Operationalizing Carbon-Neutral Living: A Case Study of A Business Model for Carbon-Negative Products

Abstract

1. Introduction

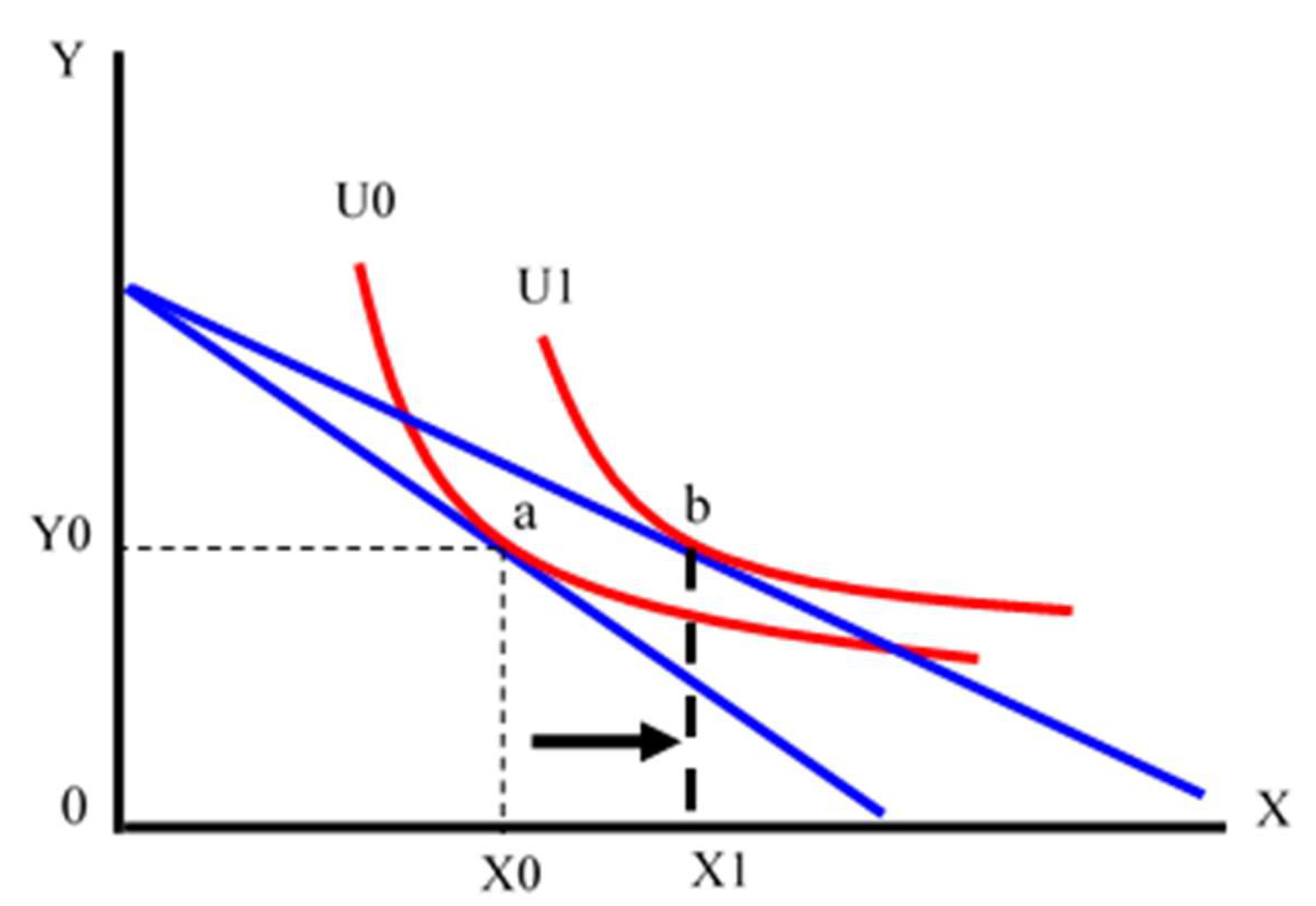

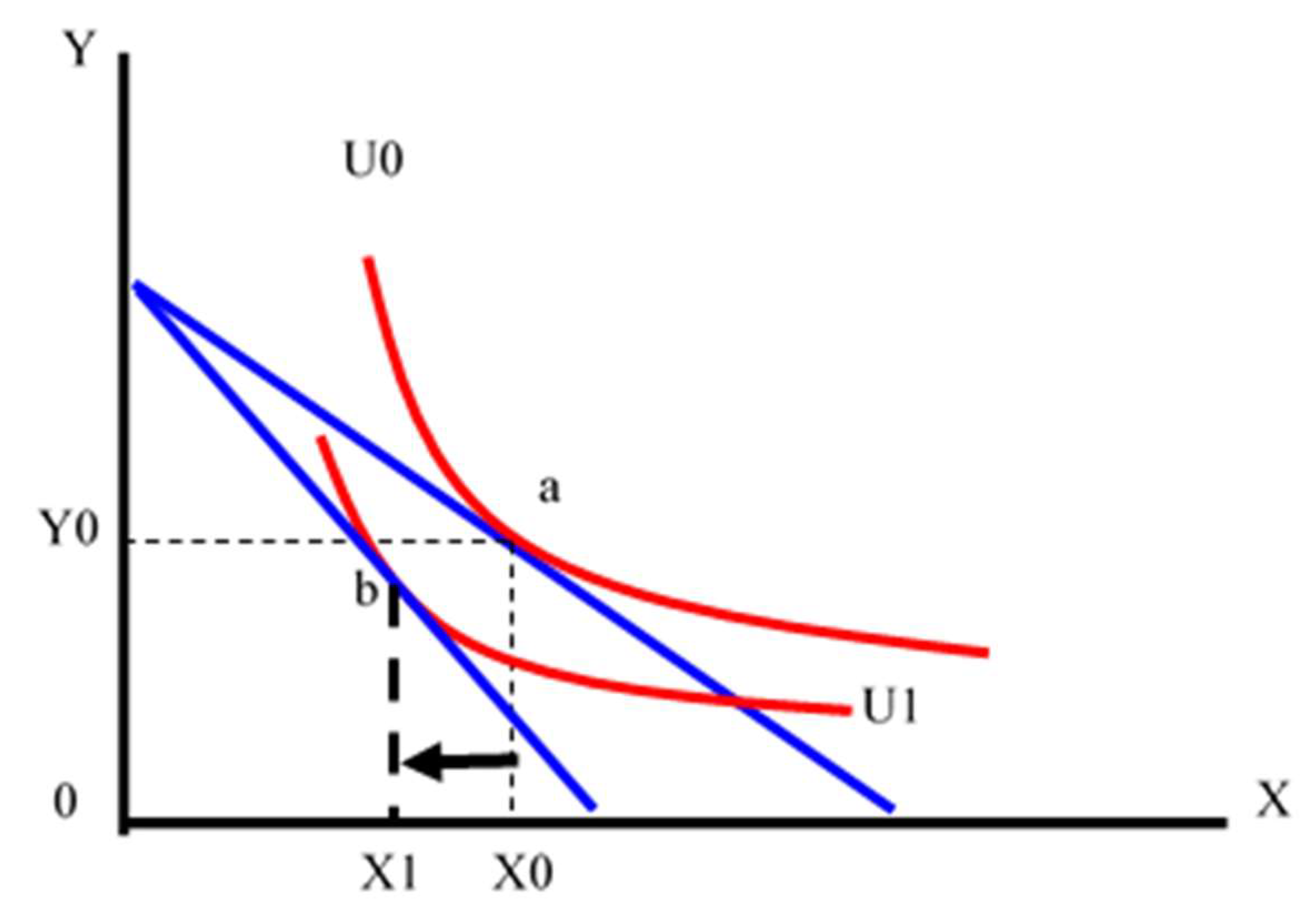

