Research on the Impact of the EU’s Carbon Border Adjustment Mechanism: Based on the GTAP Model

Abstract

1. Introduction

2. Literature Review

2.1. CBAM Nature Research

2.2. CBAM Impact Research

2.3. Methodology of CBAM Impact Research

3. Theoretical Mechanism

4. Research Methods and Results

4.1. Research Methods

4.2. Scenarios Setting

4.3. Simulation Results

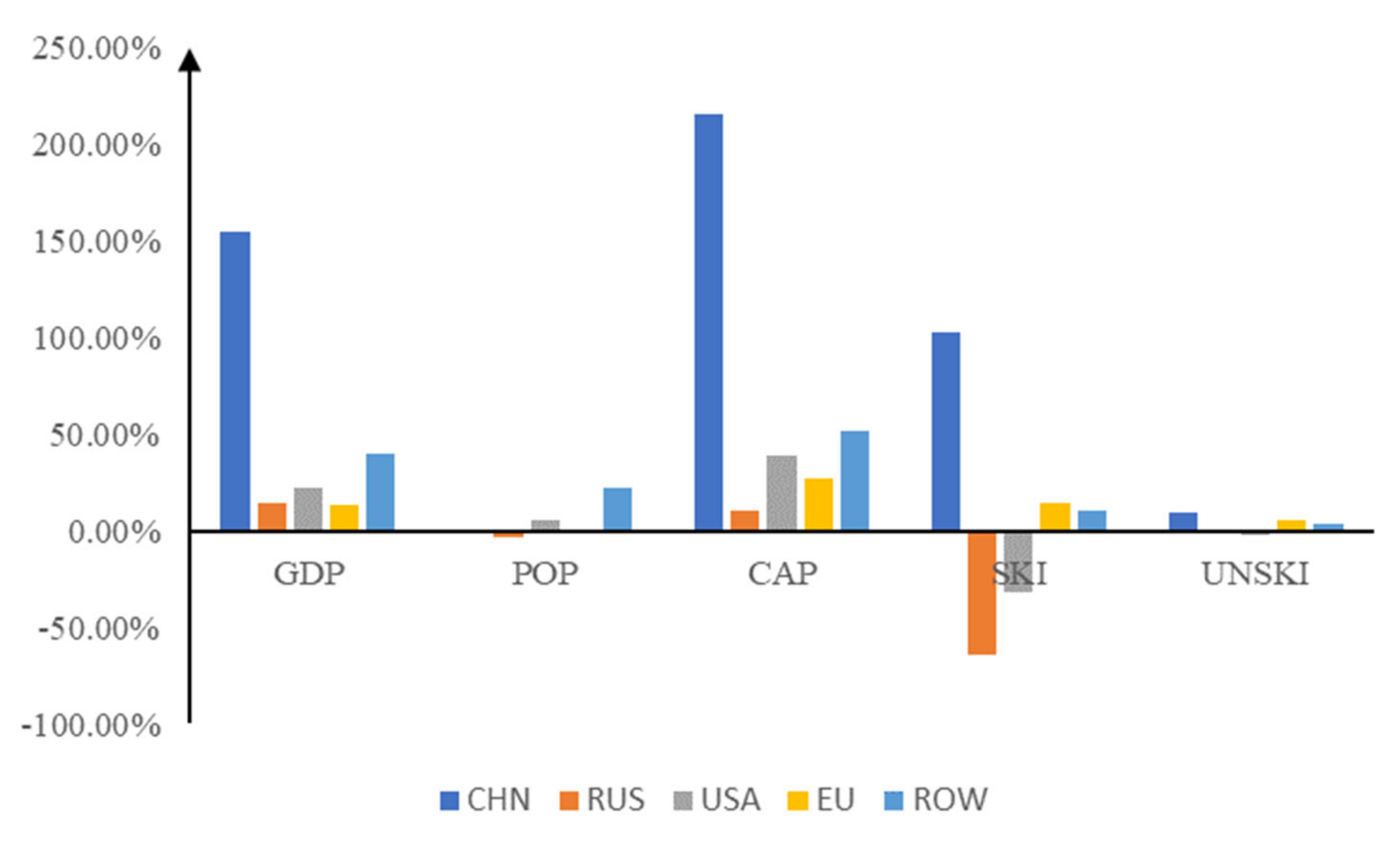

4.3.1. Changes in the EU’s Source of Electricity

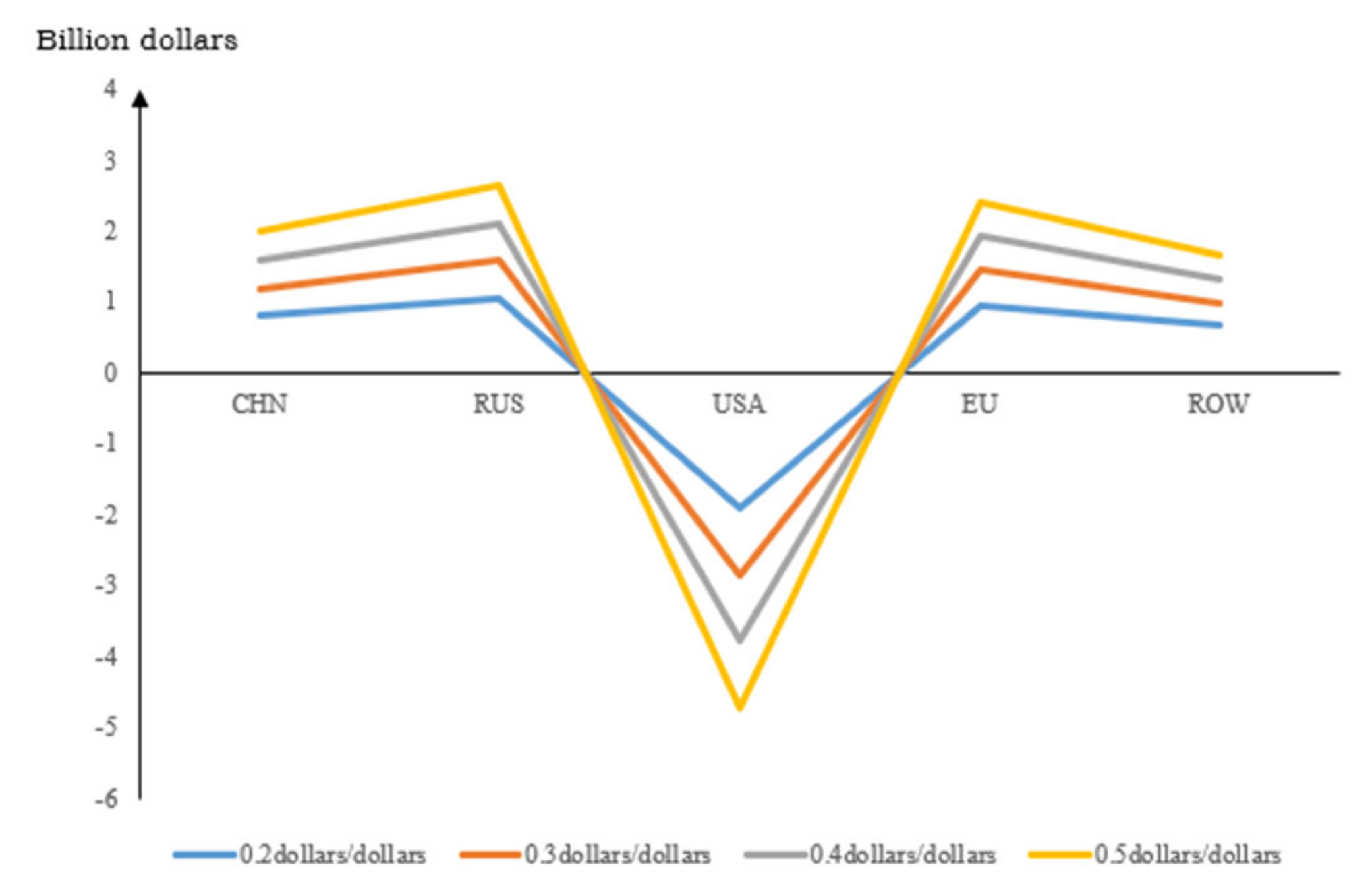

4.3.2. Changes in Social Welfare

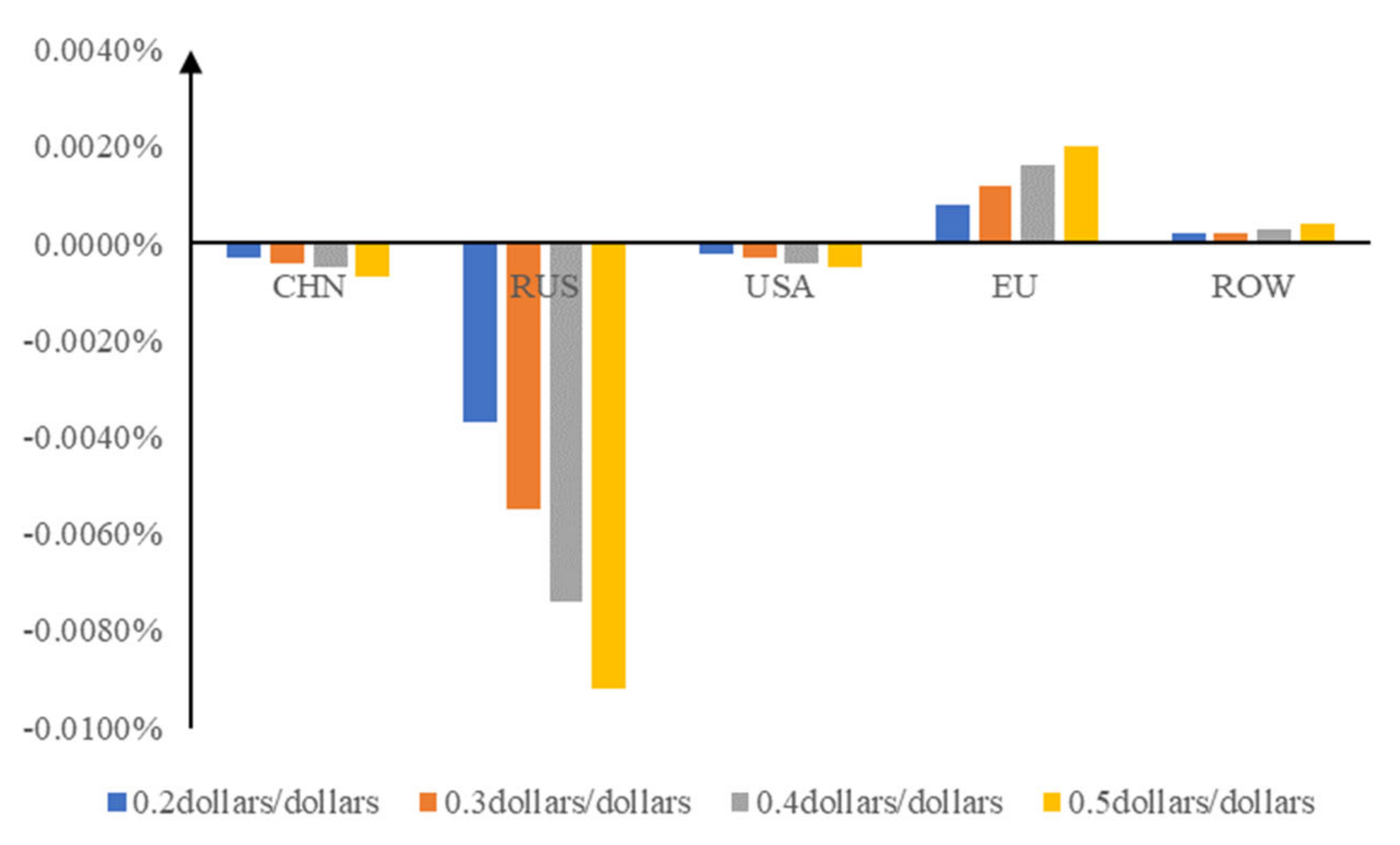

4.3.3. Changes in Carbon Emissions

