Role of Logistics Integration Capability in Enhancing Performance in Omni-Channel Retailing: Supply Chain Integration as Mediator

Abstract

1. Introduction

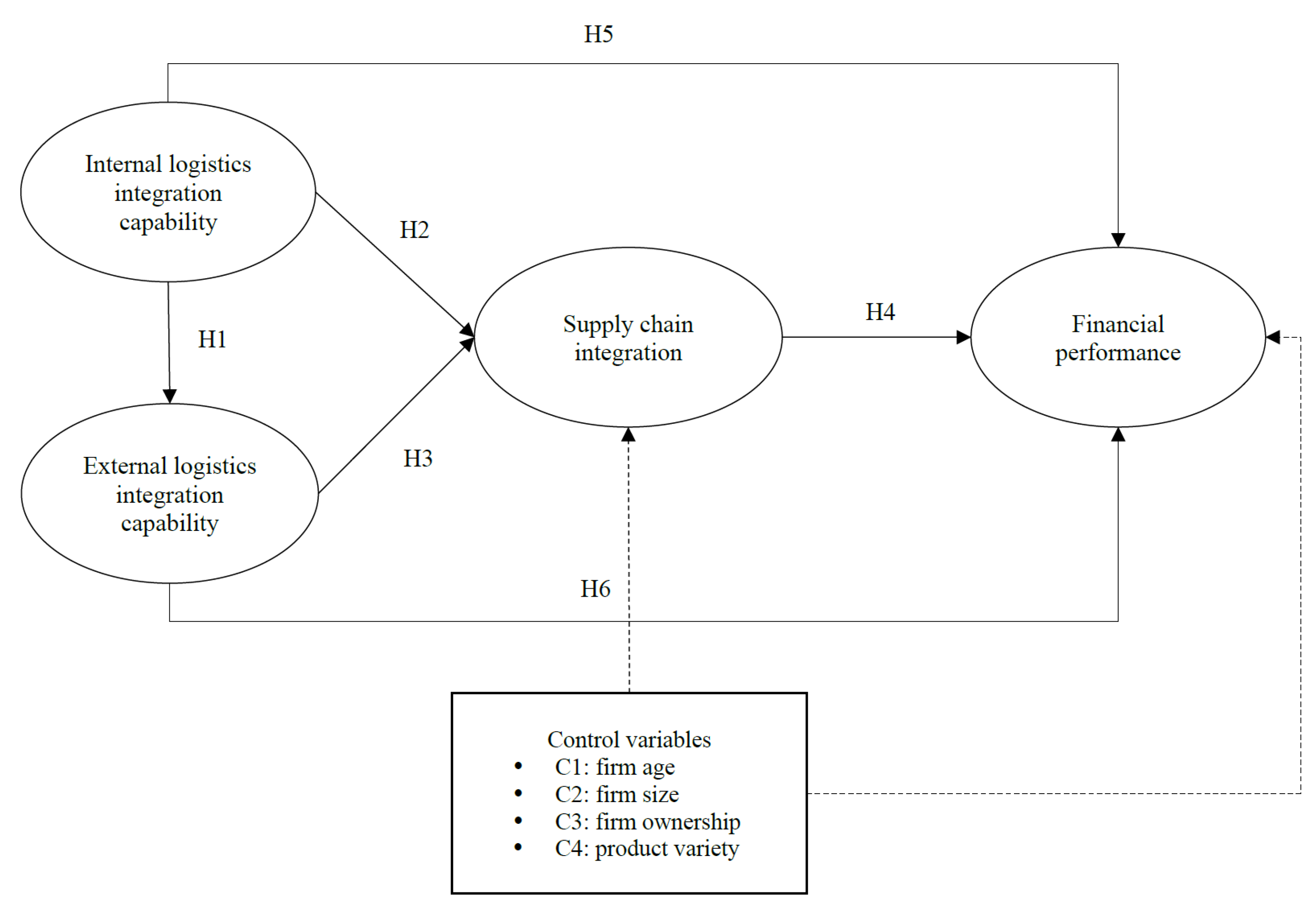

- RQ1:How do OC retailers’ internal logistics integration capabilities influence their external logistics integration capabilities?

- RQ2:How do OC retailers’ internal and external logistics integration capabilities impact SCI?

- RQ3:How do OC retailers’ internal and external logistics integration capabilities and SCI affect FP?