2. Theoretical Model of the PCT

2.1. Optimal Solution

2.2. Discussion

3. Experimental Design

3.1. Nudging Experimental Design

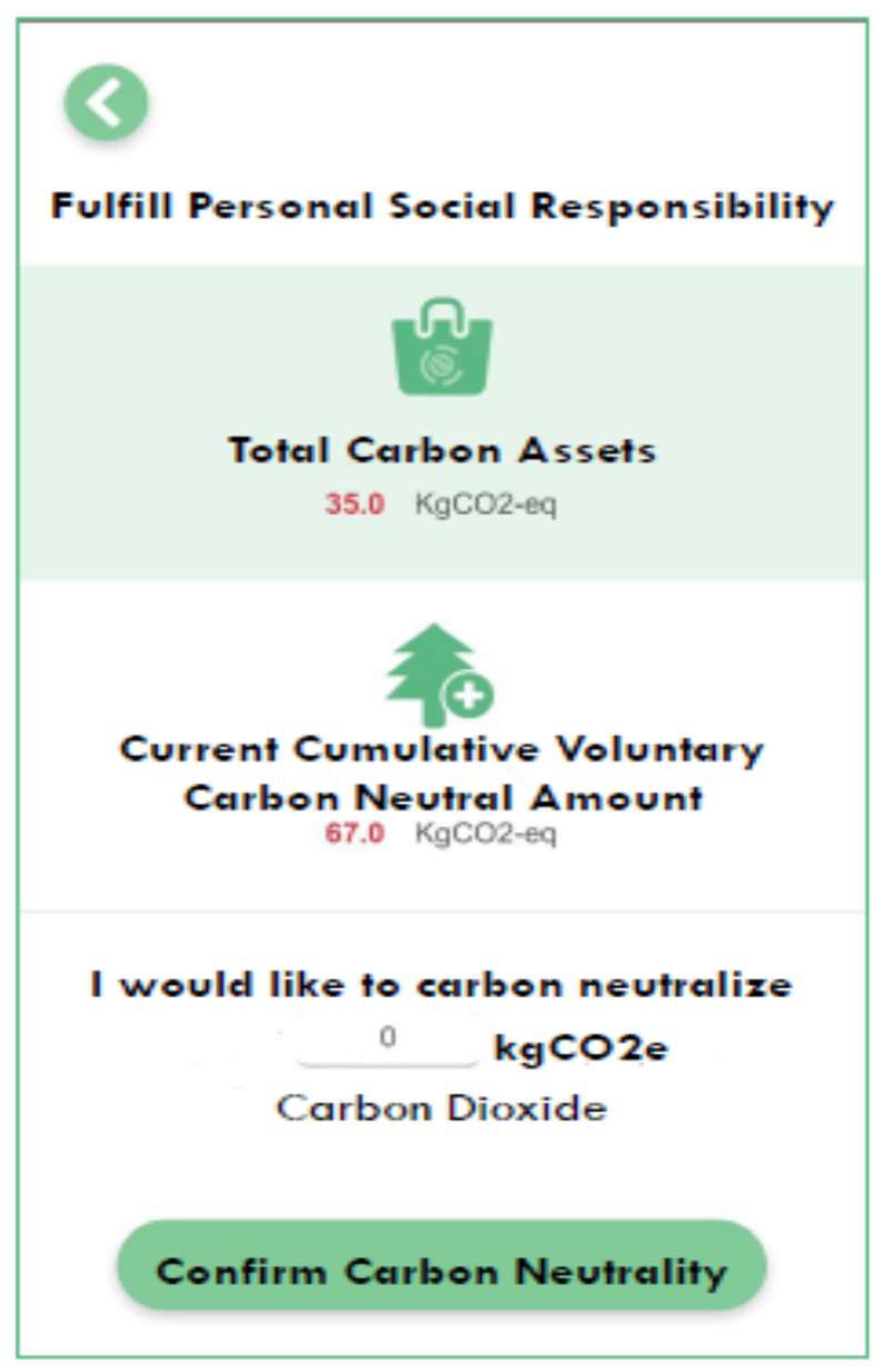

3.2. The IoTs System of Carbon Assets Account

