Renewable Energy: A Curse or Blessing—International Evidence

Abstract

1. Introduction

2. Review of the Literature and Theoretical Analysis

2.1. Review of the Literature

2.2. Research Hypothesis

2.2.1. Renewable Energy Phase Characteristics Are a Contribution to the Limited Literature

2.2.2. Structure of Factor Endowment

3. Methodology and Data

3.1. Model Specification

3.2. Data and Variables

4. Empirical Result and Analysis

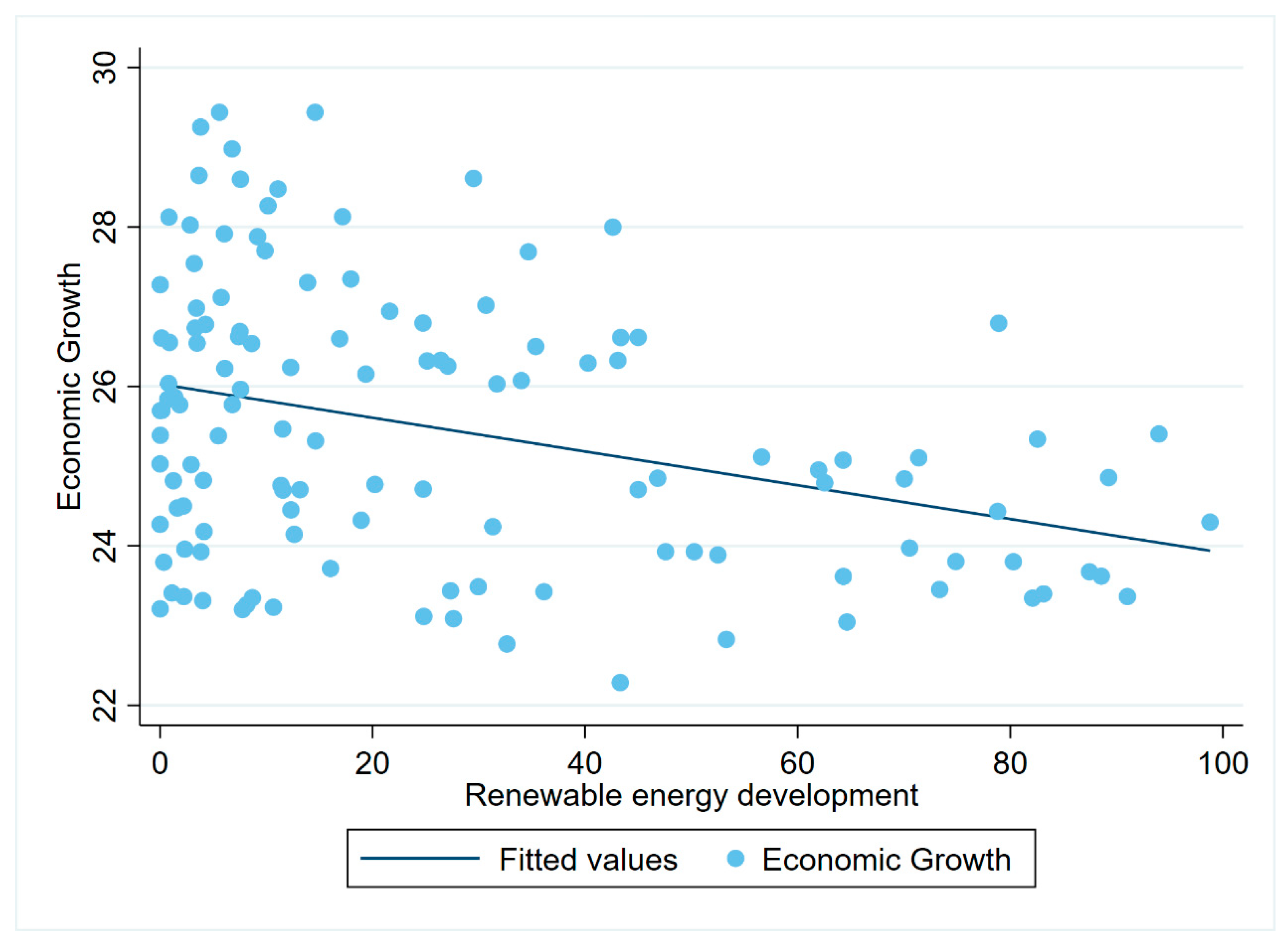

4.1. The Average Economic Impact of Renewable Energy

4.2. The Impact of Renewable Energy on Economic Growth at Different Stages of Development

4.3. Heterogeneity Analysis

4.4. Robustness Test

5. Mechanism Analysis

5.1. The Mechanism Explanation of the Impact of Trade Structure on the Renewable Energy Curse

5.1.1. Trade Openness and Energy Development Interact

5.1.2. Learning Effect and Scale Effect

5.1.3. Structural Effect

5.1.4. Technical Effect

5.2. Energy Trade Structure and Economic Development under Different Economic Development Levels

5.3. Energy Trade Structure under Different Natural Resource Abundance and Economic Development

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Ma, J.; Li, Q.; Kühn, M.; Nakaten, N. Power-to-gas based subsurface energy storage: A review. Renew. Sustain. Energy Rev. 2018, 97, 478–496. [Google Scholar] [CrossRef]

- Lopion, P.; Markewitz, P.; Robinius, M.; Stolten, D. A review of current challenges and trends in energy systems modeling. Renew. Sustain. Energy Rev. 2018, 96, 156–166. [Google Scholar] [CrossRef]

- Alam, M.M.; Murad, M.W. The impacts of economic growth, trade openness and technological progress on renewable energy use in organization for economic co-operation and development countries. Renew. Energy 2020, 145, 382–390. [Google Scholar] [CrossRef]

