1. Introduction

According to the World Bank, for almost 30 years, the average annual temperature in Ukraine has risen by approximately 2 degrees. By previous standards, it was previously 7.8 °C, and now it is 9.5 °C. As a result, climatic zones have shifted 200 km to the north [

1]. Thus, the area of cultivation of almonds has increased significantly.

Extremely high temperatures began to prevail over moderate ones. Precipitation has become critically low. In particular, according to the Kherson regional climatic station, the average rainfall in 2021 did not exceed 60 mm [

2].

These factors forced significant adjustments in traditional grain production, especially in the south of the country. Over the past 20 years, the profitability of grain production has decreased significantly (from 48% to 22%). There were noticed years when the harvest was almost wholly lost [

3]. In this regard, the Ukrainian Nut Association and climatologists, soil scientists, and microbiologists have developed three promising alternative areas for the agroindustry: walnuts, hazelnuts, and almonds.

Today, more than 10 major types of nuts are grown worldwide. Ukraine is among the top five world producers of walnuts and ranks seventh in the world in terms of production. The main range of nuts produced in Ukraine includes walnuts, Brazil nuts, cashews, pistachios, almonds, hazelnuts, and others. However, in 2020, walnut shipments abroad fell by 29% to USD 98.1 million, and production fell by 10% [

4]. This was due to a general decline in world trade in walnuts, which was not the case with other types of nuts such as almonds.

The relevance of this work was justified by the need to study the almond market, the possibilities of Ukrainian walnut growing, and the formation of production strategies in the new climate. Growing almonds can be a reliable investment in the future of Ukraine and is one of the options for the diversification of domestic enterprises in response to global demand and the general shortage of almonds in the world market. When developing an almond-production strategy, there is a need for a comprehensive assessment of Ukraine’s capabilities in industrial almond growing in terms of covered areas, such as the abilities to saturate the consumer market, model the situation and respond quickly to changes, select efficient industrial varieties, introduce innovative technologies, and monitor the market.

The fat and oil sub-complex is one of the most tidily connected to the nut production sectors [

5]. There is a need to study global trends in the oil market for the main types of products presented in it, identify opportunities for participation of fat and oil sub-complex enterprises in value chains at the global and regional levels, and conduct fat and oil sub-complex margin analyses. The results of the study in [

6] indicated that Ukraine is involved in the process of diversification of the world market of edible oil and the development of innovations. For example, in [

5] a critical analysis of the fat and oil sub-complex of deep processing of walnuts was provided in order to determine and compare the profitability of enterprises using different business models for implementation in the agri-food value chain. As a result of business modeling, it was found that the most cost-effective business model was a combination of walnut production and processing, which would provide a profitability of up to 4640.32% in the 20th year of the operation. This study, however, had some significant limitations regarding the interests of all supply chain actors and needs to be further developed. A more detailed analysis of the value chain in the fat and oil sub-complex that took into account different types of products and the general interests of the subjects of the value chain [

7] was carried out in another study [

6]. The value obtained in the results was the possibility of their practical use for agricultural and food enterprises in solving the problem of ensuring the competitiveness of the enterprise and its products for export in a highly dynamic business environment (with particular emphasis on a reduction in price risks in the agricultural sector) based on the system relationships of the manufacturing enterprise.

Currently, in developing the deep nut-processing industry, the emphasis is on confectionery kernels and oils. Innovative products will be developed via research and supporting approaches to the integrated use of raw materials. Some developments in this direction may include methodological approaches to calculating the economic efficiency of processing waste into biofuels [

8]. At the same time, the assessment of the importance of restructuring and trends in the management of enterprise restructuring is one of the key factors of enterprise operations. Enterprise restructuring is a tool for entrepreneurs and managers to find areas of activity that need improvement and require immediate action such as the management of innovative activities in the fat and oil sub-complex. For example, an e-commerce platform supply chain might be considered. Stakeholders of the e-commerce platform supply chain are increasingly using live-streaming services to increase profits. Zhang et al. modeled an operation strategy in an e-commerce platform supply chain with live-streaming services that indicated that introducing live-streaming services benefited both the e-commerce platform and the live-streaming service provider [

9].

Other important aspects of strategic management of an enterprise include the realization of opportunities for interaction with local governments in terms of identifying and occupying the community’s own niche in the regional division of labor; strengthening the participation of individuals and legal entities in regional and international economic development projects; development of human resources and social infrastructure; providing research, information, and methodological support for a business activity of the population; and achieving full compliance of the ecological profile of the territory with regulatory requirements for the organization of production of certain types of goods and services [

10]. Research on the almond market in Ukraine and the determination of prospects for the development of the sub-complex will be carried out by representatives of the NGO “Ukrainian Nut Association” [

11] and the International Trade Center within the project “Promoting the entry of small and medium enterprises in the fruit and vegetable sector into foreign markets and their inclusion in the value chain” [

12]. Meanwhile, the underdevelopment of the topic of almond production indicates the relevance of and the deep need for detailed study and research in this area.

Thus, this study’s primary goal was to establish strategic priorities for resource allocation based on nut-growing productivity in Ukraine for different regions and product portfolios in relation to resource utilization. In addition, the strategic priorities for almond production should be determined using the expertise of indigenous farmers. The research was dedicated to the formation process and ways to implement the strategy for almond production in Ukraine. The subject of the research was the product portfolio and the priorities of the formation and implementation of the strategy of almond production in Ukraine.

Problems of corporate governance and the formation of enterprise strategy were revealed in detail by I. Ansoff [

13]. However, many scholars have criticized corporate strategy for its commitment to the rational approach of its time. The evolution of strategic planning and strategic management was described in [

14]. Mintzberg and Waters [

15] emphasized that because strategy is designed in terms of what an organization’s leaders “plan” to do in the future, strategy formation is usually seen as an analytical process to establish long-term goals and action plans for organizations; that is, as a way to formulate instructions for further implementation. They also criticized overly theorized approaches; the process of strategic management needs to be considered from a broader perspective to be able to study the variety of ways in which strategies are actually formed. In this context, the change in ideas regarding the theory of Ansof and its practical application can be illustrated by studying the practice of multidimensional components of the strategic management system and the effectiveness of each of its components in formulating and implementing corporate strategy in commercial organizations. Based on empirically validated research, Kipley and Alfred proved both implicit and explicit recognition of the applicability of Ansoff’s approaches and their value in whole or in part that provide an increase in financial performance for companies competing in turbulent conditions. An essential value of the work of Kipley and Alfred can be considered the generalization of the requirements for optimal use of approaches to strategic management by Ansoff. In addition, they showed the principles for use by small and medium enterprises that, as proven empirically, increase the likelihood of strategic success of the enterprise [

16].

