Government Attention, Market Competition and Firm Digital Transformation

Abstract

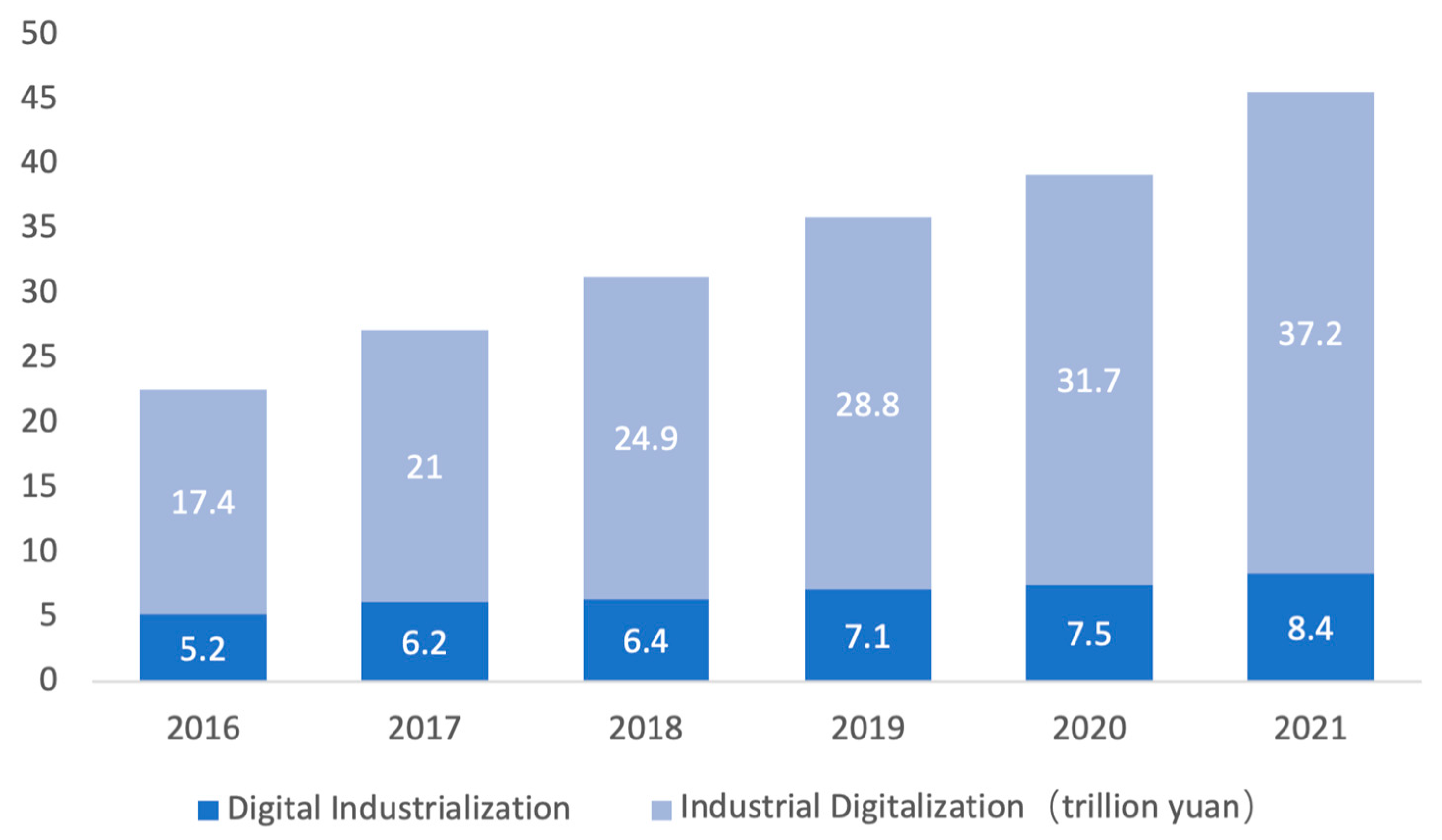

1. Introduction

2. Theoretical Framework

2.1. Theory and Research on Digital Transformation

2.2. Analysis of the Mechanism of Government Attention to the Digital Economy Affecting Enterprise Digital Transformation

