Influence of Media Attention on the Quality of Environmental, Social, and Governance Information Disclosure in Enterprises: An Adjustment Effect Based on the Shareholder Relationship Network

Abstract

:1. Introduction

2. Literature Review and Research Hypothesis

2.1. The Impact of ESG Information Disclosure Quality

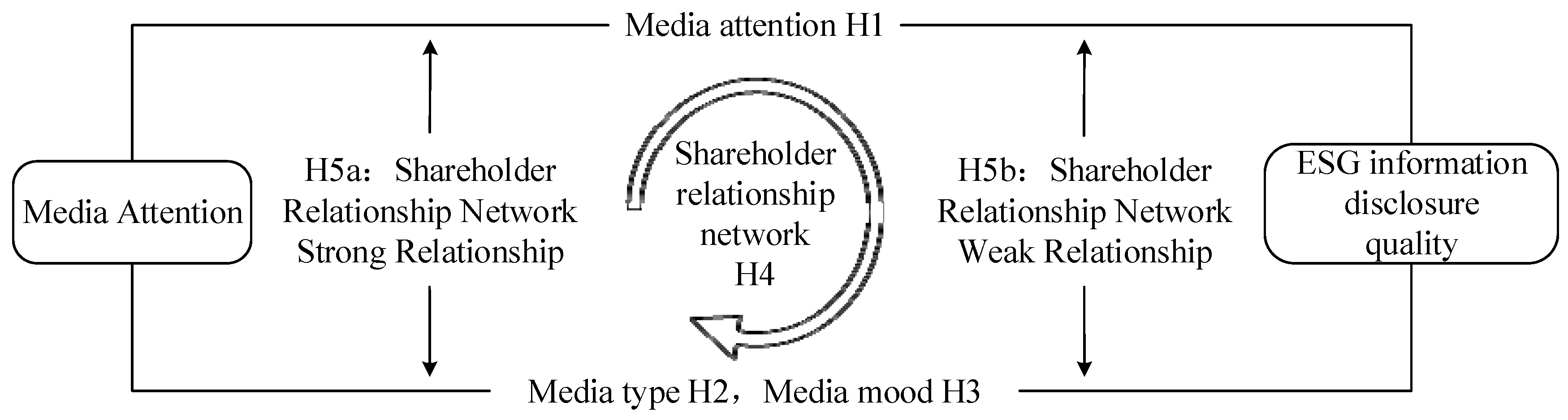

2.2. The Relationship between Media Attention and ESG Information Disclosure Quality

2.2.1. The Relationship between Media Types and ESG Information Disclosure Quality

2.2.2. The Relationship between Media Emotions and ESG Information Disclosure

2.3. Relationship between Shareholder Relationship Network and ESG Information Disclosure Quality

2.3.1. The Regulatory Role of the Shareholder Relationship Network

2.3.2. The Resource Effect of a “Strong Relationship” or the Information Advantage of a “Weak Relationship”

3. Methodology

3.1. Variable Measurement

3.1.1. Media Attention: Independent Variable

3.1.2. ESG Information Disclosure Quality: Dependent Variable

3.1.3. Shareholder Relationship Network: Regulating Variable

3.1.4. Control Variables

3.2. Data Source

- The quality of the ESG information disclosure is obtained through the ESG rating information in the Bloomberg database. The main ESG information data come from publicly disclosed information of the company, such as ESG reports, CSR reports, annual filings, power of attorney, corporate governance reports, and company websites. The Bloomberg ESG disclosure score includes three pillars: E, S, and G, which are divided into different themes and fields. The theme score is calculated based on the scores and weights of different fields, and the theme score is ultimately calculated as the pillar score. Based on the scores of the E, S, and G pillars, the final ESG score is formed.

- Media attention data are mainly obtained via Python text sentiment analysis technology. The basic data are downloaded from the news section of the CSMAR database.

- The shareholder relationship network data are mainly calculated via the social network analysis method and using Pajek software. The basic data are the data of the top ten shareholders in the CSMAR database.

- The control variables and other data are downloaded from the tidal information network and CSMAR database.

3.3. Model Building

4. Empirical Results Analysis

4.1. Descriptive Analysis

4.2. Correlation Analysis

4.3. Regression Analysis

4.3.1. Test of the Relationship between Media Attention and ESG Information Disclosure Quality

4.3.2. Test of the Regulatory Function of the Shareholder Relationship Network

4.4. Robustness Test

4.4.1. Substitution Variable Method

4.4.2. Tool Variable Method

4.4.3. Propensity Score Matching (PSM) Method

5. Discussion

6. Conclusions and Future Implications

6.1. Main Conclusions

6.2. Management Implications

6.3. Research Deficiencies and Prospects

Author Contributions

Funding

Conflicts of Interest

References

- Miralles-Quirós, M.M.; Miralles-Quirós, J.L.; Redondo Hernández, J. ESG performance and shareholder value creation in the banking industry: International differences. Sustainability 2019, 11, 1404. [Google Scholar] [CrossRef]

