Can Technological Innovation and Financial Agglomeration Promote the Growth of Real Economy? Evidence from China

Abstract

:1. Introduction

2. Literature Review and Theoretical Mechanism Analysis

2.1. Research on the Growth of Real Economy

2.2. The Impact of Technological Innovation on Economic Growth

2.3. The Impact of Financial Agglomeration on Economic Growth

2.4. Theoretical Mechanism Analysis

3. Measurement of Technological Innovation and Financial Agglomeration

3.1. Measurement of Technological Innovation

3.1.1. Fuzzy Matter–Element Analysis Method

3.1.2. Index Selection and Data Source

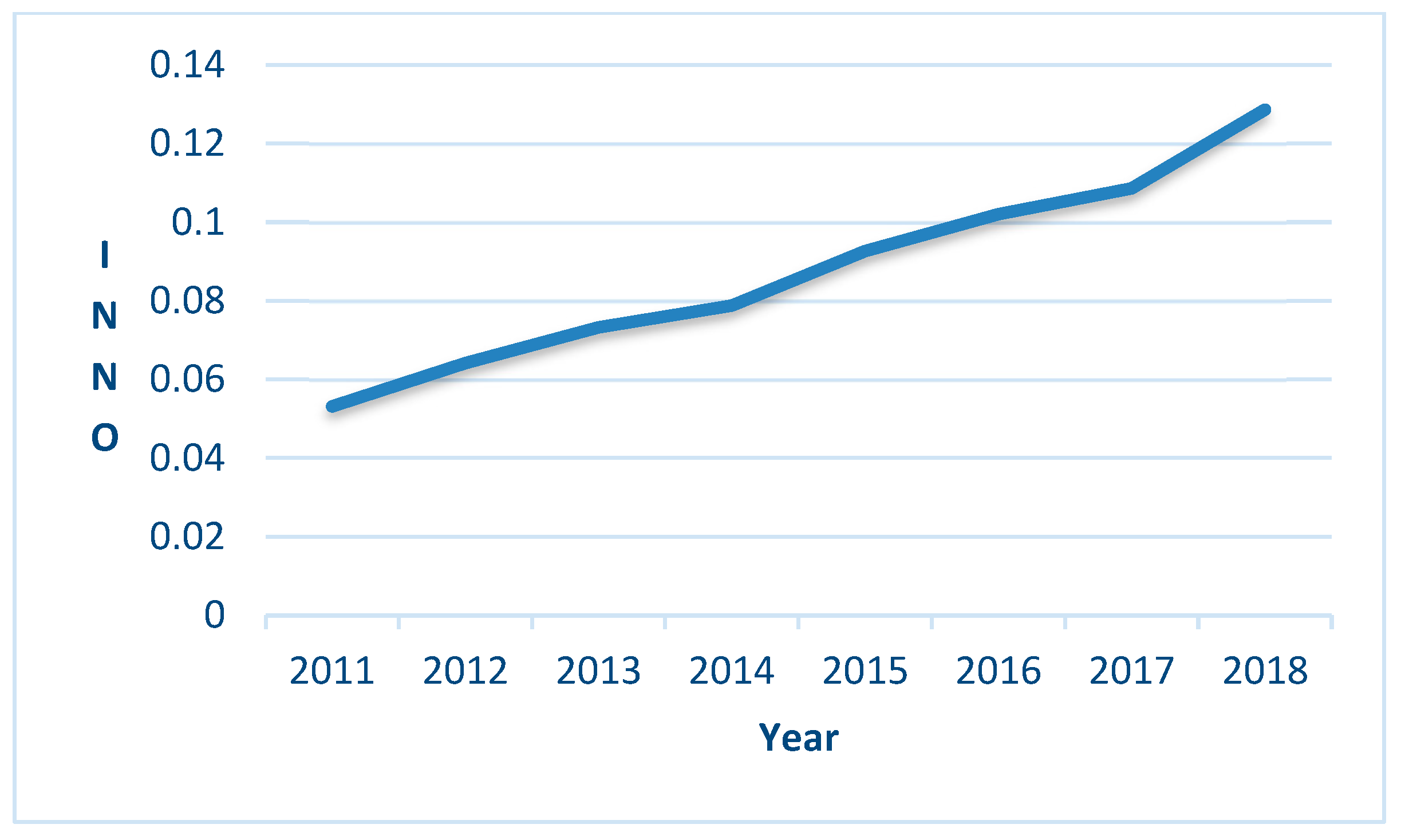

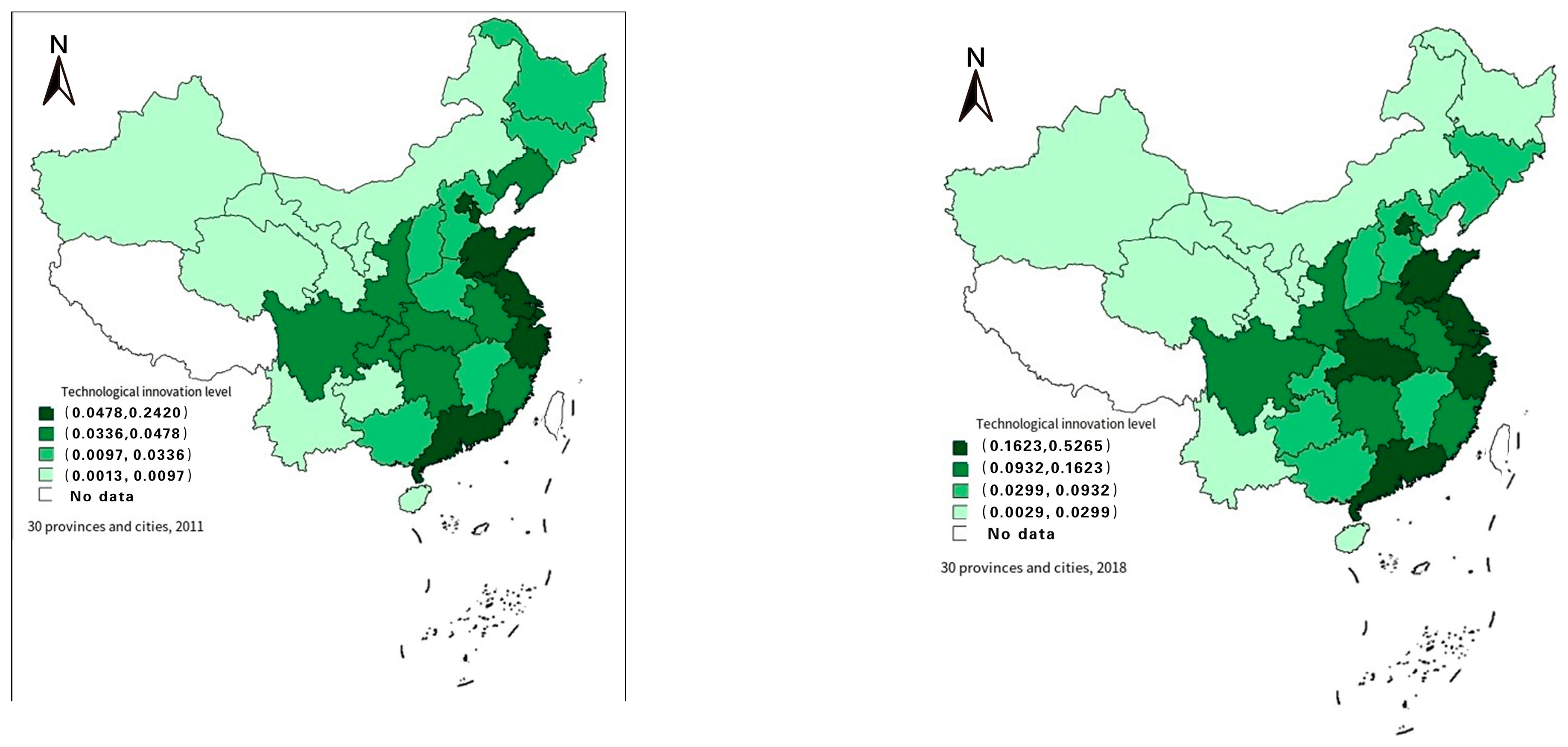

3.1.3. The Evaluation and Evolution Characteristics of China’s Technological Innovation Level Based on the Measurement Results

