Abstract

Based on the panel data from 30 provincial capitals in China from 2005 to 2019, the level of green development in China’s provincial capitals was measured using the entropy value method, and their spatial distribution was analyzed using ArcGIS software. The impact of excise tax and technological innovation on the green development of China’s provincial capitals was examined by constructing a dynamic spatial Durbin model. This study shows that: (1) There are spatial differences in the green development level of the cities, with the overall characteristics of “east > central > west”; (2) The level of green development in Chinese cities has “time inertia” and positive “spatial spillover” effect; (3) Excise tax can promote green development in cities, and it exerts differential effects on green development in the eastern, central and western regions; (4) The results of the mediating effects model demonstrate that technological innovation mediates the relationship between consumption tax and green development in China’s provincial capitals.

1. Introduction and Literature Review

As China transitions from high-speed economic growth to high-quality economic development, green development will certainly become the inevitable choice to resolve and reconcile the dilemma and conflict of economic growth and environmental degradation. In the 20th Party Congress (2022), Chinese leadership mandated the implementation of the new development concept completely, accurately and comprehensively, which is to build a beautiful China, and actively promote a green development and lifestyle. In this endeavor, excise tax is expected to play a vital role in promoting green consumption and production, and green development with its characteristics of selective taxation, differential taxation and earmarking of funds. Technological innovation is also expected to play a vital role in this endeavor, which is the motivation and source of economic growth and sustainable green development through breaking resource constraints and creating new dynamic energy. As an important component of the country’s economic activities, Chinese cities, particularly the provincial capitals, play a crucial leading role in the process of building an ecological civilization and achieving sustainable development. Therefore, it is important to study how excise tax can influence the green development of China’s provincial capitals through technological innovation.

Studies on excise tax and urban green development mainly focus on the influence of environmental tax on city green development for research, which can be summarized into three aspects. First, researchers generally believe that the imposition of environmental tax can decrease pollution emissions and improve the ecological environment. For example, Tamura (1996), Tric (2012) and Niu (2018) argue that the levy of environmental taxes can protect the environment by curbing pollution emissions and reducing carbon emissions [1,2,3]. Liu and Zhang (2018) find that there are regional differences in the emission reduction effect of sewage charges [4]. Second, with respect to the economic dividend of environmental tax, scholars hold different views: He and Huang (2017) think the imposition of emission charges will stimulate corporate technological innovation and then improve corporate performance [5], while Lu et al. (2019) argue that in the context of a lack of capacity constraints, imposing environmental tax will inhibit the enhancement of corporate green innovation capacity and instead create negative incentives for economic growth [6]. Third, with respect to its combined effect, Gast et al. (2017) find that the implementation of environmental tax can improve both social efficiency and environmental quality [7]. Yu et al. (2021) argue that changing environmental protection fees to taxes would significantly promote the green transformation of heavily polluters [8]. Hu et al. (2019) believe the levy of emission fees and green total factor productivity exhibit a “U” type relationship that decreases first and then increases later [9]. In the research area regarding the effects of innovation in technology on the green development of cities, scholars also have different views. Han et al. (2021) find that the coupling coordination degree between technological innovation and green development increases year by year, and that city size is directly proportional to the coupling coordination [10]. Omri (2020) finds that technological innovation is conducive to green development only in rich countries and there is no facilitation effect in low-income countries [11]. Zeng and Hu (2021) believe that technological innovation has a “U” type relationship of first inhibiting and then promoting green development in cities [12]. Regarding the study of excise tax and technological innovation, the current literature mostly refers to environmental compliance, green taxation and technological innovation indirectly, mainly focusing on the “innovation compensation effect [13]” and “compliance cost effect [14]”. Brunnermeier and Cohen (2003) argue that environmental compliance can greatly facilitate technological innovation in manufacturing industries [15]. Guo et al. (2017) argue that environmental compliance effectively promotes technological progress [16]. Li, Sihui and Xu (2020) demonstrate that environmental compliances are conducive to technological innovation and that they push technological innovation more significantly in provincial capitals than in non-capital cities [17].

In summary, most literature focuses on pairwise studies of environmental taxes and urban green development or technological innovation and regional green development in the context of green taxation. There are fewer discussions on consumption tax and urban green development, and even fewer studies on the mediating effect of technological innovation in it. Most of the data analysis in the existing studies is also based on provincial panel data, and there are few studies based on provincial capital city data. To fill the gap in the existing studies, this paper applies the entropy value method to evaluate the degree of green development in China’s 30 capital cities. We use two spatial weight matrices to establish a dynamic spatial Durbin model to measure the influence of consumption tax on green development in provincial capital cities, respectively, and then use technological innovation as an intermediate variable to explore its mediating role in the effect of consumption tax on city green development. This study provides a more original, novel and comprehensive perspective to find the inter-relationship between excise tax and urban green development.

