Discovering Hidden Associations among Environmental Disclosure Themes Using Data Mining Approaches

Abstract

1. Introduction

2. Literature Review

3. Methodological Background

3.1. Association Rule Mining (ARM)

3.2. Apriori Algorithm

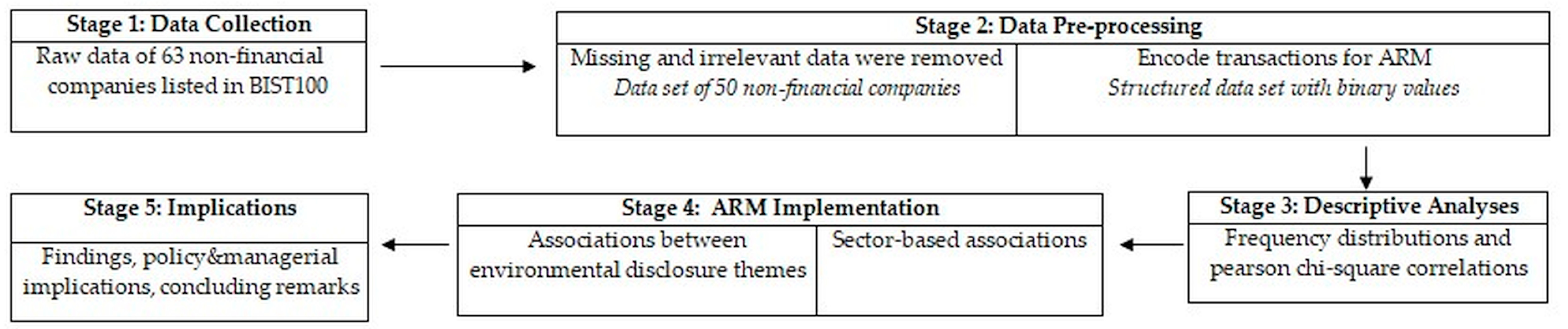

4. Methods

4.1. Data Set

4.2. General Concept

4.3. ARM Implementation

4.4. Measures

5. Results

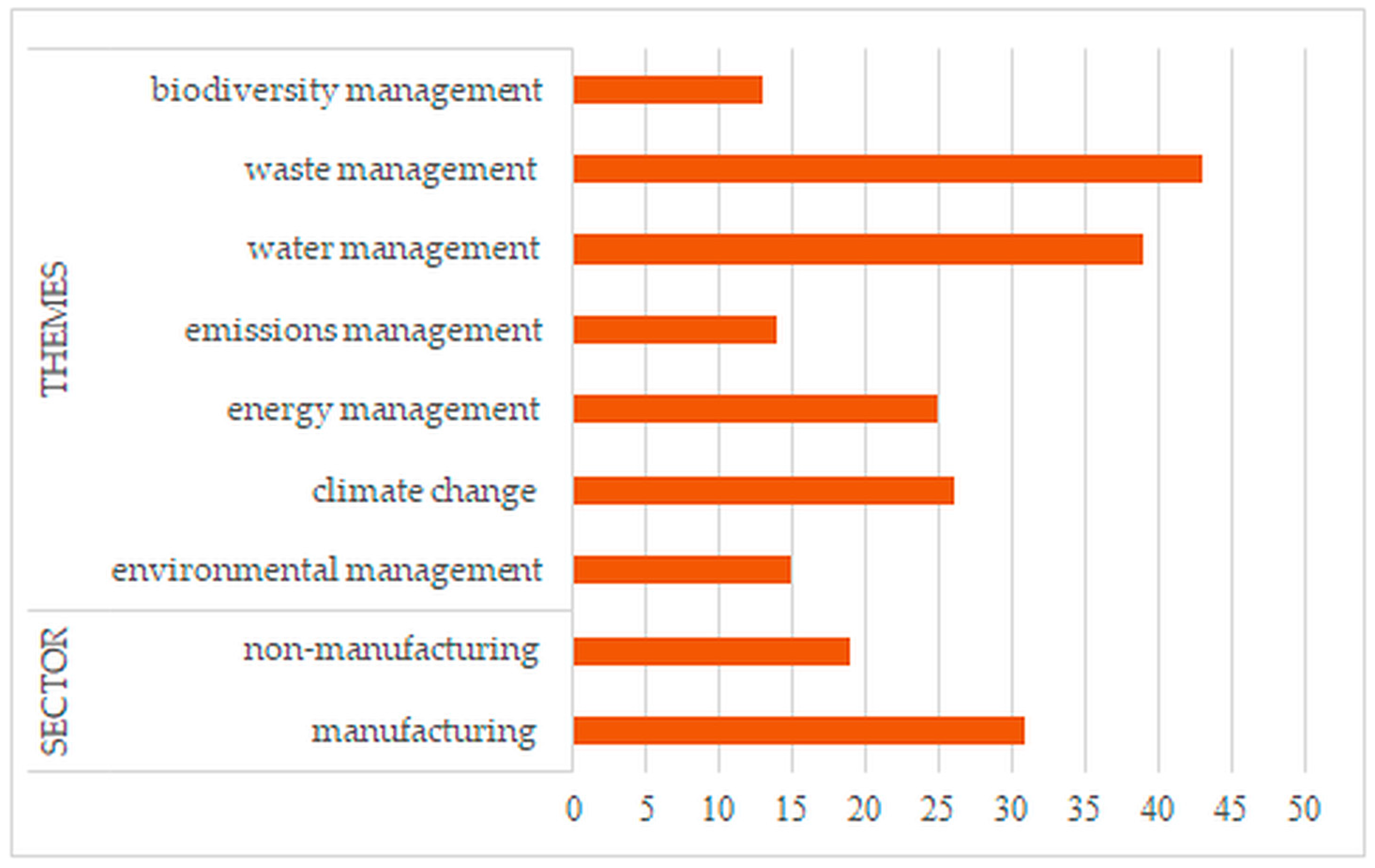

5.1. Descriptive Analysis

5.2. Association Rules between Environmental Themes

5.3. Sector-Based Association Rules

6. Discussion and Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Habibullah, M.S.; Din, B.H.; Tan, S.H.; Zahid, H. Impact of climate change on biodiversity loss: Global evidence. Environ. Sci. Pollut. Res. 2022, 29, 1073–1086. [Google Scholar] [CrossRef] [PubMed]

- Akram, A.; Jamil, F.; Alvi, S. The effects of natural disasters on human development in developing and developed countries. Int. J. Glob. Warm. 2022, 27, 155–172. [Google Scholar] [CrossRef]

- Machingura, T.; Adetunji, O.; Maware, C. A hierarchical complementary Lean-Green model and its impact on operational performance of manufacturing organisations. Int. J. Qual. Reliab. Manag. 2023. ahead of print. [Google Scholar] [CrossRef]

- Chen, F.; Hussain, M.; Khan, J.A.; Mir, G.M.; Khan, Z. Voluntary disclosure of greenhouse gas emissions by cities under carbon disclosure project: A sustainable development approach. Sustain. Dev. 2021, 29, 719–727. [Google Scholar] [CrossRef]

- Mongie, C.; Willows, G.; Herbert, S. The Impact of the Paris Climate Change Agreement and Other Factors on Climate Change Disclosure in South Africa. In Green House Gas Emissions Reporting and Management in Global Top Emitting Countries and Companies; Emerald Publishing Limited: Bingley, UK, 2023; Volume 11, pp. 107–125. [Google Scholar]

- Raza, M.S.; Khahro, S.H.; Memon, S.A.; Ali, T.H.; Memon, N.A. Global trends in research on carbon footprint of buildings during 1971–2021: A bibliometric investigation. Environ. Sci. Pollut. Res. 2021, 28, 63227–63236. [Google Scholar] [CrossRef] [PubMed]

- Dubey, R.; Gunasekaran, A.; Ali, S.S. Exploring the relationship between leadership, operational practices, institutional pressures and environmental performance: A framework for green supply chain. Int. J. Prod. Econ. 2015, 160, 120–132. [Google Scholar] [CrossRef]