- Das, S.; Hittinger, E.; Williams, E. Learning is not enough: Diminishing marginal revenues and increasing abatement costs of wind and solar. Renew. Energy 2020, 156, 634–644. [Google Scholar] [CrossRef]

- Halkos, G.E.; Gkampoura, E.C. Reviewing usage, potentials, and limitations of renewable energy sources. Energies 2020, 13, 2906. [Google Scholar] [CrossRef]

- Fang, G.; Yang, K.; Tian, L.; Ma, Y. Can environmental tax promote renewable energy consumption?—An empirical study from the typical countries along the Belt and Road. Energy 2022, 260, 125193. [Google Scholar] [CrossRef]

- Minh, T.B.; Van, H.B. Evaluating the relationship between renewable energy consumption and economic growth in Vietnam, 1995–2019. Energy Rep. 2023, 9, 609–617. [Google Scholar] [CrossRef]

- Chang, C.L.; Fang, M. Renewable energy-led growth hypothesis: New insights from BRICS and N-11 economies. Renew. Energy 2022, 188, 788–800. [Google Scholar] [CrossRef]

- Mohsin, M.; Kamran, H.W.; Nawaz, M.A.; Hussain, M.S.; Dahri, A.S. Assessing the impact of transition from nonrenewable to renewable energy consumption on economic growth-environmental nexus from developing Asian economies. J. Environ. Manag. 2021, 284, 111999. [Google Scholar] [CrossRef]

- Zhang, Y. How Economic Performance of OECD economies influences through Green Finance and Renewable Energy Investment Resources? Resour. Policy 2022, 79, 102925. [Google Scholar] [CrossRef]

- Leonard, A.; Ahsan, A.; Charbonnier, F.; Hirmer, S. The resource curse in renewable energy: A framework for risk assessment. Energy Strategy Rev. 2022, 41, 100841. [Google Scholar] [CrossRef]

- Fasheyitan, O.D.; Omankhanlen, A.E.; Okpalaoka, C.I. Effects of renewable energy consumption and financial development: Using Nigeria’s economy as a case study. Energy Convers. Manag. X 2022, 16, 100329. [Google Scholar] [CrossRef]

