The Effects of Local Government Expenditures on Carbon Dioxide Emissions: Evidence from Republic of Korea

Abstract

:1. Introduction

2. Literature Review

2.1. Impact of Government Expenditure on Economic Growth

2.2. Impact of Economic Growth on Environmental Quality

2.3. Impact of Government Expenditure on Environmental Quality

3. Materials and Methods

3.1. Data

3.2. Methodology

4. Results

5. Discussion

6. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- BOK. National Accounts; Economic Statistics System, Bank of Korea: Seoul, Republic of Korea, 2021. Available online: https://ecos.bok.or.kr/#/SearchStat (accessed on 27 July 2023).

- GIR. Regional Greenhouse Gas Inventory (1990–2019); Greenhouse Gas Inventory and Research Center, Ministry of Environment: Sejong-si, Republic of Korea, 2021. Available online: https://www.gir.go.kr/home/board/read.do?pagerOffset=0&maxPageItems=10&maxIndexPages=10&searchKey=title&searchValue=%EC%A7%80%EC%97%AD%EB%B3%84&menuId=36&boardId=55&boardMasterId=2&boardCategoryId= (accessed on 27 July 2023).

- Carlsson, F.; Lundström, S. Political and Economic Freedom and the Environment: The Case of CO2 Emissions; Department of Economics, Goteborg University: Göteborg, Sweden, 2001. [Google Scholar]

- Bernauer, T.; Koubi, V. States as Providers of Public Goods: How Does Government Size Affect Environmental Quality? University of Bern: Bern, Switzerland, 2006; SSRN 900487. [Google Scholar]

- López, R.; Galinato, G.I.; Islam, A. Fiscal spending and the environment: Theory and empirics. J. Environ. Econ. Manag. 2011, 62, 180–198. [Google Scholar] [CrossRef]

- Kwon, H.Y.; Jung, C.H.; Kim, Y.P. The Impact of Local Government’s Expenditure on Air Quality in Korea. J. Korean Soc. Atmos. Environ. 2016, 32, 583–592. [Google Scholar] [CrossRef]

- Keynes, J.M. The general theory of employment. Q. J. Econ. 1937, 51, 209–223. [Google Scholar] [CrossRef]

- Romer, P.M. Increasing returns and long-run growth. J. Polit. Econ. 1986, 94, 1002–1037. [Google Scholar] [CrossRef]

- Lowenberg, A.D. Neoclassical economics as a theory of politics and institutions. Cato J. 1990, 9, 619–639. [Google Scholar]

- Grossman, G.M.; Krueger, A.B. Environmental Impacts of a North American Free Trade Agreement; National Bureau of Economic Research: New York, NY, USA, 1991. [Google Scholar]

- Grossman, G.M.; Krueger, A.B. Economic growth and the environment. Q. J. Econ. 1995, 110, 353–377. [Google Scholar] [CrossRef]

- Jiranyakul, K.; Brahmasrene, T. The relationship between government expenditures and economic growth in Thailand. J. Econ. Econ. Educ. Res. 2007, 8, 93. [Google Scholar]

- Yoon, J.W.; Kim, T.Y.; Kim, J.K. The Role of Local Expenditures for Regional Development in Korea. Korean J. Local Gov. Stud. 2009, 13, 135–157. [Google Scholar]

- Tuladhar, M.A.; Bruckner, M. Public Investment as a Fiscal Stimulus: Evidence from Japan’s Regional Spending during the 1990s; IMF Working Papers 1–34; International Monetary Fund: Washington, DC, USA, 2010. [Google Scholar]

- Lee, K.; Choe, B. Fiscal multiplier of local governments and the implication for local fiscal restructuring. Korean J. Local Gov. Stud. 2015, 19, 299–317. [Google Scholar]

- Chandio, A.A.; Jiang, Y.; Rehman, A.; Jingdong, L.; Dean, D. Impact of government expenditure on agricultural sector and economic growth in Pakistan. Int. J. Adv. Biotechnol. Res. 2016, 7, 1046–1053. [Google Scholar]

- Tatahi, M.; Cetin, E.I.; Cetin, M.K. The cause of higher economic growth: Assessing the long-term and short-term relationships between economic growth and government expenditure. Macroecon. Dyn. 2016, 20, 229–250. [Google Scholar] [CrossRef]

