Informal Board Hierarchy and High-Quality Corporate Development: Evidence from China

Abstract

1. Introduction

2. Theoretical Analysis and Research Hypothesis

2.1. Analysis of the Direct Effect of the Informal Level of the Board of Directors on the High-Quality Development of the Company

2.2. Analysis of the Conduction Effect of the Informal Level of the Board of Directors on the High-Quality Development of the Enterprise

2.2.1. Transmission Effect of Business Performance

2.2.2. The Transmission Effect of Agency Costs

2.3. Analysis of the Moderating Effect of Environmental Factors on the Informal Board Hierarchy and High-Quality Corporate Development

2.3.1. Analysis of the Impact of the External Environment

2.3.2. Analysis of the Impact of the Internal Environment

3. Study Design

3.1. Sample Selection and Data Sources

3.2. Variable Definition

3.2.1. Explained Variables

3.2.2. Explanatory Variables

3.2.3. Mediating Variables

3.2.4. Moderating Variables

3.2.5. Control Variables

3.3. Research Model

4. Empirical Analysis

4.1. Descriptive Statistics

4.2. Correlation Analysis

4.3. Empirical Analysis of the Direct Effect of the Informal Level of the Board of Directors on the High-Quality Development of the Company

4.3.1. Baseline Regression Analysis

4.3.2. Heterogeneity Analysis

- Heterogeneous analysis of the nature of property rights

- 2.

- Internal control quality heterogeneity analysis

4.3.3. Robustness Test

- Replace the explanatory variables

- 2.

- Reduce the sample size

- 3.

