Impact of Digital Finance on Manufacturing Technology Innovation: Fixed-Effects and Panel-Threshold Approaches

Abstract

1. Introduction

2. Literature Review

2.1. Digital Finance

2.2. Manufacturing Technology Innovation

2.3. Digital Finance and Manufacturing Technology Innovation

3. Theoretical Analysis and Hypotheses

3.1. The Impact of Digital Finance on Manufacturing Technology Innovation

3.2. Digital Finance, Financial Constraint, and Manufacturing Technology Innovation

3.3. The Threshold Effect of Market Competition

4. Research Design and Methodology

4.1. Variables Selection

4.1.1. Explained Variable

4.1.2. Explanatory Variable

4.1.3. Mediating Variable

4.1.4. Threshold Variable

4.1.5. Control Variables

4.2. Sample Selection and Data Sources

4.3. Model Building

5. Empirical Analysis

5.1. Benchmark Regression Analysis

5.2. Mechanism Analysis

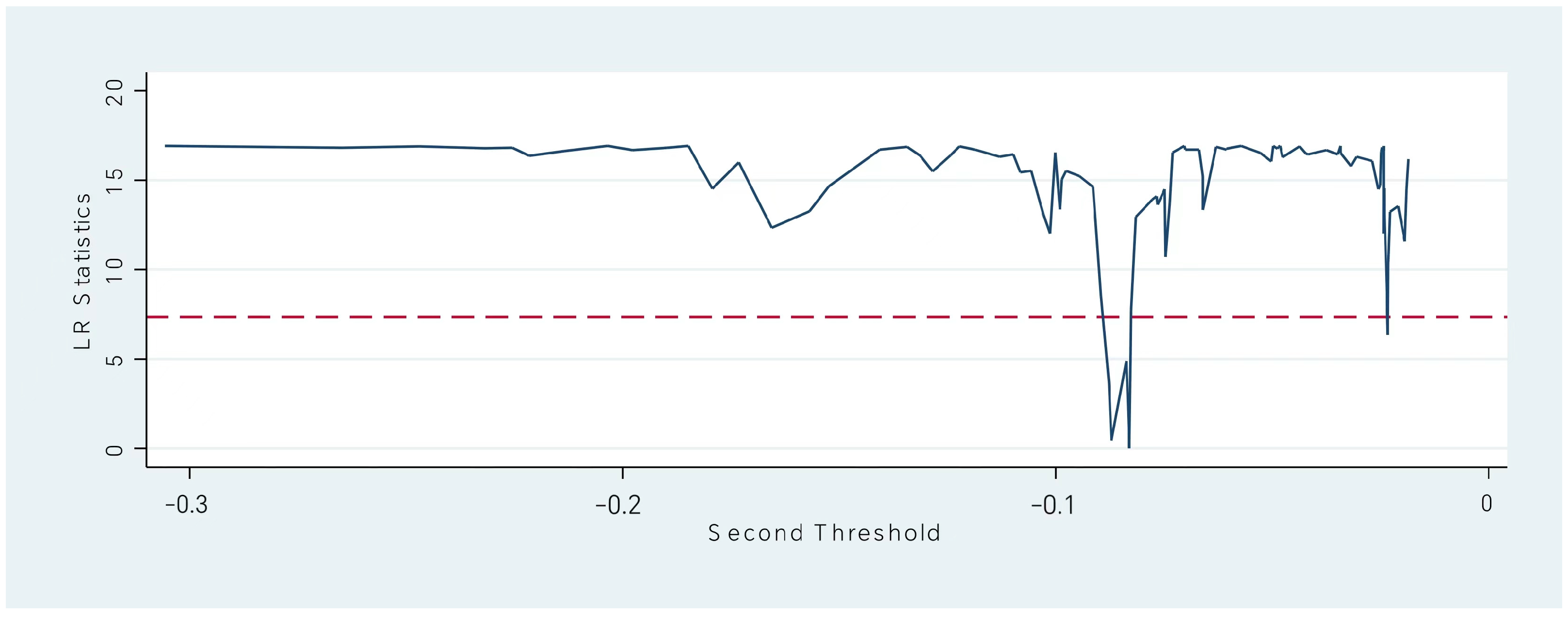

5.3. Threshold Effect Analysis

5.4. Robust Test

5.4.1. Replacing the Dependent Variable

5.4.2. Tobit Model

5.4.3. Endogeneity Testing

5.5. Heterogeneity Analysis

5.5.1. Regional Heterogeneity

5.5.2. Heterogeneity of Enterprise Nature

5.5.3. Factor-Intensive Type Heterogeneity

6. Conclusions and Policy Implications

6.1. Conclusions

6.2. Theoretical and Practical Implications

6.3. Limitations and Future Directions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Victor, D.; Jean-Pierre, K.; Hof, L.A. Integration of operational lockout/tagout in a joint production and maintenance policy of a smart production system. Int. J. Prod. Econ. 2023, 263, 108925. [Google Scholar] [CrossRef]