- Sáez, M.P.; García, S.A. Government Spending and Economic Growth in the European Union Countries: An Empirical Approach; University of Cantabria: Santander, Spain; University of Oviedo (Department of Economics): Oviedo, Spain, 2006; 11p. [Google Scholar]

- Alexiou, C. Government spending and economic growth: Econometric evidence from the South Eastern Europe (SEE). J. Soc. Econ. Res. 2009, 11, 1. [Google Scholar]

- Frank, A.; Joseph, O.M.; Ackah, I. Government Expenditures and Economic Growth in Ghana. Int. J. Econ. Bus. Res. 2014, 2, 180–190. [Google Scholar]

- Ono, H. The government expenditure–economic growth relation in Japan: An analysis by using the ADL test for threshold cointegration. Appl. Econ. 2014, 46, 3523–3531. [Google Scholar] [CrossRef]

- Ajayi, M.A.; Aluko, O.A. The Causality between Government Expenditure and Economic Growth in Nigeria: A Toda-Yamamoto Approach. J. Econ. Bus. 2016, 22, 77–89. [Google Scholar]

- Sáez, M.P.; Álvarez-García, S.; Rodríguez, D.C. Government expenditure and economic growth in the European Union countries: New evidence. Bull. Geogr. Socio-Econom. Ser. 2017, 36, 127–133. [Google Scholar] [CrossRef]

- Chu, T.T.; Hölscher, J.; McCarthy, D. The impact of productive and non-productive government expenditure on economic growth: An empirical analysis in high-income versus low-to middle-income economies. Empir. Econ. 2020, 58, 2403–2430. [Google Scholar] [CrossRef]

- Gurdal, T.; Aydin, M.; Inal, V. The relationship between tax revenue, government expenditure, and economic growth in G7 countries: New evidence from time and frequency domain approaches. Econ. Chang. Restruct. 2021, 54, 305–337. [Google Scholar] [CrossRef]

- Gwartney, J.D.; Lawson, R.; Holcombe, R.G. The Size and Functions of Government and Economic Growth; Joint Economic Committee: Washington, DC, USA, 1998. [Google Scholar]

- Muhammad, S.D.; Wasti, S.K.A.; Hussain, A.; Lal, I. An empirical investigation between money supply government expenditure, output & prices: The Pakistan evidence. Eur. J. Econ. J. Econ. Financ. Adm. Sci. 2009, 17, 60. [Google Scholar]

- Bergh, A.; Karlsson, M. Government size and growth: Accounting for economic freedom and globalization. Public Choice 2010, 142, 195–213. [Google Scholar] [CrossRef]

- Moon, S.; Lee, K.; Choe, B. Spatial spillovers of SOC in Korea: The implication for the local fiscal restructuring. Korea Spat. Plan. Rev. 2015, 84, 55–73. [Google Scholar] [CrossRef]

- Zimcik, P. The scope of government and economic growth. Polit. Ekon. 2016, 64, 439–450. [Google Scholar] [CrossRef]

- Zhang, Q.; Zhang, S.; Ding, Z.; Hao, Y. Does government expenditure affect environmental quality? Empirical evidence using Chinese city-level data. J. Clean. Prod. 2017, 161, 143–152. [Google Scholar] [CrossRef]

- Kuznet, S. Economic growth and income inequality. Am. Econ. Rev. 1955, 45, 1–28. [Google Scholar]

- Shafik, N. Economic development and environmental quality: An econometric analysis. Oxf. Econ. Pap. 1994, 46 (Suppl. 1), 757–773. [Google Scholar] [CrossRef]

- Saboori, B.; Sulaiman, J. Environmental degradation, economic growth and energy consumption: Evidence of the environmental Kuznets curve in Malaysia. Energy Policy 2013, 60, 892–905. [Google Scholar] [CrossRef]

- Bilgili, F.; Koçak, E.; Bulut, Ü. The dynamic impact of renewable energy consumption on CO2 emissions: A revisited Environmental Kuznets Curve approach. Renew. Sustain. Energy Rev. 2016, 54, 838–845. [Google Scholar] [CrossRef]