3.2. The Measurement of Financial Agglomeration

3.2.1. The Measurement Method of Financial Agglomeration

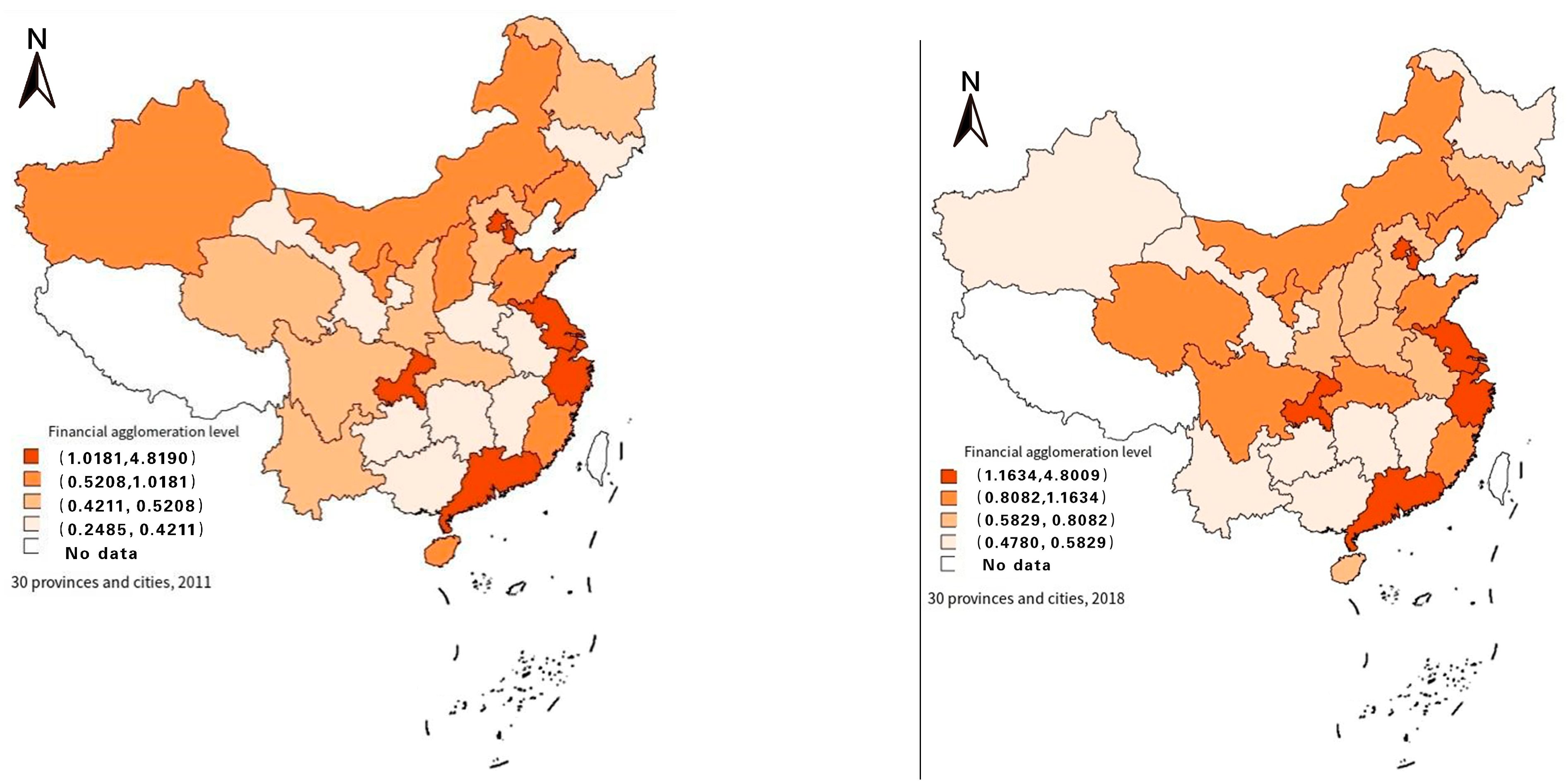

3.2.2. Evaluation and Evolution Characteristics of China’s Financial Agglomeration Level Based on the Measurement Results

3.3. The Comparison of Technological Innovation and Financial Agglomeration

4. Analysis of the Spatial Spillover Effect of Technological Innovation and Financial Agglomeration on Economic Growth

4.1. Construction of Spatial Econometric Model

4.2. Index Selection and Data Source

4.2.1. Dependent Variable

4.2.2. Primary Explanatory Variables

4.2.3. Control Variables

- Government intervention (GOV) is defined as the local public finance expenditure’s proportion to the GDP of the respective provinces and cities. Data were sourced from the Wind database.

