Static and Dynamic Evaluation of Financing Efficiency in Enterprises’ Low-Carbon Supply Chain: PCA–DEA–Malmquist Model Method

Abstract

1. Introduction

- (1)

- Previous studies on supply chain financing rarely involve low-carbon levels, some of them are mostly related to corporate decision-making models, and there is still no research on its efficiency [14,15]. This paper takes the lead in designing an enterprise low-carbon supply chain financing efficiency evaluation scale, which enriches the existing literature on supply chain financing;

- (2)

- The research on enterprise low-carbon behavior is a hot topic at present, but there are few studies on low-carbon supply chain financial behavior [19,20]. The reason is that the measurement of low-carbon supply chain finance behavior is a major challenge. This paper develops the enterprise low-carbon supply chain financial behavior scale and uses the text information of the corporate social responsibility report and NVivo software to quantify the low-carbon supply chain financial behavior, expanding on the existing research on low-carbon supply chain management;

- (3)

- It is the first time PCA, DEA, and other models have been used to calculate the financing efficiency of a low-carbon supply chain; the evaluation process has strong logic and maneuverability. According to the evaluation indicators and evaluation results, this paper put forward targeted optimization suggestions, which have important guidance and reference significance for some enterprises and industries aiming to improve the financing efficiency of the low-carbon supply chain.

2. Literature Review

3. Research Design

3.1. Model Selection

3.2. Evaluation Index Selection

- Input Indicators

- ①

- Total assets. Total assets mainly measure the financing scale of the company. Total assets refer to everything owned by the enterprise as a result of previous transactions or events. This index can reflect the size of a company. Since the assets contain capital from different financing channels, this index can represent a certain financing scale of an enterprise;

- ②

- Asset–liability ratio. The asset–liability ratio is the ratio of total liabilities to total assets of an enterprise, and mainly measures the capital structure of a company. This index shows the proportion of debt in the assets of an enterprise. It is also the degree of risk that creditors provide loans to the enterprise. It is generally believed that the level of debt to asset ratio is 40–60%;

- ③

- Commercial credit. Commercial credit is a common financing method and operation means in the purchase and sale activities of enterprises. It has an important impact on the financing of enterprises and the financing activities of the whole supply chain. As an alternative financing method, commercial value can help enterprises relieve financing constraints, so companies meet their capital needs by incorporating commercial credit from upstream and downstream companies into the supply chain. At the same time, the company will actively provide business credit to these companies to increase the stickiness of the supply chain [61]. We measure commercial credit by the total amount of accounts payable, notes payable, and accounts received in advance;

- ④

- Low carbon supply chain finance behavior. Based on the research results of Tseng et al. [57], Zhou et al. [62], and The CDP2017 Climate Change Questionnaire [63], we designed eight items as shown in Table 1. If the sample company has disclosed the project, the value is 1; otherwise, the value is 0. The disclosure of financial behavior data of a low-carbon supply chain mainly appears in the environment and sustainability section of corporate social responsibility reports. Therefore, qualitative analysis software NVivo 11 was used to search for keywords in annual reports, social responsibility reports, or sustainable development reports, and these keywords and statements were collected and sorted. Because NVivo software can only search files with extractable fields, social responsibility reports from some companies are presented in the form of pictures, and corporate reports with missing information were collected manually. We mainly investigated the following chapters: supplier, customer, and consumer rights protection (e.g., low-carbon procurement, low-carbon industrial chain), environmental protection, and sustainable development. In the calculation of low carbon supply chain finance, the different effects of enterprises’ different financial behaviors are considered comprehensively. The PCA model was first used to measure the low carbon supply chain financial behaviors, and then the data were applied to evaluate the financing efficiency of enterprises’ low carbon supply chain.

- 2.

- Output indicators

- ①

- Total asset turnover. Total asset turnover rate refers to the turnover times of all the assets of the company in an accounting period; that is, the total efficiency of the effective operation of all the assets of the company. Generally speaking, the larger the value of total asset turnover is, the better. On the one hand, it reflects the strong turnover capacity of the company’s total assets; on the other hand, it indicates that the company’s assets have been effectively utilized, which can create more production benefits and operating profits for the company;

- ②

- Operating income. Operating income is the most direct index to evaluate the development ability of an enterprise. The growth or decline of income directly reflects an enterprise’s operating efficiency and the use of funds;

- ③

- Return on equity. Return on equity indicates the profitability of an enterprise’s net assets. Generally speaking, highly profitable assets can attract capital inflows. Therefore, highly profitable enterprises usually have a strong financing capacity;

- ④

- Supply chain integration. Supply chain integration refers to the strategic cooperation between enterprises and the node companies in the supply chain. These enterprises have aligned goals and jointly manage their internal and external business processes to maximize value. Supply chain integration can reflect the real situation of the company’s supply chain relationship. We adopted the ratio of mean and variance of the proportion of the trading volume of five suppliers and customers in the annual total trading volume in three consecutive years to measure supply chain integration. This was to better reflect the transaction scale and stability between the company and the upstream/downstream companies in the supply chain.