- Jebli, M.B.; Youssef, S.B.; Ozturk, I. Testing environmental Kuznets curve hypothesis: The role of renewable and non-renewable energy consumption and trade in OECD countries. Ecol. Indic. 2016, 60, 824–831. [Google Scholar] [CrossRef]

- Salim, R.A.; Rafiq, S.; Shafiei, S. Urbanization, Energy Consumption, and Pollutant Emission in Asian Developing Economies: An Empirical Analysis; ADBI Working Paper: Tokyo, Japan, 2017. [Google Scholar]

- Allard, A.; Takman, J.; Uddin, G.S.; Ahmed, A. The N-shaped environmental Kuznets curve: An empirical evaluation using a panel quantile regression approach. Environ. Sci. Pollut. Res. 2018, 25, 5848–5861. [Google Scholar] [CrossRef]

- Fang, D.; Hao, P.; Wang, Z.; Hao, J. Analysis of the influence mechanism of CO2 emissions and verification of the environmental Kuznets curve in China. Int. J. Environ. Res. Public Health 2019, 16, 944. [Google Scholar] [CrossRef]

- Abdallah, K.B.; Belloumi, M.; De Wolf, D. Indicators for sustainable energy development: A multivariate cointegration and causality analysis from Tunisian road transport sector. Renew. Sustain. Energy Rev. 2013, 25, 34–43. [Google Scholar] [CrossRef]

- Lee, G.H.; Li, C.H. Searching for an environmental Kuznets curve for CO2 emissions in the Seoul metropolitan area and its policy implications. Seoul Stud. 2009, 10, 83–95. [Google Scholar] [CrossRef]

- Choi, E.; Heshmati, A.; Cho, Y. An Empirical Study of the Relationships between CO2 Emissions, Economic Growth and Openness; IZA Discussion Paper No. 5304; The Institute for the Study of Labor: Bonn, Germany, 2010. [Google Scholar]

- Lee, G.H. Estimation and comparison of regional environmental Kuznets curves for CO2 emissions in Korea. J. Environ. Policy 2010, 9, 53–76. [Google Scholar] [CrossRef]

- Kim, J.W.; Ro, Y.J.; Kim, W.K. Analysis on the Economic Factors of CO2 Emission in Korea. Korean Energy Econ. Rev. 2012, 11, 87–119. [Google Scholar] [CrossRef]

- Bae, J.H.; Kim, M.S. Analysis of determinants of emission of greenhouse gases applying a production function approach. Korea Rev. Appl. Econ. 2012, 14, 107–132. [Google Scholar]

- Kim, S.; Jung, K.H. EKC hypothesis testing for the CO2 emissions of Korea considering total factor productivity: Focusing on the CO2 emissions by region and GRDP. Environ. Resour. Econ. Rev. 2014, 23, 667–688. [Google Scholar] [CrossRef]

- Kim, S.W.; Lee, K.; Nam, K. The relationship between CO2 emissions and economic growth: The case of Korea with nonlinear evidence. Energy Policy 2010, 38, 5938–5946. [Google Scholar] [CrossRef]

- López, R.; Palacios, A. Have Government Spending and Energy Tax Policies Contributed to Make Europe Environmentally Cleaner? University of Maryland: College Park, MD, USA, 2010. [Google Scholar]

- Halkos, G.E.; Paizanos, E.A. The effect of government expenditure on the environment: An empirical investigation. Ecol. Econ. 2013, 91, 48–56. [Google Scholar] [CrossRef]

- Tamazian, A.; Chousa, J.P.; Vadlamannati, K.C. Does higher economic and financial development lead to environmental degradation: Evidence from BRIC countries. Energy Policy 2009, 37, 246–253. [Google Scholar] [CrossRef]

- Omri, A.; Daly, S.; Rault, C.; Chaibi, A. Financial development, environmental quality, trade and economic growth: What causes what in MENA countries. Energy Econ. 2015, 48, 42–252. [Google Scholar] [CrossRef]

- Halkos, G.E.; Paizanos, E.A. The effects of fiscal policy on CO2 emissions: Evidence from the USA. Energy Policy 2016, 88, 317–328. [Google Scholar] [CrossRef]

- Adewuyi, A.O. Effects of public and private expenditures on environmental pollution: A dynamic heterogeneous panel data analysis. Renew. Sustain. Energy Rev. 2016, 65, 489–506. [Google Scholar] [CrossRef]