- Peter, K.; Maria, L.; Cláudia, N.; Carlos, O. Preventive investment, malfunctions and liability. Int. J. Prod. Econ. 2023, 263, 108930. [Google Scholar] [CrossRef]

- Tang, S.; Wu, X.; Zhu, J. Digital finance and enterprise technology innovation: Structural Feature, mechanism identification and effect difference under financial supervision. J. Manag. World 2020, 36, 52–66. [Google Scholar] [CrossRef]

- Berger, S.C.; Gleisner, F. Emergence of Financial Intermediaries in Electronic Markets: The Case of Online P2P Lending. BuR—Bus. Res. 2009, 2, 39–65. [Google Scholar] [CrossRef]

- Huang, Y.; Huang, Z. The development of digital finance in China: Present and future. China Econ. Q. 2018, 17, 1489–1502. [Google Scholar] [CrossRef]

- Georgiana, M.A.; Gabriela, B.; Maria, B.R.; Mihaela, D.N. Does Banking Accessibility Matter in Assuring the Economic Growth in the Digitization Context? Evidence from Central and Eastern European Countries. Electronics 2023, 12, 279. [Google Scholar] [CrossRef]

- Liu, P.; Zhang, Y.; Zhou, S. Has Digital Financial Inclusion Narrowed the Urban–Rural Income Gap? A Study of the Spatial Influence Mechanism Based on Data from China. Sustainability 2023, 15, 3548. [Google Scholar] [CrossRef]

- Luo, S.; Sun, Y.; Zhou, R. Can fintech innovation promote household consumption? Evidence from China family panel studies. Int. Rev. Financ. Anal. 2022, 82, 102137. [Google Scholar] [CrossRef]

- Helen, B.; Florencio, L.-d.-S.; Armin, S. Fintech and access to finance. J. Corp. Financ. 2021, 68, 101941. [Google Scholar] [CrossRef]

- Ren, X.; Zeng, G.; Gozgor, G. How does digital finance affect industrial structure upgrading? Evidence from Chinese prefecture-level cities. J. Environ. Manag. 2023, 330, 117125. [Google Scholar] [CrossRef]

- Fatturroyhan. Go-Mudaraba: The Solution of Poverty and Unemployment in the Digital Era. In Proceedings of the 3rd International Conference of Integrated Intellectual Community (ICONIC), Hanover, Germany, 28–29 April 2018. [Google Scholar]

- Rahayu, K.S.; Budiarti, I.; Firdauas, D.W.; Onegina, V. Digitalization and informal MSME: Digital financial inclusion for MSME development in the formal economy. J. East. Eur. Cent. Asian Res. 2023, 10, 9–19. [Google Scholar]

- Xie, H.; Wen, J.; Wang, X. Digital Finance and High-Quality Development of State-Owned Enterprises—A Financing Constraints Perspective. Sustainability 2022, 14, 15333. [Google Scholar] [CrossRef]

- Cisheng, W.; Teng, L.; Xiaoxian, Y. Assessing the Impact of Digital Finance on the Total Factor Productivity of Commercial Banks: An Empirical Analysis of China. Mathematics 2023, 11, 665. [Google Scholar] [CrossRef]

- Zhang, P.; Wang, Y.; Wang, R.; Wang, T. Digital finance and corporate innovation: Evidence from China. Appl. Econ. 2023, 1–24. [Google Scholar] [CrossRef]

- Yao, L.; Yang, X. Can digital finance boost SME innovation by easing financing constraints?: Evidence from Chinese GEM-listed companies. PLoS ONE 2022, 17, e0264647. [Google Scholar] [CrossRef]

- Han, H.; Gu, X. Linkage Between Inclusive Digital Finance and High-Tech Enterprise Innovation Performance: Role of Debt and Equity Financing. Front. Psychol. 2021, 12, 814408. [Google Scholar] [CrossRef]

- Li, G.; Li, X.; Wang, N. Research on the influence of environmental regulation on technological innovation efficiency of manufacturing industry in China. Int. J. Environ. Sci. Technol. 2022, 19, 5239–5252. [Google Scholar] [CrossRef]

- Hanifah, H.; Zadeh, A.V.; Ping, T.A. The impact of government support and innovation culture on new product development of manufacturing SMEs: Does innovation strategy matter? Int. J. Manag. Pract. 2021, 14, 519–538. [Google Scholar] [CrossRef]

- Chakravorty, U.; Liu, R.; Tang, R.; Zhao, L. Firm Innovation under Import Competition from Low-Wage Countries. SSRN 4020433. 2022. Available online: http://hdl.handle.net/10419/167555 (accessed on 5 July 2023).

