Abstract

Investors are increasingly concerned with the sustainability of firms and their impact on global development, resulting in a rise in Socially Responsible Investing (SRI) that considers environmental, social, and governance (ESG) factors. Integrating sustainability into company strategies can affect various aspects of an organization, including IPOs (initial public offerings). Given the growing importance of ESG information disclosure, this study wants to examine the potential effect of an ESG report disclosure on IPO performance, since there are not studies focused on analyzing how ESG factors and IPO performance are correlated. The purpose of this study is to examine how ESG disclosure affects IPO underpricing and increases transparency for stakeholders to reduce information asymmetry. This study explores the impact of disclosing ESG information on IPO underpricing using a sample of 100 European IPOs from 2017 to 2021, with 50 firms disclosing an ESG report prior to the IPO and 50 that did not. The results showed that the publication of a sustainable report before an IPO has a positive effect on underpricing by reducing it. This finding suggests that companies that publish sustainability reports are perceived to be less risky, and investors value ESG disclosure as a tool to reduce the risks associated with ESG issues. The work contributes to the research on firms’ incentives to disclose ESG information. Our study is limited by the size of the sample, which is limited and only focused on European companies; therefore, future studies should consider companies from other parts of the world, and with more data related to IPO performance.

1. Introduction

In recent times, an increasing number of stakeholders have expressed interest in environmental, social, and governance (ESG) risks faced by organizations and their respective management strategies. The integration of ESG elements into a company’s strategy aligns with the concept of risk governance, which covers both macro- and-micro risk management, with the macro level focusing on Corporate Social Responsibility (CSR) requirements and the micro level on operational and financial risks [1,2]. Evidence shows that a company’s ESG profile is linked to economic results, with studies such as Giese et al. (2019) [3] revealing a connection between firm-level ESG ratings and performance. As a result, ESG investing strategies have gained popularity, with investors considering ESG factors in addition to traditional financial elements when making investment decisions. The relevance of ESG investment strategies is supported by the fact that investment managers used ESG criteria to allocate approximately USD 11.6 trillion in U.S. domiciled assets in 2018, representing a 44% increase in two years, according to the US SIF Foundation.

The fact that ESG ratings include information able to affect the firm value has significant effects for a big number of market transactions [4]. The initial public offerings (IPOs) are perhaps important in the information asymmetry that influence the IPO participants [5,6]. Information on IPO issuers is often not complete because they are not subject to the same kind of disclosure as listed companies. Therefore, information that reduces uncertainty is appreciated by IPO participants.

It may be that a higher transparency level of a company’s ESG risks supports a diminution of information asymmetry and creates a stronger request for company ESG disclosure [7]. Despite the documented need for a better ESG disclosure, the answer of the national and international regulations has been diversified. In fact, the European Union (EU) has forced ESG disclosure from many years, while the United States regulatory bodies have lately excluded ESG disclosure such as the one in the EU. However, considering the investors’ interest, a rising number of organizations have decided to build proprietary ESG ratings (Morgan Stanley Capital International).

Similarly, the concept of a circular economy has gained significant attention in recent years as a model for sustainable development. It promotes a regenerative approach that aims to maintain the value of products, materials, and resources in the economy for as long as possible while minimizing waste generation. In this context, ESG disclosure has emerged as a means of communicating information to stakeholders about a firm’s sustainability performance. Circular economy and ESG disclosure are closely linked, as both promote sustainable practices that aim to minimize negative environmental impacts while creating value for businesses. The adoption of circular economy principles requires firms to design products with a focus on durability, recyclability, and repairability, and to optimize the use of resources. This approach enables firms to reduce their environmental footprint and achieve cost savings through improved resource efficiency. In turn, the adoption of circular economy principles can lead to better ESG performance, as firms are likely to achieve reduced environmental impact, improved social outcomes, and better governance practices. We believe that firms that adopt circular economy principles are likely to benefit from ESG disclosure, particularly in terms of improved performance and reduced IPO underpricing.

One area where the benefits of a circular economy and ESG disclosure may be particularly relevant is in IPO underpricing. The reasons for IPO underpricing are complex and multifaceted, but one factor that has been identified is information asymmetry, where investors lack complete information about the firm’s value and performance. ESG disclosure has been shown to reduce information asymmetry by providing stakeholders with more comprehensive information about a firm’s ESG risks and opportunities. Firms that disclose ESG information are also more likely to be seen as trustworthy and credible, which can increase investor confidence.

Our research aims to investigate the relationship between ESG factors and underpricing in IPOs by utilizing the disclosure report on ESG issued by companies. We posit that this report contains value-relevant information, and therefore can be used to examine the impact of ESG policies on IPO underpricing. This assumption is supported by Dyck et al. (2019) [8], who found that institutional investors from countries with strong ESG disclosure regulations have a positive impact on companies’ ESG policies. Since institutional investors are often significant IPO stakeholders and regularly communicate with companies during the IPO process, they can influence companies’ ESG policies and decisions to disclose ESG reports.

If, as prior studies show, higher ESG ratings are correlated to better quality disclosures [9] and a reduced information asymmetry [10], IPO underpricing should be lesser for firms with a higher ESG rating.