- Seele, P. Envisioning the digital sustainability panopticon: A thought experiment of how big data may help advancing sustainability in the digital age. Sustain. Sci. 2016, 11, 845–854. [Google Scholar] [CrossRef]

- Seele, P.; Lock, I. The game-changing potential of digitalization for sustainability: Possibilities, perils, and pathways. Sustain. Sci. 2017, 12, 183–185. [Google Scholar] [CrossRef]

- Goloshchapova, I.; Poon, S.H.; Pritchard, M.; Reed, P. Corporate social responsibility reports: Topic analysis and big data approach. Eur. J. Financ. 2019, 25, 1637–1654. [Google Scholar] [CrossRef]

- Agostini, M.; Arkhipova, D.; Mio, C. Corporate accountability and big data analytics: Is non-financial disclosure a missing link? Sustain. Account. Manag. Policy J. 2023, 14, 62–89. [Google Scholar] [CrossRef]

- Koh, H.C.; Low, C.K. Going concern prediction using data mining techniques. Manag. Audit. J. 2004, 19, 462–476. [Google Scholar]

- McAfee, A.; Brynjolfsson, E.; Davenport, T.H.; Patil, D.J.; Barton, D. Big data: The management revolution. Harv. Bus. Rev. 2012, 90, 60–68. [Google Scholar]

- Han, J.; Pei, J.; Kamber, M. Data Mining: Concepts and Techniques; Elsevier: Amsterdam, The Netherlands, 2011. [Google Scholar]

- Kiron, D.; Prentice, P.K.; Ferguson, R.B. The analytics mandate. MIT Sloan Manag. Rev. 2014, 55, 1–25. [Google Scholar]

- Sariyer, G.; Mangla, S.K.; Kazancoglu, Y.; Xu, L.; Tasar, C.O. Predicting cost of defects for segmented products and customers using ensemble learning. Comput. Ind. Eng. 2022, 171, 108502. [Google Scholar] [CrossRef]

- Garnsey, M.R. Automatic classification of financial accounting concepts. J. Emerg. Technol. Account. 2006, 3, 21–39. [Google Scholar] [CrossRef]

- Kumar, P.R.; Ravi, V. Bankruptcy prediction in banks and firms via statistical and intelligent techniques–A review. Eur. J. Oper. Res. 2007, 180, 1–28. [Google Scholar] [CrossRef]

- Hofmann, E.; Lampe, K. Financial statement analysis of logistics service providers: Ways of enhancing performance. Int. J. Phys. Distrib. Logist. Manag. 2013, 43, 321–342. [Google Scholar] [CrossRef]

- Amani, F.A.; Fadlalla, A.M. Data mining applications in accounting: A review of the literature and organizing framework. Int. J. Account. Inf. Syst. 2017, 24, 32–58. [Google Scholar] [CrossRef]

- Brammer, S.J.; Pavelin, S. Corporate reputation and social performance: The importance of fit. J. Manag. Stud. 2006, 43, 435–455. [Google Scholar] [CrossRef]

- Eleftheriadis, I.M.; Anagnostopoulou, E.G. Relationship between corporate climate change disclosures and firm factors. Bus. Strategy Environ. 2015, 24, 780–789. [Google Scholar] [CrossRef]

- Prado-Lorenzo, J.M.; Gallego-Alvarez, I.; Garcia-Sanchez, I.M. Stakeholder engagement and corporate social responsibility reporting: The ownership structure effect. Corp. Soc. Responsib. Environ. Manag. 2009, 16, 94–107. [Google Scholar] [CrossRef]

- Eccles, R.G.; Serafeim, G.; Krzus, M.P. Market interest in nonfinancial information. J. Appl. Corp. Financ. 2011, 23, 113–127. [Google Scholar] [CrossRef]

- Al-Tuwaijri, S.A.; Christensen, T.E.; Hughes Ii, K.E. The relations among environmental disclosure, environmental performance, and economic performance: A simultaneous equations approach. Account. Organ. Soc. 2004, 29, 447–471. [Google Scholar] [CrossRef]

- Clarkson, P.M.; Li, Y.; Richardson, G.D.; Vasvari, F.P. Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Account. Organ. Soc. 2008, 33, 303–327. [Google Scholar] [CrossRef]

