Abstract

Countries around the world have carried out digital transformations to improve their economic resilience. As the largest developing country, China put forward the “channeling computing resources from the East to the West (CCREW)” project in 2022 to balance and promote the development of various regions. This paper constructs a three-region computable general equilibrium model covering the eastern, western, and other regions and evaluates the impact of the project on economic development, social welfare, and carbon emissions in different regions. By simulating the transfer share of the CCREW project, this paper attempts to further reveal the impact of the policy both on regional differences and national development. The results show that the effects of the project are quite different among regions. Our findings can be summarized as follows. (1) In terms of carbon dioxide emissions, the policy will cause emissions to shift from the East to the West. (2) In terms of economic development, the policy will lead to an overall downward trend in the GDP of the eastern and other regions, whereas for the western region, the policy will promote the development of the regional economy. Regional differences may affect the implementation of the policy and its effects. (3) In terms of social welfare, the policy will result in an inverted U-shaped change in social welfare at the national level, which first rises and then falls, and will change from positive to negative when the transfer share exceeds 20%. At the regional level, social welfare in the eastern and other regions will decline, whereas that in the western region will show an inverted U-shaped change that first increases and then decreases. (4) In the short term, the project at the national level has reduced carbon emissions at the expense of economic development and incurred a loss in social welfare.

1. Introduction

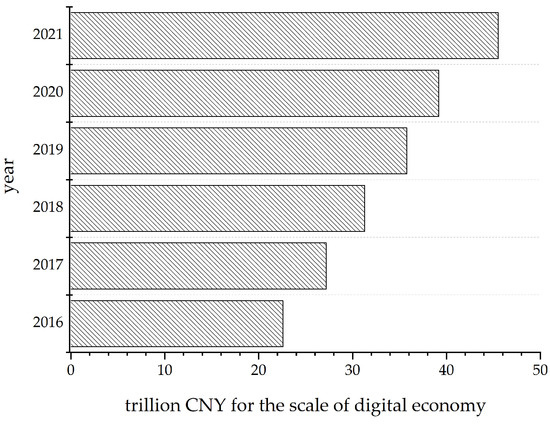

Facing the impact of the COVID-19 pandemic and the pressure to maintain economic growth, countries around the world have paid more attention to the development of the digital economy, increased investment in digital technology research and development, formulated digital economic development strategies, and promoted the digital transformation to promote economic growth and transformation. As the future development direction of the global economy, the digital economy has shown resilience in the face of external shocks and become an important driving force for global economic recovery and development. Japan proposed the concept of Society 5.0 to solve social problems such as population aging and labor shortage. Similarly, the European Union successively proposed the concepts of Industry 4.0 and Industry 5.0 to promote sustainable development. As a major new economic engine for China’s development, the digital economy has been the focus of China’s domestic development in recent years. China hopes to join the ranks of innovative countries by 2035. In the field of informatization, it proposes three major goals of “a digital China, network power, and a smart society,” which emphasize the integration of new forms of industrialization and informatization using the Internet of Things, big data, artificial intelligence, and the real economy [1]. Against the background of China’s unbalanced regional development and under the dual pressures of economic development and green development, the development of the digital economy will become an important step in China’s path toward industrialization and serve as an important engine for economic development. China’s digital economy is developing rapidly. According to the China Academy of Information and Communications Technology, the average annual economic growth rate was 15% from 2016 to 2021. As shown in Figure 1, in 2021, the scale of China’s digital economy reached 45.5 trillion yuan, which is double that in 2016.

Figure 1.

2016–2021 China’s digital development.

Facing the reality that China’s economic development and regional resource endowments are quite different, it must take the comparative advantages of regional endowments into account and promote the coordinated development of China’s various regions. In 2022, China proposed the CCREW project to construct a new computing network system that integrates data centers, cloud computing, and big data and shifts the computing power currently located in the East to the West in an orderly manner. The specific construction conditions are shown in Table 1.

Table 1.

Hub classification of the CCREW.

It is necessary to further study the impact of the CCREW project at the national and regional levels. From an economic perspective, it is a large cross-regional project that represents the Chinese government’s efforts to improve industrial planning and the coordination of regional development. It is a tool that is often used and has played an important role in the social development of both countries as a whole as well as specific regions. As early as China’s trans-regional power reform—that is, the “West-to-East Power Transmission” stage—interprovincial power transmission between the eastern and western regions was proposed. However, in the new high-quality stage of China‘s economic development, problems related to the energy trade in China‘s eastern and western regions have become prominent, as they are used as energy inputs and outputs, respectively. Although the demand for power trading is increasing, the western region is unwilling to simply package and send digital elements to the eastern region, as it prefers local consumption. For example, the Shanghai Miao Economic Development Zone in Inner Mongolia has vigorously developed the equipment manufacturing industry but is unwilling to transmit digital elements to Shandong Electric Power, and, similarly, Yunnan Province is unwilling to transmit digital elements to Guangdong. Therefore, considering that the Chinese government has focused on strengthening its economic prediction and analysis capabilities, quantifying the policy effects and externalities produced by such projects is very important in evaluating their efficacy in doing so. The goals of regional governments have become an important issue in the operability of such policies.

Some papers emphasize the regional differences in digital economy. Regional heterogeneities in the role of digital economy in boosting economic growth actually exist. The promoting effect is more significant in the eastern and central regions of China, compared with the driving effect on the western region [2]. Namely, the digital economic dividend has not been fully realized in western areas in China. Similarly, the research of Pan et al. also provides evidence for this regional diversity; digital integration accelerates high-quality growth in eastern China, whereas in the central and western regions this growth is relatively inferior [3]. Our paper aims at to contribute to the insufficient research about regional divergences in developing digital economy. We comprehensively explore economic growth, welfare loss, and carbon emissions of different regions in China after implementing the national digital economy policy. Specifically, by simulating the transfer share of the CCREW project, this paper attempts to further reveal the impact of the policy both on regional differences and national development.