The economic and financial performance as a consequence of ESG practices has been widely studied; some other effects of ESG practices should be analyzed, given the growing interest in those practices of the last years. The interest of the stakeholders and shareholders on ESG practices should not be focused only on economic and financial traditional indicators (ROI, ROE, ROA, ROS, EBITDA, etc.), but also on new indicators of performance. From this, the present study wants to enrich the actual literature showing that there are also other elements affected by ESG disclosure, showing how important it is for companies to invest and to disclose information in terms of ESG. Past studies analyzed only the correlation between ESG ratings and quality disclosure, and in some cases analyzing firm economic and financial performance, but they do not pay attention to how the performance in terms of IPO underpricing is affected by ESG elements, and that, therefore, remains an open question.

The research question consequently aims to analyze the direction of the possible consequence of the presence of the disclosure of non-financial information on the performance in the IPO phase, represented by the underpricing. The analysis has been executed on the European IPOs which took place between 01.01.2017 and 30.04.2021, considering a sample of 100 companies, of which 50 disclosed the ESG report prior to the IPO, and 50 companies, comparable to the previous ones, which did not disclose the report. The target of the research is therefore to comprehend the perception of ESG factors by investors, represented in this analysis by the existence of the ESG report disclosure. The work represents a new contribution concerning the motivation of firms to integrate sustainability elements within their business strategies and to disclose this activity, thus mounting the level of transparency towards all the categories of stakeholders.

To inspect if sustainability reports published prior to the IPO can influence the performance obtained by a firm in the IPO phase as a dependent variable, we used the underpricing during the IPO, which is defined as the initial return on the first day of listing [11].

Consequently, with the findings that higher ESG ratings are correlated to a reduced information asymmetry, we discover a negative correlation between the ESG disclosure and firm-level IPO underpricing. In fact, our analyzes demonstrate that the disclosure of a sustainable report before an IPO reduces the underpricing and, consequently, the higher disclosure of ESG information is appreciated and valuable to investors. In this sense, this corroborates the fact that the market rewards firms that show disclosure of sustainability factors not only in the long term [12] but also in the short term during an IPO, accrediting to them a lower level of underpricing and a subsequent higher valuation. Our results are robust since they are confirmed by three different models: (i) MLR, (ii) mixed effect model, and (iii) random forest.

Our results provide new understandings to different areas of investigation in the academic literature.

First, we provide proof that ESG disclosure makes available value-relevant information of new shares issued during an IPO. To the best of our knowledge, this study is the first to show that ESG disclosure is correlated to lower IPO underpricing. Since underpricing is a significant cost for companies that choose to be listed on a financial market [13], our results suggest that rules issued to improve a company’s quality information in terms of ESG may reduce IPO costs and facilitate the gate for private firms to the capital markets.

Our research findings are consistent with the previous literature that has investigated information asymmetry as an explanation for IPO underpricing. Specifically, Ljungqvist (2007) [14] highlights information asymmetry as one of the primary reasons for IPO underpricing, which is supported by our study results. Furthermore, our analysis indicates that information asymmetry is a mechanism through which ESG disclosure affects IPO underpricing, contributing to the existing literature on this topic. These findings complement recent studies, such as Lopez-de-Silanes et al. (2019) [9], which found a positive impact of ESG disclosure on firm disclosure quality, and El Ghoul et al. (2011) [10], which showed a negative correlation between higher ESG ratings and information asymmetry.

2. Literature Review

2.1. Environmental, Social, and Governance Risk

During the last years, investors are contemplating even more and more ESG factors together with traditional financial and economic indicators when deciding to allocate money for investments [15,16]. A growing number of firms acknowledge that prioritizing the environment, employee’s needs, and the interests of local communities makes financial sense [17].

In recent years, the significance of ESG factors for firms has led to an increase in interest, to the extent that it is now common to have a top management team member with the title of “ESG” [18]. Scholars have also increasingly recognized the positive impact of ESG on firms’ financial and share price performance. For instance, research has shown that higher ESG ratings are related to lower costs of capital, greater firm valuations, and higher profitability [3]. Moreover, Crifo et al. (2015) [19] revealed that private equity firms allocate only a small amount of funds to buy companies with poor ESG practices because of lower expected return on investments. There are numerous reasons for the positive correlation between ESG and firm performance and value [20].

Dimson et al. (2015) [21] find that the firm-specific attention on ESG elements has an important and positive influence on elements such as customer and employee loyalty, which are elements appreciated by investors. Lins et al. (2017) [22] show a positive effect of ESG on firms’ social capital and trust, which justifies a higher value of those companies during an eventual crisis of confidence.

Investor interest in ESG factors has spurred the development of improved ESG investment strategies and the creation of dedicated investment instruments. Some investors now refuse to invest in industries deemed to have poor ESG characteristics, with potential impacts on the information environment around those firms [17]. In line with these observations, Hong and Kacperczyk (2009) [23] find that companies operating in the alcohol, tobacco, and gaming sectors have lower institutional ownership and analyst coverage than those in other industries. A recent study exploring the relationship between ESG and share price demonstrates that a long-short strategy using quantitative mispricing signals generates superior returns when applied to shares favored by firms involved in ESG investing [24]. The authors suggest that ESG investors, who place greater weight on ESG performance, are less sensitive to quantifiable mispricing signals than investors who discount ESG factors in evaluating their investments.

