COVID-19 and Behavioral Factors of e-Payment Use: Evidence from Serbia

Abstract

1. Introduction

2. Theoretical Background and Literature Review

2.1. Theoretical Background

2.2. Literature Review

3. Materials and Methods

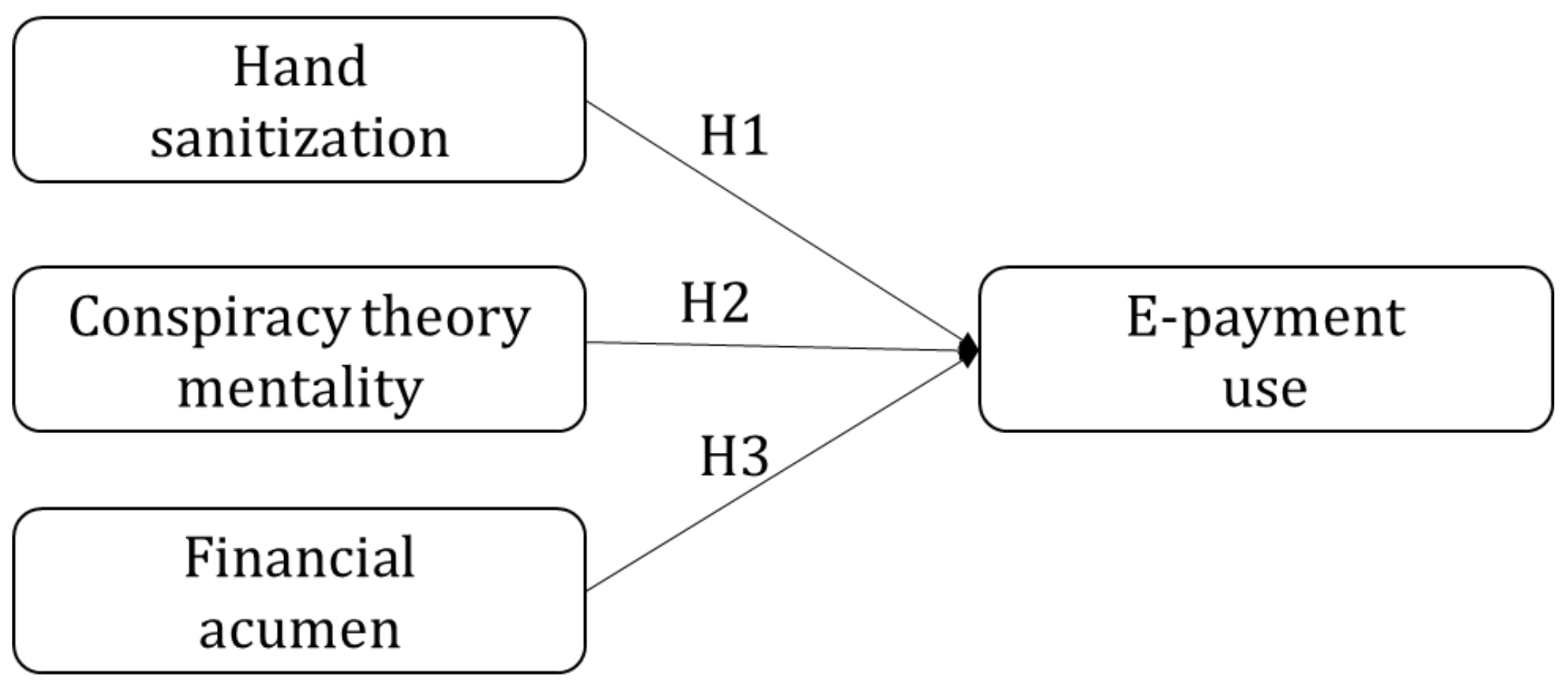

3.1. Hypotheses

3.2. Research Instrument, Variables and Measures

4. Results

4.1. Sample Features

4.2. Pre-Analysis

4.3. Main Analysis

5. Discussion and Conclusions

5.1. Key Findings

5.2. Contributions

5.3. Implications

5.4. Limitations and Further Recommendations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Gedik, H.; Voss, T.A.; Voss, A. Money and transmission of bacteria. Antimicrob. Resist. Infect. Control 2013, 2, 22. [Google Scholar] [CrossRef] [PubMed]

