1. Introduction

High carbon emissions represent a serious problem for the mining industry worldwide [

1,

2]. A large number of carbon emissions produced by the exhaustive exploitation of mineral resources bring a burden on the environment. Especially in the context of global warming, mining companies have to consider energy conservation and emission reduction in the mining process with the impact of carbon quota and ever-increasing carbon tax [

3,

4,

5].

The large-scale exploitation of mineral resources leads to serious carbon emissions, land destruction, and environmental damage in the process of mining, which is not conducive to the sustainable exploitation of mineral resources [

6,

7]. The independent exploitation of each deposit is prone to the problems of rapid resource consumption, the high energy consumption of equipment, and low production efficiency. The mineral resources exploitation method is changing from the independent exploitation of a single deposit to the integrated exploitation of multiple deposits simultaneously under the guidance of efficient resource exploitation and low-carbon economy strategy.

Integrated exploitation methods could accelerate collaborative production among multiple deposits and realize the large-scale extraction and processing of mineral resources [

8]. The complex interaction influence among multiple deposits should be considered comprehensively compared with the conventional exploitation of a single deposit. The mining method, production organization, operation cost, and extracted ore grade of each orebody differ due to the different characteristics of each deposit. All deposits supply mineral resources together, and they compete for investment and equipment as well. Therefore, the optimal utilization of multiple deposits could be in the way of production capacity allocation, extracted ore grade control, and mining sequence arrangement to maximize the overall economic benefit [

9,

10].

Each mining company has a certain carbon quota. The advantage of a high-benefit orebody could not be exploited if the carbon quota was allocated to each deposit equally. Therefore, the scientific allocation of production capacity for each deposit under the constraint of a carbon quota to obtain an optimal economic decision scheme in the integrated exploitation of mineral resources is very important for mining companies [

11,

12].

A theoretical system of integrated exploitation for mineral resources was proposed with optimization methods and models, which facilitates the optimization of a comprehensive mining system and has practical application in multiple deposits [

13,

14]. Several methods and models have been presented to optimize the mine planning and production process in the context of carbon emission [

15,

16]. Ivanova et al. analyzed the carbon footprint generated by the increase in carbon emissions in mining regions due to coal mining and production. It was of great significance to reduce the negative influence of mining on the environment [

17]. Valderrama et al. presented a model that integrated ore grade and carbon cost in the whole mining process for the first time to reduce greenhouse gas emissions and operating costs. Furthermore, the proposed model was verified in an iron mine, which suggested that the ore grade had a direct effect on costs and carbon emissions [

18]. Azhar et al. proposed a new mine planning approach to realize maximum profits when obeying the given carbon emission target. The efficient approach considered resource constraints in mining and promoted carbon-aware mining practices [

19].

Low-carbon technologies effectively obtained practical applications in the integrated exploitation of mineral resources. Boubault and Maïzi pointed out that the widespread application of low-carbon technologies would lead to dynamic adjustments in mineral product demand and supply against a low-carbon-economy background [

20]. Large amounts of tailings and waste generated from the integrated exploitation of deposits are still valuable with the development of new technology. The expansion of low-carbon technologies and production increase the recycling of resources. The efficient utilization of low-grade ores and the optimization of low-carbon mining have become the main goals of sustainable mining for deposits [

21].

Mathematical programming has been used widely to calculate the optimum value of the objective function on the basis that the decision variables are under certain constraints [

22]. It has the characteristics of multi-disciplinary integration, rigorous theory, and extensive application [

23]. Currently, mathematical programming has obtained some practice in resource allocation and production planning. Several resource allocation models are applied to optimize mine production and improve economic efficiency. A fuzzy linear programming optimization model of multiple deposit mining systems was presented to seek the optimal plan of production, which was applied in the Bauxite Basin Niksic with five deposits [

24]. Rahmanpour and Osanloo formulated a fuzzy linear programming model to optimize short-term mine production planning. The optimal scheme was provided to determine the amount of material that needs to be mined from each site [

25]. Gligorić et al. implemented a mathematical model in a small hypothetical lead–zinc mineral deposit, which demonstrated that it could define the sequence of mining of different areas by quantifying the metal price and operating costs of mining [

26]. Ahmadi and Shahabi developed a grade optimization model to optimize mine production planning. The output results of the model figured out the optimum grade was beneficial to maximizing profits, which gave a feasible vision to determine the cutoff grade [

27].

Additionally, some scholars established multi-objective programming to handle mineral resource allocation and management problems. The improvement of comprehensive optimization for the mine production process was advocated to promote production efficiency and achieve economic and environmental objectives [

28,

29,

30]. However, most optimization models do not consider the constraint of carbon quota and production capacity for the integrated exploitation of mineral resources. Profits are closely related to the resource allocation of all deposits under the limitation of carbon emission. Therefore, the overall economic benefit would not be optimal if the production coordination and competition among multiple deposits are ignored.

