Explore the Complex Interaction between Green Investment and Green Ecology: Evaluation from Spatial Econometric Models and China’s Provincial Panel Data

Abstract

1. Introduction

2. Literature Review

2.1. Green Investment Promotes Green Ecological Development

2.2. Green Ecological Development Attracts Green Investment

3. Research Model and Index Construction

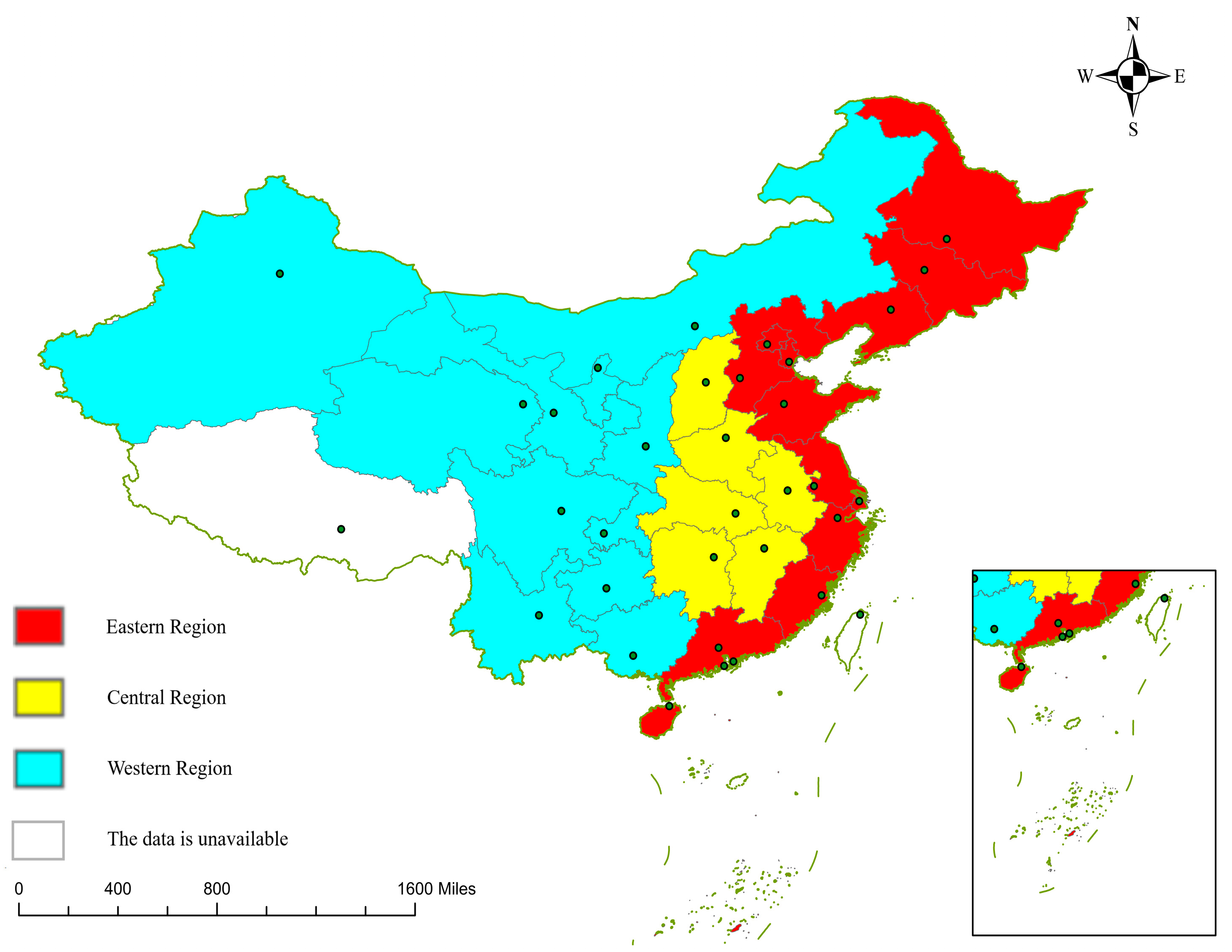

3.1. Study Area

3.2. Model Construction

3.3. Indicator Construction and Variable Selection

3.3.1. Construction of Green Investment and Green Ecological Development Index System

3.3.2. Variable Selection and Processing

4. Empirical Analysis

4.1. Unit Root Test and Cointegration Test

4.2. Selection of the Optimal Lag Period for the PVAR Model

4.3. Basic Regression of PVAR Model

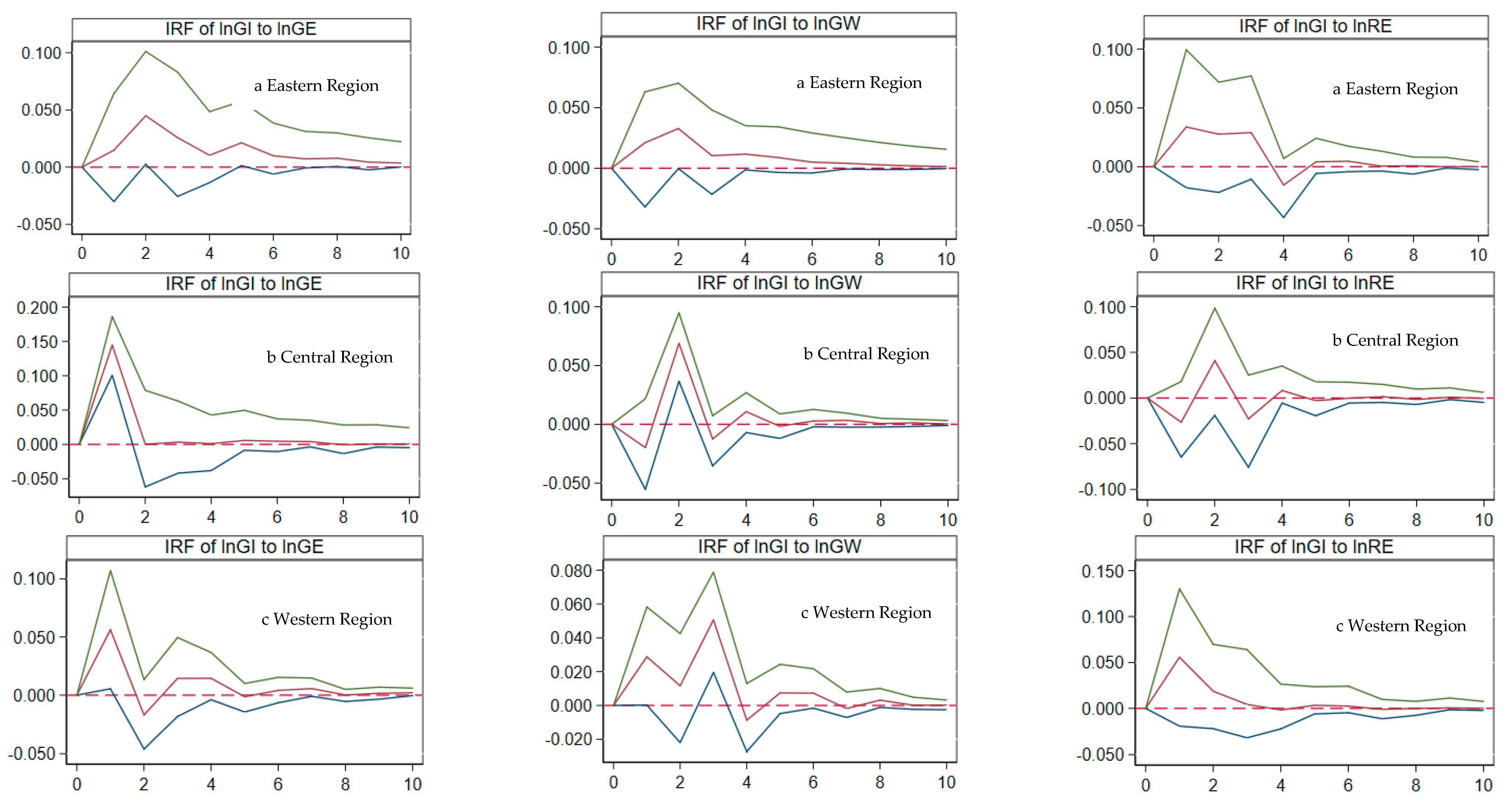

4.4. Research on the Dynamic Relationship between Green Investment and Green Ecology

4.5. Research on the Contribution of Green Investment and Green Ecology

5. Discussion

6. Conclusion and Policy Implications

6.1. Conclusions

