Abstract

The research’s purpose is to analyze the direct and indirect effects on financial crisis management in light of the accounting information system’s success in the local government context. The study adopted the positivist paradigm, a deductive quantitative approach, and a descriptive-analytical nature. Data were collected through the questionnaire, and the local authorities in Palestine represented the study population. The sample focused on the accounting and finance departments, and the analysis unit was based on the accounting information systems users. The study employed the techniques of Smart-PLS software in analyzing the data. The originality and novelty of the study mainly stem from the development of its own theory and model based on the fact that financial crisis management depends on accounting information systems. Establishing a model that clarifies accounting information system’s success–financial crisis management relationships, allowed examining that theory and relationships empirically. Empirical results and evidence prove the theory’s validity and the high reliability of its tested empirical model. The outcomes revealed the significant direct influence of the accounting information system’s success, with its dimensions system quality, information quality, service quality, system use, and user satisfaction, on the financial crisis management. In addition to the significant indirect influences of system quality and information quality on financial crisis management through the mediation of system use and user satisfaction. On the other hand, the system use and user satisfaction did not perform a mediating role in the influences between service quality and financial crisis management.

Keywords:

information systems effectiveness; accounting information systems; crisis management; local authorities; pre & during-financial crisis management JEL Classification:

M41; H12; L86; G01; D80; H70

1. Introduction

The International Monetary Fund (IMF) indicated that financial crises arise in the midst of the economic, administrative and accounting systems adopted by organizations, as their weakness is one of the most important drivers towards the emergence of the crisis [1,2]. The rule in crisis management is that every crisis is a problem, but not every problem is a crisis. This implies that some minor issues may escalate and extend their influence to countries, organizations and people if they are not handled immediately or slowed down. Every crisis seems to be a complex and multidimensional situation, and financial crises have proven this belief. The financial crisis also showed that the Palestinian local authorities suffer from a crisis of not paying enough attention to crisis management [3]. Al-Khatib (2015) [4] expressed that there is a defect in the Palestinian local authorities’ dealing with the crises they are exposed to. The performance of local authorities was not at the required level during crises and emergencies, despite the recurrence of such crises, in addition to the existence of a real financial crisis [5]. Palestinian local authorities’ financial management practices remain weak, not to mention the administrative fragmentation that prevents savings in service provision [6].

In this regard, Ghorab (2017) [7] indicated that integrated accounting systems play an important role in financial management and cost accounting. Accounting information systems (AIS) work critically to reduce uncertainties and transform them into certain cases that contribute to managing and addressing financial crises. In order to develop the accounting information system in managing financial crises, it is crucial to intensify efforts and devote attention to its study because the current world depends on information as a main source for decision-making, and this century has become dependent on information as a cornerstone in all fields [8]. The Palestinian Local Government Ministry emphasized the importance of financial spending and investment in the field of information technology. In addition to accrediting technical staff who are able to deal with technology, and establishing an administrative unit responsible for information systems and their development in local authorities (LAs) [9]. Due to the fact that these authorities need financial and accounting systems, as well as follow accounting standards in their work [10].

The Palestinian Administrative and Financial Control Bureau’s report indicated the importance of local authorities adopting accounting information systems that are characterized by a high degree of reliability, security, integration, and access control, in addition to comprehensive financial databases. This would provide the necessary financial information and data for use in planning, supervision and direction processes, which leads to strengthening the ability of local authorities to manage financial affairs effectively [11,12,13,14]. In the context of this, Al-Buhaisi (2013) [15] pointed out the consequences of the failure of AIS to provide the information necessary for decision-makers in a timely manner and with appropriate details, which affects its validity in the process of making decisions. Likewise, the loss of the ability of the financial statements to display the results of the local authorities’ work and their financial position correctly, and the low level of reliance on the financial statements in decision-making, which undermines their ability to manage the financial crisis [16]. Thus, AIS acts a vital role in managing financial crises, and any weakness in the systems will have an impact on the effectiveness and ability of those local authorities to confront financial crises [17].

Consequently, the purpose of this research is to explore and analyze the effects between the accounting information systems success and financial crisis management in the Palestinian local authorities. This purpose is motivated by the theoretical and contextual gap in the literature, as defining the theory and models adopted in the study of variables and measures, whether related to information systems or crisis management, was not sufficient [18,19,20,21,22]. Studies focused on studying the effectiveness of management information systems in general, without relying on specific and clear model variables to study the effectiveness or success of information systems. In addition, some did not clearly define the information system to be studied [19,20,21,22,23,24,25]. Crisis management was studied without clearly defining the crisis to be studied, while ignoring the nature and specificity of each crisis that the organization might face [22,23,24,25,26,27,28,29,30]. Emphasis was placed on studying the association between management information systems and crisis management [19,20,21,22,25,28,31,32,33].

Studies examining the mediation of system use and user satisfaction have largely focused on various information systems, including management information systems, mobile banking, e-commerce, mobile learning, and enterprise resource planning systems e.g., [34,35,36,37,38,39,40]. Previous studies were carried out in different sectors and settings than the current study. It has been applied in sectors such as ministries, government agencies, universities and colleges, banking sector, tourism and industrial companies, and charitable organizations. In addition, previous studies were conducted in other countries [18,19,20,21,23,31,33]. Previous studies focused on managers, directors, heads of departments, and workers from various departments and offices in their research population and assigned them without explicitly specifying which departments and departments they targeted in the environment to which the study was applied [19,20,21,22,23,33].

Accordingly, this study demonstrates its novel contribution to the literature and the scientific community by developing a framework that depicts and characterizes the relationship between AIS success and financial crisis management. Contribute to the expansion of cognitive and theoretical aspects in the area of successful AIS and financial crisis management. The original contribution towards the development of measures that focus on the success of accounting IS and take into account the nature of those systems. Likewise, the novelty in developing a measure of the effectiveness of financial crisis management, taking into account its nature and characteristics, and allowing the ability to measure it empirically through specific and focused measures. In addition, the empirical contribution originality and novelty of this study is demonstrated by exploring the associations and effects on financial crisis management in the light of successful AIS adoption. They are relationships that have not been studied before, and it is interesting to reveal their results, whether in terms of direct or indirect effects, as it is the first study of its kind.

Regarding the originality of the professional and practical contribution, this study is the first study to investigate whether the success of AIS had an impact on the managing of financial crises (FCM) in the Palestinian localities. Therefore, the results of this study will draw attention to the impacts and importance of the role of AIS in managing the financial crisis, both at the level of the scientific and professional communities. This is in the direction towards developing smart accounting and financial information systems through which the financial crisis is managed professionally. It contributes to enhancing the awareness of the Palestinian local authorities of the importance of adopting a successful AIS, which improves the role of the financial and accounting departments in the local authorities in decision-making and increases their ability to manage financial crises. The study contributes to defining the main effective lines for managing the financial crisis with advanced professionalism. Furthermore, confirming the originality and novelty of the study is the scarcity and absence of studies related to accounting information systems and financial crises in the Palestinian local authorities. As many studies and reports provided recommendations in this regard e.g., [1,8,9,14,18,19,23,29,33,41,42].

Thus, the issue of the research could be understood and realized through the next study questions: What is the influence of the AIS success (system quality, information quality, service quality, system use, user satisfaction) on financial crisis management in the Palestinian LAs? What are the influence of both system use and user satisfaction as a mediating variable on the relationship between the quality dimensions of AIS success (system quality, information quality, service quality) and financial crisis management in Palestinian LAs?

The article is organized as follows: starting with the introduction, then the literary review, which included the theoretical background and framework, then the hypotheses were developed, as the relationship between accounting information systems and financial crisis management was discussed, as well as the variables of the study. This was followed by Section 4, where the study method, population, sample, and measures were defined. Then Section 5, in addition to Section 6 and Section 7.

2. Literature Review

Theoretical Background and Framework

Information system (IS) success, IS effectiveness, and IS evaluation or IS assessment are usually the terms used in literature to measure the value of information systems. Evaluating an IS may help achieve a number of goals, including but not limited to assuring the future success of the system, facilitating changes to the system, and deciding whether or not to scrap it altogether. When thinking about the implications of an Information system project, it is important to see assessment as a process that might occur at many points in time or be ongoing. Effectiveness is used as an IS evaluation measure since IS systems are object-oriented. Effective IS helps a corporation accomplish its objectives [43,44,45,46,47,48]. Components of IS success are described as including improved productivity. IS success (ISS) refers to the achievement of those activities, where the measurement was reliant on the technical level using technical properties that focus on performance features, such as resource utilization, reliability, response time, and ease of use. IS success/effectiveness represents the craved state of an information system primarily on the usage level using dimensions such as use and user satisfaction [49,50,51,52,53].