- Guenther, E.; Endrikat, J.; Guenther, T.W. Environmental management control systems: A conceptualization and a review of the empirical evidence. J. Clean. Prod. 2016, 136, 147–171. [Google Scholar] [CrossRef]

- Busch, T.; Hoffmann, V.H. How hot is your bottom line? Linking carbon and financial performance. Bus. Soc. 2011, 50, 233–265. [Google Scholar] [CrossRef]

- Ziegler, A.; Busch, T.; Hoffmann, V.H. Disclosed corporate responses to climate change and stock performance: An international empirical analysis. Energy Econ. 2011, 33, 1283–1294. [Google Scholar] [CrossRef]

- Al Amosh, H.; Mansor, N. The implications of ownership structure on the environmental disclosure in Jordan. Int. J. Acad. Res. Bus. Soc. Sci. 2020, 10, 330–346. [Google Scholar] [CrossRef]

- Calza, F.; Profumo, G.; Tutore, I. Corporate ownership and environmental proactivity. Bus. Strategy Environ. 2016, 25, 369–389. [Google Scholar] [CrossRef]

- Dintimala, Y.; Amril, T.A. The effect of ownership structure, financial and environmental performances on environmental disclosure. Account. Anal. J. 2018, 7, 70–77. [Google Scholar]

- Kılıç, M.; Kuzey, C. Determinants of climate change disclosures in the Turkish banking industry. Int. J. Bank Mark. 2019, 37, 901–926. [Google Scholar] [CrossRef]

- Halme, M.; Huse, M. The influence of corporate governance, industry and country factors on environmental reporting. Scand. J. Manag. 1997, 13, 137–157. [Google Scholar] [CrossRef]

- Akbaş, H.E.; Canikli, S. Determinants of voluntary greenhouse gas emission disclosure: An empirical investigation on Turkish firms. Sustainability 2018, 11, 107. [Google Scholar] [CrossRef]

- Kılıç, M.; Kuzey, C. The effect of corporate governance on carbon emission disclosures: Evidence from Turkey. Int. J. Clim. Change Strateg. Manag. 2018, 11, 35–53. [Google Scholar] [CrossRef]

- Coakley, J.R.; Brown, C.E. Artificial neural networks in accounting and finance: Modeling issues. Intell. Syst. Account. Financ. Manag. 2000, 9, 119–144. [Google Scholar] [CrossRef]

- Kloptchenko, A.; Eklund, T.; Karlsson, J.; Back, B.; Vanharanta, H.; Visa, A. Combining data and text mining techniques for analysing financial reports. Intell. Syst. Account. Financ. Manag. Int. J. 2004, 12, 29–41. [Google Scholar] [CrossRef]

- Magnusson, C.; Arppe, A.; Eklund, T.; Back, B.; Vanharanta, H.; Visa, A. The language of quarterly reports as an indicator of change in the company’s financial status. Inf. Manag. 2005, 42, 561–574. [Google Scholar] [CrossRef]

- Gaganis, C. Classification techniques for the identification of falsified financial statements: A comparative analysis. Intell. Syst. Account. Financ. Manag. Int. J. 2009, 16, 207–229. [Google Scholar] [CrossRef]

- Tackett, J.A. Association rules for fraud detection. J. Corp. Account. Financ. 2013, 24, 15–22. [Google Scholar] [CrossRef]

- Alpar, P.; Winkelsträter, S. Assessment of data quality in accounting data with association rules. Expert Syst. Appl. 2014, 41, 2259–2268. [Google Scholar] [CrossRef]

- Aguinis, H.; Forcum, L.E.; Joo, H. Using market basket analysis in management research. J. Manag. 2013, 39, 1799–1824. [Google Scholar] [CrossRef]

- Agrawal, R.; Imieliński, T.; Swami, A. Mining association rules between sets of items in large databases. In Proceedings of the 1993 ACM SIGMOD International Conference on Management of Data, Washington, DC, USA, 26–28 May 1993; pp. 207–216. [Google Scholar]