3.3. Data Collection

4. Empirical Results

4.1. Financial Behavior Measurement of Enterprise Low-Carbon Supply Chain

4.1.1. Reliability Test

4.1.2. Applicability Test

4.1.3. Principal Component Analysis

4.1.4. Low Carbon Supply Chain Financial Behavior Measurement

4.2. Static Measurement of Financing Efficiency of Low-Carbon Supply Chain

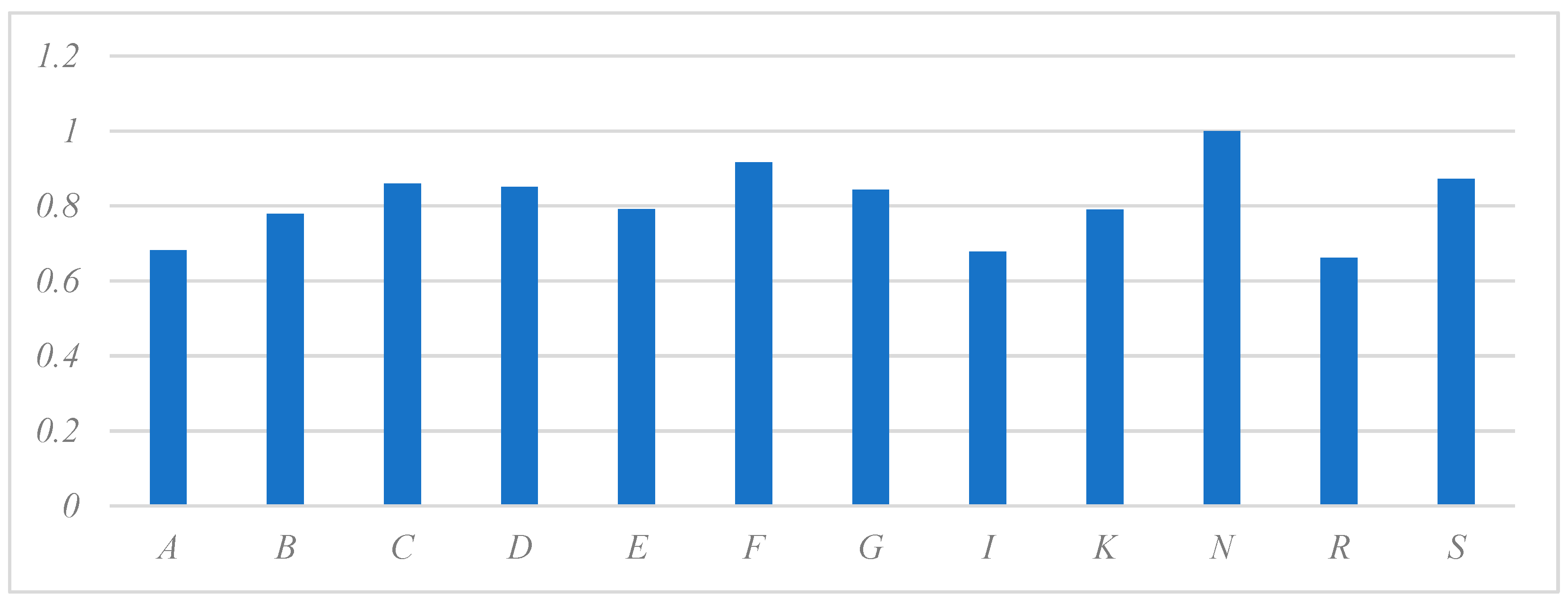

4.2.1. Measurement of the Total Efficiency