2.2. ESG Factors and Performance

Studies dedicated to the relationship between ESG elements and company performance date back to the 1970s and even if they are many, the indication for this relationship is still controversial. Nollet et al. (2016) [25] examined the relationship between company social performance and company performance, exploiting the ESG disclosure score taken from the Bloomberg database; the sample includes all the companies listed on the US index S&P500. Company performance is measured through two balance sheet variables, return on assets (ROA) and return on capital (RoC), and through a market-based measure such as equity return. The model explains a negative relationship between firm social performance and return on capital, while the same independent variable does not indicate a relevant effect on return on assets (ROA) and on equity return (ROE). The examination shows, however, a U-shaped relationship between company social responsibility performance and company performance: company social responsibility displays economic benefits only after a given number of investments and after having obtained specific results on firm social performance [25]. Therefore, to attract different types of stakeholders and to sensitize the investment decisions of investors it is necessary that the strategy of sustainable business is efficient. The principal finding of Nollet et al. (2016) [25], therefore, is that they identify the need for a long-term planning strategy and the use of substantial resources.

The study of Hu et al. (2018) [26], based on Chinese manufacturing firms that have been listed between 2010 and 2015, displays a significant and positive relationship between company social responsibility and firm value, because it permits the company to obtain positive feedbacks from stakeholders. This theory is also confirmed by the study of Davis and Blomstrom (1975) [27], who, through the analysis of a sample of firms listed on the Taiwan Stock Exchange in the period 2001−2009, reveal that the success of company social responsibility has a positive effect on the share value. With opposite conclusions, however, there are additional theories which state that company social responsibility can have a negative impact on share price. An example is the “overinvestment” theory: the people who are part of the company, such as top managers and large shareholders, may invest a greater amount of resources than the sum requested for firm social responsibility activities, with the purpose to obtain private benefits, including the improvement of their reputation [28].

2.3. ESG Factors and the Investments

From the point of view of investing in sustainable companies, the impact generated by the integration of ESG factors in investments is confirmed by several works.

Kumar et al. (2016) [29] conducted a study on 157 socially responsible listed firms of the Down Jones Sustainability Index and on 809 firms that were not part of this index. The authors conclude that the volatility of the shares of firms that integrate ESG elements within their business strategy is lower in comparison to the shares of comparable firms operating in the same industry, and thus exhibiting, contrary to prior analyzes, higher risk-adjusted returns.

Revelli and Viviani (2015) [30] concentrated on the relationship between socially responsible investment (SRI) and financial performance through the examination of 85 papers. From the analysis of the relationship between the inclusion of sustainability elements within investment portfolios and the performance obtained appear heterogeneous results, caused by the different method related to the size of the sustainable investment within the various works.

2.4. ESG Factors and the IPO

Now, investors are selecting even more to invest in companies that are not only financially profitable but are also sustainable in the long-term horizon. So, those investors consider ESG factors together with traditional economic indicators to assume investment decisions; in the present context, consequently, it is possible to define ESG factors as critical elements for the choices of the so-called “capital providers”.

In consideration to this, companies that decide to be listed on a financial market could have a greater chance of success concluding the initial public offering (IPO), indicating a better ability to implement a transition to a sustainable business [31].

As for private firms, data about IPO firms are often incomplete. A limited set of data generate information inequalities between underwriters and issuers [5].

The occurrence of information asymmetry in IPOs leads to increased uncertainty, resulting in higher initial returns, according to Ritter’s (1984) [13] model. Studies have demonstrated that underpricing is correlated with firm characteristics associated with information asymmetry, such as size and industry. Recent research has found that higher ESG ratings may help to decrease information asymmetry in IPO firms. Merton’s (1987) [32] model suggests that investors are more likely to invest in assets that they understand well. El Ghoul et al. (2011) [10] applied this model to show that firms with higher ESG ratings attract more attention from stock analysts, leading to lower information asymmetry. As a result, firms with higher ESG ratings have a wider investor base and are perceived as having lower risks [17]. Analysts’ forecast accuracy is also improved by ESG disclosure, according to Dhaliwal et al. (2012) [33], as ESG factors influence firm performance. Lins et al. (2017) [22] found that investors are willing to pay a premium for firms with high ESG ratings during a crisis of confidence due to their greater information reliability. Feng et al. (2018) [34] demonstrated that ESG ratings are negatively correlated with underpricing of seasoned equity offerings because more ethical firms are more transparent [35].

The study of Cui, Jo and Na (2018) [36] highlights an association between the commitment to ESG elements and the information asymmetry of a group of US firms, displaying an inverse relationship between the two: an increase in information disclosure, in fact, brings an increase in the share price. The analysis of Ji, Xu and Zhao (2019) [37] indicates that the firms that show a greater disclosure of ESG elements, with more detailed information, have shares with a greater liquidity and a better efficiency from the point of view of the definition of the price.

Regular communication can, consequently, be considered a positive factor in the IPO phase: communicating properly with investors and, in general, with all stakeholders is specifically relevant for the success of the process [38], showing a reduction in the level of information asymmetry. Therefore, can be assumed that there is a relevant relationship between ESG communication and the assessment in the IPO [39,40,41].

The study of Huang et al. (2019) [42] analyzes the relationship between the disclosure of ESG elements in the IPO report and the post-IPO financial performance on a sample of Chinese firms. According to the study, therefore, a superior disclosure is positively associated with long-term return. In specific, the dependent variables in this work are represented by the HPR (holding period return) and the CAR (cumulative abnormal return) with the aim of evaluating the impact of information related to ESG elements on newly listed firms. The conclusions of the examination show that better disclosure from a social point of view is positively linked with the holding period return, while the corporate environmental performance does not show a significant relationship with the dependent variable.

