Abstract

Financial literacy is a critical life skill that is essential for achieving financial security and individual well-being, economic growth and overall sustainable development. Based on the analysis of research on financial literacy, we aim to provide a balance sheet of current research and a starting point for future research with the focus on identifying significant predictors of financial literacy, as well as variables that are affected by financial literacy. The main methods of our research are a systematic literature review, and bibliometric and bibliographical analysis. We establish a chronological path of the financial literacy topic in the scientific research. Based on the analysis of the most cited articles, we develop a comprehensive conceptual framework for mapping financial literacy. We identified a large number of predictors of financial literacy starting with education, gender, age, knowledge, etc. Financial literacy also affects variables such as retirement planning, financial inclusion, return on wealth, risk diversification, etc. We discuss in detail the main trends and topics in financial literacy research by involving financial literacy of the youth, financial literacy from the gender perspective, financial inclusion, retirement planning, digital finance and digital financial literacy. Our research can help policymakers in their pursuit of improving the levels of individual financial literacy by enabling individuals to make better financial decisions, avoid financial stress and achieve their financial goals. It can also help governments in their efforts in achieving sustainable development goals (SDGs).

1. Introduction

Recent instabilities in financial markets caused by events such as pandemics or wars, as well as the growing trend of digitalization of financial products, have emphasized the need for financial literacy as a socially useful practice. Financial literacy is defined as “a combination of awareness, knowledge, skills, attitude and behavior necessary for making rational financial decisions and ultimately achieving individual financial well-being, which are also its greatest advantages” [1].

There are many other definitions of financial literacy. Lusardi and Mitchell [2] define financial literacy as the ability to process economic information and make informed decisions for financial planning, wealth accumulation, debt and retirement. Huston [3] defines financial literacy as a component of human capital that can be used in financial activities to increase the expected benefit from consumption. Another more well-known definition comes from the U.S. Commission on Financial Literacy and Education [4], where it states that financial literacy includes the skills, knowledge and tools that enable people to make individual financial decisions in order to achieve their own goals.

The evolution of financial systems is accompanied by a growing number of financial products, services and innovations, which additionally contributed to the increasingly complex process of making financial decisions. Likewise, the number of financial decisions that individuals and companies have to make has grown significantly [5]. This line of thought is supported by empirical research. In a report on the S&P global literacy survey, Klapper et al. [6] found that countries with higher GDP per capita tend to have higher financial literacy rates. In a separate research based on an OECD financial literacy survey, Pașa et al. [7] have shown that the level of GDP growth in a country is positively influenced by financial well-being and that financial well-being is positively influenced by financial literacy components that include financial behavior, financial attitude and financial knowledge. Grohmann et al. [8] found that there is a significant correlation between financial literacy and financial inclusion, which in turn has a positive impact on economic development. In their analysis, they included 119 countries across the world at different stages of economic development.

Empirical research show that poor level of financial literacy can have negative consequences not only for individuals but also for the well-being of the population as a whole. Pasa et al. [7] argued that income instability is a consequence of uncertain economic situations such as the COVID-19 pandemic and that the decline of the population’s financial well-being is a direct consequence. According to them and the OECD [1], financial education is the first line of defense, and the importance of financial literacy is increasing. While looking at the relation between financial literacy and over-indebtedness in low-income households, French and McKillop [9] found that financial illiteracy and failures to understand interest rate correlate with high debt burdens.

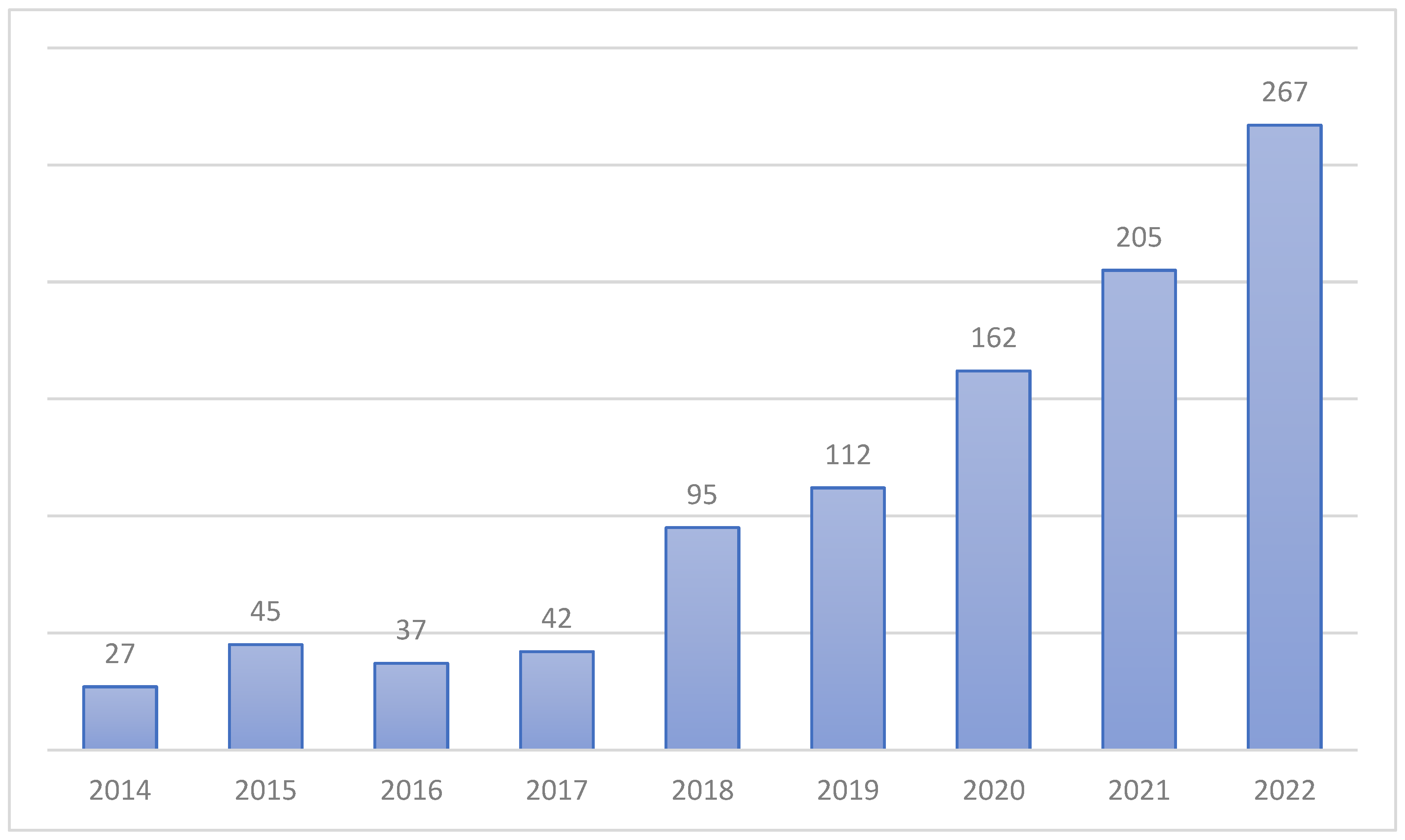

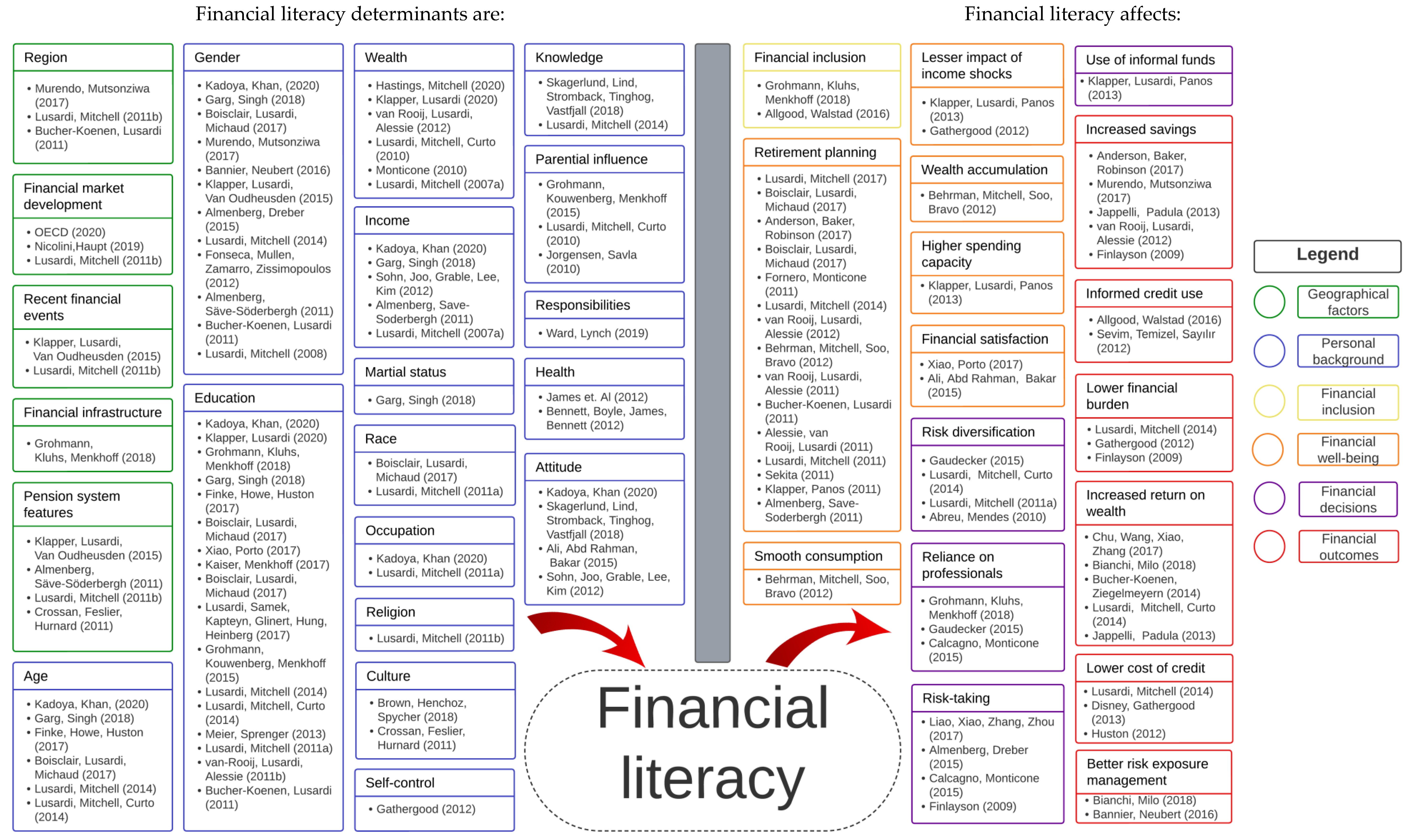

The importance of financial literacy has also been recognized by the academic community, which can be seen through the growing number of published articles. In the Web of Science database, there were 27 published articles in 2014 compared to 267 published articles in 2022, as shown in Figure 1.