6.2. Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Khan, Z.; Ali, S.; Umar, M.; Kirikkaleli, D.; Jiao, Z. Consumption-based carbon emissions and international trade in G7 countries: The role of environmental innovation and renewable energy. Sci. Total Environ. 2020, 730, 138945. [Google Scholar] [CrossRef] [PubMed]

- Gutberlet, J. Cooperative urban mining in Brazil: Collective practices in selective household waste collection and recycling. Waste Manag. 2015, 45, 22–31. [Google Scholar] [CrossRef] [PubMed]

- Khan, S.; Anjum, R.; Raza, S.T.; Ahmed Bazai, N.; Ihtisham, M. Technologies for municipal solid waste management: Current status, challenges, and future perspectives. Chemosphere 2022, 288, 132403. [Google Scholar] [CrossRef]

- Fuller, R.; Landrigan, P.J.; Balakrishnan, K.; Bathan, G.; Bose-O’Reilly, S.; Brauer, M.; Caravanos, J.; Chiles, T.; Cohen, A.; Corra, L.; et al. Pollution and health: A progress update. Lancet Planet. Health 2022, 6, e535–e547. [Google Scholar] [CrossRef] [PubMed]

- Landrigan, P.J.; Fuller, R.; Acosta, N.J.; Adeyi, O.; Arnold, R.; Baldé, A.B.; Bertollini, R.; Bose-O’Reilly, S.; Boufford, J.I.; Breysse, P.N. The Lancet Commission on pollution and health. Lancet 2018, 391, 462–512. [Google Scholar] [CrossRef]