Our research findings can be described as follows. From a regional perspective, the policy will result in a shift in emissions from the East to the West and will lead to an increase in carbon emissions in other regions. In terms of economic development, it will lead to an overall downward trend in the GDP of the eastern and other regions, whereas for the western region, it will promote the development of the regional economy. At the regional level, social welfare in the eastern and other regions will decline, whereas that in the western region will show an inverted U-shaped change that first increases and then decreases. From a national perspective, in the short term, the CCREW project reduces carbon emissions at the national level as well as the cost of economic development. In terms of social welfare, the policy will create an inverted U-shaped change in social welfare at the national level, which first rises and then falls and changes from positive to negative when the transfer share exceeds 20%.

The possible contributions of this paper include the following. (1) In terms of data, this paper uses the information entropy optimization method to construct a social accounting matrix in units of regions, which reduces data errors and is the latest inter-regional data matrix currently available. (2) In terms of models, this paper carries out elemental processing of the digital industry. On the one hand, this method is more consistent with the characteristics of digital elements than those used in previous studies, and thus the use of digital elements is affected by factors such as price rather than a fixed proportion of input. On the other hand, this article also portrays the commodity characteristics of the digital industry and thus reflects the behavioral characteristics of the industry. Taken together, the description of the operating mechanism of the digital industry is more in line with the actual economic situation. (3) This paper further quantifies the impact of the CCREW project on the economic–social–carbon emissions system and clarifies regional changes and at the same time analyzes the national impact, which provides a reference for follow-up evaluations of the project’s implementation.

The remainder of this paper proceeds as follows. Section 1 is the introduction. Section 2 is the literature review. Section 3 is the model establishment, data collation, calculation process, and the impact scenario setting of the model. Section 4 presents the model results and analysis, and Section 5 concludes and offers policy recommendations.

2. Literature Review

This paper takes China‘s CCREW project as the research object and seeks to explore its impact on the regional economy–welfare–carbon emissions system by constructing a multiregional general equilibrium model. As far as we know, we don’t find any similar research on this topic. Fortunately, we find some clues from the following literatures.

Intrinsically, implementing such an incentive digitalization policy is based on the underlying logic that digital economy can impose a positive function on development. Existing literatures about digital economy principally focus on three points: the definition of digitalization, the indicators to assess the actual level of digital economy, and possible influences on some important aspects for economy growth, such as productivity, innovation, industrial structure, carbon emissions, energy, and balance of regional development. A common conclusion of these literatures indicates that digital economy can encourage the long-term development for countries, regions, and business entities. As digital economy significantly facilitates social productivity through high-tech innovation and application, including mobile networks, artificial intelligence (AI), blockchain, and cloud computing, digital economy works as an innovation driver for the extensive and sustainable development of TFP [4,5,6]. Chirkunavo and others point out the transition to digital technologies in both industrial and social sectors can affect the transformation of the modern economy. Specially, differences of financing for the information and communication technologies (ICT) lead to the divergence of regional innovative development [7]. Similar findings also appear in the research of Ding and his coauthors. They find that digital economy promotes high-quality economic development in the way of boosting technological innovation [2]. Besides, the development of the digital economy has become a new vector to promote the upgrading of China’s industrial structure. In the promotion of the industrial structure by the digital economy, heterogeneous technological innovation plays an intermediary role [8]. In addition, some researchers have mentioned about the relation between digital economy and carbon emission. In the work of Zhang and his partners, digital economy has significantly promoted carbon emission performance, especially by reducing energy intensity, energy consumption scale, and enhancing urban afforestation [9]. Other researches also support that digital economy can have a multiplier effect on green and low-carbon development [10,11,12]. More recently, there are some contradictory findings about the relation between digital economy and energy. Digital economy can optimize energy allocation [13] and subvert the traditional concept of energy consumption [14]. However, others propose that the digital economy will increase energy consumption [15,16]. Likewise, Coyne and Denny hold the view that the development of the digital economy needs infrastructure support, which is very energy consuming [17]. A recent paper of Lin and Huang states that digital economy has a dramatically positive impact on electricity intensity [18].

The economical essence of CCREW project is industrial transfer. Many academic researchers have analyzed a lot on the impact of industrial transfer on economic development and carbon emissions. Akbar et al. observe the impact of carbon transfer network on ecological performance. Their findings prove that the volume of China’s carbon transfer is increasing year by year, and the energy-intensive regions and heavy industries bases in central and western China have undertaken the carbon transfer from the eastern coastal areas [19]. Liu and his coauthors show that pollution transfer may lead to heterogeneous impacts on different regions, according to the analysis on industrial pollutant per capital in eastern and western China from 2003 to 2015 [20]. Mao and his partners pick Jiangsu Province of China as an example to study the changes in spatial structure of industrial transfer. Finally, they show that industrial transfer can cause spatial pollution redistribution, which presents a significant hierarchical pattern. The transfer of different industries also leads to different impacts on regional pollution [21]. Mo et al. have a similar conclusion after they discuss the situation in Guangdong Province [22]. However, Yu and Zhang insist the policy of industrial transfer can dramatically promote the carbon emission reduction, as they concentrate their research objective around those demonstration areas of China’s industrial transfer [23]. Liu et al. apply a CGE model to predict the policy effect of industrial transfer within the Beijing-Tianjin-Hebei region of China. They believe that the impact differs for industries providers and recipients [24]. Li et al. use a multi-regional input-output model to testify the path changes of inter-provincial industrial transfer and carbon transfer. Their research findings offer important evidences to support that industrial transfer plays a critical factor on carbon transfer [25]. Bai and his team members study the industrial transfer and environmental quality in 30 provinces of China and finally prove the existing interaction and spatial spillover effects between the two factors. Thus, they propose the evaluation of industrial transfer polices should start from the entire region and the whole country [26].

