In Search of Sustainability and Financial Returns: The Case of ESG Energy Funds

Abstract

1. Introduction

2. Description of Applied Methodology

- The research and analysis process consists of the following steps: “Search Keyword” involves determining keywords for further analysis (number of keywords is not limited). The authors have agreed on a number of keywords based on the literature analysis and authors’ experience in the field.

- “URLs List” involves determining the address of the internet homepage (used for the search of the determined keywords). The authors have agreed to use the ESG funds homepages.

- “Scanning” involves starting the scanning process. The researcher can use an unlimited amount of scanning within one homepage in different time periods which allows searching for changes made in different time periods.

- “Search Results” involves allowing the researches access to the research results where they can access the keywords found on the web page, which allows for deeper analysis (to be considered in the coming research papers).

- “Graphical Research Results” involves the identification of related keywords and the determination of its popularity. They are then presented in a graphical way suitable for further analysis.

3. Research Results and Discussion

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- European Commission. Delivering the European Green Deal. Climate Action, 14 July 2021. Available online: https://commission.europa.eu/strategy-and-policy/priorities-2019-2024/european-green-deal/delivering-european-green-deal_en (accessed on 12 October 2022).

- Bioy, H.; Lamont, K. Passive sustainable funds: The global landscape. J. Index Invest. 2018, 9, 4–17. [Google Scholar] [CrossRef]

- Mercereau, B.; Sertã, J.P.C.; Gavini, C. Promoting Sustainability Using Passive Funds. J. Index Invest. 2019, 10, 43–62. [Google Scholar] [CrossRef]

- Kuzmina, J.; Lindemane, M. Development of investment strategy applying corporate social responsibility. Trends Econ. Manag. 2017, 11, 37–47. [Google Scholar] [CrossRef]

- Kuzmina, J.; Lindemane, M. ESG Investing: New Challenges and New Opportunities. J. Bus. Manag. 2017, 85–98. Available online: https://journals.riseba.eu/index.php/jbm/article/view/62/45 (accessed on 12 October 2022).

- Silvola, H.; Landau, T. Global Investment Trends and Impacts on Sustainable Investing; Palgrave Macmillan: London, UK, 2021; pp. 231–237. [Google Scholar]

- Sourd, L.S.; Safaee, S. The European ETF Market: Growth, Trends, and Impact on Underlying Instruments. J. Portf. Manag. 2021, 47, 95–111. [Google Scholar] [CrossRef]

- Fernandez-Perez, A.; Garel, A.; Indriawan, I. In the mood for sustainable funds? Econ. Lett. 2022, 217, 110691. [Google Scholar] [CrossRef]

- Sládková, J.; Kolomazníková, D.; Formánková, S.; Trenz, O.; Kolomazník, J.; Faldík, O. Sustainable and responsible investment funds in Europe. Meas. Bus. Excell. 2021, 26, 229–244. [Google Scholar] [CrossRef]

- Geczy, C.C.; Stambaugh, R.F.; Levin, D. Investing in socially responsible mutual funds. Rev. Asset Pricing Stud. 2021, 11, 309–351. [Google Scholar] [CrossRef]

- Koval, V.; Hrymalyuk, A.; Atstaja, D.; Nesenenko, P.; Kovshun, N.; Masina, L. Hypothesis of a Two-Level Investment System and the Prospects for the Planned Development of the Socialist Market Economy. Visnyk Natsionalnoho Hirnychoho Universytetu 2022, 4, 138–144. [Google Scholar] [CrossRef]

- Fraune, C.; Knodt, M. Sustainable energy transformations in an age of populism, post-truth politics, and local resistance. Energy Res. Soc. Sci. 2018, 43, 1–7. [Google Scholar] [CrossRef]

- Dominković, D.F.; Bačeković, I.; Pedersen, A.S.; Krajačić, G. The future of transportation in sustainable energy systems: Opportunities and barriers in a clean energy transition. Renew. Sustain. Energy Rev. 2018, 82, 1823–1838. [Google Scholar] [CrossRef]

- Markandya, A.; Arto, I.; González-Eguino, M.; Román, M.V. Towards a green energy economy? Tracking the employment effects of low-carbon technologies in the European Union. Appl. Energy 2016, 179, 1342–1350. [Google Scholar] [CrossRef]

- Genus, A.; Iskandarova, M.; Goggins, G.; Fahy, F.; Laakso, S. Alternative energy imaginaries: Implications for energy research policy integration and the transformation of energy systems. Energy Res. Soc. Sci. 2021, 73, 101898. [Google Scholar]

