Green Credit Policy and Short-Term Financing for Long-Term Investment: Evidence from China’s Heavily Polluting Enterprises

Abstract

1. Introduction

2. Theoretical Analysis and Research Hypothesis

3. Research Design

3.1. Sample Selection and Data Source

3.2. Variable Definition

3.3. Model Design

4. Results of Empirical Tests

4.1. Descriptive Statistics

4.2. Basic Test Results

4.3. Mediation Test Results for Short-Term Debt and Over-Investment

4.4. Moderating Test Results for Government Subsidies

5. Robustness Tests

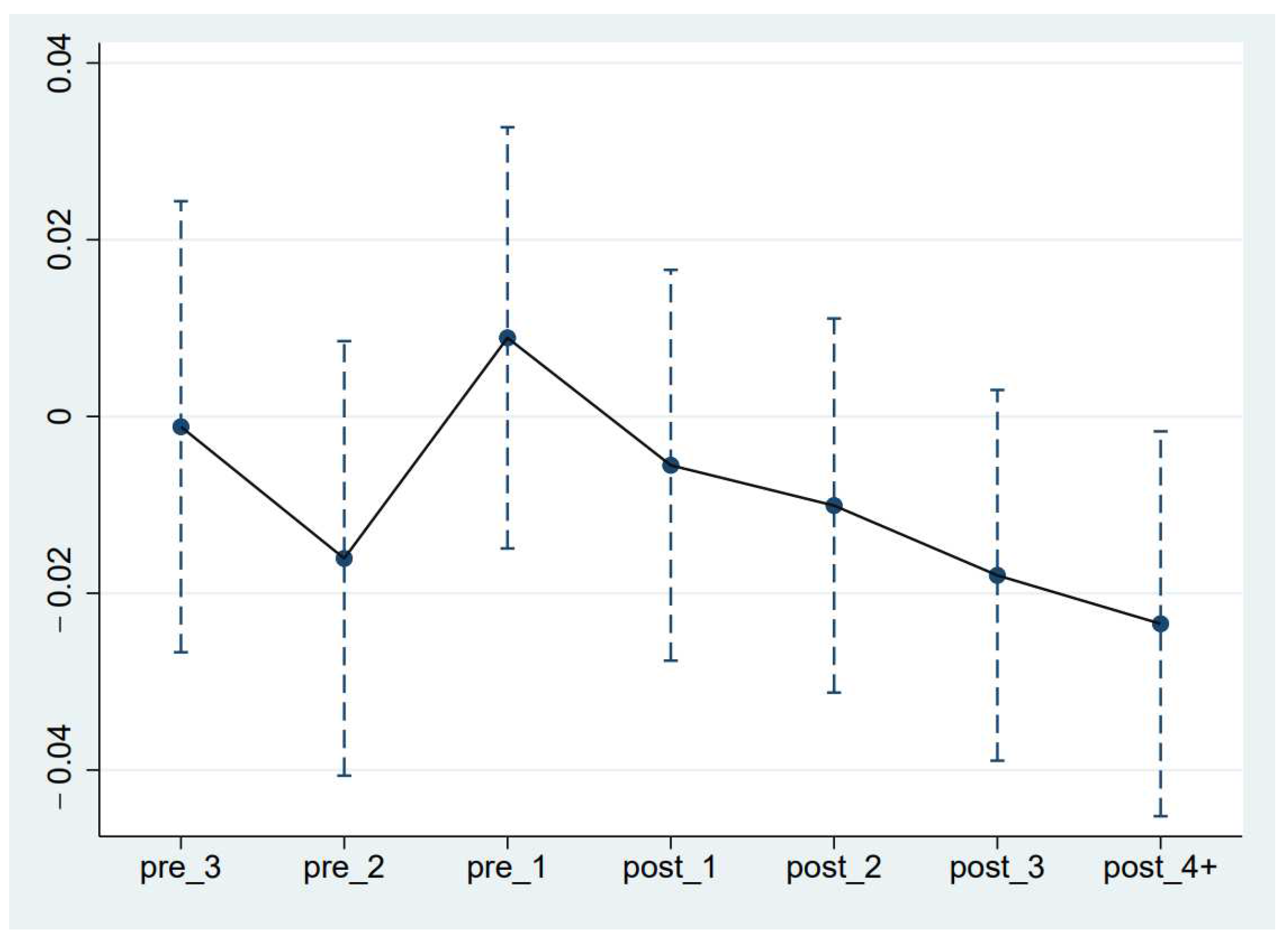