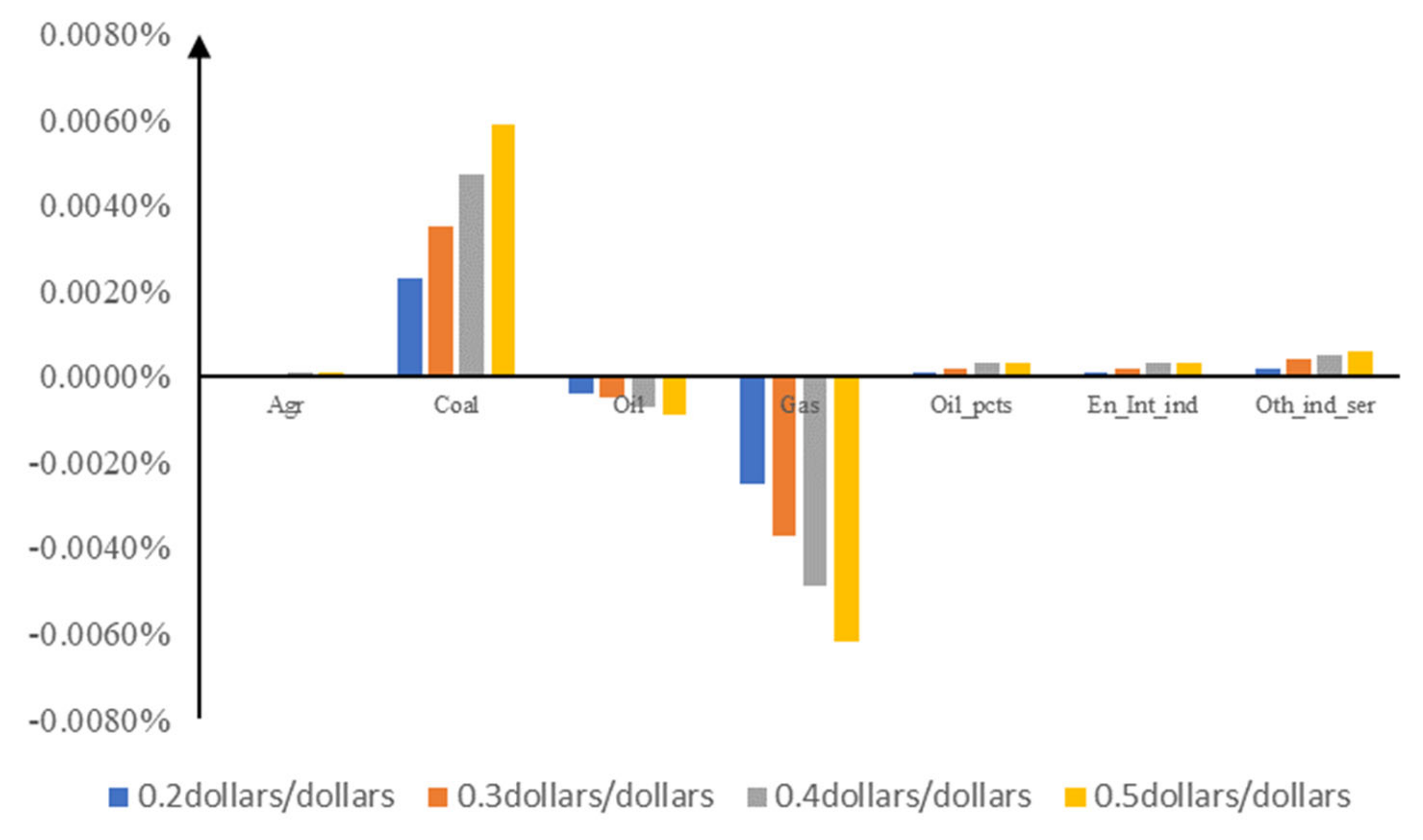

4.3.4. Changes in the Exports of Other Commodities from China to the EU

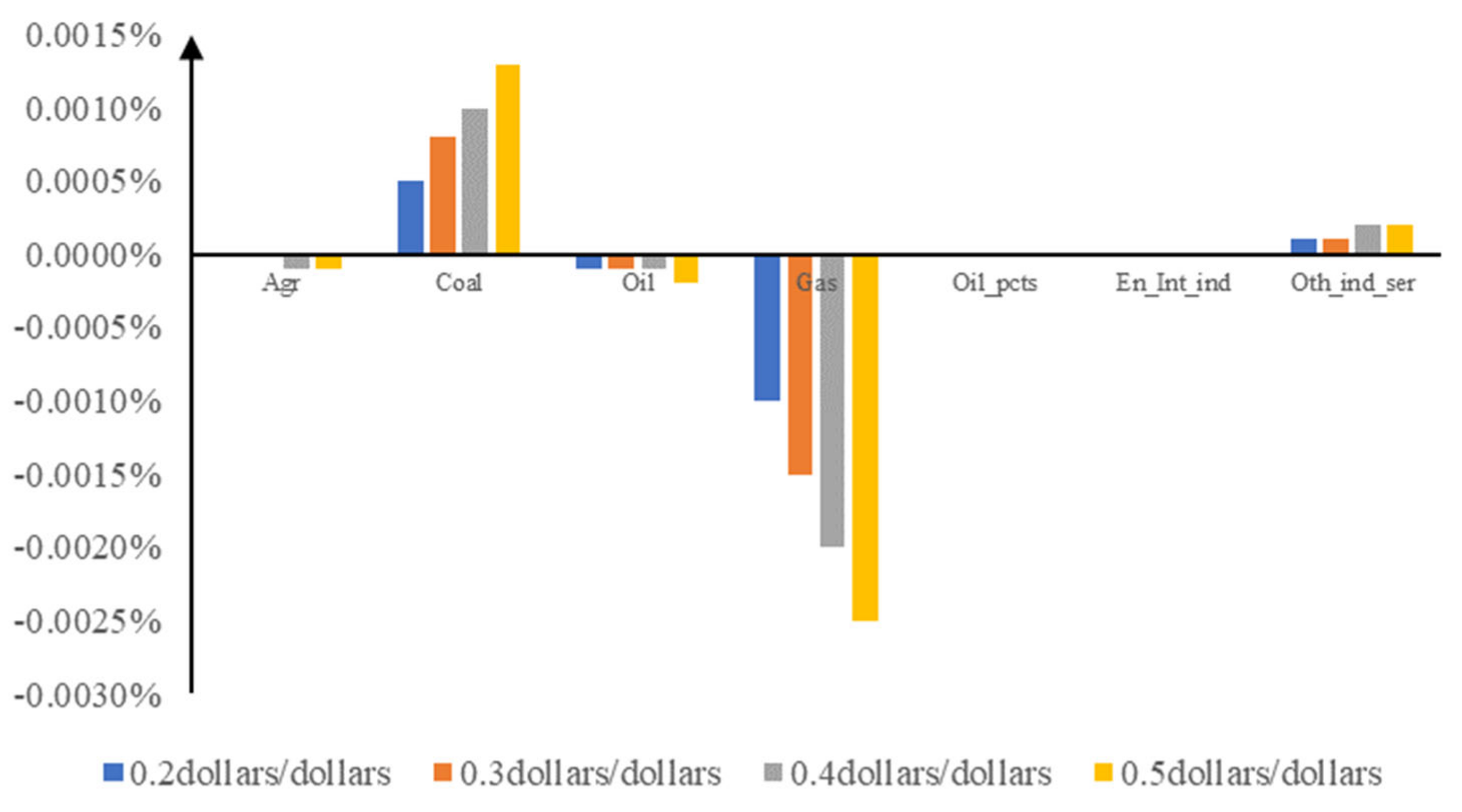

4.3.5. Changes in China’s Exports

5. Conclusions and Policy Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Parry, I.; Black, S.; Roaf, J. Proposal for an International Carbon Price Floor among Large Emitters; IMF Staff Climate Note 2021/001; International Monetary Fund: Washington, DC, USA, 2021. [Google Scholar]

- Yu, X.; Zhan, X. Review of global carbon emission responsibility division principle. Sci. Technol. Ind. 2016, 16, 137–143. [Google Scholar]

