Abstract

Embracing corporate sustainability has emerged as a crucial strategy for companies to bolster their competitive edge and reputation. This research delves into the connection between environmental, social, and governance practices (ESG) and the cost of debt, as well as the moderating role of financial distress within this connection. By analyzing data from Saudi-listed firms between 2013 and 2021, we discovered that ESG practices have a notable negative impact on borrowing costs. This implies that organizations with increased transparency in their ESG disclosure gain access to external financial resources under more favorable terms. Additionally, we observed that the effect of ESG on the cost of debt is significantly and negatively moderated by the financial distress encountered by a firm. To bolster the credibility of these findings, dynamic generalized method of moments (GMM) models were utilized to address any potential endogeneity concerns, thereby enhancing the strength and resilience of the outcomes. The findings of this paper hold substantial value for investors, lenders, corporate management, and policymakers when considering the implementation and significance of a company’s ESG practices.

1. Introduction

As the world’s focus shifts toward a more sustainable future, the spotlight on corporate responsibility intensifies, and companies now face heightened expectations from stakeholders, who are demanding more conscientious business practices that minimize societal and environmental impacts. A crucial aspect of this movement is the call for comprehensive disclosure policies that shed light on organizations’ sustainability efforts [1,2,3].

Various studies emphasize the interconnected nature of global economies, bound together through trade and investments, making disclosure a vital aspect for policymakers around the world [4,5,6,7]. However, traditional financial disclosure falls short in satisfying the information appetites of stakeholders, investors, and policymakers alike. The answer lies in the rise of nonfinancial disclosures [4,8,9]. This encompasses a variety of reporting formats, such as environmental, social, sustainability, and integrated reports, which are gaining traction for their comprehensive approach. Vitolla and Raimo [10] note that nonfinancial disclosure not only broadens the scope of information shared by companies but also increases the audience for whom the information is relevant.

Going deeper, nonfinancial disclosure covers a range of topics that go beyond the reach of financial disclosure. These include greenhouse gas emissions, waste handling, environmental pollution, labor practices, gender-related issues, corporate governance, and human rights considerations, offering a more holistic picture of a company’s impact and efforts in the realm of sustainability. Furthermore, nonfinancial disclosure caters to a diverse audience that includes suppliers, customers, employees, investors, lenders, and governments [11]. This broader scope transforms nonfinancial disclosure into a versatile instrument adept at fulfilling the information requirements of stakeholders and investors alike. In particular, the value of nonfinancial disclosure extends beyond mere information sharing. It yields tangible financial advantages, including the potential for enhanced access to funding opportunities [10].

In light of this, numerous studies have delved into the connection between nonfinancial disclosure and the cost of equity [12,13,14,15,16]. However, the influence of disclosure pertaining to non-financial aspects on the cost of debt has received relatively less attention [4]. This study aims not only to address this gap concerning the ESG and cost of debt in an emerging market such as Saudi Arabia but also to consider a moderating factor in this relationship, such as financial distress.

ESG disclosure holds significant weight. It serves as a crucial gauge for assessing management quality for a multitude of investors [17]. In fact, the incorporation of environmental, social, and governance aspects empowers stakeholders to evaluate a company’s transparency, opportunities, and risks, as well as present and prospective performance [15]. Recognizing the power of such non-financial information disclosure and the growing interest creditors have in it [3], it is reasonable to anticipate that enhanced levels of ESG disclosure might also assist firms in achieving reductions in their cost of debt. Moreover, such an adverse correlation between ESG and the expense of debt can be moderated by financial distress. In fact, financially distressed firms may struggle to produce top-notch ESG disclosures due to limited capital and expertise. Often, they lack access to strategies and resort to low-cost approaches. According to the conservation of resources and slack resources theories, the management of such firms may act irrationally due to the apprehension about resource depletion hindering their drive for higher performance [18,19]. This mindset can deter firms from delivering high-quality ESG reporting, resulting in a higher cost of debt compared to their non-financially distressed peers.

Drawing upon a sample of 38 enterprises featured on the Saudi stock exchange from 2013 to 2021, the findings reveal a robust negative association between a company’s ESG rating and its cost of debt. These results lend credence to agency theory, which states that ESG practices reduce asymmetry information, and stakeholder theory, which posits that organizations stand to benefit from cultivating a strong reputation by improving their ESG ratings. In doing so, they can reduce the concealment of unfavorable information, leading to lower borrowing costs. Moreover, the empirical evidence suggests that financial distress may further diminish the positive influence of ESG disclosures on reducing debt-related costs, emphasizing the importance of maintaining a healthy financial position alongside robust ESG practices.

This study offers a substantial contribution to the existing body of knowledge on ESG, the cost of debt, and financial distress. Firstly, it delves deeper into the overall ESG performance and scrutinizes its influence on the cost of debt. By enhancing the current data with outcomes from our empirical investigation, our study introduces a fresh viewpoint to the credit market landscape. Secondly, it broadens the scope of ESG practices by examining their effects in the burgeoning Saudi market. Our analysis sheds light on the economic ramifications of ESG, emphasizing its beneficial impact on lowering debt expenses within the unique context of the Saudi capital market, which varies greatly from other markets in aspects such as regulations, language, culture, currency, and market systems. The insights gleaned from our research offer a comprehensive and generalizable understanding of ESG’s favorable impact on the Saudi capital markets. Furthermore, this study accentuates the critical role of financial distress in ESG operations by illustrating how financially troubled firms weaken the positive effect of ESG on lowering the cost of debt in the Saudi capital market. This underlines the importance of considering financial distress when devising ESG strategies and investments. As a consequence, companies looking to implement ESG initiatives should first tackle their financial distress before advancing.

The rest of this paper is structured as follows: Section 2 offers an in-depth review of pertinent theories and literature, and outlines the study’s hypotheses. Section 3 delves into the research methodology, encompassing elements such as sample size, data gathering, measurements, and the models employed. Section 4 presents and examines the study’s findings, which include descriptive statistics, Pearson’s correlation, regression outcomes, and supplementary and robustness analyses. Lastly, in Section 5, we recap the paper’s discoveries, discuss the practical and theoretical implications, address its limitations, and propose avenues for future research.

2. Theatrical Framework on ESG Practices

2.1. Agency Theory

Under the lens of agency theory [20], lenders, classified as principals, provide financial resources to a business, the agent, with the expectation of a return on their capital along with risk-corresponding interest. Inherent to this theory is the supposition that agents possess an information advantage, resulting in an asymmetry of information between the two parties.

Lenders, concerned with the prompt return of their capital and the attainment of a risk-appropriate interest, tailor their lending decisions and terms based on their evaluation of financial difficulty within the firm. This evaluation encompasses anticipated future cash flows, prospective performance, and the firm’s capacity to meet its financial commitments [21,22].

Despite being external stakeholders, creditors face considerable information asymmetry due to limited access to the firm’s private data. As a result, they rely on publicly available information to estimate potential financial distress [23]. When pertinent information is absent or difficult to access, raising the prospect of unethical behavior or increasing agency costs, investors may necessitate additional safeguards or a higher interest rate [24,25]. This situation is especially relevant to public bond investors, who, unlike private lenders such as banks and insurance companies, often have to pay high fees to assess the risk of borrower default. These costs could be attributed to factors such as the inability to access non-public information, the challenge of crafting customized debt obligations, or the inefficiency in scrutinizing potentially problematic firms [12,26,27,28].

From an agency theory standpoint, it is thus recommended that companies furnish comprehensive and enlightening disclosures [29] to lessen the information gap between creditors and management, lower agency costs, augment transparency, and avoid undesirable selection [30,31].

Voluntary disclosures and transparency in reporting can serve as a binding instrument that mitigates the monitoring costs of creditors, reduces the risk of conflicts of interest, and potentially discourages management from engaging in actions detrimental to creditors. Through these voluntary disclosures, management can demonstrate a commitment to transparency and ameliorate information asymmetry [32,33]. As Gong et al. [22] posited, bondholders place a higher value on the signaling effect of voluntary disclosures, such as ESG disclosures, compared to mandatory ones. Given the positive correlation between corporate disclosure and a business’s financial and non-financial performance, as well as management’s optimism about future opportunities [34,35], these voluntary disclosures could signify the potential profitability of the investment opportunity to debtholders.