5.1. Parallel Trend Test

5.2. PSM-DID

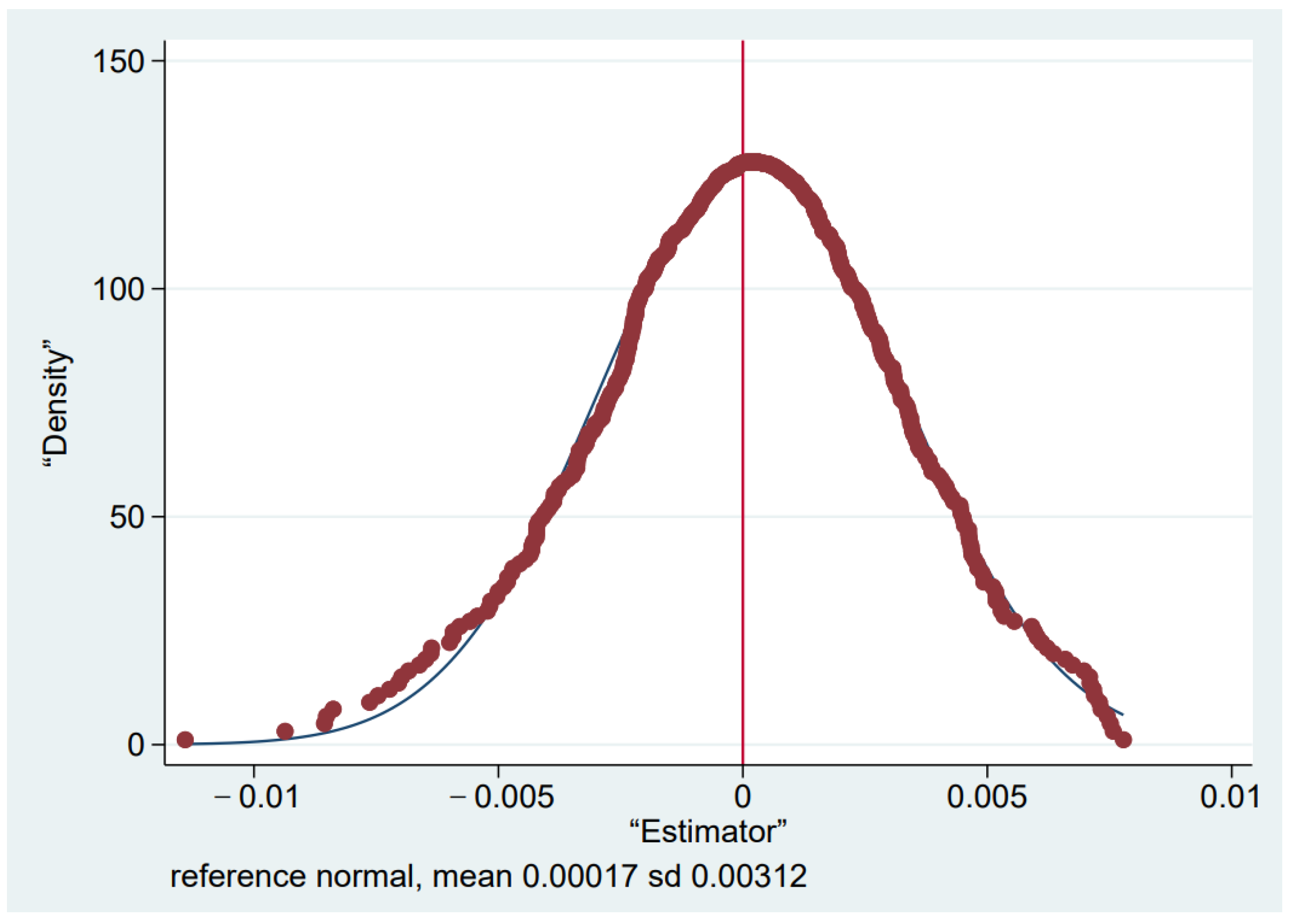

5.3. Placebo Test

6. Heterogeneity Analysis

6.1. Analysis of Heterogeneity of Environmental Regulatory Intensity

6.2. Analysis of Heterogeneity of Bank-Enterprise Shareholding Linkages

6.3. Analysis of Heterogeneity of Experience in Financial Institutions

6.4. Analysis of Heterogeneity of Innovation Intensity

7. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Scholtens, B. Finance as a Driver of Corporate Social Responsibility. J. Bus. Ethics 2006, 68, 19–33. [Google Scholar] [CrossRef]