- Chua, M.H.; Cheng, W.; Goh, S.S.; Kong, J.; Li, B.; Lim, J.Y.C.; Mao, L.; Wang, S.; Xue, K.; Yang, L.; et al. Face masks in the New COVID-19 normal: Materials, testing, and perspectives. Research 2020, 2020, 1–40. [Google Scholar] [CrossRef] [PubMed]

- Taylor, C.; China is Sterilizing Cash in an Attempt to Stop the Coronavirus Spreading. CNBC Asia-Pacific News. Available online: https://www.cnbc.com/2020/02/17/coronavirus-china-disinfects-cash-in-a-bid-to-stop-virus-spreading.html (accessed on 30 August 2022).

- Cevik, S. Dirty money: Does the risk of infectious disease lower demand for cash? Int. Financ. 2020, 23, 460–471. [Google Scholar] [CrossRef]

- Allam, Z. The forceful reevaluation of cash-based transactions by COVID-19 and its opportunities to transition to cashless systems in digital urban networks. Surv. Covid-19 Pandemic Implic. 2020, 107–117. [Google Scholar] [CrossRef]

- Imhoff, R.; Lamberty, P. A Bioweapon or a Hoax? The Link Between Distinct Conspiracy Beliefs About the Coronavirus Disease (COVID-19) Outbreak and Pandemic Behavior. Soc. Psychol. Personal. Sci. 2020, 11, 1110–1118. [Google Scholar] [CrossRef]

- Purnat, T.D.; Vacca, P.; Czerniak, C.; Ball, S.; Burzo, S.; Zecchin, T.; Wright, A.; Bezbaruah, S.; Tanggol, F.; Dubé, È.; et al. Infodemic signal detection during the COVID-19 pandemic: Development of a methodology for identifying potential information voids in online conversations. JMIR Infodemiology 2021, 1, e30971. [Google Scholar] [CrossRef] [PubMed]

- Council of Europe, Kristoffer Tamsons: Hate Speech and Fake News Detrimental Effect on Working Conditions of Local and Regional Elected Representatives. Available online: https://www.coe.int/en/web/congress/-/kristoffer-tamsons-hate-speech-and-fake-news-detrimental-effect-on-working-conditions-of-local-and-regional-elected-representatives (accessed on 30 August 2022).

- Bagus, P.; Peña-Ramos, J.A.; Sánchez-Bayón, A. COVID-19 and the political economy of mass hysteria. Int. J. Environ. Res. Public Health 2021, 18, 1376. [Google Scholar] [CrossRef] [PubMed]

- McAndrews, J.J. The case for cash. Lat. Am. J. Cent. Bank. 2020, 1, 100004. [Google Scholar] [CrossRef]

- Lind, T.; Ahmed, A.; Skagerlund, K.; Strömbäck, C.; Västfjäll, D.; Tinghög, G. Competence, confidence, and gender: The role of objective and subjective financial knowledge in household finance. J. Fam. Econ. Issues 2020, 41, 626–638. [Google Scholar] [CrossRef]

- Joo, S.; Grable, J.E. An exploratory framework of the determinants of financial satisfaction. J. Fam. Econ. Issues 2004, 25, 25–50. [Google Scholar] [CrossRef]

- Bryan, D.; Martin, R.; Montgomerie, J.; Williams, K. An important failure: Knowledge limits and the financial crisis. Econ. Soc. 2012, 41, 299–315. [Google Scholar] [CrossRef]

- Dowd, K. Killing the Cash Cow: Why Andy Haldane is Wrong about Demonetisation. Available online: https://static1.squarespace.com/static/56eddde762cd9413e151ac92/t/58e261e0725e250f97324ece/1491231222152/Kevin+Dowd+paper.pdf (accessed on 30 August 2022).