Figure 1.

Number of published works per year in the WOS database.

One of the most recognized literature reviews about financial literacy was conducted by Lusardi and Mitchell in 2014 [2], focusing on the economic importance of financial literacy. Their work is closely followed by Fernandes et al. [10] where authors performed an analysis of the relationship of financial literacy and financial education to financial behaviors in 201 studies. Goyal and Kumar [11] conducted a systematic review of the literature describing trends, highlighted the most important research and identified areas that need additional research.

With this literature review, we focus on the bibliometric and bibliographical analysis, and map the financial literacy by the identification of the main determinants of financial literacy and main variables that can be described by financial literacy, together with recent and major trends in the field by analyzing financial literacy of the youth, gender, financial inclusion, and retirement planning. We analyze the most prominent researchers and lines of thought, and discuss them in order to offer direction and clarity within the many studies conducted in each separate field of financial literacy.

2. Data and Methods

In general, a literature review is an important part of every research. It is well known that advances in knowledge are expected to be built on the existing studies. The main purpose is to probe the breadth and depth of the existing academic writings in order to identify gaps. By summarizing and analyzing specific bodies of literature, answers to existing and new questions can be provided, and the groundwork for new theories can be developed. It is also often used to assess the relevance and quality of existing academic articles against set criteria.

Since this is a stand-alone literature review, its main purpose is to develop the understanding of existing academic writings by aggregating, integrating, interpreting and explaining available knowledge. According to Xiao and Watson [12], this type of research would fall under the descriptive category of reviews known as the textual narrative synthesis. This format includes standardized data extraction and combines quantitative data such as various bibliometric statistics with qualitative data and applies a narrative [12].

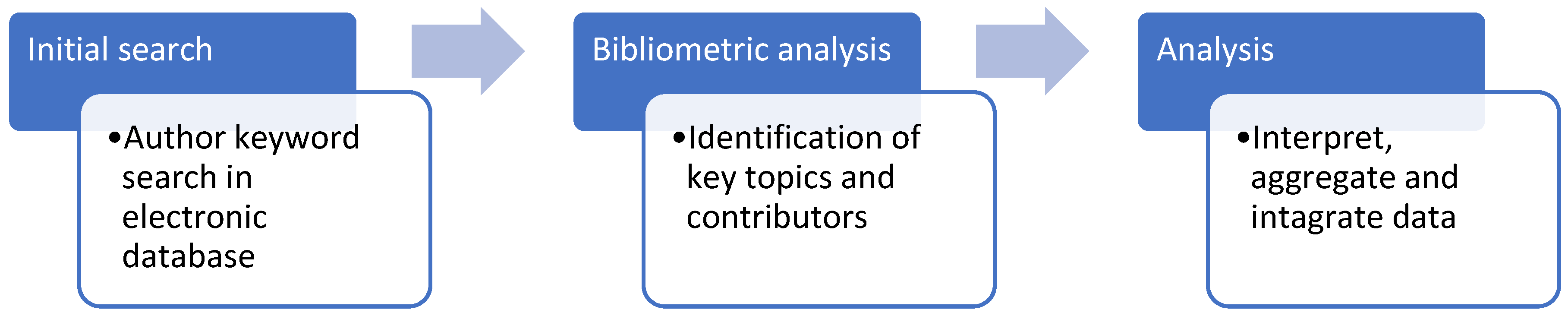

The process of writing the literature review consists of three main steps, displayed and described in Figure 2.

Figure 2.

Main steps of conducting a literature review.

The main search of articles was conducted in the most prominent scientific database, Clarivate Web of Science. Research papers were retrieved at the beginning of November 2022, covering a period of 1997–2022. However, since financial literacy is a new research topic, there were very few articles prior to 2014, and since our analysis focuses on trends, more recent publications were given an advantage in the analysis.

The main objectives of our research are (1) to identify key determinants of financial literacy, (2) to identify variables that are impacted by financial literacy, and (3) to analyze key trends and developments in financial literacy literature regarding financial literacy of youth, gender, financial inclusion and retirement planning. We also address digital finance and digital financial literacy in a special section, as the most recent trends in the field of research.

We defined a string of search terms in order to encompass all of the topics that will be a subject of this literature review. The string that was applied to author keywords was “financial *literacy” and “financial inclusion” or “financial *literacy” and “young” or “financial *literacy” and “retir*” or “financial *literacy” and “gender*”. The initial search undertaken in November 2022 yielded 1097 articles. Limiting the results to articles only in English language reduced this number to 1071 articles that were included in the bibliometric analysis for further processing.

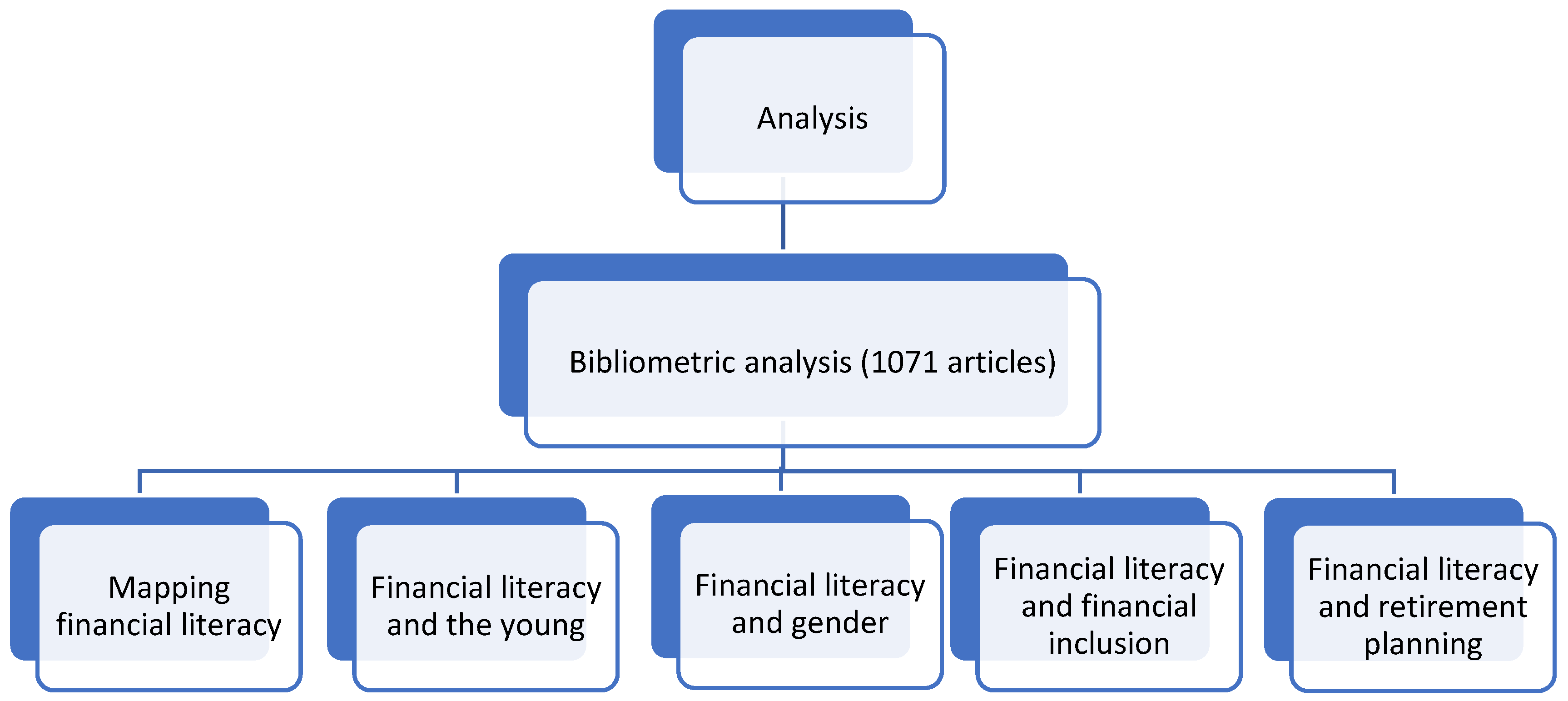

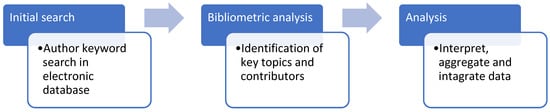

Chapters of our research matched the most important trends and topics in the field of financial literacy based on the bibliometric analysis we conducted. They are shown in Figure 3 above. Each chapter can be treated as a separate literature review.