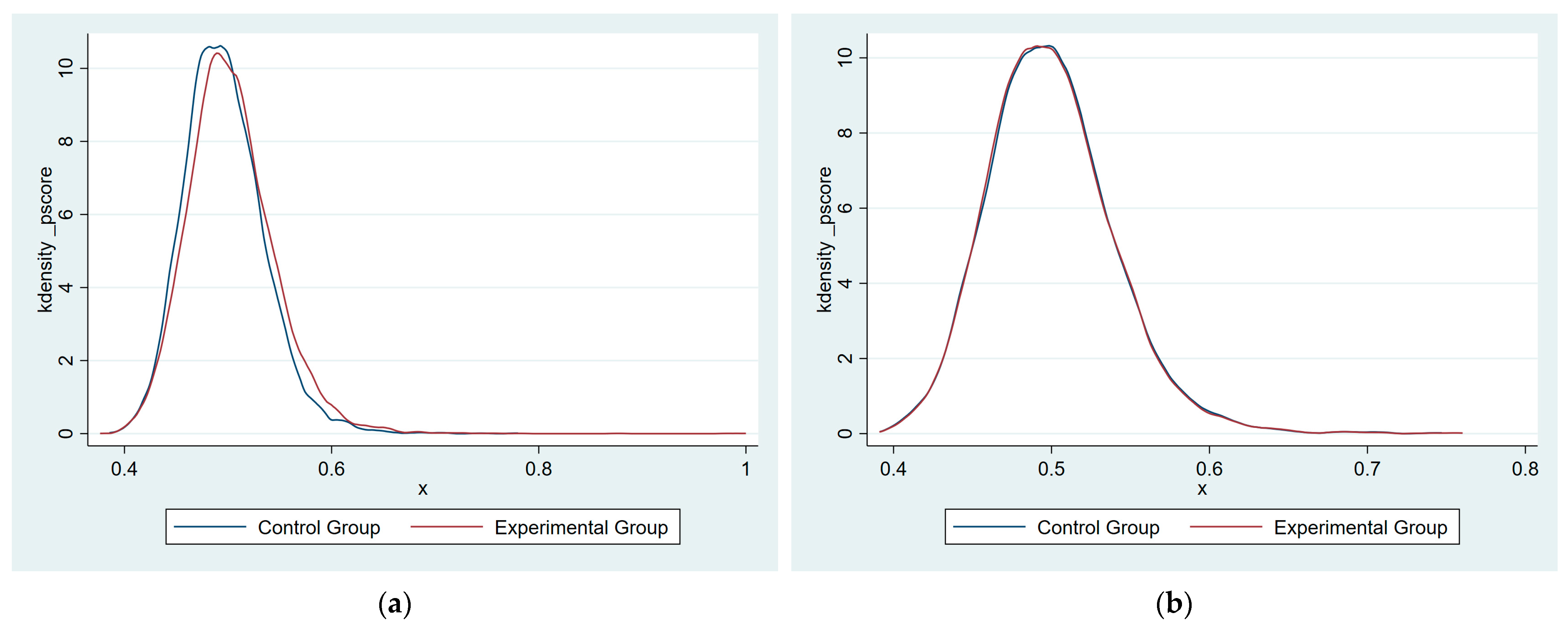

- Endogeneity test

4.4. Empirical Analysis of the Transmission Effect of the Informal Level of the Board of Directors on the High-Quality Development of the Company

4.5. Empirical Analysis of the Moderating Effect of Environmental Factors on Informal Board Levels and High-Quality Corporate Development

5. Summary

5.1. Conclusions

5.2. Insights

- Properly grasp and utilize the role of informal hierarchy in promoting high-quality corporate development

- 2.

- The role of the informal hierarchy in the quality development of enterprises needs to consider the impact of the different environments in which enterprises are located.

5.3. Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Jin, B. Economic research on “high-quality development”. China Ind. Econ. 2018, 4, 5–18. (In Chinese) [Google Scholar]

- Jiang, X.; He, J.; Fang, L. Measurement of manufacturing industry’s high-quality development level, regional difference and improvement path. Shanghai Econ. Res. 2019, 7, 70–78. [Google Scholar]

- Wang, G.; Liu, F.; Pang, Y.; Ren, H. Coal mine intelligentization: The core technology support of high quality development of coal industry. J. China Coal Soc. 2019, 44, 349–357. [Google Scholar] [CrossRef]

- Huang, S.; Xiao, H.; Wang, X. On the high-quality development of state-owned enterprises. China Ind. Econ. 2018, 367, 19–41. [Google Scholar]

- Ren, Z. To promote high-quality development, we need to enhance opportunity awareness and risk awareness. Econ. J. 2020, 11, 14–15. [Google Scholar]

- Li, W.; Yu, M. Ownership nature, marketization process and enterprise risk-taking. China Ind. Econ. 2012, 297, 115–127. [Google Scholar]

- Shi, B.; Tang, H. What kind of leverage ratio is conducive to the high-quality development of enterprises. Financ. Sci. 2019, 376, 80–94. [Google Scholar]

- Zhang, P. The plight of high-quality development of small and medium-sized enterprises and the way out. Res. Social. Chin. Charact. 2019, 149, 25–31. [Google Scholar]

- Duan, S.; Liu, X.; Yin, R.; Cai, L. Do tax and fee cuts enable enterprises to develop with high quality? Econ. Issues 2022, 509, 20–30. [Google Scholar]

- Chen, Z.; Liu, Y. Government subsidies, enterprise innovation and high-quality development of manufacturing enterprises. Reform 2019, 306, 140–151. [Google Scholar]

- Luo, B.; Liu, Y. Tax incentives, innovation investment and high-quality development of enterprises. Tax Econ. Res. 2020, 25, 13–21. [Google Scholar]

- Chen, T.; Wang, Y.; Zhao, X. Business environment, enterprise confidence and high-quality development of enterprises: Empirical evidence from the 2018 China Enterprise Comprehensive Survey (CEGS). J. Macro Qual. Res. 2020, 8, 110–128. [Google Scholar]

- Xu, G.; Zhang, W.; Chen, X. Market-based allocation of energy factors promotes high-quality development and synergy of pollution reduction and carbon reduction. China Environ. Sci. 2023, 1–14. [Google Scholar] [CrossRef]

- Zhang, G.; Meng, M. Internal control, media attention and high-quality development of manufacturing enterprises. Mod. Econ. Res. 2020, 5, 81–87. [Google Scholar]

- Wang, J.; Liao, Z. Media attention and high quality development of state-owned enterprises: Path analysis based on internal control. J. Jishou Univ. (Soc. Sci. Ed.) 2022, 43, 55–64. [Google Scholar]

- He, Y.; Ma, T. Board informal hierarchy and M&A performance. Audit Econ. Res. 2021, 36, 74–84. [Google Scholar]