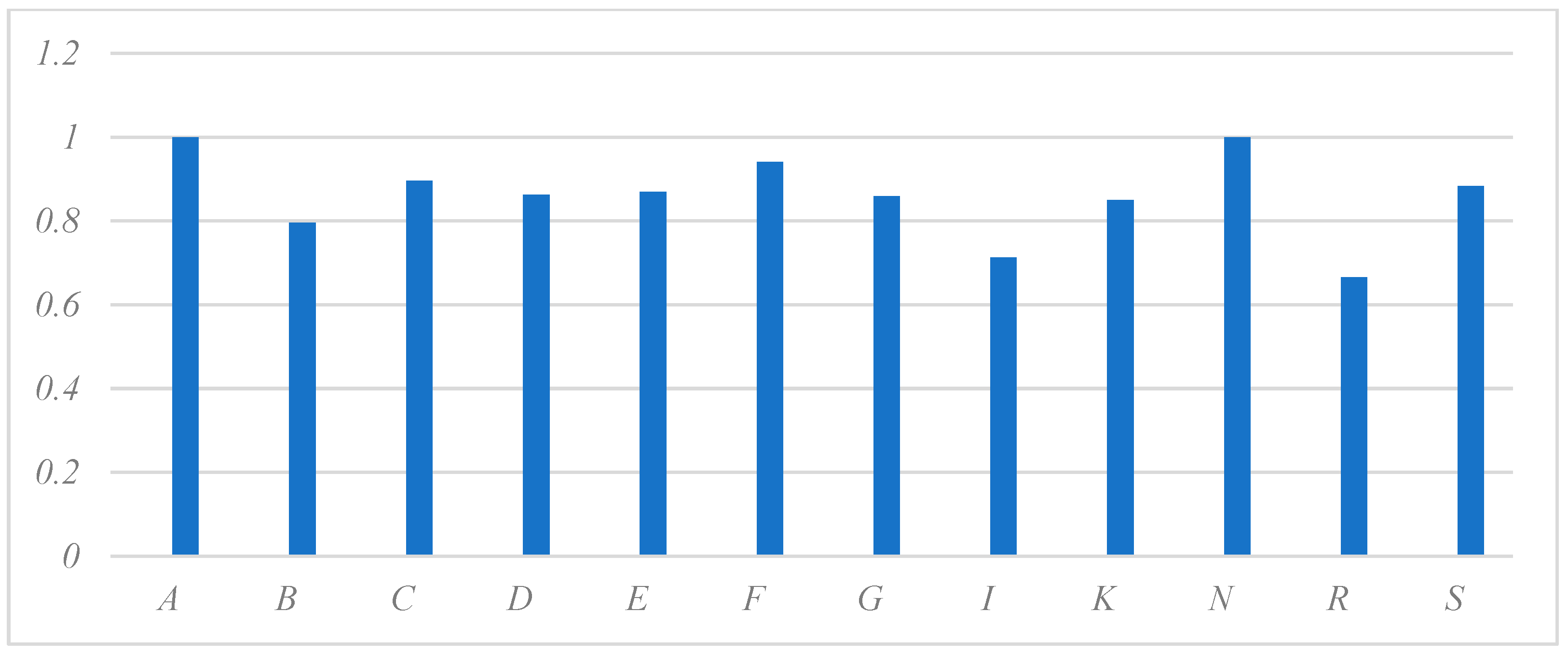

4.2.2. Measurement of the Pure Technical Efficiency

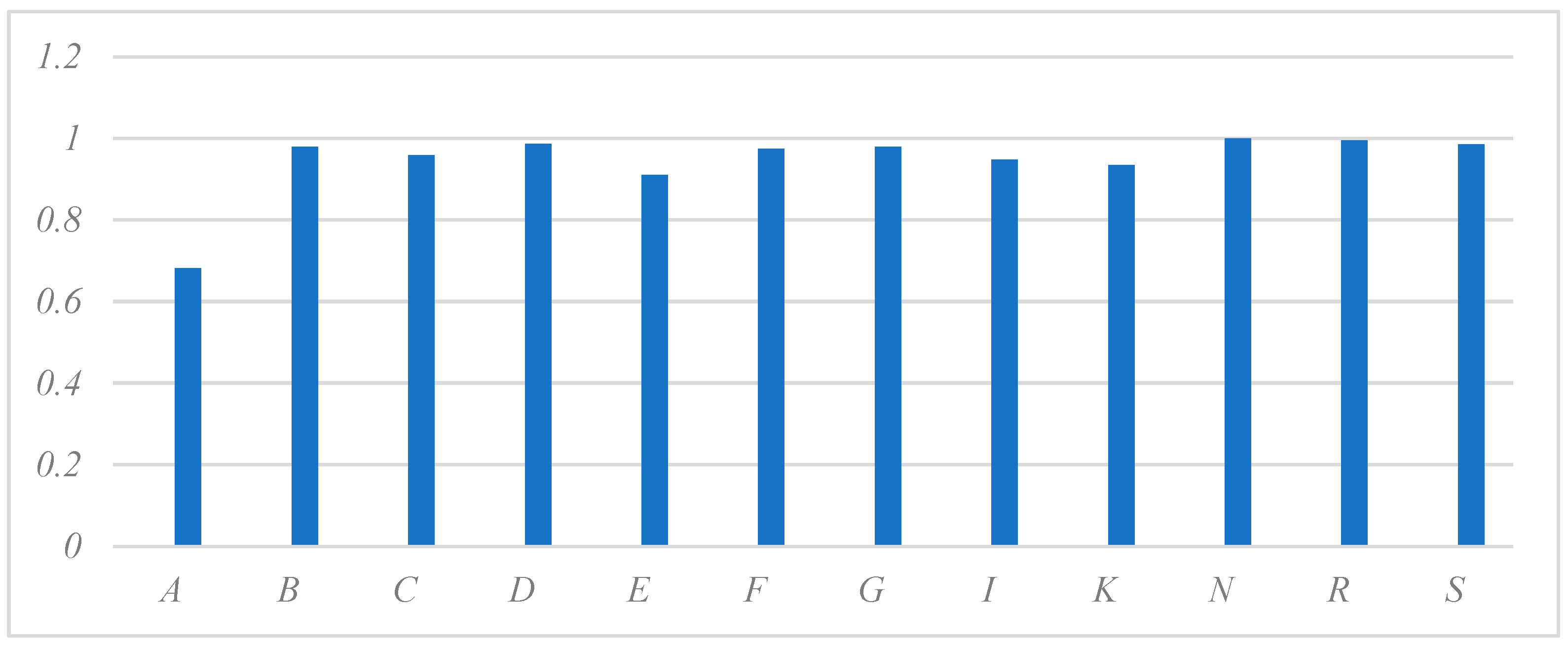

4.2.3. Measurement of the Scale Efficiency and Scale Return

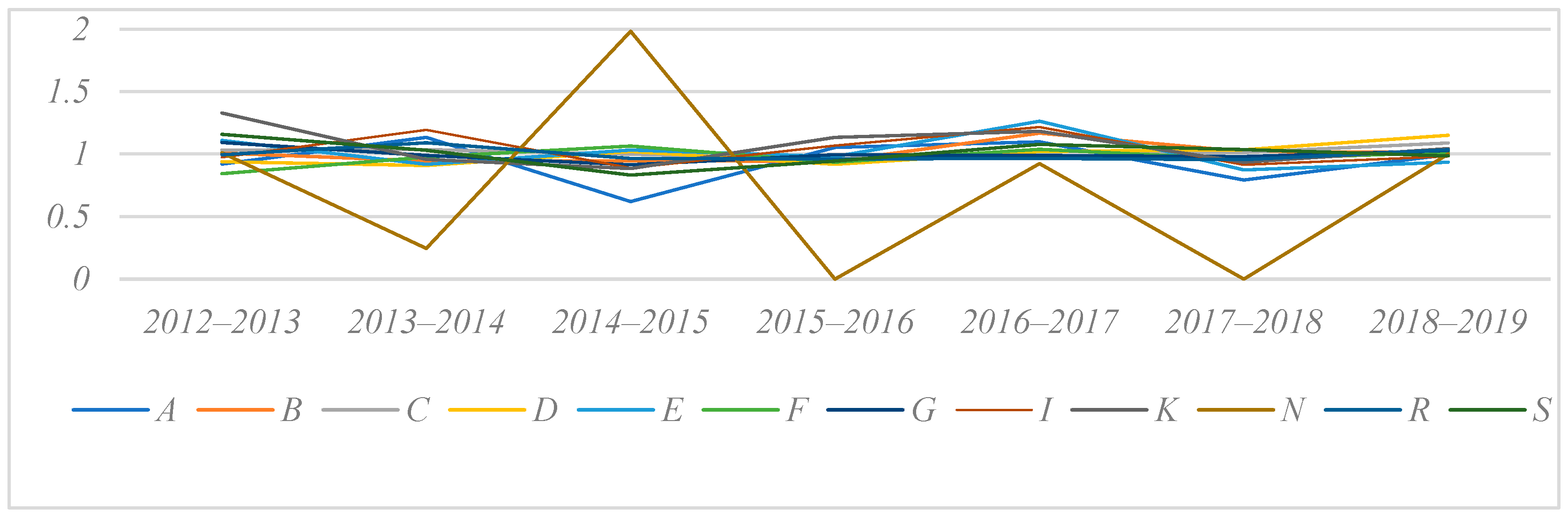

4.3. Dynamic Measurement of Financing Efficiency of Low-Carbon Supply Chain

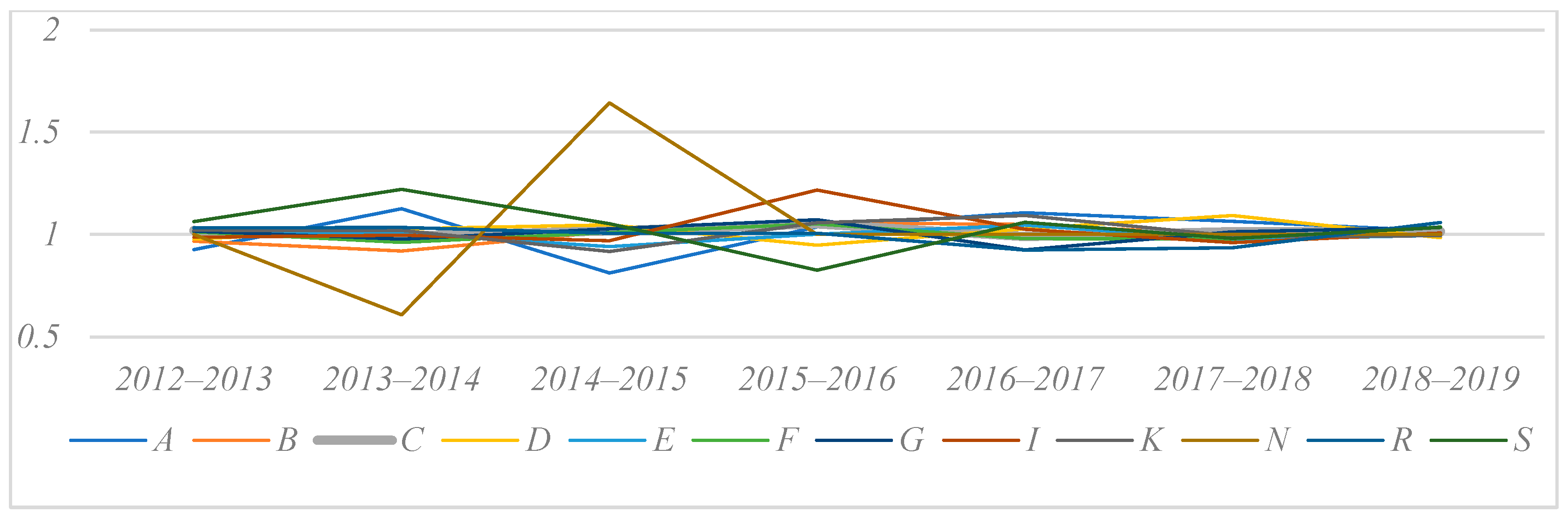

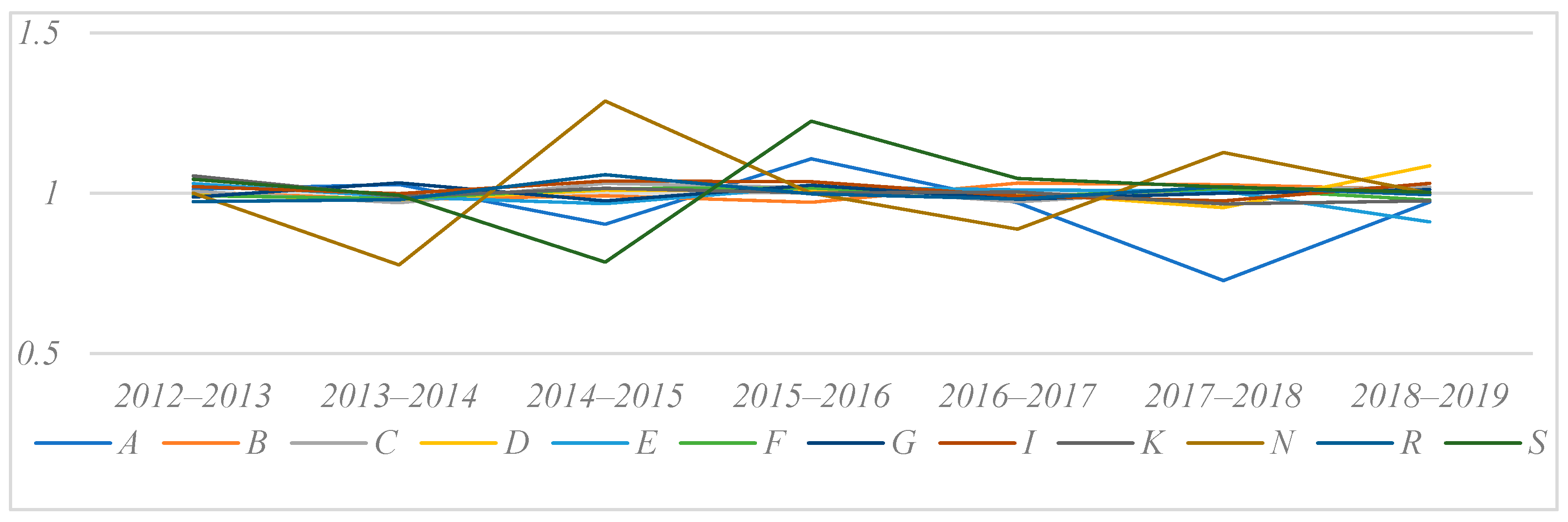

4.3.1. Measurement of the Change in Total Factor Productivity Index

4.3.2. Measurement of the Change in Pure Technical Efficiency

4.3.3. Measurement of Changes in Scale Efficiency

4.3.4. Measurement of Changes in Technological Progress

4.3.5. Agriculture, Forestry, Animal Husbandry, and Fishing Industry (A)

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Mallapaty, S. How China could be carbon neutral by mid-century. Nature 2020, 586, 482–484. [Google Scholar] [CrossRef] [PubMed]