- Bagus, P.; Howden, D. The legitimacy of loan maturity mismatching: A risky, but not fraudulent, undertaking. J. Bus. Ethics 2009, 90, 399–406. [Google Scholar] [CrossRef][Green Version]

- Davidson, L. Ethical differences between loan maturity mismatching and fractional reserve banking: A natural law approach. J. Bus. Ethics 2015, 131, 9–18. [Google Scholar] [CrossRef]

- Morris, J.R. On corporate debt maturity strategies. J. Financ. 1976, 31, 29–37. [Google Scholar] [CrossRef]

- Zhang, X.; Hao, T. Investment and financing maturity mismatch and corporate bond default risk. Res. Financ. Issue 2022, 2, 63–71. [Google Scholar]

- Converse, N. Uncertainty, capital flows, and maturity mismatch. J. Int. Money Financ. 2018, 88, 260–275. [Google Scholar] [CrossRef]

- Bleakley, H.; Cowan, K. Maturity mismatch and financial crises: Evidence from emerging market Corporations. J. Dev. Econ. 2010, 93, 189–205. [Google Scholar] [CrossRef]

- Chai, S.; Zhang, K.; Wei, W.; Ma, W.; Abedin, M.Z. The impact of green credit policy on enterprises’ financing behavior: Evidence from Chinese heavily-polluting listed companies. J. Clean. Prod. 2022, 363, 132458. [Google Scholar] [CrossRef]

- Tian, C.; Li, X.; Xiao, L.; Zhu, B. Exploring the impact of green credit policy on green transformation of heavy polluting industries. J. Clean. Prod. 2022, 335, 130257. [Google Scholar] [CrossRef]

- Tang, Y.; Ho, K.C.; Wu, J.; Zou, L.; Yao, S. Directors and officers liability insurance and maturity mismatch: Evidence from China. Appl. Econ. 2023, 55, 3747–3765. [Google Scholar] [CrossRef]

- Custódio, C.; Ferreira, M.A.; Laureano, L. Why are US firms using more short-term debt? J. Financ. Econ. 2013, 108, 182–212. [Google Scholar] [CrossRef]

- Goyal, V.K.; Lehn, K.; Racic, S. Growth opportunities and corporate debt policy: The case of the US defense industry. J. Financ. Econ. 2002, 64, 35–59. [Google Scholar] [CrossRef]

- Etudaiye-Muhtar, O.F.; Ahmad, R.; Matemilola, B.T. Corporate debt maturity structure: The role of firm level and institutional determinants in selected African countries. Glob. Econ. Rev. 2017, 46, 422–440. [Google Scholar] [CrossRef]

- Fan, J.P.H.; Titman, S.; Twite, G. An international comparison of capital structure and debt maturity choices. J. Finac. Quant. Anal. 2012, 47, 23–56. [Google Scholar] [CrossRef]

- Antoniou, A.; Guney, Y.; Paudyal, K. The determinants of debt maturity structure: Evidence from France, Germany and the UK. Eur. Financ. Manag. 2006, 12, 161–194. [Google Scholar] [CrossRef]

- Feng, Y.; Liang, Z. How does green credit policy affect total factor productivity of the manufacturing firms in China? The mediating role of debt financing and the moderating role of environmental regulation. Environ. Sci. Pollut. Res. 2022, 29, 31235–31251. [Google Scholar] [CrossRef]

- Wang, E.; Liu, X.; Wu, J.; Cai, D. Green credit, debt maturity, and corporate investment—Evidence from China. Sustainability 2019, 11, 583. [Google Scholar] [CrossRef]

- Du, M.; Chai, S.; Wei, W.; Wang, S.; Li, Z. Will environmental information disclosure affect bank credit decisions and corporate debt financing costs? Evidence from China’s heavily polluting industries. Environ. Sci. Pollut. Res. 2022, 29, 47661–47672. [Google Scholar] [CrossRef]

- Zhang, M.; Zhang, X.; Song, Y.; Zhu, J. Exploring the impact of green credit policies on corporate financing costs based on the data of Chinese A-share listed companies from 2008 to 2019. J. Clean. Prod. 2022, 375, 134012. [Google Scholar] [CrossRef]

- Sakawa, H.; Watanabel, N. Earnings quality and internal control in bank-dominated corporate governance. Asian Bus. Manag. 2021, 20, 188–220. [Google Scholar] [CrossRef]

