Digital Economy and the Sustainable Development of China’s Manufacturing Industry: From the Perspective of Industry Performance and Green Development

Abstract

1. Introduction

2. Theoretical Analysis and Research Hypotheses

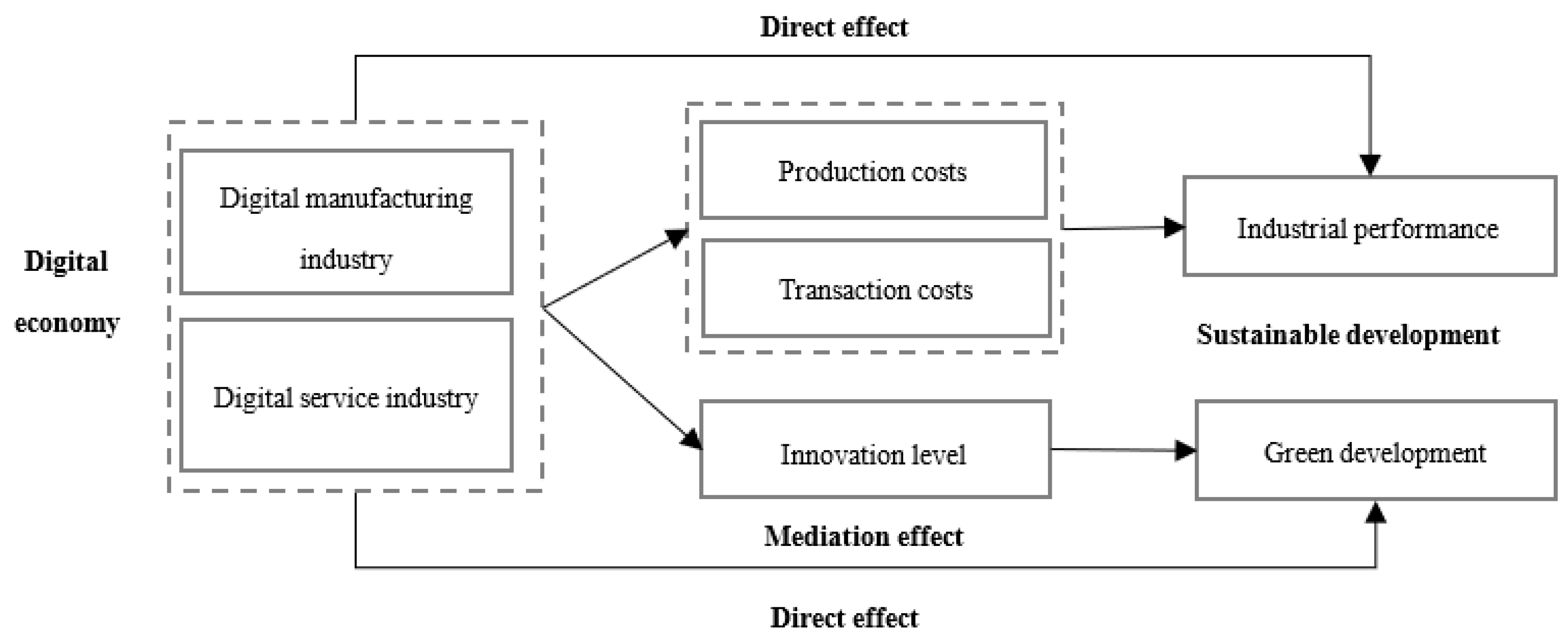

2.1. Direct Impact of the Digital Economy on the Sustainable Development of Manufacturing Sectors

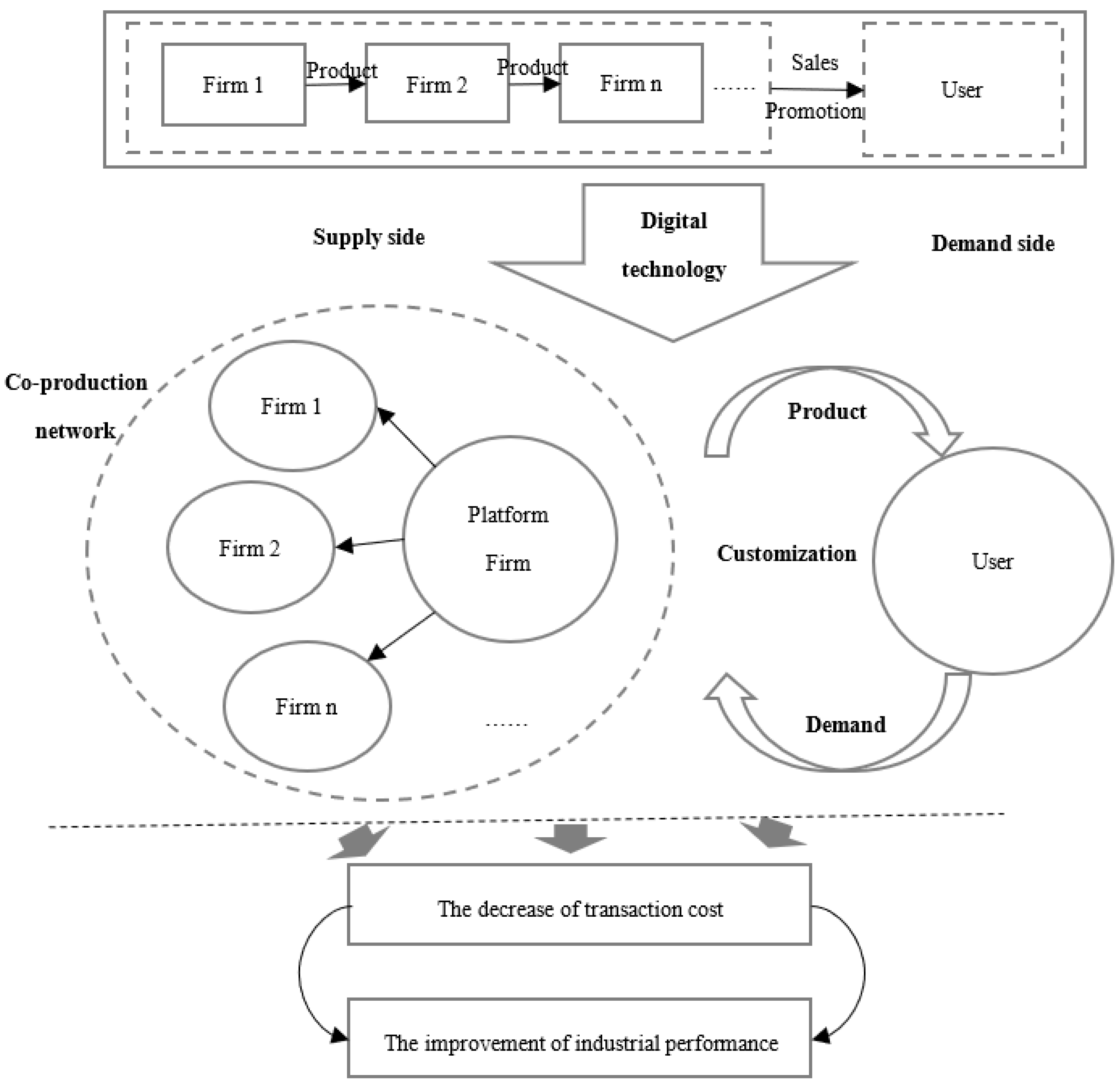

2.2. Indirect Impact Mechanism on Industrial Performance: Reduction in Production Costs

2.3. Indirect Impact Mechanism on Industrial Performance: Reduction in Transaction Costs

2.4. Indirect Impact Mechanism on Green Development: Improvement of the Innovation Level

3. Research Design

3.1. Model Specification

3.2. Data Source and Variables Design

3.3. Descriptive Statistics

4. Empirical Results and Analysis

4.1. Basic Regression Results

4.1.1. Direct Impact of the Digital Economy on Industrial Performance

4.1.2. Direct Impact of the Digital Economy on Green Development

4.2. Robustness Test

4.2.1. Robustness Test on the Direct Effect of the Digital Economy on Industrial Performance

4.2.2. Robustness Test on the Direct Effect of Digital Economy on Green Development

5. Mechanism Analysis

5.1. Mechanism Analysis on Industrial Performance: Reduction in Production Costs and Transaction Costs

5.2. Mechanism Analysis about Green Development: Promotion of Innovation

6. Discussion and Conclusions

6.1. Conclusions

6.2. Marginal Contribution to Related Research

6.3. Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Jiang, H.; Murmann, J.P. The rise of China’s digital economy: An overview. Manag. Organ. Rev. 2022, 18, 790–802. [Google Scholar] [CrossRef]

- Liu, Y.; Zhao, X.; Mao, F. The synergy degree measurement and transformation path of China’s traditional manufacturing industry enabled by digital economy. Math. Biosci. Eng. 2022, 19, 5738–5753. [Google Scholar] [PubMed]

- Sun, Y.; Li, L.; Shi, H.; Chong, D. The transformation and upgrade of China’s manufacturing industry in Industry 4.0 era. Syst. Res. Behav. Sci. 2020, 37, 734–740. [Google Scholar] [CrossRef]

- Zhou, J. Digitalization and intelligentization of manufacturing industry. Adv. Manuf. 2013, 1, 1–7. [Google Scholar] [CrossRef]