In general, current literatures mainly focus on the estimation of economic and environmental impacts of industry providers and receivers. They all point out the transfer effects of different industries vary among regions. Hence, about the CCREW project encouraging the transfer of digital industries, we should discuss the combined effects both across regions and the whole nation, covering the possible impacts on economic and environmental performance.

3. Data, Model, and Shocks

3.1. Model

The CGE model started from the general equilibrium theory [27] and afterwards was developed by Johansen [28]. In the study of multi-regional models, the existing literatures mainly estimate the impact of industrial transfer by observing the impact of industrial transfer on changes in production equipment and equipment sectors [29,30,31,32]. In model construction, this paper refers to the previous literatures and adjusts according to our research topics. Regional model construction can be classified into subject behavior module, production behavior module, consumption behavior module, and trade behavior module, according to the differences in the behavior and subject. Specifically, the subject behavior module can be classified into consumer behavior module, government behavior module, enterprise behavior module, and investment behavior module. Among them, the consumer behavior module includes welfare measurement, which is mainly used to measure the social welfare change in consumers compared with the baseline.

3.1.1. Production Module

The production behavior is combined with the added value part, composed of labor, capital, and digital element, the intermediate input part, composed of the input matrix, and the three-layer nested structure, composed of the constant elasticity invariant function; the Leontief input output matrix is used as the mathematical expression. The comprehensive price of added value elements plays a role in the selection process of added value and intermediate inputs. The price of each factor plays a decisive role in the distribution process of the use of each factor. Specifically, the first layer consists of digital elements and capital, which together form a capital power integrated element. This element communicates with labor to form a mixed element of capital, labor, and digital elements, and is included in the total product production as added value. For intermediate input products, the total intermediate input products are aggregated through the fixed input factor matrix, and finally the total output is formed through the constant elasticity function of the added value. See Formulas (1)–(6) for details.

The first-layer production equation is shown in Formulas (1) and (2). represents the composite element of capital and digital elements, represents the price of capital element, stands for capital element, stands for digital element, represents the price of digital elements factor, represents the share coefficient of capital, represents the technical parameters of the first layer, and represents the elastic parameters of the first layer, where i represents the industry.

The second-layer production equation is shown in Formulas (3) and (4). represents the composite element of capital, digital element, and labor, represents labor, represents labor price, represents the share coefficient of capital digital composite factor, represents the technical parameters of the second floor, and represents the elastic coefficient of the second layer.

The third-layer production equation is shown in Formulas (5) and (6). stands for total output, represents total intermediate input stands for composite factor price, represents the composite price of intermediate inputs, represents the share coefficient of capital figure labor composite factor, represents the technical parameters of the third layer, and represents the elasticity coefficient of the third layer in the production stage.

3.1.2. Trade Module

The trade module includes information on three aspects: industrial transfer location (i.e., industry undertaking location), other regions, and import and export trade. Based on this information, the trade module builds a trade function with a three-layer nested structure. In the trade phase, it is assumed that although the quality of imported and exported products from different sources varies, the products can be substituted. Therefore, this paper mainly uses the Armington function to express this stage behavior. In the first layer, the two out-of-region trade flows are compounded by the Armington function to form the domestic trade flow equation; in the second layer, the domestic and international trade flows are reviewed by the Armington function, which constitutes the regional trade flow equation; in the third layer, the regional trade flow and local use are checked by the Armington function to form the total regional output/total use equation. See Formulas (7)–(12) for details.

The first-level import trade equation is shown in Formulas (7) and (8), where represents the total amount of domestic inflow trade, represents the total amount of inflow trade in the domestic target area, represents the value of commodity trade inflows in the target domestic area, and represents inflows from other domestic areas. The total amount of trade represents the price of commodity trade inflows from other domestic regions, represents the share parameters of domestic target regions in domestic inflows, represents the commodity differential spillover from domestic trade, and represents the elasticity of domestic inflows.

The second-level import trade equation is shown in Formulas (9) and (10), where represents total inflows (including imports), represents the price of domestic commodity inflows, represents the total import value, represents the value of commodity imports, and represents the share of commodity imports. represents the trade elasticity of imported goods, and represents the goods differential spillover resulting from trade inflows.

The third-level import trade equation is shown in Formulas (11) and (12), where represents the total commodity circulation in the region, represents the self-supply of local commodities in the region, represents the self-supply price of local commodities in the region, represents the outflow of commodities (including exports), represents the total value of imported commodities, represents the trade share parameter of local and self-supplied commodities, represents the commodity differential spillover in the total circulation of commodities in the region, and represents the elasticity of commodity trade in the region.

3.1.3. Consumption Module

The consumption behavior forms a circular relationship with the main body behavior, which is composed of representative consumers, industry enterprises, and the government. Income is obtained by selling labor, lending, investing capital and taxation, and connecting with the consumption module to facilitate the interconnection of trade modules.

In particular, we discuss the social effects of policies through welfare analysis. This paper uses residents’ welfare EV as a reference and introduces residents’ utility U to compare and measure; details are shown in Formula (13). In Formula (14), and are the residents’ utility before and after the project goes, respectively.