- Balaguer-Coll, M.T.; Brun-Martos, M.I. The effects of the political environment on transparency: Evidence from Spanish local governments. Policy Stud. 2021, 42, 152–172. [Google Scholar] [CrossRef]

- Luo, H.; Jia, X.; Wu, J. Internal control quality and maturity mismatch of enterprises’ investment and financing. Stud. Int. Financ. 2021, 9, 76–85. [Google Scholar]

- Ma, H.; Hou, G.S.; Wang, Y.Y. Financial-industrial integration and maturity mismatch of investment and financing in China. Nankai Bus. Rev. 2018, 21, 46–53. [Google Scholar]

- Marks, J.M.; Shang, C. Does stock liquidity affect corporate debt maturity structure? Q. J. Financ. 2021, 11, 2150005. [Google Scholar] [CrossRef]

- Mandelker, G.N.; Rhee, S.G. The impact of the degrees of operating and financial leverage on systematic risk of common stock. J. Financ. Quant. Anal. 1984, 19, 45–57. [Google Scholar] [CrossRef]

- Liu, B.; Li, Y. A study on the mechanism of managers’ business risk perception on firms’ extreme cash flow risk—Empirical evidence based on dual levels of empirical research and case studies. Nankai Manag. Rev. 2023, 1–21. Available online: http://kns.cnki.net/kcms/detail/12.1288.f.20221129.1155.002.html (accessed on 10 November 2023).

- Wang, C.W.; Chiu, W.C.; King, T.H.D. Debt maturity and the cost of bank loans. J. Bank Financ. 2020, 112, 105235. [Google Scholar] [CrossRef]

- DeMarzo, P.M.; He, Z. Leverage dynamics without commitment. J. Financ. 2021, 76, 1195–1250. [Google Scholar] [CrossRef]

- He, Z.; Xiong, W. Rollover Risk and Credit Risk. J. Financ. 2012, 67, 391–430. [Google Scholar] [CrossRef]

- Huang, R.; Tan, K.J.K.; Faff, R.W. CEO overconfidence and corporate debt maturity. J. Corp. Financ. 2016, 36, 93–110. [Google Scholar] [CrossRef]

- Yang, M.; Wang, H. The decision of investment and financial influenced by executives with overseas values: Based on individualism-overconfidence. Appl. Econ. 2023, 1–19. [Google Scholar] [CrossRef]

- Shang, C. Dare to play with fire? Managerial ability and the use of short-term debt. J. Corp. Financ. 2021, 70, 102065. [Google Scholar] [CrossRef]

- Kalemli-Özcan, Ş.; Laeven, L.; Moreno, D. Debt overhang, rollover risk, and corporate investment: Evidence from the European crisis. J. Eur. Econ. Assoc. 2022, 20, 2353–2395. [Google Scholar] [CrossRef]

- Jensen, M.C. Agency costs of free cash flow, corporate finance, and takeovers. Am. Econ. Rev. 1986, 76, 323–329. [Google Scholar]

- Park, K.; Jang, S.S. Capital structure, free cash flow, diversification and firm performance: A holistic analysis. Int. J. Hosp. Manag. 2013, 33, 51–63. [Google Scholar] [CrossRef]

- Lei, N.; Miao, Q.; Yao, X. Does the implementation of green credit policy improve the ESG performance of enterprises? Evidence from a quasi-natural experiment in China. Econ. Model. 2023, 127, 106478. [Google Scholar] [CrossRef]

- Lin, Y.E.; Li, Y.W.; Cheng, T.Y.; Lam, K. Corporate social responsibility and investment efficiency: Does business strategy matter? Int. Rev. Financ. Anal. 2021, 73, 101585. [Google Scholar] [CrossRef]

- Qi, M. Green credit, financial ecological environment, and investment efficiency. Complexity 2021, 2021, 5539195. [Google Scholar] [CrossRef]

- Dang, M.; Puwanenthiren, P.; Jones, E.; Nguyen, T.Q.; Vo, X.V.; Nadarajah, S. Strategic archetypes, credit ratings, and cost of debt. Econ. Model. 2022, 114, 105917. [Google Scholar] [CrossRef]

- Howell, S.T. Financing innovation: Evidence from R&D grants. Am. Econ. Rev. 2017, 107, 1136–1164. [Google Scholar]

- Yan, Z.; Li, Y. Signaling through government subsidy: Certification or endorsement. Financ. Res. Lett. 2018, 25, 90–95. [Google Scholar] [CrossRef]

- Meuleman, M.; De Maeseneire, W. Do R&D subsidies affect SMEs’ access to external financing? Res. Policy 2012, 41, 580–591. [Google Scholar]