- Ge, G.; Xiao, X.; Li, Z.; Dai, Q. Does ESG Performance Promote High-Quality Development of Enterprises in China? The Mediating Role of Innovation Input. Sustainability 2022, 14, 3843. [Google Scholar] [CrossRef]

- Tang, Y.; Sun, M.; Ma, W.; Bai, S. The external pressure, internal drive and voluntary carbon disclosure in China. Emerg. Mark. Financ. Trade 2020, 56, 3367–3382. [Google Scholar] [CrossRef]

- Zhu, W.; Sun, Y.; Tang, Q. Substantive disclosure or selective disclosure: The impact of corporate environmental performance on the quality of environmental information disclosure. Account. Res. 2019, 3, 10–17. [Google Scholar]

- Liu, Q.; Zhang, L. Institutional Constraints, Incentive Policies and Corporate Environmental Information Disclosure. Econ. Manag. Res. 2020, 41, 32–48. [Google Scholar]

- Tang, X. Internal Control, Institutional Environment and the Quality of Corporate Social Responsibility Information Disclosure. Account. Econ. Res. 2016, 30, 85–104. [Google Scholar]

- Lian, Y.; Zhang, W.; Bi, Q. Environmental policy uncertainty and corporate environmental information disclosure—Evidence from the change of local environmental protection officials. J. Shanghai Univ. Financ. Econ. 2020, 22, 35–50. [Google Scholar]

- Saeidi, S.P.; Sofian, S.; Saeidi, P.; Saeidi, S.P.; Saaeidi, S.A. How does corporate social responsibility contribute to firm financial performance? The mediating role of competitive advantage, reputation, and customer satisfaction. J. Bus. Res. 2015, 68, 341–350. [Google Scholar] [CrossRef]

- Wang, X.; Xu, X.; Wang, C. Public Pressure, Social Reputation, Internal Governance and Corporate Environmental Information Disclosure—Evidence from China Manufacturing Listed Companies. Nankai Bus. Rev. 2013, 16, 82–91. [Google Scholar]

- Xiao, H.; Zhang, G.; Li, J. Institutional Pressure, Characteristics of Senior Executives and Environmental Information Disclosure of Companies. Econ. Manag. 2016, 38, 168–180. [Google Scholar]

- Yu, Z.; Tian, G.; Qi, B.; Zhang, H. Corporate governance mechanism concerned by the media-based on the perspective of earnings management. Manag. World 2011, 9, 127–140. [Google Scholar]

- Tian, G.; Feng, H.; Yu, Z. Research on the Corporate Governance Role of Media in Capital Market. Account. Res. 2016, 6, 21–29+94. [Google Scholar]

- Cao, Q.; Xu, Q. Research on the Construction of Financial Environment, Society and Governance (ESG) System. Res. Financ. Superv. 2019, 88, 95–111. [Google Scholar]

- Drempetic, S.; Klein, C.; Zwergel, B. The influence of firm size on the ESG score: Corporate sustainability ratings under review. J. Bus. Ethics 2020, 167, 333–360. [Google Scholar] [CrossRef]

- Amel-Zadeh, A.; Serafeim, G. Why and how investors use ESG information: Evidence from a global survey. Financ. Anal. J. 2018, 74, 87–103. [Google Scholar] [CrossRef]

- Zhang, F.; Qin, X.; Liu, L. The interaction effect between ESG and green innovation and its impact on firm value from the perspective of information disclosure. Sustainability 2020, 12, 1866. [Google Scholar] [CrossRef]

- He, F.; Qin, S.; Liu, Y.; Wu, J. CSR and Idiosyncratic Risk: Evidence from ESG information disclosure. Financ. Res. Lett. 2022, 49, 102936. [Google Scholar] [CrossRef]

- Braam, G.J.; Weerd, L.U.; Hauck, M. Determinants of corporate environmental reporting: The importance of environmental performance and assurance. J. Clean. Prod. 2016, 129, 24–734. [Google Scholar] [CrossRef]

- Mei, X.; Ge, Y.; Zhu, X. Study on the mechanism of environmental legitimacy pressure on carbon information disclosure of enterprises. Soft Sci. 2020, 34, 78–83. [Google Scholar]

- Krueger, P.; Sautner, Z.; Tang, D.Y.; Zhong, R. The effects of mandatory ESG disclosure around the world. Eur. Corp. Gov. Inst.–Financ. Work. Pap. 2021, 754, 21–44. [Google Scholar] [CrossRef]

- Camilleri, M.A. Environmental, social and governance disclosures in Europe. Sustain. Account. Manag. Policy J. 2015, 6, 224–242. [Google Scholar] [CrossRef]

- Wang, L.; Qu, J.; Liu, X. Portfolio of Heterogeneous Institutional Investors, Environmental Information Disclosure and Enterprise Value. Manag. Sci. 2019, 32, 31–47. [Google Scholar]