In conclusion, it is consequently possible to state that firms in the listing stage have a high degree of information asymmetry and, in consideration of this, the value of the information associated to the ESG disclosure can be very high. The target of this work therefore consists in determining the impact of such information on firm valuation in the IPO phase, in terms of underpricing.

Given the negative correlation between ESG disclosure and information asymmetry, it is reasonable to assume that IPO underpricing is negatively related to ESG disclosure. In fact, we expect that if companies decide to do not disclose ESG information prior to the IPO, information asymmetry is more pronounced (less information isa disclosed), and therefore the underpricing will be higher (as demonstrated by prior studies that explain the positive correlation between information asymmetry and underpricing). Consequently, we can formulate the hypothesis that IPO firms with a higher ESG disclosure are expected to exhibit lower underpricing levels, thus:

H1:

ESG reporting disclosure is negatively linked with firm IPO underpricing.

3. Materials and Methods

3.1. Data

Our sample consists of companies that are listed on European markets from January 2017 to April 2021.

This time range was chosen in order to focus the analysis only on recent years where sustainability issues have begun to gain increasing importance. The data were collected by using the database S&P Capital IQ (https://www.capitaliq.com (accessed on 8 November 2022). Precisely 50 companies were identified that prior to listing had published either a sustainability report or a non-financial disclosure. Subsequently, a pairwise sampling procedure was applied in order to identify another 50 comparable European listed companies that had not published any sustainability report. The companies were chosen in order to be comparable in terms of revenues, size, and sector.

The description of the sample is presented in Table 1.

Table 1.

Sample Description.

3.2. Model

In order to understand whether the publication of sustainability reports prior to the IPO may affect the financial performance of a company in the IPO phase, the underpricing during IPO, defined as the initial return on the first day of listing [11,43], was used as the dependent variable. Precisely, the formula used for calculating the underpricing is as follows:

As the main independent variable, we created a dummy variable “ESG reporting”, equal to 1 if the company published a sustainability report before the IPO, or 0 otherwise.

As control variables, we used:

- Total assets: As a proxy for the size of the company, the total value of assets was used. Larger companies tend to have lower underpricing than smaller companies because they are perceived as less risky. This variable is calculated as:

- Total revenues: Underwriters use revenues for estimating the value of a company, and, therefore, its underpricing, during an IPO process [44]. This variable is calculated as:

- Number of shares: The number of shares, similar to the previous variables, affects the underpricing during an IPO. Small offers are considered to be riskier since less information is available, and, thus, a higher underpricing is applied [45]. This variable is calculated as:

- Age: The age of a company, in other terms the year in which it was created, has an impact on the value of a company [13,45]. “Younger” companies tend to be riskier due to the fact that less historical data and, thus, reliable forecasts are available. This variable is calculated as:

- Financial system: This variable is a dummy variable that was created in order to consider the country of the IPO. In particular, the variable is equal to 1 if the country of the company belongs to a bank-based system and 0 in the case if it belongs to a market-based system. Bank-centric systems tend to be characterized by the fact the financing of private enterprise is totally dependent on bank credit (Demirgüç-Kunt and Levine, 1999) [46]. On the contrary, market-centric systems are characterized by the fact that the financing of private enterprise is diversified (e.g., bonds). This system provides, therefore, a marginal role for banks, as they only finance projects characterized by a low degree of risk and are mainly concerned with exercising control over enterprises and facilitating risk management [46]. European countries can be divided according to the following scheme [47]:

- ◦

- Bank-based countries: Austria, Bulgaria, Croatia, Czech Republic, Denmark, Estonia, Germany, Greece, Hungary, Italy, Latvia, Lithuania, Malta, Poland, Portugal, Romania, Slovakia, Slovenia, and Spain;

- ◦

- Market-based countries: Belgium, Finland, France, Ireland, Luxembourg, the Netherlands, Sweden, and the United Kingdom.

Regarding the model, we developed an MLR model (Y = β0 + β1X1 + β2X2 + βnXn) as it follows:

4. Results

The descriptive statistic of each variable is presented in Table 2.

Table 2.

Descriptive statistics.

In Table 3 the correlation statistics are shown.

Table 3.

Correlation.

The results of the correlation analysis, contrary to our expectations, explain the absence of correlation between the publication of ESG reports and the underpricing.

In Table 4 the results are shown.

Table 4.

MLR model.

The results, in line with our expectations, confirm that the variable ESG reporting is statically significant at 10% with a negative impact on the underpricing. This analysis confirms, therefore, the fact that the publication of a sustainable report before an IPO has a positive effect on the underpricing by reducing it. The results seem, therefore, to suggest that companies that publish sustainability reports are perceived to be less risky. Given the various scandals over the past few years related to ESG issues, investors seem to value ESG disclosure rather than being unaware of the related risks/problems the company is facing. Sustainability factors are an essential component to improve and ensure the competitiveness, health, and longevity of a company [48]. Reporting the business model of a company from an ESG point of view allows investors to observe and consider it in their valuation process.

These results confirm that investors are attributing long-term value to companies that tend to disclose ESG data. This is in line with the tendency of investors to allocate more and more of their capital to companies that seize the green economy as an opportunity, with the aim of protecting their investments from environmental, social, and governance risks [49]. Companies that would like to list should, therefore, be aligned with this trend by publishing high-quality information about their ESG strategy in order to attract long-term investors with the possibility also of reducing their cost of capital [12].