- Zhang, Y.; Chen, S.; Li, W. Research on the performance effect and influencing mechanism of board informal hierarchy. J. Manag. Sci. 2015, 28, 1–17. [Google Scholar]

- He, J.; Zhi, H. Board Informal Hierarchy and Firm Financial Performance: Exploring a Tacit Structure Guiding Boardroom Interactions. Acad. Manag. J. 2011, 54, 1119–1139. [Google Scholar] [CrossRef]

- Wang, X.; Wu, J. Does board informal hierarchy affect innovation strategy: Based on the test of GEM listed companies. Mon. J. Financ. Account. 2022, 13, 51–60. [Google Scholar]

- Xue, K.; Wu, L.; Wang, K. How does board informal hierarchy affect corporate innovation? Empirical evidence from Chinese listed companies. Forecasting 2021, 40, 25–31. [Google Scholar]

- Yuan, T.; Wang, X. Board informal hierarchy and enterprise innovation: The perspective of relational contract theory. Sci. Technol. Prog. Policy 2022, 39, 81–91. [Google Scholar]

- Liu, Y.W.; Ma, M.X.; Liu, H. Research on the Information Hierarchy of the Board of Directors and Enterprise Innovation Capability. Financ. Account. Commun. 2022, 888, 43–48. [Google Scholar] [CrossRef]

- Magee, J.C.; Galinsky, A.D. 8 Social Hierarchy: The Self-Reinforcing Nature of Power and Status. Acad. Manag. Ann. 2008, 2, 351–398. [Google Scholar] [CrossRef]

- Ma, L.; Gao, Y.; Du, B. Implicit order: Review and prospect of research on board informal hierarchy. Foreign Econ. Manag. 2019, 41, 111–125. [Google Scholar]

- Zheng, Z.; Kan, S.; Huang, J. The part-time job of independent directors: Whether they work more or are too busy. World Econ. 2017, 40, 153–178. [Google Scholar]

- Xie, Y.; Zhang, Y.; Wu, L. Research on the impact of directors’ status difference and decision-making behavior intensity on the financial performance of private listed companies. Chin. J. Manag. 2017, 14, 1767–1776. [Google Scholar]

- Wu, L.; Jiang, J.; Wang, K. Status difference of board members, environmental uncertainty and corporate investment behavior. J. Manag. Sci. 2016, 29, 52–65. [Google Scholar]

- Shan, H.; Hu, E.; Bao, J.; Zhang, M. Study on the impact of perceived organizational status on turnover intention of employees in non-state-owned enterprises. Chin. J. Manag. 2015, 12, 1144–1153. [Google Scholar]

- Chen, S.; Zhang, R. The impact of board informal hierarchy on director dissent. Manag. World 2020, 36, 95–111. [Google Scholar]

- Xie, Y.; Zhang, Y.; Zhang, H.; Zheng, Y. The impact of the formal and informal structure of the board of directors on the frequency of board meetings: The moderating effect of informal communication on the intensity of board behaviors. Foreign Econ. Manag. 2015, 37, 15–28. [Google Scholar]

- Gong, H.; Peng, Y. Expert effect, R&D investment and innovation performance of technical directors. China Soft Sci. 2021, 1, 127–135. [Google Scholar]

- Farhan, N.; Tabash, M.; Almaqtari, F.; Yahya, A. Board composition and firms’ profitability: Empirical evidence from pharmaceutical industry in India. J. Int. Stud. 2020, 13, 180–194. [Google Scholar] [CrossRef]

- Cortellese, F. Does the gender composition of the board of directors have any effect on tax aggressiveness in western countries? Econ. Sociol. 2022, 15, 11–22. [Google Scholar] [CrossRef]

- Mishchuk, H.; Štofkova, J.; Krol, V.; Joshi, O.; Vasa, L. Social Capital Factors Fostering the Sustainable Competitiveness of Enterprises. Sustainability 2022, 14, 11905. [Google Scholar] [CrossRef]

- Liu, Y.; Jiang, N.Y. Review of principal-agent theory. Academia 2006, 1, 69–78. [Google Scholar]

- Eisenhardt, K.M.; Zbaracki, M.J. Strategic decision making. Strateg. Manag. J. 1992, 13, 17–37. [Google Scholar] [CrossRef]