3.3. Personal Social Responsibility Initiative

4. Results and Discussion

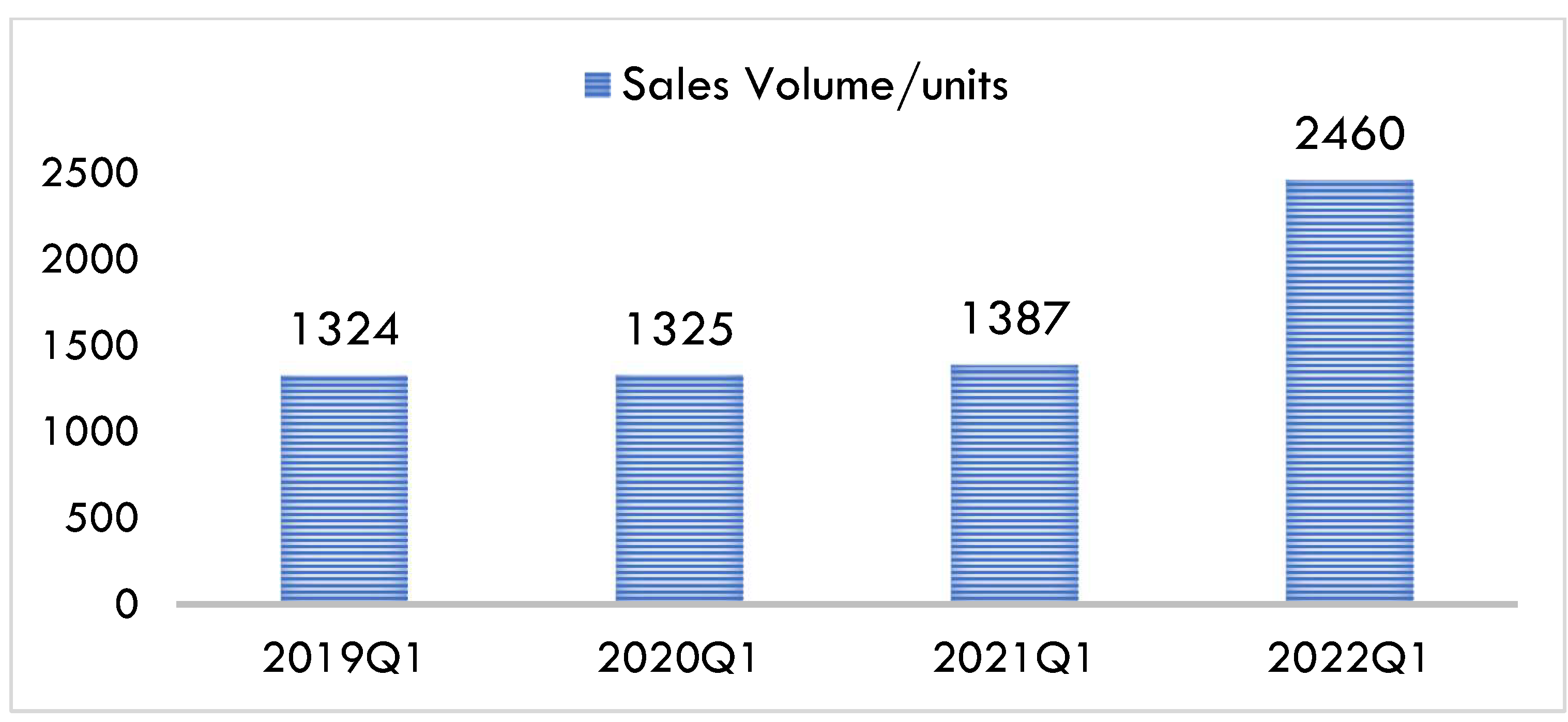

4.1. Sales Volume of Carbon-Negative Products

4.2. Regression Results

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- World Resource Institute. The State of Nationally Determined Contributions: 2022; World Resource Institute: Washington, DC, USA, 2022. [Google Scholar]