Stakeholder Theory

According to Freeman [36] (p. 46), stakeholders encompass “any group or individual who can affect or is influenced by the attainment of an organization’s objectives”. The stakeholder theory advocates that corporations are accountable to all of their stakeholders, which comprise primary stakeholders such as customers and employees, as well as secondary stakeholders including creditors, local authorities, suppliers, social communities, subcontractors, and non-governmental organizations. Given this, it becomes vital for an organization to adeptly manage these stakeholders, who bear differing forms and origins of legitimacy.

The stakeholder theory further postulates that corporate disclosure serves as an instrument for management to disseminate information to its various stakeholders—shareholders, debtholders, public authorities, employees, and non-governmental organizations. Deegan [37] and Cho and Patten [38] contend that corporations strive to earn legitimacy from their stakeholders by releasing information linked to environmental, social, and governance aspects. Within this framework, the disclosure of corporate social responsibility (CSR) emerges as a means to manage or react to the diverse stakeholders’ demands, primarily those perceived as prominent or influential. The fundamental aim of any organization, as emphasized by Islam & Deegan [39] and Elijido-Ten et al. [40], is to prove that it delivers on the promises made to its stakeholders.

2.2. The Conservation of Resources Framework (COR)

The theory suggests that humans are primarily driven by a desire to cultivate, safeguard, and nurture their resources in order to preserve their sense of self and maintain crucial social connections [41]. At the heart of COR theory is the notion that resource depletion holds greater significance than resource accumulation [18]. This concept helps explain why not all firms are eager to optimize their ESG reporting, as doing so could potentially deplete their wealth. Particularly, if the resources needed to implement ESG practices are concentrated in a single or a few instances and are of a relatively insignificant amount, the likelihood of firms resisting such reporting increases, despite the potential long-term benefits it may offer. Moreover, the conservation of resources theory emphasizes that the perceived imbalance between resource depletion and resource acquisition is intensified when an individual is already resource constrained. This notion mirrors the circumstances of financially troubled firms, which typically experience restricted availability of resources. As a result, both stakeholders and management are thought to adopt a protective stance, striving to conserve the company’s resources while sometimes acting defensively, assertively, and irrationally [18].

The slack resources theory posits that a company’s ability to perform its activities stems from its ownership of dedicated resources. These resources facilitate the company’s successful adaptation to internal or external pressures for adjustment or change [42]. Slack, referring to available or free resources such as financial and organizational resources, plays a crucial role in enabling the company to achieve its specific goals [43,44].

Waddock and Graves [19] propose that as a company’s financial performance improves, it gains access to slack resources that can be utilized for corporate social performance, including activities related to community and society relations, environmental performance, and employee relations. These ESG initiatives aim to give the company a competitive edge over its rivals by building its image, market segmentation, reputation, and long-term cost savings [45,46,47].

According to slack resources theorists, firms that exhibit superior financial performance are more likely to possess resources that can be allocated towards corporate social responsibility initiatives. Given the necessity of financial and other resources for enhancing corporate social performance, a correlation between the two is anticipated. Consequently, improved corporate financial performance is expected to correspond with enhanced ESG [19]. In essence, while all firms may aspire to achieve excellence in CSR, only those with adequate resources will be able to achieve high levels of performance in this realm [48]. McGuire et al. [49] state that corporate social responsibility falls within the realm of managerial discretion, implying that the extent of corporate social performance is contingent upon the availability of resources. In line with the slack resources theory, financially successful firms are more likely to engage in socially responsible practices compared to those with weaker financial performance.

2.3. Existing Literature and Study Hypotheses

ESG as an Alleviator of Debt Expenses

Recently, significant research attention has been devoted to ESG issues. For instance, many studies have focused on the benefits of ESG for shareholders. Friede et al. [50] conducted a meta-analysis of over 2000 empirical studies and found a positive relationship between ESG activities and financial performance. Velte [51] and Bruna et al. [52] demonstrated that ESG performance increases both return on assets (ROA) and Tobin’s Q. Brooks and Oikonomou [53] and Bruna et al. [54] indicated that companies engaged in ESG practices tend to generate higher market value and financial performance.

Other studies have examined the implications of ESG investments for creditors and investors, specifically regarding the reduction of information asymmetry. Guidara et al. [25], Eliwa et al. [3], and Gerwanski [55] have contributed to the discussion of the relationship between information disclosure and the cost of capital in the field of corporate finance and accounting. Previous research provides two key reasons to anticipate an inverse connection between transparency and debt expenses. First, disclosure helps reduce information asymmetry between corporations and lenders, enabling lenders to more accurately evaluate borrower default risk. Disclosure is also beneficial to lenders as it facilitates their estimation of borrowers’ default risk. In this context, agency theory suggests that enhanced transparency through ESG disclosure has the potential to improve a company’s financial condition and reduce borrowing costs by reducing information asymmetries and agency costs [56,57].

According to stakeholder theory, financial institutions have the potential to mitigate reputational and default risks faced by borrowing firms by incorporating ESG information into their lending assessments [58,59]. Consequently, integrating ESG factors into lending decisions can reduce the cost of debt for these firms.

Previous studies have examined how disclosure affects firms’ risk profiles in the choice of granting loans. As noted by Sengupta [60], underwriters and debtholders consider the disclosure practices implemented by a company when assessing its default risk. Specifically, a strategy of providing timely and comprehensive disclosures can reduce the perception of default risk associated with the company, thus lowering its debt cost. This is because lenders take into account the possibility that the firm may be attempting to conceal data that could negatively impact its value when assessing default risk. Furthermore, both individual investors and financial institutions rely on all available information to assess the possibility of companies defaulting [60].

The importance of nonfinancial information in assessing default risk has become increasingly evident to creditors. Thus, ESG strategy has become a critical tool in evaluating the creditworthiness and risks associated with borrowers. Financial markets have begun to incorporate ESG factors into lending decisions, with debtholders showing particular concern regarding the reputational implications they face. Supporting companies with poor or negative ESG activities could harm the lender’s reputation, as they may be seen as endorsing firms that do not meet ESG criteria [61,62,63,64,65,66].

Empirically, previous studies have found that firms disclosing environmental, social, and governance practices benefit from a lower cost of debt [3,4,57,67,68,69,70,71].

Considering the aforementioned, we propose the theory stated below:

H1.

ESG disclosure is inversely related to the cost of debt.

2.4. Financial Distress and the ESG Disclosure–Cost of Debt Relationship

According to the conservation of resources theory, financially distressed firms face a lack of resources, and their primary focus shifts towards resource preservation and survival. The management of such firms may act irrationally due to the fear of losing resources, hindering their drive for higher performance [18]. In such circumstances, firms may face constraints in allocating resources to various activities, including ESG initiatives.

Furthermore, the slack resource theory states that financially performing companies are more likely to engage in socially responsible practices, while companies facing financial constraints may lack the resources to invest in ESG activities [19]. Campbell [72] suggests that companies are less likely to engage in ESG activities during financially vulnerable or economically challenging periods, and Chan et al. [73] argue that in situations where financial constraints are significant, companies prioritize survival over ESG activities, resulting in reduced ESG investments. Hong et al. [74] have shown through modeling that financial constraints are crucial determinants of ESG investments, regardless of whether the motivation for ESG investments is profit seeking, social responsibility, or agency problems. Various empirical analyses, including Harymawan et al. [75], Leong & Yang [76], Antunes et al. [77], and Al-Hadi et al. [78], have used various financial constraint variables and found that financially troubled companies may exhibit poorer ESG reporting standards than firms not in financial distress.