2.3. Analysis of the Mechanism of Market Competition Affecting Enterprise Digital Transformation

3. Study Design

3.1. Methods for Data Collection and Sample Selection

3.2. Descriptions and Definitions of Variables

3.2.1. Dependent Variable

3.2.2. Core Independent Variables

3.2.3. Control Variables

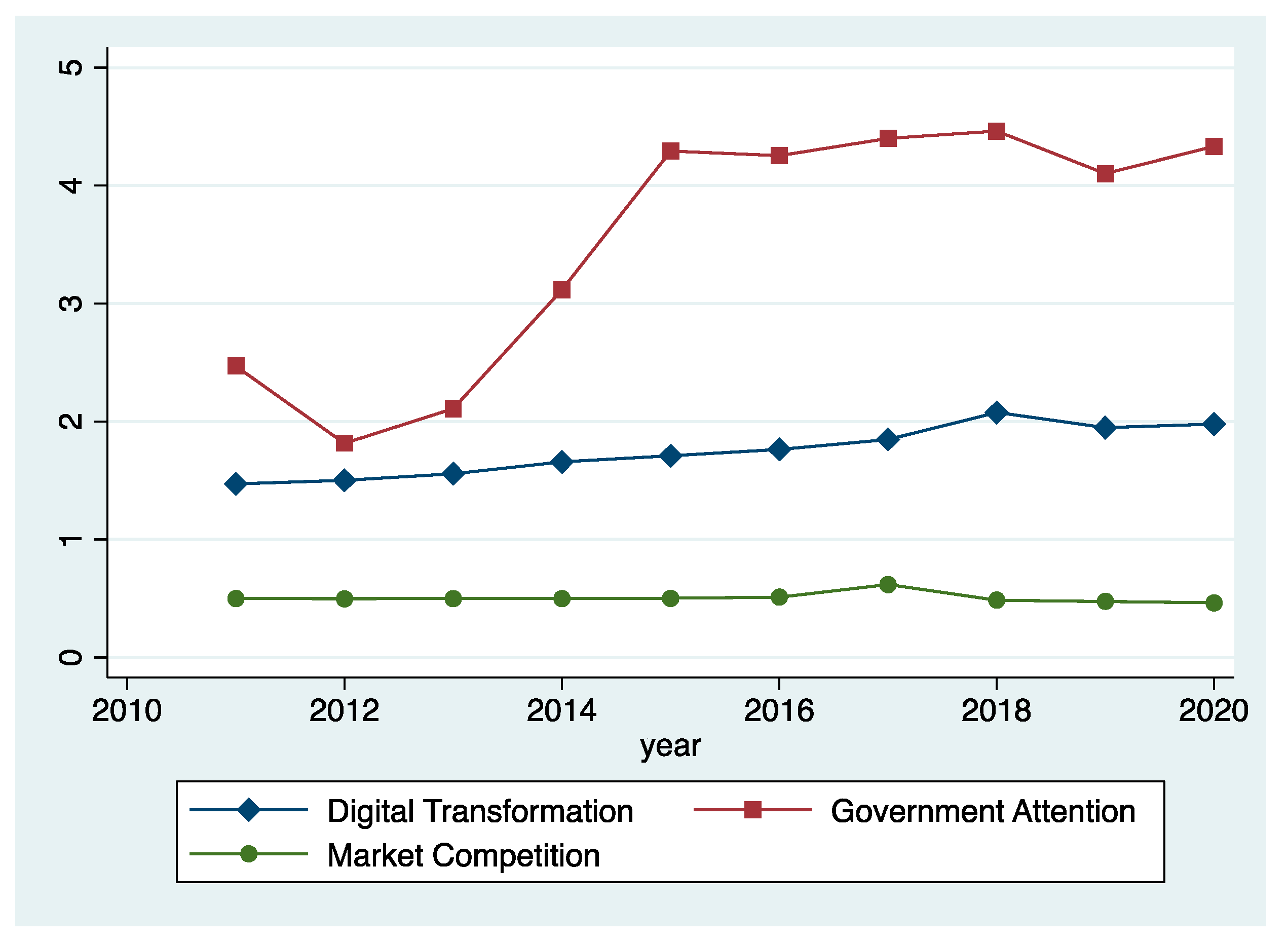

3.2.4. Descriptive Statistics

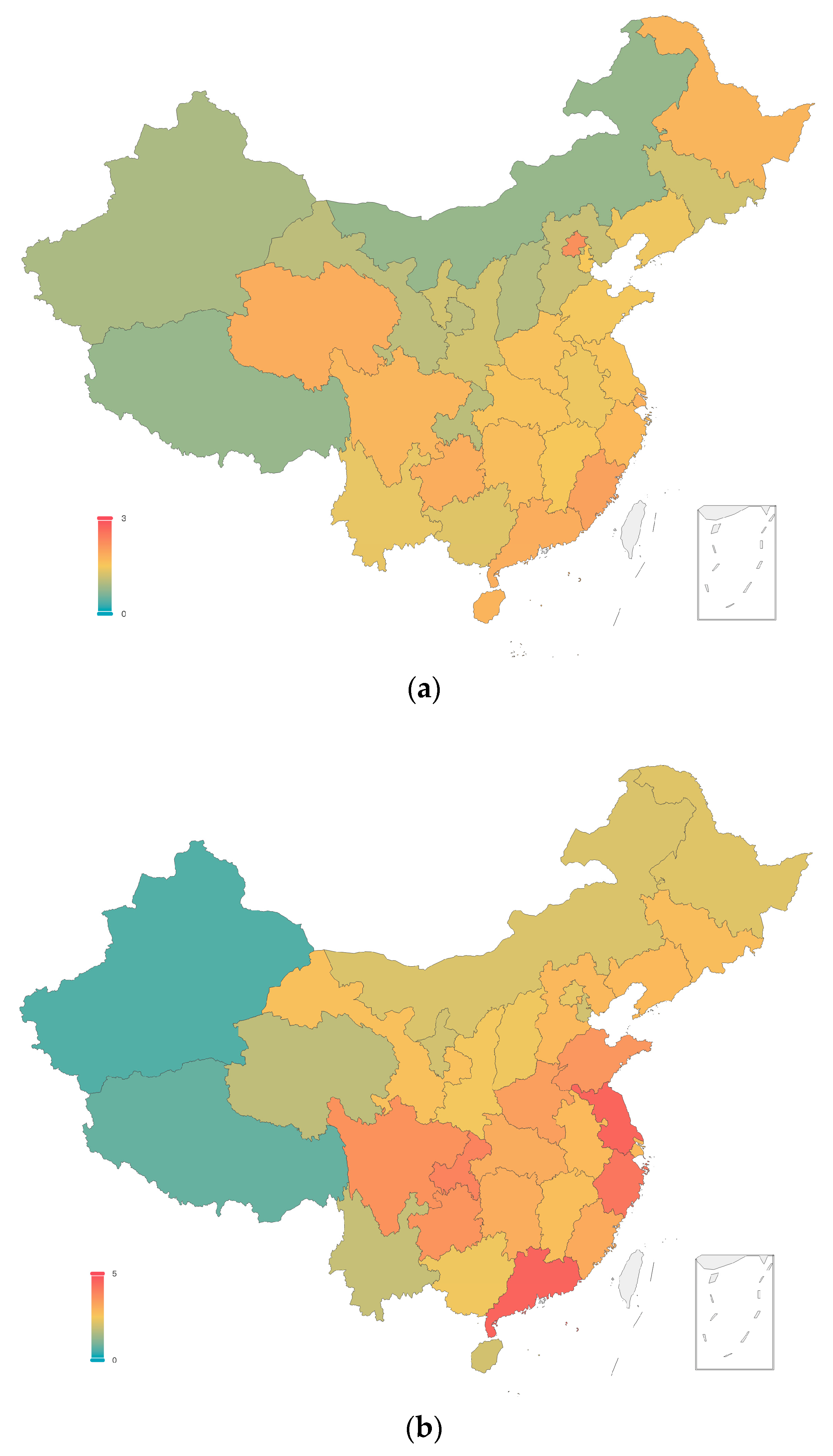

3.2.5. Typical Scenario

3.3. Baseline Model Setting

4. Empirical Results and Analysis

4.1. Impact of Government Attention and Industry Competitiveness on Enterprise Digital Transformation

4.2. Mechanism of Government Attention to the Digital Economy in Influencing DT

4.2.1. Channels of Fiscal Science and Technology Expenditure

4.2.2. Digital Economy and Digital Financial Inclusion Level Channels

4.2.3. Digital Economy Industry Aggregation Channel

4.2.4. Firm Nature Channel

4.2.5. Further Analysis: Market Competition and Enterprise Size

4.3. Analyses of Robustness

4.3.1. Adjusting the Sample Period

4.3.2. Independent Variables Lagged by One and Two Periods

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Matarazzo, M.; Penco, L.; Profumo, G.; Quaglia, R. Digital Transformation and Customer Value Creation in Made in Italy SMEs: A Dynamic Capabilities Perspective. J. Bus. Res. 2021, 123, 642–656. [Google Scholar] [CrossRef]

- Shi, Y.; Wang, Y.; Zhang, W. Digital Transformation of Enterprises in China: Current Situation, Problems and Prospects. Economist 2021, 12, 90–97. [Google Scholar] [CrossRef]

- Wang, B.; Tian, J.; Cheng, L.; Hao, F.; Han, H.; Wang, S. Spatial Differentiation of Digital Economy and Its Influencing Factors in China. Sci. Geogr. Sinica 2018, 38, 859–868. [Google Scholar] [CrossRef]

- Andersson, J.; Jonsson, P. Big Data in Spare Parts Supply Chains: The Potential of Using Product-in-Use Data in Aftermarket Demand Planning. Int. J. Phys. Distrib. Logist. Manag. 2018, 48, 524–544. [Google Scholar] [CrossRef]

- Frank, A.G.; Dalenogare, L.S.; Ayala, N.F. Industry 4.0 Technologies: Implementation Patterns in Manufacturing Companies. Int. J. Prod. Econ. 2019, 210, 15–26. [Google Scholar] [CrossRef]

- Kiel, D.; Arnold, C.; Voigt, K.-I. The Influence of the Industrial Internet of Things on Business Models of Established Manufacturing Companies—A Business Level Perspective. Technovation 2017, 68, 4–19. [Google Scholar] [CrossRef]

- Huesig, S.; Endres, H. Exploring the Digital Innovation Process: The Role of Functionality for the Adoption of Innovation Management Software by Innovation Managers. Eur. J. Innov. Manag. 2018, 22, 302–314. [Google Scholar] [CrossRef]

- Gürdür, D.; El-khoury, J.; Törngren, M. Digitalizing Swedish Industry: What Is next?: Data Analytics Readiness Assessment of Swedish Industry, According to Survey Results. Comput. Ind. 2019, 105, 153–163. [Google Scholar] [CrossRef]

- Trantopoulos, K.; von Krogh, G.; Wallin, M.W.; Woerter, M. External Knowledge and Information Technology. MIS Q. 2017, 41, 287–300. [Google Scholar] [CrossRef]

- Matt, D.T.; Pedrini, G.; Bonfanti, A.; Orzes, G. Industrial Digitalization. Syst. Lit. Rev. Res. Agenda. Eur. Manag. J. 2023, 41, 47–78. [Google Scholar] [CrossRef]

- Bauer, W.; Hämmerle, M.; Schlund, S.; Vocke, C. Transforming to a Hyper-Connected Society and Economy–towards an “Industry 4.0”. Procedia Manuf. 2015, 3, 417–424. [Google Scholar] [CrossRef]