- Fixed asset investment intensity (INV) was quantified by the ratio of the adjusted total fixed asset investment to the adjusted GDP, which used the 2011-based GDP deflator. The fixed asset investment and its associated price index were referenced from the National Bureau of Statistics.

- Infrastructure (FRU) was represented by the combined railway and road mileage relative to the provincial land area. The data for both mileages were derived from the National Bureau of Statistics, while land area statistics were from the Yearbook of China Regional Economic Statistics.

- Urbanization level (URB) was measured by the urban population’s ratio to the year-end permanent residents of each province or city, with data sourced from the National Bureau of Statistics.

- Labor force intensity (LAB) was determined by the ratio of urban unit employees to the year-end permanent residents in each province or city. Data were obtained from the National Bureau of Statistics.

- Foreign trade intensity (TRAD) was defined by the business unit location’s total import and export volume’s ratio to the GDP of each province and city. It is noteworthy that this metric was computed in USD. To mitigate the influence of exchange rate volatility, we first discerned the annual exchange rate from 2011 to 2018 by dividing the RMB-based national GDP by the USD-based one. We then converted the USD-valued total imports and exports using this rate. The resulting value’s proportion to the provincial GDP quantified foreign trade intensity. The USD-based national GDP data were sourced from the World Bank. The panel data descriptive statistics of the above variables are shown in Table 2.

4.3. Panel Unit Root Check

4.4. Empirical Analysis Based on Spatial Econometric Model

4.4.1. Global Spatial Autocorrelation Test

4.4.2. Local Spatial Autocorrelation Test

4.4.3. The Model Estimation Results and Analysis

- Technological innovation (INNO) significantly bolsters real economic growth. Directly, as an economic production input, it enhances societal productivity and real economic operations. Indirectly, it fosters high-tech entrepreneurship, facilitating China’s industrial structural upgrade, thus optimizing market resource allocation.

- Regarding financial agglomeration (FINA), while it theoretically enhances real economic growth by streamlining financial resource allocation, its coefficient is not statistically significant. Excessive financial agglomeration might dilute this effect due to its inherent siphon effect.

- Government intervention (GOV) poses a notable dampening effect on real economic growth. Driven by societal equity goals, such intervention may “crowd out” real economy operations, resulting in growth impediments.

- Fixed asset investment (INV) showed a robust positive relationship with real economic growth, underlining its pivotal role in fostering sustainable societal development.

- Urbanization level (URB) potentially drives real economic growth, though its p-value is not significant.

- Labor force level (LAB) is a significant enhancer for real economic growth as an integral operational input.

- Foreign trade level (TRAD) exhibits a pronounced negative correlation with real economic growth. Given escalating trade protectionism and growing anti-globalization sentiments, China’s foreign trade faces unprecedented challenges, impacting real economic growth.

- Infrastructure development (FRU)’s correlation with real economic growth is not statistically robust.

4.4.4. Spatial Spillover Effect Decomposition

- Technological Innovation (INNO)

- 2.

- Financial Agglomeration (FINA)

- 3.

- Government Intervention (GOV)

- 4.

- Fixed Asset Investment (INV)

- 5.

- Urbanization Level (URB)

- 6.

- Labor Force Level (LAB)

- 7.

- Foreign Trade Level (TRAD)

- 8.

- Infrastructure Development (FRU)

5. Conclusions

5.1. Research Summary

- Dual roles of technological innovation (INNO) and financial agglomeration (FINA)

- 2.

- Predominance of technological innovation

- 3.

- Investment (INV) and Labor (LAB) Remain Integral

- 4.

- Diminishing government intervention (GOV) and foreign trade level (TRADE) concerns

5.2. Limitations and Future Research

5.2.1. Limitations

5.2.2. Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Cavalieri, A.; Reis, J.; Amorim, M. Circular economy and internet of things: Mapping science of case studies in manufacturing industry. Sustainability 2021, 13, 3299. [Google Scholar] [CrossRef]

- Wang, S.; Tian, W.; Lu, B. Impact of capital investment and industrial structure optimization from the perspective of” resource curse”: Evidence from developing countries. Resour. Policy 2023, 80, 103276. [Google Scholar] [CrossRef]

- He, F.; Ma, Y.; Zhang, X. How does economic policy uncertainty affect corporate Innovation?–Evidence from China listed companies. Int. Rev. Econ. Financ. 2020, 67, 225–239. [Google Scholar] [CrossRef]

