1. Introduction

With the prosperity of the global economy and trade, the pressure of economic activities on the environment is increasing. Global warming, climate anomalies, water pollution, air pollution, and other environmental problems have become increasingly prominent [

1]. People are gradually becoming aware of the importance of ecology environment while paying attention to their own health. In 2022, the Summit on the Impact of Sustainable Development discussed how to establish various cooperation alliances among regions and countries, and use cutting-edge science, technology, and innovation platforms to promote sustainable development [

2]. All countries in the world are striving for green ecology and actively introducing various measures to promote sustainable development. For instance, China declared its intention to work toward reaching the peak of carbon dioxide emissions by 2030 and achieving carbon neutrality by 2060 [

3].

Agriculture is the basic industry of the national economy, and the agricultural ecosystem is one of the most important and vulnerable ecosystems [

4]. All nations in the world have always been very concerned with how to coordinate the link between agricultural output and agricultural ecosystem protection and how to employ the idea of green innovation to achieve sustainable agricultural growth. The traditional agricultural development model has the problem of extensive use. In the production process of agricultural products, excessive use of chemical fertilizers and pesticides has occurred, and there are many chemical residues that pose a threat to the development of agricultural ecology [

5]. To promote green innovation in China’s seed industry, China will inject more green genes into seed life, support the research, development, and application of green and low-carbon technologies in the seed industry, and accelerate the green, intelligent, digital development and application of new materials in the seed industry [

6]. In addition, China’s rural areas have also developed many innovative green technologies to achieve the coordinated development of agriculture and green ecology. For example, the full coverage and no-tillage cultivation technology of corn straw in Northeast China, the efficient production technology of alfalfa interplanting silage corn, and the technology of straw carbonization and returning to the field to reduce emissions and fix carbon are all conducive to the green development of agriculture and have laid an important foundation for building a green agriculture [

7].

After the farming cooperative invests in green innovation costs, how to sell agricultural products is the most concerning issue for the farming cooperative. In order to solve this problem, the Chinese government actively promotes “cooperative + enterprise” contract farming [

8,

9]. In contract farming, the farming cooperative produces green agricultural products according to the agriculture contract. After the production period, the agricultural enterprise purchases all green agricultural products and puts them on the market. The cooperatives and the enterprise are connected through contract farming to complete the production and sales of green agricultural products. At present, contract farming has been widely promoted in China [

10].

However, in the actual promotion process, the agricultural cooperative needs to pay a high input cost for green innovation, and the problem of difficulty fulfilling contracts in contract farming is more prominent. The farming cooperative and the enterprise choose to break the contract due to opportunistic behavior and other reasons, which seriously hinders the development of contract farming. The domestic and foreign theorists also put forward some solutions to the problem of contract fulfillment difficulties in contract farming. Some studies also show that the cooperative’s access to production factors and new technology support can effectively enhance the enthusiasm of the cooperative to expand production; improving contract performance also plays a great role in realizing the normal performance of contract farming [

11]. The development of a coordination mechanism for mutual benefit and risk sharing is crucial to maintaining and strengthening contract farming [

12]. In order to improve the green innovation level and ensure the stable development of agricultural cooperation modes, the purpose of this paper is to design an effective agricultural cooperation mechanism to coordinate the decision-making behavior of agricultural supply chain participants. This will also help ensure the development of green agriculture.

In this way, based on the stochastic yield characteristics of agricultural products, this paper studies a contract farming supply chain system that includes a farming cooperative considering the green innovation level and an agricultural enterprise. We analyze the centralized and decentralized modes and propose a “Cost sharing + Alliance cost” coordination mechanism to coordinate the decision-making behavior of supply chain participants. In particular, we would like to answer the following questions:

1. What are the impacts of market size, yield uncertainty, and other factors on the planting area and green innovation level of the farming cooperative?

2. What are the impacts of market size and other factors on the decision-making of the agricultural enterprise.

3. Can the coordination mechanism improve the profit of supply chain participants, so as to enhance the stability of contract farming?