- Ahmed, Z.; Cary, M.; Le, H.P. Accounting asymmetries in the long-run nexus between globalization and environmental sustainability in the United States: An aggregated and disaggregated investigation. Environ. Impact Assess. Rev. 2021, 86, 106511. [Google Scholar] [CrossRef]

- Ahmad, M.; Wu, Y. Combined role of green productivity growth, economic globalization, and eco-innovation in achieving ecological sustainability for OECD economies. J. Environ. Manag. 2022, 302, 113980. [Google Scholar] [CrossRef]

- Lin, Z. The connotation and strategic conception of green ecology in the new era. China Soft Sci. 2022, S1, 25–33. [Google Scholar]

- Wang, L.; Su, C.-W.; Ali, S.; Chang, H.-L. How China is fostering sustainable growth: The interplay of green investment and production-based emission. Environ. Sci. Pollut. Res. 2020, 27, 39607–39618. [Google Scholar] [CrossRef]

- Li, Z.-Z.; Li, R.Y.M.; Malik, M.Y.; Murshed, M.; Khan, Z.; Umar, M. Determinants of Carbon Emission in China: How Good is Green Investment? Sustain. Prod. Consum. 2021, 27, 392–401. [Google Scholar] [CrossRef]

- Ekeh, J.; Wara, S.; Orovwode, H. Management of Existing Capacity of Electric Power with Energy Saving Devices; Advanced Materials Research, Trans Tech Publ: Wollerau, Switzerland, 2007; pp. 117–124. [Google Scholar]

- Leung, C.K.Y.; Sarpça, S.; Yilmaz, K. Public housing units vs. housing vouchers: Accessibility, local public goods, and welfare. J. Hous. Econ. 2012, 21, 310–321. [Google Scholar] [CrossRef]

- Zhu, S.; He, C.; Liu, Y. Going green or going away: Environmental regulation, economic geography and firms’ strategies in China’s pollution-intensive industries. Geoforum 2014, 55, 53–65. [Google Scholar] [CrossRef]

- Sun, Y.; Song, Y.; Yang, C. The Impact of Environmental Regulations on the Quality of Economic Growth: Promote or Restrain?—From the Perspective of Total Factor Productivity. Contemp. Econ. Manag. 2019, 41, 11–17. [Google Scholar]

- Schillebeeckx, S.J.; Kautonen, T.; Hakala, H. To buy green or not to buy green: Do structural dependencies block ecological responsiveness? J. Manag. 2022, 48, 472–501. [Google Scholar] [CrossRef]

- Shen, Y.; Su, Z.-W.; Malik, M.Y.; Umar, M.; Khan, Z.; Khan, M. Does green investment, financial development and natural resources rent limit carbon emissions? A provincial panel analysis of China. Sci. Total Environ. 2021, 755, 142538. [Google Scholar] [CrossRef] [PubMed]

- Sun, Y.; Guan, W.; Razzaq, A.; Shahzad, M.; Binh An, N. Transition towards ecological sustainability through fiscal decentralization, renewable energy and green investment in OECD countries. Renew. Energy 2022, 190, 385–395. [Google Scholar] [CrossRef]

- Pang, Q.; Li, M.; Li, H. Research on spatial coupling coordinated development between financial agglomeration, regional innovation and ecological efficiency of Yangtze River Economic Belt. J. Ind. Technol. Econ. 2019, 38, 68–76. [Google Scholar]

- Labatt, S.; White, R.R. Environmental Finance: A Guide to Environmental Risk Assessment and Financial Products; John Wiley & Sons: Hoboken, NJ, USA, 2002; Volume 98. [Google Scholar]

- Wang, X.; Wang, S. The impact of green finance on inclusive economic growth—Empirical Analysis Based on Spatial Panel. Open J. Bus. Manag. 2020, 8, 2093. [Google Scholar] [CrossRef]

- Anderson, J.E. Financing urban development in China. Chin. Econ. 2009, 42, 48–62. [Google Scholar] [CrossRef]

- Henderson, J.V.; Wang, H.G. Urbanization and city growth: The role of institutions. Reg. Sci. Urban Econ. 2007, 37, 283–313. [Google Scholar] [CrossRef]

- Leiter, A.M.; Parolini, A.; Winner, H. Environmental regulation and investment: Evidence from European industry data. Ecol. Econ. 2011, 70, 759–770. [Google Scholar] [CrossRef]

- Testa, F.; Iraldo, F.; Frey, M. The effect of environmental regulation on firms’ competitive performance: The case of the building & construction sector in some EU regions. J. Environ. Manag. 2011, 92, 2136–2144. [Google Scholar]

- Alpay, E.; Kerkvliet, J.; Buccola, S. Productivity growth and environmental regulation in Mexican and US food manufacturing. Am. J. Agric. Econ. 2002, 84, 887–901. [Google Scholar] [CrossRef]

- Pimonenko, T.V.; Lieonov, S.V.; Ibragimov, Z. Green investing for SDGS: EU experience for developing countries. Econ. Soc. Dev. 2019, 2019, 867–876. [Google Scholar]