- Schaeffer, G.J. Energy sector in transformation, trends and prospects. Procedia Comput. Sci. 2015, 52, 866–875. [Google Scholar] [CrossRef]

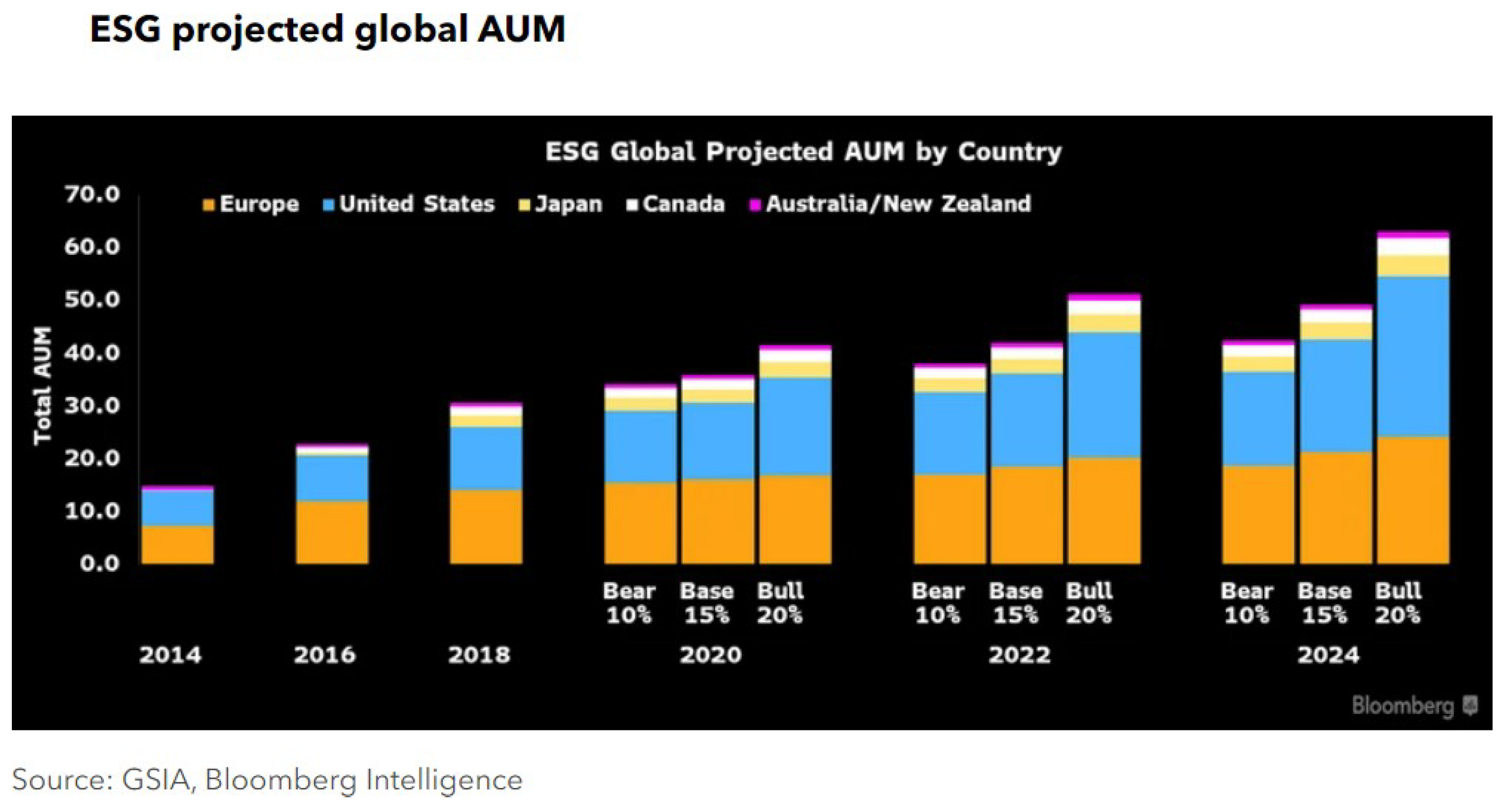

- Diab, A.; Martin, G. ESG assets may hit $53 trillion by 2025, a third of global AUM. Bloomberg Intelligence, 23 February 2021. Available online: https://www.bloomberg.com/professional/blog/esg-assets-may-hit-53-trillion-by-2025-a-third-of-global-aum/ (accessed on 12 October 2022).