- Fan, W.; Li, L.; Wang, F.; Li, D. Driving factors of CO2 emission inequality in China: The role of government expenditure. China Econ. Rev. 2020, 64, 101545. [Google Scholar] [CrossRef]

- Jin, X.; Ahmed, Z.; Pata, U.K.; Kartal, M.T.; Erdogan, S. Do investments in green energy, energy efficiency, and nuclear energy R&D improve the load capacity factor? An augmented ARDL approach. Geosci. Front. 2023, 101646. [Google Scholar]

- Erdogan, S.; Pata, U.K.; Solarin, S.A. Towards carbon-neutral world: The effect of renewable energy investments and technologies in G7 countries. Renew. Sustain. Energy Rev. 2023, 186, 113683. [Google Scholar] [CrossRef]

- Pata, U.K.; Erdogan, S.; Ozcan, B. Evaluating the role of the share and intensity of renewable energy for sustainable development in Germany. J. Clean. Prod. 2023, 421, 138482. [Google Scholar] [CrossRef]

- Ministry of the Interior and Safety. Local Finance Yearbook; Local Finance Integrated Open System, Ministry of the Interior and Safety: Seoul, Republic of Korea, 2021. Available online: https://www.lofin365.go.kr/portal/LF3130101.do (accessed on 27 July 2023).

- KOSIS. Regional Income Dataset; Korean Statistical Information Service, Statistics Korea: Seoul, Republic of Korea, 2021. Available online: https://kosis.kr/eng/ (accessed on 27 July 2023).

- KESIS. Yearbook of Regional Energy Statistics; Korea Energy Statistical Information System, Ministry of Trade, Industry and Energy: Sejong-si, Republic of Korea, 2018. Available online: https://www.keei.re.kr/main.nsf/index.html?open&p=%2Fweb_keei%2Fd_results.nsf%2F0%2FCE6CD3D752FC85BC49258393002B248B&s=%3Fopendocument%26menucode%3DSS50%26category%3D%25C1%25F6%25BF%25AA%25BF%25A1%25B3%25CA%25C1%25F6%25C5%25EB%25B0%25E8%25BF%25AC%25BA%25B8%26rescategory%3D%25EC%25A0%2584%25EC%25B2%25B4%26viewname%3Dmain_periodicals_09 (accessed on 27 July 2023).

- Korea Land and Housing Corporation. Urban Planning Status; Ministry of Land, Infrastructure and Transport: Jinju-si, Republic of Korea, 2021. Available online: https://www.lx.or.kr/kor/publication/city/list.do (accessed on 27 July 2023).

- Agras, J.; Chapman, D. A dynamic approach to the environmental Kuznets curve hypothesis. Ecol. Econ. 1999, 28, 267–277. [Google Scholar] [CrossRef]

- Cole, M.A. Corruption, income and the environment: An empirical analysis. Ecol. Econ. 2007, 62, 637–647. [Google Scholar] [CrossRef]

- Hansen, L.P. Large sample properties of generalized method of moments estimators. Econom. J. Econom. Soc. 1982, 50, 1029–1054. [Google Scholar] [CrossRef]

- Arellano, M.; Bond, S. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev. Econ. Stud. 1991, 58, 277–297. [Google Scholar] [CrossRef]

- OECD. The Economic Consequences of Climate Change; Organisation for Economic Co-Operation and Development: Paris, France, 2015; Available online: https://www.oecd.org/env/the-economic-consequences-of-climate-change-9789264235410-en.htm (accessed on 27 July 2023).

- Kahn, M.E.; Mohaddes, K.; Ng, R.N.; Pesaran, M.H.; Raissi, M.; Yang, J.C. Long-term macroeconomic effects of climate change: A cross-country analysis. Energy Econ. 2021, 104, 105624. [Google Scholar] [CrossRef]

- Madeira, C. A review of the future impact of climate change in Chile: Economic output and other outcomes. Mitig. Adapt. Strateg. Glob. Chang. 2022, 27, 56. [Google Scholar] [CrossRef]