2. Mechanism Analysis and Research Hypothesis

2.1. Effects of Excise Tax on Urban Green Development

The impact of excise tax on urban green development can be analyzed in two dimensions: consumers’ behavioral choices and producers’ product restructuring. On the one hand, excise tax plays a special role in guiding consumption that cannot be replaced by other taxes [18,19], which allows the government to effectively regulate consumers’ behavior and promote green consumption by imposing excise tax on specific or targeted commodities. For example, imposing excise tax on highly polluting and energy-consuming products and raising their prices can reduce consumers’ demand for those commodities and steer consumers toward non-taxed, environmentally friendly alternatives, thus promoting green living. On the other hand, consumer demand largely influences and even determines the scale of production and product mix of producers in a buyer’s market. In order to gain more profits, producers will respond to market demand by producing fewer highly polluting products and expanding the scale of production of green products, thus promoting urban green development. Therefore, in the process of guiding consumers to green consumption, excise tax also indirectly affects the production behavior of producers [20]. Accordingly, the following hypothesis is postulated:

H1:

The collection of consumption tax has an active effect on urban green development.

2.2. The Role of Technological Innovation in Mediating between Excise Tax and Urban Green Development

The “compliance cost effect” and the “innovation compensation effect” explain the path of environmental compliance affecting urban green development through technological innovation from two perspectives: inhibition and promotion, respectively. Although they hold different perspectives, they both illustrate that the relationship between environmental compliance and urban green development is influenced by the intermediate factor of technological innovation. The same applies to environmental taxes as an important instrument of environmental regulation. Consumption taxes, as an important component of environmental taxation, are inextricably linked to this. As a punitive fiscal policy, the creation and collection of environmental taxes internalize the negative external costs of polluting enterprises, increasing their production costs. As a component of environmental tax, excise tax also has characteristics that are unmatched by other taxes in promoting the green transformation of enterprises. It can indirectly promote corporate eco-innovation by influencing consumers’ behavioural choices [21]. Theoretically, as an indirect tax, the tax burden is ultimately borne by the consumers. When the environmental tax on goods is too heavy, consumers will find it difficult to afford and will turn to eco-innovation products with price advantages, which in turn will drive market demand and promote green development. For example, more and more consumers are choosing to buy new energy vehicles in the face of rising oil prices, which in turn motivates companies to innovate and develop various new energy vehicles. Accordingly, the following hypothesis is postulated:

H2:

Technological innovation mediates between excise tax and urban green development, i.e., excise tax advances urban green development by facilitating technological innovation.

3. Measurement of Green Development Level and Spatial Correlation Analysis

3.1. Measurement Method and Selection of Indicators

In this paper, the assessment system of regional green development level structured by Chen et al. [22] is used to measure the urban green development level with three dimensions: socio-economic characteristics, environmental pressure and green environmental protection activities. The detailed indicator system built is shown in Table 1.

Table 1.

Urban green development indicator system.

To mitigate the relative lack of objectivity of the subjective assignment method, this paper chooses the entropy method, an objective assignment approach, to test the green development level of China’s 30 provincial capitals, and the operation steps are as follows:

The first step is process standardization to clarify whether the size of each indicator has a positive or negative affect on the overall evaluation system:

Treatment of positive indicators:

Treatment of negative indicators:

In the second step, calculate the weight of indicator t in the aggregate in year i:

In the third step, calculate the entropy value of an index:

In the fourth step, calculate the redundancy of an index entropy value:

In the fifth step, calculate the weights of every indicator:

In the sixth step, the weight of each individual indicator is multiplied with the standardized value . The resulting multiplication value is the final score of the indicator in the total evaluation system, which is the level of urban green development required for analysis in this paper.

3.2. Time-Series Characteristics of the Level of Green Development in Cities

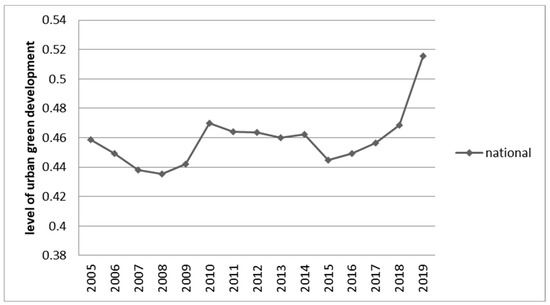

To portray graphically the changing characteristics of the green development level of China’s provincial capital cities over the past fifteen years, this paper combines the above measurement results and presents in Figure 1 the green development level in the whole country from 2005 to 2019. The profile shows a slight decline in the first period and a gradual increase in the later period. The reason for this phenomenon may be that at the beginning of the twenty-first century, China started to recognize gradually the importance of sustainable development while pursuing rapid economic growth and began to formulate a series of measures to rectify the country’s extensive economic development model, which was characterized with high energy consumption and high pollution. However, the corrective efforts take time to achieve results, and hence there was a weak downward trend in green development in the early part of the period. Nonetheless, as time progresses, the level of green development in the cities began to rise gradually, indicating that the various environmental protection measures implemented in recent years began to show results. In order to maintain the positive momentum, the country needs to make further efforts and take relevant measures in accordance with local conditions, raise the national awareness of environmental protection and strive to achieve nationwide green sustainability.