Figure 3.

The main topics covered by the literature review.

In addition to the main search, a secondary search was performed for new under-researched trends of digital finance and financial literacy as well as digital financial literacy. The string of search terms was topic based and consisted of terms “digital financ*” and “literacy” which yielded 54 results, of which, 15 were published in the year 2021 and 27 in year 2022. Since the body of research on this topic is relatively small, a full bibliometric analysis was not performed as we opted for a qualitative approach in order to discuss these trends.

3. Bibliometric Analysis

Bibliometric analysis is being used with the aim to analyze the content of citations within the scientific papers and to investigate the topics of interest in more detail. Bibliographical analysis is used to research citation and co-citation networks, key words, most influential authors and papers, and to identify the roots of the field.

The bibliometric and bibliographic analysis includes 1071 articles from the initial search. To gain a better understanding of the studies, we started with the Web of Science search statistics, and continued with BibExcel, Pajek and VOSviewer software packages that have been used for the bibliographic and bibliometric analysis. Qualitative content analysis was conducted for in-depth analysis of the research topics.

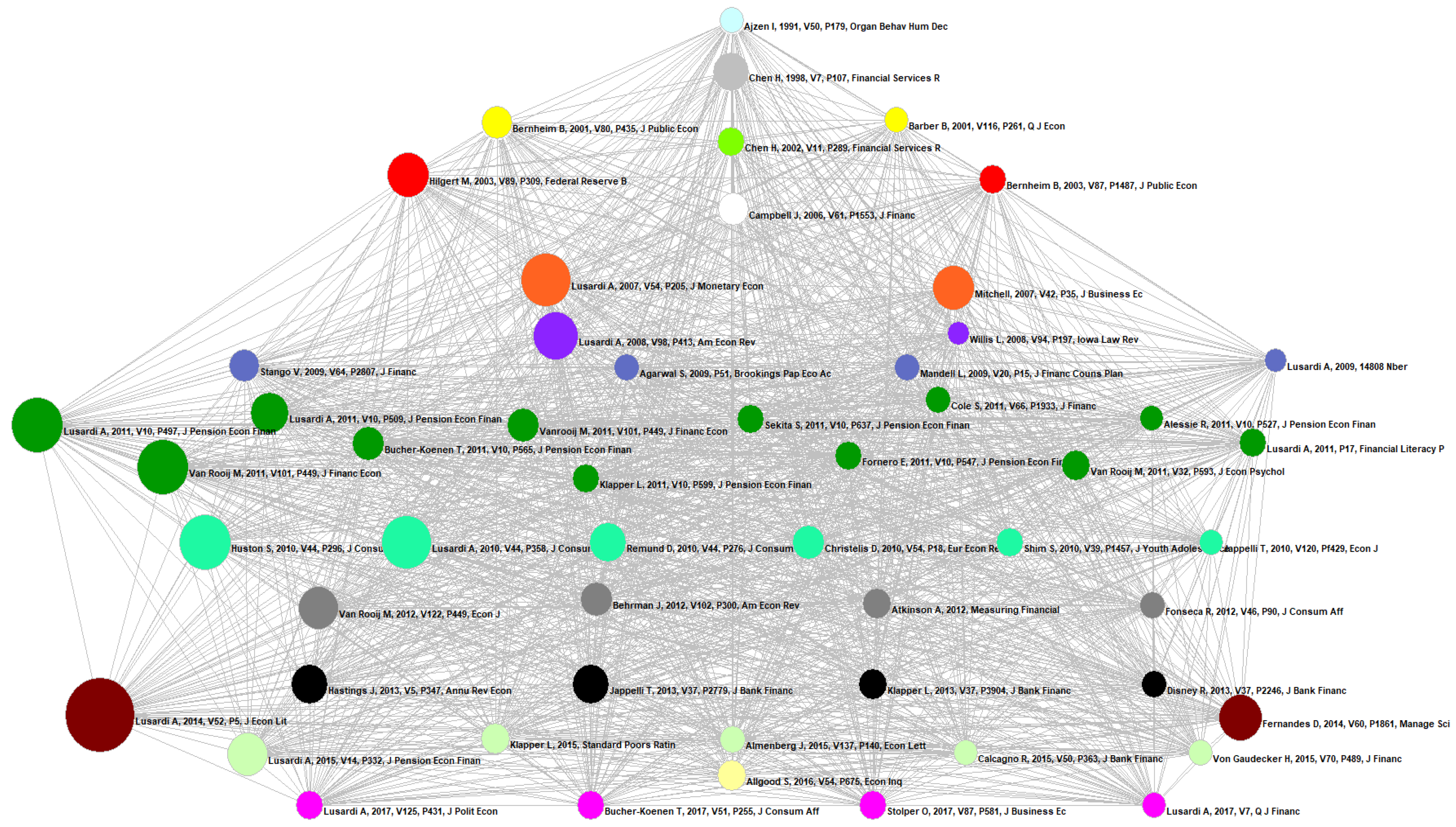

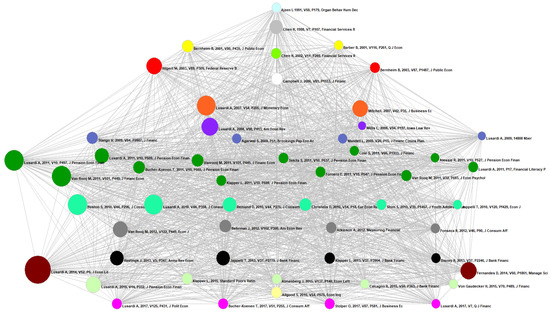

Based on the co-citation analysis of our dataset, we can establish the chronological path of the financial literacy topic in scientific research, as shown in Figure 4. For the representation of the chronological development of the theory, we used a threshold of 50 and more co-citations. A large number of authors who have been involved in financial literacy research in the last few decades refer to Ajzen Icek’s Theory of Planned Behavior published in 1991 [13], which can be seen as the theory on which financial literacy is founded on. The paper from Chen and Volpe in 1998 [14] is the first relevant paper about personal financial literacy, followed by article written by Bernheim et al. [15] about education and saving, and Barber et al. [16] about gender, overconfidence and common stock investments. Lusardi has been the leading author on financial literacy in the past 16 years, from 2007.

Figure 4.

Chronological path of the financial literacy topic. [2,3,6,10,13,14,15,16,17,18,19,20,21,22,23,24,25,26,27,28,29,30,31,32,33,34,35,36,37,38,39,40,41,42,43,44,45,46,47,48,49,50,51,52,53,54,55,56,57,58,59,60].

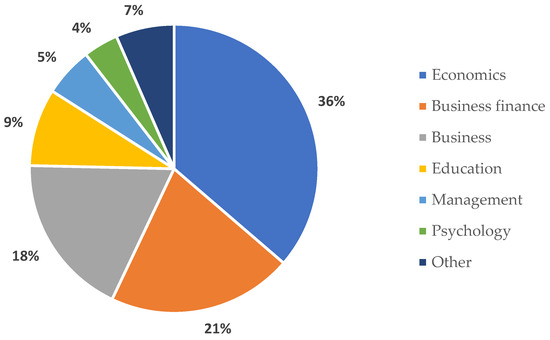

Of the 1071 articles, most are from the fields of Economics, Business finance and Business, which make up 36%, 21% and 18% of the dataset, respectively, as shown in Figure 5. Together, they account for approximately 75% of the dataset. The fields of Education, Management and Psychology account for 9%, 5% and 4% of the dataset, respectively. All of the other categories did not cross the 2% threshold and were listed as “other”.

Figure 5.

Share of articles by subject area.

Table 1 showcases the top ten journals, authors, affiliates and countries based on article production. The number of published articles is included right next to names, followed by the percentage it makes of the entirety of the dataset used for the bibliometric analysis.

Table 1.

Leading journals, authors, affiliates and countries by number of articles.

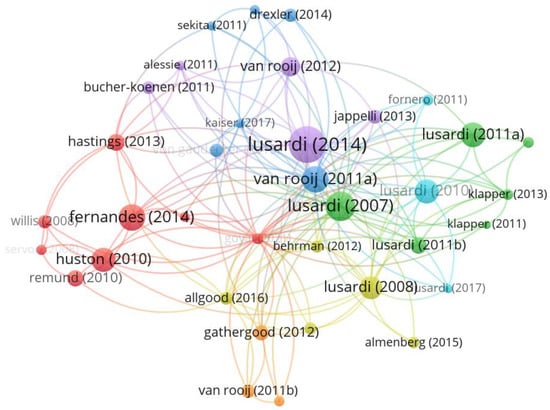

Figure 6 represents the authors’ citation network and citation frequency of our dataset. Nodes represent researchers. The relatedness of the nodes is determined based on the number of times they cite each other. The minimum article citation threshold was set at 90 citations, which yielded 36 results, i.e., authors. The larger the node size, the more often an author was cited.

Figure 6.

Document citation analysis. [2,3,10,11,19,20,28,29,30,31,32,33,34,35,36,37,39,40,44,45,48,49,50,53,55,56,60,61,62,63,64].

This analysis confirms our previous insights into the most popular authors, but also establishes a citation network. Whilst there are numerous connections between the displayed published works, a few notable clusters have emerged. Annamaria Lusardi, the most cited author with the largest number of contributions, is also responsible for the Lusardi cluster, as in all of her newer works, she references most of the preceding ones. Olivia Mitchell was identified as the second top author based on scientific production, but she does not appear in the citation analysis; the main reason is that in almost all instances, she co-authored together with Lusardi. Moreover, among the most cited authors are Fernandes, Van Rooij and Huston that are important to mention as each forms a separate cluster whilst also being connected to each other along with the five most cited works of Lusardi.