- Wang, W.; Rehman, M.A.; Fahad, S. The dynamic influence of renewable energy, trade openness, and industrialization on the sustainable environment in G-7 economies. Renew. Energy 2022, 198, 484–491. [Google Scholar] [CrossRef]

- Apergis, N.; Payne, J.E. Renewable energy consumption and growth in Eurasia. Energy Econ. 2010, 32, 1392–1397. [Google Scholar] [CrossRef]

- Liu, Y.; Hao, Y. The dynamic links between CO2 emissions, energy consumption and economic development in the countries along “the Belt and Road”. Sci. Total Environ. 2018, 645, 674–683. [Google Scholar] [CrossRef] [PubMed]

- Sadorsky, P. Renewable energy consumption and income in emerging economies. Energy Policy 2009, 37, 4021–4028. [Google Scholar] [CrossRef]

- Li, R.; Xu, L.; Hui, J.; Cai, W.; Zhang, S. China’s investments in renewable energy through the belt and road initiative stimulated local economy and employment: A case study of Pakistan. Sci. Total Environ. 2022, 835, 155308. [Google Scholar] [CrossRef]

- Leonard, A.; Ahsan, A.; Charbonnier, F.; Hirmer, S. Renewable Energy in Morocco: Assessing Risks to Avoid a Resource Curse. Available at SSRN 4025835. 2022. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4025835 (accessed on 19 March 2022).

- Nishio, K.; Asano, H. Supply amount and marginal price of renewable electricity under the renewables portfolio standard in Japan. Energy Policy 2006, 34, 2373–2387. [Google Scholar] [CrossRef]

- Menegaki, A.N. Growth and renewable energy in Europe: A random effect model with evidence for neutrality hypothesis. Energy Econ. 2011, 33, 257–263. [Google Scholar] [CrossRef]

- Zhang, M.M.; Zhou, P.; Zhou, D.Q. A real options model for renewable energy investment with application to solar photovoltaic power generation in China. Energy Econ. 2016, 59, 213–226. [Google Scholar] [CrossRef]

- Zhong, Z.; Peng, B.; Xu, L.; Andrews, A.; Elahi, E. Analysis of regional energy economic efficiency and its influencing factors: A case study of Yangtze river urban agglomeration. Sustain. Energy Technol. Assess. 2020, 41, 100784. [Google Scholar] [CrossRef]

- Yang, J.; Zhang, W.; Zhang, Z. Impacts of urbanization on renewable energy consumption in China. J. Clean. Prod. 2016, 114, 443–451. [Google Scholar] [CrossRef]

- Gollin, D.; Jedwab, R.; Vollrath, D. Urbanization with and without industrialization. J. Econ. Growth 2016, 21, 35–70. [Google Scholar] [CrossRef]

- Yu, B.; Fang, D.; Meng, J. Analysis of the generation efficiency of disaggregated renewable energy and its spatial heterogeneity influencing factors: A case study of China. Energy 2021, 234, 121295. [Google Scholar] [CrossRef]

- Lewbel, A. Endogenous selection or treatment model estimation. J. Econom. 2007, 141, 777–806. [Google Scholar] [CrossRef]

- Su, X.; Tan, J. Regional energy transition path and the role of government support and resource endowment in China. Renew. Sustain. Energy Rev. 2023, 174, 113150. [Google Scholar] [CrossRef]

- Wen, H.; Liu, Y.; Huang, Y. Place-Based Policies and Carbon Emission Efficiency: Quasi-Experiment in China’s Old Revolutionary Base Areas. Int. J. Environ. Res. Public Health 2023, 20, 2677. [Google Scholar] [CrossRef]

- Li, H.S.; Geng, Y.C.; Shinwari, R.; Yangjie, W.; Rjoub, H. Does renewable energy electricity and economic complexity index help to achieve carbon neutrality target of top exporting countries? J. Environ. Manag. 2021, 299, 113386. [Google Scholar] [CrossRef]