Figure 1.

National green development level trend chart, 2005–2019.

3.3. Regional Differences in Urban Green Development Level

This paper measures the green development level in 30 provincial capitals from 2005 to 2019 according to the constructed urban green development index system described in the preceding section. The average green development level values of each provincial capital city are shown in Table 2.

Table 2.

Average green development level of 30 provincial capitals in China, 2005–2019.

From Table 2, it can be seen that the cities at the forefront of green development are Beijing, Guangzhou, Hangzhou, Shanghai and Nanjing, all of which have an average green development level greater than 0.6; and the cities at the bottom of the list are Yinchuan, Chongqing and Xining, all of which have an average green development level below 0.3. Cities in the eastern region, except Shijiazhuang, have the average green development level placed in the middle and upper ranks. Table 2 also shows that there are considerable regional differences in the level of green development in China. In general, cities in the eastern region have higher green development levels, followed by the central region and the western region has a lower level. This pattern is also consistent with the findings in the existing literature.

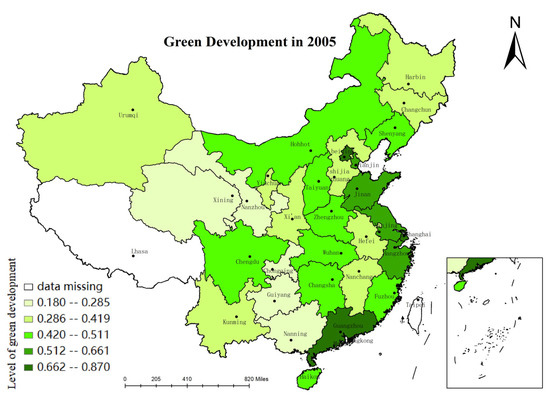

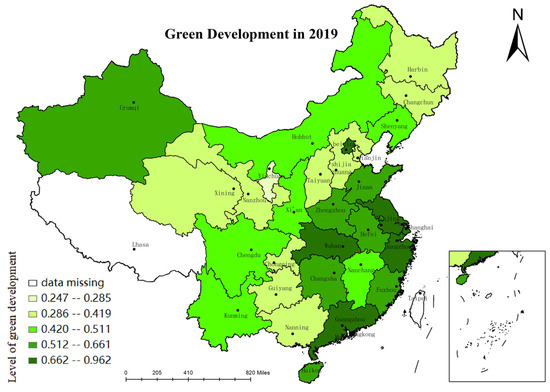

In order to more intuitively understand the spatio-temporal variation characteristics of the green development level of each provincial capital city in China, this paper uses ArcGIS software to graphically display the spatial distribution of the urban green development level in 2005 and 2019. (To make the presentation more intuitive, the data from the provincial capital cities are represented by the region of each province). The specific results are shown in Figure 2 and Figure 3. From a national perspective, the overall green development level from 2005 to 2019 shows an upward trend, with cities reaching a higher level of green development in 2019 compared to 2005. At the regional level, most of the provincial capitals with higher levels of green development are located in the eastern region, and the low-value areas are mainly located in the western region. The results in Figure 2 and Figure 3 are basically consistent with the above analysis in Table 2, with the overall green development level of the country showing an upward trend, and the eastern region having a higher green development level than the central and western regions. These results are closely related to factors such as the cities’ resource endowment, technological development level and economic development level. The eastern cities, with their strong economic strength, better talent reserves and advanced technological means, can more easily promote industrial structure upgrading and transformation, and vigorously develop green economy. In addition, they have a higher economic level, a better tax collection and management system, and a higher tax awareness and compliance of the taxpayers, all of which enable them to reasonably use the restraining function of consumption tax to reduce the supply and demand for highly polluting taxable goods by producers and consumers, thus resulting in a higher level of regional green development. The central region is dominated by resource-based industrial structure, and its economic growth relies more on the high-pollution, high-energy consumption development model, so the level of green development has been at a lower level compared with the eastern region. Due to the backward level of economic development in the western region, there is the phenomenon of over-exploitation of energy resources in the process of development, which is difficult to recover once it occurs and can only be intervened to stop deterioration. Therefore, the western region has the lowest level of urban green development.