2. Literature Review

2.1. Omni-Channel Retailing

2.2. Logistics Integration in OC Retailing

2.3. SCI and Firm Performance

2.4. Dynamic Capability View

3. Conceptual Model

4. Methodology

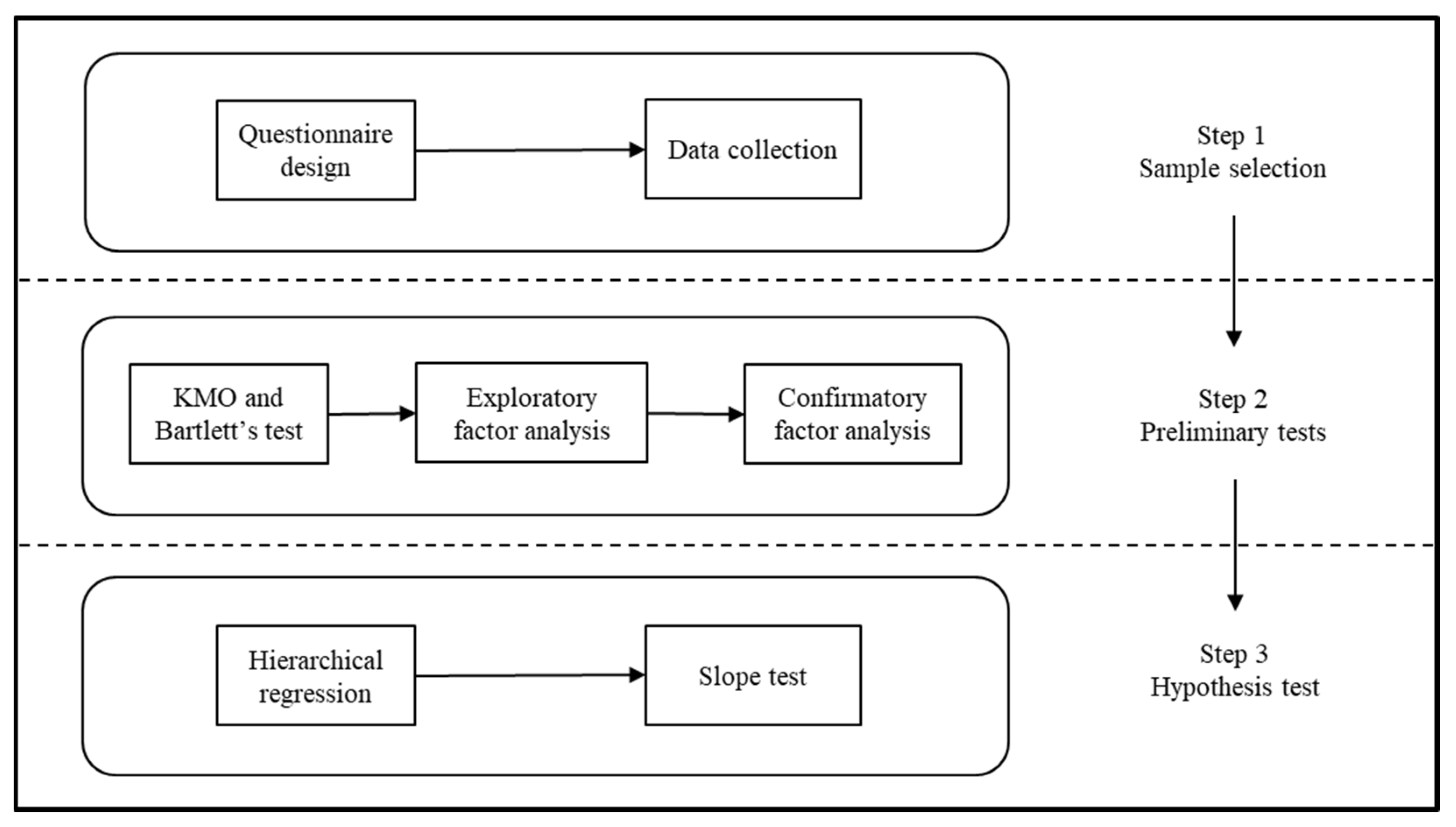

4.1. Research Process

4.2. Measures and Survey Development

4.3. Sample Selection

5. Analysis Results

5.1. Preliminary Study

5.2. Exploratory Study

5.3. Confirmatory Study

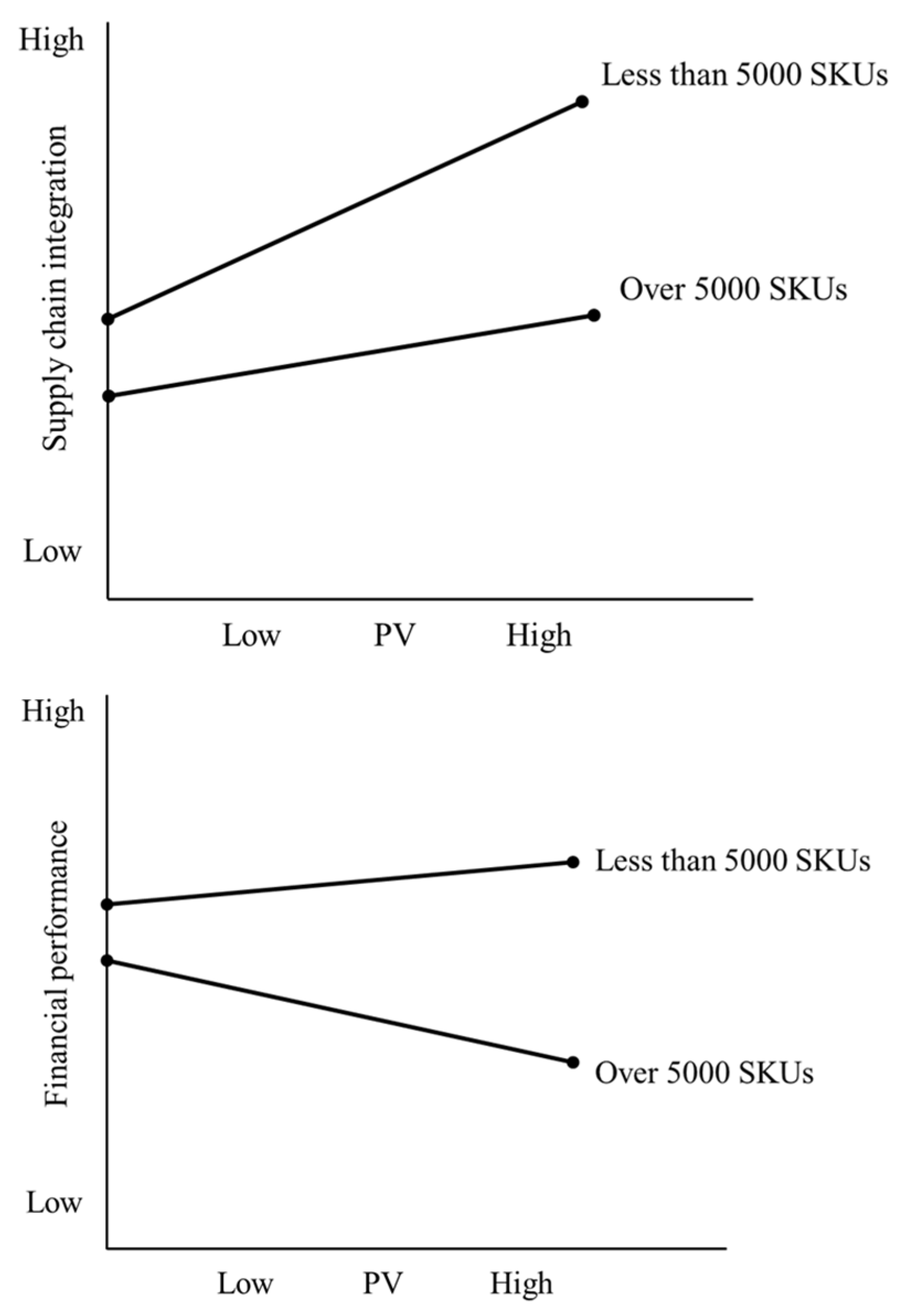

5.4. Hypotheses Testing and Results

6. Discussion and Implications

6.1. Enabling Role of Internal Logistics Integration Capability in External Dimension

6.2. Logistics-Driven SCI in OC Retailing

6.3. Critical Factors Affecting FP of OC Retailers

6.4. Fair Business Environment of the OC Retail Industry

7. Conclusions and Outlook

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- MOFCOM. MOFCOM Regular Press Conference (27 January 2022). Available online: http://english.mofcom.gov.cn/article/newsrelease/press/202202/20220203278924.shtml (accessed on 29 January 2022).

- GOV.CN. China to Promote Innovative Transformation of Offline Retail Sector. Available online: http://www.gov.cn/zhengce/content/2016-11/11/content_5131161.htm (accessed on 11 November 2016).

- Gallino, S.; Moreno, A. Integration of online and offline channels in retail: The impact of sharing reliable inventory availability information. Manag. Sci. 2014, 60, 1434–1451. [Google Scholar] [CrossRef]

- Chopra, S. How omni-channel can be the future of retailing. Decision 2016, 43, 135–144. [Google Scholar] [CrossRef]

- Lehrer, C.; Trenz, M. Omnichannel business. Electron. Mark. 2022, 32, 687–699. [Google Scholar] [CrossRef]

- MOFCOM. The Ministry of Commerce Held a National Retail Industry Innovation and Development Site Meeting. Available online: http://ltfzs.mofcom.gov.cn/article/bi/202010/20201003007744.shtml (accessed on 14 October 2020).

- ChinaIRN.com. Available online: https://www.chinairn.com/news/20230117/173046429.shtml (accessed on 17 January 2023).

- Murfield, M.; Boone, C.A.; Rutner, P.; Thomas, R. Investigating logistics service quality in omni-channel retailing. Int. J. Phys. Distrib. Logist. Manag. 2017, 47, 263–296. [Google Scholar] [CrossRef]