- Khan, S.A.R.; Razzaq, A.; Yu, Z.; Miller, S. Industry 4.0 and circular economy practices: A new era business strategies for environmental sustainability. Bus. Strategy Environ. 2021, 30, 4001–4014. [Google Scholar] [CrossRef]

- Wang, T.; Wang, D.; Yu, L.N.; Ryoo, J.; Min, K.S.; Guo, H.W. Relationship between Vaccination in COVID-19 and the Number of Patients and Serious Illnesses in the Republic of Korea from a Financial Risk Transmission Perspective: An Analysis Based on Var Model. Medicine 2023, 102, 17. [Google Scholar]

- Laibman, D. Productive and unproductive labor: A comment. Rev. Radic. Political Econ. 1999, 31, 61–73. [Google Scholar] [CrossRef]

- Bernat, G.A., Jr. Does manufacutring matter? a spatial econometric view of kaldor’s laws. J. Reg. Sci. 1996, 36, 463–477. [Google Scholar] [CrossRef]

- Mohun, S. Productive and unproductive labor in the labor theory of value. Rev. Radic. Political Econ. 1996, 28, 30–54. [Google Scholar] [CrossRef]

- Drucker, P.F. Marketing and economic development. J. Mark. 1958, 22, 252–259. [Google Scholar] [CrossRef]

- Hausmann, R.; Hidalgo, C.A.; Bustos, S.; Coscia, M.; Simoes, A. The Atlas of Economic Complexity: Mapping Paths to Prosperity; MIT Press: Cambridge, MA, USA, 2014; Volume 2, pp. 18–26. [Google Scholar]

- Croitoru, A.; Schumpeter, J.A. The theory of economic development: An inquiry into profits, capital, credit, interest and the business cycle. J. Comp. Res. Anthropol. Sociol. 2008, 3, 137–148. [Google Scholar]

- Lucas, R.E., Jr. On the mechanics of economic development. J. Monet. Econ. 1988, 22, 3–42. [Google Scholar] [CrossRef]

- Romer, P.M. Two strategies for economic development: Using ideas and producing ideas. In The Strategic Management of Intellectual Capital; Routledge: New York, NY, USA, 2009; pp. 211–238. [Google Scholar]

- Bravo-Ortega, C.; Marín, Á.G. R&D and productivity: A two way avenue? World Dev. 2011, 39, 1090–1107. [Google Scholar]

- Koh, W.T. Terrorism and its impact on economic growth and technological innovation. Technol. Forecast. Soc. Chang. 2007, 74, 129–138. [Google Scholar] [CrossRef]

- Adak, M. Technological progress, innovation and economic growth; the case of Turkey. Procedia-Soc. Behav. Sci. 2015, 195, 776–782. [Google Scholar] [CrossRef]

- Aali Bujari, A.; Venegas Martínez, F. Technological innovation and economic growth in Latin America. Rev. Mex. Econ. Finanz. 2016, 11, 77–89. [Google Scholar]

- Feki, C.; Mnif, S. Entrepreneurship, technological innovation, and economic growth: Empirical analysis of panel data. J. Knowl. Econ. 2016, 7, 984–999. [Google Scholar] [CrossRef]

- Li, X.; Ma, D. Financial agglomeration, technological innovation, and green total factor energy efficiency. Alex. Eng. J. 2021, 60, 4085–4095. [Google Scholar] [CrossRef]

- Krugman, P. Increasing returns and economic geography. J. Political Econ. 1991, 99, 483–499. [Google Scholar] [CrossRef]

- Fujita, M.; Krugman, P.R.; Venables, A. The Spatial Economy: Cities, Regions, and International Trade; MIT Press: Cambridge, MA, USA, 2001; Volume 1, pp. 283–285. [Google Scholar]

- Greenwood, J.; Jovanovic, B. Financial development, growth, and the distribution of income. J. Political Econ. 1990, 98 Pt 1, 1076–1107. [Google Scholar] [CrossRef]

- Iyare, S.; Moore, W. Financial sector development and growth in small open economies. Appl. Econ. 2011, 43, 1289–1297. [Google Scholar] [CrossRef]

- Levine, R. Financial development and economic growth: Views and agenda. J. Econ. Lit. 1997, 35, 688–726. [Google Scholar]