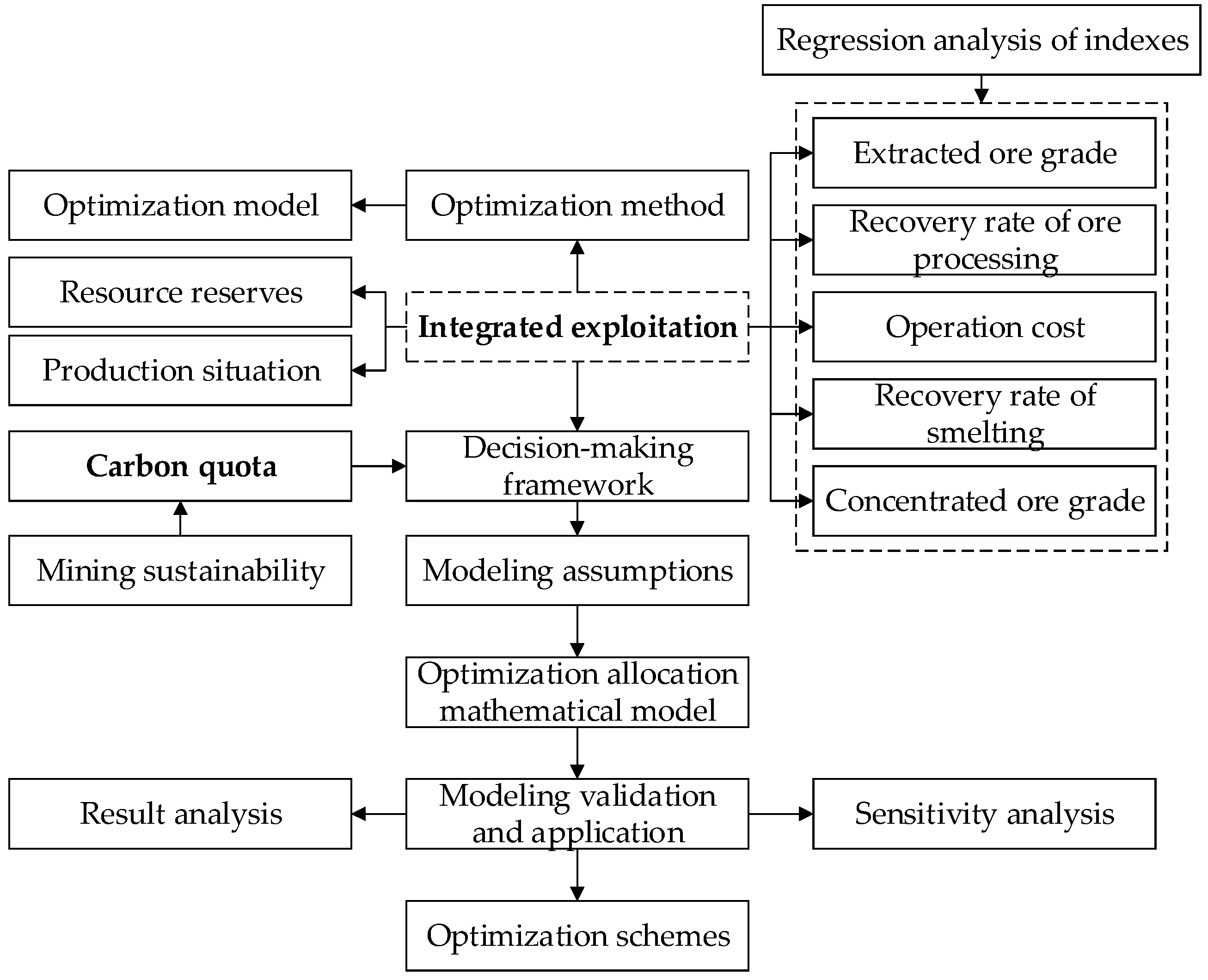

In the context of carbon quota, the production strategy optimization of integrated exploitation for multiple deposits is meaningful for a mining company. The integrated exploitation theory and mathematical planning method are introduced to propose an optimization framework and modeling assumptions. Then, this paper presents a new mathematical model for optimizing the allocation of production capacity and technical and economic indexes for multiple deposits. Constraints of maximum and minimum production capacity, extracted ore grade and concentrated ore grade requirement, and metal output target are considered. The model is verified in three deposits of a gold mining company in China. Eventually, sensitivity analysis is conducted to support dynamic decision making for multiple deposits. The detailed research content is shown in

Figure 1.

2. Integrated Exploitation of Mineral Resources Considering Carbon Quota

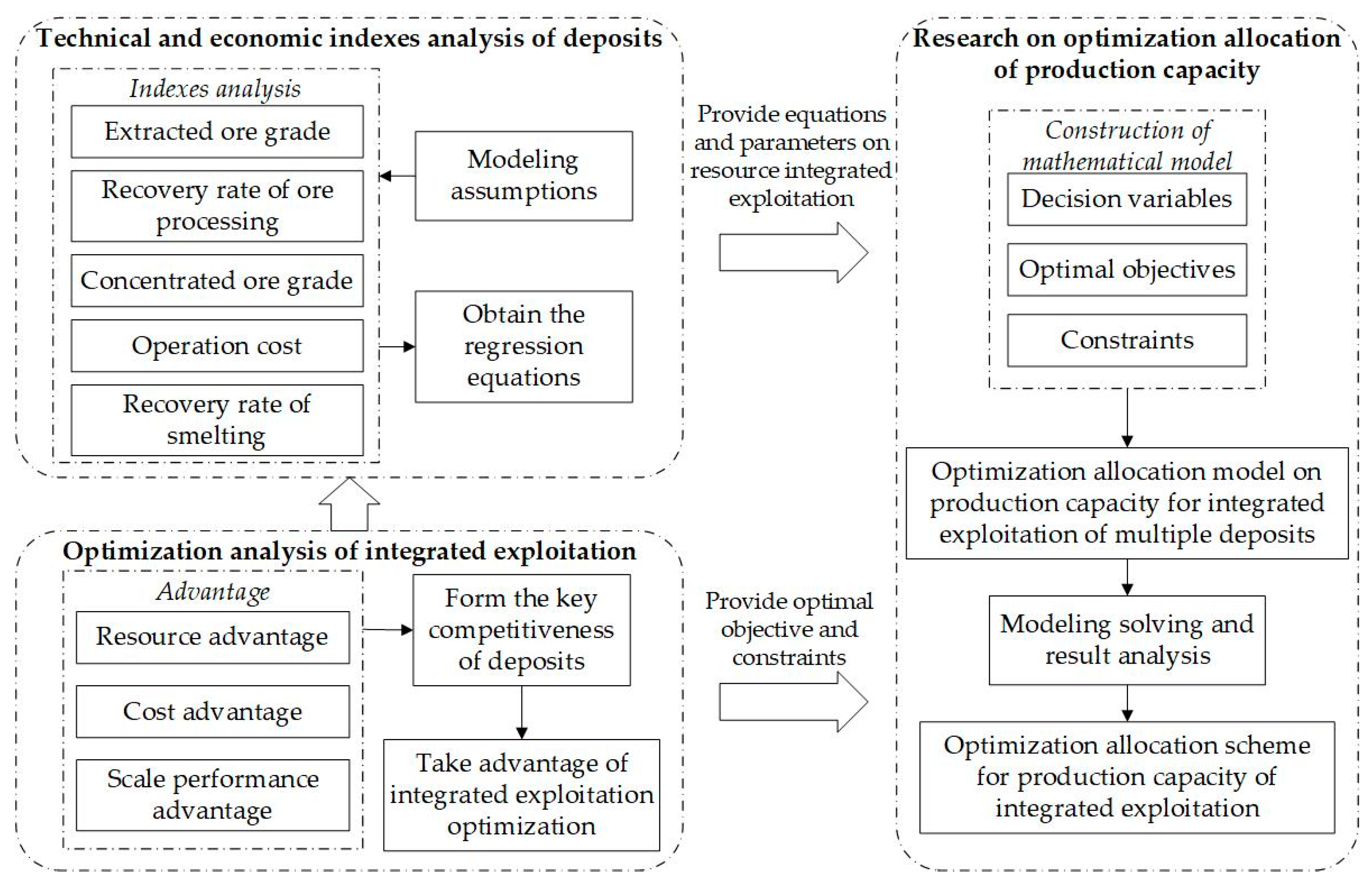

Reserve information from a gold mining company in China is collected, and the production process of each deposit is determined. Furthermore, the advantage of the integrated exploitation of resources is analyzed in detail to maximize the competitive advantage of multiple deposits. Simultaneously, a decision-making framework is constructed to guide the optimization of the enterprise’s production planning.

2.1. Background

A gold mining company in China has abundant geological resources, a high mechanization degree, advanced mining technology, and a management level, which owns three deposits: I, II, and III. All deposits have been designed and mined for several years. The carbon emission has been increasing sharply as the mining scale of each deposit has continued to expand. Today, the advantages of rich geological resources are no longer prominent as the shallow mineral resources have been rapidly consumed. The gold mining company has formulated a strategy-oriented integrated exploitation plan to relieve the pressure of resource sustainable development and reduce carbon emissions.

Table 1 shows the reserves of three deposits at the end of 2021. The reserve of deposit I is the highest. Deposit III has the lowest reserves. The average grade of deposit II is the highest, and deposit III has the lowest grade.

From the perspective of the overall production process, three deposits have a complete production process including mining, mineral processing, and smelting. Each deposit has its mining processes and ore processing independently, while the three deposits share one smelting plant to improve the overall recovery efficiency. The extracted ore is processed in the respective mill and then transported to the shared smelting plant, as shown in

Figure 2, which implies that the deposits differ in terms of resource reserves, production capacity, gold throughput, mining cost, and processing cost.