Figure 2.

Spatial distribution of green development levels in China’s provincial capitals, 2005.

Figure 3.

Spatial distribution of green development levels in China’s provincial capitals, 2019.

4. Empirical Analysis of Excise Tax and Technological Innovation on Urban Green Development

4.1. Spatial Econometric Model

4.1.1. Construction of the Spatial Econometric Model

- Test model of the respective impact of excise tax on urban green development

As the green development level between regions has a spatial spillover effect, regions with a high level of green development will drive the green development of neighboring regions, and China’s green development indeed shows the spatial and temporal characteristics of endogenous and benign interaction [23]. Therefore, the influence of spatial effects needs to be incorporated into the construction of an econometric model. Spatial panel models are broadly divided into three types: spatial lag models (SLM), spatial error models (SEM) and spatial Durbin models (SDM). Both the spatial lag model and the spatial error model can be transformed from the spatial Durbin model, i.e., the spatial Durbin model is more general in nature and can encompass SLM and SEM. Because green development is a dynamic and sequential process, the present level of green development is not only influenced by the present period factors, but also the role of former factors. Therefore, this paper introduces the lagged first order of the explanatory variables into the model, which can break through the limitations of the static spatial panel model and generate more accurate and reasonable results. As such, we construct a dynamic spatial Durbin model as follows:

In which gdl is the explanatory variable level of urban green development; is the spatial autoregressive coefficient; W is the spatial weight matrix; ct is the core explanatory variable, the proportion of excise tax revenue in GDP of provincial capitals; control is each control variable; , and denote individual fixed effects, time fixed effects and random disturbance terms, respectively.

- 2.

- A test model of the mediating effect of technological innovation

To verify the aforementioned Hypothesis 2 (H2), that excise tax may achieve green urban development through the improvement of technological innovation level, this paper constructs a more normative mediating effect model for further empirical testing. Drawing on the stepwise mediating effect test proposed by Wen Zhonglin et al. [24], the indirect effect of the core explanatory variable (X) on the explanatory variable (Y) through the mediating variable (M) can be judged by the significant coefficients of the mediating effect model to determine whether the mediating effect exists and the specific form of its existence. The basic model is shown as follows:

In this paper, according to the dynamic spatial Durbin model, the green development level (gdl) of the city is taken as the explained variable Y, technological innovation (rd) is taken as the mediating variable M to be tested and excise tax (ct) is taken as the core explanatory variable X. The specific control variables remain the same as the original model, and the specific mediating effect test model is set up as shown below:

Thus, Equations (8), (12) and (13) constitute the mediating effect test model. The specific steps are as follows: Step 1, test Equation (8), if the regression coefficient is significant, then it indicates that the levy of excise tax can promote urban green development; if it is not significant, then the mediating effect test should be stopped. Step 2, test Equations (12) and (13), if the regression coefficients of and are significant, then the mediation effect test is passed; if there are insignificant coefficients, then the Sobel test is used to test. In addition, if the regression coefficient in Equation (13) is not significant, but is significant, it means that the level of technological innovation has a full mediation effect; if both are significant, it means that the level of technological innovation has a partial mediation effect.

4.1.2. Selection of the Spatial Weight Matrix

In order to comprehensively examine the spatial effects of excise tax and technological innovation on urban green development, also considering the robustness of the test results, two weighting matrices, the inverse distance matrix and economic geography matrix, are selected and standardized, respectively, in the econometric modeling.

- Inverse distance matrix: The inverse of the square of the rectilinear distance between city i and city j. The spatial spillover effect decreases as the distance between the two cities increases.

- 2.

- Economic geography matrix: The inverse of the absolute value of the difference in GDP per capita between two cities. The smaller the difference in GDP per capita between the two cities, the larger the economic geographic weight in determining the spatial spillover effect.

4.1.3. Variable Selection and Data Description

- Dependent variable

City green development level (gdl), measured by the aforementioned method.

- 2.

- Core explanatory variables

Consumption tax (ct) is expressed as the amount of consumption tax revenue as a percentage of GDP in each provincial capital city.

- 3.

- Mediating variables

Technological innovation (rd), the number of patents granted in each provincial capital city was chosen to measure.

- 4.

- Control variables

Considering that the green development of cities may have a certain continuity, and the green development level of the current period will be influenced by the prior period level, this paper introduces a lagged one-period term to reflect the dynamic changes of urban green development. The level of economic growth (gdp) in terms of GDP per capita (yuan); the industrial structure (sins, tins) is respectively expressed as the proportion of the secondary industry and value added in the tertiary industry to GDP(%); the opening-up degree (fdi) is expressed as the proportion of actual foreign capital utilized to GDP(%); the expenditure on environmental protection (hb) is expressed as the proportion of expenditure on environmental protection to GDP(%); the level of urbanization (ur) is denoted by the share of urban resident population in the total population (%); education expenditure (edu) is expressed as a share of education expenditure in fiscal expenditure (%).