- Schwer, K.; Hitz, C. Designing Organizational Structure in the Age of Digitization. J. East. Eur. Cent. Asian Res. (JEECAR) 2018, 5, 11. [Google Scholar] [CrossRef]

- Kolloch, M.; Dellermann, D. Digital Innovation in the Energy Industry: The Impact of Controversies on the Evolution of Innovation Ecosystems. Technol. Forecast. Soc. Chang. 2018, 136, 254–264. [Google Scholar] [CrossRef]

- Katsamakas, E. Value Network Competition and Information Technology. Hum. Syst. Manag. 2014, 33, 7–17. [Google Scholar] [CrossRef]

- Scuotto, V.; Caputo, F.; Villasalero, M.; Del Giudice, M. A Multiple Buyer–Supplier Relationship in the Context of SMEs’ Digital Supply Chain Management. Prod. Plan. Control. 2017, 28, 1378–1388. [Google Scholar] [CrossRef]

- Warner, K.S.; Wäger, M. Building Dynamic Capabilities for Digital Transformation: An Ongoing Process of Strategic Renewal. Long Range Plan. 2019, 52, 326–349. [Google Scholar] [CrossRef]

- Müller, E.; Hopf, H. Competence Center for the Digital Transformation in Small and Medium-Sized Enterprises. Procedia Manuf. 2017, 11, 1495–1500. [Google Scholar] [CrossRef]

- Neirotti, P.; Pesce, D. ICT-Based Innovation and Its Competitive Outcome: The Role of Information Intensity. Eur. J. Innov. Manag. 2019, 22, 383–404. [Google Scholar] [CrossRef]

- Valenduc, G.; Vendramin, P. Digitalisation, between Disruption and Evolution. Transf. Eur. Rev. Labour Res. 2017, 23, 121–134. [Google Scholar] [CrossRef]

- CPC Central Committee. Recommendations for the 13th Five-Year Plan for National Economic and Social Development; Central Compilation & Translation Press: Beijing, China, 2015; ISBN 978-7-5117-2887-6. [Google Scholar]

- Ghobakhloo, M.; Iranmanesh, M.; Vilkas, M.; Grybauskas, A.; Amran, A. Drivers and Barriers of Industry 4.0 Technology Adoption among Manufacturing SMEs: A Systematic Review and Transformation Roadmap. J. Manuf. Technol. Manag. 2022, 33, 1029–1058. [Google Scholar] [CrossRef]

- Matzler, K.; Friedrich von den Eichen, S.; Anschober, M.; Kohler, T. The Crusade of Digital Disruption. J. Bus. Strategy 2018, 39, 13–20. [Google Scholar] [CrossRef]

- Frishammar, J.; Richtnér, A.; Brattström, A.; Magnusson, M.; Björk, J. Opportunities and Challenges in the New Innovation Landscape: Implications for Innovation Auditing and Innovation Management. Eur. Manag. J. 2019, 37, 151–164. [Google Scholar] [CrossRef]

- Ranganathan, C.; Teo, T.S.; Dhaliwal, J. Web-Enabled Supply Chain Management: Key Antecedents and Performance Impacts. Int. J. Inf. Manag. 2011, 31, 533–545. [Google Scholar] [CrossRef]

- Lanz, M.; Tuokko, R. Concepts, Methods and Tools for Individualized Production. Prod. Eng. 2017, 11, 205–212. [Google Scholar] [CrossRef]

- Coreynen, W.; Matthyssens, P.; Van Bockhaven, W. Boosting Servitization through Digitization: Pathways and Dynamic Resource Configurations for Manufacturers. Ind. Mark. Manag. 2017, 60, 42–53. [Google Scholar] [CrossRef]

- Pagani, M.; Pardo, C. The Impact of Digital Technology on Relationships in a Business Network. Ind. Mark. Manag. 2017, 67, 185–192. [Google Scholar] [CrossRef]

- Stone, M.; Aravopoulou, E.; Gerardi, G.; Todeva, E.; Weinzierl, L.; Laughlin, P.; Stott, R. How Platforms Are Transforming Customer Information Management. Bottom Line 2017, 30, 216–235. [Google Scholar] [CrossRef]

- Hirsch-Kreinsen, H. Digitization of Industrial Work: Development Paths and Prospects. J. Labour Mark. Res. 2016, 49, 1–14. [Google Scholar] [CrossRef]

- Dengler, K.; Matthes, B. The Impacts of Digital Transformation on the Labour Market: Substitution Potentials of Occupations in Germany. Technol. Forecast. Soc. Chang. 2018, 137, 304–316. [Google Scholar] [CrossRef]

- Schlegel, A.; Langer, T.; Putz, M. Developing and Harnessing the Potential of SMEs for Eco-Efficient Flexible Production. Procedia Manuf. 2017, 9, 41–48. [Google Scholar] [CrossRef]

- Beier, G.; Niehoff, S.; Ziems, T.; Xue, B. Sustainability Aspects of a Digitalized Industry–A Comparative Study from China and Germany. Int. J. Precis. Eng. Manuf.-Green Technol. 2017, 4, 227–234. [Google Scholar] [CrossRef]

- Tiefenbeck, V.; Goette, L.; Degen, K.; Tasic, V.; Fleisch, E.; Lalive, R.; Staake, T. Overcoming Salience Bias: How Real-Time Feedback Fosters Resource Conservation. Manag. Sci. 2018, 64, 1458–1476. [Google Scholar] [CrossRef]

- Peng, Y.; Tao, C. Can Digital Transformation Promote Enterprise Performance? —From the Perspective of Public Policy and Innovation. J. Innov. Knowl. 2022, 7, 100198. [Google Scholar] [CrossRef]

- WU, F.; Hu, H.; Lin, H.; Ren, X. Enterprise Digital Transformation and Capital Market Performance:Empirical Evidence from Stock Liquidity. J. Manag. World 2021, 37, 130–144. [Google Scholar] [CrossRef]

- Jiang, D.; Ni, Z.; Chen, Y.; Chen, X.; Na, C. Influence of Financial Shared Services on the Corporate Debt Cost under Digitalization. Sustainability 2023, 15, 428. [Google Scholar] [CrossRef]

- Xue, L.; Zhang, Q.; Zhang, X.; Li, C. Can Digital Transformation Promote Green Technology Innovation? Sustainability 2022, 14, 7497. [Google Scholar] [CrossRef]

- Huang, D.; Xie, H.; Meng, X.; Zhang, Q. Digital Transformation and Enterprise Value—Empirical Evidence Based on Text Analysis Methods. Economist 2021, 33, 41–51. [Google Scholar] [CrossRef]

- Erkut, B. From Digital Government to Digital Governance: Are We There Yet? Sustainability 2020, 12, 860. [Google Scholar] [CrossRef]

- Asgarkhani, M. Digital Government and Its Effectiveness in Public Management Reform. Public Manag. Rev. 2005, 7, 465–487. [Google Scholar] [CrossRef]

- Janowski, T. Digital Government Evolution: From Transformation to Contextualization. Gov. Inf. Q. 2015, 32, 221–236. [Google Scholar] [CrossRef]

- Sanina, A.; Balashov, A.; Rubtcova, M. The Socio-Economic Efficiency of Digital Government Transformation. Int. J. Public Adm. 2023, 46, 85–96. [Google Scholar] [CrossRef]

- Peng, X.; Peng, Y. Research on the Differences of Attention Allocation and Governance Logic of Local Governments in Rural Revitalization—Based on the Grounded Analysis of 410 Policy Texts. Chin. Public Adm. 2022, 80–88. [Google Scholar] [CrossRef]

- Qi, H.; Cao, X.; Liu, Y. The Influence of Digital Economy on Corporate Governance: Analyzed from Information Asymmetry and Irrational Behavior Perspective. Reform 2020, 4, 50–64. [Google Scholar]