- Hauff, C.J.; Nilsson, J. Is ESG mutual fund quality in the eye of the beholder? An experimental study of investor responses to ESG fund strategies. Bus. Strategy Environ. 2022; early view. Available online: https://onlinelibrary.wiley.com/doi/full/10.1002/bse.3181 (accessed on 12 October 2022).

- Grim, D.M.; Berkowitz, D.B. ESG, SRI, and impact investing: A primer for decision-making. J. Impact ESG Invest. 2020, 1, 47–65. [Google Scholar] [CrossRef]

- Sciarelli, M.; Cosimato, S.; Landi, G.; Iandolo, F. Socially responsible investment strategies for the transition towards sustainable development: The importance of integrating and communicating ESG. TQM J. 2021, 33, 39–56. [Google Scholar] [CrossRef]

- Curtis, Q.; Fisch, J.; Robertson, A.Z. Do ESG mutual funds deliver on their promises. Mich. Law Rev. 2021, 120, 393. [Google Scholar]

- Folqué, M.; Escrig-Olmedo, E.; Santamaría, T. Sustainable development and financial system: Integrating ESG risks through sustainable investment strategies in a climate change context. Sustain. Dev. 2021, 29, 876–890. [Google Scholar] [CrossRef]

- Tucker, J.J., III; Jones, S. Environmental, Social, and Governance Investing: Investor Demand, the Great Wealth Transfer, and Strategies for ESG Investing. J. Financ. Serv. Prof. 2020, 74, 56–75. [Google Scholar]

- Abhayawansa, S.; Tyagi, S. Sustainable investing: The black box of environmental, social, and governance (ESG) ratings. J. Wealth Manag. 2021, 24, 49–54. [Google Scholar] [CrossRef]

- Kotsantonis, S.; Serafeim, G. Four things no one will tell you about ESG data. J. Appl. Corp. Financ. 2019, 31, 50–58. [Google Scholar] [CrossRef]

- Engelhardt, N.; Ekkenga, J.; Posch, P. ESG ratings and stock performance during the COVID-19 crisis. Sustainability 2021, 13, 7133. [Google Scholar] [CrossRef]

- Christensen, D.M.; Serafeim, G.; Sikochi, A. Why is corporate virtue in the eye of the beholder? The case of ESG ratings. Account. Rev. 2022, 97, 147–175. [Google Scholar] [CrossRef]

- Gyönyörová, L.; Stachoň, M.; Stašek, D. ESG ratings: Relevant information or misleading clue? Evidence from the S&P Global 1200. J. Sustain. Financ. Invest. 2021, 1–35. Available online: https://www.tandfonline.com/doi/abs/10.1080/20430795.2021.1922062 (accessed on 12 October 2022).

- Zumente, I.; La¯ce, N. ESG Rating-Necessity for the Investor or the Company? Sustainability 2021, 13, 8940. [Google Scholar] [CrossRef]

- Dimson, E.; Marsh, P.; Staunton, M. Divergent ESG ratings. J. Portf. Manag. 2020, 47, 75–87. [Google Scholar] [CrossRef]

- Zorina, I.; Corlett-Roy, L. The Hunt for Alpha in ESG Fixed Income: Fund Evidence from around the World. J. Impact ESG Invest. 2022, 3, 102–120. [Google Scholar] [CrossRef]

- Das, N.; Chatterjee, S.; Sunder, A.; Ruf, B. ESG ratings and the performance of socially responsible mutual funds: A panel study. J. Financ. Issues 2018, 17, 49–57. [Google Scholar]

- Liang, H.; Sun, L.; Teo, S.W.M. Responsible hedge funds. Rev. Financ. 2022, 26, 1585–1633. [Google Scholar] [CrossRef]

- Dorfleitner, G.; Kreuzer, C.; Sparrer, C. ESG controversies and controversial ESG: About silent saints and small sinners. J. Asset Manag. 2020, 21, 393–412. [Google Scholar] [CrossRef]

- Milonas, N.; Rompotis, G.; Moutzouris, C. The performance of ESG funds vis-à-vis non-ESG funds. The Journal of Impact and ESG Investing. J. Impact ESG Invest. 2022. [Google Scholar] [CrossRef]

- Clifford Chance LLP., The Institute for Human Rights and Business, CDC Group. A White Paper on Just Transition and the Banking Sector. 2021. Available online: https://www.cliffordchance.com/content/dam/cliffordchance/PDF/just-transactions-whitepaper.pdf (accessed on 12 October 2022).

