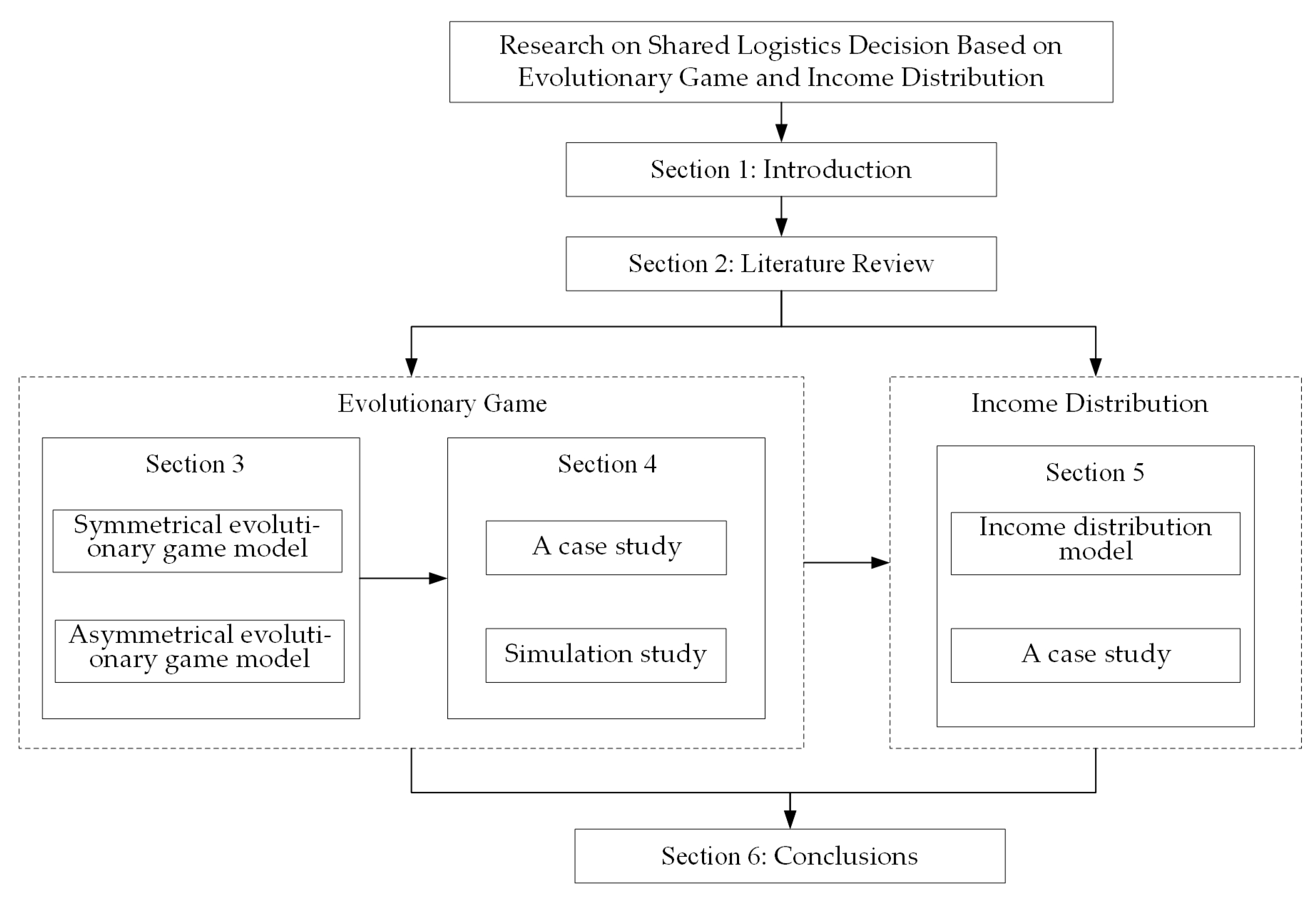

Research on Shared Logistics Decision Based on Evolutionary Game and Income Distribution

Abstract

1. Introduction

2. Literature Review

3. Evolutionary Game Model of Logistics Sharing

3.1. Problem Description and Assumptions

3.2. Symmetric Evolutionary Game Model of Logistics Sharing

3.2.1. Stability Analysis

- (1)