The remainder of this paper is divided into several parts. We review the relevant literature in

Section 2. In

Section 3, we describe the problem definition and basic model. In

Section 4, we examine how the agricultural enterprise and farming cooperative make decisions in decentralized and centralized systems. We study the coordination mechanism that can induce both parties to adopt coordinated decisions in

Section 5.

Section 6 provides a numerical analysis. In

Section 7, we summarize the article and present possible future research topics. All proofs are relegated to the

Appendix A.

2. Literature Review

The production process of agricultural products is often affected by the natural weather, which also leads to a strong randomness in agricultural production. The randomness in agricultural product yield will lead to fluctuations in agricultural product demand and price. Therefore, considering the multiple uncertainties of the agricultural supply chain, many scholars have studied production decision-making in the agricultural supply chain. Kazaz (2004) analyzed the contract farming supply chain decision-making system in which the market price of agricultural products and the contract’s purchase price are affected by random yield at the same time. The study found that expanding the source of olive purchases can effectively reduce the optimal land lease area for olive oil producers to make decisions and reduce the production cost of olive oil [

13]. On the basis of Kazaz (2004), Kazaz and Webster (2011) analyzed the impact of transaction costs on the decision-making of agricultural supply chain members when the agricultural products’ yield is uncertain. The study found that risk averse agricultural enterprises will lease more land for agricultural products [

14]. Furthermore, some scholars consider that farmers can reduce the uncertainty risk in the agricultural supply chain through multicycle production or crop rotation. For example, Livingston et al. (2015) studied the impact of the randomness of agricultural product prices and fertilizer prices on agricultural product planting decisions and built a multi-cycle farmer planting decision model for this purpose. The study found that crop rotation can improve the output of agricultural products [

15]. Boyabatli et al. (2017) considered that farmers should carry out planting plans for multiple crops at the same time in a production season and discussed the optimal farmland allocation strategy to optimize production decisions to maximize farmers’ income [

16]. Additionally, because the randomness of agricultural product yield is largely due to the impact of natural weather changes, some scholars focus on the relationship between natural weather and agriculture. For example, Anderson et al. (2019) designed an agricultural supply chain composed of fertilizer suppliers, farmers, and agricultural enterprises and analyzed the relationship between output, fertilizer use, and weather [

17]. In light of the characteristics of the African continent’s rainfall uncertainty, Zhang et al. (2020) proposed a new production sowing plan to increase the income of local farmers and improve their living standards [

18]. Chen et al. (2021) studied the problem of multiple farmers with the uncertain yield producing high-value agricultural products. They discovered that if the production cost of high-value products is low, farmers with low product yield rates can effectively improve their profits and close the income gap by opting for contract farming [

19]. Compared with the above work, this study not only discusses the impact of yield randomness on agricultural production, but also proposes a coordination mechanism to optimize supply chain performance. In other words, this study expands the relevant theories of the agriculture supply chain.

Coordinating and optimizing the agricultural supply chain can not only improve the supply chain members’ profits, but also improve the stability of the supply chain. Therefore, many scholars have proposed cost sharing, revenue sharing, and other mechanisms to coordinate and optimize the agricultural supply chain. For example, He et al. (2008) found that the random yield of agricultural products would directly affect the production decisions and profit of all members in the supply chain. Therefore, they proposed a risk sharing contract to coordinate the interaction between supply chain members and found that the yield’s randomness may reduce the supply chain’s double marginal effect under specific conditions [

20]. Guler et al. (2009) considered the uncertainty of consumer demand and product supply and found that the mixed contract can coordinate the decentralized production of multiple agricultural product suppliers [

21]. Chen et al. (2010) analyzed the supply chain performance under the influence of weather on the yield level of agricultural products. Manufacturers can use weather derivatives and rebate contracts designed for risk compensation to deal with the uncontrollable risks of weather and achieve coordination and optimization of the agricultural supply chain, so as to gain a competitive advantage and improve the performance level [