- Chen, Y.; Yang, M. Digital Transformation, Business Mode Innovation and Business Efficiency. Econ. Forum 2022, 36, 135–146. [Google Scholar] [CrossRef]

- Zhang, J.; Long, J.; von Schaewen, A.M.E. How Does Digital Transformation Improve Organizational Resilience?—Findings from PLS-SEM and FsQCA. Sustainability 2021, 13, 11487. [Google Scholar] [CrossRef]

- Chen, L.; Moretto, A.; Jia, F.; Caniato, F.; Xiong, Y. The Role of Digital Transformation to Empower Supply Chain Finance: Current Research Status and Future Research Directions (Guest Editorial). Int. J. Oper. Prod. Manag. 2021, 41, 277–288. [Google Scholar] [CrossRef]

- Fan, X.; Wang, Y.; Lu, X. Digital Transformation Drives Sustainable Innovation Capability Improvement in Manufacturing Enterprises: Based on FsQCA and NCA Approaches. Sustainability 2023, 15, 542. [Google Scholar] [CrossRef]

- Zhao, C.; Wang, W.; Li, X. How Does Digital Transformation Affect the Total Factor Productivity of Enterprises? Financ. Trade Econ. 2021, 42, 114–129. [Google Scholar] [CrossRef]

- Chen, Q.; Wang, Y.; Wan, M. Research on Peer Effect of Enterprise Digital Transformation and Influencing Factors. Chin. J. Manag. 2021, 18, 653–663. [Google Scholar]

- Yuan, C.; Xiao, T.; Geng, C.; Sheng, Y. Digital Transformation and Division of Labor between Enterprises: Vertical Specialization or Vertical Integration. China Ind. Econ. 2021, 9, 137–155. [Google Scholar] [CrossRef]

- Du, M.; Geng, J.; Liu, W. Enterprises’ Digital Transformation and Quality Upgrading in Chinese Export Products: Micro-Evidence from Listed Companies. J. Int. Trade 2022, 48, 55–72. [Google Scholar] [CrossRef]

- Wu, C.; Zhang, K.; Zhou, X.; Zhou, Z. Digital Transformation, Choice of Competitive Strategy, and High-Quality Development of Firms: From Evidence of Machine Learning and Text Analysis. Bus. Manag. J. 2022, 44, 5–22. [Google Scholar] [CrossRef]

- Dubey, R.; Gunasekaran, A.; Childe, S.J.; Blome, C.; Papadopoulos, T. Big Data and Predictive Analytics and Manufacturing Performance: Integrating Institutional Theory, Resource-Based View and Big Data Culture. Br. J. Manag. 2019, 30, 341–361. [Google Scholar] [CrossRef]

- El Hilali, W.; El Manouar, A.; Janati Idrissi, M.A. Reaching Sustainability during a Digital Transformation: A PLS Approach. Int. J. Innov. Sci. 2020, 12, 52–79. [Google Scholar] [CrossRef]

- Li, L. Digital Transformation and Sustainable Performance: The Moderating Role of Market Turbulence. Ind. Mark. Manag. 2022, 104, 28–37. [Google Scholar] [CrossRef]

- Gangwar, H. Understanding the Determinants of Big Data Adoption in India: An Analysis of the Manufacturing and Services Sectors. Inf. Resour. Manag. J. (IRMJ) 2018, 31, 1–22. [Google Scholar] [CrossRef]

- Sultan, N. Cloud Computing for Education: A New Dawn? Int. J. Inf. Manag. 2010, 30, 109–116. [Google Scholar] [CrossRef]

- Xu, H.; Zhang, Y.; Cao, Y. Digital Economy, Technology Spillover and Dynamic Coopetition Policy. Manag. World 2020, 36, 63–84. [Google Scholar] [CrossRef]

- Yu, D.; Wang, C.; Chen, L. Government Subsidies, Industrial Chain Coordination and Enterprise Digitalization: Evidence from Listed Companies. Bus. Manag. J. 2022, 44, 63–82. [Google Scholar] [CrossRef]

- Wu, F.; Chang, X.; Ren, X. Government-Driven Innovation: Fiscal Technology Expenditure and Enterprise Digital Transformation. Public Financ. Res. 2021, 42, 102–115. [Google Scholar] [CrossRef]

- Yang, X.; Ning, Z.; Xiang, H.; Chen, J. Local Economic Growth Goals and Corporate Digital Transformation: Based on Empirical Evidence of Text Recognition of Listed Companies’ Annual Reports. China Soft Sci. 2021, 172–184. [Google Scholar]

- Tang, S.; Li, Q.; Wu, F. Financial Marketization Reform and Enterprise Digital Transformation—Empirical Evidence from the Marketization of Interest Rates in China. J. Beijing Technol. Bus. Univ. (Soc. Sci.) 2022, 37, 13–27. [Google Scholar]

- Zhang, X.; Xu, Y.; Ma, L. Research on Successful Factors and Influencing Mechanism of the Digital Transformation in SMEs. Sustainability 2022, 14, 2549. [Google Scholar] [CrossRef]

- Ren, X.; Ning, Z.; Wu, F. Corporate Financialization and Digital Transformation: Identification and Inspection of Digital Text Information Based on Annual Reports of Listed Companies. Econ. Manag. 2022, 36, 84–92. [Google Scholar]

- Zhang, L.; Su, X.; Yuan, L. Supply Chain Finance and Digital Transformation of Enterprises:Heterogeneous Features, Channel Mechanisms, and Effect Differences in an Untrustworthy Environment. Financ. Econ. Res. 2021, 36, 51–67. [Google Scholar]

- Tang, H.; Jiang, D. Digital M&A and Digital Transformation of Enterprises:Connotation, Facts and Experience. Economist 2021, 4, 22–29. [Google Scholar] [CrossRef]

- Rupeika-Apoga, R.; Petrovska, K.; Bule, L. The Effect of Digital Orientation and Digital Capability on Digital Transformation of SMEs during the COVID-19 Pandemic. J. Theor. Appl. Electron. Commer. Res. 2022, 17, 669–685. [Google Scholar] [CrossRef]

- Eller, R.; Alford, P.; Kallmünzer, A.; Peters, M. Antecedents, Consequences, and Challenges of Small and Medium-Sized Enterprise Digitalization. J. Bus. Res. 2020, 112, 119–127. [Google Scholar] [CrossRef]

- Porfírio, J.A.; Carrilho, T.; Felício, J.A.; Jardim, J. Leadership Characteristics and Digital Transformation. J. Bus. Res. 2021, 124, 610–619. [Google Scholar] [CrossRef]

- Meng, T. Elements, Mechanisms and Approaches Towards Digital Transformation of Government: The Dual Drivers from Technical Empowerment to the State and Society. Gov. Stud. 2021, 37, 5–14. [Google Scholar] [CrossRef]

- Wang, X.; Huang, H.; Xia, Y. E-Governance Construction and Enterprise Innovation. Financ. Econ. 2021, 65, 118–132. [Google Scholar] [CrossRef]

- Li, E.; Chen, Q.; Zhang, X.; Zhang, C. Digital Government Development, Local Governments’ Attention Distribution and Enterprise Total Factor Productivity: Evidence from China. Sustainability 2023, 15, 2472. [Google Scholar] [CrossRef]

- Lucas, H.; Agarwal, R.; Clemons, E.K.; El Sawy, O.A.; Weber, B. Impactful Research on Transformational Information Technology: An Opportunity to Inform New Audiences. MIS Q. 2013, 37, 371–382. [Google Scholar] [CrossRef]

- Steiber, A.; Alänge, S.; Ghosh, S.; Goncalves, D. Digital Transformation of Industrial Firms: An Innovation Diffusion Perspective. Eur. J. Innov. Manag. 2020, 24, 799–819. [Google Scholar] [CrossRef]