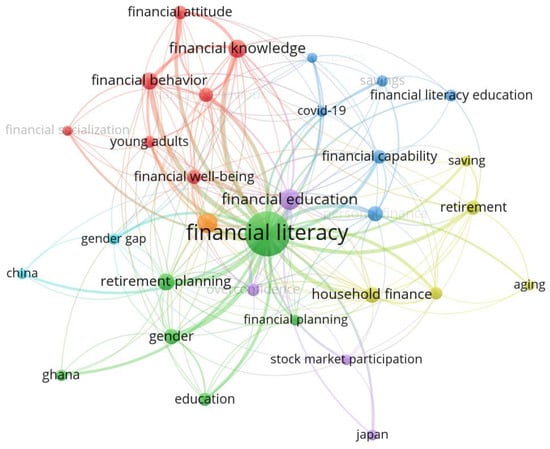

Figure 7 is a visualization of the cluster analysis performed on the co-occurrence of author keywords. The minimum threshold for a keyword to be included was set at 10 occurrences. This yielded 31 results in total, divided across 6 different but interconnected clusters. The bigger the node size, the more often the keyword is used.

Figure 7.

Cluster analysis of author–keyword co-occurrences. Authors.

The first and the largest identified cluster is the financial knowledge–behavior–attitude cluster. Many authors researched the connection between financial literacy and behavior as well as attitude, with special focus on financial knowledge as one of the components of financial literacy. The second identified cluster is the gender-financial planning cluster as many studies investigate the connections between financial literacy, gender and financial planning. The third identified cluster is smaller and it describes the connection between financial capability and financial literacy. The fourth cluster focuses on ageing, retirement and household finance, while the fifth cluster links the fields of financial education and behavioral finance. The sixth cluster is interesting, as it suggests that gender gaps in financial literacy are commonly researched in China.

4. Mapping Financial Literacy—Financial Literacy Determinants and Outcomes

One of the main questions that today’s academic research tries to answer is what the significant predictors of financial literacy are, i.e., on what does the level of financial literacy depend on. Another interesting question concerns the benefits of financial literacy, i.e., what impact does financial literacy have? We found a large number of articles dealing with these questions, and on the following pages, we summarize their findings.

Financial education has been identified as the main determinant of the financial literacy by Huston [3]. This research about measuring financial literacy identifies financial education as the main determinant with the argument that it explains the variation of financial outcomes. This notion is supported in the FinLit report [6] written by Klapper, Lusardi and Van Oudheusden where they concluded that “financial literacy sharply increases with educational attainment”. In their report on financial literacy, OECD [1] identified financial education policy as the core component of financial empowerment and resilience as well as the main contributor to financial stability. Financial education was also the main topic of Fernandes et al. [10], as they noticed that many experts reached a conclusion that financial education leads to increased financial literacy.

The close link between financial knowledge and financial education also makes financial knowledge one of the most important determinants of financial literacy, as is argued in the OECD 2020 report that “financial knowledge is an important component of financial literacy for individuals to help them compare financial products and services and make appropriate, well-informed financial decisions”. Hastings et al. [48] identified financial knowledge as one of the measures for financial literacy, with the argument that it includes financial concepts such as inflation, compounding, diversification and credit scores necessary for effective financial decision making. Allgood and Walstad [55] conducted a large survey of U.S. households with 28,146 participants where they proved that financial knowledge and financial perception influence financial literacy and consequently financial decisions and behavior.

The next important determinant of financial literacy identified by authors is financial behavior. As is the case with financial knowledge, it is also closely linked to financial education. This link was investigated by Kaiser and Menkhoff [62] where they conducted a meta-analysis of 126 studies and concluded that financial education has a significant impact on financial behavior and, to a larger extent, on financial literacy. OECD [1] recognized financial behavior as the most important determinant of financial literacy as it shapes the financial situations of individuals as well as their well-being. Grohmann et al. [65] also managed to prove the importance of financial behavior while surveying 491 respondents living an urban Asian economy. They concluded that in line with other literature on the topic, higher level of financial literacy leads to improved financial behavior and vice versa.

The term financial attitude was commonly used by authors to describe an individual’s feelings and beliefs related to spending and investing money. Sohn et al. [66] found that money attitudes are significantly associated with financial literacy. Skagerlund et al. [67] observed attitude towards numbers as a part of financial attitude and concluded that attitude and affinity towards numbers are predictors of financial literacy. Atkinson and Messy [68] identified attitude as an important component of financial literacy. The most conclusive argument was provided by OECD [1], as they recognized that even if individuals have financial knowledge and exhibit responsible financial behaviors, the decision to act is in major part determined by their attitudes.

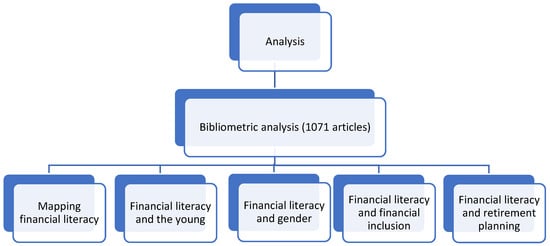

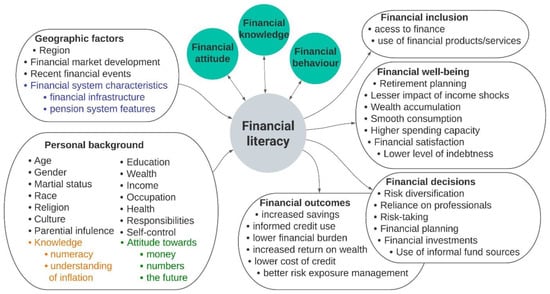

Figure 8 expands on the three main determinants of financial literacy by listing all of the factors that explain financial literacy as well as the consequential outcomes and variables affected by financial literacy that were identified in analyzed empirical researches in field of financial literacy. For easier representation, these factors were grouped.

Figure 8.

Financial literacy—conceptual framework (Authors).

First, Lusardi and Mitchell [2] found that people who are more numerate tend to exhibit higher levels of financial literacy. The same conclusion was reached by Skagerlund et al. [67] who focused specifically on the role of numeracy in financial literacy. Lusardi and Mitchell [2] also proved that an understanding of inflation is strongly correlated with higher levels of financial literacy.

We expand the framework of our analysis to geographic factors. Many authors researched differences in financial literacy of the population in different countries as well as different regions within countries. Again, Lusardi and Mitchell [28] were among the first to gather data from eight countries and observe significant differences in financial literacy scores. Some of these differences were credited to factors such as financial market development, financial system characteristics or recent financial events such as inflation or financial crisis. Similar observations were made by many different authors including Bucher-Koenen and Lusardi [34], Hastings et al. [48] and Murendo and Mutsonziwa [69]. Of important note is that some authors found a correlation between pension systems and financial literacy, mainly Almenberg and Säve-Söderbergh [70] and Crossan et al. [71] linked pension privatization as a significant factor influencing financial literacy.

The largest number of works and authors focused on personal factors as determinants of financial literacy. While Huston [3] established that education has a strong positive correlation with financial literacy, Van Rooij et al. [44] observed the same for wealth. Lusardi and Mitchell established links with the factors of age, gender, race and religion across three separate works [28,72,73]. They found that the young and the old are less financially literate, that women overall are less financially literate and that there are differences in levels of financial literacy across different races and religions that even inhabit the same area. Another notable factor is the parental influence, as proved significant by Grohmann et al. [65].

When it comes to what financial literacy has an impact on, four main groups of outcomes were identified. The first and the smallest group relates to financial inclusion. Grohmann et al. [8] observed that higher levels of financial literacy result in increased financial inclusion through increased access to finance and increased use of different financial goods and services.

The second group involves outcomes that relate to financial well-being. By a large margin, the most discussed topic here is retirement planning. Alessie et al. [33], Fornero and Monticone [36] and Van Rooij et al. [37] are just a few prominent authors whose research concluded that more financially literate people exhibit higher degrees of retirement readiness. It is also worth to mention that more financially literate are also more financially satisfied [74] and accumulate more wealth [45].

When it comes to financial decisions, research in the field concluded that risk diversification [28], consequently risk-taking [53] and reliance on professionals for financial advice [54] are positively impacted by financial literacy, while the use of informal fund sources is reduced [50].

The last, fourth group, lists financial benefits identified for the population that has higher levels of financial literacy. The most frequently identified ones include increased savings [28], lower financial burden [64], and increased return on wealth/investments [49].

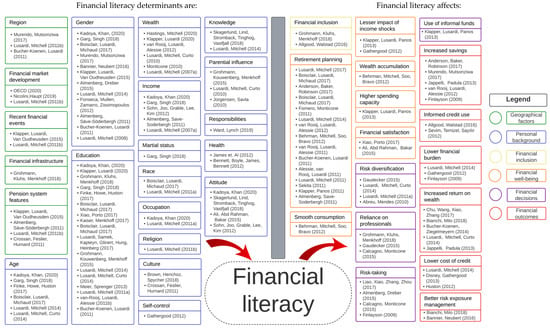

We mapped the main financial literacy determinants and main variables that are affected by financial literacy in Figure 9. The following page contains the complete conceptual framework based on the dataset of relevant articles, which includes the most cited works for every field within each group. Different groups are represented with different colors as is visible from the included legend. Often authors researched multiple fields, so they also appear in the conceptual map multiple times.

Figure 9.

Mapping financial literacy. [1,2,5,6,8,18,20,28,29,30,31,33,34,35,36,37,39,44,45,47,49,50,51,53,54,55,56,60,62,64,65,66,67,69,70,71,73,74,75,76,77,78,79,80,81,82,83,84,85,86,87,88,89,90,91,92,93,94,95,96,97,98,99].