- 5.

- Data sources

The data are mainly obtained from the statistical yearbooks and the statistical bulletins on national economic and social development. Excise taxes that are not available in the statistical yearbooks are provided by the local taxation bureaus in the form of government disclosure on applications. A few missing figures were filled in by interpolation. In order to mitigate the effects of heteroskedasticity, the above variables are logarithmically treated. The descriptive statistics for every variable in the model are shown in Table 3.

Table 3.

Summary of variables and descriptive statistics (2005–2019).

4.2. Empirical Results

4.2.1. Spatial Correlation Test of Urban Green Development Level

Spatial correlation analysis is a pre-step for spatial econometric analysis. In this paper, we first measured the green development level of 30 provincial capitals in China from 2005 to 2019, and then used Stata software to calculate the Moran’s I index for the green development level of the cities. Table 4 shows the global Moran’s I index for the green development level of the cities under the inverse distance matrix and the economic geography matrix. The values are all highly significantly positive at the 1% level. This finding reveals that the green development level of the provincial capital cities in China has an obvious positive spatial correlation and is significantly spatially dependent. It also indicates that the level of green development among the 30 provincial capitals in China exhibits a significant spatial agglomeration. Therefore, a comprehensive analysis of the level of green development cannot ignore its spatial correlation pattern, otherwise it may cause bias in the model estimation.

Table 4.

Moran’s I values for green development levels in 30 provincial capitals in China, 2005–2019.

4.2.2. Analysis of Overall Results

The overall results are shown in Table 5, where Models 1 and 2 display the influence of excise tax on urban green development under the inverse distance matrix and economic geography matrix, respectively.

Table 5.

Empirical results of the influence of excise tax on city green development.

Under both spatial weight matrices, the coefficients of the lagged first-order green development levels of the provincial capitals are highly significantly positive at the 1% level. This finding indicates the time inertia property of the green development level of China’s provincial capitals, and that the current period’s green development level is influenced by the level in previous periods. This result also reflects the rationality of the dynamic spatial Durbin model. Moreover, the coefficient , the spatial lag of green development level, is highly significantly positive in all models, indicating that the green development level of the cities has a highly significant positive spatial spillover effect, i.e., provincial capitals with higher green development levels can drive the green development of the neighboring provincial capitals.

Among the core explanatory variables, the effect of excise tax on urban green development is highly significantly positive at the 10% and 5% levels, which indicates its positive contribution to the green development of the region. This is in line with Hypothesis 1 (H1) presented earlier. This may be determined by the regulatory nature of excise tax, as it is only levied on some selected goods with the policy intent, apart from regulating income distribution, to eliminate positive and negative externalities and promote green development in cities. For example, by taxing highly polluting goods such as cars and motorbikes, it can dampen consumer demand and in turn reduce producer production, thereby achieving the goal of curbing polluting products at the source.

Among the control variables, the economic development level of the region has a highly significant positive effect on the city’s green development; as the economy continues to develop, people begin to pursue a higher quality green lifestyle with a rising awareness of environmental protection, which induces them to be more focused on energy saving and environmental protection and promote the green development of the city. However, the economic development level of the neighboring cities has a significant negative effect (at the 1% level) on the green development level of the city, which may be due to the fact that the neighboring cities may relax their environmental regulations in pursuit of rapid economic growth, resulting in serious pollution in the region and even causing some pollution spillover to the neighboring cities. The development of the second (manufacturing) industry has an inhibiting influence on urban green development, whereas the development of the tertiary (service) industry has a positive effect on urban green development, proving that the upgrading of industrial structure plays an important role in the green development of cities. Increased openness to the outside world would inhibit urban green development, probably because some governments, in order to accelerate economic growth of the city, may choose to attract foreign enterprises at the expense of the environment, which produces serious pollution to the environment. On the other hand, government spending on environmental protection can promote the green development of cities, indicating that government intervention is also important for green urban development.

4.2.3. Direct and Indirect Effects

In order to more accurately analyze the dynamic impact of excise tax on urban green development, the total effect of excise tax on urban green development was further divided into direct and indirect effects through a partial differential matrix. Due to space constraints, only the specific results under the economic matrix are shown in Table 6 (Since the empirical results from the inverse distance matrix do not differ much from the economic matrix, considering the length of the paper, only the empirical results from the economic matrix will be presented in detail).

Table 6.

Direct and indirect effects.