Drucker described the actions and behaviors of entrepreneurs that in his opinion should be part of the profile of each leader. The study in [

17] also revealed the role and functions of institutions that promote entrepreneurship. The main ideas of Drucker can be developed in the direction of public–private partnerships in the agricultural sector of the economy with the definition of its digitization [

18]. Through public–private partnerships in the agricultural sector, the state can act as a partner that monitors food security, animal health, social norms, agricultural product logistics, etc., without directly penetrating the industry. Realizing this is possible at the expense of providing in the field of digital technologies, which will allow us to provide modern economic activity schemes.

In our opinion, an essential part of Drucker’s work is a detailed description of business strategies that offer ways to successfully bring innovation to market. The work of Birknerová and Uher [

19], which was devoted to defining managerial competencies in terms of manager personality traits, can serve as a practical illustration of Drucker’s approaches. Based on the use of a questionnaire to assess managerial competencies, the management style (managerial competencies and personality characteristics) was investigated using a management grid and correlation analysis (Pearson’s correlation coefficient). This study identified significant correlations between managerial competencies and management style. Further research in this area may be aimed at testing, improving, and creating a model that further clarifies management competencies.

According to Porter, the essence of strategy formulation is revealed in overcoming competition. As noted by Porter, the five forces of competition seek to explain how companies can achieve competitive advantage in their branch of industry [

20]. Porter’s theory has its limitations. Such limitations can be revealed by comparing them with various other approaches that attempt to explain sustainable competitive advantages. Goyal [

21] showed the progress of tools used by management theorists to understand the importance of (sustainable) competitive advantage. The study used models that included sectoral representation (such as the five Porter forces) and resource-based approaches (such as Barney’s VRIN structure) [

22]. In one of his recent works, Porter also noted that business is beginning to recognize its responsibility to society. The very nature of business competition is changing as companies work to meet social and economic needs through profitable business models, thus creating shared value [

23]. Moreover, in the struggle for market share, competition is manifested not only by other players; instead, competition in the economic sector is based on the economy itself, and there are competitive forces that go far beyond existing enterprises in a particular area. Customers, suppliers, potential participants, and substitutes are all competitors who may be more or less visible or active depending on the sector. Understanding these processes adds to the need to analyze sectors, complexes, sub-complexes, and value chains.

The following theoretical bases are considered for the formation and realization of manufacturing strategies at enterprises: the maintenance and purposes of strategic manufacture, the types of production strategies of the enterprise, the stages of construction of the enterprise’s production strategy, and the product portfolio of the company/producer of nut crops. The analysis of the formation of the nut market in Ukraine and the strategy of their production while providing for the current state of production resource allocation within Ukrainian regions and a SWOT analysis of strategic priorities for nut production in Ukraine provided the conceptual model of the product portfolio of the company/producer of nuts with a focus on growing almonds. In general, the analysis results provided an opportunity to obtain an accurate picture of the development of the nut plant and its future prospects. We also researched the experience of global strategies for the development of almond production and identified the advantages and disadvantages of implementing best practices for growing almonds in Ukraine. The main result of the work was the development of strategic directions for growing almonds on the basis of a roadmap for the development of the Ukrainian nut sector.

Conceptual Framework

A content analysis of research studies on the development and implementation of production strategy enabled us to identify several approaches to be used in the given study.

The most common type of classification of strategic approaches to management is the classification of McKiernan [

24]. The corresponding key approaches are the planning approach [

13], evolutionary approach [

15], positioning approach [

23], and resource approach [

25]. However, to achieve this study’s goal, we considered a slightly different classification of approaches. Thus, the approaches determining the essence of the production strategy could be generalized as shown in

Table 1.

The production strategy of the company was considered as follows:

The implementation of a plan that ensures the maximum use of the production capacity of the company in the long term;

A set of solutions for gaining strategic market advantages;

A plan for the use of corporate resources;

A long-term plan for product development and sales;

A plan for the highly competitive production potential and an effective management plan for achieving the strategic goals.

Thus, we assumed an integrated approach that envisaged that in conditions of great uncertainty, the environment for developing large investment projects is irrational [

31,

32]. It was better to divide them into smaller parts in order to ensure the possibility of the following steps, which could be compared to a gradual ascent of stairs while giving yourself the right to refuse further ascent [

33].