- Charles, M.; Kudzai, M.B.; Kuda, N.G.P. Factors influencing small and medium enterprises’ innovativeness: Evidence from manufacturing companies in Harare, Zimbabwe. Glob. Bus. Organ. Excell. 2022, 42, 10–23. [Google Scholar] [CrossRef]

- Sabourin, D.; Baldwin, J.R.; Hanel, P. Determinants of Innovative Activity in Canadian Manufacturing Firms: The Role of Intellectual Property Rights. Anal. Stud. Branch Res. Pap. 2000. [Google Scholar] [CrossRef]

- Phakpoom, T.; Nattapon, S.-A.; Panisa, V. External knowledge sourcing, knowledge management capacity and firms’ innovation performance: Evidence from manufacturing firms in Thailand. J. Asia Bus. Stud. 2023, 17, 149–169. [Google Scholar] [CrossRef]

- Xie, Z.; Zang, G.; Wu, F. On the Relationship between Innovation Activity and Manufacturing Upgrading of Emerging Countries: Evidence from China. Sustainability 2019, 11, 1309. [Google Scholar] [CrossRef]

- Kafetzopoulos, D.; Psomas, E. The impact of innovation capability on the performance of manufacturing companies. J. Manuf. Technol. Manag. 2015, 26, 104–130. [Google Scholar] [CrossRef]

- Younas, M.Z.; Rehman, F.U. Exploring the nexus between innovation and firm performance: New evidences from manufacturing innovation survey of Pakistan. Asian J. Technol. Innov. 2021, 29, 16–51. [Google Scholar] [CrossRef]

- Li, R.; Rao, J.; Wan, L. The digital economy, enterprise digital transformation, and enterprise innovation. Manag. Decis. Econ. 2022, 43, 2875–2886. [Google Scholar] [CrossRef]

- Chen, S.; Zhang, H. Does digital finance promote manufacturing servitization: Micro evidence from China. Int. Rev. Econ. Financ. 2021, 76, 856–869. [Google Scholar] [CrossRef]

- Zhang, Y. The Empirical Research on Impact of Digital Finance Development on the Performance of Small and Medium-sized Company in Manufacture Industry in China. Front. Bus. Econ. Manag. 2022, 6, 81–84. [Google Scholar] [CrossRef]

- Tian, Y.; Hong, J. In the Context of Digital Finance, Can Knowledge Enable Manufacturing Companies to Be More Courageous and Move towards Sustainable Innovation? Sustainability 2022, 14, 10634. [Google Scholar] [CrossRef]

- Santiago, F.; Freire, C.; Lavopa, A. Digitalization of Manufacturing Development in Latin America and the Caribbean; Springer: Cham, Switzerland, 2023. [Google Scholar]

- Jiang, Z.; Xu, C. Disrupting the Technology Innovation Efficiency of Manufacturing Enterprises Through Digital Technology Promotion: An Evidence of 5G Technology Construction in China. IEEE Trans. Eng. Manag. 2023, 1–11. [Google Scholar] [CrossRef]

- Jin, L.; Dai, J.; Jiang, W.; Cao, K. Digital finance and misallocation of resources among firms: Evidence from China. N. Am. J. Econ. Financ. 2023, 66, 101911. [Google Scholar] [CrossRef]

- Zhao, H.; Zheng, W.; Loutfoullina, I. Digital Finance and Collaborative Innovation: Case Study of the Yangtze River Delta, China. Sustainability 2022, 14, 10784. [Google Scholar] [CrossRef]

- Arslan, Ö.; Florackis, C.; Ozkan, A. The role of cash holdings in reducing investment–cash flow sensitivity: Evidence from a financial crisis period in an emerging market. Emerg. Mark. Rev. 2006, 7, 320–338. [Google Scholar] [CrossRef]

- Zhong, W.; Jiang, T. Can internet finance alleviate the exclusiveness of traditional finance? Evidence from Chinese P2P lending markets. Financ. Res. Lett. 2020, 40, 101731. [Google Scholar] [CrossRef]

- Blazsek, S.; Escribano, A. Patent propensity, R&D and market competition: Dynamic spillovers of innovation leaders and followers. J. Econom. 2016, 191, 145–163. [Google Scholar] [CrossRef]

- Cette, G.; Lopez, J.; Mairesse, J. Upstream Product Market Regulations, ICT, R&D and Productivity. Rev. Income Wealth 2017, 63, 68–89. [Google Scholar] [CrossRef]

- Aghion, P.; Bloom, N.; Blundell, R.; Griffith, R.; Howitt, P. Competition and Innovation: An Inverted-U Relationship. Q. J. Econ. 2005, 120, 701–728. [Google Scholar] [CrossRef]

- Brodzicki, T. The intensity of market competition and the innovative performance of firms. Innovation 2019, 21, 336–358. [Google Scholar] [CrossRef]

- Huang, X. The roles of competition on innovation efficiency and firm performance: Evidence from the Chinese manufacturing industry. Eur. Res. Manag. Bus. Econ. 2023, 29, 100201. [Google Scholar] [CrossRef]

- Liu, J.; Jiang, Y.; Gan, S.; He, L.; Zhang, Q. Can digital finance promote corporate green innovation? Environ. Sci. Pollut. Res. Int. 2022, 29, 35828–35840. [Google Scholar] [CrossRef]

- Hadlock, C.J.; Pierce, J.R. New Evidence on Measuring Financial Constraints: Moving Beyond the KZ Index. Rev. Financ. Stud. 2010, 23, 1909–1940. [Google Scholar] [CrossRef]