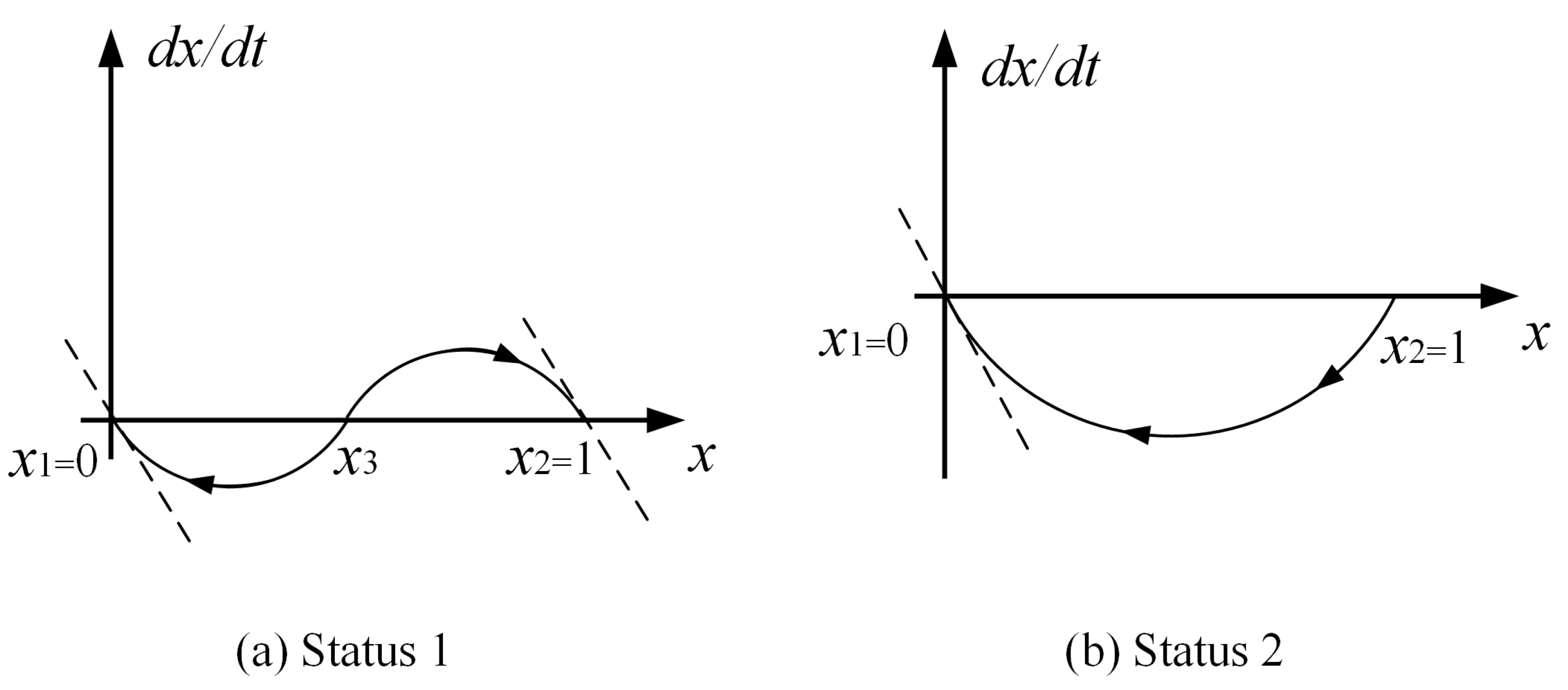

- When , we can obtain , , , . According to the stability of the differential equation, and are stable points of the system, and is the saddle point. The changing trend of express delivery company dynamic evolution is shown in Figure 2a.At this point, the game outcome of the system depends on the initial state. If the initial value of is between (, ) at the beginning of the game, the system will eventually stabilize at , and the express delivery company will tend to adopt a competitive strategy. If the initial value of is between (, ) at the beginning of the game, the system will eventually stabilize at , and the express delivery company will eventually adopt a cooperative strategy to achieve joint distribution.

- (2)

- When or , we can obtain , which means that is out of the picture. In this case, , . There is only a stable point , which means that express delivery companies will adopt a competitive strategy. Therefore, logistics resource sharing between express delivery companies cannot be achieved. The changing trend of express delivery company dynamic evolution is shown in Figure 2b.

- (3)

- When , we can obtain . At this point, and coincide, and the change trend of the system is the same as that of the case (2), with only one stable point, = 0. Express delivery companies will eventually choose the competitive strategy; the system cannot achieve cooperation.

3.2.2. Sensitivity Analysis

- (1)

- The impact ofAccording to Equation (5), it can be seen that is a monotonically increasing function of . With other conditions unchanged, as the input cost increases, the larger is. Express delivery companies will be more likely to choose a competitive strategy, and the probability of the system reaching cooperation becomes smaller.

- (2)

- The impact ofAccording to Equation (6), it can be seen that is a monotonically increasing function of . With other conditions unchanged, as the profit from independent operation increases, the larger is. Therefore, express delivery companies will be more likely to choose a competitive strategy, and the probability of the system reaching cooperation becomes smaller.

- (3)

- The impact ofAccording to Equation (7), it can be seen that is a monotonically decreasing function of . With other conditions unchanged, as the income distribution coefficient increases, the smaller is. Therefore, express delivery companies will be more likely to choose a cooperation strategy, and the probability of the system reaching cooperation becomes larger.

- (4)

- The impact ofAccording to Equation (8), it can be seen that is a monotonically decreasing function of . When other factors are fixed, as the joint distribution income increases, the smaller is. Therefore, express delivery companies will be more likely to choose a cooperation strategy, and the probability of the system reaching cooperation becomes larger.

- (5)

- The impact ofAccording to Equation (9), it can be seen that is a monotonically decreasing function of . When other factors are fixed, as the default penalty coefficient increases, the smaller is. Therefore, express delivery companies will be more likely to choose a cooperation strategy, and the probability of the system reaching cooperation becomes larger.

3.3. Asymmetric Evolutionary Game Model of Logistics Sharing

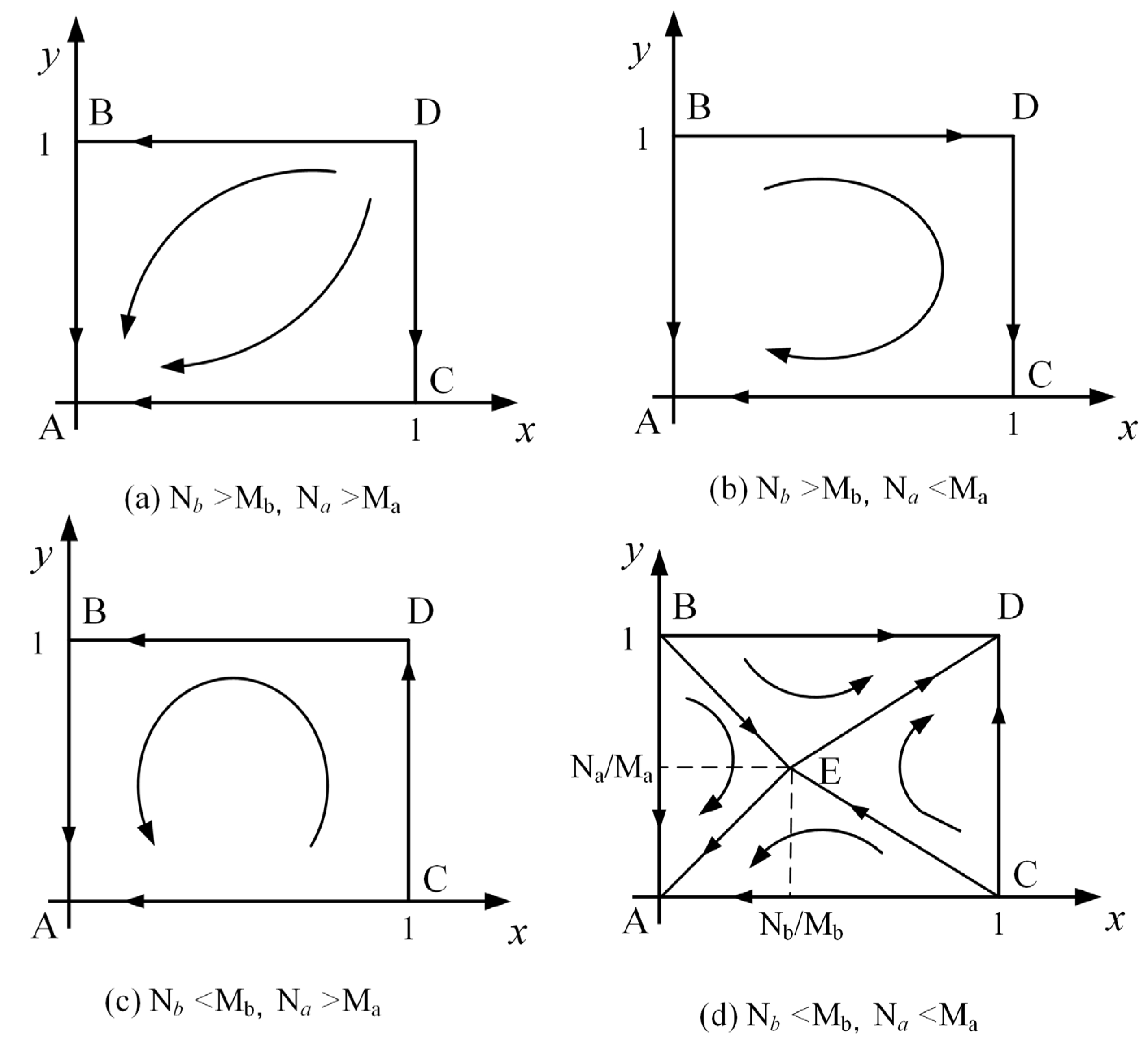

3.3.1. Stability Analysis

3.3.2. Sensitivity Analysis

- (1)