- Hussain, S.; Xuetong, W.; Maqbool, R.; Hussain, M.; Shahnawaz, M. The influence of government support, organizational innovativeness and community participation in renewable energy project success: A case of Pakistan. Energy 2022, 239, 122172. [Google Scholar] [CrossRef]

- Wang, J.; Zhang, S.; Zhang, Q. The relationship of renewable energy consumption to financial development and economic growth in China. Renew. Energy 2021, 170, 897–904. [Google Scholar] [CrossRef]

- Autor, D.; Dorn, D.; Hanson, G.; Majlesi, K. Importing political polarization? The electoral consequences of rising trade exposure. Am. Econ. Rev. 2020, 110, 3139–3183. [Google Scholar] [CrossRef]

- Johnson, R.C.; Noguera, G. Accounting for intermediates: Production sharing and trade in value added. J. Int. Econ. 2012, 86, 224–236. [Google Scholar] [CrossRef]

- Wen, H.; Jiang, M.; Zheng, S. Impact of information and communication technologies on corporate energy intensity: Evidence from cross-country micro data. J. Environ. Plan. Manag. 2022. [Google Scholar] [CrossRef]

- Gürsan, C.; de Gooyert, V. The systemic impact of a transition fuel: Does natural gas help or hinder the energy transition? Renew. Sustain. Energy Rev. 2021, 138, 110552. [Google Scholar] [CrossRef]

| Variable | Definitions and Measures |

|---|---|

| RED | Renewable energy generation, measured by the total renewable energy generation in a country |

| EG | Economic growth, which is the logarithm of a country’s total GDP |

| ES | Energy–resource structure, which is the share of renewable energy consumption in the total energy consumption |

| NRA | Natural resource abundance, the logarithm of the proportion of total natural resource rent in GDP |

| TS | Technical structure, which is the value added by high-tech manufacturing industries |

| Urban | Urbanization level, which is the proportion of urban population to total population |

| Technology | Number of articles in scientific journals, which is the logarithm of the number of scientific journal papers |

| IAR | Internet access rate, the fixed broadband subscriptions (per 100 people) |

| FDI | Foreign direct investment, measured by the FDI in the proportion of GDP |

| Industrial | Industrial structure, which is the proportion of manufacturing value added in GDP |

| Variables | EG | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| RED | −0.0323 *** | −0.0167 *** | −0.0136 *** | −0.0130 *** |