- Hübner, A.; Hense, J.; Dethlefs, C. The revival of retail stores via omnichannel operations: A literature review and research framework. Eur. J. Oper. Res. 2022, 302, 799–818. [Google Scholar] [CrossRef]

- CNR.cn. Available online: http://tech.cnr.cn/techph/20220329/t20220329_525779886.shtml (accessed on 29 March 2022).

- Hübner, A.; Wollenburg, J.; Holzapfel, A. Retail logistics in the transition from multi-channel to omni-channel. Int. J. Phys. Distrib. Logist. Manag. 2016, 46, 562–583. [Google Scholar] [CrossRef]

- Ishfaq, R.; Defee, C.C.; Gibson, B.J.; Raja, U. Realignment of the physical distribution process in omni-channel fulfillment. Int. J. Phys. Distrib. Logist. Manag. 2016, 46, 543–561. [Google Scholar] [CrossRef]

- Simangunsong, E.; Subagyo, I. Investigation and Analysis of Omnichannel Logistics Models: A Study in The Electronic Retail Industry in Indonesia. Oper. Supply Chain. Manag. Int. J. 2021, 14, 221–231. [Google Scholar] [CrossRef]

- Jones, A.L.; Miller, J.W.; Griffis, S.E.; Whipple, J.M.; Voorhees, C.M. An examination of the effects of omni-channel service offerings on retailer performance. Int. J. Phys. Distrib. Logist. Manag. 2022, 52, 150–169. [Google Scholar] [CrossRef]

- Galipoglu, E.; Kotzab, H.; Teller, C.; Yumurtaci Hüseyinoglu, I.Ö.; Pöppelbuß, J. Omni-channel retailing research–state of the art and intellectual foundation. Int. J. Phys. Distrib. Logist. Manag. 2018, 48, 365–390. [Google Scholar] [CrossRef]

- Cai, Y.J.; Lo, C.K. Omni-channel management in the new retailing era: A systematic review and future research agenda. Int. J. Prod. Econ. 2020, 229, 107729. [Google Scholar] [CrossRef]

- Nguyen, A.; McClelland, R.; Hoang Thuan, N.; Hoang, T.G. Omnichannel marketing: Structured review, synthesis, and future directions. Int. Rev. Retail. Distrib. Consum. Res. 2022, 32, 221–265. [Google Scholar] [CrossRef]

- Song, G.; Song, S.; Sun, L. Supply chain integration in omni-channel retailing: A logistics perspective. Int. J. Logist. Manag. 2019, 30, 527–548. [Google Scholar] [CrossRef]

- Mirzabeiki, V.; Saghiri, S.S. From ambition to action: How to achieve integration in omni-channel? J. Bus. Res. 2020, 110, 1–11. [Google Scholar] [CrossRef]

- Arslan, A.N.; Klibi, W.; Montreuil, B. Distribution network deployment for omnichannel retailing. Eur. J. Oper. Res. 2021, 294, 1042–1058. [Google Scholar] [CrossRef]