- Wang, W.; Zhu, H.; Zhang, B. Capital market opening and the quality of environmental information disclosure. Manag. Sci. 2021, 34, 29–42. [Google Scholar]

- Tang, J.; Cheng, L.; Chen, D. Capital Market Opening and Voluntary Information Disclosure—An Experimental Test Based on Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect. Econ. Theory Econ. Manag. 2021, 41, 85–97. [Google Scholar]

- Pedersen, L.H.; Fitzgibbons, S.; Pomorski, L. Responsible investing: The ESG-efficient frontier. J. Financ. Econ. 2021, 142, 572–597. [Google Scholar] [CrossRef]

- Elfakhani, S. An Empirical Examination of the Information Content of Balance Sheet and Dividend Announcement: A Signaling Approach. J. Financ. Strateg. Decis. 1995, 8, 65–76. [Google Scholar]

- Li, Z.; Zhang, T. Internal Control, Property Rights and Social Responsibility Information Disclosure—Empirical Evidence from Listed Companies in China. Account. Res. 2017, 10, 86–92+97. [Google Scholar]

- Lee, H.; Yuan, X. Agency cost of enterprises and environmental information disclosure—Moderating effect based on management’s hometown feelings and marketization process. J. Nanjing Audit Univ. 2019, 16, 72–80. [Google Scholar]

- García-Sánchez, I.; Aibar-Guzmán, B.; Aibar-Guzmán, C.; Azevedo, T. CEO ability and sustainability disclosures: The mediating effect of corporate social responsibility performance. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 1565–1577. [Google Scholar] [CrossRef]

- Saraswati, E.; Iqbal, S. Do CEO Power And Industry Type Affect the CSR Disclosure? J. Reviu Akunt. Dan Keuang. 2022, 12, 159–170. [Google Scholar]

- Miller, G.S. The press as a watchdog for accounting fraud. J. Account. Res. 2006, 44, 1001–1033. [Google Scholar] [CrossRef]

- Lu, D.; Fu, P.; Yang, D. Media types, media concerns and internal control quality of listed companies. Account. Res. 2015, 4, 78–85+96. [Google Scholar]

- Zhou, K.; Ying, Q.; Zhong, C. Can media supervision play the role of external governance?—Evidence of violations from listed companies in China. Financ. Res. 2016, 432, 193–206. [Google Scholar]

- Wu, X.; Zheng, G. Does media attention have a supervisory effect on major shareholders’ illegal reduction? Foreign Econ. Manag. 2021, 43, 86–103. [Google Scholar]

- Dai, L.; Parwada, J.T.; Zhang, B. The governance effect of the media’s news dissemination role: Evidence from insider trading. J. Account. Res. 2015, 53, 331–366. [Google Scholar] [CrossRef]

- Baloria, V.P.; Heese, J. The effects of media slant on firm behavior. J. Financ. Econ. 2018, 129, 184–202. [Google Scholar] [CrossRef]

- Zhao, L.; Zhang, L. The influence of media attention on green technology innovation of enterprises: The regulatory role of marketization level. Manag. Rev. 2020, 32, 132–141. [Google Scholar]

- Ying, Q.; Jian, H.; Deng, K. The market pressure effect of media attention and its transmission mechanism. J. Manag. Sci. China 2017, 20, 32–49. [Google Scholar]

- Wang, F.; Wang, Y.; Liu, S. Research on the influence of media attention and managers’ overconfidence on earnings management. J. Manag. 2022, 19, 832–840. [Google Scholar]

- An, H.Y.; Gu, X.; Obrenovic, B.; Godinic, D. The Role of Job Insecurity, Social Media Exposure, and Job Stress in Predicting Anxiety Among White-Collar Employees. Psychol. Res. Behav. Manag. 2023, 16, 3303–3318. [Google Scholar] [CrossRef]

- Chen, Z.; Zhu, W.; Feng, H.; Luo, H. Changes in Corporate Social Responsibility Efficiency in Chinese Food Industry Brought by COVID-19 Pandemic—A Study with the Super-Efficiency DEA-Malmquist-Tobit Model. Front. Public Health 2022, 10, 875030. [Google Scholar] [CrossRef]

- Zhang, C.; Chen, Y.; Cheng, F. Research on the effectiveness of environmental information disclosure in management discussion and analysis-based on the perspective of ownership nature and media governance. Econ. Issues 2019, 10, 121–129. [Google Scholar]

- Yang, G.; Du, Y.; Liu, Y. Business Performance, Media Concern and Environmental Information Disclosure. Econ. Manag. 2020, 42, 55–72. [Google Scholar]

- Bushee, B.J.; Core, J.E.; Guay, W.; Hamm, S.J.W. The role of the business press as an information intermediary. J. Account. Res. 2010, 48, 1–19. [Google Scholar] [CrossRef]

- Wang, B.; Wu, Q.; Ye, Y. Media attention, marketization process and corporate social responsibility performance-based on the empirical evidence of China A-share listed companies. Mod. Econ. Discuss. 2017, 7, 30–36. [Google Scholar]