- Chiappini, R.; Montmartin, B.; Pommet, S.; Demaria, S. Can direct innovation subsidies relax SMEs’ financial constraints? Res. Policy 2022, 51, 104493. [Google Scholar] [CrossRef]

- Brander, J.A.; Du, Q.; Hellmann, T. The effects of government-sponsored venture capital: International evidence. Rev. Financ. 2015, 19, 571–618. [Google Scholar] [CrossRef]

- Wu, T.; Yang, S.; Tan, J. Impacts of government R&D subsidies on venture capital and renewable energy investment—An empirical study in China. Resour. Policy 2020, 68, 101715. [Google Scholar]

- Tang, D.; Li, Y.; Zheng, H.; Wang, B. Government Science and Technology Expenditures, Fiscal Policy Instruments and Corporate Risk Taking-An Analysis Based on Public Risk Perspective. Financ. Resour. 2021, 5, 55–69. [Google Scholar]

- Fan, L.; Yang, K.; Liu, L. New media environment, environmental information disclosure and firm valuation: Evidence from high-polluting enterprises in China. J. Clean. Prod. 2020, 277, 123253. [Google Scholar] [CrossRef]

- Liu, S.; Li, D.; Chen, X. Environmental regulatory pressures and the short-term debt for long-term investment of heavy-polluting enterprises: Quasi-natural experiment from China. Environ. Sci. Pollut. Res. 2023, 30, 62625–62640. [Google Scholar] [CrossRef] [PubMed]

- Bai, M. Rollover restrictions and the maturity mismatch between investment and enterprise financing. Manag. Decis. Econ. 2022, 43, 3286–3300. [Google Scholar] [CrossRef]

- Richardson, S. Over-investment of free cash flow. Rev. Account. Stud. 2006, 11, 159–189. [Google Scholar] [CrossRef]

- Machokoto, M.; Mahonye, N.; Makate, M. Short-term financing sources in Africa: Substitutes or complements? Res. Int. Bus. Financ. 2022, 60, 101572. [Google Scholar] [CrossRef]

- Feng, T.; Xue, Z. The impact of government subsidies on corporate resilience: Evidence from the COVID-19 shock. Econ. Chang. Restruct. 2023, 1–23. [Google Scholar] [CrossRef]

- Cai, W.; Ye, P. How does environmental regulation influence enterprises’ total factor productivity? A quasi-natural experiment based on China’s new environmental protection law. J. Clean. Prod. 2020, 276, 124105. [Google Scholar] [CrossRef]

- Kong, G.; Wang, S.; Wang, Y. Fostering firm productivity through green finance: Evidence from a quasi-natural experiment in China. Econ. Model. 2022, 115, 105979. [Google Scholar] [CrossRef]

- Wang, S.; Zhao, H. Research on the impact of environmental protection tax reform on the green development of enterprises. Res. Manag. 2023, 44, 139–151. [Google Scholar]

| Abbreviation | Variable Name | Definition | |

|---|---|---|---|

| Explained variable | SFLI | Short-term financing for long-term investment | [Cash paid for buying fixed assets, intangible assets and other long-term assets − (The increase in long term loans + Increase in owners’ equity + Net cash flow from operating activities + Net cash flow from disposing fixed assets, intangible assets and other long-term assets)]/Total assets at the beginning of the year. |

| Explaining variable | DID | Interaction term | Time × Treat. |

| Time | Time dummy variable | Takes the value of 1 for 2012 and onwards, 0 for before. | |

| Treated | Group dummy variable | Heavily polluting companies equal to 1, otherwise equal to 0. | |

| Mediating variable | Ove-inv | Over-investment | Takes the value of residual if the residual is larger than 0, Otherwise the value is 0. |

| SD | Short-term Debt | Current liabilities/Asset size at year-end. | |

| Moderating variable | Sub | Government subsidies | total government subsidies/total operating income for the year. |

| Control Variables | Tasset | Ratio of tangible assets | (Total assets-net intangible assets-net goodwill)/Total assets at end of year. |

| Cash | Operating cash flow | Net cash flows from operating activities/total assets at end of year. | |

| Roa | Return on net assets | Net profit/shareholders’ equity. | |

| Growth | Total asset growth rate | Increase in assets for the year/total assets at year-beginning. | |

| Bo | Board size | Measured by the number of board members. | |

| Bi | Independent directors | The proportion of independent directors. | |

| Ins | Shareholding of Institutional investors | The proportion of shares held by institutional investors. | |