- Daily, C.M.; Dalton, D.R.; Rajagopalan, N. Governance through Ownership: Centuries of Practice, Decades of Research. Acad. Manag. J. 2003, 46, 151–158. [Google Scholar] [CrossRef]

- Yang, J.; Zang, M. Impact of top management team faultlines on innovation efficiency in uncertain environment: A tracking study based on high-tech manufacturing enterprises. J. Manag. Eng. 2022, 36, 46–56. [Google Scholar]

- Yu, W.; Liang, P. Uncertainty, business environment and business vitality of private enterprises. China Ind. Econ. 2019, 136–154. [Google Scholar]

- Shen, H.; Yu, P.; Wu, L. State ownership, environmental uncertainty and investment efficiency. Econ. Res. J. 2012, 47, 113–126. [Google Scholar]

- Jones, C.; Volpe, E.H. Organizational identification: Extending our understanding of social identities through social networks. J. Organ. Behav. 2011, 32, 413–434. [Google Scholar] [CrossRef]

- Mishra, A.K.; Spreitzer, G.M. Explaining How Survivors Respond to Downsizing: The Roles of Trust, Empowerment, Justice, and Work Redesign. Acad. Manag. Rev. 1998, 23, 567–588. [Google Scholar] [CrossRef]

- Ding, Z.; Tan, X. Research on Board Supervision of management behavior under Uncertainty. J. Bus. Econ. Manag. 2014, 270, 23–32. [Google Scholar]

- Lu, X.; Lian, Y. Estimation of total factor productivity of Chinese industrial firms: 1999–2007. China Econ. Q. 2012, 11, 541–558. [Google Scholar]

- Wu, X.; Wang, M.; Su, C. Board informal hierarchy and corporate debt financing. Financ. Res. 2022, 12, 92–103. [Google Scholar]

- Wen, Z.; Ye, B.J. Mediating effect analysis: Methods and model development. Adv. Psychol. Sci. 2014, 22, 731–745. [Google Scholar] [CrossRef]

| Variable Type | Variable Name | Variable Symbols | Variable Definition |

|---|---|---|---|

| Explained variables | High-quality development of enterprises | TFP | Determination by LP method |

| Explanatory variables | Informal Board Hierarchy | GINI | Calculated from model (1) |

| Intermediate variables | Operating Performance | ROA | Net profit/total assets |

| Agency Costs | AC | Administrative expenses/operating income | |

| Adjustment variables | Environmental Uncertainty | EU | From the model calculations (2) we get |

| Level of Board Member Interaction | NBM | Number of board meetings | |

| Control variables | Company Size | SIZE | Natural logarithm of the number of employees |

| Business Growth | GROWTH | (Operating profit for the period/operating profit for the same period last year)-1 | |

| Enterprise Value | Q | Market value/replacement cost | |

| Major shareholders’ shareholding | TOP1 | Percentage of shareholding of the largest shareholder | |

| Nature of ownership | NPR | State-owned enterprises are assigned a value of 1, and non-state-owned enterprises are assigned a value of 0 | |

| Corporate leverage | LEV | Corporate gearing ratio | |

| Cash Flow Ratio | OC | Net cash flow from operating activities/total assets | |

| Executive Shareholding | MH | Several shares held by executives/total share capital. | |

| Percentage of independent directors Internal control | PD DIBO | Number of independent directors/total number High internal control = 1, low internal control = 0 | |