- Oliveira-martins, J.; Burniaux, J.M.; Martin, J.P. Trade and the effectiveness of unilateral CO2 abatement policies: Evidence from green. OECD Econ. Stud. 1992, 19, 123. [Google Scholar]

- Shin, S. Developing country’s perspective on COP3 development (Kyoto Protocol). Energy Policy 1998, 26, 519–526. [Google Scholar] [CrossRef]

- Mody, M. The Economics of Organization: The Transaction Cost Approach. Am. J. Sociol. 1981, 87, 548–577. [Google Scholar]

- Qin, A.; Hou, X. Current situation and development trend of the global carbon emissions market mechanism. China Ship Surv. 2021, 77–81. [Google Scholar] [CrossRef]

- Xie, Z. The carbon peaking schedule of various industries should not be “one-size-fits-all”. China Energy News, 27 March 2021. [Google Scholar]

- Parry, I.; Peter, D.; Cory, H.; Martin, K.; Kyung, K.; Florian, M.; James, R.; Christophe, W. What Role for Borden Carbon Adjustment? International Monetary Fund: Washington, DC, USA, 2021. [Google Scholar]

- Ringius, L.; Torvanger, A.; Underdal, A. Burden sharing and fairness principles in international climate policy. Int. Environ. Agreem. 2002, 2, 1–22. [Google Scholar]