- Tadesse, S. Financial architecture and economic performance: International evidence. J. Financ. Intermediation 2002, 11, 429–454. [Google Scholar] [CrossRef]

- Hassan, M.K.; Sanchez, B.; Yu, J.S. Financial development and economic growth: New evidence from panel data. Q. Rev. Econ. Financ. 2011, 51, 88–104. [Google Scholar] [CrossRef]

- Ottaviano, G.; Robert-Nicoud, F.; Baldwin, R.; Forslid, R.; Martin, P. Economic Geography and Public Policy; Princeton University Press: Princeton, NJ, USA, 2011; Volume 1, pp. 6–9. [Google Scholar]

- Anwar, S.; Cooray, A. Financial development, political rights, civil liberties and economic growth: Evidence from South Asia. Econ. Model. 2012, 29, 974–981. [Google Scholar] [CrossRef]

- Pradhan, R.P.; Arvin, M.B.; Hall, J.H.; Nair, M. Innovation, financial development and economic growth in Eurozone countries. Appl. Econ. Lett. 2016, 23, 1141–1144. [Google Scholar] [CrossRef]

- Yuan, H.; Zhang, T.; Feng, Y.; Liu, Y.; Ye, X. Does financial agglomeration promote the green development in China? A spatial spillover perspective. J. Clean. Prod. 2019, 237, 117808. [Google Scholar] [CrossRef]

- Wen, Y.; Zhao, M.; Zheng, L.; Yang, Y.; Yang, X. Impacts of financial agglomeration on technological innovation: A spatial and nonlinear perspective. Technol. Anal. Strateg. Manag. 2023, 35, 17–29. [Google Scholar] [CrossRef]

- Haggett, P. Geography in a steady-state environment. Geography 1977, 62, 159–167. [Google Scholar]

- Pandit, N.R.; Cook, G.A.; Swann, P.G.M. The dynamics of industrial clustering in British financial services. Serv. Ind. J. 2001, 21, 33–61. [Google Scholar] [CrossRef]

| Secondary Index | Indicator Description | Data Sources | Weights |

|---|---|---|---|

| Patent output levels | Number of patents granted | Wind Database | 0.2917 |

| Technical market transaction | Technology market turnover/GDP deflator after fixed basis | Wind Database World Bank | 0.4269 |

| Income from scientific and technological achievements | New product sales income/PPI after fixed base | National Bureau of Statistics | 0.2814 |

| Variables | Categories | Mean Value | Standard Deviation | Minimum | Maximum | Observed Value |