- Liu, T.-L.; Lin, T.T.; Hsu, S.-Y. Continuance usage intention toward e-payment during the COVID-19 pandemic from the financial sustainable development perspective using perceived usefulness and electronic word of mouth as mediators. Sustainability 2022, 14, 7775. [Google Scholar] [CrossRef]

- Coskun, M.; Saygili, E.; Karahan, M.O. Exploring online payment system adoption factors in the age of COVID-19—Evidence from the Turkish banking industry. Int. J. Financ. Stud. 2022, 10, 39. [Google Scholar] [CrossRef]

- Tomić, N.; Kalinić, Z.; Todorović, V. Using the UTAUT model to analyze user intention to accept electronic payment systems in Serbia. Port. Econ. J. 2022, 1, 3–5. [Google Scholar] [CrossRef]

- Naumoski, A.; Juhász, P. The impact of inflation and operating cycle on the corporate cash holdings in South-East Europe. Manag. J. Sustain. Bus. Manag. Solut. Emerg. Econ. 2018, 24, 35–46. [Google Scholar] [CrossRef]

- Zhao, Y.; Bacao, F. How Does the Pandemic Facilitate Mobile Payment? An Investigation on Users’ Perspective under the COVID-19 Pandemic. Int. J. Environ. Res. Public Health 2021, 18, 1016. [Google Scholar] [CrossRef]

- Yuktadatta, P.; Ono, S.; Khan, M.S.R.; Kadoya, Y. Satisfaction with the COVID-19 Economic Stimulus Policy: A Study of the Special Cash Payment Policy for Residents of Japan. Sustainability 2022, 14, 3401. [Google Scholar] [CrossRef]

- Ming-Yen Teoh, W.; Choy Chong, S.; Lin, B.; Wei Chua, J. Factors affecting consumers’ perception of electronic payment: An empirical analysis. Internet Res. 2013, 23, 465–485. [Google Scholar] [CrossRef]

- Kar, A.K. What affects usage satisfaction in mobile payments? Modelling user generated content to develop the “Digital Service Usage Satisfaction Model”. Inf. Syst. Front. 2020, 23, 1341–1361. [Google Scholar] [CrossRef]

- Milanović, N.; Milosavljević, M.; Benković, S.; Starčević, D.; Spasenić, Ž. An acceptance approach for novel technologies in car insurance. Sustainability 2020, 12, 10331. [Google Scholar] [CrossRef]

- Baert, P. Unintended consequences: A typology and examples. Int. Sociol. 1991, 6, 201–210. [Google Scholar] [CrossRef]

- Radonic, M.; Vukmirovic, V.; Milosavljevic, M. The impact of hybrid workplace models on intangible assets: The case of an emerging country. Amfiteatru Econ. 2021, 23, 770. [Google Scholar] [CrossRef]

- Wenner, G.; Bram, J.T.; Marino, M.; Obeysekare, E.; Mehta, K. Organizational models of mobile payment systems in low-resource environments. Inf. Technol. Dev. 2017, 24, 681–705. [Google Scholar] [CrossRef]

- WorldPay. The Global Payment Report—WorldPay. In Global Payments Report (Issue January). Available online: https://worldpay.globalpaymentsreport.com/#/en/home (accessed on 30 August 2022).

- National Bank of Serbia. Payment System Statistics. Available online: https://nbs.rs/en/ciljevi-i-funkcije/platni-sistem/statistika/ (accessed on 30 August 2022).

- Pitić, G.; Radosavljević, G.; Babin, M.; Erić, M. Digitalization of the tax administration in Serbia. Ekon. Preduz. 2019, 67, 131–145. [Google Scholar] [CrossRef]

- Angelakis, E.; Azhar, E.I.; Bibi, F.; Yasir, M.; Al-Ghamdi, A.K.; Ashshi, A.M.; Elshemi, A.G.; Raoult, D. Paper money and coins as potential vectors of transmissible disease. Future Microbiol. 2014, 9, 249–261. [Google Scholar] [CrossRef]

- Minakawa, S.; Terui, H.; Matsuzaki, Y.; Saito, N.; Kayaba, H.; Sawamura, D. Microbiological analysis of 1000-Yen banknotes in a hospital environment. J. Cutan. Immunol. Allergy 2020, 4, 19–21. [Google Scholar] [CrossRef]

- Zarayneh, S.; Sepahi, A.A.; Jonoobi, M.; Rasouli, H. Comparative antibacterial effects of cellulose nanofiber, chitosan nanofiber, chitosan/cellulose combination and chitosan alone against bacterial contamination of Iranian banknotes. Int. J. Biol. Macromol. 2018, 118, 1045–1054. [Google Scholar] [CrossRef]

