1. Introduction

Saudi Arabia launched its Vision 2030 economic program on 25 April 2016, and sustainable economic development is the program’s main objective. Like other Gulf Cooperation Council (GCC) countries, Saudi Arabia relies on oil revenue as a source of income. However, Saudi Arabia attended its first G20 meeting in 2008 at the Washington summit. Moreover, Saudi Arabia hosted the G20 meeting in 2020, and one of the presidency meetings focused on the net zero emission transition. The G20 members motivated the adaptation of the programs that vindicated the impact of this transition. However, Saudi Arabia has been invited to be a member of BRICS in their 2023 summit, where sustainability is playing a role in its agenda with the importance of having sustainability to be socially and environmentally responsible. On the other hand, Saudi Arabia has been ranked 94 out of 166 in the SDG index with 67.70% goal achievement. The Saudi Vision 2030 has been promoted as a structural change in the Saudi Arabian economy, and this structural change should affect different sectors of the economy in different directions. It is important to address the wide range of impacts of this change to have greater visibility of the challenges that Saudi Arabia’s economy could face in the future. However, Vision 2030 has seventeen goals covering a wide range of concepts directly relevant to the United Nations Sustainable Development Goals. Those goals will have direct or indirect impacts on Saudi Arabia’s economic activities, and such impacts can be assessed with the Human Development Index (HDI) or the Sustainable Development Index (SDI). However, the SDI has an advantage over the HDI because it builds on the HDI formula, implements a threshold for the income per capita of a country, and divides its outcomes by two ecological indicators with ecological impacts, CO2 emissions and material footprint. Therefore, the SDI can be used to conduct strong measurements of ecological efficiency. A country’s economy comprises different simultaneously active elements that affect its current and future directions. One of these elements is the real exchange rate; like the rest of the world, Saudi Arabia pays close attention to its real exchange rate to ensure economic stability. However, government policies in the service of sustainable economic development may impact the real exchange rate in different ways, and understanding the impact of sustainable economic development on the real exchange rate can help a government mitigate the challenges associated with launching economic sustainability programs. The aim of the study is to examine the existence of the long-run relationship between sustainable economic development and real exchange rates in Saudi Arabia. However, the SDI will be used to assess the impact of sustainable economic development on the real exchange rate in Saudi Arabia, which is the spirit of the Saudi Vision 2030. There are two methods to assess the relationship among economics variables. These methods are Johansen cointegration and Autoregressive Distributed Lag (ARDL) cointegration. The choice between the two methods depends on the property of the data that satisfies one of these two methods’ inquiries. Sustainability is a new arena in economics research, and the focus has been driven toward developed countries. This study will try to touch on the impact of sustainability on an important factor, which is the real exchange rate in the economy that counts as the biggest oil producer in the world. However, this study, unlike other studies, focuses on Saudi Arabia and assesses the relationship between local and international macroeconomics factors. Using SDI as a factor within the econometrics model will increase the credibility of the result since SDI is an external assessment that has been conducted by an external organization. Moreover, this study carries out a new side of research that has not been investigated within the recent Saudi Arabia economics research literature. Furthermore, Saudi Arabia’s GDP is ranked 18th in the world based on the World Bank database. Saudi Arabia’s responsibility toward high-world origination and the obligations toward its 2030 vision within the sustainability context, as well as its position as a major oil producer in the world, motivates this study to be the country’s focus.

2. Literature Review

The exchange rate is affected by different theoretical and practical elements. The Quantity Theory of Money (QTM) characterizes the local demand for money, which affects the real exchange rate through three elements, including income. However, additional elements can affect the exchange rate according to econometric models. Ref. [

1] developed and assessed an econometric model of the real exchange rate for oil-producing countries in the Middle East and North Africa (MENA). They used an ARDL panel regression framework to conduct estimations for the set of studied countries. They found that the money supply, GDP, government expenditure, oil prices, and the USA’s externally financed debt per GDP had long-run relationships with the real exchange rate. However, income was found to have a negative impact on the real exchange rate in the short and long run. Ref. [