- Huang, Y.; Khan, J. Has the information and communication technology sector become the engine of China’s economic growth? Rev. Ddv. Econ. 2022, 26, 510–533. [Google Scholar] [CrossRef]

- Zhang, W.; Zhao, S.; Wan, X.; Yao, Y. Study on the effect of digital economy on high-quality economic development in China. PLoS ONE 2021, 16, e0257365. [Google Scholar] [CrossRef] [PubMed]

- Ding, C.; Liu, C.; Zheng, C.; Li, F. Digital economy, technological innovation and high-quality economic development: Based on spatial effect and mediation effect. Sustainability 2022, 14, 216. [Google Scholar] [CrossRef]

- Carlsson, B. The Digital Economy: What is new and what is not? Struct. Chang. Econ. D 2004, 15, 245–264. [Google Scholar] [CrossRef]

- Zhao, S.; Peng, D.; Wen, H.; Song, H. Does the digital economy promote upgrading the industrial structure of Chinese cities? Sustainability 2022, 14, 10235. [Google Scholar] [CrossRef]

- Liu, Y.; Yang, Y.; Li, H.; Zhong, K. Digital economy development, industrial structure upgrading and green total factor productivity: Empirical evidence from China’s cities. Int. J. Environ. Res. Public Health 2022, 19, 2414. [Google Scholar] [CrossRef]

- Guan, H.; Guo, B.; Zhang, J. Study on the impact of the digital economy on the upgrading of industrial structures—Empirical analysis based on cities in China. Sustainability 2022, 14, 11378. [Google Scholar] [CrossRef]

- Ren, X.; Zeng, G.; Gozgor, G. How does digital finance affect industrial structure upgrading? Evidence from Chinese prefecture-level cities. J. Environ. Manag. 2023, 330, 117125. [Google Scholar] [CrossRef]

- Zhang, Y.; Ren, S.; Liu, Y.; Si, S. A big data analytics architecture for cleaner manufacturing and maintenance processes of complex products. J. Clean. Prod. 2017, 142, 626–641. [Google Scholar] [CrossRef]

- Kılıçaslan, Y.; Sickles, R.C.; Atay Kayış, A.; Üçdoğruk Gürel, Y. Impact of ICT on the productivity of the firm: Evidence from Turkish manufacturing. J. Prod. Anal. 2017, 47, 277–289. [Google Scholar] [CrossRef]

- Sharma, R.; Mithas, S.; Kankanhalli, A. Transforming decision-making processes: A research agenda for understanding the impact of business analytics on organisations. Eur. J. Inf. Syst. 2014, 23, 433–441. [Google Scholar] [CrossRef]

- Wamba, S.F.; Akter, S.; Edwards, A.; Chopin, G.; Gnanzou, D. How ‘big data’can make big impact: Findings from a systematic review and a longitudinal case study. Int. J. Prod. Econ. 2015, 165, 234–246. [Google Scholar] [CrossRef]

- Wen, H.; Zhong, Q.; Lee, C.C. Digitalization, competition strategy and corporate innovation: Evidence from Chinese manufacturing listed companies. Int. Rev. Financ. Anal. 2022, 82, 102166. [Google Scholar] [CrossRef]

- Jun, W.; Nasir, M.H.; Yousaf, Z.; Khattak, A.; Yasir, M.; Javed, A.; Shirazi, S.H. Innovation performance in digital economy: Does digital platform capability, improvisation capability and organizational readiness really matter? Eur. J. Innov. Manag. 2022, 25, 1309–1327. [Google Scholar] [CrossRef]

- Liu, Q.; Leng, J.; Yan, D.; Zhang, D.; Wei, L.; Yu, A.; Zhao, R.; Zhang, H.; Chen, X. Digital twin-based designing of the configuration, motion, control, and optimization model of a flow-type smart manufacturing system. J. Manuf. Syst. 2021, 58, 52–64. [Google Scholar] [CrossRef]

- Barua, A.; Chellappa, R.; Whinston, A.B. The design and development of internet-and intranet-based collaboratories. Int. J. Electron. Comm. 1996, 1, 32–58. [Google Scholar] [CrossRef]

- David, P.A.; Wright, G. General purpose technologies and surges in productivity: Historical reflections on the future of the ICT revolution. In Economic Future in Historical Perspective; David, P.A., Thomas, M., Eds.; Oxford University Press for the British Academy: Oxford, UK, 2003; Chapter 4; pp. 135–166. [Google Scholar]

- Cai, Y.; Zhang, J. The substitution and pervasiveness effects of ICT on China’s economic growth. Econ. Res. J. 2015, 50, 100–114. (In Chinese) [Google Scholar]

- Jorgenson, D.W.; Stiroh, K.J. Information technology and growth. Am. Econ. Rev. 1999, 89, 109–115. [Google Scholar] [CrossRef]