- Prabhuram, T.; Rajmohan, M.; Tan, Y.; Robert Johnson, R. Performance evaluation of Omni channel distribution network configurations using multi criteria decision making techniques. Ann. Oper. Res. 2020, 288, 435–456. [Google Scholar] [CrossRef]

- Gasparin, I.; Panina, E.; Becker, L.; Yrjölä, M.; Jaakkola, E.; Pizzutti, C. Challenging the “integration imperative”: A customer perspective on omnichannel journeys. J. Retail. Consum. Serv. 2022, 64, 102829. [Google Scholar] [CrossRef]

- Verhoef, P.C. Omni-channel retailing: Some reflections. J. Strateg. Mark. 2021, 29, 608–616. [Google Scholar] [CrossRef]

- Tallón-Ballesteros, A.J.; Santana-Morales, P. Research on Omni-Channel Transformation of Retail Enterprises Under Digital Background. In Digitalization and Management Innovation: Proceedings of DMI 2022; IOS Press: Amsterdam, The Netherlands, 2023. [Google Scholar]

- Lim, X.J.; Cheah, J.H.; Dwivedi, Y.K.; Richard, J.E. Does retail type matter? Consumer responses to channel integration in omni-channel retailing. J. Retail. Consum. Serv. 2022, 67, 102992. [Google Scholar] [CrossRef]

- Song, H.G.; Jo, H. Understanding the Continuance Intention of Omnichannel: Combining TAM and TPB. Sustainability 2023, 15, 3039. [Google Scholar] [CrossRef]

- Kembro, J.; Norrman, A. Exploring trends, implications and challenges for logistics information systems in omni-channels: Swedish retailers’ perception. Int. J. Retail. Distrib. Manag. 2019, 47, 384–411. [Google Scholar] [CrossRef]

- Kadłubek, M.; Jereb, B. Measurement of the Logistic Customer Service Level in Commercial Cargo Motor Transport Companies. Logist. Supply Chain. Sustain. Glob. Chall. 2014, 5, 8–15. [Google Scholar] [CrossRef]

- Risberg, A.; Jafari, H.; Sandberg, E. A configurational approach to last mile logistics practices and omni-channel firm characteristics for competitive advantage: A fuzzy-set qualitative comparative analysis. Int. J. Phys. Distrib. Logist. Manag. 2023, 53, 53–70. [Google Scholar] [CrossRef]

- Mirsch, T.; Lehrer, C.; Jung, R. Channel integration towards omnichannel management: A literature review. In Proceedings of the 20th Pacific Asia Conference on Information Systems (PACIS), Chiayi, Taiwan, 27 June–1 July 2016. [Google Scholar]

- Taylor, D.; Brockhaus, S.; Knemeyer, A.M.; Murphy, P. Omnichannel fulfillment strategies: Defining the concept and building an agenda for future inquiry. Int. J. Logist. Manag. 2019, 30, 863–891. [Google Scholar] [CrossRef]

- Wollenburg, J.; Hübner, A.; Kuhn, H.; Trautrims, A. From bricks-and-mortar to bricks-and-clicks: Logistics networks in omni-channel grocery retailing. Int. J. Phys. Distrib. Logist. Manag. 2018, 48, 415–438. [Google Scholar] [CrossRef]

- de Santos Pérez, M.J.; Flores, M.; Luis, J.; Cano-Olivos, P.; Sánchez-Partida, D. Conceptual Model for the Integration of the Supply Chain. Glob. J. Bus. Res. 2018, 12, 63–71. [Google Scholar]

- Song, S.; Shi, X.; Song, G. The Effect of Omni-Channel Retailer’s Logistics Integration on Firm Performance. In Proceedings of the 15th International Conference on Service Systems and Service Management (ICSSSM), Hangzhou, China, 21–22 July 2018; IEEE: Piscataway, NJ, USA, 2018. [Google Scholar]

- Fairchild, A.M. Extending the network: Defining product delivery partnering preferences for omni-channel commerce. Procedia Technol. 2014, 16, 447–451. [Google Scholar] [CrossRef]

- Fairchild, A.M. What is the role of Third Party Logistics (3PL) partners in an omni-channel strategy? Int. J. Oper. Res. Inf. Syst. 2016, 7, 22–32. [Google Scholar] [CrossRef]

- Leung, K.H.; Mo, D.Y.; Ho, G.T.; Wu, C.H.; Huang, G.Q. Modelling near-real-time order arrival demand in e-commerce context: A machine learning predictive methodology. Ind. Manag. Data Syst. 2020, 120, 1149–1174. [Google Scholar] [CrossRef]

- Liu, C.L.; Lai, P.Y. Impact of external integration capabilities of third-party logistics providers on their financial performance. Int. J. Logist. Manag. 2016, 27, 263–283. [Google Scholar] [CrossRef]

- Picot-Coupey, K.; Huré, E.; Piveteau, L. Channel design to enrich customers’ shopping experiences: Synchronizing clicks with bricks in an omni-channel perspective-the Direct Optic case. Int. J. Retail. Distrib. Manag. 2016, 44, 336–368. [Google Scholar] [CrossRef]

- Song, G.; Song, S. Fostering supply chain integration in omni-channel retailing through human resource factors: Empirical study in China’s market. Int. J. Logist. Res. Appl. 2021, 24, 1–22. [Google Scholar] [CrossRef]

- Zhu, Q.; Krikke, H.; Caniëls, M.C. Supply chain integration: Value creation through managing inter-organizational learning. Int. J. Oper. Prod. Manag. 2018, 38, 211–229. [Google Scholar] [CrossRef]

- Gimenez, C.; Ventura, E. Logistics-production, logistics-marketing and external integration: Their impact on performance. Int. J. Oper. Prod. Manag. 2005, 25, 20–38. [Google Scholar] [CrossRef]

- Huo, B.; Han, Z.; Chen, H.; Zhao, X. The effect of high-involvement human resource management practices on supply chain integration. Int. J. Phys. Distrib. Logist. Manag. 2015, 45, 716–746. [Google Scholar] [CrossRef]