- Sun, H.; Wan, Y.; Zhang, L.; Zhou, Z. Evolutionary game of the green investment in a two-echelon supply chain under a government subsidy mechanism. J. Clean. Prod. 2019, 235, 1315–1326. [Google Scholar] [CrossRef]

- Gray, W.B.; Shadbegian, R. Environmental Regulation and Manufacturing Productivity at the Plant Level; National Bureau of Economic Research Cambridge: Cambridge, MA, USA, 1993. [Google Scholar]

- Holtz-Eakin, D.; Newey, W.; Rosen, H.S. Estimating vector autoregressions with panel data. Econom. J. Econom. Soc. 1988, 1371–1395. [Google Scholar] [CrossRef]

- Samuel, G.M. Ibsen: The Open Vision; JSTOR: London, UK, 1984. [Google Scholar]

- Canova, F.; Ciccarelli, M. Forecasting and turning point predictions in a Bayesian panel VAR model. J. Econom. 2004, 120, 327–359. [Google Scholar] [CrossRef]

- Love, I.; Zicchino, L. Financial development and dynamic investment behavior: Evidence from panel VAR. Q. Rev. Econ. Financ. 2006, 46, 190–210. [Google Scholar] [CrossRef]

- Di, W.; Haibo, K.; Xianyou, P. Research on the Effects of Environmental Investments on Regional Spatial Spillover Effects. Manag. Rev. 2018, 30, 49. [Google Scholar]

- Cheng, Y.; Wang, J.; Wang, Y.; Ren, J. A comparative research of the spatial-temporal evolution track and influence mechanism of green development in China. Geogr Res 2019, 38, 1–21. [Google Scholar]

- Peng, B.; Zhang, X.; Elahi, E.; Wan, A. Evolution of spatial–temporal characteristics and financial development as an influencing factor of green ecology. Environ. Dev. Sustain. 2022, 24, 789–809. [Google Scholar] [CrossRef]

- Fei, R.; Cui, A.; Qin, K. Can technology R&D continuously improve green development level in the open economy? Empirical evidence from China’s industrial sector. Environ. Sci. Pollut. Res. 2020, 27, 34052–34066. [Google Scholar]

- Huber, P.J. Projection pursuit. Ann. Stat. 1985, 13, 435–475. [Google Scholar] [CrossRef]

- Tang, Q.; Wang, J.; Jing, Z. Tempo-spatial changes of ecological vulnerability in resource-based urban based on genetic projection pursuit model. Ecol. Indic. 2021, 121, 107059. [Google Scholar] [CrossRef]

- Liu, H.; Peng, C.; Chen, L. The impact of OFDI on the energy efficiency in Chinese provinces: Based on PVAR model. Energy Rep. 2022, 8, 84–96. [Google Scholar] [CrossRef]

- Ren, S.; Hao, Y.; Wu, H. Government corruption, market segmentation and renewable energy technology innovation: Evidence from China. J. Environ. Manag. 2021, 300, 113686. [Google Scholar] [CrossRef]

- Su, X. Can Green Investment Win the Favor of Investors in China? Evidence from the Return Performance of Green Investment Stocks. Emerg. Mark. Financ. Trade 2021, 57, 3120–3138. [Google Scholar] [CrossRef]

- Guo, J.; Zhou, Y.; Ali, S.; Shahzad, U.; Cui, L. Exploring the role of green innovation and investment in energy for environmental quality: An empirical appraisal from provincial data of China. J. Environ. Manag. 2021, 292, 112779. [Google Scholar] [CrossRef]

- Lei, Z.; Dayong, Z. Relationship between Ecological Civilization and Balanced Population Development in China. Energy Procedia 2011, 5, 2532–2535. [Google Scholar] [CrossRef]

- Yu, Y.; Wu, W.; Zhang, T.; Liu, Y. Environmental catching-up, eco-innovation, and technological leadership in China’s pilot ecological civilization zones. Technol. Forecast. Soc. Chang. 2016, 112, 228–236. [Google Scholar] [CrossRef]

- Wei, Z.; Yuguo, J.; Jiaping, W. Greenization of Venture Capital and Green Innovation of Chinese Entity Industry. Ecol. Indic. 2015, 51, 31–41. [Google Scholar] [CrossRef]

- Chen, Y.; Ma, Y. Does green investment improve energy firm performance? Energy Policy 2021, 153, 112252. [Google Scholar] [CrossRef]

- Zahan, I.; Chuanmin, S. Towards a green economic policy framework in China: Role of green investment in fostering clean energy consumption and environmental sustainability. Environ. Sci. Pollut. Res. 2021, 28, 43618–43628. [Google Scholar] [CrossRef] [PubMed]

- Eyraud, L.; Clements, B.; Wane, A. Green investment: Trends and determinants. Energy Policy 2013, 60, 852–865. [Google Scholar] [CrossRef]

- Liao, X. Public appeal, environmental regulation and green investment: Evidence from China. Energy Policy 2018, 119, 554–562. [Google Scholar] [CrossRef]

- Gao, X.; Zheng, H. Environmental concerns, environmental policy and green investment. Int. J. Environ. Res. 2017, 14, 1570. [Google Scholar] [CrossRef]