- Xu, W.; Wang, X.; Zhang, Z. The role of the information technology in the industrial structure optimization and upgrading in China. Singap. Econ. Rev. 2022, 67, 2023–2048. [Google Scholar] [CrossRef]

- Longo, S.B.; York, R. How does information communication technology affect energy use? Hum. Ecol. Rev. 2015, 22, 55–72. [Google Scholar] [CrossRef]

- Yang, D.; Liu, Y. Why can internet plus increase performance. China Ind. Econ. 2018, 362, 80–98. (In Chinese) [Google Scholar]

- Jin, B. The mission and value of industry-The theorical logic of industrial transformation and upgrading in China. China Ind. Econ. 2014, 318, 51–64. (In Chinese) [Google Scholar]

- May, G.; Stahl, B.; Taisch, M.; Kiritsis, D. Energy management in manufacturing: From literature review to a conceptual framework. J. Clean. Prod. 2017, 167, 1464–1489. [Google Scholar] [CrossRef]

- Ghobakhloo, M.; Fathi, M. Industry 4.0 and opportunities for energy sustainability. J. Clean. Prod. 2021, 295, 126427. [Google Scholar] [CrossRef]

- Zhang, S.; Wei, X. Does information and communication technology reduce enterprise’s energy consumption—Evidence from Chinese manufacturing enterprises survey. China Ind. Econ. 2019, 371, 155–173. (In Chinese) [Google Scholar]

- David, H.; Dorn, D. The growth of low-skill service jobs and the polarization of the US labor market. Am. Econ. Rev. 2013, 103, 1553–1597. [Google Scholar]

- Shan, S.; Wen, X.; Wei, Y.; Wang, Z.; Chen, Y. Intelligent manufacturing in industry 4.0: A case study of Sany heavy industry. Syst. Res. Behav. Sci. 2020, 37, 679–690. [Google Scholar] [CrossRef]

- Jin, X.; Wah, B.W.; Cheng, X.; Wang, Y. Significance and challenges of big data research. Big Data Res. 2015, 2, 59–64. [Google Scholar] [CrossRef]

- Kim, J.; Abe, M.; Valente, F. Impacts of the digital economy on manufacturing in emerging Asia. Asian J. Technol. Innov. 2019, 8, 1–30. [Google Scholar]

- Huang, Q.; Yu, Y.; Zhang, S. Internet development and productivity growth in manufacturing industry: Internal mechanism and China experiences. China Ind. Econ. 2019, 377, 5–23. (In Chinese) [Google Scholar]

- Wu, H.X.; Yu, C. The impact of the digital economy on China’s economic growth and productivity performance. China Econ. J. 2022, 15, 153–170. [Google Scholar] [CrossRef]

- Khuntia, J.; Saldanha, T.J.V.; Mithas, S.; Sambamurthy, V. Information technology and sustainability: Evidence from an emerging economy. Prod. Oper. Manag. 2018, 27, 756–773. [Google Scholar] [CrossRef]

- Meijers, H. Does the Internet generate economic growth, international trade, or both? Int. Econ. Econ. Pol. 2014, 11, 137–163. [Google Scholar] [CrossRef]

- Yushkova, E. Impact of ICT on trade in different technology groups: Analysis and implications. Int. Econ. Econ. Pol. 2014, 11, 165–177. [Google Scholar] [CrossRef]

- Berg, H.; Wilts, H. Digital platforms as market places for the circular economy—Requirements and challenges. Nachhalt. Manag. Forum 2019, 27, 1–9. [Google Scholar] [CrossRef]

- Wang, M.; Zhang, M.; Chen, H.; Yu, D. How does digital economy promote the geographical agglomeration of manufacturing industry? Sustainability 2023, 15, 1727. [Google Scholar] [CrossRef]

- Palma, M.A.; Collart, A.J.; Chammoun, C.J. Information asymmetry in consumer perceptions of quality-differentiated food products. J. Consum. Aff. 2015, 49, 596–612. [Google Scholar] [CrossRef]

- Du, X.; Jiao, J.; Tseng, M.M. Understanding customer satisfaction in product customization. Int. J Adv. Manuf. Technol. 2006, 31, 396–406. [Google Scholar] [CrossRef]

- Liu, Y.; Wu, A.; Song, D. Exploring the impact of cross-side network interaction on digital platforms on internationalization of manufacturing firms. J. Int. Manag. 2022, 28, 100954. [Google Scholar] [CrossRef]

- Jiang, X. Resource reorganization and the growth of the service industry in an interconnected society. Econ. Res. J. 2017, 52, 4–17. (In Chinese) [Google Scholar]

- Schwörer, T. Offshoring, domestic outsourcing and productivity: Evidence for a number of European countries. Rev. World Econ. 2013, 149, 131–149. [Google Scholar] [CrossRef]