- Zhuang, G.; Zhu, X. European Green Deal: Contents, Influences, and Implications. Int. Econ. Rev. 2021, 157 (Suppl. 1), 8+116–133. [Google Scholar]

- Parry, I.; Simon, B.; Karlygash, Z. Carbon Taxes or Emissions Trading Systems? Instrument Choice and Design; International Monetary Fund: Washington, DC, USA, 2022. [Google Scholar]

- Li, Y. Carbon tariffs are coming! The European Parliament passes the “Carbon Border Adjustment Mechanism” Proposal, Posing Challenges to Many Industries [EB/OL]. Available online: https://news.cnstock.com/news,bwkx-2021034671469.htm (accessed on 13 March 2021).

- Liu, X. Analysis of the WTO compliance of the EU Carbon Border Adjustment Mechanism. J. Shanghai Univ. Int. Bus. Econ. 2022, 29, 5–22+37. [Google Scholar] [CrossRef]

- Sato, S. EU’s Carbon Border Adjustment Mechanism: Will It Achieve Its Objective(s)? J. World Trade 2022, 56, 383. [Google Scholar]

- Ni, S.; Ma, Y. EU’s Carbon Border Adjustment Mechanism and its impact on China. Mod. SOE Res. 2022, 86–89. [Google Scholar]

- Li, J. Eurostat: China Becomes the Largest Trading Partner of the EU in 2020 [EB/OL]. Available online: http://www.gov.cn/xinwen/2021-02/16/content_5587302.htm (accessed on 16 February 2021).