|---|---|---|---|---|---|---|

| PGDP | Overall | 4.3417 | 1.7923 | 1.5119 | 9.5438 | N = 240 |

| Between | 1.7261 | 2.1943 | 8.5302 | n = 30 | ||

| Within | 0.5659 | 2.7874 | 6.1107 | T = 8 | ||

| INNO | Overall | 0.0877 | 0.1032 | 0.0012 | 0.5265 | N = 240 |

| Between | 0.0991 | 0.0019 | 0.3351 | n = 30 | ||

| Within | 0.0334 | 0.0494 | 0.2812 | T = 8 | ||

| FINA | Overall | 1.0643 | 1.0253 | 0.2485 | 4.8190 | N = 240 |

| Between | 1.0333 | 0.3874 | 4.5982 | n = 30 | ||

| Within | 0.1216 | 0.6481 | 1.7225 | T = 8 | ||

| GOV | Overall | 0.2460 | 0.1030 | 0.0458 | 0.6274 | N = 240 |

| Between | 0.1022 | 0.1237 | 0.5935 | n = 30 | ||

| Within | 0.0216 | 0.0809 | 0.3003 | T = 8 | ||

| INV | Overall | 0.8264 | 0.2583 | 0.2296 | 1.5066 | N = 240 |

| Between | 0.2230 | 0.2603 | 1.2389 | n =30 | ||

| Within | 0.1358 | 0.3925 | 1.1902 | T = 8 | ||

| FRU | Overall | 0.0094 | 0.0047 | 0.0009 | 0.0194 | N = 240 |

| Between | 0.0047 | 0.0011 | 0.0168 | n =30 | ||

| Within | 0.0006 | 0.0070 | 0.0122 | T = 8 | ||

| URB | Overall | 0.5711 | 0.1230 | 0.3497 | 0.8961 | N = 240 |

| Between | 0.1216 | 0.4112 | 0.8864 | n =30 | ||

| Within | 0.0280 | 0.5095 | 0.6352 | T = 8 | ||

| LAB | Overall | 0.1309 | 0.0587 | 0.0690 | 0.3804 | N = 240 |

| Between | 0.0584 | 0.0809 | 0.3582 | n = 30 | ||

| Within | 0.0118 | 0.0651 | 0.1637 | T = 8 | ||

| TRAD | Overall | 0.2747 | 0.3121 | 0.0168 | 1.5488 | N = 240 |

| Between | 0.3072 | 0.0355 | 1.1923 | n = 30 | ||

| Within | 0.0763 | 0.0951 | 0.7228 | T = 8 |

| Variables | LLC Test | Fisher Type Test | Smoothness | |||

|---|---|---|---|---|---|---|

| Adj-t * Statistic | P Statistic | Z Statistic | L * statistic | Pm Statistics | ||

| PGDP | 13.3879 *** | 108.1377 *** | 2.9261 *** | 3.0758 *** | 4.3944 *** | Smooth and steady |

| (0.0000) | (0.0001) | (0.0017) | (0.0012) | (0.0000) | ||

| INNO | 23.8554 *** | 85.5163 ** | 1.7125 ** | 1.7969 ** | 2.3293 *** | Smooth |

| (0.0000) | (0.0169) | (0.0434) | (0.0372) | (0.0099) | ||

| FINA | 11.4934 *** | 145.8741 *** | 6.9268 *** | 6.8433 *** | 7.8392 *** | Smooth |

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | ||

| GOV | 30.1765 *** | 103.4039 *** | 4.3320 *** | 4.1405 *** | 3.9622 *** | Smooth |

| (0.0000) | (0.0004) | (0.0000) | (0.0000) | (0.0000) | ||

| INV | 7.4903 *** | 147.4878 *** | 6.4990 *** | 6.5015 *** | 7.9865 *** | Smooth |

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | ||

| FRU | 8.6623 *** | 128.5222 *** | 4.9756 *** | 5.1003 *** | 6.2552 *** | Smooth |

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | ||

| URB | 13.5586 *** | 87.2865 ** | 2.1589 ** | 2.1005 ** | 2.4909 *** | Smooth |

| (0.0000) | (0.0123) | (0.0154) | (0.0187) | (0.0064) | ||

| LAB | 37.0871 *** | 222.3900 *** | 9.3152 *** | 10.6654 *** | 14.8241 *** | Smooth |

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | ||

| TRAD | 11.5037 *** | 117.9598 *** | 5.2625 *** | 5.0328 *** | 5.2910 *** | Smooth |

| (0.0000) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | ||

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | |

|---|---|---|---|---|---|---|---|---|

| PGDP | 0.284 *** | 0.269 *** | 0.257 *** | 0.238 ** | 0.236 ** | 0.241 ** | 0.281 *** | 0.279 *** |

| (2.913) | (2.772) | (2.657) | (2.475) | (2.451) | (2.505) | (2.875) | (2.850) | |

| INNO | 0.000 | 0.003 | 0.004 | 0.004 | 0.022 | 0.009 | 0.034 | 0.065 |

| (0.627) | (0.574) | (0.506) | (0.631) | (0.713) | (0.570) | (0.853) | (1.055) | |

| FINA | 0.213 ** | 0.218 ** | 0.212 ** | 0.205 ** | 0.178 ** | 0.172 ** | 0.175 ** | 0.167 ** |

| (2.522) | (2.554) | (2.498) | (2.435) | (2.179) | (2.123) | (2.155) | (2.070) |