- The impact of ,According to Equations (21) and (22), it can be seen that is a monotonically increasing function of and . As the profit from independent operation increases, the larger S is. Therefore, the probability of system evolution to a (competition, competition) strategy becomes larger, and the express delivery companies will eventually choose to operate independently.

- (2)

- The impact of ,According to Equations (23)–(26), it can be seen that the influence of and on S is non-monotonic, but . Therefore, when = 0, has a minimum value. This means that the system has the greatest probability of evolving to a (cooperative, collaborative) strategy. Thus, there is an optimal ratio of income to make cooperation smooth.

- (3)

- The impact ofAccording to Equation (27), it can be seen that is a monotonically decreasing function of . As the joint distribution income increases, the smaller S is. Therefore, the probability of system evolution to a (cooperation, cooperation) strategy becomes larger, and the express delivery companies will eventually choose to join distribution.

- (4)

- The impact ofAccording to Equation (28), it can be seen that is a monotonically decreasing function of . As the default penalty coefficient increases, the smaller S is. Therefore, the probability of system evolution to a (cooperation, cooperation) strategy becomes larger, and the express delivery companies will eventually choose to join distribution.

4. Simulation of Evolutionary Game of Logistics Sharing

4.1. A Case Study

- (1)

- Input cost of joint distribution

| Enterprise | Courier Outlets | Delivery Vehicles | Delivery Personnel | Service Personnel | Input Costs |

|---|---|---|---|---|---|

| Zto | 16 | 70 | 70 | 32 | 7439.0 |

| YTO | 13 | 60 | 60 | 26 | 6272.0 |

| Yunda | 26 | 80 | 80 | 52 | 9628.0 |

| Best | 20 | 55 | 55 | 40 | 6929.5 |

| Sto | 14 | 40 | 40 | 28 | 4960.0 |

- (2)

- The profit from independent operation

- (3)