3.1.4. Carbon Module

To analyze carbon emissions, this paper also adds the carbon emissions module as a subsidiary module to the model. It calculates carbon emissions by multiplying the endogenous energy consumption and exogenous carbon emissions factors in the model. See Formula (9) for detailed calculations.

Specifically, the environment module, as a subsidiary module, is calculated according to the intermediate energy consumption, the final energy consumption, and emissions factors in the model. stands for carbon dioxide emissions, represents the energy input in the intermediate input, represents the government‘s energy consumption in the final consumption, represents the energy consumption of consumers in final consumption, and each represent the CO2 emissions factors in the intermediate input and final consumption stages, respectively.

3.2. Data

According to the definition of the digital economy in the “Statistical Classification of the Digital Economy and Its Core Industries (2021)” issued by the Chinese government [33], its core industries are related to digital industrialization and mainly include computer communications and other electronic equipment manufacturing. Telecommunications, broadcasting, television and satellite transmission services, the Internet and related services, software, and information technology services, etc., are essential to the development of the digital economy. According to its definition, this paper lists communications equipment, computers and other electronic equipment, information transmission, software, and information technology services in the corresponding 42 industry classifications as digital industries. In terms of regional classification, this paper divides China into the eastern, western, and other regions. The eastern region includes Hebei, Tianjin, Beijing, Anhui, Jiangsu, Zhejiang, Shanghai, and Guangdong; the western region includes Sichuan, the Inner Mongolia Autonomous Region, Guizhou, Gansu, and Ningxia; other regions include other provinces not covered by the above two regions.

The data processing in this paper is divided into two steps. The first step is to use the existing inter-provincial and provincial input–output tables as the data source to integrate and estimate the inter-regional input–output table. In the second step, the industries are merged, and the social accounting matrix is compiled by combining macro data and inter-regional input–output tables. The compiled tables are the 2017 provincial-level input–output tables released by the National Bureau of Statistics of China and the multiprovincial input–output table based on inter-regional trade flows, with inter-provincial trade as the main object [34].

The two types of tables have their own emphases on the data collected through the input–output process. Provincial-level input–output tables contain data on intermediate inputs, added value, final products, imports and exports, inflows from outside the province, and outflows from outside the province. The inflow and outflow items rarely describe inter-provincial trade flows. To include most of the original provincial input–output table, the inter-provincial input–output table describes the inter-provincial trade flows in intermediate inputs and final products, but it lacks information on provincial imports. From the perspective of data quality, there is a certain difference between the two because of the differences in their calculation methods. The provincial input–output table (SRIO) is used as the official table to ensure the accuracy of the data. The inter-provincial input–output table (PRIO) uses it as a data source to describe the regional trade flows. The calculation process is detailed in Appendix A.

The multiregional computable general equilibrium model uses the social accounting matrix prepared by the input–output table to complete the basic teaching of the model. The compilation units of the input–output table are generally classified according to the countries and provinces in the administrative regions, but if there is no classification and compilation of economic regions such as “eastern region”, “western region” and “other regions”, it is passed in the previous step. Algorithms are used to address this problem. Therefore, after obtaining the new inter-regional input–output table, it is necessary to consolidate and organize it according to sectoral classifications to obtain the social accounting matrix. Considering the size of the model and the necessary calculation simplification, this paper compresses the social accounting matrix (SAM) of the original 42 departments into 7 departments according to the 3 industry classifications and department types, namely, agriculture, light industry, heavy industry, construction, energy, services, and the digital industry.

The SAM is the data source used for this model. The SAM table is compiled according to the input–output table and describes the economic structure of the region in the form of a matrix. The rows and columns represent the income and expenditures of the same account, and the totals are equal; that is, the total income of the account is equal to its total expenditure. The SAM table constructed in this paper includes activities, commodities, elements, residents, enterprises, government, investment, domestic policy, other domestic areas, and foreign countries, for a total of 10 accounts.

3.3. Shocks

This paper constructs a relatively static system by comparing the standard environment and a shock environment to analyze the CCREW policy. By constructing a static model, the explanatory power of the model is focused on short-term policy impacts. Although the observation of long-term policy impacts is sacrificed, as mentioned above, in the real economy, the short-term effects of an industrial policy will directly affect subsequent policies. Therefore, it is necessary to build a relatively static system. The analysis in this paper is based on the baseline scenario; that is, the regional economies will remain in their original state. In the setting of the shock state, we simulated the scenario in which the transfer share of the digital industry from the eastern to the western region increases from 0% to 100%. Specifically, this paper simulates the situation of relevant economic, environmental, and welfare indicators for every 5% transfer of the digital industry from the East to the West. The corresponding scenarios are shown in the Table 2. The items correspond to the baseline scenario and the scenarios formed under different transfer share conditions.

Table 2.

Impact Scenario Setting of the CCREW.

4. Results

By setting different shares of digital industries transferred from the East to the West as shocks, this paper simulates the impact of the CCREW project on regional and national economic development, social welfare, and carbon emissions.