- Martina, P.F.; Martinez, M.; Centeno, C.K.; Von Specht, M.; Ferreras, J. Dangerous passengers: Multidrug-resistant bacteria on hands and mobile phones. J. Prev. Med. Hyg. 2019, 60, E293–E299. [Google Scholar] [CrossRef]

- Gabriel, E.M.; Coffey, A.; O’Mahony, J.M. Investigation into the prevalence, persistence and antibiotic resistance profiles of staphylococci isolated from euro currency. J. Appl. Microbiol. 2013, 115, 565–571. [Google Scholar] [CrossRef]

- Sasidharan, S.; Dhillon, H.S.; Singh, V.; Manalikuzhiyil, B. COVID-19: Pan(info)demic. Turk. J. Anesthesiol. Reanim. 2020, 48, 438–442. [Google Scholar] [CrossRef]

- COMPACT Education Group, The Conspiracy Theory Handbook. Available online: https://conspiracytheories.eu (accessed on 30 August 2022).

- Oleksy, T.; Wnuk, A.; Maison, D.; Łyś, A. Content matters. Different predictors and social consequences of general and government-related conspiracy theories on COVID-19. Personal. Individ. Differ. 2021, 168, 110289. [Google Scholar] [CrossRef]

- Costantini, M. Pandemics, power, and conspiracy theories. Crit. Q. 2020, 62, 24–31. [Google Scholar] [CrossRef]

- Fishbein, M.; Ajzen, I. Belief, Attitude, Intention and Behaviour; Addison-Wesley: Reading, MA, USA, 1975. [Google Scholar]

- Teovanović, P.; Lukić, P.; Zupan, Z.; Lazić, A.; Ninković, M.; Žeželj, I. Irrational beliefs differentially predict adherence to guidelines and pseudoscientific practices during the COVID-19 pandemic. Appl. Cogn. Psychol. 2020, 35, 486–496. [Google Scholar] [CrossRef] [PubMed]

- Skvarciany, V.; Jurevičienė, D. Factors influencing individual customers trust in internet banking: Case of Baltic states. Sustainability 2018, 10, 4809. [Google Scholar] [CrossRef]

- Azmi, A.; Ang, Y.D.; Talib, S.A. Trust and justice in the adoption of a welfare e-payment system. Transform. Gov. People Process Policy 2016, 10, 391–410. [Google Scholar] [CrossRef]

- Hafer, R.W. Cross-country evidence on the link between IQ and financial development. Intelligence 2016, 55, 7–13. [Google Scholar] [CrossRef]

- Zhang, Y.; Jia, Q.; Chen, C. Risk attitude, financial literacy and house-hold consumption: Evidence from stock market crash in China. Econ. Model. 2021, 94, 995–1006. [Google Scholar] [CrossRef]

- Gerrans, P.; Heaney, R. The impact of undergraduate personal finance education on individual financial literacy, attitudes and intentions. Account. Financ. 2016, 59, 177–217. [Google Scholar] [CrossRef]

- Kirana, M.Y.; Havidz, S.A.H. Financial literacy and mobile payment usage as financial inclusion determinants. In Proceedings of the International Conference on Information Management and Technology (ICIMTech), Bandung, Indonesia, 13–14 August 2020. [Google Scholar] [CrossRef]

- Philippas, N.D.; Avdoulas, C. Financial literacy and financial well-being among generation-Z university students: Evidence from Greece. Eur. J. Financ. 2019, 26, 360–381. [Google Scholar] [CrossRef]

- Onescu, L.; Florescu, D. Adapting fiscal polities for the Covid 19 pandemic. Setting up a fiscal system appropriate for the digital world. Smart Cities Reg. Dev. (SCRD) J. 2021, 5, 51–58. [Google Scholar]

- Trtovac Šabović, M.; Milosavljevic, M.; Benkovic, S. Participation of citizens in public financial decision-making in Serbia. Slovak J. Political Sci. 2021, 21, 209–229. [Google Scholar] [CrossRef]

- Tüzün, H.; Karakaya, K.; Deniz, E.B. Turkey Handwashing Survey: Suggestion for taking the ecological model into better consideration. Environ. Health Prev. Med. 2015, 20, 325–331. [Google Scholar] [CrossRef]

- Głąbska, D.; Skolmowska, D.; Guzek, D. Population-based study of the influence of the COVID-19 pandemic on hand hygiene behaviors—Polish Adolescents’ COVID-19 experience (PLACE-19) study. Sustainability 2020, 12, 4930. [Google Scholar] [CrossRef]