From Table 6, it can be seen that the short-term effects of some of the explanatory variables are significant, but the long-term effects of all variables are not significant. This indicates that in the short term, consumption tax can promote green urban development, but in the long term, if it does not keep up with the times; it will not be able to better promote urban green development through consumption tax policies.

From the short-term effects, the direct effect of consumption tax is obviously positive at the 5% level, while the indirect effect is not significant. As a punitive taxation policy, consumption tax can promote the green transformation and development of a region by increasing the tax burden, but it cannot solve the green development problems of all regions. The levy of consumption tax to promote green development in cities will have a significant effect on regions with high tax awareness, but for regions with low tax compliance, they may make decisions that are contrary to green development in order to develop the regional economy. Even in some less economically developed regions, there will be a reverse effect by actively absorbing heavy polluting enterprises that have moved out of the economically developed regions in order to develop their economies. Moreover, the consumption tax only levies taxes on some goods, and there are still many environmentally polluting goods that are not included in the scope of the consumption tax. This may lead to the excise tax not significantly promoting the green development of neighboring areas and may even have a suppressive effect on green development in neighboring regions. In addition, as a central tax, excise tax is collected and uniformly controlled by the state, which makes it impossible for local governments to make use of local excise tax revenue for green development. Those areas with high pollution levels are also generally economically backward, and local governments lack sufficient financial resources to balance environmental protection with the economy. This feature will also lead to the inability to effectively play the environmental protection function of excise tax. Currently, in the reform policies of consumption tax adopted by China, there is a countermeasure to this problem—to shift the link of tax collection to the retail link, and to place the tax collection at the local level. We believe that with the reform, the local governments will be able to take the initiative in collecting excise tax, make better use of local fiscal funds and explore a path of win–win development that balances both economic and green development.

4.2.4. Sub-Regional Regression Analysis

To better substantiate the influence of excise tax on urban green development, we divided the 30 provincial capitals into three regions, the eastern, the central and the western region for further analysis. The eastern region included Beijing, Tianjin, Shijiazhuang, Shenyang, Jinan, Nanjing, Shanghai, Hangzhou, Fuzhou, Guangzhou and Haikou; a total of 11 cities. The central region included Hefei, Zhengzhou, Taiyuan, Wuhan, Changsha, Nanchang, Changchun, Harbin; a total of eight cities. The western region included Chongqing, Kunming, Chengdu, Guiyang, Nanning, Urumqi, Xining, Yinchuan, Lanzhou, Xi’an and Hohhot, total of 11 cities. The outcomes are shown in Table 7.

Table 7.

Empirical results by region.

It appears that while both excise tax and technological innovation can promote green development in all regions, the excise tax only has a significant boosting effect for the eastern region. This could be because the eastern region has established a higher level of economic development, the government can afford to place a greater emphasis on green urban development, coupled with a greater number of high-quality personnel and the taxpayers’ generally stronger awareness of taxation, all of which are conducive to uplifting the green role of excise taxes. In contrast, the central and western regions have comparatively lower economic levels, and the government focuses more on vigorously developing the regional economy, which may neglect the green development of the region. Moreover, people do not have a strong awareness of taxation and cannot accurately perceive the relationship between changes in taxation policies and green development, so the excise tax has a relatively small contribution to the level of green development in the central and western regions.

Among the other control variables, a notable variable is the effect of openness to the outside world on the green development of the cities. The results show that it can promote green development in the eastern region but is not conducive to green development in the central and western regions. The reason for this phenomenon may be that the eastern region has a higher level of economic development and foreign investors invest more in high-tech industries, which cause less environmental pollution. While the central and western regions have a lower level of economy, in order to develop their economy rapidly, they will absorb foreign enterprises that cause more serious environmental pollution, which will be detrimental to the green development of the city.

4.2.5. The Mediating Effect of Technological Innovation

Following the specific test steps for the mediating effect described in the previous section, the combination of Equations (8), (12) and (13) can further verify whether technological innovation acts as a mediating variable for the influence of consumption tax on city green development. The first step, the effect of consumption tax on urban green development, was tested using Equation (8) to obtain models 1 and 2 in Table 5, which showed that the regression coefficient of consumption tax on urban green development was significantly positive. The second step, the effect of consumption tax on the level of technological innovation, was tested by applying Equation (12) to obtain model 3 and model 5 in Table 8. The results showed that the regression coefficient of consumption tax on technological innovation was obviously positive at the 1% significance level. The third step, the impact of consumption tax and technological innovation on urban green development, was tested by applying Equation (13) to obtain models 4 and 6 in Table 8, which showed that the regression coefficients of consumption tax and technological innovation on urban green development were all significantly positive. This indicated that technological innovation has a partial mediating effect, which was consistent with Hypothesis 2 (H2) in this paper. The proportion of the mediating effect in the total effect was 23.2% and 15.84%, respectively. In other words, about 20% of the positive effect of excise tax on urban green development was achieved indirectly through technological innovation.