- Ren, S.; Hao, Y.; Wu, H. How Does Green Investment Affect Environmental Pollution? Evidence from China. Environ. Resour. Econ. 2022, 81, 25–51. [Google Scholar] [CrossRef]

- Hanna, R.; Xu, Y.; Victor, D.G.J.N. After COVID-19, green investment must deliver jobs to get political traction. Nature 2020, 582, 178–180. [Google Scholar] [CrossRef]

- Huang, L.; Lei, Z. How environmental regulation affect corporate green investment: Evidence from China. J. Clean. Prod. 2021, 279, 123560. [Google Scholar] [CrossRef]

- Zhang, S.; Wu, Z.; Wang, Y.; Hao, Y. Fostering green development with green finance: An empirical study on the environmental effect of green credit policy in China. J. Environ. Manag. 2021, 296, 113159. [Google Scholar] [CrossRef] [PubMed]

- Geall, S.; Ely, A. Narratives and Pathways towards an Ecological Civilization in Contemporary China. China Q. 2018, 236, 1175–1196. [Google Scholar] [CrossRef]

| System Layer | Element Layer | Indicator Layer (Indicator Code) | Unit | Indicator Attributes | |

|---|---|---|---|---|---|

| Green ecology | Green growth | Economic Growth | GDP per capita (X1) | CNY | + |

| Per capita local fiscal revenue (X2) | CNY | + | |||

| Ecological Economy | Energy consumption per CNY 10,000 GDP (X3) | Tons of standard coal/CNY ten thousand | − | ||

| CNY 10,000 GDP SO2 emissions (X4) | kg/CNY ten thousand | − | |||

| Wastewater discharge per ten thousand CNY GDP (X5) | kg/CNY ten thousand | − | |||

| Output level | Primary industry labor productivity (X6) | CNY/person | + | ||

| Labor productivity in the secondary industry (X7) | CNY/person | + | |||

| Tertiary industry labor productivity (X8) | CNY/person | + | |||

| Proportion of the added value of the tertiary industry (X9) | % | + | |||

| Green welfare | Standard of living | Per capita disposable income of urban residents (X10) | CNY | + | |

| Net income of rural residents (X11) | CNY | + | |||

| Housing area per capita (X12) | m2 | + | |||

| Public Service | Park green area per capita (X13) | m2/person | + | ||

| Green coverage rate in built-up area (X14) | % | + | |||

| Harmless treatment rate of municipal solid waste (X15) | % | + | |||

| Comprehensive utilization rate of industrial solid waste (X16) | % | + | |||

| Resources and Environment | Resource consumption | Per capita domestic water consumption (X17) | L/person | − | |

| Energy consumption per capita (X18) | kg standard coal/person | − | |||

| Environmental pressure | SO2 emissions per unit land area (X19) | t/km2 | − | ||

| Wastewater discharge per unit land area (X20) | t/km2 | − | |||

| Ecological quality | Forest cover rate (X21) | % | + | ||

| The ratio of the area occupied by nature reserves (X22) | % | + | |||

| Green investment | Environmental pollution control investment | Industrial pollution control investment (Y1) | CNY ten thousand | + | |

| Urban environmental infrastructure construction investment (Y2) | + | ||||

| “Three Simultaneities” project environmental protection engineering investment (Y3) | + | ||||

| Water conservancy construction investment | Investment in water conservancy construction (Y4) | + | |||

| Forestry investment | Forestry investment (Y5) | + | |||

| Variable | All Regions | Eastern Region | Central Region | Western Region | ||||

|---|---|---|---|---|---|---|---|---|

| LLC | IPS | LLC | IPS | LLC | IPS | LLC | IPS | |

| ln(GE) | −11.341 *** | −4.786 *** | −7.174 *** | −3.369 *** | −5.231 *** | 0.209 | −8.466 *** | −4.395 *** |

| (0.000) | (0.000) | (0.000) | (0.0004) | (0.000) | (0.583) | (0.000) | (0.000) | |

| ln(GW) | −14.446 *** | −3.904 *** | −8.143 *** | −0.786 | −5.290 *** | −3.662 *** | −11.279 *** | −2.889 *** |

| (0.000) | (0.000) | (0.000) | (0.216) | (0.000) | (0.000) | (0.000) | (0.002) | |

| ln(RE) | −16.150 *** | 0.228 | −15.942 *** | 0.4778 | −1.970 ** | 0.913 | −1.952 ** | −0.818 |

| (0.000) | (0.590) | (0.000) | (0.684) | (0.024) | (0.819) | (0.026) | (0.207) | |

| ln(GI) | −7.178 *** | −1.723 ** | −3.100 *** | −0.337 | −2.366 *** | 0.025 | −6.374 *** | −2.497 *** |

| (0.000) | (0.042) | (0.000) | (0.368) | (0.009) | (0.510) | (0.000) | (0.006) | |

| dln(GE) | −8.032 *** | −6.237 *** | −6.414 *** | −4.121 *** | −3.752 *** | −3.885 *** | −4.041 *** | −2.951 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.001) | |