- Song, X.; Jiang, X.; Han, J.; Zhao, C.; Guo, Y.; Yu, Z. Study on the value effect of carbon information disclosure of enterprises-based on the regulatory role of public pressure. Account. Res. 2019, 12, 78–84. [Google Scholar]

- Xiao, H.; Yang, Z.; Ling, H. Will media attention drive artificial intelligence enterprises to fulfill their social responsibilities?—Empirical test of artificial intelligence enterprises based on China A-share listed companies. J. Nanjing Univ. (Philos. Humanit. Sci. Soc. Sci.) 2022, 59, 42–66+161, 162. [Google Scholar]

- Li, P.; Shen, Y. Corporate Governance of Media: Empirical Evidence from China. Econ. Res. 2010, 45, 14–27. [Google Scholar]

- Li, M.; Ye, Y. An empirical study on the influence of negative media reports on the tunneling behavior of controlling shareholders. Manag. Rev. 2016, 28, 73–82. [Google Scholar]

- Kwahk, K.Y.; Kim, B. Effects of social media on consumers’ purchase decisions: Evidence from Taobao. Serv. Bus. 2017, 11, 803–829. [Google Scholar] [CrossRef]

- Huang, C.; Li, S. Shareholder Relationship Network, Information Advantage and Enterprise Performance. Nankai Bus. Rev. 2019, 22, 75–88+127. [Google Scholar]

- Granovetter, M.S. The Strength of Weak Ties. Am. J. Sociol. 1973, 36, 1360–1380. [Google Scholar] [CrossRef]

- Huang, C.; Jiang, Q. Shareholder Relationship Network and Enterprise Innovation. Nankai Econ. Res. 2021, 2, 67–87. [Google Scholar]

- Song, C.; Hou, X. The influence of ownership network structure on enterprise innovation: Theoretical analysis and empirical test based on knowledge spillover effect. Mod. Financ. Econ. (J. Tianjin Univ. Financ. Econ.) 2021, 41, 19–38. [Google Scholar]

- Luo, D.; Chen, Q.; Shi, X. Media Report, Shareholder Network Relationship and Corporate Performance. Invest. Res. 2022, 41, 85–106. [Google Scholar]

- Dai, Y.; Pan, Y.; Liu, S. Media Supervision, Government Intervention and Corporate Governance: Evidence from the Perspective of Financial Restatement of Listed Companies in China. World Econ. 2011, 11, 121–144. [Google Scholar]

- Shen, Y.; Wang, J. Media Reports and Information Transparency in Immature Financial Markets—China peer-to-peer lending Market Perspective. Manag. World 2021, 37, 35–50+4+17–19. [Google Scholar]

- Liu, J.; Gu, F. Emotional Analysis of Unbalanced Text of Internet Public Opinion Based on BERT and BiLSTM Hybrid Method. J. Inf. 2022, 41, 104–110. [Google Scholar]

- Zhou, N.; Zhong, N.; Jin, G.; Liu, B. Emotion analysis of Chinese text in dual-channel attention network based on mixed word embedding. Data Anal. Knowl. Discov. 2023, 7, 58–68. [Google Scholar]

- Peng, Z.; Luo, G. Can the shareholder network improve the innovation performance of enterprises?—Study on the Intermediary Effect of Two Kinds of Agency Costs. J. Bus. Econ. 2022, 5, 28–45. [Google Scholar]

- Wan, S.; Li, X. Media attention, marketization process and corporate social responsibility. J. Dongbei Univ. Financ. Econ. 2019, 4, 30–38. [Google Scholar]

- Bellemare, M.F.; Masaki, T.; Pepinsky, T.B. Lagged explanatory variables and the estimation of causal effect. J. Politics 2017, 79, 949–963. [Google Scholar] [CrossRef]

- Rosenbaum, P.R.; Rubin, D.B. The Central Role of the Propensity Score in Observational Studies for Causal Effects. Biometrika 1983, 70, 41–55. [Google Scholar] [CrossRef]

- Zhou, L.; Jin, F.; Wu, B.; Chen, Z.; Wang, C. Do fake followers mitigate influencers’ perceived influencing power on social media platforms? The mere number effect and boundary conditions. J. Bus. Res. 2023, 158, 13589. [Google Scholar] [CrossRef]