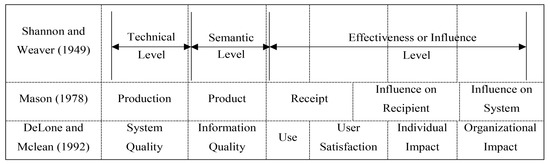

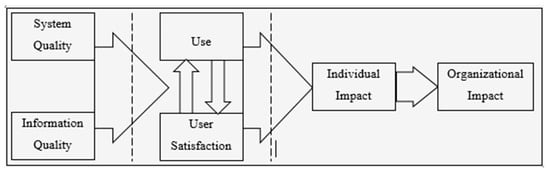

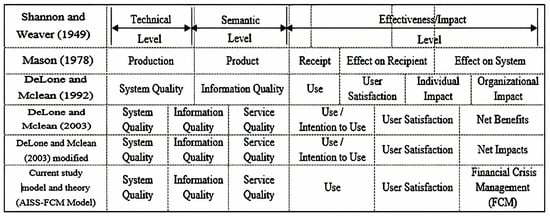

In the context, Shannon and Weaver (1949) [54] presented the mathematical theory of communications, which became known as the information theory. It works on measuring the information produced by the communication system in different circumstances from several levels: Technical, it represents the accuracy and efficiency of the information-producing system. Semantic, represents the success of information in conveying the desired meaning. Effectiveness, representing the effects of information on the recipient. Mason (1978) [55] presented the theory of the effect of information, considering that the information system represents a source of information. It worked on modifying the communication theory to fit the information system. DeLone and Mclean (D&M) (1992) [51] showed that the concept of the levels of outputs in the communication theory explains the serial nature of information since the information system produces the information, and it is communicated to the beneficiaries. In this sense, information moves through a series of levels from the moment it is produced to its use or consumption through its impact on the individual or organization. Based on this understanding, they worked on distributing the three mentioned levels into six categories, which can be applied to information systems. The categories are as follows: System quality represents the characteristics of the IS itself. Information quality represents the standards of the information and data used and their characteristics. Usage represents the end user’s use of the results supplied by the information system. User satisfaction represents the user’s response to the effective use of the information system. Individual influence represents the effect of information on the behavior of the recipient or user. Organizational impact represents the impact of information on the performance of the organization in general. The ISS is a multi-dimensional structure with interdependent relationships between these classifications. Figure 1 summarizes the foundational theories and the theory of DeLone and Maclean (1992) [51]. Figure 2 shows a model of the effectiveness of IS and the interrelationships between their dimensions and their various elements.

Figure 1.

Communication theory and its modification [51,54,55].

Figure 2.

DeLone and McLean Model (1992) [51].

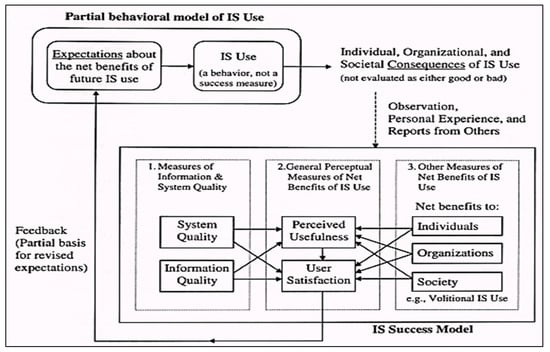

Seddon (1997) [56] worked to redesign the DeLone and McLean model [51], where the idea of operations was removed from the model. The new model was considered a contrast model. The part that includes the use is considered behavioral, and the second part includes the effectiveness of the IS. Figure 3 shows the Seddon model.

Figure 3.

Seddon Model (1997) [56].

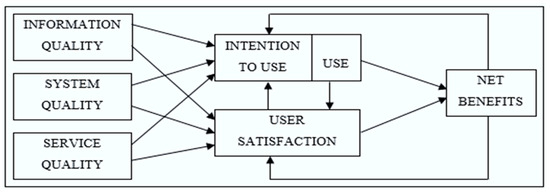

In this regard, DeLone and Mclean (2002) [57] conducted a study aimed at testing, revising, and rewriting their model presented in 1992. They added or replaced some model dimensions, such as intention to use, service quality, and final benefits. Following up on the model that they designed, DeLone and Mclean (2003) [49] worked on updating this model, as shown in Figure 4. In addition, they provided some important definitions and metrics necessary for the success of the model work. They showed that quality has three dimensions. Since they affect usage and satisfaction, they must be measured independently.

Figure 4.

DeLone and Mclean Model (2003) [49].

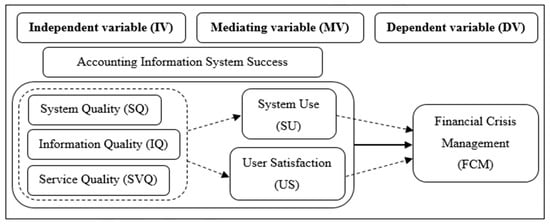

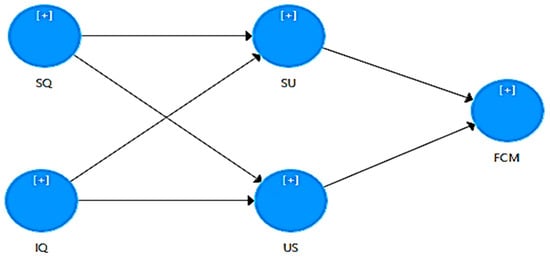

The theories and models discussed above, demonstrate that the quality of IS has a consequence on individual performance and the overall performance of an organization. The use of high-quality AIS serves users’ information demands and makes their job easier, which boosts satisfaction and reuse. These advantages help the system achieve its goals and objectives. The Finance Department’s presence is one of the main reasons for the adoption of an advanced and high-quality AIS system by the organization. Hence, organizations need high-quality AIS systems in their various fields of work. AIS play an important role in managing the financial crises that organizations are exposed to. Consequently, the current study develops its theory from the fact that accounting information systems are used to handle financial affairs, which affect the organization’s financial crisis management. The theory states, “Effective financial crisis management is among the consequences of successful accounting information systems”. This creates a framework for testing this theory empirically, explaining its constituent structures, and developing hypotheses. Figure 5 presents and illustrates the theoretical context and originality of the current study. Figure 6 establishes the developed framework and model for this study, revealing the accumulative nature of knowledge and scientific research for achieving novelty and innovation.

Figure 5.

The Study Theory, Model and Underpinning Theories [49,50,51,54,55]. Source: Preparation of researchers.

Figure 6.

Study Framework (AISS-FCM Model). Source: Preparation of researchers.

3. Hypotheses Development

3.1. Accounting Information System Success (AISS) and Financial Crisis Management (FCM)

Information systems of all kinds have an important role in facing crises before, during, and after their occurrence, by providing effective information to the organization’s management to make sound and correct decisions regarding the crises that the organization is exposed to. As the use of information systems was not limited to large organizations, but also small organizations due to the need of all these organizations for new and useful information that helps them make successful decisions [24,32].

The concept of financial crisis management is related to crisis prevention and preparedness. These tasks include identifying potential crises through the detection of early warning signals and developing crisis plans, where the crisis team uses their powers and applies plans involving the management of a crisis as it occurs. The real test of the plans and equipment prepared in advance and the training conducted before the crisis occurred is actually responding to a crisis as it occurs. The goal is to contain and reduce the damage from the crisis. Thus, FCM includes looking at ways and means of preparedness for coming crises, recording the flow of information during the crisis, and benefiting from it in the future. Hence, it can be concluded that FCM is an administrative approach to dealing with crises using sound scientific methodological methods, including planning, organizing, directing, following up, forming crisis teams, leadership, communication system, information system, and evaluating at all stages of the crisis. Effectiveness in crisis management is achieved through the availability of decision support systems in the organization, whether supporting activities related to management before, during, or after the crisis. Such as the activities of discovering early warning signs, preparedness and prevention, containment and harm reduction, restoring normal activity, and learning [18]. The organization’s support for electronic management would enhance its ability to manage crises [26]. Dahham, Atu, and Abdullah (2020) [58] emphasize that effective management IS have a crucial act in the ability to manage crises. Improving processes of crisis management in the pre-crisis, during, and after the crisis stages through the effective information they provide for decision-making regarding the crises facing the organization [19,33]. Employing information systems in crisis management would enable the administration to diagnose and plan to confront crises and reduce the seriousness of the crisis [21]. Appendix D explains the empirical results of studies on the relationship between IS success and crisis management. Based on the previous discussions, the following hypothesis is formulated:

H1:

Accounting information systems success (AISS) has a significant influence on financial crisis management (FCM) in the Palestinian ALs.