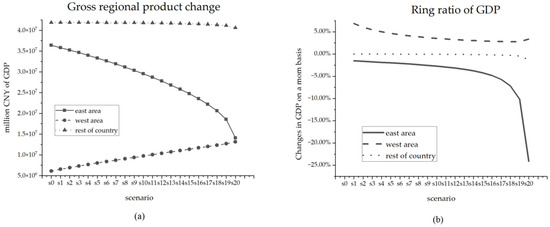

4.1. Impact on Regional GDP

As shown in Figure 2a, as the digital industry transfers from the East to the West increase, the GDP of the eastern region is significantly reduced, the GDP of the western region is significantly increased, and the GDP will also be slightly reduced in other regions due to spillover effects. The decline in the GDP of the eastern region can be understood from two aspects. On the one hand, transferring the digital industry will lead to a lack of alternative industries to stimulate economic development in the eastern region in the short term. Its digital goods become imports, which also leads to a reduction in its GDP. For the western region, the main reason for the increase in its GDP is that the digital industry in the eastern region it absorbs has brought new economic growth vectors. The reduction in GDP in other regions can be attributed to the fact that the production efficiency of the digital industry in the eastern region is higher than that in the western region. Furthermore, its transfer will lead to a further increase in the cost of using digital goods, which in turn will lead to a reduction in GDP. In addition, as shown in Figure 2b, the three broken lines in the figure correspond to the quarter-on-quarter changes in the regional GDP of the eastern, western, and other regions for every 5% of digital industry transfer. In other words, the marginal effect of transfer decreases and is always positive. For the eastern region, the result is the opposite: the marginal effect of transfer is always negative, and as the transfer increases, its marginal effect increases; for other regions, the marginal effect of transfer is negative, but the value is very small. However, as the transfer increases, its marginal effect further increases.

Figure 2.

Gross regional product and its ring ratios.

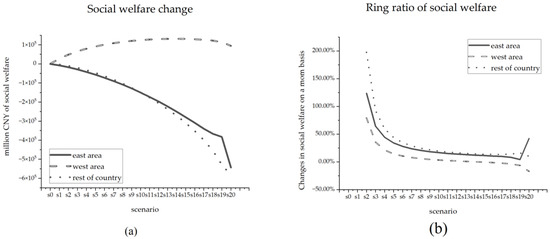

4.2. Impact on Regional Social Welfare

As shown in Figure 3a, as the transfer of the digital industry from the East to the West increases, the welfare of consumers in the East and other regions will continue to decline, whereas that of the West will be further improved. The change in welfare depends on two factors: income level and commodity prices. As mentioned above, on the one hand, due to differences in technical efficiency and production structure, the transfer of digital industries from the eastern region to the western region will lead to a rise in the price of digital commodities, which will in turn lead to negative social welfare effects in the three regions due to price increases and thus lower social welfare. For the western region, it is just the opposite, as the migration of digital industries will lead to an increase in income, which in turn leads to an increase in the level of social welfare.

Figure 3.

Regional social welfare and MoM changes.

In addition, as shown in Figure 3b, the three broken lines in the figure correspond to the quarter-on-quarter changes in social welfare for every 5% transfer in the East, West, and other regions. Changes in social welfare have diminishing marginal effects and are always positive. This suggests that consumers in the eastern and other regions will be less sensitive to the impact of the transfer policy as it is further implemented. For the western region, the marginal effect of social welfare is first positive and then negative. This is mainly because on the one hand, with the implementation of the transfer policy, the overall industrial structure of the society has changed. Changes in the ratio of capital, labor, digital goods, and intermediate inputs lead to the gradual emergence of the replacement of capital with labor as prices increase with the deepening of the policy, thereby resulting in a decline in social income levels. On the other hand, the increase in the price of digital products drives up the prices of other products, which also negatively affects social welfare.

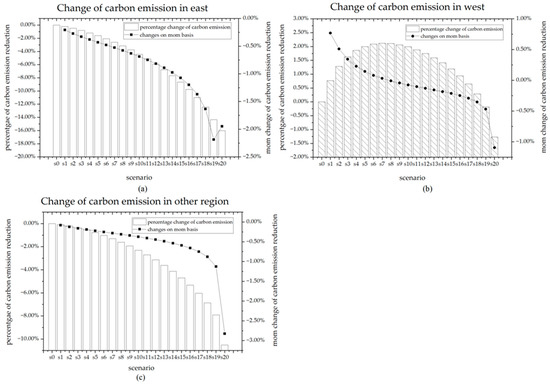

4.3. Impact on Regional Carbon Dioxide Emissions

Figure 4 represents the absolute changes in carbon emissions in the eastern, the western and other regions compared with the base period, as well as the chain changes in the previous period. In terms of absolute changes in carbon emissions, the eastern region’s carbon dioxide emissions showed a downward trend; those in other regions also showed a downward trend of similar magnitude; those in the western region showed an inverted U-shaped trend of first rising and then falling. The main reason for this finding is that the relative prices of energy products gradually increase with the implementation of the policy, and those products are then replaced by other factors.

Figure 4.

Changes in regional carbon emissions compared to the base period and their MOM changes.

With the in-depth implementation of the transfer policy, the marginal effect of carbon emissions is further strengthened and transitions from positive to negative.