- World Economic Forum. The Global Risks Report 2021; World Economic Forum: Cologny, Switzerland, 2021. [Google Scholar]

- Nordhaus, W. The Climate Casino: Risk, Uncertainty, and Economics for a Warming World; Yale University Press: New Haven, CT, USA, 2013. [Google Scholar]

- International Energy Agency. Net Zero by 2050: A Roadmap for the Global Energy Sector; International Energy Agency: Paris, France, 2021. [Google Scholar]

- Vendenbergh, M.P.; Steinemann, A.C. The Carbon-Neutral Individual; Working Paper No. 07–22; Vanderbilt University Law School: Nashville, TN, USA, 2007. [Google Scholar]

- Energy Research Partnership. How Behavior Change Will Unlock Net-Zero; Energy Research Partnership: Birmingham, UK, 2021. [Google Scholar]

- Michie, S.; van Stralen, M.; West, R. The behaviour change wheel: A new method for characterising and designing behaviour change interventions. Implement. Sci. 2011, 6, 42. [Google Scholar] [CrossRef] [PubMed]

- Kahnemann, D.; Tversky, A. prospect theory: An analysis of decision under risk. Econometrica 1979, 47, 263–291. [Google Scholar] [CrossRef]

- Allais, M. The fundaments of a positive theory of choice involving risk and a criticism of the postulates and axioms of the American School. Econometrie 1952, 15, 257–332. [Google Scholar]

- Tversky, A.; Kahnemann, D. The framing of decisions and the psychology of choice. Science 1981, 211, 453–458. [Google Scholar] [CrossRef]

- Paserman, M.D. Job search and hyperbolic discounting: Structural estimation and policy evaluation. Econ. J. 2008, 118, 1418–1452. [Google Scholar] [CrossRef]

- Mas, A.; Moretti, E. Peer at work. Am. Econ. Rev. 2009, 99, 112–145. [Google Scholar] [CrossRef]

- Thaler, R. Toward a positive theory of consumer choice. J. Econ. Behav. Organ. 1980, 1, 39–60. [Google Scholar] [CrossRef]

- Kahnemann, D.; Tversky, A. Extensional versus intuitive reasoning: The conjunction fallacy in probability judgment. Psychol. Rev. 1983, 91, 293–315. [Google Scholar]

- Low, R. An Investigation into the Public Acceptability of the Personal Carbon Allowances Proposal for Reducing Personal Greenhouse Gas Emissions. Master’s Thesis, Edinburgh University, Edinburgh, UK, 2005. [Google Scholar]

- Starkey, R.; Anderson, K. Domestic Tradable Quotas: A Policy Instrument for the Reduction of Greenhouse Gas Emissions; Tyndall Centre for Climate Change Research: Norwich, UK, 2005. [Google Scholar]

- Howell, R. Would Personal Carbon Allowances be Acceptable to the UK Public as a Means of Reducing Individuals’ Carbon Dioxide Emissions. Master’s Thesis, University of Edinburgh, Edinburgh, UK, 2007. [Google Scholar]

- Raux, C.; Croissant, Y.; Pons, D. Would personal carbon trading reduce travel emissions more effectively than a carbon tax? Transp. Res. Part D Transp. Environ. 2015, 35, 72–83. [Google Scholar] [CrossRef]

- Dogterom, N.; Ettema, D.; Dijst, M. Tradable credits for managing car travel: A review of empirical research and relevant behavioural approaches. Transp. Rev. 2017, 37, 322–343. [Google Scholar] [CrossRef]

- Al-Guthmy, F.M.O.; Yan, W. Mind the gap: Personal carbon trading for road transport in Kenya. Clim. Policy 2020, 20, 1141–1160. [Google Scholar] [CrossRef]