3.2. System Quality (SQ) and Financial Crisis Management (FCM)

The compatibility of information systems with the administrative level and its response to emerging changes and speed in decision-making would enhance the ability of organizations to manage crises [24,25,30,58]. Equipment, software, and the organization’s possession of the latest systems are among the main pillars of its ability to face the crisis [20]. Effective crisis management is closely related to the characteristics of management information systems in terms of the degree of availability of devices, reliability, and flexibility of systems [32]. Al-Hayaly (2011) [59] emphasized the important role played by the quality of banking information systems in crisis management. Whereas, technical resources and appropriate equipment are among the most important dimensions in the electronic management of organizations because of their effective contribution to their ability to manage crises [26]. The importance of system quality in crisis management has been proven in telecom organizations [60]. Adwan (2019) [33] indicated that the improvement of crisis management processes in government organizations is affected by the system quality of management information systems. In addition, this dimension in the context of accounting information systems has critical importance in all phases of crisis management [29]. Detecting early warning signs, preparedness and prevention, containing and limiting damage, restoring activity and learning are among the activities of crisis management that depend on the quality of the system [28]. In contrast, Gopinathan and Raman (2020) [61] indicated that system quality did not play an important role in the emergency management process. Appendix E explains the results of studies on the relationship between system quality and crisis management. Based on the previous discussions, a perception is reached about the association between “SQ” as an AIS success dimension and FCM. Thus, the following hypothesis was formulated:

H1.1:

System quality (SQ) has a significant direct influence on financial crisis management (FCM) in the Palestinian ALs.

3.3. Information Quality (IQ) and Financial Crisis Management (FCM)

Alabaddi, et al. (2020) [60] the crisis management process in organizations is critically affected by information quality. The availability of information for organizations is vital to their continuity, and the quality of that information is highly influential in their ability to manage crises, whether before, during or after their occurrence [33]. Al-Amyan (2016) [62] confirmed the clear impact on the work of disaster management in the case of providing accurate, clear, comprehensive, and rapid information, with a high degree of work completed without errors. In the same context, Gopinathan and Raman (2020) [61] pointed out the pivotal role of information quality in the emergency management process and success in crisis management. The quality of information constitutes a major basis in crisis management activities related to detecting early warning signals, preparedness and prevention, damage containment, recovery, and learning [27,28]. For managers’ ability to manage crises, the quality of information is critical [26,59]. The relationship between the quality of the outputs of management information systems in terms of their dimensions (modernity, accuracy, relevance, comprehensiveness, timeliness) and crisis management strategies. It is imperative for organizations to adopt high-quality information systems that increase their ability to face the crises they are exposed to and in a way that enables them to get out of the crisis with minimal losses [31]. In the context of accounting information systems, information quality was essential in crisis management in all its stages and activities [29]. Information security and speed in decision-making are also critical factors in the organization’s ability to effectively manage the crisis [25,30,58]. The organization’s management obtains high-quality information that enables it to make appropriate decisions about crises and overcome them [24]. Crisis management strategies and practices require adequate and quality information [20]. On the contrary, Fatiha (2022) [23] indicated that the quality of information did not have an impact on crisis management in the context of communication companies. Appendix E explains the results of studies on the relationship between information quality and crisis management. Based on the previous discussions, a perception is reached about the association between “IQ” as an AIS success dimension and FCM. Thus, the following hypothesis was formulated:

H1.2:

Information quality (IQ) has a significant direct influence on financial crisis management (FCM) in the Palestinian ALs.

3.4. Service Quality (SVQ) and Financial Crisis Management (FCM)

Service quality is one of the most important dimensions of the effectiveness of management information systems in improving crisis management processes before, during and after the crisis in the government context [33]. The quality of personal characteristics of system management and its employees is a decisive factor in crisis management in banks [59]. Dalloul et al. (2023) [1] emphasized that management during financial crises was affected by the quality of service as a quality dimension of the success of accounting information systems in the Palestinian Ministry of Finance. In contrast, Gopinathan and Raman (2020) [61] indicated that service quality did not affect the emergency management process. Appendix E explains the results of studies on the relationship between information quality and crisis management. Based on the previous discussions, a perception is reached about the association between “SVQ” as an AIS success dimension and FCM. Thus, the following hypothesis was formulated:

H1.3:

Service quality (SVQ) has a significant direct influence on financial crisis management (FCM) in the Palestinian ALs.

3.5. System Use (SU) and Financial Crisis Management (FCM)

The use of information systems had a role in the ability of organizations to manage crises, especially during activities related to preparedness, prevention, containment and damage reduction, and recovery [22]. In the same context, Nour Al-Daem (2015) [28] emphasized the importance of using information systems in crisis management, whether before, during, or after the crisis [24]. Alkshali & Al-Qutob (2007) [30] pointed out that the ability of organizations to prepare, prevent, contain damage, restore activity, and learn are crisis management activities dependent on the use of management information systems in the organization. Likewise, the use of accounting information systems has an impact on all activities related to crisis management in terms of detecting warning signs, preparedness and prevention, containing or limiting damage, restoring normal activity, and learning [29]. Crisis management practices such as problem-solving, crisis analysis, crisis management, and crisis follow-up require the use of information systems [20]. Appendix E explains the results of studies on the relationship between system use and crisis management. Based on the previous discussions, a perception is reached about the association between “SU” as an AIS success dimension and FCM. Thus, the following hypothesis was formulated:

H1.4:

System use (SU) has a significant direct influence on financial crisis management (FCM) in the Palestinian ALs.

3.6. User Satisfaction (US) and Financial Crisis Management (FCM)

User satisfaction with information systems is a cornerstone in enabling organizations to manage crises in their various stages and activities, such as detecting early warning signals, preparedness and prevention, damage containment, recovery and learning [24,25]. Additionally, Alkshali and Al-Qutob (2007) [30] stressed that the activities of crisis management related to detecting early warning signs, containing damage, and learning showed that they were affected by the level of end-user satisfaction with management information systems. In context, Dahham et al., (2020) [58] indicated the significant impact of user satisfaction on crisis management in banks. Training programs related to information systems have a role in the ability of organizations to manage crises [32]. Moreover, training, participation in decision-making, motivation, and control affected the ability of organizations to manage crises in terms of detecting warning signs, readiness and prevention, containing damage, restoring activity, and learning [63]. On the contrary, Nour Al-Daem (2015) [28] and Zwyalif, (2015) [29] indicated that crisis management was not affected by the dimension of user satisfaction with information systems. Appendix E explains the results of studies on the relationship between user satisfaction and crisis management. Based on the previous discussions, a perception is reached about the association between “US” as an AIS success dimension and FCM. Thus, the following hypothesis was formulated:

H1.5:

User satisfaction (US) has a significant direct influence on financial crisis management (FCM) in the Palestinian ALs.

3.7. System Use (SU) as Mediator

Turkmendag and Tuna (2022) [34] found that empowering leadership affects followers’ knowledge management practices through acceptance and utilization of hotel management system. In the study by Quyen and Nguyen (2020) [35], the SU variable serves as a mediator between the perceived accounting benefits and ERP system success. Ease of use mediate the association between antecedent factors and behavioral intention to use, according to Chen and Aklikokou (2019) [36]. Perceived ease of use and openness to experience affect the association between awareness and e-purchase intention [64]. Perceived utility mediates the association between trust in system factors (correctness, reaction time, and security) and continuing usage intention [65]. Ke and Su (2018) [66] observed that IS success metrics and net benefit are mediated by user experience usability. Al-Jabri (2015) [67] revealed that ease of use entirely and partially mediates training, satisfaction, communications, and benefits. Outcomes from Mustapha and Obid’s (2015) [68] study showed that the perceived ease of use mediates the association between tax service quality and the online tax system. The results of Dalloul et al. (2023) [1] revealed that the use of the system played an essential mediating role in the effect of both SQ and IQ on financial crisis management in the Palestinian Ministry of Finance. In contrast, this mediation has not been proven with regard to the quality of service. Appendix F explains the results of studies on the role of system use as a mediator variable. Based on the previous discussions, which point to the mediating role of SU in many associations and in different contexts. Thus, a perception was reached about the mediation of SU in the association between the quality dimensions of AIS success (SQ, IQ, SVQ) and FCM. Thus, the following hypotheses were formulated:

Hypothesis Hm1:

System quality (SQ) has a significant indirect influence on financial crisis management (FCM) via system use (SU) in the Palestinian ALs.

Hypothesis Hm2:

Information quality (IQ) has a significant indirect influence on financial crisis management (FCM) via system use (SU) in the Palestinian ALs.

Hypothesis Hm3:

Service quality (SVQ) has a significant indirect influence on financial crisis management (FCM) via system use (SU) in the Palestinian ALs.