- Zhang, S.; Bai, X.; Zhao, C.; Tan, Q.; Luo, G.; Wu, L.; Xi, H.; Li, C.; Chen, F.; Ran, C. China’s carbon budget inventory from 1997 to 2017 and its challenges to achieving carbon neutral strategies. J. Clean. Prod. 2022, 347, 130966. [Google Scholar] [CrossRef]

- Chi, Y.; Xiao, M.; Pang, Y.; Yang, M.; Zheng, Y. Financing Efficiency Evaluation and Influencing Factors of Hydrogen Energy Listed Enterprises in China. Energies 2022, 15, 281. [Google Scholar] [CrossRef]

- Liu, Z.; Deng, Z.; He, G.; Wang, H.; Zhang, X.; Lin, J.; Qi, Y.; Liang, X. Challenges and opportunities for carbon neutrality in China. Nat. Rev. Earth Environ. 2022, 3, 141–155. [Google Scholar] [CrossRef]

- Giebel, M.; Kraft, K. External financing constraints and firm innovation. J. Ind. Econ. 2019, 67, 91–126. [Google Scholar] [CrossRef]

- Calabrese, R.; Cowling, M.; Liu, W. Understanding the dynamics of UK COVID-19 SME financing. Brit. J. Manag. 2022, 33, 657–677. [Google Scholar] [CrossRef]

- Chowdhury, P.; Paul, S.K.; Kaisar, S.; Moktadir, M.A. COVID-19 pandemic related supply chain studies: A systematic review. Transp. Res. Part E Logist. Transp. Rev. 2021, 148, 102271. [Google Scholar] [CrossRef]

- Ghosh, B.; Papathanasiou, S.; Dar, V.; Gravas, K. Bubble in Carbon Credits during COVID-19: Financial Instability or Positive Impact (“Minsky” or “Social”)? J. Risk Financ. Manag. 2022, 15, 367. [Google Scholar] [CrossRef]

- Li, F.; Di, H. Analysis of the financing structure of China’s listed new energy companies under the goal of peak CO2 emissions and carbon neutrality. Energies 2021, 14, 5636. [Google Scholar] [CrossRef]

- Liang, X.; Zhao, X.; Wang, M.; Li, Z. Small and medium-sized enterprises sustainable supply chain financing decision based on triple bottom line theory. Sustainability 2018, 10, 4242. [Google Scholar] [CrossRef]

- Randall, W.S.; Farris, M.T. Supply chain financing: Using cash-to-cash variables to strengthen the supply chain. Int. J. Phys. Distr. Log. 2009, 39, 669–689. [Google Scholar] [CrossRef]

- Huang, C.; Chan, F.T.; Chung, S.H. Recent contributions to supply chain finance: Towards a theoretical and practical research agenda. Int. J. Prod. Res. 2022, 60, 493–516. [Google Scholar] [CrossRef]

- Kang, K.; Zhao, Y.; Zhang, J.; Qiang, C. Evolutionary game theoretic analysis on low-carbon strategy for supply chain enterprises. J. Clean. Prod. 2019, 230, 981–994. [Google Scholar] [CrossRef]

- Xia, T.; Wang, Y.; Lv, L.; Shen, L.; Cheng, T. Financing decisions of low-carbon supply Chain under Chain-to-Chain competition. Int. J. Prod. Res. 2022, 1–24. [Google Scholar] [CrossRef]

- Yang, L.; Chen, Y.; Ji, J. Cooperation modes of operations and financing in a low-carbon supply chain. Sustainability 2018, 10, 821. [Google Scholar] [CrossRef]

- An, S.; Li, B.; Song, D.; Chen, X. Green credit financing versus trade credit financing in a supply chain with carbon emission limits. Eur. J. Oper. Res. 2021, 292, 125–142. [Google Scholar] [CrossRef]

- Cao, E.; Du, L.; Ruan, J. Financing preferences and performance for an emission-dependent supply chain: Supplier vs. bank. Int. J. Prod. Econ. 2019, 208, 383–399. [Google Scholar] [CrossRef]

- Liu, Z.; Xu, J.; Wei, Y.; Hatab, A.A.; Lan, J. Nexus between green financing, renewable energy generation, and energy efficiency: Empirical insights through DEA technique. Environ. Sci. Pollut. R 2021, 1–14. [Google Scholar] [CrossRef]

- Wang, Y.; Yu, Z.; Jin, M.; Mao, J. Decisions and coordination of retailer-led low-carbon supply chain under altruistic preference. Eur. J. Oper. Res. 2021, 293, 910–925. [Google Scholar] [CrossRef]

- Han, Q.; Wang, Y. Decision and coordination in a low-carbon e-supply chain considering the manufacturer’s carbon emission reduction behavior. Sustainability 2018, 10, 1686. [Google Scholar] [CrossRef]

- Rad, R.S.; Nahavandi, N. A novel multi-objective optimization model for integrated problem of green closed loop supply chain network design and quantity discount. J. Clean. Prod. 2018, 196, 1549–1565. [Google Scholar]

- Zhou, X.; Li, T.; Ma, X. A bibliometric analysis of comparative research on the evolution of international and Chinese green supply chain research hotspots and frontiers. Environ. Sci. Pollut. R 2021, 28, 6302–6323. [Google Scholar] [CrossRef] [PubMed]

- Suryanto, T.; Haseeb, M.; Hartani, N.H. The correlates of developing green supply chain management practices: Firms level analysis in Malaysia. Int. J. Supply Chain. Manag. 2018, 7, 316. [Google Scholar]