- Network for Greening the Financial System. Enhancing Market Transparency in Green and Transition Finance; Network for Greening the Financial System: Paris, France, 2022; Available online: https://www.ngfs.net/sites/default/files/medias/documents/enhancing_market_transparency_in_green_and_transition_finance.pdf (accessed on 12 October 2022).

- Bointner, R.; Pezzutto, S.; Grilli, G.; Sparber, W. Financing innovations for the renewable energy transition in Europe. Energies 2016, 9, 990. [Google Scholar] [CrossRef]

- Fragkiadakis, K.; Fragkos, P.; Paroussos, L. Low-carbon R&D can boost EU growth and competitiveness. Energies 2020, 13, 5236. [Google Scholar]

- Geddes, A.; Schmidt, T.S. Integrating finance into the multi-level perspective: Technology niche-finance regime interactions and financial policy interventions. Res. Policy 2020, 49, 103985. [Google Scholar] [CrossRef]

- Polzin, F.; Sanders, M. How to finance the transition to low-carbon energy in Europe. Energy Policy 2020, 147, 111863. [Google Scholar] [CrossRef]

- Egli, F.; Polzin, F.; Sanders, M.; Schmidt, T.; Serebriakova, A.; Steffen, B. Financing the energy transition: Four insights and avenues for future research. Environ. Res. Lett. 2022, 17, 51003. [Google Scholar] [CrossRef]

- Kemfert, C.; Schäfer, D.; Semmler, W. Great green transition and finance. Intereconomics 2020, 55, 181–186. [Google Scholar] [CrossRef]

- Polzin, F.; Sanders, M.; Serebriakova, A. Finance in global transition scenarios: Mapping investments by technology into finance needs by source. Energy Econ. 2021, 99, 105281. [Google Scholar] [CrossRef]

- Hall, S.; Roelich, K.E.; Davis, M.E.; Holstenkamp, L. Finance and justice in low-carbon energy transitions. Appl. Energy 2018, 222, 772–780. [Google Scholar] [CrossRef]

- Roy, J.; Ghosh, D.; Ghosh, A.; Dasgupta, S. Fiscal instruments: Crucial role in financing low carbon transition in energy systems. Curr. Opin. Environ. Sustain. 2013, 5, 261–269. [Google Scholar] [CrossRef]

- Ibikunle, G.; Steffen, T. European green mutual fund performance: A comparative analysis with their conventional and black peers. J. Bus. Ethics 2017, 145, 337–355. [Google Scholar] [CrossRef]

- Gonçalves, T.; Pimentel, D.; Gaio, C. Risk and performance of European green and conventional funds. Sustainability 2021, 13, 4226. [Google Scholar] [CrossRef]

- Yue, X.G.; Han, Y.; Teresiene, D.; Merkyte, J.; Liu, W. Sustainable funds’ performance evaluation. Sustainability 2020, 12, 8034. [Google Scholar] [CrossRef]

- Durán-Santomil, P.; Otero-González, L.; Correia-Domingues, R.H.; Reboredo, J.C. Does sustainability score impact mutual fund performance. Sustainability 2019, 11, 2972. [Google Scholar] [CrossRef]

- Carhart, M.M. On persistence in mutual fund performance. J. Financ. 1997, 52, 57–82. [Google Scholar] [CrossRef]

- ESMA. Performance and Costs of EU Retail Investment Products 2022; Publication Office of the European Union: Luxembourg, 2022; Available online: https://www.esma.europa.eu/sites/default/files/library/esma_50-165-1677_asr_performance_and_costs_of_eu_retail_investment_products.pdf (accessed on 12 October 2022).

- Raghunandan, A.; Rajgopal, S. Do ESG funds make stakeholder-friendly investments. Rev. Account. Stud. 2022, 27, 822–863. [Google Scholar] [CrossRef]

- Baily, C.; Gnabo, J.Y. How different are ESG Mutual Funds? Evid. Implic. 2022. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4048577 (accessed on 12 October 2022).