- Verhoef, P.C.; Broekhuizen, T.; Bart, Y.; Bhattacharya, A.; Qi Dong, J.; Fabian, N.; Haenlein, M. Digital Transformation: A Multidisciplinary Reflection and Research Agenda. J. Bus. Res. 2021, 122, 889–901. [Google Scholar] [CrossRef]

- Gurbaxani, V.; Dunkle, D. Gearing up for Successful Digital Transformation. MIS Q. Exec. 2019, 18, 6. [Google Scholar] [CrossRef]

- Mhlungu, N.S.M.; Chen, J.Y.J.; Alkema, P. The Underlying Factors of a Successful Organisational Digital Transformation. South Afr. J. Inf. Manag. 2019, 21, 10. [Google Scholar] [CrossRef]

- Raimo, N.; De Turi, I.; Albergo, F.; Vitolla, F. The Drivers of the Digital Transformation in the Healthcare Industry: An Empirical Analysis in Italian Hospitals. Technovation 2023, 121, 102558. [Google Scholar] [CrossRef]

- Llopis-Albert, C.; Rubio, F.; Valero, F. Impact of Digital Transformation on the Automotive Industry. Technol. Forecast. Soc. Chang. 2021, 162, 120343. [Google Scholar] [CrossRef]

- Borowski, P.F. Digitization, Digital Twins, Blockchain, and Industry 4.0 as Elements of Management Process in Enterprises in the Energy Sector. Energies 2021, 14, 1885. [Google Scholar] [CrossRef]

- Battisti, E.; Shams, S.M.R.; Sakka, G.; Miglietta, N. Big Data and Risk Management in Business Processes: Implications for Corporate Real Estate. Bus. Process Manag. J. 2019, 26, 1141–1155. [Google Scholar] [CrossRef]

- Feyen, E.; Frost, J.; Gambacorta, L.; Natarajan, H.; Saal, M. Fintech and the Digital Transformation of Financial Services: Implications for Market Structure and Public Policy. BIS Papers 2021. Available online: https://www.bis.org/publ/bppdf/bispap117.pdf (accessed on 18 January 2023).

- Chung, C.-S.; Choi, H.; Cho, Y. Analysis of Digital Governance Transition in South Korea: Focusing on the Leadership of the President for Government Innovation. J. Open Innov. Technol. Mark. Complex. 2022, 8, 2. [Google Scholar] [CrossRef]

- Chen, C.-L.; Lin, Y.-C.; Chen, W.-H.; Chao, C.-F.; Pandia, H. Role of Government to Enhance Digital Transformation in Small Service Business. Sustainability 2021, 13, 1028. [Google Scholar] [CrossRef]

- Van den Born, A.; Bosma, B.; Van Witteloostuijn, A. The Effect of Digital Maturity on Digital Innovation under Extreme Adversity. 2020. Available online: https://osf.io/r6c5j/download (accessed on 10 January 2023).

- Klein, V.B.; Todesco, J.L. COVID-19 Crisis and SMEs Responses: The Role of Digital Transformation. Knowl. Process Manag. 2021, 28, 117–133. [Google Scholar] [CrossRef]

- Kuzior, A.; Arefiev, S.; Poberezhna, Z. Informatization of Innovative Technologies for Ensuring Macroeconomic Trends in the Conditions of a Circular Economy. J. Open Innov. Technol. Mark. Complex. 2023, 9, 100001. [Google Scholar] [CrossRef]

- Sira, M. Efficient Practices of Cognitive Technology Application for Smart Manufacturing. Manag. Syst. Prod. Eng. 2022, 30, 187–191. [Google Scholar] [CrossRef]

- Kuzior, A.; Kettler, K.; Rąb, Ł. Digitalization of Work and Human Resources Processes as a Way to Create a Sustainable and Ethical Organization. Energies 2022, 15, 172. [Google Scholar] [CrossRef]

- Caputo, A.; Fiorentino, R.; Garzella, S. From the Boundaries of Management to the Management of Boundaries: Business Processes, Capabilities and Negotiations. Bus. Process Manag. J. 2019, 25, 391–413. [Google Scholar] [CrossRef]

- Fenech, R.; Baguant, P.; Ivanov, D. The Changing Role of Human Resource Management in an Era of Digital Transformation. J. Manag. Inf. Decis. Sci. 2019, 22, 166–175. [Google Scholar]

- Schlüter, N.; Sommerhoff, B. Development of the DGQ Role Bundle Model of the Q Occupations. Int. J. Qual. Serv. Sci. 2017, 9, 317–330. [Google Scholar] [CrossRef]

- Schwarzmüller, T.; Brosi, P.; Duman, D.; Welpe, I.M. How Does the Digital Transformation Affect Organizations? Key Themes of Change in Work Design and Leadership. Manag. Rev. 2018, 29, 114–138. [Google Scholar] [CrossRef]

- Liu, Y.; Bian, Y.; Zhang, W. How Does Enterprises’ Digital Transformation Impact the Educational Structure of Employees? Evidence from China. Sustainability 2022, 14, 9432. [Google Scholar] [CrossRef]

- Simon, H.A. Administrative Behavior: A Study of Decision-Making Processes in Administrative Organization; Collier Macmillan Publishers: London, UK, 1976. [Google Scholar]

- Anderson, J.R.; Crawford, J. Cognitive Psychology and Its Implications; W. H. Freeman: San Francisco, CA, USA, 1980; ISBN 0-7167-1197-4. [Google Scholar]

- Zhang, W.; Liu, Z. Behavior for Policy Conflicts of Local Government from the Perspective of Attention—Case Analysis Based on Targeted Poverty Alleviation. J. Public Manag. 2020, 17, 152–162. [Google Scholar] [CrossRef]

- Baumgartner, F.R.; Jones, B.D. Agendas and Instability in American Politics; University of Chicago Press: Chicago, IL, USA, 1993; ISBN 0-226-03939-0. [Google Scholar]

- Jones, B.D.; Baumgartner, F.R.; Talbert, J.C. The Destruction of Issue Monopolies in Congress. Am. Political Sci. Rev. 1993, 87, 657–671. [Google Scholar] [CrossRef]

- Xiao, H.; Yang, Z.; Jiang, B. The Government’s Attention Evolution of Corporate Social Responsibility Governance—Text Analysis Based on the Report on the Work of the Central Government from 1978 to 2019. Mod. Econ. Sci. 2021, 43, 58–73. [Google Scholar]

- Kang, Z. Financing Constraints, Government Support and Chinese Local Enterprises’ R&D Investment. Nankai Bus. Rev. 2013, 16, 61–70. [Google Scholar]

- Bai, J. Are Government R&D Subsidies Efficient in China? Evidence from Large and Medium Enterprises. China Econ. Q. 2011, 10, 1375–1400. [Google Scholar] [CrossRef]

- Zhang, C.; Xie, K. Government Transformation and Digital Government in the Digital Age. Adm. Trib. 2020, 27, 34–41. [Google Scholar] [CrossRef]

- Zhu, K.; Kraemer, K.L.; Xu, S. The Process of Innovation Assimilation by Firms in Different Countries: A Technology Diffusion Perspective on E-Business. Manag. Sci. 2006, 52, 1557–1576. [Google Scholar] [CrossRef]

- Lai, Y.; Sun, H.; Ren, J. Understanding the Determinants of Big Data Analytics (BDA) Adoption in Logistics and Supply Chain Management: An Empirical Investigation. Int. J. Logist. Manag. 2018, 29, 676–703. [Google Scholar] [CrossRef]

- Lyu, F.; Zhu, Y.; de la Robertie, C.; Zhou, J. The Effect of External Environment on the Adoption of Digital Technology for Chinese SMEs. Stud. Sci. Sci. 2021, 39, 2232–2240. [Google Scholar] [CrossRef]

- Hsu, P.-F.; Ray, S.; Li-Hsieh, Y.-Y. Examining Cloud Computing Adoption Intention, Pricing Mechanism, and Deployment Model. Int. J. Inf. Manag. 2014, 34, 474–488. [Google Scholar] [CrossRef]