2.2. Advantage Analysis of Integrated Exploitation of Resources

The integrated exploitation of resources is typical of large-scale, integrated planning and manufacturing management, the coexistence of internal synergy and competition, and decision-making consistency [

31,

32,

33]. The integrated exploitation of multiple deposits is regarded as carrying out production decision making from a global perspective instead of only considering the economic benefit of individual deposits, which is consistent with sustainable mineral resource management and development in the context of a low-carbon economy [

34].

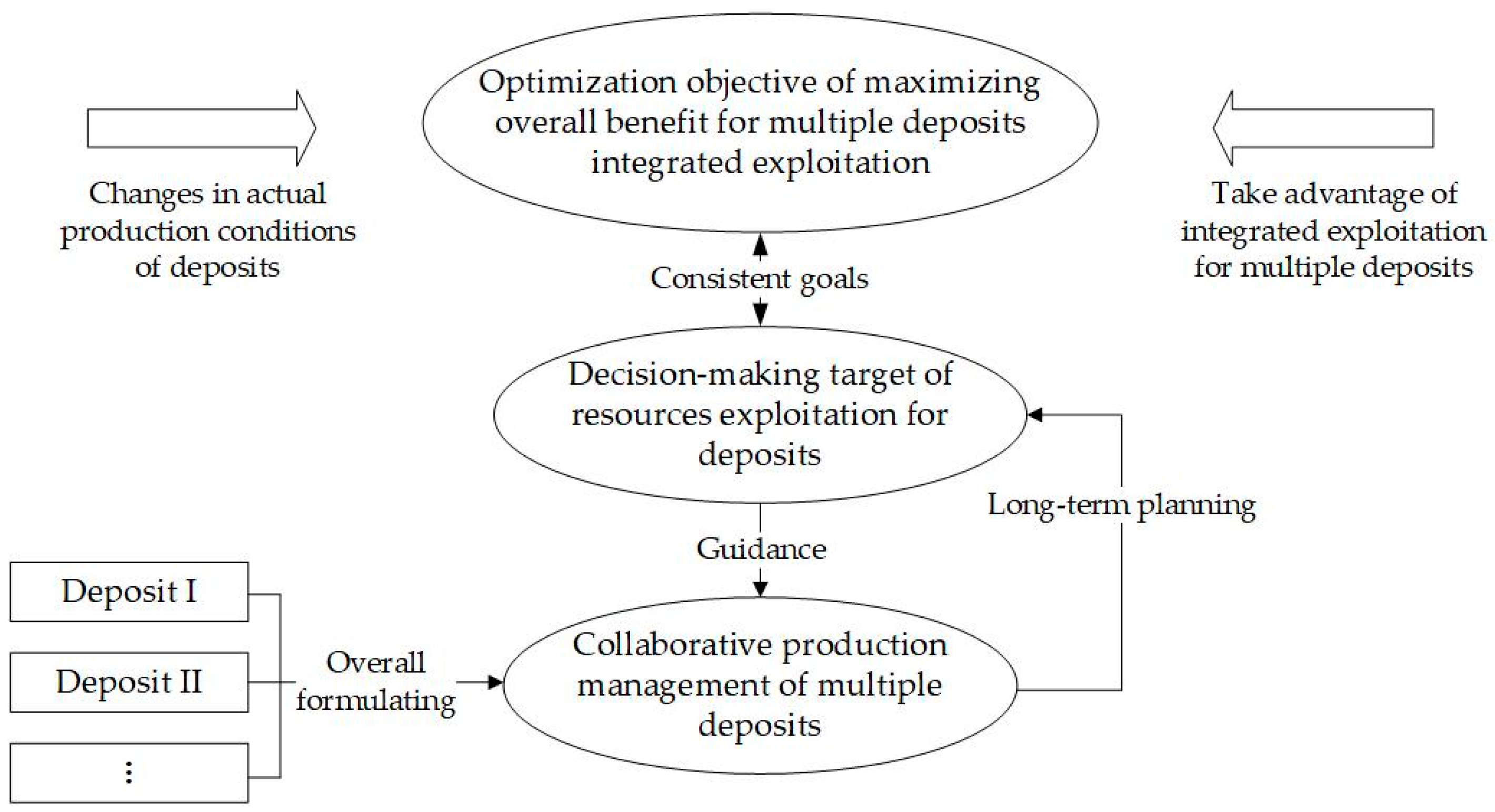

Figure 3 demonstrates the mine planning optimization strategy for integrated exploitation in multiple deposits. The strategy is conducive to the coordinated management of all deposits, the realization of the optimum goal for integrated exploitation, and the advantage of large-scale performance.

There are obvious synergetic and competitive relationships between different deposits in the mode of integrated exploitation. The carbon quota for all deposits is fixed, which results in the overall production capacity being limited [

35,

36]. The optimal allocation of production capacity for each deposit needs to take the technical and economic conditions into account. In this condition, the overall economic benefit for the mining company could be improved under the carbon emission constraint. The advantage of the integrated exploitation of resources is analyzed from three aspects shown as follows [

37,

38,

39,

40]:

Resource-based enterprises should have sufficient resource conditions in order to survive and develop better in fierce market competition. The advantage for enterprises with richer resources is more obvious when the demand for resources is greater in the market. Mining companies could make full use of the resource advantage to avoid the waste of resources by way of the integrated exploitation of resources. The ore from high-grade deposits could be mixed with the ore from lower-grade deposits in smelt processing.

- (2)

Cost advantage

The integrated exploitation of mineral resources takes overall economic efficiency as the target. The mining company should attempt to optimize production to realize the optimal economic benefit of multiple deposits, which is the core competitiveness of integrated exploitation.

- (3)

Scale performance advantage

Considering the coexistence of production coordination and competition, the advantage of production and the technical and economic indexes of each deposit should be fully utilized to improve the comprehensive utilization efficiency of resources and the overall economic benefit of multiple deposits. In addition, the competitive advantage of economies with large-scale mining should be brought into play.

2.3. Decision-Making Framework

The optimum decision-making framework for the integrated exploitation of multiple deposits is proposed based on the advantage analysis of integrated exploitation. The optimization problem of multiple deposits’ simultaneous exploitation could be transformed into a mathematical model. Resources, economy, and technology are considered as constraints in the mathematical model to obtain the optimal solution, which eventually forms an optimal scheme of production capacity allocation for each deposit. The optimum decision-making framework is given in

Figure 4, which is beneficial for all deposits.

3. Optimization Model Construction

Modeling assumptions are formed in this section. Then, the optimization model is constructed to achieve optimum production capacity allocation and improve technical and economic indexes of integrated exploitation.

3.1. Assumptions

Mathematical modeling is performed to solve the problem of production capacity allocation for multiple deposits’ integrated exploitation, which considers the factors of annual sales revenue, mining cost, mineral processing, and smelting cost, cost of smelted ore transported to a smelting plant, reserve information, technical and economical indexes, and the production scale limitation. Eventually, an optimization model of production capacity allocation will be constructed using mathematical planning methods. The basic ideas and assumptions of the model construction are as follows:

- (1)

The production capacity assigned to the deposit is adjustable

There are differences in resource reserves, technical and economic levels, and production capacity among all deposits. The production capacity of one deposit is often related to the mining scale, the capital expenditure, the supply of raw materials, and the production technology. The production capacity is limited against the background of low-carbon mining. The optimum production capacity allocation scheme needs to be calculated through the optimization model instead of being determined solely from a single deposit in the mining plan, which aims to maximize the overall economic benefit of integrated exploitation for multiple deposits.