Based on the analysis of the most cited articles from our dataset, we found 21 determinants of financial literacy; those are education, gender, age, income, wealth, attitude, knowledge, parental influence, region, financial market development, recent financial events, financial infrastructure, pension system features, marital status, race, occupation, religion, culture, self-control, responsibilities and health. At the same time, we found that financial literacy impacts 17 other variables; those are retirement planning, financial inclusion, risk diversification, risk taking attitude, return on wealth, savings, income shocks, wealth accumulation, spending capacity, financial satisfaction, reliance on professionals, use of informal funds, informed credit use, lower financial burden, cost of credit and risk exposure management. The detailed references can be found in Figure 9.

The comprehensive conceptual framework presented in Figure 9, in addition to providing us with the information of the most cited works within an identified field, also provides us with three additional insights. First, the most cited works in each field are ordered from the most recent ones to the oldest ones. This provides us with the information of which fields were popular areas for research at which time. We can see from the framework that the majority of the most cited works appeared starting in the year 2011, which goes in line with the previous bibliometric analysis. Additionally, we notice that the connection between gender and financial literacy and education and financial literacy have been major fields of interest in the past and are still being researched today, while the connection between financial literacy and pension funds piqued the interest of researchers mostly during the start of the previous decade. Second, the framework provides us with the information about the most relevant groups of research among the most cited works. The personal background is by far the most relevant group by having the largest number of fields with a sizable number of studies. It is followed by the financial well-being and financial outcomes groups in the second and third places, respectively. Third, we also gain insight into the most relevant fields within a group of interest. It is clear that gender and education are the most represented fields in the personal background group, while retirement planning is the main field of interest in the financial well-being group.

Individual financial well-being is the ultimate goal of financial literacy. As already shown, financial literacy affects the behavior of adults in different ways and it has many interesting determinants. We selected four topics that reflect current trends in financial literacy literature for more detailed literature discussion presented in separate chapters in the following pages. Those topics are financial literacy of youth, financial literacy from the gender perspective, financial inclusion and retirement planning. Special attention was given to the topic of financial literacy and technology, i.e., digital finance and digital financial literacy, as the most recent trends in the field of interest.

5. Trends in Financial Literacy Literature

5.1. Financial Literacy of the Youth

Low levels of financial literacy have been found in young adults in many studies even though financial literacy is nowadays globally recognized as an essential life skill [100] since consumers, in order to achieve their financial goals, need to be able to identify differences among a wide range of financial products and services as well as among providers of financial products and it is also required in all aspects of adult life [14,20,39,101]. Even less than one-third of young adults had elementary knowledge of financial terms such as inflation, interest rate, and risk diversification [39].

Low financial literacy among young people is particularly alarming [102] especially if we consider young individuals as a significant factor in the development of national economies. A high level of financial literacy in the youth could give a great contribution to the state economy [103]. Moreover, financial literacy is positively correlated with well-being [104], which leads to life satisfaction, psychological well-being and academic performance [105]. Abdullah et al. [106] confirmed a positive relationship between financial literacy and debt management and attitudes towards money. A study conducted by Mata [107] shows that the most financially knowledgeable young adults have fewer intentions to take passive strategies. High levels of financial literacy result in increased business success among young entrepreneurs [108] and have a positive impact on entrepreneurial intent [109].

The high and increasing level of debt is the main characteristic of the financial situation of today’s young adults [110]. Lusardi and Tufano [111] found that people with low financial literacy are more likely to have problems with debt. Moreover, a low level of financial literacy is correlated with a low level of participation in stock markets [112]. Previous studies confirmed that these youth are less likely to invest in mutual funds with low fees [113], accumulate wealth and manage wealth effectively [21], as well as make a plan for retirement [18,72,114]. Furthermore, poor financial literacy among young homeowners is correlated with their taking larger mortgage debts and using alternative mortgage products [110].

Various socio-economic and demographic factors such as gender, age, income, educational attainment, marital status, educational attainment and influence of parents have been considered for the level of financial literacy among youth. Significant differences in financial literacy of youth by gender are confirmed in many studies [76,107,115,116]. Fletschner and Mesbah [116] also found that women are less financially informed than men, but their knowledge has significantly increased with wealth, education, and encouragement by spouses to obtain and use it. Chen and Volpe [117] revealed that men are more interested in and enthusiastic about obtaining financial knowledge than women are. According to these authors, men have greater knowledge of personal finances and finances in general. Moreover, the same study showed that men have more confidence in their knowledge and a better understanding of the importance of financial knowledge. Dundure and Sloka [115] found that young persons who have incomes from their professional activities owing, to their increasing age also have a higher financial literacy level. Siegfried and Wuttke [118] use gender and educational background to moderate the effects appearing between self-reported financial literacy, financial learning opportunities, delay of gratification and financial literacy.

Gender-related experiences and attitudes toward money are closely related with the family as the social structure. The impact of family and parents on the financial literacy of adolescents is significant, not only as a source of information but also in the context of gender [119]. The financial role of parents in childhood is the key basis for the financial behavior and assumptions in adolescents that they have to possess in their adult lives [120]. The effect of parental influence by including three facets, i.e., parents’ direct teaching, parents’ financial behavior and parents as role models, are according to Bhatia et al. [121] significant determinants of the level of financial literacy and are also confirmed in studies by Pandey et al. [122], Vijaykumar [123], Bamforth et al. [124] and Esmail Alekam [125]. Lusardi et al. [39] found that family financial sophistication was a significant variable of financial literacy of young adults in the USA, while Jorgensen and Savla [87] indicated that perceived parental influence had a direct and moderately significant influence on financial attitude; indirect and moderately significant influence on financial behavior, mediated through financial attitude; and no effect on financial knowledge. In contrast to previous studies, Sharif et al. [126] found a negative relationship between parental teaching and financial literacy among males.

Time orientation and delay of gratification from the aspect of financial literacy were considered by Zsoter [127] who found that the future orientation of young adults has the most radical effect, especially concerning the ability to delay gratification. According to this study, individuals with a future-orientated attitude can more easily forgo certain things in the present and wait for long-term future rewards. The overconfidence of young adults was found significantly and positively related to unhealthy debt behavior in the study by Cwynar et al. [128].

As significant predictors of financial literacy across countries Moreno-Herrero et al. [100] identified the well-functioning educational system by the quality of its mathematical and scientific education as well as understanding the value of saving and discussing money matters with parents. The exposure to financial products, such as holding a bank account, has improved their financial knowledge as well. Mancebon et al. [129] found similar results, in which the first order determinant of scores in math, reading and science is family, which is also a key variable in the development of financial skills.

The research conducted by Grohmann et al. [65] showed that there are two main factors that affect a child’s experience in financial skills—family and school. Totenhagen et al. [130] concluded that the alignment between delivery methods and young adults’ motivation is a key to success.

5.2. Financial Literacy and Gender

The lower financial literacy in women compared to men is well documented and mostly confirmed in various empirical studies [131,132,133,134], where the gender gap is noted and the importance of education to reduce the gap is highlighted. On the other hand, the determinants of the gender gap are insufficiently understood and are the subject of ongoing research. Preston and Wright [135] point out that human capital variables such as age and education do not play a role in explaining the gender gap in financial literacy, while labor market variables are important and explain about 16 percent of the gap. This paper also points to a large unexplained gap, suggesting that the most important determinants are neither human capital nor labor market factors.

Driva et al. [136] confirm the existence of a gender gap already among teenagers and link it to gender stereotypes regarding attitudes toward household finances. For example, Agnew and Cameron-Agnew [137] point to the impact that financial discussions in the home have on the financial literacy levels of children and adolescents. Research has shown that, on average, males have their first financial conversations at home at a younger age than females. Pahlevan Sharif et al. [126] show that parental education and behavior directly affect financial behavior and thus financial literacy among young adults in Malaysia, with a positive correlation between financial behavior and financial literacy for females and a negative relationship between parental education and financial literacy for males. The social and cultural environment in which girls and boys live plays a key role in explaining gender differences, highlighting the role of the mother in girls’ financial knowledge. The role of women has also been shown to influence gender differences in financial literacy in the past [138].

Personality traits such as self-confidence, perseverance, financial anxiety, rationality and motivation affect financial literacy and explain part of the gender differences [139,140,141,142]. Moreover, objective mathematical ability is predictive of financial literacy for men, while self-efficacy is predictive of financial literacy for women [143]. Financial experience in transactions [144] and in making financial decisions [47] is recognized as an important determinant of the gender gap. Yu et al. [145] show, in their analysis, that part of the gender gap in financial literacy could be explained by gender differences in risk tolerance, numeracy and financial knowledge.

A significant gender difference was found in both investment behavior and risk attitudes [146], but no relationship was found between gender and portfolio quality. Similarly, the results of Almenberg and Dreber [53] show that the estimated gender difference in stock market participation decreases as financial literacy increases, while the gender difference in risk attitude remains significant regardless of financial literacy. The relationship between perceived and actual financial literacy for standardized investments was found for men, while for women, there was only a relationship between actual financial literacy and standardized investments. For sophisticated investments, the relationship between perceived financial literacy and investments is evident for both [79]. Similarly, Cupák et al. [147] emphasize the role of self-confidence in financial literacy when it comes to investing in risky assets, and self-confidence emerges as a strong determinant of the gender gap in this type of investment. Bannier et al. [148] show that women know less about the characteristics of Bitcoin compared to men, highlighting that actual and perceived financial literacy explains about 40 percent of the gender gap in Bitcoin knowledge. A significant gender difference in borrowing for investment has also been documented, even when controlling for risk attitudes [149,150].