- Sethiya, A.; Thenmozhi, M. Does product market competition moderate the impact of promoter ownership on firm value? Manag. Financ. 2023, 49, 378–397. [Google Scholar] [CrossRef]

- Babar, M.; Habib, A. Product market competition and operating leverage: International evidence. J. Corp. Account. Financ. 2022, 33, 189–216. [Google Scholar] [CrossRef]

- Hansen, B.E. Threshold effects in non-dynamic panels: Estimation, testing, and inference. J. Econom. 1999, 93, 345–368. [Google Scholar] [CrossRef]

- Luo, S. Digital Finance Development and the Digital Transformation of Enterprises: Based on the Perspective of Financing Constraint and Innovation Drive. J. Math. 2022, 2022, 1607020. [Google Scholar] [CrossRef]

- Yang, L.; Gong, S.; Wang, B.; Chao, Z. Human capital, technology progress and manufacturing upgrading. China Soft Sci. 2018, 1, 138–148. [Google Scholar]

| Variable Type | Variable Name | Symbol | Measurement Indicators |

|---|---|---|---|

| explained variable | manufacturing technology innovation | TI | ln(1 + number of patent applications of listed companies) |

| explanatory variables | digital finance | DF | Peking University digital financial inclusion index |

| coverage breadth | DFc | ||

| use depth | DFu | ||

| digital degree | DFd | ||

| mediating variable | financial constraints | FC | SA index |

| threshold variable | market competition | HHI | Herfindahl–Hirschman Index |

| corporate size | size | ln(total assets) | |

| control variables | leverage | lev | total liabilities/total assets |

| return on assets | ROA | net profit/total assets | |

| fixed assets | FA | net fixed assets/total assets | |

| growth | growth | (operating income of current year-operating income of last year)/operating income of last year | |

| operating cash flow | CF | net operating cash flow/total assets | |

| proportion of independent directors | Indd | number of independent directors/total number of directors | |

| equity concentration | Tops | shareholding ratio of the largest shareholder | |

| economic development level | GDP | ln(Per capita GDP) | |

| industrial structure | IS | output value of secondary sector of the economy/GDP |

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| TI | 12,610 | 3.197 | 1.681 | 0.000 | 7.296 |

| DF | 12,610 | 5.321 | 0.597 | 3.381 | 6.038 |

| DFc | 12,610 | 5.213 | 0.661 | 2.706 | 5.982 |

| DFu | 12,610 | 5.348 | 0.553 | 3.439 | 6.102 |

| DFd | 12,610 | 5.498 | 0.737 | 2.816 | 6.112 |

| size | 12,610 | 22.165 | 1.213 | 19.658 | 25.675 |

| lev | 12,610 | 0.423 | 0.207 | 0.051 | 0.969 |

| ROA | 12,610 | 0.032 | 0.066 | −0.279 | 0.197 |

| FA | 12,610 | 0.238 | 0.144 | 0.010 | 0.642 |

| growth | 12,610 | 0.147 | 0.391 | −0.575 | 2.499 |

| CF | 12,610 | 0.044 | 0.067 | −0.157 | 0.233 |

| Indd | 12,610 | 0.374 | 0.053 | 0.333 | 0.571 |

| Tops(%) | 12,610 | 32.911 | 14.010 | 8.480 | 71.240 |

| GDP | 12,610 | 11.272 | 0.525 | 9.928 | 12.153 |

| IS(%) | 12,610 | 43.704 | 10.826 | 16.200 | 66.990 |

| TI | DF | size | lev | ROA | FA | growth | CF | Indd | Tops | GDP | IS | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| TI | 1 | |||||||||||

| DF | 0.254 *** | 1 | ||||||||||

| size | 0.549 *** | 0.223 *** | 1 | |||||||||

| lev | 0.144 *** | 0.011 | 0.407 *** | 1 | ||||||||

| ROA | 0.116 *** | −0.074 *** | 0.086 *** | −0.372 *** | 1 | |||||||

| FA | −0.110 *** | −0.044 *** | 0.121 *** | 0.172 *** | −0.119 *** | 1 | ||||||

| growth | 0.040 *** | −0.056 *** | 0.038 *** | 0.001 | 0.240 *** | −0.060 *** | 1 | |||||

| CF | 0.098 *** | 0.128 *** | 0.155 *** | −0.138 *** | 0.378 *** | 0.198 *** | 0.011 | 1 | ||||

| Indd | 0.002 | 0.061 *** | 0.020 ** | 0.002 | −0.052 *** | −0.020 ** | −0.012 | −0.021 ** | 1 | |||

| Tops | 0.052 *** | −0.121 *** | 0.173 *** | 0.01 | 0.141 *** | 0.039 *** | 0.026 *** | 0.092 *** | 0.043 *** | 1 | ||

| GDP | 0.235 *** | 0.428 *** | 0.104 *** | −0.024 *** | −0.005 | −0.155 *** | −0.004 | 0.033 *** | 0.038 *** | −0.011 | 1 | |

| IS | −0.134 *** | −0.370 *** | −0.109 *** | 0.005 | 0.031 *** | 0.177 *** | −0.001 | 0.006 | −0.050 *** | −0.028 *** | −0.268 *** | 1 |