- Fort, T.C. Technology and production fragmentation: Domestic versus foreign sourcing. Rev. Econ. Stud. 2017, 84, 650–687. [Google Scholar]

- Koch, T.; Windsperger, J. Seeing through the network: Competitive advantage in the digital economy. J. Organ. Des. 2017, 6, 6. [Google Scholar] [CrossRef]

- Ma, D.; Zhu, Q. Innovation in emerging economies: Research on the digital economy driving high-quality green development. J. Bus. Res. 2022, 145, 801–813. [Google Scholar] [CrossRef]

- Li, Y.; Yang, X.; Ran, Q.; Wu, H.; Irfan, M.; Ahmad, M. Energy structure, digital economy, and carbon emissions: Evidence from China. Environ. Sci. Pollut. Res. 2021, 28, 64606–64629. [Google Scholar] [CrossRef]

- Gao, Y.; Jin, S. Corporate nature, financial technology, and corporate innovation in China. Sustainability 2022, 14, 7162. [Google Scholar] [CrossRef]

- Zhou, Z.; Liu, W.; Cheng, P.; Li, Z. The impact of the digital economy on enterprise sustainable development and its spatial-temporal evolution: An empirical analysis based on urban panel data in China. Sustainability 2022, 14, 11948. [Google Scholar] [CrossRef]

- Zhang, W.; Liu, H.; Yao, Y.; Fan, Z. A study measuring the degree of integration between the digital economy and logistics industry in China. PLoS ONE 2022, 17, e0274006. [Google Scholar] [CrossRef]

- Zhou, R.; Tang, D.; Da, D.; Chen, W.; Kong, L.; Boamah, V. Research on China’s manufacturing industry moving towards the middle and high-end of the GVC driven by digital economy. Sustainability 2022, 14, 7717. [Google Scholar] [CrossRef]

- Kou, Z.; Liu, X. FIND Report on City and Industrial Innovation in China; Fudan Institute of Industrial Development, School of Economics, Fudan University: Shanghai, China, 2017. (In Chinese) [Google Scholar]

- Bartelsman, E.J.; Doms, M. Understanding productivity: Lessons from longitudinal microdata. J. Econ. Lit. 2000, 38, 569–594. [Google Scholar] [CrossRef]

- Sun, Z.; Wang, W. The impact of industrial ownership structure change on industrial performance: Empirical evidence from China’s industry. J. Manag. World 2011, 215, 66–78. (In Chinese) [Google Scholar]

- Bain, J.S. Relation of profit rate to industry concentration: American manufacturing: 1936–1940. Q. J. Econ. 1951, 65, 293–324. [Google Scholar] [CrossRef]

- Bernstein, S.; Lerner, J.; Sorensen, M.; Strömberg, P. Private equity and industry performance. Manage. Sci. 2017, 63, 1198–1213. [Google Scholar] [CrossRef]

- Musaad, O.A.S.; Zhuo, Z.; Siyal, Z.A.; Shaikh, G.M.; Shah, S.A.A.; Solangi, Y.A.; Musaad, O.A.O. An integrated multi-criteria decision support framework for the selection of suppliers in small and medium enterprises based on green innovation ability. Processes 2020, 8, 418. [Google Scholar] [CrossRef]

- Jing, S.; Wu, F.; Shi, E.; Wu, X.; Du, M. Does the digital economy promote the reduction of urban carbon emission intensity? Int. J. Environ. Res. Public Health 2023, 20, 3680. [Google Scholar] [CrossRef] [PubMed]

- Su, J.; Su, K.; Wang, S. Does the digital economy promote industrial structural upgrading?—A test of mediating effects based on heterogeneous technological innovation. Sustainability 2021, 13, 10105. [Google Scholar] [CrossRef]

| Variable | Name | Formula | Source |

|---|---|---|---|

| Dependent variables | |||

| PROFIT1 | Return on total assets (ROTA) | Net profit/total assets | China Statistical Yearbook |

| PROFIT2 | Return on capital (ROC) | Added value/net fixed assets | China Industrial Statistical Yearbook |

| CO2_Asset | Carbon dioxide emissions per unit asset | Carbon dioxide emissions/total assets | China Industrial Statistical Yearbook |

| CO2_Market | Carbon dioxide emissions per unit market value | Carbon dioxide emissions/total market value | China Industrial Statistical Yearbook |

| Independent variables | |||

| DCC | Direct input coefficient of manufacturing industry to the digital economy | - | China Input–Output Table |

| DCC1 | Direct input coefficient of manufacturing industry to the digital manufacturing industry | China Input–Output Table | |

| DCC2 | Direct input coefficient of the manufacturing industry to the digital service industry | - | China Input–Output Table |