3.8. User Satisfaction (US) as Mediator

According to research by Riandi et al. (2021) [37], user satisfaction mediates the association between system quality, service quality, and student performance in online learning. An intermediate factor between m-banking usage and customer engagement was found to be user satisfaction, as shown by Kamboj et al. (2021) [38]. Akel and Armağan (2021) [39] determined that the satisfaction factor has a significant mediating effect between hedonic, utilitarian benefits and the intention to continue implementation. Demir et al. (2021) [40], in the context of online meeting platforms, displayed that perceived value and satisfaction mediate the relationships between service quality and willingness to pay. In the context of electronic commerce, Trivedi and Yadav (2020) [69] found that e-satisfaction acts as a mediator between security concerns, usability, and willingness to repurchase. Pramod and Bae (2019) [70] revealed that the indirect influence of IQ and SQ on the intent to use the system is observed via US. Ahmad and Balal (2019) [71] demonstrated that US is a complete mediator of the association between perceived MIS quality and managerial innovation. In online ride-hailing services, Phuong and Trang (2018) [72] demonstrated that customer satisfaction mediates SVQ and repurchase intention. In m-learning, user satisfaction mediates the effects of information, system, and service quality on system use, according to Alorfi (2018) [73]. Appendix F explains the results of studies on the role of user satisfaction as a mediator variable. Based on the previous discussions, which point to the mediating role of US in many relationships and in different contexts. Thus, a perception was reached about the mediation of US in the relationship between the quality dimensions of AIS success (SQ, IQ, SVQ) and FCM. Thus, the following hypotheses were formulated:

Hypothesis Hm4:

System quality (SQ) has a significant indirect influence on financial crisis management (FCM) via user satisfaction (US) in the Palestinian ALs.

Hypothesis Hm5:

Information quality (IQ) has a significant indirect influence on financial crisis management (FCM) via user satisfaction (US) in the Palestinian ALs.

Hypothesis Hm6:

Service quality (SVQ) has a significant indirect influence on financial crisis management (FCM) via user satisfaction (US) in the Palestinian ALs.

4. Data and Methodology

Research Philosophy, the study followed a quantitative/positivist paradigm. It concentrated on theories and variables from the literature. Quantitative design/deductive approach measure phenomena objectively. It requires numerical data analysis and statistical tests. It uses ‘testing theory’, which involves deduction from the theory to construct hypotheses, data collection, and summarize results to confirm or deny the hypotheses. Which are suitable for analyzing the relationship between groups and understanding the dependence of variables, as well as testing the proposed hypotheses. This study used the questionnaire survey as its research strategy and adopted the five-point Likert scale in its questionnaire design (see Appendix A). It can be classified as descriptive and analytical in nature. The population of this research is the Palestinian local authorities in the Gaza Strip (the southern Palestinian governorates). There are 25 municipalities registered with the Palestinian Ministry of Local Government. According to the estimates of the Palestinian Ministry of Local Authorities, there are 132 employees in the financial and accounting departments in 25 Palestinian municipalities in the Gaza Strip. These numbers constitute the frame and setting for taking the sample for this research. Thus, according to Krejcie and Morgan’s (1970) [74] table for determining sample size, the appropriate sample size was 97 employees. However, the sample size was increased to 132 to mitigate the possibility of sampling error and address the non-response rate. Therefore, the units of analysis for this research are represented by the employees in the LAs’ accounting and finance department. The motive behind adopting them as the units of analysis is that they are direct users of the accounting information systems and have sufficient knowledge and specialized information about the systems. They are also the ones who have the information and actually deal with financial crises and are the most capable of managing them.

The data collection period took about a month and a half. Descriptive statistics and tests provide a better understanding and clarification of variables and their underlying structures to summarize and present data in a logical and comprehensive way, using software such as Smart PLS and SPSS. Descriptive statistical analysis is followed by the quantitative inferential analysis of the data using Partial Least Squares Structural Equation Modelling (PLS-SEM) using Smart PLS software techniques. To ensure the validity of the questionnaire and its components, experts, academics and professionals with knowledge and experience in the subject of the research were consulted. The pilot study was also conducted in many business sectors, organizations and companies, thus ensuring the validity of the questionnaire to proceed with the main study.

This section displays measurements of variables based on studies related to the issues of AIS and FCM (see Appendix D, Appendix E and Appendix F). Previous studies focused on SQ, IQ, SVQ, use/intent to use, and US as determinants for evaluating the ISS. These dimensions, which have attracted the attention of previous researchers, have their roots mainly in the model of D&M (1992). Regarding FCM, previous studies have adopted the study of crisis management by understanding the stages through which organizations deal with various crises. These stages, which have attracted the attention of researchers, have their roots mainly in Mitroff’s (1994) model [75]. Focus on the five phases that fall within three time periods: the signal detection phase, the preparation and prevention phase, the containment/damage reduction phase, the recovery phase, and the learning phase. For the current study, to measure the AISS, the following dimensions were adopted: SQ, IQ, SVQ, SU, and US. Whereas, to measure the financial crisis management effectiveness, the following levels or categories were adopted: the level of Pre–financial crisis management (Pre-FCM) includes (signal detection tasks, and preparation and prevention tasks), the level of During–financial crisis management (D-FCM) includes (containment/damage limitation tasks), and the level of Post–financial crisis management (Post-FCM) includes (recovery tasks and learning tasks). Regarding this aspect, the study will focus on the level of Pre-financial crisis management and During-financial crisis management. The fact that financial crisis in the Palestinian local authorities is still in a state of continuity and repetition. Table 1 presents measures of AIS success dimensions and measures of FCM. It is worth noting that these measures have been adopted in a manner that takes into account the nature of both accounting information systems and financial crises.

Table 1.

Measurement of Independent and Dependent Variables.

5. Findings and Analysis

5.1. Descriptive Analysis

This research distributed 132 questionnaires to the respondents, who are employees of the accounting and finance department in the Palestinian local authorities, and 115 questionnaires were returned valid for statistical analysis, with a response rate of 87.12%. Table 2 presents the descriptive analysis of respondents and constructs.

Table 2.

Descriptive Analysis.

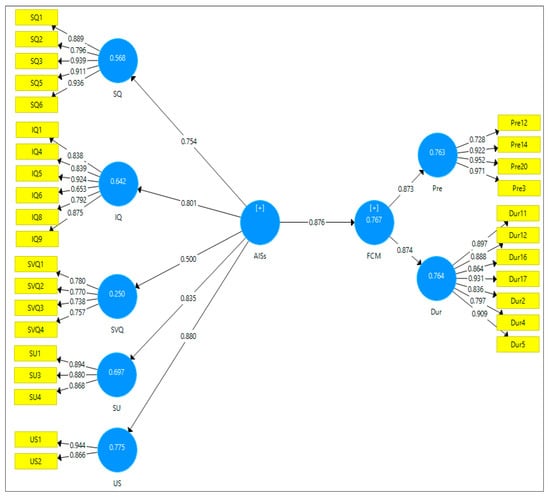

5.2. Measurement Model Assessment

The first stage in analyzing a research model is to evaluate the measurement model or outer model through the PLS-SEM technique. The main purpose is to evaluate the reliability and validity of the elements associated with the model constructs. Figure 7 displays the measurement model for this study.

Figure 7.

PLS-SEM Measurement Model.

Table 3 presents the findings related to the reliability and validity tests of the measurement model. Regarding the factor loading (FL) values, they must be ≥0.5. The coefficient values of Cronbach’s alpha (CA) and composite reliability (CR) > 0.7, “good & acceptable” in general. Values < 0.6 is “poor”, 0.6–0.8 is “acceptable”, and >0.8 is “good”. The average variance extracted (AVE) value > 0.5, “acceptable” [76,77,78,79,80,81].

Table 3.

Constructs Reliability and Validity.

5.3. Structural Model Assessment

The next stage is to evaluate the structural model (inner model). The model estimates the direct and indirect associations between independent and dependent variables.

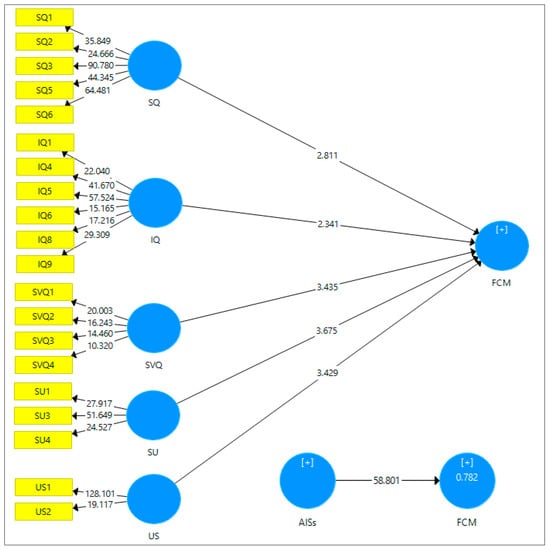

5.3.1. Hypotheses Testing (Path Analysis): Direct Influences

The magnitude of path parameters for variables was observed using the PLS-SEM algorithm. Meanwhile, the bootstrapping technique, using Smart PLS 3.0, was used to test the associations between the independent and dependent variables, with 5000 bootstrapping samples. Figure 8 and Table 4 display the output of the PLS-SEM algorithms for determining the statistical estimates of the structural model path parameters. In addition, the bootstrapping method outcomes are introduced to determine the significance of the associations between the variables.