The literature on gender differences in financial behavior is very sparse, and Cwynar [151] found no gender differences in the overall index of financial behavior in his study of couples’ financial behavior in Poland. He emphasizes that Central and Eastern Europe may differ from Western Europe in terms of the gender gap and that the absence of gender differences in financial behavior is more likely to be observed in Central and Eastern European countries. Analyzing international OECD microdata, Cupák et al. [152] show that gender gaps in financial literacy are larger in more developed countries. They conclude that only part of the gender gap in financial literacy can be explained by personal characteristics and suggest that social norms about women’s participation in the economy are a better predictor of gender differences in financial literacy. Financial behavior as a component of financial literacy is a significant predictor of financial satisfaction in both gender groups, while the financial attitude component explains additional differences in financial satisfaction for men. Financial knowledge as the third component of financial literacy was neither a significant predictor of financial satisfaction nor for gender [153]. Financial fragility and financial optimism are negatively related, and this relationship is even stronger for women [154].

In a literature review, Furrebøe and Nyhus [155] examined the role of financial self-efficacy in relation to the financial literacy and gender. Conceptual ambiguities were noted that prevent a coherent theoretical foundation, the impossibility of generalization due to different measures of financial self-efficacy and the lack of studies to identify causality.

5.3. Financial Literacy and Financial Inclusion

A number of studies show that financial literacy is one of the main determinants of financial inclusion. The results show a positive and significant relationship between financial literacy and financial inclusion [156,157,158,159]. Financial literacy aids in the understanding of complex financial products; people who buy them acquire more knowledge and as a result increase their financial literacy levels to a greater extent.

With increase in financial literacy levels, the demand for formal and informal financial products as well as financial inclusion has increased. There can be different mediating variables between financial literacy and financial inclusion, i.e., financial self-efficacy that mediated the relationship between financial attitude, financial literacy and financial inclusion among individuals in Uganda, or internet usage and digital financial products usage that mediated the relationship between financial literacy and financial inclusion [160,161]. Rastogi and Ragabiruntha [159] show that online banking, understanding banking services and financial literacy are the drivers of financial inclusion; they additionally show that financial inclusion can lead to economic development. Furthermore, it has been identified that financial inclusion is a multi-dimensional construct that includes access to finance, general country characteristics, use of financial services, financial infrastructure of country and institutional country characteristics [8]. Some of these determinants/drivers are closely examined in the content analysis below.

Along with financial literacy socio-demographic and geographic factors such as age, education, gender, family size, race, region and income affect financial inclusion [162,163]. Lyons and Kass-Hanna [164] show that economically vulnerable residents have lower financial inclusion than the other groups. Residents of the MENA region that are more financially literate are more probable to have positive saving patterns and less debt, especially debt from informal institutions.

A number of studies highlight the importance of financial education and training on financial inclusion. Koomson et al. [165] show that recipients of financial literacy lectures and training are more probable to magnify their financial inclusion, while the magnification of inclusion is bigger for male and young recipients. The results emphasize the importance of financial literacy training with the aim of closing the gender financial inclusion gap. Hence, the results suggest that improving financial inclusion through increasing financial education could be an important instrument of financial development in addition to the more conventional policy of expanding financial infrastructure [8]. This is because both, the demand for financial services in the form of financial literacy and the supply of financial services, are significant factors for financial inclusion [8,166]. Singh [167] also examines the demand-side factors influencing financial inclusion, especially frequency and the amount of borrowing. The paper concludes that the studied latent barriers in regard to the usage of financial inclusion needs higher policy responsiveness to be in line with the supply-side factors.

Behavioral phenomena have been proved to have significant effects on financial inclusion. Bongomin et al. [168] revealed that cognition considerably moderates the relationship between financial literacy and financial inclusion of the economically vulnerable population in Uganda. In addition, cognition and financial literacy also have direct effects on financial inclusion. Moreover, Liu et al. [169] found negative influence of self-control, optimism, and herding on financial inclusion; similarly, financial literacy has a decreasing effect on financial inclusion due to religious beliefs. On the other hand, loss aversion caused the increase in financial inclusion. It has been found that financial literacy moderates all relationships except loss aversion. The authors find that individual homes that do not have access to IT services and products from formal financial institutions better handle the behavioral biases that were limiting them to make informed financial decisions. Ofosu-Mensah et al. [170] found that human development is a catalyst for greater financial inclusion in the banking industry; they ultimately conclude that low human development generates low financial inclusion.

Kondogo [171] demonstrates the relationship between financial regulation and financial inclusion in Kenya. They have found that agency banking regulations and financial literacy enhance formal financial access and know-your-customers rules, while capital and liquidity macro-prudential rules damage financial inclusion. A lack of awareness and financial literacy, high cost of financial services, constant reliance of rural population on borrowers, regional inequalities in terms of outreach, etc. were some of the main concerns [172]. The entry of Big Tech firms in the financial ecosystem impact financial stability, especially through financial inclusion among other factors [173]. Jonker and Kosse [173] also state that financial-inclusion opportunities created by Big Tech firms could cause different financial stability risks and highpoint the significance of appropriate supervision and regulation.

Authors also focus on how financial inclusion and financial literacy might affect different sectors of society and economic development. Jungo et al. [174] showed the effect on stability and competitiveness indicators in the banking sector. Their results suggest that financial literacy and financial inclusion decrease credit risk and improve banks’ stability. Akpene et al. [175] examined the impact of financial literacy and financial inclusion on stock market participation in Ghana. They found that financial literacy is the determinant of stock market participation contrary to the previous studies in Ghana; on the other hand, interaction of financial literacy and financial inclusion had no effect. Financial inclusion through the usage of an account to save significantly affects stock market participation. Didenko et al. [176] show the effect of financial inclusion on the amount of illegally acquired income of countries with different economic developments. Overall, it has been concluded that the level of financial inclusion of the country’s population positively affects the fight against money laundering in all countries studied.

5.4. Financial Literacy and Retirement Planning

There are many studies worldwide that have examined the impact of financial literacy on retirement planning with a special focus on the country level data. Both developed and developing countries have been researched including Finland, Sweden, Germany, Canada, the US, China, Chile, New Zealand, Russia, Ghana, South Africa, etc. Most of these have found that higher financial literacy leads to better retirement planning [29,34,35,78,177,178]. The study conducted in Sweden shows that people who report to have been planning for retirement are more financially literate; they also found that an understanding of risk diversification is strongly correlated with planning for retirement [70]. China’s higher marks on the financial literacy are related both to better retirement planning and higher propensity to actively use financial markets for retirement preparation [178]. Furthermore, a subsequent study conducted in China shows that financial literacy has a strong and positive impact on several aspects of retirement preparation among Chinese people, including defining retirement financial needs, making long-term financial plans and purchasing private pension insurance [179].

However, a number of authors have found no correlation or negative relation between financial literacy and retirement planning on the country level. For example, Finland is an interesting case that shows countervailing effects where a high level of education increases financial literacy, while the high provision of social security decreases it and deteriorates its relationship with pension planning [180]. Additionally, a study conducted in New Zealand found that financial literacy is not significantly associated with planning for retirement, which was explained by the central role of New Zealand’s universal public pension system in providing retirement income security [71]. Similarly, Tan and Singaravelloo [181] examined retirement planning of government officers in Malaysia; their results found that financial literacy does not correlate with retirement planning and neither does it mediate the relationship between financial behavior and retirement planning.

Separately, several studies showed that financial literacy can affect the composition of retirement financial portfolio. Yeh [182] provided mechanisms through which financial literacy is related to retirement saving; they included three phases of the decision-making process: information perception, information search and evaluation, and decision-making and implementation. The results show that financial literacy has a positive influence on the awareness of retirement financial requirements, choosing among different financial products and retirement planning. Nguyen et al. [183] found that a basic financial literacy level and pension knowledge are main factors that significantly increase the probability of exercising retirement investment choice of employees, while an advanced financial literacy level factor has a significant effect on choosing growth investing options for their retirement. Another study results show that financial literacy has a significant positive impact on the choice of wealth management products, risky financial assets and the total amount of retirement financial assets, while it has a negative impact on the choice of bank savings [184].

Clark et al. [185] examined the relationship between financial literacy and retirement portfolio returns; the results show that investors who are more financially literate get higher returns on their retirement investments. This is in accordance with the findings of other authors, primarily Kristjanpoller and Olson [186] and Nguyen et al. [183]. In their research, Kristjanpoller and Olson [186] have investigated how financial knowledge and demographic factors influenced Chile’s pension holders’ choice between a default life-cycle retirement plan and active management. They found that people with low financial knowledge were more likely to choose the default fund, while nearly three quarters of active investors chose more risky funds in their age group.

Furthermore, several authors discuss determinants of retirement planning in addition to financial literacy. Chua and Chin [187] examined the relationship between financial literacy, financial attitude, financial well-being, financial behavior and retirement preparation. The empirical evidence indicated that financial behavior is positively associated with retirement preparation; in addition, they found that financial well-being positively effects retirement confidence. Fernández et al. [188] analyzed what factors were driving the retirement savings of European individuals; the results found that decision about retirement savings was positively related to the individuals’ age, financial literacy, household income and saving habits. Additionally, the results emphasize the importance of country-level institutional factors in the individual’s retirement attitudes.

