Green Financial Supervision Information System Based on Genetic Algorithm Optimization under Carbon Peaking and Carbon Neutrality Goals

Abstract

:1. Introduction

2. Necessity of Optimizing the Green Financial Regulatory Information System

2.1. Investigation of the Construction of a Green FS Information System

2.2. Optimized Green FS Information System Based on a GA

- (1)

- ; this represents the identity of the judgment matrix.

- (2)

- ; reciprocal property of judgment matrix.

- (3)

- ; consistency conditions of judgment matrices.

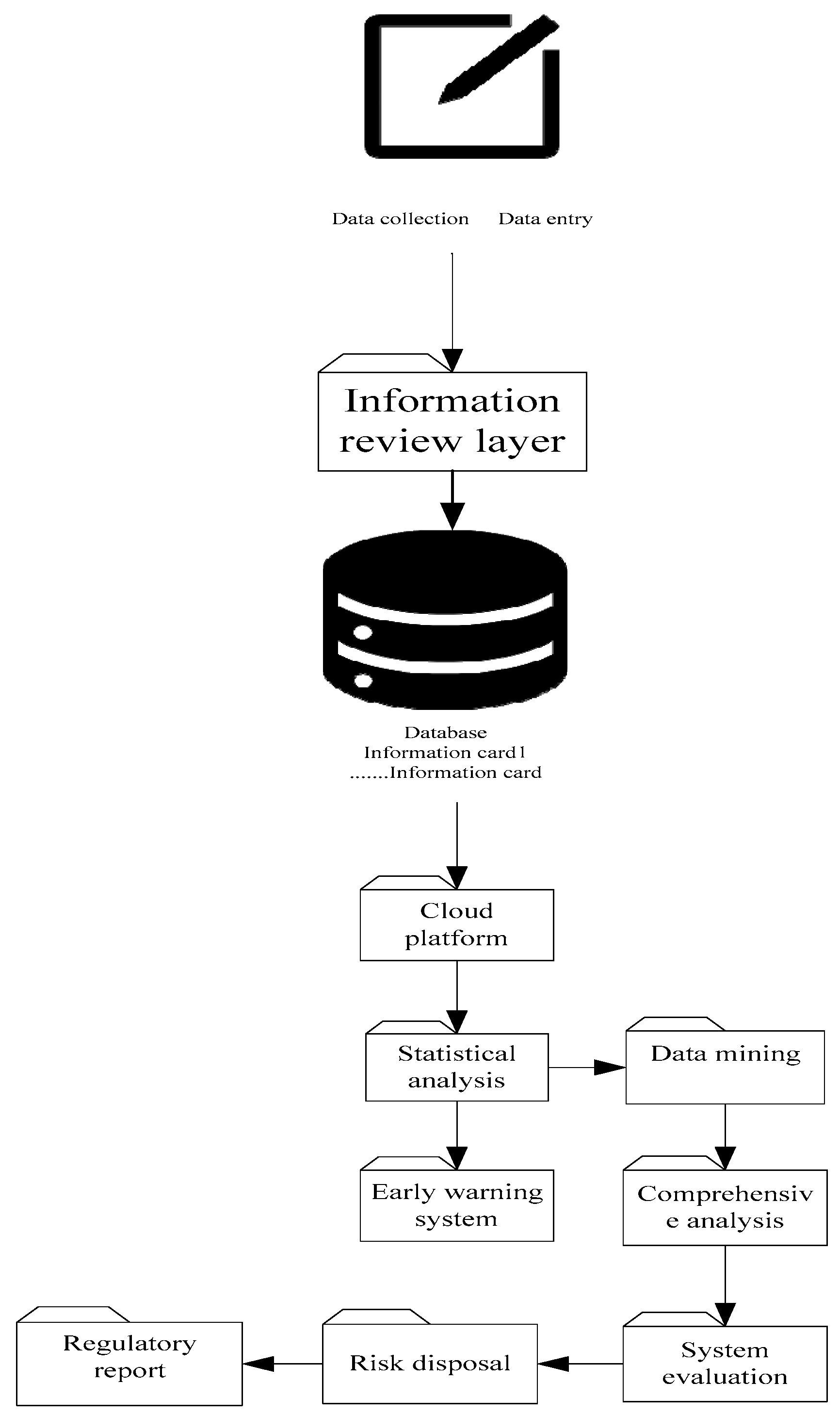

2.3. Optimization of the Green Financial Supervision Information System

3. Optimization of the Green FS Information System

- (1)