- Luo, J.; Zhuo, W.; Xu, B. The bigger, the better? Optimal NGO size of human resources and governance quality of entrepreneurship in circular economy. Manag. Decis. 2023, 7, 1–38. [Google Scholar] [CrossRef]

| Variable | Name | Symbol | Definition |

|---|---|---|---|

| Dependent variable | ESG information disclosure quality | ESG | ESG rating, obtained through Bloomberg database |

| Independent variable | Media attention | Media | Total number of media reports |

| Network media reports | Media-W | Total number of online media reports | |

| Policy-oriented media coverage | Media-Z | Total number of policy-oriented media reports | |

| Market-oriented media reports | Media-S | Total number of market-oriented media reports | |

| Negative emotional media reports | Media-X | The total number of negative emotional media reports is obtained by Python text emotion analysis | |

| Positive emotional media coverage | Media-J | The total number of positive emotional media reports is obtained by Python text emotion analysis | |

| Neutral emotional media coverage | Media-M | The total number of neutral emotional media reports is obtained by Python text emotional analysis | |

| Regulated variable | Degree centrality | Centrality-D | Measure the central position of the enterprise shareholder relationship network, which is calculated via Pajek software |

| Control variable | Tight centrality | Centrality-C | Measure the tightness of the enterprise shareholder relationship network, which is calculated via Pajek software |

| Intermediary centrality | Centrality-B | The function of the “information bridge” to measure the enterprise shareholder relationship network is calculated via Pajek software | |

| Institutional investor shareholding ratio | Inst | Proportion of shares of listed companies held by institutional investors | |

| Combination of two jobs | Dual | The chairman and CEO are concurrently employed, which is 1, not 0 | |

| Independent director ratio | Ind | Ratio of the number of independent directors to the size of directors | |

| Profitability | ROE | Average balance of net profit/shareholders’ equity | |

| Growth ability | Growth | Operating income growth rate | |

| Book to market ratio | MtB | Shareholders’ equity/company market value | |

| Currency ratio | Cash | Closing balance of cash and cash equivalents/current liabilities | |

| Asset-liability ratio | Debt | Total liabilities/total assets | |

| Tangible assets ratio | Tar | Proportion of tangible assets to all assets | |

| Tobin q value | Tq | Market capitalization A/total assets | |

| Nature of the property right | Prn | 1 for state-owned enterprises and 0 for non-state-owned enterprises | |

| Industry virtual variable | Industry | ||

| Annual dummy variable | Year |

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| ESG | 498 | 30.762 | 10.109 | 10.744 | 60.744 |

| Media | 498 | 96.518 | 113.955 | 9 | 730 |

| Media-W | 498 | 5.924 | 10.334 | 0 | 62 |

| Media-Z | 498 | 46.6 | 42.226 | 4 | 297 |

| Media-S | 498 | 16.671 | 31.707 | 0 | 221 |

| Media-X | 498 | 3.323 | 8.99 | 0 | 75 |

| Media-J | 498 | 3.546 | 6.83 | 0 | 47 |

| Media-M | 498 | 89.801 | 102.944 | 7 | 668 |

| CentralityDT10 | 498 | 328.47 | 131.847 | 6 | 571 |

| CentralityCT10 | 498 | 0.002 | 0.002 | 0 | 0.011 |

| CentralityBT10 | 498 | 0.746 | 0.099 | 0.409 | 0.863 |

| Inst | 498 | 68.28 | 19.356 | 12.741 | 97.533 |

| Dual | 498 | 0.221 | 0.415 | 0 | 1 |

| ROE | 498 | 0.13 | 0.090 | −0.146 | 0.367 |

| Growth | 498 | 0.147 | 0.233 | −0.4 | 1.12 |

| Ind | 498 | 40.536 | 9.037 | 21.053 | 80 |

| MtB | 498 | 0.702 | 0.322 | 0.087 | 1.24 |

| Cash | 498 | 0.149 | 0.116 | 0.011 | 0.588 |

| Debt | 498 | 0.519 | 0.184 | 0.046 | 0.828 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | |

|---|---|---|---|---|---|---|---|---|---|---|

| ESG | 1 | |||||||||

| Media | 0.146 *** | 1 | ||||||||

| Cen~DT10 | 0.186 *** | 0.113 ** | 1 | |||||||

| Inst | 0.341 *** | 0.024 | 0.150 *** | 1 | ||||||

| Dual | −0.107 ** | 0.069 | −0.126 *** | −0.444 *** | 1 | |||||

| ROE | −0.153 *** | 0.130 *** | 0.069 | −0.097 ** | 0.044 | 1 | ||||

| Growth | −0.096 ** | −0.043 | −0.066 | −0.143 *** | 0.117 *** | 0.312 *** | 1 | |||

| Ind | −0.037 | 0.067 | 0.042 | 0.051 | 0.082 * | 0.030 | 0.021 | 1 | ||

| MtB | 0.417 *** | −0.014 | 0.139 *** | 0.292 *** | −0.190 *** | −0.493 *** | −0.223 *** | 0.068 | 1 | |

| Cash | −0.320 *** | 0.144 *** | 0.032 | −0.095 ** | −0.061 | 0.309 *** | 0.098 *** | 0.086 * | −0.452 *** | 1 |

| Debt | 0.300 *** | 0.078 * | 0.036 | 0.020 | −0.100 ** | −0.283 *** | −0.043 | 0.136 *** | 0.611 *** | −0.328 *** |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| ESG | ESG | ESG | ESG | |