- Clustering analysis

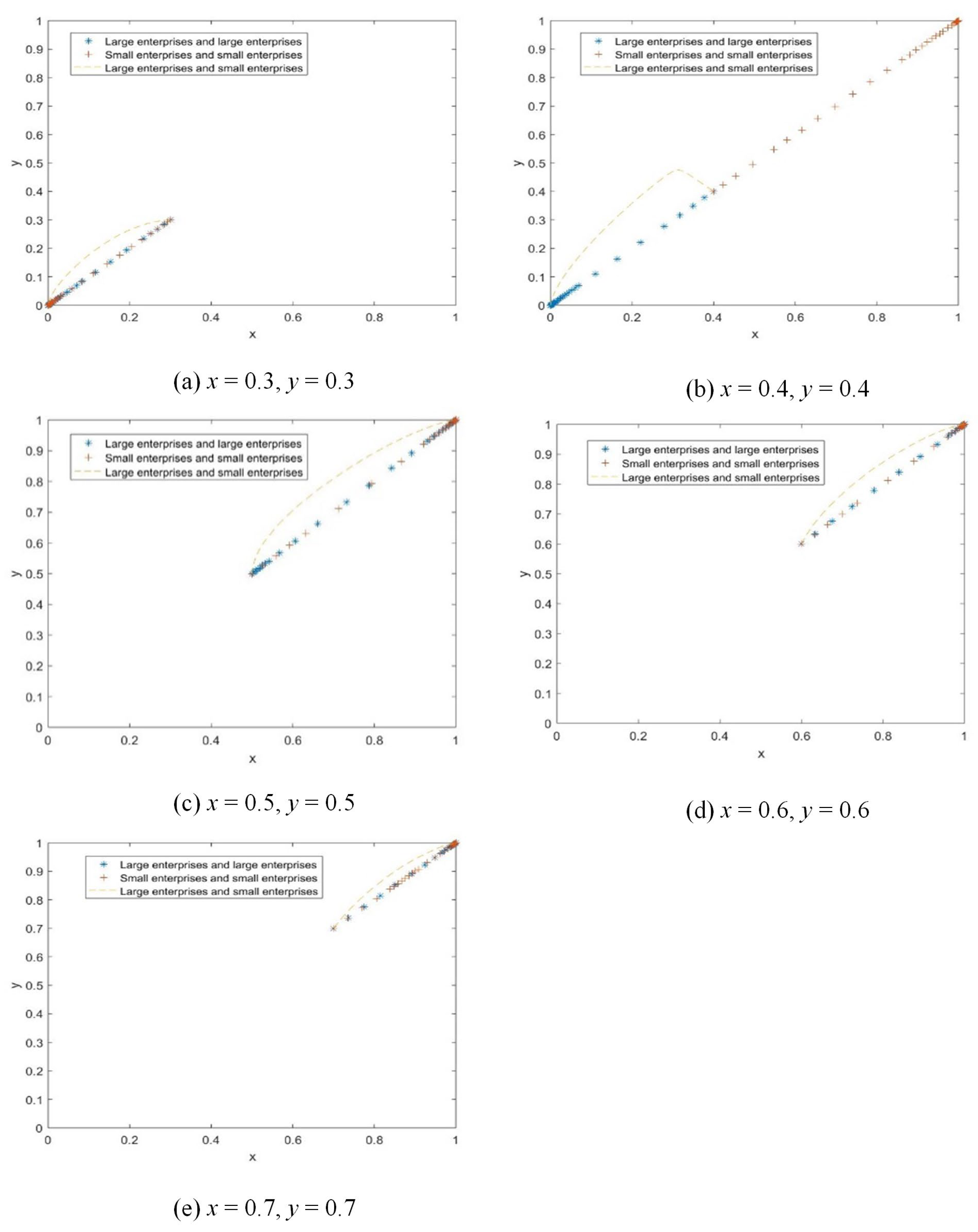

4.2. Simulation Study

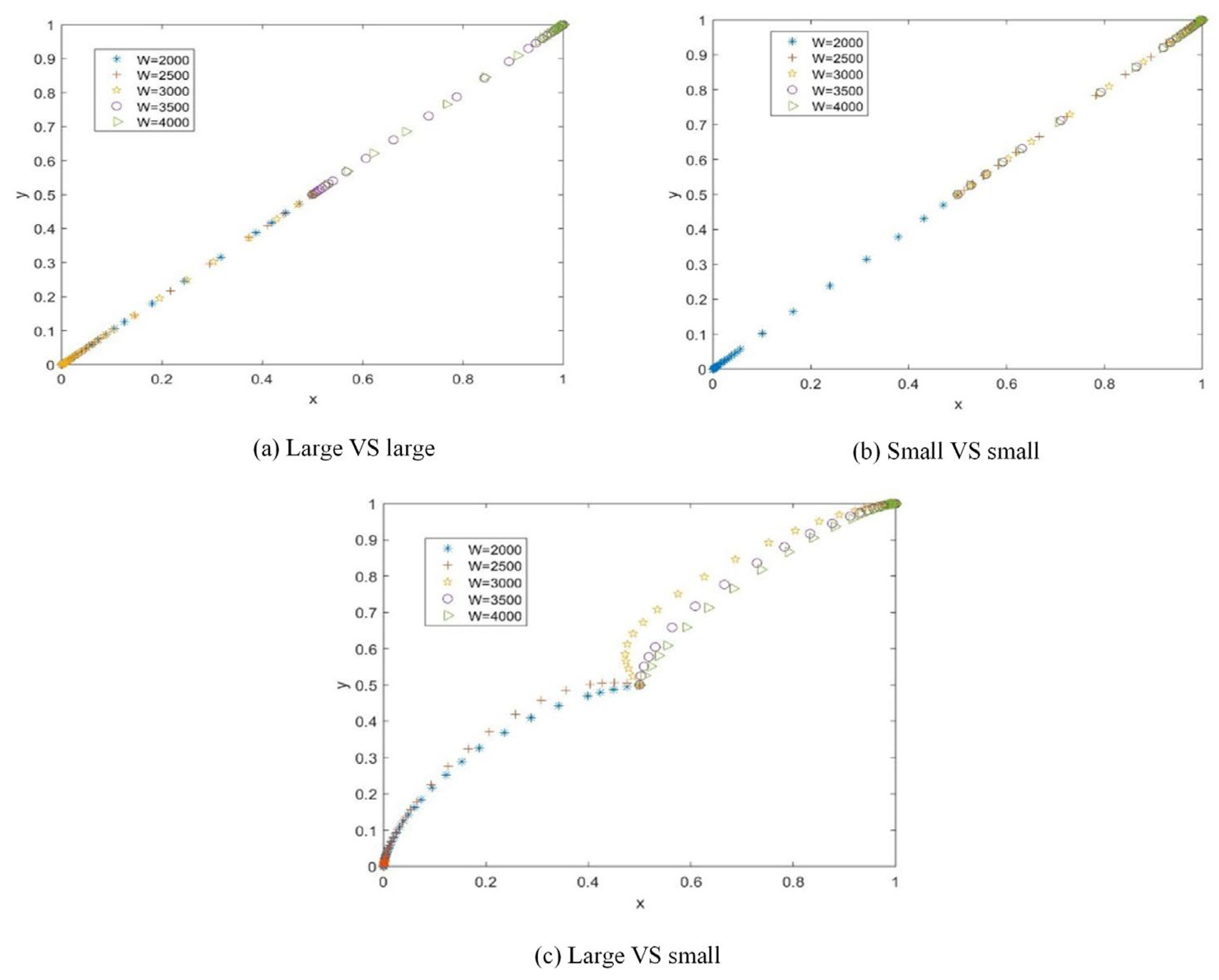

- (1)

- The impact of enterprise scale on cooperation

- (2)

- The impact of joint distribution income on cooperation

- (3)