- Châlons, C.; Dufft, N. The Role of IT as an Enabler of Digital Transformation. In The Drivers of Digital Transformation: Why There’s No Way Around the Cloud; Abolhassan, F., Ed.; Springer International Publishing: Cham, Switzerland, 2017; pp. 13–22. ISBN 978-3-319-31824-0. [Google Scholar]

- Mithas, S.; Tafti, A.; Mitchell, W. How a Firm’s Competitive Environment and Digital Strategic Posture Influence Digital Business Strategy. MIS Q. 2013, 37, 511–536. [Google Scholar] [CrossRef]

- Alsaad, A.; Mohamad, R.; Taamneh, A.; Ismail, N.A. What Drives Global B2B E-Commerce Usage: An Analysis of the Effect of the Complexity of Trading System and Competition Pressure. Technol. Anal. Strateg. Manag. 2018, 30, 980–992. [Google Scholar] [CrossRef]

- Kane, G. The Technology Fallacy: People Are the Real Key to Digital Transformation. Res.-Technol. Manag. 2019, 62, 44–49. [Google Scholar] [CrossRef]

- Low, C.; Chen, Y.; Wu, M. Understanding the Determinants of Cloud Computing Adoption. Ind. Manag. Data Syst. 2011, 111, 1006–1023. [Google Scholar] [CrossRef]

- Oliveira, T.; Martins, M.F. Literature Review of Information Technology Adoption Models at Firm Level. Electron. J. Inf. Syst. Eval. 2011, 14, 110–121. [Google Scholar]

- Giroud, X.; Mueller, H.M. Does Corporate Governance Matter in Competitive Industries? J. Financ. Econ. 2010, 95, 312–331. [Google Scholar] [CrossRef]

- Chang, Y.-K.; Chen, Y.-L.; Chou, R.K.; Huang, T.-H. Corporate Governance, Product Market Competition and Dynamic Capital Structure. Int. Rev. Econ. Financ. 2015, 38, 44–55. [Google Scholar] [CrossRef]

- Ali, A.; Klasa, S.; Yeung, E. Industry Concentration and Corporate Disclosure Policy. J. Account. Econ. 2014, 58, 240–264. [Google Scholar] [CrossRef]

- Jiang, F.; Kim, K.A.; Nofsinger, J.R.; Zhu, B. Product Market Competition and Corporate Investment: Evidence from China. J. Corp. Financ. 2015, 35, 196–210. [Google Scholar] [CrossRef]

- Zhu, K.; Dong, S.; Xu, S.X.; Kraemer, K.L. Innovation Diffusion in Global Contexts: Determinants of Post-Adoption Digital Transformation of European Companies. Eur. J. Inf. Syst. 2006, 15, 601–616. [Google Scholar] [CrossRef]

- Haushalter, D.; Klasa, S.; Maxwell, W.F. The Influence of Product Market Dynamics on a Firm’s Cash Holdings and Hedging Behavior. J. Financ. Econ. 2007, 84, 797–825. [Google Scholar] [CrossRef]

- Kleer, R. Government R&D Subsidies as a Signal for Private Investors. Res. Policy 2010, 39, 1361–1374. [Google Scholar] [CrossRef]

- Feng, G.; Jingyi, W.; Fang, W.; Zhiyun, C.; Tao, K.; Xun, Z. Measuring China’s Digital Financial Inclusion: Index Compilation and Spatial Characteristics. China Econ. Q. 2020, 19, 1401–1418. [Google Scholar] [CrossRef]

- Zhao, T.; Zhang, Z.; Liang, S. Digital Economy, Entrepreneurship, and High-Quality Economic Development: Empirical Evidence from Urban China. Manag. World 2020, 36, 65–76. [Google Scholar] [CrossRef]

- Han, F.; Li, Y. Industrial Agglomeration, Public Service Supply and Urban Expansion. Econ. Res. J. 2019, 54, 149–164. [Google Scholar]

- Combes, P.-P. Economic Structure and Local Growth: France, 1984–1993. J. Urban Econ. 2000, 47, 329–355. [Google Scholar] [CrossRef]

- Chen, Z.; Wang, S. Impact of Product Market Competition on Corporate Cash Flow Risk—Analysis Based on the Competition Degree of Industry and the Competitive Position of Enterprise. China Ind. Econ. 2015, 3, 96–108. [Google Scholar] [CrossRef]

| Variables Names | Symbols | Measurement Method |

|---|---|---|

| Regional financial industry development | FD | Domestic and foreign currency deposit balances by province/GDP by province |

| Industry digitization | ID | Average value of digital transformation for all companies in the industry |

| Size | Size | Natural logarithm of total assets for the year |

| Leverage | Lev | Total liabilities/total assets at the end of the year |

| Operating income growth rate | Growth | Operating income of the current year/operating income of the previous year, minus 1 |

| Number of board members | Board | Natural logarithm of the number of board members |

| Percentage of independent directors | Indep | Number of independent directors/number of directors |

| Duality | Dual | Chairperson and general manager are the same = 1 and 0 otherwise |

| Variable Name | Number of Observations | Mean | Standard Deviation | Median | Minimum | Maximum |

|---|---|---|---|---|---|---|

| DT | 13,697 | 1.84 | 1.35 | 1.79 | 0.00 | 5.01 |

| GA | 13,697 | 3.97 | 1.34 | 4.25 | 0.00 | 5.88 |

| HHI | 13,697 | 0.49 | 0.41 | 0.74 | 0.00 | 0.95 |

| FD | 13,697 | 3.89 | 1.53 | 3.53 | 1.75 | 7.88 |

| ID | 13,697 | 1.82 | 0.79 | 1.62 | 0.30 | 3.82 |

| Size | 13,697 | 22.24 | 1.26 | 22.08 | 19.78 | 26.14 |

| Lev | 13,697 | 0.42 | 0.20 | 0.41 | 0.05 | 0.90 |

| Growth | 13,697 | 0.17 | 0.43 | 0.11 | −0.59 | 2.80 |

| Board | 13,697 | 2.11 | 0.20 | 2.20 | 1.61 | 2.71 |

| Indep | 13,697 | 0.38 | 0.05 | 0.36 | 0.33 | 0.57 |

| Dual | 13,697 | 0.31 | 0.46 | 0.00 | 0.00 | 1.00 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| DT | DT | DT | DT | |

| GA | 0.031 *** | 0.031 *** | 0.031 *** | 0.031 *** |

| (3.46) | (3.38) | (3.90) | (3.58) | |

| HHI | −0.010 | 0.050 | −0.010 | 0.050 |

| (−0.45) | (0.34) | (−0.52) | (1.25) | |

| FD | 0.020 *** | 0.022 *** | 0.020 | 0.022 |

| (2.93) | (3.21) | (0.95) | (1.08) | |

| ID | 1.031 *** | 1.030 *** | 1.031 *** | 1.030 *** |

| (80.06) | (45.87) | (62.61) | (40.04) | |

| Size | 0.117 *** | 0.125 *** | 0.117 *** | 0.125 *** |

| (12.71) | (13.26) | (8.70) | (9.53) | |

| Lev | −0.272 *** | −0.231 *** | −0.272 *** | −0.231 *** |

| (−5.01) | (−4.09) | (−4.45) | (−3.36) | |

| Growth | 0.110 *** | 0.109 *** | 0.110 *** | 0.109 *** |

| (5.01) | (4.94) | (4.85) | (4.97) | |

| Board | −0.031 | −0.035 | −0.031 | −0.035 |

| (−0.52) | (−0.59) | (−0.25) | (−0.28) | |

| Indep | 0.030 | 0.017 | 0.030 | 0.017 |

| (0.14) | (0.08) | (0.07) | (0.04) | |

| Dual | 0.107 *** | 0.106 *** | 0.107 *** | 0.106 *** |

| (5.24) | (5.13) | (3.58) | (3.45) | |

| Constant | −2.601 *** | −2.825 *** | −2.601 *** | −2.825 *** |

| (−10.78) | (−9.91) | (−5.66) | (−5.54) | |

| Industry FE | No | Yes | No | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Observations | 13,697 | 13,697 | 13,697 | 13,697 |