- The Development of GF

- (2)

- The development status of GF in China

- (3)

- Optimization of the green FS information system

4. Discussion

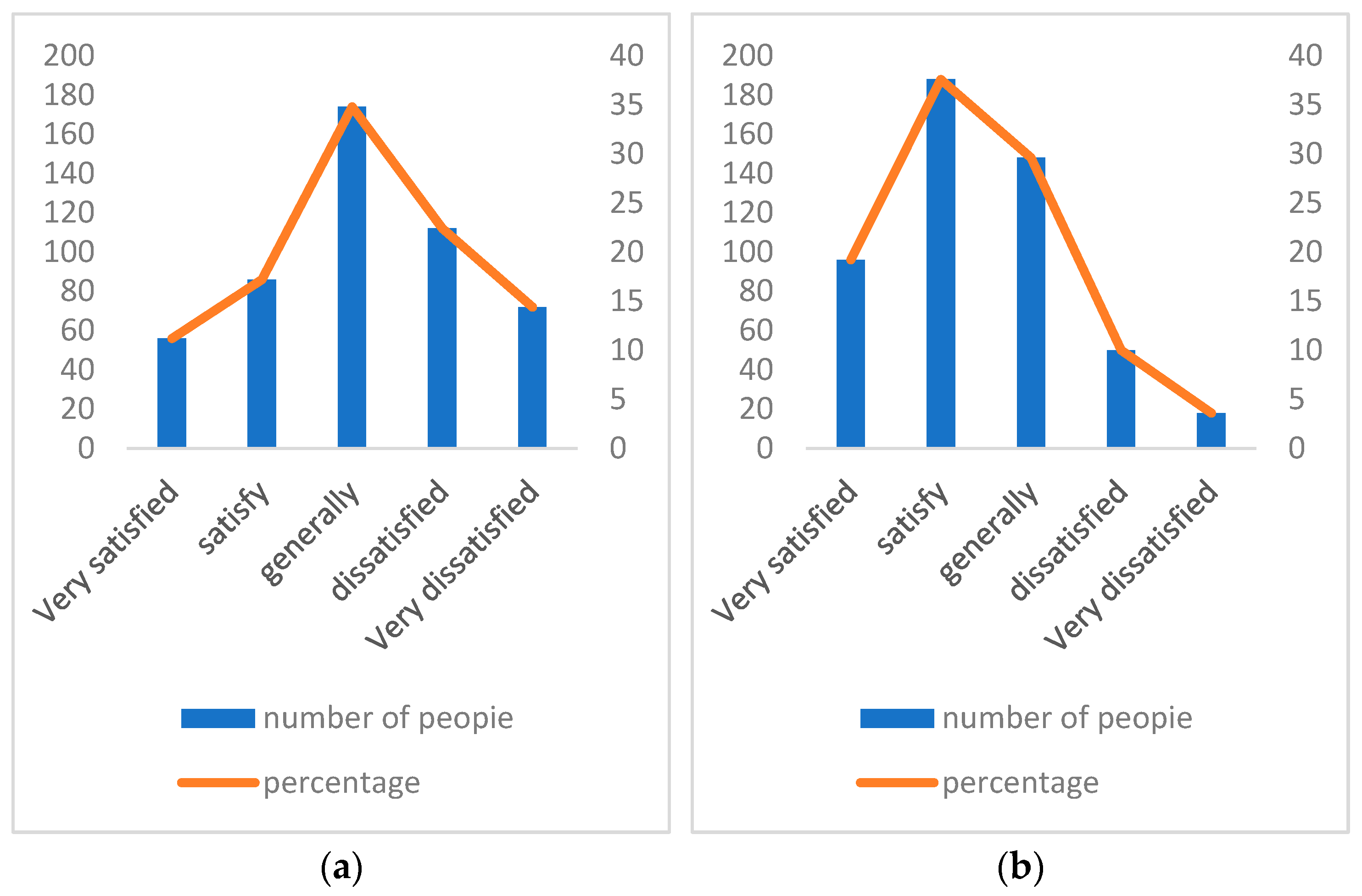

- (1)

- Green Finance Development Results

- (2)

- Results of the current development status of green finance

5. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Huang, Q. Ecological Strategies for Rural Nature Conservation Environment Based on Big Data Information System. Nat. Environ. Prot. 2022, 3, 42–49. [Google Scholar] [CrossRef]