| TI | |||||

|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | |

| DF | 0.564 *** | 0.302 *** | |||

| (6.95) | (3.79) | ||||

| DFc | 0.086 * | ||||

| (1.85) | |||||

| DFu | 0.445 *** | ||||

| (7.29) | |||||

| DFd | 0.025 | ||||

| (0.45) | |||||

| size | 0.791 *** | 0.791 *** | 0.791 *** | 0.791 *** | |

| (70.48) | (70.38) | (70.63) | (70.27) | ||

| lev | −0.409 *** | −0.423 *** | −0.385 *** | −0.434 *** | |

| (−5.77) | (−5.96) | (−5.44) | (−6.13) | ||

| ROA | 1.818 *** | 1.821 *** | 1.800 *** | 1.825 *** | |

| (8.12) | (8.13) | (8.04) | (8.15) | ||

| FA | −0.496 *** | −0.493 *** | −0.506 *** | −0.488 *** | |

| (−5.06) | (−5.02) | (−5.18) | (−4.97) | ||

| growth | −0.024 | −0.024 | −0.023 | −0.025 | |

| (−0.75) | (−0.76) | (−0.72) | (−0.78) | ||

| CF | 0.676 *** | 0.700 *** | 0.634 *** | 0.710 *** | |

| (3.36) | (3.48) | (3.16) | (3.53) | ||

| Indd | −0.765 *** | −0.764 *** | −0.768 *** | −0.763 *** | |

| (−3.69) | (−3.68) | (−3.71) | (−3.67) | ||

| Tops | −0.0008 | −0.0008 | −0.0008 | −0.0008 | |

| (−0.93) | (−0.89) | (−0.93) | (−0.86) | ||

| GDP | 0.108 *** | 0.133 *** | 0.072 *** | 0.152 *** | |

| (4.02) | (5.13) | (2.74) | (6.38) | ||

| IS | 0.0005 | −0.0001 | 0.0007 | −0.0007 | |

| (0.46) | (−0.12) | (0.56) | (−0.57) | ||

| _cons | 0.195 | −16.670 *** | −15.760 *** | −17.050 *** | −15.630 *** |

| (0.45) | (−35.54) | (−40.20) | (−40.95) | (−31.09) | |

| Year | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes |

| N | 12,610 | 12,610 | 12,610 | 12,610 | 12,610 |

| adj. R2 | 0.215 | 0.493 | 0.493 | 0.495 | 0.493 |

| FC | TI | |

|---|---|---|

| (1) | (2) | |

| DF | −0.070 *** | |

| (−5.01) | ||

| FC | −0.455 *** | |

| (−9.77) | ||

| size | 0.020 *** | 0.800 *** |

| (7.68) | (70.98) | |

| lev | 0.340 *** | −0.276 *** |

| (26.03) | (−3.79) | |

| ROA | 0.191 *** | 1.911 *** |

| (4.26) | (8.55) | |

| FA | −0.019 | −0.498 *** |

| (−1.04) | (−5.10) | |

| growth | −0.034 *** | −0.041 |

| (−5.16) | (−1.27) | |

| CF | 0.019 | 0.715 *** |

| (0.51) | (3.57) | |

| Indd | −0.286 *** | −0.892 *** |

| (−7.10) | (−4.30) | |

| Tops | −0.0009 *** | −0.001 |

| (−5.69) | (−1.35) | |

| GDP | −0.038 *** | 0.130 *** |

| (−8.00) | (5.43) | |

| IS | −0.0007 *** | −0.0008 |

| (−3.19) | (−0.75) | |

| _cons | 4.237 *** | −13.680 *** |

| (45.57) | (−32.61) | |

| Year | Yes | Yes |

| Industry | Yes | Yes |

| N | 12,610 | 12,610 |

| adj. R2 | 0.178 | 0.496 |

| Threshold Variables | Type | Threshold Value | Confidence Interval | f Value | p Value | 10% Critical Value | 5% Critical Value | 1% Critical Value |

|---|---|---|---|---|---|---|---|---|

| HHI | single threshold | −0.028 | [−0.083, −0.026] | 19.34 | 0.070 | 17.931 | 20.947 | 27.328 |

| double threshold | −0.083 | [−0.087, −0.083] | 17.14 | 0.087 | 16.110 | 19.725 | 26.203 | |

| triple threshold | −0.101 | [−0.106, −0.091] | 11.12 | 0.700 | 27.973 | 31.937 | 41.302 |