| dln(GW) | −11.674 *** | −7.935 *** | −5.548 *** | −5.251 *** | −7.130 *** | −4.225 *** | −7.460 *** | −4.276 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| dln(RE) | −26.086 *** | −9.312 *** | −25.456 *** | −6.283 *** | −4.181 *** | −4.335 *** | −3.909 *** | −5.347 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| dln(GI) | −9.652 *** | −10.180 *** | −6.626 *** | −6.636 *** | −4.706 *** | −4.551 *** | −5.352 *** | −6.237 *** |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | |

| Testing Method | Statistic Name | Statistics | p Value |

|---|---|---|---|

| Kao | Dickey–Fuller t | −2.330 *** | 0.0099 |

| westerlund | Variance ratio | −2.875 *** | 0.0020 |

| Pedroni | Modified Phillips-Perron t | 2.549 *** | 0.0054 |

| Phillips-Perron t | −7.261 *** | 0.0000 | |

| Augmented Dickey–Fuller t | −7.369 *** | 0.0000 |

| Hysteresis Order | All Regions | Eastern Region | Central Region | Western Region | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AIC | BIC | HQIC | AIC | BIC | HQIC | AIC | BIC | HQIC | AIC | BIC | HQIC | |

| 1 | −8.49 | −7.02 | −7.90 | −10.52 | −9.19 * | −9.98 | −12.29 | −11.03 * | −11.79 | −6.69 | −5.38 | −6.16 |

| 2 | −8.97 | −7.22 | −8.27 | −10.76 * | −9.02 | −10.05 * | −12.68 | −10.83 | −11.95 | −7.02 | −5.27 | −6.31 |

| 3 | −9.42 | −7.35 * | −8.59 * | −10.43 | −8.23 | −9.53 | −13.13 * | −10.62 | −12.15 * | −7.64 | −5.38 * | −6.73 * |

| 4 | −9.46 * | −7.01 | −8.47 | −10.17 | −7.44 | −9.06 | 11.11 | 14.36 | 12.36 | −7.84 * | −5.01 | −6.70 |

| Variable | All Regions | Eastern Region | Central Region | Western Region | ||||

|---|---|---|---|---|---|---|---|---|

| h_lnGE | h_lnGW | h_lnGE | h_lnGW | h_lnGE | h_lnGW | h_lnGE | h_lnGW | |

| L.h_lnGE | 0.063 | 0.092 | 0.040 | 0.211 | −0.319 | 0.439 | 0.080 | 0.022 |

| (0.378) | (0.570) | (0.789) | (0.113) | (0.201) | (0.171) | (0.336) | (0.933) | |

| L.h_lnGW | −0.004 | 0.003 | 0.094 | 0.063 | 0.047 | 0.142 | −0.021 | −0.038 |

| (0.891) | (0.964) | (0.124) | (0.562) | (0.418) | (0.287) | (0.531) | (0.649) | |

| L.h_lnRE | 0.022 | 0.052 | −0.179 | −0.129 | −0.014 | 0.197 | 0.050 | 0.090 |

| (0.665) | (0.492) | (0.280) | (0.431) | (0.889) | (0.246) | (0.271) | (0.343) | |

| L.h_lnGI | 0.002 | −0.011 | 0.006 | 0.015 | 0.010 | 0.023 * | −0.008 | −0.045 |

| (0.769) | (0.417) | (0.550) | (0.107) | (0.248) | (0.065) | (0.469) | (0.145) | |

| L2.h_lnGE | 0.099 | 0.179 | 0.149 ** | 0.244 ** | −0.143 | 0.178 | 0.0488 | 0.221 |

| (0.131) | (0.212) | (0.035) | (0.028) | (0.469) | (0.484) | (0.636) | (0.362) | |

| L2.h_lnGW | 0.013 | 0.044 | 0.052 | 0.008 | 0.057 | 0.203 ** | 0.013 | −0.003 |

| (0.583) | (0.564) | (0.485) | (0.949) | (0.225) | (0.033) | (0.668) | (0.974) | |

| L2.h_lnRE | −0.029 | −0.074 | −0.027 | 0.052 | −0.156 | 0.067 | −0.007 | −0.081 |

| (0.385) | (0.343) | (0.752) | (0.670) | (0.263) | (0.673) | (0.874) | (0.337) | |

| L2.h_lnGI | 0.007 | 0.020 | −0.001 | 0.027 *** | 0.006 | −0.003 | 0.012 | 0.019 |

| (0.157) | (0.131) | (0.979) | (0.014) | (0.496) | (0.767) | (0.219) | (0.548) | |

| L3.h_lnGE | 0.273 *** | 0.133 | 0.197 ** | 0.209 * | 0.059 | 0.266 | 0.301 *** | 0.102 |

| (0.000) | (0.329) | (0.022) | (0.099) | (0.639) | (0.142) | (0.000) | (0.590) | |

| L3.h_lnGW | 0.002 | 0.104 *** | 0.007 | −0.005 | 0.002 | 0.032 | −0.004 | 0.106 |

| (0.895) | (0.000) | (0.838) | (0.926) | (0.924) | (0.458) | (0.853) | (0.041) | |

| L3.h_lnRE | −0.028 | −0.017 | 0.010 | 0.059 | −0.208 * | −0.252 * | −0.028 | −0.003 |