Robustness Tests

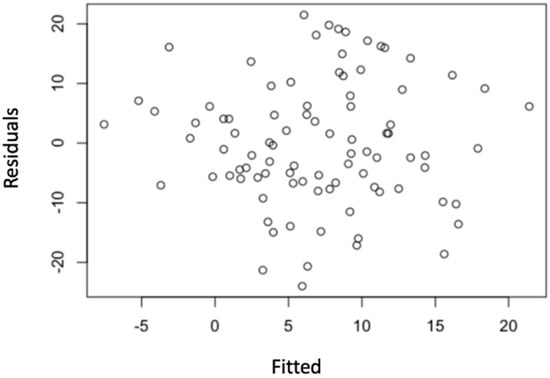

Several additional analyzes were done in order to harden the results and validate them further. Specifically, we conducted the following tests: (i) VIF test in order to test multicollinearity; (ii) residuals versus fitted plot in order to detect non-linearity, unequal error variances, and outliers; (iii) Breusch–Pagan to test homoscedasticity; and (iv) the Shapiro–Wilk for verifying the normality hypotheses of the MLR model.

Firstly, a VIF test was performed. The results in Table 5 show that the VIF values do not overcome the critical threshold of 5, typically used to indicate high multicollinearity.

Table 5.

VIF test.

Similarly, the residuals versus fitted plot in Figure 1 provides proof of the consistency of the linearity hypothesis of the MLR model.

Figure 1.

Residual and fitted.

Secondly, the Breusch–Pagan and the Shapiro–Wilk test were performed. Results confirm the homoscedasticity and the normality hypotheses of the MLR model.

However, in order to reinforce our results, we ran the MLF model in two other different versions: (i) in the first we deleted the variable total revenues given its high correlation with the variable total assets; and (ii) in the second version, in order to reduce the impact of outliers, we applied the winsorisation technique at the 95%. Results are shown in Table 6 and they confirm the previous analysis.

Table 6.

New MLR model.

Furthermore, the other two statistical models were performed as robustness tests: the mixed effect model and the random forest model. The mixed effect model is a statistical model which contains both random and fixed effect. The mixed effect model is particularly suitable where measurements are made on clusters of related statistical units. In Table 7 the results are shown.

Table 7.

Mixed effect model.

In the mixed effect model, the variable ESG reporting is statically significant at 5% with a negative impact on the underpricing. Therefore, the results confirm the previous analysis of the MLR model.

The random forest model is a machine learning model which, by applying the bagging technique, allows us to randomly select a subset of characteristics from each node of a tree. In this sense, past research [50,51] have shown that the machine learning model, and specifically the random forest model, are able to perform better than “traditional models” such as logit and MLR. Moreover, machine learning models are robust to outlier and missing data [51].

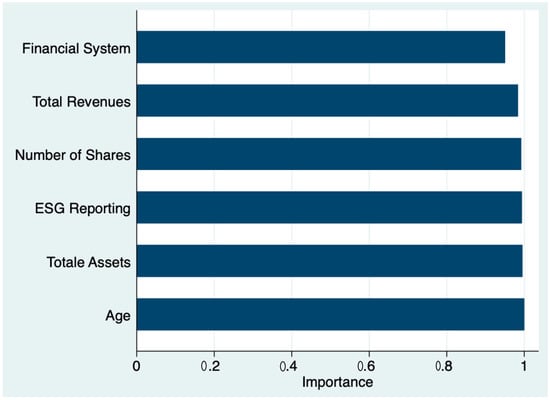

However, one of the main issues of this models is their lack of interpretability [41]. Therefore, in order to interpret the results, the relative variables importance was applied. The relative variables importance shows the variables on a scale ranging from 0 to 1, depending on the number of times they are used by the decision trees [50]. The more the value tends towards 1, the greater the importance and, therefore, the significance of the variable. The results of the random forest model are shown in Table 8 and Figure 2.

Table 8.

Random forest model.

Figure 2.

Relative variable importance.

The results of our analysis demonstrate the effectiveness and reliability of the random forest model. As shown in Table 8, the model has a low out-of-bag (OOB) error rate, indicating its ability to accurately predict the underpricing of IPOs.

Furthermore, the variable importance analysis reveals that ESG reporting is one of the most significant variables in the model, with a score near 1, which means it is almost always used in every decision tree. This highlights the importance of ESG reporting in predicting IPO underpricing and suggests that companies that disclose ESG information are perceived as less risky by investors.

Interestingly, the relative importance of ESG reporting is even higher than that of total revenues, suggesting that sustainability variables are becoming increasingly important in comparison to financial variables. This finding is consistent with the growing awareness among investors of the importance of ESG factors in evaluating a company’s performance and long-term viability.

Moreover, Figure 2 provides further evidence of the significant impact of ESG reporting on IPO underpricing. The plot clearly shows that companies that disclose their ESG performance before an IPO experience lower levels of underpricing compared to those that do not. This finding reinforces the conclusion of our MLR model analysis and underscores the importance of ESG reporting as a tool for reducing information asymmetries and mitigating risk.

Therefore, all the robustness tests have shown the relationship with the underpricing and the significance of publishing an ESG report before an IPO. Our results support the notion that ESG disclosure is a significant factor in predicting IPO underpricing, and our random forest model provides a reliable and accurate means of evaluating the impact of ESG variables on IPO pricing. These findings have important implications for companies seeking to go public, as they suggest that adopting and disclosing ESG strategies and data can increase the likelihood of a successful IPO by reducing perceived risk and increasing investor confidence.