- Willis, G.; Genchev, S.E.; Chen, H. Supply chain learning, integration, and flexibility performance: An empirical study in India. Int. J. Logist. Manag. 2016, 27, 755–769. [Google Scholar] [CrossRef]

- Tarigan, Z.; Mochtar, J.; Basana, S.; Siagian, H. The effect of competency management on organizational performance through supply chain integration and quality. Uncertain Supply Chain. Manag. 2021, 9, 283–294. [Google Scholar] [CrossRef]

- Wong, W.P.; Sinnandavar, C.M.; Soh, K.L. The relationship between supply environment, supply chain integration and operational performance: The role of business process in curbing opportunistic behaviour. Int. J. Prod. Econ. 2021, 232, 107966. [Google Scholar] [CrossRef]

- Flynn, B.B.; Huo, B.; Zhao, X. The impact of supply chain integration on performance: A contingency and configuration approach. J. Oper. Manag. 2010, 28, 58–71. [Google Scholar] [CrossRef]

- Zhao, G.; Feng, T.; Wang, D. Is more supply chain integration always beneficial to financial performance? Ind. Mark. Manag. 2015, 45, 162–172. [Google Scholar] [CrossRef]

- Bernon, M.; Cullen, J.; Gorst, J. Online retail returns management: Integration within an omni-channel distribution context. Int. J. Phys. Distrib. Logist. Manag. 2016, 46, 584–605. [Google Scholar] [CrossRef]

- Huo, B.; Han, Z.; Prajogo, D. Antecedents and consequences of supply chain information integration: A resource-based view. Supply Chain. Manag. Int. J. 2016, 21, 661–677. [Google Scholar] [CrossRef]

- Yu, W.; Jacobs, M.A.; Chavez, R.; Feng, M. The impacts of IT capability and marketing capability on supply chain integration: A resource-based perspective. Int. J. Prod. Res. 2017, 55, 4196–4211. [Google Scholar] [CrossRef]

- Kim, H.J. Information technology and firm performance: The role of supply chain integration. Oper. Manag. Res. 2017, 10, 1–9. [Google Scholar] [CrossRef]

- Feng, M.; Yu, W.; Chavez, R.; Mangan, J.; Zhang, X. Guanxi and operational performance: The mediating role of supply chain integration. Ind. Manag. Data Syst. 2017, 117, 1650–1668. [Google Scholar] [CrossRef]

- Pettus, M.L.; Kor, Y.Y.; Mahoney, J.T. A theory of change in turbulent environments: The sequencing of dynamic capabilities following industry deregulation. Int. J. Strateg. Change Manag. 2009, 1, 186–211. [Google Scholar] [CrossRef]

- Teece, D.J.; Pisano, G.; Shuen, A. Dynamic capabilities and strategic management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Zhang, L.; Wu, L.; Huang, L.; Zhang, Y. Wield the power of omni-channel retailing strategy: A capability and supply chain resilience perspective. J. Strateg. Mark. 2021, 1–25. [Google Scholar] [CrossRef]

- Mrutzek-Hartmann, B.; Kotzab, H.; Yumurtacı Hüseyinoğlu, I.Ö.; Kühling, S. Omni-channel retailing resources and capabilities of SME specialty retailers–insights from Germany and Turkey. Int. J. Retail. Distrib. Manag. 2022, 50, 1129–1155. [Google Scholar] [CrossRef]

- Zhang, M.; Ren, C.; Wang, G.A.; He, Z. The impact of channel integration on consumer responses in omni-channel retailing: The mediating effect of consumer empowerment. Electron. Commer. Res. Appl. 2018, 28, 181–193. [Google Scholar] [CrossRef]

- Wang, M.; Jie, F.; Abareshi, A. Evaluating logistics capability for mitigation of supply chain uncertainty and risk in the Australian courier firms. Asia Pac. J. Mark. Logist. 2015, 27, 486–498. [Google Scholar] [CrossRef]

- Gruchmann, T.; Seuring, S. Explaining logistics social responsibility from a dynamic capabilities perspective. The International J. Logist. Manag. 2018, 29, 1255–1278. [Google Scholar] [CrossRef]

- Irfan, M.; Wang, M.; Akhtar, N. Enabling supply chain agility through process integration and supply flexibility: Evidence from the fashion industry. Asia Pac. J. Mark. Logist. 2020, 32, 519–547. [Google Scholar] [CrossRef]

- Ahmed, W.; Najmi, A.; Mustafa, Y.; Khan, A. Developing model to analyze factors affecting firms’ agility and competitive capability: A case of a volatile market. J. Model. Manag. 2019, 14, 476–491. [Google Scholar] [CrossRef]

- Rajaguru, R.; Matanda, M.J. Role of compatibility and supply chain process integration in facilitating supply chain capabilities and organizational performance. Supply Chain. Manag. Int. J. 2019, 24, 301–316. [Google Scholar] [CrossRef]

- Madani, M.; Jermsittiparsert, K. A conceptual and empirical model of supply chain risk management model in Indonesian SMEs. Humanit. Soc. Sci. Rev. 2019, 7, 703–710. [Google Scholar] [CrossRef]

- Jeanpert, S.; Paché, G. Successful multi-channel strategy: Mixing marketing and logistical issues. J. Bus. Strategy 2016, 37, 12–19. [Google Scholar] [CrossRef]

- Rosenzweig, E.D.; Roth, A.V.; Dean, J.W., Jr. The influence of an integration strategy on competitive capabilities and business performance: An exploratory study of consumer products manufacturers. J. Oper. Manag. 2003, 21, 437–456. [Google Scholar] [CrossRef]

- Demeter, K.; Szász, L.; Rácz, B.G. The impact of subsidiaries’ internal and external integration on operational performance. Int. J. Prod. Econ. 2016, 182, 73–85. [Google Scholar] [CrossRef]