| Duality | CEO Duality | If the general manager is also the chairman of the board, the value is 1, otherwise it is 0. | |

| Soe | State-owned enterprise | State-owned enterprises equals to 1, otherwise equals to 0. | |

| TQ | Tobin Q | Market value/book value of assets | |

| Fin | Regional financial development | (local deposits + local loans)/local GDP. | |

| Variables | Mean | Sd | Min | P25 | P50 | P75 | Max |

|---|---|---|---|---|---|---|---|

| SFLI | −0.1157 | 0.3182 | −2.2351 | −0.1491 | −0.0529 | 0.0212 | 0.2998 |

| SD | 0.3795 | 0.1820 | 0.0478 | 0.2381 | 0.3652 | 0.5055 | 0.8307 |

| Overinv | 0.0178 | 0.0365 | 0.0000 | 0.0000 | 0.0000 | 0.0181 | 0.1870 |

| Sub | 0.0113 | 0.0182 | 0.0000 | 0.0015 | 0.0048 | 0.0125 | 0.1117 |

| Tasset | 0.9219 | 0.0966 | 0.4775 | 0.9063 | 0.9543 | 0.9802 | 1.0000 |

| Cash | 0.0422 | 0.0731 | −0.1830 | 0.0024 | 0.0408 | 0.0841 | 0.2434 |

| Roa | 0.0633 | 0.1316 | −0.6259 | 0.0245 | 0.0694 | 0.1216 | 0.3743 |

| Growth | 0.2160 | 0.4852 | −0.2908 | 0.0164 | 0.1072 | 0.2464 | 3.6728 |

| Bo | 9.5489 | 2.2991 | 5.0000 | 8.0000 | 9.0000 | 11.0000 | 17.0000 |

| Bi | 0.3753 | 0.0622 | 0.2500 | 0.3333 | 0.3636 | 0.4286 | 0.5833 |

| Ins | 49.2761 | 23.3630 | 0.9741 | 32.5130 | 50.6608 | 66.9919 | 97.0067 |

| Duality | 0.2213 | 0.4151 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 1.0000 |

| Soe | 0.4670 | 0.4989 | 0.0000 | 0.0000 | 0.0000 | 1.0000 | 1.0000 |

| TQ | 2.2475 | 1.5241 | 0.9024 | 1.2945 | 1.7504 | 2.5834 | 9.7212 |

| Fin | 3.4938 | 1.3736 | 1.7937 | 2.5584 | 3.1215 | 3.8331 | 7.5520 |

| Variables | SFLI |

|---|---|

| DID | −0.0161 *** |

| (−2.57) | |

| Tasset | 0.1707 *** |

| (6.64) | |

| Cash | −1.1961 *** |

| (−50.11) | |

| Roa | −0.1407 *** |

| (−10.49) | |

| Growth | −0.5419 *** |

| (−166.98) | |

| Bo | −0.0017 ** |

| (−2.03) | |

| Bi | 0.0874 *** |

| (2.83) | |

| Ins | −0.0005 *** |

| (−3.60) | |

| Duality | 0.0044 |

| (0.80) | |

| Soe | 0.0091 |

| (0.76) | |

| TQ | −0.0105 *** |

| (−6.78) | |

| Fin | 0.0081 |

| (1.52) | |

| Constant | −0.0939 *** |

| (−2.73) | |

| Year FE | YES |

| Firm FE | YES |

| R2 | 0.7961 |

| N | 12,076 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| SD | SFLI | Overinv | SFLI | |