| Company | Company | Dummy Variables | |

| Annual | YEAR | Dummy Variables |

| Variables | N | Mean | Median | Sd | Min | Max |

|---|---|---|---|---|---|---|

| TFP | 18,048 | 9.26 | 9.16 | 1.10 | 6.80 | 12.09 |

| GINI | 18,048 | 0.33 | 0.31 | 0.13 | 0.00 | 1.00 |

| AC | 18,048 | 0.09 | 0.07 | 0.07 | 0.01 | 0.44 |

| ROA | 18,048 | 0.04 | 0.03 | 0.06 | −0.19 | 0.21 |

| NBM | 18,038 | 10.02 | 9.00 | 4.44 | 1.00 | 58.00 |

| EU | 18,048 | 1.30 | 4.44 | 1.14 | 0.13 | 6.66 |

| NPR | 18,048 | 0.43 | 0.00 | 0.50 | 0.00 | 1.00 |

| GROWTH | 18,048 | −0.07 | 0.11 | 3.49 | −20.48 | 12.66 |

| Q | 18,048 | 2.37 | 1.79 | 3.29 | 0.68 | 349.10 |

| LEV | 18,048 | 0.45 | 0.45 | 0.20 | 0.05 | 0.87 |

| TOP1 | 18,048 | 33.63 | 31.26 | 14.65 | 8.77 | 73.82 |

| MH | 18,048 | 8.75 | 0.09 | 15.45 | 0.00 | 67.43 |

| PD | 18,048 | 0.38 | 0.33 | 0.05 | 0.33 | 0.57 |

| OC | 18,048 | 0.05 | 0.05 | 0.07 | −0.16 | 0.24 |

| SIZE | 18,048 | 7.85 | 7.80 | 1.24 | 4.65 | 11.10 |

| DIBO | 18,048 | 0.56 | 1.00 | 0.50 | 0.00 | 1.00 |

| TFP | GINI | AC | ROA | EU | NBM | LEV | SIZE | NPR | GROWTH | Q | MH | PD | OC | TOP1 | DIBO | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| TFP | 1 | |||||||||||||||

| GINI | 0.140 *** | 1 | ||||||||||||||

| AC | −0.580 *** | −0.017 ** | 1 | |||||||||||||

| ROA | 0.140 *** | 0.070 *** | −0.145 *** | 1 | ||||||||||||

| EU | −0.065 *** | −0.012 * | 0.078 *** | −0.082 *** | 1 | |||||||||||

| NBM | 0.208 *** | 0.067 *** | −0.028 *** | −0.064 *** | 0.072 *** | 1 | ||||||||||

| LEV | 0.467 *** | 0.072 *** | −0.307 *** | −0.314 *** | 0.037 *** | 0.237 *** | 1 | |||||||||

| SIZE | 0.656 *** | 0.129 *** | −0.271 *** | 0.096 *** | −0.168 *** | 0.115 *** | 0.313 *** | 1 | ||||||||

| NPR | 0.218 *** | 0.021 *** | −0.136 *** | −0.065 *** | −0.056 *** | −0.050 *** | 0.255 *** | 0.203 *** | 1 | |||||||

| GROWTH | 0.070 *** | 0.007 | −0.100 *** | 0.447 *** | −0.00100 | 0.013 * | −0.067 *** | 0.019 ** | −0.022 *** | 1 | ||||||

| Q | −0.208 *** | 0.015 ** | 0.210 *** | 0.121 *** | 0.073 *** | −0.039 *** | −0.204 *** | −0.172 *** | −0.120 *** | 0.017 ** | 1 | |||||

| MH | −0.194 *** | −0.038 *** | 0.116 *** | 0.090 *** | −0.00700 | −0.00200 | −0.265 *** | −0.155 *** | −0.465 *** | 0.017 ** | 0.099 *** | 1 | ||||

| PD | −0.002 | 0.054 *** | 0.052 *** | −0.022 *** | 0.00200 | 0.051 *** | −0.015 ** | −0.029 *** | −0.069 *** | −0.009 | 0.041 *** | 0.063 *** | 1 | |||

| OC | 0.076 *** | 0.00200 | −0.094 *** | 0.396 *** | −0.092 *** | −0.132 *** | −0.182 *** | 0.157 *** | −0.032 *** | 0.105 *** | 0.044 *** | 0.024 *** | −0.012 | 1 | ||

| TOP1 DIBO | 0.225 *** 0.203 *** | 0.058 *** 0.074 *** | −0.174 *** −0.132 *** | 0.108 *** 0.337 *** | 0.0120 −0.071 *** | −0.045 *** −0.014 * | 0.115 *** −0.001 | 0.183 *** 0.145 *** | 0.267 *** 0.070 *** | 0.019 ** 0.198 *** | −0.050 *** 0.001 | −0.159 *** −0.011 | 0.034 *** −0.011 *** | 0.079 *** 0.120 *** | 1 0.096 *** | 1 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Variables | Full Sample | Non-State Enterprises = 0 | State-Owned Enterprises = 1 | Low Quality of Internal Control = 0 | High Quality of Internal Control = 1 |