5. Discussion

This study aimed to examine the impact of ESG reporting on underpricing during IPOs. The results showed that ESG reporting is statistically significant with a negative impact on underpricing, indicating that the publication of a sustainable report before an IPO has a positive effect on underpricing by reducing it. This finding suggests that companies that publish sustainability reports are perceived to be less risky, and investors value ESG disclosure as a tool to reduce the risks associated with ESG issues.

The study also found that ESG disclosure Is increasingly important for firms that adopt circular economy principles and disclose their ESG performance. Such disclosure can provide investors with valuable information about a firm’s sustainability performance, particularly in terms of resource efficiency and environmental impact, which can contribute to reducing performance and risk. As a result, firms that disclose their ESG performance are likely to experience reduced IPO underpricing as investors have more complete information about the firm’s value and performance. Our results confirm that stock markets tend to reward the release of ESG data not only in the long term [12] but also in the short term during an IPO, by attributing to them a higher valuation. Specifically, given the coefficient of the variable ESG reporting in Table 4 and Table 7, we can determine that the publication of the ESG reporting can reduce the IPO underpricing by 8% and, thus, its magnitude is extremely significant given the fact that the average IPO underpricing is between 15–25% [11].

Furthermore, this study contributes to the empirical evidence that investors and stakeholders are increasingly interested in the disclosure of extra financial information and, in general, sustainability. The release of an ESG report can reduce information asymmetries and be considered a transparency tool, making ESG reports a significant factor for the success of an IPO. Companies that are transparent about their ESG practices are more likely to attract investment capital, as investors are increasingly focused on ESG factors.

Moreover, in the context of a circular economy, ESG disclosure can provide investors with valuable information about a firm’s sustainability performance, particularly in terms of resource efficiency and environmental impact. These factors can contribute to reducing performance and risk, which can be communicated through ESG disclosure. As a result, firms that adopt circular economy principles and disclose their ESG performance are likely to experience reduced IPO underpricing, as investors have more complete information about the firm’s value and performance.

The study shows that ESG reporting is a crucial factor in reducing the underpricing of IPOs, and firms that adopt circular economy principles and disclose their ESG performance are likely to experience a reduced IPO underpricing. The research highlights the growing importance of ESG disclosure and sustainability reporting in the business world, where investors and stakeholders are increasingly interested in extra financial information to make informed decisions.

6. Conclusions

In recent years, there has been growing attention towards the role of ESG factors in the financial industry. The increasing importance of ESG disclosure is a result of heightened awareness and concern about the impact of corporations on the environment and society, as well as the belief that strong ESG practices can lead to better long-term financial performance. In this context, knowledge disclosure plays a critical role in capital markets as it helps investors make informed decisions about companies and their potential for growth.

The objective was to demonstrate the importance of knowledge disclosure in terms of ESG information [14] on capital markets and its impact on firm value, specifically on the underpricing during an IPO. In this sense, this research analyzed the relationship between the disclosure of ESG data/report and the underpricing during an IPO, given the growing interest of investors in ESG companies [49].

The importance of ESG disclosure in capital markets can be understood in the context of the information asymmetry that often exists between companies and investors. Companies typically have more information about their operations, financials, and prospects than the public, creating an asymmetry of information. This information asymmetry can lead to inefficient capital markets, where investors cannot accurately price securities due to a lack of information. ESG disclosure helps to reduce this information asymmetry by providing investors with more detailed information about a company’s ESG practices. In particular, ESG disclosure can provide valuable information about a company’s potential risks and opportunities related to environmental and social issues. For example, disclosure of a company’s environmental practices can provide insight into the potential costs of compliance with environmental regulations, or the impact of climate change on the company’s operations. Similarly, disclosure of a company’s social practices can provide insight into the company’s treatment of employees, supply chain practices, or community relations. In turn, this information can help investors make more informed decisions about the potential long-term financial performance of a company.

However, our study is limited by the dimension of the sample, which is limited and only focused on European companies, and the type of data used. Secondly, our pairwise sampling procedure did not consider the year of the IPO, even though every comparable IPO was chosen in order to be dated not more than three years. Future research could use a more variable and international sample, by also including different ESG variables in order to analyze the impact of environment, social, and governance variables separately given the limited literature on the matter.

Author Contributions

Conceptualization, S.F., A.T., R.S. and F.C.; methodology, S.F., A.T., R.S. and F.C.; software, S.F., A.T., R.S. and F.C.; validation, S.F., A.T., R.S. and F.C.; formal analysis, S.F., A.T., R.S. and F.C.; investigation, S.F., A.T., R.S. and F.C.; resources, S.F., A.T., R.S. and F.C.; data curation, S.F., A.T., R.S. and F.C.; writing—original draft preparation, S.F., A.T., R.S. and F.C.; writing—review and editing, S.F., A.T., R.S. and F.C.; visualization, S.F., A.T., R.S. and F.C.; supervision, S.F., A.T., R.S. and F.C.; project administration, S.F., A.T., R.S. and F.C.; funding acquisition, S.F., A.T., R.S. and F.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Data available on request due to restrictions. The data presented in this study are available on request from the corresponding author. The data are not publicly available due to fact they are obtained from third party.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Bifulco, G.M.; Savio, R.; Izzo, M.F.; Tiscini, R. Stopping or Continuing to Follow Best Practices in Terms of ESG during the COVID-19 Pandemic? An Exploratory Study of European Listed Companies. Sustainability 2023, 15, 1796. [Google Scholar] [CrossRef]