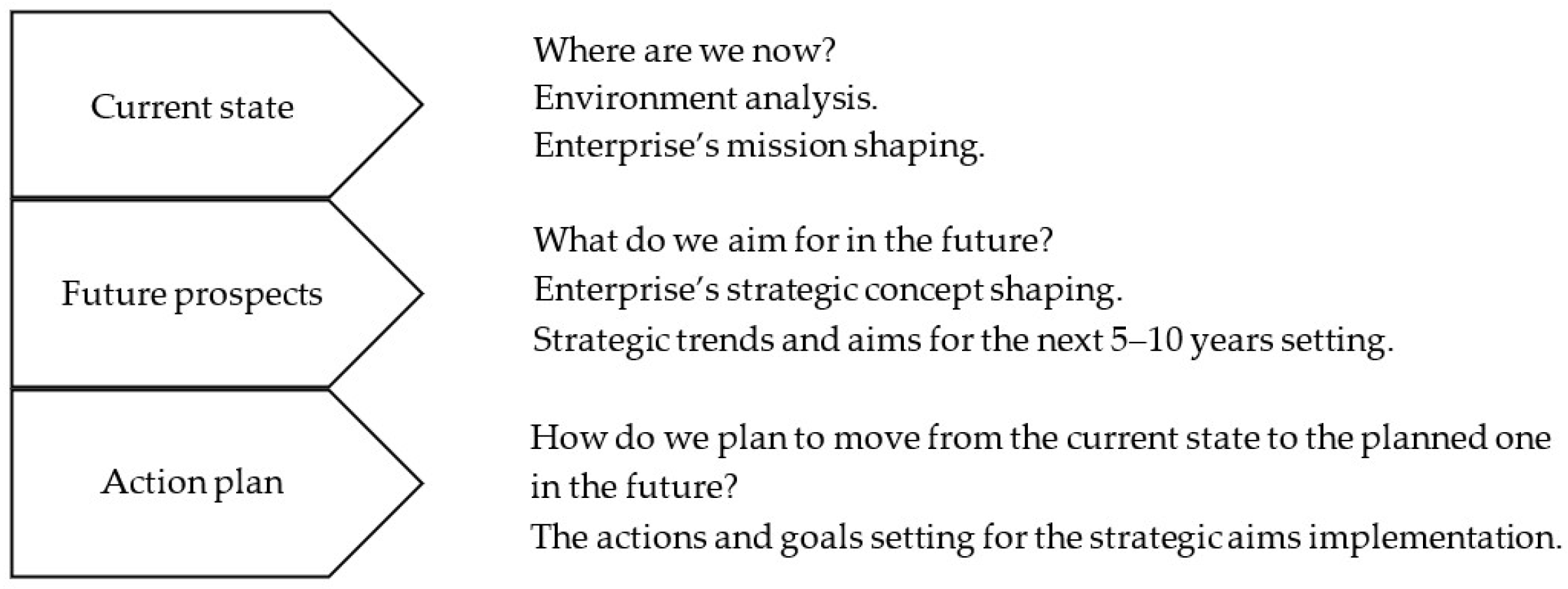

The three main stages of the strategic planning process (

Figure 1) are: the current state, future prospects, and the action plan.

Chase, Jacobs, and Aquilano proposed to recognize the following as strategic priorities of the organization of production activities of an enterprise (however, they also interpreted them as “competitive indicators” of production) [

35]: production costs, product quality and reliability, speed of deliveries, reliability of deliveries, ability to respond to changes in demand, flexibility and speed of development of new production, and other criteria determined by the specifics of the products.

A literature review showed that it is possible to allocate some uniform approaches to the formation of sequence of the primary stages of the process of formation of a production strategy based on the hierarchical structure of all strategies in the organization. In our opinion, such an approach was formulated in the most detailed and close to practical goals by Gaither [

36] (

Figure 2).

Gaither emphasized that the nature of the goals to be achieved by a company in the area of production and the production strategy’s nature is directly determined by the overall goals and direction of the organization’s business strategy. The company—acting in a competitive environment—performs all its activities to acquire new and maintain existing competitive advantages. Since the process cannot be started until the long-term goals of the enterprise are set, we considered a SWOT analysis for this purpose. It was also necessary to conduct an audit of the production processes; i.e., a survey of production capacity, the results of which served as a basis for assessing production capacity and identifying opportunities and needs for its increase or change of character [

37]. In this regard, the product portfolio should be considered as allowing for the leading performance indicators such as contribution to income, contribution to expenses, and share in the range.

2. Materials and Methods

2.1. Clustering for the Areas of Nut Production in Ukraine

The regions where nut crops are produced were grouped into clusters using a cluster analysis procedure. To group the regions, the indicator of the average area of growing walnut crops by region in 2019–2021 was used [

38].

A measure of similarity was chosen to measure the “normal Euclidean distance” [

39]:

where

is the value of the

l-th component of the

i-th (

j-th) object (

l = 1, 2, …,

k;

i,

j = 1, 2, …,

n).

The hierarchical agglomeration procedure consisted of the consistent unification (division) of groups of regions using the principle of the “nearest neighbor”:

where

are clusters and

is the distance between clusters

and

.

The input data for the cluster analysis is shown in

Table 2.

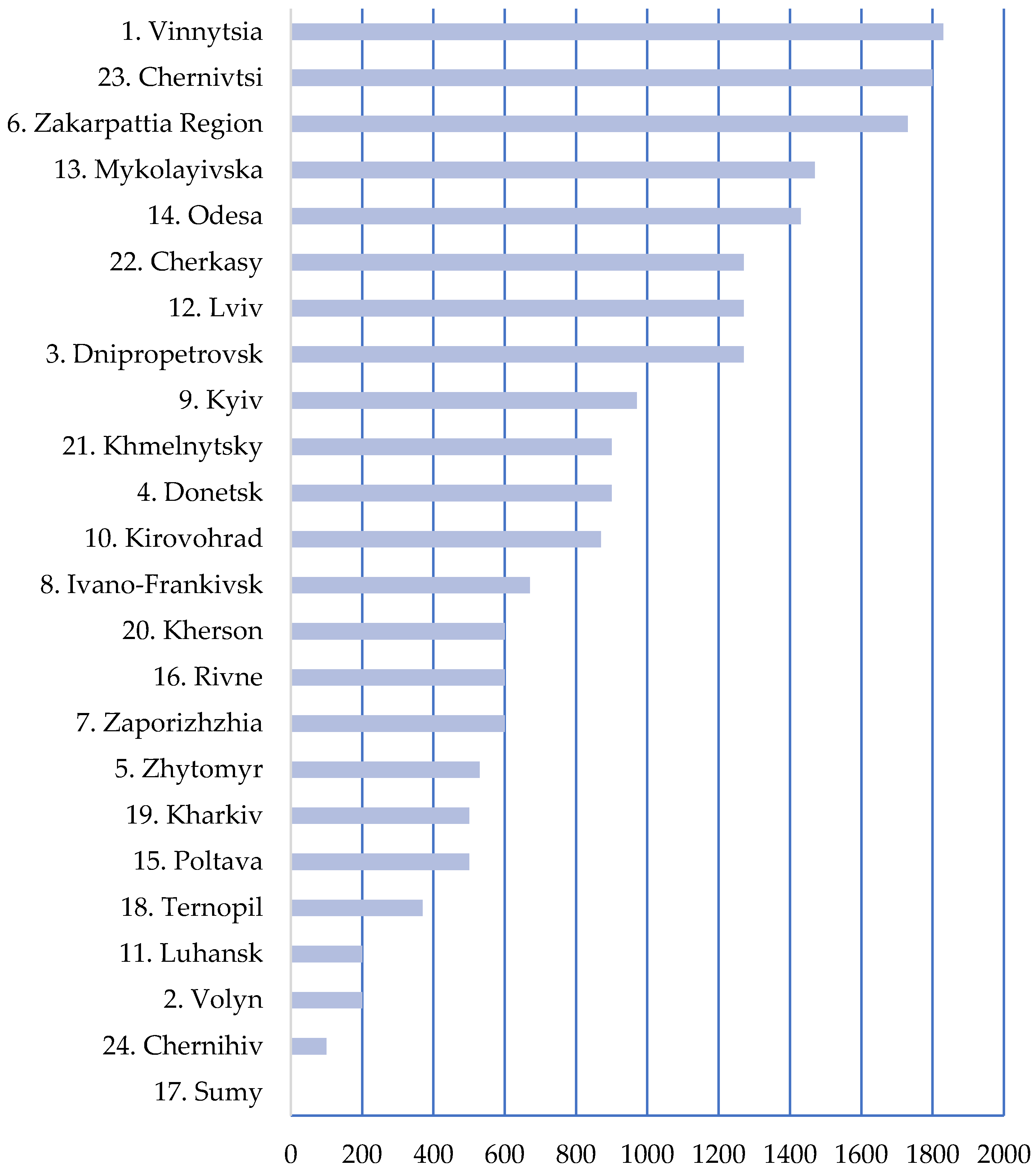

Figure 3 shows the regions ordered by the range.