| GINI | 0.180 *** | 0.223 *** | 0.098 * | 0.231 *** | 0.123 *** |

| (4.26) | (3.73) | (1.72) | (2.95) | (2.48) | |

| Controls | YES | YES | YES | YES | YES |

| Company/Year | YES | YES | YES | YES | YES |

| Adj-R2 | 0.906 | 0.907 | 0.928 | 0.914 | 0.943 |

| Differences | 0.125 ** | 0.108 * | |||

| Variable | Unmatched Matched | Mean Treated Control | %Bias | %Reduct Bias | t-test | ||

|---|---|---|---|---|---|---|---|

| t | p > t | ||||||

| TOP1 | U | 33.973 | 33.291 | 4.7 | - | 3.12 | 0.002 |

| M | 33.980 | 34.338 | −2.4 | 47.4 | −1.63 | 0.103 | |

| NBM | U | 10.210 | 9.827 | 8.6 | - | 5.81 | 0.000 |

| M | 10.211 | 10.198 | 0.3 | 96.6 | 0.19 | 0.851 | |

| LEV | U | 0.461 | 0.446 | 7.6 | - | 5.13 | 0.000 |

| M | 0.461 | 0.462 | −0.3 | 95.9 | −0.21 | 0.833 | |

| Q | U | 2.425 | 2.319 | 3.2 | - | 2.15 | 0.032 |

| M | 2.366 | 2.348 | 0.6 | 82.6 | 0.63 | 0.531 | |

| PD | U | 0.376 | 0.373 | 6.4 | - | 4.31 | 0.000 |

| M | 0.376 | 0.376 | −0.0 | 99.6 | −0.02 | 0.987 | |

| SIZE | U | 7.909 | 7.786 | 9.9 | - | 6.67 | 0.000 |

| M | 7.911 | 7.910 | 0.1 | 99.2 | 0.05 | 0.958 | |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Variables | TFP | AC | TFP | ROA | TFP | TFP |

| GINI | 0.180 *** | −0.010 ** | 0.134 *** | 0.014 *** | 0.146 *** | |

| (4.26) | (−2.26) | (3.82) | (4.14) | (3.57) | ||

| AC | −4.657 *** | |||||

| (−26.06) | ||||||

| ROA | 2.392 *** | 2.374 *** | ||||

| (17.26) | (17.28) | |||||

| LEV | 0.618 *** | −0.026 *** | 0.496 *** | −0.109 *** | 0.880 *** | 0.876 *** |

| (7.41) | (−3.47) | (7.04) | (−19.20) | (10.62) | (10.60) | |

| SIZE | 0.345 *** | −0.009 *** | 0.302 *** | 0.005 *** | 0.335 *** | 0.334 *** |

| (14.07) | (−5.64) | (13.93) | (3.44) | (14.07) | (14.07) | |

| NPR | −0.063 | 0.000 | −0.062 | −0.005 | −0.051 | −0.050 |

| (−1.16) | (0.02) | (−1.45) | (−1.52) | (−0.99) | (−0.97) | |

| GROWTH | 0.009 *** | −0.002 *** | 0.002 ** | 0.005 *** | −0.003 *** | −0.003 *** |

| (8.91) | (−11.05) | (2.34) | (33.41) | (−2.98) | (−2.86) | |

| Q | −0.007 * | 0.001 * | −0.002 | 0.001 | −0.009 * | −0.009 * |

| (−1.92) | (1.83) | (−1.50) | (1.29) | (−1.72) | (−1.72) | |

| MH | 0.000 | 0.000 | 0.001 | 0.000 *** | −0.001 | −0.001 |

| (0.04) | (0.98) | (0.43) | (3.45) | (−0.47) | (−0.67) | |

| PD | 0.142 | −0.003 | 0.128 | −0.005 | 0.167 | 0.155 |

| (0.88) | (−0.22) | (0.90) | (−0.38) | (1.08) | (0.99) | |

| OC | 0.644 *** | −0.054 *** | 0.393 *** | 0.120 *** | 0.356 *** | 0.358 *** |

| (7.44) | (−5.91) | (5.53) | (13.25) | (4.24) | (4.26) | |

| TOP1 | 0.000 | −0.000 | −0.000 | 0.000 *** | −0.001 | −0.001 |

| (0.13) | (−0.61) | (−0.08) | (4.72) | (−0.71) | (−0.69) | |

| DIBO | 0.116 *** | −0.008 *** | 0.078 *** | 0.017 *** | 0.077 *** | 0.077 *** |

| (14.48) | (−10.11) | (11.60) | (21.80) | (9.87) | (9.89) | |

| Constant | 5.792 *** | 0.178 *** | 6.621 *** | 0.026 * | 5.794 *** | 5.730 *** |