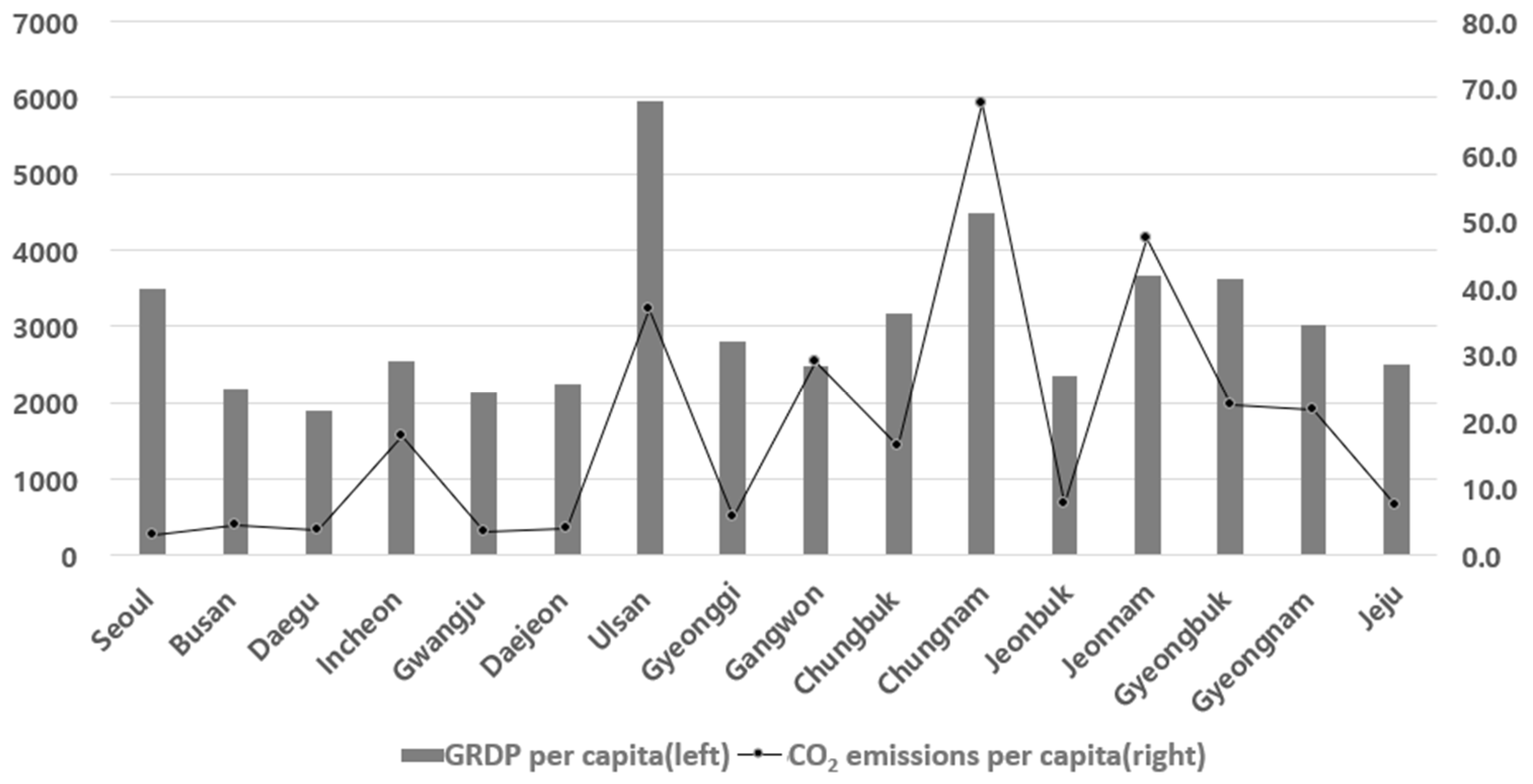

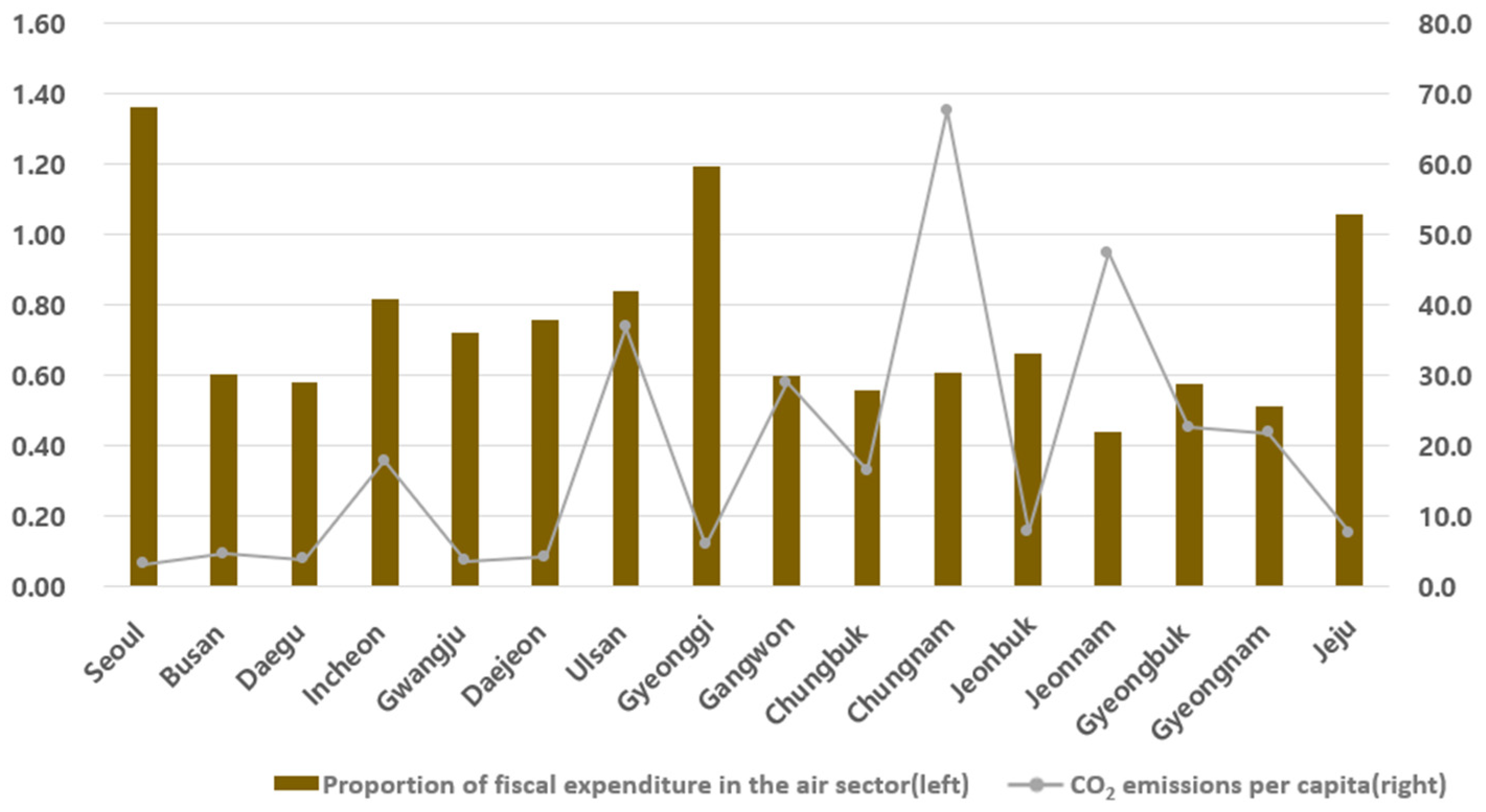

| Variable | Unit | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| Gross regional domestic product (GRDP) | Ten thousand KRW/person | 3030.3 | 1102.4 | 1504.9 | 6537.0 |

| Fiscal expenditure for air quality (AEXP) | Ten thousand KRW/person | 404.2 | 497.7 | 0.7 | 2799.0 |

| CO2 emission (CO2) | tons/person | 18.7 | 18.2 | 3.0 | 74.0 |

| Number of workers (LABOR) | 1000 people | 1579.8 | 1577.6 | 284.0 | 6790.0 |

| Value of tangible assets (CAPITAL) | Million KRW/person | 8712.9 | 8207.3 | 382.4 | 30,274.2 |

| Final energy consumption per GRDP (ENERGY) | 1000 toe/person | 394.3 | 281.8 | 34.9 | 1161.2 |