- Uusitalo, E.; Kuokkanen, A.; Uusitalo, V.; von Wright, T.; Huttunen, A. Personal carbon trading in mobility may have positive distribution effect. Case Stud. Transp. Policy 2021, 9, 315–323. [Google Scholar] [CrossRef]

- Nie, Q.; Zhang, L.; Li, S. How can personal carbon trading be applied in electric vehicle subsidies? A Stackelberg game method in private vehicles. Appl. Energy 2022, 313, 118855. [Google Scholar] [CrossRef]

- Li, J.; Gao, L.; Hu, X.; Jia, J.; Wang, S. Effects of personal carbon trading scheme on consumers’ new energy vehicles replacement decision: An economic trade-off analysis. Environ. Impact Assess. Rev. 2023, 101, 107108. [Google Scholar] [CrossRef]

- Harwatt, H. Reducing Carbon Emissions from Personal Road Transport through the Application of a Tradable Carbon Permit Scheme: Empirical Findings and Policy Implications from the UK. In Proceedings of the International Transport Forum, Leipzig, Germany, 30 May–1 June 2008. [Google Scholar]

- Lane, C.; Harris, B.; Roberts, S. An Analysis of the Technical Feasibility and Potential Cost of a Personal Carbon Trading Scheme; Defra: London, UK, 2008. [Google Scholar]

- Fawcett, T. Carbon Trading: Using Stated Preference to Investigate Behavioral Response; Loughborough University: Loughborough, UK; University of Leeds: Leeds, UK, 2010. [Google Scholar]

- Fawcett, T.; Parag, Y. An introduction of personal carbon trading. Clim. Policy 2010, 4, 329–338. [Google Scholar] [CrossRef]

- Bristow, A.L.; Zanni, A.M.; Wardman, M.; Chintakayala, P.K. Personal CA ERC Research Report; UK Environmental Change Institute, University of Oxford: Oxford, UK, 2008. [Google Scholar]

- IPPR. IPPR Says Public More Receptive to Personal Carbon Trading than Policy-Makers Believe; Institute for Public Policy Research: London, UK, 2008. [Google Scholar]

- Fleming, D. Descending the Energy Staircase with Tradable Energy Quotas (TEQS); Technical Report; The Lean Economy Connection: London, UK, 2005. [Google Scholar]

- Johnson, M.; Harfoot, M.; Musser, C.; Wiley, T. A Study in Personal Carbon Allocation: Cap and Share; Comhar Sustainable Development Council: Dublin, Ireland, 2008. [Google Scholar]

- Keay-Bright, S. Personal Carbon Trading (PCT): Bringing Together the Research Community; Workshop Report; UK Energy Research Centre: London, UK, 2009. [Google Scholar]

- Fan, J.; Li, Y.; Wu, Y.; Wang, S.; Zhao, D. Allowance trading and energy consumption under a personal carbon trading scheme: A dynamic programming approach. J. Clean Prod. 2016, 112, 3875–3883. [Google Scholar] [CrossRef]

- Bristow, A.L.; Wardman, M.; Zanni, A.M.; Chintakayala, P.K. Public acceptability of personal carbon trading and carbon tax. Ecol. Econ. 2010, 69, 1824–1837. [Google Scholar] [CrossRef]

- Alcott, B. Impact caps: Why population, affluence and technology strategies should be abandoned. J. Clean. Prod. 2010, 18, 552–560. [Google Scholar] [CrossRef]

- Organization for Economic Co-operation and Development. Towards Green Growth; OECD Publications: Paris, France, 2011. [Google Scholar]

- Satoh, I. IT-enabled personal-level carbon emission allowance. Proc. Comput. Sci. 2014, 32, 665–672. [Google Scholar] [CrossRef]

- Allcott, H.; Mullainathan, S. Behavior and energy policy. Science 2010, 327, 1204–1205. [Google Scholar] [CrossRef]

- The Behavior Sciences Team. Behavioural Government-Using Behavioural Science to Improve How Governments Make Decisions; The Behavior Sciences Team: London, UK, 2018. [Google Scholar]