- Krishankumar, R.; Mishra, A.R.; Rani, P.; Cavallaro, F.; Ravichandran, K.S. A Novel Integrated q-Rung Fuzzy Framework for Biomass Location Selection with No Apriori Weight Choices. Sustainability 2023, 15, 3377. [Google Scholar] [CrossRef]

- Sarıyer, G.; Öcal Taşar, C. Highlighting the rules between diagnosis types and laboratory diagnostic tests for patients of an emergency department: Use of association rule mining. Health Inform. J. 2020, 26, 1177–1193. [Google Scholar] [CrossRef] [PubMed]

- Tandan, M.; Acharya, Y.; Pokharel, S.; Timilsina, M. Discovering symptom patterns of COVID-19 patients using association rule mining. Comput. Biol. Med. 2021, 131, 104249. [Google Scholar] [CrossRef] [PubMed]

- Sadgali, I.; Sael, N.; Benabbou, F. Human behavior scoring in credit card fraud detection. IAES Int. J. Artif. Intell. 2021, 10, 698. [Google Scholar] [CrossRef]

- Agrawal, R.; Srikant, R. Fast algorithms for mining association rules. In Proceedings of the 20th International Conference on Very Large Data Bases, Santiago de Chile, Chile, 12–15 September 1994; Volume 1215, pp. 487–499. [Google Scholar]

- Zeng, L.; Wang, B.; Fan, L.; Wu, J. Analyzing sustainability of Chinese mining cities using an association rule mining approach. Resour. Policy 2016, 49, 394–404. [Google Scholar] [CrossRef]

- Northey, S.A.; Mudd, G.M.; Werner, T.T.; Haque, N.; Yellishetty, M. Sustainable water management and improved corporate reporting in mining. Water Resour. Ind. 2019, 21, 100104. [Google Scholar] [CrossRef]

| No. | Themes | Description |

|---|---|---|

| 1 | Environmental Management | Use of natural resources like soil, water, and air with environmentally acceptable practices. |

| 2 | Climate Change | Climate change, which is driven by greenhouse effects, refers to changes in climate together with global warming. |

| 3 | Energy Management | Correct management of natural resources to contribute to the lives of living things. |

| 4 | Emissions Management | Emissions management; reducing emissions, including greenhouse gases (GHG); and tackling climate change. |

| 5 | Water Management | The effort to transfer and sustain the resource, which is ultimately found in nature for the survival and development of living things, to future generations. |

| 6 | Waste Management | Recycling and energy production of foreign and waste materials released to nature after the consumption of living things and companies. |

| 7 | Biodiversity Management | Deliberate regulation of resources by humans to conserve biodiversity. |

| Themes | Abbreviation | Manufacturing | Non-Manufacturing | ||

|---|---|---|---|---|---|

| 31 Companies | 19 Companies | ||||

| N | % | n | % | ||

| Environmental management | Env.Man. | 10 | 32.26 | 5 | 26.32 |

| Climate change | Cli.Chn. | 14 | 45.16 | 12 | 63.16 |

| Energy management | Eng.Man. | 14 | 45.16 | 11 | 57.89 |

| Emissions management | Emis.Man. | 9 | 29.03 | 5 | 26.32 |

| Water management | Wat.Man. | 23 | 74.19 | 16 | 84.21 |

| Waste management | Wast.Man. | 26 | 83.87 | 17 | 89.47 |

| Biodiversity management | Biod.Man. | 8 | 25.81 | 5 | 26.32 |

| Env.Man. | Cli.Chn. | Eng.Man. | Emis.Man. | Wat.Man. | Wast.Man. | Biod.Man. | |