- Gu, A.; He, J.; Zhou, L. The impact of foreign trade development on China’s carbon emissions under the new normal of economy. China Environ. Sci. 2020, 40, 2295–2303. [Google Scholar]

- UNFCCC (United Nations Framework Convention on Climate Change). Kyoto Protocol to the United to the United Nations Framework Convention on Climate Change [EB/OL]. Available online: https://unfccc.int/documents/2409 (accessed on 29 March 2020).

- United Nations. United Nations Framework Convention on Climate Change [EB/OL]. Available online: https://unfccc.int/resource/docs/convkp/conveng.pdf (accessed on 28 June 1996).

- Mehling, M.A.; Van Asselt, H.; Das, K.; Droege, S.; Verkuijl, C. Designing Border Carbon Adjustments for Enhanced Climate Action. Am. J. Int. Law 2017, 113, 433–481. [Google Scholar] [CrossRef]

- Nevalainen, A. EU’s Carbon Border Adjustment Mechanism—Its Purpose and Effects on Carbon Leakage. Bachelor’s Thesis, Aalto University School of Business, Helsinki, Finland, 2021. [Google Scholar]

- Yan, Q.; Yang, L. Research on the impact of the EU Carbon Border Adjustment Mechanism (CBAM) on foreign trade and relevant countermeasures—Taking Wuxi City, Jiangsu Province as an example. J. Commer. Econ. 2022, 2095, 161–164. [Google Scholar]

- Bellora, C.; Fontagné, L. EU in Search of a WTO-Compatible Carbon Border Adjustment Mechanism; Working Papers 2022-01; CEPII Research Center: Paris, France, 2022. [Google Scholar]

- Mörsdorf, G. A simple fix for carbon leakage? Assessing the environmental effectiveness of the EU carbon border adjustment. Energy Policy 2022, 161, 112596. [Google Scholar] [CrossRef]

- Caron, J. Estimating carbon leakage and the efficiency of border adjustments in general equilibrium—Does sectoral aggregation matter? Energy Econ. 2012, 34, S111–S126. [Google Scholar] [CrossRef]

- Branger, F.; Quirion, P. Would border carbon adjustments prevent carbon leakage and heavy industry competitiveness losses? Insights from a meta-analysis of recent economic studies. Ecol. Econ. 2014, 99, 29–39. [Google Scholar] [CrossRef]

- Palacková, E. Saving face and facing climate change: Are border adjustments a viable option to stop carbon leakage? Eur. View 2019, 18, 149–155. [Google Scholar] [CrossRef]

- Hufbauer, G.C.; Kim, J. Can EU Carbon Border Adjustment Measures Propel WTO Climate Talks? Policy Briefs PB21-23; Peterson Institute for International Economics: Washington, DC, USA, 2021. [Google Scholar]

- Jakob, M. Why carbon leakage matters and what can be done against it. One Earth 2021, 4, 609–614. [Google Scholar] [CrossRef]

- Perdana, S.; Vielle, M. Making the EU Carbon Border Adjustment Mechanism Acceptable and Climate Friendly for Least Developed Countries. Energy Policy 2022, 170, 113245. [Google Scholar] [CrossRef]

- Lim, B.; Hong, K.; Yoon, J.; Chang, J.I.; Cheong, I. Pitfalls of the EU’s carbon border adjustment mechanism. Energies 2021, 14, 7303. [Google Scholar] [CrossRef]

- Chen, X.; Zuo, P. Impact of EU’s carbon border adjustment mechanism and relevant countermeasures. Energy 2022, 7, 49–52. [Google Scholar]

- Liu, B.; Zhao, F. Impact of EU’s carbon border adjustment mechanism on China’s exports and relevant countermeasures. J. Tsinghua Univ. 2021, 36, 185–194. [Google Scholar]

- Xu, Q. Impact of EU’s carbon border adjustment tax on China and its strategic choice. Reform Econ. Syst. 2022, 3, 157–163. [Google Scholar]