| (0.0063) | (0.0035) | (0.0022) | (0.0025) | |

| NRA | 0.8509 * | −0.1955 | −0.2210 | |

| (0.4851) | (0.5116) | (0.5403) | ||

| TS | 0.0067 * | 0.0056 *** | 0.0026 | |

| (0.0040) | (0.0021) | (0.0022) | ||

| Urban | 3.3996 *** | −0.4030 | −1.2078 | |

| (0.7209) | (0.5290) | (0.7316) | ||

| Technology | 0.2936 *** | 0.0866 *** | 0.0585 ** | |

| (0.0495) | (0.0272) | (0.0253) | ||

| IAR | 1.8912 *** | −1.1380 *** | −1.3020 *** | |

| (0.2657) | (0.2186) | (0.2401) | ||

| FDI | 0.7274 ** | −0.0192 | −0.0421 | |

| (0.3501) | (0.1502) | (0.1442) | ||

| Industrial | −1.2036 | 0.1651 | 0.1749 | |

| (0.8445) | (0.4601) | (0.4588) | ||

| _cons | 25.5666 *** | 20.9129 *** | 23.7597 *** | 24.4212 *** |

| (0.2424) | (0.3947) | (0.3529) | (0.4327) | |

| YearFE | No | No | Yes | Yes |

| CourtyFE | No | No | No | Yes |

| N | 3875 | 3875 | 3875 | 3875 |

| r2_w | 0.0706 | 0.6221 | 0.8342 | 0.8367 |

| Variables | EG | |||||

|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | |

| RED | −0.0091 | −0.0278 | −0.0132 *** | −0.0141 *** | −0.0167 *** | −0.0158 *** |

| (0.0274) | (0.0274) | (0.0042) | (0.0043) | (0.0029) | (0.0032) | |

| NRA | −0.3433 | −0.5726 | −3.9305 *** | −4.0928 *** | 0.3535 | 0.2972 |

| (0.4336) | (0.4437) | (0.9837) | (0.8452) | (0.6239) | (0.6525) | |

| TS | 0.0060 | 0.0012 | 0.0012 | −0.0025 | 0.0076 | 0.0027 |

| (0.0038) | (0.0038) | (0.0036) | (0.0036) | (0.0047) | (0.0045) | |

| Urban | −2.0411 ** | −4.3802 *** | 0.1428 | −0.7975 | 0.9191 | 0.7006 |

| (0.9936) | (1.5497) | (0.8038) | (1.2648) | (0.5967) | (0.8455) | |

| Technology | 0.2301 *** | 0.1563 *** | 0.0667 ** | 0.0307 | 0.0470 | 0.0072 |

| (0.0432) | (0.0455) | (0.0278) | (0.0189) | (0.0341) | (0.0366) | |

| IAR | −1.3578 *** | −1.5866 *** | −0.7274 ** | −0.8951 ** | −0.7613 ** | −0.8995 ** |

| (0.4849) | (0.5183) | (0.3554) | (0.3732) | (0.3463) | (0.3713) | |

| FDI | −0.0974 | 0.0458 | 0.0417 | −0.0575 | −1.0577 ** | −0.9825 ** |

| (0.1695) | (0.2065) | (0.2186) | (0.2189) | (0.4235) | (0.4533) | |

| Industrial | −0.1957 | 0.1545 | 1.0656 | 0.8082 | 0.0734 | −0.1082 |

| (0.6390) | (0.6364) | (1.0633) | (0.9647) | (1.0780) | (1.1254) | |

| _cons | 24.0757 *** | 26.3141 *** | 23.8016 *** | 24.8313 *** | 23.2462 *** | 23.5082 *** |

| (0.8469) | (1.1531) | (0.5520) | (0.7590) | (0.3457) | (0.3557) | |

| YearFE | Yes | Yes | Yes | Yes | Yes | Yes |

| CourtyFE | No | Yes | No | Yes | No | Yes |

| N | 1162 | 1162 | 1550 | 1550 | 1163 | 1163 |

| r2_w | 0.7983 | 0.8098 | 0.8537 | 0.8592 | 0.8839 | 0.8861 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| EG | ||||