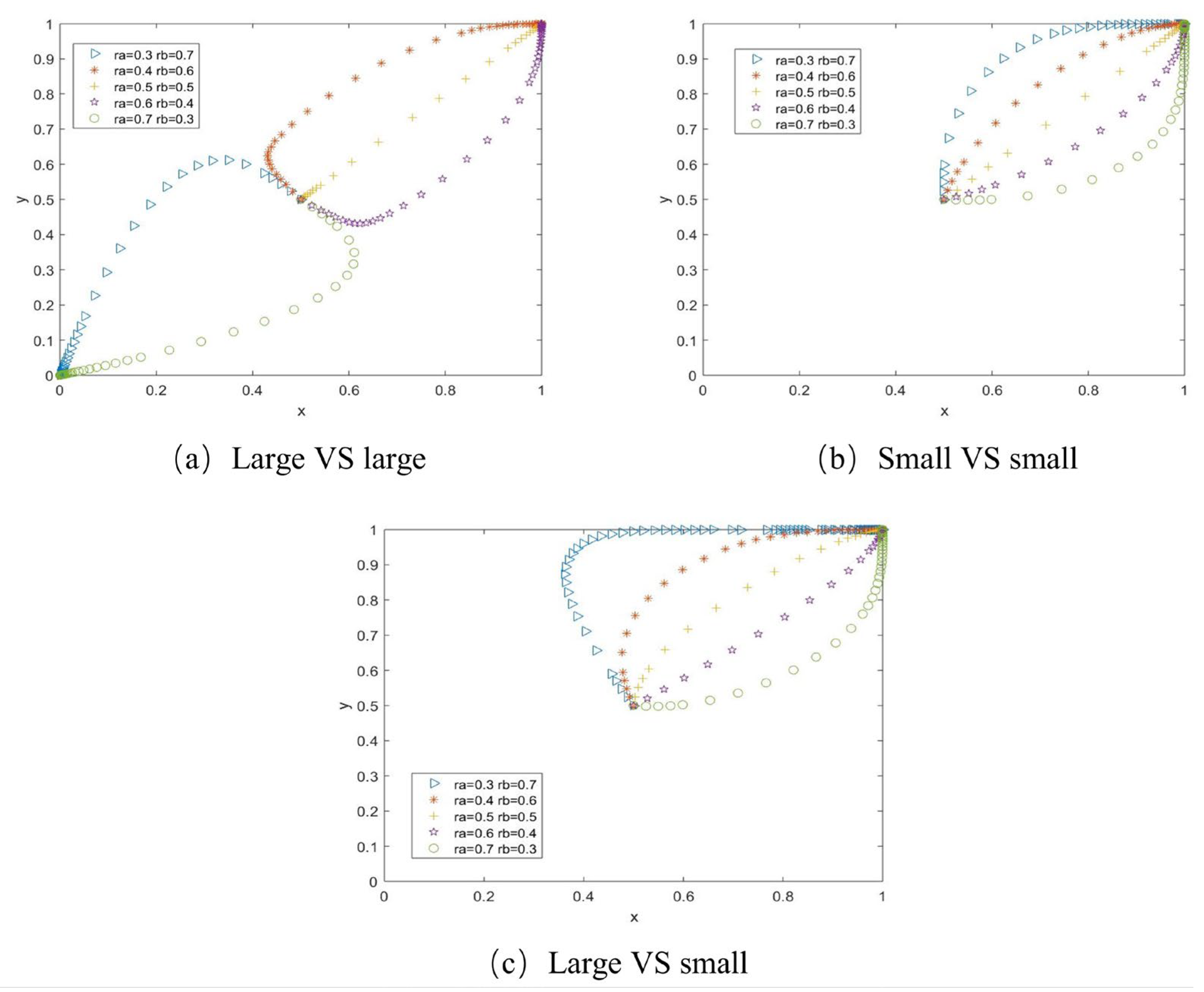

- The impact of income distribution coefficient on cooperation

- (4)