| Industrial area (INDUSTRY) | 1000 m2/1000 people | 30.5 | 23.8 | 2.1 | 93.9 |

| Energy Price Index (EPI) | 2020=100 | 116.3 | 10.8 | 99.5 | 132.6 |

| Pooled OLS | Fixed Effect | System-GMM | |

|---|---|---|---|

| 0.980 *** (−0.010) | 0.661 *** (−0.041) | 0.866 *** (−0.024) | |

| −0.001 (−0.002) | 0.008 *** (−0.002) | 0.008 *** (−0.002) | |

| 0.004 (−0.006) | 0.133 (−0.084) | −0.011 (−0.008) | |

| 0.002 (−0.003) | 0.098 *** (−0.027) | 0.007 (−0.009) | |

| −0.005 (−0.006) | −0.179 *** (−0.022) | 0.020 *** (−0.007) | |

| Constant | 0.086 * (−0.048) | 0.441 (−0.501) | 0.423 *** (−0.083) |

| Hansen test | 0.115 | ||

| AR(1) | 0.011 | ||

| AR(2) | 0.172 |

| Pooled OLS | Fixed Effect | System-GMM | |

|---|---|---|---|

| 0.986 *** (−0.015) | 0.389 *** (−0.081) | 0.585 *** (−0.110) | |

| −0.004 (−0.005) | −0.012 * (−0.007) | −0.017 ** (−0.008) | |

| 0.352 (−0.473) | −0.039 (−0.641) | 6.714 ** (−3.160) | |

| −0.053 (−0.067) | 0.043 (−0.088) | −0.912 ** (−0.451) | |

| −0.036 (−0.025) | −0.391 * (−0.230) | −0.409 *** (−0.112) | |

| 0.010 (−0.014) | 0.068 (−0.079) | 0.005 (−0.055) | |

| 0.038 * (−0.021) | 0.063 (−0.067) | 0.382 *** (−0.096) | |

| −0.017 (−0.023) | 0.156 * (−0.092) | 0.077 (−0.083) | |

| −0.148 ** (−0.072) | −0.050 (−0.074) | −0.162 ** (−0.067) | |

| Constant | 0.153 (−0.819) | 2.669 (−1.633) | −10.028 * (−5.297) |

| Hansen test | 0.143 | ||

| AR(1) | 0.071 | ||

| AR(2) | 0.974 |

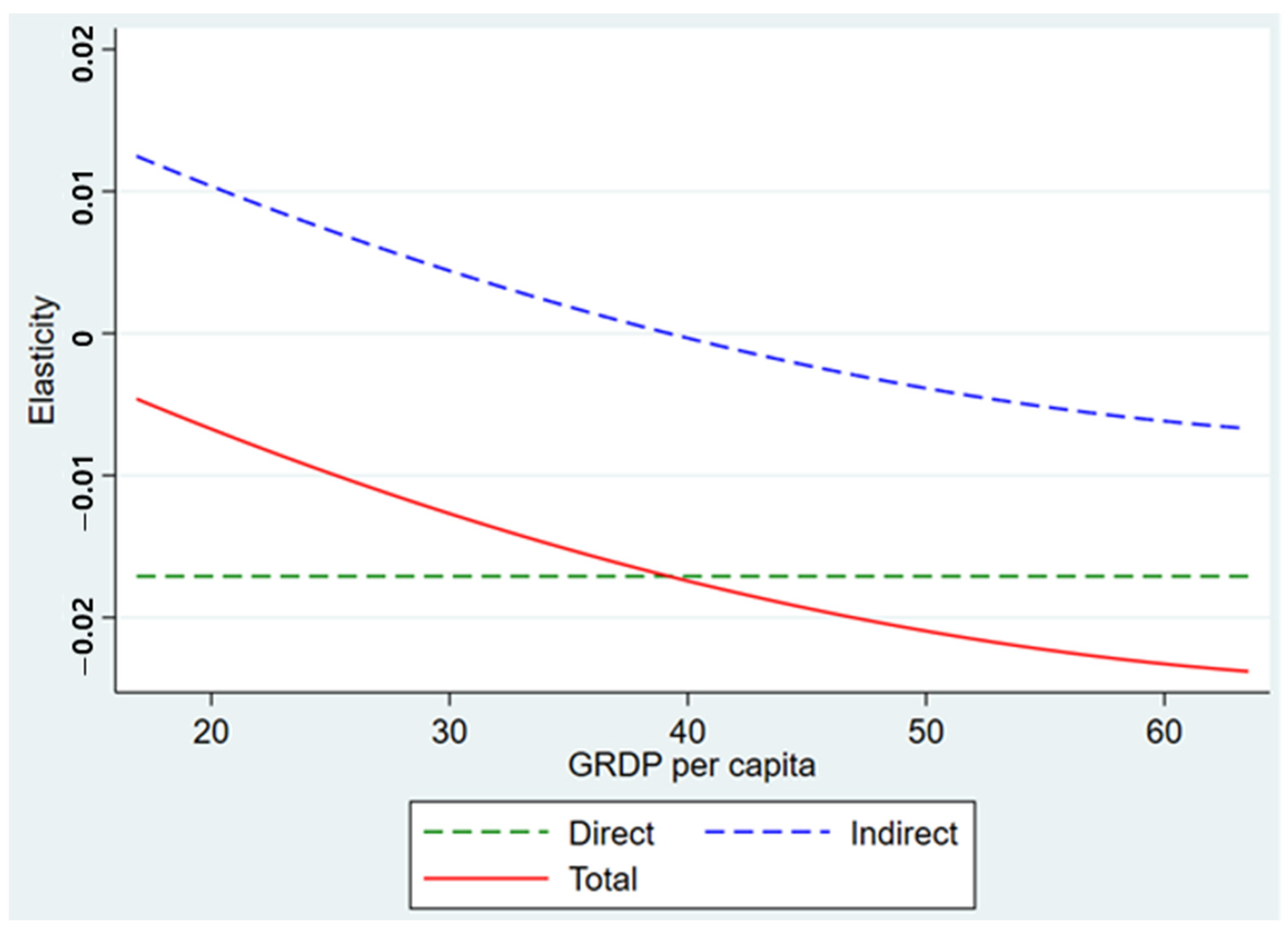

| Region | GRDP per Capita | Direct Effect | Indirect Effect | Total Effect |

|---|---|---|---|---|