Considering stakeholder theory, the reduction in ESG activities in financially distressed firms carries the risk of damaging their reputation and being perceived as higher in risk and uncertainty by lenders and investors. Consequently, these firms may face an increase in the cost of debt [79]. To illustrate, Boubaker et al. [80] contend that CSR is associated with reduced risks of financial distress and defaults, creating a more favorable corporate environment and improving the financial stability of firms. Guillamon-Saorin et al. [81] examined the correlation between operational inefficiency and CSR, focusing on a subset of American firms from 2004 to 2015. Their findings suggest that engaging in CSR initiatives brings various benefits to firms, including reputation enhancement, protection similar to insurance, improvement in shareholder wealth, enhanced risk management, increased customer-driven market demand, greater transparency in reporting and disclosure, and improved access to financial markets under favorable circumstances.

Overall, in financially constrained firms, the effectiveness of ESG initiatives in mitigating the cost of debt may be limited compared to their non-constrained counterparts. Considering the aforementioned, we propose the theory stated below:

H2.

The ESG–cost of debt association is mitigated by financial distress.

3. Methodology

3.1. Data and Sample

We aimed to investigate the connection between ESG disclosure and the cost of debt in Saudi Arabian companies listed on the Tadawul exchange. To achieve this goal, we thoroughly examined a range of businesses listed on the Tasi index between 2013 and 2021. We selected this specific time period with great care because comprehensive ESG data on Saudi Arabian-based enterprises had been readily accessible since it was incorporated into the Bloomberg database in 2013. By concluding the investigation in 2021, we were able to obtain the most precise results and comprehensively assess any potential impacts of ESG disclosure on earnings management. Our study analyzed a considerable body of data, consisting of 309 company-year observations obtained from 37 organizations, providing a sizable sample size for examination.

3.2. Measurement of Dependent Variable

The cost of borrowing money is a component of the overall cost associated with a firm raising capital. This cost is determined by the rate of return that lenders expect in exchange for providing financial assistance to the company, taking into account the interest due on both short-term and long-term debts. To calculate an accurate figure for this cost, we can aggregate all the interest payments made during a certain year and divide that number by the sum of the total annual short-term and long-term financial obligations. Previous researchers, such as [3,25,82,83,84,85], have extensively used this interest rate as a measurement.

Given the absence of financial indicators such as bond yields and actuarial rates in the region, this research relies on an accounting metric to calculate the cost of debt for Saudi Arabian corporations. This approach was chosen due to the limited availability of such data, which may be attributed to the underdeveloped and inactive bond markets in the Saudi region, where most debt is acquired through bank loans. Jabbouri et al. [86] provide supporting evidence for this information.

3.3. Measurement of Independent Variable

Investors are increasingly relying on ESG ratings to assess the sustainability and social responsibility of firms. In recent years, there has been a noticeable shift towards incorporating ESG aspects into the decision-making process of corporations. Our research highlights the relevance of environmental, social, and governance (ESG) ratings in determining a company’s success and their impact on financial results. To provide a comprehensive and diverse range of ESG indicators relevant to each company’s industry sector, we derived ESG scores from various studies conducted by [87,88,89,90]. Our objective was to develop a reliable method of measuring ESG performance, with the ESG score serving as the independent variable in our investigation. This allowed us to assess the environmental, social, and governance performance of the Saudi corporations under study. The ESG-related data disclosed by the corporations was used to calculate these scores, which were obtained from Bloomberg. The scores range from 0% to 100%, with higher scores indicating greater ESG transparency. Bloomberg analysts assigned weights to the relevant ESG data points for each firm based on their industrial sector to determine the scores.

3.4. Measurement of Moderator

On the Saudi Arabian capital market, companies in financial trouble are given one of three levels of “insolvency flags”, which show how bad their situation is. Tadawul adds these yellow, orange, and red flags to the company’s name on the stock exchange website. This shows investors that the company has lost 20% or more of its capital. The range of accumulated losses for the yellow flag is 20% to less than 35%, while the range for the orange flag is 35% to less than 50%. The red flag means that the total losses are at least 50%. So, distress is a binary variable with a value of 1 if a corporation’s total losses are more than 20% of its average net worth and a value of 0 if they are less than 20% [91].

3.5. Measurement of Control Variables

To enhance the effectiveness of the regression model, we incorporate a set of control variables that account for factors known to have a significant impact on the cost of debt, as determined by previous theoretical and empirical research [4,66,83]. These control variables include firm size (SIZE), calculated by taking the logarithm of total assets. Prior research suggests that larger companies have greater ease in accessing external funding, exhibiting reduced information asymmetry and monitoring costs [92]. Moreover, larger firms tend to have better resilience to adverse shocks and can benefit from economies of scale, resulting in lower debt costs [93]. Hence, we anticipate an inverse relationship between firm size and the expenses associated with debt financing. We also include financial leverage (LEV), obtained by dividing total debts by total assets; return on assets (ROA), calculated by dividing net profits by total assets; company risk (Beta), obtained from the company’s beta; and firm age, measured by the number of years since the company’s establishment.

3.6. Conceptual Model

The objective of this research is to examine the impact of a company’s ESG disclosure practices on its borrowing costs. The study employs an empirical approach to analyze how the level of ESG disclosure affects the cost of debt for the company. The research incorporates a multiple regression framework, including control variables that have been previously studied, to investigate the relationship.

In this research, we propose that ESG disclosure may have an adverse influence on the borrowing costs of publicly traded companies in Saudi Arabia. To test this hypothesis, we have developed a regression model that will serve as the basis for our investigation:

COSTi,t = α0 + α1 ESGi,t + α2 SIZEi,t + α3 LEVERAGEi,t + α4 ROAi,t + α5 BETAi,t + α6 AGEi,t Yri,t + FIRMi,t + INDi,t + ei,t

Moving on to our investigation, we are now addressing the second hypothesis, which proposes that financial distress could potentially negatively moderate the relationship between a company’s ESG disclosure scores and their cost of debt. To test this assertion, we will employ the subsequent regression model:

where i stands for firms and t stands for fiscal years. ESGi,t stands for the score for the environment, society, and government. DISTRESSi,t is a “dummy” variable that has a value of 1 if the company is in financial trouble and a value of 0 if it is not. SIZEi,t is the logarithm of a company’s total assets, LEVERAGEi,t is the total debts divided by the total assets, ROAi,t is the return on assets, BETAi,t is a company’s risk, and AGEi,t is the age of a company. The error term is shown by the letter ei,t. Standard errors are grouped together at the firm level to take into account any possible correlations within the firm.

COSTi,t = α0 + α1 ESGi,t + α2 DISTRESSi,t + α3 ESGi,t × DISTRESSi,t + α4 SIZEi,t + α5 LEVERAGEi,t + α6 ROAi,t + α7 BETAi,t + α8 AGEi,t Yri,t + FIRMi,t + INDi,t + ei,t

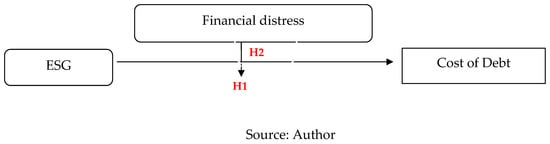

In this investigation, we used three different types of panel data regression approaches. To solve the problem of independent observations for each company over time, we first estimated the hypotheses using pooled ordinary least squares (OLS) with robust standard errors that were clustered by company and adjusted for heteroskedasticity. This allowed us to account for the fact that each company’s observations were collected at different times. The Breusch and Pagan Lagrangian multiplier test was then carried out in order to determine which estimate method, out of pooled OLS and random effects, was the most appropriate. It was determined that the random effects estimator was the most accurate. In the end, we chose an appropriate and efficient estimator between random effects and fixed effects by employing the Hausman test. The results of the Hausman test indicated that the fixed effects estimator was the method with the highest productivity. As a consequence of this, we put both hypotheses to the test by employing regressions with random effects as well as regressions with fixed effects, all the while taking into account time-invariant firm-specific effects. Figure 1 illustrates the conceptual framework on the study.

Figure 1.

Conceptual framework.