22]. Niu et al. (2016) used the Nash negotiation model to explore the role of agricultural intermediary enterprises in the agricultural supply chain composed of farmers and enterprises, in which agricultural intermediary enterprises and farmers cooperate by signing revenue-sharing contracts. The study found that the cooperation model can achieve coordination of the agricultural supply chain [

23]. Ye et al. (2017) proposed a production cost sharing mechanism to coordinate and optimize the operation of the bioethanol supply chain based on the reality that China uses cassava as a biomass raw material to produce bioethanol. The study found that cassava processing enterprises implementing the cost sharing mechanism increased their earnings [

24]. Tajbakhsh (2021) studied a tripartite agricultural supply chain composed of agricultural comprehensive enterprises, organic farmers, and traditional farmers, and proposed a trilateral cooperative contract agriculture, which promoted the centralized development of the supply chain and alleviated the conflict between horizontal and vertical channels [

25]. The above research on coordination mechanisms has not considered the products’ green level. The coordination mechanism proposed in this study can improve the products’ green level and has reference significance for the improvement of the agricultural cooperation model.

Environmental protection is an important condition for sustainable development [

26,

27]. Actually, the production and sale of green products are not only conducive to improving the competitiveness of enterprises but also to environmental protection. Li and Zhu (2016) [

28] considered the dual-channel supply chain, including green products, and discussed the pricing and greening strategies of supply chain members in different coordination modes under the unified pricing strategy. Zhu and He (2017) [

29] studied the development of green products with different supply chain structures, analyzed how the nature of green products affects company decisions, and obtained the optimal pricing strategy for green products. Jamali et al. (2018) [

30] discussed the situation of two manufacturers selling green and nongreen products in dual distribution channels and analyzed the decision-making behavior of participants in the two supply chains. Raza (2018) [

31] studied inventory pricing and corporate social responsibility investment decision-making and coordination for the green supply chain system of manufacturers and retailers. Wang and Dai (2018) [

32] found that green supply chain management practices are conducive to improving the environmental and social performance of enterprises, and with the improvement of environmental and social performance, enterprises will also have better economic performance. Rong et al. (2020) [

33] analyzed the role of the revenue-sharing contract in the green supply chain based on game theory. Li et al. (2021) [

34] investigated the relationship between product greenness and profit level while taking market potential, environmental awareness, demand elasticity, and customer loyalty into account, and proposed a reasonable coordination mechanism. Ghosh et al. (2021) [

35] studied the supply chain model with sales effort and green sensitive demand, considering whether two different types of retailers are subject to capital constraints. The previous research focused on traditional industries. In the context of agricultural production, this study not only analyzes the green level decision of agricultural products but also analyzes the planting strategy of agricultural products. In short, this study is conducive to the sustainable development of agriculture.

3. The Basic Model

3.1. Problem Description

Consider the contract farming supply chain system composed of a farming cooperative and an agricultural enterprise. In this agricultural supply chain system, the farming cooperative and the agricultural enterprise produce and sell a single agricultural product in a cycle. Without considering the loss and processing cost of agricultural products during transportation, there is no information asymmetry between the two.

At the beginning of production, the farming cooperative needs to decide the planting area of agricultural products

, the farming cooperative’s production cost is described as

, in which

is the planting cost coefficient [

36]. The larger planting cost coefficient

is, the lower the planting efficiency is. In addition, the agricultural products yield has the risk of yield uncertainty. The final agricultural products yield that the farming cooperative can obtain at the end of the production period is

, among

is a random variable, representing the yield per unit planting area, and

,

.

We use

to express the green innovation level of agricultural products.

means green innovation cost per unit planting area and

is the cost coefficient of green innovation [

37]. After the end of the production period of agricultural products, the agricultural enterprise will use the contract price

purchase all agricultural products produced by the farming cooperative, in which

is the basic contract price decided by the enterprise when there is no green innovation in agricultural products.

means the enterprise is willing to pay a higher purchase price for agricultural products invested in green innovation.