- (2)

The extracted ore grade of deposits is different

The ore-matching work of deposits has a significant impact on the stability of ore quality and the improvement of resource utilization efficiency. It is necessary to optimize the extracted ore grade of deposits to effectively ensure that the ore production meets the requirements.

- (3)

Sustainable exploitation is required for deposits

In order to ensure the continuity of the production for all deposits and the stable supply of mineral products, the deposit should not be interrupted for one single year, nor should a single deposit be over-mined or almost stopped. Therefore, the certain carbon quota and actual resource reserves of each deposit should be considered to limit production capacity in the optimization model.

- (4)

Set constraints to meet production requirements of deposits

Constraints such as maximum and minimum mining capacity, extracted ore grade range, average concentrated ore grade requirement, overall production scale, and metal output target of each deposit are set for the optimization model to meet the production requirements of deposits. The technical and economic indexes associated with the integrated exploitation of multiple deposits are considered due to the actual production situation.

- (5)

Consider interaction relations between deposits

The interaction between multiple deposits is closely linked to the overall economic benefit in the context of integrated exploitation. Competition relations between deposits to compete resources needs to be considered when constructing the optimization model.

3.2. Modeling Variables and Parameters

Table 2 represents sets in the model.

Table 3 and

Table 4 express the variables of the mathematical model. The parameters in the model are shown in

Table 5.

3.3. Objective Function

The objective function is given by Equation (1), which seeks to maximize the overall economic benefit and the optimal allocation of production capacity of multiple deposits. Simultaneously, it may reduce the total cost and relieve the pressure of resource continuity. Equation (1) is obtained by subtracting the total cost of mining, ore processing and smelting, and the transportation cost of concentrated ore from the total sales revenues of the metal product.

3.4. Constraints

Equation (2) represents the total annual metal output of the integrated exploitation for multiple deposits. The total annual metal output of multiple deposits may reach a certain value in order to meet production requirements while constraining the total metal output under a certain carbon quota of deposits.

Equations (3) and (4) ensure that it is not possible to exploit more ores than the production capacity of deposits. Equation (3) illustrates that setting a minimum production capacity of multiple deposits is to avoid enterprise layoffs. The production capacity of the respective deposits is limited and influenced by the scale, capital expenditure, raw material supply, and technical level of mines. In other words, the annual operating volume of the deposits cannot exceed the maximum productive capacity constraints.

Equations (5) and (6) control the extracted ore grade of deposits so that the fluctuation range of the deposits’ extracted ore grade is in accordance with the actual resource conditions. It ensures the stability of ore quality and improves resource utilization efficiency.

The average concentrated ore grade constraint of all deposits can be evaluated and restrained using Equations (7)–(9), which could ensure that the average concentrated ore grade from ore processing plants to the shared smelter each year is within a reasonable interval.

4. Modeling Application and Result Analysis

4.1. Regression Analysis

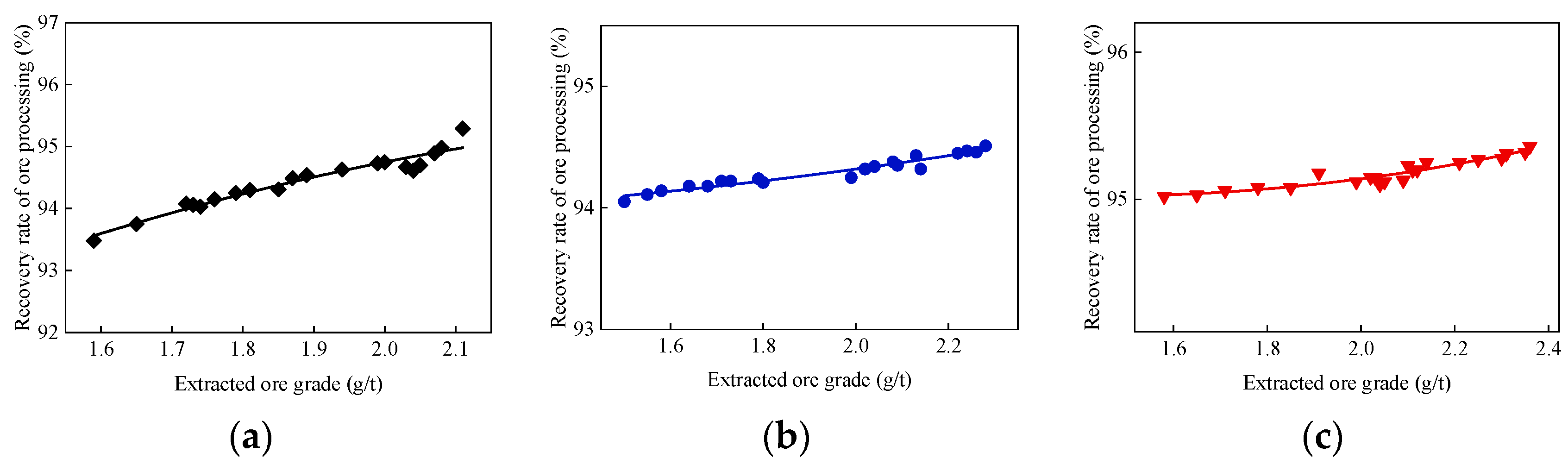

The annual production capacity range of the three deposits is 2.3 × 106 t to 2.9 × 106 t, 2.1 × 106 t to 2.5 × 106 t, and 1.6 × 106 t to 2.2 × 106 t, respectively. In the process of the integrated exploitation of mineral resources, the change in the extracted ore grade will affect the change in other technical and economic indexes of each deposit, which may have a significant impact on the benefit and the resource utilization rate as well. Therefore, the establishment of a regression analysis of indexes based on historical data is considered. The regression equations of the three deposits’ indexes are derived by gathering actual production data of three deposits from 2020 to 2021, excluding anomalies.

- (1)

Recovery rate of ore processing and extracted ore grade

The least square method is used for polynomial fitting. Equations (10)–(12) demonstrate the correlations between the recovery rate of ore processing and extracted ore grade from the regression results for deposits I, II, and III, which are shown in

Figure 5.

represents the extracted ore grade of each deposit, and the unit is g/t.

represents the recovery rate of ore processing, and the unit is %.

- (2)

Concentrated ore grade and extracted ore grade

The least square method is used for polynomial fitting. Equations (13)–(15) demonstrate the correlations between concentrated ore grade and extracted ore grade from the regression results for deposits I, II, and III, which are shown in

Figure 6.

represents the extracted ore grade of each deposit, and the unit is g/t.

represents the concentrated ore grade of the deposit, and the unit is g/t.