- Mertens, S.; Herberz, M.; Hahnel, U.J.J.; Brosch, T. The effectiveness of nudging: A meta-analysis of choice architecture interventions across behavioral domains. Proc. Natl. Acad. Sci. USA 2022, 119, 2107346118. [Google Scholar] [CrossRef] [PubMed]

- Lee, C.M.; Hong, Y.R.; Hsieh, Y.T.; Chen, C.Y. The study of low carbon living practice—The case of negative emissions product and personal carbon trading. J. Bus. Adm. 2019, 44, 45–74. [Google Scholar]

- Taiwan Environmental Protection Administration. Taiwan Greenhouse Gas Inventory 2022; Environmental Protection Administration: Taipei, Taiwan, 2022. [Google Scholar]

- Bednar, J.; Obersteiner, M.; Baklanov, A.; Thomson, M.; Wagner, F.; Geden, O.; Allen, M.; Hall, J.W. Operationalizing the net-negative carbon economy. Nature 2021, 596, 377–383. [Google Scholar] [CrossRef] [PubMed]

| Sales Volume (Units) /Month | Carbon Credits Attachment (g)/Month | Cumulative Membership (Person)/Month |

|---|---|---|

| 448 | 136,600 | 149 |

| 275 | 27,200 | 225 |

| 609 | 61,000 | 285 |

| 604 | 24,800 | 288 |

| 969 | 81,000 | 326 |

| 1177 | 122,800 | 346 |

| 77 | 8800 | 350 |

| 803 | 12,800 | 357 |

| 1049 | 31,400 | 359 |

| 1256 | 53,800 | 450 |

| 937 | 21,400 | 477 |

| 270 | 10,400 | 484 |

| 209 | 11,800 | 484 |

| 908 | 29,000 | 491 |

| 980 | 60,200 | 498 |

| 732 | 22,800 | 501 |

| 159 | 10,400 | 503 |

| 61 | 2600 | 508 |

| 499 | 15,000 | 516 |

| 1137 | 62,600 | 869 |

| 1352 | 45,000 | 1040 |

| 660 | 16,400 | 1060 |

| 288 | 4800 | 1061 |

| 1512 | 23,600 | 1090 |

| 859 | 1800 | 1091 |

| 332 | 4200 | 1092 |

| 4053 | 221,400 | 1410 |

| 6104 | 3200 | 1427 |

| 6174 | 39,600 | 1598 |

| 6351 | 41,600 | 1693 |

| 5340 | 24,400 | 1741 |

| 3549 | 4600 | 1751 |

| Parameter | Estimated Value | t-Value | p-Value | R2 |

|---|---|---|---|---|

| Slope | −1142.76 *** | 2.79 | <0.01 | 0.681 |

| Carbon Credit Attachment | 1.60 * | 1.86 | 0.07 | |

| Participants Accumulation | 3.12 *** | 7.73 | <0.01 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hong, Y.-R.; Lee, C.-M.; Kuo, T.-C. Operationalizing Carbon-Neutral Living: A Case Study of A Business Model for Carbon-Negative Products. Sustainability 2023, 15, 11315. https://doi.org/10.3390/su151411315

Hong Y-R, Lee C-M, Kuo T-C. Operationalizing Carbon-Neutral Living: A Case Study of A Business Model for Carbon-Negative Products. Sustainability. 2023; 15(14):11315. https://doi.org/10.3390/su151411315

Chicago/Turabian StyleHong, Yue-Rong, Chien-Ming Lee, and Tsai-Chi Kuo. 2023. "Operationalizing Carbon-Neutral Living: A Case Study of A Business Model for Carbon-Negative Products" Sustainability 15, no. 14: 11315. https://doi.org/10.3390/su151411315

APA StyleHong, Y.-R., Lee, C.-M., & Kuo, T.-C. (2023). Operationalizing Carbon-Neutral Living: A Case Study of A Business Model for Carbon-Negative Products. Sustainability, 15(14), 11315. https://doi.org/10.3390/su151411315