Table 8.

Empirical results of the intermediation effect.

5. Conclusions and Recommendations

According to the panel data of 30 provincial capitals across China from 2005 to 2019, this paper measures the green development level of each provincial capital city using the entropy method, examines the spatial correlation of the regional green development level and constructs a dynamic spatial Durbin model to ascertain the influence of excise tax on green development of each city. In addition, we test the mediating effect of technological innovation in consumption tax and urban green development. The key findings are as follows:

Firstly, the green development level of the cities in China has shown a rising trend during the sample period and has grown remarkably especially in the past two years. However, the level of green development in the cities varies greatly by region, which overall shows high levels in the east and low levels in the west.

Secondly, the green development level of 30 provincial capital cities in China has “temporal inertia” and positive “spatial spillover” effects. The current level of green development is influenced by the previous levels, and the city with a high level of green development will drive the neighboring cities’ green development.

Thirdly, there exists an apparent positive correlation between the administration of excise taxes and green development, and excise tax promotes green development in cities by facilitating technological innovation.

In response to the results of the above analysis, this paper gives the following policy implications and recommendations:

First, policymakers need to continue to promote the green development of cities and break the imbalance of regional development. Each region can combine the general guidelines and policies with its own local situation, to establish a green development initiative with collaboration between the government, enterprises and residents. The eastern region can continue to play a leading role, while the mid-western region needs to catch up and narrow the gap, both regions working jointly towards the early realization of a truly green and sustainable nation.

Second, strengthen inter-city cooperation and vigorously promote the collaborative development of regions to exploit the positive spatial effect. Cities with a more advanced level of green development can play a demonstration role and exert a radiation-driven effect, also strengthen support and assistance to cities with a lower level of green development in terms of green technology innovation, environmental governance and protection, so as to achieve a common green development across cities.

Thirdly, increase efforts in scientific and technological innovation and focus on the human capital development of talents. Regions can increase the supply of innovation funds and exercise fiscal functions to reduce the risks and costs of technological innovation for enterprises. At the same time, regional governments need to actively train and recruit innovative talents, combine technological innovation with environmental protection and encourage the research and development of green innovative technologies.

Fourth, optimize and adjust the excise tax system to influence green development. More excise taxes can be directed toward high pollution and high energy consumption products through the imposition of “prohibitive tax” to promote green consumption, stimulate green technology innovation and reduce environmental pollution. In terms of setting tax rates, a progressive taxation system can be considered, whereby products that do not exceed the pollution standard are exempted from taxation, while those that exceed the standard are taxed proportionately or progressively according to the degree of pollution, so that incentives and penalties are used together to better guide enterprises to green production. In addition, appropriate adjustments can be made to the tax revenue-sharing system between the central and local governments. Furthermore, part of the consumption tax levying power can be delegated to local authorities, so that they can make taxation adjustments to fit the local economic characteristics and effectively promote regional green development. At the same time, the tax collected due to environmental pollution can be used for local environmental improvement and green development. For example, it can provide financial support for enterprises researching green technology, provide incentives for residents choosing new energy vehicles and other intuitive and specific measures to let everyone feel the impact of urban green development. Moreover, the local governments should also use tax funds to explore the best way to balance economy and green development, and truly realize that tax revenue is taken from the people and used for the people, therefore better promoting the green and healthy development of the city.

Author Contributions

Original draft preparation: X.F. and M.L.; review, revise and editing: X.F. and W.-C.H. All authors have read and agreed to the published version of the manuscript.

Funding

This research received funding support from the 2021 Major Project on Humanities and Social Sciences Research in Anhui Universities: Research on Green Transformation of Traditional Manufacturing Industry in Anhui Province under the Double Carbon Target: Driving Mechanism, Effect Evaluation and Path Optimization (SK2021ZD0014), project manager: Xingcun Fang.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Most of the data on excise tax in this paper has been provided by the local taxation bureaus in the form of government disclosure on applications and is used only for this paper, other data has been obtained from local government annual reports and statistical yearbooks.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Tamura, H.; Nakanishi, R.; Hatono, I.; Umano, M. Is Environmental Tax Effective for Total Emission Control of Carbon Dioxide?-Systems Analysis of an Environmental-Economic Model. IFAC Proc. Vol. 1996, 29, 5435–5440. [Google Scholar] [CrossRef]

- Piciu, G.C.; Tric, C.L. Assessing the Impact and Effectiveness of Environmental Taxes. Procedia Econ. Financ. 2012, 3, 728–733. [Google Scholar] [CrossRef]