- (3)

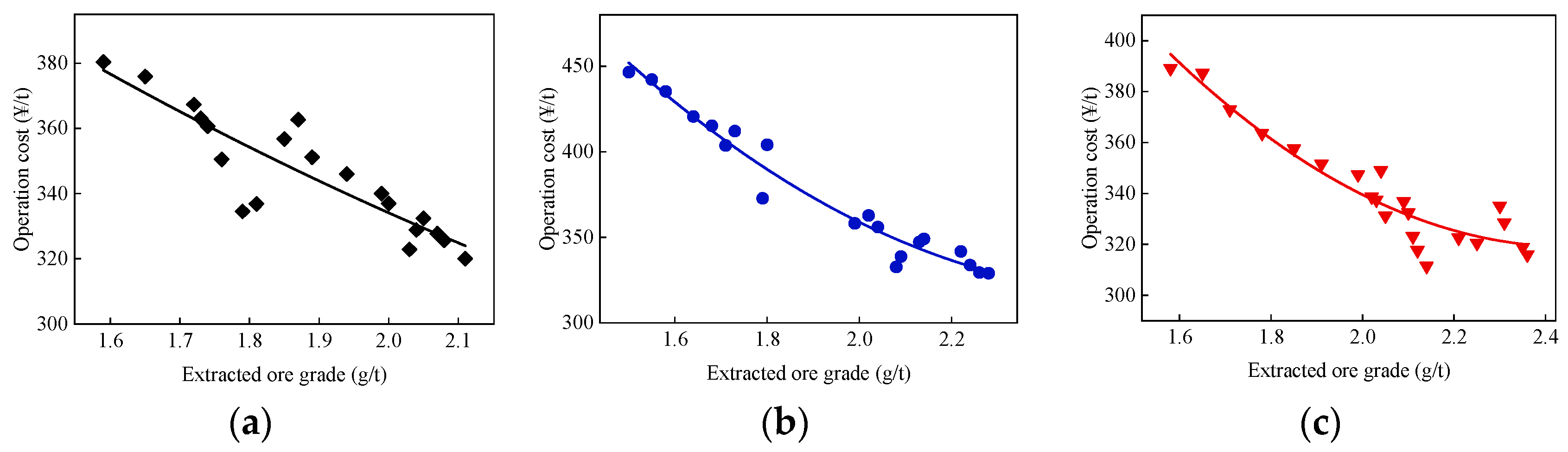

Operation cost and extracted ore grade

The least square method is used for polynomial fitting. Equations (16)–(18) demonstrate the correlations between operation cost and extracted ore grade from the regression results for deposits I, II, and III, which are shown in

Figure 7. The currency utilized is Chinese RMB (¥).

represents the extracted ore grade of each deposit, and the unit is g/t.

represents the operating cost of each deposit, and the unit is RMB/t.

- (4)

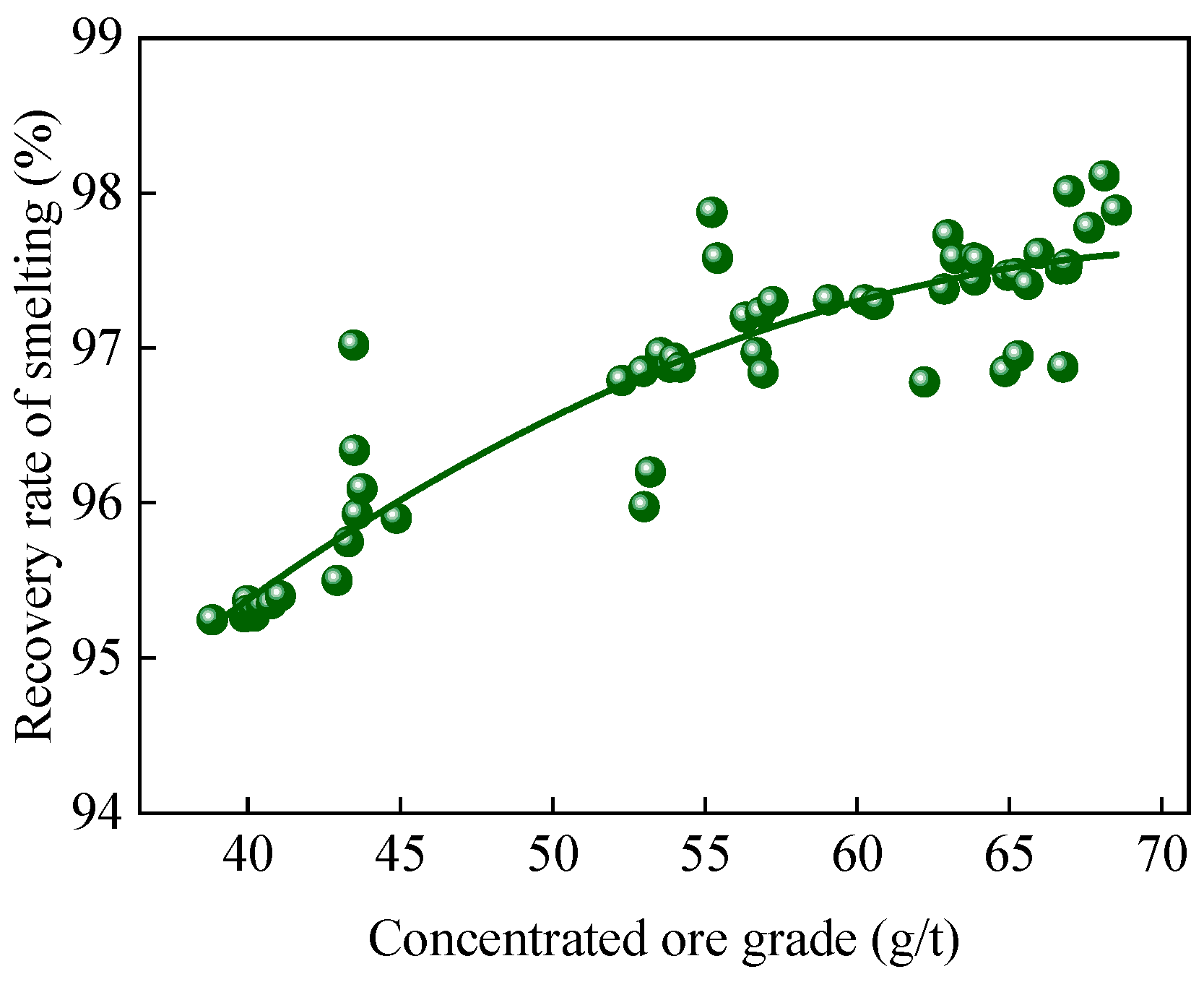

Recovery rate of smelting and concentrated ore grade

Exploring change rules of the smelting recovery rate and concentrated ore grade of deposits is conducive to defining the limited smelting recovery rate and feeding back the reasonable concentrated ore grade of the ore processing plant. It is of great significance for determining the reasonable concentrated ore grade of deposits, which may improve the smelting recovery rate and reduce the operation cost.

The least square method is used for polynomial fitting. Equation (19) demonstrates the correlations between the recovery rate of smelting and concentrated ore grade from the regression results for deposits, which are shown in

Figure 8.

represents the concentrated ore grade of deposits, and the unit is g/t.

represents the recovery rate of smelting, and the unit is %.

4.2. Parameters

To implement the optimization model, some parameters such as gold price, total gold throughput, transportation cost of per ton, limitation of extracted ore grade, and concentrated ore grade are collected as shown in

Table 6.