- Cariou, P.; Parola, F.; Notteboom, T. Towards low carbon global supply chains: A multi-trade analysis of CO2 emission reductions in container shipping. Int. J. Prod. Econ. 2019, 208, 17–28. [Google Scholar] [CrossRef]

- Mao, Z.; Zhang, S.; Li, X. Low carbon supply chain firm integration and firm performance in China. J. Clean. Prod. 2017, 153, 354–361. [Google Scholar] [CrossRef]

- Nishitani, K.; Kokubu, K.; Kajiwara, T. Does low-carbon supply chain management reduce greenhouse gas emissions more effectively than existing environmental initiatives? An empirical analysis of Japanese manufacturing firms. J. Manag. Control 2016, 27, 33–60. [Google Scholar] [CrossRef]

- Yuan, B.; He, L.; Gu, B.; Zhang, Y. The evolutionary game theoretic analysis for emission reduction and promotion in low-carbon supply chains. Appl. Sci. 2018, 8, 1965. [Google Scholar] [CrossRef]

- Zhang, X.; Xiu, G.; Shahzad, F.; Duan, C. The Impact of Equity Financing on the Performance of Capital-Constrained Supply Chain under Consumers’ Low-Carbon Preference. Int. J. Environ. Res. Public Health 2021, 18, 2329. [Google Scholar] [CrossRef]

- Wu, C.; Xu, C.; Zhao, Q.; Lin, S. Research on financing strategy of low-carbon supply chain based on cost-sharing contract. Environ. Sci. Pollut. R 2022, 29, 48358–48375. [Google Scholar] [CrossRef]

- Shaharudin, M.S.; Fernando, Y.; Jabbour, C.J.C.; Sroufe, R.; Jasmi, M.F.A. Past, present, and future low carbon supply chain management: A content review using social network analysis. J. Clean. Prod. 2019, 218, 629–643. [Google Scholar] [CrossRef]

- Liu, X.; Du, W.; Sun, Y. Green supply chain decisions under different power structures: Wholesale price vs. revenue sharing contract. Int. J. Environ. Res. Public Health 2020, 17, 7737. [Google Scholar] [CrossRef] [PubMed]

- Peng, Q.; Wang, C.; Xu, L. Emission abatement and procurement strategies in a low-carbon supply chain with option contracts under stochastic demand. Comput. Ind. Eng. 2020, 144, 106502. [Google Scholar] [CrossRef]

- Li, B.; Geng, Y.; Xia, X.; Qiao, D. The impact of government subsidies on the low-carbon supply chain based on carbon emission reduction level. Int. J. Environ. Res. Public Health 2021, 18, 7603. [Google Scholar] [CrossRef]

- Lou, G.X.; Xia, H.Y.; Zhang, J.Q.; Fan, T.J. Investment strategy of emission-reduction technology in a supply chain. Sustainability 2015, 7, 10684–10708. [Google Scholar] [CrossRef]

- Tong, W.; Mu, D.; Zhao, F.; Mendis, G.P.; Sutherland, J.W. The impact of cap-and-trade mechanism and consumers’ environmental preferences on a retailer-led supply Chain. Resour. Conserv. Recycl. 2019, 142, 88–100. [Google Scholar] [CrossRef]

- Tseng, M.; Lim, M.; Wu, K.; Zhou, L.; Bui, D.T.D. A novel approach for enhancing green supply chain management using converged interval-valued triangular fuzzy numbers-grey relation analysis. Resour. Conserv. Recycl. 2018, 128, 122–133. [Google Scholar] [CrossRef]

- Ali, Z.; Bi, G.; Mehreen, A. Predicting supply chain effectiveness through supply chain finance: Evidence from small and medium enterprises. Int. J. Logist. Manag. 2019, 30, 488–505. [Google Scholar] [CrossRef]

- Fu, W.; Zhang, H.; Huang, F. Internet-based supply chain financing-oriented risk assessment using BP neural network and SVM. PLoS ONE 2022, 17, e0262222. [Google Scholar] [CrossRef] [PubMed]

- Hahn, G.J.; Brandenburg, M.; Becker, J. Valuing supply chain performance within and across manufacturing industries: A DEA-based approach. Int. J. Prod. Econ. 2021, 240, 108203. [Google Scholar] [CrossRef]

- Rumelhart, D.E.; Hinton, G.E.; Williams, R.J. Learning representations by back-propagating errors. Nature 1986, 323, 533–536. [Google Scholar] [CrossRef]

- Kuo, Y.; Yang, T.; Huang, G. The use of grey relational analysis in solving multiple attribute decision-making problems. Comput. Ind. Eng. 2008, 55, 80–93. [Google Scholar] [CrossRef]

- Bai, C.; Sarkis, J. Integrating sustainability into supplier selection with grey system and rough set methodologies. Int. J. Prod. Econ. 2010, 124, 252–264. [Google Scholar] [CrossRef]

- Kaswan, M.S.; Rathi, R. Investigation of life cycle assessment barriers for sustainable development in manufacturing using grey relational analysis and best worst method. Int. J. Sustain. Eng. 2021, 14, 672–685. [Google Scholar] [CrossRef]

- Doan, T. Supply chain management drivers and competitive advantage in manufacturing industry. Uncertain Supply Chain. Manag. 2020, 8, 473–480. [Google Scholar] [CrossRef]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Zhao, T.; Xie, J.; Chen, Y.; Liang, L. Coordination efficiency in two-stage network DEA: Application to a supplier–manufacturer sustainable supply chain. Int. J. Logist. Res. Appl. 2021, 25, 656–677. [Google Scholar] [CrossRef]

- Zhou, F.; Wang, X.; Lim, M.K.; He, Y.; Li, L. Sustainable recycling partner selection using fuzzy DEMATEL-AEW-FVIKOR: A case study in small-and-medium enterprises (SMEs). J. Clean. Prod. 2018, 196, 489–504. [Google Scholar] [CrossRef]