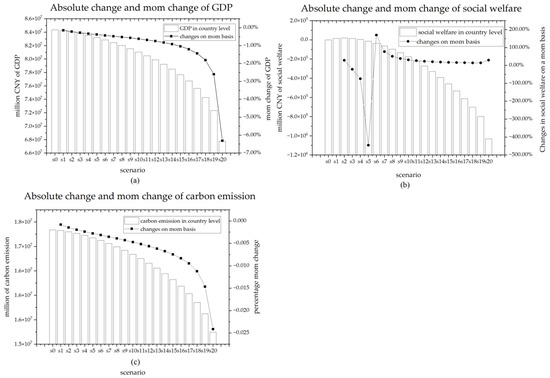

4.4. The Overall Impact on National Development

The graphs in Figure 5 correspond to the absolute and month-on-month changes in GDP, social welfare, and carbon emissions after the implementation of the transfer policy. It can be seen from the figure that the GDP shows a downward trend with the implementation of the policy, and its negative impact on the economy becomes stronger as the intensity increases. The underlying mechanism is that at the regional level, the impact of industrial transfer on the eastern and other regions is not enough to be replaced by the economic growth of the western region, which has led to the decline of the overall economic level of the country. As the intensity of industrial transfer increases, the economic gap between the western and the eastern and other regions further widens, thereby deepening the policy’s marginal impact on economic change. Carbon emissions are further curbed with increases in transfer intensity, and, under the substitution of capital and other factors, the marginal change in carbon emissions is further enhanced. The changes in social welfare are more complicated and generally follow an inverted U-shaped pattern. Within the range of 10% of the transfer intensity, the overall level of domestic social welfare can continue to rise. Within the range of 20% of the transfer intensity, the domestic level of social welfare can also rise, after which it will decline as the intensity increases. There is also a downward trend in terms of carbon emissions similar to that in economic change. On the whole, as the transfer share from the East to the West increased, economic development was sacrificed to reduce carbon emissions.

Figure 5.

The impact on the national economy–welfare–carbon emissions system.

5. Conclusions and Policy Recommendations

By constructing a general equilibrium model that includes three regions, this paper simulates the impact of the CCREW policy on regional economic development, industrial development, social welfare, and carbon dioxide emissions. In terms of models, this paper describes the elements of and manufacturers in the digital industry to ensure accuracy. This paper analyzes both the country as a whole and individual regions, as well as the direct and indirect effects of the policy, then analyzes its comprehensive effect. Based on this process, we arrive at the following conclusions.

(1) In terms of carbon dioxide emissions, the policy will cause emissions to shift from the East to the West, which will lead to an increase in carbon emissions in other regions. (2) In terms of economic development, the policy will lead to an overall downward trend in the GDP of the eastern and other regions, whereas for the western region, it will promote the development of the regional economy. The results of this difference may affect the implementation of the policy and its effects. (3) In terms of social welfare, the policy will lead to an inverted U-shaped change in social welfare at the national level, which first rises and then falls, then shifts from positive to negative as the transfer share exceeds 20%. At the regional level, social welfare in the eastern and other regions declines, whereas that in the western region shows an inverted U-shaped change that first increases and then decreases. (4) The short-term overall impact of the project at the national level will come at the expense of economic development, although carbon emissions are reduced. However, it is worth noting that as the policy intensity increases, the western region will have a strong energy–capital substitution effect in terms of industrial inputs such that capital will gradually substitute for energy inputs, which can simultaneously stimulate economic development and reduce carbon emissions.

Therefore, this paper puts forward the following policy suggestions. First, policymakers should clarify the relationship between power and responsibility among regions and optimize the evaluation of indicators related to economic development and carbon emissions. The project is a process of production transfer, economic transfer, and, most significantly, carbon emissions transfer. This paper summarizes the impact of the economic development–social welfare–carbon emissions system in different regions. The government should pay attention to differences in the policy’s impact in different regions. In the existing regional evaluation system, balancing regional development, regional economic development, and carbon emissions has become a top priority. Second, there should be policy support for areas affected by spillovers. The findings of this paper indicate that during the implementation of the project, the economic development and social welfare of areas affected by policy spillovers from other regions are also affected to a certain extent. The damage is manifested in the loss of economic development and social welfare. The rest of China will require a matching stimulus package. Third, efforts should be made to further improve efficiency and accelerate the digital transformation and technological progress of industries in the western region. This paper finds that under the current circumstances, the project has reduced China’s overall economic efficiency. Therefore, determining how to improve the efficiency of the digital economy is very important for the successful implementation of the project. Last, the space should continue to be optimized for economic development and carbon emissions to ensure the completion of the goal of effectively reducing carbon emissions while ensuring economic development.

The limitations of this model are mainly reflected in two points. On the one hand, static model is insufficient to support the long-term analysis of this policy. On the other hand, due to the lack of relevant exogenous data such as distortion coefficients, the detailed description of our model is not very accurate in factoring changes, including labor force flow.

Regarding future research plans, we have the following ideas:

- (1)

- Construct dynamic model to evaluate the long-term policy impact.

- (2)

- Consider the impact of technological progress in the western region caused by industrial transfer on regional economic development.

- (3)

- This paper also intends to explore and evaluate the supporting policy tools for the coordination of regional development in the future.

Author Contributions

Conceptualization, Z.F. and Y.H.; methodology, Z.F.; software, Z.F.; validation, Z.F.; formal analysis, Z.F.; investigation, Z.F.; resources, Y.H.; data curation, Z.F.; writing, Z.F. and Y.H.; review and editing and supervision, Z.K. All authors have read and agreed to the published version of the manuscript.

Funding

This research has been supported by the Special Project of Education and Teaching Reform for the Central Universities in UIBE [grant number 102/78220301].

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data presented in this study are available on request from the corresponding author.

Acknowledgments

The authors are grateful to the anonymous reviews for their comments.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

The construction of the inter-regional input–output table can be divided into three steps as follows.