| Media | 0.016 *** | |||

| (0.003) | ||||

| Media-W | 0.159 *** | |||

| (0.039) | ||||

| Media-Z | 0.043 *** | |||

| (0.009) | ||||

| Media-S | 0.046 *** | |||

| (0.012) | ||||

| Inst | 0.119 *** | 0.120 *** | 0.120 *** | 0.118 *** |

| (0.027) | (0.027) | (0.027) | (0.027) | |

| Dual | 2.187 ** | 2.358 ** | 2.234 ** | 2.309 ** |

| (0.908) | (0.913) | (0.906) | (0.916) | |

| ROE | 22.011 *** | 21.874 *** | 20.586 *** | 21.931 *** |

| (5.181) | (5.222) | (5.181) | (5.226) | |

| Growth | −1.296 | −1.606 | −1.219 | −1.374 |

| (1.438) | (1.448) | (1.437) | (1.451) | |

| Ind | −0.024 | −0.022 | −0.020 | −0.024 |

| (0.037) | (0.038) | (0.037) | (0.038) | |

| MtB | 12.440 *** | 12.020 *** | 12.064 *** | 11.865 *** |

| (2.001) | (2.010) | (1.988) | (2.008) | |

| Cash | −15.403 *** | −14.842 *** | −15.763 *** | −15.424 *** |

| (3.764) | (3.788) | (3.769) | (3.811) | |

| Debt | 18.060 *** | 18.904 *** | 18.267 *** | 19.306 *** |

| (3.152) | (3.163) | (3.137) | (3.149) | |

| _cons | 3.105 | 3.383 | 2.763 | 3.748 |

| (3.049) | (3.075) | (3.047) | (3.081) | |

| Industry | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes |

| N | 498.000 | 498.000 | 498.000 | 498.000 |

| F | 24.354 | 23.181 | 24.495 | 23.050 |

| r2 | 0.629 | 0.623 | 0.630 | 0.623 |

| (1) | (2) | (3) | |

|---|---|---|---|

| ESG | ESG | ESG | |

| Media-J | 0.125 ** | ||

| (0.055) | |||

| Media-X | 0.067 * | ||

| (0.038) | |||

| Media-M | 0.019 *** | ||

| (0.004) | |||

| Inst | 0.120 *** | 0.118 *** | 0.120 *** |

| (0.027) | (0.027) | (0.027) | |

| Dual | 2.682 *** | 2.688 *** | 2.152 ** |

| (0.920) | (0.922) | (0.906) | |

| ROE | 21.099 *** | 22.128 *** | 22.034 *** |

| (5.295) | (5.304) | (5.168) | |

| Growth | −1.799 | −1.555 | −1.224 |

| (1.468) | (1.470) | (1.435) | |

| Ind | −0.022 | −0.021 | −0.023 |

| (0.038) | (0.038) | (0.037) | |

| MtB | 11.751 *** | 11.420 *** | 12.445 *** |

| (2.050) | (2.042) | (1.994) | |

| Cash | −14.682 *** | −14.284 *** | −15.275 *** |

| (3.869) | (3.873) | (3.750) | |

| Debt | 20.274 *** | 21.106 *** | 17.849 *** |

| (3.191) | (3.154) | (3.146) | |

| _cons | 3.383 | 3.240 | 2.984 |

| (3.116) | (3.122) | (3.041) | |

| Industry | Yes | Yes | Yes |

| Year | Yes | Yes | Yes |

| N | 498.000 | 498.000 | 498.000 |

| F | 21.361 | 21.031 | 24.735 |

| r2 | 0.614 | 0.612 | 0.631 |

| (1) | (2) | (3) | |

|---|---|---|---|

| ESG | ESG | ESG | |

| Media | 0.020 *** | 0.012 *** | 0.029 ** |

| (0.006) | (0.003) | (0.013) | |

| Centrality-D × Media | −0.000 | ||

| (0.000) | |||

| Centrality-C × Media | 5.719 *** | ||

| (1.351) | |||

| Centrality-B × Media | −0.018 | ||

| (0.017) | |||

| Inst | 0.121 *** | 0.118 *** | 0.120 *** |

| (0.027) | (0.026) | (0.027) | |

| Dual | 2.120 ** | 2.281 ** | 2.066 ** |

| (0.913) | (0.892) | (0.916) | |

| ROE | 22.412 *** | 21.529 *** | 22.322 *** |

| (5.208) | (5.088) | (5.189) | |

| Growth | −1.328 | −1.242 | −1.311 |

| (1.439) | (1.412) | (1.438) | |

| Ind | −0.024 | −0.016 | −0.025 |

| (0.038) | (0.037) | (0.037) | |

| MtB | 12.483 *** | 11.686 *** | 12.426 *** |

| (2.002) | (1.972) | (2.001) | |

| Cash | −15.189 *** | −14.794 *** | −15.201 *** |

| (3.776) | (3.699) | (3.769) | |

| Debt | 18.148 *** | 17.412 *** | 18.200 *** |

| (3.156) | (3.099) | (3.155) | |

| _cons | 2.861 | 3.336 | 2.968 |

| (3.067) | (2.994) | (3.052) | |

| Industry | Yes | Yes | Yes |

| Year | Yes | Yes | Yes |

| N | 498.000 | 498.000 | 498.000 |

| F | 21.960 | 24.527 | 22.024 |

| r2 | 0.630 | 0.643 | 0.630 |

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

|---|---|---|---|---|---|---|---|---|

| ESG | ESG | ESG | ESG | ESG | ESG | ESG | ESG | |

| Media | 0.019 *** | 0.018 *** | 0.015 *** | 0.015 *** | 0.018 *** | 0.011 *** | 0.019 *** | 0.016 *** |