2.2. SWOT Analysis for the Production of Almonds in Ukraine

To obtain a list of strengths, weaknesses, opportunities, and threats (SWOT analysis) for almond production in Ukraine, the factor analysis method was used. In the period of July 2019 to December 2021, we conducted a content analysis of the reporting documentation of 98 enterprises and farms producing nut crops in Ukraine together with the survey. The instrument of the survey was a questionnaire created on Google Forms. The questionnaire was passed around to experts from 98 domestic almond companies.

We considered the procedure for selecting the weaknesses of almond production in Ukraine. The list of weaknesses consisted of 22 statements.

- W-1.

Almonds can be grown without risk only in limited areas due to spring frosts.

- W-2.

Industrial production of almonds is limited. Most products are made in households.

- W-3.

Almond production in Ukraine per area is relatively low compared to other producer countries.

- W-4.

Growing on homesteads and harvesting systems—traceability, mixed varieties, post-harvest processing, and unclear ownership system.

- W-5.

Commercial plantations—difficulties associated with access to land, land ownership, and the land formation in the required area.

- W-6.

The product line is very limited due to the lack of industrial use of almonds compared to other countries.

- W-7.

Almond varieties produced in Ukraine are primarily of low quality. Therefore, the image of Ukrainian almonds in world markets is very weak.

- W-8.

Lack of certification in food safety and quality management systems.

- W-9.

The quality of the product, especially in matters of color, unstable quality, aging trees, and mixed varieties.

- W-10.

Distribution channels and product storage capabilities are inadequate on a national and international platform.

- W-11.

An opportunistic strategy is often focused on connecting fragments of the internal value chain with international markets on a one-time basis.

- W-12.

The organization of producers is either absent or very weak.

- W-13.

Lack of production and sales cooperatives.

- W-14.

Weak organization of the sector, including weak ties between all stakeholders, and a lack of trust—trade associations are just starting to be active, creating a lack of trust in the cooperative organization of a business.

- W-15.

Processing facilities are not equipped with modern technological solutions.

- W-16.

Insufficient number of warehouses.

- W-17.

Lack of research on regional image formation and branding.

- W-18.

Lack of information about markets throughout the value chain complicates the establishment of fair value at each stage, which leads to trade in “commodity style” on the principle of the “lowest common denominator”; i.e., when we take as a basis the price of the lowest quality product and trade from it.

- W-19.

The presence of an insufficient number of almond-processing enterprises in the region.

- W-20.

Lack of farmers’ technical knowledge related to production.

- W-21.

Almond marketing research is inadequate.

- W-22.

Marketing preparation processes are incomplete (cracking, peeling, packaging, sorting, standardization, etc.).

These were the key questions, and the respondents’ answers helped the authors understand their level of status/influence (weak or strong). The statements in the questionnaire were evaluated using a four-point scale ((1)—“completely agree”; (2)—“partially agree”; (3)—“partially disagree”; (4)—“strongly disagree”).

A factor analysis of the results obtained from the survey was carried out using the software package IBM® SPSS® Statistics 29.

For factor analysis in SPSS, we selected the principal components method, which was based on a consistent search for the most influential factors in descending order of their importance to explain the relationships between variables. In this case, the first selected factor would explain the most significant proportion of the feature’s variance, the second factor would explain the following most significant proportion of variance, etc.

The first stage of the interpretation of the acquired results involved obtaining information about what part of the variance of each of the considered variables could be explained by the proposed factor model. The results of the first stage are shown in

Table 3.

The data in

Table 4 were used to exclude “unpredictable” variables from the analysis, thereby increasing the overall prognostic success of the factor model. In our case, no question’s variable could be excluded because all values were more significant than 0.5.

In addition, SPSS calculated the sample adequacy measure using the Kaiser–Meyer–Olkin (KMO) test together with Bartlett’s criterion of sphericity. The results of the calculations showed that the sample was adequate (KMO = 0.516 > 0.5), and the factor analysis was expedient due to the correlation of factors (the significance was 0.000 < 0.05).

Table 4 shows what share of the total variance could be explained by each of the selected factors separately and the constructed factor model as a whole. In our case, the computer-based factor model could explain 64.4% of the variance.

The data in

Table 4 was used to decide on the number of selected factors because it was reasonable to use only factors that could explain the variance well. This factor was best taken from the total number of factors. In addition, this would simplify the model and enhance the accuracy of interpretation. Based on the distribution of total initial eigenvalues, we suggested that increasing the number of factors by more than seven did not make sense. For this reason, we withdrew only seven factors with total eigenvalues of more than two while adjusting the factor analysis.

The next stage of the factor analysis involved ensuring the clarity of the results. To ensure this, we set a number of factors. A seven-factor model with an explanatory capacity of 64.4% was taken as a basis. We performed the following steps to make the results of building a factor model clearer. First, we removed from the table the values of the correlation coefficients of less than 0.5. They could be ignored because they did not significantly affect the study results. Secondly, we used the rotation method of factors and saw its effectiveness. Rotation was needed to simplify the interpretation of factors or variables. The rotation was performed using the varimax method, which minimized the number of variables with high loads on each factor and simplified the interpretation of factors.