4. Results and Discussions

4.1. Univariate Analysis

4.1.1. Descriptive Statistics

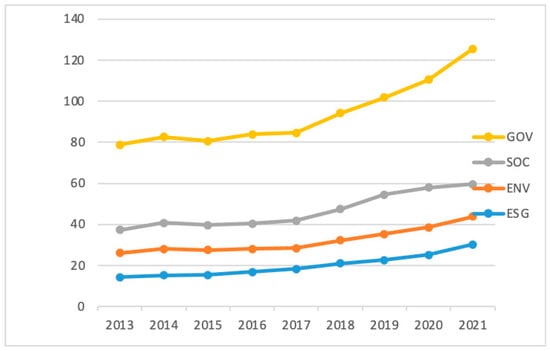

Figure 2 presents the ESG (environmental, social, governance) scores for each year from 2013 to 2021. The scores are divided into four categories: ENV (Environmental), SOC (Social), GOV (Governance), and the total ESG score. Upon reviewing the data, it is evident that the total ESG score exhibited a consistent upward trend from 2013 to 2021. Similarly, the scores in the individual categories generally increased over time, albeit with some fluctuations.

Figure 2.

ESG scores over time: trends and patterns in environmental, social, and governance factors.

Among the individual categories, the highest score in 2021 was observed in the GOV category, followed by ESG, ENV, and SOC, respectively. This implies that the governance practices of the companies in the dataset are particularly robust. The ENV and SOC scores have shown relatively stable patterns over time, with minor fluctuations from year to year. However, the GOV score has demonstrated a consistent upward trend, indicating a growing emphasis on sound governance practices by companies. Overall, the dataset suggests that firms are increasingly recognizing the importance of ESG factors and are making efforts to improve their scores in these areas, especially after the launch of Saudi Vision 2030. However, there is still room for improvement, particularly in the environmental and social categories.

Table 1 provides further insights into the various metrics used in our research. According to the data, the average company size, as denoted by the logarithm of total assets, is 10.70, with a median of 11.03. The size data exhibits a standard deviation of 1.30, reflecting a considerable diversity in the sizes of firms participating in the Saudi Stock Exchange. This aligns with the research by ref. [88] which notes the extensive variability in firm size in the Saudi business context. The financial leverage of the firms, represented as a ratio of total debt to total assets, has an average value of 23.34 and a median of 22.11. This showcases the level of risk and indebtedness taken on by firms within the sample. The standard deviation of 4.67 demonstrates a broad range of debt levels among these firms, a characteristic previously reported in the study conducted by ref. [83]. Return on assets (ROA), an indicator of profitability, averaged at 3.70 with a median of 3.55, implying that firms on average generate 3.7% of profits from their total assets. The standard deviation is 1.58, underlining a substantial difference in profitability levels across firms, which resonates with findings from [94]. Our study further captures the risk levels within companies, reported as a standard deviation of stock returns, with an average of 0.91 and a median of 0.85. The large standard deviation of 0.35 demonstrates that risk levels in the Saudi market vary significantly, a point also raised by [95]. Lastly, the average age of companies in our study, calculated from their date of establishment, is 1.44 with a median of 1.31. The standard deviation of 0.50 suggests a healthy mix of both established and new firms in the Saudi Stock Exchange. This supports the argument presented by [96] about the evolving and dynamic nature of the Saudi business environment.

Table 1.

Descriptive statistics.

4.1.2. Correlations

This study looked at whether or not there is a connection between firms’ disclosure of ESG factors and the cost of their borrowing. The Pearson correlation matrix of the important variables is shown in Table 2, and the results of our investigation showed that there is an inverse connection (−0.0689) between ESG practices and COST. This lends credence to our theory that businesses with superior ESG performance enjoy reduced interest rates on their loans. To substantiate the validity and reliability of our results, we also evaluated the potential role of multicollinearity in our findings. Multicollinearity, a phenomenon in which two or more predictor variables in a multiple regression model are highly correlated, can distort or inflate the individual contribution of each variable, leading to unreliable results. Therefore, we utilized the variance inflation factor (VIF) as a diagnostic tool to detect multicollinearity. The VIF values obtained were significantly below the generally accepted threshold of 10, suggesting that multicollinearity does not pose a significant concern in our study. This underscores that the predictor variables in our model are not unduly interrelated and hence reaffirms the trustworthiness of our findings. By addressing this potential issue of multicollinearity, we enhanced the robustness of our study. This methodological rigor provides additional confidence in the legitimacy of our conclusions, substantiating the assertion that superior ESG performance can influence a firm’s borrowing costs favorably.

Table 2.

Correlation matrix.

4.2. Multivariate Analysis

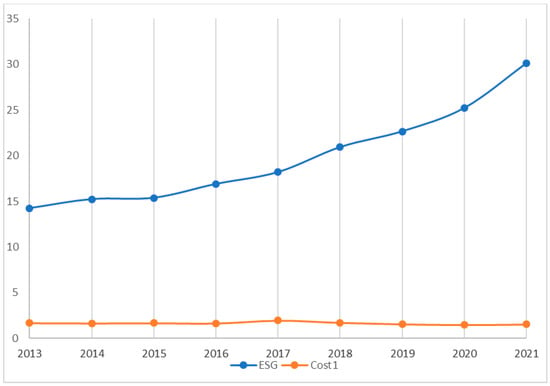

Figure 3 presents data on ESG scores and associated costs for each year from 2013 to 2021. The data shows that as ESG initiatives increase, the cost of debt decreases, indicating a negative correlation between these variables.

Figure 3.

Evolution of ESG and cost of debt.

As was discussed in the previous section, the most acceptable method to use is the fixed effects regression. As a result, our understandings are founded on the outcomes of the fixed effects regressions, despite the fact that the outcomes of the three regressions are comparable to one another.

In this section, the regression outcomes are presented utilizing the three distinct estimators specified for the study framework. Table 3 details the results of debt-related costs (COST) regressed on the environmental, social, and governance disclosures (ESG). For this analysis, we utilize pooled OLS in conjunction with random effects and fixed effects regression methods.

Table 3.

The influence of ESG on the cost of debt.

In model (3) of Table 3, the findings of the study support our hypothesis, revealing a significant negative relationship between ESG activities and debt-related costs (COST) with a t-value of −4.69. This result holds true for both pooled OLS (model 1) and random effects (model 2). It indicates that companies that are more transparent in disclosing ESG information benefit from reduced costs of debt financing.

These findings are consistent with previous research that has identified an inverse link between information transparency and the cost of debt capital. This relationship has been observed across various contexts, including voluntary disclosure [97,98], financial reporting [99], business political openness [100], CSR communication [101,102], carbon emissions reporting [103], environmental and societal disclosure [104,105], intellectual capital disclosure [106], and ESG disclosures [107].

The outcomes of this study can be attributed to the nuanced pathways through which ESG disclosure lowers debt-related expenses. Firstly, ESG disclosure bridges the information gap between companies and lenders, improving their understanding of the likelihood of borrowers defaulting on their obligations. Secondly, it assists lending institutions in assessing default risk by providing comprehensive insights into a company’s environmental, social, and governance aspects that traditional disclosures may not capture. The findings suggest that lenders value enhanced transparency in ESG reporting, leading to reduced costs of debt capital for companies with clearer ESG disclosures. This reduction in information asymmetry, particularly regarding nonfinancial aspects of corporate management, contributes to lower debt costs.

Additionally, the results indicate that lenders take into account the possibility of hidden adverse information during default risk assessments. Wider ESG disclosures signal a company’s commitment to transparency, reducing concerns about concealed negative information. This enables lending institutions to better evaluate default risk, resulting in lower costs associated with debt financing.

Regarding the control variables, the outcomes align with expected effects. The cost of debt (COST) exhibits a negative association with firm size (SIZE), which is consistent with previous research suggesting that larger companies benefit from reduced debt financing costs due to factors such as easier access to external funding, decreased information disparities, lower oversight costs, increased resilience to adverse shocks, and economies of scale in debt costs. Similarly, the results support the inverse relationship between firm performance (ROA) and the cost of debt (COST). Well-performing companies are generally perceived as less risky and more capable of generating resources and servicing debt compared to less profitable counterparts [108]. Additionally, a positive correlation is observed between the cost of debt (COST) and both financial leverage (LEVERAGE) and firm risk (Beta). This is driven by the positive relationship between the level of indebtedness and the risk of default [109]. Lastly, there is no significant association between the age of a firm and its cost of debt.