The market price of agricultural products follows the inverse demand function

, where

represents the market scale of agricultural products,

represents the consumer’s preference for green innovative agricultural products, which also means that consumers are willing to pay more for green agricultural products [

38].

3.2. Profit Function of the Farming Cooperative and Agricultural Enterprise

In contract farming, the farming cooperative will sell the agricultural products to the agricultural enterprise, and the agricultural enterprise will put agricultural products on the market. The farming cooperative needs to determine the agricultural products planting area

and the corresponding green innovation level

. The profit function of the farming cooperative can be expressed as:

where

means the agricultural product planting cost of the farming cooperative,

means the cost of green innovation,

is the sales income of the farming cooperative.

The agricultural enterprise purchases agricultural products produced by the farming cooperative at price

and sells them to the market at price

. Therefore, the profit function of agricultural enterprise can be expressed as:

where

represents the cost of purchasing,

represents the agricultural enterprise’s market sales profit.

When the farming cooperative cooperates with the agricultural enterprise, the profit function of the whole supply chain can be expressed as:

4. Decision-Making Model

4.1. Centralized Decision Model

Under the centralized decision model, the expected profit of the whole supply chain

can be expressed as:

where

.

From Equation (4), it is easy to obtain the uniquely determined optimal planting area and optimal green innovation level to maximize the expected profit of the whole supply chain.

Theorem 1. Under the centralized decision model, the optimal planting areaand optimal green innovation levelis: Lemma 1. (1) Under the centralized decision model, the optimal planting areaincreases with the market scale, and decreases with the planting cost coefficientand green innovation cost coefficient.

(2) Under the centralized decision model, the green innovation levelincreases with the green innovation valueand the yield per planting area, and decreases with the green innovation cost coefficient.

The expansion of market scale can promote the agricultural enterprise to set higher purchase prices, enhance the planting enthusiasm of the farming cooperative, and thus increase the yield of agricultural products. The increase in planting costs and green innovation costs will increase the input costs of the farming cooperative. The farming cooperative chooses to reduce the planting scale in order to reduce risks.

The higher consumers’ preference for green agricultural products, the higher the market selling price of green agricultural products, which directly promotes the farming cooperative to improve the green innovation level. In addition, the increase in yield per planting area can also improve the green innovation level of the agricultural cooperative.

4.2. Centralized Decision Model

4.2.1. The Farming Cooperative’s Decision

At the beginning of production, the cooperative and the enterprise sign a farming contract. The cooperative needs to decide the planting area

and green innovation level

. The expected profit function of the farming cooperative can be obtained from Equation (1):

Theorem 2. The optimal planting areaand the optimal green innovation levelunder the decentralized decision model can be obtained: According to Equation (7), the optimal planting area of agricultural products under the decentralized decision model is related to the yield per area, which is consistent with reality. Generally speaking, the higher the yield per area, the higher the enthusiasm of the farming cooperative for planting, and the farming cooperative will actively expand the planting area of agricultural products. In addition, according to Equation (7), the higher the planting cost and green innovation cost, the more the farming cooperative will reduce the planting area to avoid planting risks.

Different from centralized decision-making, the green innovation level of agricultural products under the decentralized decision model is mainly related to the yield per area and green innovation cost. Compared with the green innovation level under the centralized decision model , it can be found that the optimal green innovation level under the decentralized decision model is not affected by the consumer preference .

4.2.2. The Agricultural Enterprise’s Decision

From Equation (2), the expected profit function of the agricultural enterprise is:

By substituting Equation (7) into Equation (8), it is easy to find that the expected profit function of the company is a concave function about the contract price , so it is easy to infer that there is only one optimal contract price under the decentralized decision model.

Theorem 3. Under the decentralized decision model, the optimal contract priceis: Because , there is a hypothesis . The optimal contract price can be inferred from Equation (9). The increase in market size can effectively promote the agricultural enterprise to increase the contract price, thus promoting the farming cooperative to expand the planting scale of agricultural products.