- Niu, T.; Yao, X.; Shao, S.; Li, D.; Wang, W. Environmental tax shocks and carbon emissions: An estimated DSGE model. Struct. Change Econ. Dyn. 2018, 47, 9–17. [Google Scholar] [CrossRef]

- Liu, Y.; Zhang, X.C. Analysis of the emission reduction effect of environmental protection tax and regional differences—An empirical study based on the adjustment of emission fees in China. Tax. Res. 2018, 2, 41–47. [Google Scholar]

- He, H.Q.; Huang, L.F. Can levying sewage charges effectively improve enterprise performance? Res. Financ. Econ. 2017, 7, 28–33. [Google Scholar]

- Lu, H.Y.; Liu, Q.M.; Xu, X.X.; Yang, N.N. Can environmental protection tax achieve “pollution reduction” and “growth”?—A perspective on the changes of emission fee collection standards in China. China Popul.-Resour. Environ. 2019, 29, 130–137. [Google Scholar]

- Gast, J.; Gundolf, K.; Cesinger, B. Doing Business in a Green Way: A Systematic Review of the Ecological Sustainability Entrepreneurship Literature and Future Research Directions. Clean Technol. 2017, 147, 44–56. [Google Scholar] [CrossRef]

- Yu, L.C.; Zhang, W.G.; Bi, Q. Did the change of environmental protection fee to tax promote the green transformation of heavy polluting enterprises?Evidence from a quasi-natural experiment on the implementation of the Environmental Protection Tax Law. China Popul.-Resour. Environ. 2021, 31, 109–118. [Google Scholar]

- Hu, Z.Y.; Zhang, L.N.; Li, Y. Research on the impact effect of emission levy on green total factor productivity—An assessment of policy effect based on GPSM. Financ. Theory Pract. 2019, 40, 9–15. [Google Scholar]

- Han, Y.N.; Ge, P.F.; Zhou, B.L. Evolutionary differences in the coupling and coordination of technological innovation and green development in Chinese municipalities. Econ. Geogr. 2021, 41, 12–19. [Google Scholar]

- Omri, A. Technological innovation and sustainable development:Does the stage of development matter. Environ. Impact Assess. Rev. 2020, 83, 106398. [Google Scholar] [CrossRef]

- Zeng, G.; Hu, L. Study on the impact of technological innovation on green development of cities in the Yellow River Basin. Geoscience 2021, 41, 1314–1323. [Google Scholar]

- Porter, M.E.; van der Linde, C. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Gray, W.B.; Shadbegian, R.J. Environmental Regulation, Investment Timing, and Technology Choice. J. Ind. Econ. 1998, 46, 235–256. [Google Scholar] [CrossRef]

- Brunnermeier, S.B.; Cohen, M.A. Determinants of Environmental Innovation in US Manufacturing Industries. J. Environ. Econ. Manag. 2003, 45, 278–293. [Google Scholar] [CrossRef]

- Guo, L.L.; Qu, Y.; Tseng, M.L. The Interaction Effects of Environmental Regulation and Technological Innovation on Regional Green Growth Performance. J. Clean. Prod. 2017, 162, 894–902. [Google Scholar] [CrossRef]

- Li, S.H.; Xu, B.C. Environmental regulation and technological innovation—Empirical evidence from the prefecture-level city in China. Mod. Econ. Inq. 2020, 11, 31–40. [Google Scholar]

- Luo, Q. Rethinking consumption tax reform under the new development pattern. Tax. Res. 2021, 4, 56–63. [Google Scholar]

- Huiwen, G.; Ping, L.; Qinxue, L.; Zhang, S.; Research Group of Institute of Taxation Science; State Administration of Taxation. Building a green taxation system to promote green economic development. Int. Tax. 2018, 1, 13–17. [Google Scholar]

- Zang, C.Q.; Zhu, C.C.; Shen, P.H. The environmental protection effect of consumption tax—An empirical analysis based on Chinese empirical data from 2000–2011. Haipai Econ. 2015, 13, 118–130. [Google Scholar]

- Ouyang, J.; Zhang, J.K.; Zhang, K.Z. Exploring the fiscal policy system for promoting eco-innovation. Tax. Res. 2020, 9, 105–110. [Google Scholar]

- Chen, J.M.; Huo, Z.H. Evaluation and comparison of the level of green development in regions along the Yangtze River Economic Belt. Sci. Technol. Manag. Res. 2020, 40, 244–249. [Google Scholar]

- Zhang, X.S.; Zhang, X. Fiscal decentralization, tax competition and green development. Stat. Decis. Mak. 2022, 38, 126–131. [Google Scholar]

- Wen, Z.L.; Zhang, L.; Hou, J.T.; Liu, H.Y. The mediation effect test procedure and its application. J. Psychol. 2004, 5, 614–620. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).