| (0.454) | (0.776) | (0.924) | (0.630) | (0.057) | (0.062) | (0.569) | (0.971) | |

| L3.h_lnGI | 0.003 | −0.003 | −0.007 | 0.005 | 0.004 | 0.006 | 0.016 | −0.014 |

| (0.499) | (0.756) | (0.191) | (0.485) | (0.599) | (0.514) | (0.157) | (0.587) | |

| Variable | All Regions | Eastern Region | Central Region | Western Region | ||||

|---|---|---|---|---|---|---|---|---|

| h_lnRE | h_lnGI | h_lnRE | h_lnGI | h_lnRE | h_lnGI | h_lnRE | h_lnGI | |

| L.h_lnGE | 0.010 | 1.075 | 0.128 * | 0.643 | 0.323 | 9.603 *** | −0.068 | 1.162 |

| (0.943) | (0.153) | (0.058) | (0.556) | (0.349) | (0.001) | (0.791) | (0.265) | |

| L.h_lnGW | 0.034 | 0.157 | −0.001 | −0.412 | 0.047 | −1.902 * | 0.027 | 0.299 |

| (0.113) | (0.156) | (0.994) | (0.556) | (0.660) | (0.087) | (0.392) | (0.261) | |

| L.h_lnRE | −0.115 | 0.408 | −0.189 * | 0.812 | −0.105 | −0.917 | −0.083 | 0.542 |

| (0.238) | (0.478) | (0.090) | (0.650) | (0.253) | (0.504) | (0.470) | (0.409) | |

| L.h_lnGI | −0.007 | −0.311 *** | −0.002 | −0.329 *** | 0.002 | 0.061 | −0.007 | −0.310 *** |

| (0.299) | (0.000) | (0.775) | (0.003) | (0.884) | (0.495) | (0.676) | (0.003) | |

| L2.h_lnGE | 0.045 | 0.362 | 0.128 * | 1.702 ** | 0.299 | 1.614 | 0.006 | −0.215 |

| (0.430) | (0.454) | (0.077) | (0.036) | (0.199) | (0.554) | (0.960) | (0.676) | |

| L2.h_lnGW | 0.007 | 0.224 | −0.021 | −0.142 | −0.071 | 2.210 *** | 0.002 | 0.230 |

| (0.780) | (0.305) | (0.655) | (0.821) | (0.143) | (0.000) | (0.952) | (0.429) | |

| L2.h_lnRE | −0.307 * | 0.500 | −0.220 * | 1.296 | 0.076 | 0.878 | −0.326 | 0.357 |

| (0.074) | (0.184) | (0.054) | (0.318) | (0.534) | (0.650) | (0.123) | (0.335) | |

| L2.h_lnGI | −0.001 | −0.018 | 0.005 | 0.018 | 0.008 | −0.133 | −0.014 | 0.005 |

| (0.876) | (0.773) | (0.440) | (0.850) | (0.325) | (0.134) | (0.425) | (0.964) | |

| L3.h_lnGE | 0.204 | 0.035 | 0.087 | 1.072 | 0.002 | 0.647 | 0.338 | −0.205 |

| (0.133) | (0.937) | (0.245) | (0.291) | (0.990) | (0.664) | (0.125) | (0.724) | |

| L3.h_lnGW | −0.026 | 0.382 * | −0.016 | −0.332 | 0.015 | −0.824 *** | −0.042 | 0.699 *** |

| (0.127) | (0.054) | (0.539) | (0.350) | (0.661) | (0.005) | (0.163) | (0.004) | |

| L3.h_lnRE | −0.018 | 0.307 | −0.046 | 2.056 * | 0.008 | −1.024 | −0.003 | 0.238 |

| (0.800) | (0.456) | (0.493) | (0.066) | (0.931) | (0.572) | (0.978) | (0.610) | |

| L3.h_lnGI | 0.001 | 0.004 | 0.009 ** | 0.068 | 0.008 | −0.215 ** | −0.018 * | −0.017 |

| (0.987) | (0.944) | (0.011) | (0.347) | (0.439) | (0.021) | (0.097) | (0.845) | |

| Variable | Forecast Period | All Regions | Eastern Region | Central Region | Western Region | ||||