| Control variables | |||

| PRI | Ownership structure | The proportion of paid-in capital of private firms | China Industrial Statistical Yearbook |

| SCALE | Market concentration | The gross output value of industry i/number of firms | China Industrial Statistical Yearbook |

| FOR | Market openness | The proportion of total foreign assets | China Industrial Statistical Yearbook |

| Mediator variables | |||

| COGS | Main business cost | - | China Industrial Statistical Yearbook |

| OE | Admin expense | - | China Industrial Statistical Yearbook |

| SE | Sales expense | - | China Industrial Statistical Yearbook |

| INNO | Innovation index | - | FIND Report on City and Industrial Innovation in China |

| Variable | Observations | Mean | Std | Min | Max |

|---|---|---|---|---|---|

| PROFIT1 | 112 | 0.074 | 0.029 | −0.018 | 0.141 |

| PROFIT2 | 112 | 0.266 | 0.126 | −0.043 | 0.536 |

| CO2_Asset | 112 | 1.408 | 3.303 | 0.007 | 18.400 |

| CO2_Market | 112 | 1.000 | 1.536 | 0.004 | 7.839 |

| DCC | 112 | 0.056 | 0.125 | 0.001 | 0.538 |

| DCC1 | 112 | 0.051 | 0.124 | 0.000 | 0.524 |

| DCC2 | 112 | 0.005 | 0.005 | 0.000 | 0.022 |

| SCALE | 112 | 1.857 | 2.361 | 0.196 | 15.785 |

| FOR | 112 | 0.296 | 0.134 | 0.072 | 0.726 |

| PRI | 112 | 0.223 | 0.116 | 0.024 | 0.514 |

| COGS | 112 | 0.849 | 0.034 | 0.736 | 0.950 |

| OE | 112 | 0.044 | 0.013 | 0.021 | 0.085 |

| SE | 112 | 0.029 | 0.011 | 0.008 | 0.063 |

| INNO | 96 | 53.004 | 107.559 | 0.150 | 560.430 |

| Independent Variables | Model (1) | Model (2) | Model (3) | Model (4) | Model (5) |

|---|---|---|---|---|---|

| PROFIT1 | PROFIT1 | PROFIT1 | PROFIT1 | PROFIT1 | |

| DCC1 | - | −0.173 (0.149) | −0.172 (0.152) | −0.124 (0.172) | 0.034 (0.145) |

| DCC2 | - | 0.775 ** (0.328) | 0.789 ** (0.317) | 0.981 *** (0.319) | 1.176 *** (0.361) |

| DCC | 0.011 (0.163) | - | - | - | - |

| SCALE | 0.003 (0.002) | - | 0.000 (0.002) | 0.000 (0.002) | 0.003 * (0.002) |

| FOR | −0.027 (0.048) | - | - | −0.039 (0.072) | −0.045 (0.047) |

| PRI | 0.216 *** (0.055) | - | - | - | 0.218 *** (0.054) |

| CONS | 0.023 * (0.012) | 0.034 *** (0.006) | 0.034 *** (0.006) | 0.042 ** (0.018) | 0.016 (0.011) |

| Industry fixed | Yes | Yes | Yes | Yes | Yes |

| Time fixed | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.776 | 0.732 | 0.733 | 0.736 | 0.788 |

| N | 105 | 105 | 105 | 105 | 105 |

| Independent Variables | Model (1) | Model (2) | Model (3) | Model (4) | Model (5) |

|---|---|---|---|---|---|

| CO2_Asset | CO2_Asset | CO2_Asset | CO2_Asset | CO2_Asset | |

| DCC | 4.755 | - | - | - | - |

| (0.886) | - | - | - | - | |

| DCC1 | - | 4.341 | 6.346 | 3.888 | 3.299 |

| - | (0.569) | (1.023) | (0.741) | (0.709) | |

| DCC2 | - | −91.17 | −60.21 * | −70.05 * | −70.78 * |

| - | (−1.444) | (−1.825) | (−2.043) | (−2.086) | |

| SCALE | −0.667 *** | - | −0.631 *** | −0.659 *** | −0.669 *** |

| (−14.26) | - | (−9.156) | (−0.998) | (−16.07) | |

| FOR | 0.873 | - | - | 2.020 | 2.039 |

| (0.455) | - | - | (1.105) | (1.120) | |

| PRI | −0.709 | - | - | −0.812 | |

| (−0.230) | - | - | (−0.300) | ||

| CONS | 1.421 *** | 2.663 *** | 1.914 *** | 1.869 *** | 1.739 *** |

| (3.063) | (4.499) | (6.697) | (6.697) | (3.754) | |

| Industry fixed | Yes | Yes | Yes | Yes | Yes |

| Time fixed | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.757 | 0.302 | 0.782 | 0.787 | 0.788 |