- Xiao, G.; Wang, T.; Chen, X.; Zhou, L. Evaluation of Ship Pollutant Emissions in the Ports of Los Angeles and Long Beach. J. Mar. Sci. Eng. 2022, 10, 1206. [Google Scholar] [CrossRef]

- Ma, J.Z.; Huang, H.Y.; Zhu, Q.; Shen, X. Corporate Social Responsibility Disclosure, Market Supervision, and Green Investment. Emerg. Mark. Financ. Trade 2022, 58, 4389–4398. [Google Scholar] [CrossRef]

- Park, H.; Kim, J.D. Transition towards green banking: Role of financial regulators and financial institutions. Asian J. Sustain. Soc. Responsib. 2020, 5, 5. [Google Scholar] [CrossRef]

- Hsu, C.C.; Quang-Thanh, N.; Chien, F.S. Evaluating green innovation and performance of financial development: Mediating concerns of environmental regulation. Environ. Sci. Pollut. Res. 2021, 28, 57386–57397. [Google Scholar] [CrossRef] [PubMed]

- Debrah, C.; Darko, A.; Chan, A.P.C. A bibliometric-qualitative literature review of green finance gap and future research directions. Clim. Dev. 2023, 15, 432–455. [Google Scholar] [CrossRef]

- Falcone, P.M. Environmental regulation and green investments: The role of green finance. Int. J. Green Econ. 2020, 14, 159–173. [Google Scholar] [CrossRef]

- Asima, M.; Ali Abbaszadeh Asl, A. Developing a Hybrid Model to Estimate Expected Return Based on Genetic Algorithm. Financ. Res. J. 2019, 21, 101–120. [Google Scholar]

- Ramachandran, R. A novel ODV based genetic algorithm model for green VRPs. Int. J. Pure Appl. Math. 2018, 119, 427–446. [Google Scholar]

- Gomber, P.; Kauffman, R.J.; Parker, C.; Weber, B.W. On the fintech revolution: Interpreting the forces of innovation, disruption, and transformation in financial services. J. Manag. Inf. Syst. 2018, 35, 220–265. [Google Scholar] [CrossRef]

- Sadiq, M.; Nonthapot, S.; Mohamad, S.; Chee Keong, O.; Ehsanullah, S.; Iqbal, N. Does green finance matter for sustainable entrepreneurship and environmental corporate social responsibility during COVID-19? China Financ. Rev. Int. 2022, 12, 317–333. [Google Scholar] [CrossRef]

- Wang, Q. Obstacles to China’s Implementation of Environmental Protection Financial Policies. Nat. Environ. Prot. 2022, 2, 15–28. [Google Scholar] [CrossRef]

- Duan, F. Analysis of Financial Supervision under the Supervision of Mixed Operation. Account. Audit. Financ. 2022, 3, 21–30. [Google Scholar]

- Komea-Frimpong, I.; Adeabah, D.; Ofosu, D.; Tenakwah, E.J. A review of studies on green finance of banks, research gaps and future directions. J. Sustain. Financ. Invest. 2022, 12, 1241–1264. [Google Scholar] [CrossRef]

- Campiglio, E.; Dafermos, Y.; Monnin, P.; Ryan-Collins, J.; Schotten, G.; Tanaka, M. Climate change challenges for central banks and financial regulators. Nat. Clim. Chang. 2018, 8, 462–468. [Google Scholar] [CrossRef]

- Julia, T.; Kassim, S. Exploring green banking performance of Islamic banks vs conventional banks in Bangladesh based on Maqasid Shariah framework. J. Islam. Mark. 2020, 11, 729–744. [Google Scholar] [CrossRef]

- Harlan, T. Green development or greenwashing? A political ecology perspective on China’s green Belt and Road. Eurasian Geogr. Econ. 2021, 62, 202–226. [Google Scholar] [CrossRef]

- Jia, Q. The impact of green finance on the level of decarbonization of the economies: An analysis of the United States’, China’s, and Russia’s current agenda. Bus. Strategy Environ. 2023, 32, 110–119. [Google Scholar] [CrossRef]

- Ruan, J.; Wang, Y.; Chan, F.T.S.; Hu, X.; Zhao, M.; Zhu, F.; Shi, B.; Shi, Y.; Lin, F. A life cycle framework of green IoT-based agriculture and its finance, operation, and management issues. IEEE Commun. Mag. 2019, 57, 90–96. [Google Scholar] [CrossRef]