- Swami, V.; Chamorro-Premuzic, T.; Furnham, A. Unanswered questions: A preliminary investigation of personality and individual difference predictors of 9/11 conspiracist beliefs. Appl. Cogn. Psychol. 2010, 24, 749–761. [Google Scholar] [CrossRef]

- Bruder, M.; Haffke, P.; Neave, N.; Nouripanah, N.; Imhoff, R. Measuring individual differences in generic beliefs in conspiracy theories across cultures: Conspiracy Mentality Questionnaire. Front. Psychol. 2013, 4, 225. [Google Scholar] [CrossRef] [PubMed]

- Stojanov, A.; Halberstadt, J. The Conspiracy Mentality Scale. Soc. Psychol. 2019, 50, 215–232. [Google Scholar] [CrossRef]

- Goreis, A.; Voracek, M. A systematic review and meta-analysis of psychological research on conspiracy beliefs: Field characteristics, measurement instruments, and associations with personality traits. Front. Psychol. 2019, 10, 205. [Google Scholar] [CrossRef]

- Jolley, D.; Paterson, J.L. Pylons ablaze: Examining the role of 5G COVID-19 conspiracy beliefs and support for violence. Br. J. Soc. Psychol. 2020, 59, 628–640. [Google Scholar] [CrossRef]

- Lukić, P.; Žeželj, I.; Stanković, B. How (ir)rational is it to believe in contradictory conspiracy theories? Eur. J. Psychol. 2019, 15, 94–107. [Google Scholar] [CrossRef]

- Lusardi, A.; Mitchelli, O.S. Financial literacy and retirement preparedness: Evidence and implications for financial education. Bus. Econ. 2007, 42, 35–44. [Google Scholar] [CrossRef]

- Riskinanto, A.; Kelana, B.; Hilmawan, D.R. The moderation effect of age on adopting e-payment technology. Procedia Comput. Sci. 2017, 124, 536–543. [Google Scholar] [CrossRef]

- Kim, C.; Tao, W.; Shin, N.; Kim, K.-S. An empirical study of customers’ perceptions of security and trust in e-payment systems. Electron. Commer. Res. Appl. 2010, 9, 84–95. [Google Scholar] [CrossRef]

- Radonić, M.; Milosavljević, M. Human resource practices, failure management approaches and innovations in Serbian public administration. Transylv. Rev. Adm. Sci. 2019, 15, 77–93. [Google Scholar] [CrossRef]

- Radonić, M.; Milosavljević, M.; Knežević, S. Intangible Assets as Financial Performance Drivers of IT Industry: Evidence from an Emerging Market. E+M Ekon. Manag. 2021, 24, 119–135. [Google Scholar] [CrossRef]

- Stein, R.A. Should we launder our money? Int. J. Clin. Pract. 2020, 74, e13442. [Google Scholar] [CrossRef]

- Zhang, J.; Xu, N.; Bai, S. The optimal pricing decisions for e-tailers with different payment schemes. Electron. Commer. Res. 2021, 21, 955–982. [Google Scholar] [CrossRef]

- Andreou, P.C.; Anyfantaki, S. Financial literacy and its influence on internet banking behavior. Eur. Manag. J. 2020, 39, 658–674. [Google Scholar] [CrossRef]

- Al-Okaily, M.; Lutfi, A.; Alsaad, A.; Taamneh, A.; Alsyouf, A. The determinants of digital payment systems’ acceptance under cultural orientation differences: The case of uncertainty avoidance. Technol. Soc. 2020, 63, 101367. [Google Scholar] [CrossRef]

- Allen, F.; Gu, X.; Jagtiani, J. A Survey of Fintech Research and Policy Discussion. Rev. Corp. Financ. 2021, 1, 259–339. [Google Scholar] [CrossRef]

- Raman, P.; Aashish, K. To continue or not to continue: A structural analysis of antecedents of mobile payment systems in India. Int. J. Bank Mark. 2021, 39, 242–271. [Google Scholar] [CrossRef]

- Travica, B.; Jošanov, B.; Kajan, E.; Vidas-Bubanja, M.; Vuksanovic, E. E-commerce in Serbia: Where roads cross electrons will flow. J. Glob. Inf. Technol. Manag. 2007, 10, 34–56. [Google Scholar] [CrossRef]