- Sassen, R.; Hinze, A.K.; Hardeck, I. Impact of ESG factors on firm risk in Europe. J. Bus. Econ. 2016, 86, 867–904. [Google Scholar] [CrossRef]

- Giese, G.; Lee, L.; Melas, D.; Nagy, Z.; Nishikawa, L. Foundations of ESG investing: How ESG affects equity valuation, risk, and performance. J. Portf. Manag. 2019, 45, 69–83. [Google Scholar] [CrossRef]

- Savio, R.; D’Andrassi, E.; Ventimiglia, F. A Systematic Literature Review on ESG during the COVID-19 Pandemic. Sustainability 2023, 15, 2020. [Google Scholar] [CrossRef]

- Baron, D. A model of the demand for investment banking advising and distribution services for new issues. J. Corp. Financ. 1982, 37, 955–976. [Google Scholar] [CrossRef]

- Rock, K. Why new issues are underpriced. J. Financ. Econ. 1986, 15, 187–212. [Google Scholar] [CrossRef]

- Singh, M.; Peters, S. The Case for Quarterly and Environmental, Social, and Governance Reporting; The CFA Institute: Charlottesville, VA, USA, 2019. [Google Scholar]

- Dyck, A.; Lins, K.; Roth, L.; Wagner, H. Do institutional investors drive corporate social responsibility? International evidence. J. Financ. Econ. 2019, 131, 693–714. [Google Scholar] [CrossRef]

- Lopez-de-Silanes, F.; McCahery, J.; Pudschedl, P. ESG Performance and Disclosure: A Cross-Country Analysis; ECGI Working Paper No. 481/2019; ECGI: Brussels, Belgium, 2019. [Google Scholar]

- El Ghoul, S.; Guedhami, O.; Kwok, C.; Mishra, D. Does corporate social responsibility affect the cost of capital? J. Bank. Financ. 2011, 35, 2388–2406. [Google Scholar] [CrossRef]

- Loughran, T.; Ritter, J. Why has IPO underpricing changed over time? Financ. Manag. 2004, 33, 5–37. [Google Scholar] [CrossRef]

- Wong, W.; Batten, J.; Ahmad, A.; Mohamed-Arshad, S.; Nordin, S.; Adzis, A. Does ESG certification add firm value? Financ. Res. Lett. 2021, 39, 101593. [Google Scholar] [CrossRef]

- Ritter, J.R. The “hot issue” market of 1980. J. Bus. 1984, 57, 215–240. [Google Scholar] [CrossRef]

- Ljungqvist, A. IPO underpricing. In Handbook of Empirical Corporate Finance; Eckbo, E., Ed.; Elsevier: Amsterdam, The Netherlands, 2007; Volume 1, pp. 375–422. [Google Scholar]

- Boulton, T.J.; Smart, S.B.; Zutter, C.J. Earnings quality and international IPO underpricing. Account. Rev. 2011, 86, 483–505. [Google Scholar] [CrossRef]

- Boulton, T.J.; Smart, S.B.; Zutter, C.J. Conservatism and international IPO underpricing. J. Int. Bus. Stud. 2017, 48, 763–785. [Google Scholar] [CrossRef]

- Baker, E.D.; Boulton, T.J.; Braga-Alves, M.V.; Morey, M.R. ESG government risk and international IPO underpricing. J. Corp. Financ. 2021, 67, 101913. [Google Scholar] [CrossRef]

- Strand, R. The chief officer of corporate social responsibility: A study of its presence on top management teams. J. Bus. Ethics 2013, 112, 721–734. [Google Scholar] [CrossRef]

- Crifo, P.; Forget, V.; Teyssier, S. The price of environmental, social and governance practice disclosure: An experiment with professional private equity investors. J. Corp. Financ. 2015, 30, 168–194. [Google Scholar] [CrossRef]

- Liu, L.X.; Sherman, A.E.; Zhang, Y. The long-run role of the media: Evidence from initial public offerings. Manag. Sci. 2014, 60, 1945–1964. [Google Scholar] [CrossRef]

- Dimson, E.; Karakas, O.; Li, X. Active ownership. Rev. Financ. Stud. 2015, 28, 3225–3268. [Google Scholar] [CrossRef]

- Lins, K.; Servaes, H.; Tamayo, A. Social capital, trust, and firm performance: The value of corporate social responsibility during the financial crisis. J. Financ. 2017, 72, 1785–1824. [Google Scholar] [CrossRef]

- Hong, H.; Kacperczyk, M. The price of sin: The effects of social norms on markets. J. Financ. Econ. 2009, 93, 15–36. [Google Scholar] [CrossRef]

- Cao, J.; Titman, S.; Zhan, X.; Zhang, W. ESG preference, institutional trading, and stock return patterns. J. Financ. Quant. Anal. 2019, 1–58. [Google Scholar] [CrossRef]

- Nollet, J.; Filis, G.; Mitrokostas, E. Corporate social responsibility and financial performance: A non-linear and disaggregated approach. Econ. Model. 2016, 52, 400–407. [Google Scholar] [CrossRef]