Figure 8.

PLS-SEM Structural Model.

Table 4.

Hypotheses Testing Results (Direct Influences).

5.3.2. Hypotheses Testing (Path Analysis): Indirect Influences

This study applied the bootstrapping method using PLS-SEM to confirm the effect of mediation between variables. The test began by evaluating the model’s path coefficients for direct relationships between variables without the mediating variables. The results of this evaluation are displayed in Table 4. The table shows that the association between the variables (SQ, IQ, SVQ) and the (FCM) is significant. It also shows that the relationship between SU and US and FCM is significant. Appendix B shows the results of the direct relationship test between the independent variables (SQ, IQ, SVQ) and the mediating variables (SU, US), where the results were significant. Nevertheless, the result for SVQ is not significant with both mediating variables. Thus, the US and SU variables should not have any mediating role in any relationship with them. Figure 9 and Table 5 present the computed mediation outcomes.

Figure 9.

PLS-SEM Mediation Relationship.

Table 5.

Hypotheses Testing Results (Indirect Influences) and Bootstrap Confidence Intervals.

Table 5 shows the results of the bootstrap confidence interval. The results of the bootstrapped indirect effect of the variables SQ and IQ on FCM via SU reveal that the point estimates are 0.073 and 0.239, respectively, with upper and lower bounds from 0.03 to 0.13 and 0.17 to 0.31, respectively. The results of the bootstrapped indirect effect of the SQ and IQ variables on FCM via US reveal that the point estimates are 0.347 and 0.075, respectively, with lower and upper bounds from 0.22 to 0.45 and 0.02 to 0.13, respectively. The results are significant at a confidence level of 95%. Since zero is not observed in the confidence interval, the outcome values are aligned with the assumption that SQ and IQ effects on FCM are indirectly and partially via both SU and US.

5.4. Determination Coefficient (R2), Effects Sizes (f2) and Predictive Relevance (Q2)

Falk and Miller (1992) [82] considered the 0.10 value of R2, as the lowest acceptable level. The value of 0.26 “substantial”, 0.13 “moderate” and 0.02 “weak” [83]. The value is above 0.67 “substantial”, 0.67–0.33 “moderate”, and 0.33–0.19 “weak” (Chin, 1998) [84]. R2 values of 0.75 “substantial”, 0.50 “moderate”, and 0.25 “weak” [76]. On the other hand, a value less than 0.19 is “unacceptable” [85,86,87]. Cohen (1988) [83] Interprets the effect size values, higher than 0.35 “high effect” size, 0.35–0.15 “medium effect”, and 0.15–0.02 “small effect”, less than 0.02 “no effect” [76,88]. Q2 values larger than zero, indicating that the exogenous constructs have predictive relevance for the endogenous construct under consideration [76,81,88,89]. Table 6 illustrations the values of the determination coefficient (R2), effect size, and predictive relevance.

Table 6.

R2, f2 & Q2.

6. Discussion

In this study, in the context of the Palestinian local government sector, the following hypotheses related to the success of accounting information systems and financial crisis management were analyzed. This study’s main hypothesis H1 is ‘accounting information systems success (AISS) has a significant influence on financial crisis management (FCM) in the Palestinian ALs’. This hypothesis is supported, and the hypothesis tests for the two stages of FCM reveals a significant direct relationship between AIS success and the two stages (P-FCM and D-FCM) (see Appendix C). These results are consistent, e.g., with [18,19,20,21,26,29,33,58]. The first sub-hypothesis H1.1 is ‘System quality (SQ) has a significant direct influence on financial crisis management (FCM) in the Palestinian ALs’. This hypothesis is supported, this relationship implies that if the system quality is sufficiently improved and the necessary development and periodic maintenance of accounting information systems are carried out, they will increase the ease of learning, understanding, and use and improve integration, response time, reliability, and availability. Thus, AIS success will promote the effectiveness of FCM at the management tasks level before and during the financial crisis. These results are consistent, e.g., with [26,32,33,58,60]. However, the results are not consistent with [61]. The second sub-hypothesis H1.2 is ‘Information quality (IQ) has a significant direct influence on financial crisis management (FCM) in the Palestinian ALs’. This hypothesis is supported, this result shows that improving the IQ by making it more relevant, accurate, complete, timely, understandable, well-formatted, comparable, verifiable, and predictable would increase the effectiveness of FCM. Effective FCM would enable the LAs to detect early warning signs of financial crises, improve the tasks of preparedness and prevention of the financial crisis, and contain and limit its damage. The result is consistent, e.g., with [26,27,58,60,61]. However, this result differ from [23]. The third sub-hypothesis H1.3 is ‘Service quality (SVQ) has a significant direct influence on financial crisis management (FCM) in the Palestinian ALs’. This hypothesis is supported, this result confirming the importance of availability of a high level of support and services provided by the staff of information systems to users of accounting information systems. These services and support are characterized by a great deal of empathy, reliability, assurance, and tangibles, improving AIS effectiveness and keeping them updated and developed. Effective AIS leads to effective FCM and enhances its probability of detecting financial crises before they occur, thereby improving the preparedness, prevention, and control of the financial crises and mitigating their effects. The results are consistent with [1,33,37,59], but differ from [61]. The fourth sub-hypothesis H1.4 is ‘System use (SU) has a significant direct influence on financial crisis management (FCM) in the Palestinian ALs’. This hypothesis is supported, the use of accounting information systems is considered key in the performance of financial and accounting functional tasks, and the level of use of a system by employees shows the extent of the success achieved by those systems. This success will be reflected in the LAs’ ability to manage financial affairs and financial crises effectively. The increase in the frequency of use, required reports, period of use, expected use, and the trend towards use is an indication of the essential role played by accounting systems for employees and the organization. It also reflects their reliance on AIS in managing financial crises. The result is consistent with [18,22,24,28,29,30]. The fifth sub-hypothesis H1.5 states, ‘User satisfaction (US) has a significant direct influence on financial crisis management (FCM) in the Palestinian ALs’. This hypothesis is supported, user satisfaction is an important indicator of the success of accounting information systems. The systems’ high-quality performance would assist the users to effectively achieve their desires and needs, along with adequate training and being involved in the development of these systems. This would create a high level of user satisfaction with the information systems, which will be reflected in the greater effectiveness of FCM. The result is consistent with [25,30,32,58,63]. However, it differs from [28,29]. The results are mixed regarding the hypotheses of system use as a mediating variable. These findings indicate the importance of the mediating role played by system use in most of the tested relationships. The findings are consistent with several previous studies, such as [1,34,35,36,90]. Hypothesis Hm1 states, ‘System quality (SQ) has a significant indirect influence on financial crisis management (FCM) via system use (SU) in the Palestinian ALs’. This hypothesis is supported. This outcome is consistent with many previous studies, for example [1,66,91,92,93]. Hypothesis Hm2 states, ‘Information quality (IQ) has a significant indirect influence on financial crisis management (FCM) via system use (SU) in the Palestinian ALs’. This hypothesis is supported. This result is consistent with numerous previous studies, for example [1,66,92,93]. However, it disagrees with [91]. However, hypothesis Hm3 states, ‘Service quality (SVQ) has a significant indirect influence on financial crisis management (FCM) via system use (SU) in the Palestinian ALs’. This hypothesis is not supported. The direct relationship between SVQ and SU is not significant (see Appendix B). Hence, it is not assumed to be mediated by SU. This result is consistent with many previous studies, for example [1,91]. However, differs from [66,68]. The results are mixed regarding the hypotheses of user satisfaction as a mediating variable. These results indicate the important mediating role of user satisfaction in most of the tested relationships. They are consistent with many previous studies, such as [38,39,69,72,94,95,96,97]. Hypothesis Hm1 states, ‘System quality (SQ) has a significant indirect influence on financial crisis management (FCM) via user satisfaction (US) in the Palestinian ALs’. This hypothesis is supported. This result is consistent with many previous studies, for example, [37,70,71,73,98,99]. Hypothesis Hm2 states, ‘Information quality (IQ) has a significant indirect influence on financial crisis management (FCM) via user satisfaction (US) in the Palestinian ALs’. This hypothesis is supported. This result is consistent with many previous studies, for example, [70,71,73]. However, it disagrees with [91]. However, hypothesis Hm3 states, ‘Service quality (SVQ) has a significant indirect influence on financial crisis management (FCM) via user satisfaction (US) in the Palestinian ALs’. This hypothesis is not supported. The direct relationship between SVQ and US is not significant (see Appendix B). Hence, it is not assumed to be mediated by US. This result differs from many previous studies, for example [37,40,71].