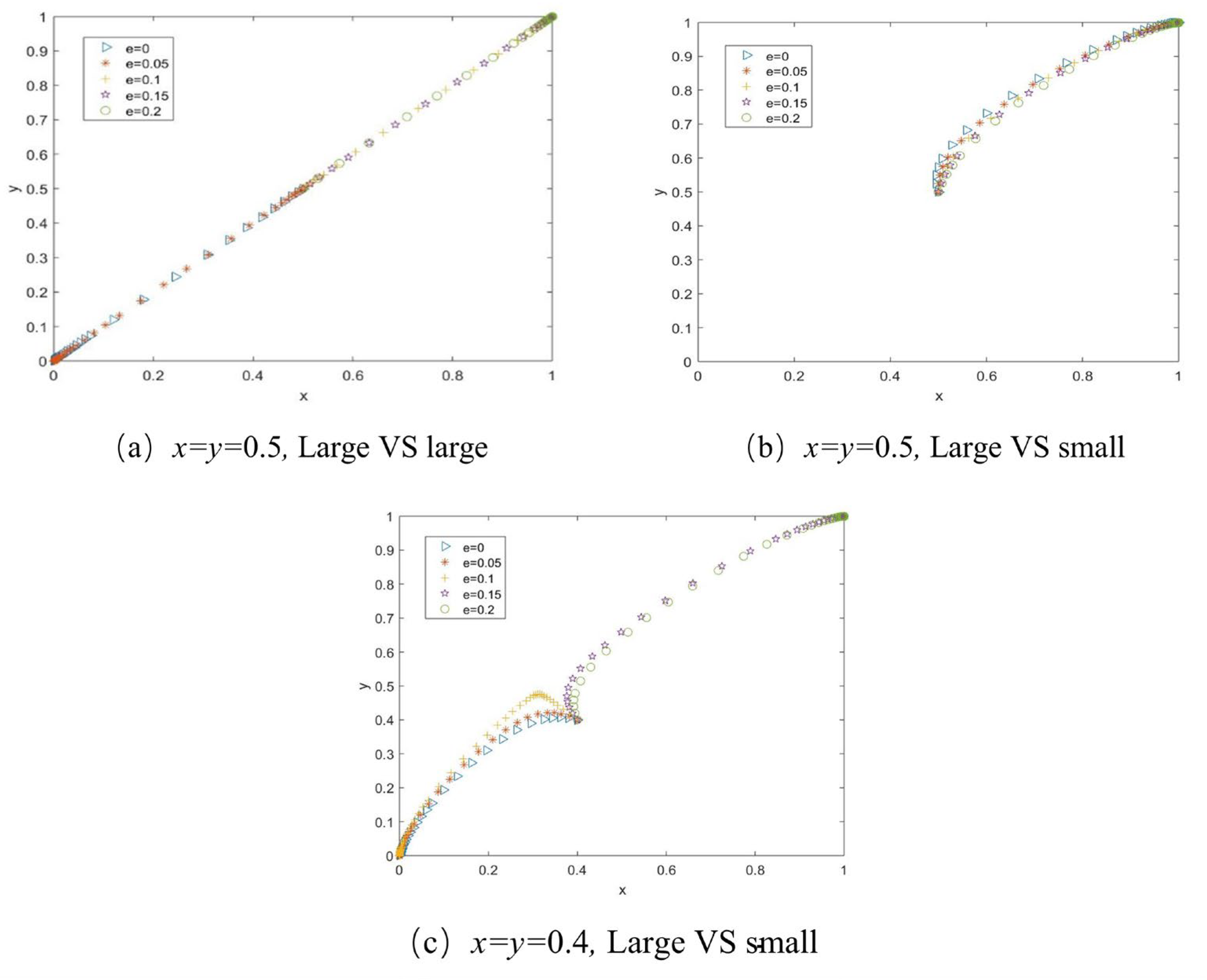

- The impact of default penalty coefficient on cooperation

5. Research on Income Distribution of Logistics Sharing

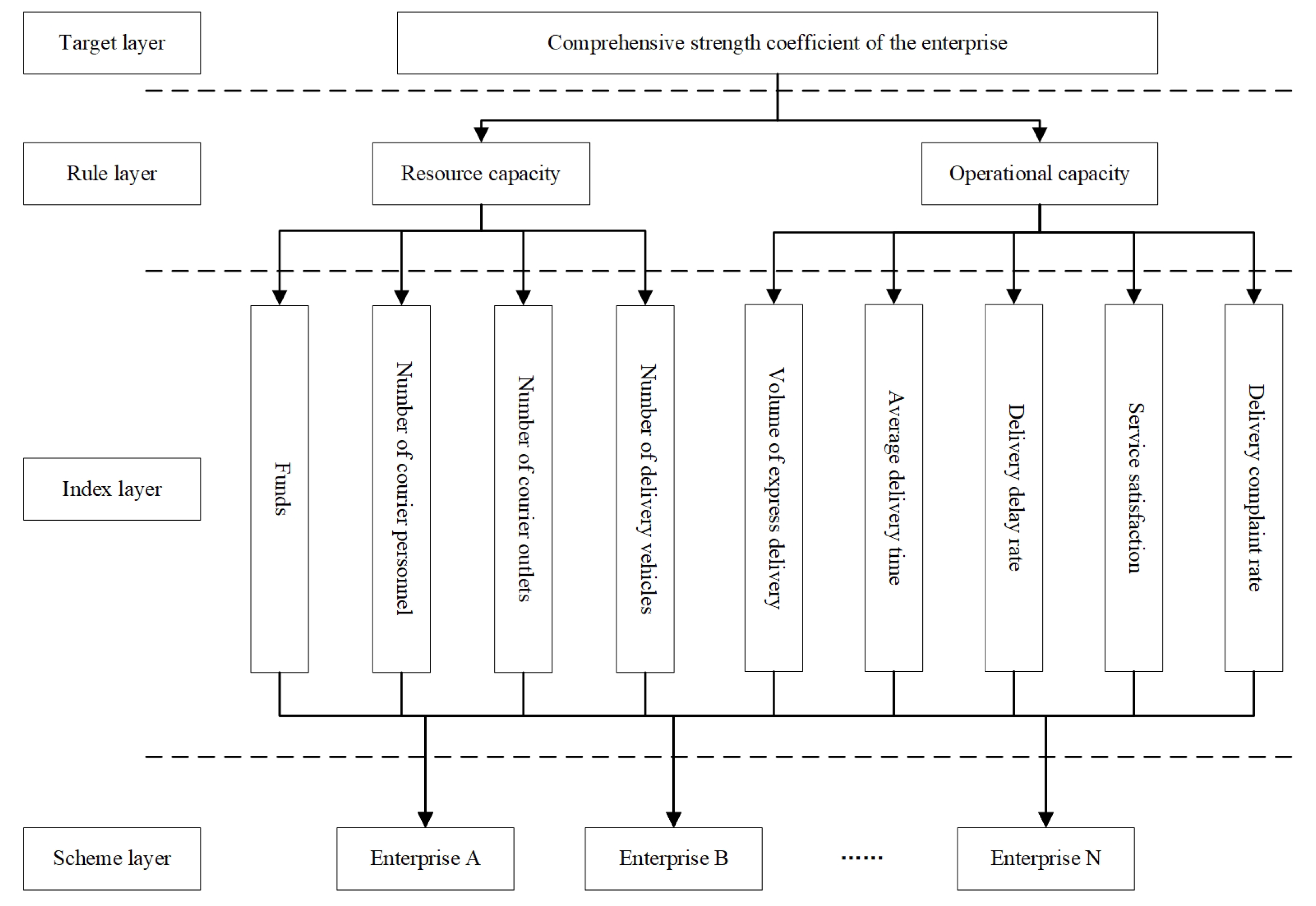

5.1. Comprehensive Strength Coefficient

5.2. Income Distribution Model

- (1)

- Use the Raiffa solution to calculate the initial income distribution. represents the initial income of the joint distribution for enterprise . is the joint distribution income of all enterprises (there are n enterprises). represents the joint distribution income of the sub-alliance, excluding express enterprise .

- (2)

- Determine the weight of evaluation indexes and express delivery enterprises, respectively. Firstly, the weight of each evaluation index for the target task is determined by using the analytic hierarchy process (AHP). Secondly, according to the actual situation of the enterprise, confirm the weight (proportion) of the evaluation index for the enterprise. It should be noted that the indexes are divided into the qualitative index and quantitative index, efficiency index, and cost index. Therefore, it is necessary to consider the classification of indicators when calculating them.

- (3)

- Calculate the comprehensive strength coefficient of the enterprise. Using and , the comprehensive strength coefficient of the enterprise can be calculated and recorded as . Among them, n refers to the number of enterprises participating in logistics resource sharing, and m refers to the number of evaluation indicators.

- (4)

- Calculate the income adjustment coefficient of the enterprise. Record it as , and the calculation formula is as follows.When , it indicates that the comprehensive strength of the enterprise is greater than the average of the enterprises participating in resource sharing, and compensation for its income distribution is required. When , the situation is reversed.

- (5)

- Calculate the final income distribution of the enterprise. The influence adjustment coefficient is added, which represents the influence degree of the enterprise’s comprehensive strength on the income distribution. Furthermore, is determined by the enterprises participating in the logistics resource sharing.

5.3. A Case Study

- (1)

- Use the Raiffa solution to calculate the initial income distribution

- (2)

- Determine the weight of evaluation indexes and express delivery enterprises.

- (3)

- Calculate the comprehensive strength coefficient of the enterprise

- (4)

- Calculate the income adjustment coefficient of the enterprise

- (5)

- Calculate the final income distribution of the enterprise

6. Conclusions

- (1)

- The initial cooperation intention of the enterprise will affect the game results. Cooperation is easy to achieve only when enterprises have a relatively obvious tendency to cooperate. Therefore, the realization of joint distribution requires the government and society to guide enterprises to participate in resource sharing from several aspects and to enhance their cooperation awareness.

- (2)

- Smaller express delivery companies are more willing to participate in logistics sharing and joint distribution. The logistics industry is characterized by significant economies of scale. Therefore, shared logistics resources are highly attractive to small enterprises. In practice, resource sharing alliances can be established among smaller enterprises. For large enterprises, it is necessary to take measures to increase their sense of cooperation.

- (3)

- Cooperation between express delivery companies of similar scales is more likely to be achieved. If the difference in the scales of the enterprises is too large, it will increase the difficulty of unified management of the express alliance, causing unbalanced growth of the income of the alliance enterprises, which will lead to various non-cooperative behaviors and affect the effectiveness of cooperation. Therefore, it is recommended that logistics resources be shared among enterprises of a similar scale. When the scales of enterprises in the alliance are uneven, it is necessary to anticipate the above problems and to develop rules to avoid them.

- (4)

- The scale of the enterprise should be considered when the logistics alliance makes income allocation. The optimal income distribution coefficient of an enterprise is positively related to its scale. The difference between enterprises’ scales implies that the enterprises contribute differently to joint distribution.