| TI | |

|---|---|

| (1) | |

| size | 0.703 *** |

| (16.83) | |

| lev | −0.386 ** |

| (−3.08) | |

| ROA | 0.311 |

| (1.59) | |

| FA | −0.210 |

| (−1.14) | |

| growth | 0.028 |

| (1.15) | |

| CF | 0.007 |

| (0.05) | |

| Indd | −0.594 |

| (−1.93) | |

| Tops | −0.003 |

| (−1.39) | |

| GDP | 0.297 ** |

| (3.20) | |

| IS | −0.019 *** |

| (−5.52) | |

| 0._cat#c.DF | 0.158 *** |

| (4.49) | |

| 1._cat#c.DF | 0.135 *** |

| (3.86) | |

| 2._cat#c.DF | 0.110 ** |

| (3.20) | |

| _cons | −15.140 *** |

| (−12.26) | |

| N | 12,610 |

| R2 | 0.352 |

| TI | |||||

|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | |

| DF | 0.504 *** | 0.305 *** | |||

| (6.42) | (3.88) | ||||

| DFc | 0.083 | ||||

| (1.62) | |||||

| DFu | 0.477 *** | ||||

| (7.38) | |||||

| DFd | 0.024 | ||||

| (0.39) | |||||

| size | 0.739 *** | 0.739 *** | 0.739 *** | 0.738 *** | |

| (69.12) | (68.99) | (69.35) | (68.87) | ||

| lev | −0.325 *** | −0.340 *** | −0.304 *** | −0.349 *** | |

| (−4.88) | (−5.10) | (−4.58) | (−5.26) | ||

| ROA | 1.117 *** | 1.121 *** | 1.096 *** | 1.124 *** | |

| (5.30) | (5.31) | (5.21) | (5.32) | ||

| FA | −0.476 *** | −0.471 *** | −0.486 *** | −0.468 *** | |

| (−5.17) | (−5.11) | (−5.29) | (−5.07) | ||

| growth | −0.076 ** | −0.077 ** | −0.076 * | −0.077 ** | |

| (−2.56) | (−2.58) | (−2.56) | (−2.59) | ||

| CF | 0.716 *** | 0.740 *** | 0.671 *** | 0.749 *** | |

| (3.85) | (3.98) | (3.61) | (4.03) | ||

| Indd | −0.448 ** | −0.446 ** | −0.446 ** | −0.445 ** | |

| (−2.30) | (−2.29) | (−2.29) | (−2.28) | ||

| Tops | 0.0003 | 0.0003 | 0.0003 | 0.0004 | |

| (0.36) | (0.40) | (0.34) | (0.43) | ||

| GDP | 0.094 *** | 0.121 *** | 0.056 ** | 0.139 *** | |

| (3.66) | (4.84) | (2.18) | (6.09) | ||

| IS | 0.002 | 0.001 | 0.002 | 0.001 | |

| (1.56) | (0.94) | (1.71) | (0.51) | ||

| _cons | 0.211 | −15.890 *** | −14.970 *** | −16.410 *** | −14.840 *** |

| (0.51) | (−35.03) | (−38.98) | (−40.16) | (−28.78) | |

| Year | Yes | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes | Yes |

| N | 12,610 | 12,610 | 12,610 | 12,610 | 12,610 |

| adj. R2 | 0.222 | 0.487 | 0.487 | 0.489 | 0.487 |

| TI | ||||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| DF | 1.203 ** | |||

| (2.05) | ||||

| DFc | 0.481 * | |||

| (1.77) | ||||

| DFu | 1.281 ** | |||

| (2.87) | ||||

| DFd | −0.244 | |||

| (−0.78) | ||||

| size | 2.350 *** | 2.349 *** | 2.345 *** | 2.350 *** |

| (13.11) | (13.10) | (13.11) | (13.09) | |

| lev | −2.598 *** | −2.617 *** | −2.539 *** | −2.665 *** |

| (−4.94) | (−4.97) | (−4.83) | (−5.06) | |

| ROA | 1.437 | 1.414 | 1.477 | 1.406 |

| (1.17) | (1.15) | (1.20) | (1.14) | |

| FA | −0.264 | −0.250 | −0.285 | −0.259 |

| (−0.37) | (−0.35) | (−0.40) | (−0.36) | |

| growth | 0.108 | 0.113 | 0.112 | 0.111 |

| (0.66) | (0.68) | (0.68) | (0.68) | |

| CF | 1.437 | 1.464 | 1.404 | 1.456 |

| (1.30) | (1.33) | (1.27) | (1.32) | |

| Indd | −2.781 | −2.831 | −2.803 | −2.792 |

| (−1.59) | (−1.62) | (−1.61) | (−1.60) | |

| Tops | −0.007 | −0.006 | −0.007 | −0.006 |

| (−0.75) | (−0.71) | (−0.76) | (−0.68) | |

| GDP | 0.121 | 0.177 | 0.0953 | 0.279 |

| (0.40) | (0.60) | (0.32) | (0.97) | |

| IS | 0.008 | 0.005 | 0.007 | 0.002 |

| (0.54) | (0.39) | (0.51) | (0.12) | |

| _cons | −52.350 *** | −48.610 *** | −52.390 *** | −45.360 *** |

| (−8.50) | (−8.75) | (−8.94) | (−7.87) | |

| sigma_u | 3.986 *** | 3.998 *** | 3.960 *** | 4.010 *** |

| (15.26) | (15.27) | (15.26) | (15.27) | |

| sigma_e | 3.138 *** | 3.137 *** | 3.140 *** | 3.137 *** |

| (18.55) | (18.55) | (18.56) | (18.54) | |

| Year | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes |

| N | 12,610 | 12,610 | 12,610 | 12,610 |

| DF | TI | DF | TI | |

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| DF | 1.222 * | 0.248 ** | ||