| (0.005) | (0.005) | (0.004) | (0.004) | (0.005) | (0.003) | (0.004) | (0.004) | |

| CentralityT7 × Media | −0.000 | |||||||

| (0.000) | ||||||||

| CentralityT6 × Media | −0.000 | |||||||

| (0.000) | ||||||||

| CentralityT5 × Media | 0.000 | |||||||

| (0.000) | ||||||||

| CentralityT4 × Media | 0.000 | |||||||

| (0.000) | ||||||||

| CentralityR7 × Media | −0.000 | |||||||

| (0.000) | ||||||||

| CentralityR6 × Media | 3.558 *** | |||||||

| (1.014) | ||||||||

| CentralityR5 × Media | −0.000 | |||||||

| (0.000) | ||||||||

| CentralityR4 × Media | −0.000 | |||||||

| (0.000) | ||||||||

| Inst | 0.120 *** | 0.121 *** | 0.118 *** | 0.118 *** | 0.119 *** | 0.117 *** | 0.119 *** | 0.119 *** |

| (0.027) | (0.027) | (0.027) | (0.027) | (0.027) | (0.026) | (0.027) | (0.027) | |

| Dual | 2.123 ** | 2.139 ** | 2.225 ** | 2.201 ** | 2.137 ** | 2.187 ** | 2.149 ** | 2.185 ** |

| (0.912) | (0.912) | (0.912) | (0.910) | (0.913) | (0.897) | (0.908) | (0.909) | |

| ROE | 22.391 *** | 22.325 *** | 21.826 *** | 21.670 *** | 22.026 *** | 21.232 *** | 22.179 *** | 22.015 *** |

| (5.202) | (5.208) | (5.200) | (5.246) | (5.185) | (5.122) | (5.179) | (5.186) | |

| Growth | −1.354 | −1.353 | −1.252 | −1.245 | −1.270 | −1.488 | −1.192 | −1.285 |

| (1.440) | (1.442) | (1.442) | (1.444) | (1.440) | (1.422) | (1.439) | (1.443) | |

| Ind | −0.023 | −0.024 | −0.025 | −0.024 | −0.023 | −0.020 | −0.022 | −0.024 |

| (0.038) | (0.038) | (0.038) | (0.038) | (0.038) | (0.037) | (0.037) | (0.038) | |

| MtB | 12.452 *** | 12.486 *** | 12.424 *** | 12.414 *** | 12.514 *** | 11.876 *** | 12.495 *** | 12.443 *** |

| (2.001) | (2.003) | (2.003) | (2.003) | (2.006) | (1.983) | (2.000) | (2.003) | |

| Cash | −15.106 *** | −15.125 *** | −15.544 *** | −15.533 *** | −15.357 *** | −15.757 *** | −15.706 *** | −15.433 *** |

| (3.782) | (3.793) | (3.779) | (3.780) | (3.768) | (3.719) | (3.769) | (3.779) | |

| Debt | 18.184 *** | 18.127 *** | 17.980 *** | 17.954 *** | 18.068 *** | 17.477 *** | 18.038 *** | 18.062 *** |

| (3.157) | (3.156) | (3.159) | (3.165) | (3.155) | (3.118) | (3.150) | (3.156) | |

| _cons | 2.862 | 2.854 | 3.256 | 3.280 | 3.033 | 3.740 | 3.042 | 3.111 |

| (3.064) | (3.077) | (3.068) | (3.079) | (3.054) | (3.017) | (3.047) | (3.053) | |

| Industry | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| N | 498.000 | 498.000 | 498.000 | 498.000 | 498.000 | 498.000 | 498.000 | 498.000 |