- Xu, Y. Application of data mining in enterprise financial risk prediction based on genetic algorithm and linear adaptive optimization. Soft Comput. 2023, 27, 10305–10315. [Google Scholar]

- Karen, Y. Algorithmic regulation: A critical interrogation. Regul. Gov. 2018, 12, 505–523. [Google Scholar]

- Chamizo-Borreguero, M. Evaluation and Optimization of Nature Reserve Interpretation System Based on Genetic Algorithm. Nat. Environ. Prot. 2023, 4, 10–21. [Google Scholar] [CrossRef]

- Hou, H. The Construction and Analysis of Natural Environmental Protection System Based on the Concept of Ecological Balance. Nat. Environ. Prot. 2022, 3, 60–68. [Google Scholar] [CrossRef]

- Moon, H.; McGregor, D.J.; Miljkovic, N.; King, W.P. Ultra-power-dense heat exchanger development through genetic algorithm design and additive manufacturing. Joule 2021, 5, 3045–3056. [Google Scholar] [CrossRef]

- Yinfeng, L.I.U.; Jafari, S.; Nikolaidis, T. Advanced optimization of gas turbine aero-engine transient performance using linkage-learning genetic algorithm: Part II, optimization in flight mission and controller gains correlation development. Chin. J. Aeronaut. 2021, 34, 568–588. [Google Scholar]

- Gu, B.; Chen, F.; Zhang, K. The policy effect of green finance in promoting industrial transformation and upgrading efficiency in China: Analysis from the perspective of government regulation and public environmental demands. Environ. Sci. Pollut. Res. 2021, 28, 47474–47491. [Google Scholar] [CrossRef] [PubMed]

- Yang, Y.; Su, X.; Yao, S. Can green finance promote green innovation? The moderating effect of environmental regulation. Environ. Sci. Pollut. Res. 2022, 29, 74540–74553. [Google Scholar] [CrossRef] [PubMed]

| Years | Accuracy of Data Analysis in Region B (%) | Accuracy of National Data Analysis (%) |

|---|---|---|

| 2007 | 90.21 | 93.05 |

| 2008 | 93.05 | 96.14 |

| 2009 | 91.17 | 91.12 |

| 2010 | 90.24 | 92.06 |

| 2011 | 93.05 | 91.53 |

| 2012 | 91.12 | 90.41 |

| 2013 | 90.11 | 93.32 |

| 2014 | 91.25 | 94.18 |

| 2015 | 91.38 | 90.02 |

| 2016 | 90.42 | 90.33 |

| Years | Accuracy of China’s Carbon Emissions GDP Data Analysis (%) | Analysis Accuracy of Deposit and Loan Balance Data (%) |

|---|---|---|

| 2007 | 93.52 | 90.11 |

| 2008 | 93.03 | 94.25 |

| 2009 | 96.15 | 91.07 |

| 2010 | 90.02 | 92.88 |

| 2011 | 91.32 | 90.16 |

| 2012 | 93.35 | 93.85 |

| 2013 | 90.14 | 92.02 |

| 2014 | 90.66 | 97.14 |

| 2015 | 95.72 | 90.33 |

| 2016 | 92.13 | 91.12 |

| Before Optimization | After Optimization | |

|---|---|---|

| Aggregate throughput (Mbps) | 69.9 | 75.1 |

| Number of starving flows | 4 | 7 |

| Level of spatial reuse | 4.8 | 5.8 |

| Average transmission rate (Mbps) | 35 | 45 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wan, W. Green Financial Supervision Information System Based on Genetic Algorithm Optimization under Carbon Peaking and Carbon Neutrality Goals. Sustainability 2023, 15, 15866. https://doi.org/10.3390/su152215866

Wan W. Green Financial Supervision Information System Based on Genetic Algorithm Optimization under Carbon Peaking and Carbon Neutrality Goals. Sustainability. 2023; 15(22):15866. https://doi.org/10.3390/su152215866

Chicago/Turabian StyleWan, Wangfangyu. 2023. "Green Financial Supervision Information System Based on Genetic Algorithm Optimization under Carbon Peaking and Carbon Neutrality Goals" Sustainability 15, no. 22: 15866. https://doi.org/10.3390/su152215866

APA StyleWan, W. (2023). Green Financial Supervision Information System Based on Genetic Algorithm Optimization under Carbon Peaking and Carbon Neutrality Goals. Sustainability, 15(22), 15866. https://doi.org/10.3390/su152215866