| DID | −0.0095 ** | −0.0113 * | −0.0027 ** | −0.0125 ** |

| (−2.32) | (−1.91) | (−1.96) | (−2.09) | |

| Overinv | 1.3024 *** | |||

| (30.04) | ||||

| SD | 0.5103 *** | |||

| (35.01) | ||||

| Tasset | 0.1135 *** | 0.1128 *** | −0.0948 *** | 0.2942 *** |

| (6.78) | (4.64) | (−16.60) | (11.79) | |

| Cash | 0.0618 *** | −1.2276 *** | 0.0086 | −1.2073 *** |

| (3.97) | (−54.48) | (1.63) | (−52.83) | |

| Roa | −0.1488 *** | −0.0648 *** | 0.0082 *** | −0.1514 *** |

| (−17.03) | (−5.05) | (2.74) | (−11.78) | |

| Growth | 0.0074 *** | −0.5457 *** | 0.0138 *** | −0.5599 *** |

| (3.52) | (−178.14) | (19.16) | (−176.95) | |

| Bo | 0.0003 | −0.0019 ** | −0.0004 ** | −0.0012 |

| (0.45) | (−2.31) | (−2.30) | (−1.43) | |

| Bi | −0.0076 | 0.0913 *** | 0.0060 | 0.0795 *** |

| (−0.38) | (3.14) | (0.88) | (2.69) | |

| Ins | −0.0004 *** | −0.0003 ** | 0.0001 *** | −0.0007 *** |

| (−4.32) | (−2.29) | (4.47) | (−5.10) | |

| Duality | 0.0013 | 0.0037 | 0.0017 | 0.0021 |

| (0.37) | (0.72) | (1.45) | (0.40) | |

| Soe | 0.0096 | 0.0042 | −0.0006 | 0.0098 |

| (1.24) | (0.37) | (−0.22) | (0.86) | |

| TQ | 0.0002 | −0.0106 *** | −0.0001 | −0.0105 *** |

| (0.17) | (−7.25) | (−0.08) | (−7.06) | |

| Fin | 0.0088 | 0.0036 | 0.0001 | 0.0080 |

| (2.53) | (0.72) | (0.11) | (1.55) | |

| Constant | 0.2662 | −0.2298 *** | 0.0966 *** | −0.2198 *** |

| (11.87) | (−7.02) | (12.63) | (−6.61) | |

| Year FE | YES | YES | YES | YES |

| Firm FE | YES | YES | YES | YES |

| R2 | 0.0389 | 0.8186 | 0.0919 | 0.8131 |

| N | 12,076 | 12,076 | 12,076 | 12,076 |

| Variables | SFLI |

|---|---|

| DDD | 0.5185 ** |

| (2.24) | |

| DID | −0.0219 *** |

| (−3.23) | |

| Sub | −0.2248 * |

| (−1.82) | |

| Tasset | 0.1713 *** |

| (6.66) | |

| Cash | −1.1962 *** |

| (−50.12) | |

| Roa | −0.1412 *** |

| (−10.49) | |

| Growth | −0.5419 *** |

| (−167.00) | |

| Bo | −0.0017 ** |

| (−2.01) | |

| Bi | 0.0880 *** |

| (2.85) | |

| Ins | −0.0005 *** |

| (−3.60) | |

| Duality | 0.0045 |

| (0.83) | |

| Soe | 0.0092 |

| (0.77) | |

| TQ | −0.0106 *** |

| (−6.80) | |

| Fin | 0.0081 |

| (1.50) | |

| Constant | −0.0920 *** |

| (−2.67) | |

| Year FE | YES |

| Firm FE | YES |

| R2 | 0.7962 |

| N | 12,076 |

| Variables | Unmatched(U) | Mean | Bias | Reduct | T-Test | ||

|---|---|---|---|---|---|---|---|

| Matched(M) | Treated | Control | |Bias| | t | p > |t| | ||

| Tasset | U | 0.9223 | 0.9210 | 0.01 | −0.35 | 0.65 | 0.52 |

| M | 0.9223 | 0.9206 | 0.02 | 0.77 | 0.44 | ||

| Cash | U | 0.0547 | 0.0361 | 0.26 | 0.91 | 13.37 | 0.00 |

| M | 0.0547 | 0.0564 | −0.02 | −1.10 | 0.27 | ||

| Roa | U | 0.0549 | 0.0675 | −0.09 | 0.56 | −5.02 | 0.00 |

| M | 0.0549 | 0.0605 | −0.04 | −1.76 | 0.09 | ||

| Growth | U | 0.1896 | 0.2310 | −0.09 | 0.92 | −4.45 | 0.00 |

| M | 0.1896 | 0.1930 | −0.01 | −0.34 | 0.77 | ||

| Bo | U | 9.7645 | 9.4267 | 0.15 | 0.99 | 7.67 | 0.00 |

| M | 9.7645 | 9.7694 | −0.00 | −0.09 | 0.93 | ||

| Bi | U | 0.3722 | 0.3773 | −0.08 | 0.72 | −4.20 | 0.00 |

| M | 0.3722 | 0.3709 | 0.02 | 1.04 | 0.30 | ||

| Ins | U | 50.5800 | 48.4950 | 0.09 | 0.99 | 4.64 | 0.00 |

| M | 50.5800 | 50.6090 | −0.00 | −0.06 | 0.95 | ||

| Duality | U | 0.1972 | 0.2363 | −0.10 | 0.97 | −4.90 | 0.00 |