Studies by Ricci and Caratelli [189] and Koh et al. [190] introduced trust as a determinant that is positively associated with retirement savings. In contrast, Fang et al. [191] presented the effect of financial advice and social interaction on the households’ retirement saving decisions. Overall, they concluded that financial advice and financial literacy positively affect retirement saving decisions through different channels, while social interaction has no effect on facilitating better retirement saving decisions. Angrisani and Casanova [192] introduce overconfidence/under confidence as the determinant for retirement preparation. Their results propose that overconfident individuals have no significant difference compared to the results of others who have the same or similar level of financial literacy, but are less interested in improving their financial literacy. On the other hand, under-confident individuals exhibit worse economic outcomes than others with same or similar financial literacy level, but are keener to learn and improve their financial knowledge [192]. A number of studies concluded that financial literacy learning programs have positively impacted employee retirement preparation and decisions. This is consistent with a lot of other research on this topic, showing that the higher levels of financial literacy cause higher retirement saving [193,194].

Many authors are proposing risk components as mediating or moderating variables in the relationship among financial literacy and retirement preparedness, savings or planning. Mahdzan et al. [195] introduced risk aversion and found that individuals with higher financial literacy and lower risk aversion are more prone to hold risky assets in their retirement portfolios. Moreover, Nguyen et al. [196] suggested that financial risk tolerance and risk perception mediate the relationship between the subjective financial literacy and retirement saving intention. It has been found that subjective financial literacy through the financial risk tolerance and risk perception leads to lower retirement intention, which further affects the saving behaviors. Thus, the authors found supporting evidence for the proposed indirect effect; in addition, the authors noticed that retirement saving intention strongly influences the retirement saving behaviors [196]. Similarly, Park and Martin [197] propose that higher levels of risk tolerance weaken the relationship between savings and retirement planning.

6. Financial Literacy and Technology

In recent years, the realm of financial literacy has witnessed an emergence of new trends driven by the increasing prominence of digital finance and the need for the development of digital financial literacy. Scientists and researchers have recognized the pressing importance of understanding and navigating the intricacies of digital transactions, cryptocurrencies, online banking, and digital investment platforms. The exploration of the relationship between technology and financial literacy has become a focal point for many scientists, representing an area that remains relatively underexplored. This significance is further underlined by the OECD, institution well-known for its pioneering work in financial literacy research and its development of the most esteemed questionnaire in the field. Notably, the OECD has just recently incorporated digital financial literacy into their questionnaire methodology specifically as of 2022 [198]. This acknowledgment highlights the expanding landscape of individuals’ financial literacy and emphasizes the need to investigate and understand its implications on digital finance.

In order to comprehensively understand the implications of these new trends, it is crucial to delve into the existing body of scientific literature, which sheds light on various aspects of digital finance and digital financial literacy. Understanding the foundations laid by previous research provides valuable insights into the current landscape and paves the way for exploring new areas of inquiry. In this regard, we defined an additional database of 54 articles. The bibliometric analysis shows that these are new articles, the oldest of which are from 2019, with a clear growth trend of 15 articles in 2021 and 27 in 2022. It was also found that the largest number of articles come from Asia: China (20), India (4), and others (4), then from the African continent—various regions (4), Europe (4), and North America (2). It is evident that research is focused on areas where digitization has been significantly introduced recently.

6.1. Financial Literacy and Digital Finance

The positive interconnection between financial literacy and digital finance has been documented by various proxies for digital finance. Prete [199] used a cross-country analysis based on the PIAAC survey, which is part of the OECD program, and found a positive correlation between financial literacy and digital literacy, where digital literacy proxy is “the ability to solve problems in a technology-enabled environment.” Digital financial tools such as i-banking [200] show a positive connection with financial literacy, while security-based crowdfunding platforms increase the survival profile of platforms when the level of financial literacy is high [201]. Mahdzan et al. [202] showed that the use of digital financial services reduces the strength of the association between financial behavior and subjective well-being, but also reduces the negative impact of financial stress on subjective well-being.

Numerous studies demonstrate the significant impact of digital finance and financial literacy on the entrepreneurial performance of SMEs. Using PLS SEM on a sample of 400 entrepreneurs from Ghana, Frimpong et al. [203] found that digital financing mediates the relationship between financial knowledge and SME performance. Using the same methodology, Thathsarani and Jianguo [204] show that access to digital finance has a mediating effect between financial inclusion and SME performance. Shen et al. [161] consider the use of digital financial products as multiple mediators between financial knowledge and financial inclusion. Measuring digital financial literacy, Luo et al. [205] demonstrated its significant and positive influence on business ownership, business innovation and financial performance. Using the probit method, Luo and Zeng [206] find positive associations between digital financial literacy and household entrepreneurship through business innovation. Moreover, digital finance increases the likelihood of applying for new investment projects and the number of projects applied for at MSEs [207].

The impact of digital finance on households is significant and reflected in the efficiency of households’ investment portfolio by influencing financial literacy and investor sentiment [208]. The results of Lu et al. [209] also suggest that digital financial inclusion significantly increases the diversification of individual stock investments, mainly by reducing investors’ perceived transaction costs and mitigating investors’ limited attention. Some work suggests that digital financial inclusion may promote household consumption [210] and household insurance purchases [211], and reduce the likelihood of households taking extreme portfolio risks by promoting diversification [209].

Vulnerable populations, especially those in rural or less developed areas [205,212] and those with fewer assets, lower income, and less financial knowledge [209,213], are the most likely to benefit from the advantages of digital financial services.

6.2. Digital Financial Literacy

While the field of digital financial literacy is currently characterized as an under-researched domain, it is imperative to provide a comprehensive review of the scientific articles published thus far. In the past two years, authors have investigated the relationship between the level of digital financial literacy and different demographic variables i.e., gender, location, age, etc. [214,215,216]. For instance, the study conducted by Raidev et al. [217] analyzed the level of digital financial literacy of graduate and post graduate students, with the aim of understanding the relationship between demographic variables and level of digital financial literacy as well as studying the link between digital financial literacy and the use of digital financial services. Findings show that male and female students do not have significant differences with respect to the level of digital financial literacy score; additionally, they found that there is a gap between the level of digital financial literacy and usage of digital financial services [217]. In contrast, Ravikumar et al. [218] conducted a study with the objective of identifying, measuring and validating the determinants of digital financial literacy (DFL) among Indian adults who utilize digital financial services (DFS). The study’s results revealed several determinants of DFL, including digital knowledge, financial knowledge, knowledge of DFS, awareness of digital finance risk, digital finance risk control, knowledge of customer rights, product suitability, product quality, gendered social norms, practical application of knowledge and skills, self-determination to use the knowledge and skills, and decision making.

A significant number of researchers examining digital financial literacy have focused on its impact across various dimensions, including financial inclusion, financial behavior and the utilization of digital financial services. Their findings consistently demonstrate that digital financial literacy plays a crucial role in promoting inclusiveness and enhancing financial resilience. Authors highlight that individuals with higher levels of financial literacy are more likely to actively participate in formal banking channels, resulting in increased financial inclusion [214,219]. Setiawan et al. [220] demonstrated that digital financial literacy positively influences individuals’ current saving and spending behavior, as well as their future saving and spending foresight. This suggests that a higher level of DFL can lead to more informed financial decisions and better financial outcomes. Branciu et al. [216] and Tian [221] emphasized the significance of a high DFL in reducing household leverage ratio, mitigating over-indebtedness and addressing systemic financial risks. These findings underscore the importance of DFL as a protective factor against potential financial vulnerabilities. Ravikumar et al. [218] emphasized that DFL is a prerequisite for effective use of digital financial services. Users lacking DFL face various challenges, including transactional difficulties, financial losses and privacy breaches. Moreover, Su et al. [222] and Divaeva et al. [223] outlined the role of digital literacy in influencing decisions related to stock markets, digital market participation and e-commerce adoption. These studies collectively explain the multifaceted impact of DFL on various aspects of individuals’ financial behavior and outcomes.

7. Discussion

As is visible from our conceptual framework for the role of financial literacy presented in Figure 8, there are many different determinants of financial literacy that can vary depending on the individuals and their socio-economic and demographic factors. The main approach of the majority of authors was to split financial literacy into multiple categories, usually three. Based on our full-text reviews, we identified the three most common categories to be financial knowledge, financial attitude and financial behavior. The body of research on the topic of financial literacy determinants agrees that the combination of understanding of finance with the right financial attitude and responsible financial behavior leads to overall higher levels of financial literacy. However, these three categories are also fields on their own and include many different factors and outcomes. Financial knowledge involves the overall understanding of financial concepts such as savings, investments and interest rates that an individual possesses. Financial attitude is used to describe an individual’s beliefs, feelings and values related to money as they can have a significant impact on financial decisions. The last, but not the least, financial behavior refers to actions that individuals take with their funds, and its importance lies in the observation from authors that good financial knowledge does not always translate into good financial behavior and that determinants such as an individual’s level of self-control and attitude towards money can have a significant impact.

One interesting piece of information is that the analyzed literature does not give any consensus about how to precisely measure each of these fields, as various different methodologies exist. Thus, there was a need to deepen the analysis to include all of them into a conceptual framework, where all relevant factors and outcomes were attributed to financial literacy instead of the three identified categories. Based on the reviewed writings, six main groups were identified, including geographic factors, personal background, financial inclusion, financial well-being, financial decisions and financial outcomes. Each group contains different factors and outcomes that were proven using empirical research to have a connection with financial literacy. These connections can have either a positive or a negative influence on the overall level of financial literacy as we were concerned mostly by the existence of the connection in the first place. However, in order to simplify the framework and avoid confusion, the positive narrative was adopted.

To further reinforce the produced framework, a comprehensive conceptual framework of mapping financial literacy was also created, as shown in Figure 9. It contains additional information in the form of short references of the most cited works where the connection between relevant factors and outcomes, and financial literacy was established, thus solidifying the approach and concepts developed during the structuring of the conceptual framework. Based on the most cited articles, financial literacy can be explained by 21 factor such as education, gender, age, income etc., while financial literacy is influenced by 17 variables such as retirement planning, financial inclusion, risk diversification, return on wealth, etc.