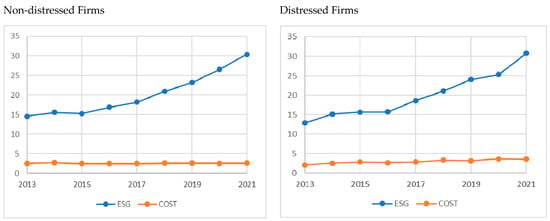

Figure 4 spans from the year 2013 to 2021, providing information on ESG scores and costs for both non-distressed and distressed firms. It is observed that the implementation of ESG initiatives has a greater impact on reducing the cost of debt for non-distressed firms compared to distressed ones.

Figure 4.

The impact of financial distress on ESG-cost of debt relationship.

To examine the influence of financial distress on the relationship between ESG and the cost of debt (COST), an interaction term between financial distress (DISTRESS) and ESG practices was introduced in the regression models. The results of the regression analysis, presented in Table 4, highlight the moderating effect of financial distress on the link between ESG and the cost of debt. Across all models, financial distress has a significant positive impact on the expense associated with debt, indicating that companies facing greater financial distress experience higher borrowing costs. This finding is consistent with the research conducted by [110].

Table 4.

The effect of financial distress on ESG-cost of debt association.

The significantly negative interaction term between financial distress and ESG provides support for Hypothesis 2. It suggests that financial distress weakens the positive influence of ESG strategies on reducing the cost of borrowing. Distressed firms must carefully consider the benefits of improving their ESG disclosures, which can enhance their reputation and increase investor confidence in a challenging market environment. Furthermore, robust ESG disclosures can help distressed firms attract sustainable capital and identify operational efficiencies and cost savings through improved environmental performance. However, implementing ESG investments can be challenging for distressed firms due to limited resources and budget constraints [111]. As a company’s financial distress worsens, its ESG performance may deteriorate, leading to reputational damage [75]. This loss of trust from investors, customers, and other stakeholders further exacerbates the company’s financial problems, resulting in higher borrowing costs [110].

4.3. Additional Analysis

Table 5 presents the regression results for the individual components of ESG (ENV, SOC, and GOV) on the cost of debt, using both pooled OLS and fixed effects regression methods. Firstly, the estimated coefficient of ENV is negative and statistically significant at the 1% level, indicating that increased levels of environmental disclosure led to reduced borrowing costs. This finding is consistent with [3], who found that environmentally responsible firms tend to obtain better loan terms compared to less environmentally conscious firms. Secondly, the estimated coefficient of SOC is negative and statistically significant at the 1% and 5% levels for OLS and fixed effects, respectively. This suggests that disclosing social information has a detrimental effect on a company’s cost of debt. Our findings align with Desender et al. [112], who found that firms with higher social capital experienced significantly lower bank loan spreads. Lastly, the estimated coefficient of GOV is negative but not statistically significant, indicating that corporate governance disclosure does not impact the cost of debt in Saudi Arabia. This result may be due to lenders perceiving these companies as already having achieved strong governance, and any further investment in governance would not affect the cost of debt.

Table 5.

The effects of environmental (ENV), social (SOC), and governance (GOV) on the cost of debt.

Robustness Check

To address potential endogeneity concerns in the relationship between ESG disclosures and a firm’s cost of debt, we employed pooled OLS, random effects, and fixed effects regression approaches, with standard errors adjusted for firm-level clustering. However, it is important to acknowledge potential endogeneity issues arising from unobserved firm attributes that may influence both ESG practices and the cost of debt, as well as the possibility of reverse causality as highlighted by [113]. In such cases, pooled OLS, random effects, and fixed effects may not be appropriate. To address these concerns, we utilized a dynamic panel GMM estimator.

Table 6 presents the results of the dynamic panel GMM approach, which takes into account the dynamic relationship between ESG, the moderating effect of financial distress, and the cost of debt. Our first hypothesis is further supported by the significantly negative coefficient for ESG, indicating that the negative relationship between corporate ESG reporting and the cost of debt remains even after addressing endogeneity using the dynamic GMM estimator. As shown in Table 6, the estimated coefficient for the lagged dependent variable is positive and significant, demonstrating the robustness of the association between ESG and the cost of debt in the presence of dynamic endogeneity. Similar findings are observed for our second hypothesis, suggesting that financial distress weakens the negative impact of ESG disclosures on firm borrowing costs.

Table 6.

Tackling endogeneity: the GMM method.

5. Conclusions

This study examines the influence of ESG disclosures on the cost of debt. The findings reveal an inverse correlation between the level of ESG transparency and debt expenses, indicating that companies adopting a more transparent approach to ESG disclosure are able to access external financing on more favorable terms. This recognition from the market incentivizes organizations to prioritize and showcase strong ESG practices. The study contributes to the ongoing discourse on ESG disclosure and its impact on debt financing, highlighting the role of financial distress in mitigating the positive effect of ESG on reducing debt costs.

The implications of the findings are significant for leaders, investors, and policymakers. Management should prioritize fostering corporate transparency and expanding ESG disclosure to reduce debt costs. Investors should favor companies with greater transparency in ESG disclosure, as these organizations are more likely to access external funding on better terms, leading to potentially higher returns and lower risks. Policymakers and regulators should promote ESG disclosure as a reporting tool to enhance capital distribution efficiency and reduce corporate financing expenses.

However, this research has some limitations. One limitation is the reliance on secondary data from the Bloomberg database to measure ESG reporting. While Bloomberg is a highly credible source and its ESG disclosure scores are widely recognized and used in academic literature, gathering primary data could strengthen the findings. Nonetheless, this limitation does not compromise the quality of the study and presents opportunities for future research.

Future investigations could replicate this study and incorporate interviews with CEOs of lending institutions to gain deeper insights into the loan decision-making process. Alternatively, researchers could develop new metrics and indicators to assess the quality and level of ESG reporting through manual assessment. Conducting these robustness tests would provide a more comprehensive understanding of the relationship between ESG reporting and the cost of borrowing. Additionally, exploring sector-specific characteristics and their influence on the link between ESG practices and the cost of debt is an underexplored area. Future research could contextualize these findings within industry-specific frameworks. Lastly, examining ESG reporting for non-publicly listed companies and expanding the study to different geographical locations would provide valuable insights into the cross-cultural implications of ESG practices on financial performance.

Author Contributions

T.A.B.: conceptualization, investigation, funding acquisition, review, editing, project administration, and resources; K.C.: conceptualization, investigation, formal analysis, data curation, validation, and methodology; A.A.A.: conceptualization, methodology, and writing; M.A.: supervision, conceptualization, review, editing, and validation. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Deputyship for Research and Innovation, Ministry of Education in Saudi Arabia (Project number INST046).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

The authors extend their appreciation to the Deputyship for Research and Innovation, Ministry of Education in Saudi Arabia, for funding this research work (Project number INST046).

Conflicts of Interest

The authors declare no conflict of interest.