Theorem 4. The optimal planting area under decentralized decision-making is:

Lemma 2. The optimal planting area of agricultural products under decentralized decision-makingis smaller than that under centralized decision-making, that is, there is a bilateral effect.

It can be seen from Lemma 2 that the planting area of agricultural products under the decentralized decision-making model is smaller than that under the centralized decision-making model, which also means that the farming cooperative needs to increase the agricultural planting area, which is conducive to increasing the overall profit of the supply chain.

Theorem 5. Under decentralized decision-making, the optimal expected profit of the cooperative and the optimal expected profit of the enterprise are:

Lemma 3. The supply chain’s expected profitwhen the farming cooperative and the agricultural enterprise are in the decentralized decision model is less than the supply chain’s expected profitwhen the supply chain is in the centralized decision model.

From Lemma 3, it can be found that the agricultural enterprise, as the main party of the contract farming supply chain, also needs to provide some reasonable contract mechanisms to coordinate the supply chain so that the profit of both the farming cooperative and the agricultural enterprise can be improved.

5. “Cost Sharing + Alliance Expense” Coordination Mechanism

In order to improve the supply chain performance and ensure the stable supply of agricultural products, the agricultural enterprise adopts the “Cost sharing + Alliance expense” coordination mechanism to reduce the green innovation costs of the farming cooperative and encourage the farming cooperative to increase yield. In the coordination mechanism, the agricultural enterprise bears part of the cost of green innovation

in order to reduce the cost pressure of green innovation of the farming cooperative.

is the cost sharing coefficient of the agricultural enterprise. The larger the

, the greater the green innovation cost shared by the agricultural enterprise. The cost sharing mechanism makes the agricultural enterprise and the farming cooperatives more closely linked and protects the benefits of the cooperative to a certain extent. In addition, the farming cooperatives cannot do without the guidance and financial support of the agricultural enterprise in the production process, so the farming cooperative need to pay a certain amount of alliance expenses

to the agricultural enterprise as compensation. The alliance expense can be regarded as the joining fee of the cooperative and can also play a role in preventing the moral hazard of the farming cooperative. To sum up, the expected profit function of the farming cooperative can be expressed as:

Similar to Equation (6), under the coordination mechanism, the optimal planting area and the optimal green innovation of agricultural cooperatives are:

Lemma 4. The cost sharing coefficientprovided by the agricultural enterprise to encourage the farming cooperative to select the optimal level of green innovation from the perspective of maximizing the whole supply chain is a monotonically decreasing function of the consumer preference.

From Equation (5), the optimal level of green innovation under centralized decision model is , the optimal green innovation under the coordination mechanism is . Therefore, it is easy to infer that the greater the consumer preference, the smaller the cost sharing coefficient can be formulated by the enterprise to improve the green innovation level. In addition, when , the optimal green innovation under the coordination mechanism is equals the optimal level of green innovation under centralized decision model. In other words, by changing the cost sharing coefficient, the green innovation level can achieve the optimal value.

Similarly, the expected profit function of the agricultural enterprise can be expressed as:

Similar to Equation (8), the optimal contract price of the agricultural enterprise under the coordination mechanism is:

Substitute Equation (15) into Equation (13) to obtain the optimal planting area of agricultural products under the coordination mechanism:

By Equations (13), (15) and (16), it can be found that under the contract coordination mechanism, the optimal expected profit of the farming cooperative and the agricultural enterprise can be expressed as:

An effective contract mechanism needs to ensure that the profits of all participants after cooperation do not decrease; that is, the profits of the farming cooperative and the agricultural enterprise after cooperation are not less than the profits before cooperation. Therefore, the coordination contract mechanism needs to meet the following constraints:

Simplify the formula to get the value range of alliance expense, that is:

where

,

,

.