The first step is to disassemble the SRIO tables of 31 provinces across the country into three quadrants according to the research objects. Specifically, it is divided into eight parts: intermediate input , final product , added value , import , export , out-of-province inflow , out-of-province outflow , and error term Then, according to the regional division, the intermediate goods, final goods, added value, imports and exports are added, where represents a province, and represents the set of province in the unit of region. The specific formula is as follows:

The balance relations are:

The second step is to eliminate the repetition of and . The regional trade flow calculated by the simple summation of the two items based on the SRIO table contains two aspects of information: on the one hand, it includes the inter-provincial trade flows within the region, and there will be frequent double counting in this step. Therefore, in this paper, based on the inter-provincial trade flow data in the existing PRIO data, this part of the flow was eliminated; on the other hand, the differentiating information of regional trade flows was included—that is, the trade flows between regions. In the second step, only the former is calculated and processed, and the latter will be further discussed in the third step. In the specific elimination process of intra-regional trade flows, as shown in the formula, represents intermediate inputs in the PRIO table, the elements in the matrix are , and represents the final product in the PRIO table. The matrix elements are , where represents the region set of the output region A, represents the region set of the input region B, represents the product, represents the industry, and represents the final use category. The inter-provincial flow in this region is calculated according to the two methods of inflow and outflow:

where represents the inflow in region x, and represents the outflow in region x. Because of the interaction in the region, the two are equal. The inflow of and outflow of of the deleted area can be obtained as follows:

The third step is to decompose the eliminated regional inflows and outflows according to the research needs and the regional principle. In this paper, the data are calculated and decomposed in the three regions studied. As mentioned above, represents the regional collection of output region A, represents the regional collection of input region B, and represents the collection of output region C—that is, the collection of other regions in the country. u stands for commodity, v stands for industry, and s stands for end-use category. Taking area A as an example, each outflow or inflow process contains two aspects of information: the input and use in the production process of intermediate goods and the consumption process of final goods. The specific calculations are as follows.

Outflows from area A to area B can be expressed as:

Outflows from area A to area C can be expressed as:

Outflows from area B to area A can be expressed as:

Outflows from area C to area A can be expressed as:

The fourth step is to correct the errors. Because there are errors in calculation and statistics between SRIO and PRIO, taking area A as an example, the area eliminated in the second step flows into the sum of , , and and flows out of and . The sum of is not equal to the others, which implies that the original relational expression does not satisfy the balance condition. To reduce the influence of the error, this paper builds a cross-entropy optimization method based on entropy strength to maximize the original data.

This paper introduces the concept of information entropy to measure the degree of optimization. The original information entropy is used to measure the information intensity brought about by certain news. Assuming that the probability distribution before an event is affected by the news is ; after being affected by the news the final probability distribution is . Then, the expected entropy intensity of this information is:

This function has good properties: its function value z satisfies and is minimized only when is satisfied and its second-order derivative is greater than zero. The greater the deviation of from the original data , the greater the objective function value . Accordingly, this paper constructs an optimization equation based on the entropy function. In addition, because the inter-regional inflows of the three regions are cross-equal in value, where represents the optimized trade volume from region to region , and represents the optimized trade volume by industry flowing from region to region . The related formulas are as follows.

Therefore, the optimization objective function in this paper can be simplified to only include the outflow part of the three regions as follows:

where represents the industry, represents the region, represents the total outflow value of a certain industry in each region in the original data, represents the optimized trade outflow of industry in region , represents the total outflow value of region j in the original data, represents the total outflow value in region j after optimization, represents the trade of industry i in the region in the original data, and represents the trade share of industry in region after optimization. represents the outflow of the original data area and represents the inflow of the original data area . Then we construct:

The optimization equation is subject to the following conditions:

References

- Xi, J. Report at the 19th National Congress of the Communist Party of China (CPC); the Central People’s Government of the People’s Republic of China: Beijing, China, 2017.

- Ding, C.; Liu, C.; Zheng, C.; Li, F. Digital Economy, Technological Innovation and High-Quality Economic Development: Based on Spatial Effect and Mediation Effect. Sustainability 2022, 14, 216. [Google Scholar] [CrossRef]

- Pan, W.; Xie, T.; Wang, Z.; Ma, L. Digital economy: An innovation driver for total factor productivity. J. Bus. Res. 2022, 139, 303–311. [Google Scholar] [CrossRef]

- Lamberton, C.; Stephen, A.T. A Thematic Exploration of Digital, Social Media, and Mobile Marketing: Research Evolution from 2000 to 2015 and an Agenda for Future Inquiry. J. Mark. 2016, 80, 146–172. [Google Scholar] [CrossRef]

- Nambisan, S.; Wright, M.; Feldman, M. The digital transformation of innovation and entrepreneurship: Progress, challenges and key themes. Res. Pol. 2019, 48, 103773. [Google Scholar] [CrossRef]

- Verhoef, P.C.; Kannan, P.K.; Inman, J.J. From Multi-Channel Retailing to Omni-Channel Retailing: Introduction to the Special Issue on Multi-Channel Retailing. J. Retail. 2015, 91, 174–181. [Google Scholar] [CrossRef]

- Chirkunova, E.; Anisimova, V.Y.; Tukavkin, N.M. Innovative Digital Economy of Regions: Convergence of Knowledge and Information. In Current Achievements, Challenges and Digital Chances of Knowledge Based Economy; Ashmarina, S.I., Mantulenko, V.V., Eds.; Springer International Publishing: Cham, Switzerland, 2021; pp. 123–130. [Google Scholar] [CrossRef]

- Su, J.; Su, K.; Wang, S. Does the Digital Economy Promote Industrial Structural Upgrading?—A Test of Mediating Effects Based on Heterogeneous Technological Innovation. Sustainability 2021, 13, 10105. [Google Scholar] [CrossRef]

- Zhang, W.; Liu, X.; Wang, D.; Zhou, J. Digital economy and carbon emission performance: Evidence at China’s city level. Energy Policy 2022, 165, 112927. [Google Scholar] [CrossRef]

- Krasota, T.; Bazhenov, R.; Abdyldaeva, U.; Bedrina, S.; Mironova, I. Development of the digital economy in the context of sustainable competitive advantage. E3S Web Conf. 2020, 208, 03042. [Google Scholar] [CrossRef]