7. Conclusions

This research addressed the literature gap by presenting new empirical evidence about the direct and indirect effects of the success of accounting information systems on managing financial crises in the context of local government, in addition to investigating the mediating role of system use and user satisfaction. The study followed the positivism paradigm and the quantitative deductive approach, with a descriptive and analytical nature, as the questionnaire was used for data collection. The Palestinian local authorities represented the study population, with a sample focusing on accounting and finance departments, and study unit analysis of employees who use accounting information systems. Accordingly, 132 questionnaires were distributed and 115 questionnaires were retrieved for statistical analysis, with a response rate of 87%.

The study included a descriptive and quantitative analysis of the direct and indirect effects. Thus, the significant direct impact of the success of accounting information systems, with its dimensions of system quality, information quality, service quality, system use and user satisfaction on financial crisis management in the Palestinian local authorities, was revealed. Besides, the analysis revealed significant indirect effects of system quality and information quality on financial crisis management in Palestinian local authorities, through the mediation of both system use and user satisfaction. In contrast, system use and user satisfaction did not play any mediating role in the effects between service quality and financial crisis management in Palestinian local authorities. Moreover, DeLone and Mclean’s theory and model of information systems success indicated that the more successful the information systems, the greater the net positive impacts, thus achieving the purpose of their adoption. Therefore, the results of this study are consistent with that theory, as the AIS success has positive effects on the FCM in the Palestinian LAs. This result shows that the Palestinian local authorities’ adoption of AIS can positively improve the effectiveness of FCM. In other words, in order to achieve effectiveness in financial crisis management for local authorities (before or during the financial crisis), it requires the assistance of AISS at a high level of success and quality (SQ, IQ, or SVQ) and a high degree of use and user satisfaction with the system.

The originality and novelty of this study stem primarily from the development of its own theory, which is that the effectiveness of managing financial crises is achieved by adopting successful accounting information systems. In fact, accounting information systems affect the management of financial crises in the organization. Thus, the study made its original contribution, as a framework and a model were developed that depict the relationship between the success of accounting information systems and the management of financial crises. This made it possible to test that theory and those relationships experimentally. The experimental results and evidence of this study have proven the validity of that theory, in addition to the high reliability and validity of its tested experimental model.

This study contributed to the development of knowledge and scientific theoretical aspects in the field of AIS success and financial crisis management. Among its original and novelty contributions is the adoption of the trend towards developing special measures that focus on the success of accounting information systems and take into account the nature of those systems. Likewise, adopting the trend towards developing special measures that focus on managing financial crises, and taking into account their nature and characteristics. In addition to allowing the ability to measure them empirically through specific and focused measures. In addition, the originality of the empirical contribution and the novelty of this study are shown by exploring the correlations and effects on financial crisis management in light of the adoption of successful accounting information systems. These relationships and effects have not been studied before. Thus, this study is the first of its kind to investigate whether the success of AIS affects financial crisis management in the context of the Palestinian local government, whether in terms of direct or indirect influences.

The results of this study support the theory and model of DeLone and Mclean of the information systems success, as well as the theory and model of the current study. In their emphasis on the importance of adopting successful accounting information systems to achieve the positive impacts that the organization aims to achieve by adopting these systems, including managing financial crises. The results of this study contributed to drawing attention not only to the direct relationships between the variables indicated by the theory and model of DeLone and Mclean about the success of information systems in particular. Rather, it went beyond to investigate the indirect relationships that the theory did not focus on significantly and clearly. The results of this study expand the scope of testing DeLone and Mclean’s theory and model of information systems success to include the investigation of indirect effects between variables.

Recommendations for this research. Accounting information systems are necessary to support the tasks of detecting early warning signs of a financial crisis, and preparing for, planning, controlling, monitoring and preventing a financial crisis. Increasing the authorities’ ability to confront financial crises and carrying out tasks to contain and limit the repercussions of the financial crisis. This finding means that system quality and information quality can drive the use and user satisfaction of accounting information systems, which in turn drives the effectiveness of financial crisis management. The higher the system quality, information quality, and service quality, the more effective it is in managing financial crises. System quality, information quality, service quality, usability and user satisfaction are critical factors for managing financial crises at a high level of effectiveness. Therefore, this study recommends raising the quality characteristics of accounting information systems, both in terms of system quality or information quality, in addition to the quality of services. The study recommends the need to pay more attention to improving the tasks of managing financial crises, whether at the level of management before or during the financial crisis. It is necessary to conduct more studies on the success of accounting information systems, in particular, to improve and support the trend towards developing special measures that take into account the characteristics and specifications of accounting information systems. It is also necessary to conduct more studies on the effectiveness of managing financial crises that would improve and support the trend towards developing measures that take into account the specificity and characteristics of financial crises and methods of managing them. It is of great importance that the current study model (AISS-FCM) has been examined in different research studies to provide further support for the theory and model in different contexts.

Regarding the limits and directions of future studies, this study is the first to investigate the relationship between the success of accounting information systems and the management of financial crises in the Palestinian local authorities, which requires further studies and investigation in this field. The population and sample of this study are the Palestinian local authorities operating in the Gaza Strip. Therefore, similar studies should be conducted in other Palestinian regions. Further studies in other types of organizations and in different countries are also necessary. This study targeted workers in the financial and accounting departments of the Palestinian local authorities. Therefore, other departments at various administrative levels have not yet been explored. This study used a questionnaire as the main tool for data collection, similar to empirical research. Thus, it is suggested that future studies use other tools and approaches, such as qualitative methods and interviews, to identify more factors that may have an impact on the effectiveness of managing financial crises and enhancing the success of accounting information systems. This study indicated the mediating roles of system use and user satisfaction. Therefore, future studies can expand this mediating role and identify other factors that are likely to have a mediating role as well.

Author Contributions

M.H.M.D.: Conceptualization, Methodology, Resources, Formal analysis, Investigation, Writing—original draft. Z.b.I.: Conceptualization, Methodology, Project administration, Validation, Funding acquisition, Supervision, Writing—review & editing. S.T.U.: Conceptualization, Methodology, Validation, Supervision, Writing—review & editing. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

All study data are included in this article.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A. Questionnaire

| Section A: The Following Statement Measures the Success of Accounting Information Systems (AIS). | Agreement Degree | |||||

| V.H. | H. | M. | L. | V.L. | ||

| System Quality | ||||||

| 1. | The AIS is easy to learn, understand, and use. | 5 | 4 | 3 | 2 | 1 |

| 2. | The AIS is flexible enough for maintenance and development. | 5 | 4 | 3 | 2 | 1 |

| 3. | The AIS is integrated with its components and the other systems. | 5 | 4 | 3 | 2 | 1 |

| 4. | The AIS reacts and responds quickly (without delay). | 5 | 4 | 3 | 2 | 1 |

| 5. | The AIS is operating properly and reliably (no crash or failure). | 5 | 4 | 3 | 2 | 1 |

| 6. | The AIS is available and easy to access whenever needed. | 5 | 4 | 3 | 2 | 1 |

| 7. | The AIS has security, access control, and permissions. | 5 | 4 | 3 | 2 | 1 |

| Information Quality | ||||||

| 8. | The information provided by AIS is appropriate and meets the needs. | 5 | 4 | 3 | 2 | 1 |

| 9. | The information provided by AIS is accurate and neutral (no errors, correct). | 5 | 4 | 3 | 2 | 1 |

| 10. | The information provided by AIS is complete and comprehensive. | 5 | 4 | 3 | 2 | 1 |

| 11. | The information provided by AIS is timely and up-to-date. | 5 | 4 | 3 | 2 | 1 |

| 12. | The information provided by AIS is understandable. | 5 | 4 | 3 | 2 | 1 |

| 13. | The information provided by AIS is clearly organized and well-formatted. | 5 | 4 | 3 | 2 | 1 |

| 14. | The information provided by AIS is consistent and comparable. | 5 | 4 | 3 | 2 | 1 |

| 15. | The information provided by AIS is verifiable. | 5 | 4 | 3 | 2 | 1 |

| 16. | The information provided by AIS is predictive and confirmatory. | 5 | 4 | 3 | 2 | 1 |

| Service Quality | ||||||

| 17. | The IS staff is willing to help users and give prompt service. | 5 | 4 | 3 | 2 | 1 |

| 18. | The IS staff gives users suitable personal attention and considers their best interests. | 5 | 4 | 3 | 2 | 1 |

| 19. | The IS staff is dependable and provides services at the promised time. | 5 | 4 | 3 | 2 | 1 |