| Seoul | 3398 | −0.017 | 0.002 | −0.015 |

| Busan | 2291 | −0.017 | 0.009 | −0.008 |

| Daegu | 2018 | −0.017 | 0.01 | −0.007 |

| Incheon | 2659 | −0.017 | 0.006 | −0.011 |

| Gwangju | 2207 | −0.017 | 0.009 | −0.008 |

| Daejeon | 2277 | −0.017 | 0.009 | −0.008 |

| Ulsan | 5731 | −0.017 | −0.006 | −0.023 |

| Gyeonggi | 2881 | −0.017 | 0.005 | −0.012 |

| Gangwon | 2571 | −0.017 | 0.007 | −0.01 |

| Chungbuk | 3143 | −0.017 | 0.004 | −0.013 |

| Chungnam | 4444 | −0.017 | −0.002 | −0.019 |

| Jeonbuk | 2481 | −0.017 | 0.007 | −0.01 |

| Jeonnam | 3768 | −0.017 | 0.001 | −0.016 |

| Gyeongbuk | 3662 | −0.017 | 0.001 | −0.016 |

| Gyeongnam | 3081 | −0.017 | 0.004 | −0.013 |

| Jeju | 2493 | −0.017 | 0.007 | −0.01 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Oh, J. The Effects of Local Government Expenditures on Carbon Dioxide Emissions: Evidence from Republic of Korea. Sustainability 2023, 15, 14913. https://doi.org/10.3390/su152014913

Oh J. The Effects of Local Government Expenditures on Carbon Dioxide Emissions: Evidence from Republic of Korea. Sustainability. 2023; 15(20):14913. https://doi.org/10.3390/su152014913

Chicago/Turabian StyleOh, Juhyun. 2023. "The Effects of Local Government Expenditures on Carbon Dioxide Emissions: Evidence from Republic of Korea" Sustainability 15, no. 20: 14913. https://doi.org/10.3390/su152014913

APA StyleOh, J. (2023). The Effects of Local Government Expenditures on Carbon Dioxide Emissions: Evidence from Republic of Korea. Sustainability, 15(20), 14913. https://doi.org/10.3390/su152014913