- Filbeck, A.; Filbeck, G.; Zhao, X. Performance assessment of firms following sustainalytics ESG principles. J. Invest. 2019, 28, 7–20. [Google Scholar] [CrossRef]

- Fama, E.F.; French, K.R. A five-factor asset pricing model. J. Financ. Econ. 2015, 116, 1–22. [Google Scholar] [CrossRef]

- Tuci, E. ESG and Corporate Financial Performance: Empirical Evidence from the Worldwide Energy Sector. Master’s Thesis, Catholic University of Portugal, Lisbon, Portugal, 2020. [Google Scholar]

- Loftsgarden, C. How ESG Performance Affects the Corporate Financial Performance. An Empirical Study of the Energy Sector. Master’s Thesis, Oslo Metropolitan University, Oslo, Norway, 2020. [Google Scholar]

- Naeem, N.; Cankaya, S. The impact of ESG performance over financial performance: A study on global energy and powergeneration companies. Int. J. Commer. Financ. 2022, 8, 1–25. [Google Scholar]

- Liu, G.; Hamori, S. Can one reinforce investments in renewable energy stock indices with the ESG index. Energies 2020, 13, 1179. [Google Scholar] [CrossRef]

| Criteria | Number of ESG Funds | Number of Non-ESG Funds |

|---|---|---|

| Market Status: Active | 433,107 | 433,107 |

| Fund Asset Class Focus: Equity | 48,104 | 48,104 |

| Fund Industry Focus: Energy | 445 | 445 |

| General Attribute: ESG | 23 | Not applicable |

| Total Number after Restrictions | 23 | 35 |

| Length of the Data Sample | Frequency | Start Date | End Date | Source of Data |

|---|---|---|---|---|

| 1305 data entries for each ESG fund and non-ESG fund | Daily closing prices | 1 September 2017 | 1 September 2022 | Bloomberg terminal (data are not public, subscription required). There are no ethical issues about obtaining the data used. |

| Year | Return (%) | Return (%) | t-Test (p Value) | |

|---|---|---|---|---|

| ESG Energy Funds | Non-ESG Energy Funds | Energy | * significant if p < 0.05 | |

| 2018 | −10.4 | −16.4 | 0.1046 | |

| 2019 | 20.0 | 22.5 | 0.3452 | |

| 2020 | 5.9 | 31.1 | 0.1988 | |

| 2021 | 21.5 | 24.7 | 0.3319 | |

| YTD | 9.5 | 31.1 | 0.0006 * |

| Regression Statistics | ||||||

| Multiple R | 0.7225 | |||||

| R Square | 0.5220 | |||||

| Adjusted R Square | 0.5211 | |||||

| Standard Error | 0.0087 | |||||

| Observations | 2606 | |||||

| Coefficients | Standard Error | tStat | p-Value | Lower 95% | Upper 95% | |

| Intercept | −0.0039 | 0.0002 | −16.2612 | 0.0000 | −0.0044 | −0.0034 |

| ESG Attribution | −0.0002 | 0.0003 | −0.5868 | 0.5574 | −0.0009 | 0.0005 |

| Risk-adjusted Market Exposure | 0.0077 | 0.0002 | 47.1512 | 0.0000 | 0.0074 | 0.0080 |

| Size Effect | 0.0028 | 0.0005 | 6.0961 | 0.0000 | 0.0019 | 0.0037 |

| Book-to-Market Value Effect | 0.0042 | 0.0003 | 13.7883 | 0.0000 | 0.0036 | 0.0048 |

| Momentum Effect | 0.0002 | 0.0002 | 0.7958 | 0.4262 | −0.0003 | 0.0007 |

| Regression Statistics | ||||||

| Multiple R | 0.7635 | |||||

| R Square | 0.5830 | |||||

| Adjusted R Square | 0.5750 | |||||

| Standard Error | 0.0054 | |||||

| Observations | 266 | |||||

| Coefficients | Standard Error | tStat | p-Value | Lower 95% | Upper 95% | |

| Intercept | 0.0006 | 0.0005 | 1.2746 | 0.2036 | −0.0003 | 0.0015 |

| ESG Attribution | −0.0001 | 0.0007 | −0.1571 | 0.8753 | −0.0014 | 0.0012 |

| Risk-adjusted Market Exposure | 0.0068 | 0.0004 | 17.3450 | 0.0000 | 0.0060 | 0.0076 |

| Size Effect | 0.0019 | 0.0011 | 1.7493 | 0.0814 | −0.0002 | 0.0039 |

| Book-to-Market Value Effect | 0.0034 | 0.0005 | 6.8403 | 0.0000 | 0.0024 | 0.0044 |