|---|---|---|---|---|---|---|---|

| Sector | 0.454 | 0.173 | 0.28 | 0.551 | 0.322 | 0.457 | 0.61 |

| Env.Man. | 0.004 | 0.108 | 0.12 | 0.184 | 0.248 | 0.163 | |

| Cli.Chn. | 0.005 | 0.446 | 0.044 | 0.453 | 0.131 | ||

| Eng.Man. | 0.173 | 0.5 | 0.5 | 0.26 | |||

| Emis.Man. | 0.636 | 0.643 | 0.264 | ||||

| Wat.Man. | 0.487 | 0.404 | |||||

| Wast.Man. | 0.594 |

| Rule # | Association Rules | Evaluation Measure | |||

|---|---|---|---|---|---|

| Antecedent | Consequent | Support | Confidence | Lift | |

| 1 | Wat.Man. = yes | Wast.Man. = yes | 0.68 | 0.87 | 1.01 |

| 2 | Cli.Chn. = yes | Wat.Man. = yes | 0.46 | 0.88 | 1.13 |

| 3 | Cli.Chn. = yes | Wast.Man. = yes | 0.46 | 0.88 | 1.03 |

| 4 | Cli.Chn. = yes & Wast.Man. = yes | Wat.Man. = yes | 0.42 | 0.91 | 1.17 |

| 5 | Biod.Man. = yes | Wat.Man. = yes | 0.22 | 0.85 | 1.08 |

| 6 | Emis.Man. = yes | Wat.Man. = yes | 0.22 | 0.79 | 1.01 |

| 7 | Env.Man. = yes | Eng.Man. = yes | 0.20 | 0.67 | 1.33 |

| 8 | Wast.Man. = yes & Biod.Man. = yes | Wat.Man. = yes | 0.18 | 0.82 | 1.05 |

| 9 | Biod.Man. = yes | Cli.Chn. = yes | 0.18 | 0.69 | 1.33 |

| 10 | Emis.Man. = yes | Eng.Man. = yes | 0.18 | 0.64 | 1.29 |

| 11 | Emis.Man. = yes & Cli.Chn. = yes | Wast.Man. = yes | 0.16 | 1.00 | 1.16 |

| 12 | Biod.Man. = yes & Cli.Chn. = yes | Wat.Man. = yes | 0.16 | 0.89 | 1.14 |

| 13 | Biod.Man. = yes & Cli.Chn. = yes | Wast.Man. = yes | 0.16 | 0.89 | 1.03 |

| 14 | Eng.Man. = yes & Emis.Man. = yes | Wast.Man. = yes | 0.16 | 0.89 | 1.03 |

| 15 | Emis.Man. = yes & Cli.Chn. = yes & Wat.Man. = yes | Wast.Man. = yes | 0.14 | 1.00 | 1.16 |

| 16 | Eng.Man. = yes & Cli.Chn. = yes | Wat.Man. = yes | 0.14 | 0.88 | 1.12 |

| 17 | Wast.Man. = yes & Biod.Man. = yes & Cli.Chn. = yes | Wat.Man. = yes | 0.14 | 0.88 | 1.12 |

| 18 | Eng.Man. = yes & Cli.Chn. = yes | Wast.Man. = yes | 0.14 | 0.88 | 1.01 |

| 19 | Wast.Man. = yes & Eng.Man. = yes & Cli.Chn. = yes | Wat.Man. = yes | 0.12 | 0.86 | 1.09 |

| 20 | Wat.Man. = yes & Env.Man. = yes | Eng.Man. = yes | 0.12 | 0.6 | 1.2 |

| Rule # | Association Rules | Evaluation Measure | |||

|---|---|---|---|---|---|

| Antecedent | Consequent | Support | Confidence | Lift | |

| 1 | sector = manufacturing & Wat.Man. = yes | Wast.Man. = yes | 0.4 | 0.87 | 1.01 |

| 2 | sector = non-manufacturing & Wat.Man. = yes | Wast.Man. = yes | 0.28 | 0.88 | 1.02 |

| 3 | sector = manufacturing & Cli.Chn. = yes | Wat.Man. = yes | 0.26 | 0.93 | 1.19 |

| 4 | sector = non-manufacturing & Cli.Chn. = yes | Wast.Man. = yes | 0.24 | 1.00 | 1.16 |

| 5 | sector = manufacturing & Wast.Man. = yes & Cli.Chn. = yes | Wat.Man. = yes | 0.22 | 1.00 | 1.28 |

| 6 | sector = non-manufacturing & Cli.Chn. = yes | Wat.Man. = yes | 0.2 | 0.83 | 1.07 |