- Petroni, A.; Braglia, M. Vendor selection using principal component analysis. J. Supply Chain Manag. 2000, 36, 63–69. [Google Scholar] [CrossRef]

- Hatami-Marbini, A.; Hekmat, S.; Agrell, P.J. A strategy-based framework for supplier selection: A grey PCA-DEA approach. Oper. Res. 2022, 22, 263–297. [Google Scholar] [CrossRef]

- Florackis, C.; Ozkan, A. The impact of managerial entrenchment on agency costs: An empirical investigation using UK panel data. Eur. Financ. Manag. 2009, 15, 497–528. [Google Scholar] [CrossRef]

- Klumpp, M. Do forwarders improve sustainability efficiency? Evidence from a European DEA Malmquist Index Calculation. Sustainability 2017, 9, 842. [Google Scholar] [CrossRef]

- Chen, K.; Song, Y.; Pan, J.; Yang, G. Measuring destocking performance of the Chinese real estate industry: A DEA-Malmquist approach. Socio-Econ. Plan Sci. 2020, 69, 100691. [Google Scholar] [CrossRef]

- Wang, C.; Nguyen, N.; Fu, H.; Hsu, H.; Dang, T. Efficiency assessment of seaport terminal operators using DEA Malmquist and epsilon-based measure models. Axioms 2021, 10, 48. [Google Scholar] [CrossRef]

- Xue, W.; Li, H.; Ali, R.; Rehman, R.U.; Fernández-Sánchez, G. Assessing the static and dynamic efficiency of scientific research of HEIs China: Three stage dea–malmquist index approach. Sustainability 2021, 13, 8207. [Google Scholar] [CrossRef]

- Tachega, M.A.; Yao, X.; Liu, Y.; Ahmed, D.; Li, H.; Mintah, C. Energy efficiency evaluation of oil producing economies in Africa: DEA, malmquist and multiple regression approaches. Clean. Environ. Syst. 2021, 2, 100025. [Google Scholar] [CrossRef]

- Lyu, X.; Shi, A. Research on the renewable energy industry financing efficiency assessment and mode selection. Sustainability 2018, 10, 222. [Google Scholar] [CrossRef]

- Tseng, M.; Wu, K.; Chiu, A.S.; Lim, M.K.; Tan, K. Reprint of: Service innovation in sustainable product service systems: Improving performance under linguistic preferences. Int. J. Prod. Econ. 2019, 217, 159–170. [Google Scholar] [CrossRef]

- Jin, Y.; Gao, X.; Wang, M. The financing efficiency of listed energy conservation and environmental protection firms: Evidence and implications for green finance in China. Energy Policy 2021, 153, 112254. [Google Scholar] [CrossRef]

- Liang, L.; Yang, F.; Cook, W.D.; Zhu, J. DEA models for supply chain efficiency evaluation. Ann. Oper. Res. 2006, 145, 35–49. [Google Scholar] [CrossRef]

- Xinxiu, X.; Tinghua, L.; Fengjuan, K. A Literature Review of the Influence of Commercial Credit on the Efficiency of Enterprise Capital Allocation. J. Financ. Res. 2021, 5, 56–66. [Google Scholar] [CrossRef]

- Ge, Y.; Qiu, J. Financial development, bank discrimination and trade credit. J. Bank Financ. 2007, 31, 513–530. [Google Scholar] [CrossRef]

- Zhou, Z.; Zhang, L.; Lin, L.; Zeng, H.; Chen, X. Carbon risk management and corporate competitive advantages:”Differential promotion” or “cost hindrance”? Bus. Strategy Environ. 2020, 29, 1764–1784. [Google Scholar] [CrossRef]

- Groth, M.; Seipold, P. Business strategies and Climate Change—Prototype Development and Testing of a User Specific Climate Service Product for Companies Handbook of Climate Services; Springer: Berlin/Heidelberg, Germany, 2020; pp. 51–66. [Google Scholar]

- Tan, X.; Na, S.; Guo, L.; Chen, J.; Ruan, Z. External Financing Efficiency of Rural Revitalization Listed Companies in China—Based on Two-Stage DEA and Grey Relational Analysis. Sustainability 2019, 11, 4413. [Google Scholar] [CrossRef]

- Marchi, B.; Zanoni, S.; Ferretti, I.; Zavanella, L.E. Stimulating investments in energy efficiency through supply chain integration. Energies 2018, 11, 858. [Google Scholar] [CrossRef]

- Chen, H.; Guo, W.; Feng, X.; Wei, W.; Liu, H.; Feng, Y.; Gong, W. The impact of low-carbon city pilot policy on the total factor productivity of listed enterprises in China. Resour. Conserv. Recycl. 2021, 169, 105457. [Google Scholar] [CrossRef]

- Zhou, Z.; Liu, J.; Zeng, H.; Zhang, T.; Chen, X. How does soil pollution risk perception affect farmers’ pro-environmental behavior? The role of income level. J. Environ. Manag. 2020, 270, 110806. [Google Scholar] [CrossRef]

- Song, H.; Yang, X.; Yu, K. How do supply chain network and SMEs’ operational capabilities enhance working capital financing? An integrative signaling view. Int. J. Prod. Econ. 2020, 220, 107447. [Google Scholar] [CrossRef]

| Item | Item Description | Keywords | Reference |

|---|---|---|---|

| Q1 | Enterprises have adopted market mechanisms to save carbon during the reporting period | Carbon, CO2, environment, environmental protection, emission reduction, value chain, industrial chain, green, ecology, climate change, sustainable, clean, target, control, management, strategy, conservation, risk, internal control, awareness, monitoring, monitoring, energy saving | Tseng et al. [57], Zhou et al. [62] and THE CDP2017 Climate Change Questionnaire [63] |

| Q2 | Enterprises actively purchase low-carbon materials in the reporting period | ||

| Q3 | Enterprises and supply chain enterprises work together to solve the low-carbon problem | ||

| Q4 | Enterprises have formulated low-carbon management regulations or documents to guide carbon emission reduction work | ||