4.3. Result Analysis

Lingo is used as a tool to calculate the mathematical optimization model with corresponding parameters. The global options function is applied to obtain the optimal solution of the model. The optimization model is a nonlinear programming mathematical model, and the global optimal solution is finally reached. The optimal results are obtained and shown in

Table 7,

Table 8 and

Table 9.

Table 10 and

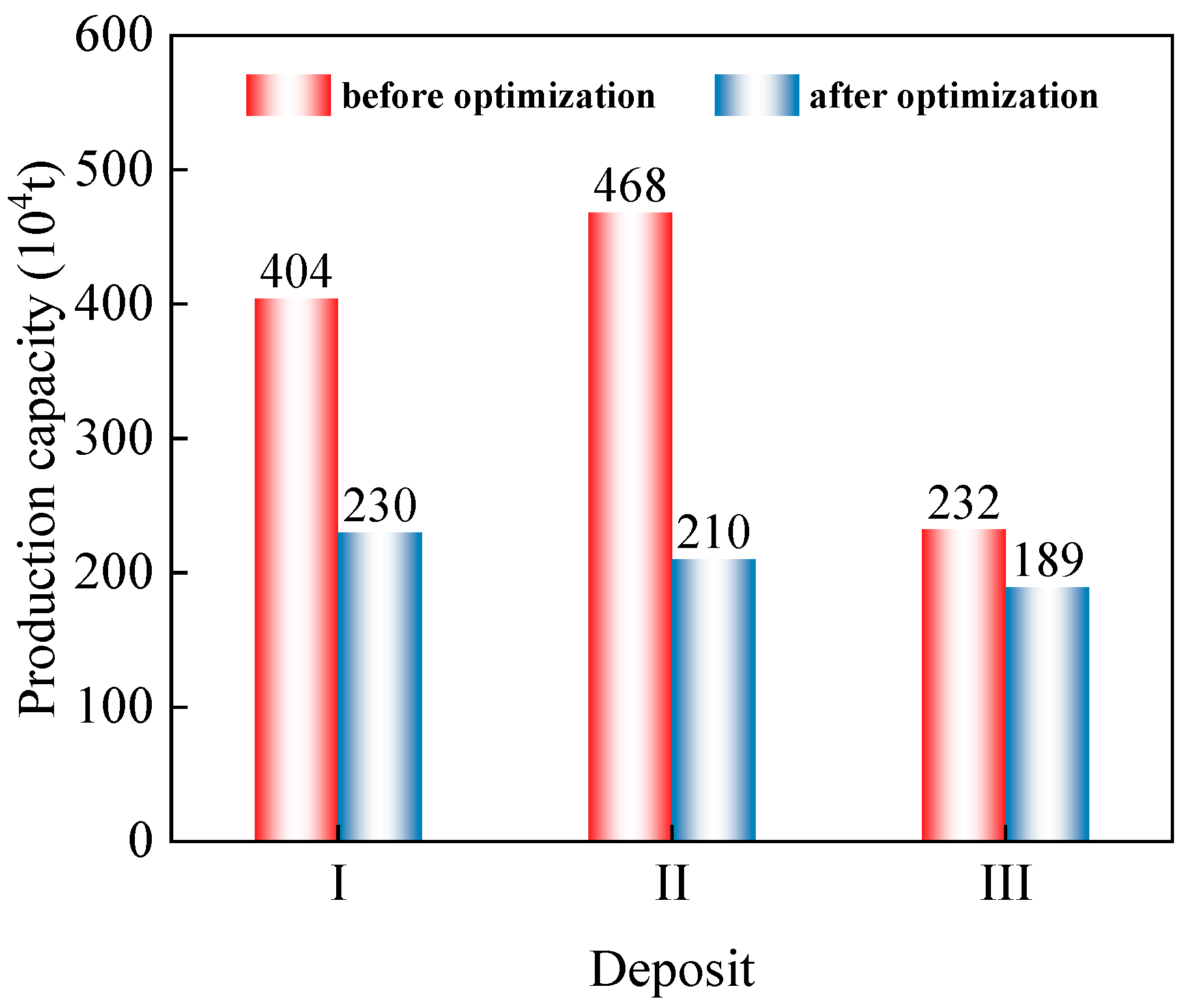

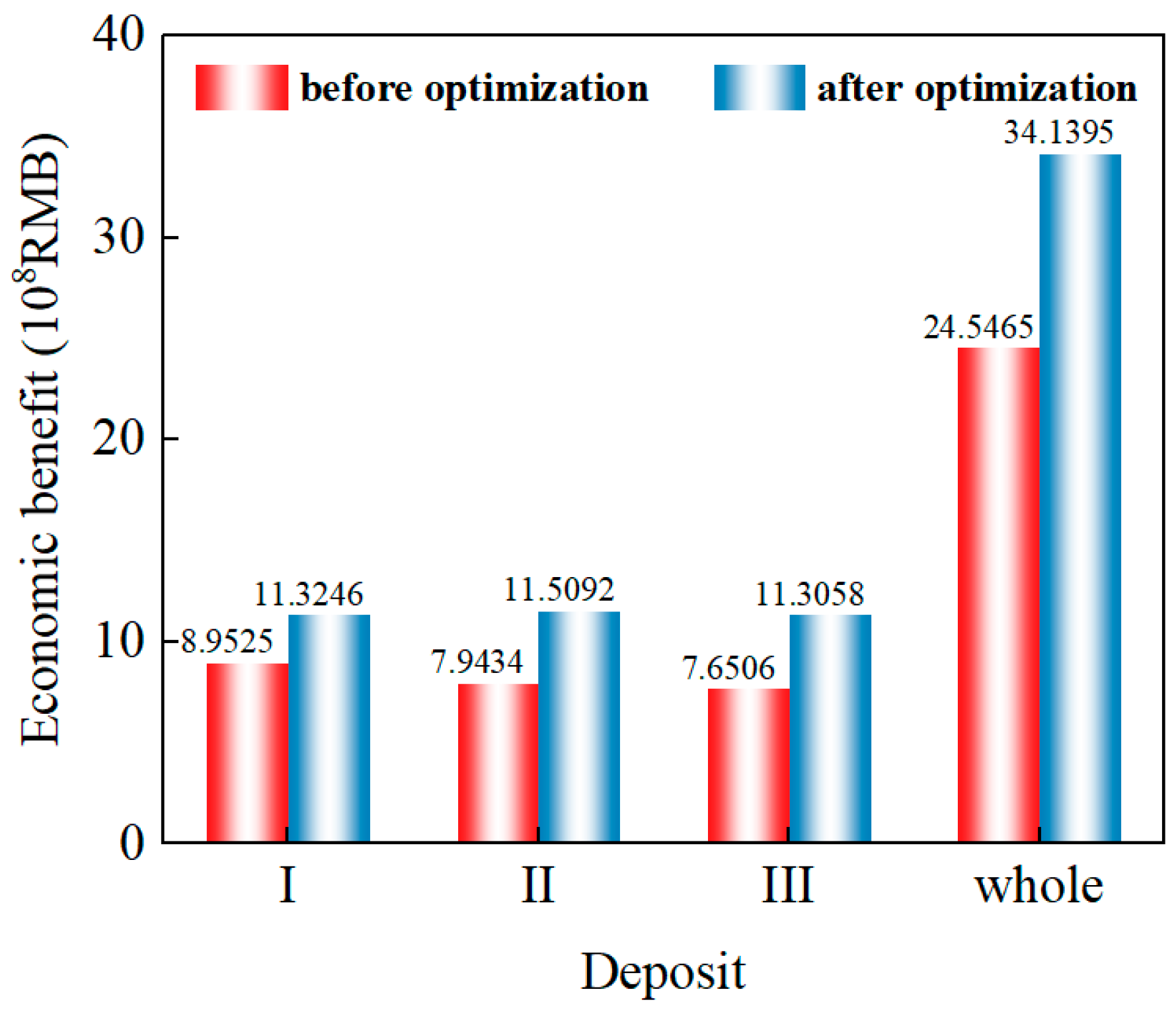

Table 11 summarize the comparative analysis of production capacity and technical and economic indexes of each gold deposit before and after the optimization. The comparison of production capacity and the economic benefit of integrated exploitation under certain carbon quota is shown in