Thus, based on the degree of compliance of all statements, the following 7 factors were identified:

- −

Product quality, especially in matters of: color, unstable quality, aging trees, and mixed varieties;

- −

Cultivation on homesteads and harvesting systems—traceability, mixed varieties, post-harvest processing, and unclear ownership system;

- −

Weak organization of the sector, including weak ties between all stakeholders, and a lack of trust—trade associations are just starting to be active, so there is lack of confidence in the cooperative organization of business;

- −

Lack of information about markets throughout the value chain makes establishing fair value at each stage difficult, leading to trading in “commodity style” on the principle of the “lowest common denominator”; i.e., using the price of the lowest quality product as a basis and trading from it;

- −

Opportunistic strategy is often focused on connecting fragments of the internal value chain with international markets on a one-time basis;

- −

Lack of certification of food safety and quality management systems;

- −

Commercial plantations—difficulties associated with access to land, land ownership, and land formation in the required area.

We singled out the factors and indicated variables that covered these factors (

Table 4). This group of factors was used to identify the weaknesses in almond production in Ukraine. Similarly, a factor analysis of the strengths of the almond production in Ukraine as well as the opportunities and threats was conducted.

2.3. The Advantages and Disadvantages of Implementing the Best World Practices in Almond Growing in Ukraine

Today’s leading players in the almond market are the United States (California), China, Türkiye, and Spain. Therefore, for the development of a production strategy in Ukraine, it was advisable to examine the experience of these countries and use benchmarking to find the tools and approaches that could be effective for the conceptualization of enterprise.

2.4. Company Conceptualization

Strategic planning should begin with a clear idea of the company’s mission and goals. Therefore, the company’s mission, in our opinion, should be set out as follows: to be a leader in agricultural production in Ukraine through experience and innovation while working as a team and guided by the principles of transparency and responsibility to employees and society.

Company values:

- −

Leadership;

- −

Responsibility;

- −

Professionalism;

- −

Effectiveness;

- −

Reliability.

The company’s strategy should include investments in highly profitable projects: irrigation and cultivation of seeds, walnut and almond orchards, and increasing efficiency through optimization of technologies and costs [

41,

42].

The life-cycle stage of the company is growth.

The company conceptualization was aimed at an investigation of the values of fundamental financial indicators and the level of workforce qualification according to the type of product (separate question for each type: the product that supported the company yesterday (PY); the product that will support the company tomorrow (PT); the product that supports the company now (PN); and the product that supports the company now or the product that the company plans to specialize in (PS)).

The analysis of the results was carried out for pairs of indicators:

Type of product and corresponding peculiarities: (1) the best technologists’ and marketers’ work; (2) new employees’ work; (3) experienced employees’ work);

Type of product and the fundamental indicators: corresponding contribution to income (CI: 0–100%), contribution to expenses (CE: 0–100%), and share in the range (SR: 0–100%).

In order to determine the major corresponding peculiarity for each type of product in an enterprise, a frequency statistical analysis was applied. The results are laid out in

Table 5.

Next, to establish the percentages of contribution to income, contribution to expenses, and share in the range, a descriptive analysis was carried out as well. The results are given in

Table 6.

The variety of the company’s products, when considered from the strategic perspective by product category and product type, was obtained by undertaking a multiple-response analysis. The questionnaire contained multiple-choice questions with a dichotomy scale for establishing the correspondence of the product to the product category. The particular product category and the list of products from which to choose were constructed so that the respondent could choose one of the two options (Yes/No) in order to correlate the type of product to the product category. The list of goods was defined as follows: wheat, barley, corn, sunflower, yellow peas, seeds, raspberry, chickpeas, perennials, peanut, dairy farming, sorghum, lentils, flax, almond, and other. Accordingly, the list of product categories was defined as follows: goods that support the company now, goods that will support the company tomorrow, specialized goods, developing goods, losers, goods that supported the company yesterday, restoration, excessive specialization, unjustified specialization, and investments.

The results of the multiple-choice analysis for the product category “Goods that feed the company now” are given in

Table 7.

The table above conveys the most significant product types that were specified by the nut-production enterprises in Ukraine as the products that supported the companies at those times. The greatest frequencies corresponded to wheat (16.6% of answers), barley (15.1%), corn (15.1%), and sunflower (15.6%).

A similar analysis was conducted for the rest of the groups of product categories.

2.5. Strategic Directions of Almond Growing by Enterprises on the Basis of the Road Map for the Development of the Ukrainian Nut Sector

At the beginning of December 2019, as part of an initiative of the ITS Project, information and consulting seminars on the possibilities of developing the nut industry in Ukraine and creating a roadmap were held in Odesa and Uman. The seminars were conducted by ITS international consultant Jim Fitzpatrick [

43].

These seminars were aimed at improving the nut industry in Ukraine and had several purposes: to hear the views and ideas of stakeholders, collect data to reflect the needs and wishes of stakeholders in the roadmap, make sure that participants understood the state of the industry at the same level, identify restrictions that hinder the development of the industry, and get the information needed to develop a roadmap.

The ITS project “Promoting the entry of small and medium-sized enterprises in the fruit and vegetable sector into foreign markets and their inclusion in value chains” within its competence decided to deepen work on the development of the nut industry in Ukraine and develop a roadmap.

The roadmap is a comprehensive strategic document (plan and recommendations) that could form the basis of a national action plan aimed at supporting the integration of Ukrainian nut producers into national and global value chains and opening access to new markets for their products [

38,

43].

The production strategy of the overall benefits for manufacturing enterprise is considered to be based on this document because it had predicted the development of nut production in Ukraine as a whole.