| Q5 | Enterprises regularly monitor the carbon reduction process through a comprehensive management assessment system and/or specific carbon management assessment system | ||

| Q6 | Enterprises have established relatively effective emission reduction targets during the reporting year | ||

| Q7 | Enterprises report ongoing mitigation actions during the year | ||

| Q8 | Enterprises have a perfect monitoring and measurement system for carbon emissions | ||

| Q9 | Enterprises disclose specific numbers of carbon emissions, emissions reductions, or emission reduction rates | ||

| Q10 | Enterprises through emission reduction management, emission reduction targets to obtain social or government recognition |

| Input/Output Indicators | Index Name | Index Definition |

|---|---|---|

| Input indicators | Total assets | Ln (total assets) |

| Asset–liability ratio | Total liabilities/total assets | |

| Commercial credit | Ln (Accounts payable + Notes payable + Accounts received in advance) | |

| Low carbon supply chain finance behavior | Obtained by qualitative analysis | |

| Output indicators | Total asset turnover | Operating income/total average assets |

| Operating income | Ln (Income from main business + income from other business) | |

| Return on equity | Net profit/net asset | |

| Supply chain integration | The ratio of mean and variance of the proportion of the trading volume of five suppliers and customers in annual total trading volume in three consecutive years |

| Component | Initial Eigenvalue | Extract the Sum of Squares of Loads | Sum of Squares of Rotational Loads | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Eigenvalue | Percentage of Variance | Cumulative (%) | Eigenvalue | Percentage of Variance | Cumulative (%) | Eigenvalue | Percentage of Variance | Cumulative (%) | |

| 1 | 5.353 | 53.528 | 53.528 | 5.353 | 53.528 | 53.528 | 3.765 | 37.654 | 37.654 |

| 2 | 1.667 | 16.669 | 70.197 | 1.667 | 16.669 | 70.197 | 3.023 | 30.228 | 67.881 |

| 3 | 1.013 | 10.131 | 80.328 | 1.013 | 10.131 | 80.328 | 1.245 | 12.446 | 80.328 |

| Item | Component | Composite Score Coefficient | Weight Coefficient | ||

|---|---|---|---|---|---|

| F1 | F2 | F3 | |||

| Q1 | −0.115 | 0.155 | 0.416 | 0.008 | 0.004 |

| Q2 | 0.372 | 0.137 | −0.146 | 0.258 | 0.146 |

| Q3 | −0.116 | 0.380 | 0.192 | 0.026 | 0.014 |

| Q4 | 0.380 | −0.213 | −0.016 | 0.207 | 0.117 |

| Q5 | −0.109 | 0.467 | −0.030 | 0.020 | 0.012 |

| Q6 | 0.308 | −0.179 | 0.113 | 0.182 | 0.103 |

| Q7 | 0.274 | 0.432 | −0.297 | 0.235 | 0.133 |

| Q8 | 0.154 | 0.097 | 0.875 | 0.233 | 0.132 |

| Q9 | 0.321 | 0.356 | 0.234 | 0.317 | 0.179 |

| Q10 | 0.308 | 0.460 | −0.138 | 0.283 | 0.160 |

| Industry | Industry Code | Total Efficiency (TE) | Pure Technical Efficiency (PTE) | Scale Efficiency (SE) | Return to Scale |

|---|---|---|---|---|---|

| Agriculture, Forestry, Animal Husbandry, and Fishing Industry | A | 0.682 | 1 | 0.681 | IRS |

| Extractive Industries | B | 0.779 | 0.796 | 0.979 | IRS |

| Manufacturing Industry | C | 0.859 | 0.896 | 0.958 | IRS |

| Electricity, Heat, Gas, and Water Production and Supply Industries | D | 0.851 | 0.862 | 0.986 | IRS |

| Construction Industry | E | 0.792 | 0.869 | 0.910 | IRS |

| Wholesale and Retail Industry | F | 0.916 | 0.940 | 0.974 | IRS |

| Transportation, Warehousing, and Postal Industries | G | 0.843 | 0.859 | 0.979 | IRS |

| Information Transmission, Software, and Information Technology Service Industry | I | 0.678 | 0.712 | 0.947 | IRS |

| Real Estate Industry | K | 0.790 | 0.849 | 0.933 | IRS |

| Water, Environment, and Utilities Management Industry | N | 1 | 1 | 1 | — |

| Culture, Sports, and Entertainment Industry | R | 0.662 | 0.666 | 0.995 | IRS |

| Comprehensive Industry | S | 0.872 | 0.883 | 0.985 | IRS |

| Mean | Mean | 0.810 | 0.861 | 0.944 | —— |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, F.; Liu, J.; Liu, X.; Zhang, H. Static and Dynamic Evaluation of Financing Efficiency in Enterprises’ Low-Carbon Supply Chain: PCA–DEA–Malmquist Model Method. Sustainability 2023, 15, 2510. https://doi.org/10.3390/su15032510

Chen F, Liu J, Liu X, Zhang H. Static and Dynamic Evaluation of Financing Efficiency in Enterprises’ Low-Carbon Supply Chain: PCA–DEA–Malmquist Model Method. Sustainability. 2023; 15(3):2510. https://doi.org/10.3390/su15032510

Chicago/Turabian StyleChen, Fayu, Jinhao Liu, Xiaoyu Liu, and Hua Zhang. 2023. "Static and Dynamic Evaluation of Financing Efficiency in Enterprises’ Low-Carbon Supply Chain: PCA–DEA–Malmquist Model Method" Sustainability 15, no. 3: 2510. https://doi.org/10.3390/su15032510

APA StyleChen, F., Liu, J., Liu, X., & Zhang, H. (2023). Static and Dynamic Evaluation of Financing Efficiency in Enterprises’ Low-Carbon Supply Chain: PCA–DEA–Malmquist Model Method. Sustainability, 15(3), 2510. https://doi.org/10.3390/su15032510