| Momentum Effect | 0.0003 | 0.0007 | 0.4082 | 0.6834 | −0.0011 | 0.0017 |

| Regression Statistics | ||||||

| Multiple R | 0.5970 | |||||

| R Square | 0.3564 | |||||

| Adjusted R Square | 0.3441 | |||||

| Standard Error | 0.0099 | |||||

| Observations | 269 | |||||

| Coefficients | Standard Error | t Stat | p-Value | Lower 95% | Upper 95% | |

| Intercept | 0.0006 | 0.0009 | 0.7476 | 0.4554 | −0.0010 | 0.0023 |

| ESG Attribution | −0.0010 | 0.0012 | −0.8165 | 0.4150 | −0.0033 | 0.0014 |

| Risk-adjusted Market Exposure | 0.0056 | 0.0005 | 11.1982 | 0.0000 | 0.0046 | 0.0065 |

| Size Effect | 0.0078 | 0.0016 | 4.7486 | 0.0000 | 0.0046 | 0.0111 |

| Book-to-Market Value Effect | 0.0013 | 0.0008 | 1.5593 | 0.1201 | −0.0003 | 0.0030 |

| Momentum Effect | 0.0016 | 0.0009 | 1.8254 | 0.0691 | −0.0001 | 0.0033 |

| Regression Statistics | ||||||

| Multiple R | 0.7866 | |||||

| R Square | 0.6188 | |||||

| Adjusted R Square | 0.6113 | |||||

| Standard Error | 0.0050 | |||||

| Observations | 260 | |||||

| Coefficients | Standard Error | tStat | p-Value | Lower 95% | Upper 95% | |

| Intercept | −0.0101 | 0.0004 | −22.9701 | 0.0000 | −0.0109 | −0.0092 |

| ESG Attribution | 0.0001 | 0.0006 | 0.1518 | 0.8795 | −0.0011 | 0.0013 |

| Risk-adjusted Market Exposure | 0.0071 | 0.0004 | 16.9627 | 0.0000 | 0.0062 | 0.0079 |

| Size Effect | −0.0006 | 0.0011 | −0.5333 | 0.5943 | −0.0027 | 0.0016 |

| Book-to-Market Value Effect | 0.0059 | 0.0014 | 4.2734 | 0.0000 | 0.0032 | 0.0087 |

| Momentum Effect | 0.0013 | 0.0010 | 1.3634 | 0.1740 | −0.0006 | 0.0032 |

| Regression Statistics | ||||||

| Multiple R | 0.8943 | |||||

| R Square | 0.7998 | |||||

| Adjusted R Square | 0.7959 | |||||

| Standard Error | 0.0116 | |||||

| Observations | 262 | |||||

| Coefficients | Standard Error | tStat | p-Value | Lower 95% | Upper 95% | |

| Intercept | −0.0002 | 0.0010 | −0.2046 | 0.8381 | −0.0023 | 0.0018 |

| ESG Attribution | −0.0007 | 0.0014 | −0.5183 | 0.6047 | −0.0036 | 0.0021 |

| Risk-adjusted Market Exposure | 0.0090 | 0.0005 | 19.8769 | 0.0000 | 0.0081 | 0.0099 |

| Size Effect | 0.0027 | 0.0012 | 2.2950 | 0.0225 | 0.0004 | 0.0050 |

| Book-to-Market Value Effect | 0.0087 | 0.0015 | 5.8680 | 0.0000 | 0.0058 | 0.0116 |

| Momentum Effect | 0.0021 | 0.0009 | 2.2099 | 0.0280 | 0.0002 | 0.0040 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kuzmina, J.; Atstaja, D.; Purvins, M.; Baakashvili, G.; Chkareuli, V. In Search of Sustainability and Financial Returns: The Case of ESG Energy Funds. Sustainability 2023, 15, 2716. https://doi.org/10.3390/su15032716

Kuzmina J, Atstaja D, Purvins M, Baakashvili G, Chkareuli V. In Search of Sustainability and Financial Returns: The Case of ESG Energy Funds. Sustainability. 2023; 15(3):2716. https://doi.org/10.3390/su15032716

Chicago/Turabian StyleKuzmina, Jekaterina, Dzintra Atstaja, Maris Purvins, Guram Baakashvili, and Vakhtang Chkareuli. 2023. "In Search of Sustainability and Financial Returns: The Case of ESG Energy Funds" Sustainability 15, no. 3: 2716. https://doi.org/10.3390/su15032716

APA StyleKuzmina, J., Atstaja, D., Purvins, M., Baakashvili, G., & Chkareuli, V. (2023). In Search of Sustainability and Financial Returns: The Case of ESG Energy Funds. Sustainability, 15(3), 2716. https://doi.org/10.3390/su15032716