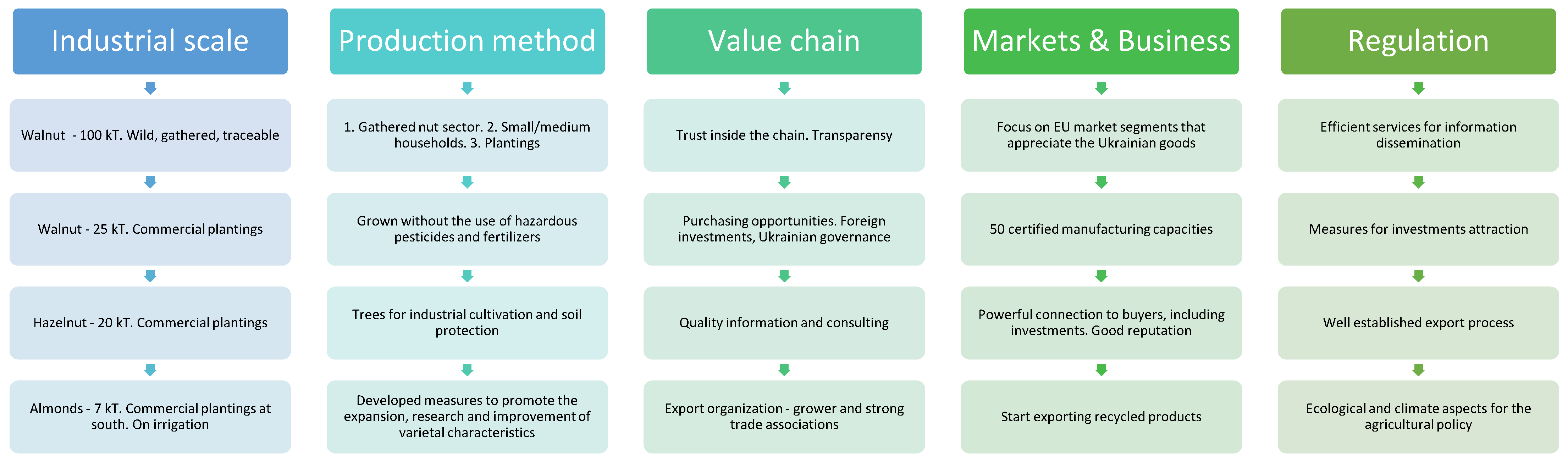

Thus, the vision of experts in the field of industrial almond orchards is presented in

Figure 4.

3. Results

According to the State Statistics Service of Ukraine, the area of plantations of Ukrainian nuts on farms of all categories in 2021 was 21.1 thousand hectares, of which 13.7 thousand hectares were at the fruiting age. Farms grew a significant amount of nuts (13.6 hectares) followed by companies (7.5 hectares) and farms (1.3 hectares) [

38].

Based on the presented research, we suggested distinguishing three clusters of regions for growing walnuts in Ukraine: Cluster 1—Vinnytsia region, Zakarpattia region, and Chernivtsi region (production of nut crops is carried out on average on areas within 1.73 thousand hectares to 1.83 thousand hectares); Cluster 2—Dnipropetrovsk region, Lviv region, Mykolaiv region, Odesa region, and Cherkasy region (production of nut crops is carried out on average in areas within 1.27 thousand hectares to 1.47 thousand hectares); Cluster 3—Volyn region, Donetsk region, Zhytomyr region, Zaporizhzhia region, Ivano-Frankivsk region, Kyiv region, Kirovohrad region, Luhansk region, Poltava region, Rivne region, Ternopil region, Kharkiv region, Kherson region, Khmelnytskyi region, and Chernihiv region (production of nut crops is carried out on average in areas within 0.1 thousand hectares to 0.97 thousand hectares). In the Sumy region, walnut crops are not grown. The results of the cluster analysis are shown in

Table 8.

The State Statistics Service of Ukraine also reported that in 2021, 809.5 hectares of nuts of all kinds were planted, and the largest increase was observed in the Zhytomyr region (+264.4 hectares to 700 hectares).

In further research, with the development of nut growing in Ukraine, another useful indicator for the clustering of regions may also be the growth rate of the area of nut plantations in the regions. Then it will be possible to use two indicators of clustering: the average areas of nut plantations and their growth rates. In this case, it will be necessary to carry out the rationing of indicators for a consistent clustering procedure and to choose the “weighted Euclidean distance” as a measure of distance [

39].

Recently, almonds have accounted for the largest share of the structure of Ukrainian imports, and in 2021 this figure was 3.4 tons (72.3% of all imports last year). This dynamic of Ukrainians’ consumption of almonds confirms the need to develop domestic production.

The “Information certificate on financial support for the development of horticulture, viticulture and hop growing in 2021” showed that in production, the emphasis had been on improving varietal characteristics and that the goal had been to enter new markets. The given document presented the following mechanism and areas of support for horticulture [

44].

We believe that Ukraine is a potential region for growing almonds as well as pistachios and hazelnuts. According to agronomists, almonds can be harvested at up to 2.5 thousand kilograms per hectare if favorable conditions are created. The first harvest of almonds can be obtained 2–3 years after planting, and the maximum volume is in the 5th or 6th year [

40].

In the next step, we considered strategic planning for the development of the almond market using a SWOT analysis. The results of a rational SWOT analysis aimed at the formation of generalized information potential should be effective solutions for the appropriate response (influence) of the subject in accordance with the environmental factors [

1,

13].

It is also important to consider possible threats and to be prepared to act in the event of them. The analysis was carried out in a similar manner (

Table 10).

The strategic goals of the company should be aimed at making full use of the capabilities and strengths of the enterprise and the results of the analysis of the economic condition in which the enterprise operates. At the same time, companies need to be clear about their weaknesses. Their elimination or maximum neutralization is essential for further development and efficiency.

Nuts are the wealthiest horticultural category, and the worldwide nut trade represents the most valuable of all fruit products that contribute globally. To elaborate a prudent enterprise strategy, the experience of the superior nut producers on the national level should be considered.

The United States (California), China, Türkiye, and Spain are the dominant competitors in the almond market.

3.1. California

Today, California cultivates almost 30 varieties of almonds, but about 70% of all production is accounted for by the main 10 varieties: Nonpareil, Carmel, Butte, Padre, Mission, Monterey, Sonora, Fritz, Price, and Peerless [

4].

The main challenges that gardeners face are: access to water (the main problem for California gardeners is that in the near future they expect the introduction of limits on the use of water for irrigation, and this could harm the nuts); almond pollination (beekeepers are constantly raising prices for the pollination service (in 2019, the average price for one hive was USD 200, and about eight hives are needed per 1 hectare, meaning that for pollination alone you have to pay USD 1600 per hectare; therefore, many self-pollinating varieties have been created (these are mostly grown in Europe)); and peeling almonds from the pericarp (today, this service has become expensive, although previously it was generally free—the amniotic sac is considered valuable animal feed, which is why the companies that clean the almonds sell the waste to dairy farms and make good money on it, but since there are now a lot of almonds, the cleaning service has become paid.