- Nande, S.; Rathod, S. A Study of Logistics Integration in Sustainable Food Supply: A Case of Samvad Social Technologies. Res. Journey 2019, 69–77. [Google Scholar]

- Chang, W.; Ellinger, A.E.; Kim, K.K.; Franke, G.R. Supply chain integration and firm financial performance: A meta-analysis of positional advantage mediation and moderating factors. Eur. Manag. J. 2016, 34, 282–295. [Google Scholar] [CrossRef]

- Huo, B. The impact of supply chain integration on company performance: An organizational capability perspective. Supply Chain. Manag. Int. J. 2012, 17, 596–610. [Google Scholar] [CrossRef]

- Hübner, A.; Holzapfel, A.; Kuhn, H. Distribution systems in omni-channel retailing. Bus. Res. 2016, 9, 255–296. [Google Scholar] [CrossRef]

- Wiengarten, F.; Pagell, M.; Ahmed, M.U.; Gimenez, C. Do a country’s logistical capabilities moderate the external integration performance relationship? J. Oper. Manag. 2014, 32, 51–63. [Google Scholar] [CrossRef]

- Pereira, M.M.; Frazzon, E.M. A data-driven approach to adaptive synchronization of demand and supply in omni-channel retail supply chains. Int. J. Inf. Manag. 2021, 57, 102165. [Google Scholar] [CrossRef]

- Mellat-Parast, M.; Spillan, J.E. Logistics and supply chain process integration as a source of competitive advantage: An empirical analysis. Int. J. Logist. Manag. 2014, 25, 289–314. [Google Scholar] [CrossRef]

- Xu, D.; Huo, B.; Sun, L. Relationships between intra-organizational resources, supply chain integration and business performance: An extended resource-based view. Ind. Manag. Data Syst. 2014, 114, 1186–1206. [Google Scholar] [CrossRef]

- Zhang, C.; Gunasekaran, A.; Wang, W.Y.C. A comprehensive model for supply chain integration. Benchmarking: Int. J. 2015, 22, 1141–1157. [Google Scholar] [CrossRef]

- Shou, Y.; Li, Y.; Park, Y.; Kang, M. Supply chain integration and operational performance: The contingency effects of production systems. J. Purch. Supply Manag. 2018, 24, 352–360. [Google Scholar] [CrossRef]

- Huo, B.; Flynn, B.B.; Zhao, X. Supply chain power configurations and their relationship with performance. J. Supply Chain. Manag. 2017, 53, 88–111. [Google Scholar] [CrossRef]

- Macarena, S.D.; Pedro, G.V.; Jose, M.F. Mediating and non-linear relationships among supply chain integration dimensions. Int. J. Phys. Distrib. Logist. Manag. 2018, 48, 698–723. [Google Scholar]

- Prajogo, D.; Oke, A.; Olhager, J. Supply chain processes: Linking supply logistics integration, supply performance, lean processes and competitive performance. Int. J. Oper. Prod. Manag. 2016, 36, 220–238. [Google Scholar] [CrossRef]

- Alfalla-Luque, R.; Marin-Garcia, J.A.; Medina-Lopez, C. An analysis of the direct and mediated effects of employee commitment and supply chain integration on organisational performance. Int. J. Prod. Econ. 2015, 162, 242–257. [Google Scholar] [CrossRef]

- Cheng, Y.; Chaudhuri, A.; Farooq, S. Interplant coordination, supply chain integration, and operational performance of a plant in a manufacturing network: A mediation analysis. Supply Chain. Manag. Int. J. 2016, 21, 550–568. [Google Scholar] [CrossRef]

- Yu, W.; Chavez, R.; Jacobs, M.A.; Feng, M. Data-driven supply chain capabilities and performance: A resource-based view. Transp. Res. Part E Logist. Transp. Rev. 2018, 114, 371–385. [Google Scholar] [CrossRef]

- Zhang, M.; Zhao, X.; Qi, Y. The effects of organizational flatness, coordination, and product modularity on mass customization capability. Int. J. Prod. Econ. 2014, 158, 145–155. [Google Scholar] [CrossRef]

- Prajogo, D.; Olhager, J. Supply chain integration and performance: The effects of long-term relationships, information technology and sharing, and logistics integration. Int. J. Prod. Econ. 2012, 135, 514–522. [Google Scholar] [CrossRef]

- Matell, M.S.; Jacoby, J. Is there an optimal number of alternatives for Likert-scale items? Effects of testing time and scale properties. J. Appl. Psychol. 1972, 56, 506–509. [Google Scholar] [CrossRef]

- Swink, M.; Song, M. Effects of marketing-manufacturing integration on new product development time and competitive advantage. J. Oper. Manag. 2007, 25, 203–217. [Google Scholar] [CrossRef]

- Fisher, M.L.; Ittner, C.D. The impact of product variety on automobile assembly operations: Empirical evidence and simulation analysis. Manag. Sci. 1999, 45, 771–786. [Google Scholar] [CrossRef]

- National Bureau of Statistics. Director of the National Bureau of Statistics Gave Answers to Journalists’ Questions on the National Economic Performance for the Year 2022. Available online: http://www.stats.gov.cn/sj/sjjd/202302/t20230202_1896734.html (accessed on 17 January 2023).