Figure 9 and

Figure 10. The total gold throughput in the optimization model is set to 13 t per year, at which time, the annual gold production capacity allocation of the three deposits shown is relatively balanced and stable. The comparison analysis displays that the optimized scheme achieves the goal of maximizing the overall economic benefit.

Generally, the optimal decision-making scheme for each deposit under carbon quota is calculated based on the optimization model, which could improve the comprehensive utilization efficiency of mineral resources while reducing the costs of mining, ore processing, and smelting under the constraint of the total gold throughput.

4.4. Sensitivity Analysis

The optimization model obtains the decision-making scheme of production capacity allocation for multiple deposits from the perspective of best condition in technology and economy. Changes in each index have different effects on the results obtained from the optimization model. Therefore, sensitivity analysis can be carried out to guide dynamic decision making by changing each parameter.

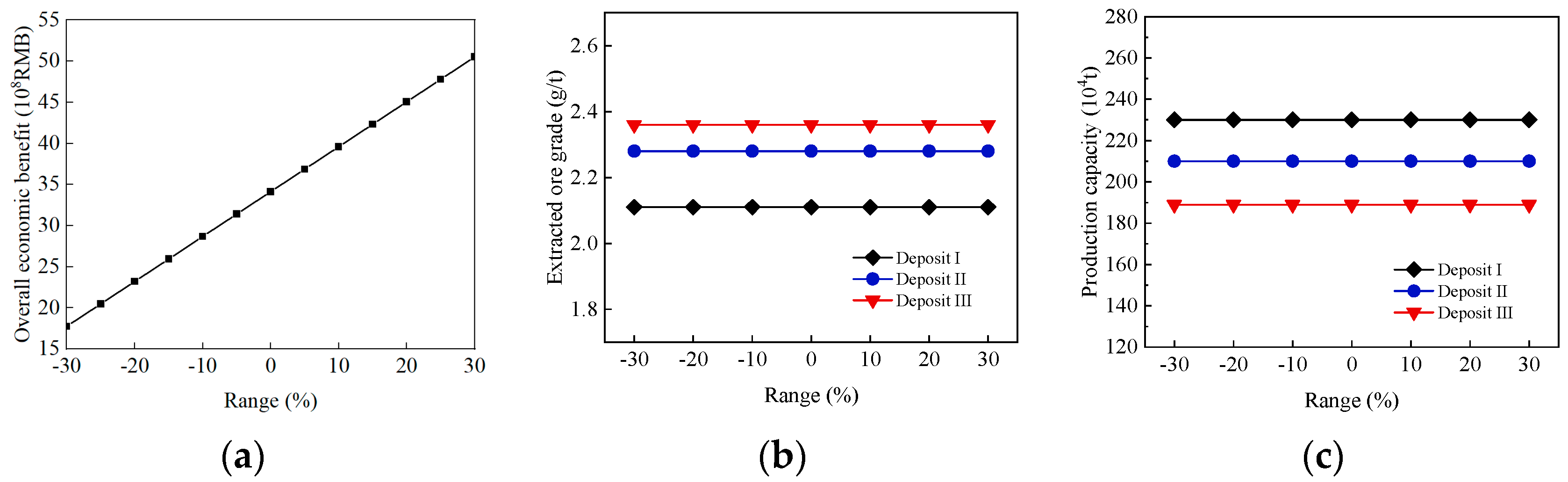

Figure 11 shows the results of the gold price sensitivity analysis. Price changes from −30% to 30% are performed to evaluate the overall economic benefit of the three deposits. It can be seen that the gold price and the overall economic benefit are positively correlated, while the change in the gold price has low sensitivity to the model decision variables. The break-even point occurs when the gold price falls to 157 RMB/g to 158 RMB/g range. Due to the gold market price changing from 150 RMB/g to 430 RMB/g in the last ten years, a positive benefit is always obtained.