Features of cultivation include: landing (the standard scheme for planting almonds in California is 5.5 to 5.5 m); pruning (recently, scientists have come to the conclusion that almonds can do without any pruning at all; however, in the first 3–4 years it is still necessary to form an almond tree); irrigation (use of two drip irrigation tapes instead of sprinklers, as is the case with walnuts because almonds require less water); soils (almonds are demanding to the soil, so in saline soils where almonds cannot grow, California farmers usually grow pistachios); and harvesting, which is carried out in several stages (first, the ground is shaken with special self-propelled shakers, then a self-propelled machine rakes the almonds at the level of the roll in the middle between the rows where they dry on the ground (because in California the temperature usually reaches 35–40 °C); after drying, self-propelled almond pickers collect them and partially clean them of leaves and soil) [

4].

3.2. China

The almond tree has been grown in Shache County in the south of the Xinjiang Uygur Autonomous Region for more than 1300 years. However, the local industry still has great potential because local farmers have recently mastered the latest agricultural skills to improve nut quality. Shache in Kashgar Prefecture is now the largest almond-growing region in China. The plantations in the county cover more than 61,500 hectares and occupy more than 95% of China’s almond area. More than 120,000 people now make a living from almond production. Therefore, the development of the almond industry is important for the existence of about 14 percent of the county’s population. The quality of almonds has improved significantly over the last few years both in the taste and look of the produced nuts [

41].

Almonds were first brought to Shacha by merchants who traveled the ancient Silk Road. Since the establishment of the cooperative in 2018, the yield per hectare has increased from 1.2 tons to 1.5 tons. Increasing yields means that farmers can earn more. The cooperative’s leading producer earned about 60,000 yuan (USD 9300) in 2020 [

41].

Despite the COVID-19 epidemic, which cast a shadow over the domestic consumer market, the Saimaa Cooperative last year processed and sold 3800 tons of almonds, which was 300 tons more than in 2019. Most of the harvest (about 3000 tons) was sold to others in some parts of China such as Shanghai, Tianjin, and Zhejiang Province, where products such as Shache almonds have become well known among health-conscious Chinese consumers.

As the almond business has flourished in recent years, the number of farmers in the cooperative has risen from 8 to 55. Another 20 have expressed a desire to join the industry this year. Shache’s long history of growing almonds has given the county a unique advantage in supporting and modernizing almond production. The district has no plans to expand plantations this year but will continue to increase yields and improve almond quality by offering farmers more support in farming and policy. Shache plans to produce 94,000 tons of almonds this year (8000 tons more than last year) to meet growing demand in domestic and international markets. Shache almond products are exported to Japan, Pakistan, and Russia. The district also plans to attract more businesses to produce more high-value-added products such as almond oil and milk. Growing almonds is no longer just a tradition for Shache people but a ticket to a better life [

41].

3.3. Spain

In Spain, almond production is concentrated in the coastal regions of the Mediterranean: Catalonia, Valencia, the Balearic Islands (Mallorca), Andalusia, and Aragon. As a producer, Spain is also a significant consumer of almonds both as a snack and as an ingredient in the traditional nougat, marzipan, and baking industries. Almonds are essential elements of the traditional Mediterranean diet. Almond trees are very strong, and they can live from 60 to 80 years and even up to a century in the Mediterranean.

There are currently more than a hundred varieties in Spain, but there are five commercial types identified and selected from the highest quality varieties, namely Marcona Largueta, Planet, Communes or Valencias, and Mallorca. The local Marcona, Largueta, and Planet are of these varieties. They are all characterized by a nonporous hard shell, which is in contrast to the Californian varieties with a soft shell. In addition, Spanish almonds are of exceptional quality due to their high oil content, which makes them juicy and soft and gives them a more intense taste. The Marcona variety is the most expensive and in demand in the baking industry and for nougat. Deprived of shells, they are fried until they acquire the desired tone for the preparation of soft or hard candies. It is the basis for the names of Gijon and Alicante and also indicates the quality of Toledo marzipan and traditional Aragonese nougat. In addition, due to having less oil in its composition, it is usually allocated for the production of roasted almonds. Largueta is more elongated and narrower than Marcona, and is a variety that most manufacturers use for snacks and appetizers. Moreover, it can be found in traditional Christmas treats such as chocolate and praline [

45].

3.4. Türkiye

Almonds are grown in almost all regions of Türkiye except northeastern and upper eastern Anatolia. However, there are great differences between almond growing areas as well as great diversity in each of these populations. Organic fertilization is carried out in the soil when the content of organic matter is less than 1%. In large gardens, inorganic fertilizers are applied by analyzing the soil and leaves.

In the vicinity of Bursa, irrigation is not required in spring or autumn due to heavy rainfall. Two or three irrigations are enough in these areas (and only in summer). Surface irrigation is the most common method in almond orchards. Drip irrigation has been introduced in some gardens, and the use of this method is becoming widespread.

Soil modification is often required in preparation for planting. Modification and preparation of the soil can consist only of careful plowing of deep homogeneous soils, which do not have solid soil, to modification of a sliding plow or excavator on layered or hard soils.

The distance between trees is 6 by 5, 6 by 6, or 6 by 7 m, which is normal, and the sizes of the gardens range from 5 to 20 hectares. These intervals may vary depending on irrigation and rainfall. Cultivation, mowing, and harvesting are simplified by a square arrangement. In young gardens, strawberries or vegetables are grown between rows of trees. Almonds are prone to certain diseases (Agrobacterium tumefaciens, Pseudomonas syringae, and Phytophthora spp.), insects (Quadraspidiotus perniciosus), and nematodes, which reduce yields and crop quality and sometimes weaken and kill trees.

Harvesting depends on the area, season, and variety, but it usually begins in July and lasts until September. Harvesting is done by hand or by tapping with a stick. Harvesting almonds costs about 25% of the total cash cost of growing.

A cooperative of producers sells fruits in the form of peeled nuts or kernels. Traditionally, almonds are sold in the industrial trade, where they serve as an ingredient in other foods. Approximately 20% of the crop is consumed at home as fried salty snacks or culinary almonds.

Overall, nuts have a great reputation among processors because of their nutritious content, flavor, and consistency. Tree nuts are often gathered in a very short harvesting season. The gathered nuts must be consumed throughout the year. As a result, it is critical to analyze the production enterprise’s product portfolio in order to develop a grasp of income-generating opportunities.

Based on the generalizations of information from the reports of the surveyed companies, we developed a conceptual model of the company’s product portfolio producing nuts for the market prospects, which is presented in

Table 11.

The generalized product portfolio for 98 surveyed nut-producing enterprises in Ukraine is given in

Table 12.