| Developed | Underdeveloped | |||

| RED | −0.0102 *** | −0.0107 *** | −0.0206 *** | −0.0255 *** |

| (0.0023) | (0.0028) | (0.0038) | (0.0048) | |

| NRA | 0.5136 | 0.4830 | −1.2147 | −1.1046 |

| (0.4300) | (0.4835) | (0.8780) | (0.8879) | |

| TS | 0.0002 | −0.0030 | 0.0019 | 0.0007 |

| (0.0026) | (0.0027) | (0.0024) | (0.0023) | |

| Urban | 0.0029 | −0.7808 | −0.2990 | −0.7932 |

| (0.5023) | (0.8425) | (0.5593) | (0.9540) | |

| Technology | 0.0323 | 0.0090 | 0.1502 ** | 0.0950 |

| (0.0204) | (0.0192) | (0.0670) | (0.0642) | |

| IAR | −0.3315 | −0.3765 | −0.5822 | −0.7171 * |

| (0.2923) | (0.3098) | (0.3819) | (0.4268) | |

| FDI | −0.0594 | −0.0743 | 0.0142 | 0.0510 |

| (0.1545) | (0.1577) | (0.0964) | (0.1009) | |

| Industrial | 0.3707 | 0.2997 | 0.6358 | 0.7745 |

| (0.5573) | (0.5689) | (0.7328) | (0.7150) | |

| _cons | 22.9473 *** | 23.1706 *** | 24.7145 *** | 25.8310 *** |

| (0.3220) | (0.4390) | (0.6332) | (0.8290) | |

| YearFE | Yes | Yes | Yes | Yes |

| CourtyFE | No | Yes | No | Yes |

| N | 2223 | 2223 | 1652 | 1652 |

| r2_w | 0.8212 | 0.8236 | 0.8424 | 0.8459 |

| Variables | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| EG | ||||

| Abundant | Shortage | |||

| RED | −0.0024 | −0.0359 *** | −0.0134 *** | −0.0129 *** |

| (0.0047) | (0.0118) | (0.0022) | (0.0025) | |

| NRA | 0.0914 | −0.5834 | −2.0947 *** | −2.1888 *** |

| (0.9356) | (0.7204) | (0.8034) | (0.7956) | |

| TS | 0.0239 *** | −0.0022 | 0.0040* | 0.0012 |

| (0.0078) | (0.0066) | (0.0022) | (0.0021) | |

| Urban | 0.5958 | −5.7508 | −0.5398 | −1.2256 * |

| (0.5275) | (3.5109) | (0.5214) | (0.7032) | |

| Technology | 0.3606 *** | 0.1629 ** | 0.0565 *** | 0.0330 * |

| (0.0796) | (0.0598) | (0.0211) | (0.0186) | |

| IAR | −0.1275 | 1.1335 | −0.9701 *** | −1.0820 *** |

| (2.0873) | (2.0479) | (0.2087) | (0.2190) | |

| FDI | −2.6135 *** | −0.5190 | 0.0887 | 0.0740 |

| (0.7755) | (0.6367) | (0.1217) | (0.1190) | |

| Industrial | −0.5575 | −1.8137 * | 0.8013 | 0.8451 |

| (1.0907) | (1.0506) | (0.5588) | (0.5370) | |

| _cons | 21.1830 *** | 27.2495 *** | 24.0282 *** | 24.6208 *** |

| (0.7580) | (2.2973) | (0.3625) | (0.4265) | |

| YearFE | Yes | Yes | Yes | Yes |

| CourtyFE | No | Yes | No | Yes |

| N | 511 | 511 | 3364 | 3364 |

| r2_w | 0.7087 | 0.8391 | 0.8691 | 0.8712 |

| Variables | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| EG | |||||

| Shock IV | Proportion of Renewable Energy Generation | Energy Consumption Structure | Excluding macro Factors Affect | ||