| N | 105 | 105 | 105 | 105 | 105 |

| Independent Variables | Model (1) | Model (2) | Model (3) | Model (4) | Model (5) |

|---|---|---|---|---|---|

| PROFIT2 | PROFIT2 | PROFIT2 | PROFIT2 | PROFIT2 | |

| DCC1 | - | −3.331 | −3.453 | −4.727 | −3.408 |

| - | (2.889) | (2.821) | (3.223) | (2.149) | |

| DCC2 | - | 14.109 ** | 12.239 ** | 7.135 | 8.765 * |

| - | (5.511) | (4.331) | (4.128) | (4.825) | |

| DCC | −3.647 | - | - | - | - |

| (2.114) | - | - | - | - | |

| SCALE | 0.044 ** | - | 0.038 *** | 0.023 * | 0.045 ** |

| (0.016) | - | (0.007) | (0.013) | (0.016) | |

| FOR | 1.196 ** | - | - | 1.048 * | 1.005 * |

| (0.440) | - | - | (0.517) | (0.474) | |

| PRI | 1.802 | - | - | - | 1.819 |

| (1.401) | - | - | - | (1.378) | |

| CONS | 8.887 *** | 9.256 *** | 9.246 *** | 9.030 *** | 8.813 *** |

| (0.182) | (0.103) | (0.088) | (0.123) | (0.165) | |

| Industry fixed | Yes | Yes | Yes | Yes | Yes |

| Time fixed | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.357 | 0.270 | 0.303 | 0.330 | 0.373 |

| N | 105 | 105 | 105 | 105 | 105 |

| Independent Variables | Model (1) | Model (2) | Model (3) | Model (4) | Model (5) |

|---|---|---|---|---|---|

| PROFIT2 | PROFIT2 | PROFIT2 | PROFIT2 | PROFIT2 | |

| DDCC1 | - | −0.041 | −0.039 | −0.050 | −0.012 |

| - | (0.095) | (0.092) | (0.085) | (0.084) | |

| DDCC2 | - | 0.986 ** | 0.984 * | 1.076 ** | 1.299 ** |

| - | (0.307) | (0.396) | (0.370) | (0.342) | |

| DDCC | −0.005 | - | - | - | - |

| (0.084) | - | - | - | - | |

| SCALE | 0.003 | - | 0.001 | 0.001 | 0.003 |

| (0.002) | - | (0.002) | (0.002) | (0.002) | |

| FOR | 0.035 | - | - | 0.026 ** | 0.041 * |

| (0.023) | - | - | (0.010) | (0.017) | |

| PRI | 0.052 | - | - | - | 0.057 * |

| (0.027) | - | - | - | (0.025) | |

| CONS | −0.021 | 0.009 | 0.007 | - | −0.023 * |

| (0.014) | (0.000) | (0.004) | - | (0.011) | |

| Industry fixed | Yes | Yes | Yes | Yes | Yes |

| Time fixed | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.095 | 0.028 | 0.052 | 0.072 | 0.140 |

| N | 90 | 90 | 90 | 90 | 90 |

| Independent Variables | Model (1) | Model (2) | Model (3) | Model (4) | Model (5) |

|---|---|---|---|---|---|

| CO2_Market | CO2_Market | CO2_Market | CO2_Market | CO2_Market | |

| DCC1 | 2.073 | 2.013 | 3.910 | 2.977 | |

| (0.598) | (0.579) | (0.919) | (0.620) | ||

| DCC2 | −25.13 * | −26.06 * | −18.47 * | −19.62 ** | |

| (−1.977) | (−1.986) | (−2.085) | (−2.287) | ||

| DCC | 3.421 | - | |||

| (0.671) | |||||

| SCALE | 0.0268 | 0.0190 | 0.0412 | 0.0261 | |

| (0.750) | (0.949) | (1.380) | (0.737) | ||

| FOR | −1.885 | −1.560 | −1.529 | ||

| (−1.289) | (−1.270) | (−1.126) | |||

| PRI | −1.255 | −1.287 | |||

| (−0.749) | (−0.758) | ||||

| CONS | 1.064 *** | 1.310 *** | 1.332 *** | 1.367 *** | 1.161 *** |

| (3.617) | (5.970) | (5.729) | (5.740) | (3.516) | |

| Industry fixed | Yes | Yes | Yes | Yes | Yes |

| Time fixed | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.223 | 0.217 | 0.218 | 0.229 | 0.233 |

| N | 105 | 105 | 105 | 105 | 105 |

| Independent Variable | Model (1) | Model (2) | Model (3) | Model (4) | Model (5) |