6. Numerical Analysis

In this part, we further discuss the effectiveness of the coordination mechanism through numerical analysis and compare and analyze the changes in the profit of the farming cooperative and the agricultural enterprise after agricultural enterprises provide the coordination mechanism of “Cost sharing + Alliance expense”.

We use the national maize yield data (ton/mu) from 2010 to 2018 of China National Bureau of Statistics for analysis. The K-S nonparametric hypothesis test found that the national corn yield per mu meets the normal distribution, and .

Other relevant parameters in the model are set as follows: market size , planting cost coefficient , green innovation input cost coefficient , consumer preference , and cost sharing coefficient , alliance expense .

6.1. Effect of Consumer Preference on Supply Chain

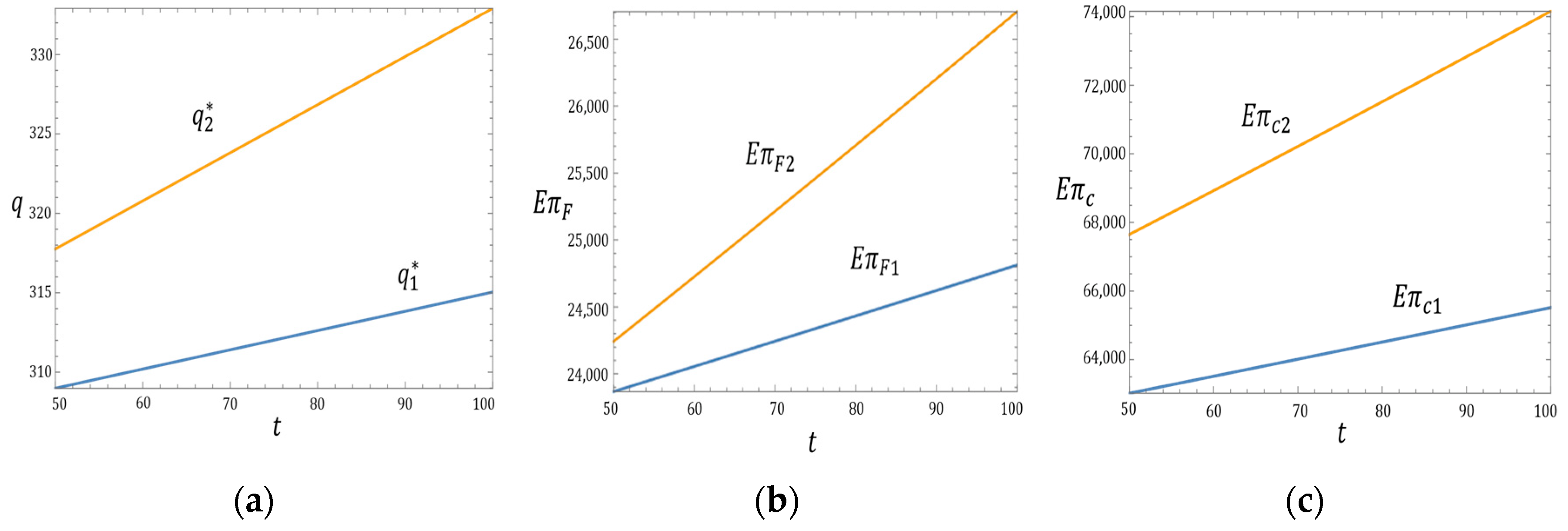

Figure 1 shows the impact of consumers’ preference for green agricultural products on the planting area, the farming cooperative’s profit, and the agricultural enterprise’s profit under different models. It can be seen from

Figure 1a that the greater consumers’ preference for green innovative agricultural products, the larger the scale of agricultural products. In addition, consumers’ green preference can also effectively promote the profit of the farming cooperative and the agricultural enterprise. Therefore, when cooperating with the agricultural enterprise, the farming cooperative should fully consider the importance of consumers’ green preferences so as to achieve greater profit. In addition, it is easy to see from

Figure 1 that after the implementation of the coordination mechanism, the planting area of agricultural products and the profit of the farming cooperative and the agricultural enterprise have improved.