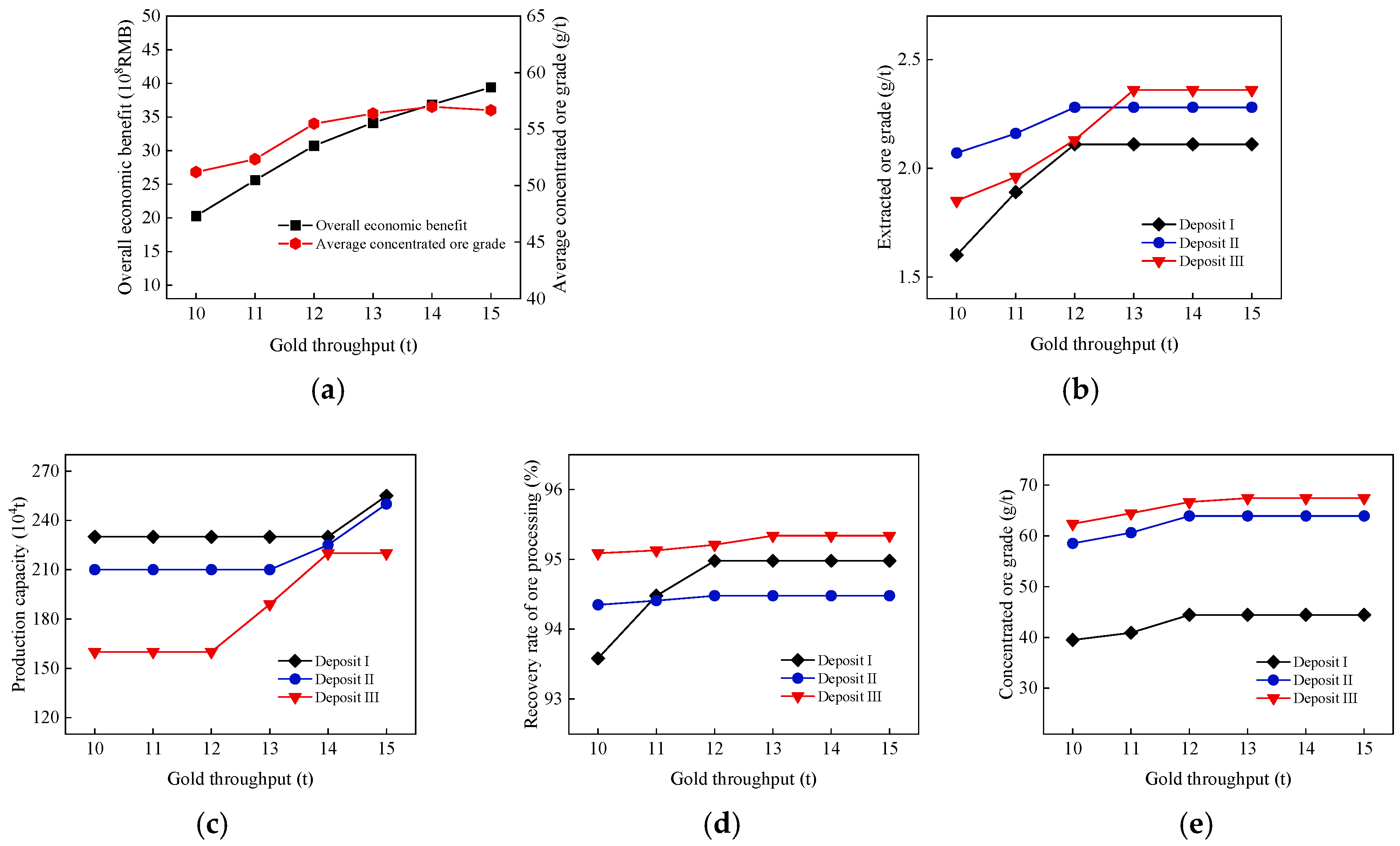

Figure 12 illustrates the results of gold throughput sensitivity analysis. It can be observed that the variation in gold throughput has the highest sensitivity to the overall economic benefit and average concentrated ore grade, followed by the sensitivity to the extracted ore grade, and the sensitivity to the recovery rate of ore processing and concentrated ore grade is lower. When the total gold throughput of three deposits is constrained to around 14t, the production capacity allocation of three deposits is relatively balanced, and the average concentrated ore grade could reach the maximum simultaneously.

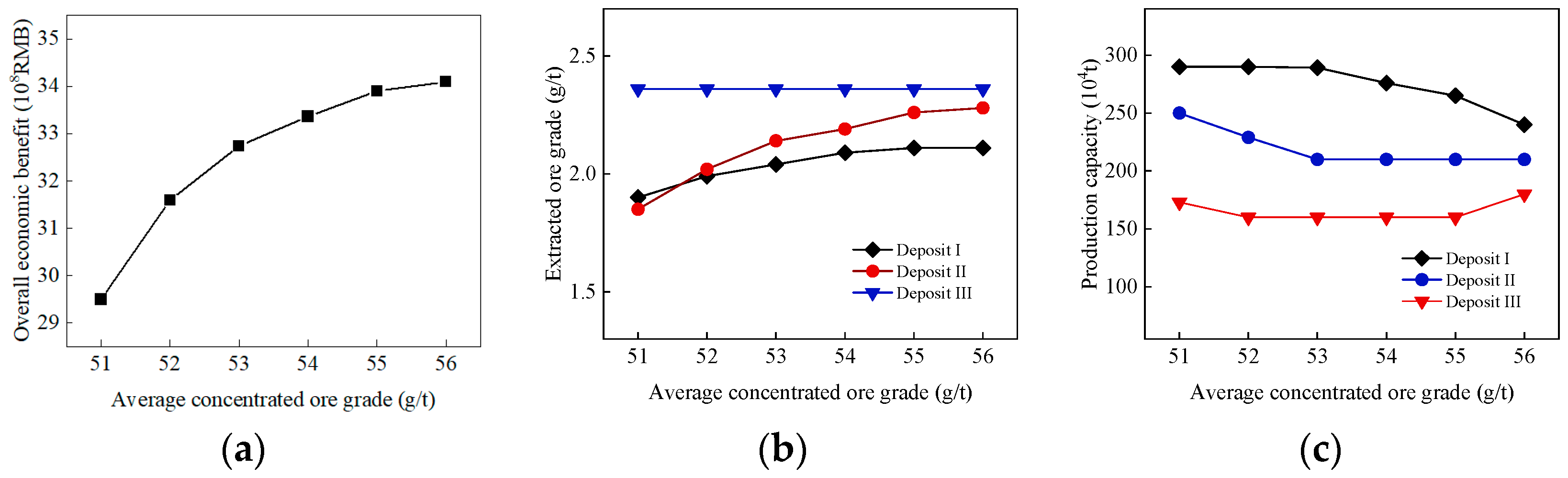

The results of the average concentrated ore grade sensitivity analysis are presented in

Figure 13. It can be seen that the variation in the average concentrated ore grade has the strongest sensitivity to the overall economic benefit. The sensitivity of the extracted ore grade for deposits I and II is higher than that of deposit III. As the average grade of the concentrated ore increases, the production capacity allocation of deposits I and III moves closer to deposit II, which implies that the allocation results tend to be balanced and stable.

Decision-making schemes of integrated exploitation for multiple deposits under different production conditions can be formed based on the above sensitivity analysis. In addition, suggestions for dynamic decision making regarding mines can be obtained. Scientific decision making regarding multiple deposits’ integrated exploitation should be made according to key factors such as actual production conditions, overall production strategic objectives, and technical and economic level of deposits. Changes to resource conditions and the market should be considered to determine the optimal allocation of production capacity under the carbon quota. Increasing the overall gold output of multiple deposits appropriately is expected to improve the comprehensive utilization efficiency of resources and maximize the economic benefit under the condition that the gold price keeps rising and the average concentrated ore grade of multiple deposits is guaranteed to meet the requirements.

5. Conclusions

The strategy of mineral resources’ integrated exploitation is considered to reduce carbon tax generated by carbon emissions. The allocation of production capacity for multiple deposits could be optimized to obtain more benefits for a mining company. The optimization decision-making framework and modeling assumptions are proposed based on the analysis of the characteristics and advantages of integrated exploitation.

An optimization model for the integrated exploitation of multiple deposits is constructed and applied to three deposits under a gold mining company. Due to integrated exploitation under the carbon emission constraints, the decision-making scheme generated using the mathematical programming method outperforms that obtained considering a single deposit independently. The optimal solution of production capacity allocation and extracted ore grade for each deposit is obtained according to the optimal scheme, which provides a new method for research on the optimization of mineral resources’ integrated exploitation.

The implementation of the model in multiple gold deposits could improve the overall economic benefit and reduce the costs of mining, ore processing, and smelting. Profits of whole gold deposits increase from 2.454 × 109 RMB to 3.414 × 109 RMB. Although the overall gold throughput of multiple deposits decreases under a carbon quota, the optimal scheme implemented by the optimization model improves the technical and economic indexes of integrated exploitation, which highlights the ability to improve the comprehensive efficiency of resource utilization and profits.

The results demonstrate that the mathematical model in this paper is reasonable and feasible. The results obtained enable enterprises to allocate production capacity more purposefully and make optimal production planning. Low-carbon mining is taken into account innovatively to make mining companies more sustainable. A sensitivity analysis forms different optimal plans for the integrated exploitation of mineral resources from different aspects, which might guide the dynamic decision making of deposits.

The optimization method and model have practical applicability to solve the production capacity allocation problem of multiple deposits during the integrated exploitation of resources. The optimization model could be applied in resource exploitation in multiple similar deposits. However, parameters should be updated based on the specific situation, and regression equations have to be fitted according to the real data from the mining company. The proposed optimization model does not consider the cyclic utilization of resources. At the same time, the complex correlations between indexes of multiple deposits are simplified. Further research could be conducted in this direction.