2] used an estimated dynamic panel regression framework to examine the relationships between the real exchange rate and macroeconomic fundamentals in Latin America; the estimation was divided into three subperiods to compare the outcomes of the three estimations, and the periods were found to overlap with each other after omitting two decades from 1980 to 2000 (including one decade at the beginning of the period). The first estimation covered the period between 1980 and 2019, and the results showed that income growth, inflation, fiscal policy, and monetary policy had positive impacts on the real exchange rate. Furthermore, the periods covering 2000–2019 and 2010–2019 showed similar outcomes in which the impact of income on the real exchange rate was negative. On the other hand, [

3] analyzed the impact of macroeconomic factors on the conversion of the USD to the Chinese Yuan Renminbi. They applied the ARDL cointegration approach to annual time series data to examine the existence of long-run relationships among the studied variables. The results suggested the existence of long-run relationships, as the variables were found to be cointegrated with each other. Furthermore, the impact of the GDP on the real exchange rate was found to be positive, whereas the impacts of the other variables were negative. Ref. [

4] examined the relationship between economic growth and the real exchange rate in India, and they found that there was a long-run relationship between the real exchange rate and economic growth in India. However, the relationship between the real exchange rate and economic growth was shown to be unidirectional. The relationships among the variables can also be tested with different variable transformation approaches. Ref. [

5] conducted the expectation transformation of variables by analyzing the real-time survey data of 29 countries. They constructed a model for the expectation of income growth, inflation, interest rates, and current accounts, and their results showed that the fundamental factor expectations were more important in the long run than in the short run. Furthermore, they found that the expectation of an increase in domestic income in comparison to income of the USA would result in an unexpected appreciation of the local currency. On the other hand, they found that expectations of an inflation increase would result in an expected depreciation. Furthermore, [

6] used a panel analysis method to assess the movement of the real exchange rate in 15 emerging countries. Their results showed the commodity prices tended to be an important factor that determined the real exchange rate movements in those countries. However, the central banks in those countries have moderately stabilized exchange rates. Additionally, the money supply growth in those countries was found to have a positive effect on the real exchange rate, whereas an increase in the money supply was found to result in the appreciation of the real exchange rate.

The impact of the money supply on the exchange rate can be observed via inflation. Ref. [

7] investigated the relationship between inflation and the real exchange rate for the Pakistani Rupee. They applied the Johansen cointegration method to test the variable relationships in their model, and their results showed that there were long-run relationships among the variables. They also found that an increase in the money supply led to a decrease in inflation and an increase in the exchange rate. These results are consistent with the idea that an inadequate money supply may have an inverse relationship with prices as long as the growth of the money supply is consistent with the growth of the economy. Ref. [

8] analyzed the Bangladesh exchange rate of the Taka to the USD with respect to an econometric model that included the money supply, inflation, and current accounts. The cointegration test proved the existence of a long-run relationship and that the money supply had a positive impact on the exchange rate. An increase in the money supply resulted in the Taka depreciating against the USD. However, money supply cannot determine the Granger causality of the exchange rate; only when all the model variables are summed will the null hypothesis of no Granger causality be rejected. The exchange rate of the local currency for the USD does not accurately reflect real exchange rate fluctuations. The real effective exchange rate (REER) has been widely used in real exchange rate analysis. [

9] implemented a cointegration method to analyze the impact of the money supply, trade balance, and inflation on the Kenyan REER; their cointegration test results confirmed the existence of long-run relationships among the variables. There was also a positive relationship between the variables and the REER; this positive relationship indicates that an increase in the money supply will depreciate the real exchange rate and also increase inflation.

Natural resources are classified as major sources of income in developing countries, including Saudi Arabia. Ref. [

10] used structural vector autoregression (SVAR) to distinguish between the impact of oil on the exchange rate for MENA oil-importer and oil-exporter countries. The results showed that the real exchange rate fluctuations could mainly be explained by oil prices in Tunisia and Morocco, which are oil-importer countries. The oil price was found to explain the fluctuations in both the real exchange rate and inflation in Bahrain and Saudi Arabia, which are oil-exporter countries. Furthermore, Iran’s inflation fluctuations were shown to be explained by the oil price. However, unlike the rest of the studied countries, oil could not explain the fluctuations in both the real exchange rate and inflation in Algeria. Ref. [

11] examined the relationship between the REER and total productivity in high-income and upper-middle-income countries using an econometric GMM method. Their results showed that in high-income countries, productivity increases caused the REER to depreciate, whereas in upper-middle-income countries, productivity increases caused the REER to appreciate. Furthermore, financial development and natural resource rents were found to have significant impacts on the REER in high-income countries compared with upper-middle-income countries, in which the effects of those factors were shown to be insignificant. Additionally, trade openness was shown to have a significant impact on the REER variations in both types of countries. Ref. [

12] used an ARDL cointegration framework to assess the relationship between oil and the REER in Saudi Arabia, and their econometric estimations confirmed long-run relationships in their model; specifically, their results suggested a direct causal relationship between oil and the REER in the short run and a bidirectional causal relationship in the long run.