- Armstrong, J.S.; Overton, T.S. Estimating nonresponse bias in mail surveys. J. Mark. Res. 1977, 14, 396–402. [Google Scholar] [CrossRef]

- Eltayeb, T.K.; Zailani, S.; Ramayah, T. Green supply chain initiatives among certified companies in Malaysia and environmental sustainability: Investigating the outcomes. Resour. Conserv. Recycl. 2011, 55, 495–506. [Google Scholar] [CrossRef]

- Skipper, J.B.; Hanna, J.B. Minimizing supply chain disruption risk through enhanced flexibility. Int. J. Phys. Distrib. Logist. Manag. 2009, 39, 404–427. [Google Scholar] [CrossRef]

- Dunn, S.C.; Seaker, R.F.; Waller, M.A. Latent variables in business logistics research: Scale development and validation. J. Bus. Logist. 1994, 15, 145–172. [Google Scholar]

- Koufteros, X.A. Testing a model of pull production: A paradigm for manufacturing research using structural equation modeling. J. Oper. Manag. 1999, 17, 467–488. [Google Scholar] [CrossRef]

- Sparkman, R.M., Jr. Multivariate data analysis with readings. J. Mark. Res. 1979, 16, 437. [Google Scholar] [CrossRef]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Jeon, J. The strengths and limitations of the statistical modeling of complex social phenomenon: Focusing on SEM, path analysis, or multiple regression models. Int. J. Econ. Manag. Eng. 2015, 9, 1634–1642. [Google Scholar]

- Zhao, X.; Huo, B.; Selen, W.; Yeung, J.H.Y. The impact of internal integration and relationship commitment on external integration. J. Oper. Manag. 2011, 29, 17–32. [Google Scholar] [CrossRef]

- Melacini, M.; Perotti, S.; Rasini, M.; Tappia, E. E-fulfilment and distribution in omni-channel retailing: A systematic literature review. Int. J. Phys. Distrib. Logist. Manag. 2018, 48, 391–414. [Google Scholar] [CrossRef]

- Shou, Y.; Hu, W.; Xu, Y. Exploring the role of intellectual capital in supply chain intelligence integration. Ind. Manag. Data Syst. 2018, 118, 1018–1032. [Google Scholar] [CrossRef]

- Haley, U.C.; Haley, G.T. The logic of Chinese business strategy: East versus West: Part I. J. Bus. Strategy 2006, 27, 35–42. [Google Scholar] [CrossRef]

- Asmare, A.; Zewdie, S. Omnichannel retailing strategy: A systematic review. Int. Rev. Retail. Distrib. Consum. Res. 2022, 32, 59–79. [Google Scholar] [CrossRef]

| Research Gap | References | |

|---|---|---|

| Research Method | Most of the studies on the impact of logistics integration on OC retailers’ performance were qualitative. Quantitative research was limited. | [15,17] |

| Research Content | The measurement of the impact of logistics integration on OC retailer’s performance is mainly from the perspective of content, such as information, process and orgaization. The impacts of logistics integration from the dimension of internal and external logistics remain unknown. | [17,18] |