References

- Vitolla, F.; Raimo, N.; Rubino, M.; Garegnani, G.M. Do cultural differences impact ethical issues? Exploring the relationship between national culture and quality of code of ethics. J. Int. Manag. 2021, 27, 100823. [Google Scholar] [CrossRef]

- Manes-Rossi, F.; Nicolò, G.; Tudor, A.T.; Zanellato, G. Drivers of integrated reporting by state-owned enterprises in Europe: A longitudinal analysis. Meditari Account. Res. 2020, 29, 586–616. [Google Scholar] [CrossRef]

- Eliwa, Y.; Aboud, A.; Saleh, A. ESG practices and the cost of debt Evidence from EU countries. Crit. Perspect. Acc. 2021, 79, 102097. [Google Scholar] [CrossRef]

- Raimo, N.; Caragnano, A.; Zito, M.; Vitolla, F.; Mariani, M. Extending the benefits of ESG disclosure: The effect on the cost of debt financing. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 1412–1421. [Google Scholar] [CrossRef]

- Nicolò, G.; Zanellato, G.; Manes-Rossi, F.; Tiron-Tudor, A. Corporate reporting metamorphosis: Empirical findings from state-owned enterprises. Public Money Manag. 2021, 41, 138–147. [Google Scholar] [CrossRef]

- García-Sánchez, I.M.; Raimo, N.; Marrone, A.; Vitolla, F. How does integrated reporting change in light of COVID-19? A revisiting of the content of the integrated reports. Sustainability 2020, 12, 7605. [Google Scholar] [CrossRef]

- Buallay, A. Is sustainability reporting (ESG) associated with performance Evidence from the European banking sector. Manag. Environ. Qual. Int. J. 2019, 30, 98–115. [Google Scholar] [CrossRef]

- Wulf, I.; Niemöller, J.; Rentzsch, N. Development toward integrated reporting, and its impact on corporate governance: A twodimensional approach to accounting with reference to the German two-tier system. J. Manag. Control 2014, 25, 135–164. [Google Scholar] [CrossRef]

- Vitolla, F.; Raimo, N.; Rubino, M.; Garzoni, A. The impact of national culture on integrated reporting quality. A stakeholder theory approach. Bus. Strategy Environ. 2019, 28, 1558–1571. [Google Scholar] [CrossRef]

- Vitolla, F.; Raimo, N. Adoption of Integrated Reporting: Reasons and Benefits-A Case Study Analysis. Int. J. Bus. Manag. 2018, 13, 244–250. [Google Scholar] [CrossRef]

- Vitolla, F.; Raimo, N.; Rubino, M.; Garzoni, A. How pressure from stakeholders affects integrated reporting quality. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 1591–1606. [Google Scholar] [CrossRef]

- Dhaliwal, D.S.; Li, O.Z.; Tsang, A.; Yang, Y.G. Voluntary nonfinancial disclosure and the cost of equity capital: The initiation of corporate social responsibility reporting. Account. Rev. 2011, 86, 59–100. [Google Scholar] [CrossRef]

- Clarkson, P.M.; Fang, X.; Li, Y.; Richardson, G. The relevance environmental disclosures: Are such disclosures incrementally informative? J. Account. Public. Policy 2013, 32, 410–431. [Google Scholar] [CrossRef]

- Boujelbene, M.A.; Affes, H. The impact of intellectual capital disclosure on cost of equity capital: A case of French firms. J. Econ. Financ. Adm. Sci. 2013, 18, 45–53. [Google Scholar] [CrossRef]

- Albarrak, M.S.; Elnahass, M.; Salama, A. The effect of carbon dissemination on cost of equity. Bus. Strategy Environ. 2019, 28, 1179–1198. [Google Scholar] [CrossRef]

- Salvi, A.; Vitolla, F.; Raimo, N.; Rubino, M.; Petruzzella, F. Does intellectual capital disclosure affect the cost of equity capital? An empirical analysis in the integrated reporting context. J. Intellect. Cap. 2020, 21, 985–1007. [Google Scholar] [CrossRef]

- Eccles, R.G.; Serafeim, G.; Krzus, M.P. Market interest in nonfinancial information. J. Appl. Corp. Financ. 2011, 23, 113–127. [Google Scholar] [CrossRef]

- Hobfoll, S.E.; Halbesleben, J.; Neveu, J.-P.; Westman, M. Dynamic Self-Regulation and Multiple-Goal Pursuit Dynamic system: A system in which the elements change over time. Annu. Rev. OrgaPsychol. OrgaBehav. 2018, 5, 103–128. [Google Scholar]

- Waddock, S.A.; Graves, S.B. The Corporate Social Performance-Financial Performance Link. Strateg. Manag. J. 1997, 18, 303–319. [Google Scholar] [CrossRef]

- Jensen, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Wang, K.T.; Li, D. Market reactions to the first-time disclosure of corporate social responsibility reports: Evidence from China. J. Bus. Ethics 2015, 138, 661–682. [Google Scholar] [CrossRef]

- Gong, G.; Xu, S.; Gong, X. On the value of corporate social responsibility disclosure: An empirical investigation of corporate bond issues in China. J. Bus. Ethics 2018, 150, 227–258. [Google Scholar] [CrossRef]

- Leftwich, R.W.; Watts, R.L.; Zimmerman, J.L. Voluntary corporat disclosure: The case of interim reporting. J. Account. Res. 1981, 19, 50–77. [Google Scholar] [CrossRef]

- Cheng, B.; Ioannou, I.; Serafeim, G. Corporate social responsibility and access to finance. Strateg. Manag. J. 2014, 35, 1–23. [Google Scholar] [CrossRef]

- Guidara, A.; Khlif, H.; Jarboui, A. Voluntary and timely disclosure and the cost of debt: South African evidence. Meditari Account. Res. 2014, 22, 149–164. [Google Scholar] [CrossRef]

- Diamond, D.W. Financial intermediation and delegated monitoring. Rev. Econ. Stud. 1984, 51, 393–414. [Google Scholar] [CrossRef]

- Ramakrishnan, R.; Thakor, A. Information reliability and a theory of financial intermediation. Rev. Econ. Stud. 1984, 513, 415–432. [Google Scholar] [CrossRef]

- Ge, W.; Liu, M. Corporate social responsibility and the cost of corporate bonds. J. Account. Public. Policy 2015, 34, 597–624. [Google Scholar] [CrossRef]

- Mazumdar, S.C.; Sengupta, P. Disclosure and the loan spread on private debt. Financ. Anal. J. 2005, 61, 83–95. [Google Scholar] [CrossRef]

- Verrecchia, R.E. Discretionary disclosure. J. Account. Econ. 1983, 5, 179–194. [Google Scholar] [CrossRef]

- Dye, R.A. Disclosure of nonproprietary information. J. Account. Res. 1985, 23, 123–145. [Google Scholar] [CrossRef]

- Spence, M. Job market signaling. Q. J. Econ. 1973, 87, 355–374. [Google Scholar] [CrossRef]

- Morris, R.D. Signalling, agency theory and accounting policy choice. Account. Bus. Res. 1987, 18, 47–56. [Google Scholar] [CrossRef]

- Gelb, D.S.; Strawser, J.A. Corporate Social Responsibility and Financial Disclosures: An Alternative Explanation for Increased Disclosure. J. Bus. Ethics 2001, 33, 1–13. [Google Scholar] [CrossRef]

- Malik, M. Value-enhancing capabilities of CSR: A brief review of contemporary literature. J. Bus. Ethics 2015, 127, 419–438. [Google Scholar] [CrossRef]

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Cambridge University Press: Cambridge, UK, 1984. [Google Scholar]

- Deegan, C. Organizational legitimacy as a motive for sustainability reporting. In Sustainability Accounting and Accountability; Unerman, J., Bebbington, J., O’Dwyer, B., Eds.; Routledge: London, UK, 2007; pp. 127–149. [Google Scholar]

- Cho, C.H.; Patten, D.M. The role of environmental disclosures as tools of legitimacy: A research note. Account. Organ. Soc. 2007, 32, 639–647. [Google Scholar] [CrossRef]

- Islam, M.A.; Deegan, C. Motivations for an organisation within a developing country to report social responsibility information: Evidence from Bangladesh. Account. Audit. Account. J. 2008, 21, 850–874. [Google Scholar] [CrossRef]

- Elijido-Ten, E.; Kloot, L.; Clarkson, P. Extending the application of stakeholder influence strategies to environmental disclosures: An exploratory study from a developing country. Account. Audit. Account. J. 2010, 23, 1032–1059. [Google Scholar] [CrossRef]

- Hobfoll, S.E. Stress, Culture, and Community: The Psychology and Physiology of Stress; Plenum: New York, NY, USA, 1998. [Google Scholar]

- Alexander, G.J.; Buchholz, R.A. Corporate Social Responsibility and Stock Market Performance. Acad. Manag. J. 1978, 21, 479–486. [Google Scholar] [CrossRef]