- (5)

- Establishing a suitable penalty mechanism for breach of contract is conducive to promoting the sharing of logistics resources among enterprises. Penalties for breach of contract can improve participants’ trust in cooperation and reduce risks. When establishing a logistics alliance, the normal operation of cooperation can be ensured by formulating an appropriate penalty mechanism for breach of contract.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Aized, T.; Srai, J.S. Hierarchical modelling of Last Mile logistic distribution system. Int. J. Adv. Manuf. Technol. 2013, 70, 1053–1061. [Google Scholar] [CrossRef]

- Counsell, C.; Dennis, M.; McDowall, M. Predicting functional outcome in acute stroke: Comparison of a simple six variable model with other predictive systems and informal clinical prediction. J. Neurol. Neurosurg. Psychiatry 2004, 75, 401–405. [Google Scholar] [CrossRef] [PubMed]

- Neghabadi, P.D.; Samuel, K.E.; Espinouse, M.-L. Systematic literature review on city logistics: Overview, classification and analysis. Int. J. Prod. Res. 2018, 57, 865–887. [Google Scholar] [CrossRef]

- Rivera, L.; Sheffi, Y.; Knoppen, D. Logistics clusters: The impact of further agglomeration, training and firm size on collaboration and value added services. Int. J. Prod. Econ. 2016, 179, 285–294. [Google Scholar] [CrossRef]

- Wang, X.; Kopfer, H. Collaborative transportation planning of less-than-truckload freight. OR Spectr. 2013, 36, 357–380. [Google Scholar] [CrossRef]

- Yao, X.; Cheng, Y.; Song, M. Assessment of collaboration in city logistics: From the aspects of profit and CO2 emissions. Int. J. Logist. Res. Appl. 2018, 22, 576–591. [Google Scholar] [CrossRef]

- Gansterer, M.; Hartl, R.F.; Wieser, S. Assignment constraints in shared transportation services. Ann. Oper. Res. 2020, 305, 513–539. [Google Scholar] [CrossRef]

- Daudi, M.; Hauge, J.B.; Thoben, K.-D. Behavioral factors influencing partner trust in logistics collaboration: A review. Logist. Res. 2016, 9, 1–11. [Google Scholar] [CrossRef]

- Rodrigues, V.S.; Harris, I.; Mason, R. Horizontal logistics collaboration for enhanced supply chain performance: An international retail perspective. Supply Chain Manag. Int. J. 2015, 20, 631–647. [Google Scholar] [CrossRef]

- Smith, J.M.; Price, G.R. The Logic of Animal Conflict. Nature 1973, 246, 15–18. [Google Scholar] [CrossRef]

- Taylor, P.D.; Jonker, L.B. Evolutionary stable strategies and game dynamics. Math. Biosci. 1978, 40, 145–156. [Google Scholar] [CrossRef]

- Arifovic, J.; Jiang, J.H.; Xu, Y. Experimental evidence of bank runs as pure coordination failures. J. Econ. Dyn. Control. 2013, 37, 2446–2465. [Google Scholar] [CrossRef]

- Hosseini-Motlagh, S.-M.; Johari, M.; Zirakpourdehkordi, R. Grain production management to reduce global warming potential under financial constraints and time value of money using evolutionary game theory. Int. J. Prod. Res. 2020, 59, 5108–5129. [Google Scholar] [CrossRef]

- Barari, S.; Agarwal, G.; Zhang, W.; Mahanty, B.; Tiwari, M. A decision framework for the analysis of green supply chain contracts: An evolutionary game approach. Expert Syst. Appl. 2012, 39, 2965–2976. [Google Scholar] [CrossRef]

- Sofitra, M.; Takahashi, K.; Morikawa, K. The coevolution of interconnected relationship strategies in supply networks. Int. J. Prod. Res. 2014, 53, 6919–6936. [Google Scholar] [CrossRef]

- Wang, D.; Lang, M.; Sun, Y. Evolutionary Game Analysis of Co-opetition Relationship between Regional Logistics Nodes. J. Appl. Res. Technol. 2014, 12, 251–260. [Google Scholar] [CrossRef]

- Zhang, X.; Zhou, G.; Cao, J.; Wu, A. Evolving strategies of e-commerce and express delivery enterprises with public supervision. Res. Transp. Econ. 2020, 80, 100810. [Google Scholar] [CrossRef]

- Zhou, L.; Chen, Y.; Jing, Y.; Jiang, Y. Evolutionary Game Analysis on Last Mile Delivery Resource Integration—Exploring the Behavioral Strategies between Logistics Service Providers, Property Service Companies and Customers. Sustainability 2021, 13, 12240. [Google Scholar] [CrossRef]

- Li, G.; Zhang, Q.; Bai, Z.; Sabeeh, P. Research on Logistics Service Supply Chain Information Sharing Mechanism in the Belt and Road Initiative. IEEE Access 2020, 8, 189684–189701. [Google Scholar] [CrossRef]

- Wang, H.; Chen, L.; Liu, J. An evolutionary game theory analysis linking manufacturing, logistics, and the government in low-carbon development. J. Oper. Res. Soc. 2021, 73, 1014–1032. [Google Scholar] [CrossRef]

- Han, R.; Yang, M. Profit distribution and stability analysis of joint distribution alliance based on tripartite evolutionary game theory under the background of green and low carbon. Environ. Sci. Pollut. Res. 2022, 29, 59633–59652. [Google Scholar] [CrossRef] [PubMed]

- Xing, X.-H.; Hu, Z.-H.; Wang, S.-W.; Luo, W.-P. An Evolutionary Game Model to Study Manufacturers and Logistics Companies’ Behavior Strategies for Information Transparency in Cold Chains. Math. Probl. Eng. 2020, 2020, 7989386. [Google Scholar] [CrossRef]

- Xing, X.-H.; Hu, Z.-H.; Luo, W.-P. Using evolutionary game theory to study governments and logistics companies’ strategies for avoiding broken cold chains. Ann. Oper. Res. 2020. [Google Scholar] [CrossRef]

- Liu, P.; Wang, S. Logistics Outsourcing of Fresh Enterprises Considering Fresh-Keeping Efforts Based on Evolutionary Game Analysis. IEEE Access 2021, 9, 25659–25670. [Google Scholar] [CrossRef]

- Lozano, S.; Moreno, P.; Adenso-Díaz, B.; Algaba, E. Cooperative game theory approach to allocating benefits of horizontal cooperation. Eur. J. Oper. Res. 2013, 229, 444–452. [Google Scholar] [CrossRef]

- Lu, F.; Wang, L.; Bi, H.; Du, Z.; Wang, S. An Improved Revenue Distribution Model for Logistics Service Supply Chain Considering Fairness Preference. Sustainability 2021, 13, 6711. [Google Scholar] [CrossRef]

- Kimms, A.; Kozeletskyi, I. Core-based cost allocation in the cooperative traveling salesman problem. Eur. J. Oper. Res. 2016, 248, 910–916. [Google Scholar] [CrossRef]

- Wang, Y.; Ma, X.; Liu, M.; Gong, K.; Liu, Y.; Xu, M.; Wang, Y. Cooperation and profit allocation in two-echelon logistics joint distribution network optimization. Appl. Soft Comput. 2017, 56, 143–157. [Google Scholar] [CrossRef]

- Li, L.; Wang, X.; Lin, Y.; Zhou, F.; Chen, S. Cooperative game-based profit allocation for joint distribution alliance under online shopping environment. Asia Pac. J. Mark. Logist. 2019, 31, 302–326. [Google Scholar] [CrossRef]