- Knežević, M. Amended legislation of payment service in Republic of Serbia. Pravo Teorija Praksa 2019, 36, 15–31. [Google Scholar] [CrossRef]

- Jonker, N.; van der Cruijsen, C.; Bijlsma, M.; Bolt, W. Pandemic payment patterns. J. Bank. Financ. 2022, 143, 106593. [Google Scholar] [CrossRef] [PubMed]

- Pintér, Z.; Tóth, K.; Bareith, T.; Varga, J. The Relationship between Decision and Payment Habits and Its Relation with Wasting—Evidence from Hungary. Sustainability 2021, 13, 7337. [Google Scholar] [CrossRef]

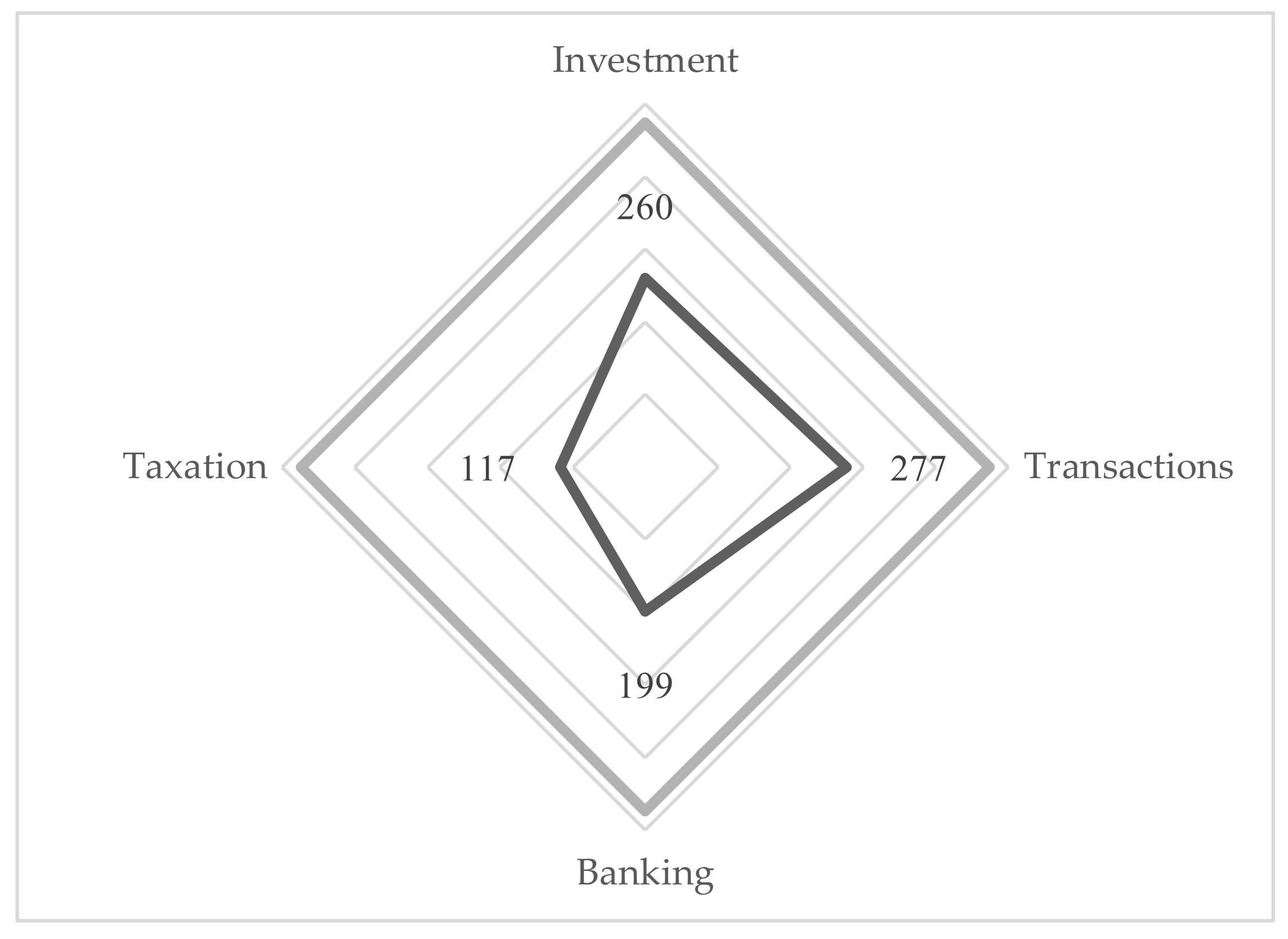

| Area | Question | Given Answers |

|---|---|---|

| Investment | If you invest $100 in a savings account at 10% p.a., how much will you have at the end of year 2? | a. $100 | b. $120 c. $121 | d. $128 |