- Bourgeois, L.J. On the Measurement of Organizational Slack. Acad. Manag. Rev. 1981, 6, 29–39. [Google Scholar] [CrossRef]

- Jensen, M.C. The Modern Industrial Revolution, Exit, and the Failure of Internal Control Systems. J. Financ. 1993, 48, 831–880. [Google Scholar] [CrossRef]

- Miles, M.P.; Covin, J.G. Environmental Marketing: A Source of Reputational, Competitive, and Financial Advantage. J. Bus. Ethics 2000, 23, 299–311. [Google Scholar] [CrossRef]

- Miles, M.P.; Russell, G.R. ISO 14000 Total Quality Environmental Management: The Integration of Environmental Marketing, Total Quality Management and Corporate Environmental Policy. J. Qual. Manag. 1997, 2, 151–168. [Google Scholar] [CrossRef]

- Miles, M.P.; Munilla, L.S.; Russell, G.R. Marketing and Environmental Registration/Certification: What Industrial Marketers Should Understand about ISO 14000. Ind. Mark. Manag. 1997, 26, 363–370. [Google Scholar] [CrossRef]

- Preston, L.E.; O’Bannon, D.P. The Corporate Social-Financial Performance Relationship: A Typology and Analysis. Bus. Soc. 1997, 36, 419–429. [Google Scholar] [CrossRef]

- McGuire, J.B.; Sundgren, A.; Schneeweis, T. Corporate and Social Responsibility and Firm Financial Performance. Acad. Manag. J. 1988, 31, 854–872. [Google Scholar] [CrossRef]

- Friede, G.; Busch, T.; Bassen, A. ESG and Financial Performance: Aggregated Evidence from More than 2000 Empirical Studies. J. Sustain. Financ. Investig. 2015, 5, 210–233. [Google Scholar] [CrossRef]

- Velte, P. Does ESG Performance Have an Impact on Financial Performance? Evidence from Germany. J. Glob. Responsib. 2017, 8, 169–178. [Google Scholar] [CrossRef]

- Bruna, M.G.; Loprevite, S.; Raucci, D.; Ricca, B.; Rupo, D. Investigating the Marginal Impact of ESG Results on Corporate Financial Performance. Financ. Res. Lett. 2022, 47, 10282. [Google Scholar] [CrossRef]

- Brooks, C.; Oikonomou, I. The effects of environmental, social and governance disclosures and performance on firm value: A review of the literature in accounting and finance. Br. Account. Rev. 2018, 50, 1–15. [Google Scholar] [CrossRef]

- Bruna, M.G.; Lahouel, B.B. CSR & financial performance: Facing methodological and modeling issues commentary paper to the eponymous FRL article collection. Financ. Res. Lett. 2022, 44, 102036. [Google Scholar]

- Gerwanski, J. Does it pay off? Integrated reporting and cost of debt: European evidence. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 2299–2319. [Google Scholar] [CrossRef]

- Lavin, J.F.; Montecinos-Pearce, A.A. Heterogeneous Firms and Benefits of ESG Disclosure: Cost of Debt Financing in an Emerging Market. Sustainability 2022, 14, 15760. [Google Scholar] [CrossRef]

- Maaloul, A.; Zéghal, D.; Ben Amar, W.; Mansour, S. The effect of environmental, social, and governance (ESG) performance and disclosure on cost of debt: The mediating effect of corporate reputation. Corp. Reput. Rev. 2023, 26, 1–18. [Google Scholar] [CrossRef]

- Arora, A.; Sharma, D. Do Environmental, Social and Governance (ESG) Performance Scores Reduce the Cost of Debt? Evidence from Indian firms. Australas. Account. Bus. Financ. J. 2022, 16, 4–18. [Google Scholar] [CrossRef]

- Adeneye, Y.; Kammoun, I. Real earnings management and capital structure: Does environmental, social and governance (ESG) performance matter? Cogent Bus. Manag. 2022, 9, 2130134. [Google Scholar] [CrossRef]

- Sengupta, P. Corporate disclosure quality and the cost of debt. Account. Rev. 1998, 73, 459–474. [Google Scholar]

- Thompson, P.; Cowton, C.J. Bringing the environment into bank lending: Implications for environmental reporting. Br. Account. Rev. 2004, 36, 197–218. [Google Scholar] [CrossRef]

- Weber, O.; Scholz, R.W.; Michalik, G. Incorporating sustainability criteria into credit risk management. Bus. Strategy Environ. 2010, 19, 39–50. [Google Scholar] [CrossRef]

- Attig, N.; El Ghoul, S.; Guedhami, O.; Suh, J. Corporate social responsibility and credit ratings. J. Bus. Ethics 2013, 117, 679–694. [Google Scholar] [CrossRef]

- Du, X.; Weng, J.; Zeng, Q.; Chang, Y.; Pei, H. Do lenders applaud corporate environmental performance? Evidence from Chinese private-owned firms. J. Bus. Ethics 2017, 143, 179–207. [Google Scholar] [CrossRef]

- Jung, J.; Herbohn, K.; Clarkson, P. Carbon risk, carbon risk awareness and the cost of debt financing. J. Bus. Ethics 2018, 150, 1151–1171. [Google Scholar] [CrossRef]

- Caragnano, A.; Mariani, M.; Pizzutilo, F.; Zito, M. Is it worth reducing GHG emissions? Exploring the effect on the cost of debt financing. J. Environ. Manag. 2020, 270, 110860. [Google Scholar] [CrossRef] [PubMed]

- Kordsachia, O. A risk management perspective on CSR and the marginal cost of debt: Empirical evidence from Europe. Eur. Rev. Manag. 2020, 15, 1611–1643. [Google Scholar] [CrossRef]

- Ratajczak, P.; Mikołajewicz, G. The impact of environmental, social and corporate governance responsibility on the cost of short- and long-term debt. Econ. Bus. Rev. 2021, 7, 74–96. [Google Scholar] [CrossRef]

- Apergis, N.; Poufinas, T.; Antonopoulos, A. ESG scores and cost of debt. Energy Econ. 2022, 112, 106186. [Google Scholar] [CrossRef]

- Gao, H.; He, J.; Li, Y. Media spotlight, corporate sustainability and the cost of debt. Appl. Econ. 2022, 54, 3989–4005. [Google Scholar] [CrossRef]

- Gigante, G.; Manglaviti, D. The ESG effect on the cost of debt financing: A sharp RD analysis. Int. Rev. Financ. Anal. 2022, 84, 102382. [Google Scholar] [CrossRef]

- Campbell, J.L. Why would corporations behave in socially responsible ways? An institutional theory of corporate social responsibility. Acad. Manag. Rev. 2007, 32, 946–967. [Google Scholar] [CrossRef]

- Chan, C.Y.; Chou, D.W.; Lo, H.C. Do financial constraints matter when firms engage in CSR? N. Am. J. Econ. Financ. 2017, 39, 241–259. [Google Scholar] [CrossRef]

- Hong, H.; Kostovetsky, L. Red and blue investing: Values and finance. J. Financ. Econ. 2012, 103, 1–19. [Google Scholar] [CrossRef]

- Harymawan, I.; Putra, F.K.G.; Fianto, B.A.; Wan Ismail, W.A. Financially distressed firms: Environmental, social, and governance reporting in Indonesia. Sustainability 2021, 13, 10156. [Google Scholar] [CrossRef]

- Leong, C.K.; Yang, Y.C. Constraints on “doing good”: Financial constraints and corporate social responsibility. Financ. Res. Lett. 2021, 40, 101694. [Google Scholar] [CrossRef]

- Antunes, J.; Wanke, P.; Fonseca, T.; Tan, Y. Do ESG Risk Scores Influence Financial Distress? Evidence from a Dynamic NDEA Approach. Sustainability 2023, 15, 7560. [Google Scholar] [CrossRef]

- Al-Hadi, A.; Chatterjee, B.; Yaftian, A.; Taylor, G.; Monzur Hasan, M. Corporate social responsibility performance, financial distress and firm life cycle: Evidence from Australia. Account. Financ. 2019, 59, 961–989. [Google Scholar] [CrossRef]