| adj. R2 | 0.364 | 0.364 | 0.364 | 0.364 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| STG | STG | STFR | STFR | |

| GA | 0.025 *** | 0.025 ** | 0.028 *** | 0.028 *** |

| (2.86) | (2.68) | (3.24) | (3.02) | |

| INTER | 0.126 ** | 0.134 ** | 0.007 | 0.007 |

| (2.16) | (2.39) | (1.58) | (1.69) | |

| GA × INTER | 0.061 ** | 0.062 ** | 0.012 *** | 0.012 *** |

| (2.16) | (2.23) | (3.88) | (4.11) | |

| HHI | −0.006 | 0.034 | −0.007 | 0.032 |

| (−0.32) | (0.79) | (−0.35) | (0.74) | |

| FD | 0.006 | 0.007 | 0.022 | 0.024 |

| (0.43) | (0.52) | (1.09) | (1.25) | |

| ID | 1.028 *** | 1.022 *** | 1.028 *** | 1.024 *** |

| (55.23) | (36.95) | (57.22) | (37.84) | |

| Size | 0.117 *** | 0.125 *** | 0.117 *** | 0.126 *** |

| (8.68) | (9.45) | (8.70) | (9.47) | |

| Lev | −0.278 *** | −0.235 *** | −0.278 *** | −0.236 *** |

| (−4.54) | (−3.46) | (−4.57) | (−3.46) | |

| Growth | 0.112 *** | 0.110 *** | 0.111 *** | 0.110 *** |

| (4.88) | (5.03) | (4.91) | (5.04) | |

| Board | −0.027 | −0.032 | −0.028 | −0.033 |

| (−0.22) | (−0.26) | (−0.22) | (−0.26) | |

| Indep | 0.013 | −0.000 | 0.019 | 0.007 |

| (0.03) | (−0.00) | (0.05) | (0.02) | |

| Dual | 0.105 *** | 0.103 *** | 0.106 *** | 0.104 *** |

| (3.69) | (3.55) | (3.68) | (3.55) | |

| Constant | −2.441 *** | −2.642 *** | −2.509 *** | −2.720 *** |

| (−5.13) | (−4.93) | (−5.42) | (−5.28) | |

| Industry FE | No | Yes | No | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Observations | 13,697 | 13,697 | 13,697 | 13,697 |

| adj. R2 | 0.364 | 0.365 | 0.364 | 0.364 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Digital Economy Index | Digital Economy Index | Digital Financial Inclusion Index of China | Digital Financial Inclusion Index of China | |

| GA | 0.003 * | 0.002 ** | 1.145 ** | 0.799 * |

| (1.94) | (2.24) | (2.13) | (1.88) | |

| lnperGDP | 0.103 *** | 40.469 *** | ||

| (10.17) | (10.37) | |||

| IS | 0.028 *** | −1.603 | ||

| (4.32) | (−0.63) | |||

| HAS | −0.041 *** | 2.628 | ||

| (−2.84) | (0.47) | |||

| UR | −0.278 *** | −232.034 *** | ||

| (−3.91) | (−8.45) | |||

| Constant | 0.270 *** | −0.628 *** | 101.977 *** | −163.136 *** |

| (39.01) | (−5.26) | (36.56) | (−3.53) | |

| prov | Yes | Yes | Yes | Yes |

| year | Yes | Yes | Yes | Yes |

| N | 300 | 300 | 300 | 300 |

| adj. R2 | 0.990 | 0.993 | 0.995 | 0.997 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| High Industrial Agglomeration | Low Industrial Agglomeration | SOEs | Non-SOEs | |

| GA | 0.058 * | 0.008 | 0.011 | 0.032 *** |

| (1.85) | (0.71) | (0.63) | (4.16) | |

| HHI | 0.132 | −0.016 | −0.036 | 0.105 |

| (0.91) | (−0.16) | (−0.29) | (0.90) | |

| FD | 0.038 * | 0.015 | −0.013 | 0.047 ** |

| (2.04) | (0.69) | (−0.61) | (2.47) | |

| ID | 0.895 *** | 1.093 *** | 1.084 *** | 0.992 *** |

| (16.86) | (40.01) | (16.86) | (23.05) | |

| Size | 0.145 *** | 0.117 *** | 0.111 *** | 0.160 *** |

| (7.07) | (6.25) | (4.61) | (6.70) | |

| Lev | −0.130 | −0.296 *** | −0.364 *** | −0.174 |

| (−0.86) | (−4.07) | (−4.00) | (−1.63) | |

| Growth | 0.059 * | 0.135 *** | 0.085 | 0.090 *** |

| (1.74) | (4.54) | (1.12) | (4.94) | |

| Board | −0.123 | 0.014 | −0.052 | 0.047 |

| (−1.30) | (0.10) | (−0.30) | (0.29) | |

| Indep | −0.130 | 0.007 | 0.511 | 0.093 |

| (−0.29) | (0.01) | (0.86) | (0.24) | |

| Dual | 0.068 | 0.131 * | 0.139 | 0.064 * |

| (1.31) | (1.97) | (1.70) | (1.98) | |

| Constant | −2.972 *** | −2.705 *** | −2.244 *** | −3.942 *** |

| (−4.61) | (−4.84) | (−6.08) | (−4.34) | |

| Industry FE | Yes | Yes | Yes | Yes |

| Year FE | Yes | Yes | Yes | Yes |

| Observations | 5336 | 8361 | 3775 | 9922 |

| adj. R2 | 0.303 | 0.404 | 0.359 | 0.361 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Large-Scale Firms | Large-Scale Firms | Small-Scale Firms | Small-Scale Firms | |

| GA | 0.068 *** | 0.039 *** | 0.016 | 0.015 |

| (4.39) | (3.21) | (0.99) | (1.08) | |

| HHI | 0.067 | −0.104 | 0.263 * | 0.292 ** |

| (0.58) | (−1.20) | (1.98) | (2.83) | |

| FD | 0.018 | 0.023 | ||

| (0.66) | (1.25) | |||

| ID | 1.072 *** | 0.978 *** | ||

| (31.56) | (19.31) | |||

| Size | 0.089 *** | 0.243 *** | ||

| (5.21) | (5.23) | |||

| Lev | −0.274 ** | −0.171 | ||

| (−2.62) | (−1.29) | |||

| Growth | 0.090 ** | 0.104 *** | ||

| (2.60) | (3.13) | |||

| Board | −0.043 | 0.011 | ||

| (−0.41) | (0.04) | |||

| Indep | −0.209 | 0.573 | ||

| (−0.39) | (1.17) | |||

| Dual | 0.180 *** | 0.048 * | ||

| (3.01) | (1.88) | |||

| Constant | 0.236 | −2.050 *** | 0.264 | −5.443 *** |

| (1.51) | (−3.63) | (1.50) | (−4.02) | |

| Industry | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes |

| N | 7642 | 7380 | 7514 | 6571 |

| Adj. R2 | 0.255 | 0.380 | 0.263 | 0.356 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| High-Tech Enterprises | Non-High-Tech Enterprises | Digital Economy Enterprises | Non-Digital Economy Enterprises | |