| Transactions | Payment by credit card does not incur any costs | True-False |

| Banking | Investment in a single company’s stock provides a safer return than an equity mutual fund | True-False |

| Taxation | John has $100 of gross honoraria. If the tax base is 50% and the tax rate is 10%, how much will John get paid net? | a. $50 | b. $65 c. $90 | d. $95 |

| Item/Measure | Mean | SD | Item/Measure | Mean | SD |

|---|---|---|---|---|---|

| Epay_1 | 3.72 | 1.38 | CMT_1 * | 4.27 | 0.98 |

| Epay_2 | 3.93 | 1.24 | CMT_2 * | 4.51 | 0.93 |

| Epay_3 | 4.00 | 1.10 | CMT_3 * | 3.56 | 1.14 |

| E-payment use | 3.88 | 1.07 | CMT_4 * | 3.81 | 1.03 |

| HS_1 | 3.67 | 1.17 | CMT_5 * | 3.74 | 1.14 |

| HS_2 | 3.70 | 1.07 | Conspiracy Mentality * | 3.98 | 0.81 |

| HS_3 | 4.11 | 0.88 | |||

| Hand sanitization | 3.83 | 0.74 |

| Mean | SD | CA | 2 | 3 | 4 | ||

|---|---|---|---|---|---|---|---|

| 1 | Hand sanitization | 3.83 | 0.74 | 0.28 1 | 0.16 ** | −0.09 * | 0.13 ** |

| 2 | Conspiracy Mentality | 3.98 | 0.81 | 0.83 | 0.02 | 0.25 ** | |

| 3 | Financial Acumen | 2.80 | 1.17 | n/a | 0.22 ** | ||

| 4 | E-payment use | 3.88 | 1.07 | 0.82 |

| Unst.Coeff | St.Coeff. | t | Sig. | |||

|---|---|---|---|---|---|---|

| B | SE | Beta | VIF | |||

| (Constant) | 1.45 | 0.33 | 4.35 | 0.00 | ||

| Hand Sanitization | 0.17 | 0.06 | 0.12 | 2.69 | 0.01 | 1.04 |

| Conspiracy Mentality | 0.30 | 0.06 | 0.23 | 5.20 | 0.00 | 1.03 |

| Financial Acumen | 0.20 | 0.04 | 0.22 | 5.13 | 0.00 | 1.01 |

| R | 0.35 | Adj R2 | 0.12 | DW | 1.87 | |

| R2 | 0.12 | SE | 1.01 | F | 21.81 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Milosavljević, M.; Okanović, M.; Cicvarić Kostić, S.; Jovanović, M.; Radonić, M. COVID-19 and Behavioral Factors of e-Payment Use: Evidence from Serbia. Sustainability 2023, 15, 3188. https://doi.org/10.3390/su15043188

Milosavljević M, Okanović M, Cicvarić Kostić S, Jovanović M, Radonić M. COVID-19 and Behavioral Factors of e-Payment Use: Evidence from Serbia. Sustainability. 2023; 15(4):3188. https://doi.org/10.3390/su15043188

Chicago/Turabian StyleMilosavljević, Miloš, Milan Okanović, Slavica Cicvarić Kostić, Marija Jovanović, and Milenko Radonić. 2023. "COVID-19 and Behavioral Factors of e-Payment Use: Evidence from Serbia" Sustainability 15, no. 4: 3188. https://doi.org/10.3390/su15043188

APA StyleMilosavljević, M., Okanović, M., Cicvarić Kostić, S., Jovanović, M., & Radonić, M. (2023). COVID-19 and Behavioral Factors of e-Payment Use: Evidence from Serbia. Sustainability, 15(4), 3188. https://doi.org/10.3390/su15043188