6.2. Effect of Yield Per Mu on Supply Chain

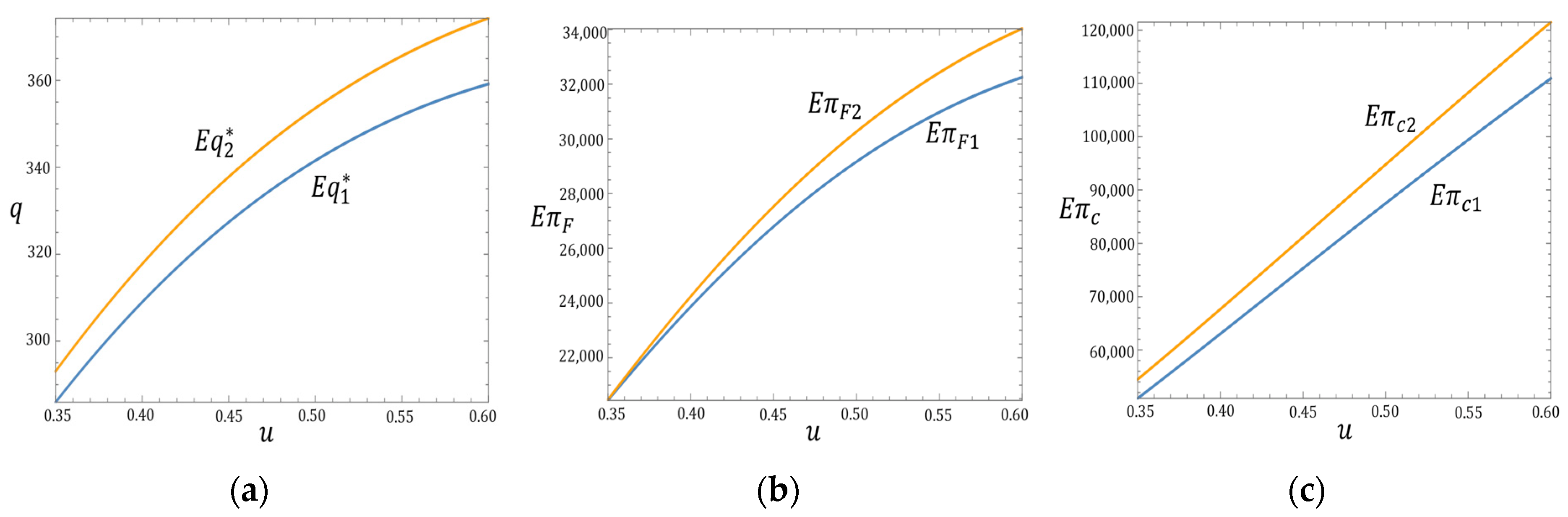

Figure 2 shows the impact of the yield per mu of agricultural products on the planting area, the profit of the agricultural cooperative and the agricultural enterprise under different models. It can be seen from

Figure 2a that the increase in yield per mu can encourage the farming cooperative to expand the planting scale, thus improving the agricultural cooperative’s profit.

Figure 2b shows that, with the increase in yield per mu, the gap between the profit of the farming cooperative under the coordination mechanism and the profit of the farming cooperative under contract farming is growing. This also means that agricultural products with a high yield per mu are more suitable for the farming cooperative under the coordination mechanism.

Figure 2c shows that the increase in yield per mu can also promote the increase in the profit of the agricultural enterprise, and the profit of the agricultural enterprise in the coordination mechanism will increase faster. It can also be seen from

Figure 2 that after the implementation of the coordination mechanism, the profit of the farming cooperative and the agricultural enterprise has achieved Pareto improvement.