| (1.95) | (2.22) | |||

| 0.001 *** | ||||

| (7.83) | ||||

| net | 0.010 *** | |||

| (76.93) | ||||

| size | −0.002 | 0.769 *** | −0.004 *** | 0.759 *** |

| (−1.57) | (60.17) | (−3.72) | (77.06) | |

| lev | −0.079 *** | −0.225 ** | −0.001 * | 0.013 ** |

| (−10.18) | (−2.45) | (−1.80) | (2.14) | |

| ROA | −0.011 | 1.094 *** | 0.064 *** | 2.248 *** |

| (−0.48) | (4.46) | (3.14) | (10.63) | |

| FA | −0.009 | −1.657 *** | 0.014 * | −0.582 *** |

| (−0.99) | (−16.76) | (1.61) | (−6.02) | |

| growth | −0.002 | 0.040 | −0.004 | −0.0409 |

| (−0.77) | (1.07) | (−1.53) | (−1.26) | |

| CF | 0.111 *** | 0.058 | 0.038 *** | 0.781 *** |

| (4.98) | (0.25) | (1.95) | (3.84) | |

| Indd | 0.014 | −0.542 ** | −0.035 * | −0.696 *** |

| (0.59) | (−2.35) | (−1.70) | (−3.46) | |

| Tops | 0.000 | −0.004 *** | 0.0003 *** | −0.001 |

| (0.64) | (−4.12) | (3.58) | (−1.61) | |

| GDP | 0.145 *** | 0.247 ** | 0.033 *** | 0.0747 *** |

| (53.57) | (2.52) | (14.46) | (3.47) | |

| IS | −0.004 *** | 0.006 ** | 0.0003 ** | −0.00003 |

| (−30.17) | (2.17) | (2.45) | (−0.03) | |

| N | 12,610 | 12,610 | 12,610 | 12,610 |

| Year | Yes | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes | Yes |

| Chi-sq(1) p value | 0.000 | 0.000 | 0.000 | 0.000 |

| Kleibergen–Paap rk LM statistic | 339.39 | 1562.26 | ||

| p value | 0.000 | 0.000 | ||

| Kleibergen–Paap–Wald rk F statistic | 61.30 | 5918.19 | ||

| Stock–Yogo weak ID test critical values | [16.38] | [16.38] | ||

| adj. R2 | 0.321 | 0.363 |

| TI | |||

|---|---|---|---|

| The Eastern Region | The Central Region | The Western Region | |

| DF | 0.176 | 2.062 *** | 1.969 *** |

| (1.45) | (4.65) | (5.48) | |

| size | 0.830 *** | 0.727 *** | 0.762 *** |

| (58.88) | (28.65) | (28.12) | |

| lev | −0.421 *** | −0.625 *** | −0.320 |

| (−5.11) | (−4.30) | (−1.93) | |

| ROA | 1.924 *** | 1.305 ** | 1.368 ** |

| (7.35) | (2.90) | (2.67) | |

| FA | −0.210 | −0.633 ** | −0.973 *** |

| (−1.86) | (−2.96) | (−4.92) | |

| growth | 0.029 | −0.049 | −0.091 |

| (0.75) | (−0.83) | (−1.48) | |

| CF | 1.000 *** | −0.285 | 0.438 |

| (4.38) | (−0.70) | (0.95) | |

| Indd | −0.493 * | −1.846 *** | −0.101 |

| (−1.98) | (−4.11) | (−0.19) | |

| Tops | −0.002 * | 0.006 ** | −0.002 |

| (−2.16) | (2.92) | (−0.95) | |

| GDP | 0.153 *** | 0.421 *** | −0.217 ** |

| (4.52) | (7.08) | (−2.97) | |

| IS | −0.002 | 0.003 | −0.010 ** |

| (−1.69) | (0.77) | (−2.96) | |

| _cons | −16.470 *** | −25.670 *** | −17.690 *** |

| (−18.54) | (−15.21) | (−10.74) | |

| Year | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes |

| N | 8130 | 2490 | 1990 |

| adj. R2 | 0.509 | 0.493 | 0.515 |

| p-value of inter-group difference test | E and C | E and W | W and C |

| 0.000 | 0.000 | 0.450 | |

| TI | ||

|---|---|---|

| Non-State-Owned Enterprises | State-Owned Enterprise | |

| DF | 0.413 *** | 0.221 * |

| (4.47) | (1.86) | |

| size | 0.753 *** | 0.738 *** |

| (48.73) | (45.41) | |

| lev | −0.264 *** | −0.261 ** |

| (−2.88) | (−2.31) | |

| ROA | 1.807 *** | 2.251 *** |

| (6.49) | (6.10) | |

| FA | −0.253 ** | −0.599 *** |

| (−1.97) | (−4.03) | |

| growth | −0.046 | 0.051 |

| (−1.08) | (1.06) | |

| CF | 0.682 *** | −0.086 |

| (2.82) | (−0.35) | |

| Indd | −0.334 | −0.996 *** |

| (−1.29) | (−3.19) | |

| Tops | 0.000 | −0.005 *** |

| (0.17) | (−3.59) | |

| GDP | 0.075 *** | 0.056 * |

| (3.00) | (1.75) | |

| IS | 0.004 ** | −0.003 |

| (2.23) | (−1.63) | |

| _cons | −16.480 *** | −14.110 *** |

| (−27.32) | (−20.86) | |

| Year | Yes | Yes |

| Industry | Yes | Yes |

| N | 7700 | 4910 |

| adj. R2 | 0.448 | 0.569 |

| p-value of inter group difference test | 0.070 | |

| Types | Specific Industries |

|---|---|