| (28.87) | (12.82) | (36.79) | (1.91) | (29.75) | (29.44) | |

| Observations | 18,048 | 18,048 | 18,048 | 18,048 | 18,048 | 18,048 |

| Adj-R2 | 0.906 | 0.711 | 0.930 | 0.628 | 0.911 | 0.911 |

| FIRM FE | YES | YES | YES | YES | YES | YES |

| Year FE | YES | YES | YES | YES | YES | YES |

| Intermediate Variables | Statistic | Intermediary Effect as a Percentage |

|---|---|---|

| Agency Costs | 2.331 | 0.355 |

| Operating Performance | 4.154 | 0.261 |

| (1) | (2) | (3) | |

|---|---|---|---|

| Variables | TFP | TFP | TFP |

| GINI | 0.180 *** | 0.175 *** | 0.184 *** |

| (4.26) | (4.18) | (4.36) | |

| EU | 0.044 *** | ||

| (6.42) | |||

| NBM | 0.007 *** | ||

| (3.10) | |||

| GINI*NBM | −0.014 ** | ||

| (−2.28) | |||

| GINI*EU | −0.062 * | ||

| (−1.70) | |||

| LEV | 0.618 *** | 0.599 *** | 0.604 *** |

| (7.41) | (7.29) | (7.32) | |

| SIZE | 0.345 *** | 0.340 *** | 0.342 *** |

| (14.07) | (14.16) | (13.98) | |

| NPR | −0.063 | −0.051 | −0.060 |

| (−1.16) | (−0.95) | (−1.11) | |

| GROWTH | 0.009 *** | 0.009 *** | 0.009 *** |

| (8.91) | (8.66) | (8.80) | |

| Q | −0.007 * | −0.007 * | −0.007 * |

| (−1.92) | (−1.92) | (−1.90) | |

| MH | 0.000 | 0.000 | 0.000 |

| (0.04) | (0.21) | (0.08) | |

| PD | 0.142 | 0.187 | 0.139 |

| (0.88) | (1.16) | (0.88) | |

| OC | 0.644 *** | 0.656 *** | 0.666 *** |

| (7.44) | (7.67) | (7.74) | |

| TOP1 | 0.000 | −0.000 | 0.000 |

| (0.13) | (−0.36) | (0.12) | |

| DIBO | 0.116 *** | 0.115 *** | 0.115 *** |

| (14.48) | (14.55) | (14.48) | |

| Constant | 5.792 *** | 5.780 *** | 5.757 *** |

| (28.87) | (29.49) | (28.86) | |

| Observations | 18,048 | 18,048 | 18,048 |

| Adj-R2 | 0.906 | 0.906 | 0.907 |

| FIRM FE | YES | YES | YES |

| Year FE | YES | YES | YES |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xie, H.; Li, N.; Wang, C.; Wang, J. Informal Board Hierarchy and High-Quality Corporate Development: Evidence from China. Sustainability 2023, 15, 8914. https://doi.org/10.3390/su15118914

Xie H, Li N, Wang C, Wang J. Informal Board Hierarchy and High-Quality Corporate Development: Evidence from China. Sustainability. 2023; 15(11):8914. https://doi.org/10.3390/su15118914

Chicago/Turabian StyleXie, Haijuan, Niankun Li, Chenglong Wang, and Jiangxuan Wang. 2023. "Informal Board Hierarchy and High-Quality Corporate Development: Evidence from China" Sustainability 15, no. 11: 8914. https://doi.org/10.3390/su15118914

APA StyleXie, H., Li, N., Wang, C., & Wang, J. (2023). Informal Board Hierarchy and High-Quality Corporate Development: Evidence from China. Sustainability, 15(11), 8914. https://doi.org/10.3390/su15118914