- Zhong, J.; Pei, J. Beggar thy neighbor? On the competitiveness and welfare impacts of the EU’s proposed carbon border adjustment mechanism. Energy Policy 2022, 162, 112802. [Google Scholar] [CrossRef]

- Zhang, H.; Zhang, H. Carbon leakage, border carbon tax adjustment and their impact on China’s export trade. Public Financ. Res. 2013, 1, 33–36. [Google Scholar]

- Wu, L.; Zhou, Y.; Qian, H. Global actions under the Paris agreement: Tracing the carbon leakage flow and pursuing countermeasures. Energy Econ. 2022, 106, 105804. [Google Scholar] [CrossRef]

- Zhang, Y. Analysis of China’s energy efficiency and influencing factors under carbon peaking and carbon neutrality goals. J. Clean. Prod. 2022, 370, 133604. [Google Scholar] [CrossRef]

- Bednar-Friedl, B.; Schinko, T.; Steininger, K.W. The relevance of process emissions for carbon leakage: A comparison of unilateral climate policy options with and without border carbon adjustment. Energy Econ. 2012, 34, S168–S180. [Google Scholar] [CrossRef]

- Overland, I.; Sabyrbekov, R. Know your opponent: Which countries might fight the European carbon border adjustment mechanism? Energy Policy 2022, 169, 113–175. [Google Scholar] [CrossRef]

- Qi, S.; Xu, Z.; Yang, Z. China’s carbon allowance allocation strategy for the steel industry under the EU carbon border adjustment mechanism. Resour. Sci. 2022, 44, 274–286. [Google Scholar]

- Guo, Q.; Chen, W. Analysis of the economic effects of China-US trade frictions based on the dynamic CGE model. World Econ. Study 2019, 8, 103–117+136. [Google Scholar]

- Li, M.; Guan, J.; Li, C. Research on the impact of additional tariffs on China’s agricultural products trade under the background of China-US trade frictions and relevant countermeasures—Based on the GTAP Model. Trade Fair Econ. 2022, 14, 156–158. [Google Scholar]

- Cai, D.; Chen, J. Comparison and enlightenment of carbon tax policies of EU member states. Res. Explor. 2012, 4, 32–36. [Google Scholar]

- Li, X. Focus on the Expected Impact of the EU’s Carbon Tariffs to Tackle the Uncertainties Ahead [EB/OL]. Available online: yicai.com.http://www.tanpaifang.com/tanshui/2022/0815/89392_3.html (accessed on 15 August 2022).

| Scenario | Baseline Scenario | Scenario 1 | Scenario 2 | Scenario 3 | Scenario 4 |

|---|---|---|---|---|---|

| Tax rate | 0 | 0.2 dollar/dollar | 0.3 dollar/dollar | 0.4 dollar/dollar | 0.5 dollar/dollar |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Siy, A.L.; Wang, A.; Zheng, T.; Hu, X. Research on the Impact of the EU’s Carbon Border Adjustment Mechanism: Based on the GTAP Model. Sustainability 2023, 15, 4761. https://doi.org/10.3390/su15064761

Siy AL, Wang A, Zheng T, Hu X. Research on the Impact of the EU’s Carbon Border Adjustment Mechanism: Based on the GTAP Model. Sustainability. 2023; 15(6):4761. https://doi.org/10.3390/su15064761

Chicago/Turabian StyleSiy, Andy L., Anzhou Wang, Tingting Zheng, and Xian Hu. 2023. "Research on the Impact of the EU’s Carbon Border Adjustment Mechanism: Based on the GTAP Model" Sustainability 15, no. 6: 4761. https://doi.org/10.3390/su15064761

APA StyleSiy, A. L., Wang, A., Zheng, T., & Hu, X. (2023). Research on the Impact of the EU’s Carbon Border Adjustment Mechanism: Based on the GTAP Model. Sustainability, 15(6), 4761. https://doi.org/10.3390/su15064761