|---|---|---|---|---|---|

| CO2_Market | CO2_Market | CO2_Market | CO2_Market | CO2_Market | |

| DCC1 | 1.213 | 1.247 | 1.822 | 3.771 | |

| (0.242) | (0.249) | (0.298) | (0.584) | ||

| DCC2 | −85.60 ** | −85.26 ** | −83.45 ** | −81.14 ** | |

| (−2.921) | (−2.889) | (−2.925) | (−2.893) | ||

| DCC | 5.155 | - | |||

| (0.749) | |||||

| SCALE | 0.0253 | −0.0167 | −0.00799 | 0.0171 | |

| (0.676) | (−0.487) | (−0.211) | (0.457) | ||

| FOR | −1.772 | −0.602 | −0.850 | ||

| (−1.208) | (−0.416) | (−0.598) | |||

| PRI | 2.693 | 2.581 | |||

| (1.156) | (1.271) | ||||

| CONS | 0.692 | 0.812 | 0.795 | 0.833 | 1.027 |

| (1.133) | (1.529) | (1.489) | (1.364) | (1.535) | |

| Industry fixed | Yes | Yes | Yes | Yes | Yes |

| Time fixed | Yes | Yes | Yes | Yes | Yes |

| R2 | 0.188 | 0.235 | 0.236 | 0.236 | 0.241 |

| N | 90 | 90 | 90 | 90 | 90 |

| Variables | Model (1) | Model (2) | Model (3) |

|---|---|---|---|

| PROFIT1 | SER | PROFIT1 | |

| DCC2 | 1.176 *** (0.361) | 0.131 (0.162) | 1.242 ** (0.417) |

| Mediator variable (SER) | - | - | −0.501 (0.553) |

| Control variable | Yes | Yes | Yes |

| Industry fixed | Yes | Yes | Yes |

| Time fixed | Yes | Yes | Yes |

| R2 | 0.788 | 0.682 | 0.791 |

| N | 105 | 105 | 105 |

| Variables | Model (1) | Model (2) | Model (3) |

|---|---|---|---|

| PROFIT1 | AER | PROFIT1 | |

| DCC2 | 1.176 *** (0.361) | 0.112 (0.195) | 1.198 *** (0.360) |

| Intermediate variable (AER) | - | - | −0.197 (0.356) |

| Control variable | Yes | Yes | Yes |

| Industry fixed | Yes | Yes | Yes |

| Time fixed | Yes | Yes | Yes |

| R2 | 0.788 | 0.847 | 0.788 |

| N | 105 | 105 | 105 |

| Variables | Model (1) | Model (2) | Model (3) |

|---|---|---|---|

| PROFIT1 | PCR | PROFIT1 | |

| DCC2 | 1.176 *** (0.361) | −0.013 *** (0.001) | 0.986 ** (0.394) |

| Mediator variable (PCR) | - | - | −0.468 *** (0.143) |

| Control variable | Yes | Yes | Yes |

| Industry fixed | Yes | Yes | Yes |

| Time fixed | Yes | Yes | Yes |

| R2 | 0.788 | 0.550 | 0.846 |

| N | 105 | 105 | 105 |

| Variables | Model (1) | Model (2) | Model (3) |

|---|---|---|---|

| CO2_Asset | INNOINNO | CO2_Asset | |

| DCC2 | −84.08 * | 4.022 * | 1.373 |

| (−2.111) | (2.126) | (0.408) | |

| Mediator variable (INNO) | - | - | 1.396 ** |

| - | - | (2.329) | |

| CONS | 2.155 *** | 1.264 *** | −0.614 |

| (4.235) | (10.11) | (−0.907) | |

| Control variable | Yes | Yes | Yes |

| Industry fixed | Yes | Yes | Yes |

| Time fixed | Yes | Yes | Yes |

| R2 | 0.790 | 0.984 | 0.794 |

| N | 75 | 75 | 75 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ji, K.; Liu, X.; Xu, J. Digital Economy and the Sustainable Development of China’s Manufacturing Industry: From the Perspective of Industry Performance and Green Development. Sustainability 2023, 15, 5121. https://doi.org/10.3390/su15065121

Ji K, Liu X, Xu J. Digital Economy and the Sustainable Development of China’s Manufacturing Industry: From the Perspective of Industry Performance and Green Development. Sustainability. 2023; 15(6):5121. https://doi.org/10.3390/su15065121

Chicago/Turabian StyleJi, Kangxian, Xiaoting Liu, and Jian Xu. 2023. "Digital Economy and the Sustainable Development of China’s Manufacturing Industry: From the Perspective of Industry Performance and Green Development" Sustainability 15, no. 6: 5121. https://doi.org/10.3390/su15065121

APA StyleJi, K., Liu, X., & Xu, J. (2023). Digital Economy and the Sustainable Development of China’s Manufacturing Industry: From the Perspective of Industry Performance and Green Development. Sustainability, 15(6), 5121. https://doi.org/10.3390/su15065121