- Song, J.; Ma, X.; Chen, R. A Profit Distribution Model of Reverse Logistics Based on Fuzzy DEA Efficiency—Modified Shapley Value. Sustainability 2021, 13, 7354. [Google Scholar] [CrossRef]

- Kou, X.; Zhang, Y.; Long, D.; Liu, X.; Qie, L. An Investigation of Multimodal Transport for Last Mile Delivery in Rural Areas. Sustainability 2022, 14, 1291. [Google Scholar] [CrossRef]

- Zhou, H.Y.; Zhou, X.G.; Yang, M.K.; Fan, J.J. A Cost Amortization Model for Urban Joint Distribution Based on Raiffa Solution. Logist. Technol. 2017, 36, 104–132. [Google Scholar]

- Jiao, Z.L.; Ma, J.Y.; Liu, B.L. Cooperative Revenue Distribution of Manufacturing Logistics Provided by Express Companies: Analysis by Corrected Raiffa Solution Model. J. Bus. Econ. 2020, 40, 18–27. [Google Scholar]

| Variable | Description |

|---|---|

| When choosing cooperation, the input cost of joint distribution for player | |

| When choosing competition, the profit of player operating independently | |

| When choosing cooperation, the income distribution coefficient of joint distribution for player | |

| When choosing cooperation, the income of joint distribution for player | |

| When choosing competition, the penalty coefficient of player . |

| Player B | ||||

|---|---|---|---|---|

| x | 1−x | |||

| Cooperation | Competition | |||

| Player A | x | Cooperation | ||

| 1−x | Competition | |||

| Player B | ||||

|---|---|---|---|---|

| y | 1−y | |||

| Cooperation | Competition | |||

| Player A | x | Cooperation | ||

| 1−x | Competition | |||

| Conditions | ||||||

| Point | det(J) | tr(J) | Stability | det(J) | tr(J) | Stability |

| (0,0) | + | − | ESS | + | − | ESS |

| (0,1) | − | saddle point | + | + | unstable | |

| (1,0) | − | saddle point | − | saddle point | ||

| (1,1) | + | + | unstable | − | saddle point | |

| () | ||||||

| Conditions | ||||||

| Point | det(J) | tr(J) | Stability | det(J) | tr(J) | Stability |

| (0,0) | + | − | ESS | + | − | ESS |

| (0,1) | − | saddle point | + | + | unstable | |

| (1,0) | + | + | unstable | + | + | unstable |

| (1,1) | − | saddle point | + | − | ESS | |

| () | − | 0 | saddle point | |||

| Company | Express Revenue | Express Costs | Express Profit | Profit in Dongpo |

|---|---|---|---|---|

| Zto | 19,606,210 | 11,575,381 | 8,030,829 | 2264.7 |

| YTO | 27,412,471 | 24,107,625 | 3,304,846 | 932.0 |

| Yunda | 31,964,131 | 28,336,434 | 3,627,697 | 1023.0 |

| Best | 21,807,598 | 20,779,992 | 1,027,606 | 289.8 |

| Sto | 22,942,603 | 20,563,552 | 2,379,051 | 670.9 |

| Company | Clustering Category | Input Costs | Independent Operation Profit |

|---|---|---|---|

| Zto | 1 | 7439.0 | 2264.7 |

| YTO | 2 | 6272.0 | 932.0 |

| Yunda | 1 | 9628.0 | 1023.0 |

| Best | 2 | 6929.5 | 289.8 |

| Sto | 2 | 4960.0 | 670.9 |

| category 1 center | 8533.5 | 1643.9 | |

| category 2 center | 6053.8 | 630.9 | |

| Game Subject | ||||||||

|---|---|---|---|---|---|---|---|---|

| Large enterprises and large enterprises | 0.5 | 0.5 | 0.1 | 35,000 | 8533.5 | 8533.5 | 1643.9 | 1643.9 |

| Small enterprises and small enterprises | 35,000 | 6053.8 | 6053.8 | 630.9 | 630.9 | |||

| Large enterprises and small enterprises | 35,000 | 8533.5 | 6053.8 | 1643.9 | 630.9 |

| Elements | Weight Value | |

|---|---|---|

| Rule layer | Resource capacity | 0.4500 |

| Operational capacity | 0.5500 | |

| Index layer | Funds | 0.2017 |

| Number of courier personnel | 0.0610 | |

| Number of courier outlets | 0.1385 | |

| Number of delivery vehicles | 0.0488 | |

| Volume of express delivery | 0.1410 | |

| Average delivery time | 0.0614 | |

| Delivery delay rate | 0.0874 | |

| Service satisfaction | 0.1245 | |

| Delivery complaint rate | 0.1357 |

| Enterprise | Income |

|---|---|

| YTO | 7730.3 |

| Best | 6149.7 |

| STO | 6469.8 |

| YTO, Best | 30,000 |

| YTO, STO | 35,000 |

| Best, STO | 25,000 |

| YTO, Best, STO | 60,000 |

| The Evaluation Index | YTO | Best | STO | |

|---|---|---|---|---|

| Resource capacity | Funds | 0.33 | 0.34 | 0.33 |

| Number of courier personnel | 0.35 | 0.38 | 0.27 | |

| Number of courier outlets | 0.28 | 0.42 | 0.30 | |

| Number of delivery vehicles | 0.39 | 0.35 | 0.26 | |

| Operational capacity | Volume of express delivery | 0.38 | 0.31 | 0.31 |

| Average delivery time | 0.15 | 0.76 | 0.09 | |

| Delivery delay rate | 0.14 | 0.62 | 0.24 | |

| Service satisfaction | 0.16 | 0.54 | 0.30 | |

| Order complaint rate | 0.33 | 0.34 | 0.33 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, Z.; Kong, J. Research on Shared Logistics Decision Based on Evolutionary Game and Income Distribution. Sustainability 2023, 15, 8621. https://doi.org/10.3390/su15118621

Chen Z, Kong J. Research on Shared Logistics Decision Based on Evolutionary Game and Income Distribution. Sustainability. 2023; 15(11):8621. https://doi.org/10.3390/su15118621

Chicago/Turabian StyleChen, Ziyu, and Jili Kong. 2023. "Research on Shared Logistics Decision Based on Evolutionary Game and Income Distribution" Sustainability 15, no. 11: 8621. https://doi.org/10.3390/su15118621

APA StyleChen, Z., & Kong, J. (2023). Research on Shared Logistics Decision Based on Evolutionary Game and Income Distribution. Sustainability, 15(11), 8621. https://doi.org/10.3390/su15118621