Through a detailed review of the literature, we find that low levels of financial literacy are found among young people, which is concerning. The studies we have reviewed indicate that young people around the world do not have a grasp of basic financial concepts. This certainly highlights the practical implications of these findings, and the need to systematically approach raising awareness of the importance of financial literacy among young people. It is necessary to work on developing educational programs and training that not only raise awareness of financial literacy, but also increase financial knowledge as well as influence other elements of financial literacy, financial attitudes and behavior. The findings can certainly be useful to policy makers.

There is strong evidence about gender differences in financial literacy as well as in the investment behavior and risk attitudes, while the determinants of gender differences are the subject of ongoing research. Among the determinants describing gender differences in financial literacy, education, financial experience and personality traits stand out. It has been pointed out that social norms about women’s participation in the economy are linked to gender stereotypes, with particular emphasis on the role of the household. These stereotypes are related to financial decision making and financial knowledge from home, and thus to financial experience. Personality traits that partially explain the gender difference in financial literacy are self-confidence, motivation, financial anxiety, risk attitude and rationality. A higher GDP is not associated with greater gender equality and that only part of the differences can be explained by personal characteristics and the rest by the specific situational environment.

After studying the literature on the relationship between financial literacy and financial inclusion, we conclude that more financial literacy means more financial inclusion. However, there are a number of inequalities in the relationship due to different socio-demographic factors including gender, income and size of family. Our findings emphasize the importance of financial literacy training with the aim of closing financial inclusion gaps. Furthermore, analysis suggests that improving financial inclusion through increasing financial education could be an important instrument of financial development in addition to the more conventional policy of expanding financial infrastructure.

Worldwide, there are a number of studies that are examining country level data for the relationship between financial literacy and retirement planning. Most of the country-based studies find positive correlations between financial literacy and retirement planning, while some show no correlation, indicating the importance of country level factors. Many variables additionally affect retirement planning or saving such as trust, financial advice, confidence levels and financial training. In addition, many authors are proposing risk tolerance and risk aversion as mediating variables in the relationship among financial literacy and retirement preparedness, savings or planning. It has been found that individuals with higher financial literacy and lower risk aversion are more prone to hold risky assets in their retirement portfolios. When it comes to the composition of retirement portfolios, the literature review indicated that a higher financial literacy leads to higher portfolio returns. These findings could be very valuable to policy makers in making their future retirement programs.

The positive connection between financial literacy and digital finance has been recorded in numerous papers. The mediating effect of digital finance on SME performance and the positive impact on financial inclusion have been noted, with particular emphasis on the growing efficiency of household investments. The benefits of digital finance for vulnerable groups (rural or less developed areas, lower income households, and lower financial literacy) have been highlighted, and digitization and education are recommended. Digital financial literacy (DFL) is still pretty much an under-researched area, but a few scholars have investigated this concept and discovered that the level of digital financial literacy exhibits significant variations depending on different control variables. It depends from the research context and sample, but thus far, a few authors have found significant differences in the DFL level depending on education and age, while gender does not seem to play a significant role in determining the level of DFL. Furthermore, researchers show that higher digital financial literacy promotes financial inclusiveness, financial resilience and leads eventually to more informed financial decisions and better financial outcomes. Moreover, we have found contrasting evidence on the relationship between digital financial literacy and the usage of digital financial services among researchers. Raidev et al. [217] found a consistent gap in the level of digital financial literacy and the use of digital financial services; hence, in spite of high digital financial literacy, students have shown a lower usage of digital financial services. On the other hand, Ravikumar et al. [218] state that DFL is a prerequisite for the effective use of digital financial services. The observed trends and relationships in digital financial literacy await further confirmation from upcoming authors who are set to publish their research in this domain in future years.

8. Conclusions

Financial literacy is a critical life skill that is essential for achieving financial security and individual well-being, economic growth and overall sustainable development. Authors identified many determinants that impact an individual’s level of financial literacy listed in two major groups of socio-economic and personal background, and geographic factors. These factors can lead to a variety of outcomes listed in four main groups: financial inclusion, financial well-being, financial decisions and financial outcomes. Surprisingly, or possibly due to the strong influence of the most prominent researchers of financial literacy, a consensus was achieved on the three main categories of determinants. As the applied research methods were very diverse, these determinants could not reliably be connected to the individual factors and outcomes that are under the domain of financial literacy, but were successfully connected to financial literacy as a concept.

The existing body of researches mainly focuses on the connection between personal background and financial well-being with financial literacy, while gender, education and retirement planning seem to be variables that are of the highest interest to researchers, as the majority of most cited works were addressed to them. The goal of our conceptual framework and comprehensive conceptual framework for mapping financial literacy is to serve as a balance sheet of current research and a starting point for future research, as it enables the visual identification of the fields of interest as well as the gaps. The information listed here should also be of use to policymakers in their pursuit of improving the levels of financial literacy with the end goal of improving individuals’ well-being by enabling them to make better financial decisions, to avoid financial stress and to achieve their financial goals.

There are a couple of limitations, including the fact that only the top 200 cited works out of the initial more than 1000 were used to create it due to software limitations and time constraints, so there is a possibility that certain relevant factors are not covered. As such, there is room to refine the framework in the future, as well as to derive new frameworks using the same model, but containing different information. For example, frameworks that use only recent writings could be created in order to more accurately assess the current research focus in the field of financial literacy, while individual sub-frameworks could be made for each group or every factor, further solidifying their relevance to financial literacy.

Numerous studies deal with the financial literacy of young people around the world, looking at it through the prism of various socio-economic factors such as gender, age, and level of education. The importance of financial literacy among young people is highlighted through the fact that young people are the drivers of the national economies, and that the higher levels of financial literacy are correlated with higher entrepreneurial intent and entrepreneurial success. Special emphasis is placed on the importance of the family, which in many studies is the first determinant of the level of financial literacy of young people, as well as the quality of educational systems that can, through the development of mathematical and scientific skills, by involving the parents, contribute to strengthening the level of financial literacy of youth. Further research can be conducted based on the analysis of the evaluations of the effects of the introduction of such programs.

The lower financial literacy level of women compared to men has been confirmed in numerous empirical studies, and a gender difference in investment behavior and risk has been found. A reduction in the gender gap can be achieved through education, but also through greater social involvement of women, especially in financial decision-making processes. It was confirmed that a higher GDP does not equate to a lower difference in financial literacy and that the historical and situational environment is a variable that influences these differences. Research on the determinants explaining gender differences in the specific environment must be viewed in the context of the situational factors of the environment, and education should be targeted to the specific environment. The literature review shows the insufficiently researched influence of financial attitudes, knowledge, and behaviors as components of financial literacy on gender differences, as well as the relationship between financial self-efficacy and gender differences in financial literacy.

Our analysis shows that, in general, better financial literacy levels lead to more financial inclusion of an individual. Along with financial literacy socio-demographic factors, such as age, education, gender, family size, race, region and income, affect financial inclusion. Furthermore, we highlight that financial inclusion is also influenced by other variables such as self-efficiency, internet usage, digitalization and online banking services, various behavioral phenomena, financial training and financial regulation. Financial inclusion as a multi-dimensional construct has effects on other financial sectors in the society such as banking and stock markets, facilitating their better performance.

Based on the analysis of the most studies that have examined the impact of financial literacy on retirement planning, we conclude that higher financial literacy leads to better retirement planning. However, some have proven that there is no correlation between the two, which shows that there are many country level factors that cause the differences, which is the area for future research. In addition, it has been shown that financial literacy can affect the composition of retirement financial portfolio and retirement portfolio returns. The findings propose that financial literacy has a positive influence on the awareness of retirement financial requirements, choosing among different financial products and retirement planning. Furthermore, the results indicate that investors who are more financially literate earn more on their retirement plan investments, which should be communicated to the public, as that would be an incentive to raise individual level of financial literacy also.

Lastly, a large number of determinants and impacts of financial literacy remain somewhat under-researched, and despite the recent popularity of the topic, there is sufficient space for new authors, especially in the domain of new trends that include digital finance and digital financial literacy. In general, we found no or a very low number of papers linking financial literacy and the level of information and communication technology, the development status of the country as well as their education systems.

Finally, based on the comprehensive analysis of relevant research, we conclude that improving financial literacy should be a priority of policy makers worldwide, as it has an impact on achieving sustainable development goals (SDGs). A higher financial literacy could be obtained via financial education and it results in financial inclusion, better retirement planning, reduction in the gender gap, etc. Financial literacy is related to a decrease in poverty (SDG 1), increased well-being (SDG 3), higher quality of education (SDG 4), gender equality (SDG 5), economic growth (SDG 8), reduction in inequalities (SDG 10), and more responsible consumption and production (SDG 12). Governments, especially ministries of education and finance, central banks and other financial regulatory bodies should pay more attention to the detailed operational plans for the improvement of the financial literacy of citizens.

Author Contributions

Conceptualization, A.Z.; methodology, A.Z. and A.T.; software, A.Z. and A.T.; validation, A.A.-B., M.N.M., L.D. and T.Z.; formal analysis, A.Z., A.T., A.A.-B., L.D. and M.N.M.; investigation, A.Z., A.T., A.A.-B., T.Z., L.D. and M.N.M.; resources, A.Z., A.T., A.A.-B., T.Z., L.D. and M.N.M.; data curation, A.Z. and A.T.; writing—original draft preparation, A.Z., A.T., A.A.-B., T.Z., L.D. and M.N.M.; writing—review and editing, A.Z., A.T., A.A.-B., T.Z., L.D. and M.N.M.; visualization, A.T.; supervision, A.Z.; project administration, L.D.; funding acquisition, A.A.-B. and T.Z. All authors have read and agreed to the published version of the manuscript.