| F | 21.976 | 21.928 | 21.904 | 21.897 | 21.920 | 23.697 | 22.116 | 21.872 |

| r2 | 0.630 | 0.629 | 0.629 | 0.629 | 0.629 | 0.639 | 0.630 | 0.629 |

| (1) | (2) | |

|---|---|---|

| A_ESG | A_ESG | |

| A_Media | 0.019 *** | 0.015 *** |

| (0.003) | (0.004) | |

| Centrality-C × Media | 4.147 * | |

| (2.184) | ||

| Inst | 0.201 *** | 0.199 *** |

| (0.036) | (0.035) | |

| Dual | 3.695 *** | 3.737 *** |

| (1.224) | (1.220) | |

| ROE | 29.989 *** | 30.044 *** |

| (7.080) | (7.058) | |

| Growth | −1.745 | −2.031 |

| (2.049) | (2.048) | |

| Ind | −0.070 | −0.068 |

| (0.051) | (0.051) | |

| MtB | 20.374 *** | 20.214 *** |

| (2.684) | (2.677) | |

| Cash | −20.721 *** | −20.154 *** |

| (5.203) | (5.196) | |

| Debt | 17.607 *** | 17.650 *** |

| (4.284) | (4.271) | |

| _cons | −36.077 *** | −35.996 *** |

| (4.185) | (4.172) | |

| Industry | Yes | Yes |

| Year | Yes | Yes |

| N | 447.000 | 447.000 |

| F | 26.385 | 24.257 |

| Lag by One Period | Lag by Two Periods | |||

|---|---|---|---|---|

| ESG | ESG | ESG | ESG | |

| Media1 | 0.016 *** | 0.013 *** | ||

| (0.004) | (0.004) | |||

| Centrality-C × Media1 | 4.852 *** | |||

| (1.487) | ||||

| Media2 | 0.019 *** | 0.016 *** | ||

| (0.004) | (0.004) | |||

| Centrality-C × Media2 | 4.567 *** | |||

| (1.609) | ||||

| Inst | 0.142 *** | 0.138 *** | 0.164 *** | 0.160 *** |

| (0.029) | (0.029) | (0.033) | (0.033) | |

| Dual | 2.581 *** | 2.690 *** | 2.792 ** | 2.604 ** |

| (0.994) | (0.982) | (1.095) | (1.084) | |

| ROE | 22.446 *** | 22.697 *** | 24.206 *** | 24.316 *** |

| (5.677) | (5.605) | (6.668) | (6.589) | |

| Growth | −0.975 | −0.908 | −1.384 | −1.362 |

| (1.607) | (1.586) | (1.802) | (1.781) | |

| Ind | −0.045 | −0.037 | −0.052 | −0.042 |

| (0.041) | (0.040) | (0.047) | (0.046) | |

| MtB | 11.454 *** | 11.137 *** | 10.976 *** | 10.518 *** |

| (2.127) | (2.102) | (2.370) | (2.347) | |

| Cash | −15.555 *** | −15.636 *** | −16.148 *** | −16.708 *** |

| (4.172) | (4.119) | (4.742) | (4.690) | |

| Debt | 22.150 *** | 21.727 *** | 22.594 *** | 22.724 *** |

| (3.458) | (3.417) | (3.890) | (3.843) | |

| _cons | 1.621 | 1.637 | 1.060 | 0.954 |

| (3.384) | (3.341) | (3.915) | (3.868) | |

| Industry | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes |

| N | 415.000 | 415.000 | 331.000 | 331.000 |

| F | 23.239 | 22.524 | 19.374 | 18.666 |

| r2 | 0.652 | 0.662 | 0.661 | 0.670 |

| Variable | Sample | Processing Group | Control Group | Discrepancy | Standard Error | t Test |

|---|---|---|---|---|---|---|

| ESG | Before matching | 31.587 | 31.587 | 1.649 | 0.904 | 1.82 |

| After matching | 31.648 | 29.292 | 2.356 | 1.151 | 2.05 ** |

| Sample | Ps R2 | LRchi2 | p > chi2 | MeanBias | MedBias | B | R | %Var |

|---|---|---|---|---|---|---|---|---|

| Before matching | 0.024 | 16.33 | 0.012 | 12.5 | 1.82 | 36.5 * | 0.92 | 40 |

| After matching | 0.008 | 5.72 | 0.456 | 7.4 | 2.05 | 21.6 | 1.25 | 60 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cui, W.; Chen, X.; Xia, W.; Hu, Y. Influence of Media Attention on the Quality of Environmental, Social, and Governance Information Disclosure in Enterprises: An Adjustment Effect Based on the Shareholder Relationship Network. Sustainability 2023, 15, 13919. https://doi.org/10.3390/su151813919

Cui W, Chen X, Xia W, Hu Y. Influence of Media Attention on the Quality of Environmental, Social, and Governance Information Disclosure in Enterprises: An Adjustment Effect Based on the Shareholder Relationship Network. Sustainability. 2023; 15(18):13919. https://doi.org/10.3390/su151813919

Chicago/Turabian StyleCui, Wei, Xiaofang Chen, Wenlei Xia, and Yu Hu. 2023. "Influence of Media Attention on the Quality of Environmental, Social, and Governance Information Disclosure in Enterprises: An Adjustment Effect Based on the Shareholder Relationship Network" Sustainability 15, no. 18: 13919. https://doi.org/10.3390/su151813919

APA StyleCui, W., Chen, X., Xia, W., & Hu, Y. (2023). Influence of Media Attention on the Quality of Environmental, Social, and Governance Information Disclosure in Enterprises: An Adjustment Effect Based on the Shareholder Relationship Network. Sustainability, 15(18), 13919. https://doi.org/10.3390/su151813919