| M | 0.1972 | 0.1984 | −0.00 | −0.13 | 0.90 | ||

| Soe | U | 0.5043 | 0.4410 | 0.13 | 0.96 | 6.64 | 0.00 |

| M | 0.5043 | 0.5018 | 0.01 | 0.22 | 0.83 | ||

| TQ | U | 2.2186 | 2.2704 | −0.03 | 0.88 | −1.77 | 0.08 |

| M | 2.2186 | 2.2121 | −0.00 | 0.20 | 0.84 | ||

| Fin | U | 3.2458 | 3.6293 | −0.29 | 0.99 | −14.66 | 0.00 |

| M | 3.2458 | 3.2493 | −0.00 | −0.14 | 0.89 | ||

| Variables | SFLI |

|---|---|

| DID | −0.0147 ** |

| (−2.37) | |

| Tasset | 0.1659 *** |

| (6.52) | |

| Cash | −1.1847 *** |

| (−49.71) | |

| Roa | −0.1468 *** |

| (−10.99) | |

| Growth | −0.5453 *** |

| (−168.82) | |

| Bo | −0.0017 ** |

| (−2.05) | |

| Bi | 0.0871 *** |

| (2.86) | |

| Ins | −0.0004 *** |

| (−3.24) | |

| Duality | 0.0047 |

| (0.88) | |

| Soe | 0.0117 |

| (0.99) | |

| TQ | −0.0109 *** |

| (−7.07) | |

| Fin | 0.0098 * |

| (1.81) | |

| Constant | −0.0983 *** |

| (−2.88) | |

| Year FE | YES |

| Firm FE | YES |

| R2 | 0.8000 |

| N | 12,042 |

| Variables | Strong Regional Environmental Regulation | Weak Regional Environmental Regulation |

|---|---|---|

| SFLI | SFLI | |

| DID | −0.0258 * | −0.0119 |

| (−1.72) | (−1.58) | |

| Controls | YES | YES |

| Year FE | YES | YES |

| Firm FE | YES | YES |

| R2 | 0.7705 | 0.8130 |

| N | 4341 | 7325 |

| Variables | Existence of Bank-Enterprise Shareholding Links | No Bank-Enterprise Shareholding Links |

|---|---|---|

| SFLI | SFLI | |

| DID | −0.0137 | −0.0186 ** |

| (−1.15) | (−2.48) | |

| Controls | YES | YES |

| Year FE | YES | YES |

| Firm FE | YES | YES |

| R2 | 0.7858 | 0.7953 |

| N | 1944 | 9870 |

| Variables | Have a Background in Financial Institutions | Have no Background in Financial Institutions |

|---|---|---|

| SFLI | SFLI | |

| DID | −0.0196 ** | −0.0197 |

| (−2.49) | (−1.42) | |

| Controls | YES | YES |

| Year FE | YES | YES |

| Firm FE | YES | YES |

| R2 | 0.8065 | 0.7392 |

| N | 8296 | 3149 |

| Variables | Low Innovation Intensity | High Innovation Intensity |

|---|---|---|

| SFLI | SFLI | |

| DID | −0.0163 ** | −0.0069 |

| (−2.43) | (−0.38) | |

| Controls | YES | YES |

| Year FE | YES | YES |

| Firm FE | YES | YES |

| R2 | 0.7334 | 0.8349 |

| N | 8638 | 2587 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Guo, X.; Ma, J.; Feng, Y.; Chen, B. Green Credit Policy and Short-Term Financing for Long-Term Investment: Evidence from China’s Heavily Polluting Enterprises. Sustainability 2023, 15, 16804. https://doi.org/10.3390/su152416804

Guo X, Ma J, Feng Y, Chen B. Green Credit Policy and Short-Term Financing for Long-Term Investment: Evidence from China’s Heavily Polluting Enterprises. Sustainability. 2023; 15(24):16804. https://doi.org/10.3390/su152416804

Chicago/Turabian StyleGuo, Xuemeng, Jiaxin Ma, Yuting Feng, and Bingyao Chen. 2023. "Green Credit Policy and Short-Term Financing for Long-Term Investment: Evidence from China’s Heavily Polluting Enterprises" Sustainability 15, no. 24: 16804. https://doi.org/10.3390/su152416804

APA StyleGuo, X., Ma, J., Feng, Y., & Chen, B. (2023). Green Credit Policy and Short-Term Financing for Long-Term Investment: Evidence from China’s Heavily Polluting Enterprises. Sustainability, 15(24), 16804. https://doi.org/10.3390/su152416804