7. Discussion and Conclusions

It is critical to implement green innovation on agricultural products in order to promote the green development of agriculture. Based on the characteristics of contract farming, considering the random yield of agricultural products and the green innovation’s level, this paper constructs an agricultural supply chain system composed of the farming cooperative and the agricultural enterprise. In contract farming, the agricultural enterprise and the farming cooperative signed an agricultural product purchase contract. The agricultural cooperative needs to decide the planting area and green innovation level of agricultural products, and the agricultural enterprise needs to decide the contract price.

We first analyzed two decision-making models, namely the centralized model and the decentralized model, and took the results as the baseline of the supply chain. Under a centralized model, we found that the green innovation level was related to the green innovation value, the yield per planting area, and the green innovation cost coefficient. It reflected that, the higher consumers’ preference for green agricultural products, the more incentive cooperatives have to improve the green innovation of agricultural products. Under the decentralized decision-making mechanism of contract farming, the optimal planting area determined by the agricultural cooperative increased with the increase in contract price, but the optimal green innovation level was not affected by the contract price. The contract price increased with the increase in market size and consumer preference. At this time, the green innovation level selected by the agricultural cooperative had nothing to do with the green innovation value and was less than the optimal green level when the whole supply chain gained the maximum benefits. This means that the traditional form of contract farming makes it difficult to promote the improvement of the green innovation level.

Therefore, this paper proposes a “Cost sharing + Alliance expense” coordination mechanism to coordinate the decision-making of the farming cooperative and the agricultural enterprise. In the coordination mechanism, the agricultural enterprise bears part of the green innovation costs, and the farming cooperative needs to pay some alliances expense to the enterprise. First, compared with the decentralized model, it helps the cooperative improve the green innovation level of agricultural products. It was found that the green innovation level of agricultural products has improved after the implementation of the coordination mechanism, which can reach the level of centralized decision-making in the supply chain. Second, although the proposed “Cost sharing + Alliance expense” coordination mechanism cannot improve the output and green innovation level perfectly under the centralized model, it is more operable in production practice. Third, we found that, compared with the decentralized model, after setting the appropriate risk sharing coefficient and the alliance expense, the profit of the farming cooperative and the agricultural enterprise has improved. In other words, the “Cost sharing + Alliance expense” coordination mechanism can realize the Pareto improvement for both players.

The results of this study have a certain reference value for the green development of agriculture. At present, green agricultural products are favored by consumers and gradually becoming the mainstream of market demand. In addition, the national sustainable development strategy also requires that agricultural production meet the requirements of green environmental protection. The “Cost sharing + Alliance expense” coordination mechanism proposed in this paper is feasible in the agricultural supply chain. The coordination mechanism can not only improve the green innovation level of agricultural products, but also improve the income of agricultural supply chain participants, thus making the cooperation between the agricultural cooperative and the agricultural enterprise more robust. Stable agricultural production cooperation ensures the production and sales of green agricultural products, which is conducive to the green development of agriculture. In the context of the current pursuit of green environmental protection in the world, it is of great significance for sustainable development to design an agricultural cooperation mechanism that can promote the green innovation level of agricultural products.

This study also has certain theoretical value. First, this study extends the relevant research on the green innovation level to a certain extent. Previous scholars, such as Rong et al. (2020) [

33] and Li et al. (2021) [

34], took the manufacturing industry represented by automobiles as the research object of green innovation level. Few scholars have quantitatively studied the green innovation level of agricultural products using mathematical models. Second, this paper also combines the level of green innovation, the yield uncertainty of agricultural products, and the agricultural cooperation mechanism, and proposes a new agricultural cooperation mechanism to promote the sustainable development of agriculture, which makes up for the research deficiencies of Ye et al. (2017) [

24], Tajbakhsh (2021) [

25].

There is often a problem of capital constraints in agricultural production. Future research can consider the scenario of agricultural cooperatives borrowing from banks or enterprises. The government plays an important role in agricultural development. In the future, we can add the variable of government subsidy level to investigate the impact of various agricultural subsidy policies on agricultural production and agricultural green innovation level. In addition, taking public policy, social mobilization, consumer behavior, and other factors into account in the model will also be an important research direction in the future.