| 7 | sector = non-manufacturing & Wast.Man. = yes & Cli.Chn. = yes | Wat.Man. = yes | 0.2 | 0.83 | 1.07 |

| 8 | sector = manufacturing & Env.Man. = yes | Wast.Man. = yes | 0.18 | 0.90 | 1.05 |

| 9 | sector = manufacturing & Eng.Man. = yes & Wat.Man. = yes | Wast.Man. = yes | 0.18 | 0.90 | 1.05 |

| 10 | sector = non-manufacturing & Eng.Man. = yes | Wat.Man. = yes | 0.18 | 0.82 | 1.05 |

| 11 | sector = non-manufacturing & Wast.Man. = yes | Eng.Man. = yes | 0.18 | 0.53 | 1.06 |

| 12 | sector = manufacturing & Emis.Man. = yes | Wast.Man. = yes | 0.16 | 0.89 | 1.03 |

| 13 | sector = manufacturing & Wat.Man. = yes & Env.Man. = yes | Wast.Man. = yes | 0.14 | 1.00 | 1.16 |

| 14 | sector = manufacturing & Biod.Man. = yes | Wat.Man. = yes | 0.14 | 0.88 | 1.12 |

| 15 | sector = manufacturing & Biod.Man. = yes | Wast.Man. = yes | 0.14 | 0.88 | 1.02 |

| 16 | sector = non-manufacturing & Wast.Man. = yes & Wat.Man. = yes | Eng.Man. = yes | 0.14 | 0.50 | 1.00 |

| 17 | sector = manufacturing & Eng.Man. = yes & Emis.Man. = yes | Wast.Man. = yes | 0.12 | 1.00 | 1.16 |

| 18 | sector = manufacturing & Biod.Man. = yes & Wat.Man. = yes | Cli.Chn. = yes | 0.12 | 0.86 | 1.65 |

| 19 | sector = manufacturing & Wast.Man. = yes & Biod.Man. = yes | Wat.Man. = yes | 0.12 | 0.86 | 1.10 |

| 20 | sector = manufacturing & Wast.Man. = yes & Emis.Man. = yes | Eng.Man. = yes | 0.12 | 0.75 | 1.50 |

| 21 | sector = non-manufacturing & Env.Man. = yes | Eng.Man. = yes | 0.10 | 1.00 | 2.00 |

| 22 | sector = manufacturing & Wast.Man. = yes & Biod.Man. = yes & Cli.Chn. = yes | Wat.Man. = yes | 0.10 | 1.00 | 1.28 |

| 23 | sector = non-manufacturing & Wast.Man. = yes & Emis.Man. = yes | Cli.Chn. = yes | 0.08 | 1.00 | 1.92 |

| 24 | sector = manufacturing & Wast.Man. = yes & Emis.Man. = yes & Cli.Chn. = yes | Wat.Man. = yes | 0.08 | 1.00 | 1.28 |

| 25 | sector = manufacturing & Eng.Man. = yes & Cli.Chn. = yes | Wat.Man. = yes | 0.08 | 1.00 | 1.28 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Acar, E.; Sarıyer, G.; Jain, V.; Ramtiyal, B. Discovering Hidden Associations among Environmental Disclosure Themes Using Data Mining Approaches. Sustainability 2023, 15, 11406. https://doi.org/10.3390/su151411406

Acar E, Sarıyer G, Jain V, Ramtiyal B. Discovering Hidden Associations among Environmental Disclosure Themes Using Data Mining Approaches. Sustainability. 2023; 15(14):11406. https://doi.org/10.3390/su151411406

Chicago/Turabian StyleAcar, Ece, Görkem Sarıyer, Vipul Jain, and Bharti Ramtiyal. 2023. "Discovering Hidden Associations among Environmental Disclosure Themes Using Data Mining Approaches" Sustainability 15, no. 14: 11406. https://doi.org/10.3390/su151411406

APA StyleAcar, E., Sarıyer, G., Jain, V., & Ramtiyal, B. (2023). Discovering Hidden Associations among Environmental Disclosure Themes Using Data Mining Approaches. Sustainability, 15(14), 11406. https://doi.org/10.3390/su151411406