot promote corporate green innovation output or even inhibit corporate green innovation patent diversity, (4) short-term borrowing is not conducive to corporate green innovation, but long-term loans are beneficial to corporate green innovation, and (5) government attention is beneficial to corporate green innovation. This strengthens corporate cooperation and the positive influence of government subsidies on corporate green innovation. This also deepens the influence of bank credit on corporate green innovation. In the study of SOEs and non-SOEs, this study finds that although SOEs have higher green innovation output and patent diversity than non-SOEs, the positive effects of corporate collaboration and government subsidies on corporate green innovation are significantly higher in non-SOEs than those in SOEs. Moreover, the moderating effect of government attention on the impact of enterprise cooperation on green innovation was stronger than that of SOEs. Additionally, this result holds when endogeneity and robustness are considered.