| Variables | SDM | SAR | SAC | SEM | |

|---|---|---|---|---|---|

| INNO | 3.7127 *** | 3.5048 *** | 3.7354 *** | 3.0961 *** | |

| (0.7327) | (0.7280) | (0.7360) | (0.8035) | ||

| FINA | 0.1086 | 0.0209 | 0.0837 | 0.0030 | |

| (0.1452) | (0.1459) | (0.1501) | (0.1490) | ||

| GOV | 3.4832 *** | 3.4224 *** | 3.3240 *** | 3.6438 *** | |

| (0.7918) | (0.8126) | (0.7989) | (0.8546) | ||

| INV | 0.4877 *** | 0.5149 *** | 0.4997 *** | 0.5245 *** | |

| (0.1577) | (0.1617) | (0.1595) | (0.1662) | ||

| URB | 2.3404 | 2.7579 | 2.3232 | 3.3027 * | |

| (1.7415) | (1.7728) | (1.7220) | (1.8916) | ||

| LAB | 5.6902 *** | 5.4400 *** | 4.7686 *** | 5.9587 *** | |

| (1.7606) | (1.7809) | (1.7667) | (1.8605) | ||

| TRAD | 1.9850 *** | 1.9343 *** | 1.8719 *** | 2.0318 *** | |

| (0.3196) | (0.3208) | (0.3121) | (0.3406) | ||

| FRU | 18.8158 | 20.4876 | 11.1092 | 45.8038 | |

| (37.2926) | (36.9260) | (36.9141) | (37.7292) | ||

| W*INNO | 5.9224 *** | -- | -- | -- | |

| (1.3904) | -- | -- | -- | ||

| W*FINA | 0.9467 *** | -- | -- | -- | |

| (0.3562) | -- | -- | -- | ||

| rho | 0.2100 *** | 36.9260 *** | 0.4550 *** | -- | |

| (0.0754) | (0.0595) | (0.0714) | -- | ||

| Lambda | -- | -- | 0.2183 * | 0.3549 *** | |

| -- | -- | (0.1313) | (0.0889) | ||

| Log-likelihood | 31.9518 | 22.5785 | 23.8530 | 12.1935 | |

| Area effect | Control | Controls | Controls | Controls | |

| Time effect | Control | Controls | Controls | Controls | |

| Hausman check | chi2(8) | 19.25 ** | 17.42 ** | -- | 25.76 *** |

| p value | 0.0136 | 0.0260 | -- | 0.0012 | |

| Model selection | Fixed effect model | Fixed effect model | Fixed effect model | Fixed effect model | |

| LR test | SDM vs. SAR | LR chi2(2) = 18.75 *** | |||

| SDM vs. SAC | LR chi2(1) = 16.20 *** | ||||

| SDM to SEM | LR chi2(2) = 39.52 *** | ||||

| Variables | Direct Effects | Indirect Effects | Total Effect |

|---|---|---|---|

| INNO | 4.0825 *** | 8.2264 *** | 12.3089 *** |

| (0.7316) | (1.3325) | (1.6111) | |

| FINA | 0.1543 | 1.2013 *** | 1.3556 *** |

| (0.1456) | (0.4504) | (0.5215) | |

| GOV | 3.4446 *** | 0.8560 ** | 4.3006 *** |

| (0.7612) | (0.3917) | (0.9495) | |

| INV | 0.4927 *** | 0.1238 * | 0.6165 *** |

| (0.1538) | (0.0665) | (0.1969) | |

| URB | 2.3912 | 0.6086 | 2.9998 |

| (1.7384) | (0.5535) | (2.2019) | |

| LAB | 5.8545 *** | 1.4890 * | 7.3435 *** |

| (1.7726) | (0.8093) | (2.3303) | |

| TRAD | 1.9959 *** | 0.5073 ** | 2.5032 *** |

| (0.3240) | (0.2388) | (0.4650) | |

| FRU | 19.9701 | 4.6665 | 24.6366 |

| (36.3143) | (9.8359) | (45.3201) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, T.; Wang, S.; Ding, W.; Guo, H. Can Technological Innovation and Financial Agglomeration Promote the Growth of Real Economy? Evidence from China. Sustainability 2023, 15, 15995. https://doi.org/10.3390/su152215995

Wang T, Wang S, Ding W, Guo H. Can Technological Innovation and Financial Agglomeration Promote the Growth of Real Economy? Evidence from China. Sustainability. 2023; 15(22):15995. https://doi.org/10.3390/su152215995

Chicago/Turabian StyleWang, Tao, Shuhong Wang, Wei Ding, and Huiwen Guo. 2023. "Can Technological Innovation and Financial Agglomeration Promote the Growth of Real Economy? Evidence from China" Sustainability 15, no. 22: 15995. https://doi.org/10.3390/su152215995

APA StyleWang, T., Wang, S., Ding, W., & Guo, H. (2023). Can Technological Innovation and Financial Agglomeration Promote the Growth of Real Economy? Evidence from China. Sustainability, 15(22), 15995. https://doi.org/10.3390/su152215995