Government expenditure is a major macroeconomic factor that plays a significant role in a country’s economy. Ref. [

13] applied ARDL cointegration to assess the relationships among productivity differences, government expenditure, foreign investment, trade openness, interest rate differentials, inflation differentials, terms of trade, foreign reserves, and net foreign assets to determine the real exchange rate of India; their results proved the existence of long-run relationships among the studied variables. However, [

14] argued that the impacts of fiscal and monetary policies depend on the fiscal regime. Furthermore, they found that the effects of contractionary monetary policies on the real exchange rate were dominated by expansionary fiscal policies, as the real exchange rate was shown to depreciate as an outcome of contradictory polices. For Brazil, such an outcome could be avoided if the government offset the debt accrued due to the increase in its current budget with a future budget surplus. Ref. [

15] analyzed the impact of disaggregated government spending in Latin American countries. Their results showed that government consumption depreciated the real exchange rate in contrast to government investment, which appreciated the real exchange rate. Ref. [

16] estimated the VAR for 38 countries to examine the impact of government spending on the real exchange rate for different exchange rate regimes. They found that in countries with fixed exchange rates, government spending exhibited asymmetric effects on the real exchange rate. Their results showed that increases in government spending, in contrast to increases in economic output and employment, caused the real exchange rate to appreciate. Ref. [

17] assessed the impact of government spending on the real exchange rate in Ethiopia. Using VAR analysis, they showed that increases in government spending caused Ethiopia’s real exchange rate to appreciate, while government investment had no impact on the real exchange rate.

Economic sustainability is the focus of governments that intend to wisely utilize their finite economic resources to enhance their economies. Ref. [

18] analyzed the impact of companies’ application of social responsibility concepts on the exchange rate of the USD for major world currencies. They used a generalized autoregressive conditional heteroskedasticity (GARCH) model to test for the volatility spillover from the stock returns of CSR companies to the USD exchange rate return against major world currencies. Their results revealed that the impact of CSR companies on the USD exchange rate against major world currencies was negative. Furthermore, they found that increases in the Dow Jones Sustainability World Index (DJSWI), which is used to measure the sustainability of companies, leads such companies to transfer their profits outside the USA, therefore depreciating the USD against major world currencies. On the other hand, a decrease in the DJSWI would indicate that the global business environment is unstable, causing investors to transfer their wealth to the USA’s secure business environment and therefore appreciating the USD against major world currencies. However, [

19] assessed the performance of environmental, social, and governance (ESG) approaches in predicting future exchange rate fluctuations; the study used data for 42 countries listed in the MSCI ESG index. The results indicated that the performance of a country in the ESG index was significantly related to its exchange rate performance, and countries with high ESG index ratings showed improved currency performance. Ref. [

20] used a hybrid machine learning method to examine the impact of macroeconomic policy news on exchange rate fluctuations. Using subjective information, the model was used to test the ability of such an approach to predict future exchange rates in the long term, and the model indicated the significant impact of subjective information on exchange rate fluctuations. The model also revealed a strong correlation between the publication of macroeconomic news and the daily exchange rate fluctuations, as well as the reliability of the model in predicting short-run exchange rates. On the other hand, the long-run exchange rate stability was found to rely on the sustainability of macroeconomic policies. These countries have the responsibility to ensure the implementation of the sustainable programs established by world organizations. Ref. [

21] assessed the environment and moderation policies considered by central banks across the world. They distinguished between the impact of environmental factors on the classic goals of central banks and the possibility of the central banks financing green and sustainable projects in order to assess which environmental policies should be mandated by the government. Out of the 133 assessed central banks, 12% had an explicit sustainability mandate, and 29% had sustainability goals to urgently implement the mandated government policies. Additionally, they reported that central banks without explicit or implicit sustainability polices will incorporate global sustainability policies to ensure the stability of their macroeconomics and, therefore, the stability of their assets and the exchange rate.