| RED | −0.0210 *** | −0.0142 *** | −0.0135 *** | ||

| (0.0015) | (0.0010) | (0.0025) | |||

| NRA | 0.8713 *** | −0.1082 | −0.3107 | −0.2746 | −0.2594 |

| (0.1561) | (0.1109) | (0.5210) | (0.5290) | (0.5568) | |

| TS | 0.0092 *** | 0.0038 *** | 0.0021 | 0.0022 | 0.0024 |

| (0.0014) | (0.0009) | (0.0022) | (0.0022) | (0.0023) | |

| Urban | 5.0996 *** | −0.7680 *** | −0.5870 | −1.0789 | −1.2515 * |

| (0.2524) | (0.1978) | (0.7412) | (0.7193) | (0.7514) | |

| Technology | 0.2223 *** | 0.0502 *** | 0.0625 ** | 0.0652 ** | 0.0553 ** |

| (0.0095) | (0.0070) | (0.0258) | (0.0267) | (0.0257) | |

| IAR | 1.7481 *** | −1.2412 *** | −1.6197 *** | −1.3098 *** | −1.3300 *** |

| (0.0927) | (0.0791) | (0.2346) | (0.2518) | (0.2485) | |

| FDI | 0.8112 *** | −0.0538 | −0.0281 | −0.1674 | −0.0626 |

| (0.1220) | (0.0841) | (0.1447) | (0.1701) | (0.1627) | |

| Industrial | −1.7424 *** | 0.0452 | 0.2783 | 0.3735 | 0.1581 |

| (0.2035) | (0.1399) | (0.5175) | (0.4798) | (0.4608) | |

| RED1 | −0.0083 * | ||||

| (0.0047) | |||||

| ES | −0.0094 *** | ||||

| (0.0032) | |||||

| _cons | 23.7208 *** | 24.1995 *** | 24.5317 *** | ||

| (0.4473) | (0.4361) | (0.4419) | |||

| YearFE | No | Yes | Yes | Yes | Yes |

| CourtyFE | Yes | Yes | Yes | Yes | Yes |

| N | 3410 | 3410 | 3875 | 3875 | 3751 |

| r2_w | 0.8298 | 0.8337 | 0.8342 | ||

| Variables | EG | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| EIRED | 0.0022 ** | 0.0024 ** | −0.0018 ** | −0.0016 * |

| (0.0011) | (0.0012) | (0.0008) | (0.0009) | |

| EI | −0.1816 ** | −0.1883 ** | 0.0405 | 0.0457 |

| (0.0771) | (0.0794) | (0.0513) | (0.0509) | |

| RED | −0.010 7*** | −0.0125 *** | −0.0216 *** | −0.0277 *** |

| (0.0024) | (0.0035) | (0.0049) | (0.0056) | |

| NRA | −0.4773 | −0.4741 | −0.9929 | −0.9109 |

| (0.3543) | (0.3817) | (0.6573) | (0.6858) | |

| TS | 0.0018 | −0.0009 | 0.0027 | 0.0019 |

| (0.0023) | (0.0024) | (0.0027) | (0.0027) | |

| Urban | −0.3399 | −1.5208 * | −0.3333 | −0.7686 |

| (0.4921) | (0.8773) | (0.6146) | (0.9678) | |

| Technology | 0.0357 * | 0.0125 | 0.2352 *** | 0.1819 *** |

| (0.0194) | (0.0194) | (0.0583) | (0.0582) | |

| IAR | −0.3979 | −0.4551 | −0.3321 | −0.3886 |

| (0.3488) | (0.3691) | (0.3159) | (0.3131) | |

| FDI | −0.0353 | −0.0463 | 0.0655 | 0.1220 |

| (0.1935) | (0.2013) | (0.1235) | (0.1389) | |

| Industrial | 0.7668 | 0.7363 | −0.2643 | −0.1836 |

| (0.5287) | (0.5048) | (0.9535) | (0.9095) | |

| _cons | 23.0617 *** | 23.5987 *** | 24.3055 *** | 25.3732 *** |

| (0.3098) | (0.4524) | (0.5498) | (0.7177) | |

| YearFE | Yes | No | Yes | No |

| CourtyFE | Yes | Yes | No | No |

| N | 1823 | 1823 | 1272 | 1272 |

| r2_w | 0.8132 | 0.8167 | 0.8652 | 0.8679 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, R.; Wen, H.; Huang, X.; Liu, Y. Renewable Energy: A Curse or Blessing—International Evidence. Sustainability 2023, 15, 11103. https://doi.org/10.3390/su151411103

Li R, Wen H, Huang X, Liu Y. Renewable Energy: A Curse or Blessing—International Evidence. Sustainability. 2023; 15(14):11103. https://doi.org/10.3390/su151411103

Chicago/Turabian StyleLi, Ruoxuan, Huwei Wen, Xinpeng Huang, and Yaobin Liu. 2023. "Renewable Energy: A Curse or Blessing—International Evidence" Sustainability 15, no. 14: 11103. https://doi.org/10.3390/su151411103

APA StyleLi, R., Wen, H., Huang, X., & Liu, Y. (2023). Renewable Energy: A Curse or Blessing—International Evidence. Sustainability, 15(14), 11103. https://doi.org/10.3390/su151411103