|---|---|---|---|---|---|---|---|---|---|

| lnGE | lnGW | lnGE | lnGW | lnGE | lnGW | lnGE | lnGW | ||

| lnGE | 1 | 1.000 | 0.000 | 1.000 | 0.000 | 1.000 | 0.000 | 1.000 | 0.000 |

| lnGW | 1 | 0.021 | 0.979 | 0.019 | 0.981 | 0.014 | 0.986 | 0.023 | 0.977 |

| lnRE | 1 | 0.001 | 0.010 | 0.000 | 0.005 | 0.019 | 0.128 | 0.004 | 0.006 |

| lnGI | 1 | 0.000 | 0.030 | 0.000 | 0.020 | 0.001 | 0.005 | 0.000 | 0.045 |

| lnGE | 10 | 0.518 | 0.039 | 0.548 | 0.023 | 0.483 | 0.024 | 0.485 | 0.062 |

| lnGW | 10 | 0.437 | 0.132 | 0.467 | 0.077 | 0.398 | 0.105 | 0.410 | 0.192 |

| lnRE | 10 | 0.453 | 0.050 | 0.500 | 0.028 | 0.400 | 0.059 | 0.415 | 0.072 |

| lnGI | 10 | 0.507 | 0.052 | 0.517 | 0.030 | 0.444 | 0.034 | 0.506 | 0.079 |

| lnGE | 15 | 0.394 | 0.031 | 0.419 | 0.018 | 0.367 | 0.017 | 0.366 | 0.051 |

| lnGW | 15 | 0.365 | 0.062 | 0.386 | 0.035 | 0.335 | 0.043 | 0.343 | 0.096 |

| lnRE | 15 | 0.376 | 0.035 | 0.401 | 0.019 | 0.341 | 0.028 | 0.352 | 0.056 |

| lnGI | 15 | 0.425 | 0.037 | 0.444 | 0.021 | 0.385 | 0.023 | 0.406 | 0.059 |

| lnGE | 20 | 0.322 | 0.026 | 0.345 | 0.015 | 0.304 | 0.013 | 0.295 | 0.044 |

| lnGW | 20 | 0.307 | 0.040 | 0.328 | 0.023 | 0.288 | 0.025 | 0.285 | 0.064 |

| lnRE | 20 | 0.313 | 0.028 | 0.335 | 0.016 | 0.292 | 0.018 | 0.290 | 0.046 |

| lnGI | 20 | 0.343 | 0.029 | 0.364 | 0.016 | 0.318 | 0.016 | 0.320 | 0.048 |

| Variable | Forecast Period | All Regions | Eastern Region | Central Region | Western Region | ||||

|---|---|---|---|---|---|---|---|---|---|

| lnRE | lnGI | lnRE | lnGI | lnRE | lnGI | lnRE | lnGI | ||

| lnGE | 1 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| lnGW | 1 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 | 0.000 |

| lnRE | 1 | 0.989 | 0.000 | 0.994 | 0.000 | 0.853 | 0.000 | 0.990 | 0.000 |

| lnGI | 1 | 0.001 | 0.969 | 0.019 | 0.961 | 0.002 | 0.993 | 0.001 | 0.954 |

| lnGE | 10 | 0.111 | 0.332 | 0.064 | 0.365 | 0.082 | 0.411 | 0.190 | 0.263 |

| lnGW | 10 | 0.074 | 0.357 | 0.051 | 0.405 | 0.056 | 0.441 | 0.122 | 0.277 |

| lnRE | 10 | 0.149 | 0.348 | 0.068 | 0.405 | 0.108 | 0.432 | 0.251 | 0.262 |

| lnGI | 10 | 0.052 | 0.389 | 0.035 | 0.417 | 0.039 | 0.483 | 0.092 | 0.322 |

| lnGE | 15 | 0.135 | 0.440 | 0.079 | 0.484 | 0.096 | 0.520 | 0.233 | 0.351 |

| lnGW | 15 | 0.114 | 0.460 | 0.072 | 0.507 | 0.081 | 0.541 | 0.195 | 0.366 |

| lnRE | 15 | 0.133 | 0.455 | 0.076 | 0.504 | 0.094 | 0.536 | 0.231 | 0.361 |

| lnGI | 15 | 0.106 | 0.433 | 0.065 | 0.470 | 0.077 | 0.516 | 0.185 | 0.350 |

| lnGE | 20 | 0.154 | 0.498 | 0.091 | 0.549 | 0.107 | 0.575 | 0.265 | 0.396 |

| lnGW | 20 | 0.141 | 0.511 | 0.086 | 0.563 | 0.099 | 0.589 | 0.243 | 0.407 |

| lnRE | 20 | 0.150 | 0.508 | 0.088 | 0.561 | 0.104 | 0.585 | 0.260 | 0.404 |

| lnGI | 20 | 0.137 | 0.490 | 0.082 | 0.537 | 0.097 | 0.569 | 0.238 | 0.393 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xiao, Y.; Yan, W.; Peng, B. Explore the Complex Interaction between Green Investment and Green Ecology: Evaluation from Spatial Econometric Models and China’s Provincial Panel Data. Sustainability 2023, 15, 9313. https://doi.org/10.3390/su15129313

Xiao Y, Yan W, Peng B. Explore the Complex Interaction between Green Investment and Green Ecology: Evaluation from Spatial Econometric Models and China’s Provincial Panel Data. Sustainability. 2023; 15(12):9313. https://doi.org/10.3390/su15129313

Chicago/Turabian StyleXiao, Yao, Weimin Yan, and Benhong Peng. 2023. "Explore the Complex Interaction between Green Investment and Green Ecology: Evaluation from Spatial Econometric Models and China’s Provincial Panel Data" Sustainability 15, no. 12: 9313. https://doi.org/10.3390/su15129313

APA StyleXiao, Y., Yan, W., & Peng, B. (2023). Explore the Complex Interaction between Green Investment and Green Ecology: Evaluation from Spatial Econometric Models and China’s Provincial Panel Data. Sustainability, 15(12), 9313. https://doi.org/10.3390/su15129313