To summarize the literature, the macroeconomics fundamental factors such as income, consumer price index, money supply, natural resources and government expenditure have an impact on the real exchange rate. The literature on the exchange rate and sustainable economic development lacks studies covering a wide range of economies with different economic structures. This study is intended to fill this research gap by considering the impact of sustainable economic development on the real exchange rate of Saudi Arabia, which is a G20 member and the leader of the Organization of the Petroleum Exporting Countries (OPEC). The size and structure of Saudi Arabia’s economy mean that our study’s results will be applicable to understanding the role of sustainable economic development on the real exchange rate in one of the emerging countries with a significant role in the world by its leading oil producers’ countries. This study will open the arena of studies focusing on sustainability in developing countries that rely on natural resources with high carbon emissions as the main source of income. Those studies will help in understanding the challenges that the economy may face in the transition toward sustainability. However, this study, by focusing on Saudi Arabia, may have a different emphasis than the rest of the studies in sustainability that are mainly focusing on developed economies.

5. Discussion

The impact of sustainability is negative in the long- and short-run dynamics, emphasizing that Saudi Arabia’s dependence on oil is not easy to omit in the near future without scarification. This result is consistent with [

18], which is applied to an industrial economy such as the USA. Saudi Arabia’s economy relies on oil in different aspects, where oil revenue is the main driver of the economy. Moreover, the economy in Saudi Arabia enjoys low cost of energy as the industrial and household sectors are heavily dependent on carbon-based fuels as a source of energy. This dependence is a result of the advantage Saudi Arabia’s economy was gifted by Mother Nature. It is not surprising that Saudi Arabia performs higher on average than the USA in SDI, with a range of less than 50%. However, most of the Gulf Corporation Consul (GCC) countries are lower than Saudi Arabia in their performance in SDI. It may be more interesting to study the impact of SDI on their real exchange rate behavior. Furthermore, selected industrial countries such as Japan, Korea and the UK are performing within the range of Saudi Arabia’s performance in SDI. It is worth looking at their real exchange rate behaviors to confirm or contradict the phenomena captured in this study. This outcome has confirmed the association between Sustainability and the real exchange rate in the long- and short-run dynamics where the null hypothesis of no cointegration between the two variables is rejected. On the other hand, income is positively impacting the exchange rate, which consistent with [

2,

3,

5] findings. The main idea of the effect of income on the real exchange rate comes from the relative prices approach. The increase in income will contribute more upward pressure on aggregate demand, and that pressure will finally end in the increase of price level in the economy. Increasing the local price level will change the ratio of the two countries’ relative prices in favor of high-income countries. However, the case of Saudi Arabia can be explained via its oil revenue. Thus, Saudi Arabia accumulates foreign currency through oil sales to the rest of the world. The economy achieves its strength by accumulating more foreign currency to satisfy the import of foreign goods and finance future projects, as well as increasing international public fund investment. Furthermore, the result boosts the importance of the income toward the real exchange rate since the coefficient of the income is the highest coefficient in the model. On the other hand, the result of income impacting the real exchange rate is unlike [

1]’s finding, and this may be due to the setup of the analysis framework as well as the period in focus. However, the price level needs to have a negative impact in the long run and a positive impact in short-run dynamics to be consistent with [

5]’s findings. Furthermore, the impact of the price level in the short-run dynamics is more notable as the highest coefficient for the first moment and the second moment after the oil coefficient. This can support the substitution effect among the variables where income carries the impact in the long run with a positive direction while prices adjust the exchange rate with a mild effect.

The impact of oil on the exchange rate is negative in both long-run and short-run dynamics, and this can be explained by the result of [

11]. The increase in oil will increase the cost of production in developed countries where oil is an important input factor to their production process. Furthermore, an increase in the cost leads to an increase in the prices, which will lower the real exchange rate based on the relative prices approach. However, the result is consistent with [

12]’s findings, where oil has a negative impact on the real exchange rate of Saudi Arabia in the long run and short run dynamics. On the other hand, government expenditure has a positive impact in the short-run dynamics, unlike the long-run, where the government expenditure is insignificant. This result is interesting as Saudi Arabia’s economy is mainly controlled by the public sector. However, this result could open a wide door for analysis of the private expenditure in the model by decomposing the GDP in its elements. Including the private expenditure could capture the long-run effect on the real exchange rate attributed to different sources of expenditures in the economy. Moreover, this result is an insight that the Saudi Arabian government gives the opportunity to other sectors to lead in the long run to have more sustainability as those sectors operate with market efficiency. On the other hand, money supply is insignificant in affecting the real exchange rate in Saudi Arabia in the long run, unlike [