| 20. | The IS staff have user confidence and sufficient knowledge of their jobs. | 5 | 4 | 3 | 2 | 1 |

| 21. | The IS staff provides updating of the hardware and software of the AIS. | 5 | 4 | 3 | 2 | 1 |

| System Use | ||||||

| 22. | The AIS is used frequently and extensively. | 5 | 4 | 3 | 2 | 1 |

| 23. | The number of reports requested from the AIS is sufficient to perform the job well. | 5 | 4 | 3 | 2 | 1 |

| 24. | The AIS is used for long periods of time. | 5 | 4 | 3 | 2 | 1 |

| 25. | The use of AIS is greater than originally expected. | 5 | 4 | 3 | 2 | 1 |

| 26. | The trend towards using the AIS will increase. | 5 | 4 | 3 | 2 | 1 |

| 27. | The use of the AIS is of major importance in performing the financial and accounting functional tasks. | 5 | 4 | 3 | 2 | 1 |

| User Satisfaction | ||||||

| 28. | The current performance of AIS and the quality of its electronic services are very satisfactory. | 5 | 4 | 3 | 2 | 1 |

| 29. | There is a conviction that the design of AIS takes into account the desires and needs of its users. | 5 | 4 | 3 | 2 | 1 |

| 30. | The users of AIS receive adequate training to develop their skills. | 5 | 4 | 3 | 2 | 1 |

| 31. | The users of AIS are involved in its development and their opinions are taken into account. | 5 | 4 | 3 | 2 | 1 |

| Section B: The following statement measures the effectiveness of Financial Crisis Management (FCM). | Agreement Degree | |||||

| V.H. | H. | M. | L. | V.L. | ||

| Pre-Financial Crisis Management (involves tasks of early warning signal detection and preparedness/prevention). | ||||||

| 32. | There is sufficient interest in identifying and collecting signs of financial crisis occurrence. | 5 | 4 | 3 | 2 | 1 |

| 33. | There is sufficient interest in the classification and analysis of signs of financial crisis emergence. | 5 | 4 | 3 | 2 | 1 |

| 34. | The internal and external work environment is monitored for detecting signs of financial crisis occurrence. | 5 | 4 | 3 | 2 | 1 |

| 35. | There is a supportive organizational culture for detecting signs of financial crisis occurrence. | 5 | 4 | 3 | 2 | 1 |

| 36. | The AIS contributes to supporting the processes for detecting signs of financial crisis occurrence. | 5 | 4 | 3 | 2 | 1 |

| 37. | The AIS contributes to supporting the processes of financial analysis and forecasting the financial crisis occurrence. | 5 | 4 | 3 | 2 | 1 |

| 38. | There is a unit/team that performs the tasks of preparing and preventing the financial crisis. | 5 | 4 | 3 | 2 | 1 |

| 39. | Sufficient courses and training programs are available in the field of financial crisis management. | 5 | 4 | 3 | 2 | 1 |

| 40. | Periodic and regular meetings and workshops are held to discuss dealing with potential financial crises. | 5 | 4 | 3 | 2 | 1 |

| 41. | Experiments and simulations are conducted to deal with a potential financial crisis. | 5 | 4 | 3 | 2 | 1 |

| 42. | There is control, monitoring, and analysis of the practices and events that lead to a financial crisis. | 5 | 4 | 3 | 2 | 1 |

| 43. | Adequate and comprehensive planning and preparedness are available for all financial crisis scenarios. | 5 | 4 | 3 | 2 | 1 |

| 44. | There is a regular and continuous review and development of plans prepared to manage the financial crisis. | 5 | 4 | 3 | 2 | 1 |

| 45. | There is effective coordination between departments to access the resources necessary to manage the financial crisis. | 5 | 4 | 3 | 2 | 1 |

| 46. | Effective channels of communication and cooperation are available with various relevant organizations to manage the financial crisis. | 5 | 4 | 3 | 2 | 1 |

| 47. | Experts and specialists are engaged and utilized to manage the financial crisis. | 5 | 4 | 3 | 2 | 1 |

| 48. | The AIS contributes to improving the processes of preparedness and prevention of the financial crisis. | 5 | 4 | 3 | 2 | 1 |

| 49. | The AIS contributes to providing comprehensive financial databases to manage the financial crisis. | 5 | 4 | 3 | 2 | 1 |

| 50. | The AIS contributes to the storage, processing, and retrieval of information effectively to manage the financial crisis with the ability to backup information. | 5 | 4 | 3 | 2 | 1 |

| 51. | The AIS contributes to financial risk assessment and financial planning for preparedness and prevention of the financial crisis. | 5 | 4 | 3 | 2 | 1 |

| During-Financial Crisis Management (involves tasks of containment and damage reduction) | ||||||

| 52. | There is an ability to manage time effectively while dealing with the financial crisis. | 5 | 4 | 3 | 2 | 1 |

| 53. | There is a rapid distribution of tasks and powers to manage the financial crisis. | 5 | 4 | 3 | 2 | 1 |

| 54. | There is speed and effectiveness in controlling the financial crisis and mitigating its effects. | 5 | 4 | 3 | 2 | 1 |

| 55. | There is a holding of immediate and periodic meetings (crisis cell) to manage and analyze the financial crisis. | 5 | 4 | 3 | 2 | 1 |

| 56. | There is an ability to raise public awareness of the financial crisis and reduce rumours. | 5 | 4 | 3 | 2 | 1 |

| 57. | There is an ability to prevent the exacerbation of the financial crisis and the occurrence of sub-crises. | 5 | 4 | 3 | 2 | 1 |

| 58. | There is effectiveness and speed in following up on the implementation of pre-prepared plans and scenarios to manage the financial crisis. | 5 | 4 | 3 | 2 | 1 |

| 59. | There is an active participation of the departments in the process of implementing the financial crisis management plans. | 5 | 4 | 3 | 2 | 1 |

| 60. | Sufficient incentives, rewards, and facilities are provided to support the financial crisis management process | 5 | 4 | 3 | 2 | 1 |

| 61. | Emergency financial allocations are created to maintain work during the financial crisis. | 5 | 4 | 3 | 2 | 1 |

| 62. | Activities expenditures are minimized to mitigate the effects of the financial crisis. | 5 | 4 | 3 | 2 | 1 |

| 63. | The AIS contributes to supporting the containment and limiting the damages processes of the financial crisis. | 5 | 4 | 3 | 2 | 1 |

| 64. | The AIS contributes to maintaining the availability of up-to-date and real-time information to manage the financial crisis | 5 | 4 | 3 | 2 | 1 |

| 65. | The AIS contributes to improving the speed of decision-making to manage the financial crisis. | 5 | 4 | 3 | 2 | 1 |

| 66. | The AIS contributes to providing the decision-maker with accurate and rapid information on the financial situation to manage the financial crisis. | 5 | 4 | 3 | 2 | 1 |

| 67. | The AIS contributes to maintaining the confidentiality, integrity, and availability of information related to financial crisis management. | 5 | 4 | 3 | 2 | 1 |

| 68. | The AIS contributes to allocating available financial resources and rationalizing expenditures accurately and effectively to manage the financial crisis. | 5 | 4 | 3 | 2 | 1 |

| Legend: V.H.: Very High. H.: High. M.: Medium. L.: Low. V.L.: Very Low. | ||||||

Appendix B. Outcomes of the Direct Association between the SQ, IQ, SVQ and SU, US

| Path | B | S.E. | t-Statistics | p-Value | Decision |

| SQ → SU | 0.181 | 0.065 | 2.789 | 0.004 | Supported |

| IQ → SU | 0.604 | 0.062 | 9.800 | 0.000 | Supported |

| SVQ → SU | 0.031 | 0.074 | 0.412 | 0.680 | Not supported |

| SQ → US | 0.719 | 0.061 | 11.824 | 0.000 | Supported |

| IQ → US | 0.167 | 0.063 | 2.650 | 0.005 | Supported |

| SVQ → US | −0.063 | 0.065 | 0.966 | 0.335 | Not supported |

| Legend: Significant at 0.05 (2-tailed). SQ: System Quality. IQ: Information Quality. SVQ: Service Quality. SU: System Use. US: User Satisfaction. | |||||

Appendix C. Outcomes of the Direct Association between the AISS and P-FCM, D-FCM

| Path | B | S.E. | t-Statistics | p-Value | Decision |

| AISS → P-FCM | 0.883 | 0.018 | 47.949 | 0.000 | Supported |

| AISS → D-FCM | 0.688 | 0.031 | 21.903 | 0.000 | Supported |

| Legend: Significant at 0.05 (2-tailed). AISS: Accounting Information Systems success. P-FCM: Pre-financial Crisis Management. D-FCM: During financial Crisis Management. | |||||