| Measurement Variables | Item | Reference(s) |

|---|---|---|

| Internally integrated IS | II1 | [43,47,77,78,79,80] |

| Real-time information sharing | II2 | |

| Internal mechanism for information confidentiality | II3 | |

| Logistics process integration among channels | II4 | |

| Internal joint decision-making | II5 | |

| Specialized team for joint decision-making | II6 | |

| Information sharing with 3PLs | EI1 | [75,76,81,82,83,84] |

| Unified data interface | EI2 | |

| Joint inventory management with 3PLs | EI3 | |

| Trans-organizational working team | EI4 | |

| Regular communication with 3PLs | EI5 | |

| Compatibility of organization culture | EI6 | |

| Effective coordination among departments | SCI1 | [85] |

| Effective coordination among channels | SCI2 | |

| Information integration with partners | SCI3 | |

| Process integration with partners | SCI4 | |

| Organization integration with partners | SCI5 | |

| Revenue | FP1 | [38,43,47] |

| Operations cost | FP2 | |

| ROA | FP3 | |

| Return on Equity | FP4 | |

| Return on investment | FP5 |

| Characteristics | Percentage (%) |

|---|---|

| Firm age (number of years in Chinese market) | |

| <5 | 21 |

| 5–10 | 23 |

| 11–15 | 16 |

| 16–20 | 13 |

| >20 | 27 |

| Firm size (annual sales in RMB M) | |

| <50 | 17 |

| 50–100 | 14 |

| 100–200 | 9 |

| 200–2000 | 25 |

| >2000 | 35 |

| Ownership of the firm | |

| State owned | 40 |

| Local private | 50 |

| Foreign | 4 |

| Joint venture | 6 |

| Number of SKU | |

| <500 | 52 |

| 500–1000 | 14 |

| 1000–5000 | 12 |

| 5000–10,000 | 4 |

| >10,000 | 18 |

| Item | Factor 1 | Factor 2 | Factor 3 | Factor 4 |

|---|---|---|---|---|

| II1 | 0.768 | |||

| II2 | 0.729 | |||

| II3 | 0.749 | |||

| II4 | 0.674 | |||

| II5 | 0.700 | |||

| II6 | 0.506 | |||

| EI1 | 0.610 | |||

| EI2 | 0.644 | |||

| EI3 | 0.640 | |||

| EI4 | 0.775 | |||

| EI5 | 0.741 | |||

| EI6 | 0.647 | |||

| SCI1 | 0.672 | |||

| SCI2 | 0.838 | |||

| SCI3 | 0.522 | |||

| SCI4 | 0.829 | |||

| SCI5 | 0.598 | |||

| FP1 | 0.773 | |||

| FP2 | 0.794 | |||

| FP3 | 0.786 | |||

| FP4 | 0.789 | |||

| FP5 | 0.813 | |||

| Mean | 3.608 | 3.621 | 3.503 | 3.745 |

| S.D. | 0.769 | 0.757 | 0.811 | 0.737 |

| Cumulative variance explained | 0.201 | 0.396 | 0.589 | 0.770 |

| Cronbach’s α | 0.929 | 0.933 | 0.916 | 0.936 |

| Factor | Item | Standardized Factor Loading | t-Value | R2 |

|---|---|---|---|---|

| Factor 1: Internal integration (II) | II1 | 0.79 | - | 0.63 |

| II2 | 0.85 | 17.83 | 0.72 | |

| II3 | 0.77 | 14.38 | 0.59 | |

| II4 | 0.83 | 13.81 | 0.68 | |

| II5 | 0.83 | 13.80 | 0.68 | |

| II6 | 0.81 | 13.55 | 0.66 | |

| Factor 2: External integration (EI) | EI1 | 0.85 | - | 0.72 |

| EI2 | 0.81 | 15.05 | 0.66 | |

| EI3 | 0.87 | 16.97 | 0.75 | |

| EI4 | 0.79 | 14.50 | 0.62 | |

| EI5 | 0.86 | 16.88 | 0.75 | |

| EI6 | 0.86 | 14.50 | 0.75 | |

| Factor 3: Supply chain integration (SCI) | SCI1 | 0.86 | - | 0.75 |

| SCI2 | 0.80 | 14.52 | 0.63 | |

| SCI3 | 0.81 | 15.83 | 0.65 | |

| SCI4 | 0.80 | 14.90 | 0.64 | |

| SCI5 | 0.86 | 16.70 | 0.73 | |

| Factor 4: Financial performance (FP) | FP1 | 0.82 | - | 0.67 |

| FP2 | 0.91 | 17.35 | 0.83 | |

| FP3 | 0.85 | 15.60 | 0.72 | |

| FP4 | 0.85 | 15.37 | 0.72 | |

| FP5 | 0.91 | 17.54 | 0.83 |

| AVE | II | EI | SCI | FP | |

|---|---|---|---|---|---|

| Internal integration (II) | 0.662 | 0.814 | |||

| External integration (EI) | 0.707 | 0.818 ** | 0.841 | ||

| Supply chain integration (SCI) | 0.683 | 0.768 ** | 0.804 ** | 0.826 | |

| Financial performance (FP) | 0.755 | 0.674 ** | 0.690 ** | 0.672 ** | 0.869 |

| Model | EI | SCI | FP | ||

|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | |

| Independent variable | |||||

| Internal integration (II) | 0.796 *** | 0.369 *** | 0.231 ** | ||

| External integration (EI) | 0.550 *** | 0.282 ** | |||

| Supply-chain integration (SCI) | 0.236 ** | ||||

| Control variable | |||||

| Firm age (C1) | 0.002 | 0.020 | 0.010 | 0.029 | 0.040 |

| Firm size (C2) | 0.023 | 0.036 | 0.050 | 0.016 | 0.016 |

| Firm ownership (C3) | 0.070 | 0.035 | 0.039 | 0.043 | 0.046 |

| Product variety (C4) | 0.038 | 0.145 *** | 0.026 | 0.097 ** | 0.003 |

| Constant | 0.874 *** | 3.303 *** | 0.336 | 3.486 *** | 1.054 *** |

| F-model | 94.279 *** | 4.321 ** | 83.032 *** | 2.685 * | 37.279 *** |

| Adjusted R² | 0.671 | 0.055 | 0.682 | 0.029 | 0.526 |

| II | EI | SCI | FP | C1 | C2 | C3 | C4 | |

|---|---|---|---|---|---|---|---|---|

| Internal integration (II) | 1 | |||||||

| External integration (EI) | 0.818 ** | 1 | ||||||

| Supply chain integration (SCI) | 0.768 ** | 0.804 ** | 1 | |||||

| Financial performance (FP) | 0.674 ** | 0.690 ** | 0.672 ** | 1 | ||||

| Firm age (C1) | 0.124 | 0.093 | 0.074 | 0.008 | 1 | |||

| Firm size (C2) | 0.166 * | 0.119 | 0.055 | 0.073 | 0.525 ** | 1 | ||

| Firm ownership (C3) | 0.061 | 0.014 | 0.015 | 0.055 | 0.034 | 0.060 | 1 | |

| Product variety (C4) | 0.278 ** | 0.280 ** | 0.260 ** | 0.203 ** | 0.253 ** | 0.362 ** | 0.055 | 1 |

| Model | FP | SCI | FP | SCI | ||

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | |

| Internal integration (II) | 0.646 *** | 0.370 *** | 0.809 *** | |||

| External integration (EI) | 0.671 *** | 0.412 *** | 0.862 *** | |||

| Supply chain integration (SCI) | 0.341 *** | 0.301 *** | ||||

| Constant | 1.416 *** | 1.217 *** | 0.583 ** | 1.314 *** | 1.199 *** | 0.383 * |

| F-model | 190.035 *** | 119.284 *** | 327.068 *** | 207.038 *** | 120.322 *** | 417.421 *** |

| Adjusted R² | 0.452 | 0.508 | 0.587 | 0.474 | 0.510 | 0.645 |

| Maximum VIF | 1.000 | 2.435 | 1.000 | 1.000 | 2.831 | 1.000 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Liu, Y.; Song, G. Role of Logistics Integration Capability in Enhancing Performance in Omni-Channel Retailing: Supply Chain Integration as Mediator. Sustainability 2023, 15, 9053. https://doi.org/10.3390/su15119053

Liu Y, Song G. Role of Logistics Integration Capability in Enhancing Performance in Omni-Channel Retailing: Supply Chain Integration as Mediator. Sustainability. 2023; 15(11):9053. https://doi.org/10.3390/su15119053

Chicago/Turabian StyleLiu, Yue, and Guang Song. 2023. "Role of Logistics Integration Capability in Enhancing Performance in Omni-Channel Retailing: Supply Chain Integration as Mediator" Sustainability 15, no. 11: 9053. https://doi.org/10.3390/su15119053

APA StyleLiu, Y., & Song, G. (2023). Role of Logistics Integration Capability in Enhancing Performance in Omni-Channel Retailing: Supply Chain Integration as Mediator. Sustainability, 15(11), 9053. https://doi.org/10.3390/su15119053