7,

8,

9]’s findings, to have a significant impact of money supply on the real exchange rate. However, [

7] has found that the money supply is insignificant in affecting the real exchange rate in the short-run dynamics. The result is not a shocking outcome in Saudi Arabia’s case, where the monetary authority adopted a bagged exchange rate to the USD as the monetary system of the Saudi riyal.

6. Conclusions

The sustainability subject is widely discussed in Saudi Arabia in Vision 2030. Vision 2030 has launched 17 sustainable programs to cover a wide range of Saudi Arabia’s economy. These programs will have an impact on different economic factors, such as the real exchange rate. The impact of sustainability on the real exchange rate should be examined to sense the future challenges that could occur to the real exchange rate within the implementation period of those programs. This study assessed the cointegration between the real exchange rate and sustainable economic development in Saudi Arabia in terms of the long-run and short-run dynamics. The study has assumed there is a long-run relationship between sustainable economic development and the real exchange rate in Saudi Arabia. An ARDL cointegration framework was implemented to examine the validity of the study assumption. Our econometric model was constructed with controlled variables based on economics theories in the monetary aspect, as well as our key variable of sustainable economic development. Additionally, macroeconomic factors were implemented in the model based on macroeconomic theories and the literature. These factors were the GDP, money supply in its broad form, the CPI, the Sustainable Development Index (SDI), oil rent, and government expenditure. This study covered the period between 1990 and 2019.