| Labor-intensive | Agricultural and sideline food processing industry; food manufacturing industry; textile industry; textile clothing and clothing industry; leather, fur, feather and its products and shoemaking industry; wood processing and wood; bamboo, rattan, palm and grass products industry; furniture manufacturing industry; printing and recording media reproduction industry; culture and education; arts and crafts; sports and entertainment supplies manufacturing industry; rubber and plastic products industry; non-metallic mineral products industry; metal products industry; other manufacturing industries; waste resources comprehensive utilization industry; machinery and equipment repair industry |

| Capital-intensive | Wine and beverage and refined tea manufacturing industry; paper making and paper products industry; petroleum processing and coking and nuclear fuel processing industry; chemical raw materials and chemical products manufacturing industry; chemical fiber manufacturing industry; ferrous smelting and rolling processing industry; nonferrous metal smelting and rolling processing industry; general equipment manufacturing industry |

| Technology-intensive | Pharmaceutical manufacturing industry; specialized equipment manufacturing industry; automotive manufacturing industry; railway, ship, aerospace, and other transportation equipment manufacturing industry; electrical machinery and equipment manufacturing industry; computer and other electronic equipment manufacturing industry; instrument and meter manufacturing industry |

| TI | |||

|---|---|---|---|

| Labor-Intensive | Capital-Intensive | Technology-Intensive | |

| DF | 0.788 *** | 0.335 ** | −0.121 |

| (4.23) | (2.33) | (−1.09) | |

| size | 0.671 *** | 0.710 *** | 0.883 *** |

| (20.96) | (37.09) | (61.33) | |

| lev | −0.522 *** | −0.757 *** | −0.139 |

| (−2.92) | (−6.10) | (−1.46) | |

| ROA | 2.972 *** | 0.911 ** | 1.668 *** |

| (5.11) | (2.25) | (5.64) | |

| FA | −0.274 | −0.866 *** | −0.081 |

| (−1.18) | (−5.44) | (−0.56) | |

| growth | −0.083 | 0.012 | −0.034 |

| (−0.94) | (0.20) | (−0.82) | |

| CF | 0.639 | 0.086 | 1.133 *** |

| (1.36) | (0.25) | (4.00) | |

| Indd | −1.715 *** | −0.495 | −0.622 ** |

| (−3.41) | (−1.21) | (−2.35) | |

| Tops | 0.003 | 0.002 | −0.003 *** |

| (1.24) | (1.25) | (−2.65) | |

| GDP | 0.092 | 0.093 * | 0.187 *** |

| (1.34) | (1.93) | (5.42) | |

| IS | −0.005 | −0.011 *** | 0.008 *** |

| (−1.61) | (−4.75) | (5.16) | |

| _cons | −16.330 *** | −14.620 *** | −17.440 *** |

| (−13.35) | (−17.92) | (−27.08) | |

| Year | Yes | Yes | Yes |

| Industry | Yes | Yes | Yes |

| N | 2550 | 3720 | 6340 |

| adj. R2 | 0.375 | 0.453 | 0.545 |

| p-value of inter-group difference test | Labor and capital | Labor and technology | Capital and technology |

| 0.010 | 0.000 | 0.000 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sheng, X.; Chen, W.; Tang, D.; Obuobi, B. Impact of Digital Finance on Manufacturing Technology Innovation: Fixed-Effects and Panel-Threshold Approaches. Sustainability 2023, 15, 11476. https://doi.org/10.3390/su151411476

Sheng X, Chen W, Tang D, Obuobi B. Impact of Digital Finance on Manufacturing Technology Innovation: Fixed-Effects and Panel-Threshold Approaches. Sustainability. 2023; 15(14):11476. https://doi.org/10.3390/su151411476

Chicago/Turabian StyleSheng, Xin, Wenya Chen, Decai Tang, and Bright Obuobi. 2023. "Impact of Digital Finance on Manufacturing Technology Innovation: Fixed-Effects and Panel-Threshold Approaches" Sustainability 15, no. 14: 11476. https://doi.org/10.3390/su151411476

APA StyleSheng, X., Chen, W., Tang, D., & Obuobi, B. (2023). Impact of Digital Finance on Manufacturing Technology Innovation: Fixed-Effects and Panel-Threshold Approaches. Sustainability, 15(14), 11476. https://doi.org/10.3390/su151411476