- Lin, B.; Zhou, Y. Does the Internet development affect energy and carbon emission performance? Sustain. Prod. Consum. 2021, 28, 1–10. [Google Scholar] [CrossRef]

- Wang, L.; Chen, Y.; Ramsey, T.S.; Hewings, G.J.D. Will researching digital technology really empower green development? Technol. Soc. 2021, 66, 101638. [Google Scholar] [CrossRef]

- Bañales, S. The enabling impact of digital technologies on distributed energy resources integration. J. Renew. Sustain. Energy 2020, 12, 045301. [Google Scholar] [CrossRef]

- Noussan, M.; Tagliapietra, S. The effect of digitalization in the energy consumption of passenger transport: An analysis of future scenarios for Europe. J. Clean. Prod. 2020, 258, 120926. [Google Scholar] [CrossRef]

- Ren, S.; Hao, Y.; Xu, L.; Wu, H.; Ba, N. Digitalization and energy: How does internet development affect China’s energy consumption? Energy Econ. 2021, 98, 105220. [Google Scholar] [CrossRef]

- Salahuddin, M.; Alam, K. Internet usage, electricity consumption and economic growth in Australia: A time series evidence. Telemat. Inform. 2015, 32, 862–878. [Google Scholar] [CrossRef]

- Coyne, B.; Denny, E. Applying a Model of Technology Diffusion to Quantify the Potential Benefit of Improved Energy Efficiency in Data Centres. Energies 2021, 14, 7699. [Google Scholar] [CrossRef]

- Lin, B.; Huang, C. How will promoting the digital economy affect electricity intensity? Energy Policy 2023, 173, 113341. [Google Scholar] [CrossRef]

- Akbar, U.; Li, Q.-L.; Akmal, M.A.; Shakib, M.; Iqbal, W. Nexus between agro-ecological efficiency and carbon emission transfer: Evidence from China. Environ. Sci. Pollut. Res. 2021, 28, 18995–19007. [Google Scholar] [CrossRef]

- Liu, T.; Pan, S.; Hou, H.; Xu, H. Analyzing the environmental and economic impact of industrial transfer based on an improved CGE model: Taking the Beijing–Tianjin–Hebei region as an example. Environ. Impact Assess. Rev. 2020, 83, 106386. [Google Scholar] [CrossRef]

- Mao, G.; Jin, W.; Zhu, Y.; Mao, Y.; Hsu, W.-L.; Liu, H.-L. Environmental Pollution Effects of Regional Industrial Transfer Illustrated with Jiangsu, China. Sustainability 2021, 13, 12128. [Google Scholar] [CrossRef]

- Mo, H.; You, Y.; Wu, L.; Yan, F.; Chang, M.; Wang, W.; Wang, P.; Wang, X. Potential impact of industrial transfer on PM2.5 and economic development under scenarios oriented by different objectives in Guangdong, China. Environ. Pollut. 2023, 316, 120562. [Google Scholar] [CrossRef]

- Yu, Y.; Zhang, N. Does industrial transfer policy mitigate carbon emissions? Evidence from a quasi-natural experiment in China. J. Environ. Manag. 2022, 307, 114526. [Google Scholar] [CrossRef] [PubMed]

- Liu, C.; Hong, T.; Li, H.; Wang, L. From club convergence of per capita industrial pollutant emissions to industrial transfer effects: An empirical study across 285 cities in China. Energy Policy 2018, 121, 300–313. [Google Scholar] [CrossRef]

- Li, M.; Li, Q.; Wang, Y.; Chen, W. Spatial path and determinants of carbon transfer in the process of inter provincial industrial transfer in China. Environ. Impact Assess. Rev. 2022, 95, 106810. [Google Scholar] [CrossRef]

- Bai, H.; Irfan, M.; Hao, Y. How does industrial transfer affect environmental quality? Evidence from China. J. Asian Econ. 2022, 82, 101530. [Google Scholar] [CrossRef]

- Walras, L. Elements of Theoretical Economics; Walker, D.A., van Daal, J., Eds.; Cambridge University Press: Cambridge, UK, 1874. [Google Scholar]

- Leif, J. A Multi-Sectoral Study of Economic Growth: Some Comments. Economica 1963, 30, 174–176. [Google Scholar] [CrossRef]

- Copeland, B.R.; Taylor, M.S. Trade, Growth, and the Environment. J. Econ. Lit. 2004, 42, 7–71. [Google Scholar] [CrossRef] [PubMed]

- Diao, X.; Rattsø, J.; Stokke, H.E. International spillovers, productivity growth and openness in Thailand: An intertemporal general equilibrium analysis. J. Dev. Econ. 2005, 76, 429–450. [Google Scholar] [CrossRef]

- Gerlagh, R.; Kuik, O. Spill or leak? Carbon leakage with international technology spillovers: A CGE analysis. Energy Econ. 2014, 45, 381–388. [Google Scholar] [CrossRef]

- Hübler, M. Technology diffusion under contraction and convergence: A CGE analysis of China. Energy Econ. 2011, 33, 131–142. [Google Scholar] [CrossRef]

- The National Bureau of Statistics. Statistical Classification of Digital Economy and Its Core Industries (2021); The National Bureau of Statistics: Beijing, China, 2021; Volume NBS-33.

- Zheng, H.; Zhang, Z.; Wei, W.; Song, M.; Dietzenbacher, E.; Wang, X.; Meng, J.; Shan, Y.; Ou, J.; Guan, D. Regional determinants of China’s consumption-based emissions in the economic transition. Environ. Res. Lett. 2020, 15, 074001. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).