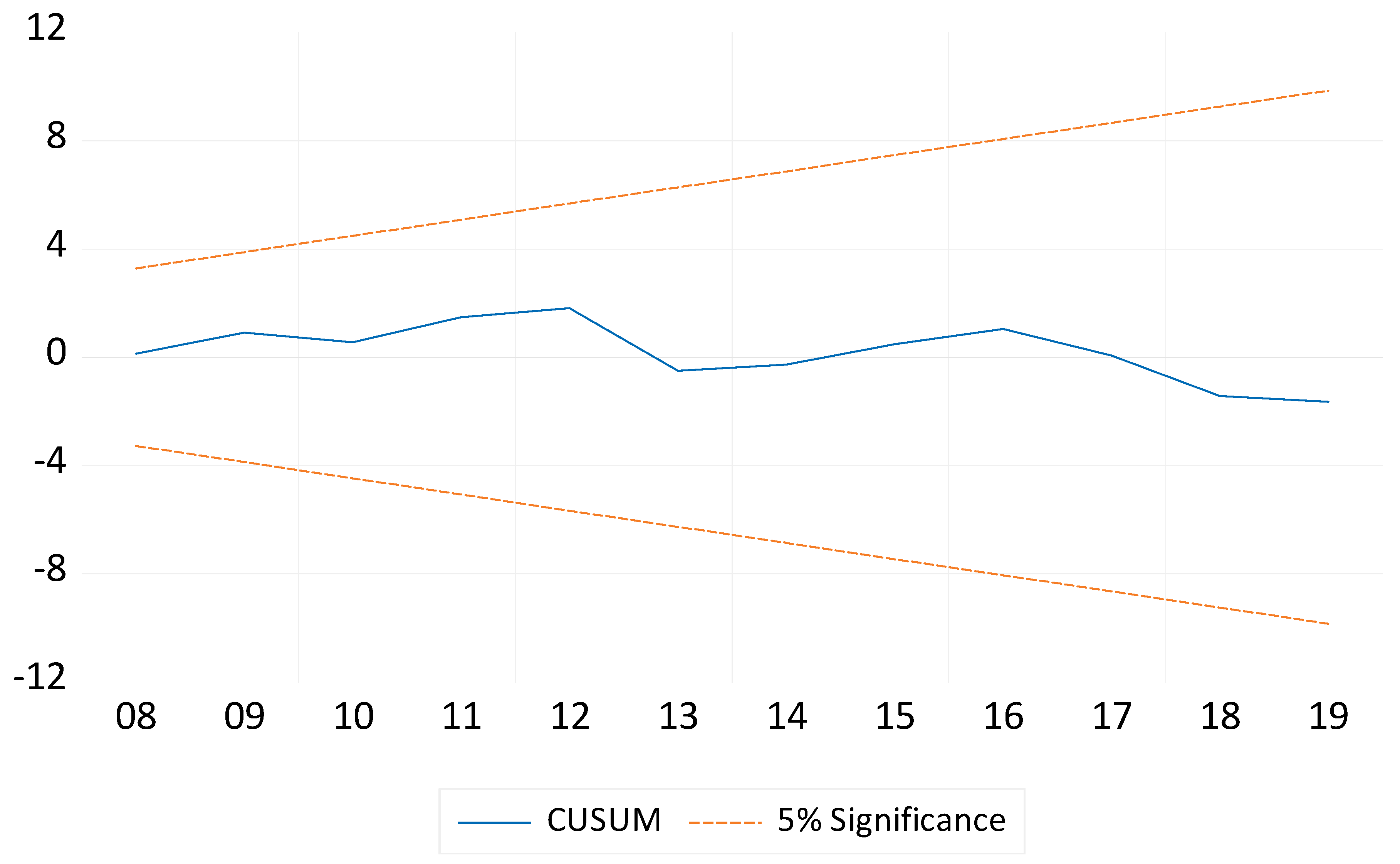

ARDL cointegration confirmed the long-run relationships among the variables. Thus, the assumption of no cointegration has been rejected within 1% significance. Furthermore, the ECT was tested, and it was significant, negative, and did not exceed -1, thus confirming the convergence of the model from the short- to long-run equilibrium. The econometrics outcomes have confirmed the correction of itself within the range of almost two years in case any distortion occurs in the short-run dynamics. The model exhibited a positive trend and was significant at the 1% level. The lag of the real exchange rate was negative and significant at the 1% level. However, income was found to positively impact the real exchange rate in the long run; this result is consistent with the work of [

2,

3,

5]. On the other hand, income was shown to have no impact on the real exchange rate in the short run. The CPI was found to negatively impact the real exchange rate in the long run and positively impact the real exchange rate in the short run. These results are consistent with those of [

5], who found that inflation expectations impact the real exchange rate. Furthermore, we found that sustainable economic development had a negative impact on the real exchange rate in the short and long run. These results are consistent with those of [

18], who found that sustainable economic development in the USA has a negative impact on the dollar exchange rate against major world currencies. This result has ensured the relationship between sustainable economic development and real exchange rate where the no cointegration null hypothesis is rejected. Furthermore, the negative sign emphasizes that an increase in the thrust toward more sustainability programs could put more undesirable burden on the real exchange rate. However, oil rent was found to have a negative impact on the real exchange rate in the long run (unlikely in the short run), and the direction of impact was negative in the first moment and positive in the second moment. Furthermore, our findings regarding the impact of oil rent on the real exchange rate were consistent with those of [

10], who confirmed the relationship between the two variables. Additionally, the impact of government expenditure was found to be insignificant in the long run and significant in the short run. The impact of government expenditure was positive in the short run, which was consistent with the work of [

17,

39].

The results of this study are important to the Saudi Arabian authorities who are implementing Saudi Vision 2030. Sustainable economic development is the core of Vision 2030, whose sustainable programs cover a wide range of Saudi Arabian economic sectors. However, the complexity of the real exchange rate and its determinants make it difficult to apply this study’s findings to the implementation challenges facing sustainable programs. Furthermore, Saudi authorities should consider the negative impact of the sustainable programs on the real exchange rate, which is relatively stronger in the long run than in the short run. Thus, the transition of the Saudi Arabian economy toward sustainable economic development should use more precautionary policies than relaxed sustainable economic policies. Implementing a new sustainable program should be assessed with different dimension analysis. The inquiries of using renewable sources for energy in factories or investing in a green economy are part of the Saudi Vision 2030 that is in progress and should be applied to selective sectors instead of generalizing the policy over the entire economic sectors. The selection should rely on the size of the impact on the economy with an assessment of risk failure. The sustainability challenges for the Saudi economy are significant, especially because the Saudi economy currently depends on nonrenewable resources. Therefore, it is worth examining the impact of the SDI in different Saudi economic sectors to ensure a broad understanding of the impacts of sustainable economic development on the entire Saudi economy.