Appendix D. Literature Review of the Relationship between ISS and CM

| Studies | Variable (Predicted Sign) |

| Crisis Management (+ve) | |

| Alsaqqa and Soufi (2021) [18]; Ahmed and Al-Ani (2021) [26]; Dahham et al. (2020) [58]; Alzoubi (2020) [32]; Adwan, (2019) [33]; Hanna et al. (2018) [19]; Almashaqba (2017) [21]; Bushra (2017) [20]; Nour Al-Daem (2015) [28]; Zwyalif (2015) [29]; Alsoudani and Altaany (2014) [22]; Abdul Razzaq (2011) [24]; Abu Omar (2009) [25]; Alkshali and Al-Qutob (2007) [30]. | Overall Supported (positive) |

Appendix E. Literature Review of the Association between SQ, IQ, SVQ, SU, US and CM

| Independent Variable (AISS) (SQ, IQ, SVQ, SU, US) | Dependent Variable (FCM) | Studies | Result | Overall |

| System Quality | Crisis Management | Dahham et al. (2020) [58]; Alzoubi (2020) [32]; Al-Hayaly (2011) [59]; Ahmed and Al-Ani (2021) [26]; Alabaddi et al. (2020) [60]; Adwan (2019) [33]; Zwyalif (2015) [29]; Nour Al-Daem (2015) [28]; Abu Omar (2009) [25]; Alkshali and Al-Qutob (2007) [30]; Bushra (2017) [20]; Abdul Razzaq (2011) [24]. | S | Supported (positive) |

| Gopinathan and Raman (2020) [61]. | NS | |||

| Information Quality | Crisis Management | Dahham et al. (2020) [58]; Qaddoriy and Mahameed (2020) [31]; Al-Hayaly (2011) [59]; Ahmed and Al-Ani (2021) [26]; Al Jaberi and Qawasmeh (2020) [27]; Gopinathan and Raman (2020) [61]. Al-Amyan (2016) [62]; Alabaddi, et al. (2020) [60]; Adwan (2019) [33]; Nour Al-Daem (2015) [28]; Zwyalif (2015) [29]; Abu Omar (2009) [25]; Alkshali and Al-Qutob (2007) [30]; Bushra (2017) [20]; Abdul Razzaq (2011) [24]. | S | Supported (positive) |

| Fatiha (2022) [23]. | NS | |||

| Service Quality | Crisis Management | Dalloul et al. (2023) [1]; Adwan (2019) [33]; Al-Hayaly (2011) [59]. | S | Supported (positive) |

| Gopinathan and Raman (2020) [61] | SN | |||

| System Use | Crisis Management | Alkshali & Al-Qutob (2007) [30]; Nour Al-Daem (2015) [28]; Zwyalif (2015) [29]; Alsoudani and Altaany (2014) [22]; Bushra (2017) [20]; Abdul Razzaq (2011) [24]. | S | Supported (positive) |

| User Satisfaction | Crisis Management | Dahham et al., (2020) [58]; Alzoubi (2020) [32]; Lshammari et al. (2020) [63]; Alkshali and Al-Qutob (2007) [30]; Abu Omar (2009) [25]; Abdul Razzaq (2011) [24]. | S | Supported (positive) |

| Nour Al-Daem (2015) [28]; Zwyalif (2015) [29]. | NS | |||

| Legend: S = statistically significant, NS = not statistically significant. | ||||

Appendix F. Literature Review on System Use and User Satisfaction as MV

| Studies | Variable (Predicted Sign) |

| Turkmendag and Tuna (2022) [34]; Quyen and Nguyen (2020) [35]; Chen and Aklikokou (2019) [36]; Kosasi et al. (2019) [90]; Keikhosrokiani et al. (2020) [91]; Moslehpour et al. (2018) [64]; Santhanamery and Ramayah (2018) [65]; Ke and Su (2018) [66]; Al-Jabri (2015) [67]. Mustapha and Obid (2015) [68]; Mahama and Cheng (2013) [99]; Ali and Younes (2013) [92,93]; Dalloul et al. (2023) [1]. | System Use (SU) as a Mediator Variable (MV) (+ve) |

| Overall Supported (positive) | |

| Riandi et al. (2021) [37]; Kamboj et al. (2021) [38]; Akel & Armağan (2021) [39]; Demir et al. (2021) [40]; Trivedi and Yadav (2020) [69]; Al-Okaily et al. (2020) [98]; Pramod and Bae (2019) [70]; Ahmad and Balal (2019) [71]; Phuong and Trang (2018) [72]; Alorfi (2018) [73]. Yassien et al. (2017) [94]; Islam et al. (2017) [95]; Waeyenberg et al. (2017) [96]. | User Satisfaction (US) as a Mediator Variable (MV) (+ve) |

| Overall Supported (positive) |

References

- Dalloul, M.H.; Ibrahim, Z.b.; Urus, S.T. The Impact of Quality Dimensions of Accounting Information System Success on the Effectiveness of During-Financial Crisis Management: The Mediating Role of System Usage in a Government Sector Context. Asian Econ. Financ. Rev. 2023, 13, 18–48. [Google Scholar] [CrossRef]

- International Monetary Fund (IMF). The IMF-FSB Early Warning Exercise—Design and Methodological Toolkit. Policy Pap. 2010, 2010, 1–41. [Google Scholar]

- Al-Ketbi, S. “Corona” and the Role of Leaders in Crisis Management. Retrieved from Elaph. Available online: https://elaph.com/Web/opinion/2020/04/1288261.html.2020 (accessed on 10 January 2021).

- Al-Khatib, M.H. Skills of Strategic Leadership and Its Relation with Crisis Management “A Field Study on the Palestinian Local Institutions in Gaza Governorates”. Master’s Thesis, Al-Azhar University-Gaza, Gaza, Palestine, 2015. [Google Scholar]

- Bakir, H.M. Obstacles in the Achievement of the Major Municipalities of the Gaza Strip for Their Services during Emergency Situations. Master’s Thesis, The Islamic University of Gaza, Gaza, Palestine, 2016. [Google Scholar]

- World Bank. World Bank: The Third Phase of the Gaza Municipal Development Project; World Bank: Washington, DC, USA, 2017. [Google Scholar]

- Ghorab, I.K.-F. The Role of the Budget as a Planning Tool to Exploit the Financial Resources in the Gaza Strip Municipalities. Master’s Thesis, The Islamic University of Gaza, Gaza, Palestine, 2017. [Google Scholar]

- Chabani, M.; Chabani, W. Managing financial crises according to accounting information systems. J. Econ. Appl. Stat. 2014, 11, 196–206. [Google Scholar]

- Ministry of Local Government. The Strategic Framework for the Transformation into Electronic Municipalities (2019–2023); State of Palestine, Ministry of Local Government: Ramallah, Palestine, 2019.

- State Audit & Administrative Control Bureau. Report of the State Audit & Administrative Control Bureau, Annual Report 2018. Control & Audit for Construction, Development & Good Governance Enhancement; State Audit & Administrative Control Bureau-State of Palestine: Ramallah, Palestine, 2018. [Google Scholar]

- State Audit & Administrative Control Bureau. Report of the State Audit & Administrative Control Bureau, Annual Report 2016: Control & Audit for Construction, Development & Good Governance Enhancement; State Audit & Administrative Control Bureau-State of Palestine: Ramallah, Palestine, 2016. [Google Scholar]

- Ministry of Local Government. A Guide to Accounting Procedures according to the Cash Basis; State of Palestine, Ministry of Local Government: Ramallah, Palestine, 2012.

- Municipal Development and Lending Fund. Financial Policies and Procedures Related to a Medium or Small Palestinian Municipality; Municipal Development and Lending Fund: Al-Bireh, Palestine, 2011. [Google Scholar]

- Ghoneim, M.A. The Role of Computerized Management Information Systems in the Decision-Making Process in the Municipalities of the Gaza Strip in Palestine. Master’s Thesis, The Islamic University of Gaza, Gaza, Palestine, 2004. [Google Scholar]

- Al-Buhaisi, E.M. Evaluating the Reality of Accounting Information System in the Gaza Strip Municipalities: A Field Study. J. Islam. Univ. Econ. Adm. Stud. 2013, 21, 79–98. [Google Scholar]

- Salim, F.M. The Effect of Applying the Cash Basis on the Significance of Accounting Information for Decision Makers in the Municipalities of the Gaza Strip in Palestine. Master’s Thesis, The Islamic University of Gaza, Gaza, Palestine, 2007. [Google Scholar]

- Dalloul, M.H.; Ibrahim, Z.b.; Urus, S.T. The Association between the Success of Information Systems and Crises Management (A Theoretical View and Proposed Framework). Int. J. Asian Soc. Sci. 2022, 12, 55–68. [Google Scholar] [CrossRef]