The data in

Table 11 and

Table 12 show that almonds are currently considered to be the product for investments. In addition, almonds fell under the type of product that the company either had planned to specialize in or would support the company tomorrow. In both cases, new employees would be in need.

4. Discussion

Thus, in accordance with the developed strategies at the national level and based on the company’s goals, we offer the following directions for an almond-growing strategy in a manufacturing enterprise (

Table 13).

We believe that the strategic development of agricultural enterprises should take into account that the cultivation of hazelnuts and almonds in Ukraine is promising. Consequently, this direction should be actively developed as mentioned in [

38,

43].

When developing the strategic perspective of an agrarian enterprise, it is recommended to give preference to the region and the obtained cluster for consideration because this determines the vast number of conditions such as logistical expenses and governmental support. A priority should be established for the most developed regions. Such regions for Ukraine could be divided in to the groups according to the growing areas (1st group—1.73 thousand hectares to 1.83 thousand hectares; 2nd group—1.27 thousand hectares to 1.47 thousand hectares; and 3rd group—0.1 thousand hectares to 0.97 thousand hectares).

When considering the weaknesses of the agrarian enterprise, a list of statements was laid out. Nevertheless, this list is not exhaustive and needs to be expanded. However, the given list encompasses the most vital aspects that should be added up [

7], including certain risks of growing almonds, limitations of industrial production, technology, land utilization, the current state of almond production in Ukraine, lack of varieties, energy supply, product quality, supply chain reachability, logistics, marketing, and scarcity of scientific support and knowledge [

19].

As the investigation into the investment prospects for the enterprise was carried out, a statement on the growth stage of the enterprise was put forward. However, this statement could be revised based on the real state of the enterprise, and there should be consideration of the McKiernan’s crisis aspects and the possibility of changing the priorities [

24]. In addition, the product types, which included suggested options, were developed on the basis of the Ukrainian enterprises so that any other enterprise could rely on the broad experience of their counterparts. In addition, the basic economic indicators of the product were simplified and encompassed only three main types: corresponding contribution to income, contribution to expenses, and share in the range. Further research could benefit from using indicators such as marginality, labor cost, active capital, passive capital, land utilization expenses, gross product, etc.

The scope of the company’s products provides the general profile of the enterprises interested in the growing of almonds. Other characteristics of an enterprise might include focusing on producing goods and marketing them directly to consumers, the acreage, the way an enterprise is run (as a sole proprietorships or otherwise), and work in tandem with market gardens and greenhouses [

37].

Only 7% of the world’s areas are suitable for growing nuts, and Ukrainian lands are included in this small percentage. The main direction of nut growing in Ukraine today is the cultivation of walnuts, but the cultivation of hazelnuts and almonds has been promising and actively developing over the past 3–5 years.

Clustering of nut-production areas in Ukraine has revealed that Ukraine is a potential region for growing almonds with vast allocations of nut production within different regions. Several regions, however, may be regarded as the most promising areas for nut cultivation and the target for direct investments in the given areas.

The SWOT analysis model served as the foundation for determining the enterprise’s scenario, strategic directions, and goals. The given study on SWOT for nut cultivation in Ukraine revealed several robust trends for further strategic endeavors that included product-quality prioritization in connection with breed certification, cultivation, and harvesting system traceability [

17]. Correspondingly, every step taken should align with government support and regulation to strengthen the value chain and make it transparent for all stakeholders [

9].

In addition, the lack of competitive struggle brings out several strict opportunities that open highly attractive access to high-value markets and commercial gardening in connection with the clustering of Ukraine’s regions. Considering the international experience of Spain and Türkiye, we anticipate further development toward the establishment of a new internal market for traditional almond products and an increase in value-added exports.

The conceptual model of the product portfolio of the company/producer of nut crops according to market prospects referred to the fact that for an agrarian enterprise, it was the best option to allocate its resources as follows: for the product that supported the company yesterday, use the best technologists’ and marketers work’ (contribution to income—37%; contribution to expenses—44%; share in the range—54%); for the product that will support the company tomorrow, it is better to use new employees’ work (contribution to income—12%; contribution to expenses—2%; share in the range—19%); for the product that supports the company now, it is better to use experienced employees’ work (contribution to income—76%; contribution to expenses—32%; share in the range—13%); for the product that supports the company now or the product that the company plans to specialize, in it is better to use new employees’ work (contribution to income—28%; contribution to expenses—21%; share in the range—13%).

The frequency analysis of distribution for technology utilization and experienced workforce implication in agricultural enterprises in Ukraine showed the structure of production, in which the leading positions were taken by wheat, barley, corn, and sunflower. Similarly, almond production was regarded as a potential investment field that could replace peanuts as losers, dairy farming as a past interest, and lentils and flax as unjustified specializations.

For the further development of almond production in Ukraine, it is recommended to use the experience of the main leaders of the industry—USA (California), China, Türkiye, and Spain. However, the example of California regards the quality characteristics of the product. China is the creator of cooperatives that can ultimately increase yields. Türkiye has a significant focus on the soil in which the garden is planted. Spain has a number of adapted varieties.

It is vital to acknowledge several similar recent investigations for strategy development on the enterprise level conducted with the application of different methodological approaches. For instance, using dynamic capabilities theory, Roh et al. provided an empirical analysis based on the structural equation model that allowed them to establish coherence between cooperation strategy and sustainable performance [

46] as well as coherence between intellectual property rights in green supply chains and green marketing while developing an enterprise strategy [

47,

48]. Although the approach was intriguing, the authors utilized the vast amount of input data concerning enterprises’ economic performance and their stakeholders by selecting an intermediary. Our approach included both the individual expertise for conducting the SWOT analysis and economic data from enterprises for conducting the product portfolio research. We believe this allowed us to develop a sophisticated firm strategy that on one hand may be more general but on the other hand is broader in terms of making managerial decisions in the early stages of the business life cycle. At the same time, subsequent research in the given field should include more narrow issues for consideration in the development of particular strategies for the different types of enterprise affairs in order to implement all the suggestions made in the practical sphere.

In our proposed areas of production strategy for almond growers, the key point is to use only certified garden material that will provide access to government support and appropriate quality education of staff because the labor market is experiencing a critical shortage of both theorists and practitioners in almond growing.

Taking all considerations into account, this study determined strategic directions for resource distribution based on nut-growing productivity in Ukraine for multiple areas and product portfolios on the basis of domestic expertise. In addition, the study determined the directions for developing and implementing an almond-production strategy in Ukraine.