- Hu, Y.; Chen, S.; Shao, Y.; Gao, S. CSR and firm value: Evidence from China. Sustainability 2018, 10, 4597. [Google Scholar] [CrossRef]

- Davis, K.; Blomstrom, R.L. Business and Society: Environment and Responsibility, 3rd ed.; McGraw Hill: New York, NY, USA, 1975. [Google Scholar]

- Barnea, A.; Rubin, A. Corporate social responsibility as a conflict between shareholders. J. Bus. Ethics 2010, 97, 71–86. [Google Scholar] [CrossRef]

- Kumar NC, A.; Smith, C.; Badis, L.; Wang, N.; Ambrosy, P.; Tavares, R. ESG factors and risk-adjusted performance: A new quantitative model. J. Sustain. Financ. Invest. 2016, 6, 292–300. [Google Scholar] [CrossRef]

- Revelli, C.; Viviani, J.L. Financial performance of socially responsible investing (SRI): What have we learned? A meta-analysis. Bus. Ethics Eur. Rev. 2015, 24, 158–185. [Google Scholar] [CrossRef]

- Hunter, R.; Picard, N. You Never Get a Second Chance to Make a First Impression: Why ESG is Critical in IPO Communications; PwC: London, UK, 2020. [Google Scholar]

- Merton, R. A simple model of capital market equilibrium with incomplete information. J. Financ. 1987, 42, 483–510. [Google Scholar] [CrossRef]

- Dhaliwal, D.; Radhakrishnan, S.; Tsang, A.; Yang, Y. Nonfinancial disclosure and analyst forecast accuracy: International evidence on corporate social responsibility disclosure. Account. Rev. 2012, 87, 723–759. [Google Scholar] [CrossRef]

- Feng, Z.; Chen, C.; Tseng, Y. Do capital markets value corporate social responsibility? Evidence from seasoned equity offerings. J. Bank. Financ. 2018, 94, 54–74. [Google Scholar] [CrossRef]

- Welch, I. Seasoned offerings, imitation costs, and the underpricing of initial public offerings. J. Financ. 1989, 44, 421–449. [Google Scholar] [CrossRef]

- Cui, J.; Jo, H.; Na, H. Does corporate social responsibility affect information asymmetry? J. Bus. Ethics 2018, 148, 549–572. [Google Scholar] [CrossRef]

- Ji, Y.; Xu, W.; Zhao, Q. The real effects of stock prices: Learning, disclosure and corporate social responsibility. Account. Financ. 2019, 59, 2133–2156. [Google Scholar] [CrossRef]

- Bajo, E.; Raimondo, C. Media sentiment and IPO underpricing. J. Corp. Financ. 2017, 46, 139–153. [Google Scholar] [CrossRef]

- Bollazzi, F.; Risalvato, G. IPO and CSR: An Analysis on Last Performance in Italian Stock Exchange. China-USA Bus. Rev. 2017, 16, 588–600. [Google Scholar]

- Fenili, A.; Raimondo, C. ESG and the Pricing of IPOs: Does Sustainability Matter; No. 3860138; SSRN: Rochester, NY, USA, 2021. [Google Scholar]

- Hastie, T.; Tibshirani, R.; Friedman, J. The Elements of Statistical Learning: Data Mining. Inference and Prediction; Springer: New York, NY, USA, 2009; Available online: https://web.stanford.edu/~hastie/Papers/ESLII.pdf (accessed on 16 November 2022).

- Huang, F.; Xiang, L.; Su, S.; Qiu, H. The IPO corporate social responsibility information disclosure: Does the stock market care? Account. Financ. 2019, 59, 2157–2198. [Google Scholar] [CrossRef]

- Loughran, T.; Ritter, J.R.; Rydqvist, K. Initial public offerings: International insights. Pac.-Basin Financ. J. 1994, 2, 165–199. [Google Scholar] [CrossRef]

- Lee, P.; Wahal, S. Grandstanding, certification and the underpricing of venture capital backed IPOs. J. Financ. Econ. 2004, 73, 375–407. [Google Scholar] [CrossRef]

- Lowry, M.; Officer, M.S.; Schwert, G.W. The variability of IPO initial returns. J. Financ. 2010, 65, 425–465. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, A.; Levine, R. Bank-Based and Market-Based Financial Systems—Cross-Country Comparisons; Policy Research Working Paper Series, No. 2143; World Bank: Washington, DC, USA, 1999. [Google Scholar]

- De Haan, J.; Schoenmaker, D.; Wierts, P. Financial Markets and Institutions: A European Perspective; Cambridge University Press: Cambridge, UK, 2021. [Google Scholar]

- Atkins, B. Implementing an ESG strategy pre-IPO. Forbes, 17 June 2021. [Google Scholar]

- OECD. ESG Investing and Climate Transition. 2021. Available online: https://www.oecd.org/finance/ESG-investing-and-climate-transition-market-practices-issues-and-policy-considerations.pdf (accessed on 5 November 2022).

- Dallocchio, M.; Ferri, S.; Tron, A.; Colantoni, F. Corporate governance and financial distress: Lessons learned from an unconventional approach. J. Manag. Gov. 2022, 1–32. [Google Scholar] [CrossRef]

- Jones, S.; Johnstone, D.; Wilson, R. Predicting Corporate Bankruptcy: An Evaluation of Alternative Statistical Frameworks. J. Bus. Financ. Account. 2017, 44, 3–34. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).