| GA | 0.029 | 0.036 ** | 0.014 | 0.038 *** |

| (0.70) | (2.70) | (1.14) | (3.54) | |

| HHI | 0.399 | −0.032 | 0.326 *** | −0.008 |

| (1.06) | (−0.51) | (28.22) | (−0.11) | |

| FD | 0.042 | 0.019 | 0.064 | −0.005 |

| (0.92) | (1.05) | (1.43) | (−0.32) | |

| ID | 0.889 *** | 1.089 *** | 1.194 *** | 1.039 *** |

| (14.94) | (69.37) | (11.98) | (76.65) | |

| Size | 0.164 *** | 0.107 *** | 0.200 *** | 0.104 *** |

| (4.50) | (9.52) | (7.01) | (9.85) | |

| Lev | −0.209 * | −0.273 *** | −0.194 *** | −0.261 ** |

| (−1.95) | (−2.93) | (−12.07) | (−2.48) | |

| Growth | 0.127 ** | 0.105 *** | 0.065 | 0.118 *** |

| (2.59) | (4.71) | (0.99) | (6.85) | |

| Board | −0.256 | 0.016 | −0.144 | 0.012 |

| (−1.37) | (0.14) | (−1.17) | (0.08) | |

| Indep | −1.024 | 0.364 | 0.121 | 0.019 |

| (−1.14) | (0.91) | (0.52) | (0.03) | |

| Dual | 0.140 *** | 0.106 ** | 0.078 * | 0.120 *** |

| (3.27) | (2.11) | (2.51) | (3.55) | |

| Constant | −2.951 ** | −2.672 *** | −4.665 ** | −2.342 *** |

| (−2.36) | (−6.05) | (−5.03) | (−3.93) | |

| Industry | Yes | Yes | Yes | Yes |

| Year | Yes | Yes | Yes | Yes |

| N | 3439 | 10,258 | 3630 | 10,067 |

| Adj. R2 | 0.351 | 0.373 | 0.296 | 0.214 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Growth Period | Mature Period | Recession Period | |

| GA | 0.038 ** | 0.027 | 0.028 * |

| (2.58) | (1.69) | (1.78) | |

| HHI | 0.129 | −0.242 | 0.214 |

| (1.18) | (−1.36) | (1.13) | |

| FD | 0.041 ** | 0.009 | 0.005 |

| (2.34) | (0.49) | (0.16) | |

| ID | 0.992 *** | 1.033 *** | 1.074 *** |

| (74.31) | (26.33) | (20.90) | |

| Size | 0.103 *** | 0.139 *** | 0.155 *** |

| (8.12) | (9.76) | (5.52) | |

| Lev | −0.242 | −0.325 *** | −0.251 ** |

| (−1.53) | (−3.79) | (−2.33) | |

| Growth | 0.091 ** | 0.085 | 0.084 |

| (2.68) | (1.45) | (1.45) | |

| Board | −0.046 | −0.029 | −0.001 |

| (−0.40) | (−0.16) | (−0.01) | |

| Indep | −0.064 | 0.006 | 0.159 |

| (−0.11) | (0.02) | (0.30) | |

| Dual | 0.128 *** | 0.084 ** | 0.090 ** |

| (3.55) | (2.44) | (2.19) | |

| Constant | −2.370 *** | −2.973 *** | −3.374 *** |

| (−5.68) | (−6.31) | (−4.67) | |

| Industry | Yes | Yes | Yes |

| Year | Yes | Yes | Yes |

| N | 6188 | 4877 | 2827 |

| Adj. R2 | 0.360 | 0.381 | 0.349 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| 2012 | 2012 | 2013 | 2013 | |

| GA | 0.030 ** | 0.030 ** | 0.031 ** | 0.032 ** |

| (2.34) | (2.73) | (2.33) | (2.63) | |

| HHI | 0.039 | −0.001 | 0.045 | 0.009 |

| (0.62) | (−0.03) | (0.74) | (0.24) | |

| FD | 0.002 | −0.000 | 0.002 | −0.001 |

| (0.13) | (−0.01) | (0.15) | (−0.04) | |

| ID | 1.068 *** | 1.046 *** | 1.063 *** | 1.045 *** |

| (49.75) | (111.56) | (51.82) | (104.37) | |

| Size | 0.123 *** | 0.111 *** | 0.124 *** | 0.110 *** |

| (5.28) | (5.50) | (5.13) | (4.92) | |

| Lev | −0.165 ** | −0.241 *** | −0.153 * | −0.219 ** |

| (−2.26) | (−3.23) | (−2.02) | (−2.74) | |

| Growth | 0.111 *** | 0.112 *** | 0.106 *** | 0.109 *** |

| (3.86) | (3.81) | (3.66) | (3.72) | |

| Board | 0.091 | 0.080 | 0.094 | 0.099 |

| (0.75) | (0.71) | (0.76) | (0.84) | |

| Indep | 0.237 | 0.227 | 0.291 | 0.318 |

| (0.41) | (0.40) | (0.48) | (0.52) | |

| Dual | 0.083 * | 0.083 ** | 0.078 * | 0.083 * |

| (2.03) | (2.28) | (1.93) | (2.05) | |

| Constant | −3.056 *** | −2.752 *** | −3.158 *** | −2.829 *** |

| (−5.05) | (−4.59) | (−4.95) | (−4.58) | |

| Industry FE | Yes | No | Yes | No |

| Year FE | Yes | Yes | Yes | Yes |

| Observations | 8929 | 9324 | 8629 | 8629 |

| Adj. R2 | 0.441 | 0.437 | 0.440 | 0.440 |

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| One-Period Lag | One-Period Lag | Two-Period Lag | Two-Period Lag | |

| GA | 0.032 ** | 0.032 ** | 0.029 ** | 0.030 *** |

| (2.13) | (2.35) | (2.67) | (2.94) | |

| HHI | 0.027 | 0.005 | 0.031 | 0.026 |

| (0.43) | (0.14) | (0.83) | (0.67) | |

| FD | 0.002 | −0.002 | −0.000 | −0.003 |

| (0.12) | (−0.11) | (−0.02) | (−0.20) | |

| ID | 1.067 *** | 1.048 *** | 1.071 *** | 1.050 *** |

| (44.15) | (95.82) | (36.81) | (84.26) | |

| Size | 0.124 *** | 0.112 *** | 0.123 *** | 0.109 *** |

| (5.26) | (5.04) | (5.29) | (5.00) | |

| Lev | −0.173 ** | −0.245 *** | −0.227 ** | −0.295 *** |

| (−2.31) | (−3.16) | (−2.78) | (−3.47) | |

| Growth | 0.110 *** | 0.114 *** | 0.089 ** | 0.094 ** |

| (3.26) | (3.35) | (2.51) | (2.65) | |

| Board | 0.084 | 0.091 | 0.091 | 0.098 |

| (0.66) | (0.74) | (0.69) | (0.79) | |

| Indep | 0.236 | 0.261 | 0.351 | 0.382 |

| (0.41) | (0.45) | (0.54) | (0.58) | |

| Dual | 0.091 ** | 0.094 ** | 0.089 * | 0.092 * |

| (2.14) | (2.21) | (1.93) | (2.00) | |

| Constant | −3.089 *** | −2.766 *** | −3.124 *** | −2.772 *** |

| (−5.31) | (−4.88) | (−5.12) | (−4.53) | |

| Industry | Yes | No | Yes | No |

| Year | Yes | Yes | Yes | Yes |

| N | 8669 | 8669 | 7910 | 7910 |

| Adj. R2 | 0.442 | 0.442 | 0.443 | 0.443 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jin, X.; Pan, X. Government Attention, Market Competition and Firm Digital Transformation. Sustainability 2023, 15, 9057. https://doi.org/10.3390/su15119057

Jin X, Pan X. Government Attention, Market Competition and Firm Digital Transformation. Sustainability. 2023; 15(11):9057. https://doi.org/10.3390/su15119057

Chicago/Turabian StyleJin, Xuejun, and Xiao Pan. 2023. "Government Attention, Market Competition and Firm Digital Transformation" Sustainability 15, no. 11: 9057. https://doi.org/10.3390/su15119057

APA StyleJin, X., & Pan, X. (2023). Government Attention, Market Competition and Firm Digital Transformation. Sustainability, 15(11), 9057. https://doi.org/10.3390/su15119057