- Molina, C.A.; Preve, L.A. Trade receivables policy of distressed firms and its effect on the costs of financial distress. Financ. Manag. 2009, 38, 663–686. [Google Scholar] [CrossRef]

- Boubaker, S.; Cellier, A.; Manita, R.; Saeed, A. Does corporate social responsibility reduce financial distress risk? Econ. Model. 2020, 91, 835–851. [Google Scholar] [CrossRef]

- Guillamon-Saorin, E.; Kapelko, M.; Stefanou, S.E. Corporate Social Responsibility and Operational Inefficiency: A Dynamic Approach. Sustainability 2018, 10, 2277. [Google Scholar] [CrossRef]

- Farooq, O.; Derrabi, M. Effect of corporate governance mechanisms on the relationship between legal origins and cost of debt: Evidence from the Middle east and North africa (MENA) region. Afr. J. Bus. Manag. 2012, 6, 2706–2715. [Google Scholar]

- Farooq, O.; Jabbouri, I. Cost of debt and dividend policy: Evidence from the MENA region. J. Appl. Bus. Res. 2015, 31, 1637–1644. [Google Scholar] [CrossRef]

- Dadashi, I.; Mansourinia, E.; Emam Gholipour, M.; Babanejad, S.A. Investigating the effect of growth and financial strength variables on the financial leverage: Evidence from the Tehran stock exchange. Manag. Sci. Lett. 2013, 3, 1125–1132. [Google Scholar] [CrossRef]

- Abdi, H.; Omri, M.A.B. Web-based disclosure and the cost of debt: MENA countries evidence. J. Financ. Rep. Acc. 2020, 18, 533–561. [Google Scholar] [CrossRef]

- Xie, J.; Nozawa, W.; Yagi, M.; Fujii, H.; Managi, S. Do environmental, social, and governance activities improve corporate financial performance? Bus. Strategy Environ. 2019, 28, 286–300. [Google Scholar] [CrossRef]

- Campanella, F.; Serino, L.; Crisci, A.; D’Ambra, A. The role of corporate governance in environmental policy disclosure and sustainable development. Generalized estimating equations in longitudinal count data analysis. Corp. Soc. Responsib. Environ. Manag. 2021, 28, 474–484. [Google Scholar] [CrossRef]

- Chebbi, K.; Ammer, M.A. Board Composition and ESG Disclosure in Saudi Arabia: The Moderating Role of Corporate Governance Reforms. Sustainability 2022, 14, 12173. [Google Scholar] [CrossRef]

- Silva, P.P. Crash risk and ESG disclosure. Borsa Istanb. Rev. 2022, 22, 794–811. [Google Scholar] [CrossRef]

- Graham, J.R.; Li, S.; Qiu, J. Corporate misreporting and bank loan contracting. J. Financ. Econ. 2008, 89, 44–61. [Google Scholar] [CrossRef]

- Saudi Capital Market Authority. Implementing Regulations. 2023. Available online: https://cma.org.sa/en/RulesRegulations/Regulations/Pages/default.aspx (accessed on 4 March 2023).

- Petersen, M.A.; Rajan, R.G. The benefits of lending relationships: Evidence from small business data. J. Financ. 1994, 49, 3–37. [Google Scholar] [CrossRef]

- Shaker, A.S.; Maki, M.I.; Aboalriha, A.M.J. The Effect of Audit Committee Effectiveness on Corporate Sustainability Reporting Practices: Empirical Evidence from Iraqi Listed Industrial Companies. Int. J. Pro. Bus. Rev. 2023, 8, e01604. [Google Scholar]

- Al Qudah, A.; Rusan, M.J.; Al-Qinna, M.I. Climate change vulnerability assessment for selected agricultural responses at Yarmouk River Basin Area, Jordan. Mitig. Adapt. Strateg. Glob. Chang. 2023, 26, 3. [Google Scholar] [CrossRef]

- Saleem, A.; Daragmeh, A.; Zahid, R.A. Financial intermediation through risk sharing vs non-risk sharing contracts, role of credit risk, and sustainable production: Evidence from leading countries in Islamic finance. Environ. Dev. Sustain. 2023. [Google Scholar] [CrossRef]

- Amrah, M.R.; Hashim, H.A. The effect of financial reporting quality on the cost of debt: Sultanate of Oman evidence. Int. J. Econ. Manag. Acc. 2020, 28, 393–414. [Google Scholar]

- Orens, R.; Aerts, W.; Cormier, D. Web-based non-financial disclosure and cost of finance. J. Bus. Financ. Acc. 2010, 37, 1057–1093. [Google Scholar] [CrossRef]

- Talbi, D.; Omri, M.A. Voluntary disclosure frequency and cost of debt: An analysis in the Tunisian context. Int. J. Manag. Financ. Acc. 2014, 6, 167–174. [Google Scholar] [CrossRef]

- Bonsall, S.B.; Miller, B.P. The impact of narrative disclosure readability on bond ratings and the cost of debt. Rev. Account. Stud. 2017, 22, 608–643. [Google Scholar] [CrossRef]

- DeBoskey, D.G.; Li, Y.; Lobo, G.J.; Luo, Y. Corporate political transparency and the cost of debt. Rev. Quant. Finan. Acc. 2021, 57, 111–145. [Google Scholar] [CrossRef]

- Chi, W.; Wu, S.J.; Zheng, Z. Determinants and consequences of voluntary corporate social responsibility disclosure: Evidence from private firms. Br. Account. Rev. 2020, 52, 100939. [Google Scholar] [CrossRef]

- Shad, M.K.; Lai, F.W.; Shamim, A.; McShane, M. The efficacy of sustainability reporting towards cost of debt and equity reduction. Environ. Sci. Pollut. Res. 2020, 27, 22511–22522. [Google Scholar] [CrossRef]

- Kleimeier, S.; Viehs, M. Carbon Disclosure, Emission Levels, and the Cost of Debt; Working paper; Maastricht University: Maastricht, The Netherlands, 2018. [Google Scholar]

- Luo, W.; Guo, X.; Zhong, S.; Wang, J. Environmental information disclosure quality, media attention and debt financing costs: Evidence from Chinese heavy polluting listed companies. J. Clean. Prod. 2019, 231, 268–277. [Google Scholar] [CrossRef]

- Najah, A.; Jarboui, A. Extra-financial disclosure and the cost of debt of big French companies. Bus. Excell. Manag. 2013, 3, 57–69. [Google Scholar]

- Orens, R.; Aerts, W.; Lybaert, N. Intellectual capital disclosure, cost of finance and firm value. Manag. Decis. 2009, 47, 1536–1554. [Google Scholar] [CrossRef]

- Dunne, T.C.; McBrayer, G.A. In the interest of small business cost of debt: A matter of CSR disclosure. J. Small Bus. Strategy 2019, 29, 58–71. [Google Scholar]

- Erragragui, E. Do creditors price firms’ environmental, social and governance risks? Res. Int. Bus. Financ. 2018, 45, 197–207. [Google Scholar] [CrossRef]

- Zhu, F. Corporate governance and the cost of capital: An international study. Int. Rev. Financ. 2014, 14, 393–429. [Google Scholar] [CrossRef]

- Kalash, I. The financial leverage–financial performance relationship in the emerging market of Turkey: The role of financial distress risk and currency crisis. EuroMed J. Bus. 2023, 18, 1–20. [Google Scholar] [CrossRef]

- Tang, H. ESG performance, investors’ heterogeneous beliefs, and cost of equity capital in China. Front. Environ. Sci. 2022, 10, 992559. [Google Scholar] [CrossRef]

- Desender, K.; López-Puertas, M.; Pattitoni, P.; Petracci, B. Corporate social responsibility and cost of financing-The importance of the international corporate governance system. Corp. Gov. 2020, 28, 207–234. [Google Scholar] [CrossRef]

- Jo, H.; Kim, H.; Park, K. Corporate environmental responsibility and firm performance in the financial services sector. J. Bus. Ethics 2014, 11, 19–35. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).